MEMBERS ONLY

TREASURY YIELDS FALL TO THREE-YEAR LOW AS PRICES SURGE -- THAT'S REALLY HURTING BANKS AND LIFE INSURERS -- PRUDENTIAL TUMBLES -- MONEY CONTINUES TO FLOW INTO TREASURY BONDS, GOLD, AND THE JAPANESE YEN -- DOW ON VERGE OF BREAKDOWN

by John Murphy,

Chief Technical Analyst, StockCharts.com

TREASURY YIELDS FALL TO THREE-YEAR ... The rapid descent in global bond yields continues uninterrupted. The 10-Year Japanese bond yield recently fell into negative territory for the first time in its history. That's helping drive sovereign bond yields lower everywhere else. Chart 1 shows the 10-Year Treasury Yield falling...

READ MORE

MEMBERS ONLY

TRANSPORTS TEST LONG-TERM SUPPORT LINES -- AIRLINES AND TRUCKERS ATTRACT SOME BUYING -- TRANSPORTATION/UTILITY RATIO IS OVERSOLD -- SO IS THE TRANSPORTATION/INDUSTRIAL RATIO -- THE DOW USUALLY HOLDS UP BETTER IN A WEAK MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS START TO SHOW SOME BOUNCE... Transportation stocks have been one of the weakest parts of the stock market over the last year. In fact, the downtrend in that economically-sensitive group was cited several times last year as a negative warning for the economy and stock market. The daily bars...

READ MORE

MEMBERS ONLY

Nasdaq May Be On Verge Of Breakdown

by John Murphy,

Chief Technical Analyst, StockCharts.com

It's never a good sign to see the Nasdaq leading the rest of the market lower, which it did this week. A -3% plunge on Friday (and a -5% loss for the week) made it the weakest of the major market indexes. Heavy selling in software and internet...

READ MORE

MEMBERS ONLY

CONSUMER DISCRETIONARY AND TECHNOLOLGY STOCKS LEAD MARKET LOWER -- NASDAQ UNDERPERFORMANCE IS A BAD SIGN -- GOLD STOCKS HAVE A STRONG WEEK -- MONEY ALSO FLOWS TO UTILITIES, TELECOM, AND FOOD -- TYSON FOODS HITS RECORD HIGH -- NETFLIX TUMBLES BELOW SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR LEADS MARKET LOWER... It's never a good sign to see economically-sensitive stocks leading the market lower. That's because they're most closely tied to investor confidence (or lack therof) in the U.S. economy. But that's what happened this week....

READ MORE

MEMBERS ONLY

NASDAQ LEADS MARKET INTO BAD END FOR THE WEEK -- INTERNET-RELATED STOCKS LEAD TECHNOLOGY SECTOR LOWER -- AMAZON.COM BREAKS 200-DAY AVERAGE -- THAT'S ALSO BAD FOR CONSUMER DISCRETIONARY STOCKS WHICH ARE BIG FRIDAY LOSERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ LEADS MARKET LOWER ... A 3% loss in the Nasdaq market is pulling the rest of the market lower. Chart 1 shows the Nasdaq Composite Index bearing down on last week's low. The Nasdaq/S&P 500 ratio (below chart) has plunged to the lowest level in...

READ MORE

MEMBERS ONLY

FALLING DOLLAR GIVES OIL AND GOLD A BOOST -- BARRICK GOLD AND NEWMONT LEAD GOLD MINERS HIGHER -- AMAZON.COM TESTS 200-DAY AVERAGE -- TESLA MOTORS FALLS TO TWO-YEAR LOW -- FINANCIAL STOCKS NEED A REBOUND IN BOND YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR PLUNGES ... The dollar is having its worst day in months. Chart 1 shows the Power Shares Dollar Index (UUP) tumbling to the lowest level in three months. That's due partially to the recent drop in U.S. rates, falling stock prices, and weak economic news which have...

READ MORE

MEMBERS ONLY

PLUNGE IN JAPANESE BOND YIELD PULLS TREASURY YIELD TO NINE-MONTH LOW -- THAT HELPS EXPLAIN WHY BONDS RALLIED WITH STOCKS ON FRIDAY -- FALLING BOND YIELD IS GOOD FOR UTILITIES AND OTHER DIVIDEND PAYERS, BUT BAD FOR BANKS AND INSURERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD FALLS TO NINE-MONTH LOW... A seemingly strange thing happened on Friday. The Bank of Japan surprised everyone by adopting a negative interest rate for the first time by pushing its short-term rate below zero. Not surprisingly, the Japanese yen plunged 2% and Japanese stocks jumped 2.8%...

READ MORE

MEMBERS ONLY

JAPANESE MOVE TO NEGATIVE RATES PUSHES YEN SHARPLY LOWER AND JAPANESE STOCKS HIGHER -- THAT FAVORS WISDOM TREE JAPAN HEDGED EQUITY ETF OVER JAPANESE ISHARES -- FTSE ALL WORLD STOCK INDEX IS AT POTENTIAL SUPPORT LEVEL AND OVERSOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

PLUNGE IN YEN... The Bank of Japan (BOJ) announced this morning a move to negative interest rates for the first time in its history. That pushed Japanese yields sharply lower and caused the yen to plunge. Chart 1 shows the Japanese yen plunging -2% today, which is its biggest drop...

READ MORE

MEMBERS ONLY

FALLING BOND YIELDS BOOST UTILITIES -- AT&T HITS RECORD HIGH -- FOOD STOCKS LEAD CONSUMER STAPLES -- DOLLAR WEAKENS WITH SHORT-TERM RATES -- DOW BOUNCES ON RISING CRUDE

by John Murphy,

Chief Technical Analyst, StockCharts.com

BONDS AND UTILITIES ARE RISING TOGETHER... With the 10-Year Treasury yield slipping back below 2.00%, bond prices are rising. The daily bars in Chart 1 show the Barclays 7-10 Year iShares (IEF) nearing its January high. Rate-sensitive stocks like utilities usually rise right along with bonds. Chart 2 shows...

READ MORE

MEMBERS ONLY

STOCKS TURN DOWN AS BONDS BOUNCE -- APPLE WEIGHS ON TECHNOLOGY AS VERIZON HAS STRONG DAY -- WEAKER DOLLAR BOOSTS GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES TURN DOWN ... Stocks are weakening after the Fed statement. Chart 1 shows the DJ Industrial SPDR (DIA) reversing down in late afternoon trading. It may now retest last week's low. Chart 2 shows the S&P 500 SPDRS (SPY) doing the same. Chart 3 shows...

READ MORE

MEMBERS ONLY

DOLLAR DIRECTION IS IMPORTANT FOR GLOBAL STOCKS AND COMMODITIES -- SAFE HAVEN BUYING HAS PUSHED JAPANESE YEN HIGHER AND STOCKS LOWER -- U.S. STOCK INDEXES TRY TO BOUNCE OFF AUGUST LOWS -- TODAY'S FED ANNOUNCEMENT COULD BE IMPORTANT

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR DIRECTION MAY HOLD KEY TO CRUDE OIL ... Everyone is waiting to hear what the Fed has to say today. Markets appear to hoping for a more dovish statement. Currency traders are also paying very close attention. That's because Fed policy has a big impact on dollar direction....

READ MORE

MEMBERS ONLY

GLOBAL SELLOFF CONTINUES -- CRUDE OIL NEARS $25 -- CRB INDEX DROPS TO LOWEST LEVEL SINCE EARLY 1970S WHICH IS DEFLATIONARY -- TREASURY ETF BREAKS OUT TO UPSIDE AS YIELD FALLS BELOW 2%

by John Murphy,

Chief Technical Analyst, StockCharts.com

LONG-TERM LOOK AT CRUDE... The price of crude oil continues to drop and is bringing global stocks down with it. The monthly bars in Chart 1 show how bad the decline has been and where it appears headed. The recent decline pushed WTIC Light Crude Oil below its early 2009...

READ MORE

MEMBERS ONLY

Advance-Decline Turns Down, Foreign Markets Already Bearish

by John Murphy,

Chief Technical Analyst, StockCharts.com

A lot of us on this site have been warning about the fact that the fourth quarter rally was mainly driven by large cap stocks and wasn't being supported by the vast majority of stocks. That's been shown by breakdowns in small and midsize stocks and...

READ MORE

MEMBERS ONLY

U.S. STOCK INDEXES THREATEN 2015 LOWS -- WHAT HAPPENS IF THEY DON'T HOLD -- THE S&P 500 COULD LOSE ANOTHER 10-12% AND DROP TOWARD 1600 -- NYSE ADVANCE DECLINE LINE TURNS DOWN -- INDEX OF FOREIGN STOCKS IS IN BEAR MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. STOCK INDEXES THREATEN 2015 LOWS ... Another week of heavy selling has pushed major U.S. stock indexes into a critical test of their 2015 lows. The first three charts tell the story. Chart 1 shows the Dow Industrials ending the week just above its late September intra-day low...

READ MORE

MEMBERS ONLY

AUTO PARTS AND RAILS LEAD MARKET LOWER -- BORGWARNER HITS THREE-YEAR LOW -- CSX AND UAL LEAD TRANSPORTS LOWER -- TREASURIES CONTINUE TO GAIN AS STOCKS SINK -- FALLING YIELDS, HOWEVER, ARE HURTING BANKS -- S&P 500 NEARS TEST OF 2015 LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

AUTO PARTS LEAD CYCLICALS LOWER... A week ago Tuesday (January 5), I showed a chart of General Motors falling below its 200-day moving while autos were leading the Consumer Discretionary SPDR lower. Today, the main drag on that sector is auto parts. Chart 1 shows the Dow Jones US Auto...

READ MORE

MEMBERS ONLY

MAJOR U.S. STOCK INDEXES ENTER CORRECTION TERRITORY -- A RETEST OF 2015 LOWS APPEARS LIKELY -- SMALL AND MIDSIZE STOCKS HAVE ALREADY BROKEN THAT SUPPORT -- DOW TRANSPORTS ENTER BEAR MARKET TERRITORY -- DEFENSIVE UTILITES SHOW RELATIVE STRENGTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES ENTER CORRECTION TERRITORY... After suffering the worst start to a new year in history, the U.S. stock market has entered correction territory which is defined by a drop of 10% from its old high. The charts pretty much speak for themselves. All three major stock indexes...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS RESUME SELLING -- U.S. STOCK RALLY HAS BEEN TOO NARROW AND VULNERABLE TO A DOWNSIDE CORRECTION -- GAP BETWEEN SMALL AND LARGE CAPS IS A WARNING SIGN -- SO IS THE DROP TO 40% IN THE NYSE BULLISH PERCENT INDEX

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS ARE LEADING LARGE CAPS LOWER... Global stocks have started the year on a bad note. Most of that is being blamed on China. A plunge in Chinese stocks and a drop in the Chinese yuan to a five-year low are certainly causing a lot of worries in global...

READ MORE

MEMBERS ONLY

DEFENSIVE STOCKS CONTINUE TO SHOW LEADERHIP -- KIMBERLY CLARK LEADS STAPLES HIGHER -- UTILITIES AND REITS CONTINUE TO GAIN GROUND -- KIMCO REALTY JUMPS 3% -- AUTOS HELP PULL CONSUMER DISCRETIONARY SPDR LOWER -- GENERAL MOTORS BREAKS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER STAPLES ARE HOLDING UP ... Last Wednesday's message showed that money was flowing toward defensive stocks, which meant that investors were ending the old year in a more cautious mood. That mood is continuing into the new year. With the stock market on the defensive during the first...

READ MORE

MEMBERS ONLY

SMALL AND MIDCAP STOCKS CONTINUE TO LAG BEHIND S&P 500 INDEX -- CONSUMER STAPLES AND UTILITIES ARE DECEMBER LEADERS -- WHILE CYCLICALS AND INDUSTRIALS LAG BEHIND -- ROTATION FROM CYCLICALS TO STAPLES IS A SIGN OF CAUTION

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALLER STOCKS STILL LAG BEHIND LARGE CAPS... A yearend stock rebound has boosted major stock indexes. Chart 1 shows the S&P 500 touching a three-week high yesterday. It still, however, remains below a falling resistance line drawn over its November/December highs, and is trying to stay above...

READ MORE

MEMBERS ONLY

Bond/Stock Ratio Still Rising

by John Murphy,

Chief Technical Analyst, StockCharts.com

Last Saturday's message showed that Treasury bonds have been doing better than stocks since the summer. That's still the case. This chart below shows a ratio of the the long-dated Treasury ETF (TLT) divided by the S&P 500 SPDRs (SPY). The rising ratio shows...

READ MORE

MEMBERS ONLY

STOCKS ARE ENDING THE WEEK ON A DOWN NOTE -- ENERGY SECTOR SPDR TESTS SUMMER LOW -- MONEY FLOWS INTO TREASURIES AS CORPORATE BONDS UNDERPERFORM -- TREASURIES ARE HAVING A BETTER DECEMBER THAN STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES UNDER HEAVY SELLING... Stocks have come under renewed selling pressure following Wednesday's Fed inspired bounce. And it looks like they're going to end the week on the downside. Chart 1 shows the Dow Industrials down nearly 200 points in late morning trading. It&...

READ MORE

MEMBERS ONLY

FED RAISES SHORT-TERM RATE A QUARTER POINT WITH DOVISH COMMENT -- DIVIDEND PAYING REITS AND UTILITIES LEAD REBOUND -- AT&T LEADS TELECOM HIGHER -- S&P CLEARS MOVING AVERAGE LINES -- VIX FALLS BACK BELOW 20

by John Murphy,

Chief Technical Analyst, StockCharts.com

UTILITIES AND REITS JUMP... The Fed raised short-term rates a quarter point as expected, but softened the move with a dovish statement. Shorter-term yields in the two to five-year range are moving higher. Stocks are trading higher on the Fed move. The biggest gainers, however, are rate-sensitive stocks that pay...

READ MORE

MEMBERS ONLY

S&P 500 FALLS BELOW NOVEMBER LOW IN HIGHER TRADING -- NYSE ADVANCE-DECLINE LINE ALSO BREAKS SUPPORT -- SECTOR ROTATIONS TURN DEFENSIVE -- CRUDE NEARS TEST OF 2009 LOW -- TREASURY BOND/STOCK RATIO STRENGTHENS AS COMMODITY INDEX TUMBLES TO MULTI-YEAR LOWS

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 FALLS BELOW SEPTEMBER LOW... My Friday afternoon message showed small caps breaking their November lows, and wrote that the S&P 500 Index was in the process of testing that important level. Chart 1 shows the S&P 500 Large Cap Index ending the...

READ MORE

MEMBERS ONLY

STOCKS ARE UNDER HEAVY PRESSURE AS CRUDE OIL HITS NEW LOW -- S&P 500 THREATENS SUPPORT -- SMALL CAPS HAVE ALREADY BROKEN NOVEMBER LOW -- TREASURIES JUMP WHILE JUNK BONDS TUMBLE TO TWO-YEAR LOW -- EMERGING MARKETS LEAD GLOBAL DECLINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS LEAD MARKET LOWER ... The drop in crude oil to another six-year low has undercut the recent bounce in energy shares, which are leading today's stock selloff. With all ten sectors in the red, energy stocks are down -3%. Commodity-related material stocks are right behind. The three...

READ MORE

MEMBERS ONLY

OIL BOUNCE FADES -- BUT ENERGY STOCKS END HIGHER -- MATERIALS JUMP ON DUPONT AND DOW CHEMICAL MERGER -- STOCKS END LOWER -- VIX NEARS 20 BARRIER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKET RECAP... A morning oil bounce on low inventory faded in afternoon trading and the testing of support continues. Even so, energy stocks held some of their gains. Chevron and Exxon Mobil helped support the Dow. Materials had a strong day on the merger of Dupont and Dow Chemical. The...

READ MORE

MEMBERS ONLY

CRUDE OIL TRIES TO REBOUND OFF AUGUST LOW -- ENERGY STOCKS ALSO REBOUND OFF CHART SUPPORT -- HIGH YIELD BONDS TEST OLD LOWS AS WELL -- TREASURIES SELL OFF -- DOLLAR DROP BOOSTS COMMODITIES -- S&P TRIES TO HOLD CHART SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

WTIC CRUDE OIL STILL TESTING LONG-TERM SUPPORT... The recent drop in the price of oil has caused energy stocks to drop which, in turn, has caused nervous selling in the rest of the market. That has pushed a number of energy-related assets into tests of important support levels. The monthly...

READ MORE

MEMBERS ONLY

Friday Jump Keeps Stocks in Uptrend

by John Murphy,

Chief Technical Analyst, StockCharts.com

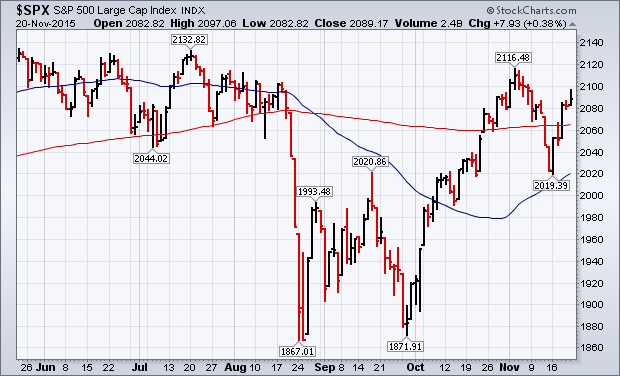

A strong rally on Friday more than erased losses from Thursday and left the market in much better shape. The chart below shows the S&P 500 ending the week back above its 200-day average after bouncing off its 50-day line on Thursday. Chartwatchers will now recognize the pattern...

READ MORE

MEMBERS ONLY

FRIDAY JUMP KEEPS STOCKS IN UPTREND -- PRICE PATTERN LOOKS POSITIVE -- GOLD STOCKS JUMP ON WEAK DOLLAR -- PROSPECTS FOR HIGHER RATES BOOST BANKS -- FALLING OIL HELPS AIRLINES RISE -- NASDAQ 100 NEARS NEW RECORD -- APPLE MAY BE TURNING UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

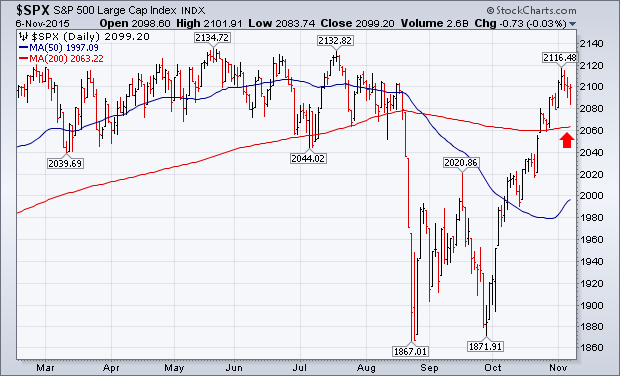

SHORT-TERM PATTERN LOOKS POSITIVE... A strong rally on Friday more than erased losses from Thursday and left the market in much better shape. Chart 1 shows the S&P 500 ending the week back above its 200-day average after bouncing off its 50-day line on Thursday. Chartwatchers will now...

READ MORE

MEMBERS ONLY

STOCKS HAVE A HUGE FRIDAY -- NEWMONT MINING LEADS GOLD STOCKS -- FINANCIAL LEADERS ARE CME GROUP, CHARLES SCHWAB, AND PNC FINANCIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES GAIN 2%... Stocks are having a huge day on Friday. Stock indexes are showing gains of 2%. Chart 1 shows the S&P 500 gaining 40 points nearing the close. Its ability to bounce back above its 200-day line is also impressive. That gives its recent pattern...

READ MORE

MEMBERS ONLY

ECB DISAPPOINTS MARKETS -- EURO JUMPS AS DOLLAR FALLS -- TREASURY YIELDS FOLLOW EUROPE HIGHER -- EUROPEAN STOCKS TUMBLE -- RISING RATES HURT UTILITIES, SUPPORT BANKS -- KROGER BREAKS OUT TO NEW HIGH -- ENERGY SECTOR WEAKENS -- S&P 500 RETESTS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DRAGHI DISAPPOINTS... Mario Draghi promised more stimulative measures to boost eurozone inflation and economic growth. The ECB today lowered its deposit rate 10 basis points to -0.3%. It also extended its QE bond buying program for an additional six months. Either those moves were already expected, or the markets...

READ MORE

MEMBERS ONLY

TECHNOLOGY ETFS TEST NOVEMBER HIGHS -- ALTHOUGH BIG TECHS LEAD RALLY, EQUAL WEIGHT ETF SHOWS STRENGTH -- SEMICONDUCTOR ETF AT SIX-MONTH HIGH -- INTEL AND NVIDIA ARE CHIP LEADERS -- STRONG DOLLAR MAY HELP AIRLINES BY MAKING INTL TRAVEL CHEAPER

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY STOCKS CONTINUE TO LEAD THE MARKET HIGHER... It's usually a good sign when the economically-sensitive technology sector is leading the market higher. And it is. Chart 1 shows the Technology Sector SPDR (XLK) in the process of testing its November high. Its relative strength ratio (above chart)...

READ MORE

MEMBERS ONLY

SMALL STOCKS START TO SHOW LEADERSHIP -- DOLLAR NEARS 13-YEAR HIGH AS EURO WEAKENS -- COMMODITY DEFLATION HOLDS BOND YIELDS DOWN -- SO DO NEGATIVE EUROZONE YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAP INDEXES TURN UP -- MIDCAPS ARE RIGHT BEHIND... Smaller stocks are not only catching up to larger stocks, they're starting to do better. That normally happens near yearend in anticipation of the "January Effect" when investors favor smaller stocks. Chart 1 shows the S&...

READ MORE

MEMBERS ONLY

THANKSIVING WEEK IS USUALLY GOOD FOR THE MARKET -- SO IS THE MONTH OF DECEMBER -- THAT'S ESPECIALLY TRUE OF SMALLER STOCKS WHICH ARE TURNING UP -- CONSUMER DISCRETIONARY SPDR NEARS RECORD -- ALEXION AND AMGEN LEAD HEALTHCARE SECTOR

by John Murphy,

Chief Technical Analyst, StockCharts.com

THANKSGIVING TREAT ... Stocks are approaching the Thanksgiving holiday in an optimistic mood. That's not unusual. According to the Stock Trader's Almanac, the Wednesday before and the Friday after Thanksgiving are up days most of the time. Following that, stocks enter December which is usually the strongest...

READ MORE

MEMBERS ONLY

S&P 500 Regains Its 200-Day Average

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 REGAINS ITS 200-DAY AVERAGE -- EQUAL WEIGHTED VERSION LAGS... This time last week, the S&P 500 Index had fallen back below its 200-day average and was testing chart support at its September peak at 2020 (and its 50-day moving average). It survived that test...

READ MORE

MEMBERS ONLY

MORE STOCKS ARE TRADING ABOVE THEIR 200-DAY AVERAGES -- S&P 500 REGAINS 200-DAY AVERAGE -- ITS EQUAL WEIGHT VERSION STILL LAGS BEHIND -- SMALL CAPS MAY BE STARTING TO CATCH UP -- CYCLICALS, INDUSTRIALS, AND TECHNOLOGY ARE WEEK'S SECTOR LEADERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MORE STOCKS CLEAR THEIR 200-DAY AVERAGES ... My Wednesday message showed that the percent of NYSE stocks above their 200-day average had declined during November to as low as 27% (about where it was at the same time in 2011). I suggested that the number needed to exceed its earlier peak...

READ MORE

MEMBERS ONLY

REGENERON, VERTEX, AND AMGEN LEAD BIOTECHS HIGHER -- AFLAC AND PRUDENTIAL ARE LIFE INSURANCE LEADERS -- STOCK INDEXES TRY TO RECLAIM 200-DAY AVERAGES -- SMALL CAPS NEED TO SHOW MORE BOUNCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

BIOTECH ISHARES TRIES TO REGAIN UPTREND... Chart 1 shows Biotech iShares (IBB) testing a falling trendline drawn over its July/September peaks. It has already regained its 50-day average, but remains below its 200-day line. Its relative strength ratio (top of chart) is also starting to recover from its September...

READ MORE

MEMBERS ONLY

MAJOR STOCK INDEXES FALL BELOW 200-DAY AVERAGES -- PLUNGING RETAILERS WEAKEN CONSUMER DISCRETIONARY SPDR -- CRUDE OIL HEADED FOR TEST OF AUGUST LOW -- RISING DOLLAR PUSHES CRB INDEX BELOW 2008 LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES FALL BELOW 200-DAY AVERAGES... The market suffered a setback this week when major U.S. stock indexes fell back below their 200-day averages. Chart 1 shows the Nasdaq Composite ending below that support line on Friday. Chart 2 shows the Dow Industrials spending Thursday and Friday below...

READ MORE

MEMBERS ONLY

CYCLICALS LOSE MARKET LEADERSHIP -- PLUNGING RETAILERS ARE A CAUTION SIGN FOR THE MARKET -- THE S&P 500 NEARS A TEST OF ITS SEPTEMBER HIGH -- SMALL CAPS LOSE MORE GROUND -- VIX CLIMBS BACK OVER 20

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR LOSES LEADERSHIP... One of the more positive signs throughout 2015 has been leadership by consumer discretionary stocks. In fact, cyclicals have been the market's strongest sector all year. That can be seen by its rising relative strength ratio on top of the chart. But not...

READ MORE

MEMBERS ONLY

RISING DOLLAR PUSHES COMMODITIES NEAR SIX-YEAR LOWS -- GOLD, COPPER, CORN, AND CRUDE TEST YEARLY LOWS -- WEAKNESS IN METAL AND ENERGY SHARES ARE STARTING TO WEIGH ON THE BROADER MARKET -- S&P 500 RETESTS SUPPORT AT ITS 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING DOLLAR PUSHES CRB INDEX NEAR AUGUST LOW ... My previous message explained that one of the casualties of a rising U.S. Dollar would be weaker commodity markets. With the dollar having recently risen to a new seven-month high, commodity prices are in retreat. The brown line in Chart 1...

READ MORE

MEMBERS ONLY

Stock End the Week Mixed, But Still In Uptrend

by John Murphy,

Chief Technical Analyst, StockCharts.com

Friday's jobs report caused some minor profit-taking in major stock indexes, but not enough to alter the current uptrend. The chart below shows the S&P 500 dropping slightly Wednesday through Friday (but closing up for the week). I've pointed out that stocks are up...

READ MORE