MEMBERS ONLY

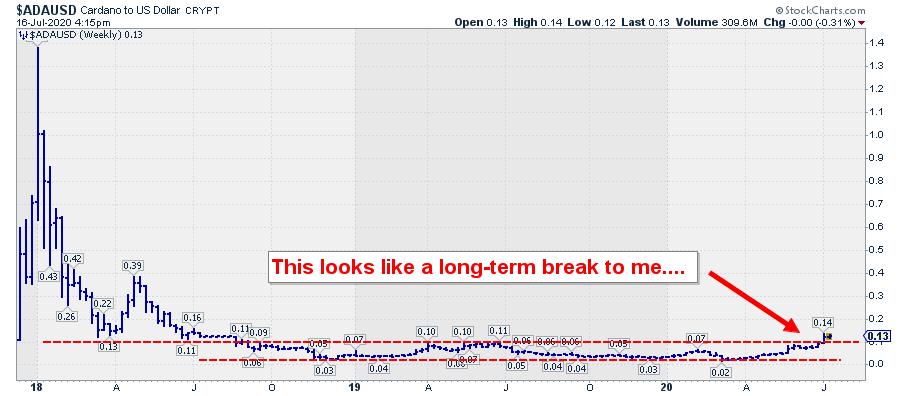

This Thing Has 70% Upside Potential...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

I got triggered to watch the chart printed above when I was scrolling through the pre-defined RRG groups.

This is a routine I go through on a regular basis; just flip through all pre-defined RRGs and see if I note any strange or particularly strong or weak rotations. Literally right...

READ MORE

MEMBERS ONLY

Sector Spotlight: Charting Mid-Year Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I spends the full show in line with StockCharts TV's theme of the week "Charting the Second Half," examining what may be in store for the markets in the next part of 2020. I look at the rotation on the...

READ MORE

MEMBERS ONLY

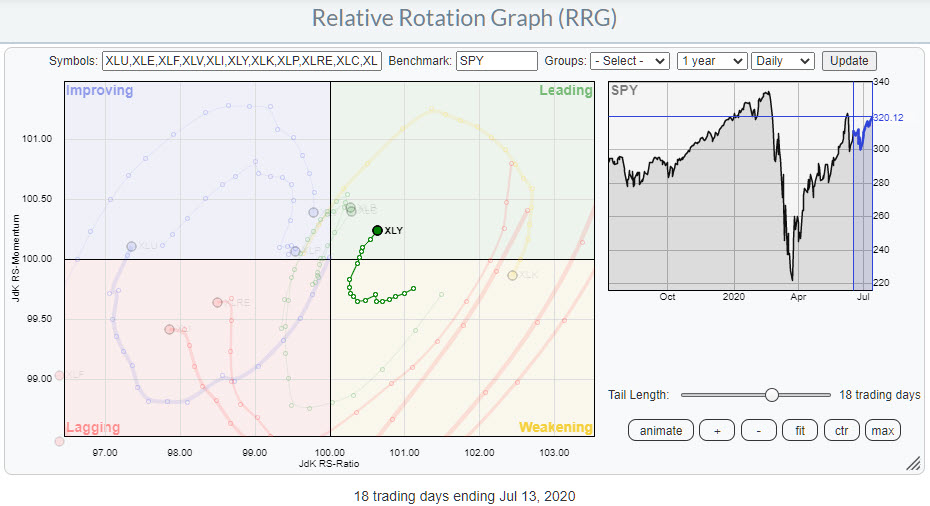

XLY Simultaneously Breaking to New Highs in Price and Relative Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the daily Relative Rotation Graph for US sectors, the Consumer Discretionary sector rotated back into the leading quadrant last week, coming up from weakening. Generally, this is a positive/strong rotation as it reflects the second (or third, etc.) leg within a relative uptrend that is already underway.

Looking...

READ MORE

MEMBERS ONLY

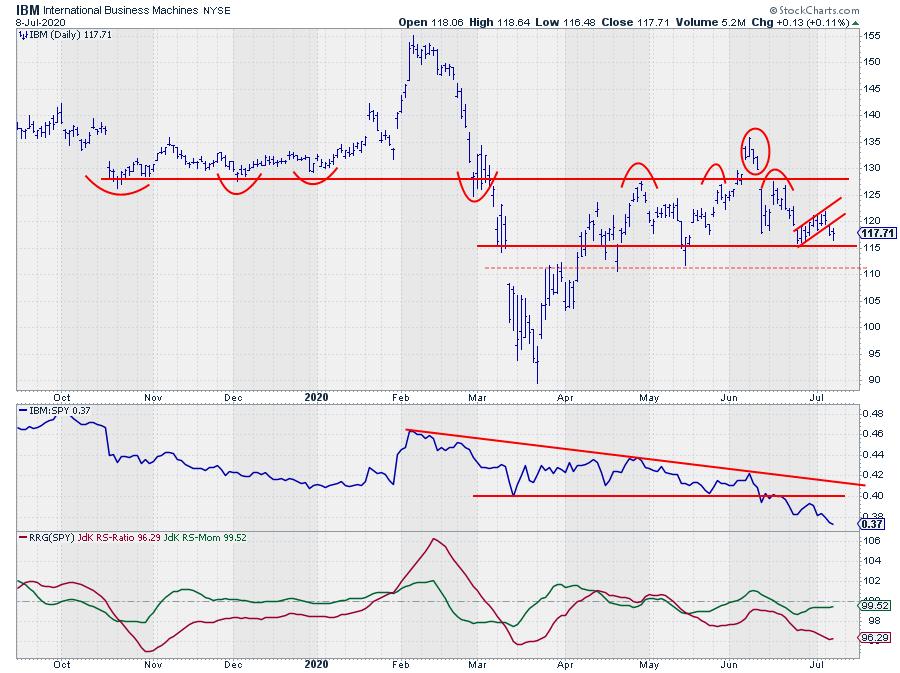

This BIG (BLUE) Tech Stock Is On The Verge Of Breaking Lower

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

There is no doubt that the technology sector is still the strongest segment in the US stock market, but, in the near term, it is losing some of its relative momentum, as you can see on the daily Relative Rotation Graph for US sectors. One of the stocks in that...

READ MORE

MEMBERS ONLY

Sector Spotlight: Why 322 is Important for SPY

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The first half of 2020 is "done and dusted." On this episode of Sector Spotlight, I start with a quick look back at the performance and rotations for asset classes and Sectors last week. Then, I take a closer look into the long-term trends using monthly charts in...

READ MORE

MEMBERS ONLY

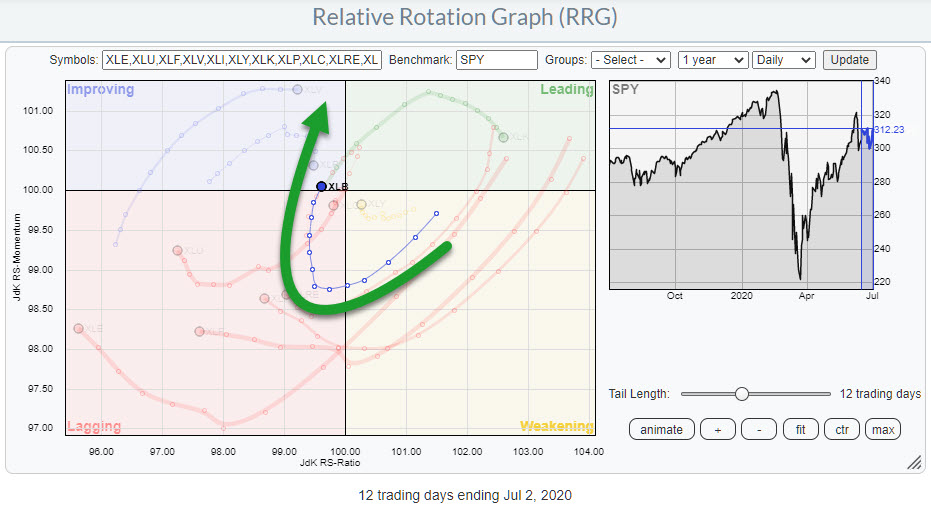

The Materials Sector (XLB) is Lining Up For a Good Week!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

I hope all of you had a great (long) 4th of July weekend. At the end of the short trading week, the Materials sector turned into a 0-90 degree heading on the Relative Rotation Graph as it crossed over into the improving quadrant from lagging at the same time.

This...

READ MORE

MEMBERS ONLY

AMZN Move Over Please... Coming Through

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the ratios that a lot of market watchers and commentators look at is the relationship between Consumer Staples and Consumer Discretionary stocks. The assumption or rationale behind watching this pair is that Consumer Discretionary stocks usually do well in a rising market (SPY), while Consumer Staples stocks tend...

READ MORE

MEMBERS ONLY

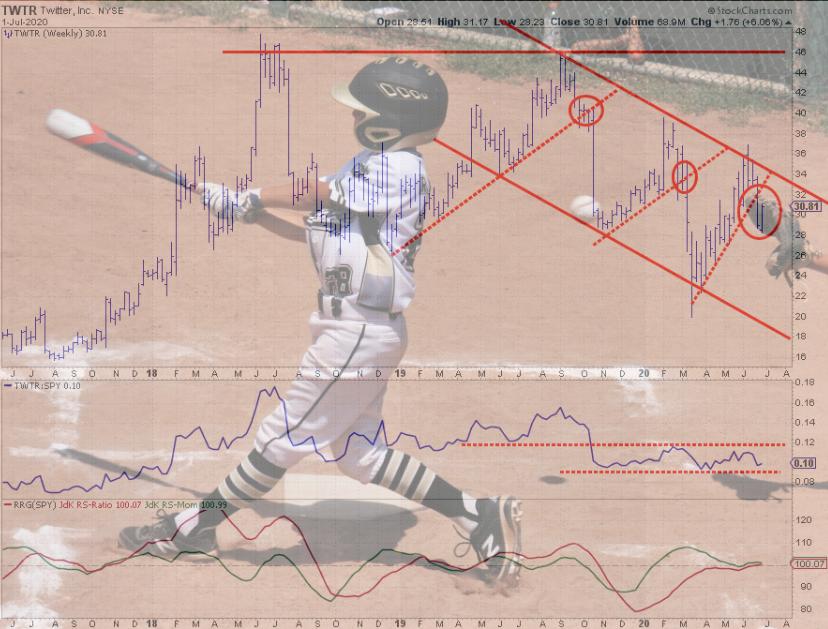

Three Tweets and you're......

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the weekly chart of Twitter (TWTR), a clear downward trend is visible. The last three peaks are lining up nicely and connecting a downward-sloping resistance line. Parallel to that downward sloping resistance line, there is an also downward-sloping support line that connects the last three lower lows.

This channel...

READ MORE

MEMBERS ONLY

Sector Spotlight: S&P Losing Momentum

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I check the seasonality for the month of July, but no clear over- or underperforming sectors are visible. The rotation of international stock markets is sending a clearer message; the US is losing momentum vs the rest of the world, especially Japan. Following some...

READ MORE

MEMBERS ONLY

Watching the Health Care Sector This Week As It Started Rotating at a Strong RRG-Heading

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week's sector rotation has pushed the Health Care sector into the improving quadrant at a positive RRG-Heading. This makes the sector stand out in a positive way on the DAILY Relative Rotation Graph for US sectors.

The only two other sectors that are rotating from left to...

READ MORE

MEMBERS ONLY

Turtle Soup Scan Triggers 29 Alerts, VRSN Ticks All The Boxes!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the scans that I run on a daily basis is my scan for "Turtle Soup" Buy signals. Actually, I have two versions of that scan - one that runs at last day's close and one that runs on last intraday update.

For the scan...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Using Breadth Data

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I perform a quick overview of asset class and sector rotation, then focus in on plotting breadth data on Relative Rotation Graphs. After the break, I answer two questions from the RRG mailbag.

This video was originally broadcast on June 23rd, 2020. Click anywhere...

READ MORE

MEMBERS ONLY

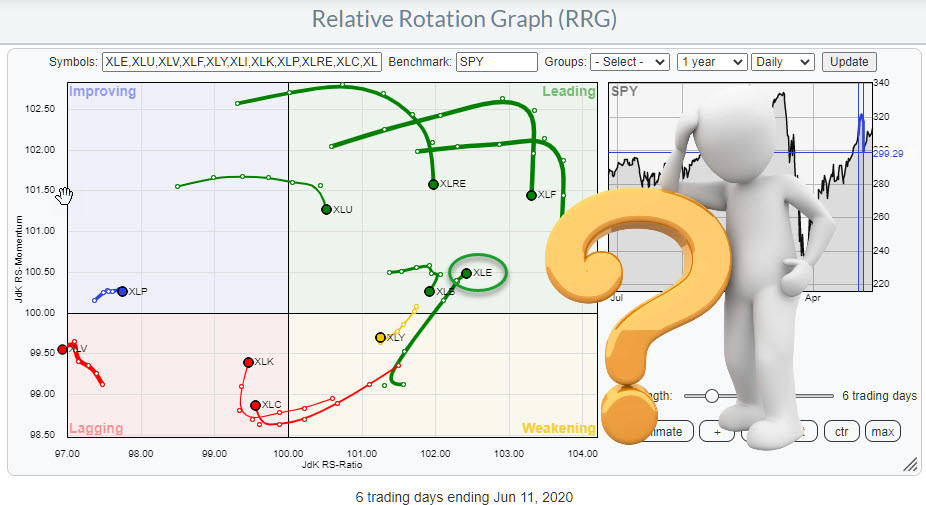

XLE is Down 9%, But Still Moving Up Into the Leading Quadrant.... Why?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This question was forwarded to me by Dave Keller after he received it in the mailbag for his show The Final Bar.

"The RRGs attached all make sense except for XLE. It was down nearly 9% the last two days, but the RRG has it moving up from weakening....

READ MORE

MEMBERS ONLY

Where Wall Street Meets Broad Street - Using Breadth Data to Confirm Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Technical analysts use a lot of breadth data in their work, which is understandable as it can give us a lot of useful information about how a market as a whole, usually a broad index level, behaves. Plus, it can help us to find developments "under the hood"...

READ MORE

MEMBERS ONLY

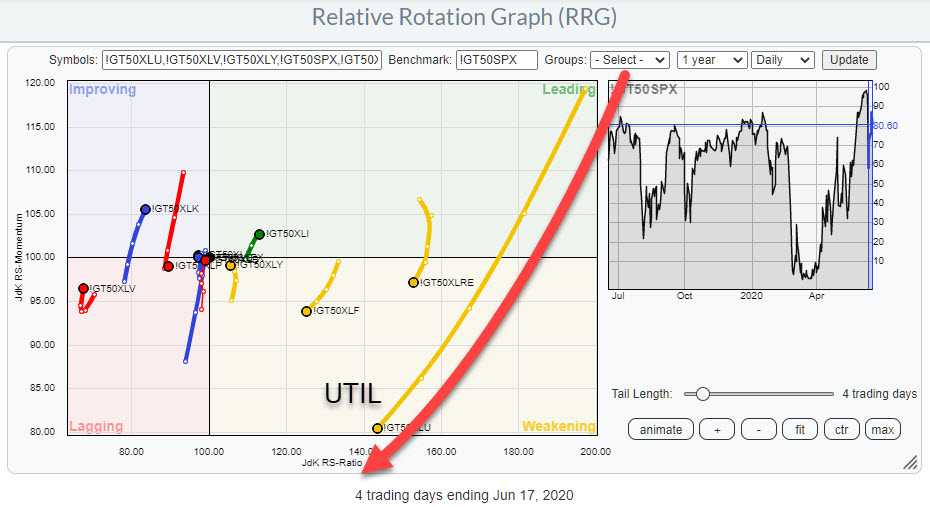

(Sector) Breadth Confirms Weak Rotation for Utilities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs are not just good for showing you the relative rotation based on price, but can also help you to see the relative development (rotation) of breadth on a sector level. There are many measures for breadth available in the StockCharts.com database, including several breadth indexes that...

READ MORE

MEMBERS ONLY

Sector Spotlight: Steepening Yield Curve a Threat?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I work my way through the Investment pyramid, introducing a new universe for commodity sub-indexes. In particular, I highlight the steepening of the yield curve, which could be a threat for the S&P.

This video was originally broadcast on June 16th, 2020....

READ MORE

MEMBERS ONLY

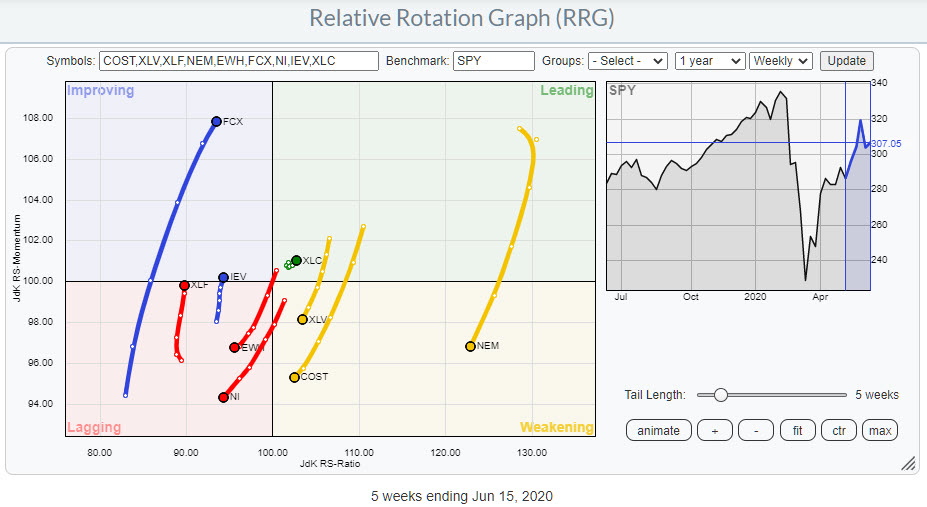

Some Long and Short Ideas from RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In my weekly Sector Spotlight show on StockCharts TV, I present a segment on pair-trading ideas from time to time. This initially started out as 1-1 pair trades ideas, later changing to a basket of long ideas vs. a basket of short ideas.

In the episode that I recorded yesterday...

READ MORE

MEMBERS ONLY

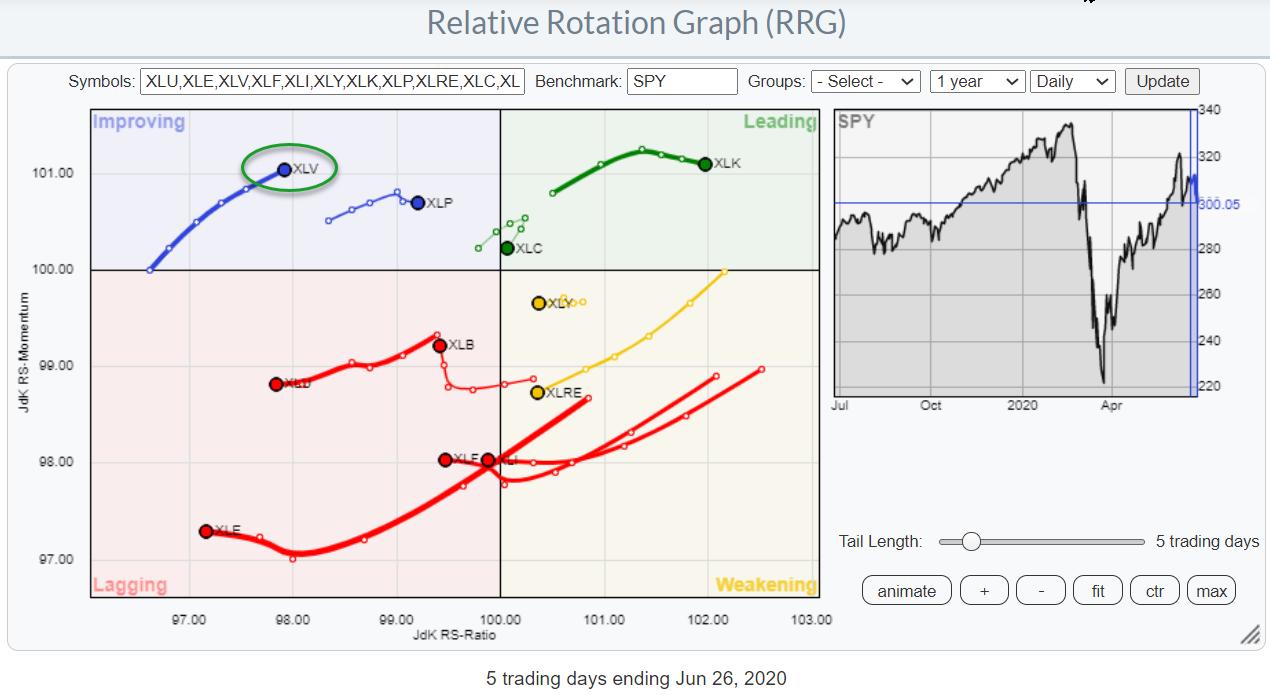

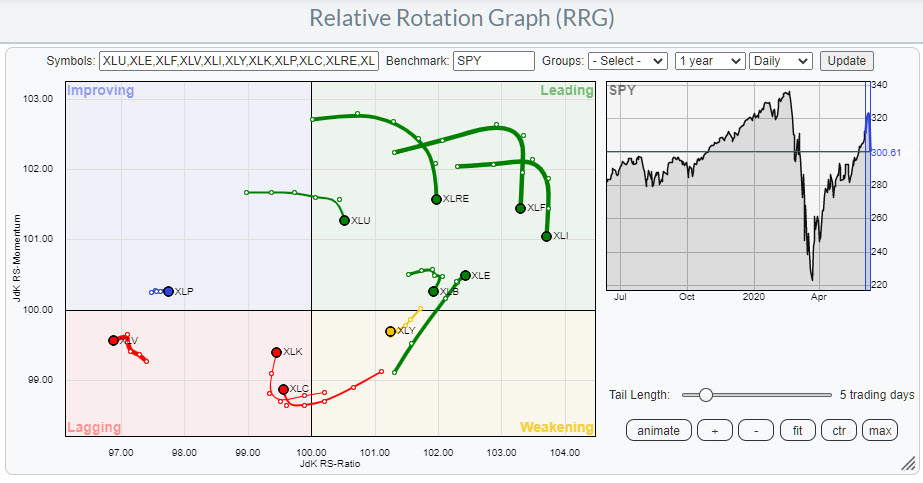

Yesterday's Impact on Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Yesterday's (6/11/2020) big drop in the S&P did not cause any weird hooks or unexpected rotations on the Relative Rotation Graph.

If we start off in the leading quadrant, we see that the tails for XLU, XLRE, XLF, XLI and XLB had already started...

READ MORE

MEMBERS ONLY

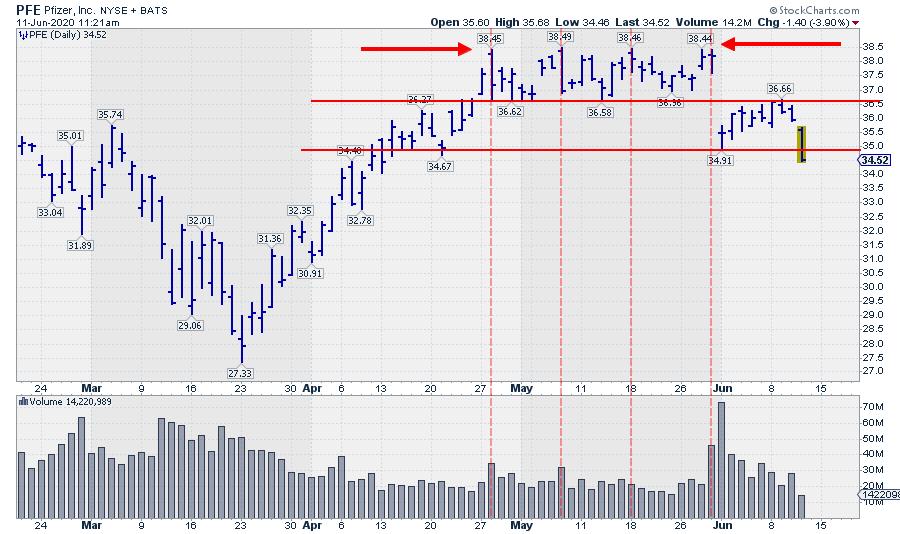

This is What Resistance Looks Like!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

A lot of (very educated) people want us to believe that the market is a random walk. And you know... Maybe sometimes it is, but not always.

This morning, I ran into the chart of Pfizer (PFE) again. I've been monitoring that chart since I wrote about it...

READ MORE

MEMBERS ONLY

Sector Spotlight: The Turn of the Tail

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, after a quick overview of asset classes and sector rotation, I dive into the mailbag and answer three questions. One of them shows two quantitative studies involving expected returns after a tail turning into a 0-90 degree heading.

This video was originally broadcast on...

READ MORE

MEMBERS ONLY

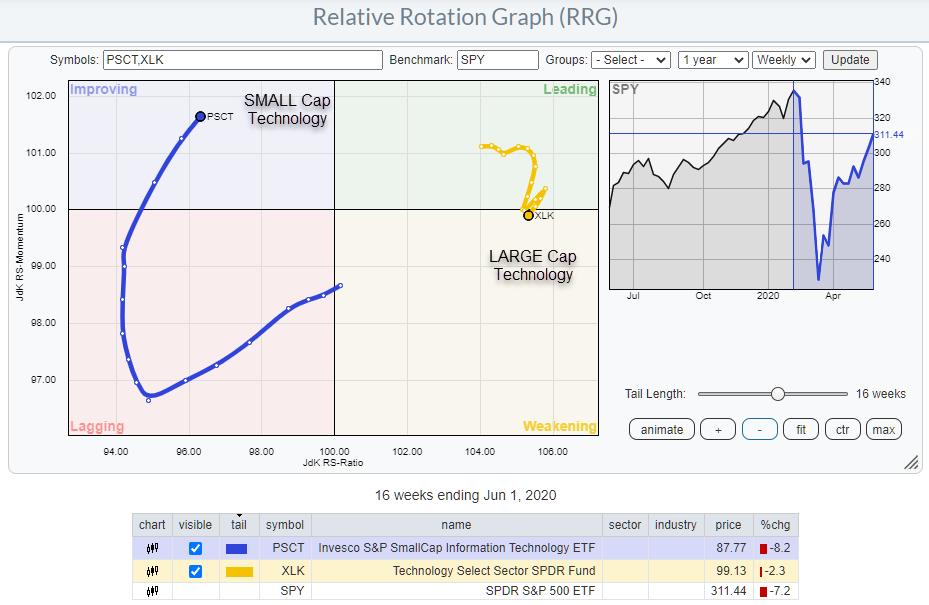

Smaller Stocks Lead at Bottoms. - JJM

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The title for this article is a quote from John Murphy's book Trading with Intermarket Analysis. And I couldn't help but think of it when I was watching the Relative Rotation Graph that shows the rotation for different segments of market capitalization.

The most well-known RRG...

READ MORE

MEMBERS ONLY

Time to Sell MSFT and AAPL?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The recovery of the Technology sector out of the March low has been in line with the S&P 500, only 1.5% better. With its strong (out)performance in the run up to the February peak and the less disastrous decline into March, XLK remained at the right...

READ MORE

MEMBERS ONLY

Sector Spotlight: Seasonality Suggests XLV over XLF for June

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I take a look at the longer-term picture for asset Classes and sectors using monthly bar-charts, then show how sometimes a shift to a line chart may give you even more insight. After this, I move on to combining the current RRG rotations with...

READ MORE

MEMBERS ONLY

Seasonality Prefers Health Care over Financials in June

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's episode of Sector Spotlight (Tuesday 10.30-11.00am ET), I ran out of time to review outstanding pair-trades so I am writing them up here in this article.

Monitoring (pair trade) ideas and how to properly communicate and track them remains an ongoing concern. Let...

READ MORE

MEMBERS ONLY

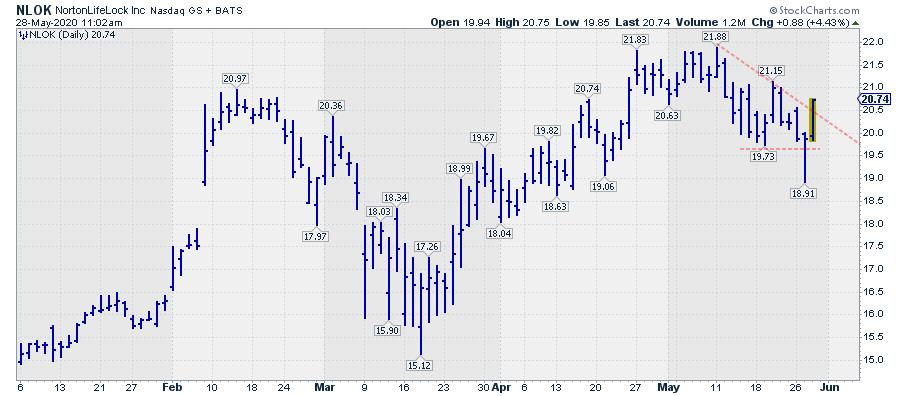

Is NortonLifeLock-ing In a New Low?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of my alerts on StockCharts.com is based on the "Turtle Soup" Strategy, which was described by Larry Connors and Linda Raschke in their book Street Smarts in 1996!!

I like this setup because it looks for entries around potential tops and bottoms, and is therefore a...

READ MORE

MEMBERS ONLY

Sector Spotlight: Your View Depends on Your Timeframe

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I review the current rotations for asset classes and sectors. In addition, I explain how your investment horizon and timeframe is crucial in determining how you view the markets.

This video was originally broadcast on May 26th, 2020. Click anywhere on the Sector Spotlight...

READ MORE

MEMBERS ONLY

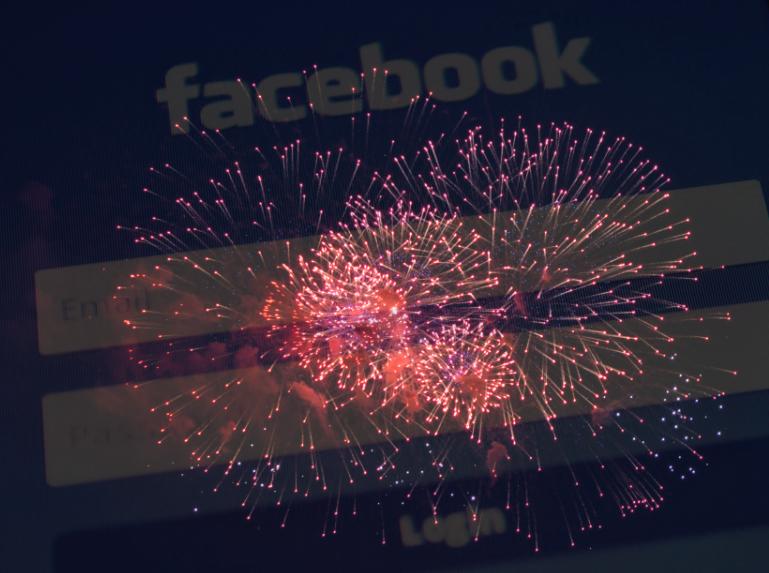

Facebook On its Way to $290

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Communication is key...

The Communication Services started to come alive again after a dull period, at least in relative terms.

Recently, I wrote about the sector here in a Don't Ignore This Chart article ("Is Everybody Calling and Texting or What?"). In addition, in the first...

READ MORE

MEMBERS ONLY

Sector BETA Can Help You with General Market Direction

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Some time ago, I started to play around with BETA as a metric to gauge risk appetite for sectors, then went from there to the general market. If you search for BETA in ChartSchool you will find this entry:

Beta: A measure of a security's systematic or market...

READ MORE

MEMBERS ONLY

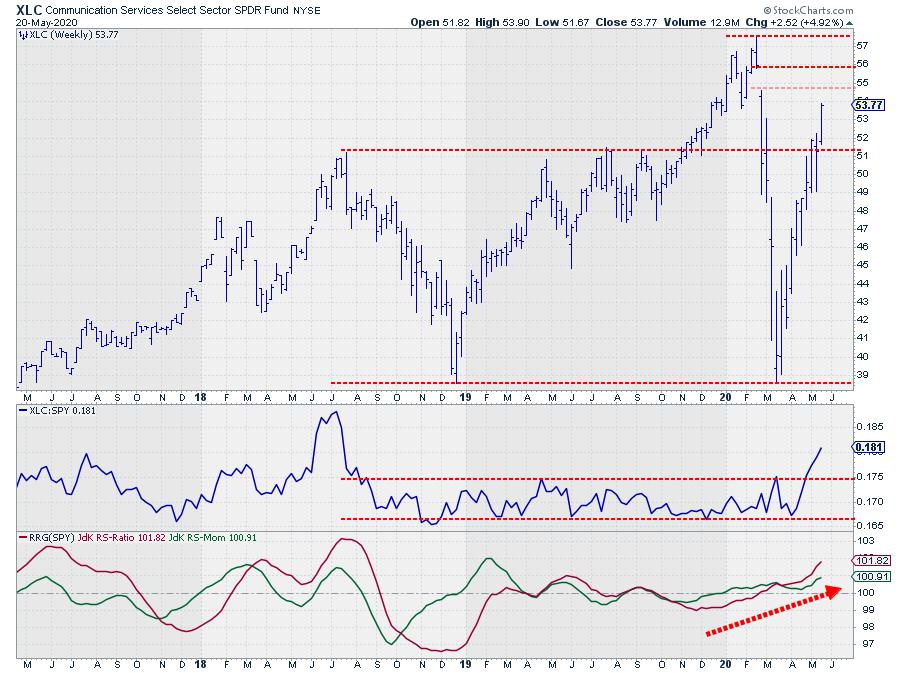

Is Everybody Calling and Texting or What?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Communication Services seem to be in high demand, looking at the price chart for XLC.

After the March crash - or was it "just a dip," with hindsight? - XLC rapidly bounced back with a vengeance. I have annotated the chart above with some horizontal support and resistance...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation to Higher BETAs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I look at recent rotations in asset classes and sectors. Next, I present updated BETA values for sectors and compare cap-weighted vs equal-weight values. Finally, I then finish up the show with a pair trade review.

This video was originally broadcast on May 19th,...

READ MORE

MEMBERS ONLY

This Health Care Stock Only Needs to Break Resistance

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Inside the Health Care sector, IDXX is one of the stocks that stands out in a positive way.

Since mid-2019, IDXX has been bouncing against resistance around $290, but never managed to get to a clear break. The peak that was set in the week beginning 2/19 was the...

READ MORE

MEMBERS ONLY

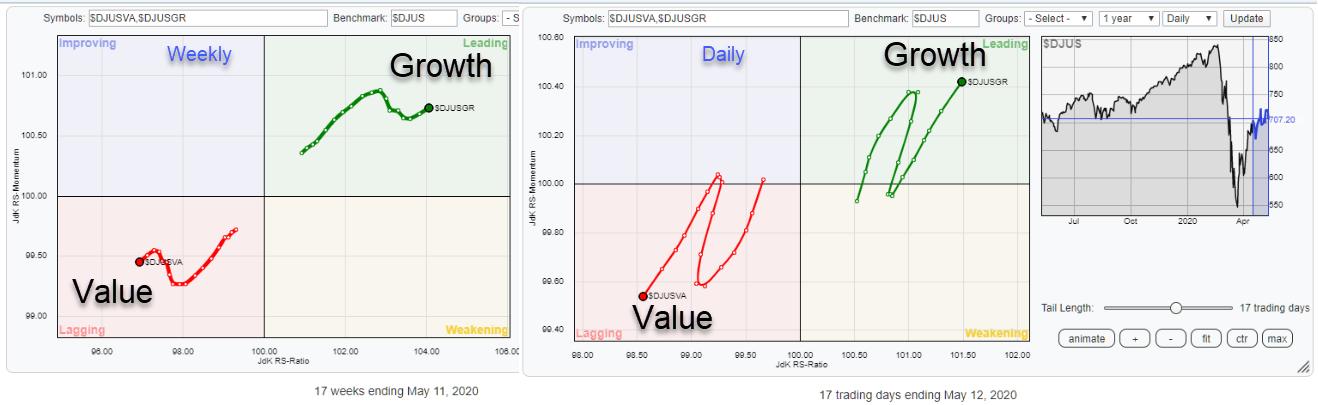

Have You Seen That Small-Cap Growth Stocks are Picking Up Momentum?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Growth-Value is a pre-defined group on the RRG page, showing the relative rotation for the Dow Jones Growth Index vs. Dow Jones Value Index, using the Dow Jones US index as the benchmark.

The last crossover for Value into the leading quadrant, and Growth into lagging, happened in November 2018....

READ MORE

MEMBERS ONLY

Sector Spotlight: Tops and Flops in Technology

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I highlight the Technology sector and picks some Tops and Flops that are worth keeping an eye on using RRG. In the second part of the show, I answers a question from the Mailbag and suggest a new pair trade idea.

This video was...

READ MORE

MEMBERS ONLY

How Daily and Weekly RRGs Are Aligned

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This article appeared in the Chartwatchers newsletter last weekend (5/9) but as it touches on one of the core interpretation basics for Relative Rotation Graphs I wanted to have it in the RRG-blog as well. So in case you missed this weekend's newsletter, here is your second...

READ MORE

MEMBERS ONLY

The Alignment of Daily and Weekly Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

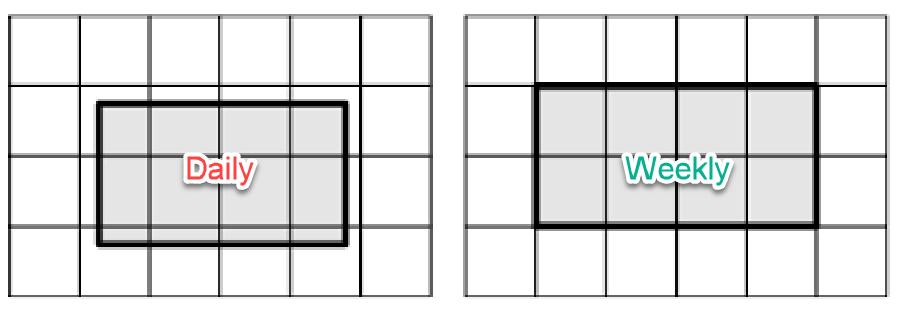

Sometimes it is unclear how daily and weekly RRGs align with each other.

Just to be clear, this is not the same as the difference between daily and weekly RRGs. With regard to that difference, there is a ChartSchool article that explains it in detail.

What we are talking about...

READ MORE

MEMBERS ONLY

PFE For The Win?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The above chart shows the daily and weekly tails for PFE overlaid on the same Relative Rotation Graph.

And before you ask... NO, you cannot do this on the site. I did need to be a little bit creative with cutting-copying-pasting-etc. But I thought it was worth it. A bit...

READ MORE

MEMBERS ONLY

Sector Spotlight: Seasonality and Sector Rotation in US Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I walk through asset classes and US sectors using RRG in combination with monthly charts. Afterwards, I answer a question from the mailbag regarding the alignment of weekly and daily RRGs. In the seasonality segment, I highlight two sectors that are showing a strong...

READ MORE

MEMBERS ONLY

Current Sector Rotation for These Two Sectors is Lining Up with Their Seasonality!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

At the end of the month, or the beginning of a new month, I like to look at the expected strength for sectors based on seasonality.

The chart above visualizes the seasonal strength for US sectors in one 3D image. The numbers in the table represent the % of occurrences for...

READ MORE

MEMBERS ONLY

XOM is Turning Around Back Into Leading vs. $INDU

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Energy sector keeps coming back on my radar as a sector that's potentially turning around. The sector has been in a relative downtrend for ages already and, from a long-term perspective, things still do not look very good. However, things never look good just before or in...

READ MORE

MEMBERS ONLY

Sector Spotlight: What Sectors are Rotating This Week?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I begin with a quick overview of what happened with asset classes and sectors in the markets last week. Afterwards, I take a look at the current state of sector rotation and finish up with an in-depth look at the relative rotation for all...

READ MORE