MEMBERS ONLY

Signing Off

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Signing Off

I want to thank the owner/President of StockCharts.com, Chip Anderson, and his son, Eric, for 25 years of friendship, over 10 years of writing 200+ articles in my "Dancing with the Trend" blog on StockCharts.com. StockCharts.com offers a giant selection of tools...

READ MORE

MEMBERS ONLY

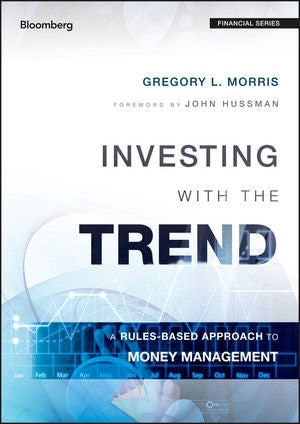

Investing with the Trend: A Review by Dr. Mark Holder

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The following is a review of my book "Investing with the Trend" by Dr. Mark Holder. You can read the entire contents of the book on this blog, starting with this article.

"History repeats itself." Never was a phrase (oft cited as a Churchill quote) more...

READ MORE

MEMBERS ONLY

Golf Geometry & Kinematics

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Here are some observations from golf that you might want to take into consideration.

1. I cannot begin to count the number of times while playing golf that someone thinks they are "away" when the distance between their ball and the cup versus the other person's...

READ MORE

MEMBERS ONLY

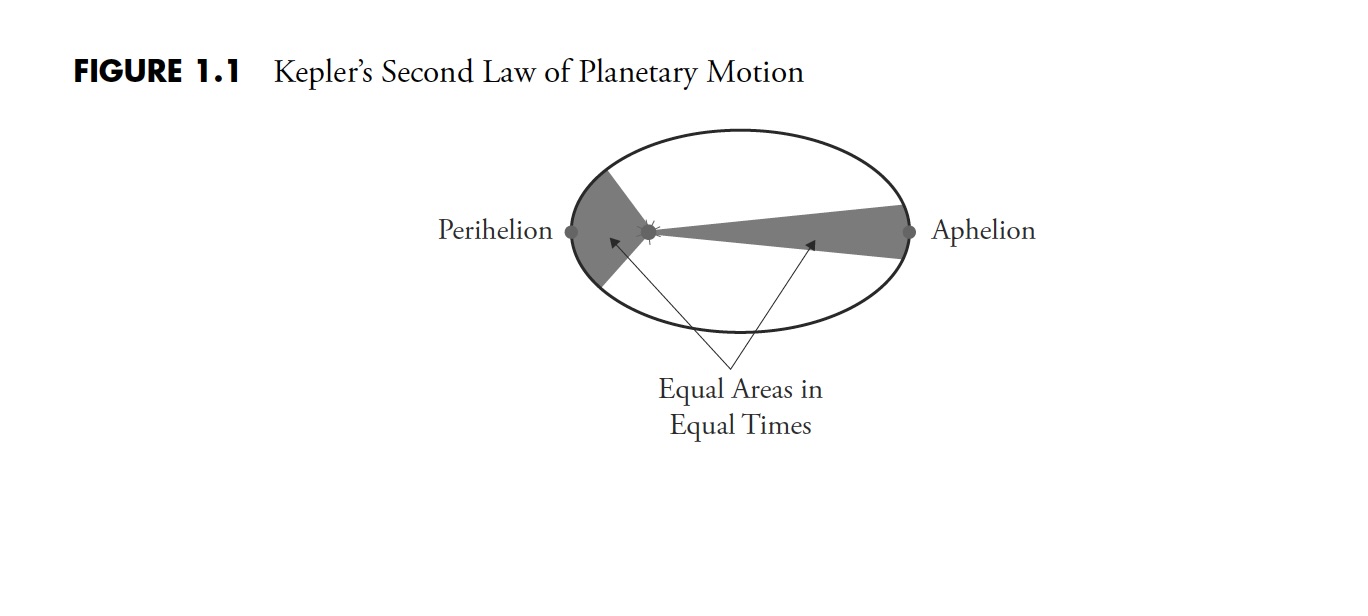

Astronomical Daze

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Editor's Note: This article was originally published on November 21, 2022.

This article has absolutely nothing to do with trend following or the markets. I have two friends; one whose birthday is June 21 and the other whose birthday is December 21. The one in December always said...

READ MORE

MEMBERS ONLY

Investing with the Trend: Conclusions

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twenty-fifth and final in a series of articles I'm publishing here, taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete...

READ MORE

MEMBERS ONLY

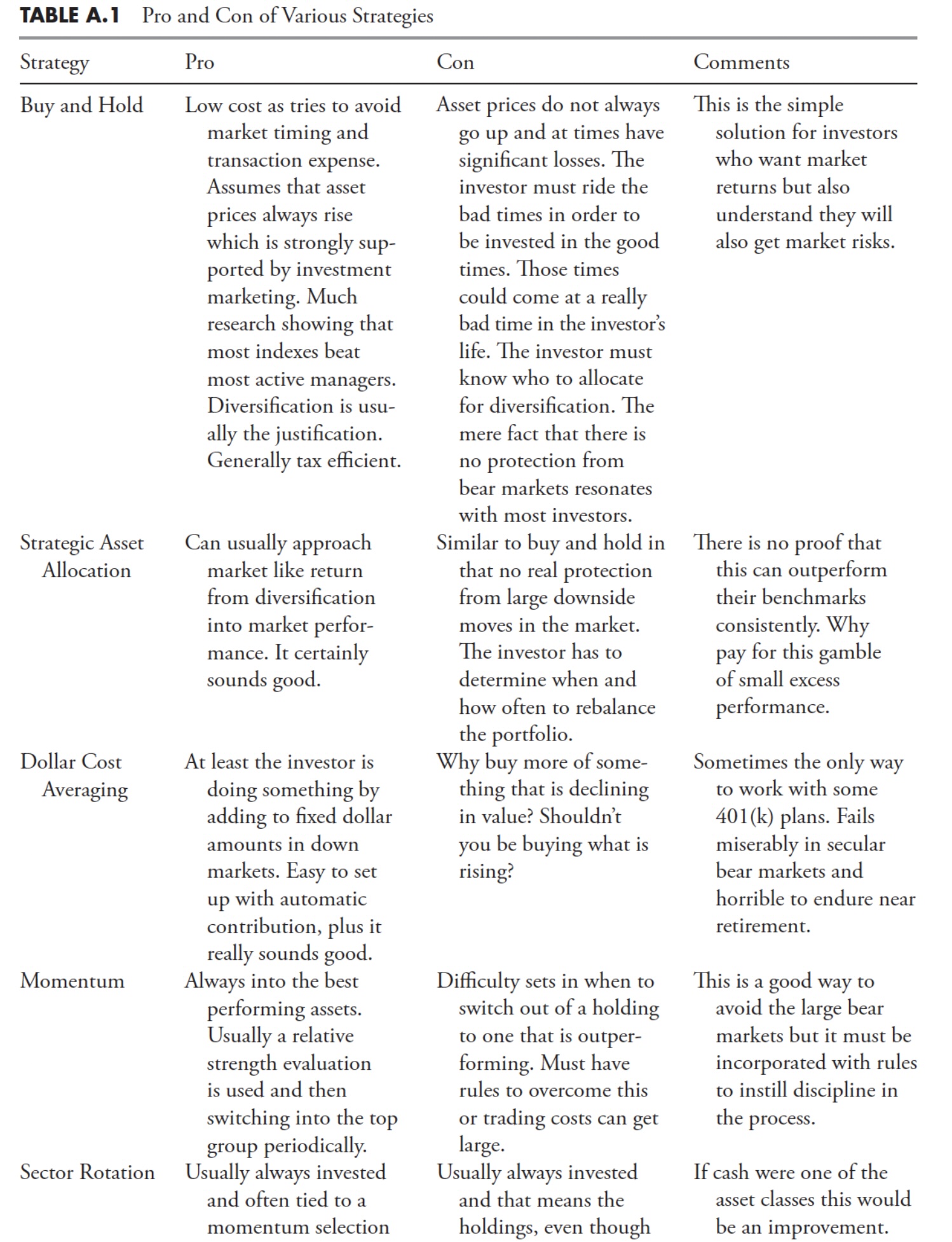

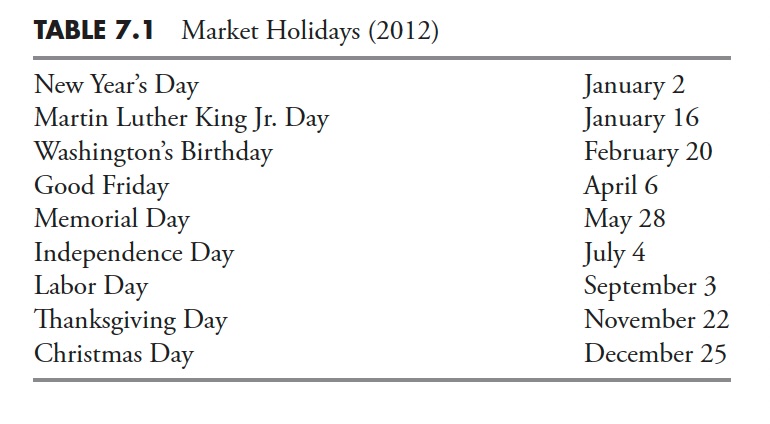

Investing with the Trend: Appendix

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is a set of appendices for a series of articles I'm publishing here, taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete...

READ MORE

MEMBERS ONLY

Rules-Based Money Management - Part 8: Putting Trend-Following to Work

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twenty-fourth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Rules-Based Money Management - Part 7: The "Dancing with the Trend" Model

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twenty-third in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Rules-Based Money Management - Part 6: Putting It All Together

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twenty-second in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Rules-Based Money Management - Part 5: Security Selection, Rules, and Guidelines

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twenty-first in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Rules-Based Money Management - Part 4: Security Ranking Measures

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twentieth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

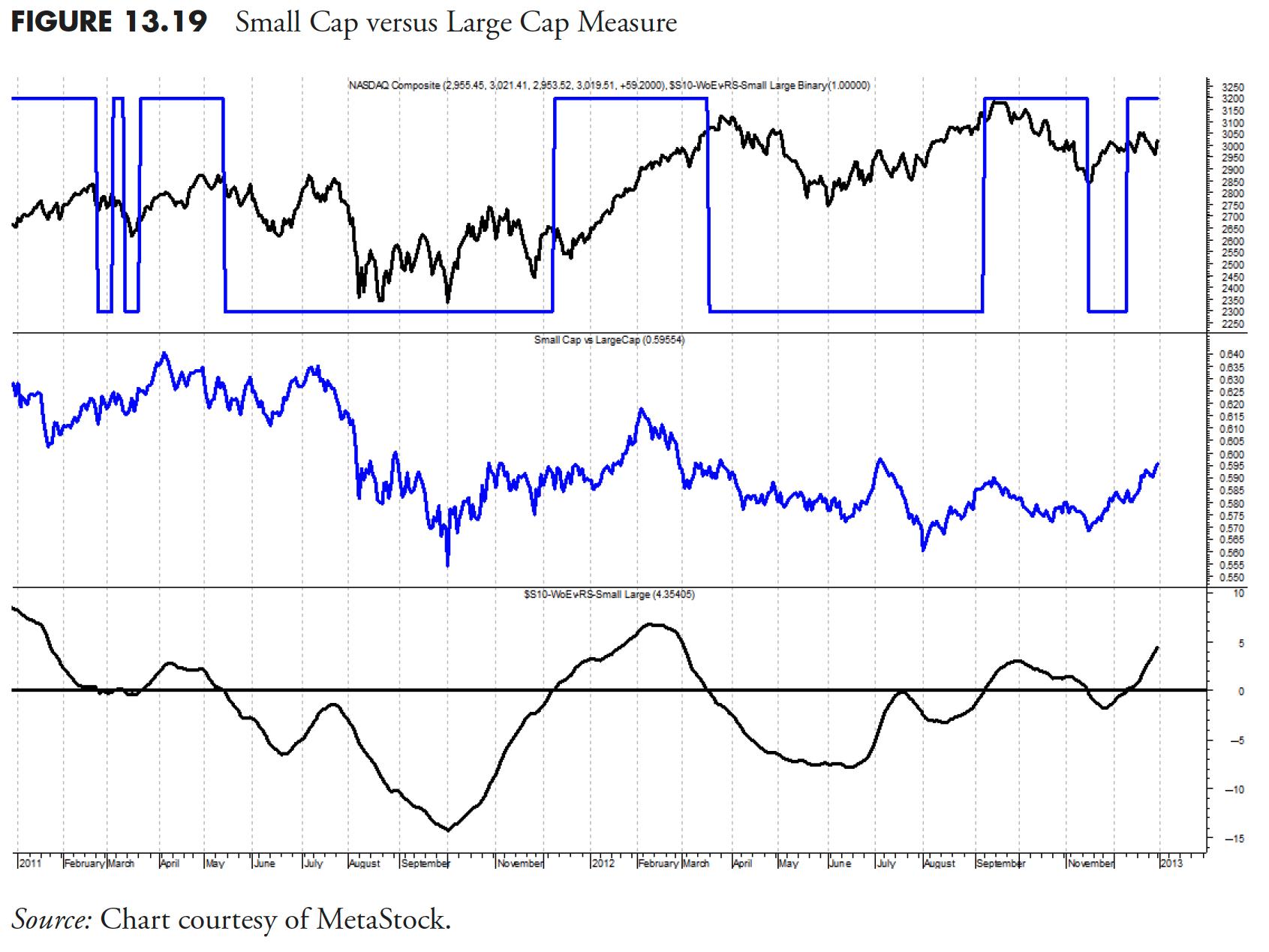

Rules-Based Money Management - Part 3: Relative Strength and Other Measures

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the nineteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Rules-Based Money Management - Part 2: Measuring the Market

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the eighteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Rules-Based Money Management - Part 1: Popular Indicators and Their Uses

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the seventeenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Market Research and Analysis - Part 5: Drawdown Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the sixteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

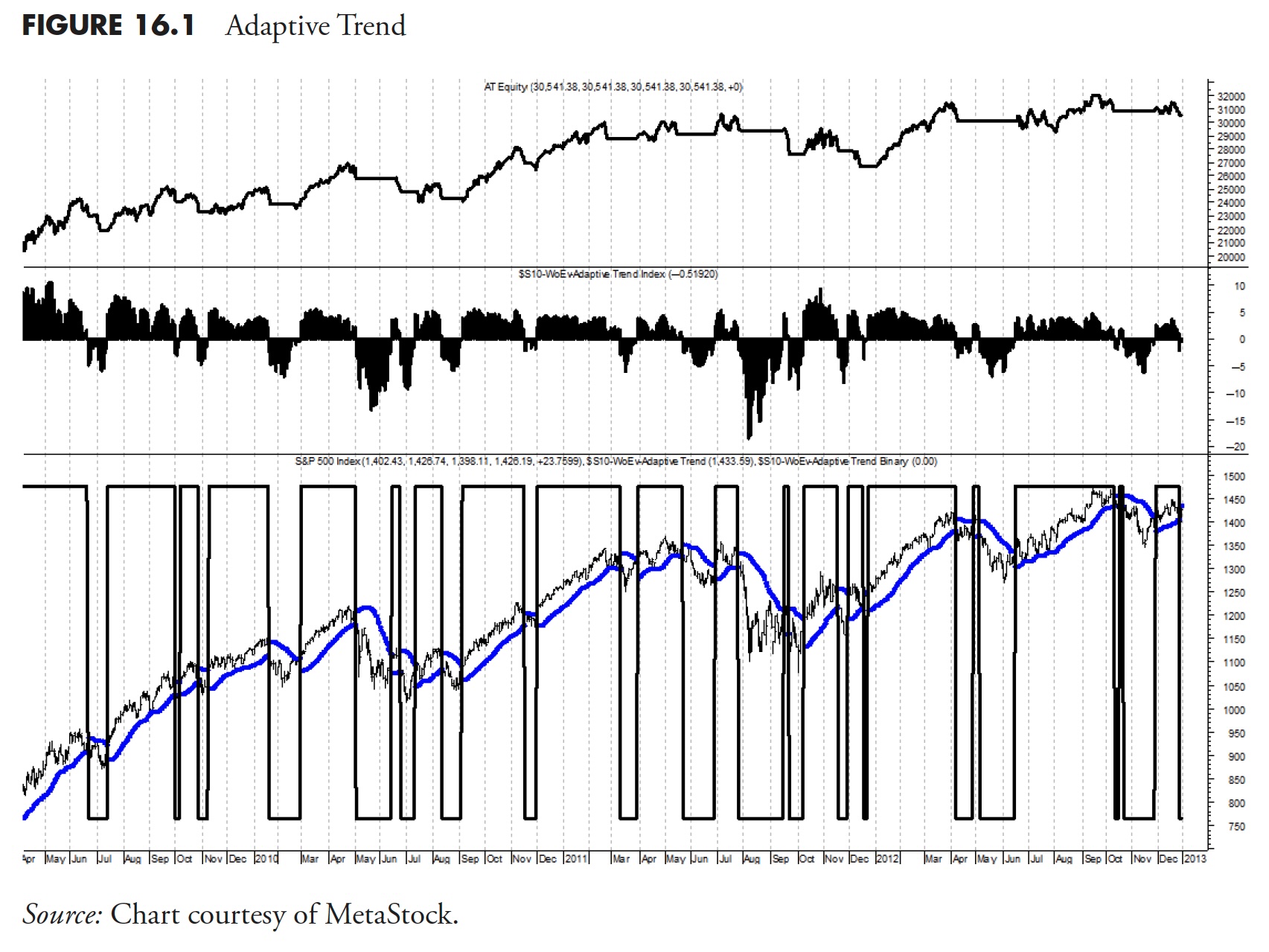

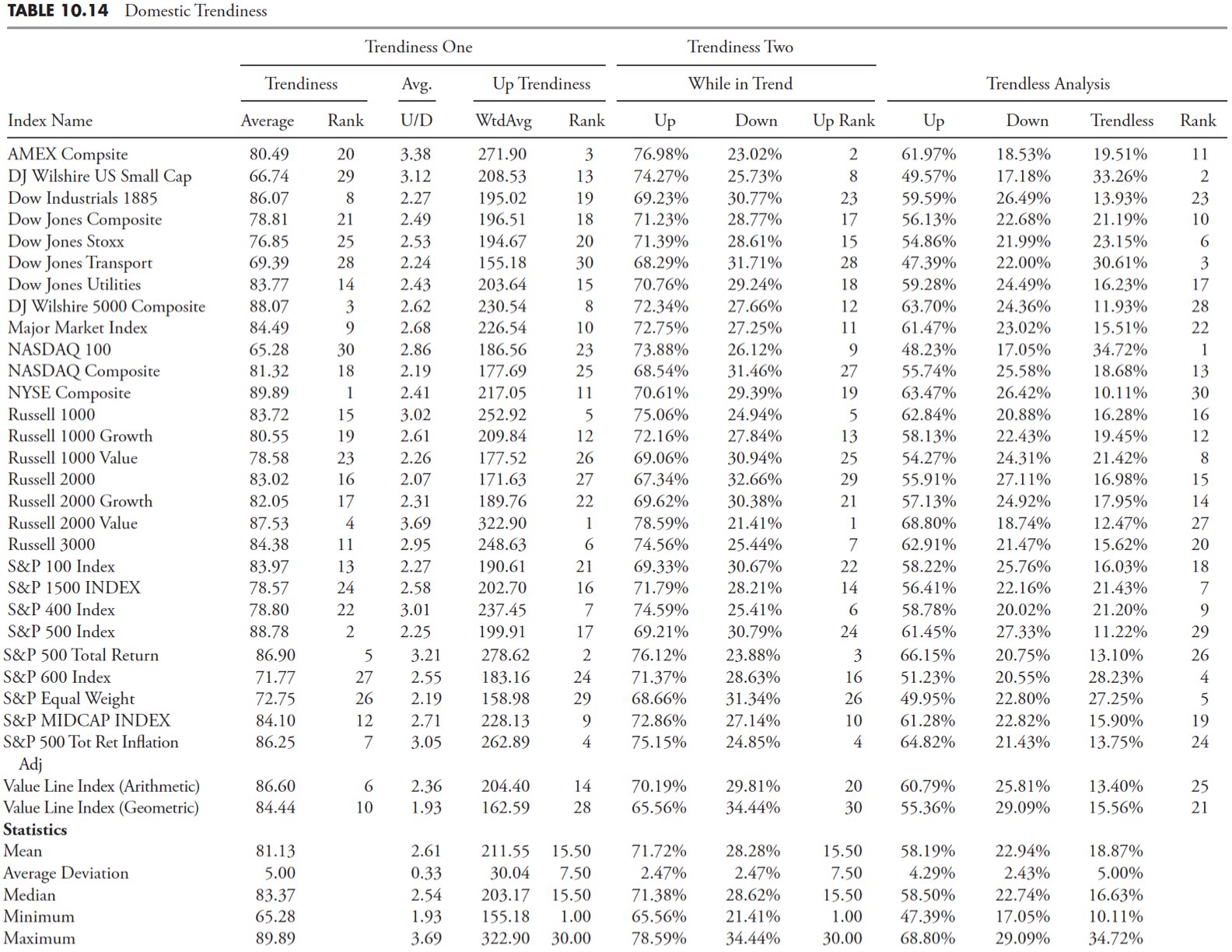

Market Research and Analysis - Part 4: Trend Analysis Continued

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the fifteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

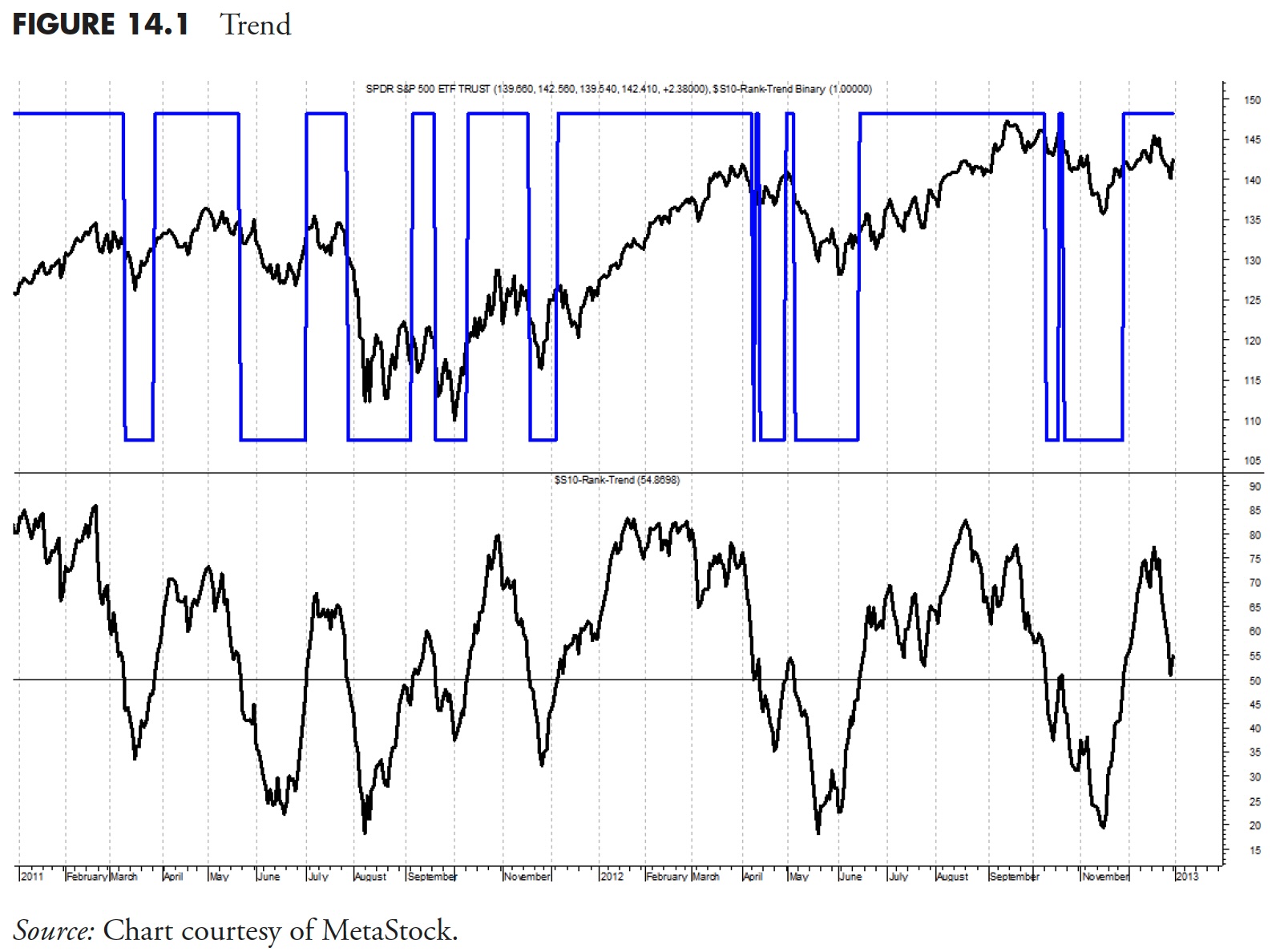

Market Research and Analysis - Part 3: Market Trend Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the fourteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

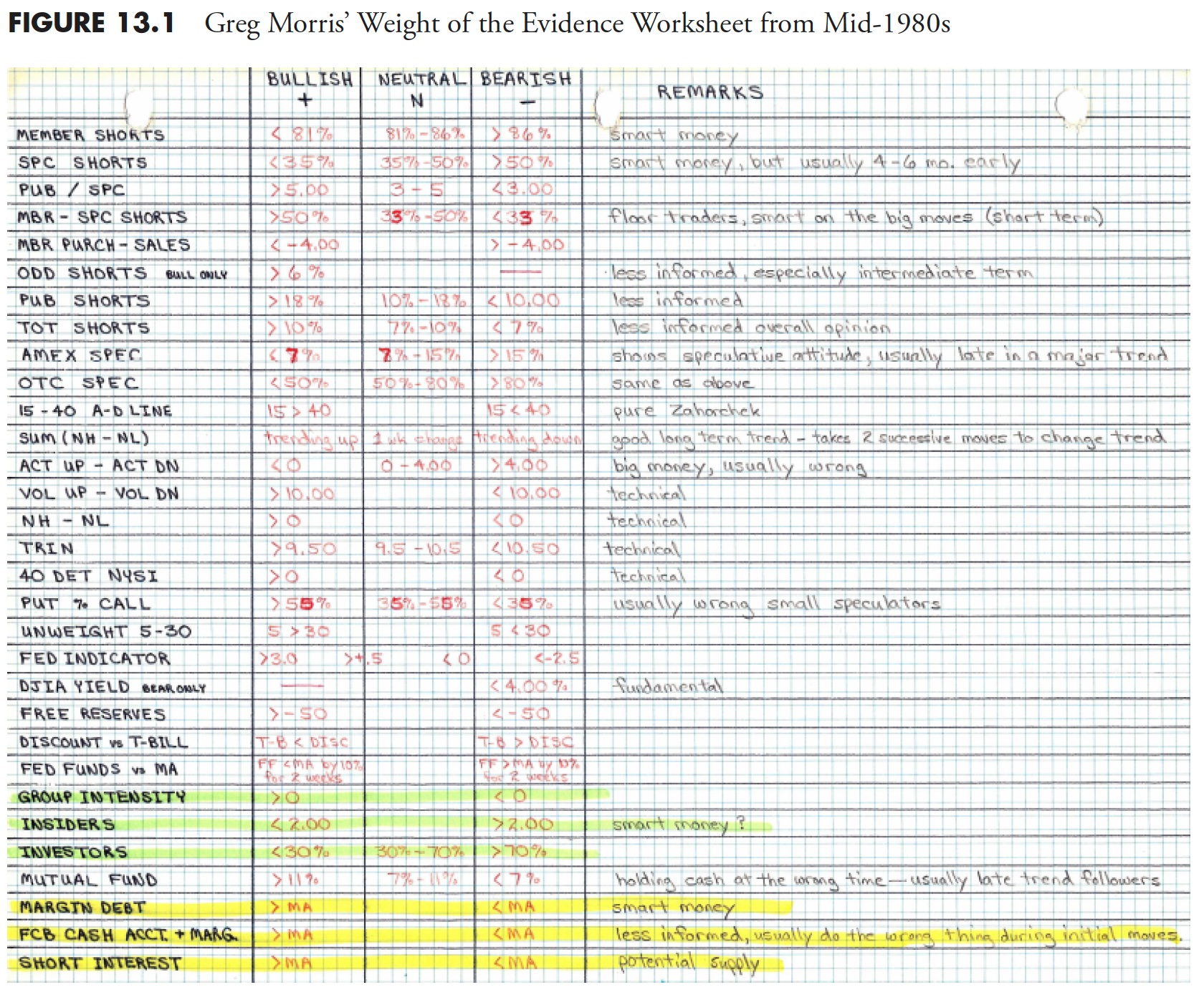

Market Research and Analysis - Part 2: Using Technical Indicators

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the thirteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Market Research and Analysis - Part 1: Why Technical Analysis?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the twelfth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

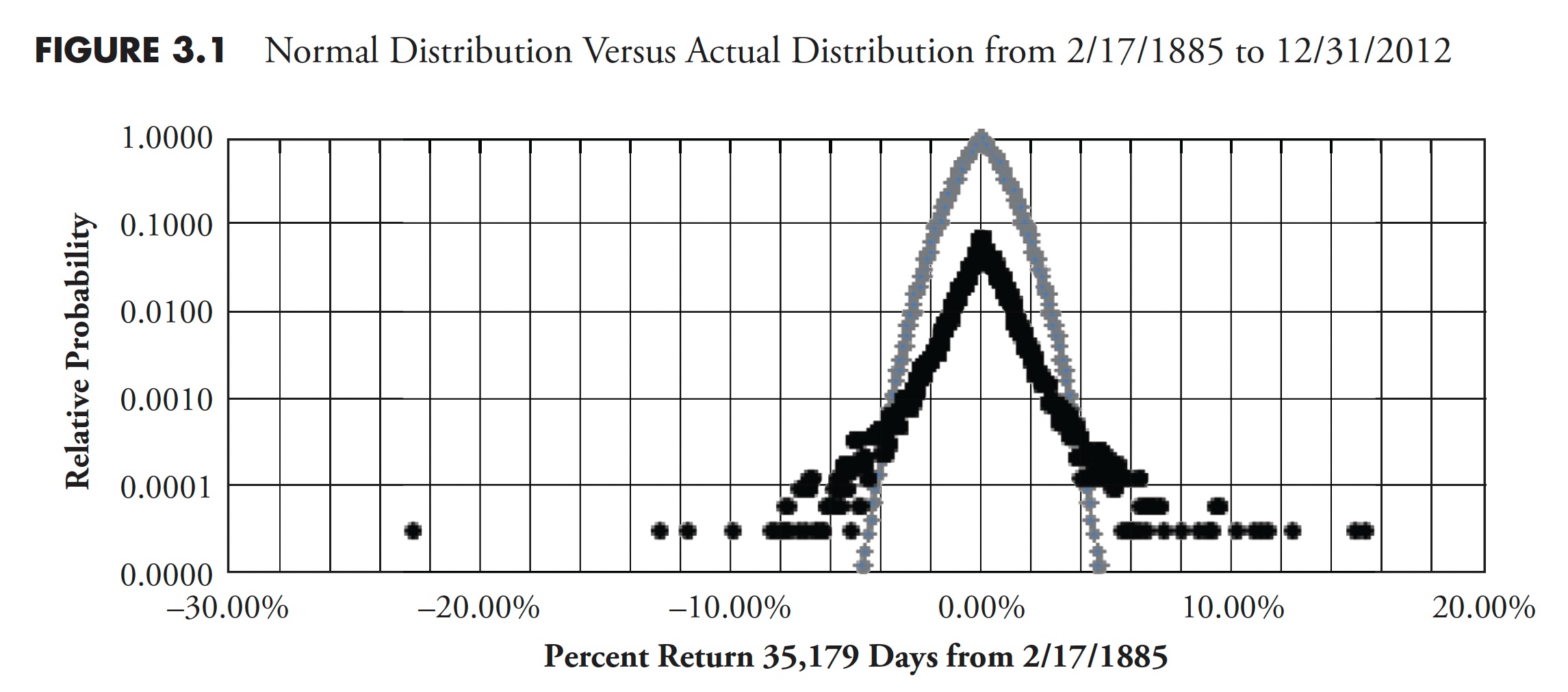

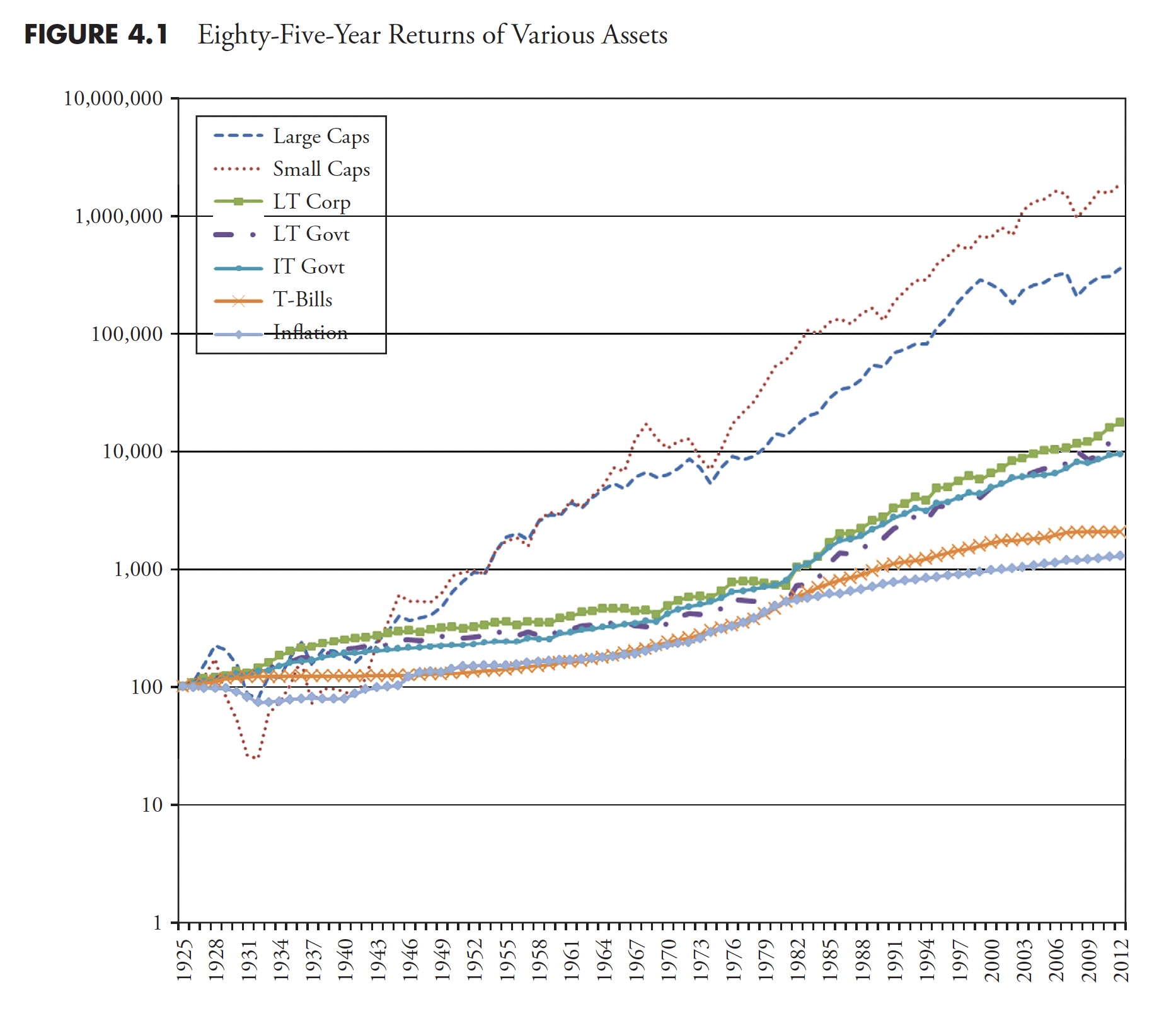

The Hoax of Modern Finance - Part 11: Valuations, Returns, and Distributions

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the eleventh in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

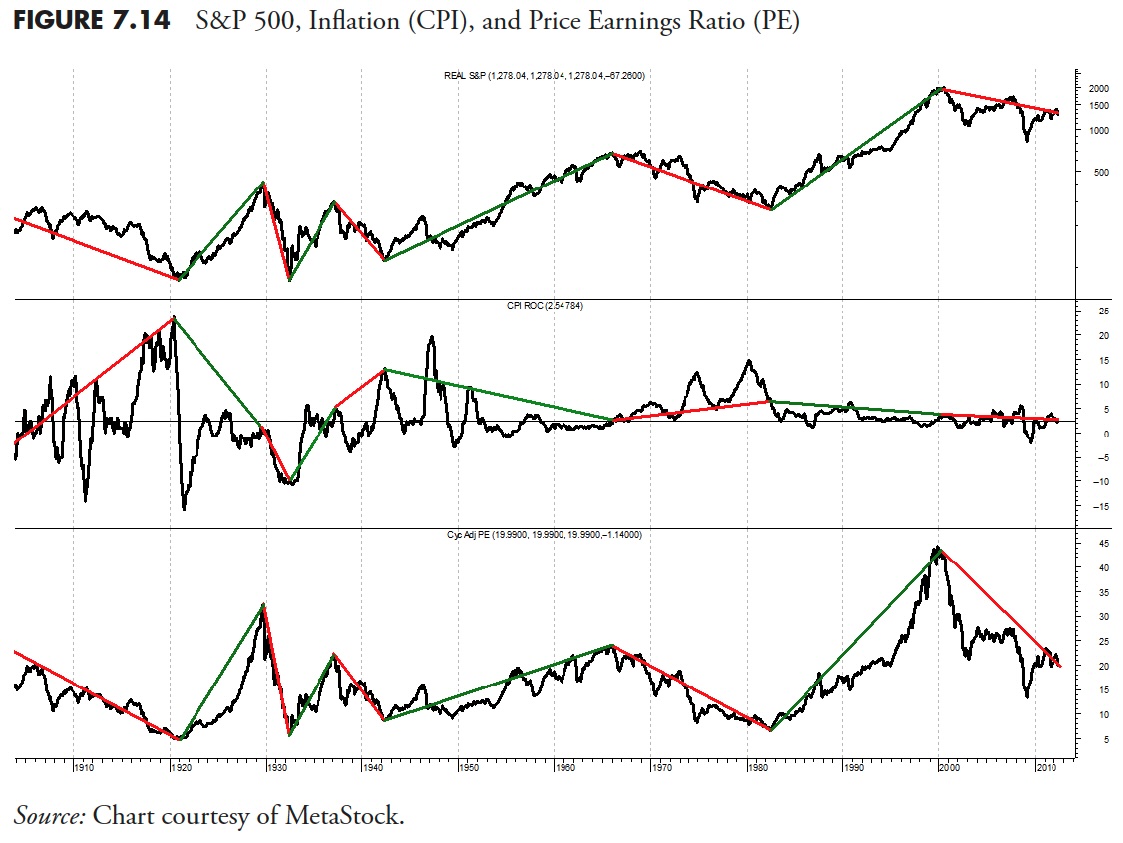

The Hoax of Modern Finance - Part 10: Market Facts — Secular Markets

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the tenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 9: Market Facts — Bull and Bear Markets

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the ninth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

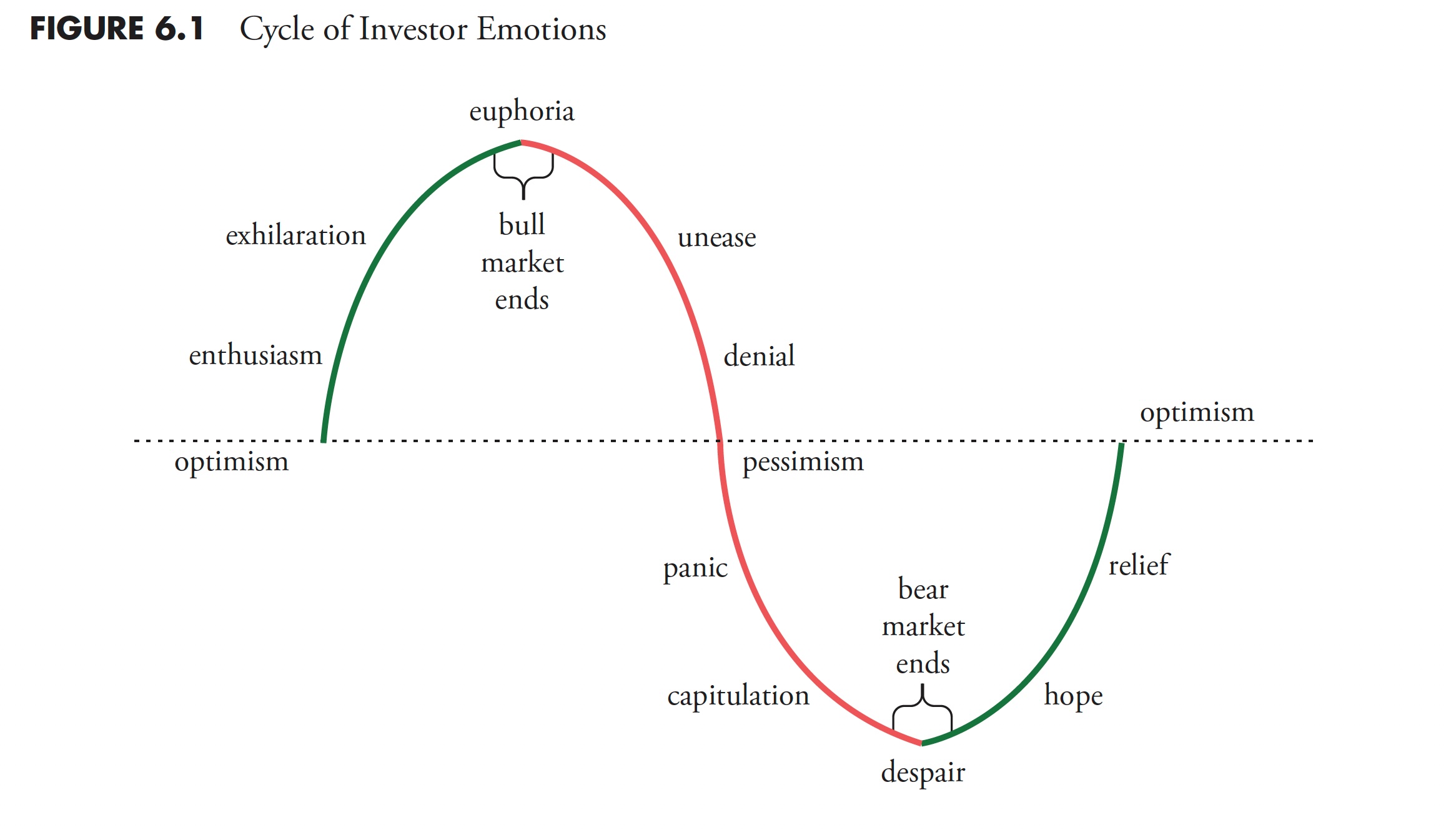

The Hoax of Modern Finance - Part 8: The Enemy in the Mirror

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the eighth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 7: The Illusion of Forecasting

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the seventh in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

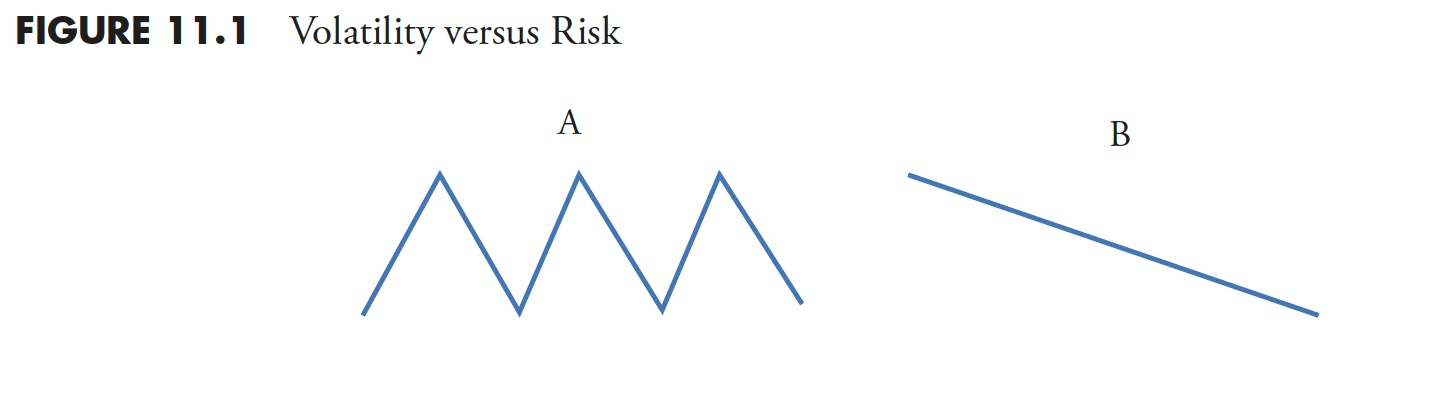

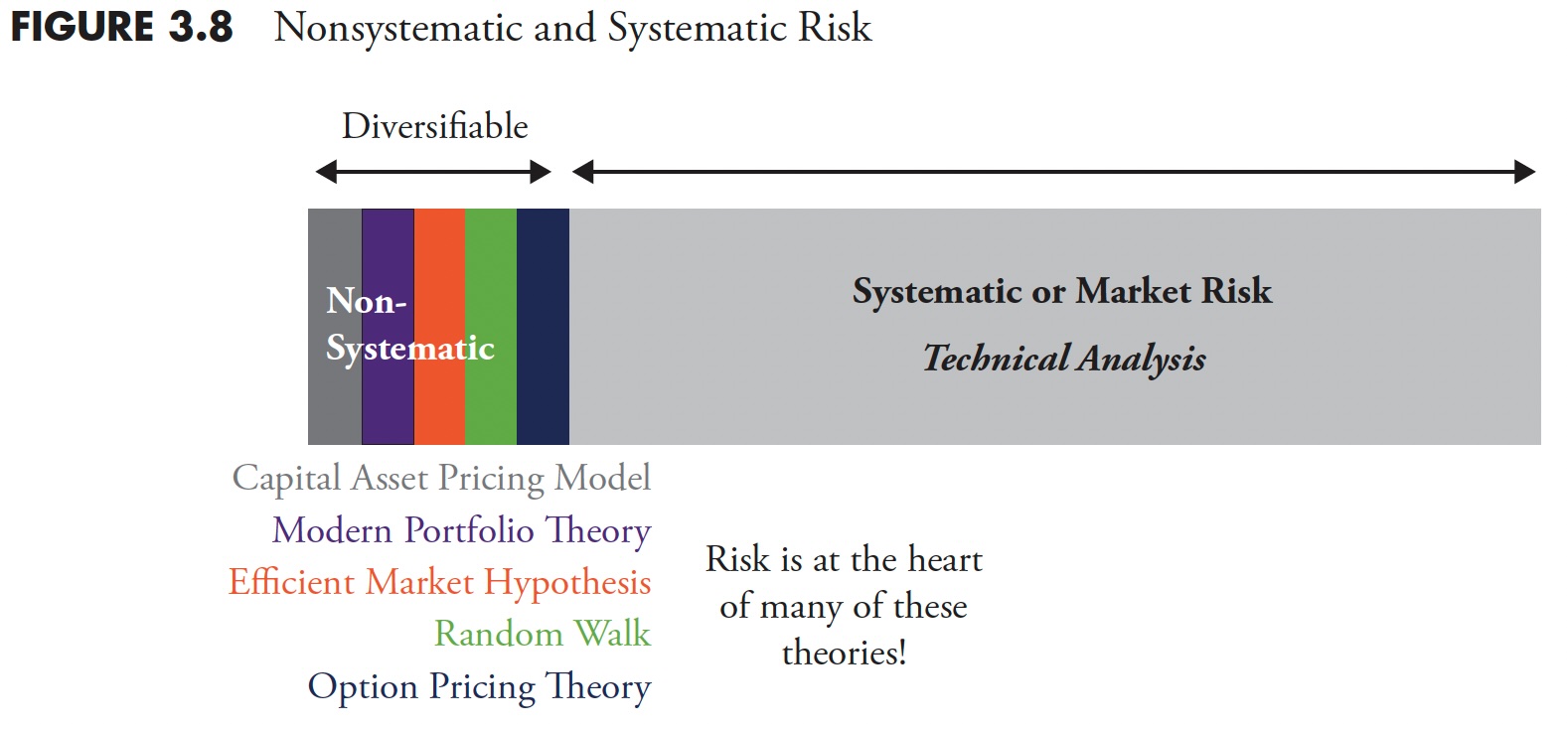

The Hoax of Modern Finance - Part 6: Is Volatility Risk?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the sixth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 5: Flaws in Modern Financial Theory

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the fifth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 4: Misuse of Statistics and Other Controversial Practices

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the fourth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Latest Interview

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I was recently interviewed. Here is the link: Traders of the World: Greg Morris (USA) - Episode 05 (youtube.com)...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 3: Fictions Told to Investors

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the third in a series of articles I'm publishing here taken from my book, "Investing with the Trend," in article form here on my blog. Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 2: Indicators, Terminology, and Noise

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: Over the next couple of weeks and months, I will be republishing the contents of my book, "Investing with the Trend," in article form here on my blog. I'm calling this series "The Hoax of Modern Finance" for reasons you...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 1: Introduction

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: Over the next couple of weeks and months, I will be republishing the contents of my book, "Investing with the Trend," in article form here on my blog. I'm calling this series "The Hoax of Modern Finance" for reasons you...

READ MORE

MEMBERS ONLY

2022 Stock Market Review

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

2022 has ended, but the bear market and need for risk management remains!

The year 2022 ended with the stock market delivering its largest yearly losses since 2008. The fourth quarter of 2022 saw new bear market lows in the S&P 500 index, Nasdaq Composite, and Bloomberg Agg...

READ MORE

MEMBERS ONLY

A Recent Interview

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I had the honor of being interviewed by longtime friends, Sunny Harris and Sam Tennis. The link below will take you to that interview. It is about 1 hour long so try to stay awake.

https://anchor.fm/sunny-j-harris/episodes/Gregory-L--Morris...

READ MORE

MEMBERS ONLY

Why Some Make Stock Market Forecasts

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Why are there entire businesses set up to make stock market forecasts? The answer is quite simple; forecasting exists because there is a giant market for it. Investors/traders thirst for forecasts. Here is the real question; why do investors want to hear/read forecasts?

Those who have knowledge don&...

READ MORE

MEMBERS ONLY

Junk Science; Junk Analysis!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I don't think I have offended anyone in quite a while and feel I'm not doing my job if I don't try to periodically; so here goes!

Often a simple mathematical series of numbers can sometimes get misinterpreted (promoted) to be something magical. My...

READ MORE

MEMBERS ONLY

Past Performance is no Guarantee of Future Results

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

There is no doubt that investors are attracted by positive performance. Unfortunately, most investors stop there and never accomplish the due diligence to confirm that the returns are meaningful. In most cases they usually place entirely too much emphasis on performance without putting it into the context of the market...

READ MORE

MEMBERS ONLY

Risk is More than a Four Letter Word

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Dictionary.com says: The exposure to the chance of injury or loss; a hazard or dangerous chance. American Heritage Dictionary says: The possibility of suffering harm or loss; danger. These are just two of the many entries and these were just for the noun. Risk in the world of investments...

READ MORE

MEMBERS ONLY

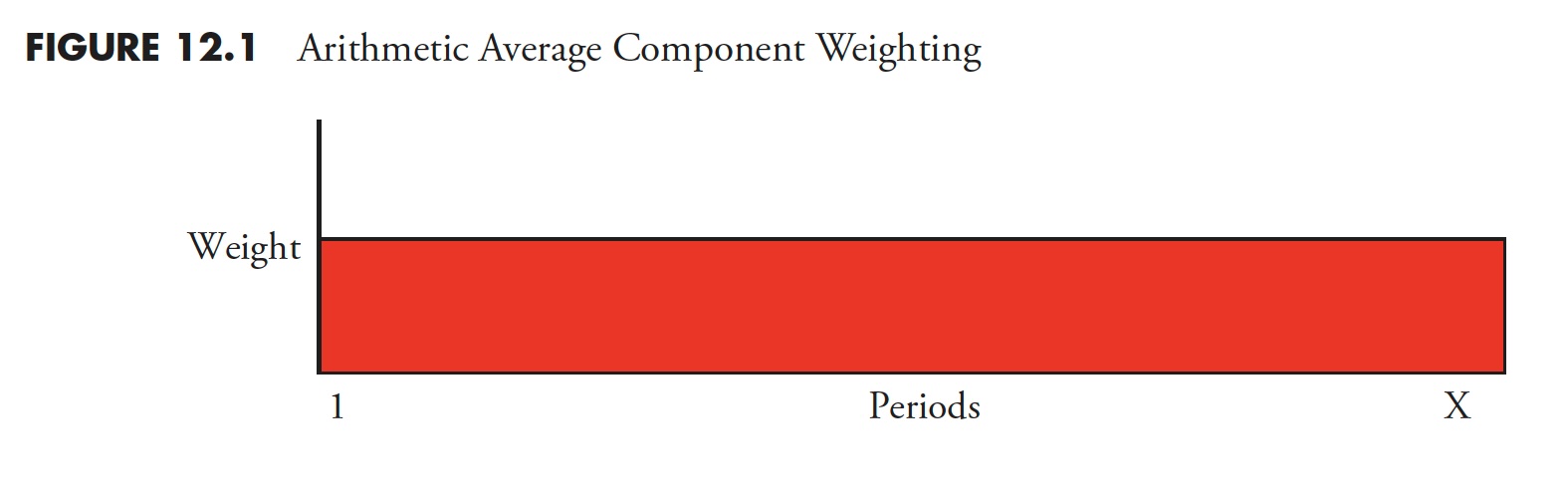

The Deception of Average

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I published this the first time in November, 2017 and think it is just as appropriate now as then.

The "World of Finance" is fraught with misleading information. The use of average is one that needs a discussion. Chart A is a chart showing the compounded rates of...

READ MORE

MEMBERS ONLY

The Enemy in the Mirror

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I first published this article in March, 2019 and believe the message then is the same as for today. As a retired money manager I want to share some thoughts on that profession and investors in general. Portfolio management is as much about managing emotions as it is about correlations,...

READ MORE

MEMBERS ONLY

"Investing with the Trend" Review

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

A review by Dr. Mark Holder.

"History repeats itself." Never was a phrase (oft cited as Churchill quote) more apt in describing a text. The book, Investing with the Trend by Gregory L. Morris, is now more in tune with today than ever. As a trainer for new...

READ MORE