MEMBERS ONLY

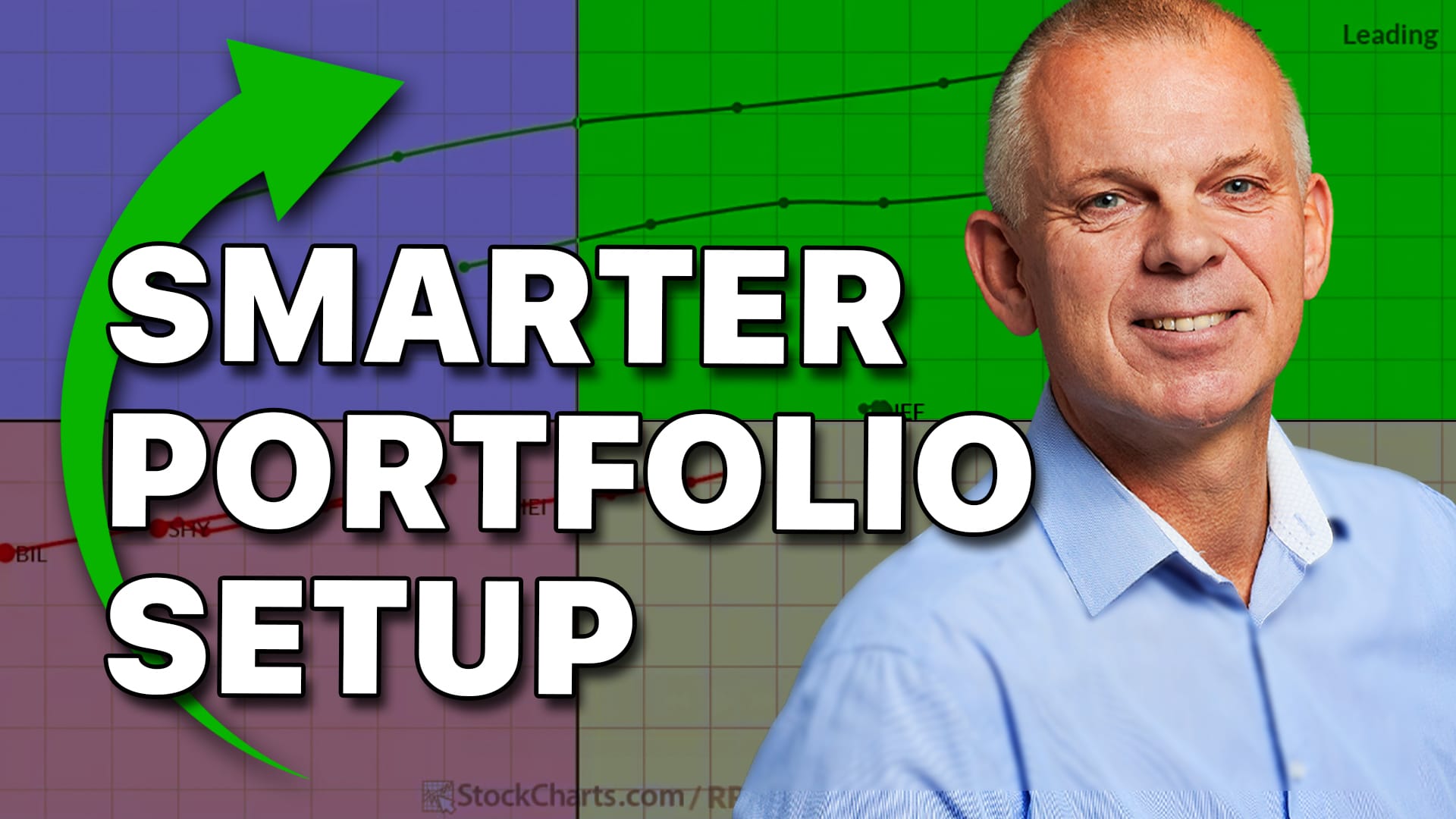

Equal Weight vs. Cap Weight: Why One Choice Changed the Outcome

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius de Kempenaer breaks down a real-world portfolio experiment from 2025 that shows how weighting decisions can dramatically change performance. See how equal- and cap-weight approaches produced very different results and why it matters for portfolio construction today....

READ MORE

MEMBERS ONLY

Stocks Look Better… Until You See This Breakdown!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Stocks are trying to stabilize, but the charts tell a more complicated story. Julius de Kempenaer explains why recent technical damage could still limit upside, along with where strength is quietly building instead....

READ MORE

MEMBERS ONLY

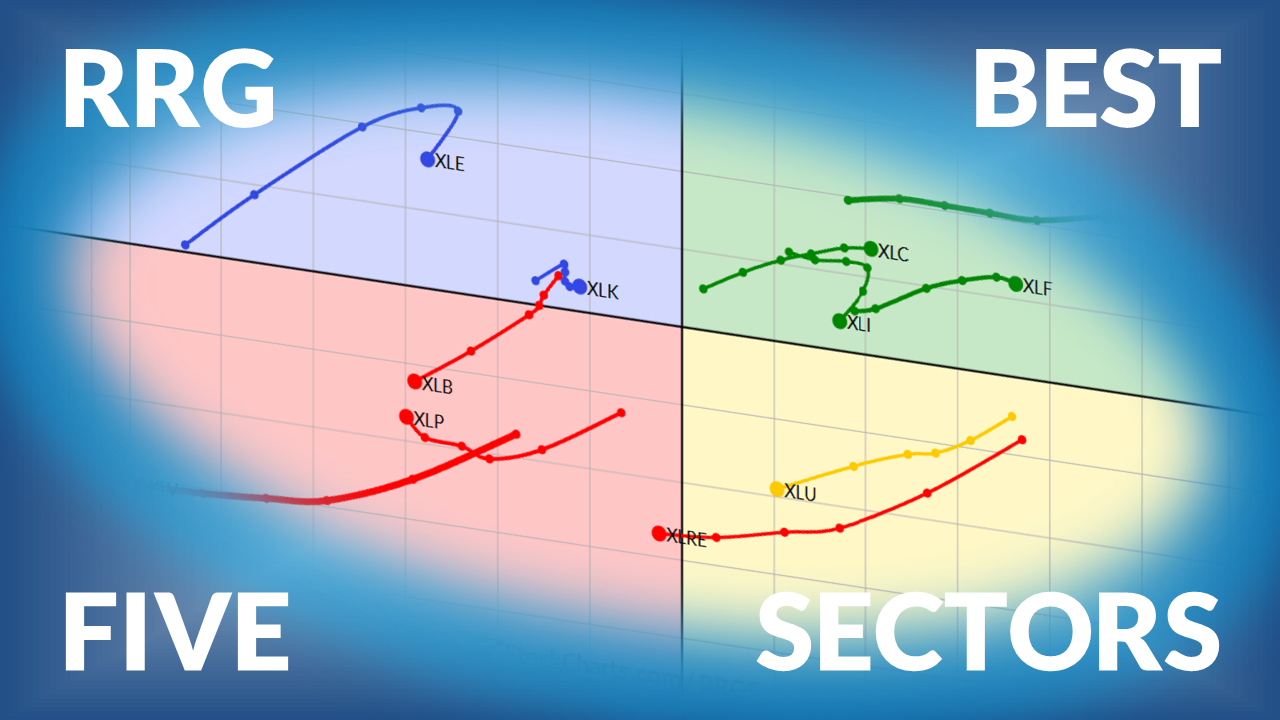

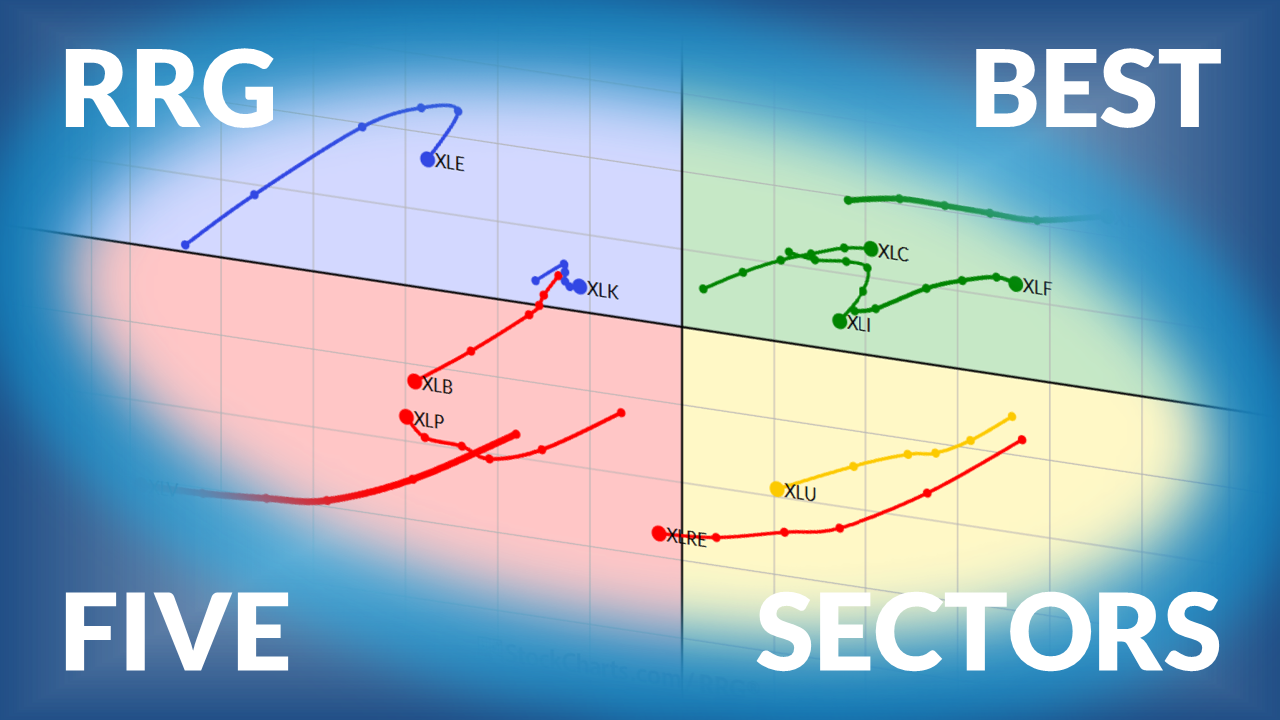

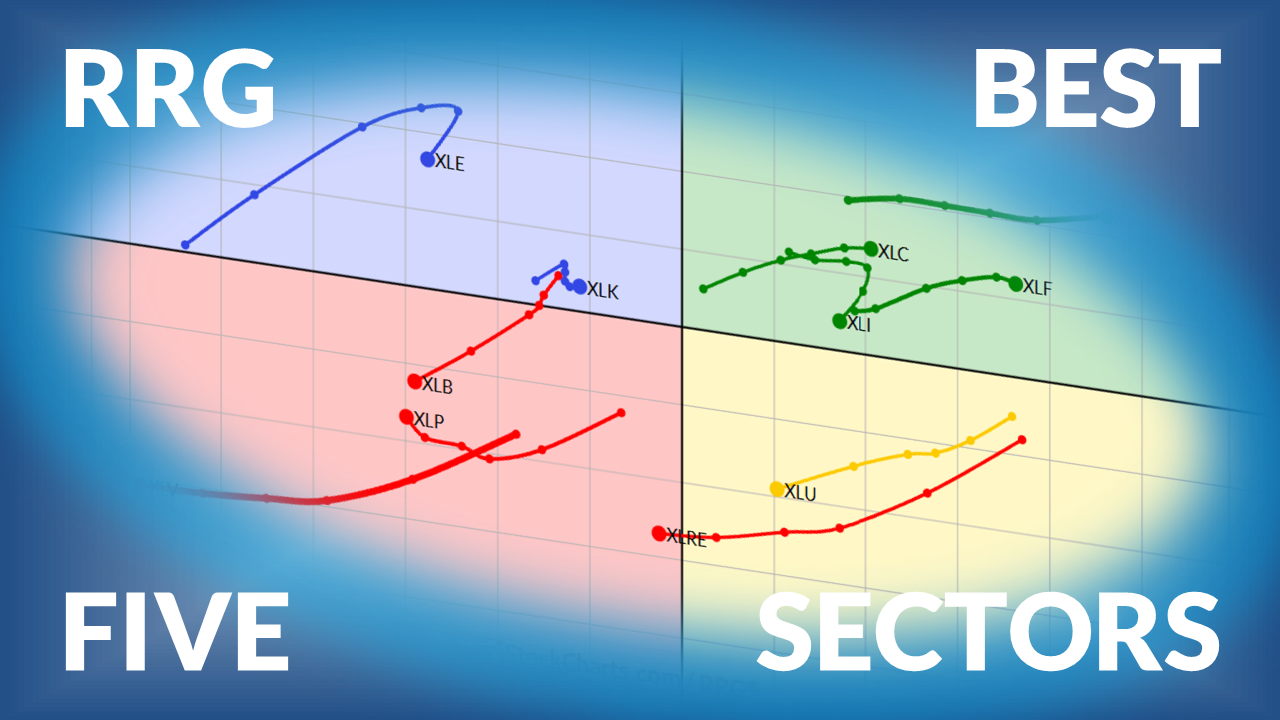

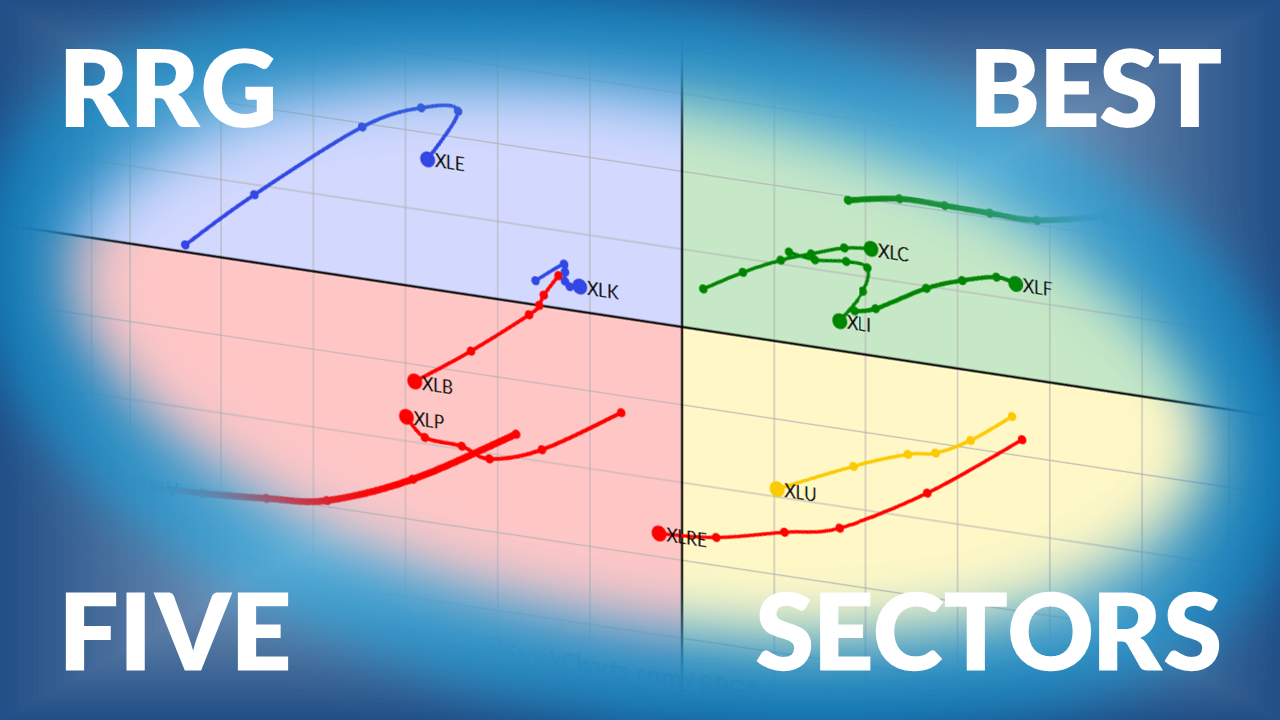

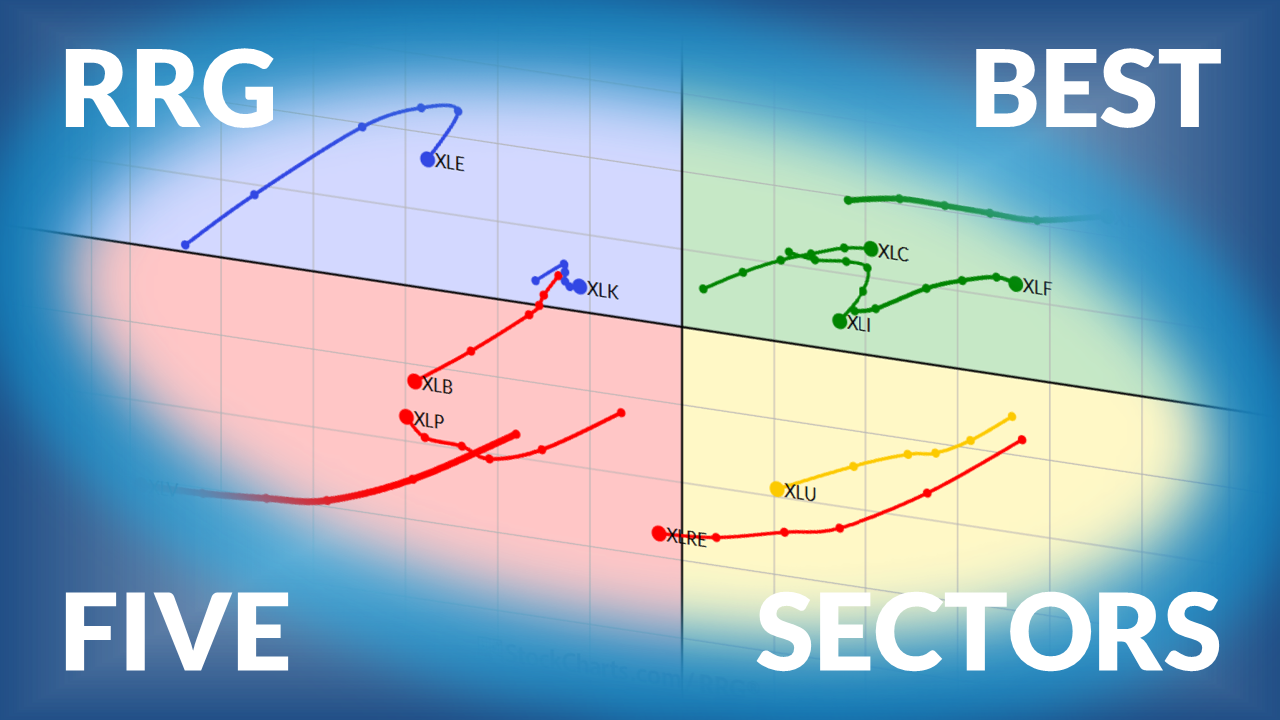

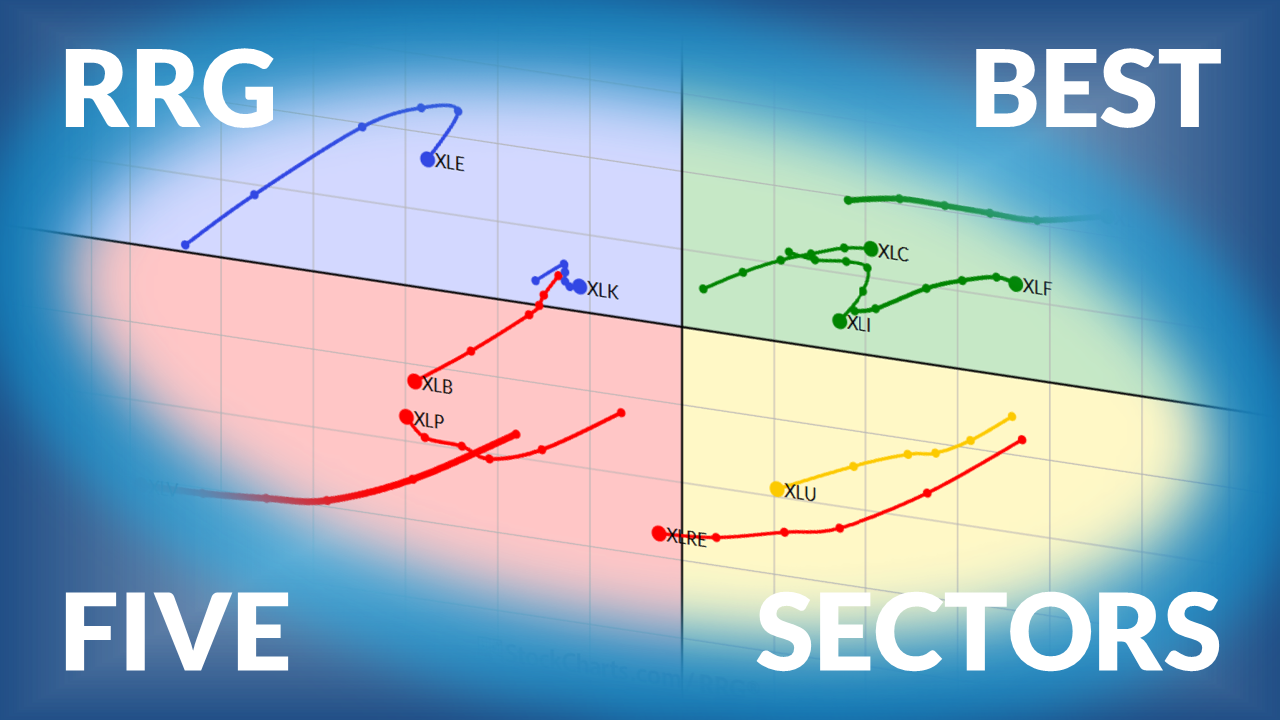

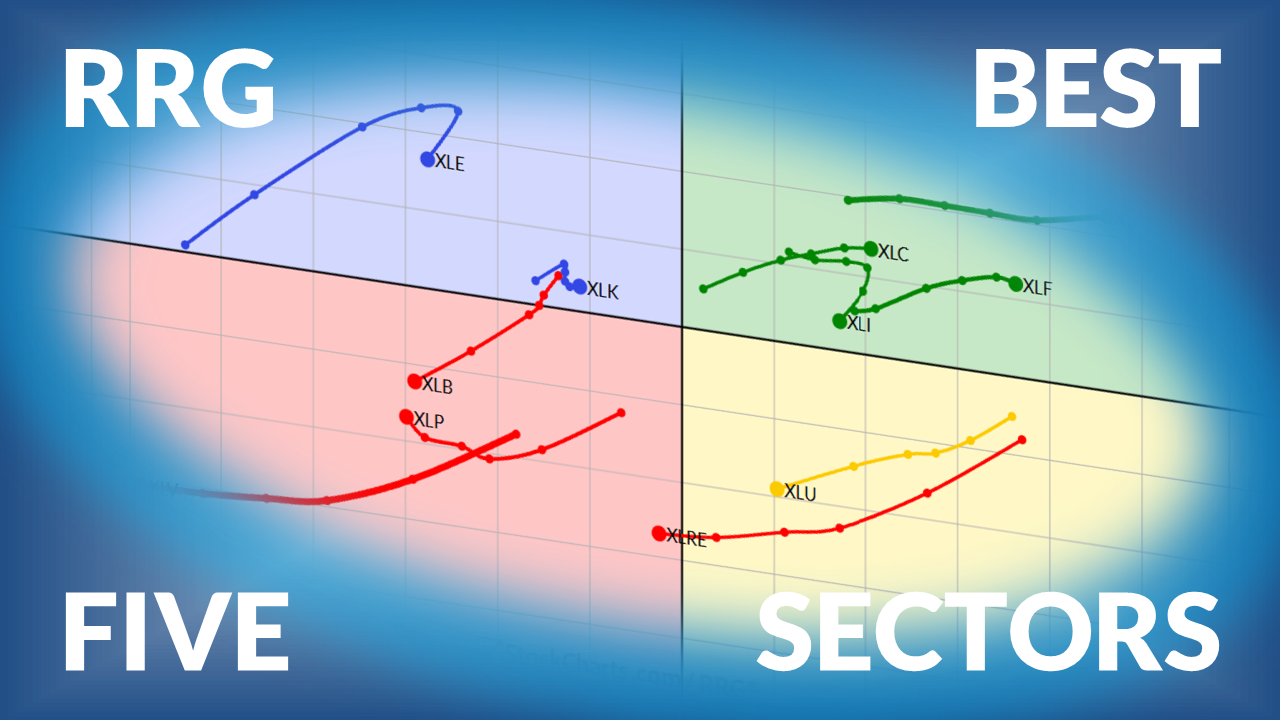

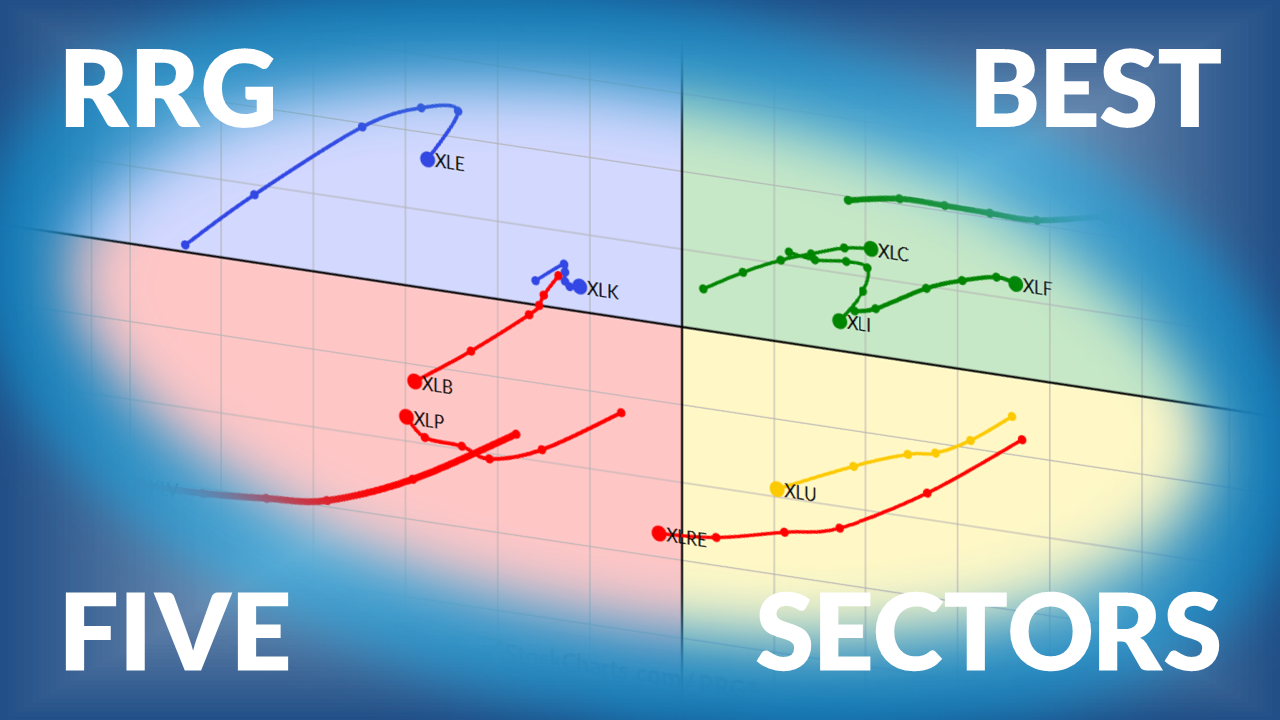

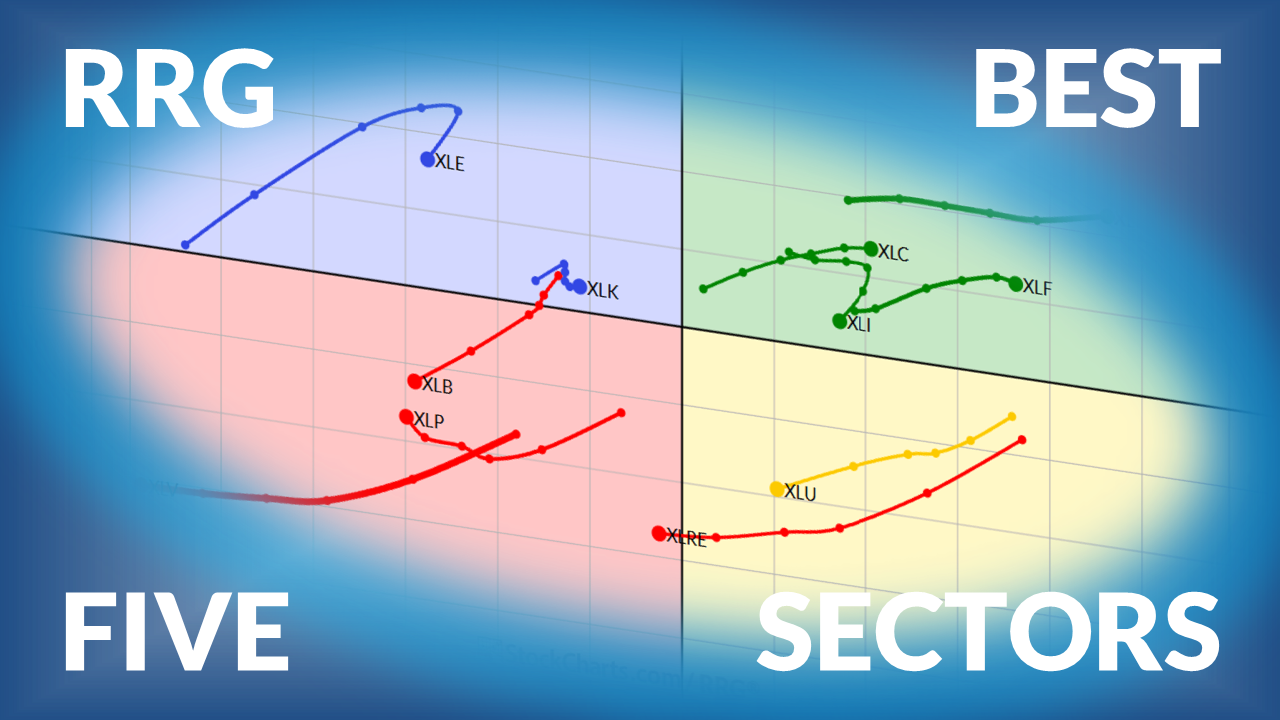

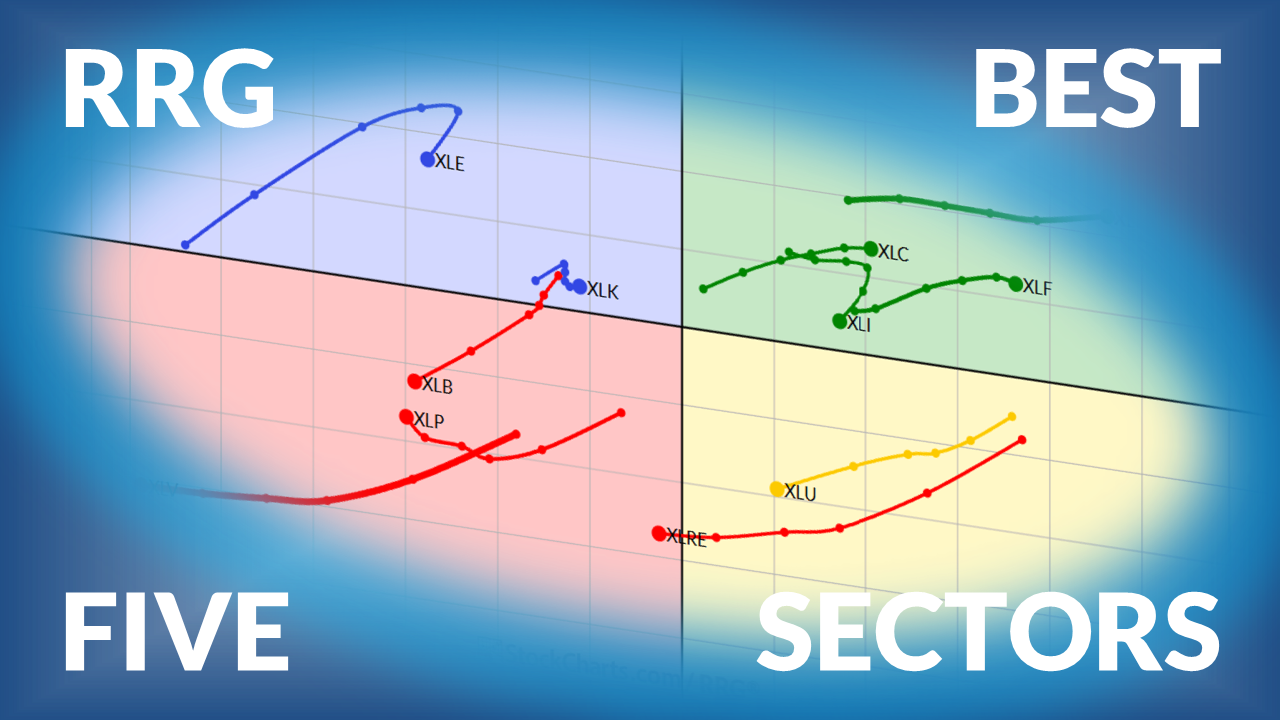

The Best Five Sectors This Week, #51

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on US sector ranking based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Stocks are Improving - So Why Am I Still Cautious?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Stocks may be improving again, but the signals aren’t lining up cleanly just yet. Julius de Kempenaer explains what’s getting better, what’s still holding the market back, and why caution might be warranted here....

READ MORE

MEMBERS ONLY

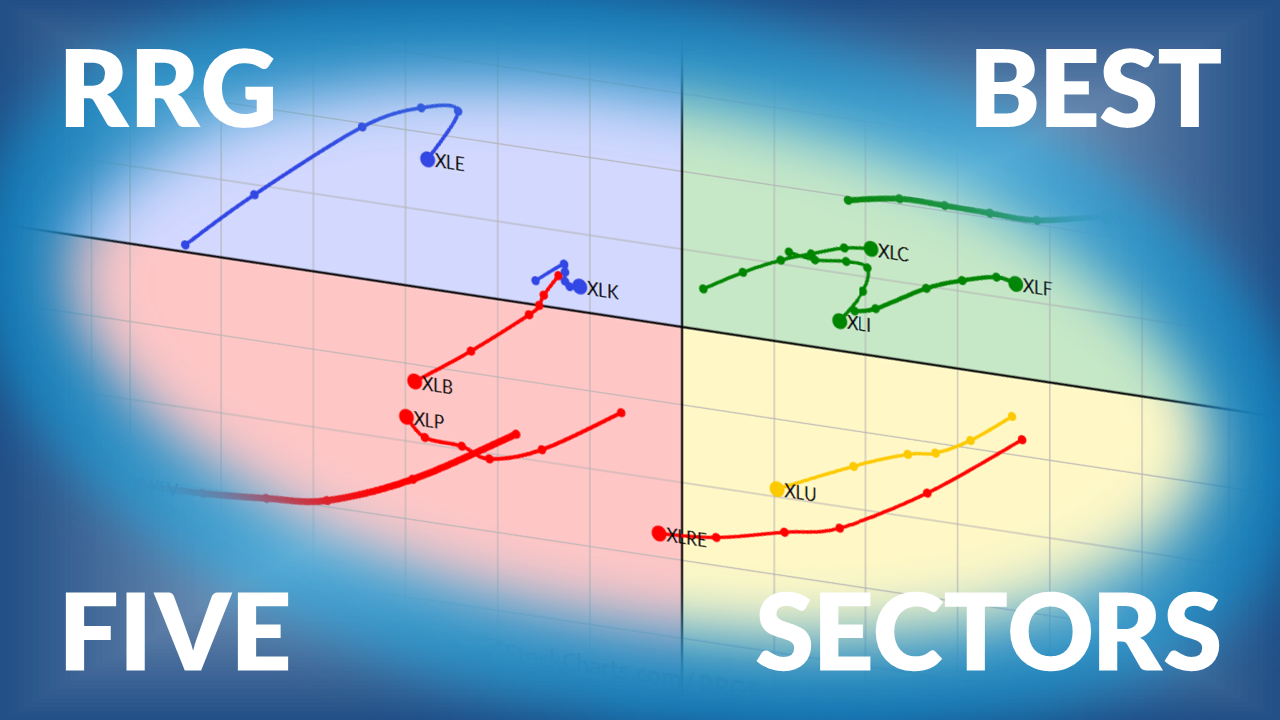

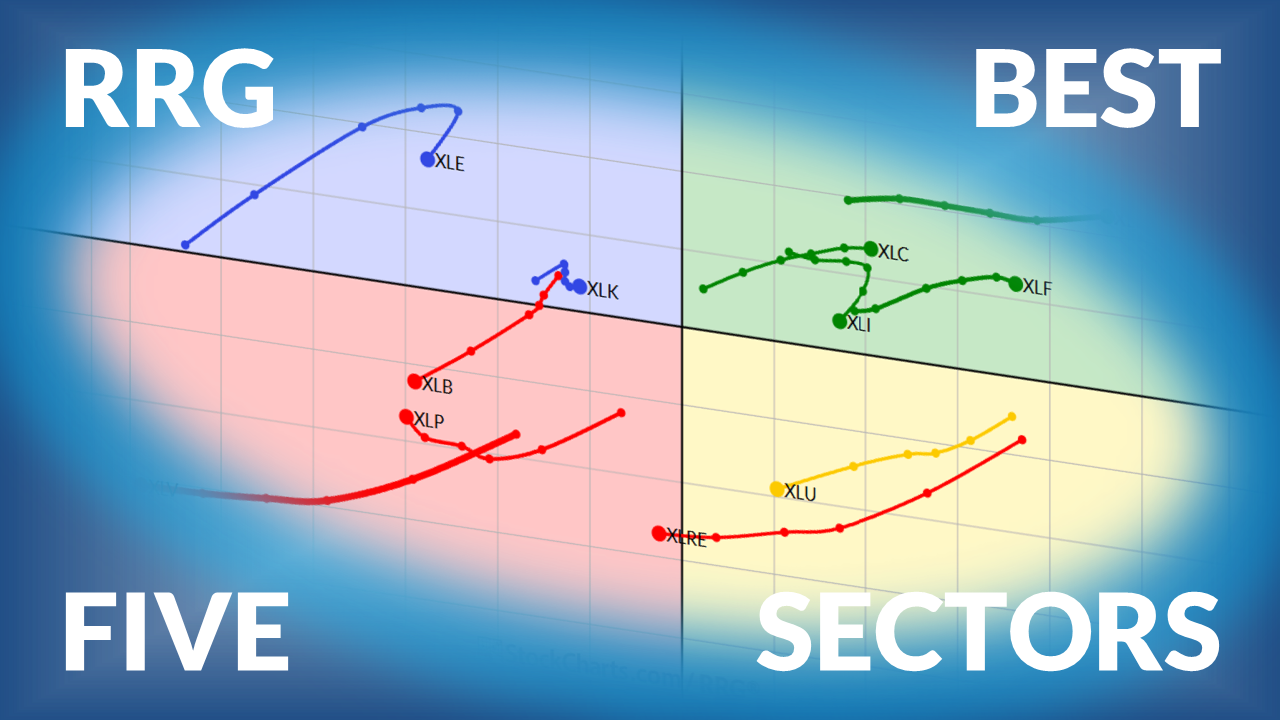

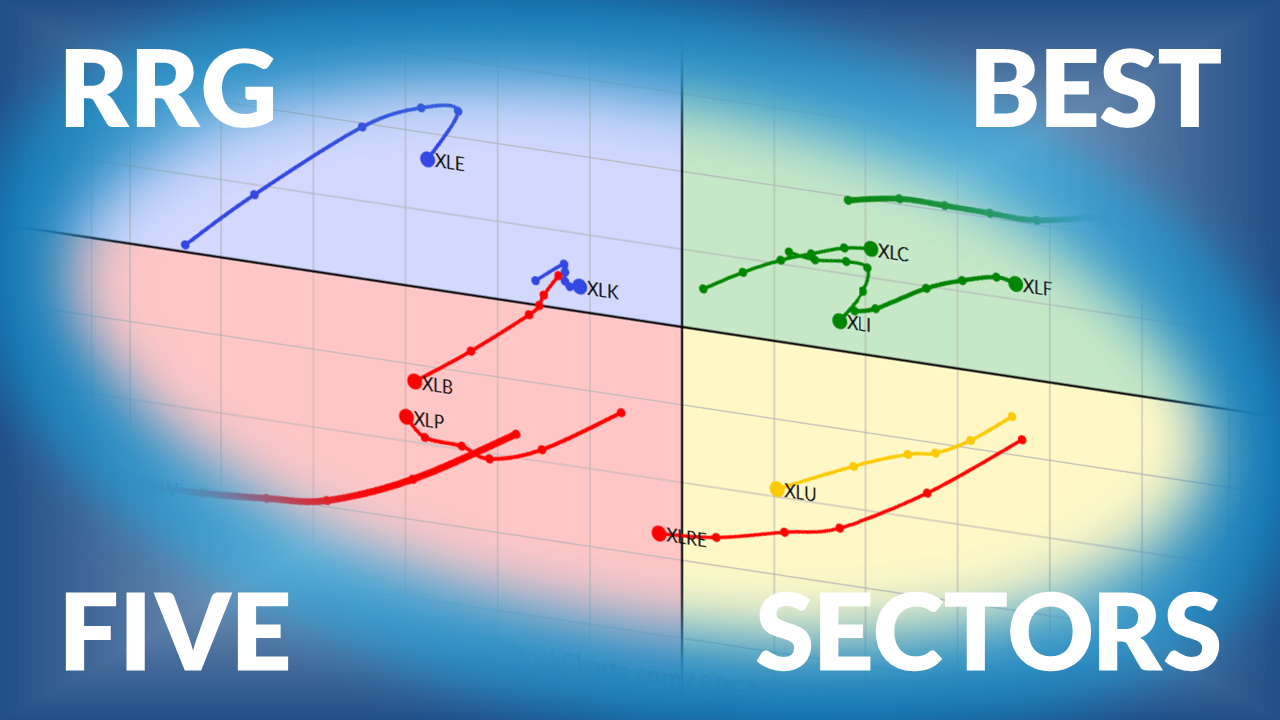

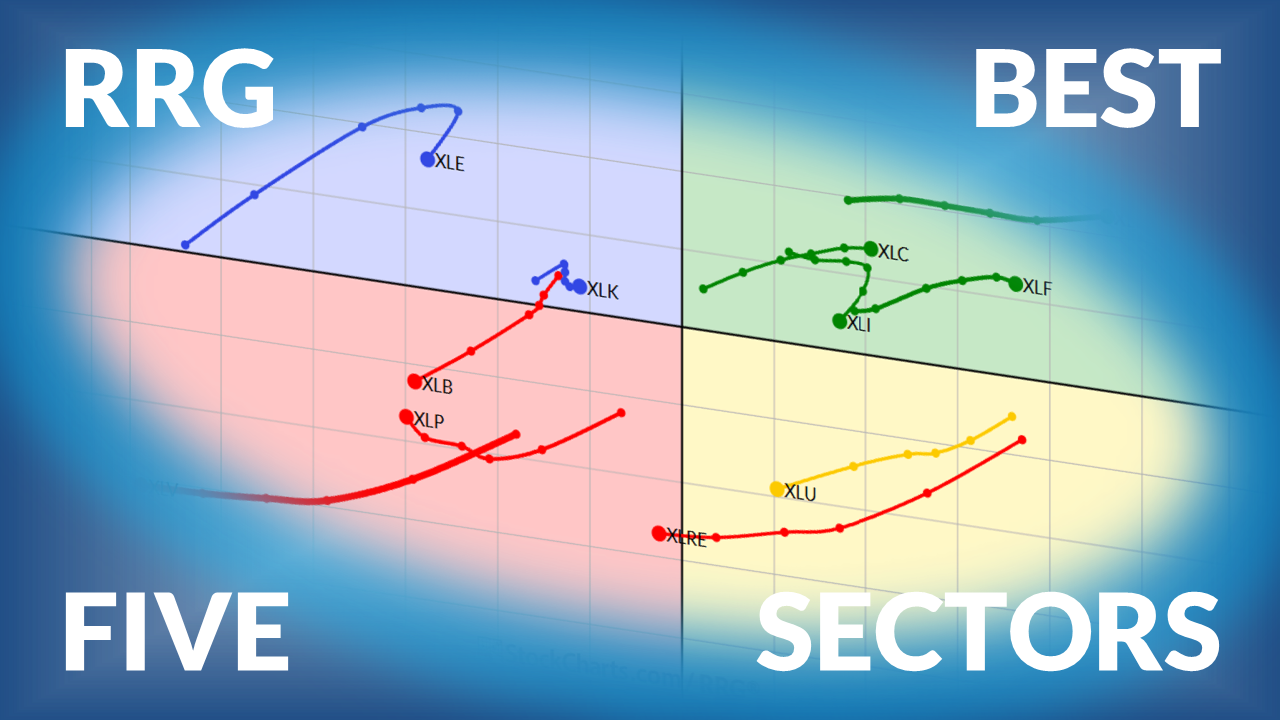

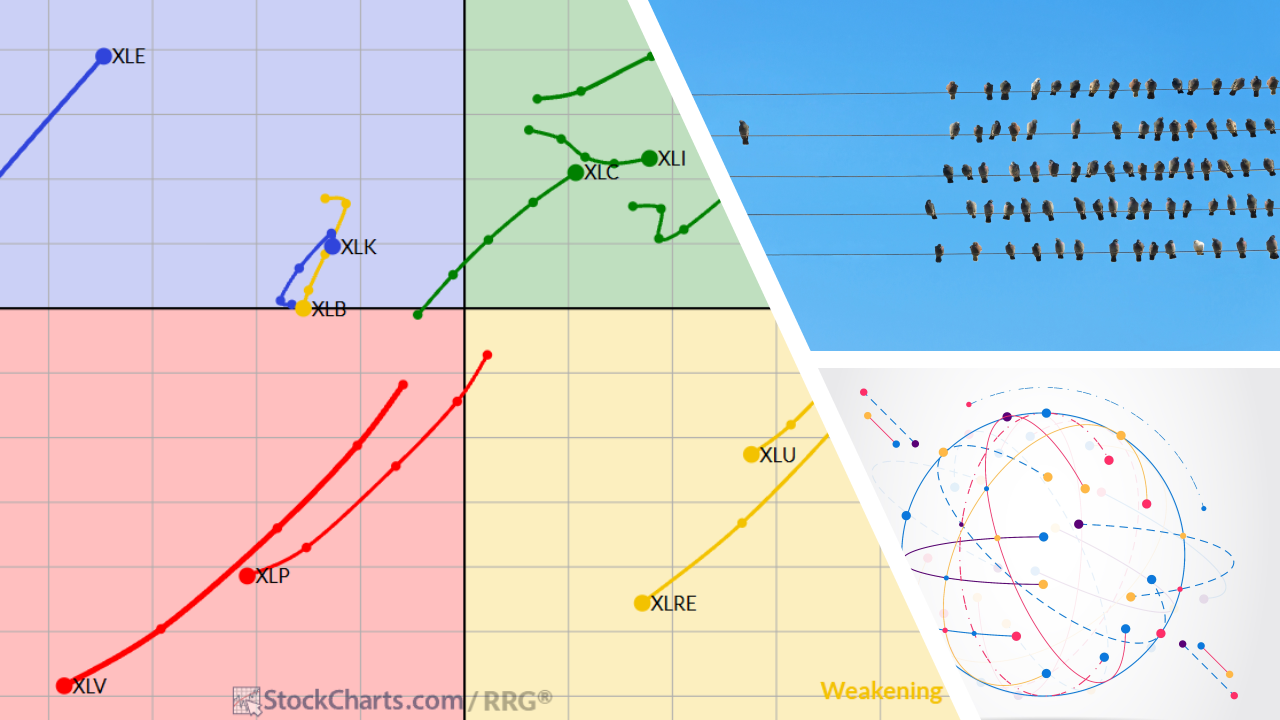

The Best Five Sectors This Week, #50

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly Sector Rotation Update for US Sectors based on Relative Rotation Graphs...

READ MORE

MEMBERS ONLY

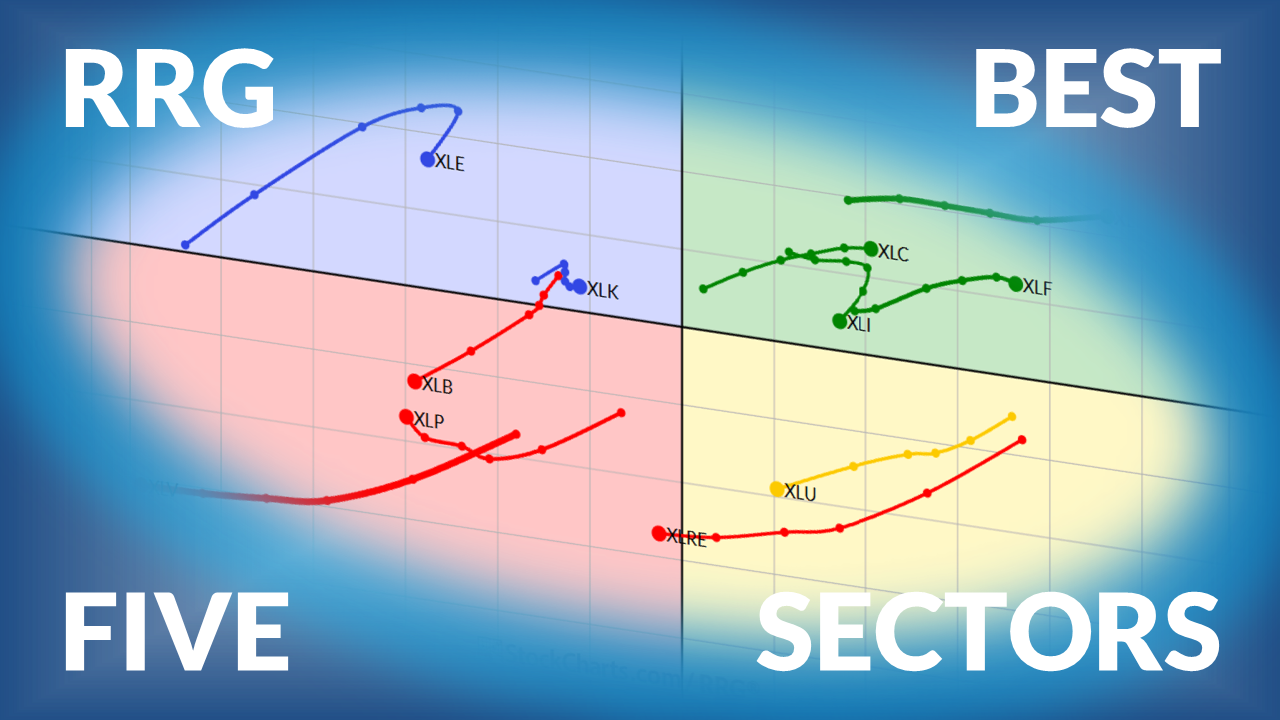

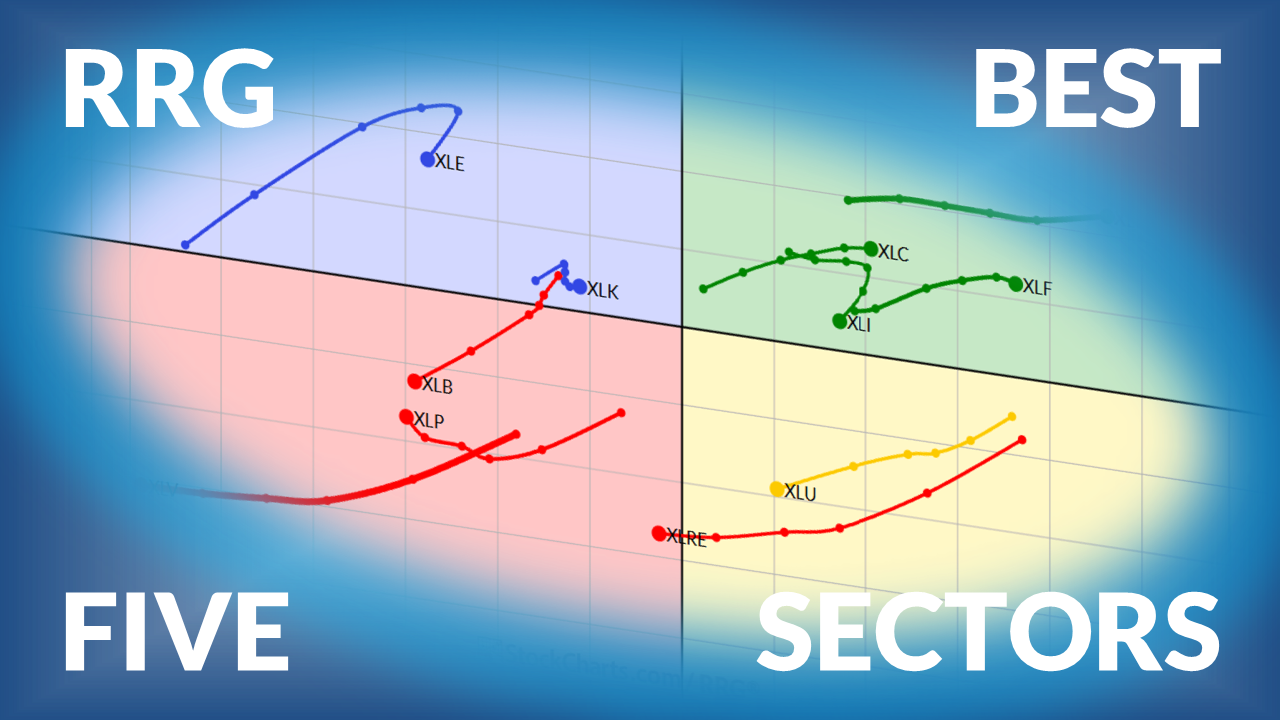

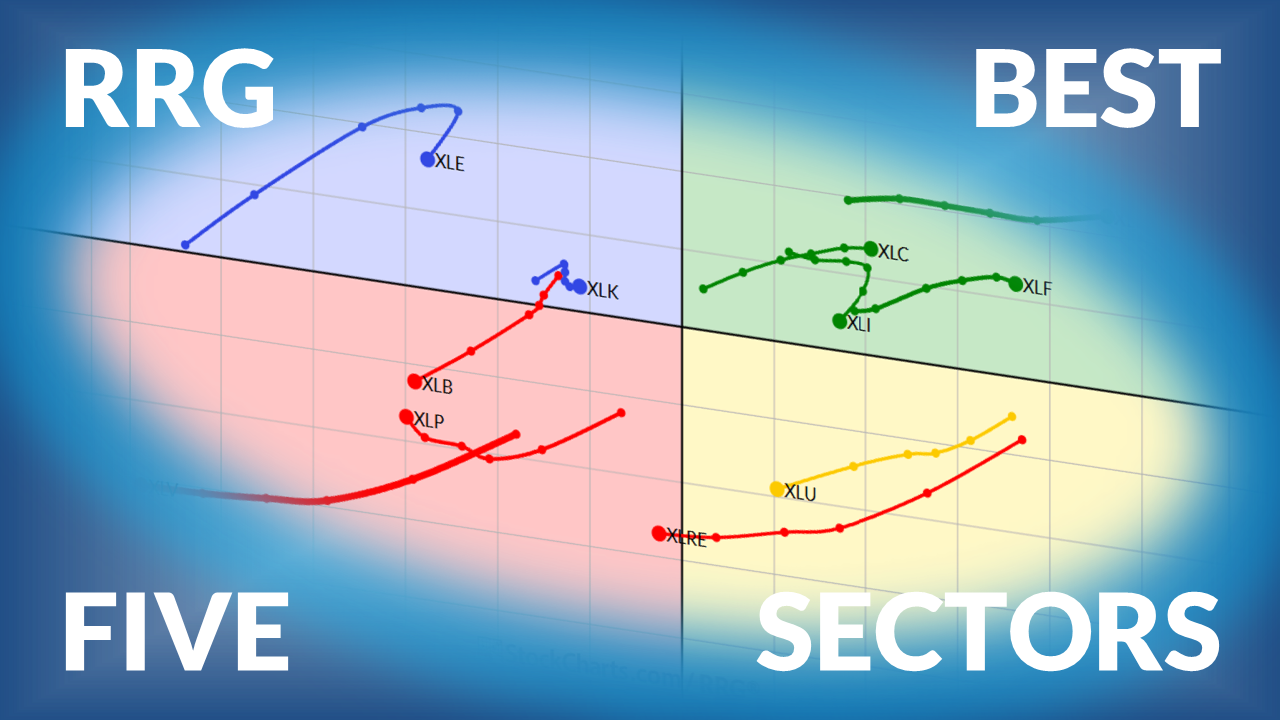

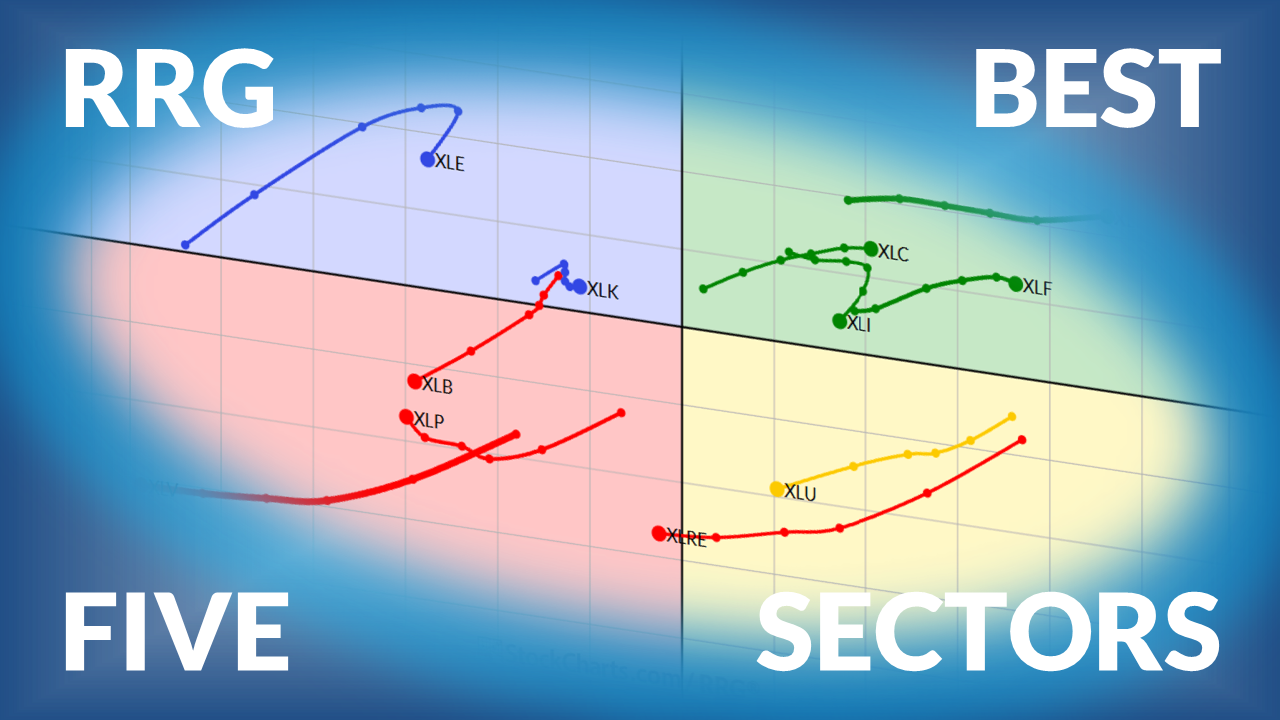

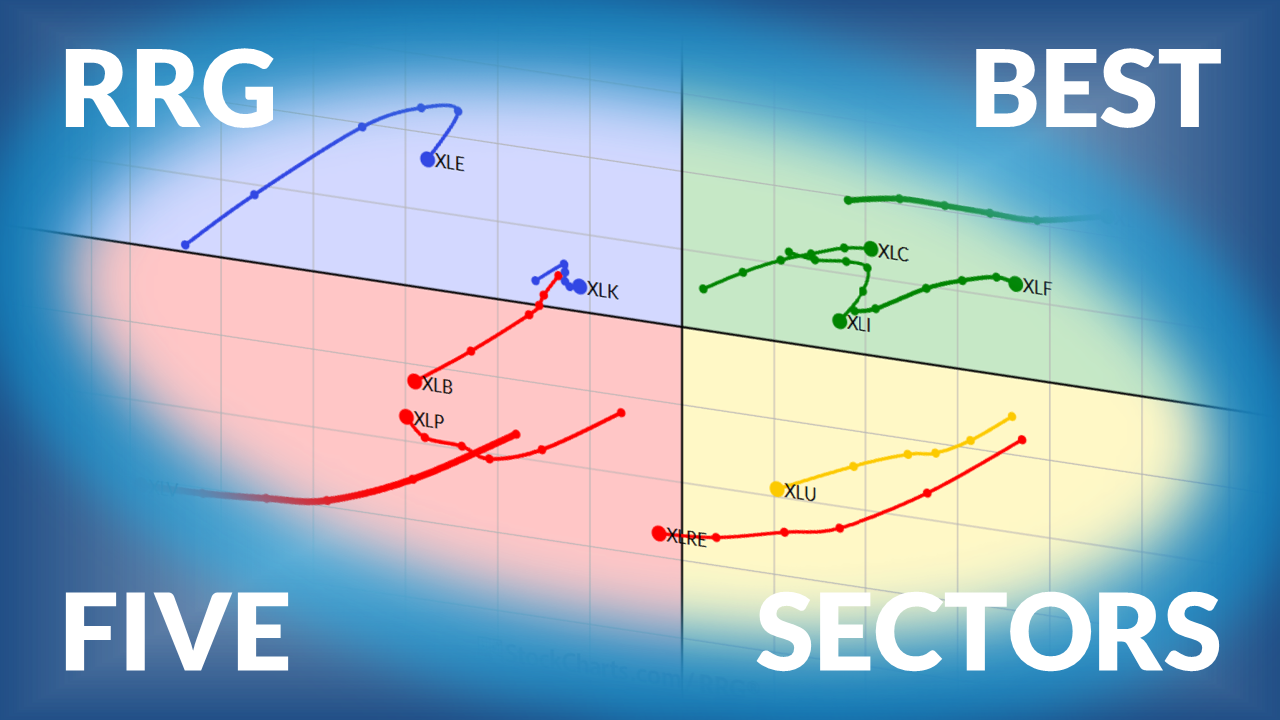

The Best Five Sectors This Week, #49

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on U.S. sector rotation using Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

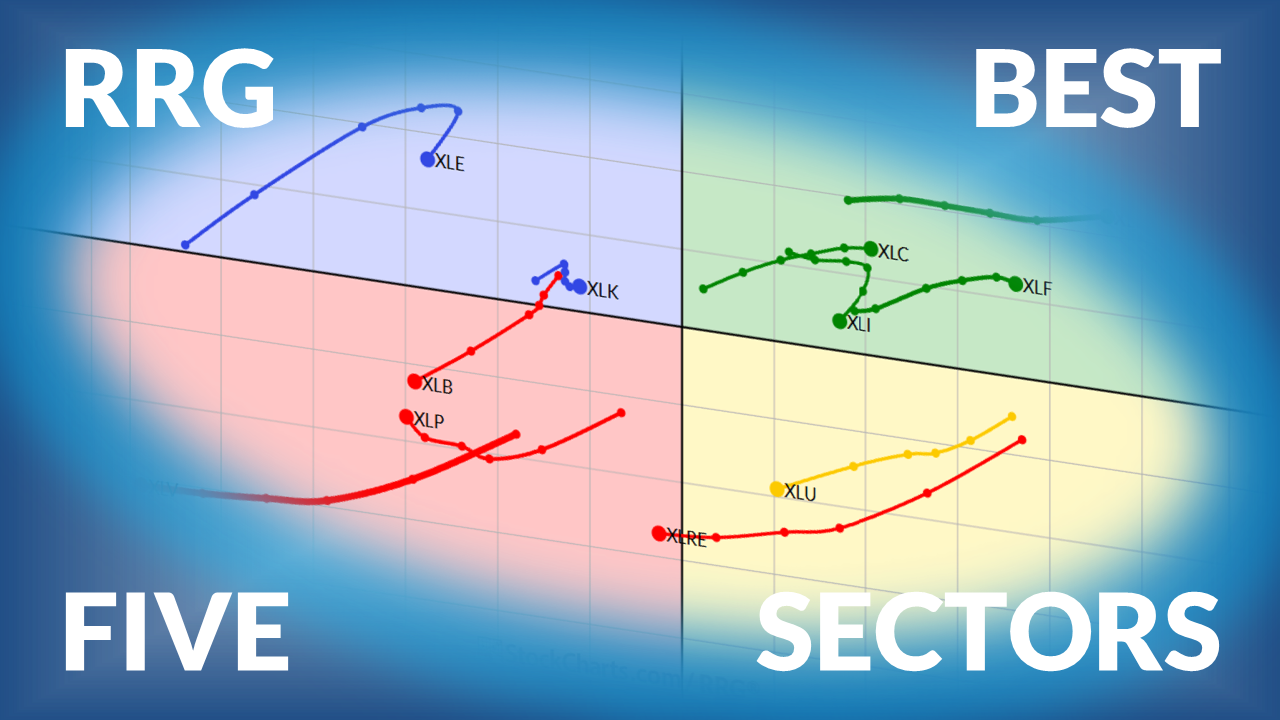

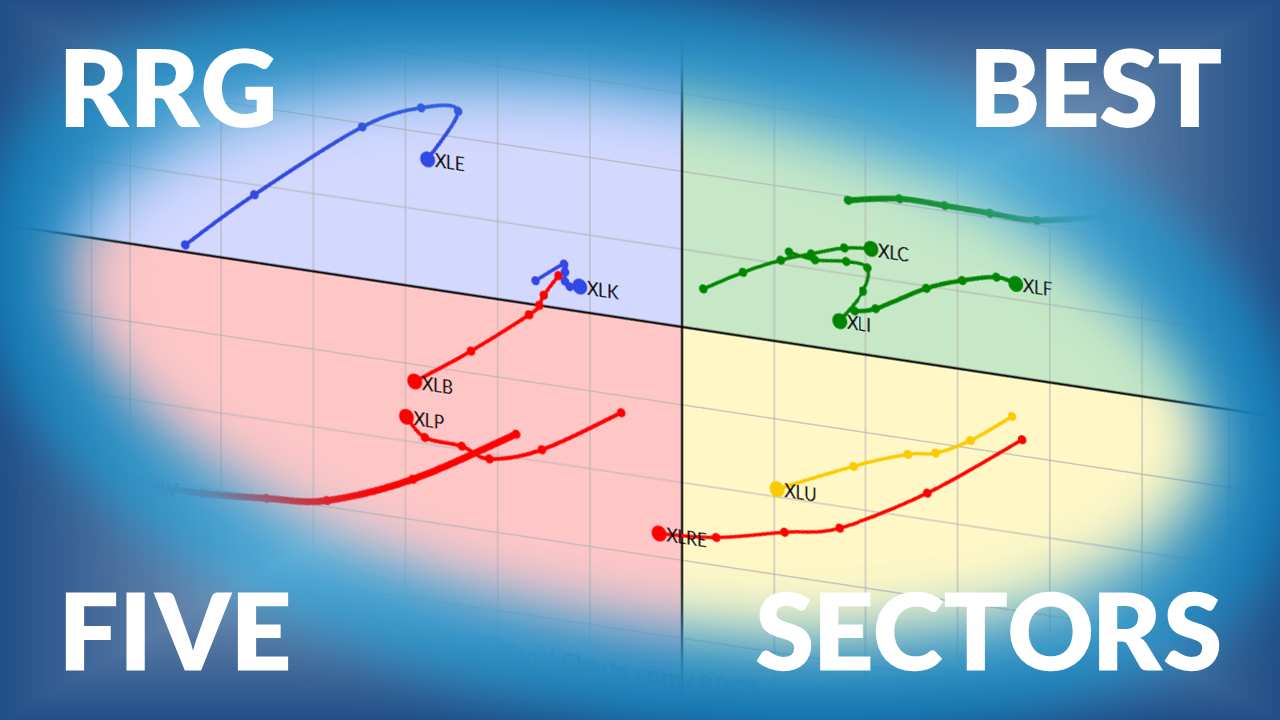

The Best Five Sectors This Week, #48

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on sector rotation ranking based on Relative Rotation Graphs...

READ MORE

MEMBERS ONLY

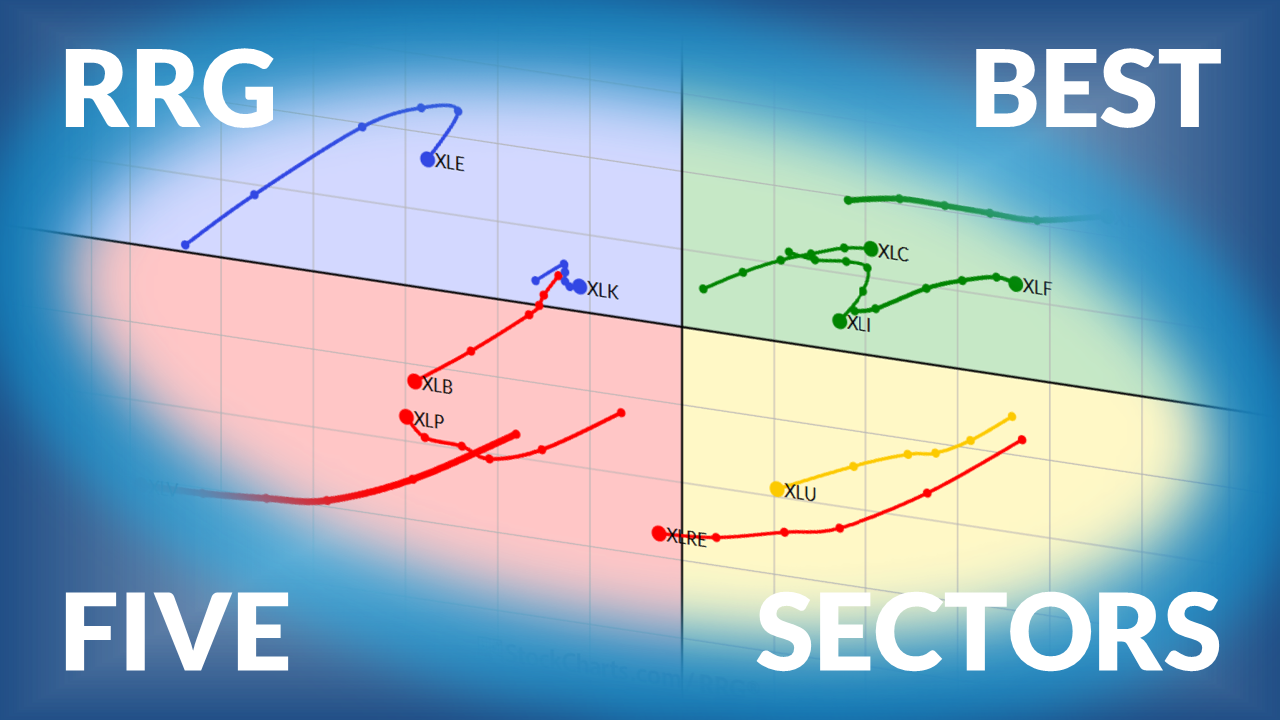

The Silent Warning in Stocks — And the One Group Breaking Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The market might look steady at first glance, but there's a subtle warning sign developing underneath.

In this week's update, Julius de Kempenaer, the creator of RRG Charts, walks through the quiet deterioration happening across stock rotations and highlights the one group that's finally...

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #47

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Your weekly update on US sector rotation based on relative rotation graphs....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #46

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly Update on Sector Ranking for US stocks based on Relative Rotation Graphs...

READ MORE

MEMBERS ONLY

Market Leadership Is Shifting — Are You Positioned for It?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With a massive shift in market leadership underway, Julius de Kempenaer looks at sector rotation to see where leadership is moving now—and what that could mean for portfolio positioning ahead....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #45

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Your weekly update on the ranking of U.S. sectors based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #44

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius presents his weekly update on US sector ranking based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Market Rotation Update: Revealing the Strongest Areas Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius builds on his new portfolio framework to reveal where market strength is shifting across asset classes and sectors. While stocks and commodities continue to lead, Julius breaks down the changes happening beneath the surface....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #43

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius presents his weekly update on ranking of US sectors based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #42

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on US sector rotation based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #41

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on Sector Rotation based on Relative Rotation Graphs...

READ MORE

MEMBERS ONLY

The StockCharts Game Show: Can You Beat These StockCharts Pros?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

by Grayson Roze,

Chief Strategist, StockCharts.com

Grayson Roze hosts Tom Bowley and Julius de Kempenaer in a fast-paced StockCharts Game Show showdown! See who dominates in this fun, competitive battle of charting tools, trading terms, and quick wit....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #40

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius provides his weekly update on US Sector Rotation based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

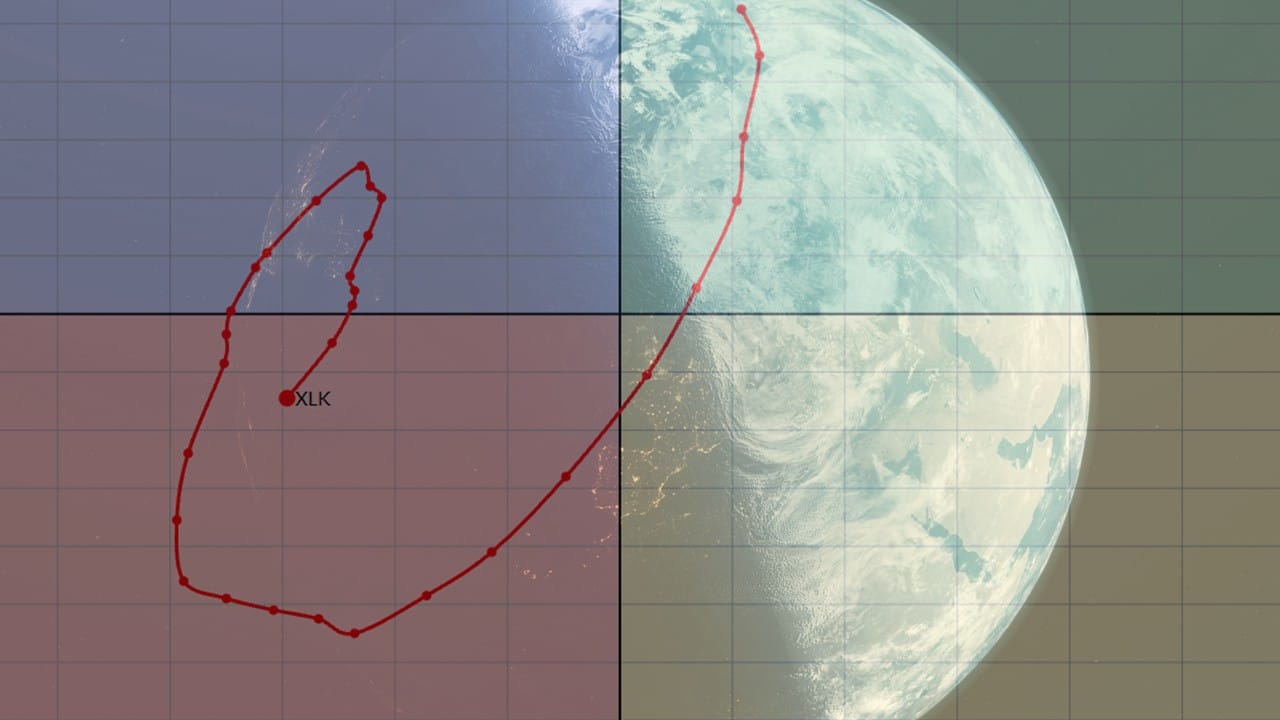

Sector Rotation Favors Technology — But for How Long?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius de Kempenaer, creator of RRG Charts, reveals why XLK & XLC remain the key market drivers while defensive sectors struggle. He also examines how asset class rotation still favors stocks over bonds—and what that means for investors watching sector leadership....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #39

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Your weekly update and ranking of US sectors based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #38

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius presents his weekly update on US sector ranking based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #37

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on US sector rotation ranking based on Relative Rotation Graphs...

READ MORE

MEMBERS ONLY

Sector Rotation Points to Large-Cap Growth Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius takes a look at the current sector rotation, in combination with growth-value and size rotation. Combining these Relative Rotation Graphs shows strength concentrating in large-cap growth and the Tech, Discretionary, and Communication Services sectors. From this vantage point, we can see continued strength for the S&P 500...

READ MORE

MEMBERS ONLY

Comparing Growth vs. Value on RRGs Across Time

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Growth and Value segments are widely used in the investment world, as investors shift from one to another based on market conditions and risk-appetite. Julius shows how to use Relative Rotation Graphs to help monitor these shifts....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #35

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius de Kempenaer presents his weekly update on the top five sectors on the leaderboard, and the movement under the surface....

READ MORE

MEMBERS ONLY

The Best Five Sectors This Week, #34

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Explore this week's sector rotation insights. See which sectors gained strength, which lost momentum, and what the RRG signals mean for investors....

READ MORE

MEMBERS ONLY

Full Rotations on One Side of an RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

What does it mean when a rotation on a Relative Rotation Graph fully completes on the right-hand side or the left-hand side of the graph...

READ MORE

MEMBERS ONLY

Is Consumer Discretionary About to Take Over the Market?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius breaks down the latest asset class and sector rotations in order to show where real market strength is building. Stocks continue to outperform bonds, but the spotlight is on sectors: technology remains strong, financials and industrials are gaining, and consumer discretionary is accelerating with broad participation. Meanwhile, defensive groups...

READ MORE

MEMBERS ONLY

The Best Five Sectors this Week, #32

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on US sector rotation using Relative Rotation Graphs...

READ MORE

MEMBERS ONLY

Visualizing Breadth and Rotation Using RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When it comes to understanding what’s really going on beneath the surface of the market, two key concepts come to mind: breadth and rotation. Breadth helps us gauge the participation behind a trend, while rotation reveals where the strength is moving within the universe we’re analyzing. Combine both,...

READ MORE

MEMBERS ONLY

Consumer Discretionary Breakouts — 3 Stocks to Watch Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Discover which sectors are leading — and which to avoid — with Julius' latest RRG analysis. Follow along as he breaks down weekly and daily sector rotations, revealing technology’s dominance, potential in consumer discretionary, and why some defensive sectors are showing unexpected strength. Julius then dives deeper into the consumer...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #31

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius presents his weekly update on US sector rotation based on Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

The Best Five Sectors, #30

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Julius presents his weekly update on US sector rotation rankings using Relative Rotation Graphs (RRG)....

READ MORE

MEMBERS ONLY

Why Daily vs. Weekly RRGs Matter in Portfolio Construction

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs can be rendered in similar intervals as regular bar- or candlestick charts. This article explains the differences between weekly and daily RRGs....

READ MORE

MEMBERS ONLY

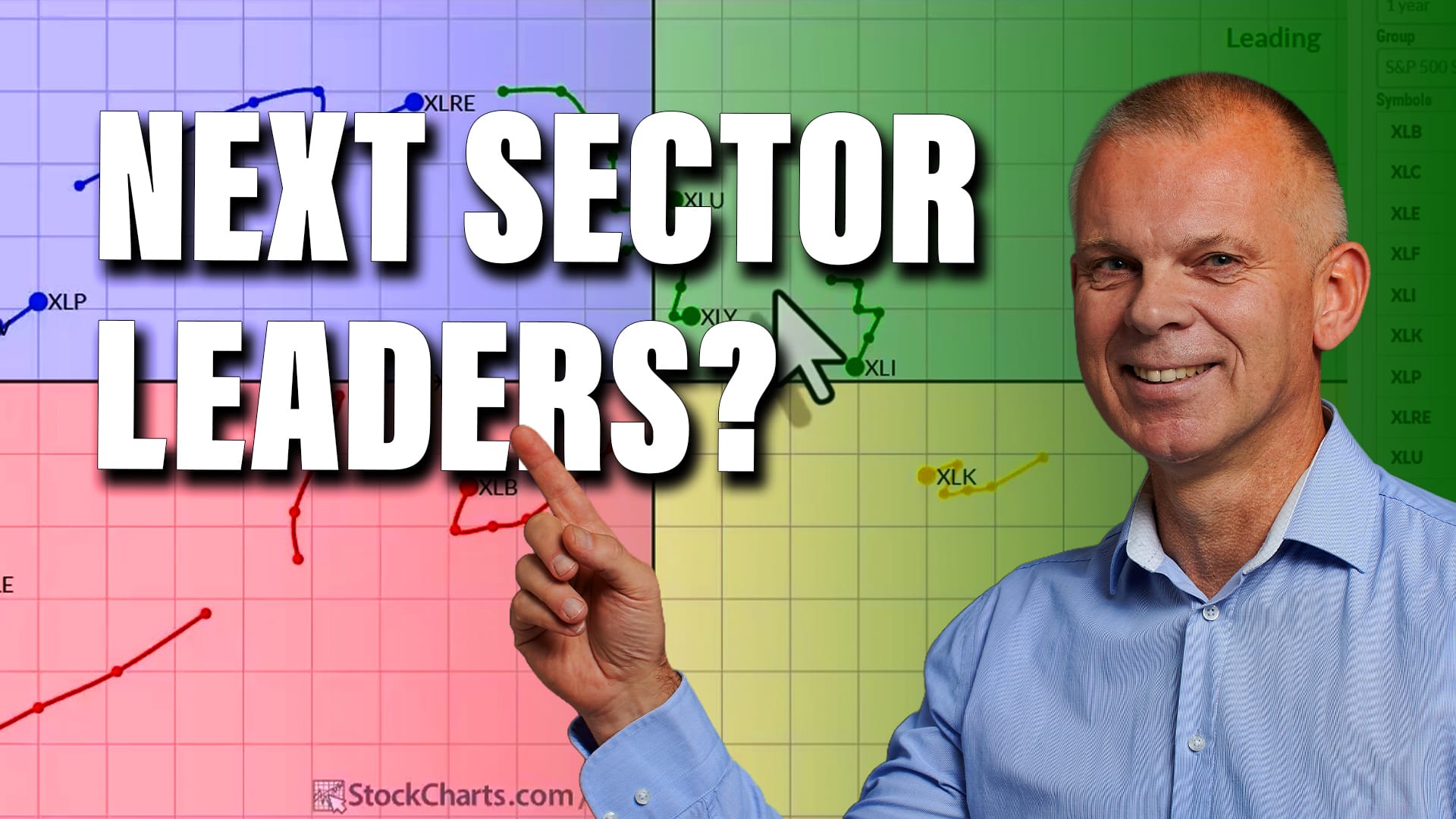

RRG Reveals the Next Big Sector Moves!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video, Julius breaks down current market trends using Relative Rotation Graphs (RRG). He examines weekly and daily asset class rotations, highlighting key developments in stocks, commodities, bonds, the U.S. dollar, and crypto. From there, Julius analyzes sector momentum shifts, including technology, energy, and real estate, and explains...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #29

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Weekly update on US sector rotation using Relative Rotation Graphs...

READ MORE