MEMBERS ONLY

Is the bond market sending us a message?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

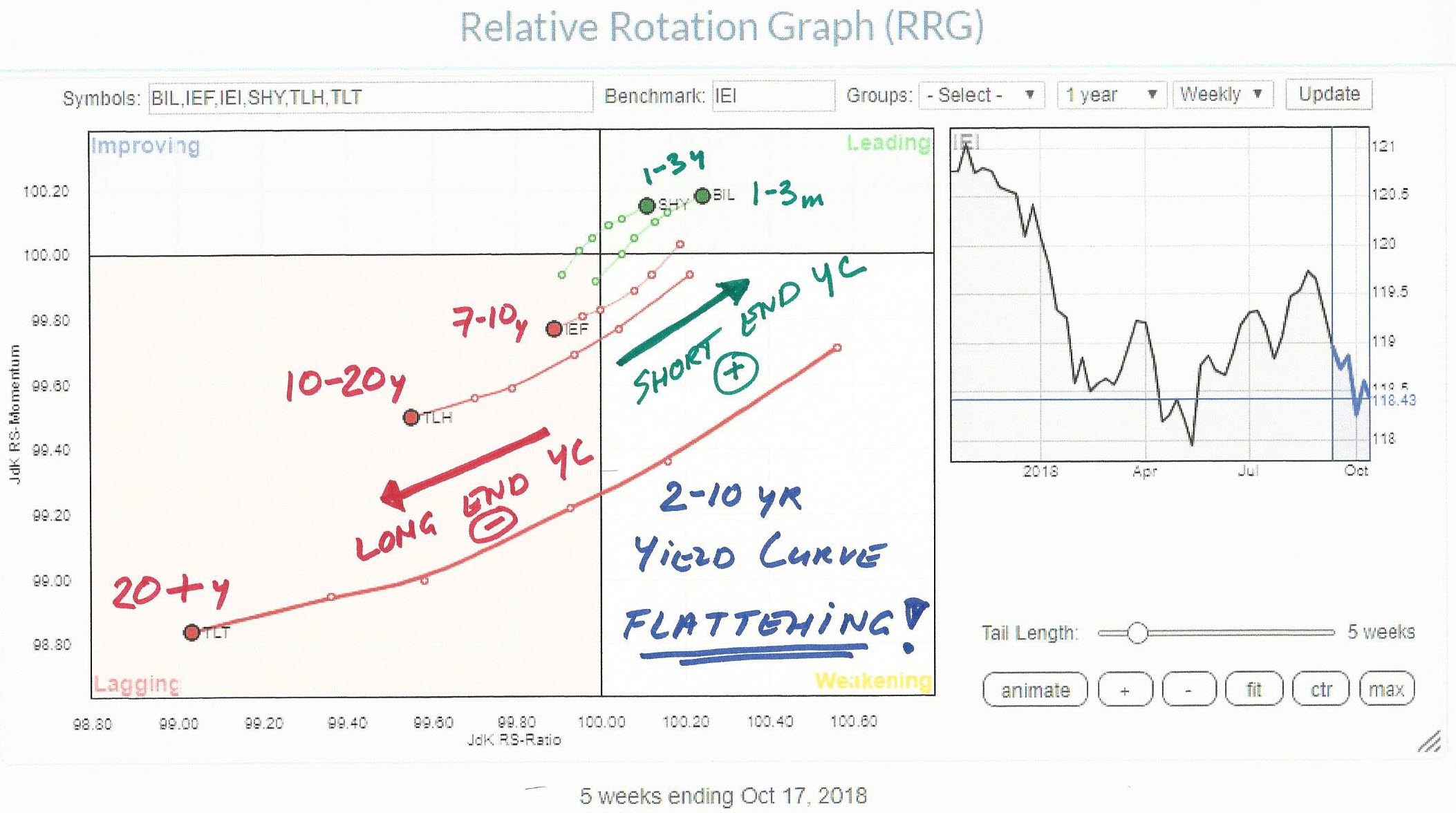

When markets are in transition and the bigger picture needs our attention it is always good to keep an eye on the yield curve.

The absolute yield levels of the various maturities on the curve, starting at 3-Months all the way out to 20+ years are important to monitor. But...

READ MORE

MEMBERS ONLY

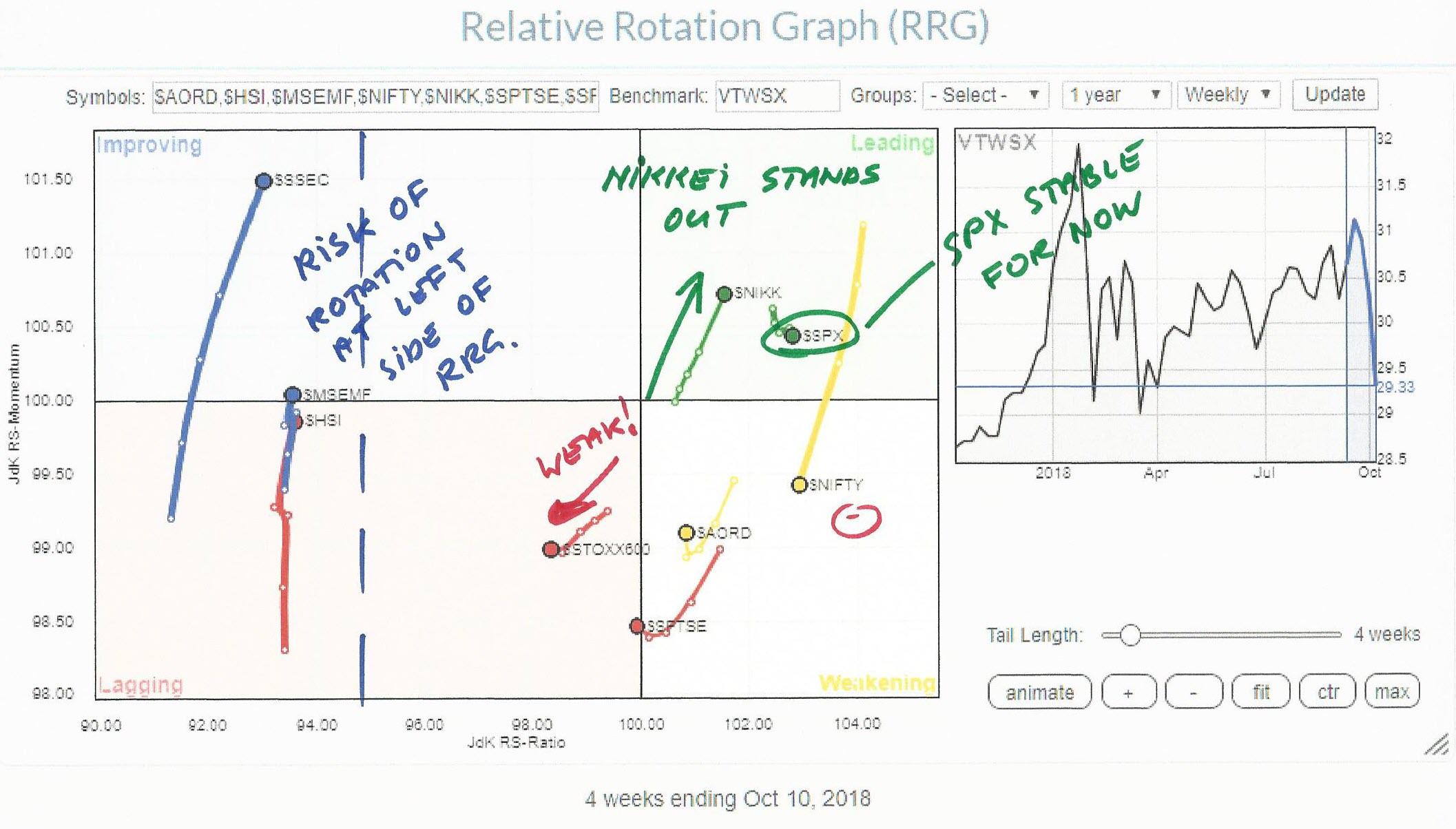

Markets are cracking. Is it just another dip or are we witnessing a bigger event in the making?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The general market conditions for the various major indexes have been commented on extensively by other commentators here on the site. There is no doubt that there is more rumble in the markets now than we have seen for a long time.

IMHO this makes it an interesting time for...

READ MORE

MEMBERS ONLY

Japan against the rest of the world!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When markets around the world start to rumble it's usually a good exercise how all these moves compare against one another.

The Relative Rotation Graph shows the relative picture for a number of major world equity markets against the Dow Jones World Index as the benchmark.

The Indian...

READ MORE

MEMBERS ONLY

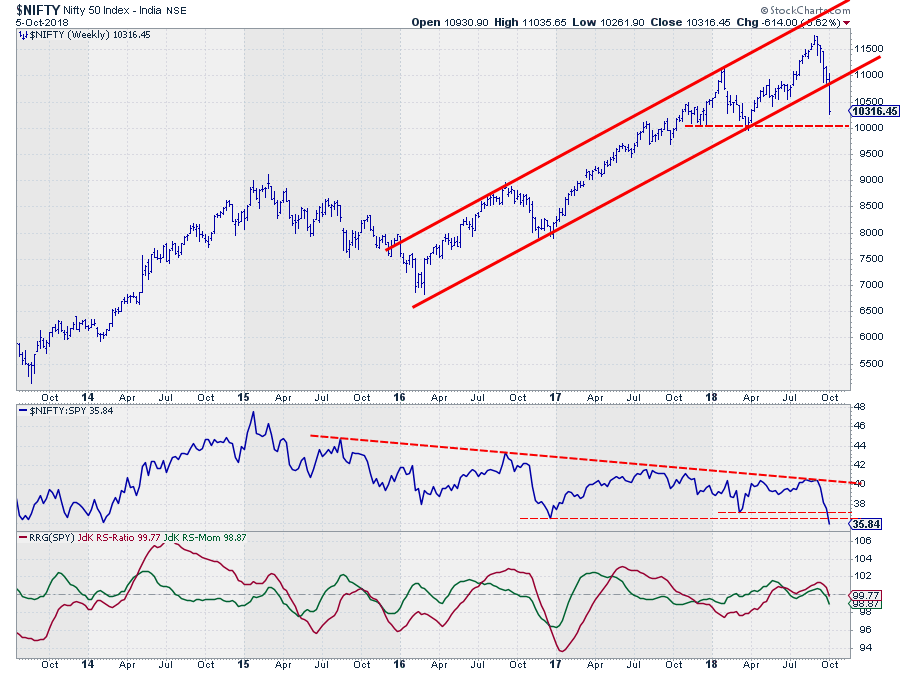

Break in $NIFTY re-shuffles sector rotation in India

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This article is an extended and updated version of the article that appeared in last weekend's Chartwatchers newsletter.

The Indian $NIFTY Index dropped out of an almost three-year uptrend at the close of last week. The rising support line that started at the low in early 2016 did...

READ MORE

MEMBERS ONLY

NIFTY breaks trend. Pharma and IT show relative strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Indian $NIFTY Index dropped out of an almost three-year uptrend at the close of last week. The rising support line that started at the low in early 2016 did not manage to hold up and was clearly broken during last week's market action.

This move changes the...

READ MORE

MEMBERS ONLY

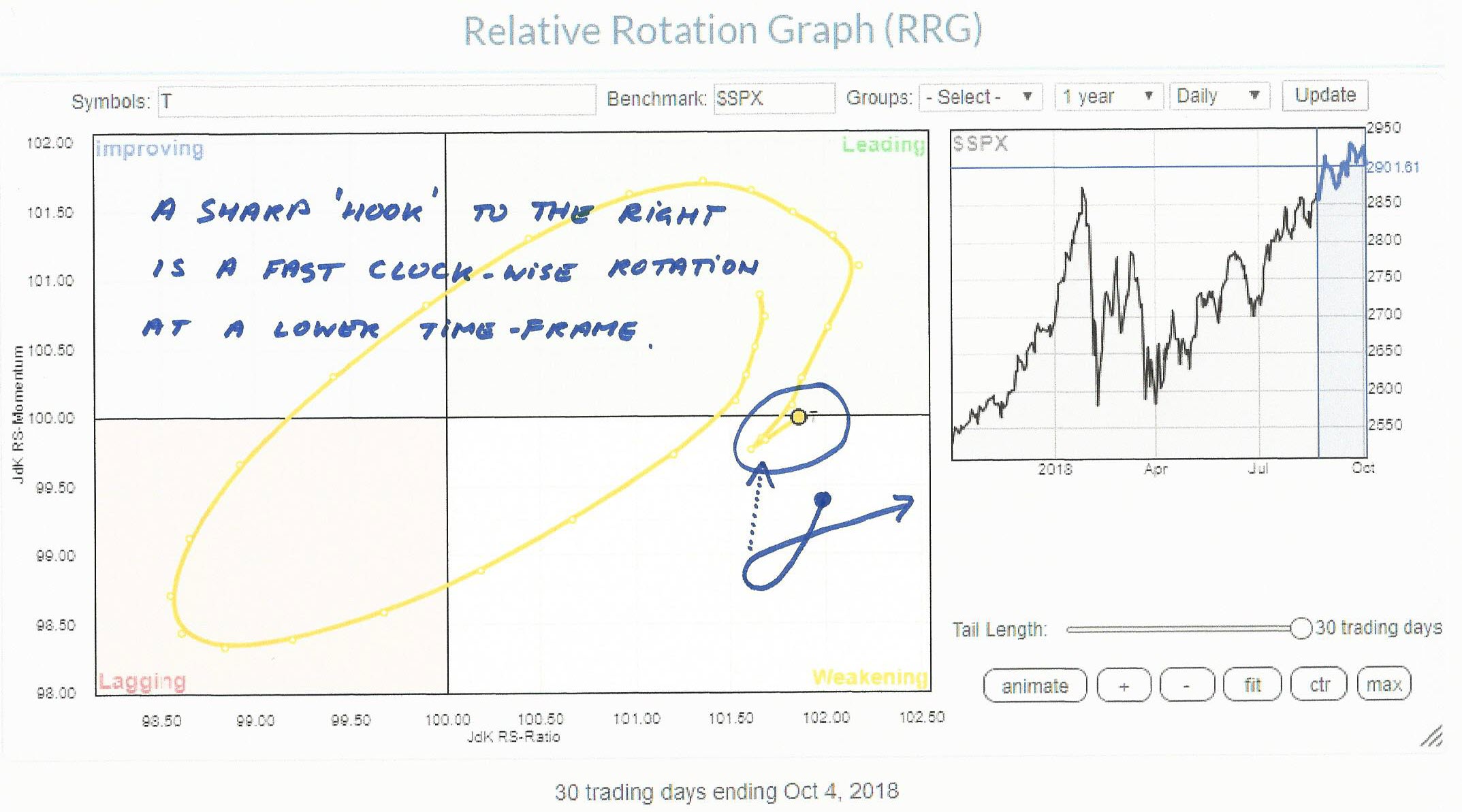

AT&T calling!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After yesterday's close (10/4) I ran a Relative Rotation Graph of the Top-10 Market Movers inside the S&P-500 index.

One of the names that popped up as potentially interesting was AT&T (T) as it is inside the improving quadrant and moving towards the...

READ MORE

MEMBERS ONLY

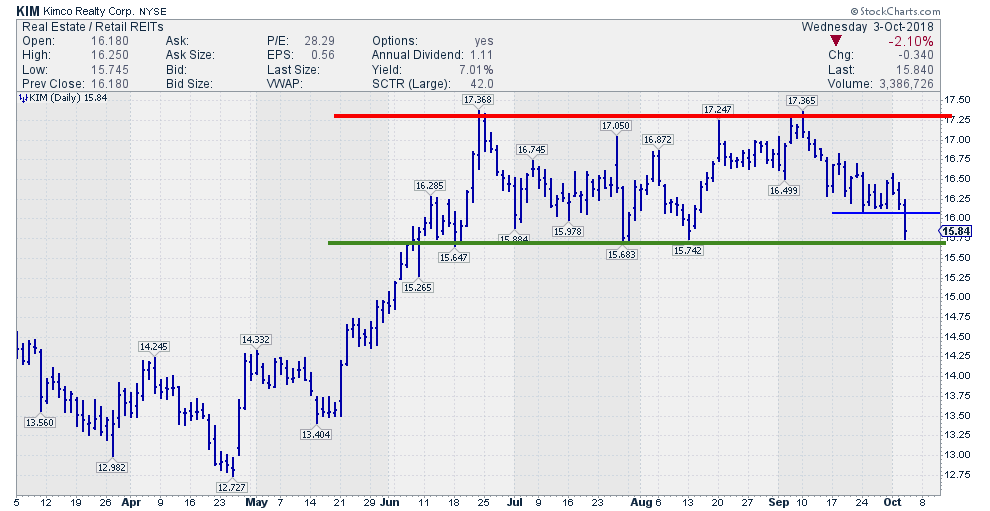

KIM at lower boundary of trading range

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the names that popped up today on my alert for potential "Turtle Soup" setups is KIM. After opening up the chart for further inspection I noticed an interesting situation.

It is very clear that the stock is in a trading range since June. The upper boundary...

READ MORE

MEMBERS ONLY

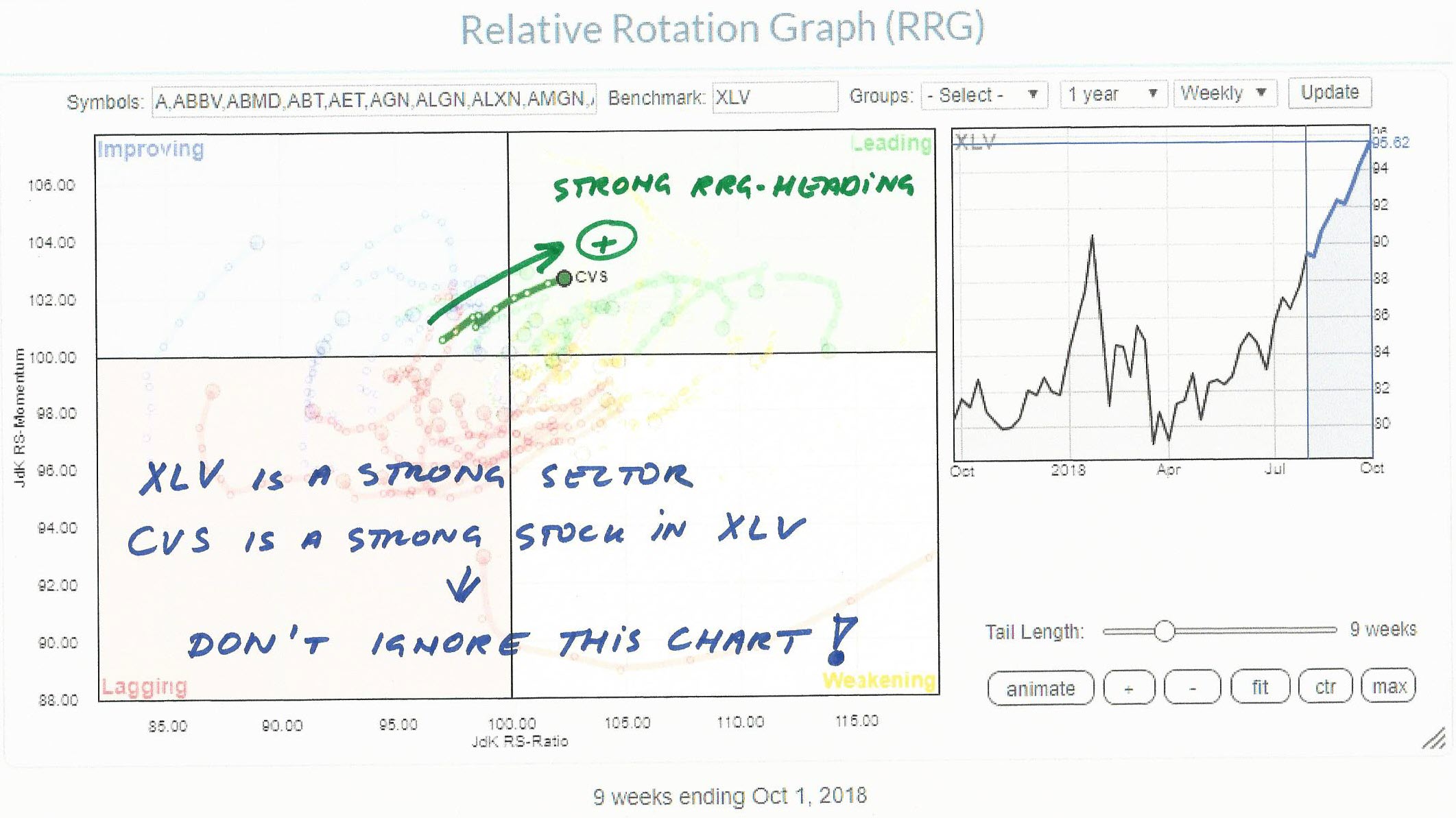

CVS: A healthy stock in a healthy sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Healthcare sector is getting a lot of attention lately. Not surprisingly as it is THE leading sector at the moment.

Yesterday when I was working on my most recent RRG blog, XLV made it to the headline. And for good reasons. At the moment it is the only sector...

READ MORE

MEMBERS ONLY

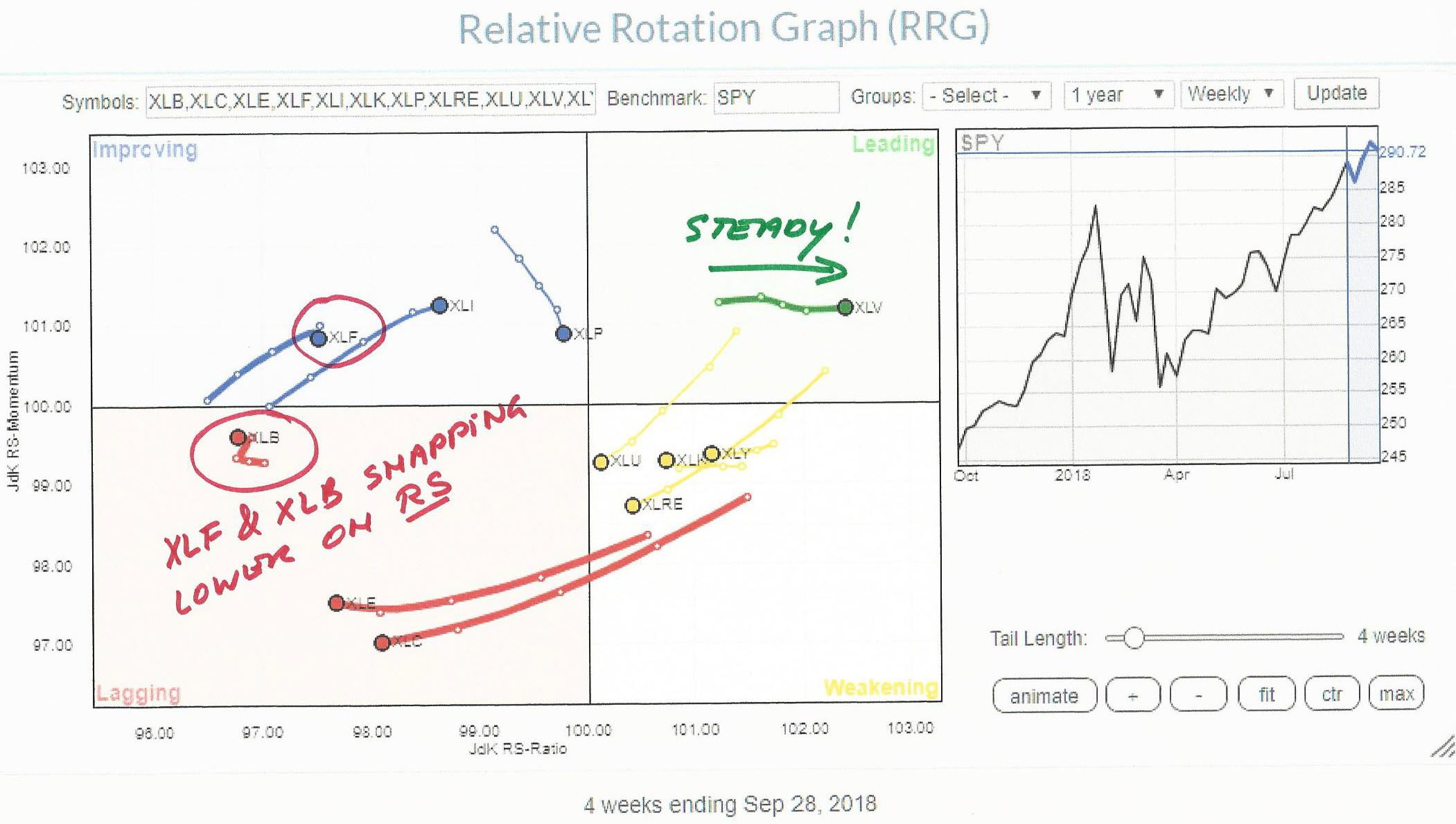

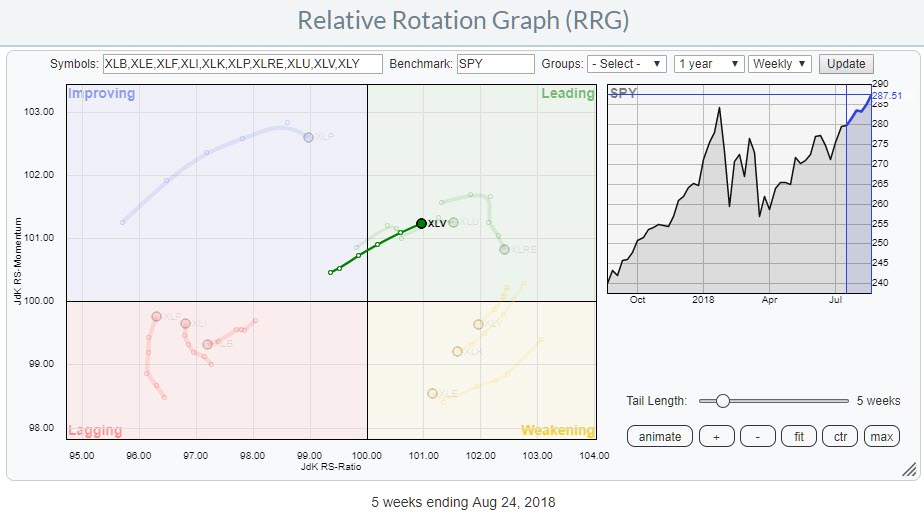

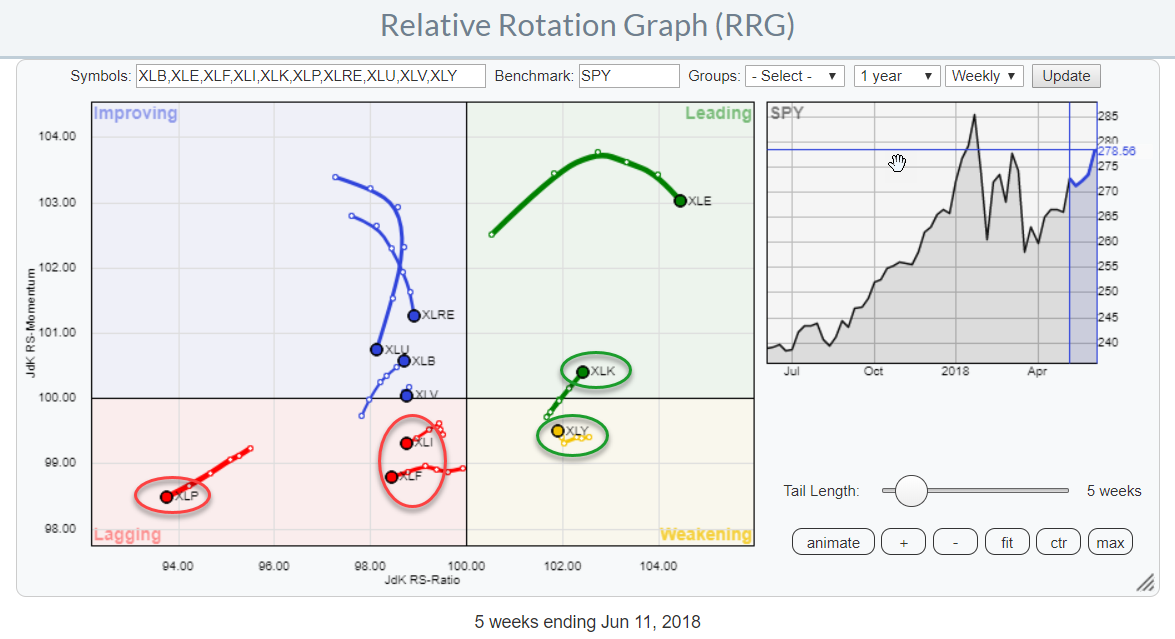

XLV continues strong in leading quadrant, XLF and XLB snap lower on Relative Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for US sectors, the Healthcare sector continues strong into the leading quadrant at a steady pace (RS Momentum). Two sectors that are showing a sudden weakness in relative strength, and therefore deserve our attention, are Materials (XLB) and Financials (XLF).

Summary

* Healthcare (XLV) moving further...

READ MORE

MEMBERS ONLY

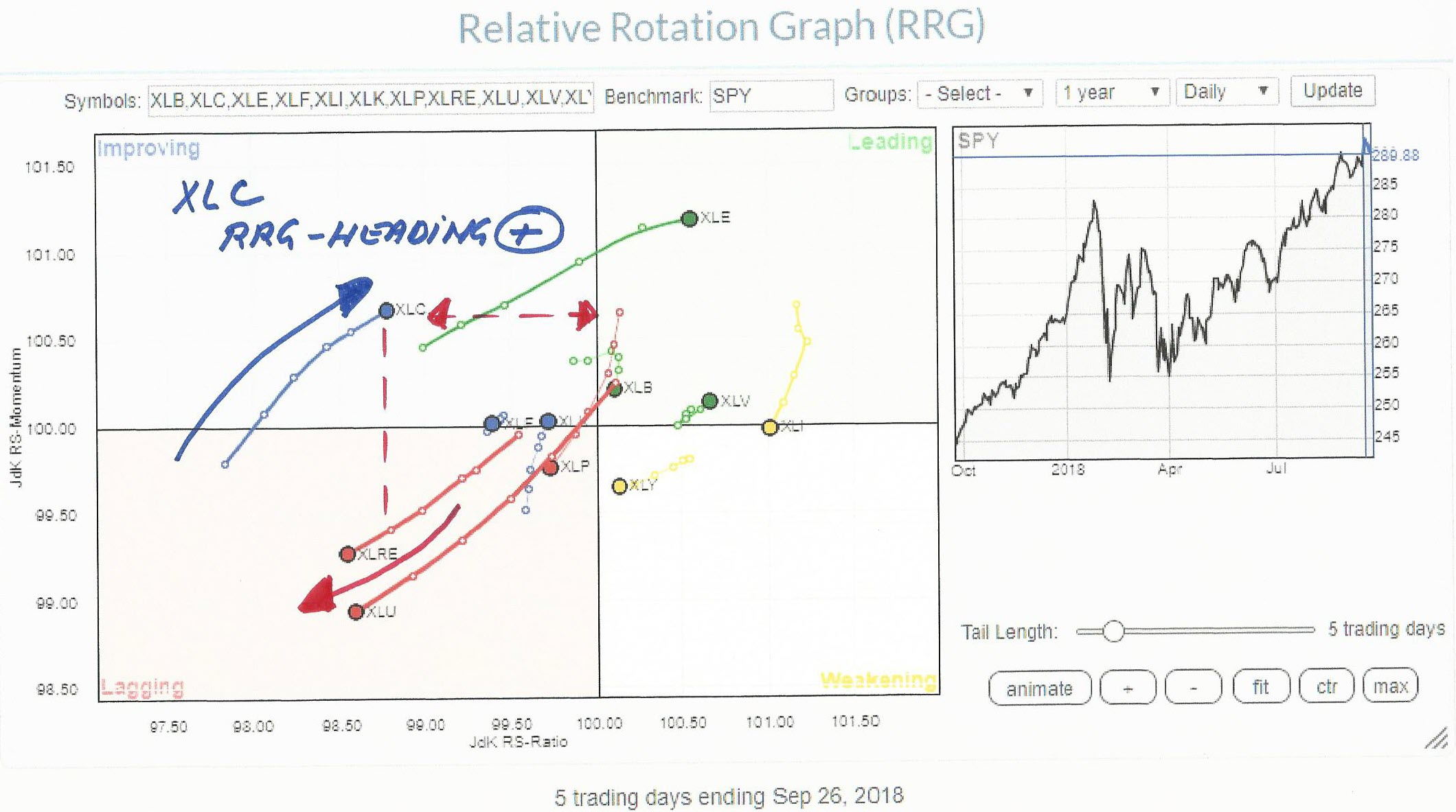

XLC recovering on Relative Rotation Graph, but for how long?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the daily Relative Rotation Graph above, the new XLC sector is positioned inside the improving quadrant. XLC moved into the improving from lagging 5 trading days ago and is now heading higher on both scales at a positive RRG-Heading.

Measured on the JdK RS-Ratio scale (horizontal axis), XLC is...

READ MORE

MEMBERS ONLY

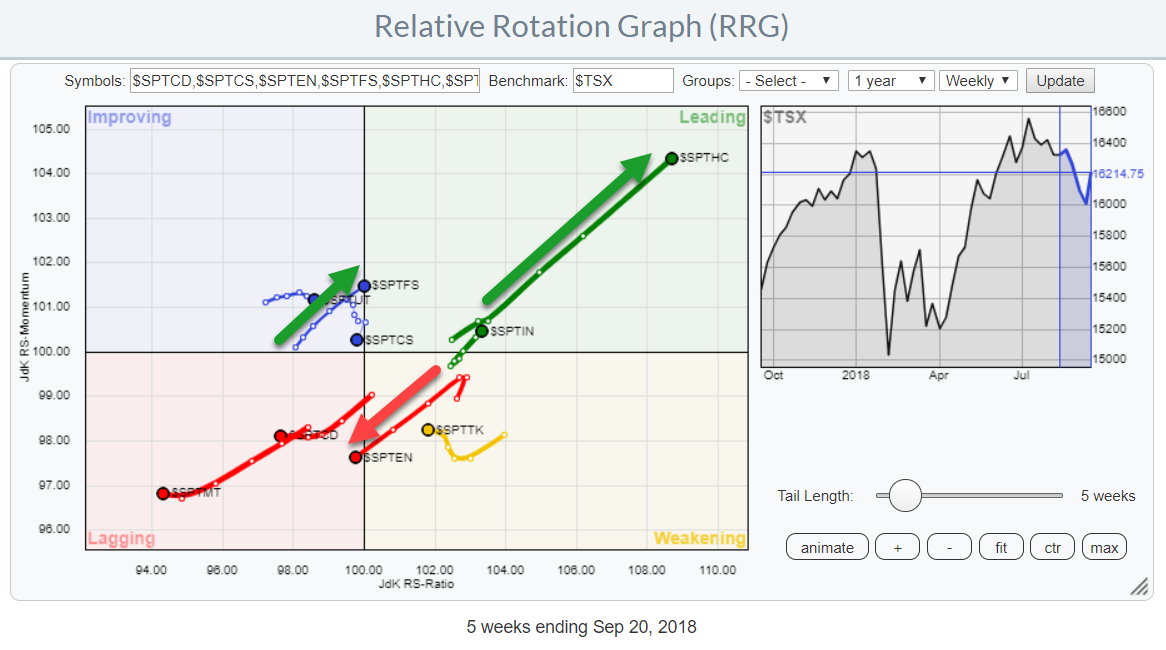

Canadian Health Care sector ($SPTHC) gunning for test of $ 155

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for Canadian sectors is showing a very distinct move for the Healthcare sector. It is inside the leading quadrant and powering further into it at a strong RRG-Heading at a very long tail. All ingredients for more strength ahead and worth a closer look on a...

READ MORE

MEMBERS ONLY

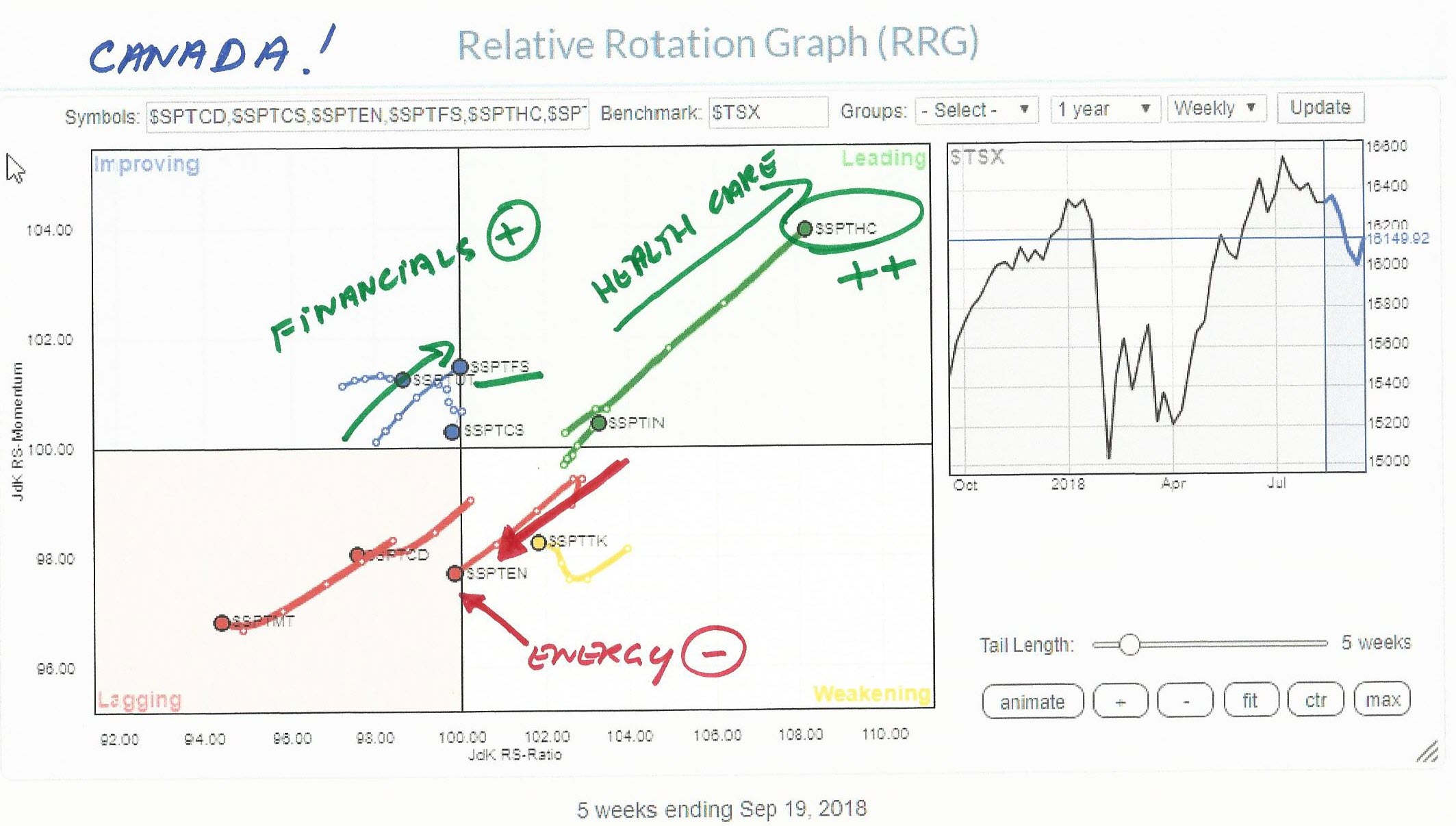

Canadian Healthcare and Financial Services winning over Energy

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

While browsing through some pre-populated RRGs on the site I stumbled upon the chart holding Canadian sectors.

What immediately triggered me was the sharp move of the Healthcare sector into the leading quadrant at almost 45 degrees which means that the sector is moving higher on both axes which is...

READ MORE

MEMBERS ONLY

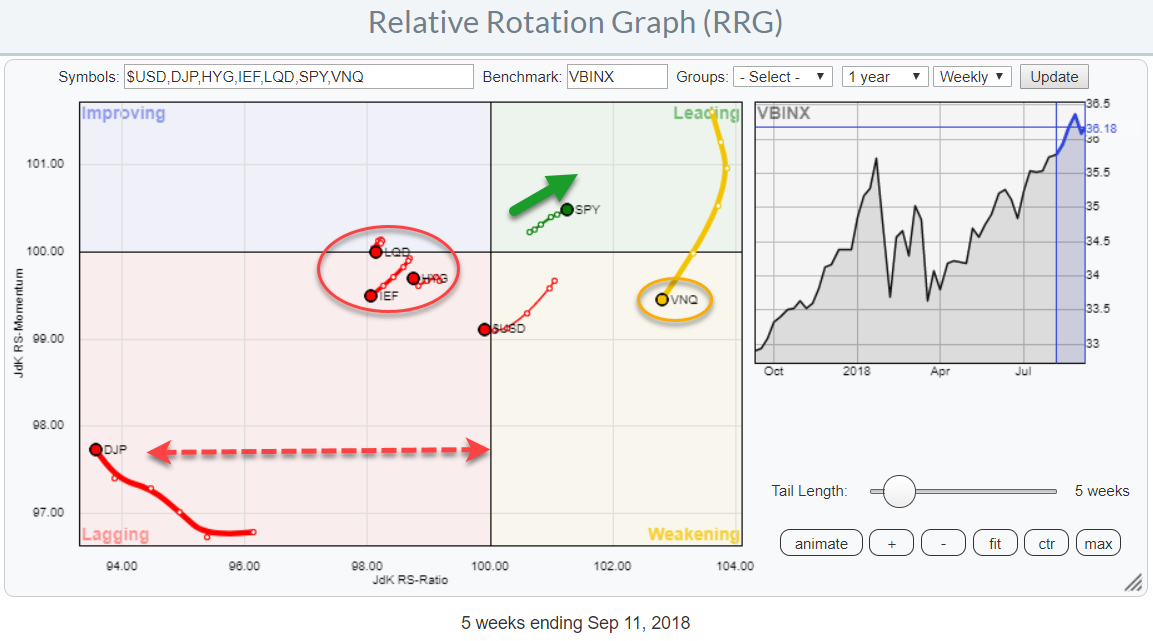

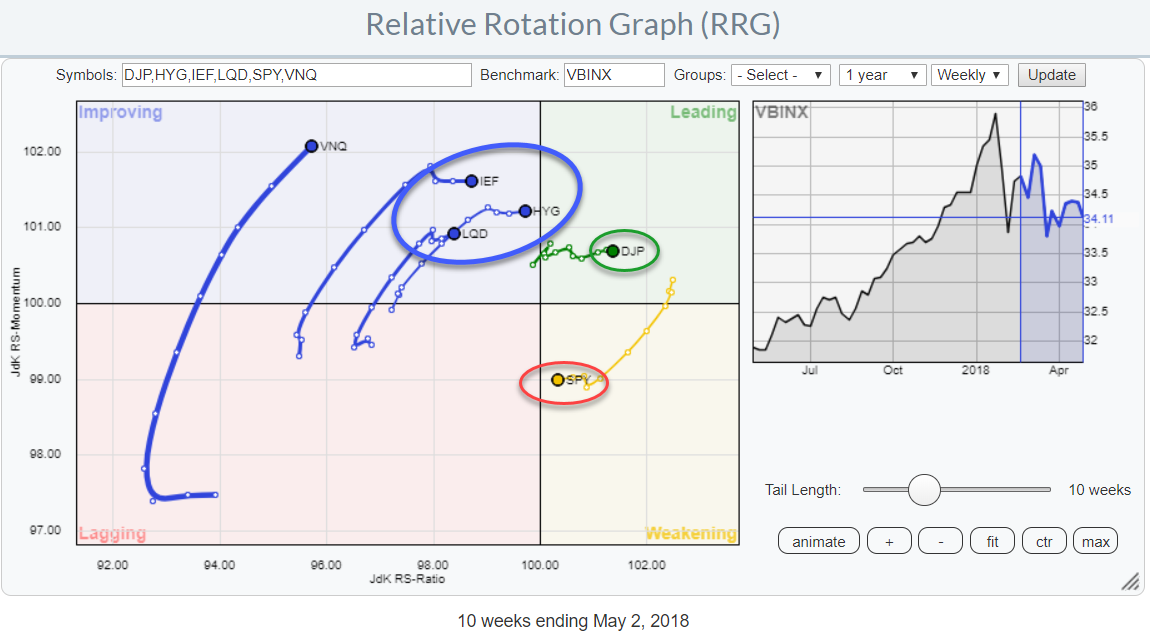

Equities (SPY) is the only asset class inside the leading quadrant AND it is at a positive RRG Heading

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph shows the relative positions of various asset classes (ETFs) against VBINX, a Vanguard balanced index fund, as the benchmark.

The long tails for Real Estate and Commodities stand out, as well as the cluster of fixed income related asset classes inside the red oval.

The strongest...

READ MORE

MEMBERS ONLY

Equities (SPY) is the only asset class at positive RRG Heading

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph shows the relative positions of various asset classes (ETFs) against VBINX, a Vanguard balanced index fund, as the benchmark.

The long tails for Real Estate and Commodities stand out, as well as the cluster of fixed income related asset classes inside the red oval.

The strongest...

READ MORE

MEMBERS ONLY

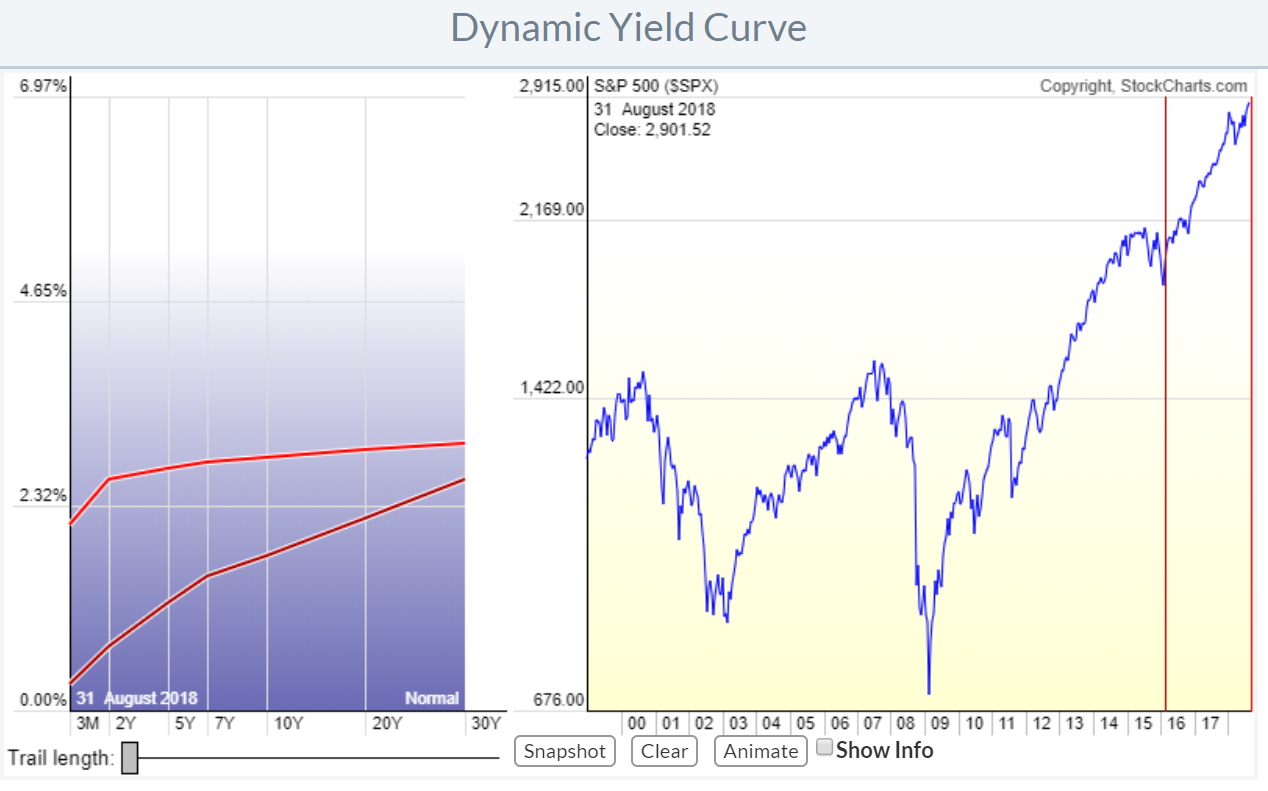

Combining RRG and the (dynamic) yield curve tool extended

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

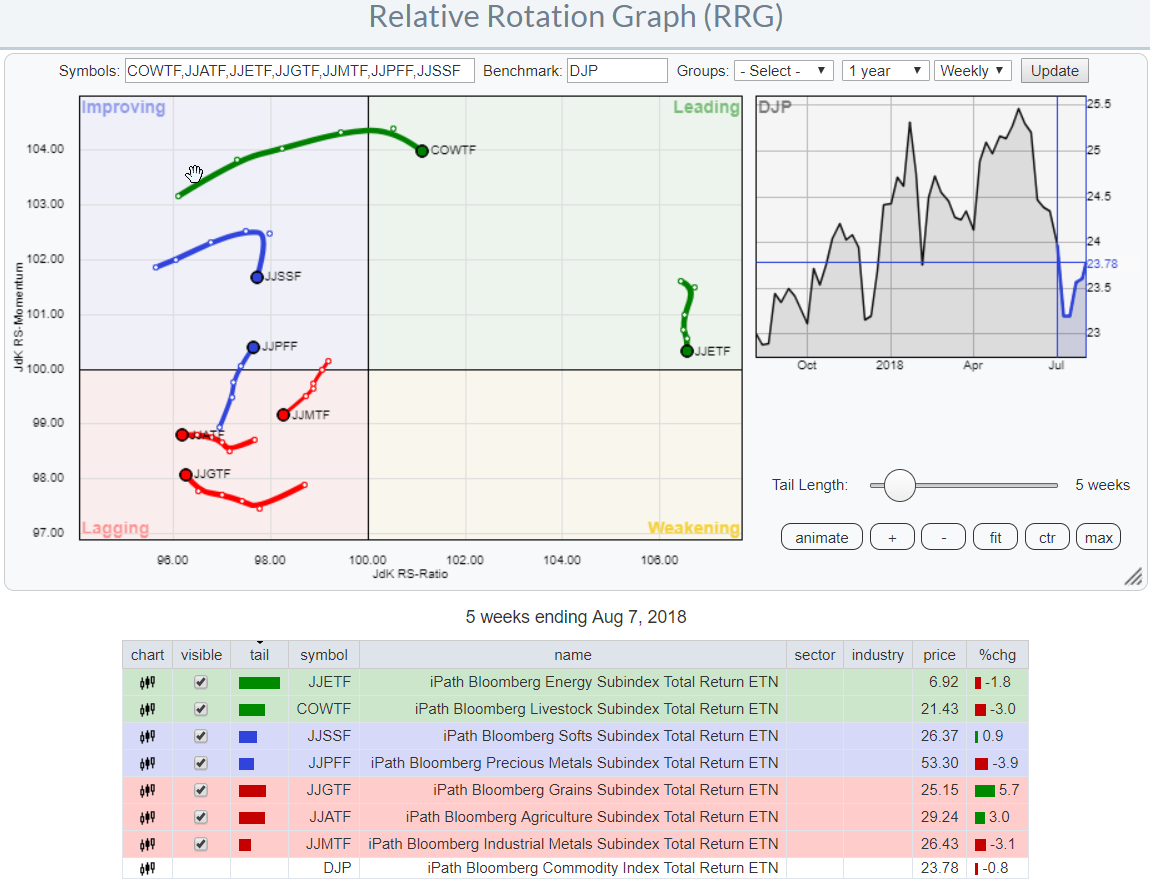

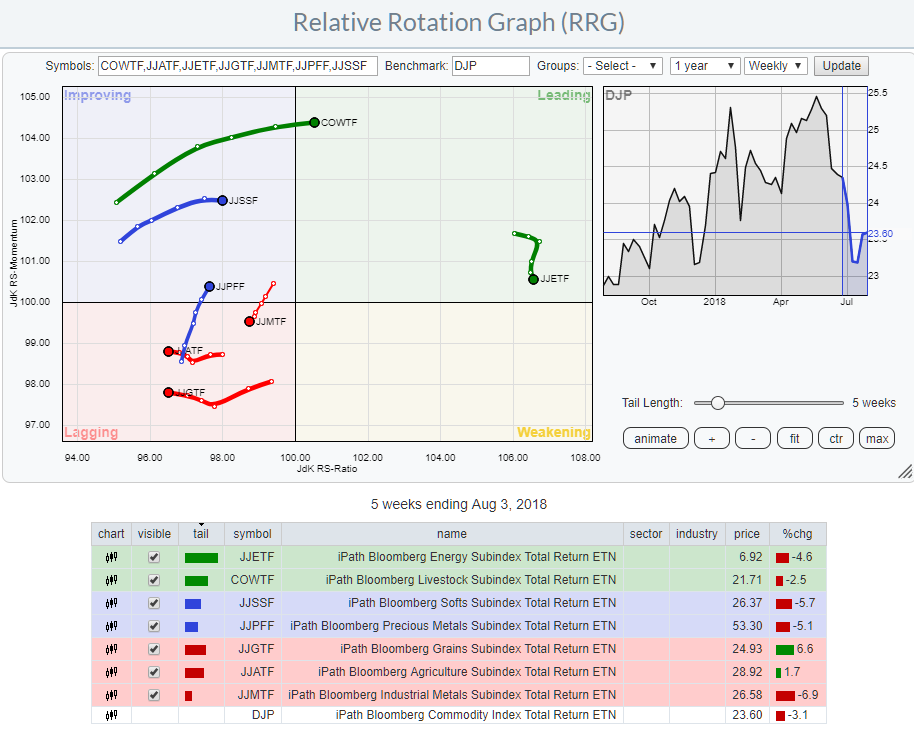

In one of my recent articles, I high lighted that Relative Rotation Graphs can do (much) more than just show equity sector rotation by showing how RRG can be used to analyze rotation among the different commodity groups against a broad commodity index.

This post expands on a recent article...

READ MORE

MEMBERS ONLY

Combining Relative Rotation Graphs and the (dynamic) yield curve tool

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In one of my recent articles, I high lighted that Relative Rotation Graphs can do (much) more than just show equity sector rotation by showing how RRG can be used to analyze rotation among the different commodity groups against a broad commodity index.

In this post, I want to expand...

READ MORE

MEMBERS ONLY

PFE takes the lead in Health Care sector rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph shows the rotation of the Health Care sector over the last five weeks against SPY. The dimmed trails are the other US sectors.

The strong rotation from improving into leading at a steady positive RRG-Heading (0-90 degrees) suggests that further improvement against SPY is likely.

In...

READ MORE

MEMBERS ONLY

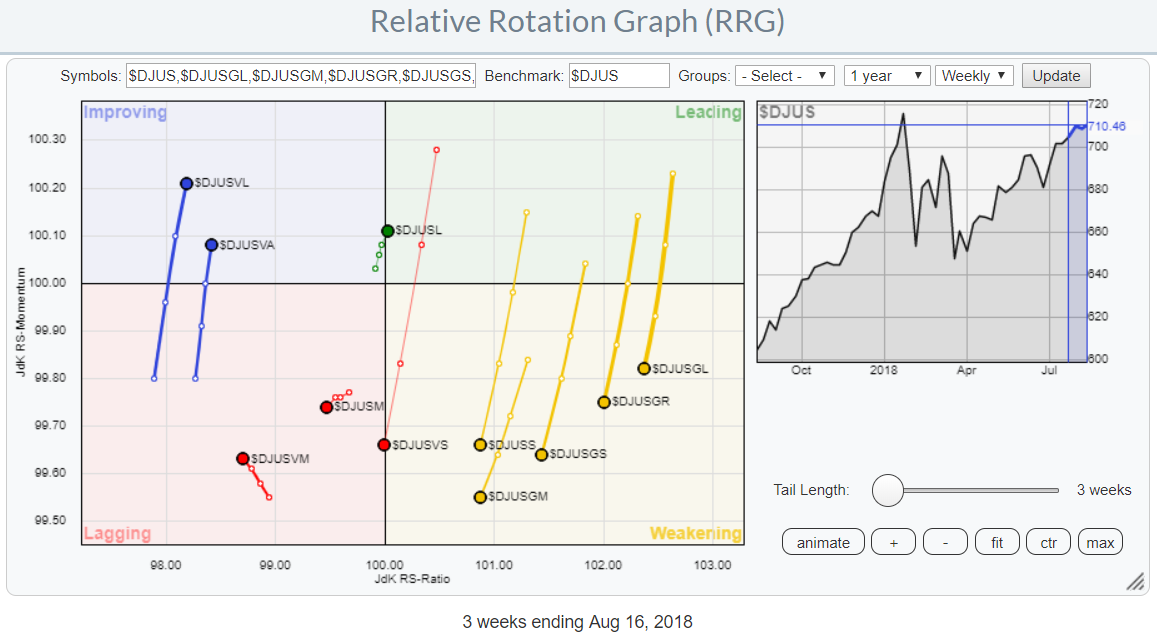

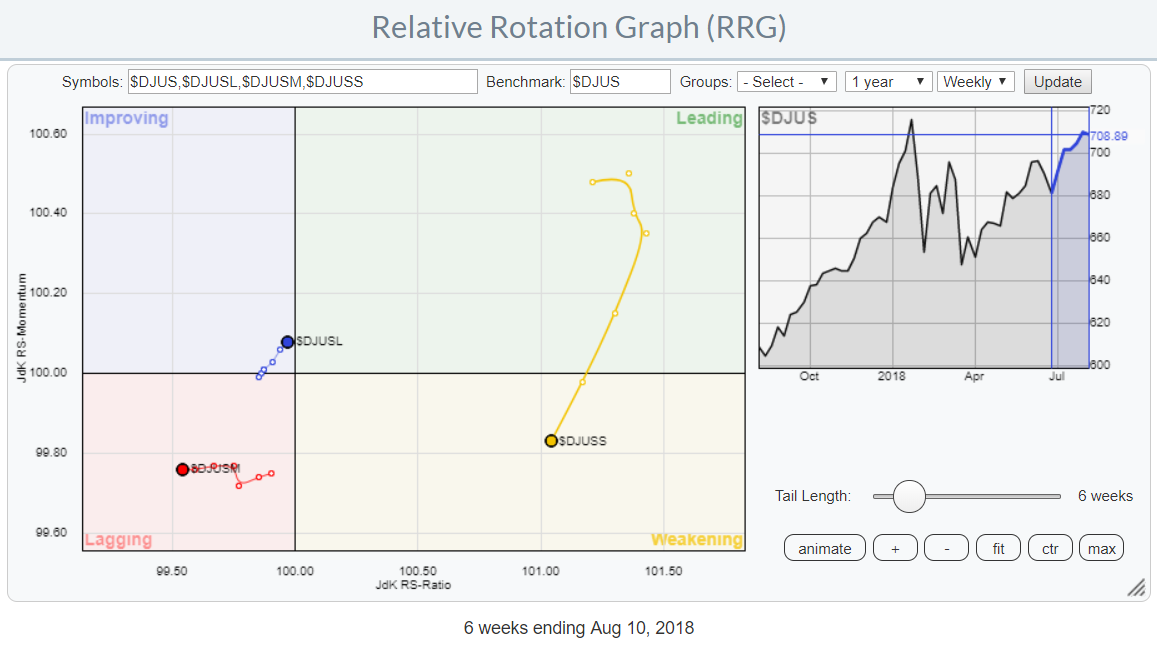

Capturing the US stock market from different angles using Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Instead of showing asset class rotation or sector rotation, Relative Rotation Graphs can also be used to show rotation among various market segments.

You have all seen or heard about a breakdown of the market in large-, mid-, and small-cap stocks. And maybe also the breakdown between growth and value...

READ MORE

MEMBERS ONLY

Value seems to be taking over from growth while small-caps are losing ground

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Every now and then I run a Relative Rotation Graph showing the rotation of various size and value/growth indices for the US market. They (can) give good insights into what areas of the stock market are in favor and which ones are rotating out of favor.

At the moment...

READ MORE

MEMBERS ONLY

Relative Rotation Graphs can show (much) more than just equity sectors (extended)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs are a great tool to visualize equity sector rotation and they are probably most used for that purpose. However, there are many more areas where RRGs can be used to get a big picture view of what is going on among a group of securities or related...

READ MORE

MEMBERS ONLY

Relative Rotation Graphs can show (much) more than just equity sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs are a great tool to visualize equity sector rotation and they are probably most used for that purpose. However, there are many more areas where RRGs can be used to get a big picture view of what is going on among a group of securities or related...

READ MORE

MEMBERS ONLY

Relative Rotation Graph showing strong rotation from Energy (XLE) to Staples (XLP)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

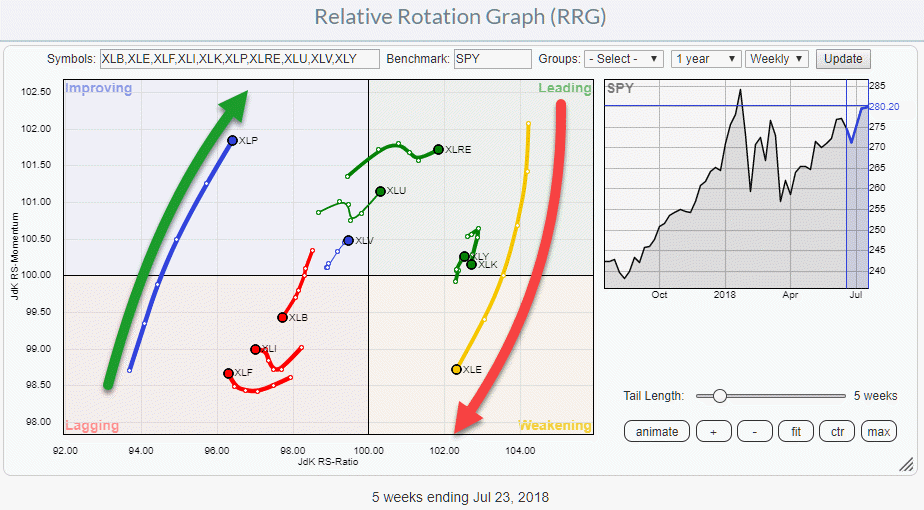

The current Relative Rotation Graph for US sectors is sending a very clear message for two sectors!

Money is flowing OUT of Energy stocks (XLE) and INTO Staples (XLP). The opposite rotation for those two sectors is almost jumping off the screen when you open up this RRG.

It is...

READ MORE

MEMBERS ONLY

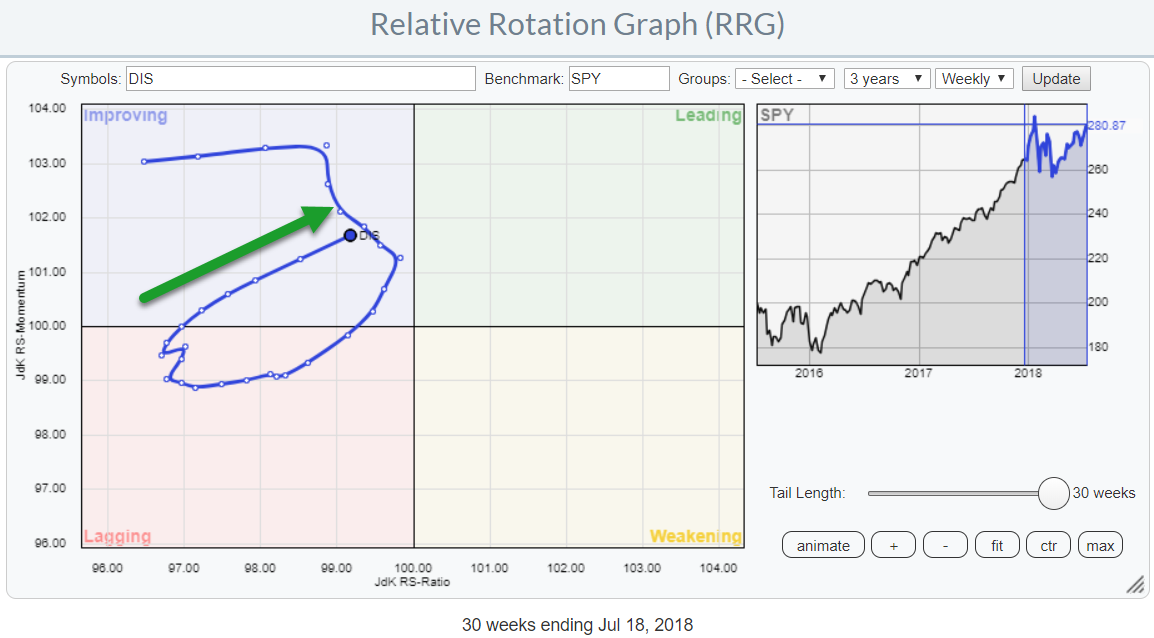

Is Walt Disney (DIS) ready to rumble?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

While working on my previous article, one stock, in particular, drew my attention. I only casually addressed it in that article as I wanted to do a more extensive review separately.

We are talking about Walt Disney (DIS).

In this post, I will try to build a longer-term picture with...

READ MORE

MEMBERS ONLY

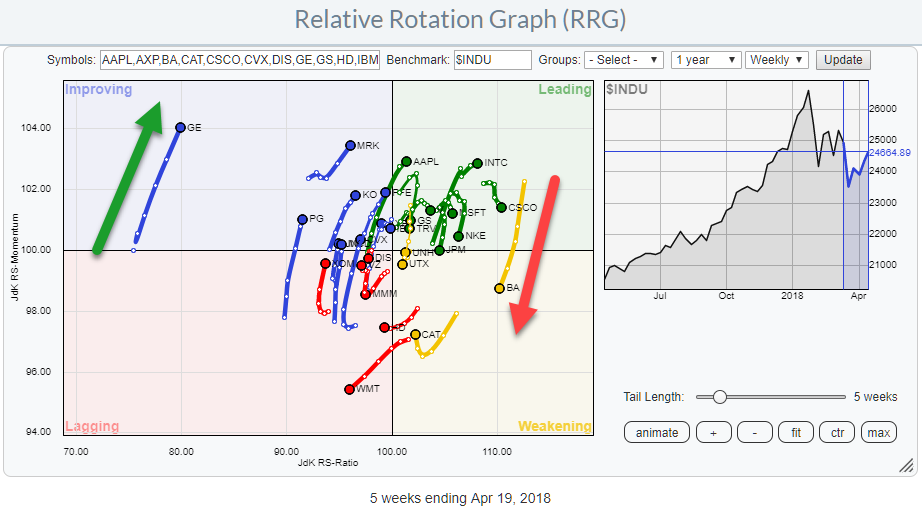

NKE poised for a further rally and outperformance vs $INDU

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

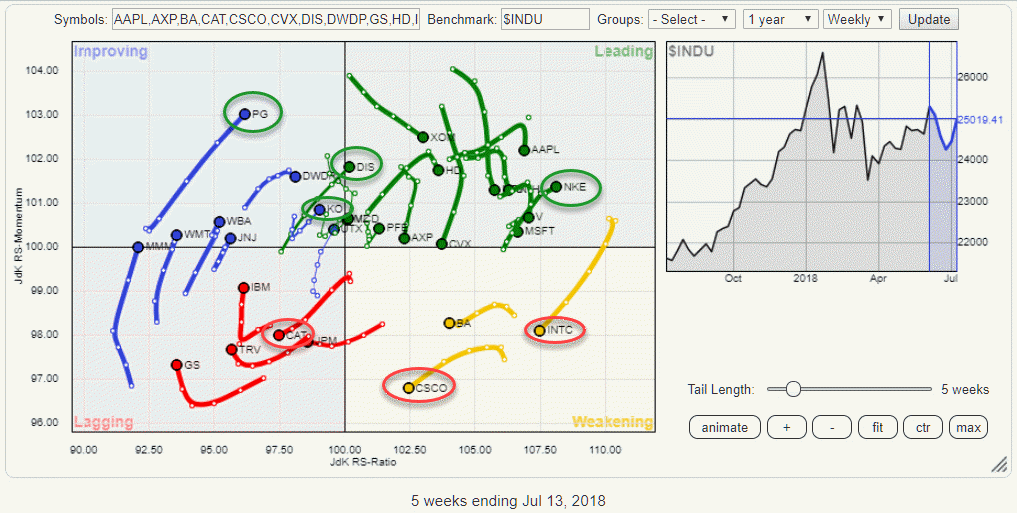

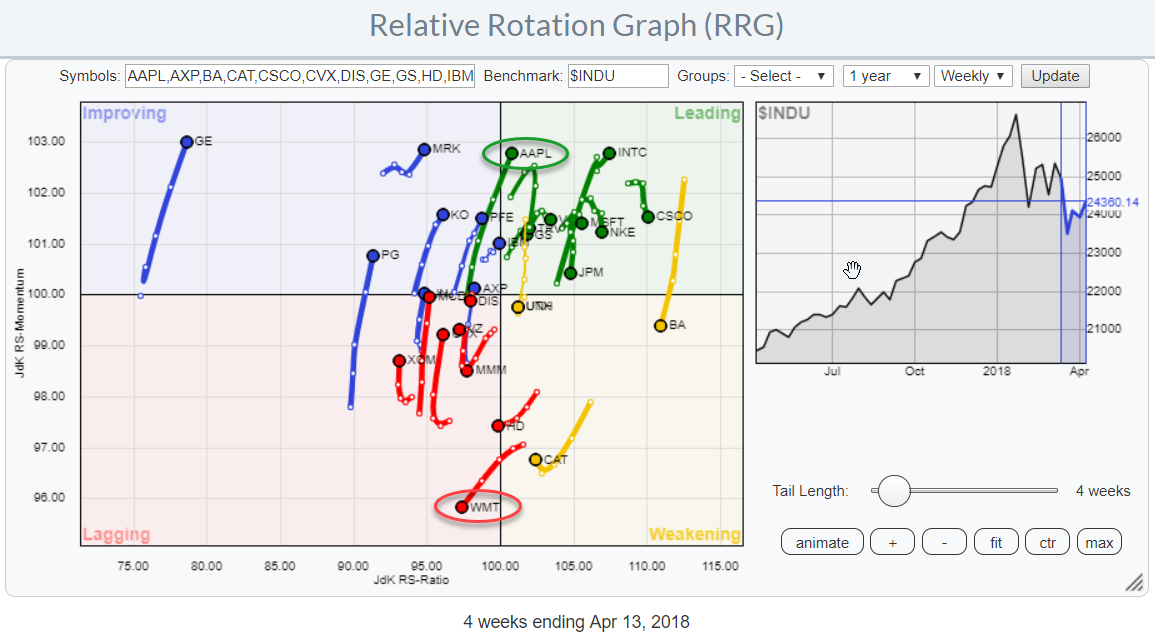

Watching the Relative Rotation Graph of the 30 Dow stocks, there are a few observations that can be made.

To begin with, there is a high concentration of stock inside the leading quadrant, including some mega-cap names like AAPL and MSFT and in the improving quadrant. The bottom half of...

READ MORE

MEMBERS ONLY

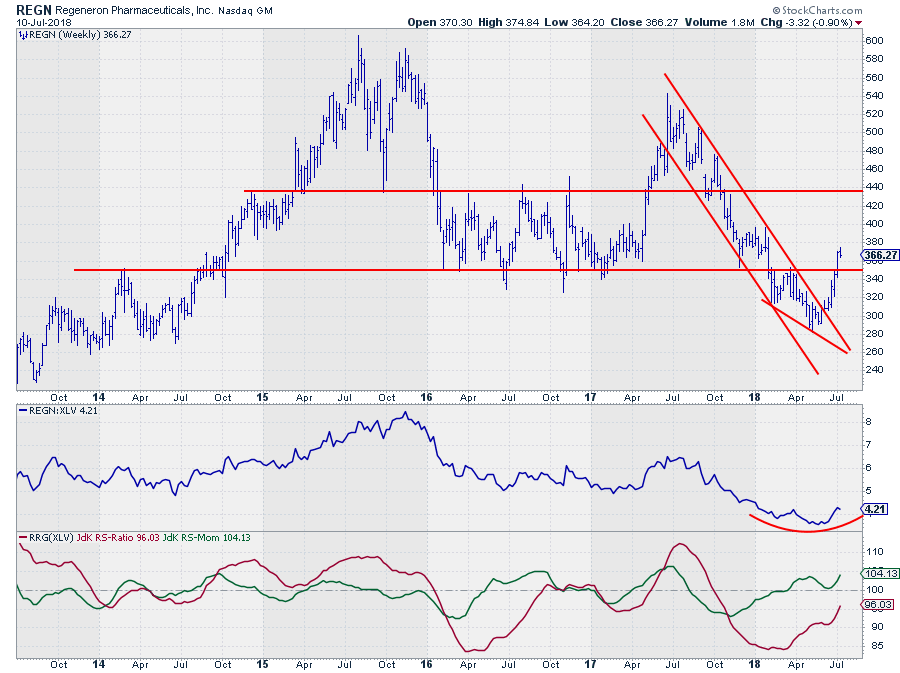

REGN reversing its downtrend?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph that shows all members of the Health Care sector (XLV) against the XLV benchmark, REGN stands out in a positive way.

On the weekly RRG, the stock is positioned inside the improving quadrant, close to leading and moving at a strong RRG-Heading while the week-to-week...

READ MORE

MEMBERS ONLY

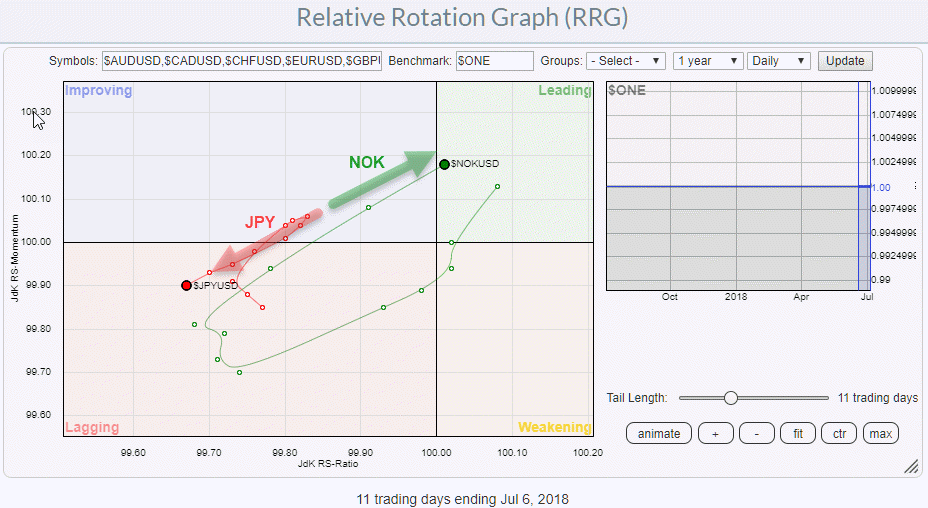

NOK/JPY, a FOREX pair trade from RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs are not only used to look at sector-rotation or help with asset allocation decisions but can also help you to pinpoint potential forex trades.

Most currency traders are short-term orientated so the RRG above is a daily chart showing the rotation of the Norwegian Krone and the...

READ MORE

MEMBERS ONLY

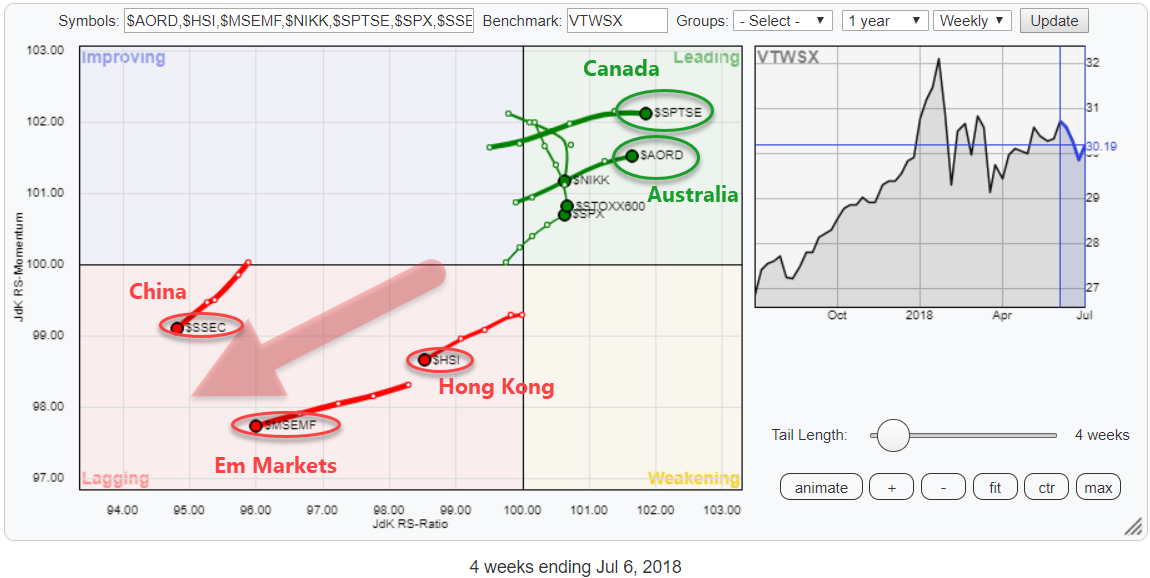

It's hard to believe but some markets are (starting to) outperform(ing) the US...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This is an extended version of the recent RRG article in Chartwatchers "Checking out the land down under on a Relative Rotation Graph".

Even if your investment portfolio is tied to a specific country or region it makes sense to keep an eye on developments around your geographical...

READ MORE

MEMBERS ONLY

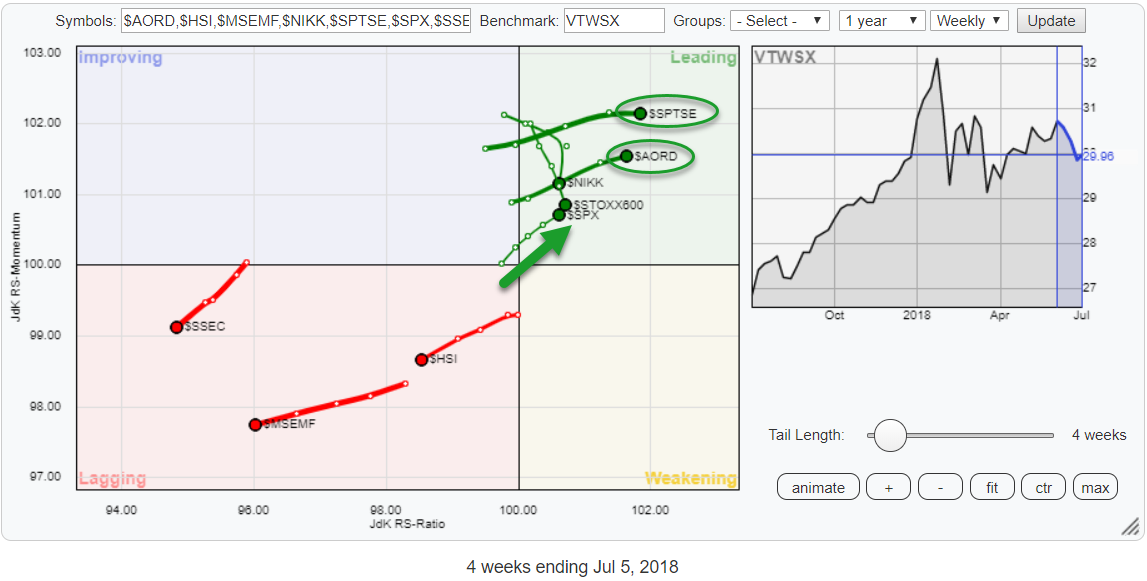

Checking out the land down under on a Relative Rotation Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph above I have grouped a selection of world equity market indices, mainly some big regions, and put them against the Vanguard Total World Stock Index (VTWSX) as the benchmark.

What immediately grabs our attention, or at least mine is the fact that this selection is...

READ MORE

MEMBERS ONLY

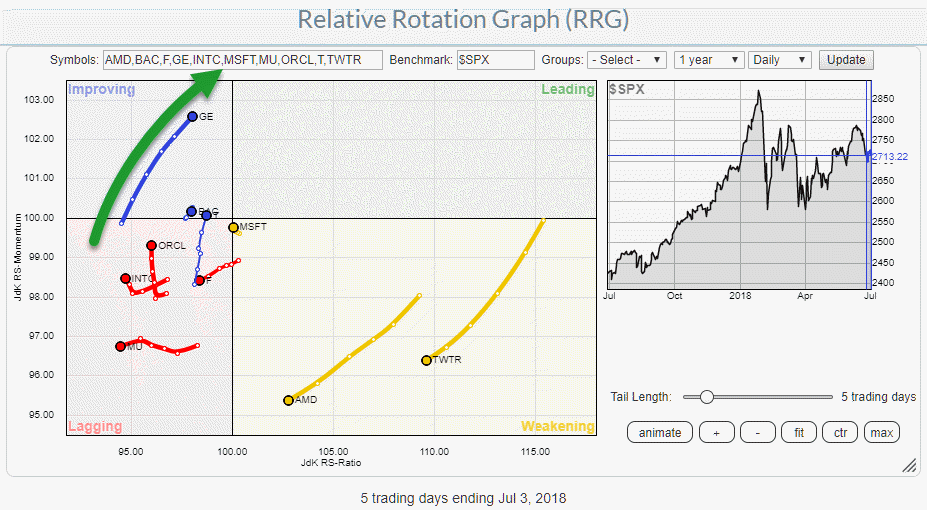

I just picked GE from the Relative Rotation Graph of most active stocks in the S&P 500

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

A good start of the day, at least for me is to go to the StockCharts.com dashboard and look at the Top 10, most active, market movers, in the S&P 500 index. The table gives a quick idea of what has happened the previous day.

From there...

READ MORE

MEMBERS ONLY

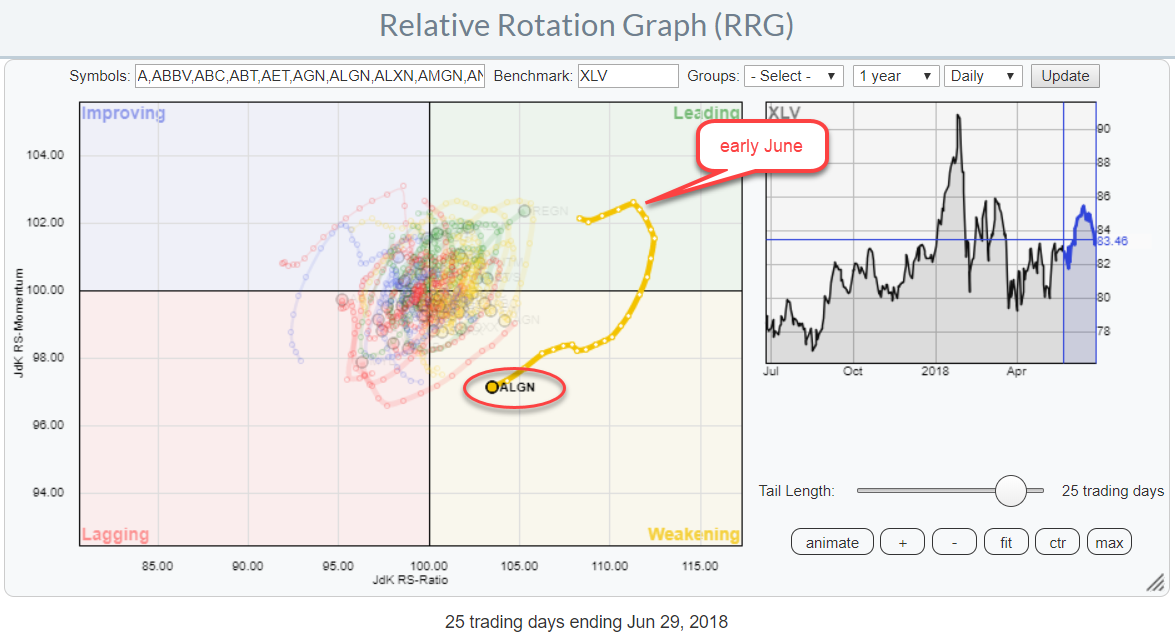

Wide rotation for ALGN on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This (DAILY) Relative Rotation Graph shows the rotation of the Health Care stocks against their XLV benchmark.

One stock really stands out because of its wide rotation.

ALGN crossed over into the leading quadrant, from improving, last May and sharply moved higher on the price chart since then while building...

READ MORE

MEMBERS ONLY

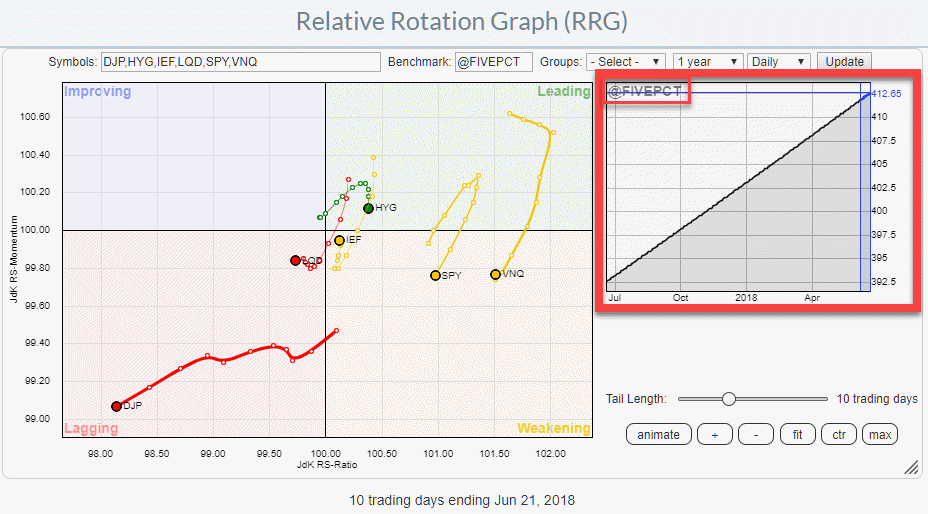

Special benchmarks for Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week Thursday (6/21) was the third Thursday (try saying that out loud ;) ) of the month. The day that I join Tom and Erin in the Market Watchers Live show to talk about Relative Rotation Graphs.

In the show, which you can play back here, I talked about different...

READ MORE

MEMBERS ONLY

The BIG picture in ONE picture

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Note 1: This article was posted earlier as part of the ChartWatchers newsletter last weekend. One paragraph and an up-to-date daily version of the Relative Rotation Graph for asset classes has been added to the bottom of this article.

Note 2: A pre-populated universe for Asset Allocation has been added...

READ MORE

MEMBERS ONLY

Technology sector rotating back to leading while Discretionary/Staples spread widens further

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph shows the rotation of the ten S&P 500 sector ETFs (SPDR family) against the S&P 500 index ETF (SPY).

The rotation of the technology sector (XLK) back into the leading quadrant after a short period of rotation through the weakening quadrant is...

READ MORE

MEMBERS ONLY

Combining Relative Rotation Graphs and the "Turtle Soup" setup

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On Monday 21 and Tuesday 22 May I stepped in for Erin Swenlin and acted as the co-host to Tom Bowley in the Market Watchers Live show. Clearly, we talked a lot about RRGs but as MWL is not all about RRG I wanted to bring something different to the...

READ MORE

MEMBERS ONLY

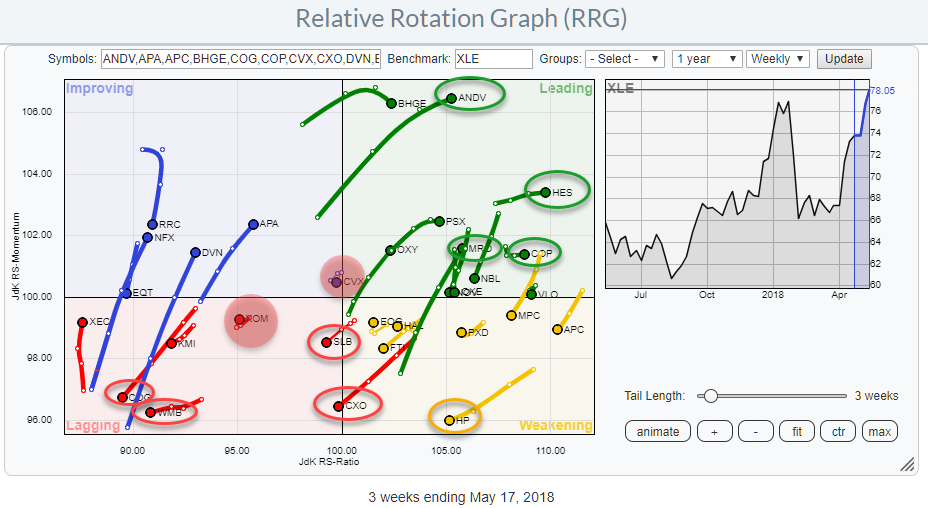

Beat the Energy sector by avoiding XOM & CVX

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In the previous RRG blog, I introduced the availability of pre-populated groups holding individual equities for each of the ten S&P sectors. This addition makes it much easier for users of the Relative Rotation Graph tool on Stockcharts.com to drill down to the individual equity level from...

READ MORE

MEMBERS ONLY

New pre-populated universes for Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

If you have ever watched one of the webinars or Market Watchers Live shows that I have done here at Stockcharts.com, you may have seen me use Relative Rotation Graphs holding individual stocks and compare them to their sector benchmark.

After each appearance, I always got a few questions...

READ MORE

MEMBERS ONLY

Commodities taking over from equities?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

For a very long time equities have been the dominating asset class, stuck at the right-hand side of the Relative Rotation Graph showing six different asset classes.

That situation is now changing. Equities (SPY) is still at the right hand (positive) side of the RRG but inside the weakening quadrant,...

READ MORE

MEMBERS ONLY

All eyes on the CAT

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Yesterday, Thursday 19th of April, it was my turn again to join Tom and Erin in their Market Watchers Live show again. By the way, I will be joining them every third Thursday of the month to talk about RRG and talk about market developments from an RRG point of...

READ MORE

MEMBERS ONLY

AAPL and WMT moving in opposite directions on Relative Rotation Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week I attended the CMT Association’s annual symposium in New York City. One of the industry events that I visit each year.

On the one hand to learn from other industry professionals but very much also to catch up with friends and maintain relationships.

As I am writing...

READ MORE

MEMBERS ONLY

Relative Rotation Graph shows near term strength for Utilities and Staples

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

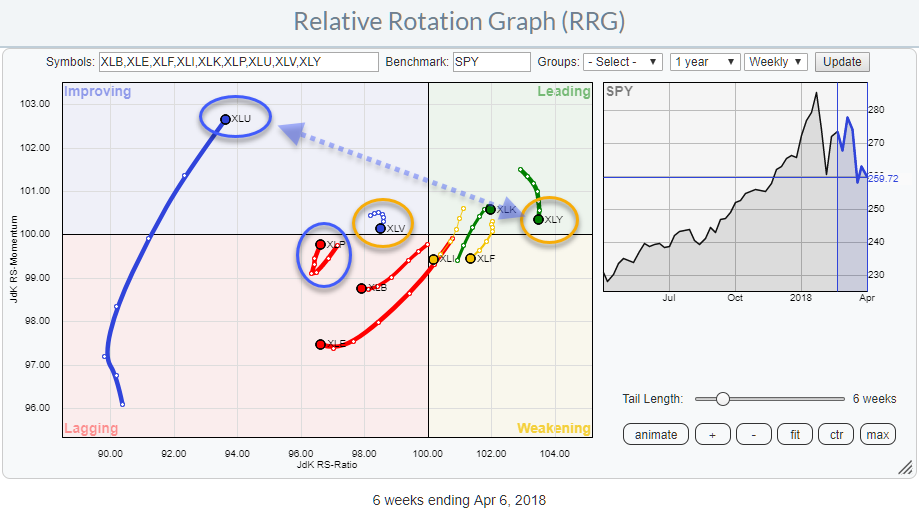

The Relative Rotation Graph for US sectors is showing us a few interesting rotational patterns for the week ending 4/6.

Studying the RRG above, there are two sector pairs which rotations I want to investigate a bit further.

The first one is Consumer Discretionary vs Utilities because they are...

READ MORE