MEMBERS ONLY

Technology Shares PLUNGE to Kick Off 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Mish Schneider of MarketGauge talks strength in small caps, leadership in retail, and the importance of watching junk bonds for risk-on conditions. Dave charts pullbacks in AAPL and NVDA, and shares two names pushing higher as value beats growth...

READ MORE

MEMBERS ONLY

Unlocking Russell 2000 SECRETS & Volatility INSIGHTS!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this special all-Mailbag edition of StockCharts TV'sThe Final Bar, Dave answers viewers' burning questions, ranging from the effectiveness of short-term moves with the 5-day MA to deciphering the mysteries of the Russell 2000's growth or value positioning and much more!

Click here to take...

READ MORE

MEMBERS ONLY

The Top Five Charts of 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* 2023 was dominated by mega cap growth stocks, but the fourth quarter saw a potential change as other sectors experienced renewed vigor.

* Three breadth indicators provided great clarity to the up and down cycles over the course of the year, as extreme readings tended to coincide with major...

READ MORE

MEMBERS ONLY

Top Five Charts of 2023 #5: Bitcoin

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In the fifth of a five-part special series on StockCharts TV'sThe Final Bar, Dave dives into the fascinating world of Bitcoin. Discover the incredible growth and performance of cryptocurrencies in 2023, surpassing even the stock market. Find out why Bitcoin's sudden breakouts and significant rallies make...

READ MORE

MEMBERS ONLY

Top Five Charts of 2023 #4: Leadership Themes

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In the fourth of a five-part special series on StockCharts TV'sThe Final Bar, Dave discusses the top leadership trends of 2023. From the concept of narrow leadership to the rise of the Magnificent Seven, he explores the most important themes that shaped the year in this engaging episode....

READ MORE

MEMBERS ONLY

Top Five Charts of 2023 #3: Market Breadth Indicators

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In the third of a five-part special series on StockCharts TV'sThe Final Bar, Dave breaks down three market breadth indicators that tell the story of market conditions in 2023. By analyzing the S&P 500 Bullish Percent Index, the percentage of stocks above their 50-day moving average,...

READ MORE

MEMBERS ONLY

Top Five Charts of 2023 #2: Ten-Year Treasury Yield

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In the second of a five-part special series on StockCharts TV'sThe Final Bar, Dave takes a deep dive into the bond markets, talking rising rates, Fed rate hikes, value vs. growth, inverted yield curves, and what the bond markets in 2023 could tell us about potential future paths...

READ MORE

MEMBERS ONLY

Top Five Charts of 2023 #1: S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In the first of a five-part special series on StockCharts TV'sThe Final Bar, Dave walks through the S&P 500 index quarter by quarter. From the strong rally phase in the 2nd quarter to the dramatic reversal at the October low, 2023 has provided a perfect case...

READ MORE

MEMBERS ONLY

Extreme Breadth Readings Say Short-Term Bearish, Long-Term Bullish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

By late October, the market conditions were dire indeed. The S&P 500 had broken below its 200-day moving average for the first time since March. Only 10% of S&P 500 members remained above their 50-day moving average, meaning a full 90% were below this key short-term...

READ MORE

MEMBERS ONLY

Larry Williams' 2024 Market Outlook

by Larry Williams,

Veteran Investor and Author

by David Keller,

President and Chief Strategist, Sierra Alpha Research

On this edition of StockCharts TV'sThe Final Bar, legendary trader and author Larry Williams joins Dave to share his lessons learned in 2023, his outlook for stocks in 2024, and which cycles he feels all investors should be following into the new year.

This video originally premiered on...

READ MORE

MEMBERS ONLY

Small-Caps Rocket to the Upside, Leave Large-Caps in the Dust

by David Keller,

President and Chief Strategist, Sierra Alpha Research

On this edition of StockCharts TV'sThe Final Bar,Julius de Kempenaer of RRG Research points out that growth vs. value is now more of a small vs. large question, with small caps rocketing to the upside in December. Host David Keller, CMT recaps the top charts of the...

READ MORE

MEMBERS ONLY

Blow-Off Top?! Market Reacts to the FED Announcement

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Happy Fed Day on this edition of StockCharts TV'sThe Final Bar. There was quite a bit of movement leading into the FOMC announcement, with exceptional amounts of movement afterwards. Markets continued to push aggressively to the upside, with the S&P 500 closing the day out above...

READ MORE

MEMBERS ONLY

This Industry Group Outperformed the S&P 500 by OVER 120% in 2023!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Joe Rabil of Rabil Stock Research shares his biggest takeaway from investing in 2023 and also conducts a deep dive in the Consumer Discretionary sector with a focus on four stocks: SIG, TSLA, RL, and ABNB. Meanwhile, Dave unveils...

READ MORE

MEMBERS ONLY

Renewed UPTREND for Semis -- SMH and SOXX ETFs Breaking Out!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps the renewed uptrend for semis, with ETFs like SMH and SOXX breaking out despite a lack of participation from the largest semiconductor name, Nvidia (NVDA). He answers viewer questions on QQQ, Netflix (NFLX), Resmed (RMD), Avis Budget Group...

READ MORE

MEMBERS ONLY

Will the S&P 500 Push Above 4600 Before Year-End?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The S&P 500 index has stalled out at its July high around 4600, and overbought readings from RSI indicate a likely pullback.

* Breadth indicators have reached bullish extreme readings, confirming the long-term bullish, short-term bearish thesis.

* Individual stocks from both growth and value sectors are overbought...

READ MORE

MEMBERS ONLY

Top 10 Charts to Watch in December 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, Dave is joined by StockCharts' own Grayson Roze as they break down the trends for the top ten stocks and ETF charts for December 2023. Together, they identify key levels and signals to watch for using technical analysis tools...

READ MORE

MEMBERS ONLY

Lift Off! Aerospace and Defense Stocks Showing Multi-Year Breakout

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Jeff Huge, CMT of JWH Investment Partners highlights one industry within the Industrial sector showing a multi-year breakout, and lays out the bull case for gold in 2024. Dave reviews travel and tourism charts, speaks to the strength in...

READ MORE

MEMBERS ONLY

High Risk of Market Downside in December?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest John Kosar, CMT of Asbury Research updates his Asbury Six tactical market model and shares how investors can be better positioned for market uncertainty into 2024. Host Dave highlights the strong rally in financials and airlines, and reveals one...

READ MORE

MEMBERS ONLY

Trend Channels Help Define Stock Pullback Scenarios

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Sam Burns, CFA of Mill Street Research focuses on strength in financials, weakness in crude oil, and key macro themes he'll be tracking into 2024. Meanwhile, Dave tracks the relentless upswing for Bitcoin, the pullback in gold...

READ MORE

MEMBERS ONLY

Is Every Stock on the Planet Overbought?!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, host David Keller, CMT shows how mega-cap growth stocks like NFLX and GOOGL have pulled back from overbought conditions, and reviews how other market segments like gold and small caps are experiencing a similar pattern of upside exhaustion. He takes...

READ MORE

MEMBERS ONLY

Pullback Imminent for Nasdaq 100

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The recent upside gap around $380 was a key moment for the QQQ, but if leading growth stocks continue to drop, this level may come into question.

* While a new all-time high for the Nasdaq 100 is a possibility over the next six to eight weeks, the overbought...

READ MORE

MEMBERS ONLY

Follow This Powerful Seasonal Playbook in Election Years

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Jeff Hirsch of theStock Trader's Almanacshares the suggested seasonal pattern for 2024 and breaks down how previous election years have played out. Host David Keller, CMT highlights a breakout in gold miners, regional banks breaking above their...

READ MORE

MEMBERS ONLY

Market Secrets Revealed! Final Bar Mailbag -- US Dollar, S&P 500 ETF, Fibonacci Pivots

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave devotes the show to the Mailbag. He answers viewer questions about the impact of the US Dollar on the stock market, why he uses the S&P 500 ETF rather than the S&P Index for relative...

READ MORE

MEMBERS ONLY

Breadth Analysis Suggests Pullback From S&P 4600

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave reviews the latest market breadth indicators, some of which are indicating a likely pullback from resistance around the 4600 level for the S&P 500. He also focuses on stocks with actionable patterns including GOOGL, NFLX, SPOT, NVDA,...

READ MORE

MEMBERS ONLY

A NEW ERA of Growth Leadership?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Mary Ann Bartels of Sanctuary Wealth describes how falling interest rates could pave the way for another leadership by mega-cap growth stocks, including semiconductors. Host David Keller, CMT breaks down two market breadth indicators to watch into December and...

READ MORE

MEMBERS ONLY

Magnificent 7 Stocks Testing HUGE Resistance

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down the technical setups on all of the Magnificent 7 stocks, addressing the balance between strong trends and overbought conditions. He answers viewer questions on investor sentiment, trailing stops, potential upside for TSLA, and the latest thinking on...

READ MORE

MEMBERS ONLY

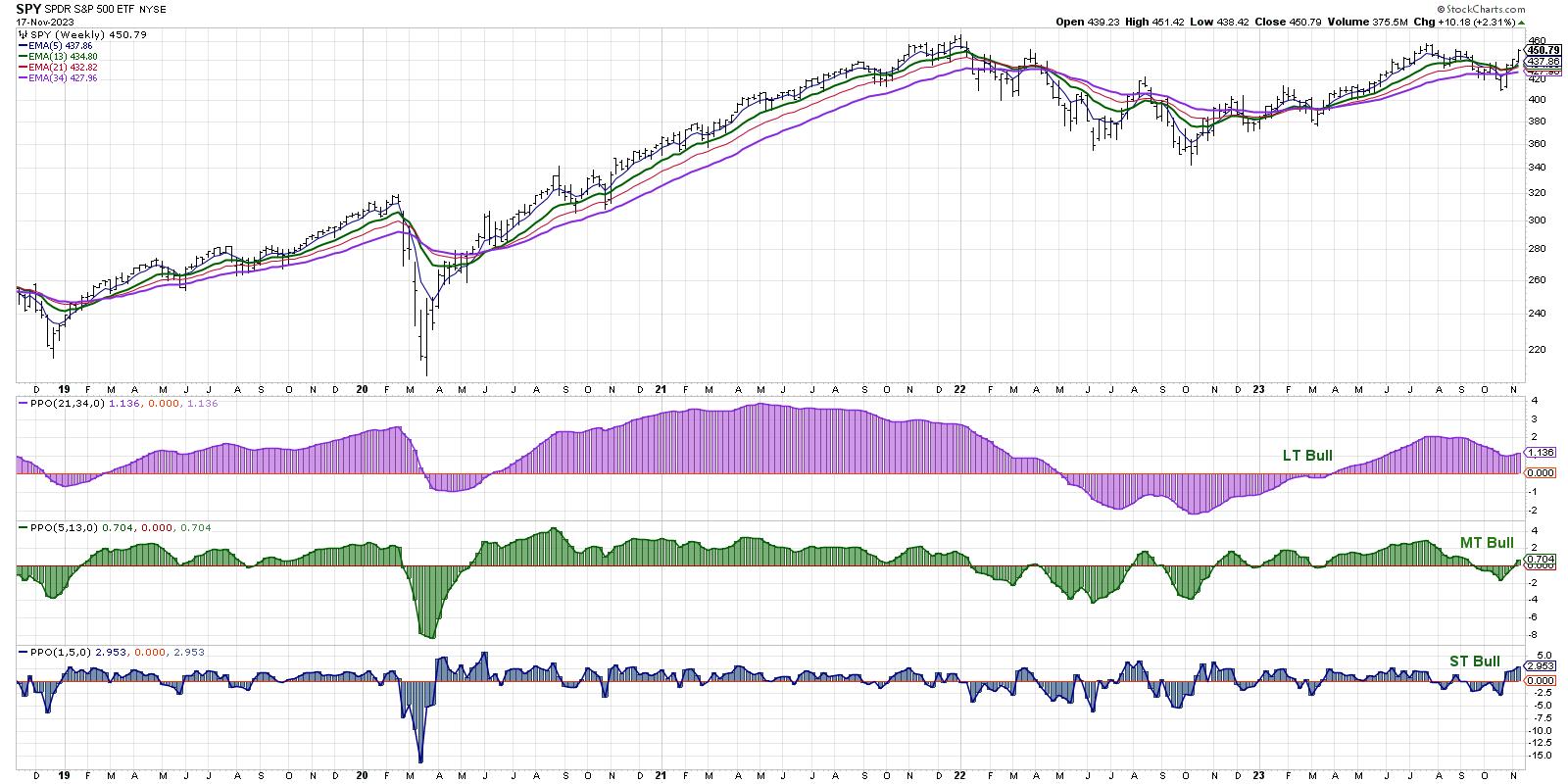

My Market Trend Model is Pretty Bulled Up

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* We use a series of weekly exponential moving averages to define the trend on three time frames.

* The medium-term model just turned bullish, suggesting a risk-on environment for stocks.

* Our Market Trend Model had a similar setup in March 2022, before a downturn eliminated the bullish configuration.

Am...

READ MORE

MEMBERS ONLY

Cutting-Edge Seasonality Insights & Bitcoin 2024 Halving Impact

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this special edition of StockCharts TV'sThe Final Bar, guest Adrien Zduńczyk, CMT, of The Birb Nest shares a groundbreaking seasonality study he created with Jeff Hirsch ofStock Trader's Almanac. Adrien and Dave explain how November and December tend to be seasonably strong for Bitcoin, why...

READ MORE

MEMBERS ONLY

The Case for Small-Caps as Major Indexes Test Overbought Conditions

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Craig Johnson, CFA CMT of Piper Sandler shares his long-term charts of the S&P 500 and 10-Year Treasury Yield and makes the case for small caps through year-end 2023. Dave shares one breadth indicator reaching a bearish extreme...

READ MORE

MEMBERS ONLY

Three Ways to Stay on the Right Side of the Market

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Dave Landry of DaveLandry.com reveals his three charts to define the market trend, limit losses, and stay on the right side of the market. Host David Keller, CMT targets names trading higher and testing key resistance, including TGT,...

READ MORE

MEMBERS ONLY

Stocks and Bonds SOAR After October CPI

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Pete Carmasino of Chaikin Analytics puts this week's action into long-term perspective using his charts of bond prices, interest rates, unemployment, and regional banks. Dave highlights three stocks with actionable signals this week: ROST, FSLR, and MCK....

READ MORE

MEMBERS ONLY

Finding Setups as Markets Wait for October CPI

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave identifies bullish and bearish momentum divergences as the equity and bond markets await the October CPI reading on Tuesday morning. He answers questions covering Brent crude oil prices, uranium stocks, inverse head and shoulders patterns, and upside potential for...

READ MORE

MEMBERS ONLY

Why is S&P 4400 So Important Right Now?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Charles Dow first popularized the concept of trends as defined by the pattern of peaks and valleys in price action.

* We can create shaded areas on a chart based on traditional support and resistance levels to create a "stoplight" effect to better define the market phase....

READ MORE

MEMBERS ONLY

Decoding Bear Markets, Divergences, & More! A Q&A with David Keller, CMT

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave dives deep into the world of market dynamics and technical analysis to answer YOUR burning questions! He talks topics like point and figure charts, moving averages, Nomura Holdings (NMR), Arthur J. Gallagher & Co. (AJG), and more!

This video...

READ MORE

MEMBERS ONLY

Top Ten Hidden Features of StockCharts, Features 6-10

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave takes a closer look at some key features on StockCharts and how to use them in new and improved ways, in order to gain a deeper understanding of market dynamics and price behavior. You might even stumble upon some...

READ MORE

MEMBERS ONLY

Top Ten Hidden Features of StockCharts, Features 1-5

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave takes a closer look at some key features on StockCharts and how to use them in new and improved ways, in order to gain a deeper understanding of market dynamics and price behavior. You might even stumble upon some...

READ MORE

MEMBERS ONLY

Why are Higher Interest Rates a Big Deal?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Mike Singleton of Invictus Research describes the impact of higher interest rates on consumer spending and growth stock valuations. Host David Keller, CMT charts the breakout for the QQQ and reviews stocks reporting earnings, including DKNG, UBER, and more....

READ MORE

MEMBERS ONLY

This Key Resistance Level is Crucial for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down the charts of the S&P 500 and Nasdaq 100 with a focus on the downtrend channel for the QQQ and key resistance at 4400 for the S&P 500. He answers viewer questions on...

READ MORE

MEMBERS ONLY

Trading the QQQ in Three Timeframes

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The short-term trend for the QQQ is positive after this week's rally, but price is now at the upper edge of a downtrend channel.

* On the medium-term timeframe, the downtrend channel is still intact, and the momentum reading is still in line with a bearish phase....

READ MORE

MEMBERS ONLY

Top Ten Charts to Watch in November 2023

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

In this edition of StockCharts TV'sThe Final Bar, join Dave and Grayson as they break down the trends for the top ten stocks and ETF charts for November 2023. Watch as they identify key levels and signals to keep an eye out for using the power of StockCharts&...

READ MORE