MEMBERS ONLY

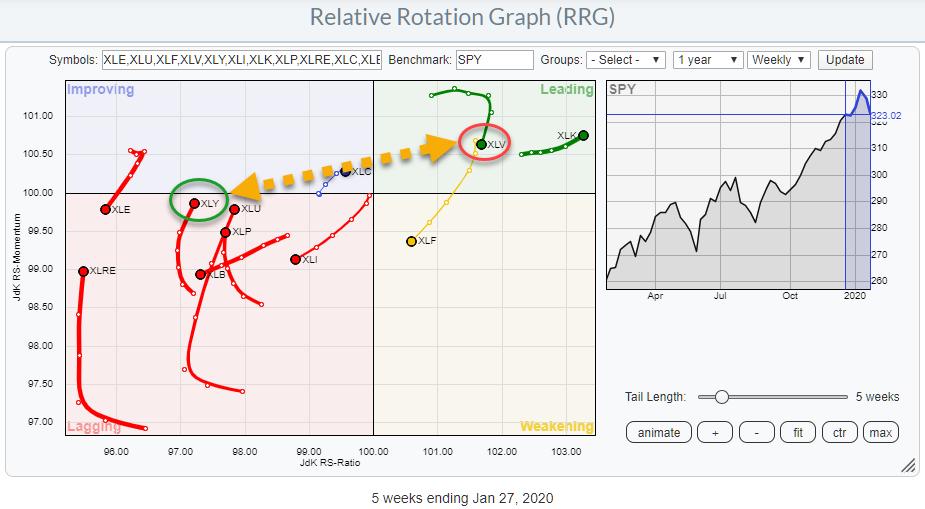

RRG Suggests Aggressive Trade Setup for XLY vs. XLV

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

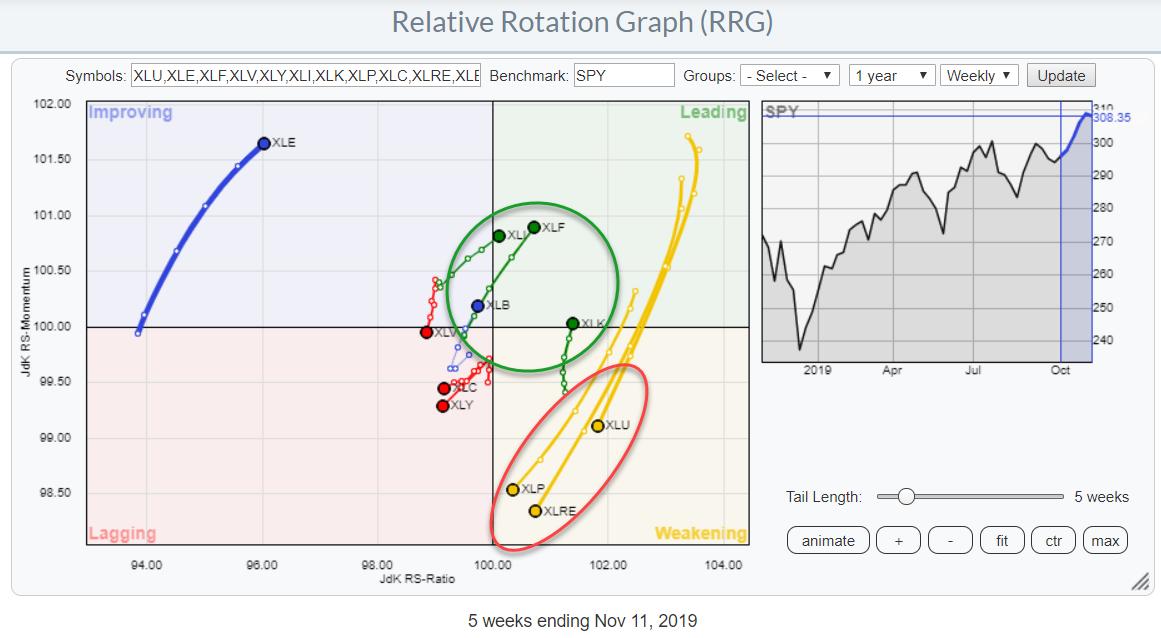

The Relative Rotation Graph above shows the weekly rotation for US sectors against SPY (S&P 500). While the S&P 500 chart is deteriorating and seems to be going into a correction, there are two tails on the RRG that suggest an interesting trade setup. (I already...

READ MORE

MEMBERS ONLY

Are People Queueing Up For a Big Mac?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for US sectors (XLY), the Consumer Discretionary sector started to curl up and move higher while inside the lagging quadrant. After a weak performance against SPY for months, XLY started to improve on the JdK RS-Momentum scale a few weeks ago and, very recently, also...

READ MORE

MEMBERS ONLY

Sector Spotlight: BETA Helps You Find Sectors To Hide When Needed

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I updated my spreadsheet for calculating the BETAs for all of the SPDR sectors. During the episode, I show users how to use this metric in combination with RRGs. This episode was originally recorded on January 28th, 2020.

Sector Spotlight airs...

READ MORE

MEMBERS ONLY

EA Sports: It's In The Game...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In a recent article in the RRG Blog titled "Is XLC taking over from XLK?", I identified the Communication Services sector as one of the potential new leading sectors in coming weeks. Currently, on the Relative Rotation Graph for US sectors, XLC is inside the improving quadrant, but...

READ MORE

MEMBERS ONLY

RRG Shows Money Rotating out of WBA into KO

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's episode of Sector Spotlight, I ran out of time to go over the pair trade idea that we usually have at the end of the show and I promised to write it up in an article. So here it is.

This idea was generated from...

READ MORE

MEMBERS ONLY

Sector Spotlight: Are RRGs "Useless" for Short-Term Trading?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I analyze the current rotations for US sectors and answer two questions from the mailbag. For one of those questions, I discuss the use of RRGs in short-term trading. This video originally aired on January 21st, 2020.

During the last few...

READ MORE

MEMBERS ONLY

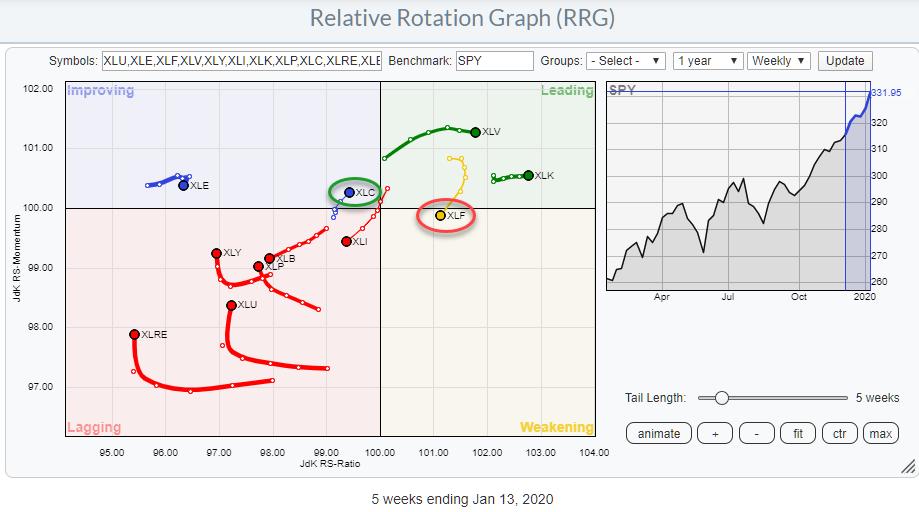

Is XLC taking over from XLF?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Here's a quick update for a rotation that caught my attention this morning.

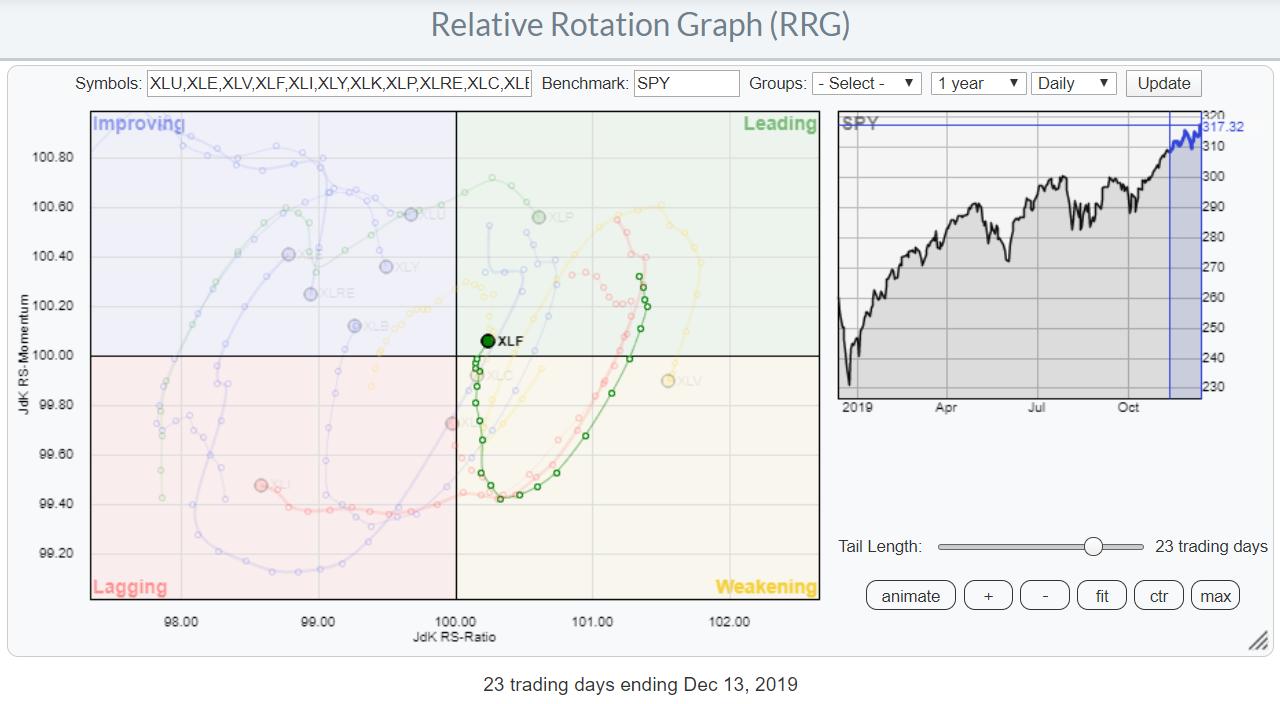

Since the end of last year, XLF has started to give up on its leading role. JdK RS-Momentum started to decline and the tail began to roll over. Last week, XLF moved from the leading...

READ MORE

MEMBERS ONLY

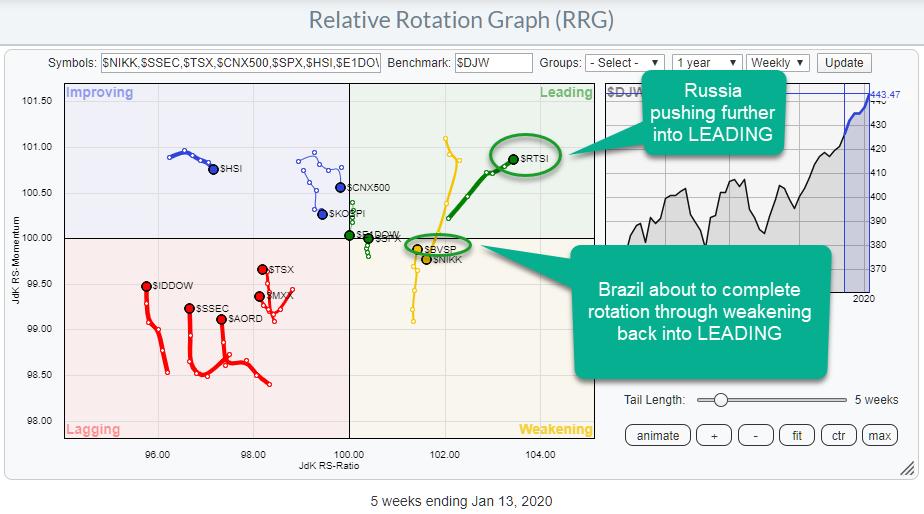

Brazil and Russia are Both Showing Promising Tails on Relative Rotation Graphs, But Russia Wins

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In my last article for the RRG blog, I wrote about the process of how to get from an idea, whether based on RRG analysis or something else, to a position in your portfolio. That post was geared towards the observation that Growth stocks are outperforming Value stocks and focused...

READ MORE

MEMBERS ONLY

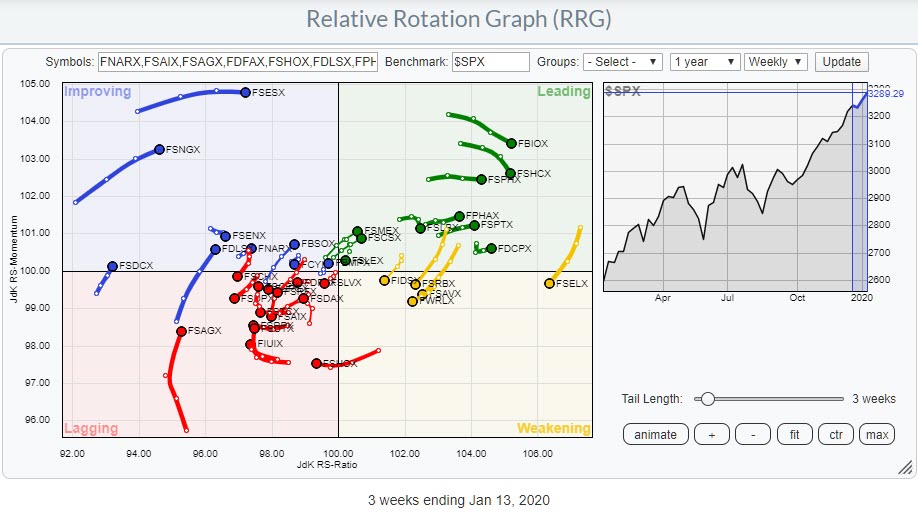

Are You Using Fidelity Funds in Your Portfolio? Here is the RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

If you are using Fidelity Funds, a Relative Rotation Graph showing the movement of all these funds can help you find the ones that are offering potential (for outperformance). The image above shows such a Relative Rotation Graph, holding 39 Fidelity Select funds.

Going over the funds on this chart,...

READ MORE

MEMBERS ONLY

From a Trading Idea To a Position

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In my last article for the Don't Ignore This Chart blog, which I write for on Thursdays, I wrote about the clear message that the rotation of Growth vs. Value is currently sending. As those are short articles meant to point to potentially interesting situations and usage of...

READ MORE

MEMBERS ONLY

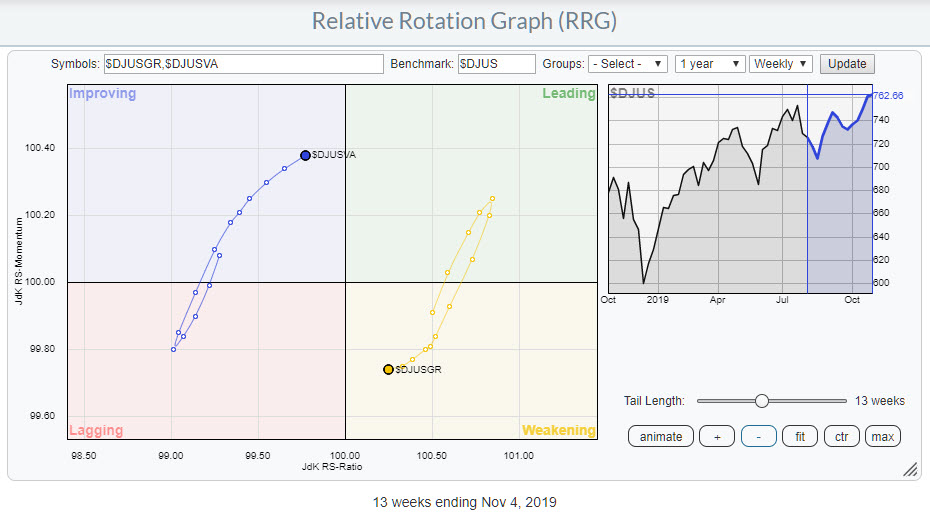

RRG Shows a Clear Winner for Growth vs. Value

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs enable us to see beyond sectors or individual stock rotations; they can also be used to visualize differently-sorted market segments.

The RRG above illustrates growth vs. value stocks, a measure that often is also used to gauge the direction for the general market. In general, growth will...

READ MORE

MEMBERS ONLY

Sector Spotlight: Monthly Charts and a Look at Asset Allocation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I take a look at new monthly charts and asset allocation. Afterwards, I build more on the Seasonality visualization and interpretation that I started during last month. This video originally aired on January 7th, 2020.

Sector Spotlight airs weekly on Tuesdays...

READ MORE

MEMBERS ONLY

Will Disney Be the New Leader in Communication Services (XLC)?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

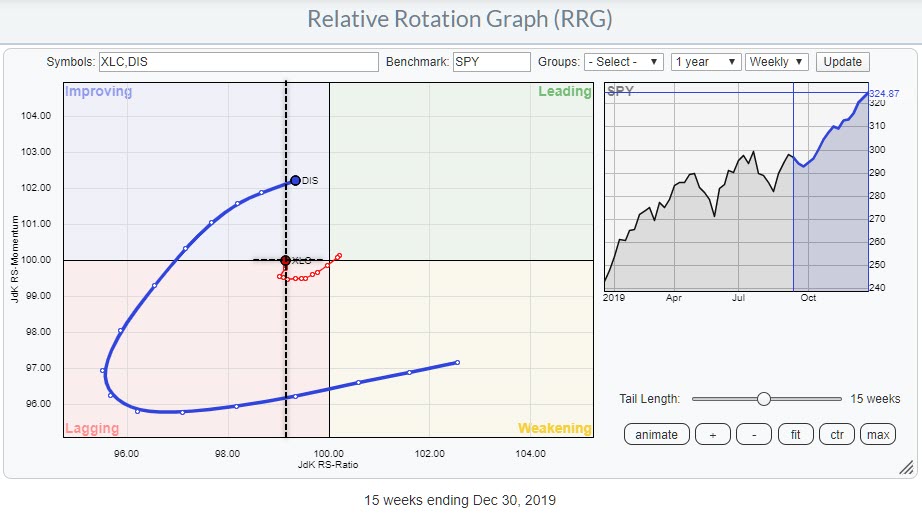

XLC, the Communication Services Sector, is sending some mixed signals.

On the price chart, XLC convincingly cleared resistance at $51 in November, when it pushed above the horizontal boundary that ran over the highs (four in total) of 2018 and 2019.

That level was tested one more time as support...

READ MORE

MEMBERS ONLY

Is Real Estate Coming to Life Again?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

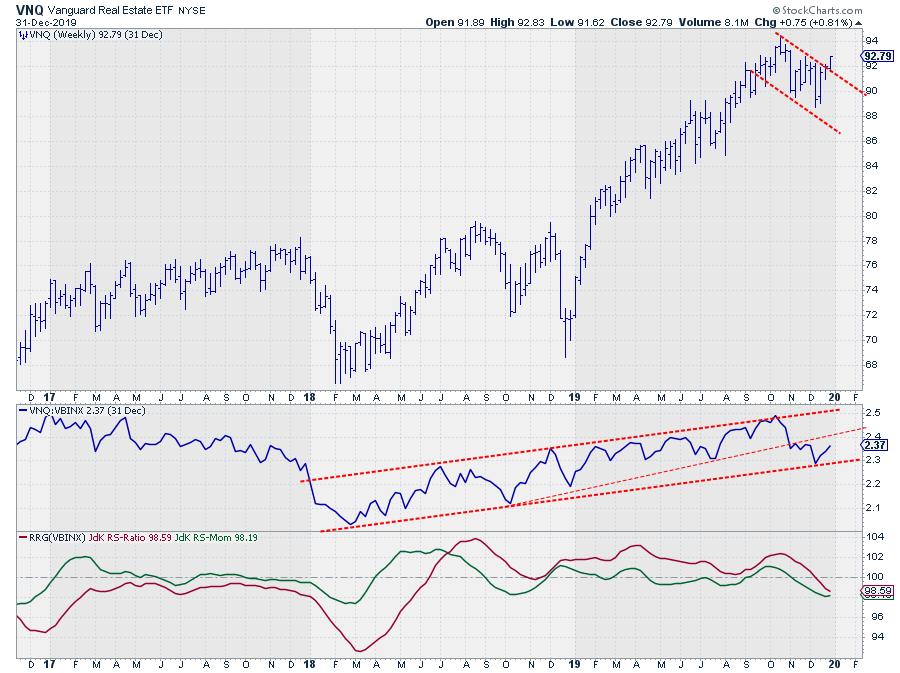

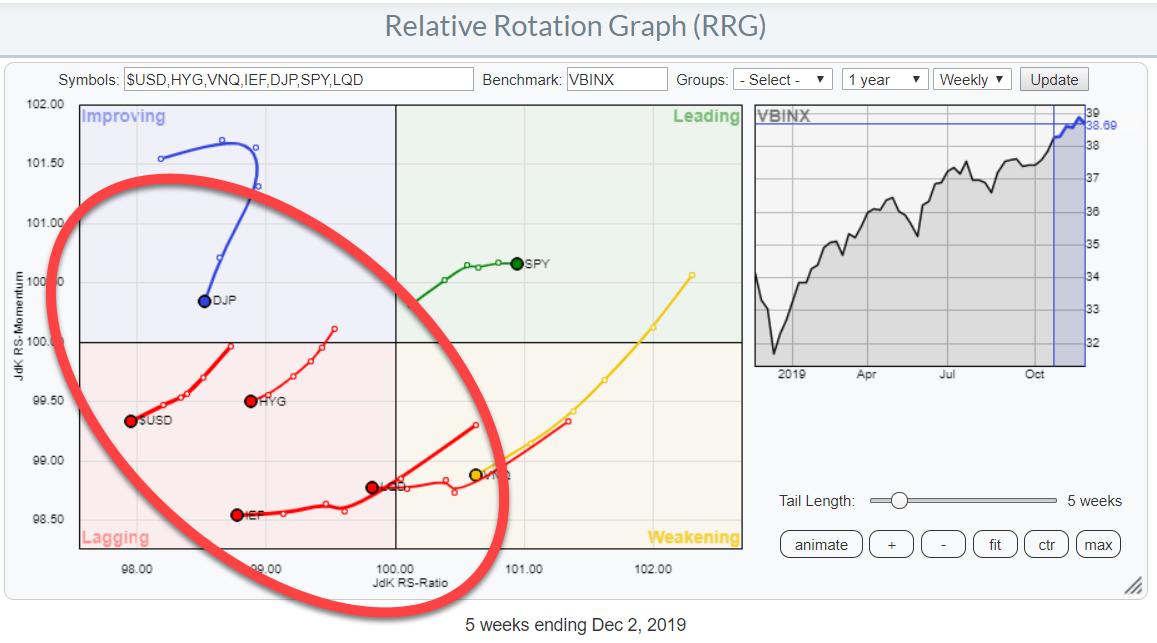

Real Estate started to lose relative strength vs. VBINX in November, then crossed over into the lagging quadrant on the weekly Relative Rotation Graph in December. On the weekly RRG for asset classes, VNQ is still well inside the lagging quadrant and considered one of the weak(er) asset classes....

READ MORE

MEMBERS ONLY

Sector Spotlight: Plotting Seasonality for All Sectors in One Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I discuss a way to plot multiple seasonality patterns on one graph and combine them with the tails on a Relative Rotation Graph. This video originally aired on December 31st, 2019.

Sector Spotlight airs weekly on Tuesdays 10:30-11:00am ET....

READ MORE

MEMBERS ONLY

Is The Energy Sector Preparing For a Turnaround?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

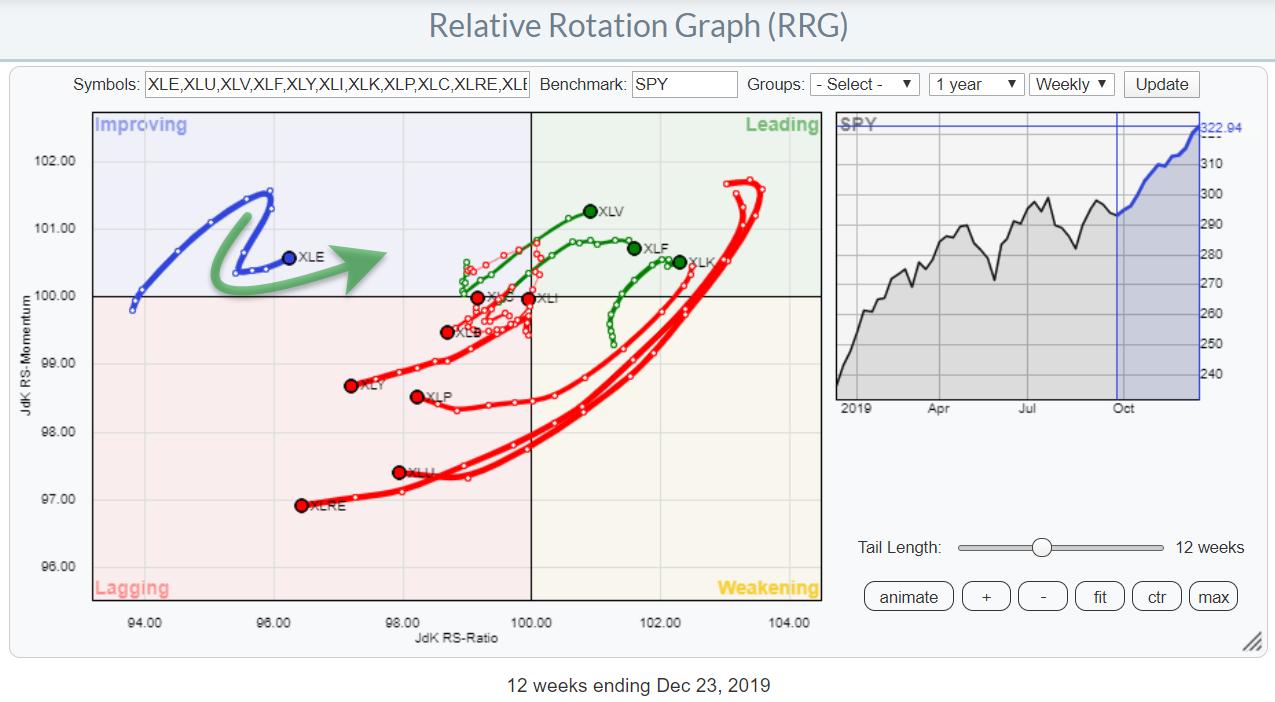

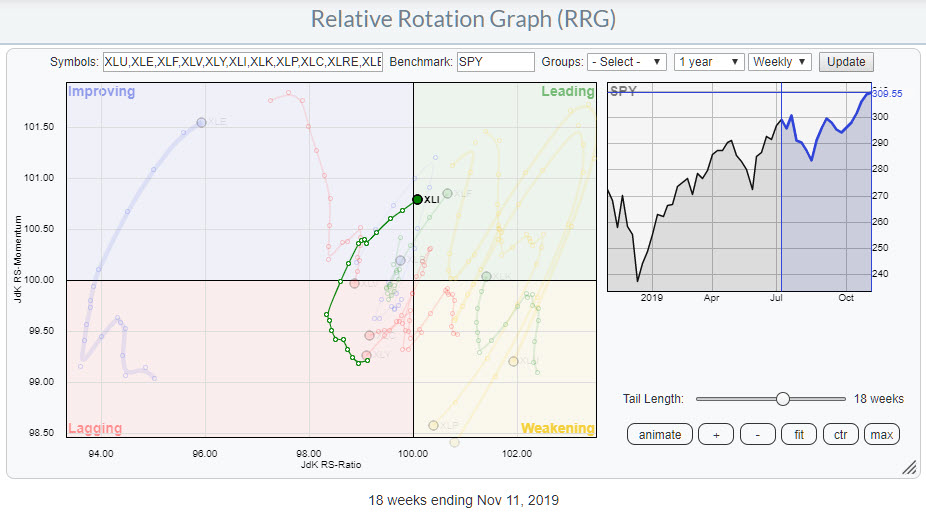

The RRG showing the Relative Rotation for US sectors has the energy sector inside the improving quadrant. Make no mistake, based on the JdK RS-Ratio reading, this is still the weakest sector in the S&P 500 - but things seem to be changing.

XLE crossed from weakening into...

READ MORE

MEMBERS ONLY

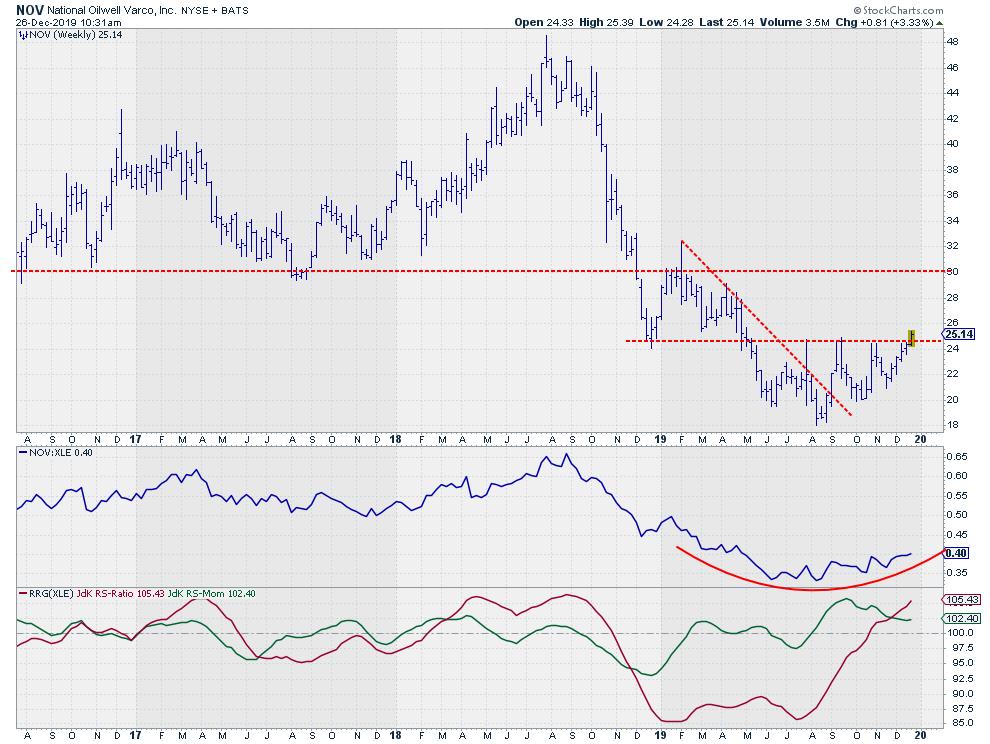

This Energy Stock is Turning Around

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the above Relative Rotation Graph, the Energy sector (XLE) hooked back towards a positive RRG-Heading while inside the improving quadrant. In terms of the JdK RS-Ratio, it is still the weakest sector, but things seem to be starting to improve.

Although the sector as a whole may not be...

READ MORE

MEMBERS ONLY

Slicing and Dicing Seasonality

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

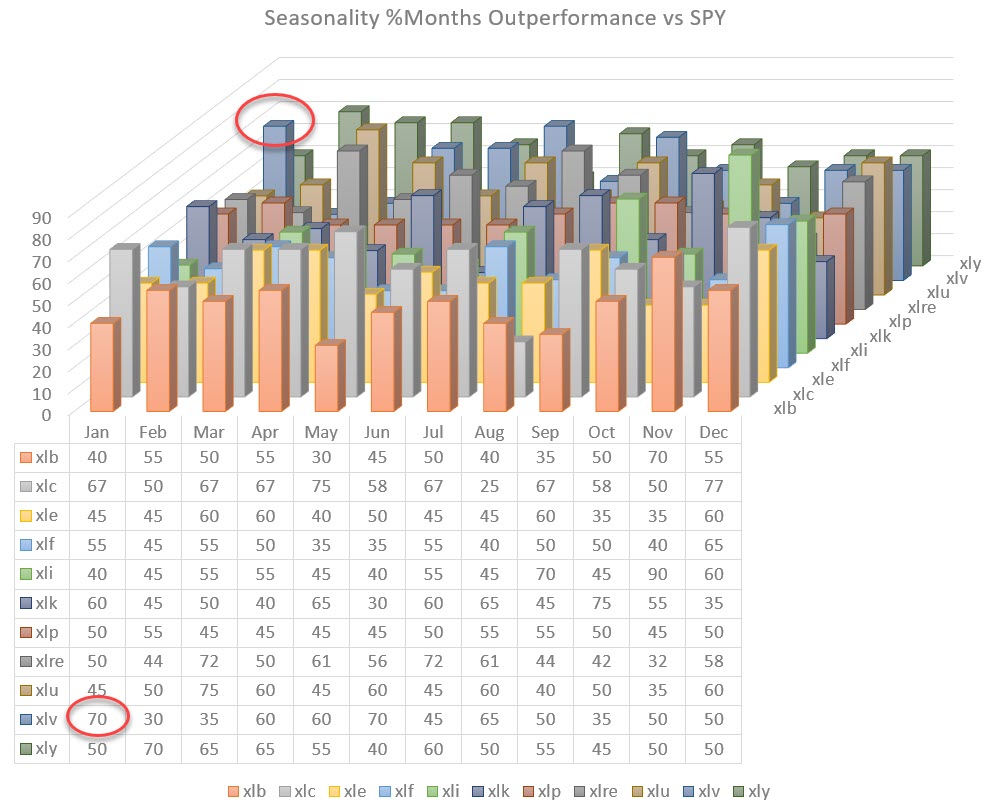

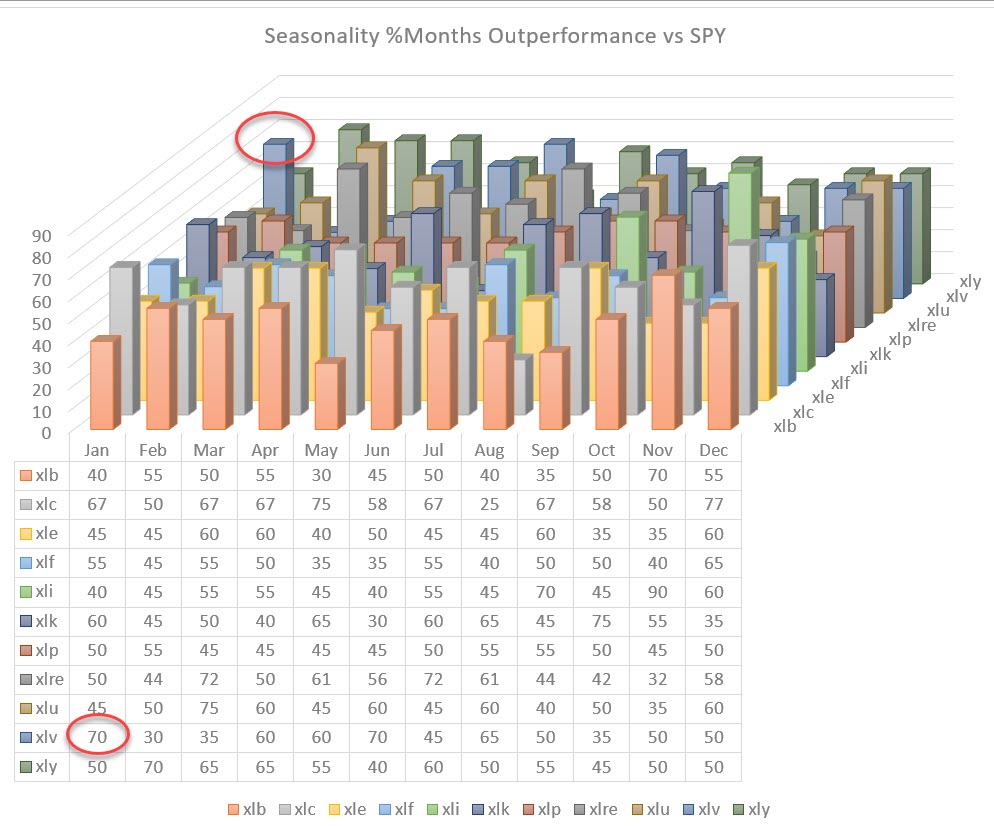

I previously highlighted the chart below in this past Thursday's DITC article (12/19). But what does it mean?

What is it Showing?

This chart visualizes the collective seasonality of all 11 sectors in the S&P 500.

To get there, I collected the numbers from the...

READ MORE

MEMBERS ONLY

When You Enter 288 Numbers, This Is What You Get

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

But What is it Showing?

The chart above shows the collective seasonality of all 11 sectors in the S&P 500.

To get there, I collected the numbers from the seasonality chart (which is available on the site) for every sector and the S&P 500 over the...

READ MORE

MEMBERS ONLY

Focus on Financials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Above is the daily Relative Rotation Graph for US sectors, highlighting the rotation for the financials sector. On the weekly RRG, this sector is solidly inside the leading quadrant and continues to move further west into positive territory.

With the current rotation on the daily RRG moving from weakening back...

READ MORE

MEMBERS ONLY

Sector Spotlight: Looking at Rotations Inside the DJ Industrials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I present a short overview of relative trends in play for asset classes and US sectors. Afterwards, I take a deep dive into the rotations of the DJ Industrials index ($INDU) and identify a pair trade idea for this week stemming...

READ MORE

MEMBERS ONLY

CFG Rotates into Leading Quadrant on RRG while Breaking Resistance on Price Chart

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The financial sector is one of the stronger sectors at the moment. Opening up the Relative Rotation Graph showing the members of this sector against XLF (as the benchmark) shows a concentration of asset managers and banks with positive rotations that are either inside the leading quadrant or moving towards...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Remains Bullish

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I discuss the current sector rotation from a weekly and a daily perspective and take a closer look at Financials. A short-term pullback appears possible in the SPY.

This episode of Sector Spotlight originally aired on December 10th, 2019.

Sector...

READ MORE

MEMBERS ONLY

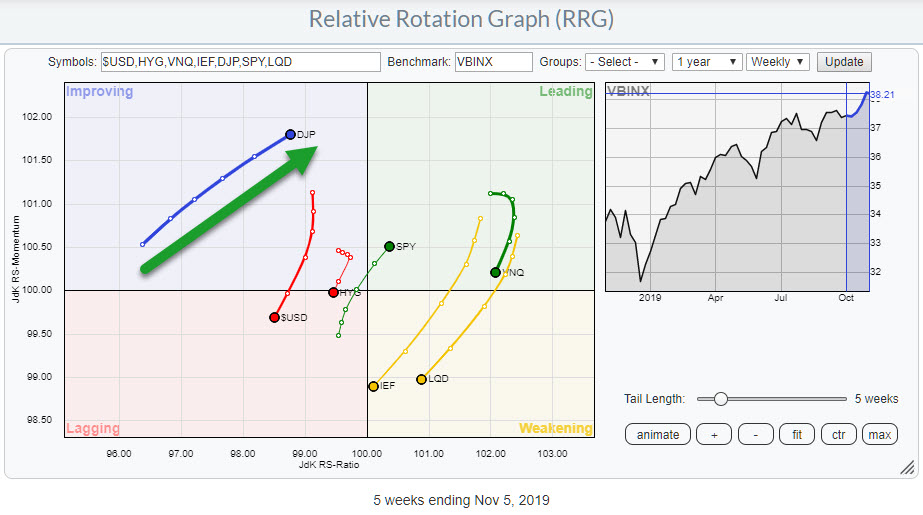

If a 100% Investment In Stocks is Too Much, Where Can You Find Diversification?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This article also appeared in our ChartWatchers newsletter (12/7).

Last Wednesday, I published an article in the RRG Charts blog titled "Stocks Remain The Only Asset Class Inside The Leading Quadrant Going into December". As the title suggests, that article primarily looks at the rotation for asset...

READ MORE

MEMBERS ONLY

Where Should You Go if You Don't Want to be 100% Invested in Stocks?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last Wednesday, I published an article in the RRG blog titled "Stocks Remain The Only Asset Class Inside The Leading Quadrant Going into December". As the title suggests, that article is primarily looking at the rotation for asset classes, with an in-depth look into the long-term chart of...

READ MORE

MEMBERS ONLY

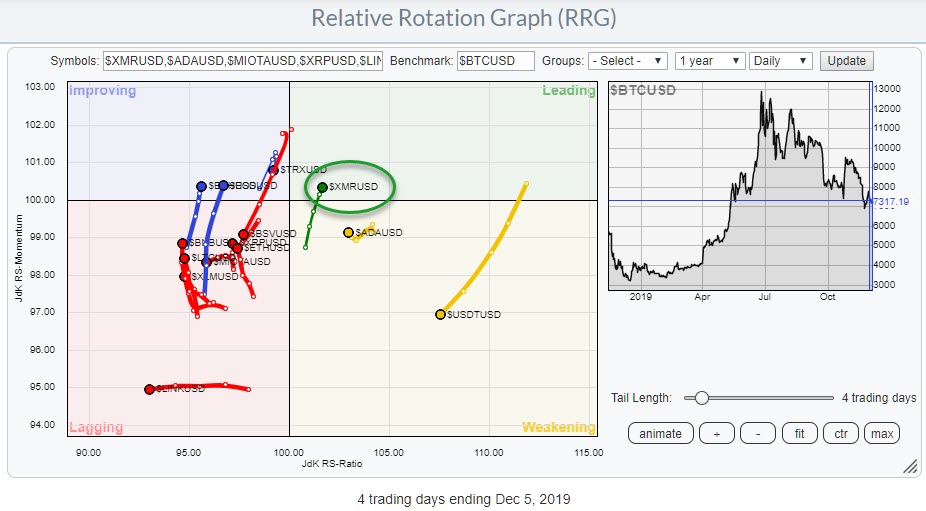

Keeping an Eye on Monero (XMR) as it Enters the Leading Quadrant on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This week is Crypto Week! Well, at least it is on StockCharts TV. Thus, I figured it would also be a good idea to once again bring to your attention to the fact that we can run RRG charts for cryptocurrencies as well.

As a quick reminder, you can find...

READ MORE

MEMBERS ONLY

Sector Spotlight: A Look At Monthly Sector Charts and Pair Trades

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of Sector Spotlight, I go over the completed monthly bars for asset classes and US sectors. Then, I present a new pair trade idea; for this video, I found one that comes from the Health Care sector.

This episode of Sector Spotlight originally aired on December 3rd,...

READ MORE

MEMBERS ONLY

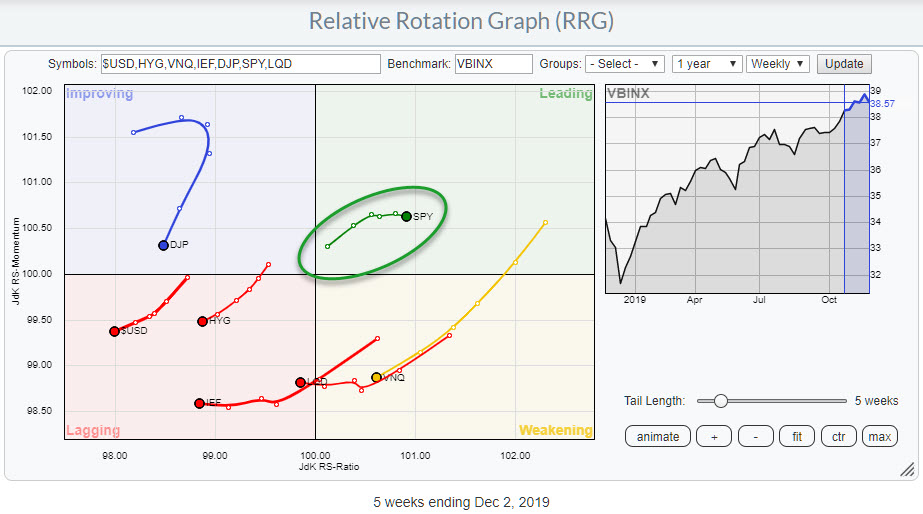

Stocks Remain the Only Asset Class Inside the Leading Quadrant Going into December

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Asset allocation is the highest point in the investment decision pyramid. The decision to invest in Stocks or Bonds or other asset classes will have far more impact on the final return for an investor than the decision to select specific stocks.

Therefore, the Relative Rotation Graph showing the rotation...

READ MORE

MEMBERS ONLY

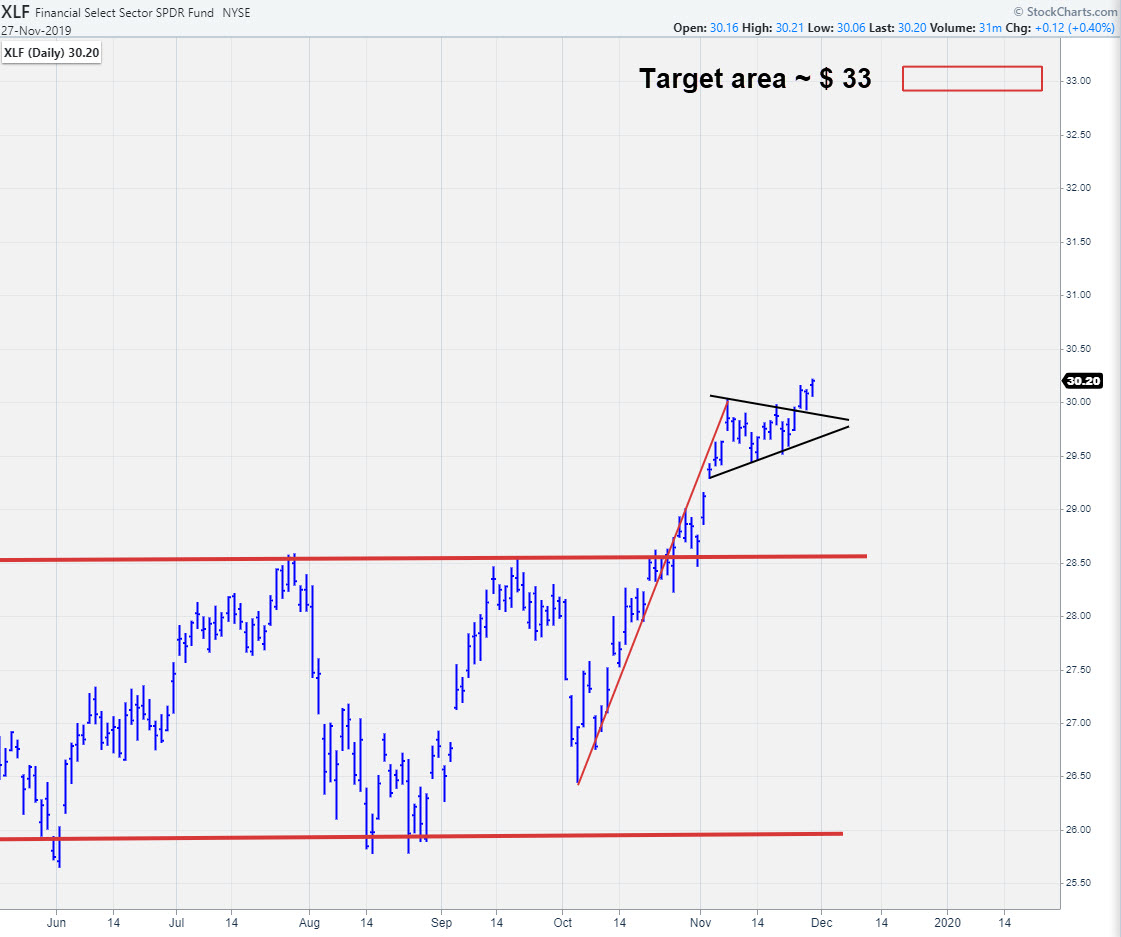

Completed Pennant in XLF Points to $33 Area

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for US sectors, Financials are in good shape. They are inside the leading quadrant and, despite a little loss of momentum in the last week, still at a good RRG-heading.

Together with Technology and Industrials, Financials is a leading sector at the moment.

A Pennant...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Continues in Favor of Tech and Financials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of Sector Spotlight, I take a look at current sector rotation and find that Tech and Financials are still the strong sectors in the US. From an international perspective, I also observe that the Indian $CNX500 index is definitely worth keeping an eye on.

This episode of...

READ MORE

MEMBERS ONLY

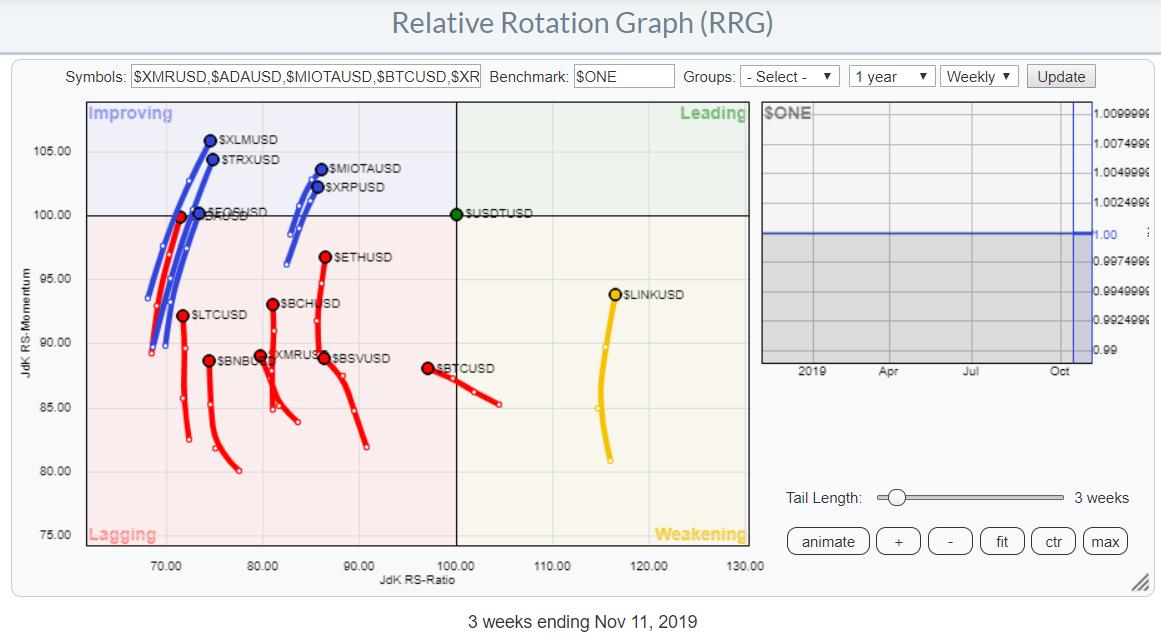

Always Wanted to See Cryptocurrencies on RRG? Now You Can.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On 8 November, StockCharts.com announced the arrival of cryptocurrency data in this ChartWatchers article. Regardless of what you think of cryptocurrencies, it's becoming increasingly hard to ignore them as the group of people that engage in trading them continues to grow.

Personally, I have no super-strong belief...

READ MORE

MEMBERS ONLY

AVGO vs. XOM - Pair Trade Idea

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

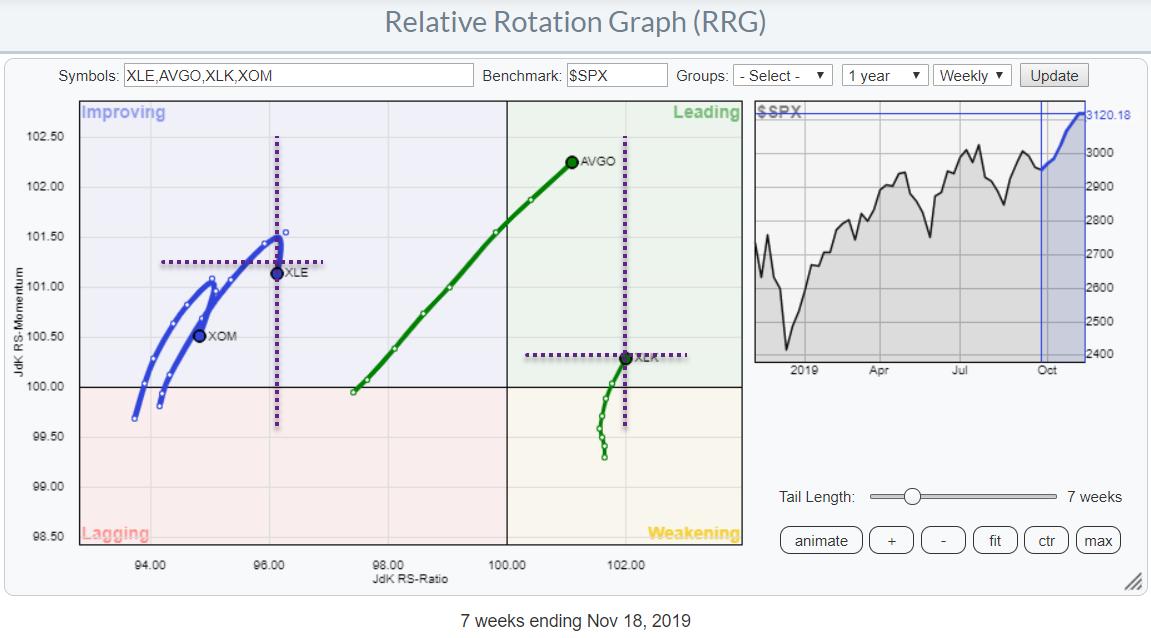

Relative Rotation Graphs are perfectly suited for finding pair trade opportunities. In this week's episode of Sector Spotlight (November 19th), I showed one way to find a possible pair-trading opportunity.

Wanting to find a sector with high (or the highest) upward potential and the sector with high (or...

READ MORE

MEMBERS ONLY

Sector Spotlight: How to Spot a Pair Trade on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

How can you use RRGs (Relative Rotation Graphs) to spot potential pair trades?

In this episode of Sector Spotlight, I explain one way to find a potential pair trading opportunity, searching for a stock with high(est) potential in a sector with high(est) potential and off-setting that position with...

READ MORE

MEMBERS ONLY

How to Plot Cryptocurrencies on Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On 8 November, StockCharts.com announced the arrival of cryptocurrency data in this ChartWatchers article.Regardless of what you think of cryptocurrencies, it's becoming hard to ignore them as the group of people that engage in trading them continues to grow.

Personally, I have no super-strong belief (yet)...

READ MORE

MEMBERS ONLY

Industrials is a Sector to Watch - Here are Two Stocks that May Stand Out

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for US sectors, Industrials continue to show a strong rotation. They are now just about to cross over into the lagging quadrant on the weekly timeframe.

I spoke about this strong rotation more in depth in last week's Sector Spotlight show on StockCharts...

READ MORE

MEMBERS ONLY

Rotating Back Into the Leading Quadrant While Breaking Above Resistance in Price and Relative Strength... What More Do You Want?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When I ran the RRG for the most active movers in the S&P 500 (at yesterday's close), I noted a strong rotation for AMD.

This stock entered the leading quadrant in the week of 18 March and moved inside that quadrant until the week of June...

READ MORE

MEMBERS ONLY

RRG Shows Bullish Sector Rotation!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

As it turns out, finding an interesting chart for today's DITC article was not very difficult!

The weekly RRG, printed above, shows a very strong rotation in favor of offensive, high BETA sectors. Industrials, Financials, and Technology are already inside the leading quadrant and showing strong RRG headings....

READ MORE

MEMBERS ONLY

The Yield Curve, What is it? Why is it important? How can we use it?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

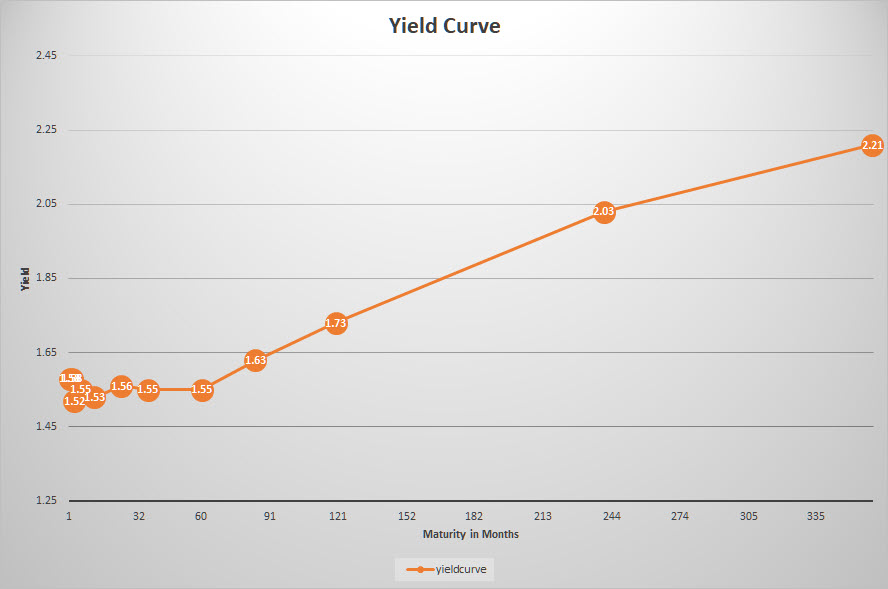

A yield curve is a graphical representation of yields on bonds with different maturities. The most common example is the government bond yield curve, but it is very well possible to render a yield curve for other types of bonds, such as corporate bonds, high yield bonds, etc.

The government...

READ MORE

MEMBERS ONLY

Growth vs Value... a Tough Call At The Moment!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Growth vs. Value relationship is always an interesting topic, as many believe it provides (additional) information or support for directional moves in the general market (S&P 500).

The Relative Rotation Graph above shows the relationship between these two market segments, using the DJ US index as the...

READ MORE

MEMBERS ONLY

Emerging Commodities?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Yesterday, 5 November, was the first Sector Spotlight show of the month. My goal is to use every first show of each month to review the big picture for asset classes and US sectors using monthly charts, and that's exactly what I did yesterday. If you missed the...

READ MORE