MEMBERS ONLY

Everyone Talks About Leaving a Better Planet for Our Children: Why Don't We Leave Better Children for Our Planet?

by Gatis Roze,

Author, "Tensile Trading"

Most religions of the world have the fundamental beliefs that are strikingly similar to the Ten Commandments. History has taught humanity that life does not seem to work well without such guiding principles. As responsible parents, we should have a parallel foundation of ten life skills that we impart part...

READ MORE

MEMBERS ONLY

My Durable Advantage as an Investor is My Experience: Here are Seven Examples

by Gatis Roze,

Author, "Tensile Trading"

It scares me to admit I've been investing for over 50 years. It's been a great ride, and fortunately I'm still going strong. One of my investment mantras thru all these years has been Charlie Munger's quintessential advice: "try to be...

READ MORE

MEMBERS ONLY

The Easiest Road to Supercharge Your Investing Reflexes and Reactions!

by Gatis Roze,

Author, "Tensile Trading"

Riches are found in reactions—your reactions to changes in the markets. By this, I mean that if you spot a change in money flowing from one asset class to another, one sector to another, one industry to another, before the masses notice, you will be rewarded handsomely. My experience...

READ MORE

MEMBERS ONLY

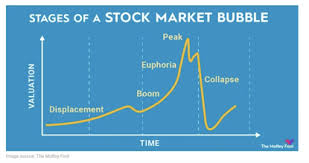

Six Dance Steps to Remember for an Extended Market

by Gatis Roze,

Author, "Tensile Trading"

"An investment in Knowledge pays the best interest." — Benjamin Franklin

It's time to revisit a few timeless lessons regarding extended markets.

As I write this, the last correction of any significance was in 2022. The past two years have been one heck of a dance if...

READ MORE

MEMBERS ONLY

Step 1: Asset Creation, Step 2: —————?, Step 3: Asset Growth

by Gatis Roze,

Author, "Tensile Trading"

The secret sauce of 1-2-3 investing is quite simple: don't skip Step 2. Far too many investors who've succeeded in creating wealth are anxious to rush forward with "all gas, no brakes" to embrace the excitement of Step 3 - Asset Growth. Only in...

READ MORE

MEMBERS ONLY

3 Essential Lessons We Investors Can Learn from Top Winemakers

by Gatis Roze,

Author, "Tensile Trading"

"It takes 10 years to learn from the vineyard, and another 10 years to learn the wine from that vineyard."

Metaphors and analogies are powerful teachers and offer behavioral adhesiveness. In other words, the ideas and lessons they present stick in our memory, and can thus more easily...

READ MORE

MEMBERS ONLY

How to Stop the "Wealth Destroyers" by Deploying Your Sell Methodology

by Gatis Roze,

Author, "Tensile Trading"

"We are in the business of making mistakes. Winners make small mistakes. Losers make big mistakes."

There are zillions of cliches that paraphrase what Ned Davis said. The umbrella axiom with your portfolio should be to cut your losers.

Nude investing is what I label an investor without...

READ MORE

MEMBERS ONLY

Your Selling Methodology is Your Paramedic to Profits

by Gatis Roze,

Author, "Tensile Trading"

"When you feel like bragging, it's probably time to sell." — John Neff

Stock market investing is simple, really. You only need to make two choices: when to buy and when to sell. The unfortunate reality is that 75% of casual investors really only want to hear...

READ MORE

MEMBERS ONLY

Common Lessons Amongst Corporate, Sports & Investment Portfolio Turnarounds!

by Gatis Roze,

Author, "Tensile Trading"

My many decades of business, investing, and sports experience has shown me time and time again that parallel lessons in all three arenas are remarkably worthy teachers. One essential lesson today (January 2024) is to not allow yourself to become a "legend in your own mind." Yes, you...

READ MORE

MEMBERS ONLY

The 2 Best Holiday Gifts You Can Give Your Kids!

by Gatis Roze,

Author, "Tensile Trading"

Let's begin with the bottom line.

As parents, our reason for being here on planet Earth is to pass on to our children the life skills they'll need to succeed. Everyone talks about leaving a better planet for our children; why don't we try...

READ MORE

MEMBERS ONLY

Don't Even Think About Investing Without Addressing These 10 Essentials (Part 2: Essentials #6 - #10)

by Gatis Roze,

Author, "Tensile Trading"

I'm not an investment arsonist! I won't try to convince you that stock market perfection is achievable. I will, however, guarantee (strong word) that if you put in the effort, the results will be as Vince Lombardi often claimed: "Perfection is not attainable, but if...

READ MORE

MEMBERS ONLY

Don't Even Think About Investing Without Addressing These 10 Essentials (Part 1: Essentials #1 - #5)

by Gatis Roze,

Author, "Tensile Trading"

We investors are frequently guilty of hearing only what we want to hear. The justification often being "that doesn't apply to me." Or my other favorite line, "Oh, I don't do that." In my previous blog — a tribute to William J. O&...

READ MORE

MEMBERS ONLY

How William O'Neil - The Legendary Investor - Changed My Life

by Gatis Roze,

Author, "Tensile Trading"

I felt it only right to publicly acknowledge and thank William J. O'Neil for the lifestyle I enjoy today. He passed away in May at the age of 90, and I wanted to wait until now to explain how he changed my life.

William O'Neil was...

READ MORE

MEMBERS ONLY

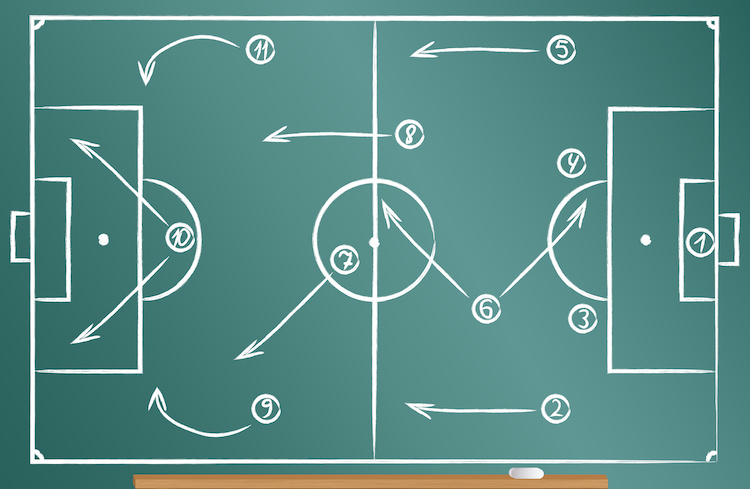

Investor Lessons from the World Cup in Qatar

by Gatis Roze,

Author, "Tensile Trading"

Excellence that we investors can learn from and utilize in our trades is all around us. I encourage you to harness that energy. Here's how to use it to motivate yourself to become better as a trader and investor.

As I watched the World Cup Soccer matches in...

READ MORE

MEMBERS ONLY

The Pearls Of Wisdom I Took Away From ChartCon 2022: Part 2

by Gatis Roze,

Author, "Tensile Trading"

Gosh, I was pleased that so many of you emailed me with your own pearls of wisdom gleaned from ChartCon 2022. It shows once again that investors can look at the same chart and have vastly different takeaways. Likewise, they can attend the same investment conference and have a diverse...

READ MORE

MEMBERS ONLY

The Pearls Of Wisdom I Took Away From ChartCon 2022: Part 1

by Gatis Roze,

Author, "Tensile Trading"

I'm going to share with you some of the gems and pearls of wisdom that I personally took away from the recent ChartCon 2022 Investor Conference. You may recall some of these nuggets. Others you won't because they occurred in belly-to-belly discussions behind the scenes.

Therein...

READ MORE

MEMBERS ONLY

Five Decades Of Personal Stock Market Passages, Tools, Lessons And Stories: Part 3

by Gatis Roze,

Author, "Tensile Trading"

When I began investing full-time, my methodology's foundation was based on William O'Neil's CANSLIM® approach. It's a deeply researched and proven strategy. The AAII's own ongoing trading models validate that fact.

For the next three decades, my efforts were focused...

READ MORE

MEMBERS ONLY

Five Decades Of Personal Stock Market Passages, Tools, Lessons And Stories: Part 2

by Gatis Roze,

Author, "Tensile Trading"

To start, I want to make two points. Investing successfully requires that you remain engaged and motivated. Just because you choose to ignore the markets, the markets won't reciprocate and ignore you. Zig Ziglar said, "People often say that motivation doesn't last. Well, neither does...

READ MORE

MEMBERS ONLY

Five Decades Of Personal Stock Market Passages, Tools, Lessons And Stories: Part 1

by Gatis Roze,

Author, "Tensile Trading"

Successful investing calls for much the same prerequisites as those required to become a professional athlete. Fortunately, we investors have a much longer shelf life than pro athletes. Here's how I took advantage of this reality.

Maturing as an investor does not automatically mean you are becoming a...

READ MORE

MEMBERS ONLY

Portfolio Profits Grow From Your Investment Garden: Here's How to Plant, Water And Weed It

by Gatis Roze,

Author, "Tensile Trading"

FACT: If investors make money, they remain engaged in the stock market with all its splendor and immense potential. If they lose money, they usually lose interest and move on. Over the past two decades, my role as I've embraced it has been to help you maximize those...

READ MORE

MEMBERS ONLY

How I Combat Disinformation And Prevent It From Corrupting My Portfolio With 5 Essential Tools

by Gatis Roze,

Author, "Tensile Trading"

Recently, academic researchers have proven and quantified the impact of fake news and how it sways stock prices to the tune of approximately 7% with small-caps, 5% with mid-caps and somewhat less with large-caps. Disinformation and propaganda is all around us. As investors, we must be attuned to how these...

READ MORE

MEMBERS ONLY

Sushi Investing, Part 3: A Final Chapter Of The Secrets To Selling

by Gatis Roze,

Author, "Tensile Trading"

For those of you who've been investing for decades, you'll immediately grasp the significance and truth of Market Wizard Stanley Druckenmiller's quote: "Every great money manager I've ever met, all they want to talk about is their mistakes. There's...

READ MORE

MEMBERS ONLY

Sushi Investing, Part 2: How To Sell Equities Before The Expiration Date

by Gatis Roze,

Author, "Tensile Trading"

Within the stock market, selling profitably is considered an art. In the real world, most folks love art and are happy to talk about it. Institutional investors will talk about the "art of the exit" before they buy an equity. So why is it that individual investors deem...

READ MORE

MEMBERS ONLY

Sushi Investing, Part 1: The Secret To Producing Profits Before The Expiration Date

by Gatis Roze,

Author, "Tensile Trading"

Profits are the product of practicing a persistent pilgrimage towards perfecting your sell disciplines. To paraphrase a sports cliche, without an exceptional defense you won't win championships. Michael Jordan has unequivocally stated that without the defensive wizardry of Dennis Rodman, the Chicago Bulls would not have been world...

READ MORE

MEMBERS ONLY

The Evolution And Essential Foundations Of The Stock Market Mastery Methodology

by Gatis Roze,

Author, "Tensile Trading"

This past week, Grayson and I had the special pleasure of being interviewed by David Keller who, in the video, posed many pithy questions as to the evolution of our Stock Market Mastery methodology.

We each reflected on the investing foundations differently, but all three of us agreed on the...

READ MORE

MEMBERS ONLY

Eight Things You Can Do To Boost The Profitability Of Your Own ChartLists

by Gatis Roze,

Author, "Tensile Trading"

Yes - believe it!

The organization of your ChartLists is an extremely high leverage investing activity that YOU control. It does and will determine your profitability. Hence, it's worthy of your time and effort. As I often quote the entrepreneur and investor Michael Dell, "You don'...

READ MORE

MEMBERS ONLY

Supercharge Your Routines With This Simple Yet Powerful Organizational Trick

by Gatis Roze,

Author, "Tensile Trading"

Academic research has proven that the profitability of investors and traders is directly linked to the quality of their organizational routines and their discipline to follow those routines.

One of the most delicious tools we have in our organizational arsenal is using different symbols as prefixes for equities in our...

READ MORE

MEMBERS ONLY

The Essential Foundation Of Stock Market Mastery Is Straightforward

by Gatis Roze,

Author, "Tensile Trading"

The investment press seems to be writing a good deal these days about mindfulness and living in the present. Similarly, a number of sports analysts are preaching the need of a "back to basics" philosophy for certain struggling athletic franchises.

My own take on all this is less...

READ MORE

MEMBERS ONLY

How To Rank, Rate And Grade The Stocks In Your Watchlist

by Gatis Roze,

Author, "Tensile Trading"

We chartists are a dedicated lot, but at the risk of alienating my fellow technicians, we are sometimes too myopically focused just on charts at the expense of profits and have been known to succumb to something I'll label "The Shiny Chart Syndrome". This blog is...

READ MORE

MEMBERS ONLY

An 18-Year Living Investment Experiment And Its Most Impactful Conclusions

by Gatis Roze,

Author, "Tensile Trading"

Last month, Grayson and I had the pleasure of Zooming online to a combined audience of both the Los Angeles and San Diego chapters of the AAII. Our investment talk to this significant group of investors was presented in three distinct pods of investment strategy and money management topics. It...

READ MORE

MEMBERS ONLY

Your Dashboard To Profits In 2021: Stock Market Mastery ChartPack - Update #31 (Q1 / 2021)

by Grayson Roze,

Chief Strategist, StockCharts.com

by Gatis Roze,

Author, "Tensile Trading"

Welcome to a virtual SWAT team of elite charts and essential organized routines. This Stock Market Mastery ChartPack is now 15 years in existence. Eight years ago we made it available to the public but prior to that, I used it in my college investment courses. The point being, that...

READ MORE

MEMBERS ONLY

How And When You Should Talk To Your Children About Money - And Why You Should Do It NOW!

by Gatis Roze,

Author, "Tensile Trading"

A frightening statistic from American Express several years ago found that over 90% of couples consistently defer ever talking about money matters with themselves and their kids. They come up with any manner of reasons not to discuss what is crucial to their lives and their futures. My belief is...

READ MORE

MEMBERS ONLY

Balance: How It Puts Money In Your Pocket, And How You Can Achieve It

by Gatis Roze,

Author, "Tensile Trading"

I just revisited the past 30 years of my trading journals. The objective of my little research study was to investigate whether there was a discernible correlation between my actual annual investment performances and if they were impacted by what I'll label as my "personal annual equilibrium...

READ MORE

MEMBERS ONLY

Why ETFs Are Best-Of-Breed For Only 50% Of Your Asset Classes

by Gatis Roze,

Author, "Tensile Trading"

This is an update to an important blog I wrote three years ago. Investors have once again been misled by the media and bamboozled by ETF sponsors such as iShares, SPDRs and Invesco. Exchange traded funds (ETFs) are not the panacea for every asset class as they all want you...

READ MORE

MEMBERS ONLY

You Profit By Respecting The Sacred Trinity Of The Stock Market

by Gatis Roze,

Author, "Tensile Trading"

If you can embrace this metaphor, consistent profits are achievable. Think of the stock market as a mythical beast that feeds on truths but its behavior is driven by rumors and beliefs. To tame this creature, your suit of armor must be woven with the finest cloth of emotional control....

READ MORE

MEMBERS ONLY

Nearly Every Stock Market Question Can Be Answered By The Tensile Trading ChartPack - Update #30 (Q4 / 2020)

by Grayson Roze,

Chief Strategist, StockCharts.com

by Gatis Roze,

Author, "Tensile Trading"

Willie Sutton, the notorious bank robber from the 1920s and 30s, was asked once by a reporter why he robbed banks. He famously replied, "Because that's where the money is." Similarly in my seminars, blogs and books, I've preached for years that achieving consistent...

READ MORE

MEMBERS ONLY

How To Draft Stocks With A Profitable "Personality" And Build A Winning Portfolio

by Gatis Roze,

Author, "Tensile Trading"

FACT: If you investigate the skill sets of the top tier General Managers of your favorite pro sports league, you'll recognize uncanny parallels to the top tier traders described in the Market Wizard books. This is not a coincidence.

Some 20 years ago, I discovered a breakthrough that...

READ MORE

MEMBERS ONLY

Insights, Lessons Learned And Skills Reinforced From 11 Market Wizards In 2020

by Gatis Roze,

Author, "Tensile Trading"

The catalyst for this blog is the new Stock Market Wizards book that happily appeared under my Christmas tree last week. When I opened this gift, I was in the midst of doing my own annual page-by-page review of my personal Traders Journal for the year 2020. Putting that aside,...

READ MORE

MEMBERS ONLY

Evaluating 2020: Did My Stock Picks Or My Asset Allocation Skills Generate The Most Profits?

by Gatis Roze,

Author, "Tensile Trading"

I'll be candid with you about my portfolio performance if you'll agree to be candid about yours.

This is the time of year when I subscribe to the routines outlined in Stage 10 of our book, Tensile Trading. The section entitled "Revisit, Retune, Refine"...

READ MORE

MEMBERS ONLY

Trader vs. Investor, IRS vs. Investor Self

by Gatis Roze,

Author, "Tensile Trading"

"It's not how much money you make, but it's how much money you keep."

—Robert Kiyosaki

This blog addresses two of my favorite topics:

(1) Minimizing taxes

(2) Aligning what we call your "Investor Self" with the unique type of trading or...

READ MORE