MEMBERS ONLY

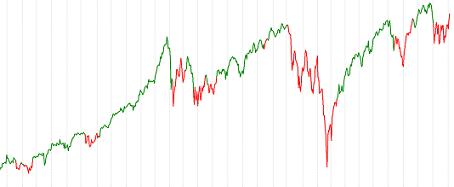

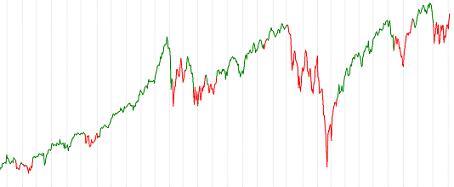

Bear Market Blues but Trend Follower's Good News!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Investors may have the blues right now because we find ourselves in another bear market just 17 months after recovering from the prior one. The last bear market started on 2/19/2020 and ended on 8/18/2020 and was the 6th worst bear market since 1927 (of the...

READ MORE

MEMBERS ONLY

WHY Standard Deviation is a Poor Measure of Risk

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I will attempt to show that high sigma is a much more frequent event than modern finance thinks it is. A few examples using the Dow Industrials back to 1885 on a daily basis are shown. Each begins with determining a look-back period to determine the average daily return and...

READ MORE

MEMBERS ONLY

"Believable" Misinformation Is a Danger to Long-Term Retirement Goals

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Many investment "truths" seem to go unchallenged but are in fact, very clearly just myths. Buy and hold investing is a good long-term strategy, economists are good at predicting the markets, diversification will protect you from losses, compounding is the eighth wonder of the world, missing the best...

READ MORE

MEMBERS ONLY

Bear Markets and Drawdowns - part 2

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is a continuation of the previous article. The Dow Jones Industrial Average, also referred to as The Dow by the financial media, is a price-weighted measure of 30 U.S. blue-chip companies. The Dow covers all industries with the exception of transportation and utilities, which are covered by the...

READ MORE

MEMBERS ONLY

Bear Markets and Drawdowns

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I thought this article that I wrote over three years ago on January 11, 2019 is quite appropriate for today. If you have read my blog you know that I use the Nasdaq Composite as my measure of the market and it is down significantly as I write this. Enjoy!...

READ MORE

MEMBERS ONLY

Whipsaws

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

We think it is a good time to revisit a topic that is always top of mind for tactical money managers and investors in rules-based strategies like trend following; and that is whipsaws.

Whipsaw trades are the one issue that will constantly concern investors using trend following strategies. Whipsaw trades...

READ MORE

MEMBERS ONLY

WHY do Most Investors do so Poorly?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

There are a number of companies that track performance for various asset classes, including the performance of investors. Table A, from J.P. Morgan, shows the Average Investor's 20-year annualized returns of only 2.3%. I have reproduced the small print below the table because it explains the...

READ MORE

MEMBERS ONLY

Fear and Greed

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I cannot tell you the number of times an investor has asked, "Considering the difficulties of the past few months, do you still believe in your investment process?" These questions always concerned me because I never once considered not believing in my process for managing money just because...

READ MORE

MEMBERS ONLY

Noise is Deafening!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

With the media constantly blaming this down market on Ukraine, I thought this article would be timely.

Just in the course of a normal week, we are bombarded with information from sources such as the FED, television analysts, brokerage firm analysts, economists' projections, newspapers, junk mail, neighbors, war reporters,...

READ MORE

MEMBERS ONLY

Misunderstanding Average

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Did you hear about the six-foot tall Texan that drowned while wading across a stream that averaged only 3 feet deep? The "World of Finance" is fraught with misleading information. The use of average is one that needs a discussion.

Figure A shows how easily it is to...

READ MORE

MEMBERS ONLY

"Believable" Misinformation Is a Danger to Long-Term Retirement Goals

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Here is another article I wrote a few years ago that I think needs to be repeated. Enjoy!

Many investment "truths" seem to go unchallenged but are in fact, very clearly just myths. Buy and hold investing is a good long-term strategy, economists are good at predicting the...

READ MORE

MEMBERS ONLY

The Intellectual Void

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is an article I wrote a few years ago and I think is worth repeating.

I'm always trying to come up with new ideas for articles and don't mind if I cross the line a little bit even if it offends a few – I just...

READ MORE

MEMBERS ONLY

2021 Review

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

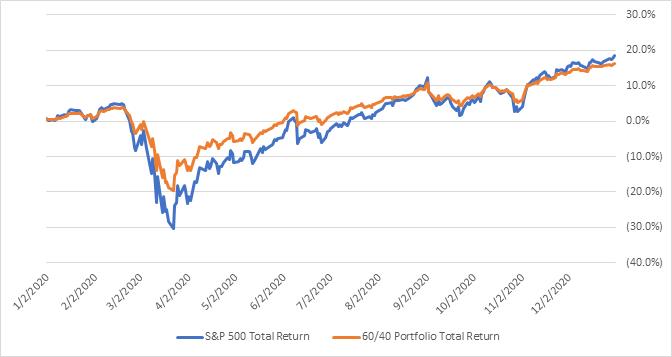

My trend following strategy delivered a net return after fees of 1.6% during 2021, while a 60/40 portfolio was up about 14% and the S&P 500 was up 26.9%. Underperforming the broad market or benchmark portfolios can be very frustrating to investors, but as we&...

READ MORE

MEMBERS ONLY

Maybe not what you want, but probably what you need.

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Investing successfully for the long term requires a balance between give and take, choosing the pros and the cons of different investment approaches, taking the good with the bad, and accepting the risks with the rewards of investing. In other words, you can't have it both ways. You...

READ MORE

MEMBERS ONLY

Choosing Frustration Over Devastation

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Trend following can offer benefits as an investing approach even when not generating positive returns. Sometimes the benefit comes from not losing, or not losing as much as other investment approaches; other times the benefit comes from allowing you to sleep more soundly at night, as selling out of equity...

READ MORE

MEMBERS ONLY

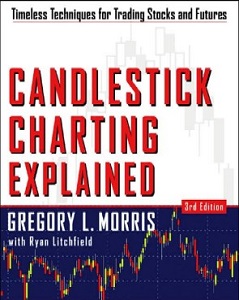

Candlestick Charting Explained & Candlestick Charting Explained Workbook

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

StockCharts.com's bookstore is offering a limited time, very low price on both books. See the end of this article for details.

The success of the first edition (1992) originally called Candlepower, and the second edition (1995) made the decision to do an expanded third edition easy. I...

READ MORE

MEMBERS ONLY

Long Days, Short Years

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

With another year in the books, we think it is a good time to provide an update on our rules-based trend following strategies, and why we think they are a better approach to investing. Let's start with a 2020 market recap.

A passive buy & hold investor in...

READ MORE

MEMBERS ONLY

Investing with the Trend

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Investing with the Trend provides an abundance of evidence for adapting a rules-based approach to investing by offering something most avoid, and that is to answer the "why" one would do it this way. It explains the need to try to participate in the good markets and avoid...

READ MORE

MEMBERS ONLY

Stop Guessing and Start Assessing

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

As of this writing, Tuesday's Presidential Election is still undecided, but one thing that seems abundantly clear to us, and should to you as well, is that people are not good at forecasting, predicting, or guessing reliably about the future. This clearly applies to politics, but also to...

READ MORE

MEMBERS ONLY

Information - Actionable or Observable

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I published this article in 2017 and believe it has even more merit today. Financial and business-related television always tries to relate an up market to good news and a down market to bad news. Some truly believe they are the ones that move the market; that is an amazing...

READ MORE

MEMBERS ONLY

Old Bear, New Trick

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The S&P 500 recently got back to positive territory for 2020, with a year-to-date return of 1.4% as of July 22nd. It didn't stay positive for long though. Trading was down on the 23rd and 24th, bringing it back into negative territory as of the...

READ MORE

MEMBERS ONLY

An Exceptional Bear Market

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

We think it is a good time to review bear markets, since we just had one, or are still in one, depending on the definition you choose to use. It is generally accepted that a bear market occurs when the stock market is down at least 20% from recent highs....

READ MORE

MEMBERS ONLY

Taxes Are the Consequence of Successful Investing

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In light of tax season being near (albeit delayed) and that we find ourselves in the midst of a bear market, we thought it was a good time to discuss active management and taxes, which is something we are asked about regularly. We often get asked about the impact of...

READ MORE

MEMBERS ONLY

Trend Following Was Ready, Were You?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

On February 13, 2020 we published an article called "Ready for a Bear?". On that day, the S&P 500 and Nasdaq Composite were closing near all-time highs, and 3 trading-days later on February 19, 2020, they both notched their peaks of this 11-year bull market cycle....

READ MORE

MEMBERS ONLY

Ready for a Bear?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The title of this article might make you believe that we are bearish on the market. If you have read some of the last 200+ articles in this blog, you know that we do not make forecasts or guess about the direction of the market; we follow our rules-based trend...

READ MORE

MEMBERS ONLY

News is Noise - 2019 Recap and Model Review

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

2019 was an easy investing year for everyone, right? The S&P 500 was up 31.5% (including dividends) while the Nasdaq Composite was up 35.2%; the best year for each since 2013. I'm sure everyone did at least that well. Many will look at the...

READ MORE

MEMBERS ONLY

Risk-adjusted Returns

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

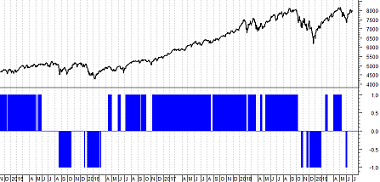

This article will wrap up the presentation of various performance metrics for two of our trend following strategies.

The last few charts will focus on risk-adjusted returns, which attempt to measure how much risk a strategy takes in order to generate the returns. Looking at risk-adjusted returns is a very...

READ MORE

MEMBERS ONLY

Reduces Ulcers

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This article will continue the presentation of various performance metrics on our trend strategies. We showed Chart A previously but are including it again before we introduce Chart B. Chart A shows the correlation of our two strategies and several other indices, relative to the S&P 500 Index....

READ MORE

MEMBERS ONLY

Investing with the Trend

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is a sales pitch for my latest and last book, Investing with the Trend. Instead of hearing from me, I have included a few actual reviews from readers. I basically tell people that I dumped 40+ years of experience in this book. There are many things in this book...

READ MORE

MEMBERS ONLY

Candlestick Charting Explained

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In 1988 I attended an MTA event at the Camelback Inn in Phoenix. At the conference there was a large contingent of Japanese traders present and they presented their charting techniques. It was the first time I had ever heard of "Hi Ashi," which is what the Japanese...

READ MORE

MEMBERS ONLY

The Complete Guide to Market Breadth Indicators

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

A few years ago StockCharts.com vastly updated not only its raw breadth database but now there are hundreds and hundreds of new market breadth indicators available to everyone. This is not really an article but an information piece about StockCharts.com's vast amount of breadth material and...

READ MORE

MEMBERS ONLY

Friends with Diversification Benefits

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Last time we showed you charts of many different market indices along with two of our strategies. We started with drawdown (our preferred measure of risk), instead of starting with returns, as we believe that managing risk is the more important aspect of developing strategies. Risk management is paramount to...

READ MORE

MEMBERS ONLY

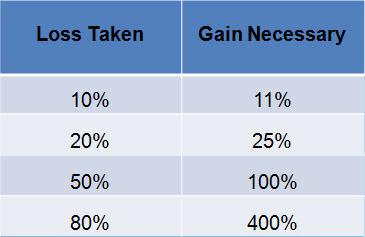

Drawdown

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

What is risk? The sterile laboratory of modern finance wants you to believe it is volatility. They say that volatility is defined as standard deviation. I have opposed that academic mentality often in these articles. If you use standard deviation it means you also believe the markets are random and...

READ MORE

MEMBERS ONLY

Trend Following Strategies

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Our rules-based trend following model is the foundation for three different money management strategies. This article will introduce you to two of them. Our model uses a weight-of-the-evidence approach to measure the strength of up-trends in the U.S. equity markets and is primarily focused on the Nasdaq Composite Index...

READ MORE

MEMBERS ONLY

TREND model - Introduction

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

As I have stated a number of times, I have used a rules-based trend following model to manage money since 1996. I have found this to be the best approach to investing long-term, as it has the ability to provide above-average compounded returns over time with far less volatility and...

READ MORE

MEMBERS ONLY

It is Time for a Change

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I have written 194 articles in my Dancing with the Trend blog on StockCharts.com in the past 4+ years. My intent was to educate about how markets work, offer full support of technical analysis, and tell real stories about being a money manager for the past 20+ years. I...

READ MORE

MEMBERS ONLY

Trend Gauge

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

A concept that was introduced to me long ago by my good friend Ted Wong is the use of multiple market indices and measuring their relationship to their moving average. Trend Gauge is comprised of two indicators; Mega Trend Plus and Trend Strength. A concept that attempts to identify overall...

READ MORE

MEMBERS ONLY

The Challenge of Technical Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I put an image of the Moon on this article because we are approaching the 50-year anniversary of Neil Armstrong setting foot on the Moon - July 20, 1969. I was between my sophomore and junior year at the University of Texas majoring in Aerospace Engineering so was especially touched...

READ MORE

MEMBERS ONLY

Volatility and Emotions

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is part of a client letter I wrote when running MurphyMorris Money Management about 20 years ago. The message is the same today. Market volatility has an emotional cost. It causes investors to make irrational decisions that are usually based on either fear or greed. Volatility also carries a...

READ MORE

MEMBERS ONLY

Various Strategies

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This article follows the concepts laid out in the previous article about Passive versus Active Management. The comments below give brief pro, con, and comments on the various strategies. With the benefit of hindsight, the market can seem predictable; however, many of these strategies are more useful in describing the...

READ MORE