MEMBERS ONLY

Four Charts to Track a Potential Market Top

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave reveals four key charts he's watching to determine whether the S&P 500 and Nasdaq 100 will be able to power through their 200-day moving averages en route to higher highs. Using the recently updated StockCharts Market Summary page, he covers moving average...

READ MORE

MEMBERS ONLY

Three Stocks With Post-Earnings Upside Potential

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With the major averages logging a strong up week across the board, and with the Nasdaq 100 finallyretesting its 200-day moving averagefrom below, it can feel like a challenging time to take a shot at winning charts. You may ask yourself, "Do I really want to be betting on...

READ MORE

MEMBERS ONLY

Top 10 Stock Charts For May 2025: Breakouts, Trends & Big Moves!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

Discover the top 10 stock charts to watch this month with Grayson Roze and David Keller, CMT. They break down breakout strategies, moving average setups, and technical analysis strategies using relative strength, momentum, and trend-following indicators. This analysis covers key market trends that could impact your trading decisions. You don&...

READ MORE

MEMBERS ONLY

Tesla: The Breakout to Bolster the Bulls

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* An absence of strong momentum tells us to be patient and wait for a better entry point on the chart.

* Momentum indicators like RSI can help us define the trend phase and better identify when buyers are taking control.

* A breakout above $290 could indicate a new accumulation...

READ MORE

MEMBERS ONLY

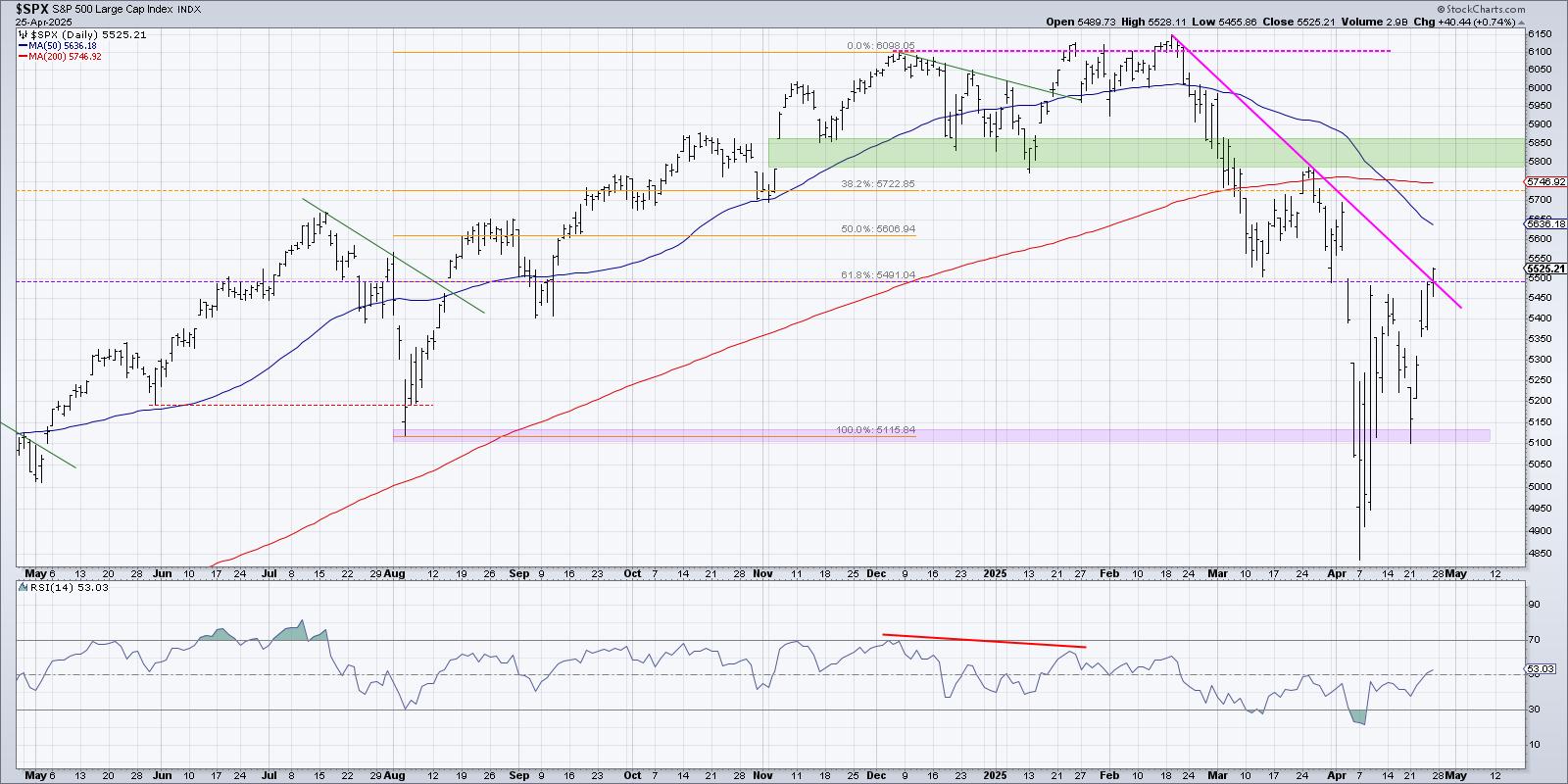

S&P 500 Rises from Bearish to Neutral, But Will It Last?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* This week's rally pushed the S&P 500 above an important trendline formed by the major highs in 2025.

* Improving market breadth indicators confirm a broad advance off the early April market low.

* Using a "stoplight" technique, we can better assess risk and...

READ MORE

MEMBERS ONLY

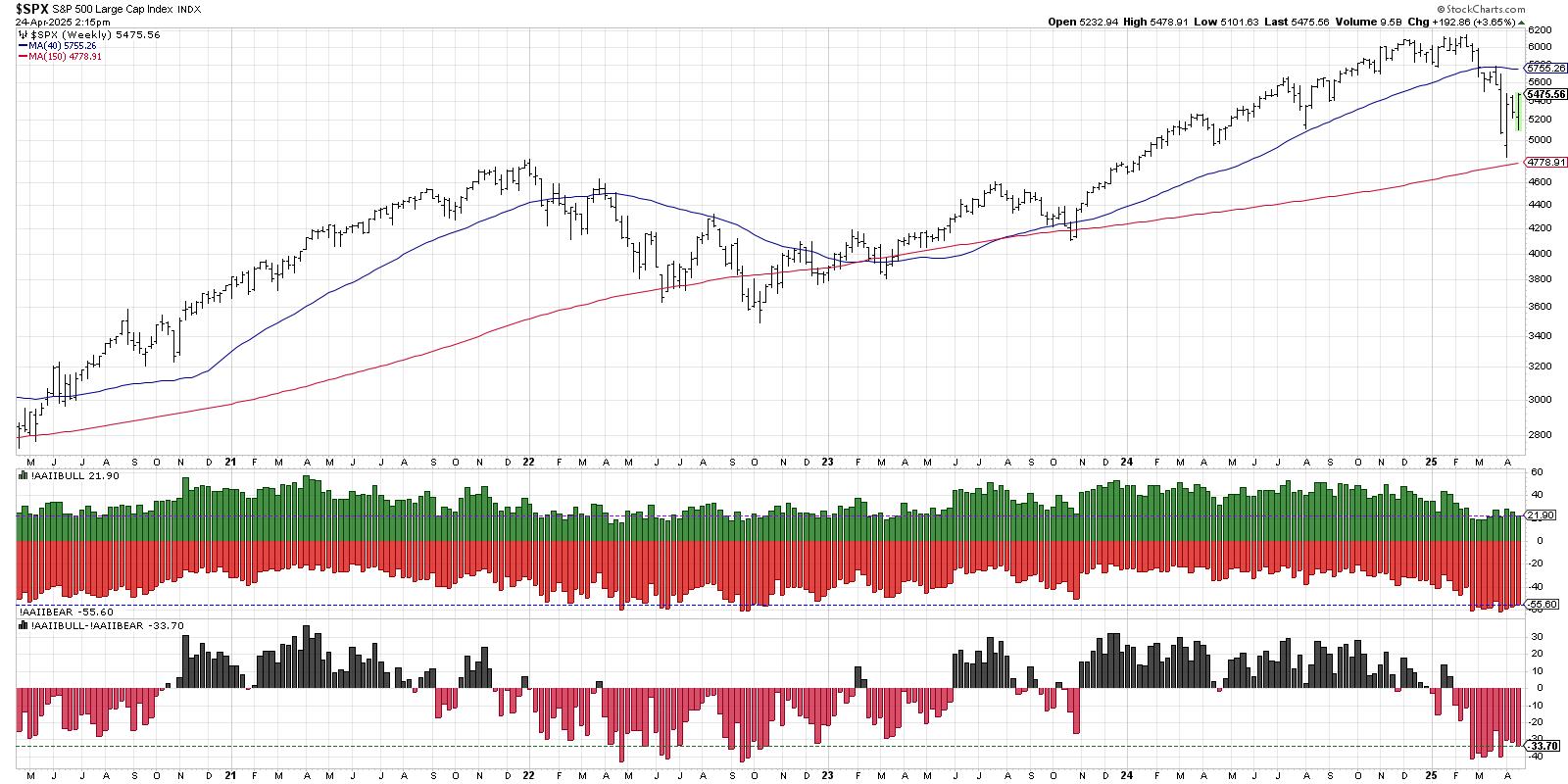

Sentiment Signals Suggest Skepticism

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The AAII survey demonstrates a lack of bullish optimism after the recent bounce higher.

* The NAAIM Exposure Index suggests that money managers remain skeptical of the recent advance.

* While Rydex fund flows show a rotation to defensive positions, previous bearish cycles have seen much larger rotations.

When I...

READ MORE

MEMBERS ONLY

Bearish Warning: 3 Market Sentiment Indicators You Can't Ignore

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, market sentiment, investor psychology, and stock market trends take center stage as David Keller, CMT, shares three powerful sentiment indicators that he tracks every week. He explains how the values are derived, what the current readings say about the market environment in April 2025, and how these...

READ MORE

MEMBERS ONLY

When in Doubt, Follow the Leadership

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The Consumer Discretionary sector has underperformed the Consumer Staples sector since February, indicating defensive positioning for investors.

* The Relative Rotation Graphs (RRG) show a clear rotation from "things you want" to "things you need" as investors fear weakening economic conditions.

* We remain focused on...

READ MORE

MEMBERS ONLY

200-Day Moving Average Confirms Bearish Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The S&P 500 currently sits about 8% below its 200-day moving average, even with a strong upswing on last week's tariff news.

* The newly updated Market Summary page on StockCharts.com allows investors to compare key market indexes to their 200-day moving averages.

* Three...

READ MORE

MEMBERS ONLY

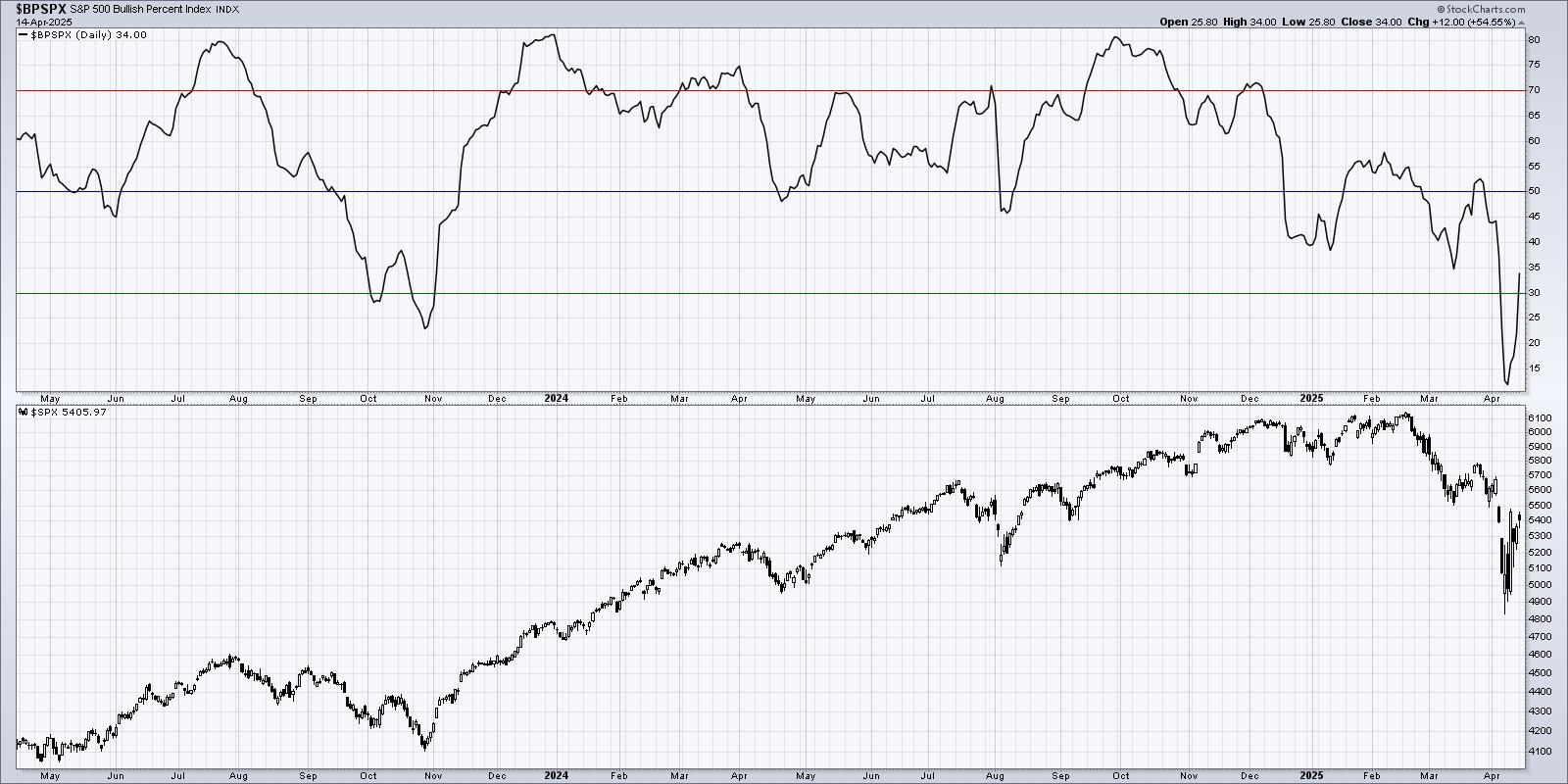

Bullish Percent Index Confirms Short-Term Rebound

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The Bullish Percent Index for both the Nasdaq 100 and S&P 500 have made moves similar to previous swing lows.

* A long-term review of these signals yields mixed results, especially during sustained bearish market regimes.

One of my favorite market breadth indicators remained in an extreme...

READ MORE

MEMBERS ONLY

Is the Stock Market Getting Ready to Bounce? Key Market Breadth Signal Explained

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When the stock market slides significantly, it's natural to question if the market has bottomed and getting ready to bounce.

In this video, David Keller, CMT highlights the Bullish Percent Index (BPI) as a key indicator to monitor during corrective moves. Learn more about how the BPI is...

READ MORE

MEMBERS ONLY

Three Defensive Plays for Post-Tariff Survival

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Kroger remains in a primary uptrend of higher highs and higher lows, a rare feature for S&P 500 members in April 2025.

* Keurig Dr Pepper has overcome gap resistance and now demonstrates strong technical characteristics.

* The Utilities sector has show improving relative strength in 2025, outperforming...

READ MORE

MEMBERS ONLY

Top 10 Stock Charts for April 2025: Big Breakouts Ahead?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

Finding stocks that show promising opportunities can be challenging in a market that goes up and down based on news headlines. But, it's possible.

In this video, watch how Grayson Roze and David Keller, CMT use the tools available in StockCharts to find stocks that are breaking out,...

READ MORE

MEMBERS ONLY

Bear Flag Alert - Downside S&P 500 Target Update

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* A confirmed bear flag pattern would imply a minimum downside objective around $SPX 5200.

Friday's overheated inflation data appears to have initiated a new downward leg for the major equity averages. This could mean a confirmed bear flag pattern for the S&P 500, and...

READ MORE

MEMBERS ONLY

Three Growth Stocks Testing the Ultimate Trend Barometer

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* META remains above an upward-sloping 200-day moving average.

* If AMZN fails to hold its 200-day, this could mean bad things for AMZN and bad things for the markets.

* TSLA has rallied up to its 200-day moving average, but so far has failed to gain a foothold above this...

READ MORE

MEMBERS ONLY

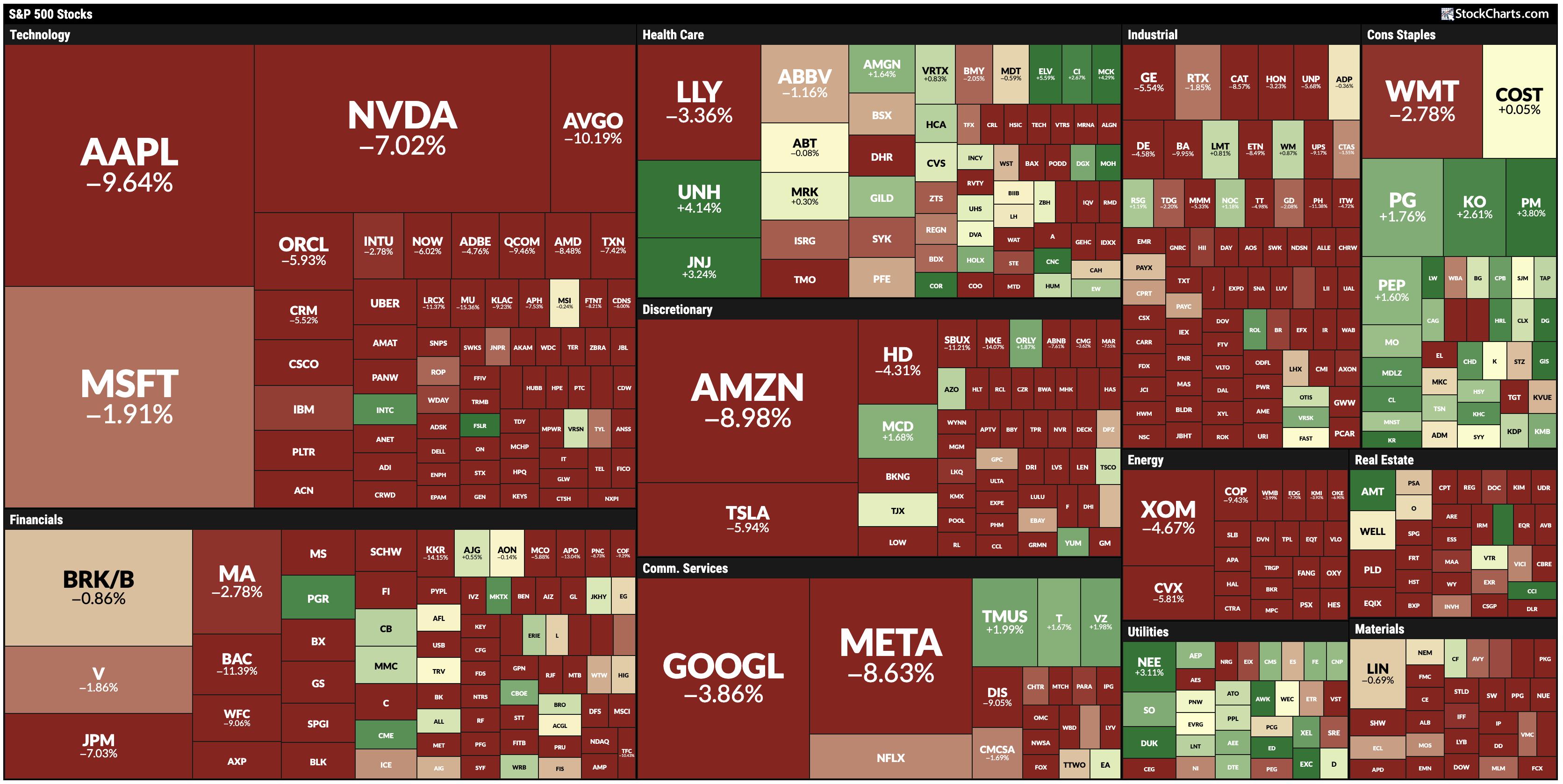

Key Levels for AAPL, AMZN, NVDA — Will This Market Rally Hold?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave breaks down the upside bounce in the Magnificent 7 stocks — AAPL, AMZN, NVDA, and more — highlighting key levels, 200-day moving averages, and top trading strategies using the StockCharts platform. Find out whether these leading growth stocks are set for a bullish reversal or more downside. Will...

READ MORE

MEMBERS ONLY

Will QQQ Retest All-Time Highs By End of April?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

After reaching an all-time around $540 in mid-February, the Nasdaq 100 ETF (QQQ) dropped almost 14% to make a new swing low around $467. With the S&P 500 and Nasdaq bouncing nicely this week, investors are struggling to differentiate between a bearish dead-cat bounce and a bullish full...

READ MORE

MEMBERS ONLY

4 Scenarios for Nasdaq 100: Bullish Surge or Bearish Collapse?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Can the Nasdaq 100 rally to all-time highs or break down below key support? In this video, Dave uses probabilistic analysis to explore 4 possible scenarios for the QQQ over the next 6 weeks — from a super bullish surge to a bearish breakdown below the August 2024 low. Discover the...

READ MORE

MEMBERS ONLY

Three Reasons to Consider Gold

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Gold has dramatically outperformed the S&P 500 and Nasdaq in 2025.

* Gold prices remain in a primary uptrend, with our Market Trend Model reading bullish on all time frames.

* Gold stocks are outperforming physical gold, and could represent a "catch up" trade going into...

READ MORE

MEMBERS ONLY

Five Stocks Showing Strength in a Bearish Tape

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* There's strength in the financial sector, but it's not the banks.

* Auto parts remains a strong group in a struggling sector.

* Three-month highs often signal renewed strength.

Where can investors find a safe haven during a period of market uncertainty? Personally, I think it&...

READ MORE

MEMBERS ONLY

5 Strong Stocks Defying the Bearish Market!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave analyzes the bearish rotation in his Market Trend Model, highlighting the S&P 500 breakdown below the 200-day moving average and its downside potential. He also identifies five strong stocks with bullish technical setups despite market weakness. Watch now for key technical analysis insights to...

READ MORE

MEMBERS ONLY

My Downside Target for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Once our "line in the sand" of SPX 5850 was broken, that confirmed a likely bear phase for stocks.

* We can use Fibonacci Retracements to identify a potential downside objective based on the strength of the previous bull trend.

* A confirmed sell signal from the Newer...

READ MORE

MEMBERS ONLY

S&P 500 Selloff: Bearish Rotation & Key Downside Targets!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave analyzes market conditions, bearish divergences, and leadership rotation in recent weeks. He examines the S&P 500 daily chart, highlighting how this week's selloff may confirm a bearish rotation and set downside price targets using moving averages and Fibonacci retracements. To validate a...

READ MORE

MEMBERS ONLY

3 Compelling Charts in the Financial Sector

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* ICE pushed to a new all-time high this week, completing a bullish rotation after finding Fibonacci support.

* V has experienced a series of bullish breakouts after completing a cup-and-handle pattern in 2024.

* JPM has pulled back to an ascending 50-day moving average, suggesting a potential short-term low during...

READ MORE

MEMBERS ONLY

Bearish Signals & Risk Management: Protect Your Portfolio!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave breaks down bearish macro signals and risk management using the "line in the sand" technique! Learn how to spot key support levels, set alerts on StockCharts, and protect your portfolio!

This video originally premiered on February 26, 2025. Watch on StockCharts' dedicated David...

READ MORE

MEMBERS ONLY

AMZN: A Case Study in Bearish Divergence

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In the later stages of a bull market cycle, we will often observe a proliferation of bearish momentum divergences. As prices continue higher, the momentum underneath the advance begins to wane, representing an exhaustion of buyers.

We've identified a series of bearish momentum divergences in the early days...

READ MORE

MEMBERS ONLY

Three Signs of the Bear and What May Come Next!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Bearish momentum divergences suggest potential exhaustion of the bulls and limited upside.

* Market breadth indicators have not confirmed recent highs, reflecting a lack of support outside the leading performers.

* Dow Theory non-confirmation, a pattern first identified by Charles Dow, shows that market indexes are not confirming one another....

READ MORE

MEMBERS ONLY

Master Multiple Timeframe Analysis With This Simple Method

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* We can use the slope of moving averages, as well as a simple crossover technique, to define trends and identify trend changes.

* Our Market Trend Model uses exponential moving averages, as they are more sensitive to changes in market direction.

* Based on our Market Trend Model, the S&...

READ MORE

MEMBERS ONLY

Bearish Divergences Plaguing Former Leadership Names

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* META and NFLX remain in strong uptrend phases, with limited drawdowns in 2025.

* Four of the Mag7 names can be classified as "broken charts", with recent breakdowns representing an important change of character.

* AMZN and GOOGL offer perhaps the most concerning short-term patterns, with bearish momentum...

READ MORE

MEMBERS ONLY

Are the Once High-Flying MAG 7 Stocks Just Mediocre Now?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave breaks down the formerly high-flying Mag 7 stocks into three distinct buckets. These include long & strong (META, NFLX & AMZN), broken down (TSLA, AAPL, MSFT & NVDA), and questionable (GOOGL). He also shows how GOOGL is not the only leading name featuring a bearish momentum...

READ MORE

MEMBERS ONLY

Three Technical Tools to Minimize Endowment Bias

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Have you ever held on too long to a winning position? You watch as that former top performer in your portfolio slows down, and then rotates lower, and then really begins to deteriorate, and you just watch it all happen without taking action?

If the answer is "yes"...

READ MORE

MEMBERS ONLY

Top 10 Charts to Watch for in February 2025

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While the major equity averages are certainly up year-to-date, we're detecting a growing number of signs of leadership rotation. As the Magnificent 7 stocks have begun to falter, with charts like Apple Inc. (AAPL) taking on a less-than-magnificent luster in February, we've identified ten key stocks...

READ MORE

MEMBERS ONLY

Three Behavioral Biases Impacting Your Portfolio Right Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave reveals three common behavioral biases, shows how they can negatively impact your portfolio returns, and describes how to use the StockCharts platform to minimize these biases in your investment process. He also shares specific examples, from gold to Pfizer to the S&P 500, and...

READ MORE

MEMBERS ONLY

What's NEXT for Semiconductors After Monday's SHOCKING Drop?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave reviews the VanEck Semiconductor ETF (SMH) from a technical analysis perspective. He focuses on the recent failure at price gap resistance, the breakdown below price and moving average support, and the frequent appearance of bearish engulfing patterns which have often indicated major highs over the last...

READ MORE

MEMBERS ONLY

Semiconductors Have More to Prove Before Breakout is Believed

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The VanEck Vectors Semiconductor ETF (SMH) broke out of a six-month base this week, suggesting further upside potential.

* While the breakout in SMH appears bullish, the ETF still has yet to eclipse a key price gap from July 2025.

* A bearish engulfing pattern to end the week indicates...

READ MORE

MEMBERS ONLY

Market Internals Point to Large Growth Leadership

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* While the stronger US Dollar suggests caution for growth stocks, the ratios shows that growth continues to dominate value.

* While macro conditions appear beneficial for small cap stocks, large caps are back to a confirmed leadership role.

* Measures of offense vs. defensive suggest that investors are favoring offense...

READ MORE

MEMBERS ONLY

Five Key Market Ratios Every Investor Should Follow

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave shares five charts from his ChartList of market ratios that investors can use to track changing market conditions through 2025. If you want to better track shifts in market leadership, identify where funds are flowing, and stay on top of evolving market trends, make sure to...

READ MORE

MEMBERS ONLY

How the S&P 500 Reaches 6500 By March 2025

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The S&P 500 experienced a sudden upside reversal to finish the week right around the 6000 level.

* If the market reacts positively to earnings, and Trump's new administration takes a more conservative approach, we could see the S&P 500 reach 6500 by...

READ MORE

MEMBERS ONLY

What Would It Take For Small Caps to Lead?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Financials represent one of the top sector weights in the IWM, and banks have kicked off earnings season with renewed strength.

* A resurgence in biotech stocks, one of the largest industries represented in the IWM, could provide an upside catalyst.

* US Dollar strength could adversely impact mega cap...

READ MORE

MEMBERS ONLY

The Bullish Case for Small Caps vs. Large Caps

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Will small cap stocks finally take on a leadership role in 2025? In this video, Dave provides a thorough technical analysis discussion of the Russell 2000 ETF (IWM) and how that compares to the current technical configuration of the S&P 500 index. He also shares three charts he&...

READ MORE