MEMBERS ONLY

STRONG JOBS REPORT PUSHES BOND YIELDS AND DOLLAR HIGHER -- RISING DOLLAR MAY BE HELPING SMALL CAPS TO PLAY CATCHUP -- RISING RATES HELP BANKS, BROKERS, AND INSURERS -- BUT HURT UTILITIES AND REITS -- RISING BOND YIELDS FAVOR CYCLICALS OVER STAPLES

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS END THE WEEK MIXED, BUT STILL IN UPTREND... Friday's jobs report caused some minor profit-taking in major stock indexes, but not enough to alter the current uptrend. Chart 1 shows the S&P 500 dropping slightly Wednesday through Friday (but closing up for the week). I&...

READ MORE

MEMBERS ONLY

STRONG JOBS REPORT PUSHES RATES SHARPLY HIGHER -- THAT HELPS BANKS, BROKERS, AND INSURERS -- BUT HURTS UTILITIES -- RISING DOLLAR PUSHES GOLD AND OTHER COMMODITIES LOWER -- EMERGING MARKETS SLIP ON RISING DOLLAR AND PROSPECTS FOR HIGHER BOND YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

SURPRISINGLY STRONG JOBS REPORT... Today's surprisingly strong jobs report took markets by surprise, but is having predictable intermaket results. First, it pushed Treasury yields sharply higher. That's based on the belief that the strong report increases the odds for a Fed rate hike in December. Chart...

READ MORE

MEMBERS ONLY

YIELDS RISE ON YELLEN OPTIMISM -- THAT PUSHED DOLLAR HIGHER AND GOLD AND OTHER COMMODITIES LOWER -- OVERBOUGHT STOCKS ARE TESTING OLD HIGHS AND MAY NEED A BREATHER -- FOREIGN STOCKS ALSO EXPERIENCE SELLING NEAR RESISTANCE LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

YELLEN PUSHES YIELDS HIGHER... Janet Yellen sounded a hawkish tone again today about the possibility of a December rate hike. That pushed U.S. rates higher. Chart 1 shows the 10-Year Treasury Note Yield climbing to the highest level in two months. Shorter-term rates climbed even more. That caused selling...

READ MORE

MEMBERS ONLY

STOCKS HAVE STRONGEST OCTOBER IN FOUR YEARS -- S&P 500 ENDS NEAR TWO-MONTH HIGH BUT LOOKS OVER-EXTENDED -- EQUAL WEIGHT STOCK ETFS NEED TO CATCH UP -- JANUARY EFFECT SHOULD BOOST SMALL CAPS -- WEEKLY MACD LINES TURN POSITIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

HALLOWEEN INDICATOR ... Stocks had the best October since 2011. That bodes well for the rest of the fourth quarter and the next six months. The three months between November and January are traditionally the best three months of the year. As is the six-month period between November and April. As...

READ MORE

MEMBERS ONLY

FED'S HAWKISH TONE BOOSTS BOND YIELDS -- THAT HELPS BANKS AND INSURERS, BUT HURTS UTILITIES -- DOLLAR RALLY HURTS GOLD -- ENERGY STOCKS REBOUND WITH CRUDE OIL -- S&P 500 HITS TWO-MONTH HIGH -- SMALL CAPS ACHIEVE BULLISH BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS RISE ... Today's Fed statement had a slightly more hawkish tone than markets were expecting, and left the door open for a possible December rate hike. After a brief dip, stocks ended strong. Financials bounced sharply on the Fed statement, while rate-sensitive utilities sold off. A bounce...

READ MORE

MEMBERS ONLY

INDUSTRIALS LEAD STRONG STOCK RALLY -- INDUSTRIAL SPDR CLEARS 200-DAY AVERAGE -- BIG MOVES SEEN IN BOEING, MMM, SOUTHWEST AIRLINES, AND RAYTHEON -- SEMICONDUCTORS LEAD TECHNOLOGY HIGHER -- PLUNGING EURO BOOSTS EUROZONE STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIAL SPDR TURNS UP ... Throughout the summer, I expressed concern about the weak performance in the economically-sensitive industrial sector. That situation has taken a dramatic turn for the better. Chart 1 shows the Industrials SPDR (XLI) leaping 3% today and trading above its 200-day average. The XLI has also broken...

READ MORE

MEMBERS ONLY

HOMEBUILDERS RISE ON GOOD NEWS -- FALLING BOND YIELDS PUSH REITS TO SIX MONTH HIGH -- NYSE ADVANCE-DECLINE LINE CLEARS 200-DAY AVERAGE -- NASDAQ TESTS 200-DAY LINE -- INTEL AND MICROSOFT SHOW TECHNOLOGY LEADERSHIP -- APPLE MAY BE TURNING UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

HOMEBUILDERS BUILD ON GOOD NEWS... Yesterday's announcement that homebuilding sentiment had jumped to a ten-year high was followed by today's report that September housing starts had the second biggest jump in eight years. Not surprisingly, homebuilders are having a strong day. The daily bars in Chart...

READ MORE

MEMBERS ONLY

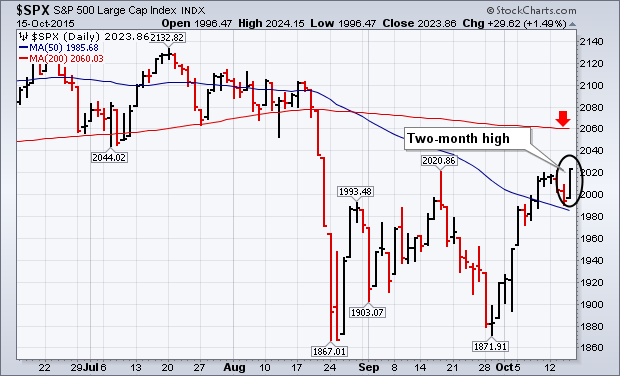

S&P 500 Hits Two Month High

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. stocks continued the rally that started in late September. On Thursday, the Dow Industrials gained 217 points (1.2%) to extend its rally. The first chart below shows the S&P 500 gaining an even stronger 1.5%. More importantly, the SPX closed at 2023 which exceeded...

READ MORE

MEMBERS ONLY

FINANCIALS LEAD MARKET HIGHER -- BANK OF AMERICA, CITIGROUP, AND GOLDMAN SACHS LEAD -- EMERGING MARKETS LEAD FOREIGN STOCKS HIGHER -- S&P 500 CLOSES AT TWO-MONTH HIGH AS NASDAQ CLOSES ABOVE 50-DAY LINE -- VIX FALLS 10% TO TWO-MONTH LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

BANK STOCKS HAVE STRONG DAY ... Financial stocks led a strong day in stocks. Several big bank stocks had big chart days. The daily bars in Chart 1 show Bank of America (BAC) surging more than 3% in heavy trading. It's also testing its 50- and 200-day moving averages....

READ MORE

MEMBERS ONLY

DOLLARS WEAKENS AS TWO-YEAR TREASURY YIELD FALLS TO THREE MONTH LOW -- THAT COMBINATION IS PUSHING PRECIOUS METALS HIGHER -- GOLD HAS RETRACED 50% OF ITS PREVIOUS BULL MARKET WHICH PUTS IT IN A POTENTIAL SUPPORT ZONE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR FALLS WITH U.S. RATES... U.S. interest rates have been dropping on reduced expectations for a Fed rate hike this year. Chart 1 shows the 2-Year Treasury Yield falling yesterday to the lowest level in three months. That's important because that shorter term yield is more...

READ MORE

MEMBERS ONLY

BREADTH INDICATORS TURN UP -- DOLLAR WEAKNESS SHOULD START TO HELP EARNINGS -- SO SHOULD A REBOUND IN ENERGY AND MATERIALS -- AND A REBOUND IN EMERGING MARKETS -- UPTURN IN EM CURRENCIES SUPPORTS EM STOCK ADVANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

PERCENT OF STOCKS ABOVE MOVING AVERAGE LINES TURNS UP ... Breadth indicators continue to show marked improvement. My Wednesday message showed the percent of NYSE stocks above their 50-day average turning up. I stated that it needed to climb above 50% to turn its trend higher. The blue line in Chart...

READ MORE

MEMBERS ONLY

SIGNS OF COMMODITY BOTTOM ARE GOOD FOR GLOBAL STOCKS -- OVERSOLD ENERGY SECTOR REBOUNDS -- FREEPORT MCMORAN LEADS COPPER RALLY -- SILVER ALSO TURNS UP -- PERCENT OF NYSE STOCKS ABOVE 5O-DAY AVERAGE IMPROVES -- HIGH YIELD BOND ETF BOUNCES OFF CHART SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY SECTOR MAY BE BOTTOMING... Global stocks continue to bounce off important support levels. One of the supporting factors is new strength in commodity-related energy and material stocks. I've written previous messages on new signs of strength in commodity markets -- especially copper and energy. My August 27...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS START WEEK ON A STRONG NOTE -- IMPORTANT SUPPORT LEVELS FOR EMERGING AND DEVELOPED FOREIGN MARKETS CONTINUE TO HOLD -- SAME IS TRUE FOR U.S. STOCK INDEXES WHICH ARE UP SHARPLY -- STOCK INDEXES APPROACH TEST OF 50-DAY LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

EMERGING MARKETS LEAD GLOBAL RALLY ... Stocks around the world are continuing the rally that began Friday after the very weak U.S. jobs report. Part of the reason for the renewed optimism may be the belief that the weak job report took a Fed rate hike off the table for...

READ MORE

MEMBERS ONLY

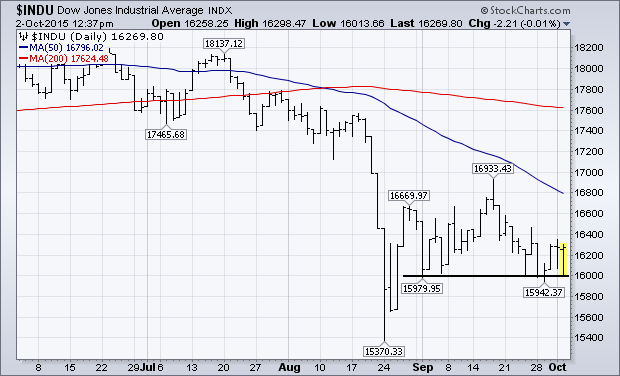

Testing Process Continues

by John Murphy,

Chief Technical Analyst, StockCharts.com

The stock market continues to test underlying support levels formed during the summer. The first chart (below) shows the Dow Industrials holding chart support along the 16,000 level. The second chart shows the Nasdaq Composite holding support along its August 25 closing low at 4500. The last chart shows...

READ MORE

MEMBERS ONLY

BOND YIELDS PLUNGE ON WEAK JOBS REPORT -- BANKS, BROKERS, AND INSURERS LEAD FINANCIALS LOWER -- WEAKER DOLLAR HELPS BOOST GOLD AND GOLD MINERS -- STOCK INDEXES CONTINUE TO TEST SUPPORT LEVELS

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELD PLUNGES... This morning's dismal jobs report pushed Treasury prices sharply higher and bond yields lower. Chart 1 shows the 10-Year Treasury Note Yield plunging to the lowest level since August. Treasury bond prices saw the biggest gains, while investment grade corporate bonds also bounced. High yield...

READ MORE

MEMBERS ONLY

BOND INVESTORS PLAY DEFENSE -- INVESTMENT GRADE CORPORATES UNDERPERFORM TREASURIES -- HIGH YIELD BONDS ARE EVEN WEAKER -- ENERGY SECTOR WEIGHS ON HIGH YIELD ETF -- NYSE BULLISH PERCENT INDEX STILL IN A DOWNTREND -- THE VIX STILL BOUNCING

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND ALIGNMENT SHOWS CAUTION ... Money has been flowing into the relative safety of bonds as stocks prices have slid. That money hasn't been flowing equally into all bond categories however. Most of the money has been flowing into Treasury bonds which are the safest of all. Investment Grade...

READ MORE

MEMBERS ONLY

BIOTECH DIVE PULLS NASDAQ AND HEALTHCARE SECTOR LOWER -- BIG PHARMA ALSO WEAKENS -- RUSSELL 2000 SMALL CAP INDEX MAY BE THE FIRST TO TEST ITS AUGUST LOW -- THAT WILL BE AN IMPORTANT TEST FOR IT AND THE REST OF THE MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

BIOTECHS CONTINUE TO TUMBLE... Biotechs have gone from market helpers to market hurters. The daily bars in Chart 1 show Biotech iShares (IBB) falling to the lowest level since August, and the lowest closing price in more than six months (in very heavy trading). The IBB lost 13% on the...

READ MORE

MEMBERS ONLY

STOCKS RETREAT TOWARD SUMMER LOWS -- TREASURY BOND PRICES GAIN -- HIGH YIELD BONDS FALL WITH STOCKS -- DOLLAR DROP PUSHES SOME MONEY INTO GOLD -- VIX STAYS ABOVE CHART SUPPORT -- AUTOS AND BIOTECHS WEAKEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

AUTOS AND BIOTECHS WEAKEN ... Two groups that had recently held up better than others have experienced heavy selling this week. Chart 1 shows the Dow Jones Automobile Index falling back below its 50-day line. Its relative strength line (top of chart) has started to weaken as well. Volkswagen has lost...

READ MORE

MEMBERS ONLY

What's the Difference Between a Correction and a Bear

by John Murphy,

Chief Technical Analyst, StockCharts.com

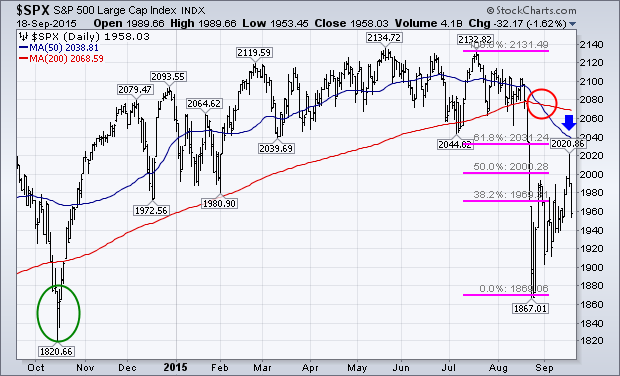

My September 2 message addressed the question about whether the market is in a normal correction or something more serious. We'll find out soon enough. I've leaned toward the correction view (a drop of 10-15%), but a lot of longer-term indicators suggest a more serious decline...

READ MORE

MEMBERS ONLY

FED INACTION BOOSTS BONDS AND SAFE HAVEN ASSETS WHILE HURTING STOCKS -- WITH SHORT-TERM BOUNCE ENDING, A RETEST OF SUMMER LOW APPEARS LIKELY BETWEEN NOW AND OCTOBER -- THAT WILL HELP DETERMINE IF THIS IS A CORRECTION OR BEAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

FED DECISION TO LEAVE RATES ALONE SHAKES MARKETS ... I'm not sure what the Fed said on Thursday that got everyone upset. It acknowledged weakness in foreign markets (like China) and low inflation. We already knew about plunging Chinese stocks and weak commodity prices. Even so, markets took a...

READ MORE

MEMBERS ONLY

SHORT-TERM STOCK BOUNCE HAS PROBABLY ENDED -- A RETEST OF SUMMER LOW NOW APPEARS LIKELY -- VIX BOUNCES OFF 20 SUPPORT LEVEL

by John Murphy,

Chief Technical Analyst, StockCharts.com

RETEST OF AUGUST LOWS LIKELY... The short-term bounce that started nearly a month ago appears to have run its course. That suggests that a retest of the August low is more likely. I recently applied Fibonacci retracement lines over the Dow Industrials to show where new selling might appear. Chart...

READ MORE

MEMBERS ONLY

FED LEAVES RATE UNCHANGED -- BONDS RALLY ON FALLING YIELDS -- DOLLAR WEAKNESS BOOSTS GOLD -- STOCKS SUFFER DOWNSIDE REVERSAL

by John Murphy,

Chief Technical Analyst, StockCharts.com

INITIAL REACTIONS... The Fed left short-term rates unchanged today. The two main reasons given were lower inflation and weakness in foreign markets. Ms. Yellen, however, stressed in her press conference that the U.S. economy still looked solid and that a rate hike by yearend was still possible. Not surprisingly,...

READ MORE

MEMBERS ONLY

CHINA BOUNCE BOOSTS ASIAN ETFS -- ENERGY STOCKS SHOW NEW LEADERSHIP AS CRUDE OIL CLEARS 50-DAY AVERAGE -- OIL STABILITY ALSO BOOSTS EMERGING MARKETS IN MEXICO AND RUSSIA -- TESLA AND FORD LEAD AUTOS -- VIX NEARS TEST OF 20 SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHINESE STOCKS REBOUND ... Emerging markets are getting some relief from a rebound in China. Hong Kong stocks are up 511 points (2.3%) while Shanghai gained 147 points (4.9%). Chinese ETFs are also bouncing off important support levels while in a deeply oversold condition. Chart 1 shows HongKong iShares...

READ MORE

MEMBERS ONLY

BOND YIELDS RISE AS MONEY LEAVES BONDS FOR STOCKS -- BANK SPDR IS BACK ABOVE ITS 200-DAY LINE -- ETRADE IS A FINANCIAL LEADER -- UPS HELPS PULL TRANSPORTS ABOVE 50-DAY AVERAGE -- S&P 500 CLEARS 20-DAY LINE AS MARKET BOUNCES

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS SURGE ON CONSUMER SPENDING... Today's jump in bond yields is being attributed to gains in consumer spending. Chart 1 shows the 10-Year Treasury Note Yield ($TNX) climbing above its 50-day average to the highest level in a month. When yields rise, bond prices fall. Chart 2...

READ MORE

MEMBERS ONLY

HOUSING GROUP CONTINUES TO LEAD -- HOMEBUILDING LEADERS INCLUDE DR HORTON, NVR, AND LENNAR -- HOUSING RELATED STOCK LEADERS INCLUDE MOHAWK, MASCO, AND HOME DEPOT -- COMPARISON OF TWO HOUSING ETFS -- MARKET AWAITS FED DECISION

by John Murphy,

Chief Technical Analyst, StockCharts.com

HOMEBUILDERS CONTINUE TO GAIN ... This is the latest of several positive messages written herein on homebuilders and housing stocks in general. Homebuilders were one of the strongest stock groups on Friday. More importantly, they're also the strongest group over the last month and the last three month periods....

READ MORE

MEMBERS ONLY

INDIVIDUAL STOCK LEADERS SHOWING RELATIVE STRENGTH INCLUDE KLA TENCOR, FREEPORT MCMORAN, GILEAD SCIENCE, AND ASSURANT -- APPLE IS ALSO STARTING TO SHOW RELATIVE STRENGTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

KLA TENCOR IS SPX LEADER... Relative strength in an individual stock during a downside correction is a positive sign. Today, I'm looking at some individual stock leaders who also happen to be in groups that are also showing relative strength. KLAC Tencor (KLAC) is the day's...

READ MORE

MEMBERS ONLY

JAPANESE STOCKS HAVE BIGGEST JUMP IN SEVEN YEARS AS YEN DROPS -- RISING BOND YIELDS HELP BANKS AND INSURERS -- BUT HURT REITS AND UTILITIES -- OVERSOLD COPPER AND COPPER STOCKS ARE BOUNCING OFF MAJOR CHART SUPPORT AND MAY BE SCRAPING BOTTOM

by John Murphy,

Chief Technical Analyst, StockCharts.com

JAPANESE STOCKS BOUNCE OFF MAJOR SUPPORT LINE... Japan was the only country that didn't participate in yesterday's global stock rally. It's making up for that today in a big way. And at a good time. I've been showing a lot of global...

READ MORE

MEMBERS ONLY

EEM ISHARES BOUNCE OFF 2011 LOW -- EAFE ISHARES ALSO HOLD SUPPORT -- OVERSOLD CANADIAN STOCKS REBOUND -- U.S. STOCKS HAVE STRONG DAY TO STAY WITHIN RECENT TRADING RANGE -- BOND YIELDS BOUNCE AS MONEY LEAVES BONDS FOR STOCKS -- VIX RETREATS ANOTHER 10%

by John Murphy,

Chief Technical Analyst, StockCharts.com

EMERGING MARKETS BOUNCE OFF CHART SUPPORT... Within the exception of Japan, global stocks are bouncing nicely today. It started in Asia with a rebound in Chinese stocks. That gave a much needed boost to emerging markets. And it may be coming just in time. The monthly bars in Chart 1...

READ MORE

MEMBERS ONLY

NYSE Percent of Stocks Above 200-Day Average Stabilizes

by John Murphy,

Chief Technical Analyst, StockCharts.com

One of the warnings that I wrote about over the summer was the drop in the percent of NYSE stocks trading over their 200-day average. I pointed out over the summer (before the August plunge) that a stock market couldn't maintain an uptrend while two-thirds of its stocks...

READ MORE

MEMBERS ONLY

BANKS AND SEMICONDUCTORS BOUNCE OFF MAJOR SUPPORT LEVELS -- LONGER RANGE CHARTS SUGGEST CURRENT PULLBACK IS A CORRECTION IN A LONGER RANGE UPTREND -- HOMEBUILDERS SHOW RELATIVE STRENGTH -- DR HORTON IS HOMEBUILDING AND MARKET LEADER

by John Murphy,

Chief Technical Analyst, StockCharts.com

BANKS BOUNCE OFF CHART SUPPORT... I've explained in previous messages that I lean toward the view that the stock market is in the midst of an overdue correction. It's been four years since the market saw a correction of more than 10%. That's much...

READ MORE

MEMBERS ONLY

WHAT'S THE DIFFERENCE BETWEEN A CORRECTION AND A BEAR MARKET? -- LONG-TERM SUPPORT LEVELS FOR S&P 500 -- STOCKS REMAIN IN TRADING RANGE WHICH IS LIKELY TO CONTINUE -- VIX RETREATS

by John Murphy,

Chief Technical Analyst, StockCharts.com

WHAT'S THE DIFFERENCE? ... There's a debate in professional circles as to whether the stock market is in a correction or a bear market. It makes a difference. Let's define what they are. A stock market "correction" is a drop of more than...

READ MORE

MEMBERS ONLY

S&P 500 STALLS BELOW BREAK, SMALL-CAPS SHOW RELATIVE STRENGTH, UTILITIES SPDR BREAKS DOWN, TREASURY BONDS FORMS BIG ENGULFING, 10-YR YIELD BOUNCES WITHIN DOWNSWING, GOLD AND SILVER BACK OFF BROKEN SUPPORT ZONES

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 STALLS WELL BELOW SUPPORT BREAK... Chart 1 shows the S&P 500 with a big support break at 2040 and some serious volatility over the last two weeks. Notice that the index fell over 10% and then bounced with a 5+ percent surge back to...

READ MORE

MEMBERS ONLY

3 STRIKES AND A TREND CHANGE, S&P 500 FORMS BIG HAMMER, JUNK BONDS UNDERPERFORM INVESTMENT BONDS, STOCKS UNDERPERFORM BONDS, AVERAGE STOCKS UNDERPERFORMS LARGE CAP STOCKS, THE DAMAGE IS NOT UNDONE, MID-CAP AND SMALL-CAP AD LINES HIT NEW LOWS

by John Murphy,

Chief Technical Analyst, StockCharts.com

3 STRIKES AND A TREND CHANGE... Link for today's video. There has certainly been a lot of noise the last two weeks and this makes it a good time to look at some weekly charts for a little perspective. We will start with the S&P 500...

READ MORE

MEMBERS ONLY

GLOBAL STOCK BOUNCE CONTINUES -- OVERSOLD CHINESE STOCKS SHOW SOME BOUNCE -- EEM AND EAFE ISHARES BOUNCE OFF CHART SUPPORT -- SELLING IN TREASURIES, THE EURO, AND YEN SHOWS MORE CONFIDENCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHINESE STOCKS REBOUND... Global stocks opened higher this morning from deeply oversold conditions. In many cases, those rebounds have also taken place from potential support levels. Chinese shares in Hong Kong and Shanghai jumped 3.6% and 5.3% respectively. That also relieved selling pressure around the globe. While it&...

READ MORE

MEMBERS ONLY

STOCK INDEXES ARE TRYING TO HOLD LAST OCTOBER'S LOW -- MORE BACKING AND FILLING IS NEEDED TO REPAIR TECHNICAL DAMAGE -- SAMPLES OF PREVIOUS CORRECTION BOTTOMS -- LONG-TERM UPTREND IS STILL INTACT

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRIES TO HOLD LAST OCTOBER'S LOW... My Saturday message suggested that U.S. stock indexes could drop to last October lows; but that those lows should hold if this is just a market correction (and not a major top). Chart 1 shows the Dow Industrials trying to...

READ MORE

MEMBERS ONLY

GRAY MONDAY, BULK OF THE EVIDENCE HAS TURNED, TREND IN FORCE UNTIL, MARKING FIRST RESISTANCE, NIKKEI BREAKS, FTSE HITS 30-MONTH LOW, DAX AND CAC TREND LOWER, EURO AND YEN SURGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

GRAY MONDAY REARS ITS UGLY HEAD... Stocks are in the midst of a global rout that is turning into another Black Monday - of sorts. So far, there have been three Black Mondays in stock market history. The first was on October 28th, 1929, when the Dow fell 13%. This...

READ MORE

MEMBERS ONLY

STOCKS HAVE ENTERED WAVE 4 CORRECTION -- 2015 DOWNTURN CLOSELY MATCHES 2011 CORRECTION WHICH BOTTOMED IN OCTOBER -- TO KEEP THE LONG-TERM UPTREND INTACT, LAST OCTOBER'S LOWS HAVE TO HOLD -- VIX INDEX SURGES TO NEW 2015 HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

AN ELLIOTT WAVE UPDATE ... My market message from July 9 offered my Elliott Wave analysis of the NYSE Composite Index. Chart 1 is an updated version of that view. The five red numerals show a five-wave advance from its 2011 bottom. My view was that the May peak in the...

READ MORE

MEMBERS ONLY

EW S&P 500 ETF CONFIRMS REVERSAL PATTERN, QUANTIFYING SELLING DISPERSION, SMALL-CAPS LEAD AD LINES LOWER, NASDAQ 100 LEADS NEW LOW EXPANSION, BANKS, BROKERS AND RETAILERS BREAK DOWN, SEVERAL ASIAN INDICES ARE IN BEAR MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

EW S&P 500 ETF CONFIRMS REVERSAL PATTERN... Programming Note: We are having technical difficulties with the screen recording software and there is no video today. I apologize and will get it fixed this weekend. The Equal-Weight S&P 500 ETF (RSP) is a good ETF to use...

READ MORE

MEMBERS ONLY

FTSE ALL WORLD INDEX FALLS BELOW SUPPORT TO DEEPEN CORRECTION -- U.S. SUFFERS MORE TECHNICAL DAMAGE AS SEVERAL STOCK INDEXES FALL TO SIX-MONTH LOWS -- THE S&P 500 FALLS BELOW 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

FTSE ALL WORLD INDEX FALLS TO SEVEN-MONTH LOW... Global stock selling is intensifying. Big losses are seen in developed and emerging markets in Asia, Europe, and the Americas. And more technical damage is being done. Chart 1 shows the FTSE All World Index (which includes the U.S.) falling below...

READ MORE

MEMBERS ONLY

GLOBAL STOCKS REMAIN UNDER PRESSURE -- EAFE ISHARES DROP BELOW 200-DAY AVERAGE -- EMERGING MARKET ISHARES FALL TO TWO YEAR LOWS -- NYSE COMPOSITE INDEX STILL LOOKS BEARISH -- SO DO MARKET BREADTH FIGURES

by John Murphy,

Chief Technical Analyst, StockCharts.com

EAFE ISHARES FALL BELOW 200-DAY AVERAGE... The trend in global stocks continues to weaken. As usually happens sooner or later, weakness in foreign markets is starting to weigh more heavily on the U.S. Chart 1 shows EAFE iShares (EFA) falling below its 200-day today for the first time since...

READ MORE