MEMBERS ONLY

Sector Spotlight: Railroad Group Pops on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I take my usual look at last week's rotation in Asset Classes and put that into longer-term perspective. From this universe, I highlight the strength of the US dollar and take a closer look at the relationship between...

READ MORE

MEMBERS ONLY

Railroads are On Track

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

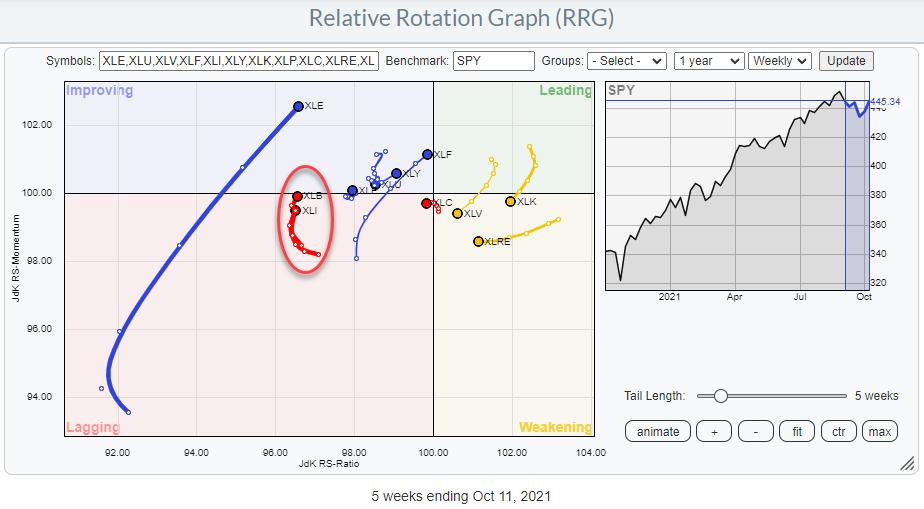

Two sectors that have my attention at the moment are Industrials (XLI) and Materials (XLB).

Looking at the Relative Rotation Graph above, we can see how similar the rotation for both sectors has been over the last 23 weeks, and still is. A few weeks ago, both tails rotated back...

READ MORE

MEMBERS ONLY

PLUG in Your Batteries

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Earlier this week, I was preparing for my participation in a new episode of The Pitch. Unfortunately, that show got canceled as our host, Dave Keller, got sick with a cold.

One of the stocks I was going to pitch is PLUG. I ran into this company while working my...

READ MORE

MEMBERS ONLY

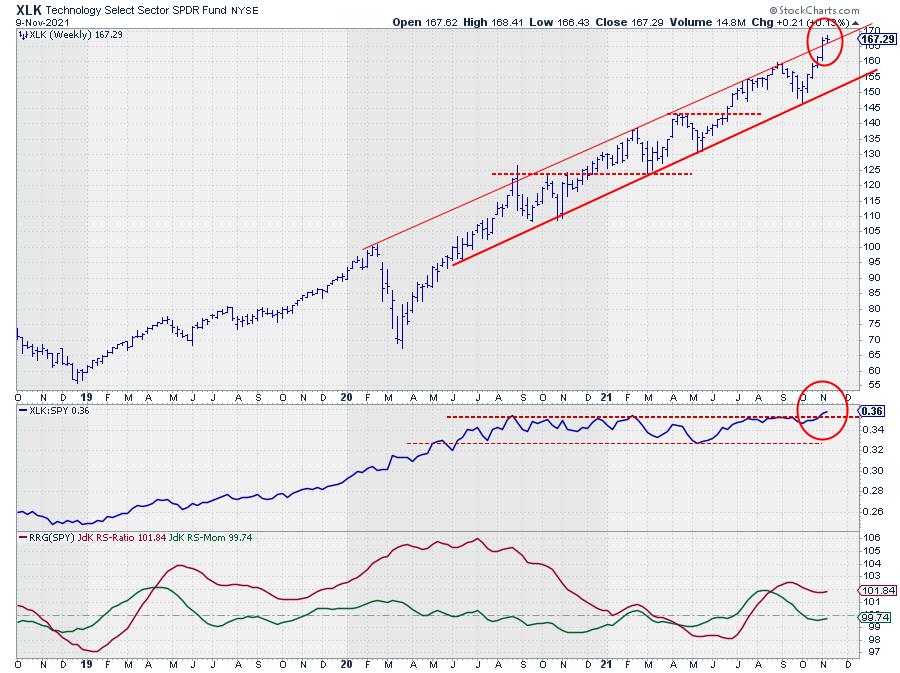

"Finally...." Tech is Breaking Out!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This may seem an odd title because, you might say, "tech broke out ages ago." While that is true with regard to price, it certainly was not the case for relative strength.

The (raw) RS-Line peaked back in August 2020 and has moved sideways in a narrow range...

READ MORE

MEMBERS ONLY

Sector Spotlight: 3 Levels of Sector Rotation on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I discuss the current rotations in asset classes and sectors and bring the daily rotations into a longer-term perspective on the weekly Relative Rotation Graphs. Then, in the second half, I extend the use of the break down into Cyclical,...

READ MORE

MEMBERS ONLY

First People Buy Cars, Then They Need Parts (and Tires)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

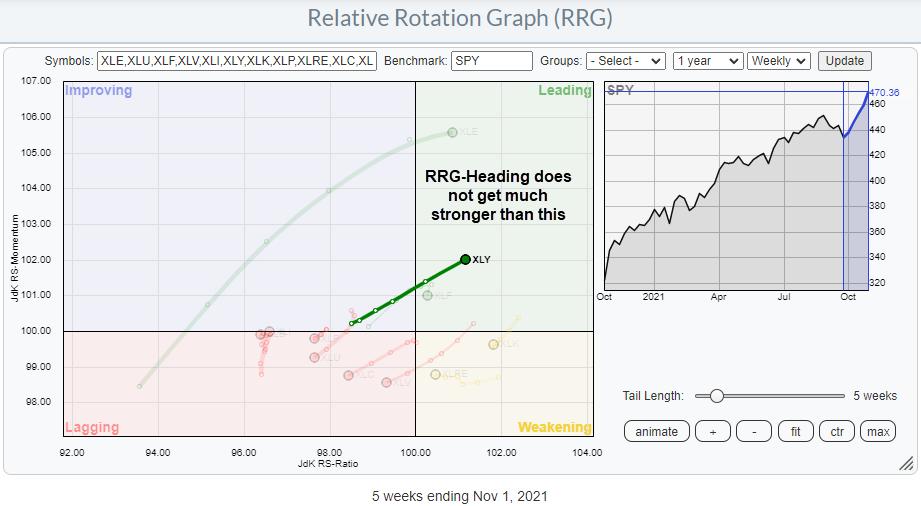

One of the (if not THE) most promising tails on the Relative Rotation Graph for US sectors is on XLY, the Consumer Discretionary sector. Over the last five weeks, the tail on XLY shows an almost straight line into the leading quadrant while gaining on both axes. Things do not...

READ MORE

MEMBERS ONLY

Sector Spotlight: Bullish New Highs on Monthly Charts

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, being the first Tuesday of the month, I take on the completed monthly charts for October. I kicks off the show with a look back at last week's rotations on the Relative Rotation Graphs for Asset Classes and...

READ MORE

MEMBERS ONLY

Offensive / Defensive Rotations & BETA Suggest More Upside For S&P 500

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

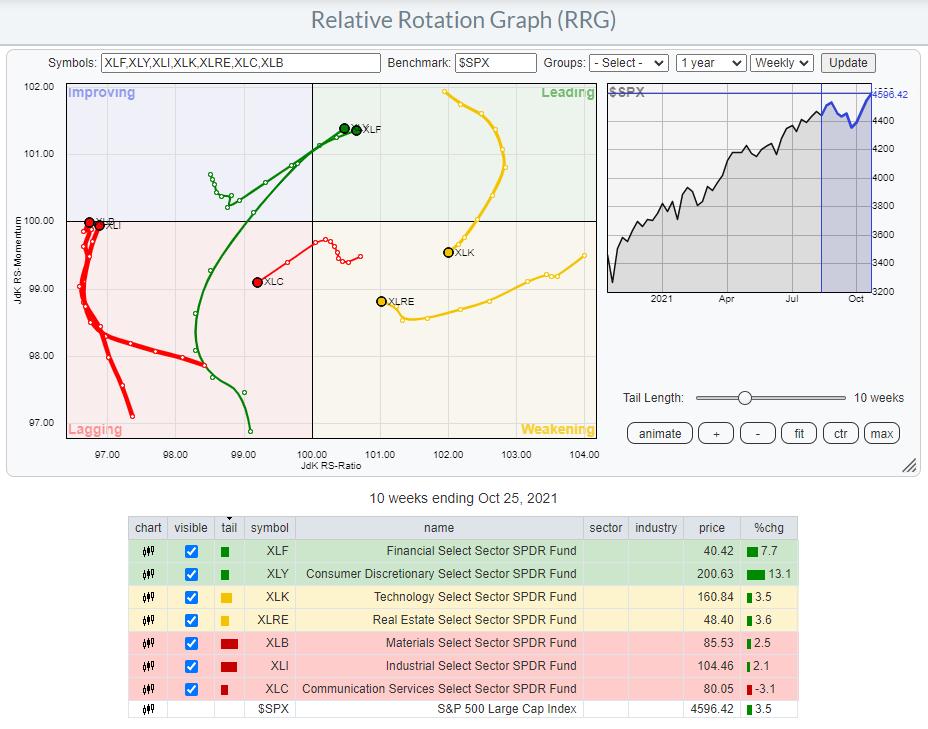

Offensive vs Defensive sector rotation always is a theme in stock markets. Sometimes a little more on the forefront, sometimes a bit more on the background. Sometimes we can read very clear messages from certain rotations, sometimes a little less.

At the moment, I believe, the offensive/defensive rotation is...

READ MORE

MEMBERS ONLY

Sector Spotlight: Strong Seasonal Trends for November

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I take a quick look at the current state of Asset Class rotation through the RRG lens. After that, I move on to Sectors. After a quick assessment of last week's rotation, I bring in BETA again to...

READ MORE

MEMBERS ONLY

What You Need to Know About Universes and Benchmarks on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

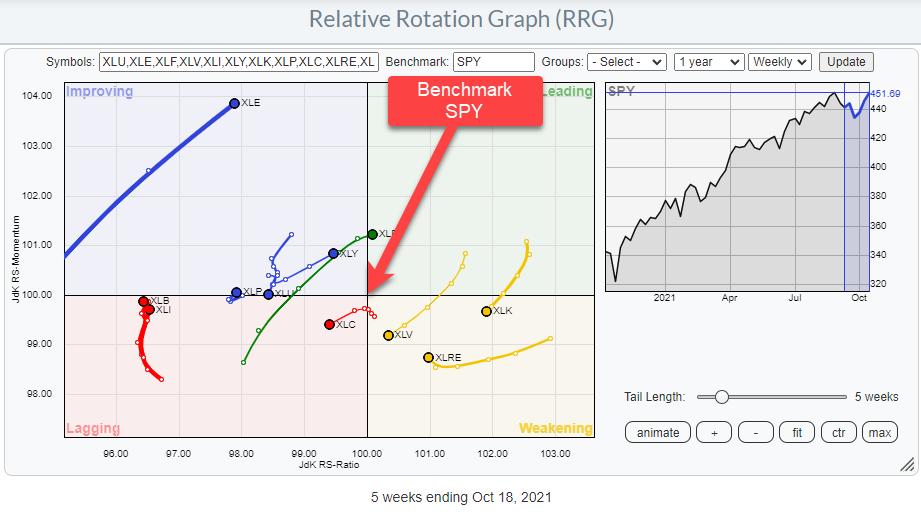

The two crucial elements of a Relative Rotation Graph (RRG) are the "universe" and the "benchmark".

The Benchmark

The benchmark for a Relative Rotation Graph is the common denominator for all securities that are present in the universe. Theoretically, the benchmark can be any index or...

READ MORE

MEMBERS ONLY

Sector Spotlight: Offense Pulling Away While SPY Improves

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I dive into the current state of sector rotation and highlight the relationship between the Consumer Discretionary and Consumer Staples sectors, as Discretionary is trying to pull away after a period of indecisiveness. The XLP:XLY ratio is breaking out...

READ MORE

MEMBERS ONLY

Sector Rotation Remains Confusing, But S&P Chart Improves

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

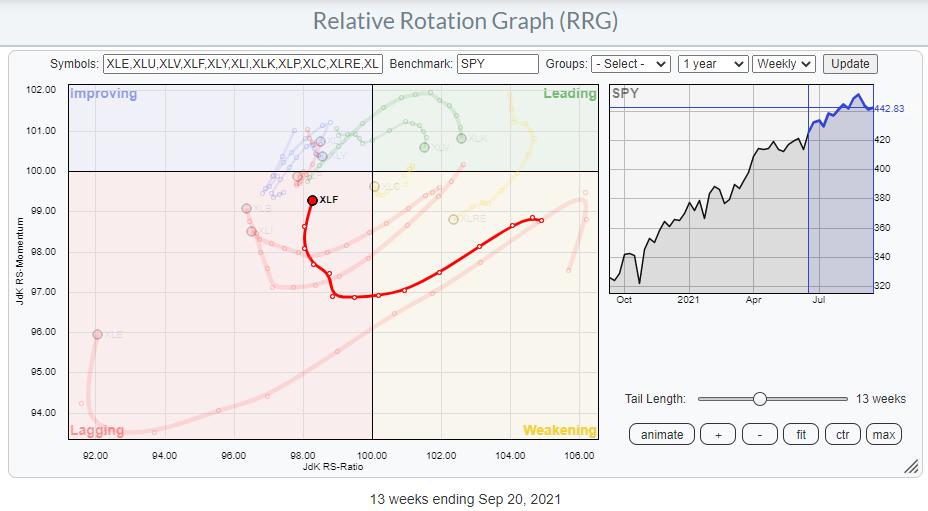

The sector rotations on the Relative Rotation Graph are still confusing. The Consumer Staples and Discretionary sectors are currently moving in the same direction where they normally move in opposite directions. Based on rising rates, one would expect both Banks/Financials and Real-Estate to benefit, but where XLF is definitely...

READ MORE

MEMBERS ONLY

Sector Spotlight: 100th Episode Special with Tom Dorsey!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

For the 100th edition of StockCharts TV's Sector Spotlight, I invite market veteran Tom Dorsey to join me for a chat and celebrate these past 100 episodes! We touch on how and when we had our ah-ha moments, or "epiphanies" as Tom refers to it, where...

READ MORE

MEMBERS ONLY

A Run on Banks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

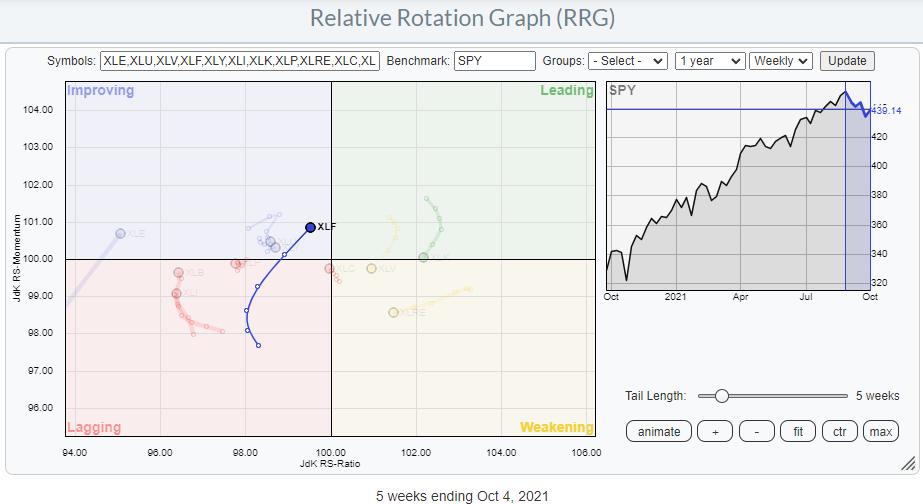

On the Relative Rotation Graph for sectors, the tail on XLF is showing one of the most promising rotations, being inside the improving sector and traveling at a strong RRG-Heading towards leading. Relative and price-technical arguments aside, I think there are two charts that support a further rotation towards and...

READ MORE

MEMBERS ONLY

NYFANG, The Index and ETF Nobody Talks About

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In a recent conversation, somebody mentioned "New York Fang" to me. I was under the impression he was referring to the FANG stocks. Only later did I understand that he was talking about an ETF and an associated index which is a bit broader than "just"...

READ MORE

MEMBERS ONLY

Sector Spotlight: Bearish Engulfing Candle for S&P

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I start the month by evaluating the monthly charts for asset classes and sectors. Despite the weak ending of the month in September, three sectors managed to squeeze out a new all-time-high. However, none of them were able to hold...

READ MORE

MEMBERS ONLY

Double Tops Could Become "A Thing" in the Bond Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Bond Market Holds all the keys. And one of the key charts here is TLT.

After setting a big double top in 2020 and completing it at the end of the year, the start of 2021 was characterized by an acceleration lower, pushing yields higher. Support was found around...

READ MORE

MEMBERS ONLY

Sector Spotlight: Does The Bond Market Hold All the Keys?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I review the current rotations for Asset Classes and Sectors. As it is the last Tuesday of the month, I bring in the seasonality segment to find out if there are any meaningful seasonal patterns coinciding with current rotations on...

READ MORE

MEMBERS ONLY

This Tech Stock Breaks Out And Is Added To The RRG Long Basket

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After the last update of the RRG Baskets we were left with 3 shorts and 3 longs:

LONG : EXR, WM, CRM

SHORT: XLY, SWKS, PSX

LONG

Looking at the recent performance for the members of the long basket we see CRM and WM holding up well vs the S&...

READ MORE

MEMBERS ONLY

Breaking Down the Financials Sector on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for sectors, the Financials sector, XLF, is positioned inside the lagging quadrant and heading upwards to the improving quadrant. The sector is gaining on the vertical JdK RS-Momentum axis, but not so much (yet) on the horizontal Jdk RS-Ratio axis.

On the price chart, XLF...

READ MORE

MEMBERS ONLY

Sector Spotlight: The Markets Take a Nose Dive -- What's Next?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Be Careful what you wish for.... the market finally seems to be starting to give in. As Europe opens the week lower and the US follows, I assess the rotations at asset class and sector level on this edition of StockCharts TV's Sector Spotlight. With the market now...

READ MORE

MEMBERS ONLY

We Can See More Than "Just" Sector Rotation on Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

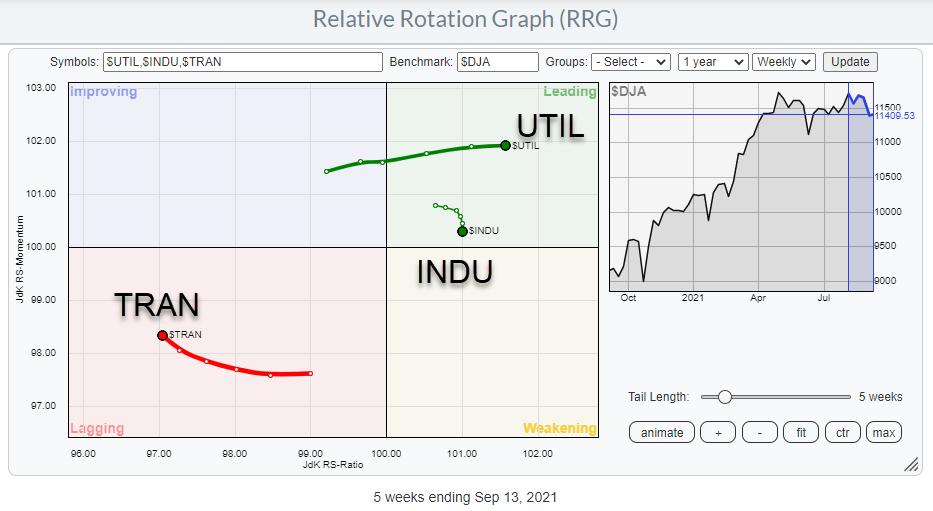

I had planned to look at some lesser-known Relative Rotation Graphs in this week's episode of Sector Spotlight, but I used too much time on asset class and sector rotations to make that happen. So I am going to publish them here and give a brief description and...

READ MORE

MEMBERS ONLY

Sector Spotlight: Rotation in the Defensive Sector is Gathering Momentum

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, asset class level stocks are still beating bonds, but the pace is slowing down. The big H&S pattern in EUR/USD, which suggested strength for the USD, is still there but lost a bit of its appetite.

Sector...

READ MORE

MEMBERS ONLY

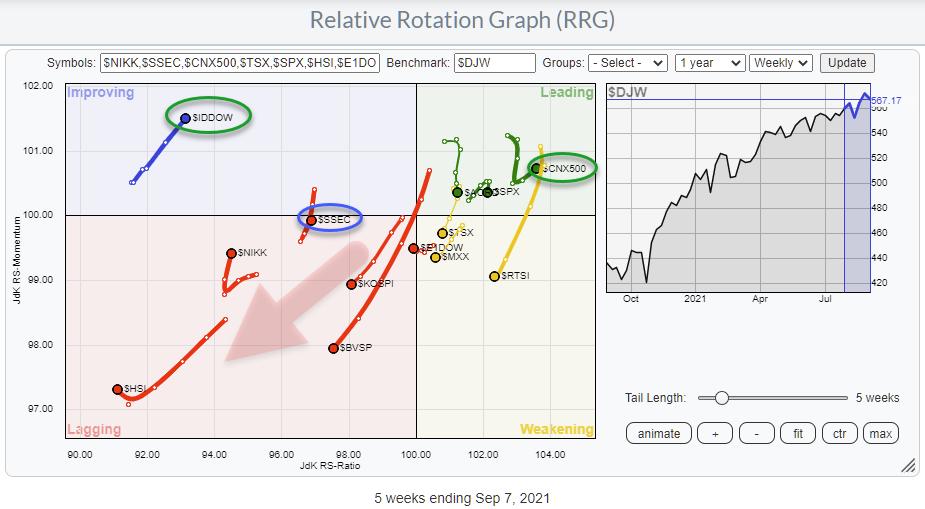

An International Perspective on (Stock) Markets From RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With the SPY/SPX chart sending curveballs, sector rotation on Relative Rotation Graphs is sending conflicting signals. With breadth continuing to deteriorate as the S&P continues to creep higher, getting a handle on the markets is not getting any easier. So instead of focusing on the S&...

READ MORE

MEMBERS ONLY

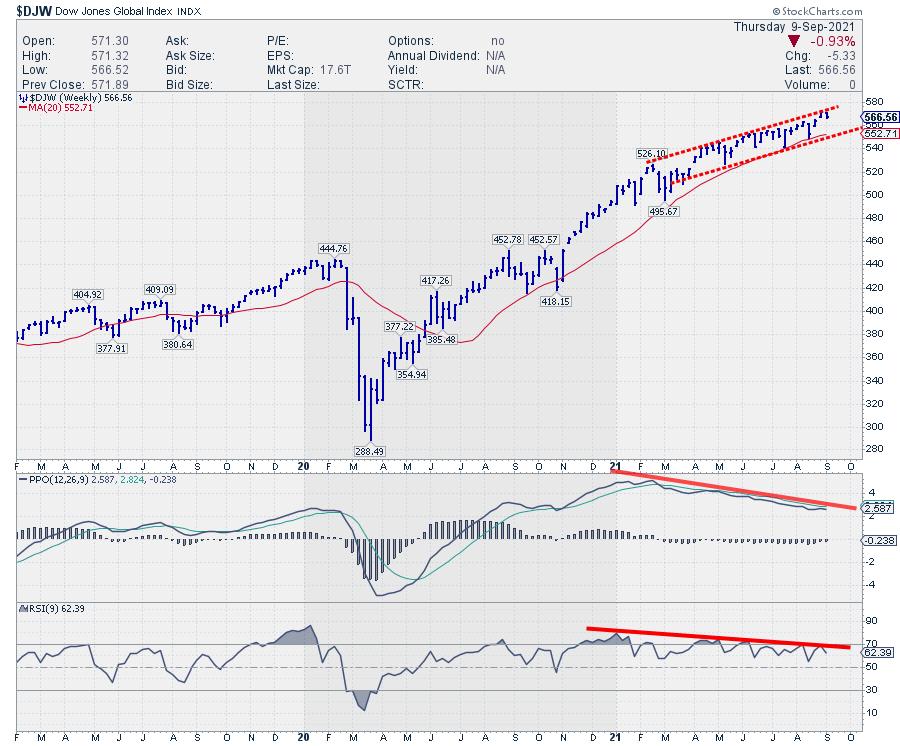

Pressure Continues to Build For Global Markets

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Over the past few weeks, I have been pointing out conflicting rotations for sectors on Relative Rotation Graphs, the negative divergence between RSI and SPY and a few more arguments that signal caution.With regard to the S&P, that has not paid off.... yet. The US stock market,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Frustration Takes Foothold in the Markets

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I talk you through the recent rotations in Asset Classes and Sectors, addressing the counter-trend move in the USD index -- which is close to negating the double bottom in the index and the H&S pattern in the...

READ MORE

MEMBERS ONLY

PSX Replacing ETR as a New Short in the RRG Basket

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The last update on the RRG baskets goes back to 20 July. In that post, I did a big clean up and left the basket with the following positions:

LONG: EXR, WM, CRM

SHORT: ETR, XLY, SWKS

LONG Basket

The RRG for the three stocks on the long side shows...

READ MORE

MEMBERS ONLY

Utilities and Staples at Opposite Rotations on RRG; What Does That Tell Us?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's episode of Sector Spotlight, I focused on the long-term trends using monthly charts. For several months already, most sectors have been in an uptrend on these charts; only the energy sector and the utilities sector did not qualify as such (higher highs and higher lows...

READ MORE

MEMBERS ONLY

Sector Spotlight: A Break in Utilities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Did you see the break in Utilities? On this edition of StockCharts TV's Sector Spotlight, it's all about the monthly charts. As the last Tuesday of this month (August) also happened to be the last day of the month, I decided to push things forward a...

READ MORE

MEMBERS ONLY

RRG's Road to StockCharts.com

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This month marks exactly seven years ago that I started contributing to the StockCharts website, after Relative Rotation Graphs were added to the graphical toolbox in July 2014.

As the number of eyeballs on RRGs, the blog and the weekly episodes of Sector Spotlight has grown substantially over these years,...

READ MORE

MEMBERS ONLY

EUR/USD Completes H&S Top Formation and Looks Ready For a BIG Move Lower

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above shows the rotation for the G10 currencies against the USD, which is the base (=benchmark) for this universe. Or, better, it shows nine of the G10 currencies against the USD.

The general direction for this universe is pretty clear. The majority is moving inside the...

READ MORE

MEMBERS ONLY

Sector Spotlight: H&S Formation Calls for BIG Move

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I take a chance and bring in seasonality for next month. Usually, we do that on the last Tuesday of the month, but this time the last Tuesday (next week) falls exactly on the last day of August and we...

READ MORE

MEMBERS ONLY

Sector Spotlight: Conflicting Sector Rotations

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I look at last week's rotations for asset classes and sectors and conclude that the current sector rotation is throwing curve balls at investors making it difficult to come up with a very clear and well-defined trend or...

READ MORE

MEMBERS ONLY

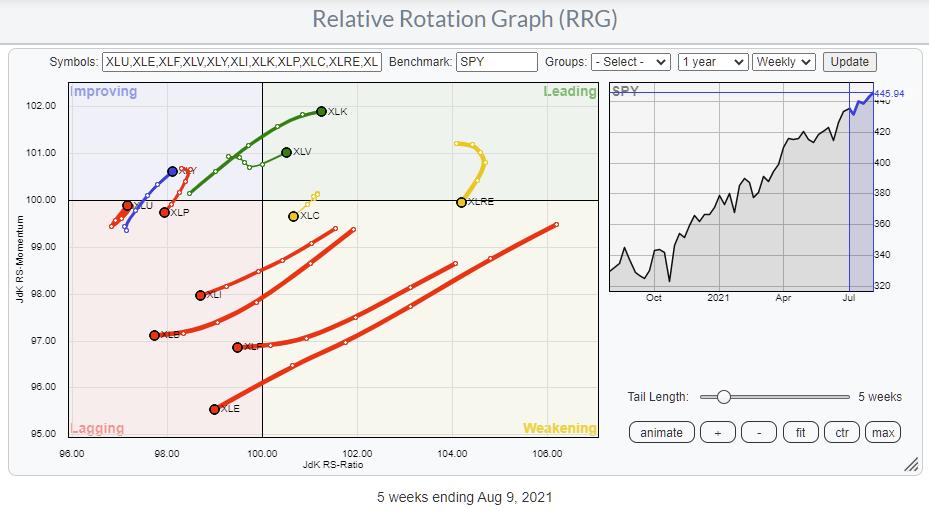

From Sectors to Groups to Stocks to Find One Name That Dominates

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs are a great tool to use for a top-down approach. Lots of people look at sectors and trade the sector ETFs. The State Street sector SPDRs range (XLK, XLY, XLP, etc.) is probably the most popular family of ETFs for that purpose. The RRG above shows the...

READ MORE

MEMBERS ONLY

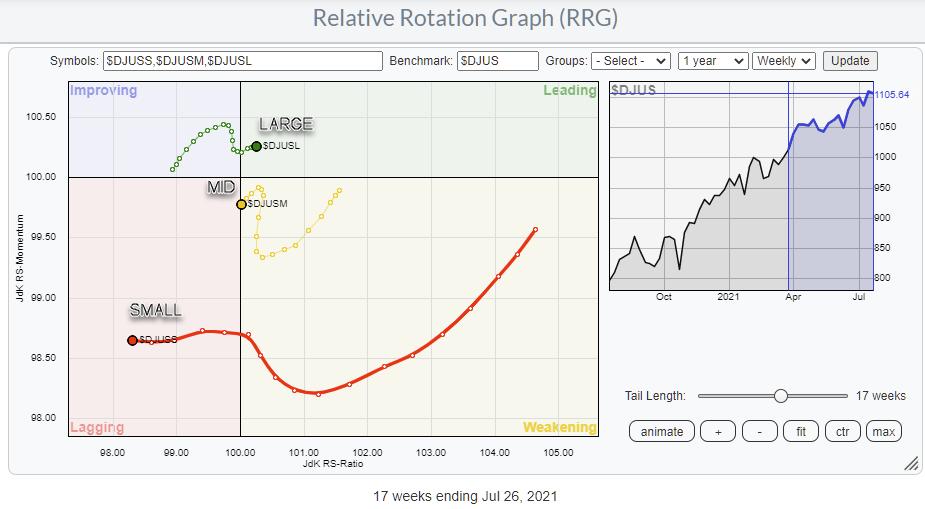

Sector Rotation to Discretionary Only in Large Cap Segment, Small Caps Lagging

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

For a few weeks already I am monitoring the rotation between large-, mid-, and small-cap segments.

On the various Relative Rotation Graphs, the deterioration for Small-Caps and, to a lesser degree, Mid-Caps vs Large-Caps is clearly visible.

Over the last 13 weeks, Large Caps have pushed into the leading quadrant...

READ MORE

MEMBERS ONLY

Sector Spotlight: Watching Healthcare for Defense

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I spend the entire show on talking you through the current rotations for Asset Classes and Sectors and how they interact with longer term trends and price charts. Caution remains for the S&P 500, while the Healthcare sector...

READ MORE

MEMBERS ONLY

Sector Spotlight: Monthly Trends Intact

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this edition of StockCharts TV's Sector Spotlight, I go over the completed monthly charts for July, highlighting the major trends and pointing out the areas of support and resistance to watch. Before the break, I give a quick overview of last week's rotations for sectors...

READ MORE

MEMBERS ONLY

In Healthcare, Focus on Supplies and Equipment; Avoid Providers

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After slowly rolling over while inside the improving quadrant, the tail on XLV (Health Care) picked up again at the start of this week and is now moving into the leading quadrant.

This move follows the recent rotation on the daily RRG, which started out in the leading quadrant, rolled...

READ MORE

MEMBERS ONLY

A Warning From Small Caps Weakness Across The Board

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph showing the rotations for Large-, Mid- and Small-Cap indexes is sending a very clear message: Avoid Small-Caps. (And also Mid-Caps.)

The large-cap segment pushes further into the leading quadrant, while small-caps are on a very long tail moving deeper into negative territory. It looked as if...

READ MORE

MEMBERS ONLY

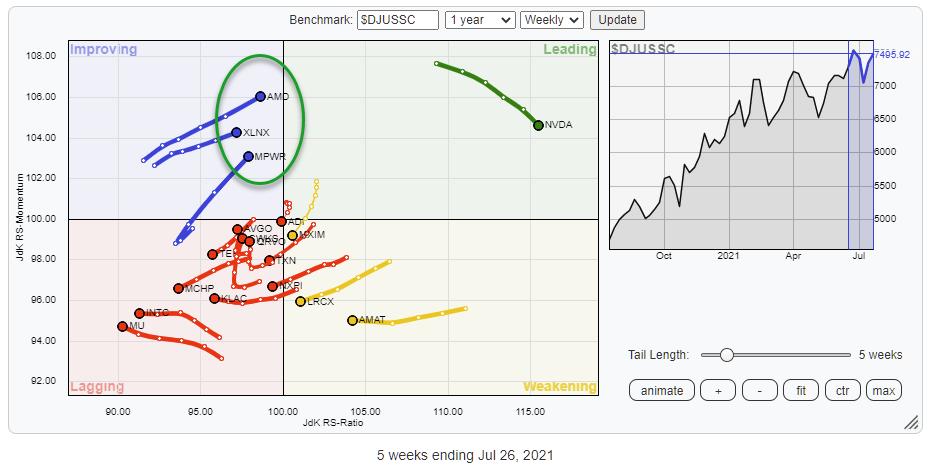

RRG Identifies 2 Interesting Semiconductor Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above shows the rotation for the members of the Semiconductor group against the DJ US Semiconductor index. Clearly, NVDA is the main component of this group, and it has been leading the group higher recently. Over the last few weeks, however, NVDA has started to lose...

READ MORE