MEMBERS ONLY

How Two Investors Warm-up Before Executing Any Trade

by Gatis Roze,

Author, "Tensile Trading"

Recently, I had a very personal conversation with my fellow trader, Harvey Baraban. I asked him what he did to “warm-up” before making a trade. I already knew that we both had specific warm-up routines. His response was essentially this: “I’ll tell you my routine if you tell me...

READ MORE

MEMBERS ONLY

The Best Source of Investable Ideas

by Gatis Roze,

Author, "Tensile Trading"

Amongst investors these days, there are a number of lively debates going on. Fundamental analysis versus technical analysis, the role of behavioral finance, or where the best investment ideas come from. Pulling no punches here, I maintain that in today’s modern stock market, you are either part of the...

READ MORE

MEMBERS ONLY

This Investor's Take on the "Pyramid of Success"

by Gatis Roze,

Author, "Tensile Trading"

“Success is peace of mind which is a direct result of self-satisfaction in knowing you made the effort to become the best of which you are capable.” – Dr. John Wooden

Yes, it’s that time of year again, and I thought I’d invite you into my trading room. I...

READ MORE

MEMBERS ONLY

How A Fellow Investor Critiqued This Trader

by Gatis Roze,

Author, "Tensile Trading"

My motives in writing these weekly blogs and in teaching investment classes are in part selfish ones. I write and teach to become a better trader myself. By weaving together the key attributes that I deem most useful in trading the stock market and sharing them with other investors, I...

READ MORE

MEMBERS ONLY

Your Investing Pipeline to Profits

by Gatis Roze,

Author, "Tensile Trading"

It might be human nature, but it’s not a good thing. In my Tensile Trading seminars, investors study six essential stages of stock market mastery before they ever arrive at Stage #7 – Buying. This foundation building is imperative if investors expect to achieve consistent profitability, but it takes some...

READ MORE

MEMBERS ONLY

The Secrets I Learned from Jesse Livermore

by Gatis Roze,

Author, "Tensile Trading"

When seasoned traders get together, we have a sort of “secret handshake” that the uninitiated may not notice. We ask each other if they’ve read Reminiscences of a Stock Operator. The insiders reply by telling you the number of times they’ve read the book. Novices ask for the...

READ MORE

MEMBERS ONLY

Ben Bernanke Speaks, This Trader Listens

by Gatis Roze,

Author, "Tensile Trading"

A good friend of mine who is a professional money manager recently invited my family to hear former Federal Reserve Chairman Ben Bernanke speak at a forum here in Seattle. As you might expect, much of his talk centered on the 2007-2008 financial meltdown. As Bernanke described these events in...

READ MORE

MEMBERS ONLY

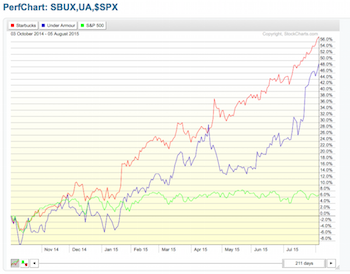

ChartPack Quarterly Update 50 New Enhancements Version 7.50

by Gatis Roze,

Author, "Tensile Trading"

I would like to acknowledge that this update has significant enhancements to many chartlists, as well as all 40 of the usual Fidelity Select Sector Funds due to a new collaboration. Grayson Roze is now working at StockCharts full-time since graduating from Swarthmore College in June. He has brought many...

READ MORE

MEMBERS ONLY

Asset Allocation: Why Strategic Versus Tactical Choices Matter

by Gatis Roze,

Author, "Tensile Trading"

How can I be energized after teaching a six-hour workshop? When investors appreciate the message, their enthusiasm is like jet fuel. Partly, I assume that contagious enthusiasm is what I love about the stock market in general. In any event, Chip Anderson, Grayson Roze and I presented our Asset Allocation...

READ MORE

MEMBERS ONLY

Selling Methodology: 1 + 1 = 3

by Gatis Roze,

Author, "Tensile Trading"

I’ve been teaching investors about Stage 9 – The Selling Stage – of the Tensile Trading methodology for over 15 years. My observation is that novice investors need a simple selling routine as a fist step. Once they are able to embrace the necessity and validity of deploying a selling strategy,...

READ MORE

MEMBERS ONLY

This is How to Maximize Your Investor Benefits

by Gatis Roze,

Author, "Tensile Trading"

After writing this column for over three years, I was recently asked by a reader what he should expect to get out of my weekly blog. In other words, he asked me for a users manual to The Traders Journal. No kidding – I looked on Amazon and found manuals for...

READ MORE

MEMBERS ONLY

Unique Insights From Dinner With An $8 Billion Investor

by Gatis Roze,

Author, "Tensile Trading"

I had the pleasure of having dinner with a mutual fund portfolio manager who manages over $8 Billion and who has the impressive record of outperforming the S&P 500 over the past 10 years. In other words, a Wall Street insider and real pro. My apologies upfront for...

READ MORE

MEMBERS ONLY

Why Stress is Like Kryptonite for Investors

by Gatis Roze,

Author, "Tensile Trading"

Years ago when I was a novice investor, I’d exhaust myself trying to figure out why things were happening in the markets. I would struggle to comprehend it all, and when there were market forces I couldn’t understand or explain, it would simply eat away at me. I...

READ MORE

MEMBERS ONLY

Why the NFL, MLB and NHL Should Hire Me (Or Another CMT - Technical Analyst)

by Gatis Roze,

Author, "Tensile Trading"

I liken old school General Managers of professional sports teams to fundamental investors. The GMs that have not yet embraced the trend of data mining and statistical analysis – under the umbrella that’s now being labeled as “Sports Analytics” – are being left behind, sliding down the leader board or being...

READ MORE

MEMBERS ONLY

Asset Allocation: The Most Important Truth About Correlations

by Gatis Roze,

Author, "Tensile Trading"

Far too many investors assume (wrongly) that if two equities – such as the S&P 500 (SPY) and the Vanguard Total Market ETF (VTI) – have a .99 correlation (as they do), then they are interchangeable investments. They expect their performance to be very similar as well. Wrong!

If you’...

READ MORE

MEMBERS ONLY

Compare Your Traders Journal to Mine

by Gatis Roze,

Author, "Tensile Trading"

I’ll show you mine, if you show me yours! What were you thinking? We are talking journals here. During periods of extreme market volatility – such as we presently have – no action can be the right action to achieve your long term goals. Understand that periodic corrections are to be...

READ MORE

MEMBERS ONLY

Here Are the Past Eight Market Corrections (I've Been Through Six of Them)

by Gatis Roze,

Author, "Tensile Trading"

Straight from the pages of my own trading journal. These are my charts from all the market corrections since 1981. Here’s why I want to share these with you.

The beauty of technical analysis is that it represents human emotions expressed by the buying and selling behavior of investors...

READ MORE

MEMBERS ONLY

The Triple Crown of Investing: Motivation, Confidence, Action

by Gatis Roze,

Author, "Tensile Trading"

As many of you know who’ve taken my Tensile Trading seminar or watched the DVD, the tenth stage of stock market mastery pulls together all previous nine stages. As the title of this blog suggests, Stage 10 incorporates all three essential ingredients: motivation, confidence and action. Successful investors must...

READ MORE

MEMBERS ONLY

Can You Believe 90% of Fortune 500 Equities Have Vaporized?

by Gatis Roze,

Author, "Tensile Trading"

Be careful where you sit. I shared a table at Starbucks last week with two investors who became very animated and energized when I disclosed that I was a full-time stock investor. What a coincidence, they said, so were they. They retired in 2004 and bought large positions in the...

READ MORE

MEMBERS ONLY

How to Profit from Momentum Investing: Guest Blogger, Harvey Baraban

by Gatis Roze,

Author, "Tensile Trading"

Harvey Baraban is a Wall Street insider. As the former CEO of Baraban Securities, he managed 1,500 brokers and trained over 30,000 men and women for certification as full-service stockbrokers. In the 1970s, he partnered with billionaire investor Gerald Tsai who was famous for starting the first publicly-sold...

READ MORE

MEMBERS ONLY

Nine Reasons for You to Join Our Club: ChartPack Update 7.25

by Gatis Roze,

Author, "Tensile Trading"

Once a quarter, I update my Tensile Trading ChartPack. With such a large number of users now it was easy to poll some of these investors to ask how and why they use the ChartPack. Their reasons were enlightening, so I’m summarizing a few of their comments in this...

READ MORE

MEMBERS ONLY

Trading the News: Lessons From My Personal Trading Journal

by Gatis Roze,

Author, "Tensile Trading"

The motto in the news business seems to be “If it bleeds, it leads.” Investors must appreciate that our news is packaged by the news media in a manner to motivate the audience to tune in. It is thus sold for the benefit of sponsors, not for the benefit of...

READ MORE

MEMBERS ONLY

How I Improved My Asset Allocation Profile by Using a Correlation Calculator

by Gatis Roze,

Author, "Tensile Trading"

Many investors would be shocked to learn that what they thought was their prudent well-diversified portfolio of five different asset classes might be effectively no different than owning the same car in five different colors. If you fail to understand asset correlations, most of your portfolio could be essentially the...

READ MORE

MEMBERS ONLY

Your Biological Passport To Profits: Use It With Care!

by Gatis Roze,

Author, "Tensile Trading"

Most professional athletes these days have biological passports. I submit to you that investors should apply the same principle to their own trading.

A biological passport is an individual’s electronic record which profiles his or her personal genetic biological markers. The premise being that rather than testing for and...

READ MORE

MEMBERS ONLY

Plunger Investing: A True Story

by Gatis Roze,

Author, "Tensile Trading"

To paraphrase P.J. O’Rourke, “Giving assets to a stock market plunger is like giving beer and car keys to teenage boys.” This is a true story. As you read this morality tale, you’ll recognize a person you know or investors you have known or possibly a person...

READ MORE

MEMBERS ONLY

Where Investment Lessons Reside

by Gatis Roze,

Author, "Tensile Trading"

Michael Jordan is probably the greatest basketball player I have ever seen. He wrote a book titled I Can’t Accept Not Trying: Michael Jordan on the Pursuit of Excellence which lays out his rules for success. This book is of interest to us as traders even though we pursue...

READ MORE

MEMBERS ONLY

Four Timeless Investing Principles

by Gatis Roze,

Author, "Tensile Trading"

I’ve spent many years of digging into my own trading journal, looking for lessons, rules, principles and insights to improve my investing. I continue to do so, not just to find fodder for this blog but to provide supporting documentation to lend more weight to the teachings of other...

READ MORE

MEMBERS ONLY

Investment Editor Retires: Leaves Us with Four Lessons That Matter

by Gatis Roze,

Author, "Tensile Trading"

Almost without exception, institutional money managers use Exchange Traded Funds (ETFs). My own trading routines call for reviewing the top 100 ETFs daily. This is a process that I encourage you to include in your own routines. Here’s how and why.

I maintain a personal ChartList of the top...

READ MORE

MEMBERS ONLY

The Vincent van Gogh Trading Toolkit - Refurbished

by Gatis Roze,

Author, "Tensile Trading"

This popular blog was first published over three years ago. I thought that a timely update was called for. You’ll see that the Equity Chartstyle has been significantly revised and I have aded a Mutual Fund Chartstyle as well.

I spent a couple of hours this past Saturday at...

READ MORE

MEMBERS ONLY

Ten Timeless Tenets of Trading: A 2,500 Year Perspective Part II

by Gatis Roze,

Author, "Tensile Trading"

Art, history and life can parallel investing. This blog is my continuation from last week’s Part I where I encouraged readers to be open to a sort of borderless-type of thinking. To be willing to challenge oneself to look backwards as an aid to moving forwards in the investment...

READ MORE

MEMBERS ONLY

Ten Timeless Tenets of Trading: A 2,500 Year Perspective

by Gatis Roze,

Author, "Tensile Trading"

For those of you who pooh-pooh the lessons of history, listen up! I myself am guilty of being overly focused on today’s web – obsessed with the latest hot stocks, investment technologies and trading methodologies. But at times, it’s important to challenge oneself to look backwards as an aid...

READ MORE

MEMBERS ONLY

The Most Profitable Takeaways from 'The Traders Journal'

by Gatis Roze,

Author, "Tensile Trading"

After many years of writing The Traders Journal, I thought it was time to revisit how investors can best maximize the takeaways from these weekly blogs.

First and foremost, the reader should understand that my perspective is somewhat irreverent since it is based on the past 25 years of trading...

READ MORE

MEMBERS ONLY

Investing: The Probability Tool

by Gatis Roze,

Author, "Tensile Trading"

Investing and thinking in probabilities should go hand in hand. Probabilities can be expressed both quantitatively (as a percentage from zero to one hundred percent) or qualitatively. I use both, but recently I have found myself gravitating more to qualitative assessments and descriptions.

Determining the precise probability of any particular...

READ MORE

MEMBERS ONLY

This is What Made a Top Hedge Manager So Successful

by Gatis Roze,

Author, "Tensile Trading"

I just read The Buy Side, Turney Duff’s book about his years as the biggest and most successful healthcare hedge fund manager on Wall Street. Let me say up front that I am not reviewing or endorsing the book or its content in any manner. In fact, I’m...

READ MORE

MEMBERS ONLY

New Potent Organizational Framework Plus 200 Timely Tradeable Insights ChartPack Update Version 7.0

by Gatis Roze,

Author, "Tensile Trading"

“You don’t have to be a genius to be successful. You just need a framework.”

—Michael Dell, Entrepreneur and Investor

For those of you who regularly download the free quarterly ChartPack updates, I don’t need to explain the value of its framework and contents. But there are still...

READ MORE

MEMBERS ONLY

An Investor Finds Motivation, Camaraderie, Discipline & Inspiration in a Unique Place

by Gatis Roze,

Author, "Tensile Trading"

Trading camaraderie provides inspiration and motivation, but it does not always emanate from fellow traders. The quest to become a consistently profitable trader demands ongoing discipline, and I often find that in unlikely places.

I spent half my life being a business entrepreneur and the last 25 plus years engaging...

READ MORE

MEMBERS ONLY

My Methodology Allocation Beats Asset Allocation: Part III - Eternal Vigilance is the Price of Profits

by Gatis Roze,

Author, "Tensile Trading"

Thomas Jefferson opined that “Eternal vigilance is the price of liberty.” For modern investors, I’d say, “Eternal vigilance is the price of profits.” This being the last installment of my three part series, I want to pull together the key pieces before I segue into the final Q &...

READ MORE

MEMBERS ONLY

My Methodology Allocation Beats Asset Allocation: Part II - Questions Answered

by Gatis Roze,

Author, "Tensile Trading"

There’s nothing like teaching a seminar to fifty sharp investors on this topic and having them demand more clarity and specifics to encourage one to do the same for my blog readership. To bring you up to speed, please read my previous blog on this subject.

https://stockcharts.com/...

READ MORE

MEMBERS ONLY

Secret Sauce: The Other 50% of Investing - Part II

by Gatis Roze,

Author, "Tensile Trading"

I wrote about this subject nearly two years ago from my own personal perspective, but now I want to expand on the original blog and share with you the perspective of a well-known international portfolio manager on the same topic. Here’s what I wrote two years ago:

https://stockcharts....

READ MORE

MEMBERS ONLY

How I Only Trade Stocks Soaked in Positive Probabilities

by Gatis Roze,

Author, "Tensile Trading"

I only trade the strongest and prettiest equities in the market. I’ve written before about how I leave my deep value purchases to the Sequoias and Fairholme Funds of the world. With my own stocks, the challenge is how to ascertain if one equity is stronger and prettier than...

READ MORE