MEMBERS ONLY

Discipline Is A Synonym For Profitability In The Stock Market - Here's How To Achieve Both

by Gatis Roze,

Author, "Tensile Trading"

Maintaining the mindset of a serious investor takes discipline. Personally, I have found necessary motivations amongst sports analogies and metaphors. I confess — I lean on them heavily. After 30 years, I've learned that stock market profitability is a synonym for discipline.

Anyone who doubts this should read Michael...

READ MORE

MEMBERS ONLY

The 7 Investing Essentials For New Investors and Recent Subscribers - ChartPack Update #29 (Q3 / 2020)

by Grayson Roze,

Chief Strategist, StockCharts.com

by Gatis Roze,

Author, "Tensile Trading"

This blog is addressed to the many thousands of recent new StockCharts subscribers. The explosive growth in our ranks suggested to me that a little welcome tutorial would be valuable. Any welcome message to an investor arena that aspires to be truthful must acknowledge upfront the "Paradox of Choice&...

READ MORE

MEMBERS ONLY

My Pocket Pads Produce Profits: 12 Sample Insights

by Gatis Roze,

Author, "Tensile Trading"

I've written multiple blogs about my pocket pads and how incessantly I jot down great insights and sustaining concepts whenever and however they cross my path. It's been a daily and profitable habit for decades.

Below is a link to a more descriptive past blog about...

READ MORE

MEMBERS ONLY

How Not To Let Five Media Frankensteins Devastate Your Portfolio

by Gatis Roze,

Author, "Tensile Trading"

No, this is not a political blog. This is three decades of blood-and-sweat soaked lessons gleaned from investing and following the media. Like condensed milk, it's all boiled down to the five essential "must knows" for you. These are the five Frankensteins that will kill your...

READ MORE

MEMBERS ONLY

After You've Pored Over The Charts And They've Yielded All Their Truths, Try These Tools

by Gatis Roze,

Author, "Tensile Trading"

Yes, I'm a chartist.

Yes, I can glean profitable insights using my technical tools.

No, charts are not the only tool in my analysis bag.

If that were the case, it would be akin to buying a Ferrari while living in a studio rental. That would be totally...

READ MORE

MEMBERS ONLY

The Dance Of The Outperformers: Peter Lynch Preaches You Best Start With Yourself

by Gatis Roze,

Author, "Tensile Trading"

Novice investors seldom like to hear that before asset growth (trading) must come asset protection. Boring! Similarly, they are reticent in embracing the reality that before they begin analyzing equities, they must first analyze themselves. Really? Legendary stock-picker Peter Lynch specifically warned investors of these "Investor Self" priorities....

READ MORE

MEMBERS ONLY

The Secret to Outperformance: Personal Teflon and Velcro - ChartPack Update #28 (Q2 / 2020)

by Grayson Roze,

Chief Strategist, StockCharts.com

by Gatis Roze,

Author, "Tensile Trading"

What is the singular attribute absolutely ALL successful investors you can name possess? It's resiliency! Consistency, profitability and longevity demand that an investor maintain an even keel through many challenging market cycles. The essential tool they all use are their "Routines". The end result: resiliency.

Routines...

READ MORE

MEMBERS ONLY

Here Comes The Sun

by Gatis Roze,

Author, "Tensile Trading"

I'm in the midst of a major life change. After 25 years in downtown Seattle, I've decided to move my office. Doing this during the fog of a pandemic seemed irrational at first blush. In truth, recalibrating the space in my brain at the same time...

READ MORE

MEMBERS ONLY

Peter Lynch's Radar: Stage #2

by Gatis Roze,

Author, "Tensile Trading"

Years ago, Peter Lynch (of Fidelity Magellan fame) preached that when looking for investment ideas, stock pickers should look closely where they shop and find those new alluring products and retail stores that held the most promise. Times change, of course, and the retail glass on the street is not...

READ MORE

MEMBERS ONLY

This Technician's Confession: There's One Essential Fundamental Indicator I've Embraced For Decades

by Gatis Roze,

Author, "Tensile Trading"

I've acknowledged in numerous previous blogs and in our book that I'm not exclusively a 100% pure chartist. I know... blasphemy!

Yes, I use fundamentals. I need fundamentals, I won't trade without fundamentals. But the key is that I'm neither a fundamentalist...

READ MORE

MEMBERS ONLY

Pro Sports Drafts: 7 Essential Lessons Investors Should Learn From The NFL, NBA, MLB and NHL

by Gatis Roze,

Author, "Tensile Trading"

In a recent survey of serious investors, it was uncovered that a majority are earnest sports fans. Count me guilty. As I write this, we just completed the National Football League's (NFL) draft. But the focus here is not on simply one sport. All the major pro sports...

READ MORE

MEMBERS ONLY

This Hasn't Been More Crucial In The 12 Years Since 2008: ChartPack Update #27 (Q1 / 2020)

by Gatis Roze,

Author, "Tensile Trading"

It's a new age. On March 25th, StockCharts TV held a sensational one-hour summit with 13 commentators focused on "Navigating the Bear Market". What came afterwards was equally big news. StockCharts made the commentators' charts available to download directly into your account together as a...

READ MORE

MEMBERS ONLY

Jesse Says "The Only Way You Get A Real Education..."

by Gatis Roze,

Author, "Tensile Trading"

When I was a young man, there was a goofy comedy film called "The Gumball Rally" about a group of cross-country lead-footed auto racers. In an opening sequence, the character racing in his Alfa Romeo sports car jumps into the driver's seat, quickly rips the rear...

READ MORE

MEMBERS ONLY

The Quarantined Investor: 10 Things To Raise Your Spirits And Your Returns

by Gatis Roze,

Author, "Tensile Trading"

First and foremost, a message to my readership: I hope you are staying safe and healthy during these difficult and unsettling times.

COVID-19 is wreaking havoc on our lives, our families, our jobs and the markets. I ask you all to be mindful of the older generation amongst us — those...

READ MORE

MEMBERS ONLY

5 Essential Lessons Investors Should Learn From Robo-Analysts And Robo-Advisors

by Gatis Roze,

Author, "Tensile Trading"

Robots beat us at chess and are driving our cars now too. FinTech is invading Wall Street and Main Street too. To say that robo-analysts and robo-advisors (think Betterment.com) are stock market disruptors is an understatement on so many levels. Even so, we individual investors still have advantages, but...

READ MORE

MEMBERS ONLY

The Straightforward Secret To Outperforming The 11 Sector SPDR ETFs

by Gatis Roze,

Author, "Tensile Trading"

There is no shortage of academic papers to validate the paramount importance of accurate sector analysis in producing market beating results. My own three decades of experience confirms this. Simply put, SECTORS MATTER! I was recently given the opportunity to attend a presentation by sector guru and strategist Denise Chisholm...

READ MORE

MEMBERS ONLY

Preparation Pays Profits, Randomness Ruins Riches - Deal With Both!

by Gatis Roze,

Author, "Tensile Trading"

Does your investing ecosystem look like meteorological chaos? Remember the three R's — Randomness Ruins Riches. You may recall Warren Buffett saying that he doesn't invest in anything he can't explain to a 10 year old. So here's my Buffett 3-R Challenge to...

READ MORE

MEMBERS ONLY

Here's Where Your Profits Will Be In 2020: ChartPack Update #26 (Q4 / 2019)

by Grayson Roze,

Chief Strategist, StockCharts.com

by Gatis Roze,

Author, "Tensile Trading"

Free money! Get your free money here! All you have to do is be willing to get off the sofa and walk over to the corner of the house where you adjust your portfolio. It's literally that easy. That's how simple it was using the ChartPack...

READ MORE

MEMBERS ONLY

Do You Use The "Krauthammer Conjecture" To Improve Your Sell Discipline?

by Gatis Roze,

Author, "Tensile Trading"

I know a majority of my fellow investors are also ardent sports fans who live-a-little or die-a-little with each win or loss by their respective team. The parallels to investing are self-evident. Afterall, our portfolios of equities are our teams as well.

According to the Krauthammer Conjecture, "the pleasure...

READ MORE

MEMBERS ONLY

Two Expectations For The New Year

by Gatis Roze,

Author, "Tensile Trading"

Happy New Year! In my world, this means looking backwards over the year just past and looking forwards to set goals for the year to come. A recent article in the Wall Street Journal about GRACE provided the catalyst for my thinking herein about my own expectations in the coming...

READ MORE

MEMBERS ONLY

The 10 Key Investing Lessons From Two Decades Of Teaching (1999 - 2019)

by Gatis Roze,

Author, "Tensile Trading"

After 20 years of teaching at over 200 continuing education classes, dozens of seminars and conferences and many other events, I've seen, heard, read, and watched it all. Witnessing 5,000 students over these years, I could write another book on the thousands of observations I've...

READ MORE

MEMBERS ONLY

Market Correction Coming: Here's Your Action Plan

by Gatis Roze,

Author, "Tensile Trading"

If you don't really know yourself, the market is an expensive place to learn about your "Investor Self". This axiom is most essential and relevant during a market correction. This blog is an exercise to help us all understand our own nature — ideally during the calm...

READ MORE

MEMBERS ONLY

Your Shortcut to Stock Market Mastery: ChartPack Update #25 (Q3 / 2019)

by Grayson Roze,

Chief Strategist, StockCharts.com

by Gatis Roze,

Author, "Tensile Trading"

Investing is like a plumbing game. For this reason, the organization and organization of your ChartLists, along with your routines, matter big time! Figuring out where the funds are flowing and adjusting your piping system accordingly is the key objective. In this case, its money flow which is being piped...

READ MORE

MEMBERS ONLY

Why Pick Stocks Over ETFs or Mutual Funds? My Personal Five Most Compelling Reasons

by Gatis Roze,

Author, "Tensile Trading"

Yes, this is personal. I'll share my own portfolio experiences from the past 25 years. Feel free to embrace those elements that strike you as most appropriate to your investing style.

First, a few ground-floor definitions before I get specific on the five reasons that motivate me to...

READ MORE

MEMBERS ONLY

Hail To The Sell-Side Savant: My Mentor

by Gatis Roze,

Author, "Tensile Trading"

I lost a mentor in September. Justin Mamis, who taught me how to formulate and engage my sell techniques, passed away at the age of 90. The lessons he taught me were the foundation for Stage Nine — the art of selling — in our book. I owe him an immeasurable debt...

READ MORE

MEMBERS ONLY

The Crisis of Complexity: A Solution

by Gatis Roze,

Author, "Tensile Trading"

Here's an important lesson I've learned. I'll call it the "crisis of complexity". There is something about most investors that makes them have an insatiable appetite for complexity. In reality, complexity is not the hoped-for portfolio accelerator — it is instead the detonator....

READ MORE

MEMBERS ONLY

Examples of Exit Disciplines Are All Around Us: Pay Attention!

by Gatis Roze,

Author, "Tensile Trading"

You board any airplane today and before it takes off, the flight attendants review all the exits with you. Cruise ships do life boat drills before departure. Exits on trains and buses are also clearly marked and labeled for emergencies. Clearly, the point is that you need to know how...

READ MORE

MEMBERS ONLY

Investing With Metaphors: These Three Are Giants!

by Gatis Roze,

Author, "Tensile Trading"

A personal secret: investing with metaphors has always enlightened and disciplined me, helping me grow as an individual investor. One of the most fertile areas for applying this axiom has been car collecting since, much like investing, it's never black and white. The reality is that both are...

READ MORE

MEMBERS ONLY

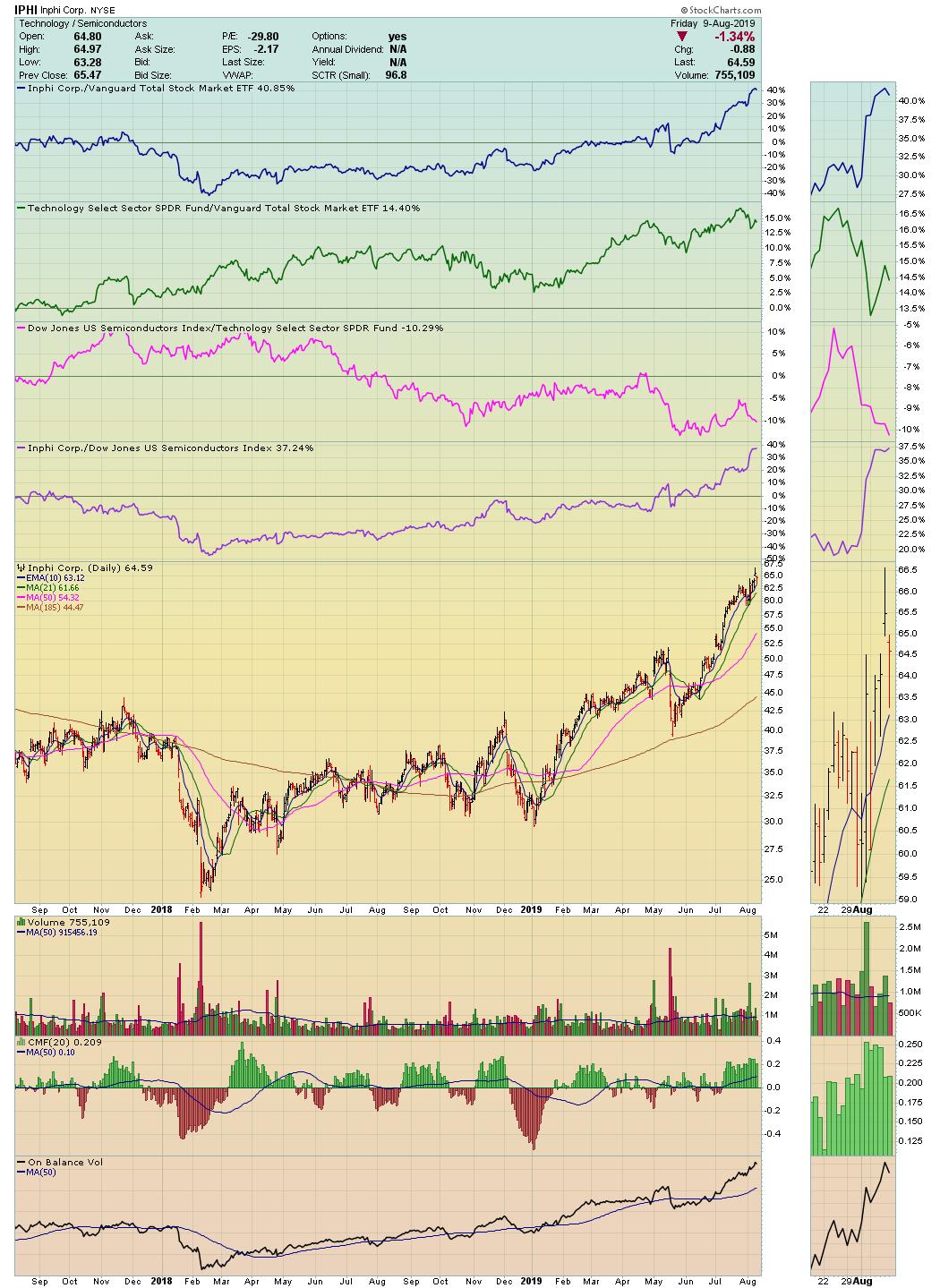

Achieve Clarity In A Nuanced Stock Market By Maximizing Relative Strength In Three Investing Arenas

by Gatis Roze,

Author, "Tensile Trading"

The stock market is indeed a nuanced creature. With that in mind, I'd like to show you how to use Relative Strength to understand what this creature is actually doing. You'll find that my suggested use of Relative Strength will keep your probability of success in...

READ MORE

MEMBERS ONLY

140 New Reasons to Join the ChartPack Investing Ecosystem - ChartPack Update #24 (Q2, 2019)

by Gatis Roze,

Author, "Tensile Trading"

Once again, a big shout-out to our Tensile Trading ChartPack User community. This has become a sensational crowd-sourced collection of the best-of-the-best charts and ChartList organization. We’re all profiting handsomely from improving this collaborative investing tool. Don’t be bashful. We invite you to be a “commentariat” as well....

READ MORE

MEMBERS ONLY

My Personal Story And Why I Ask For Your Help

by Gatis Roze,

Author, "Tensile Trading"

This is a true story about someone whom I’ll refer to as an investing “refutenik”. But first, a bit of background. The long-term financial viability of Social Security is questionable, yet some politicians like to toss around the idea of delegating more accountability to John Q. Public for taking...

READ MORE

MEMBERS ONLY

Climb a Mountain, Beat The Market: What The Mountaineers "Essential 10 Checklist" Can Teach You About Investing

by Gatis Roze,

Author, "Tensile Trading"

The mountaineers “Essential 10 Checklist” is seared into the memory of every serious hiker and climber. Why? Because it may literally determine life or death. Similarly, every investor's financial life or death is determined by what I am calling the “Investors Essential 10 Checklist”.

Both checklists are comprehensive....

READ MORE

MEMBERS ONLY

The Best of Breed Methodology: Stage 4 - A Significant Enhancement

by Gatis Roze,

Author, "Tensile Trading"

A quarter century of investing yields one paramount conclusion. Venture capitalists have known this forever. Professional sports teams as well. Investors have been a little slower on the uptake.

Venture capitalists will tell you that if you invest in one company like Netflix, Salesforce or Google, it will make up...

READ MORE

MEMBERS ONLY

Celebrating An Investor's Obituary

by Gatis Roze,

Author, "Tensile Trading"

I've begun writing my own obituary. No worries. I don’t have any incurable health issues to be concerned about. It's simply an exercise that I believe will have value and will be beneficial to my investment efforts. The catalyst for this rather unusual undertaking was...

READ MORE

MEMBERS ONLY

Interdisciplinary Investing: Combining Fundamentals and Technicals Increases Profits

by Gatis Roze,

Author, "Tensile Trading"

How does a return of 14% in six months sound to you? Last February, I wrote a blog about attending the unique interdisciplinary DENT Conference last year in Napa Valley. I credit my attendance there with directly re-energizing and reimagining my investing over the six months that followed. This past...

READ MORE

MEMBERS ONLY

How to Approach Investing Like Pro Sports and Make the Playoffs! - ChartPack Update #23 (Q1, 2019)

by Gatis Roze,

Author, "Tensile Trading"

Pick the pro league of your choice. You can have the most expensive talent on one team, but without the right organization, routines and strategy, you won’t make the playoffs.(Presently, for example. you might consider the NBA’s Los Angeles Lakers with one LeBron James and friends).

Something...

READ MORE

MEMBERS ONLY

Video Recap: My Favorite Investment Tools, Tricks and Tips on StockCharts

by Gatis Roze,

Author, "Tensile Trading"

As I announced last week, I had the pleasure of joining Tom and Erin on Wednesday morning for a special StockCharts TV guest appearance. It was a treat to be on the program, but most importantly, it was a unique joy to help celebrate StockCharts' 20th anniversary.

As a...

READ MORE

MEMBERS ONLY

My Favorite Investment Tools On StockCharts.com

by Gatis Roze,

Author, "Tensile Trading"

Time truly flies, and boy oh boy do I realize it when I think back on the nearly 20 years that I’ve been using StockCharts.com to make money as an investor.

I was planning to write this week’s blog as a “homage" to all those years...

READ MORE

MEMBERS ONLY

Learning From Legends: Gerald Loeb's Timeless Investing Wisdom Stands The Test Of Time

by Gatis Roze,

Author, "Tensile Trading"

I’m sure you’ve heard the expression, “the more things change, the more they stay the same.” Gerald Loeb used this phrase frequently. I’ve always had great respect for Mr. Loeb. True, he was an extraordinary investor and a best-selling author. But what I most respected him for...

READ MORE

MEMBERS ONLY

How To Get The Confidence To Profit From Bullish To Bearish Transitions By Recognizing The Evidence

by Gatis Roze,

Author, "Tensile Trading"

Life can be cruel if change happens and you miss the signs during the transition. I’ll offer up four examples with mild to toxic consequences: Weather, Science, Superstars and finally, the Stock Market.

Pretty much everyone is aware of the predictable and abrupt shift in the weather as the...

READ MORE