MEMBERS ONLY

Rockin' Russia!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

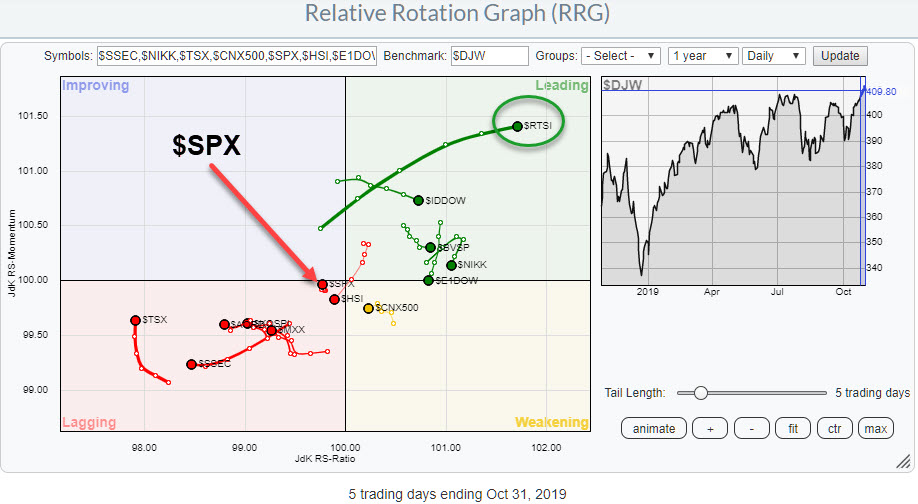

Despite the S&P 500 making new highs and looking strong on the charts, it is definitely not the strongest market in the world at the moment...

The RRG above shows the daily rotation for a universe of major stock market indexes around the world. The S&P...

READ MORE

MEMBERS ONLY

Banking Stocks Are Leading The Financial Sector Higher

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

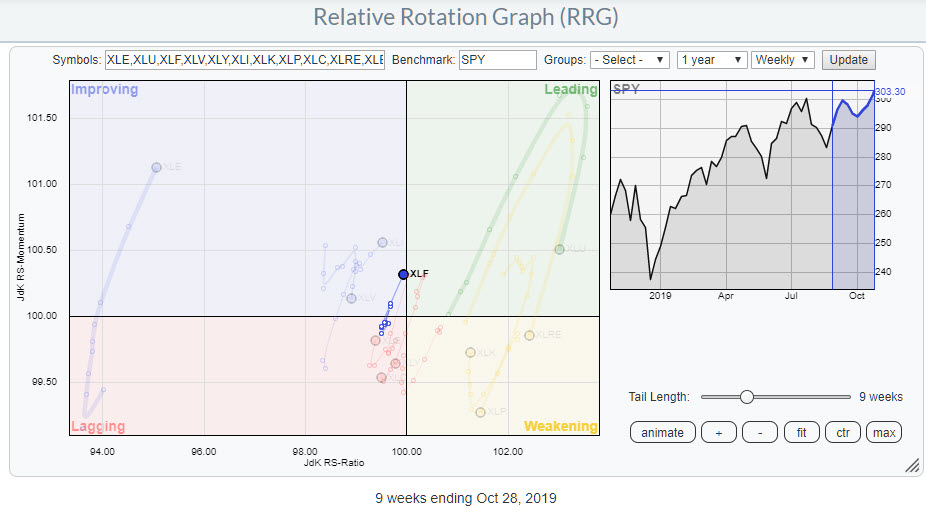

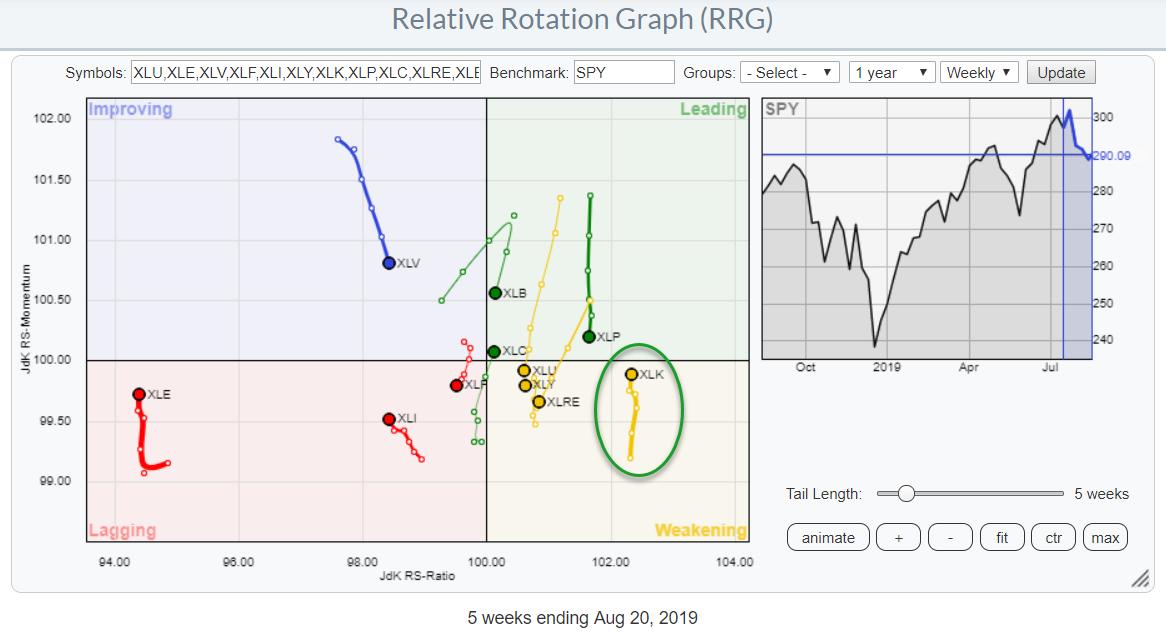

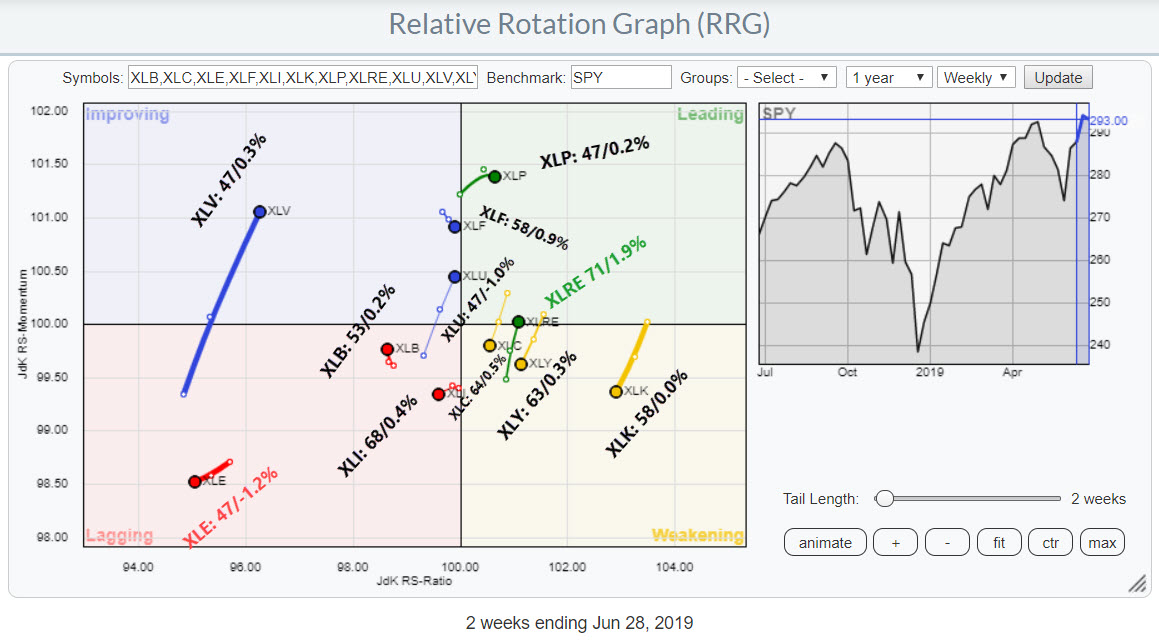

The Relative Rotation Graph for US sectors remains characterized by steep moves on the vertical (JdK RS-Momentum) axis. This is the Rate of Change metric for the underlying relative trends. Sharp moves in an almost vertical direction, up or down, indicate a sudden change of the underlying trend.

Looking at...

READ MORE

MEMBERS ONLY

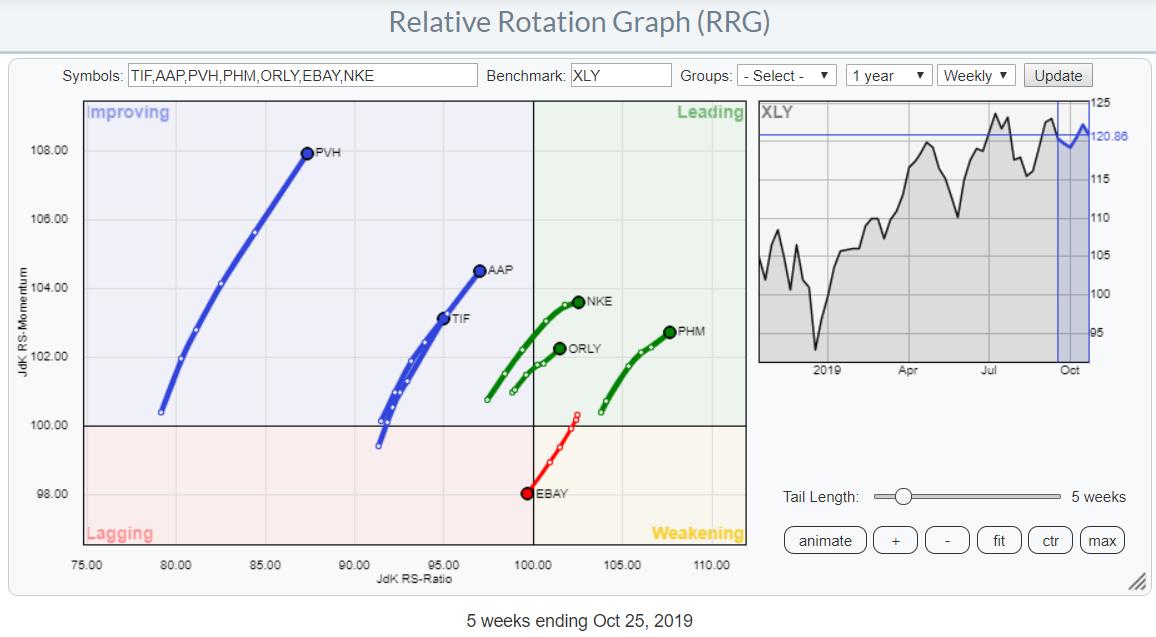

Ploughing Through Some Consumer Discretionary Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In last week's Sector Spotlight episode, I discussed the positive rotation of the Consumer Discretionary sector on RRG. During the live show, I focused (too much) on the sector and only managed to talk about a few individual stocks. This article will highlight some of the names in...

READ MORE

MEMBERS ONLY

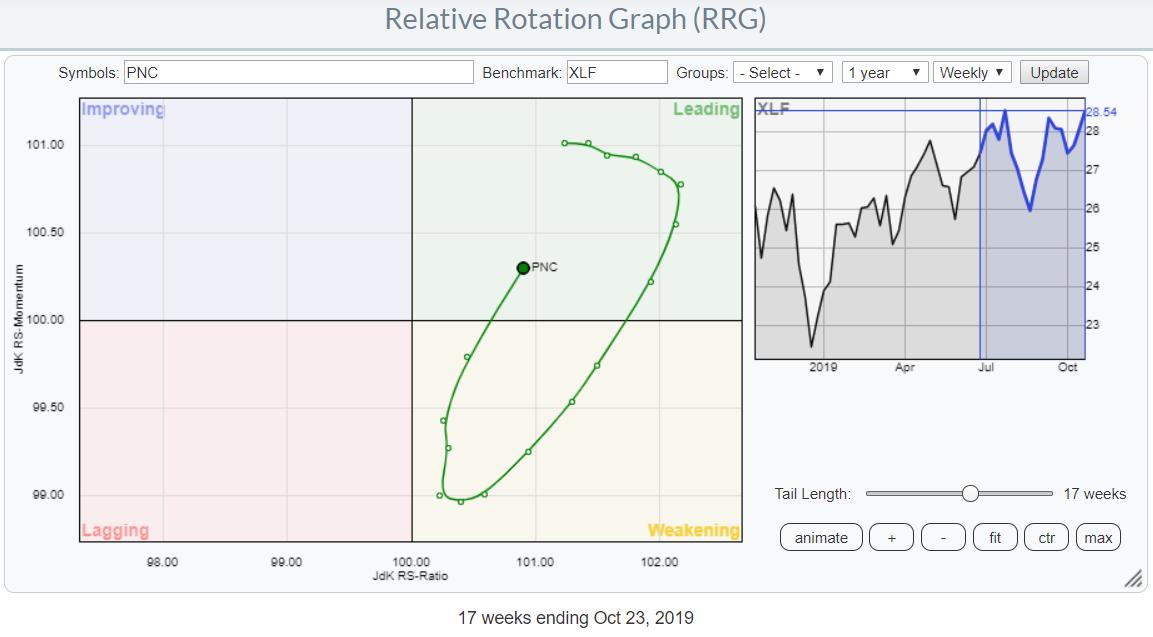

PNC Signals Strength As Its Tail Rotates Back Into The Leading Quadrant on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Financial sector (XLF) continues to pick up relative strength. On the weekly RRG, XLF just moved into the improving quadrant and is positioned very close to the center of the chart. On the daily RRG, a very nice and strong rotation can be seen over the last three weeks....

READ MORE

MEMBERS ONLY

Consumer Discretionary On the Verge of Crossing Over Into The Leading Quadrant on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

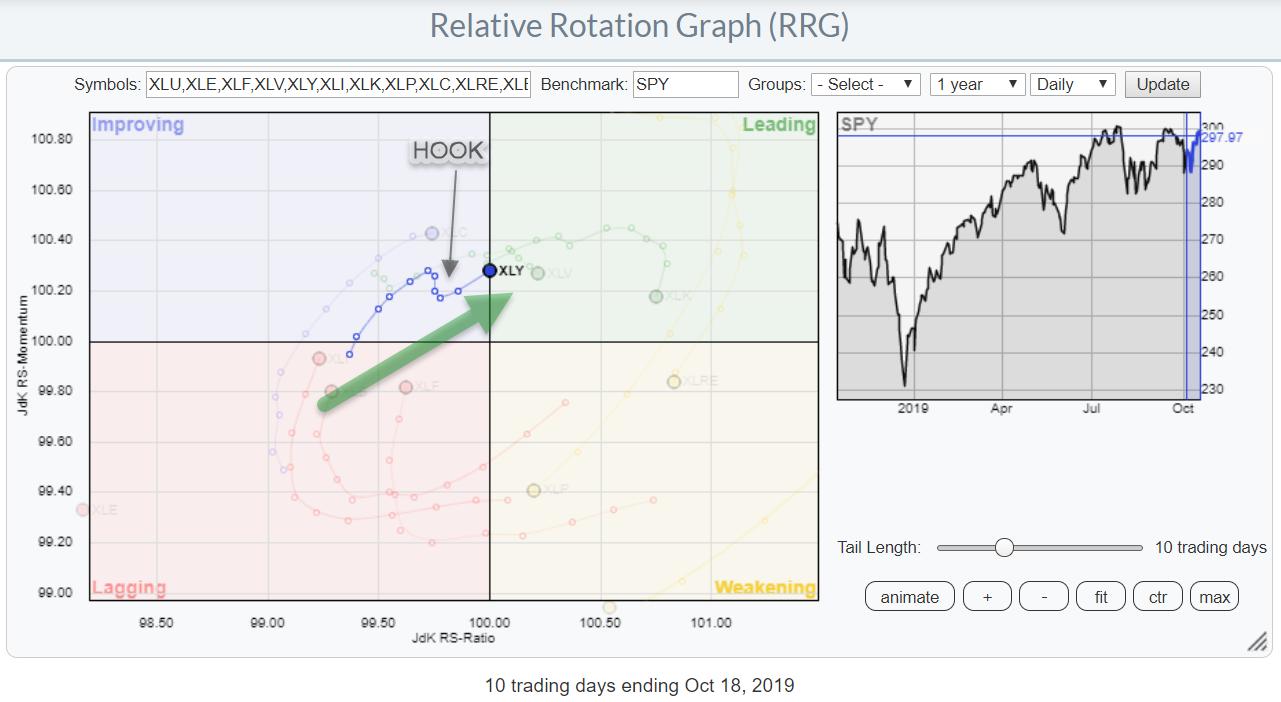

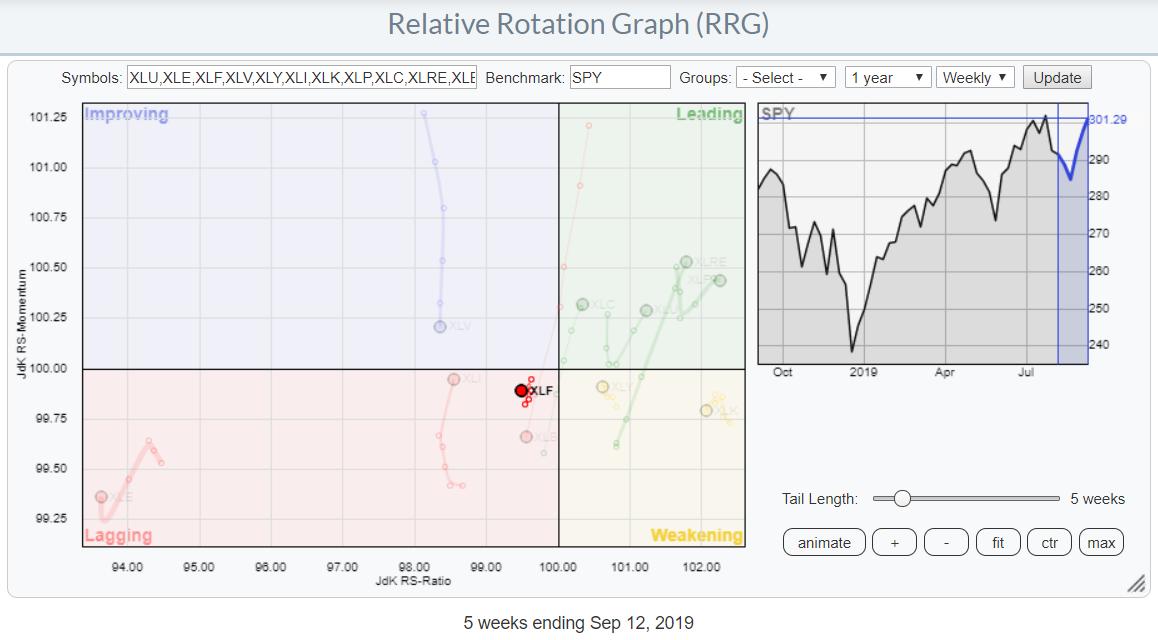

The RRG chart above shows the relative position for US sectors based on last Friday's close.

The sector that stands out most at the moment, at least for me, is Consumer Discretionary. After initially rolling over inside the improving quadrant, this sector "hooked" back on track...

READ MORE

MEMBERS ONLY

Semiconductors Have NOT Broken Out (Yet), But Here's a Pair Trade That May Offer an Opportunity

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In the past week or so, I've seen a few headlines flying by mentioning the semiconductor index ($SOX) and an alleged breakout. In response, I checked out the chart of $SOX, as printed above, in combination with relative strength versus SPY.

What I see is a pretty big...

READ MORE

MEMBERS ONLY

Measuring Offensive vs Defensive Sectors Using BETA

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

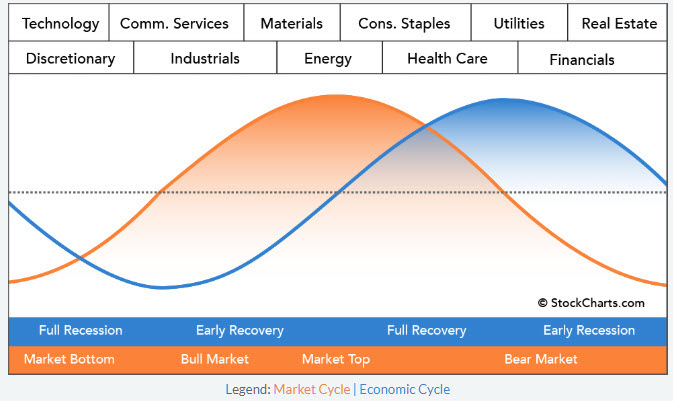

We, including myself, are always talking about offensive and defensive sectors, sector rotation from offensive to defensive, etc. Offensive sectors are the sectors that will do very well - and usually outperform - when the market goes up, while defensive sectors are the sectors that outperform when the market goes...

READ MORE

MEMBERS ONLY

Buying the Top SIX Stocks in The DJ Industrials Index (on a Monthly Basis) Can Keep You Ahead Of The Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

What Is Our Track Record?

Ever since the launch of Relative Rotation Graphs on the Bloomberg professional terminal in 2011, some of the most frequently asked questions we've received have been "What's their track record", "How well do they perform?" and "...

READ MORE

MEMBERS ONLY

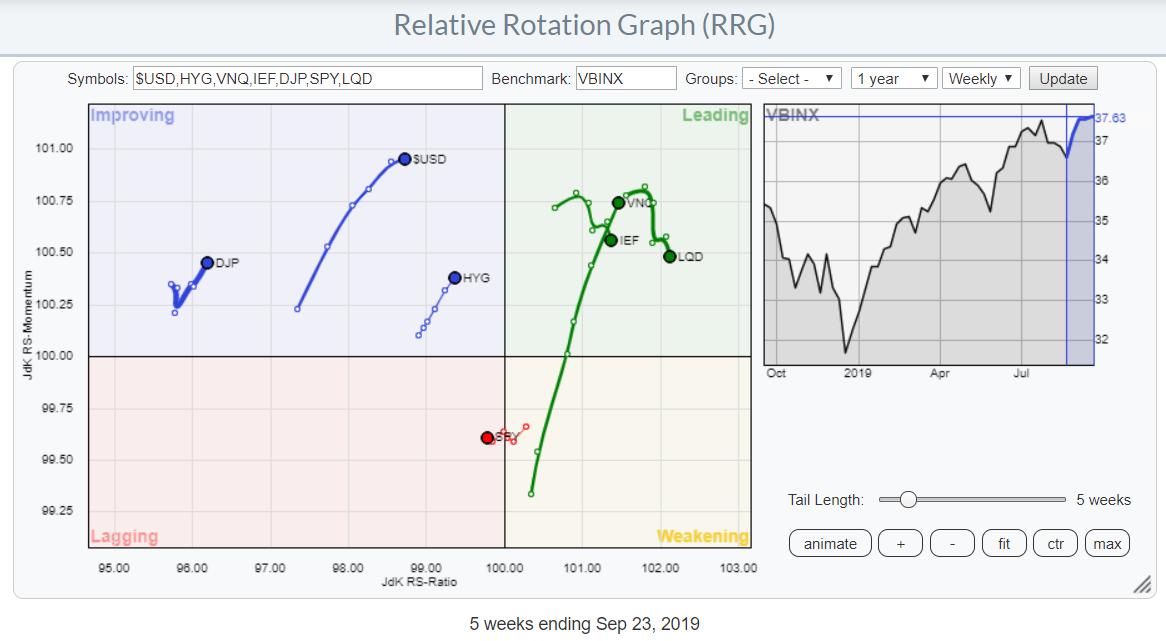

RRG Signals Risk-Off on Daily Chart

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

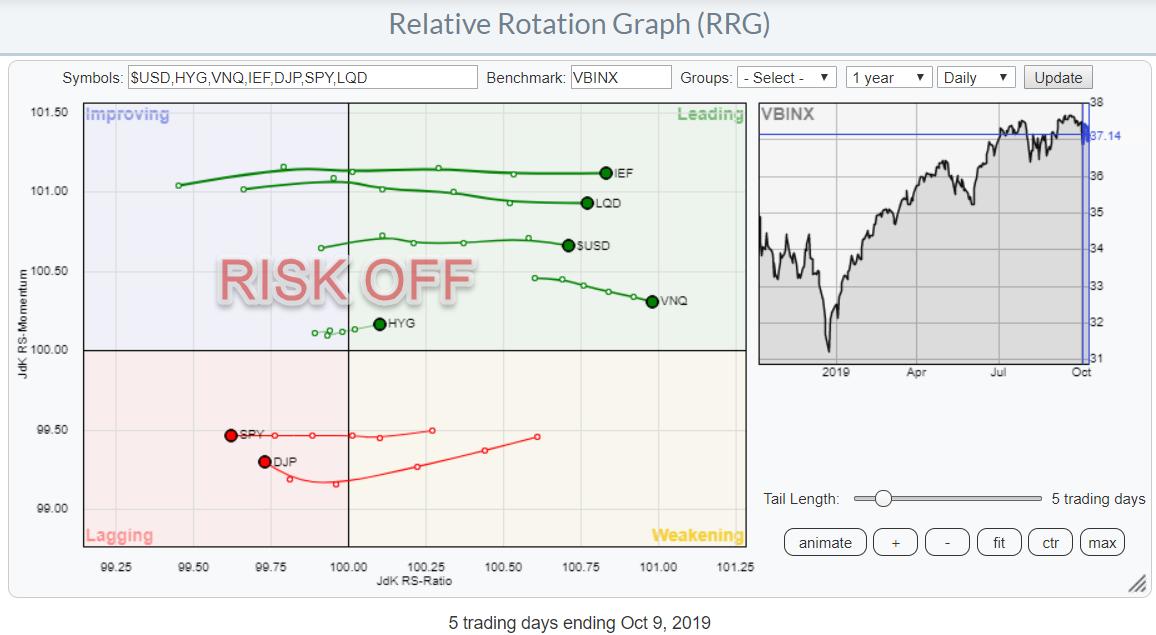

The monthly charts for major markets like the S&P 500 Index are still in clear uptrends - that has not changed. But, in shorter timeframes, things have started to shift with regard to preference for asset classes.

In the first episode of my new StockCharts TV series Sector...

READ MORE

MEMBERS ONLY

Answering Questions From the 1st Episode of Sector Spotlight.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week, on Tuesday 1st October I hosted the first episode of "Sector Spotlight".

Preparing for something new and then going into the first time hosting a live show was an exciting experience. The problem, at least for me, is that you do not really know how things...

READ MORE

MEMBERS ONLY

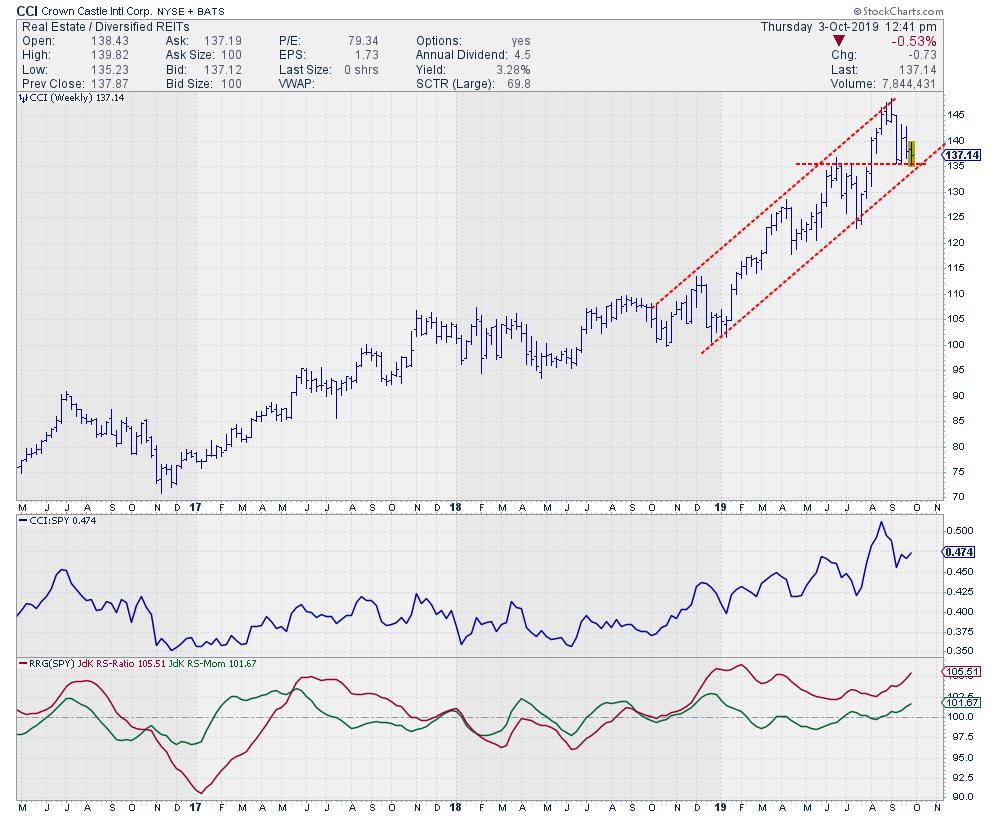

If You Are Looking To "Buy Dips" in Real Estate, Here is Your Dip For CCI!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This week is characterized by sinking stocks, at least in the first half of the week, as well as a stabilizing market (so far) on this Thursday. Situations like these lend themselves very well to search for stocks that "test support," especially when they are in a sector...

READ MORE

MEMBERS ONLY

Using Relative Rotation Graphs For "Overwatch" On International Stock Markets.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

From time to time, you come across new or different ways to look at things or describe them. In my RRG blog from Tuesday, I introduced the concept of military overwatch tactics and compared them to Relative Rotation Graphs.

Since the public launch of Relative Rotation Graphs in 2011 on...

READ MORE

MEMBERS ONLY

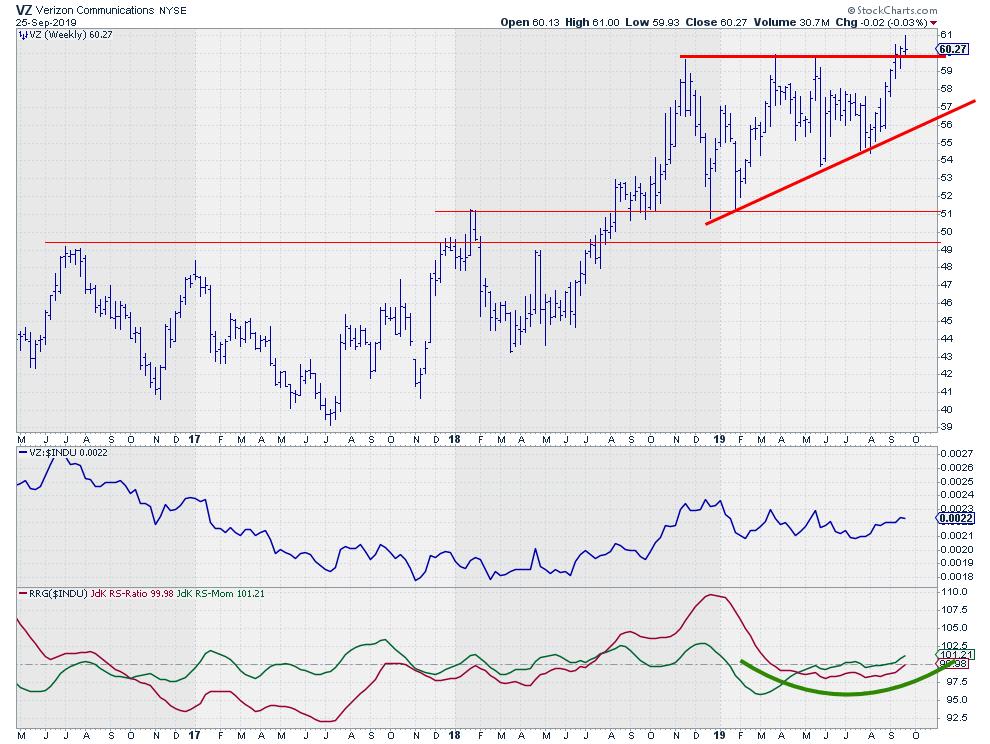

VZ Calling Home?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

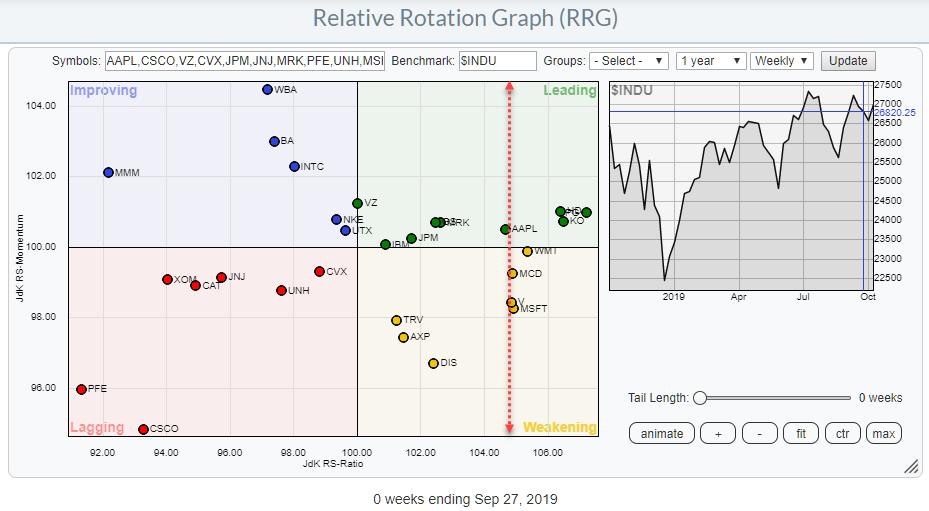

On the weekly Relative Rotation Graph holding the Dow 30 stocks, we can see Verizon (VZ) shooting from the improving quadrant towards leading.

The RRG below shows VZ in isolation. It is hard to see as the move went very fast, but, since mid-July, VZ has completed a rotation from...

READ MORE

MEMBERS ONLY

A Strong Overwatch Unit is Mission Critical

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

From time to time, you come across new or different ways to look at things or describe them.

Since the public launch of Relative Rotation Graphs in 2011 on Bloomberg terminals, we have been using the tag-line "RRG provides you with the BIG picture in ONE picture" as...

READ MORE

MEMBERS ONLY

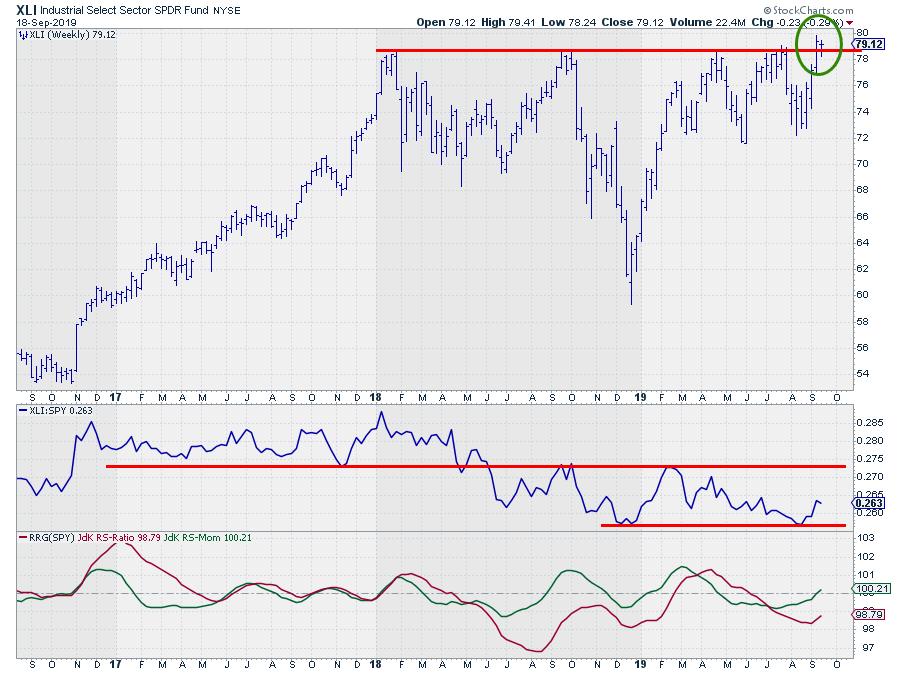

Here Is Another Sector Breaking To New Highs!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Today, I posted a Relative Rotation Graph for US sectors on my Twitter and Instagram feeds highlighting the clear split between some sectors now visible on the daily timeframe. One of these sectors is Industrials, which is traveling deeper into the leading quadrant at a stable, almost horizontal, relative momentum....

READ MORE

MEMBERS ONLY

The Financial Sector is Improving, Leadership Role for JPM

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

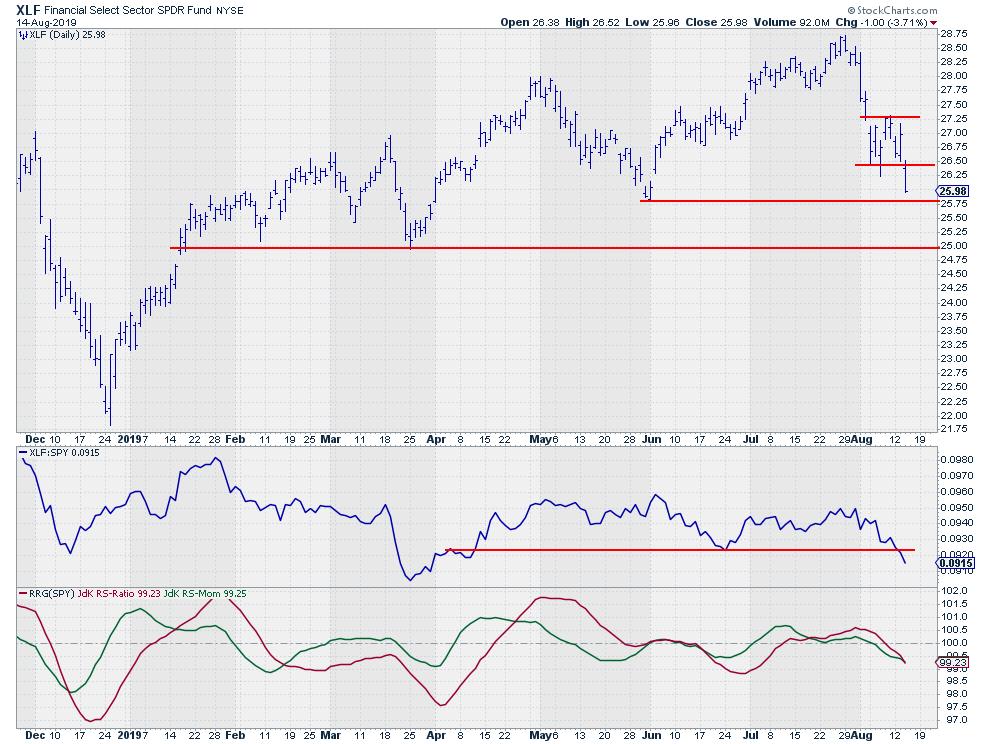

On the weekly Relative Rotation Graph for US sectors, the Financial sector is positioned just inside the lagging quadrant, very close to the benchmark (center of the chart). It arrived here after a nearly vertical drop from the improving quadrant after failing to rotate into leading.

During the last five...

READ MORE

MEMBERS ONLY

LRCX is Breaking To New Highs While Relative Strength is Picking Up

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

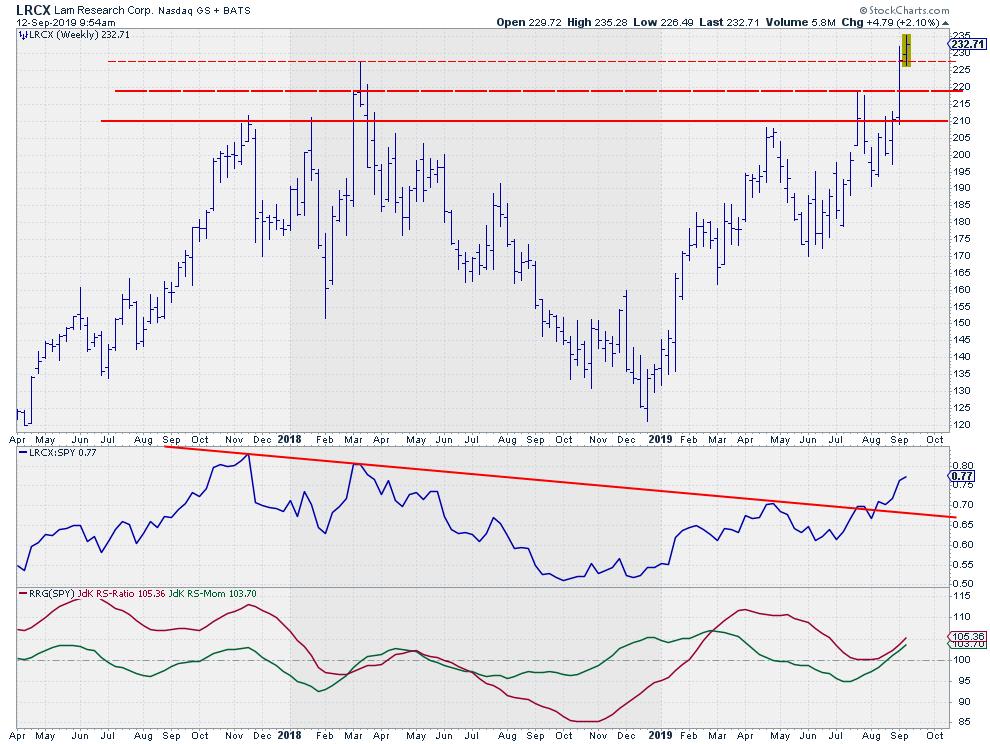

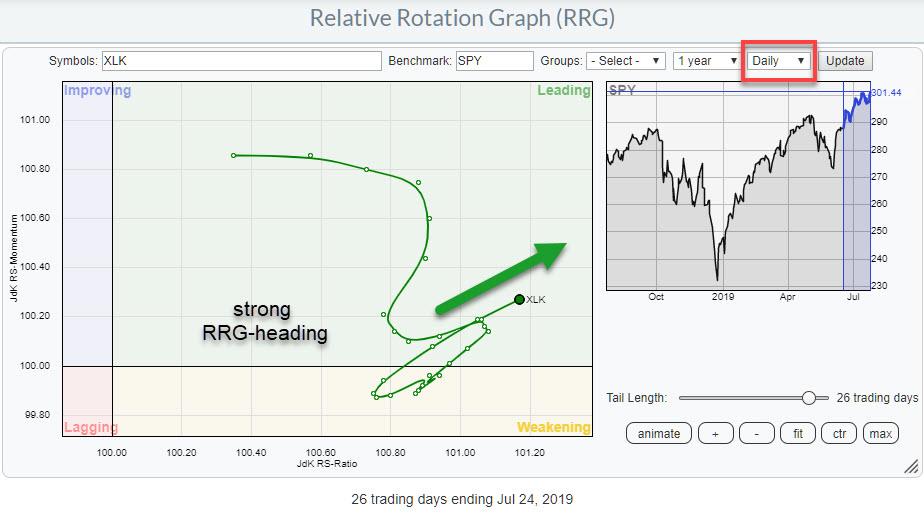

On the Relative Rotation Graph for technology stocks, LRCX stands out, with its relatively long tail and its push into the leading quadrant at a strong RRG-Heading. Such a rotation is more than enough reason to open up a regular chart for further investigation.

The chart above shows LRCX on...

READ MORE

MEMBERS ONLY

Using Scan and RRG for Bottom Fishing

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the most frequently asked questions I receive, with regard to Relative Rotation Graphs on StockCharts.com, is if and how the scan engine can be used to scan for certain events on an RRG.

Well, the answer is you can NOT - not yet, anyway. It's...

READ MORE

MEMBERS ONLY

Is This Stock Ready For a Turnaround - or Just a Quick Bounce?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

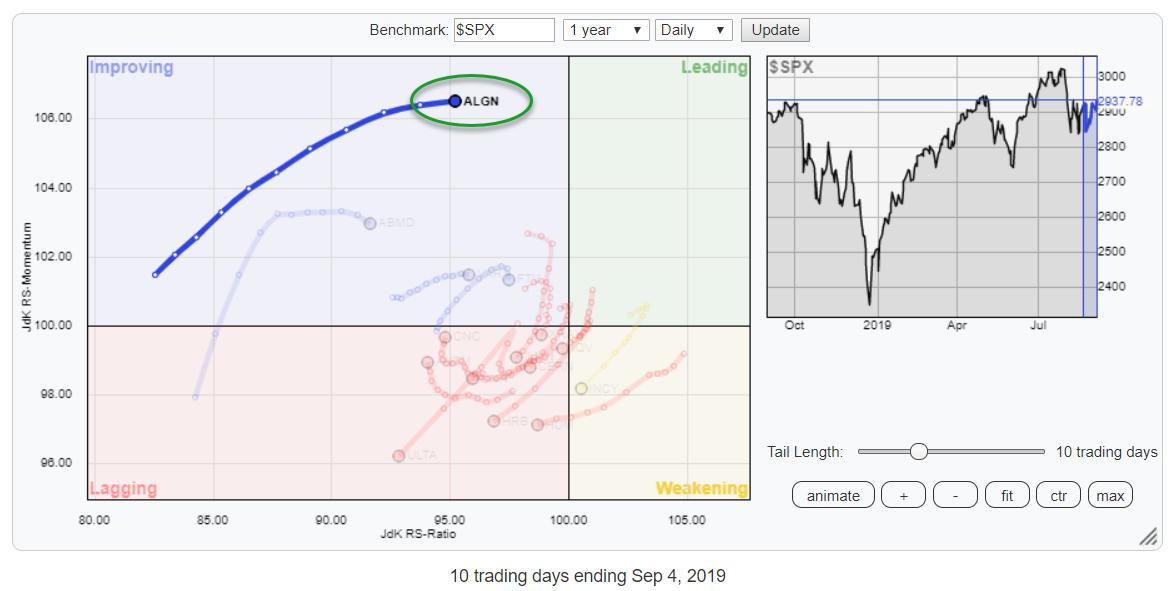

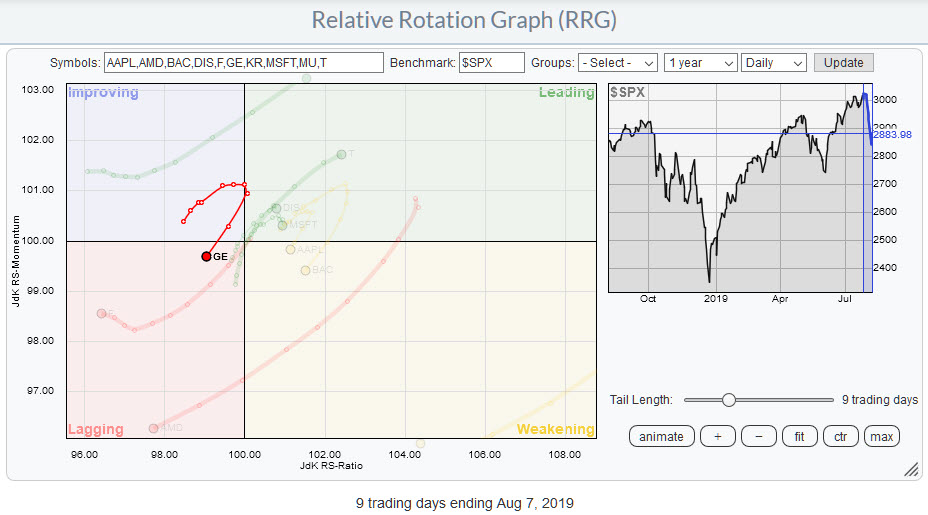

The Relative Rotation Graph (RRG) above is the result of a scan that I am running from time to time. Before you ask... ;) in an upcoming RRG Charts blog, I will explain how I got to this selection of stocks, including the scan-code.

For now, let's concentrate on...

READ MORE

MEMBERS ONLY

Growth vs. Value Rotation is Sending a Very Clear Message on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

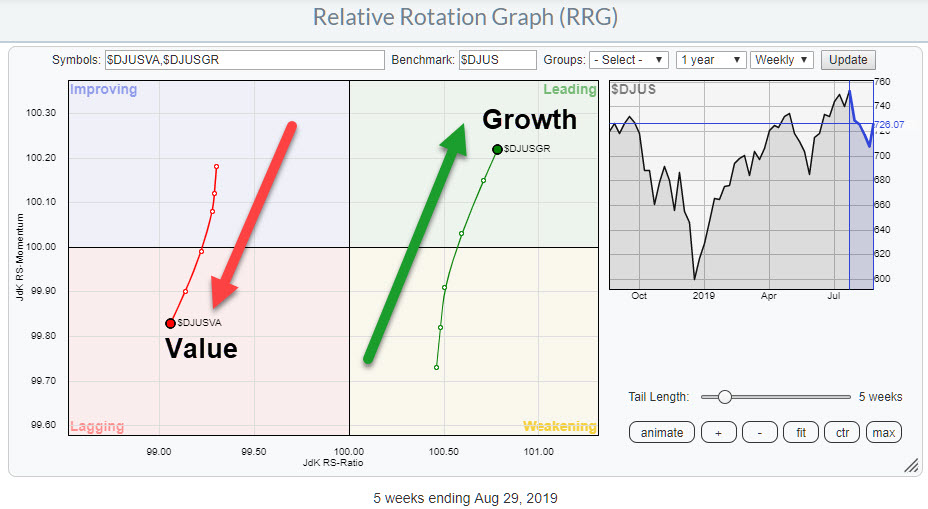

One of the Relative Rotation Graphs that I like to keep an eye on in order to get a handle on the general market condition (for stocks) is the chart above, which shows the rotation of Value versus Growth stocks using the Dow Jones US Index as the benchmark. The...

READ MORE

MEMBERS ONLY

A (pair) Trade Idea in Consumer Discretionary

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Looking at the daily Relative Rotation Graph for US sectors, we can see that Consumer Discretionary is inside the improving quadrant and about to cross over into leading at a strong RRG-Heading. For the near-term, this makes XLY a sector to keep an eye on.

In order to look for...

READ MORE

MEMBERS ONLY

What do you want from me?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Rumour has it that a new show will be launching soon on StockCharts TV. The focus for this weekly 30-minute adventure will be on sectors, with yours truly as the host/presenter for this program (so you can count on a healthy dose of RRG-related content).

Don't worry,...

READ MORE

MEMBERS ONLY

Here Is a Leading Stock In The Semiconductor Group

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

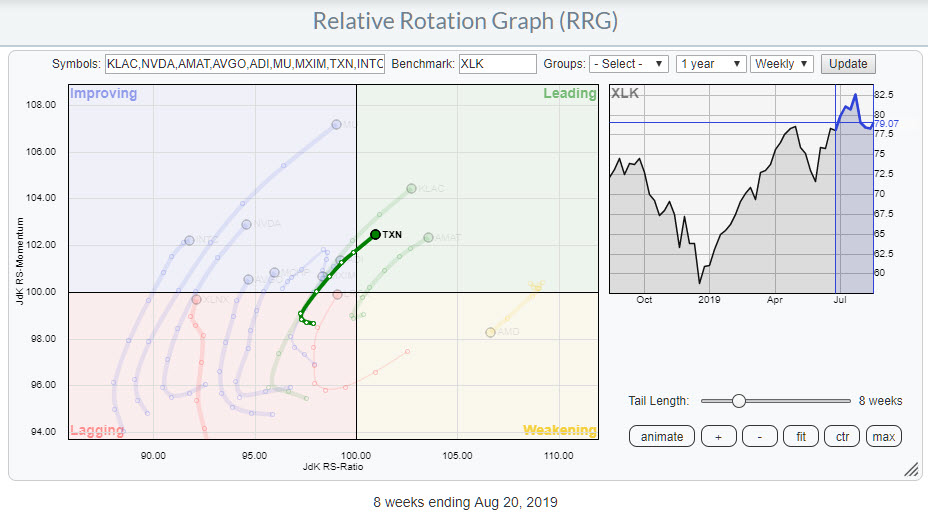

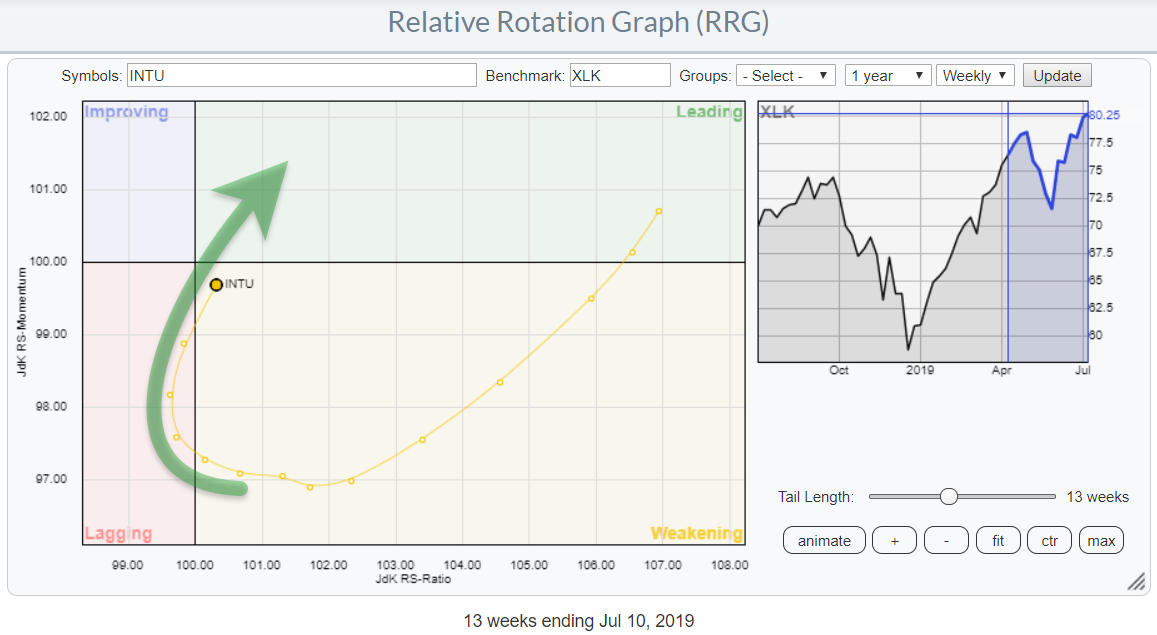

Yesterday, I wrote about the Technology sector in my RRG Charts blog, where I discussed how the semiconductor stocks as a group showed relative strength against XLK. For this DITC article, I want to work off that subset of stocks in the technology space.

The Relative Rotation Graph above shows...

READ MORE

MEMBERS ONLY

Strong Rotation for Technology Sector With a Positive RRG-Heading on Semiconductors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the weekly Relative Rotation Graph, the Technology sector is currently inside the weakening quadrant, but is moving almost vertically up towards the leading quadrant. That is to say, it's moving back to the leading quadrant, as it already completed a strong rotation through that leading quadrant from...

READ MORE

MEMBERS ONLY

Relative Rotation Graphs Can Show You So Much More Than Just Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs, or "RRGs", were born while I was working as a sell-side analyst for an investment bank in Amsterdam, doing research and making calls on stocks and sectors. The clientele of the bank were all institutional investors, ranging from pension funds and endowments to hedge funds....

READ MORE

MEMBERS ONLY

Financials Are Breaking (more) Support While Rotating Into the Lagging Quadrant On The RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for US sectors, the tail on XLF, the Financials sector, caught my eye this morning. After a short stint through the leading quadrant, XLF had a sharp turn lower and entered the weakening quadrant, in which it spent only three days before rotating into lagging....

READ MORE

MEMBERS ONLY

GE is Doing It Again!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

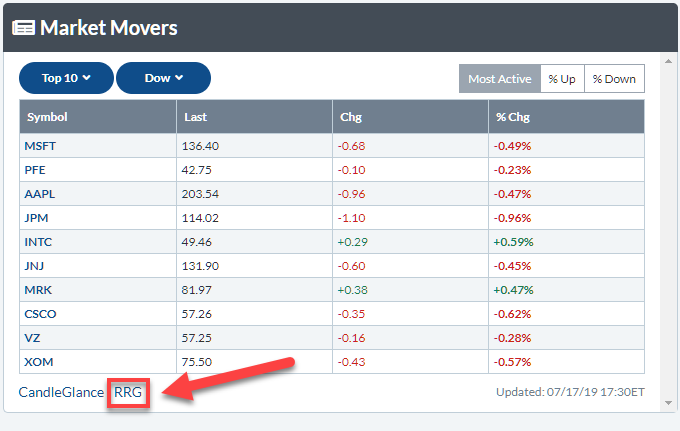

A good way for you to check what has been driving a particular market is to go to the "Market Movers" widget on your dashboard and select the universe that you are interested in.

To the right, I have printed the table showing the top 10 most active...

READ MORE

MEMBERS ONLY

This is My Trendline, Which One is Yours?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Never a dull moment when it comes to the markets. Just when you thought you had it all figured out, Mr. Market throws us another curve-ball that we all have to deal with.

The last few days have been pretty hectic, given a 200-point drop in the S&P...

READ MORE

MEMBERS ONLY

Using SCTRs to Fill Your Relative Rotation Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

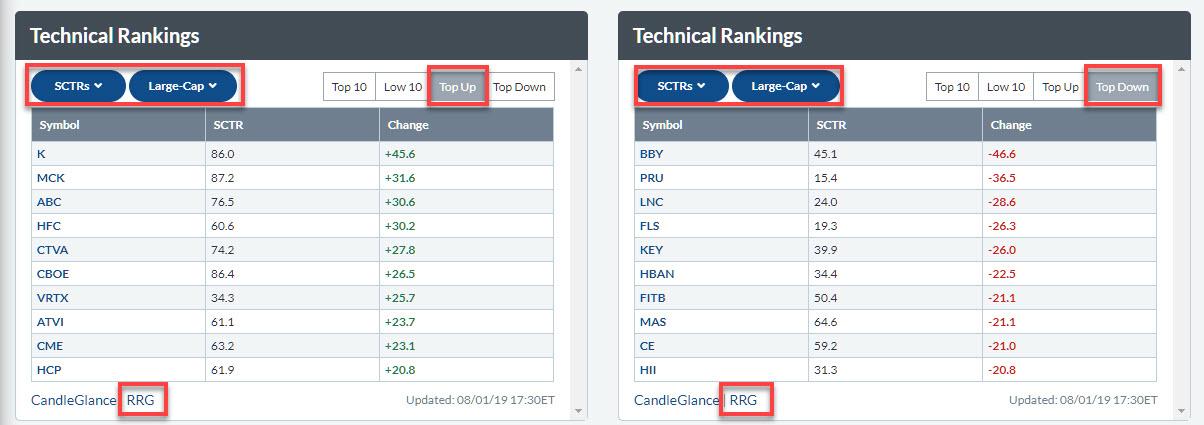

In my latest "Don't Ignore This Chart" article, I used a Relative Rotation Graph holding 20 stocks as a starting point to find an interesting-looking rotation and a possible trading opportunity for BHGE. The question: how was I able to select those 20 stocks to include...

READ MORE

MEMBERS ONLY

BHGE Rapidly Improving and Ready to Jump

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

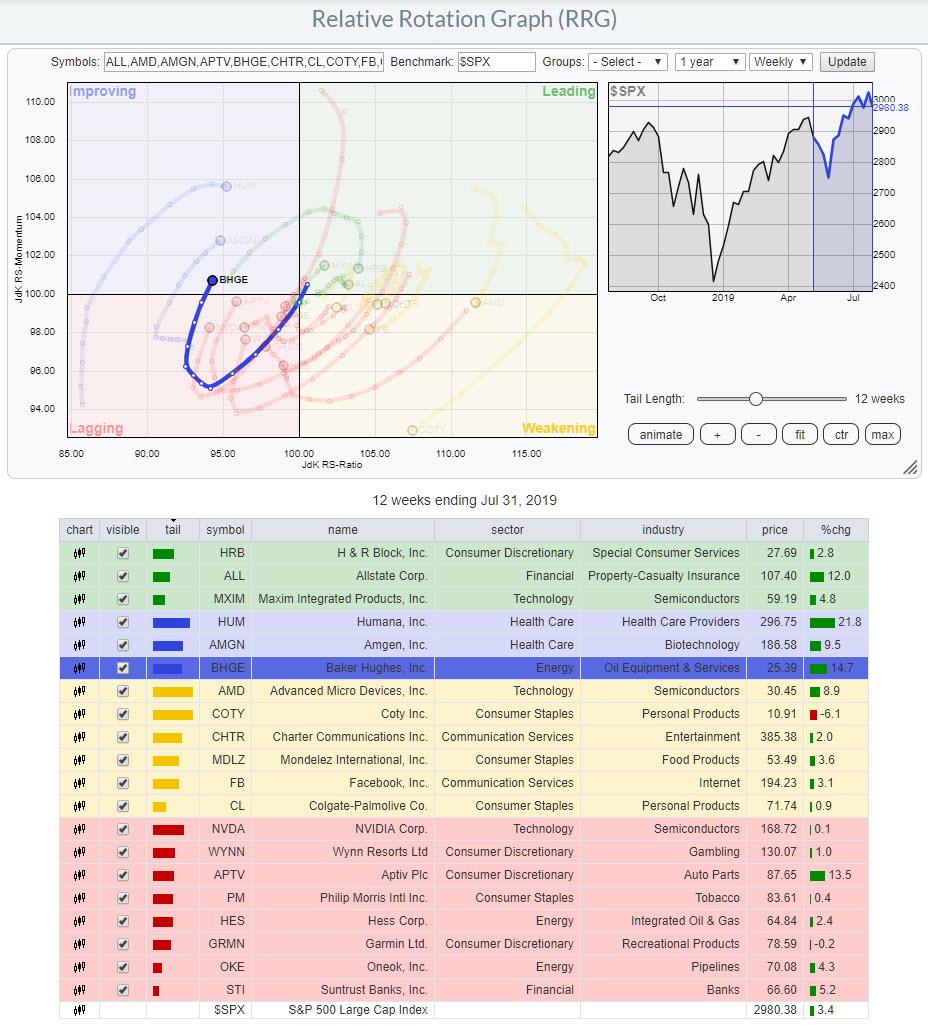

Here's a Relative Rotation Graph filled with stocks that I got off my StockCharts.com dashboard this morning:

Your Dashboard is a great way to get an overview of what's going on in the market and organize your workflow on the site. If you are interested...

READ MORE

MEMBERS ONLY

The Break to New Highs in the S&P 500 is Now Getting Support From Rotation To Offensive Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

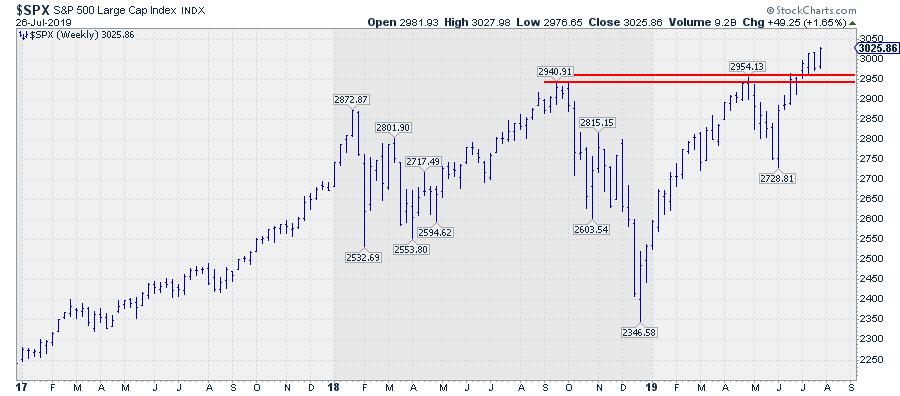

In the run-up to its resistance level (around 2950), along with first two weeks after breaking that barrier while pushing to new highs, more defensive sectors like Utilities and Consumer Staples were leading the market higher.

The situation is changing now, adding more reliability to this important breakout.

RRG Positions...

READ MORE

MEMBERS ONLY

Strong Rotation For Technology Amid Shift To More Offensive Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When I opened up the Relative Rotation Graph for US sectors (weekly version), the position and the current rotation for the Technology sector caught my attention.

If you are a regular reader of articles you will know that my default time frame is weekly. On that weekly RRG, XLK is...

READ MORE

MEMBERS ONLY

How To Get From a Table of Market Movers To a Trading Idea Based on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

StockCharts.com has an incredible wealth of technical tools available both for free users as well as subscribers. That said, though, users who subscribe will have a greater amount of tools and functionality available to them.

Very recently, there was a panel discussion on MarketWatchers LIVE with Tom, Greg and...

READ MORE

MEMBERS ONLY

Forces Are Shifting in The Battle Between INTC and MSFT

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When you open up StockCharts.com and go to Your Dashboard, one thing you'll find is a section called "Market Movers", located in the top-right corner of your screen.

I currently have this section of the page set up so that it shows the top 10...

READ MORE

MEMBERS ONLY

A Strong Rotation on RRG and a Break to New Highs Make For a Killer Combination

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

At present, the Technology sector is rotating through the weakening quadrant on the Relative Rotation Graph. Following a strong move in the first months of this year, relative strength for XLK started to level off and has remained more or less flat since April. We'll have to wait...

READ MORE

MEMBERS ONLY

Team USA Wins the Soccer Final, But Three International Markets Beat the S&P

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last night (Sunday 7/7) the Dutch women's soccer team played the World Cup final against Team USA. I am not a huge soccer fan but, as a Dutchie, you have to catch at least part of that event! It did not work out for us, so congrats...

READ MORE

MEMBERS ONLY

The S&P Just Broke Out of a Two-Year Consolidation, But There are Still Some Pockets of Concern

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

A short, but strong, trading session just before the Fourth of July holiday pushed the S&P, along with the Nasdaq 100 and the DJ Industrials indexes, to new highs.

Breaks to new highs are pretty strong signs and should not be ignored. At the end of the day,...

READ MORE

MEMBERS ONLY

Brexit is SOOO 1776!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Happy Fourth of July!

On this public holiday - for the US, anyway; not so much for me ;) - I looked up a bit more about the history of Independence Day and, while doing so, it occurred to me that even back then, the British were involved in a separation....

READ MORE

MEMBERS ONLY

An Investment Process Is All About Piecing Things Together To Get Other Or Better Insights.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In my last DITC contribution, I wrote about the Real Estate sector, which is crossing over into the leading quadrant at the same time as the seasonality chart for that sector indicates that, over the last 20 years, XLRE closed the month of July higher 71% of the time, with...

READ MORE

MEMBERS ONLY

This Sector Just Returned to the Leading RRG-Quadrant AND Shows an Outperformance 71% of the Time in July

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

I do not believe that there is just one single tool, strategy, method, etc. that fits all our needs as investors or traders. For me, the power of research and analysis lies in combining information from various sources and subsequently putting all that together into a market-view, strategy, system, etc....

READ MORE