MEMBERS ONLY

Using Relative Rotation Graphs to Visualize Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs or RRGs will help investors to keep an eye on relative trends that unfold within a universe. Among other things this will help to visualize sector rotation...

READ MORE

MEMBERS ONLY

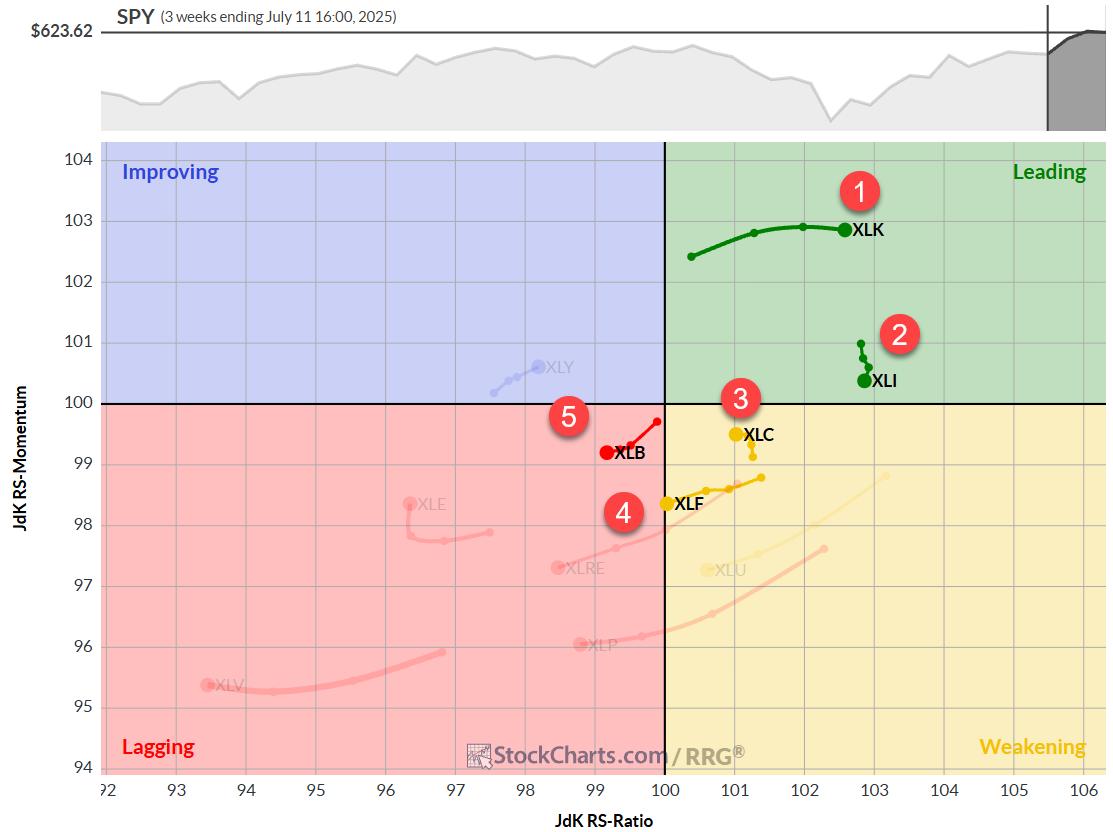

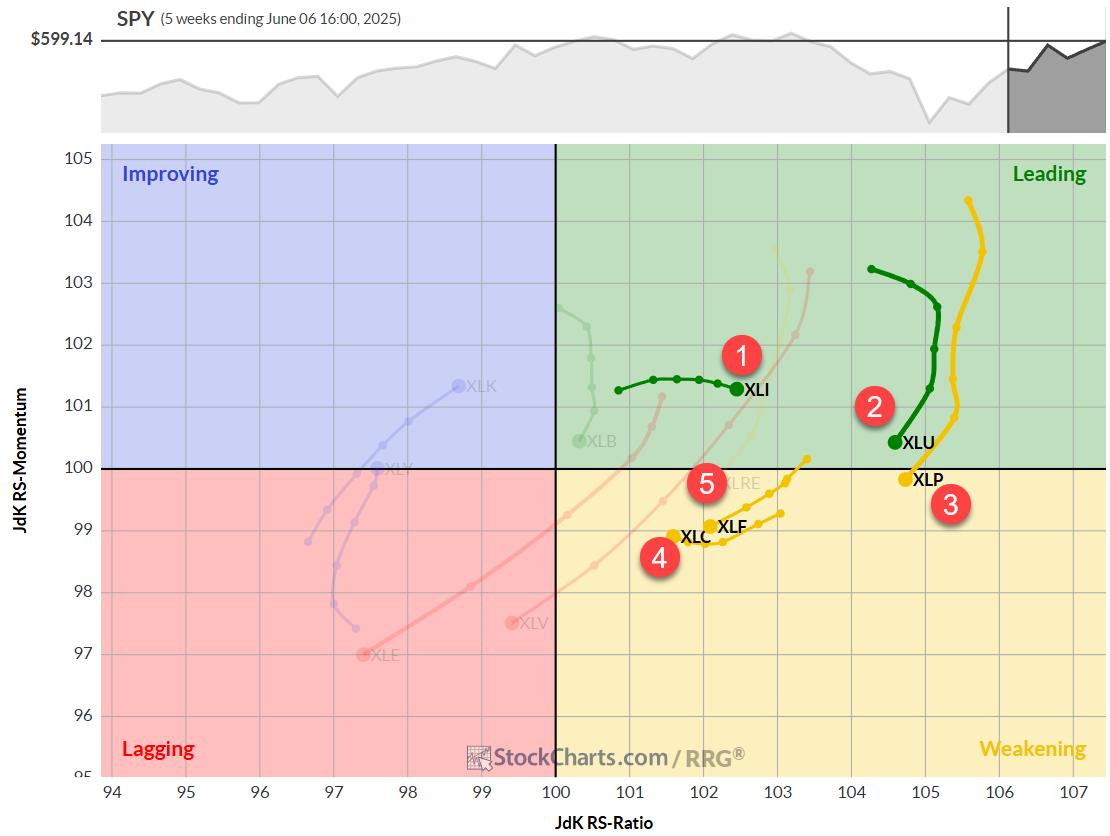

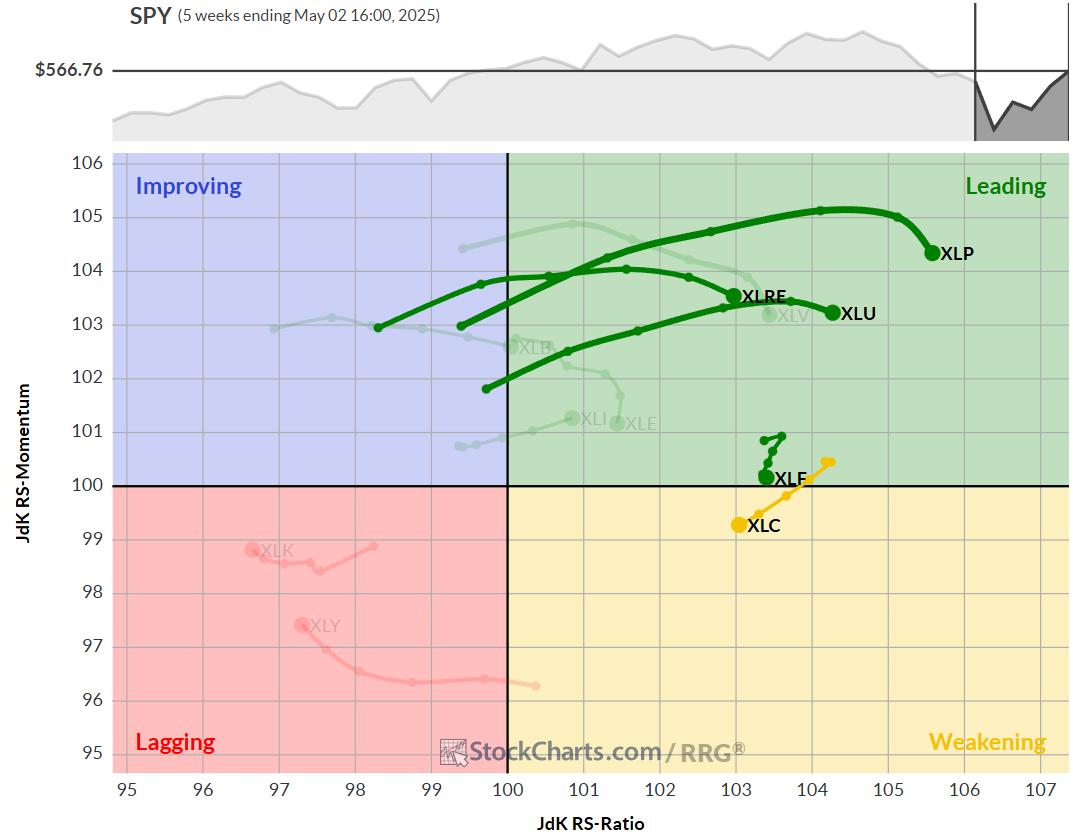

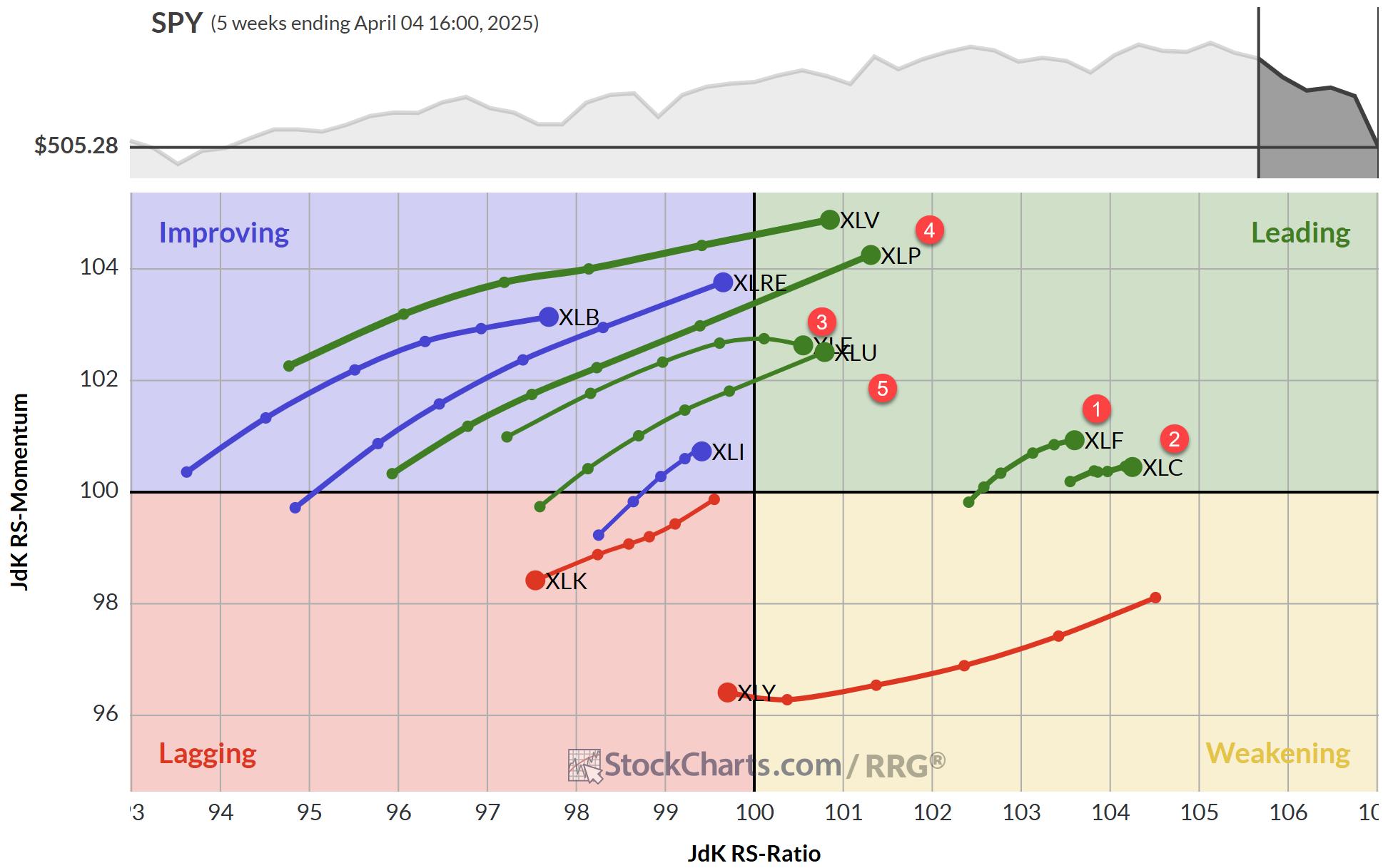

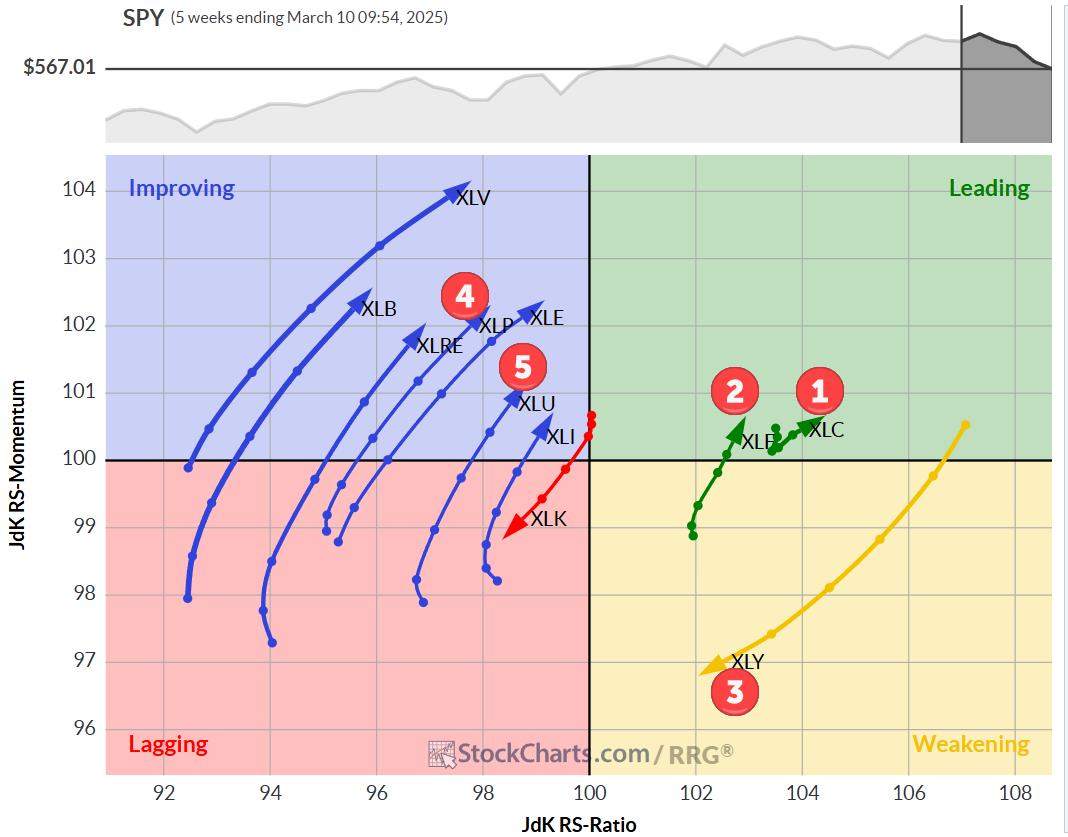

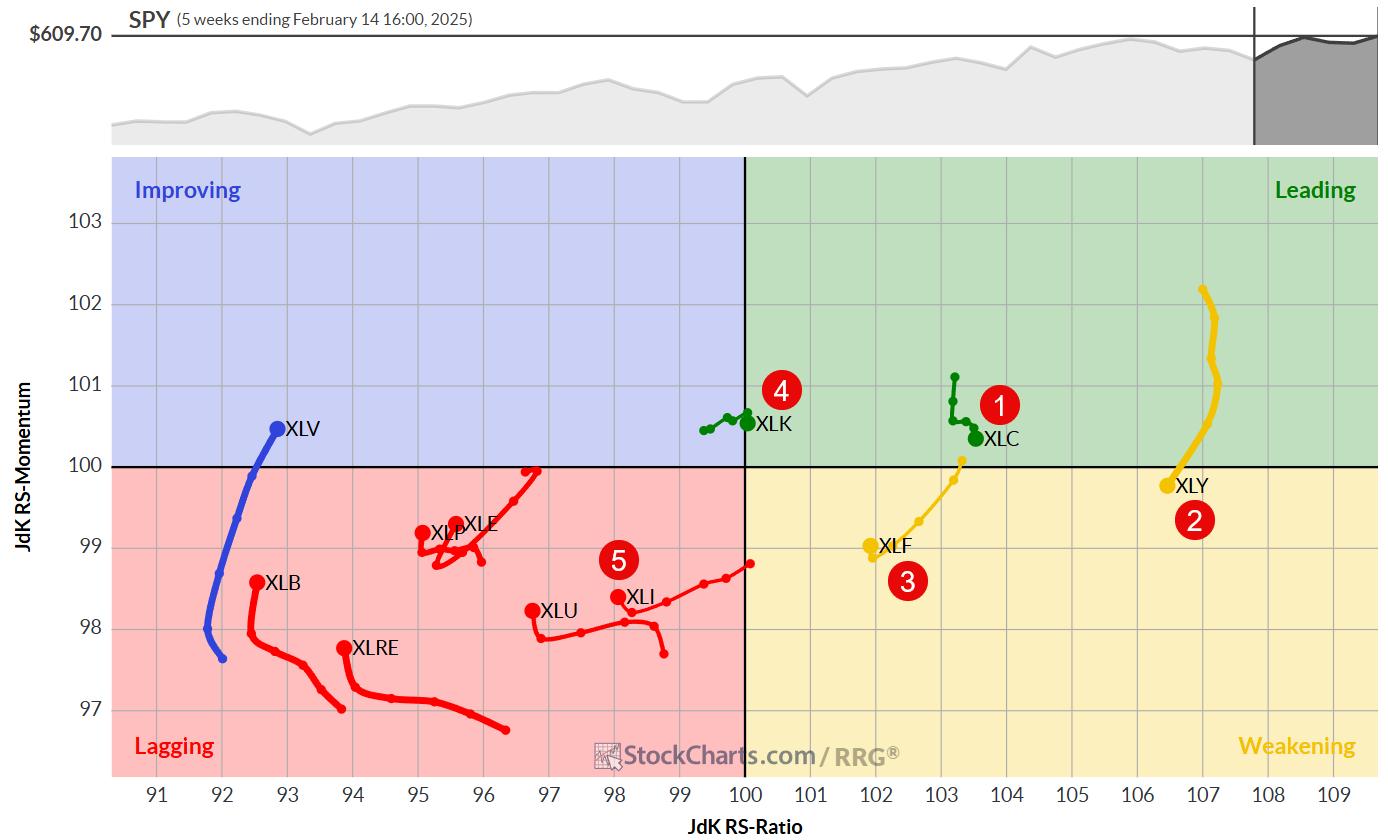

The Best Five Sectors, #28

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Technology sector continues to dominate, while Industrials are rotating out of the leading quadrant....

READ MORE

MEMBERS ONLY

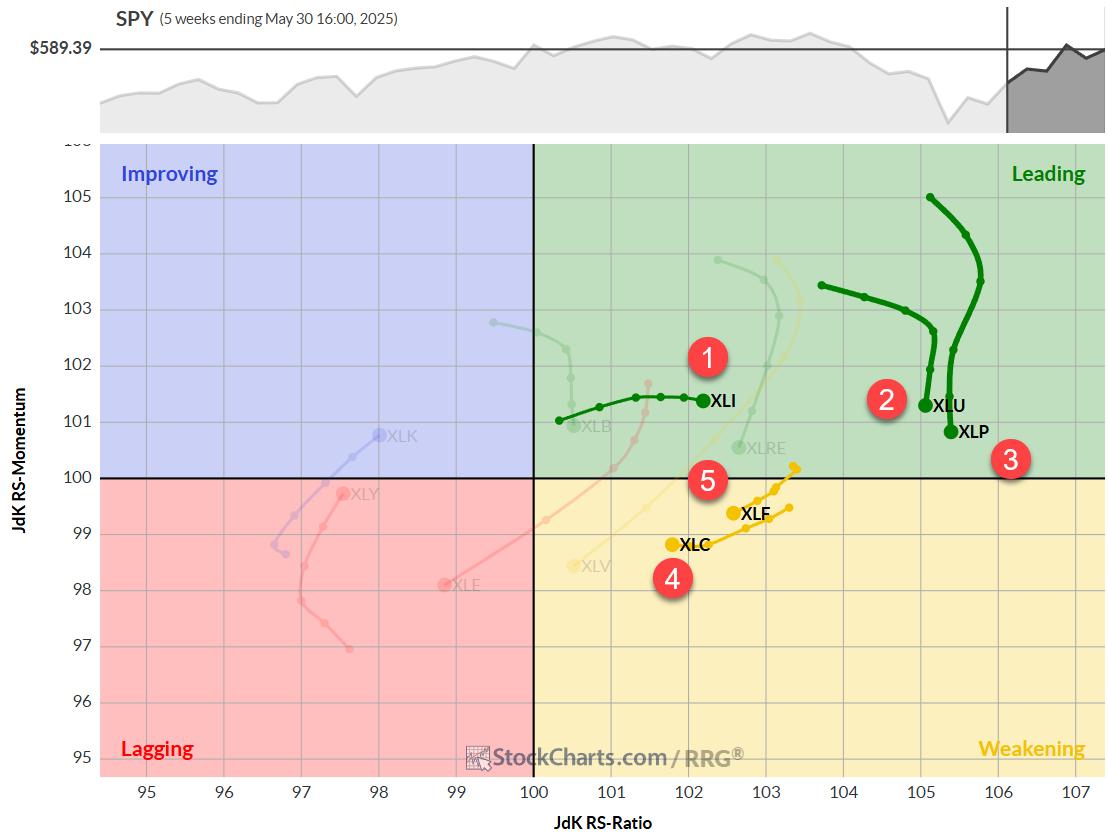

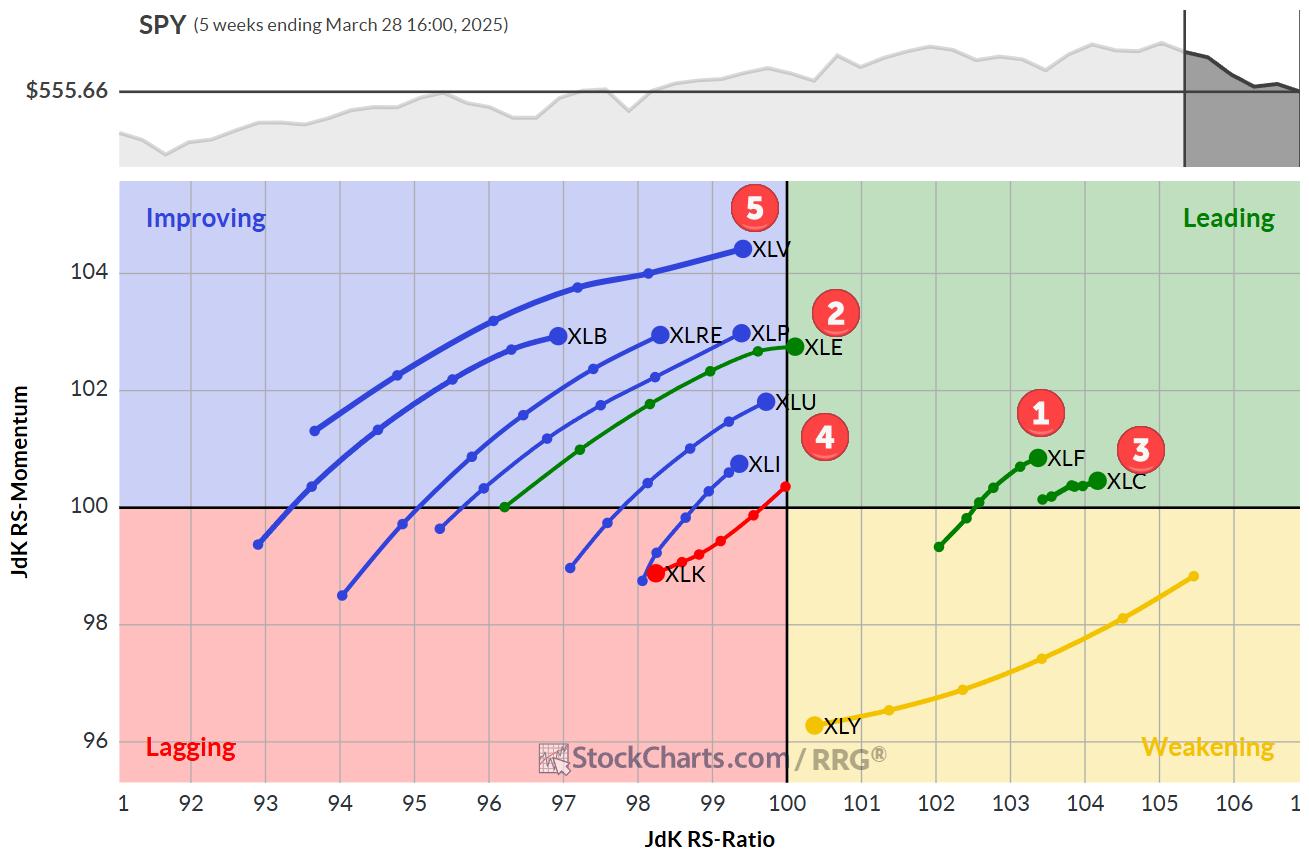

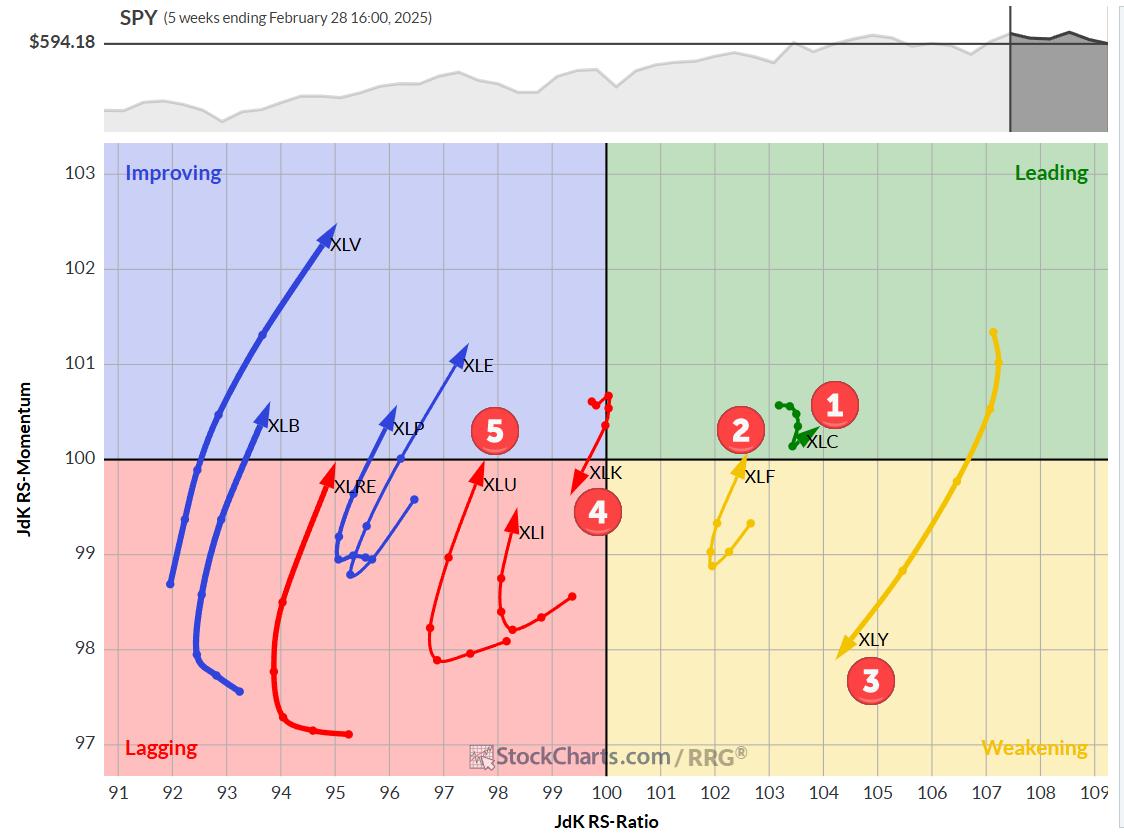

The Best Five Sectors, #27

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Materials sector climbs to #5 in rankings, displacing Utilities

* Technology maintains leadership, but Communication Services and Financials show weakness

* Daily RRG reveals potential for Materials, caution needed for Comm Services and Financials

* Portfolio drawdown continues, currently 8% behind S&P 500 YTD

After a relatively quiet week...

READ MORE

MEMBERS ONLY

Small Caps Are Rotating In — Here's Why It Matters

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After months of whiplash sector swings, the market may finally be showing signs of settling down.

In this video, Julius de Kempenaer uses Relative Rotation Graphs (RRG) to analyze asset class rotation at a high level and then dives into sectors and factors. Julius highlights the rotation into cryptocurrencies and...

READ MORE

MEMBERS ONLY

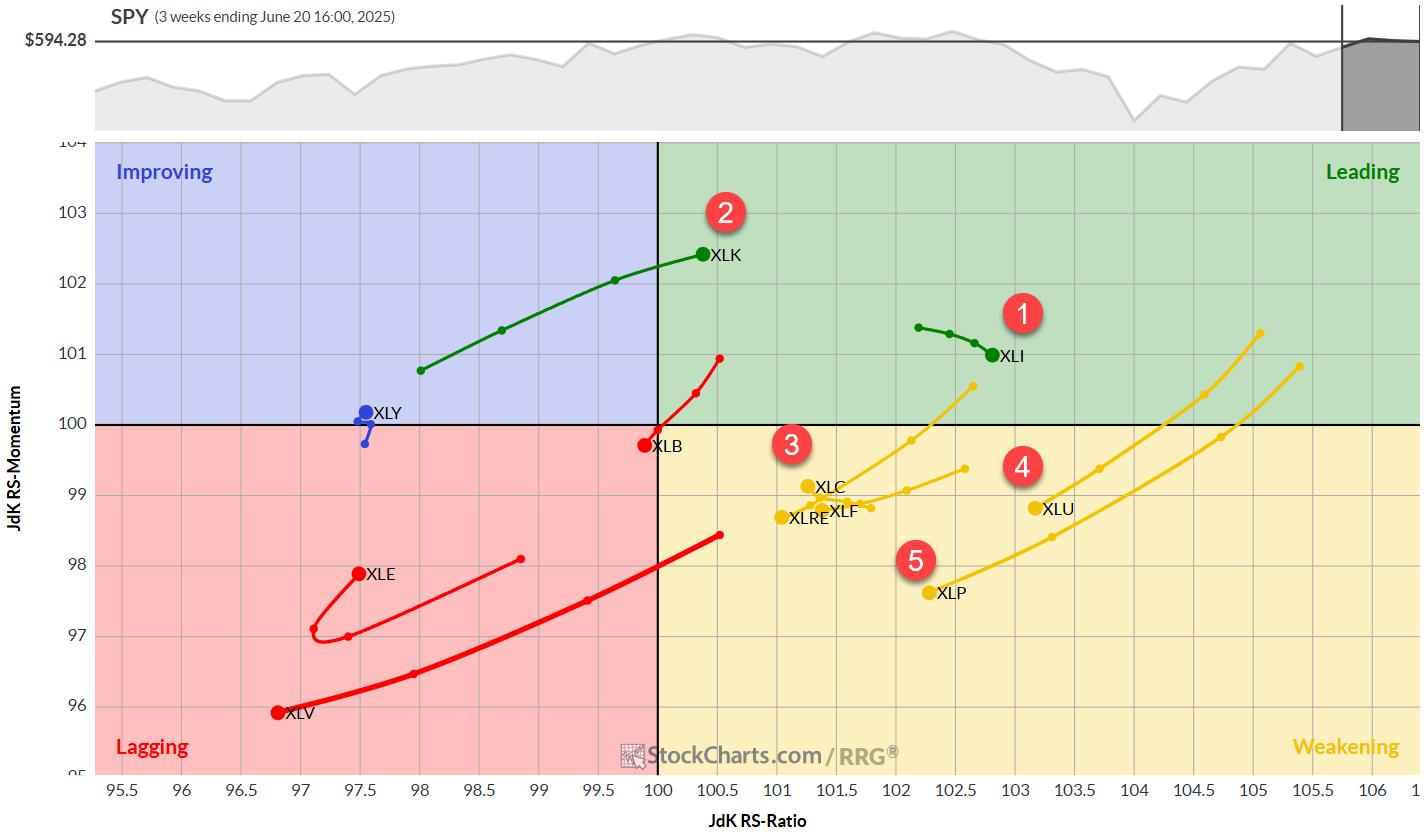

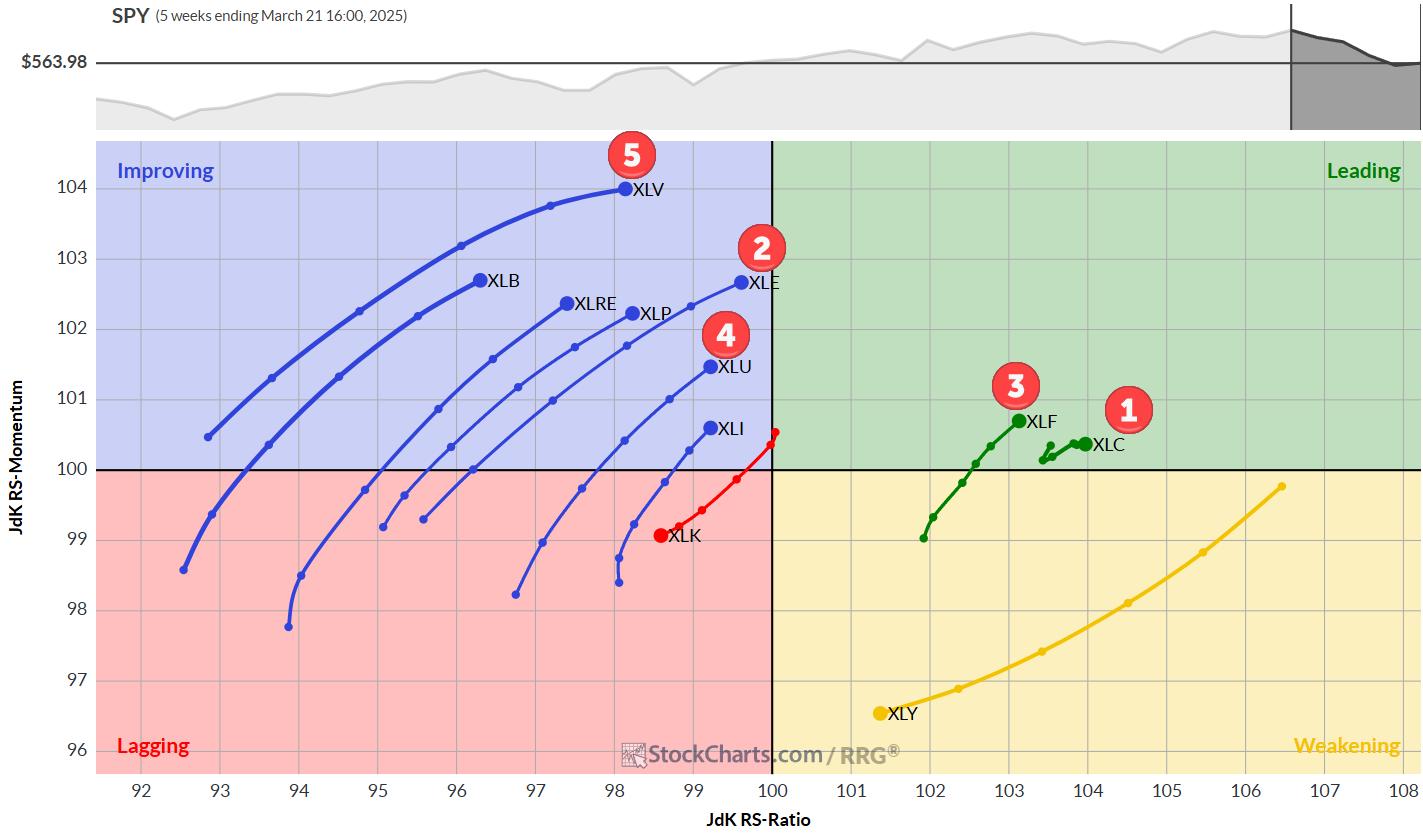

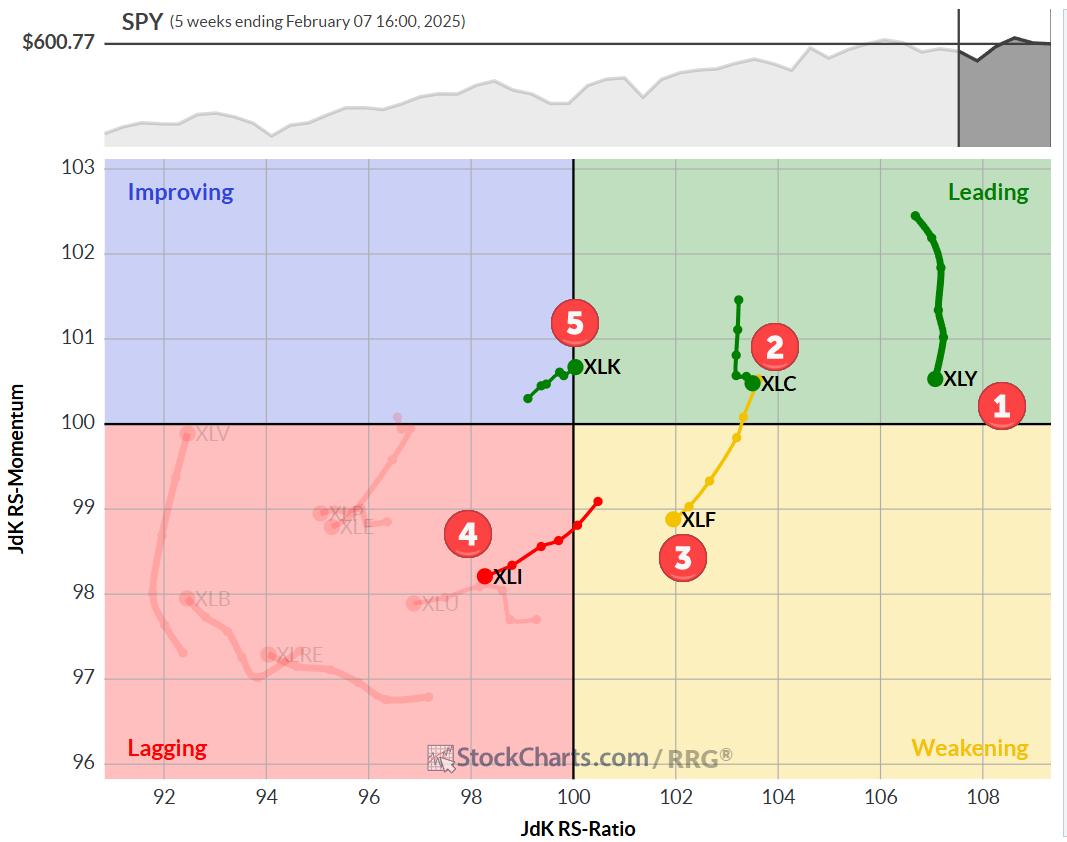

The Best Five Sectors, #26

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The past week has been relatively stable in terms of sector rankings, with no new entrants or exits from the top five. However, we're seeing some interesting shifts within the rankings that warrant closer examination. Let's dive into the details and see what the Relative Rotation...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #25

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

A Greek Odyssey

First of all, I apologize for any potential delays or inconsistencies this week. I'm currently writing this from a hotel room in Greece, surrounded by what I can only describe as the usual Greek chaos. Our flight back home was first delayed, then canceled, then...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #24

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Some Sector Reshuffling, But No New Entries/Exits

Despite a backdrop of significant geopolitical events over the weekend, the market's reaction appears muted -- at least, in European trading. As we assess the RRG best five sectors model based on last Friday's close, we're...

READ MORE

MEMBERS ONLY

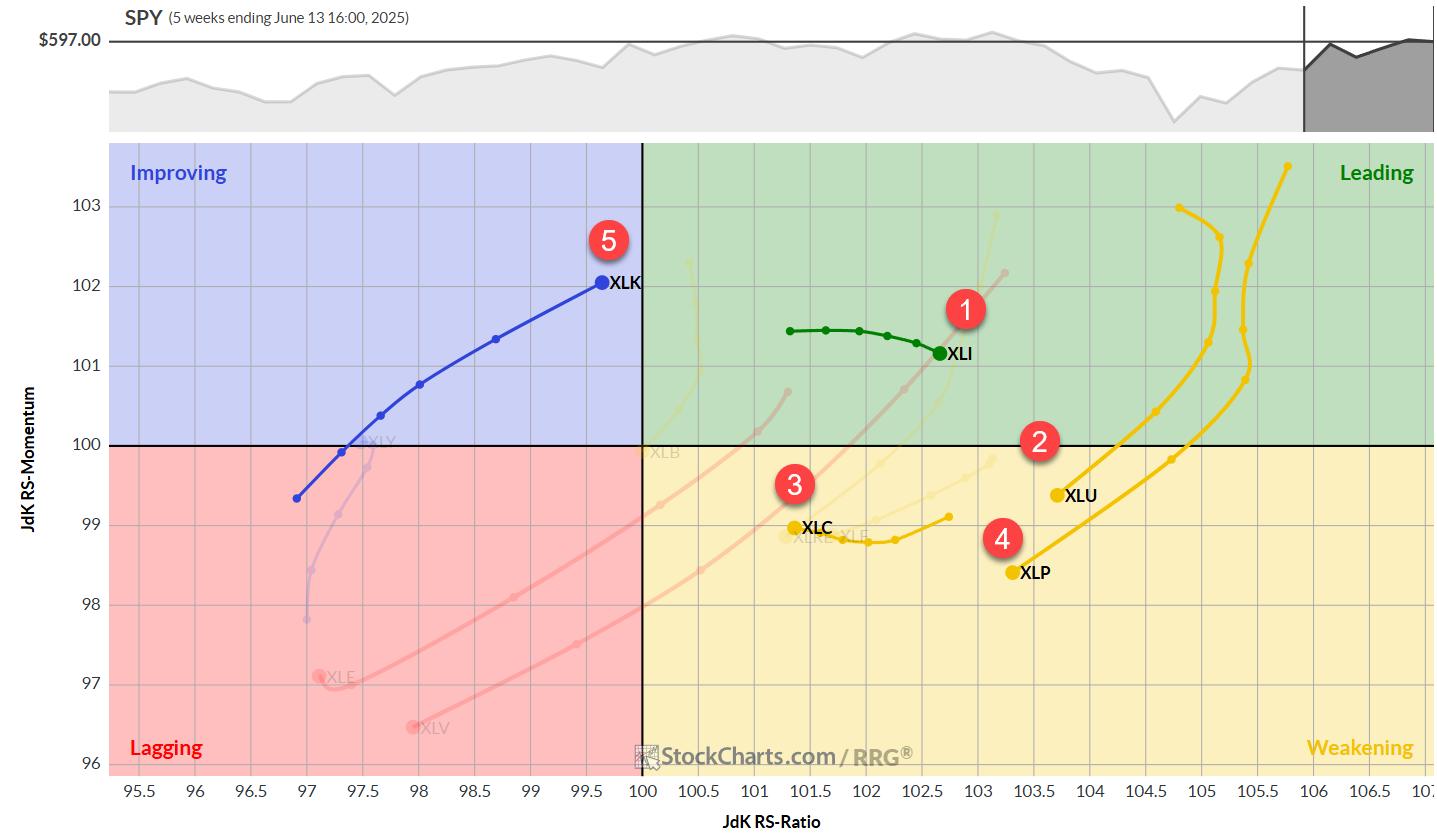

RRG Alert Tech Vaults to ‘Leading'—Is XLK Signaling a New Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This week, Julius breaks down the current sector rotation using his signature Relative Rotation Graphs, with XLK vaulting into the leading quadrant while utilities and staples fade. He spotlights strength in the technology sector, led by semiconductors and electronic groups that are outpacing the S&P 500. Microchip heavyweights...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #23

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This Time Technology Beats Financials

After a week of no changes, we're back with renewed sector movements, and it's another round of leapfrogging.

This week, technology has muscled its way back into the top five sectors at the expense of financials, highlighting the ongoing volatility in...

READ MORE

MEMBERS ONLY

RRG Update: Is Tech Ready to Break Out?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This week, Julius shows how the Technology sector is edging toward leadership, alongside Industrials and soon-to-follow Communication Services. He highlights breakout lines for SPY, XLK, and XLC, noting that conviction climbs when daily and weekly RRG tails align to point northeast together. Bitcoin is sprinting into the leading quadrant next...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #22

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Sector Rotation: A Week of Stability Amidst Market Dynamics

Last week presented an intriguing scenario in our sector rotation portfolio.

For the first time in recent memory, we witnessed complete stability across all sector positions -- no changes whatsoever in the rankings.

1. (1) Industrials - (XLI)

2. (2) Utilities...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #21

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Staples and Tech Swap Positions Again

The weekly sector rotation continues to paint a picture of a market in flux, with defensive sectors gaining ground while cyclicals take a step back. This week's shifts underscore the ongoing volatility and lack of clear directional trade that's been...

READ MORE

MEMBERS ONLY

Mixed Signals on the Charts? RRG Reveals Market Rotation Tension

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Confused by mixed market signals? Follow along as Julius analyzes sector rotation, asset rotation, and global market trends using daily and weekly Relative Rotation Graphs (RRGs).

In this video, Julius puts the current sector rotation in perspective on both weekly and daily Relative Rotation Graphs (RRGs). He also examines asset...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #20

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Technology Back in Top-5

Last week's market decline of 2-2.5% (depending on the index) has led to some notable shifts in sector performance and rankings.

This pullback, coming after a strong rally, is changing the order of highs and lows on the weekly chart -- a particularly...

READ MORE

MEMBERS ONLY

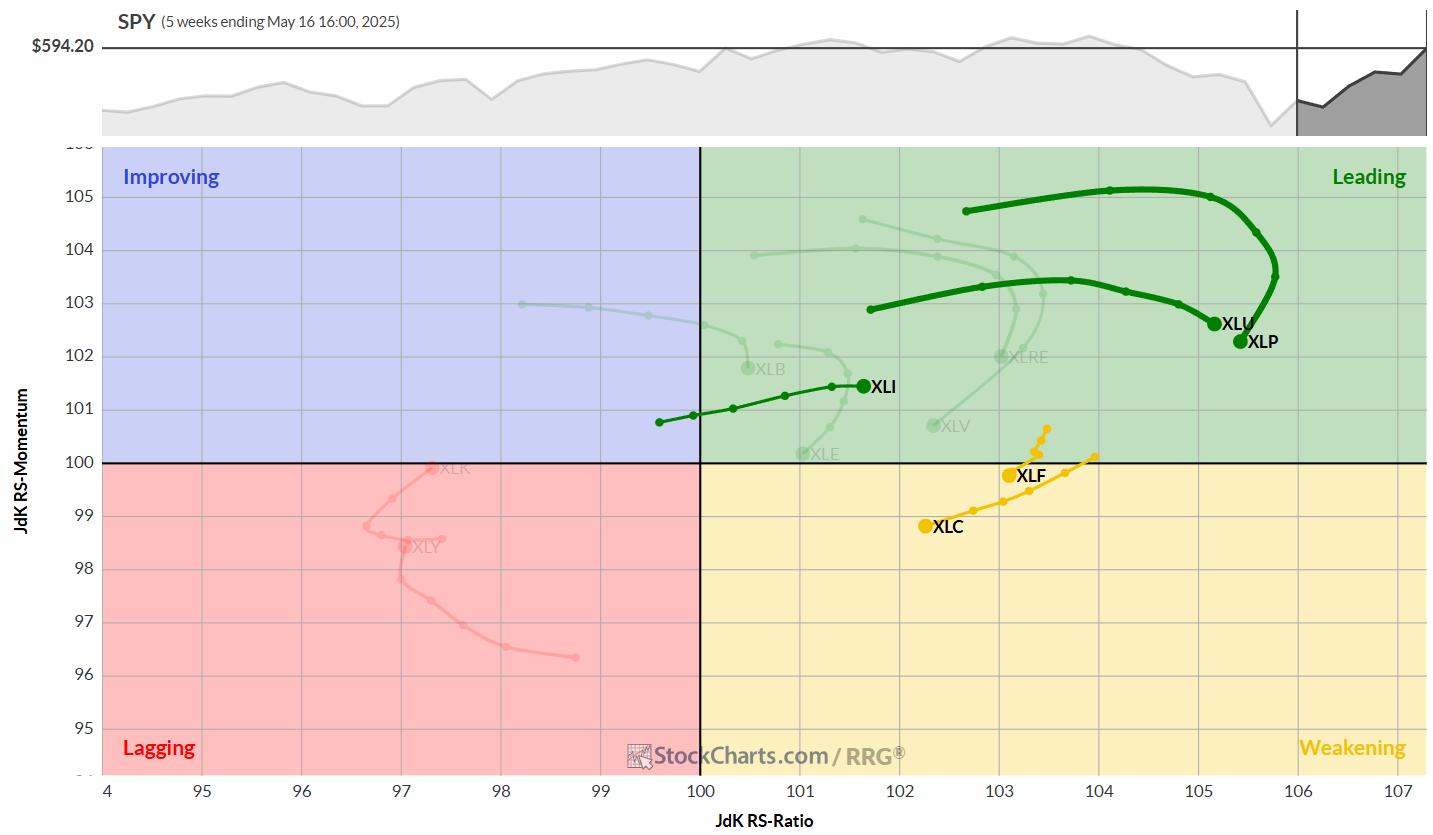

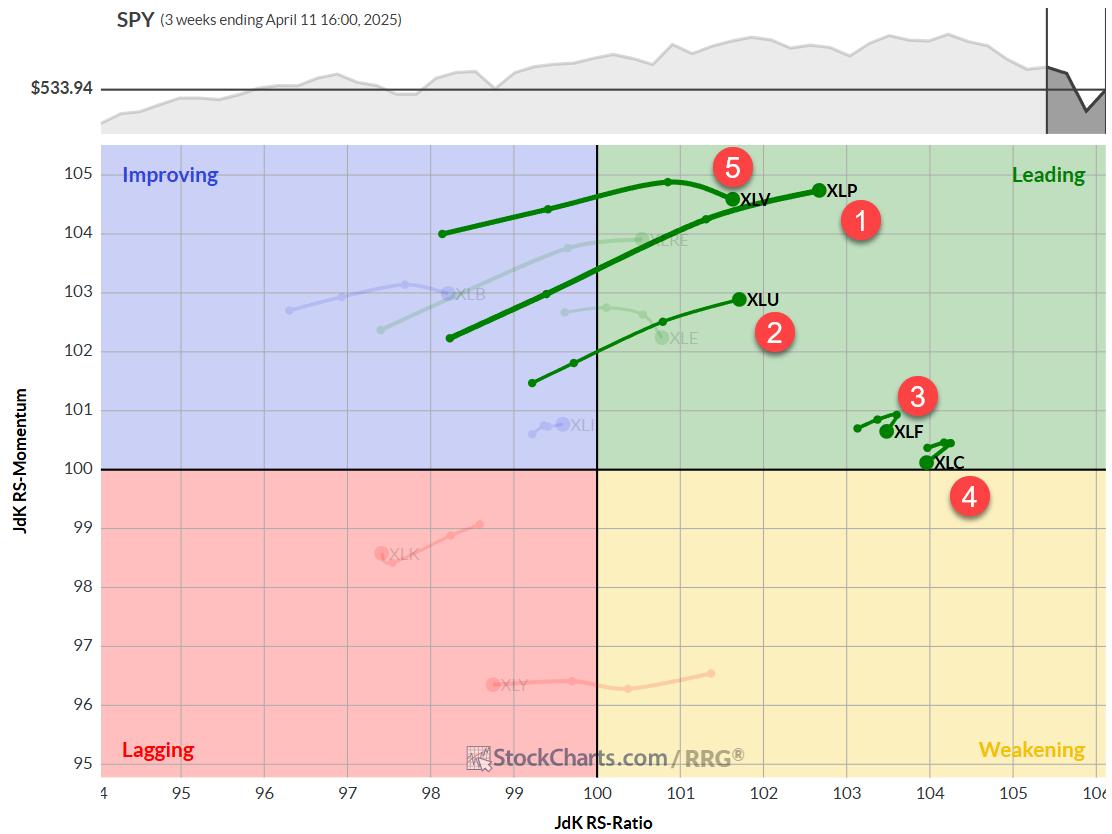

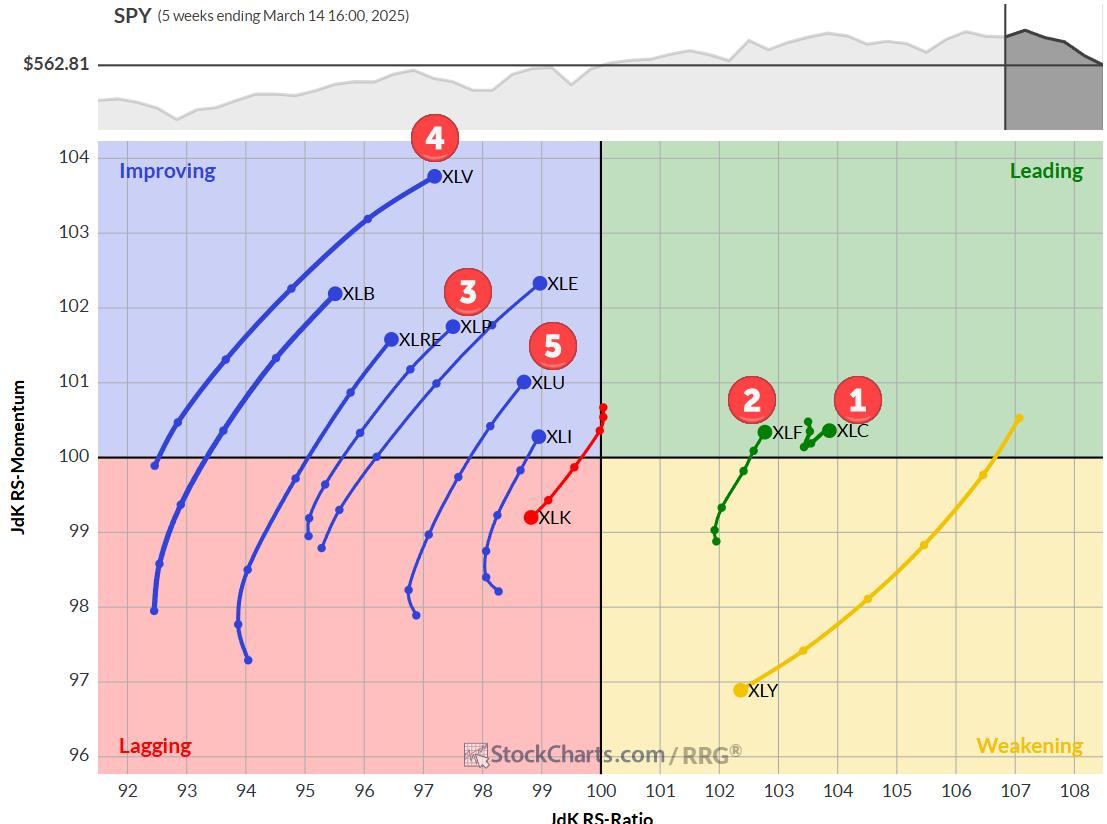

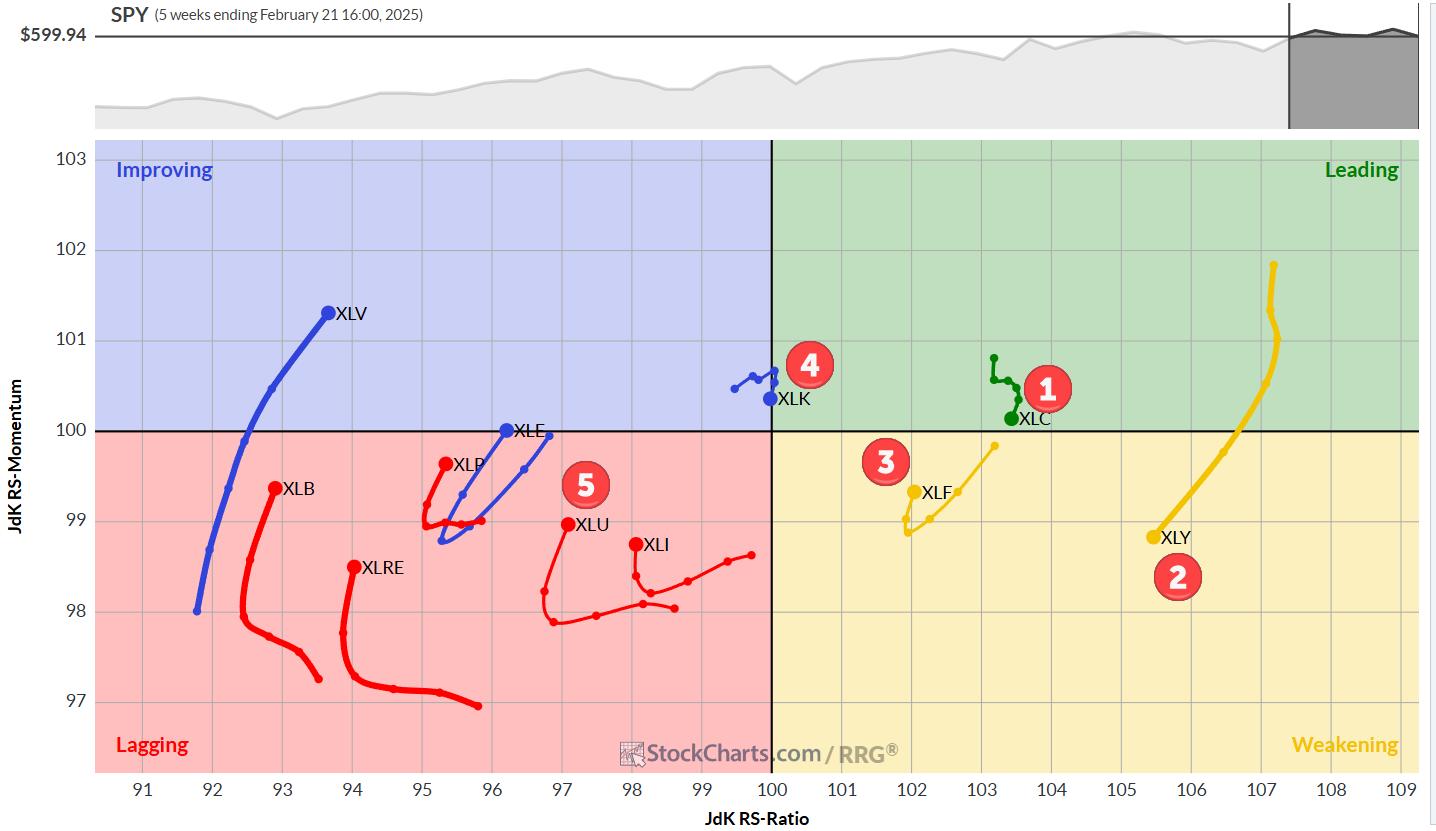

The Best Five Sectors, #19

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Industrials surge to #1 in sector ranking, replacing Real Estate in top 5

* Communication Services showing vulnerability, moving into weakening quadrant

* Utilities and Consumer Staples losing momentum but maintaining leading positions

* Portfolio maintains defensive positioning despite underperformance vs SPY

Sector Rotation Shakeup: Industrials Take the Lead

Another week...

READ MORE

MEMBERS ONLY

What Sector Rotation Says About the Market Cycle Right Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Where are we in the market cycle? In this video, Julius reviews the sector rotation and asset class performance from the past 2-3 weeks to provide an objective take on where we stand in the current market cycle. Using his signature Relative Rotation Graphs (RRG), he uncovers shifts in momentum...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #18

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* All 11 sectors changed positions, but the top-5 / bottom-6 composition remained the same.

* Utilities now strongest sector, despite overall market strength.

* Communication Services jumped from 5th to 2nd place.

* Portfolio still 3% behind the S&P 500 YTD, unchanged from last week.

Sector Shuffle: Same Players, New...

READ MORE

MEMBERS ONLY

Recession Ahead? Sector Rotation Model Warns of Rising Risk

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Is a recession coming? In this video, Julius breaks down the latest updates to his powerful Sector Rotation Model, analyzing four key macroeconomic indicators and their impact on sector performance.

This video was originally published on May 9, 2025. Click on the icon above to view on our dedicated page...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #18

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Top 5 sectors remain unchanged, with minor position shifts

* Leading sectors showing signs of losing momentum

* Daily RRG reveals top sectors in weakening quadrant

* Communication services at risk of dropping out of top 5

Communication Services Drops to #5

The composition of the top five sectors remains largely...

READ MORE

MEMBERS ONLY

Sector Rotation + SPY Seasonality = Trouble for Bulls?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video, Julius analyzes current asset class rotation, revealing why stocks in the lagging quadrant may signal continued market weakness. By combining sector rotation trends—particularly strength in defensive sectors—with SPY seasonality, Julius builds a compelling case that downside risk in the S&P 500 may outweigh...

READ MORE

MEMBERS ONLY

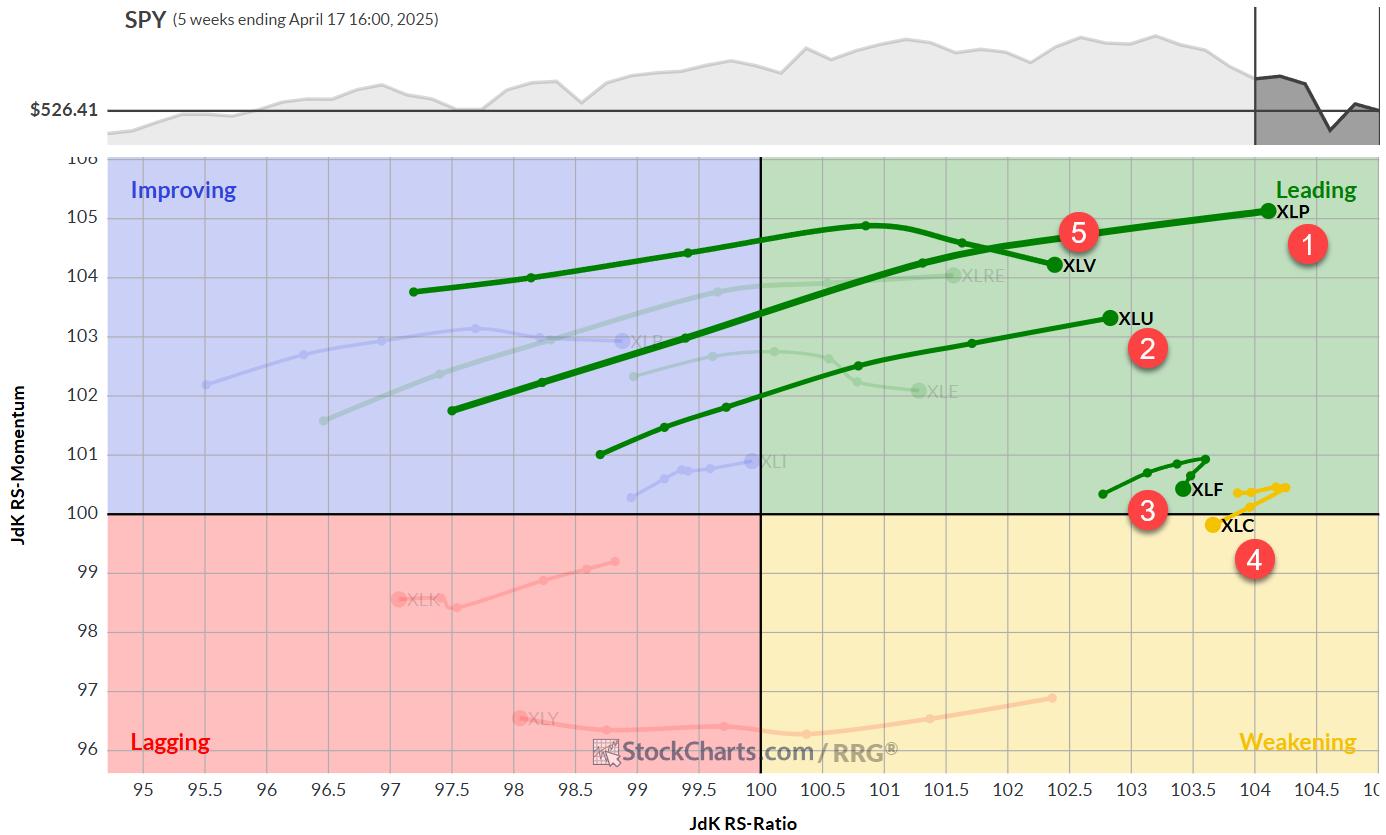

The Best Five Sectors, #17

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Defensive sectors maintain dominance in top 5, despite strong market performance.

* Real Estate enters top 5, replacing Health Care; Consumer Staples, Utilities, and Financials remain stable in top 3 positions.

* Defensive positioning has put a dent in portfolio performance after strong week.

Real Estate and Healthcare Swapping Positions...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #16

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Consumer staples and utilities continue to lead sector rankings.

* Defensive sectors are showing strength in both weekly and daily RRGs.

* Health care struggling, but maintains position in top 5

* RRG portfolio slightly underperforming S&P 500 YTD, but gap narrowing.

Top 5 Remains Unchanged

The latest sector...

READ MORE

MEMBERS ONLY

Sector Rotation Update: Value Stocks and Bonds Lead the Way!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Stocks vs. bonds? In this video, Julius breaks down the asset allocation outlook and why defensive sectors, large-cap value, and bonds may continue to outperform in this volatile market. He starts at the asset allocation level using Relative Rotation Graphs (RRGs) to analyze stocks vs bonds performance, then highlights the...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #15

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The entire top 5 has now changed positions.

* All defensive sectors are now in the top 5, while Healthcare has reentered.

* Portfolio is now lagging S&P 500.

Healthcare Re-Enters the Top 5

After a wild week in the markets, the sector ranking got quite a shake-up....

READ MORE

MEMBERS ONLY

Stock Market Volatility: Pain Points, Bright Spots, and Strategies

by Grayson Roze,

Chief Strategist, StockCharts.com

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Is the stock market volatility making you nervous?

In this video, Grayson Roze and Julius de Kempenaer unpack the volatile market environment and discuss pain points, some of the "bright spots" they are seeing in the market, and the StockCharts tools they are using to identify shifts in...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #14

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Consumer Staples replaces Healthcare in top 5

* More defensive rotation underway

* RRG portfolio remains in line with market performance

This article was first posted on 4/4/2025 and contained only rankings and charts. Then updated with comments 4/7/2025

I am attending and speaking at the...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #13

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Financials jump to #1 spot in S&P 500 sector rankings.

* Three sectors now in leading quadrant on weekly RRG

* Only Tech and Consumer Discretionary showing negative RRG headings

* RRG portfolio outperforming S&P 500 YTD by 10 basis points

Financials take the lead.

No changes...

READ MORE

MEMBERS ONLY

S&P & Tech Stocks: Will Seasonality Lead to More Pain?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Sector rotation is shaping the S&P 500's next big move! In this exclusive StockCharts video,Julius analyzes SPY support levels, key sector trends, and the latest seasonal patterns—which indicate further downside for Technology stocks. He breaks down two critical support areas that could signal the...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #12

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Energy sector jumps to position #2 in top 5

* Consumer Staples drops out of portfolio

* Communication Services remains at #1 spot

* Modest pick up of relative momentum for XLK and XLY not enough yet

Energy Jumps to #2

A big move for the energy sector last week as...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #11

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* At the moment, we're seeing a big shakeup in sector rankings.

* Healthcare has entered the top five.

* Technology is dropping to last position.

* All defensive sectors are now in the top five.

Big Moves in Sector Ranking

The ranking of US sectors continues to shift. At...

READ MORE

MEMBERS ONLY

Sector Rotation Breakdown: Spotting Market Leaders Now

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius analyzes US sector rotation using Relative Rotation Graphs (RRG), starting with the 11 S&P sectors and breaking them into Offensive, Defensive, and Sensitive sectors to uncover unusual market rotations. He then dives into the Financials sector, identifying top stocks with potential for...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #10

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Communication Services (XLC) maintains top spot, Tech (XLK) plummets

* Shift towards defensive sectors evident in rankings

* Consumer Discretionary (XLY) showing signs of weakness

* Portfolio slightly outperforming SPY benchmark

Sector Shake-Up: Defensive Moves and Tech's Tumble

Last week's market volatility stirred up the sector rankings,...

READ MORE

MEMBERS ONLY

Sector Rotation Warning: More Downside Ahead for US Markets?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius analyzes sector rotation in US markets, assessing recent damage and potential downside risks. He examines the Equal Weight RSP vs. Cap-Weighted SPX ratio and the stocks vs. bonds relationship to identify key market trends. Don't miss this deep dive into market rotation...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #9

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Communication services maintains top spot in sector ranking.

* Financials moves up to #2, pushing consumer discretionary down to #3.

* Technology and utilities hold steady at #4 and #5 respectively.

* Portfolio performance now on par with benchmark after recent outperformance.

Sector Rotation: Financials Climb as Consumer Discretionary Slips

While...

READ MORE

MEMBERS ONLY

Sector Rotation & Seasonality: What's Driving the Market Now?"

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius analyzes seasonality for U.S. sectors and aligns it with current sector rotation. He explores how these trends impact the market (SPY) and shares insights on potential movements using RRG analysis. By combining seasonality with sector rotation, he provides a deeper look at market...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #8

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Utilities entering the top-5

* Industrials dropping out of top-5 portfolio

* Real-Estate and Energy swapping positions in bottom half of the ranking

* Perfomance now 0.3% below SPY since inception.

Utilities enter top 5

Last week's trading, especially the sell-off on Friday, has caused the Utilities sector...

READ MORE

MEMBERS ONLY

Market Rotation and Cap-Weight Dynamics: A Closer Look

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Large cap growth stocks regaining favor as market faces pressure

* Cap-weighted sectors outperforming equal-weighted counterparts

* S&P 500 struggling to break above 610, suggesting potential trading range

* Exceptions in mega-cap dominated sectors (Communication Services, Technology, Consumer Discretionary)

With the market selling off into the close today, it&...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #7

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Communication services (XLC) claims the top spot, pushing consumer discretionary (XLY) to second place

* Technology (XLK) shows strength, moving up to fourth and displacing industrials (XLI)

* Industrials displaying weakness, at risk of dropping out of the top five

* RRG portfolio outperforming SPY benchmark by 69 basis points

Shifting...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #6

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Top-5 remains unchanged

* Healthcare and Staples jump to higher positions

* Price and Relative trends remain strong for XLC and XLF

No Changes In Top-5

At the end of the week ending 2/7, there were no changes in the top-5, but there have been some significant shifts in...

READ MORE

MEMBERS ONLY

Watch For These Seasonality Patterns in 2025

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this exclusive StockCharts video,Julius shares a new approach to seasonality by using a more granular, data-set constructed UDI (User Defined Index) for every sector. Using the UDI functionality on StockCharts.com allows Julius to plot the seasonal patterns for each sector forward to the end of 2025 and...

READ MORE