MEMBERS ONLY

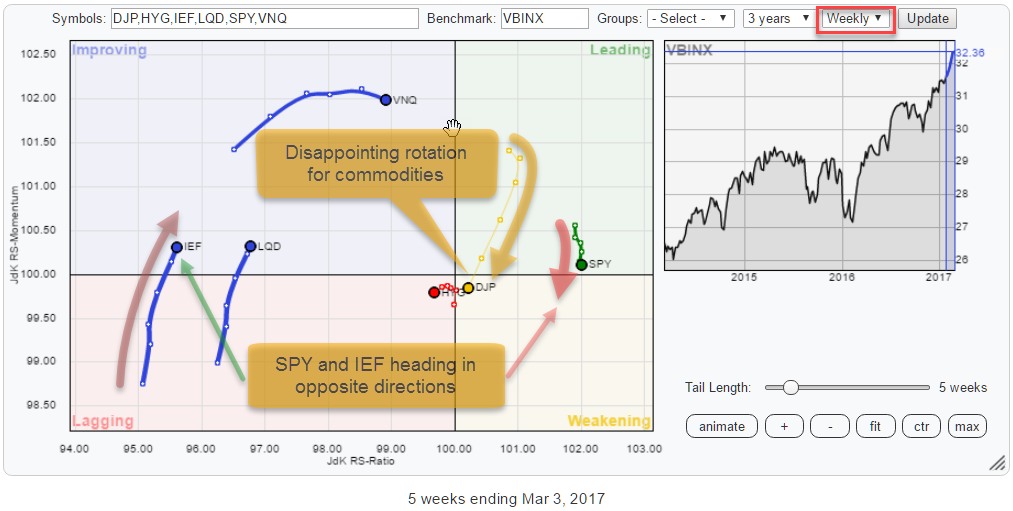

Double divergence building up in SPY:IEF ratio and commodities need another rotation through lagging.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Summary

* Opposite rotations for Equities and Bonds on both weekly and daily RRGs

* Rapid weakening of commodities over past six weeks

* Current positioning of SPY suggests some short-term weakness before resuming trend

* IEF in consolidation pattern after breaking long-term uptrend

* Double divergence in SPY:IEF ratio points to potential corrective...

READ MORE

MEMBERS ONLY

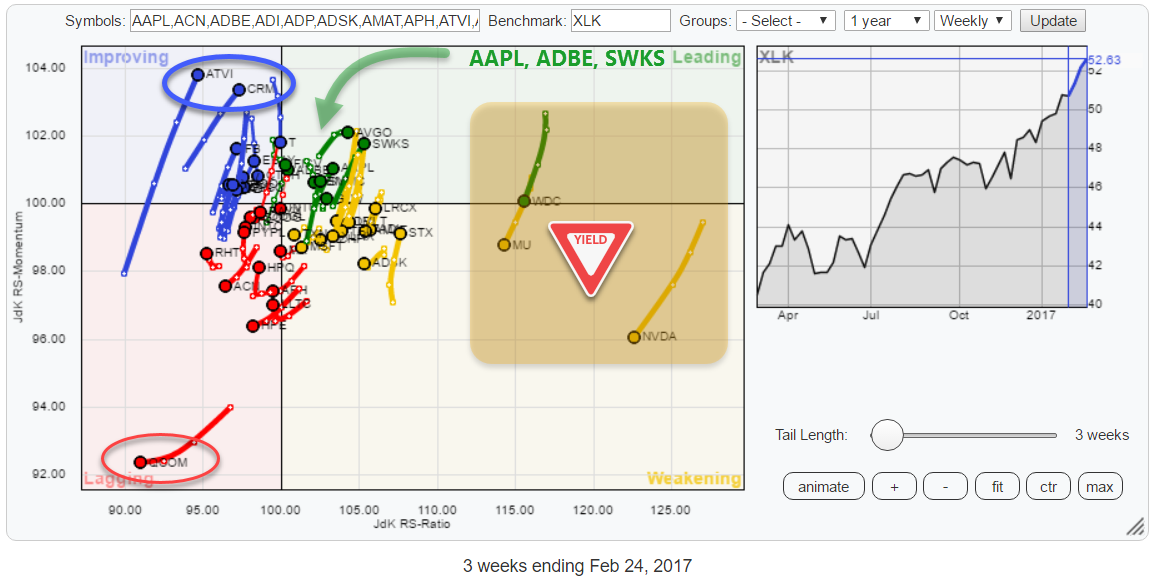

Bye bye NVDA, WDC, MU and Hello, ADBE, AAPL, SWKS

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Summary

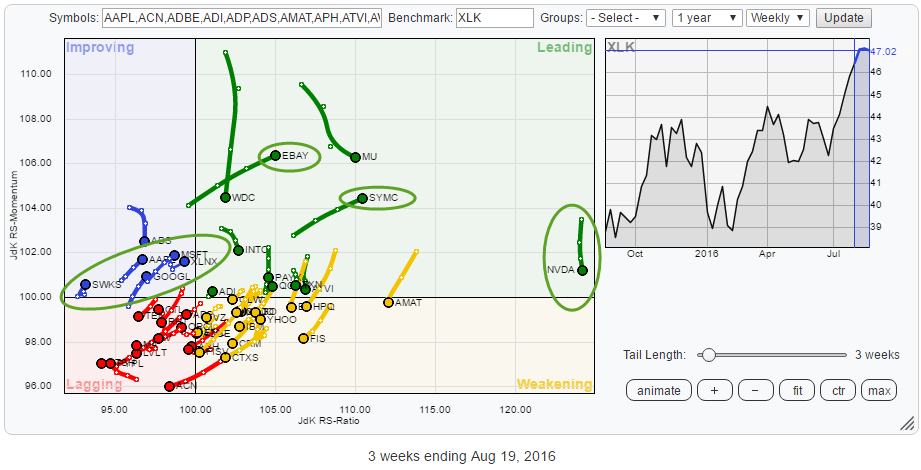

* XLK only sector inside leading quadrant for S&P 500 universe

* QCOM nosediving inside Lagging quadrant

* NVDA rapidly losing its top position within the sector

* WDC tracking MU lower into the weakening quadrant

* GLW providing excellent example of stable uptrend (price and relative)

* ADBE pushing into leading from...

READ MORE

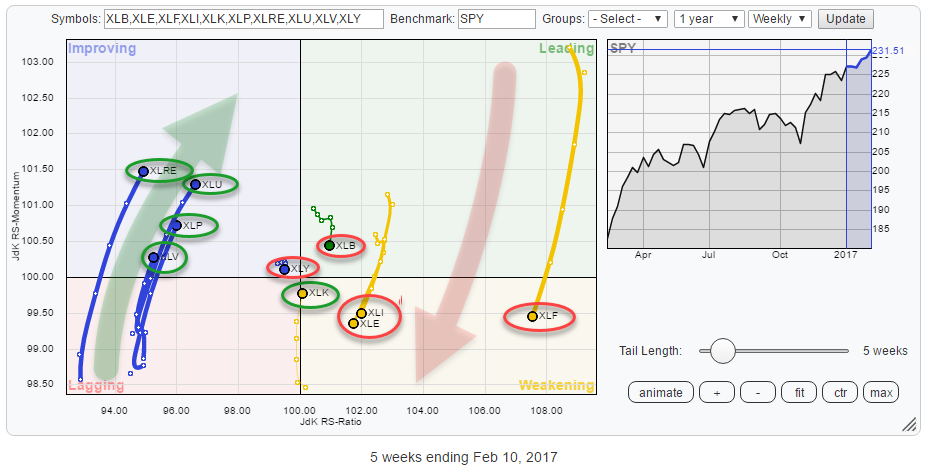

MEMBERS ONLY

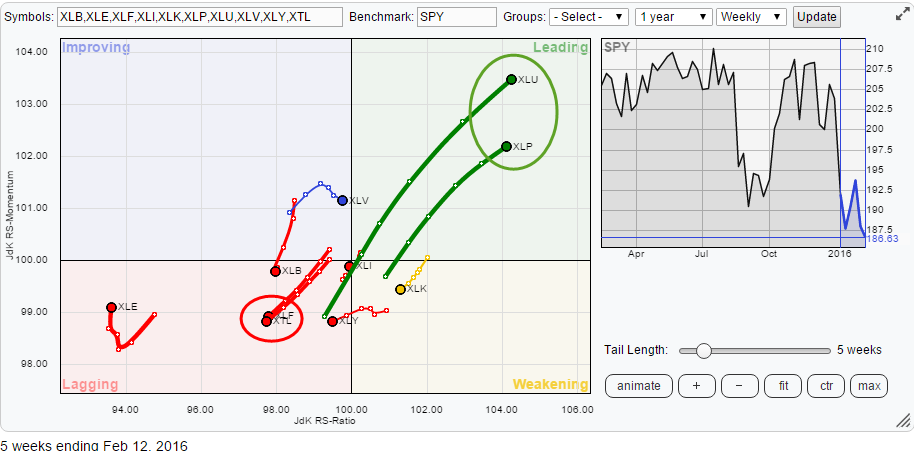

Sector rotation from Energy to Utilities, market in transition

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Summary

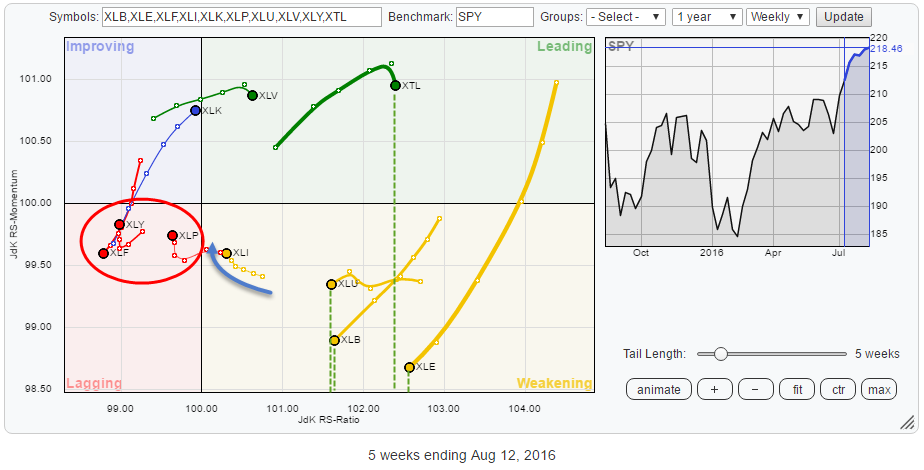

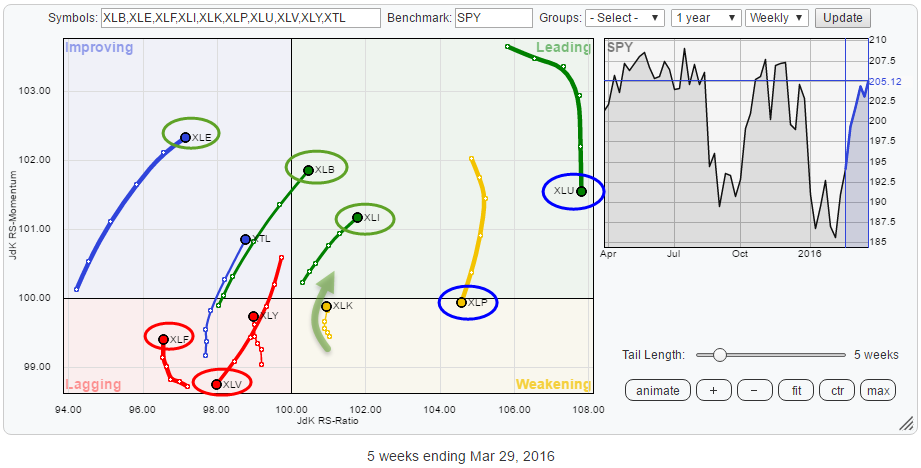

* NO sectors inside the lagging quadrant and only one in leading

* Sector rotation suggests market in transition

* Financials continue to loose ground vs Healthcare

* Technology picking up against Materials

* Sector rotation from Energy to Utilities starting to shape up

Quick scan

A first look at the Relative Rotation Graph...

READ MORE

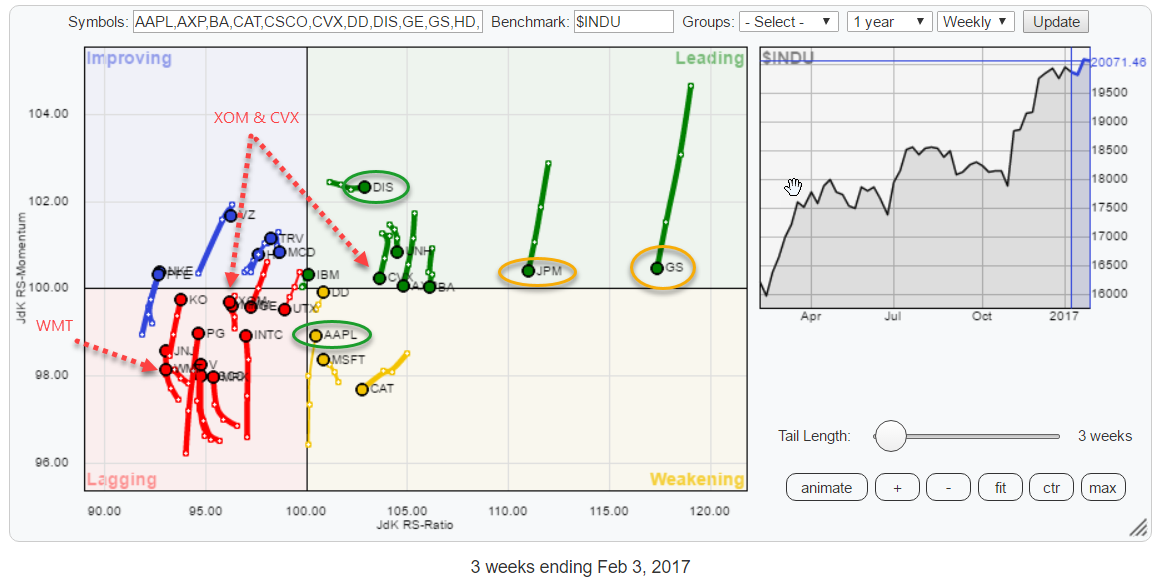

MEMBERS ONLY

AAPL starting to lead technology sector rotation again

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Summary

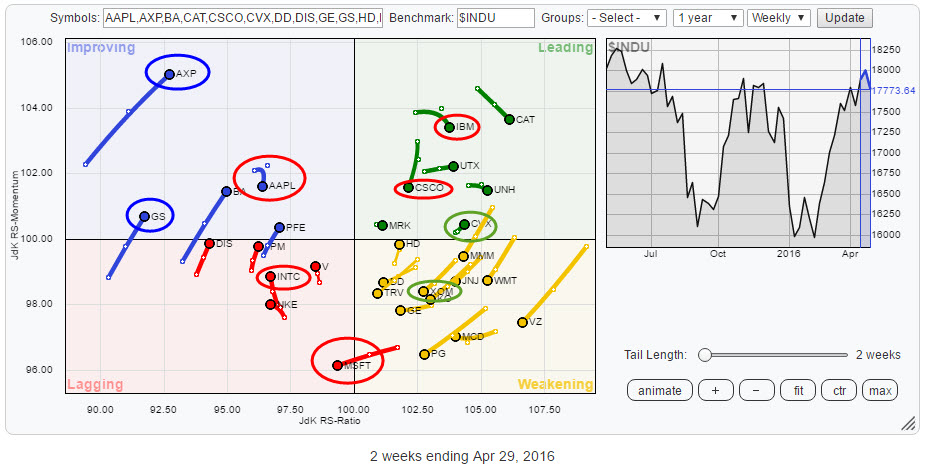

* Inside Financials, money is shifting from GS & JPM to V

* AAPL turning back up towards leading quadrant, makes it leading stock in technology

* XOM and CVX confirm weak rotation for Energy sector

* Opposite rotations for DIS and WMT inside Staples sector

Quick scan

The Relative Rotation Graph above...

READ MORE

MEMBERS ONLY

RRG shows money flowing into commodities!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

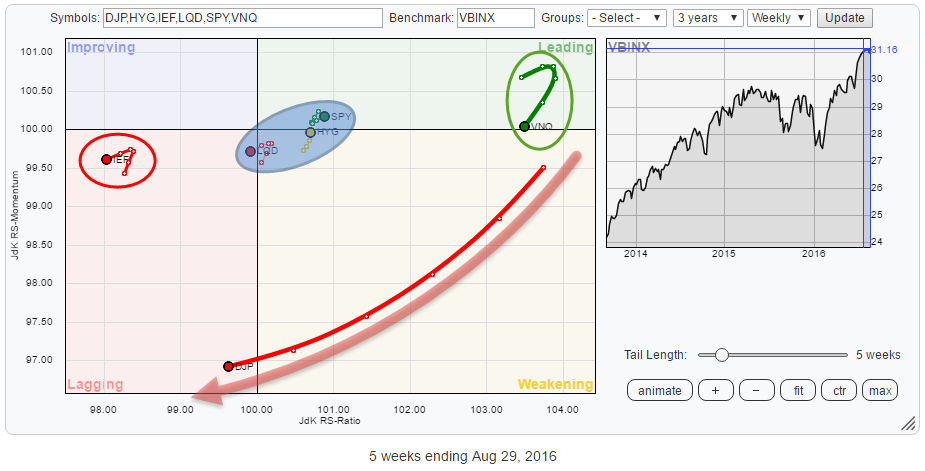

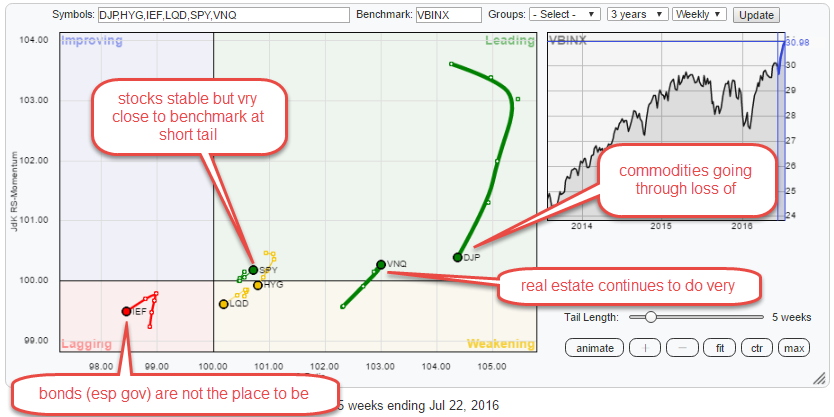

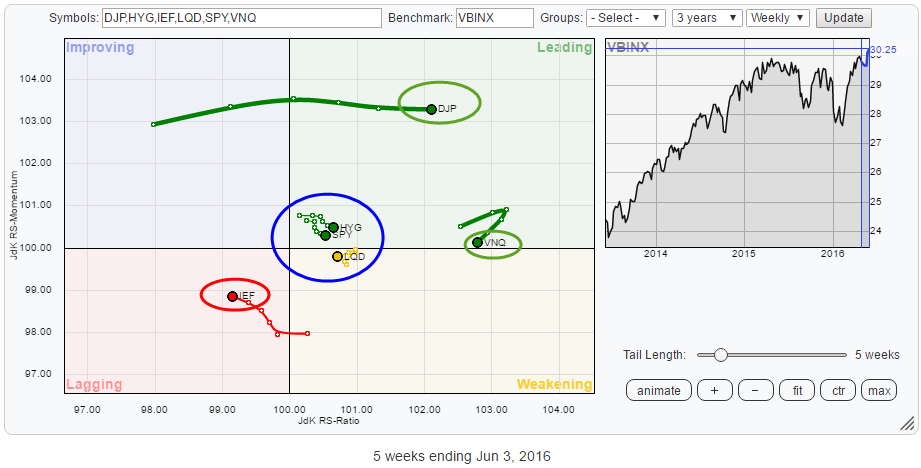

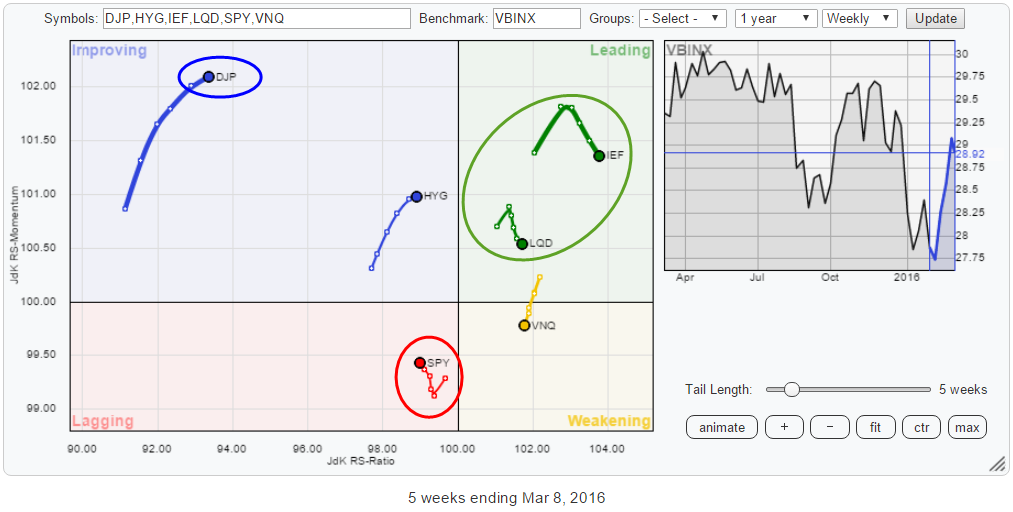

The Relative Rotation Graph holding a number of asset class ETFs is showing a strong push of commodities (DJP) into the leading quadrant. Together with Real Estate (VNQ), these two asset classes are showing the most powerful headings in combination with the longest tails.

They deserve a further investigation.

Summary...

READ MORE

MEMBERS ONLY

Is JNJ the pink elephant in the XLV room?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above holds the constituents of the XLV (Health Care) ETF. In this post, I want to follow up on my previous article which pointed at the potential rotation from Financials into Health Care and take a look at the relative rotation of individual stocks that make...

READ MORE

MEMBERS ONLY

Rotation from Financials into Health care? Two sectors at extremes.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

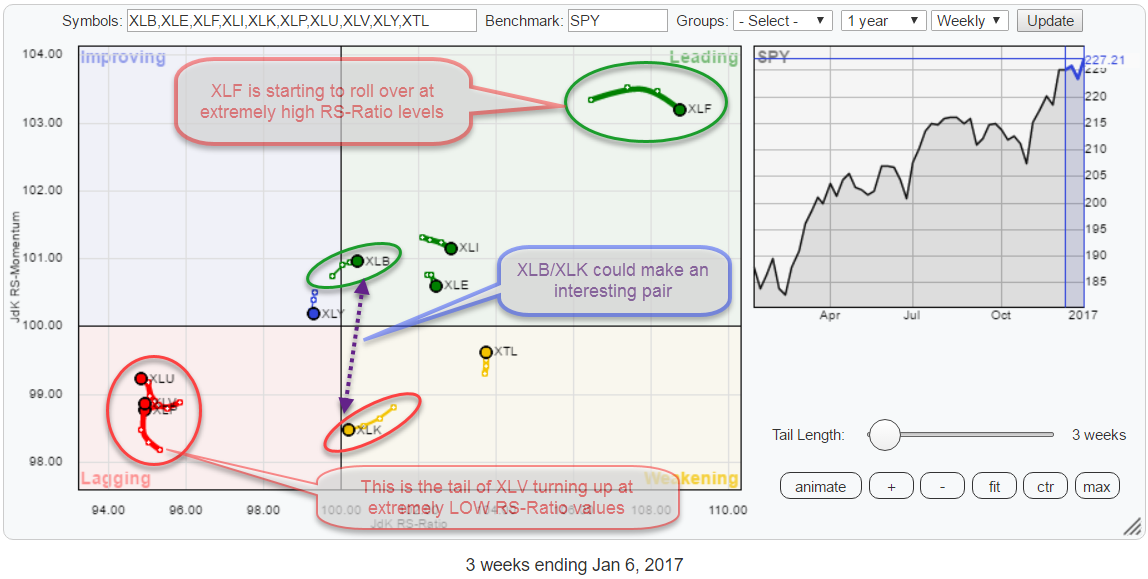

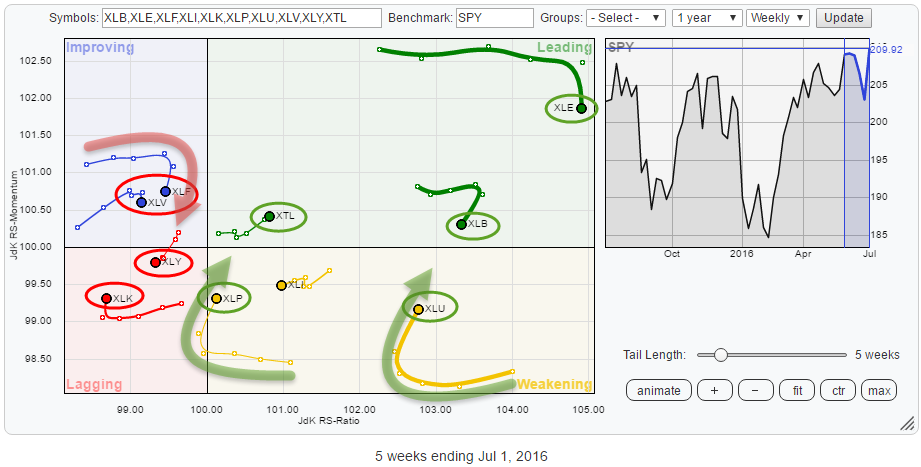

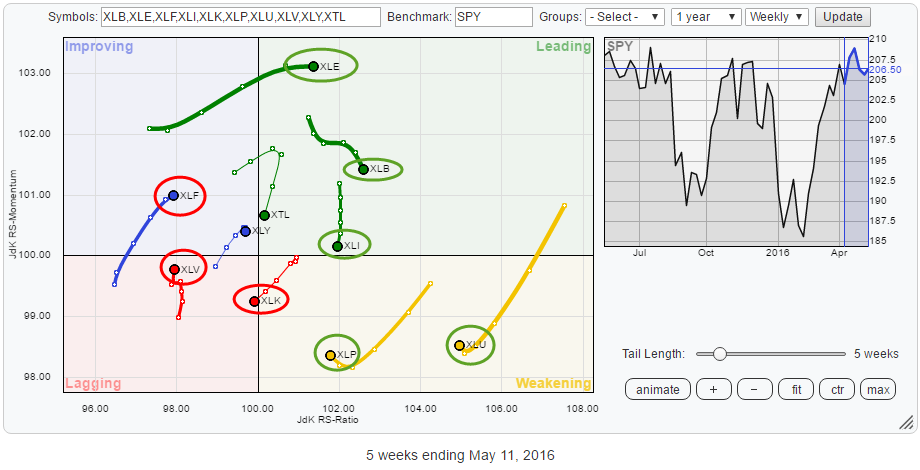

The Relative Rotation Graph below holds the sector ETFs that make up the S&P 500 universe and uses the S&P 500 index ETF (SPY) as its benchmark in the center of the graph.

Four rotational patterns, two pairs, capture my attention when I look at this...

READ MORE

MEMBERS ONLY

Tech stocks losing IT

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

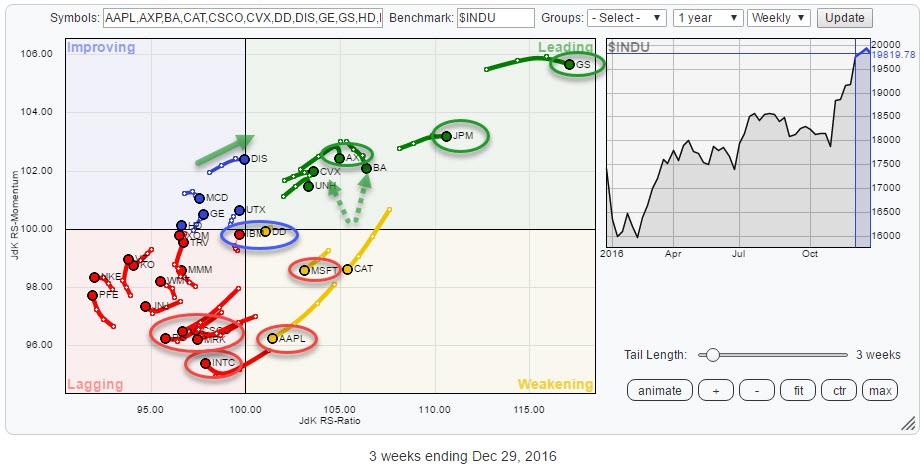

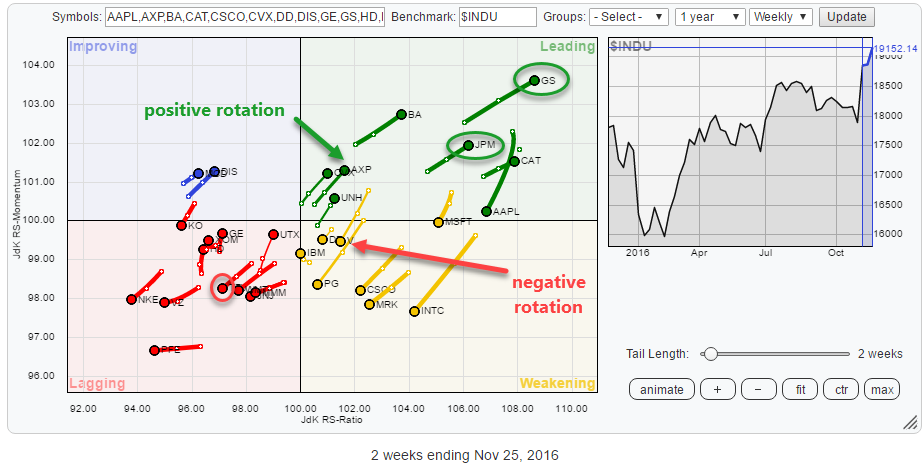

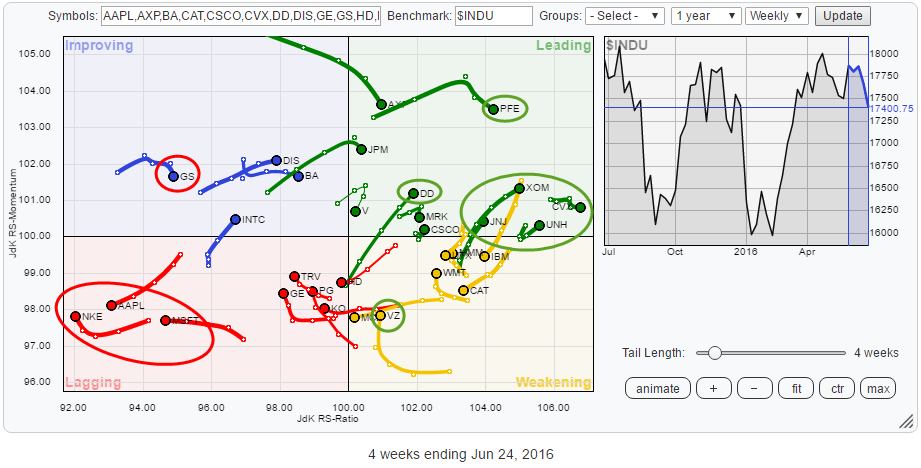

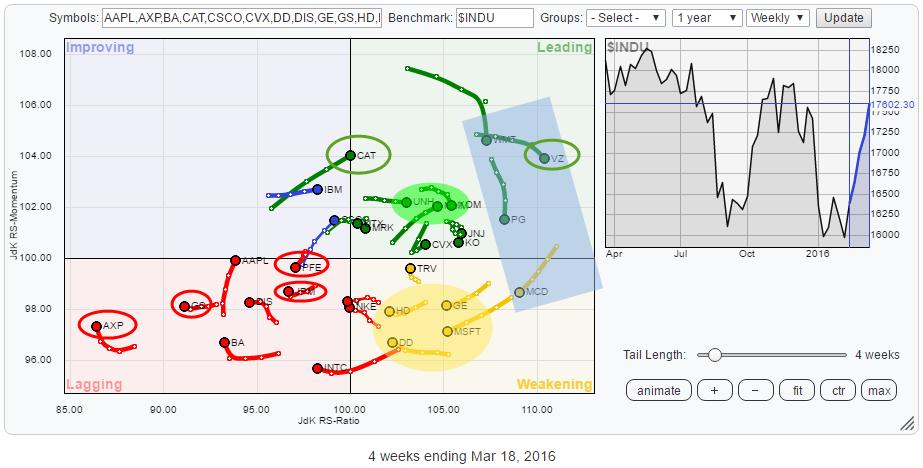

From July to November of this year Tech stocks have dominated the performance of the Dow Jones Industrials Index ($INDU) but then came November!

The Relative Rotation Graph of all DJ Industrials stocks below shows the rotational pattern of all $INDU members with a three-week tail.

The recent weakness for...

READ MORE

MEMBERS ONLY

US equities are good, Japanese are better - for now.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

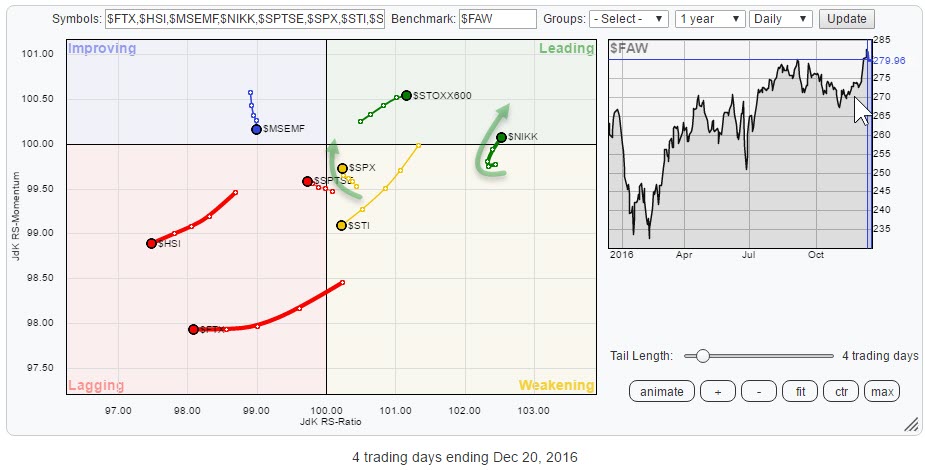

The Relative Rotation Graph above holds a number of (world) equity indices compared to the FTSE all world index as the benchmark, using daily data. For those of you who are following my regular RRG blog, this means a shorter-term view than you are used to from me.

The rotations...

READ MORE

MEMBERS ONLY

What the ....happened in the week ending 11 November?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

My last article on asset allocation was posted just before election day (11/8), and I was not happy about the rotation for equities against bonds...

What a difference a week makes.

The relative rotation graph above shows the rotation of various asset classes, represented by ETFs, over the past...

READ MORE

MEMBERS ONLY

Put some focus on the materials sector (XLB) but be aware of which stocks to avoid.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

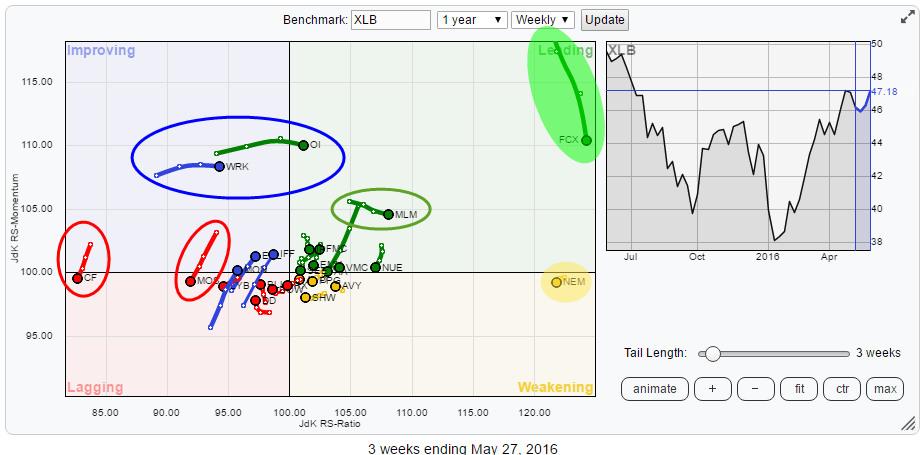

Last weeks RRG blog looked at the sector ETFs that make up the S&P 500 index. Materials, the XLB ETF, came out as one of the, more promising, sectors on its way to the leading quadrant.

In this post, I will look into the individual stocks that make...

READ MORE

MEMBERS ONLY

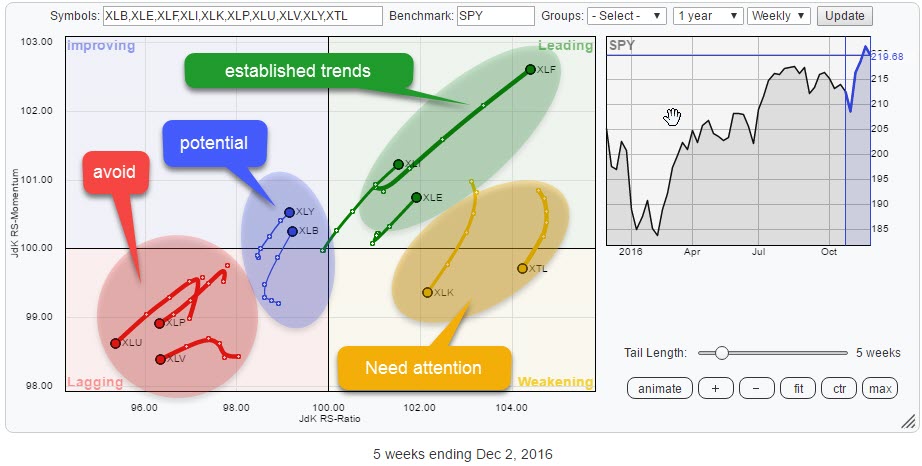

Very clear rotational picture in US sectors! Watching XLE, XLI and XLB for opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above shows the rotational picture for US sectors. For a change the rotations are well defined and clearly visible, which immediately raises the question; " For how long?"

I will try to answer the question, but no-one ever said it was easy.. ;)

Summary

* Well defined...

READ MORE

MEMBERS ONLY

Financials are leading but they are not all equally good

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After the dust has settled, it is time to assess what is going on under the hood.

The above Relative Rotation Graph holds the 30 Dow Jones Industrials components. As usual, they are fairly evenly spread out over the canvas of the RRG plot.

From the RRG of the US...

READ MORE

MEMBERS ONLY

How to use Relative Rotation Graphs to monitor your portfolio.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

As (many of) you may know my fellow commentator Arthur Hill lives in Belgium. That makes him, geographically, my closest StockCharts.com colleague.

On Tuesday 8 November, indeed election day, the Amsterdam chapter of the MTA (Market Technicians Association) had Katie Stockton of BTIG over as a guest speaker for...

READ MORE

MEMBERS ONLY

Bond market charts look horrible but they show positive rotation on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

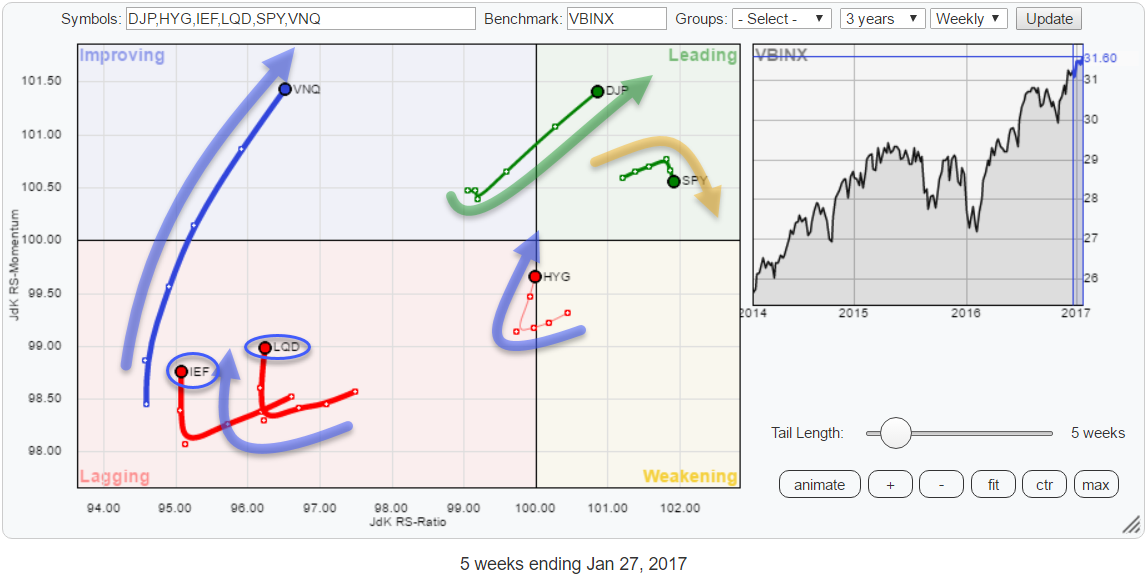

The Relative Rotation Graph above shows the rotation of various asset classes against VBINX, a balanced index fund holding 60% in equities and 40% in bonds.

The current rotational picture is highlighting a pretty clear rotational picture for various (groups of) asset classes.

The most important observation is that all...

READ MORE

MEMBERS ONLY

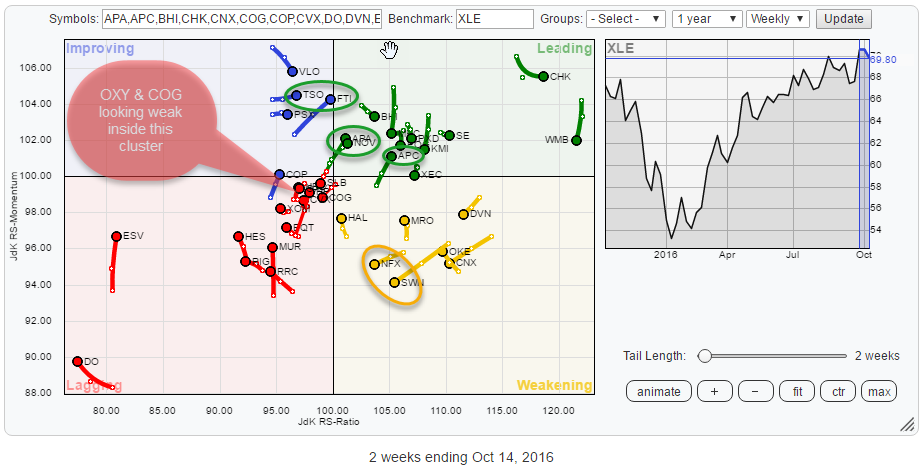

Energy stocks on the run, watch APA & APC

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

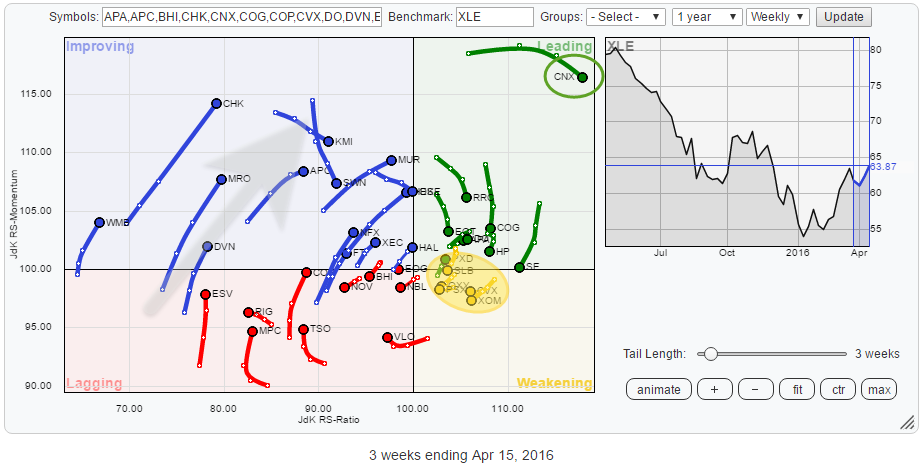

Quick scan

The Relative Rotation Graph above shows the rotation of the various members of the S&P Energy sector against XLE as a benchmark.

As usual, there are some good and some not so good names found on the plot. Inside the weakening quadrant, NFX and SWN are...

READ MORE

MEMBERS ONLY

Addressing RRG - Feedback and questions from ChartCon 2016

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

From a 100 degrees in beautiful Napa, via 70 degrees in Boston and New Hampshire, back to 50 and dropping in Amsterdam.

That pretty much sums up the excitement level that surrounds my ChartCon 2016 experience of last month!

Btw. In case you are wondering, the stop-over in Boston was...

READ MORE

MEMBERS ONLY

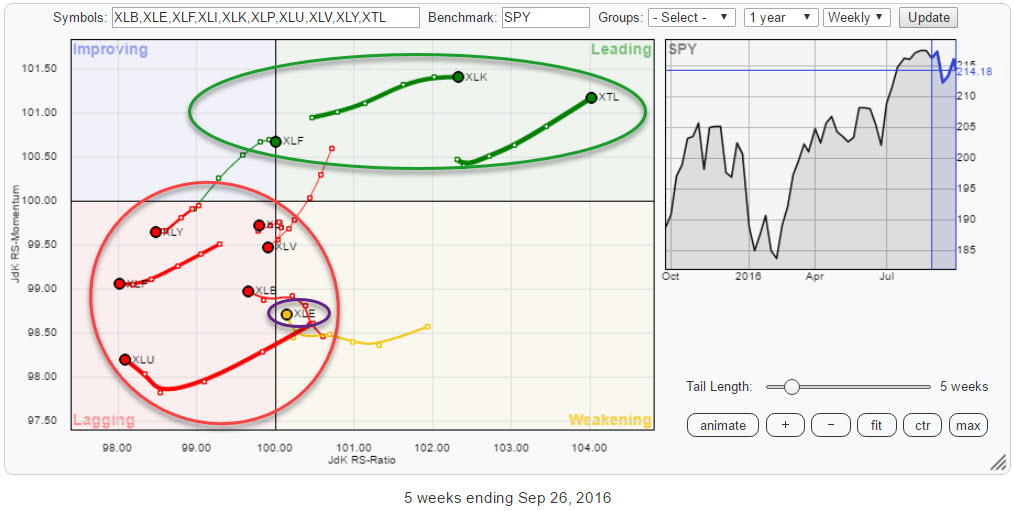

6 out of 10 sectors rotating in(to) lagging quadrant

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above shows the sector rotation for ten US sector ETFs. The new REITs sector ETF is not included yet due to a lack of historical data points.

The immediate catch on the RRG above is the separation of XLK and XTL in the leading quadrant while...

READ MORE

MEMBERS ONLY

Tech stocks dominate sector rotation but broader market at risk

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

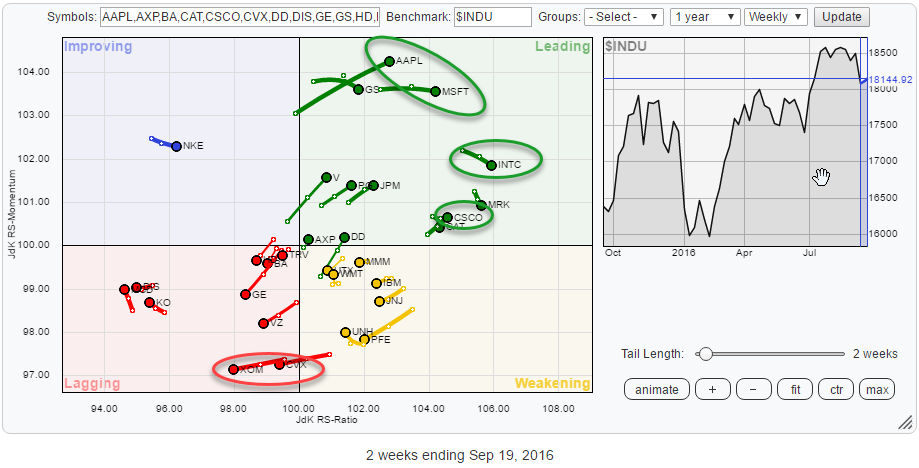

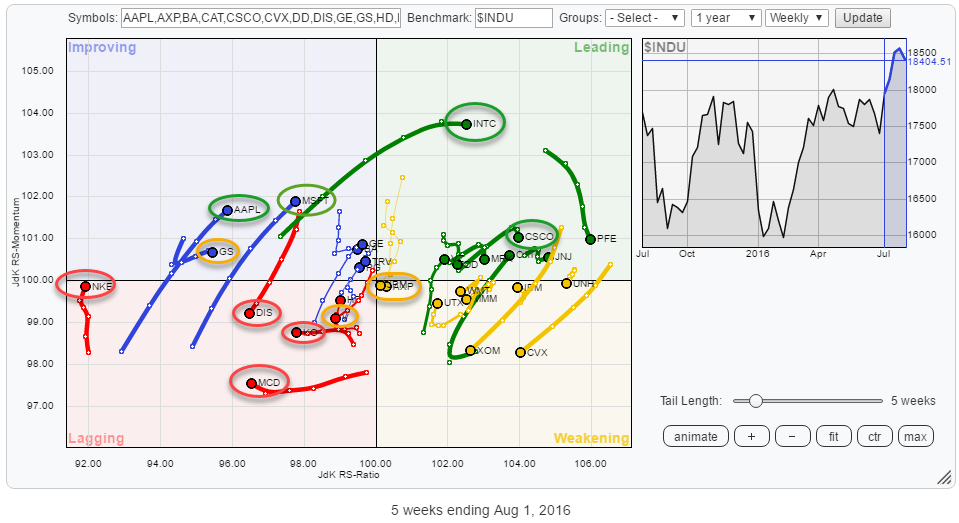

The Relative Rotation Graph below holds the components of the Dow Jones Industrials index vis-à-vis the $INDU index.

The one observation that immediately stands out to me is the domination of technology stocks inside the leading quadrant. AAPL, MSFT, INTC, and CSCO are all positioned well inside the top right-hand...

READ MORE

MEMBERS ONLY

Bonds under pressure and SPY no longer beating international equity markets

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph below, the rotation of various asset classes is shown against the Vanguard Balanced Index Fund (VBINX).

The single one tail that immediately stands out is the one of DJP (Commodities). Then there are IEF (Government bonds) on the far left inside the lagging quadrant and...

READ MORE

MEMBERS ONLY

Facebook (FB) not able to keep up with XLK

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The technology sector, as represented by XLK, started to show some positive sector rotation over the past month and last week managed to crossover from the improving quadrant to the leading quadrant on the weekly Relative Rotation Graph.

Reason enough to check out the relative technical conditions for the stocks...

READ MORE

MEMBERS ONLY

Strong rotation for Technology but SPY is still lacking fuel

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

To surrender or not to surrender? That's the question!

After a nice run up in the S&P 500, I started to worry about its ability to push higher when resistance levels coming off previous highs started to act up. At, more or less, the same time,...

READ MORE

MEMBERS ONLY

Tech stocks starting to look cool again, Financials not so much... yet!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Over the past few weeks, I have argued in some my posts that the state of sector rotation would not back a strong rise for the general market. The "defensive" sectors were simply too strong compared to the, more, cyclical sectors which are usually needed to push a...

READ MORE

MEMBERS ONLY

Real Estate shines, Stocks are still good, US stocks are even better.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph below shows the rotation for various asset classes (through ETFs) against the Vanguard Balanced Index fund (VBINX) on a weekly basis.

The picture is pretty conclusive for some asset classes but less so for others. Zooming in on the daily time-frame, usually, helps to add a...

READ MORE

MEMBERS ONLY

Utility stocks are boring .... really?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

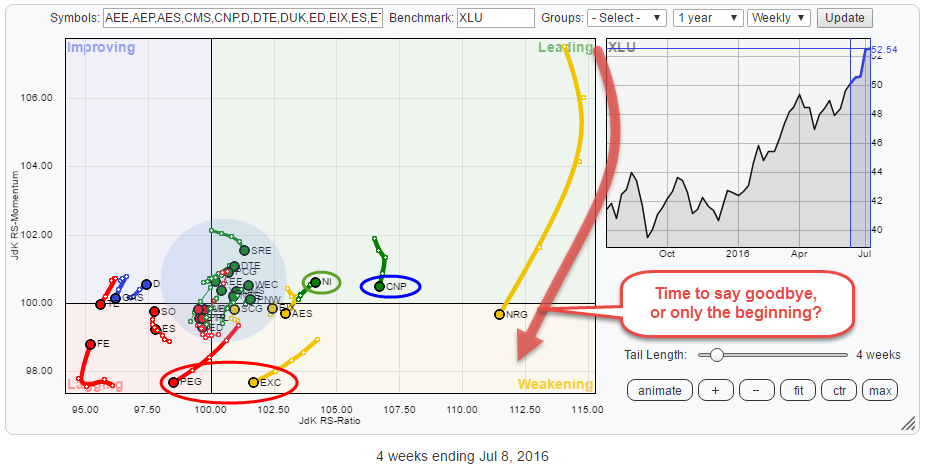

On the Relative Rotation Graph of the S&P economic sectors (GICS I), Utilities is one of the leading sectors as measured by the JdK RS-Ratio.

As described in my last RRG blog on US sectors, the fact that Utility stocks and Staples are leading the current sector rotation,...

READ MORE

MEMBERS ONLY

Staples and Utilities in the lead, what does that tell you?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Over the past few weeks markets, in general, experienced a lot of volatility and a lot of comments have are focussing on the general state and direction of the broader market indices around the world. In my last blog about US sector rotation, the conclusion was that the relative rotation...

READ MORE

MEMBERS ONLY

BrExit did not stop VZ from breaking to new highs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When you look at the Relative Rotation Graph (below) holding the members of the Dow Jones Industrials index without knowing what date the snapshot was taken you would not be able to tell that a major historical event had just happened....

Obviously, I am talking about the surprising outcome of...

READ MORE

MEMBERS ONLY

How to show "currency rotation" on a Relative Rotation Graph.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Currencies or Forex are a strange beast in financial markets. The FX market is the biggest in the world with trillions of dollars (worth) traded around the clock but no central marketplace. There is no such thing as the 'New York Currency Exchange' or the 'European Currency...

READ MORE

MEMBERS ONLY

Commodities (DJP) on the move?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The rotational pattern of the various asset classes on a Relative Rotation Graphs is showing interesting patterns at the moment. The RRG below holds a number of ETFs that cover Equities, Government Bonds, Corporate Bonds, High Yield Bonds, Real-Estate and Commodities. The benchmark is VBINX, the Vanguard Balanced Index Fund...

READ MORE

MEMBERS ONLY

FCX and NEM drive Materials (XLB) sector. Next up; FMC

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph below holds the constituents of the Materials sector (XLB) and shows the relative rotation of these stocks against XLB. FCX and NEM stand out on this chart, way out to the right, indicating that they are the two stocks with the strongest relative trends at the...

READ MORE

MEMBERS ONLY

US sector rotation on the move, not supporting a rise in $SPX

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The last RRG blog on US sector rotation dates back to late March, about six weeks ago. Since that post "Bad health (care) for XLV" some of the rotations in play continued while others were not able to maintain their expected rotational paths and moved the other way....

READ MORE

MEMBERS ONLY

Trouble in Tech but opportunities in Energy

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This Relative Rotation Graph holds the constituents of the Dow Jones Industrials Average ($INDU) and shows the position and movement of their relative trends against $INDU and each other.

In this article, I will focus on the movements in the technology- and the energy sectors and briefly touch on financials....

READ MORE

MEMBERS ONLY

Strong rotation for commodities, SPY and IEF (ratio) under threat

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph below shows the rotational picture for a number of asset classes, based on ETFs, against the Vanguard Balanced index fund on a weekly basis. For some of these asset classes, the equivalent picture on a daily basis is confirming but for others it is contrarian. Or...

READ MORE

MEMBERS ONLY

Bottom fishing in the Energy sector..

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The energy sector has been a very poor performing sector for a very long time. However, on the Relative Rotation Graph for US sectors (ETFs), XLE is now way up inside the improving quadrant and heading right towards leading. This makes it a good sector to dissect on an individual...

READ MORE

MEMBERS ONLY

Bad Health (care) for XLV

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors shows us the relative movement of the various sectors against the benchmark (SPY) and against each other and in this way visualizes the current sector rotation in the US equity market.

The RRG below shows the ETFs covering the major sectors of the...

READ MORE

MEMBERS ONLY

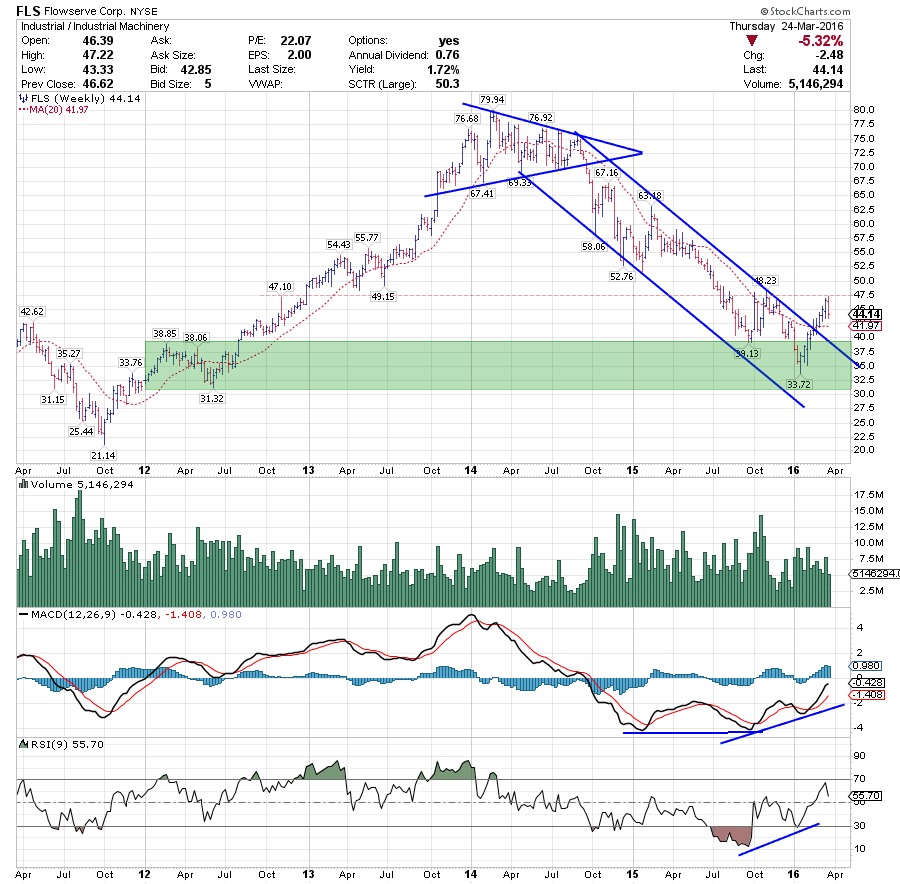

Getting in (f)LOW(serve)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

FLS is a stock that has been pretty much off the radar for two years as a potential long candidate, but this looks to be changing now!

After breaking out of an almost perfect symmetrical triangle in 2014, FLS trended lower until the beginning of this year, when a low...

READ MORE

MEMBERS ONLY

Weak relative rotation for PFE, CAT expected to keep on truckin'

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above holds the 30 stocks that make up the Dow Jones Industrials Index ($INDU). The rotational patterns of the individual stocks vary widely. The RRG shows you where the opportunities are but, maybe even more important, also shows you the threats.

Summary

* VZ leads the (relative)...

READ MORE

MEMBERS ONLY

Something cooking in commodities?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

We live in interesting times... or maybe I should say: We live in confusing times.... Because, really, markets are throwing some serious curve balls here and there. It is time to look at some asset class rotations again.

The Relative Rotation Graph shows the rotation of a number of asset...

READ MORE

MEMBERS ONLY

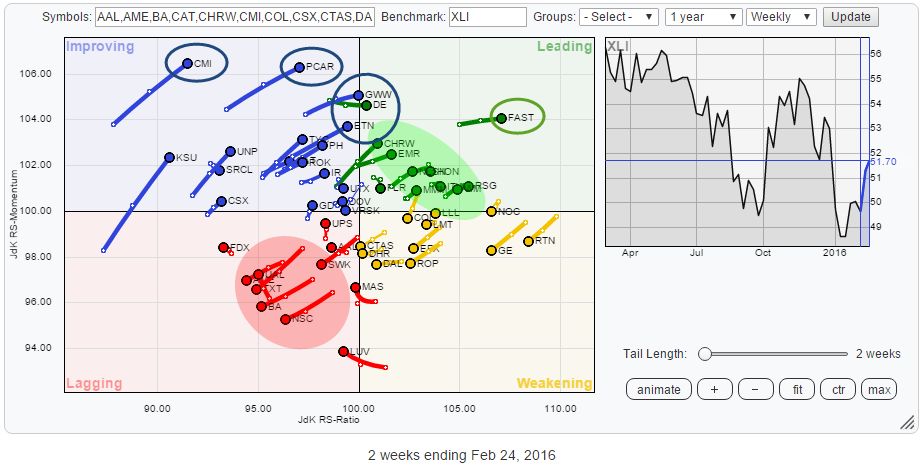

Stock rotation inside Industrials (XLI) sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Industrials sector, XLI, itself is positioned near the center of the Relative Rotation Graph holding all the sector ETFs that make up the S&P 500 index. This means that XLI is moving more or less in line with the S&P 500 and that there is,...

READ MORE

MEMBERS ONLY

Strong sector rotation inside S&P 500 suggests more weakness in Financials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Since the beginning of the year, the internal characteristics of the S&P 500 universe are characterized by strong sector rotation. The Relative Rotation Graph below shows the sector rotation over the past five weeks. A few sectors are standing out and worth a further inspection.

Summary

* XTL expected...

READ MORE