MEMBERS ONLY

Trouble in DIS(neyland) and renewed energy for XOM

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Over the past few days I have been looking at the Relative Rotation Graph of the 30 Dow stocks and its individual charts, and quite frankly I don't even know where to begin. Big swings all over the place, from +6% in DD to -9% in MSFT and...

READ MORE

MEMBERS ONLY

Price target for SPY at $ 165 ?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Big bounces all over the place, not just in equities. In this article I want to take a look at relative rotation at an asset class level, of course, using an RRG lens.

The Relative Rotation Graph below shows the relative trends in play for several asset classes over the...

READ MORE

MEMBERS ONLY

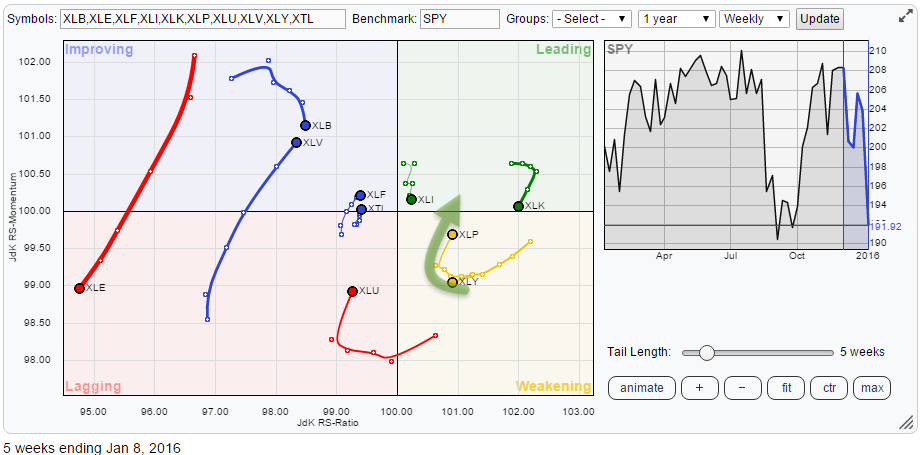

Picking stocks inside XLP

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

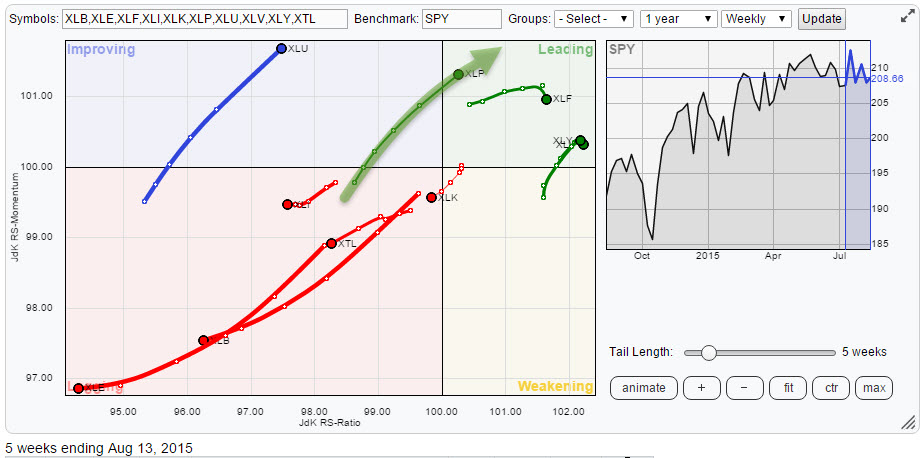

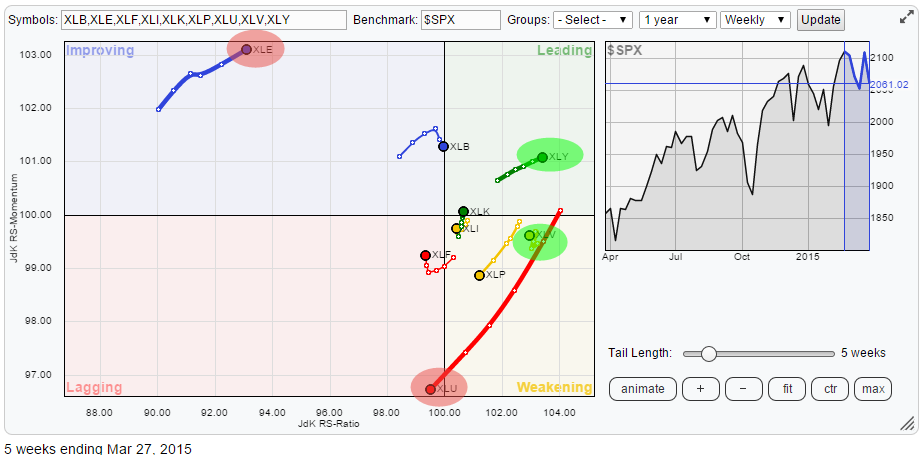

The sector rotation inside the S&P 500 index is getting more and more pronounced.

The Relative Rotation Graph holding the sector ETFs that make up the entire S&P 500 index clearly shows the recent improvement for Health Care (XLV), Utilities (XLU) and Consumer Staples (XLP). I...

READ MORE

MEMBERS ONLY

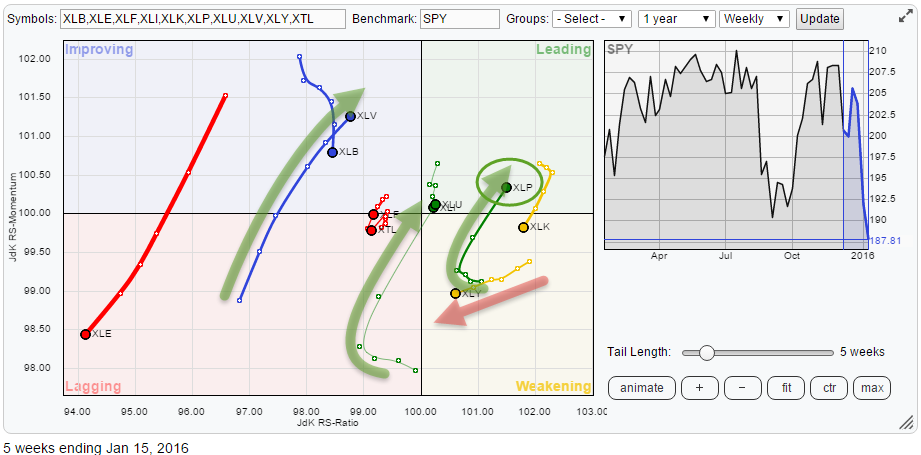

Price targets for SPY based on the relative strength of XLP.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Wow, what a start of the new year! Increased volatility sounds like an understatement.

In my previous blog on sector rotation in the US equity market, the Consumer Staples sector (XLP) popped up as potentially interesting, especially in relation to its counterpart consumer discretionary. Since the start of the new...

READ MORE

MEMBERS ONLY

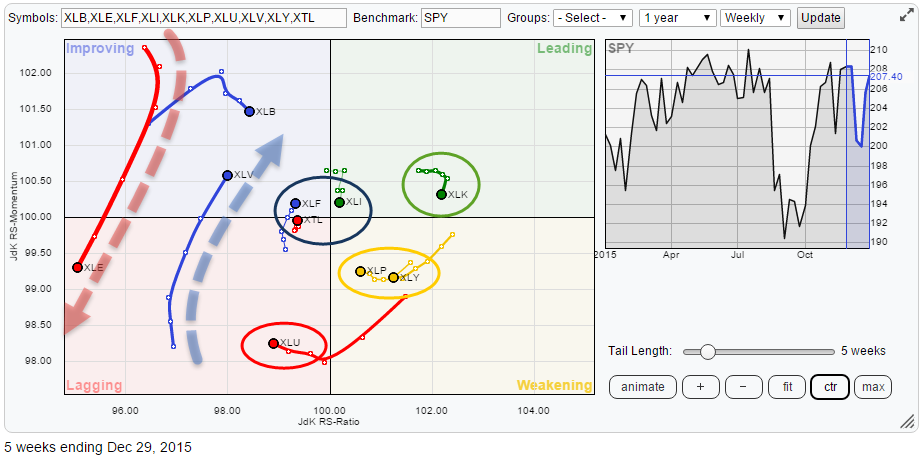

Staples or Discretionary?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

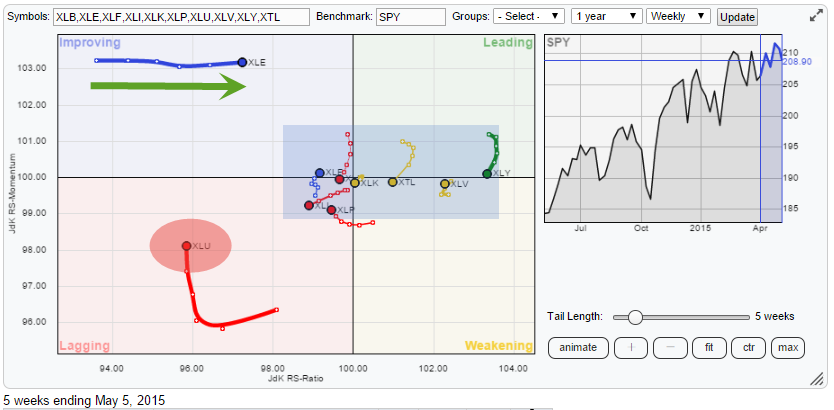

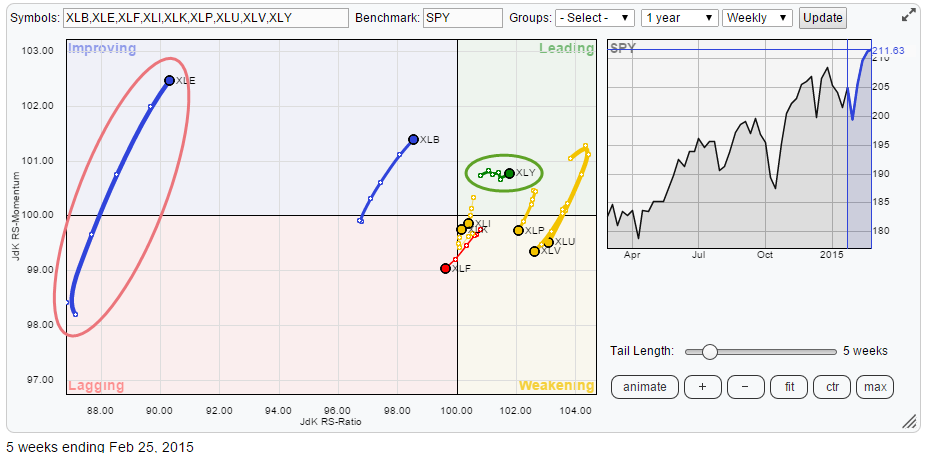

The Relative Rotation Graph for US sectors is once again showing us some interesting rotational patterns at the moment. Clearly XLE is showing us a very long tail moving from improving back to lagging again. Then there are XLU, XLV and XLB also showing long tails but sending different messages....

READ MORE

MEMBERS ONLY

AAPL up to no good?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph with the Dow Jones Industrials stocks once again shows some interesting moves. There are a few long tails that catch my attention for a quick inspection but in this article, I want to pay a closer look at some stocks with remarkably short tails. One of...

READ MORE

MEMBERS ONLY

What does a stock with an RS-Momentum value of 105 equate to in respect of time?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week I received a question from a StockCharts.com user on RRG charts via e-mail. Usually, I try to answer such questions in 1-1 fashion by replying to the particular email. Most of the time this involves pointing to information on Relative Rotation Graphs that is already present in...

READ MORE

MEMBERS ONLY

Asset class rotation: it depends on the time-frame

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Summary

* Commodities keep tanking

* Bond related asset classes weakening

* Equities leading on weekly- but weakening on daily time-frame

* US equities continue to lead international equity markets

* Chinese market coming back into play

Quick scan

A quick look at the Relative Rotation Graph holding a number of asset class ETFs, comparing...

READ MORE

MEMBERS ONLY

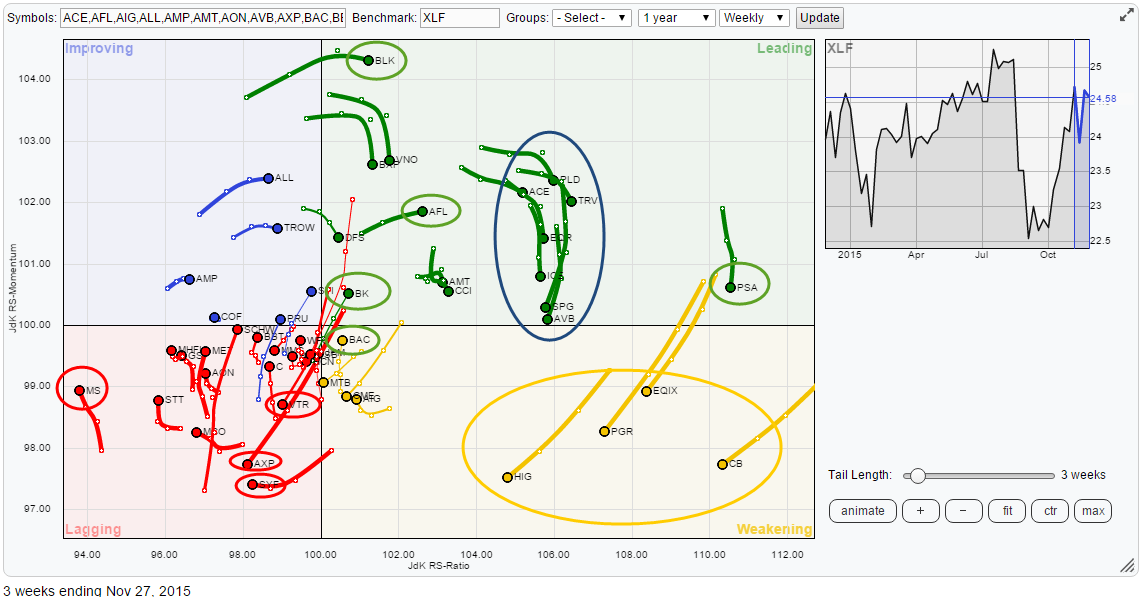

Strong rotation for AFL within the financials universe (XLF)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Summary

* MS weakest stock in the universe

* Don't chase PSA

* AXP continues to nose-dive

* VTR accelerating into lagging quadrant

* BK ready to break higher

* AFL offering opportunities

In my previous blog, we looked at sector rotation in the US based on the traded (State Street) ETFs. The headline...

READ MORE

MEMBERS ONLY

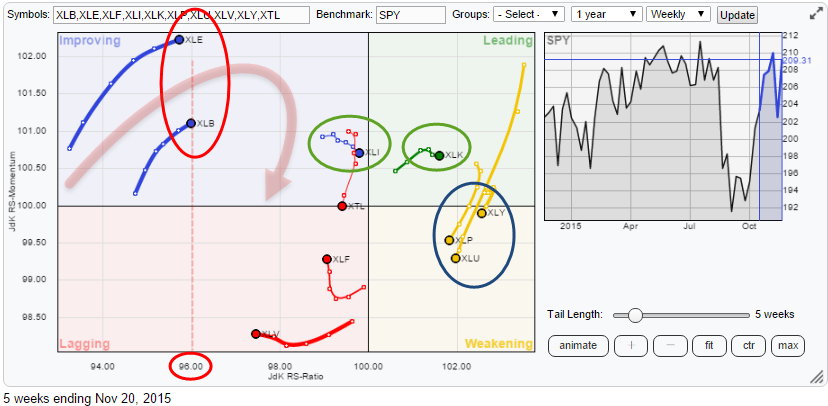

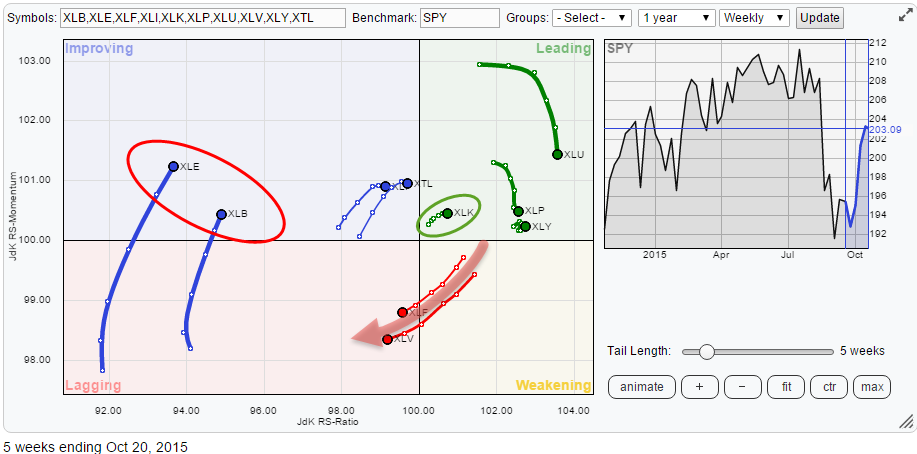

Negative sector rotation expected for XLE and XLB

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

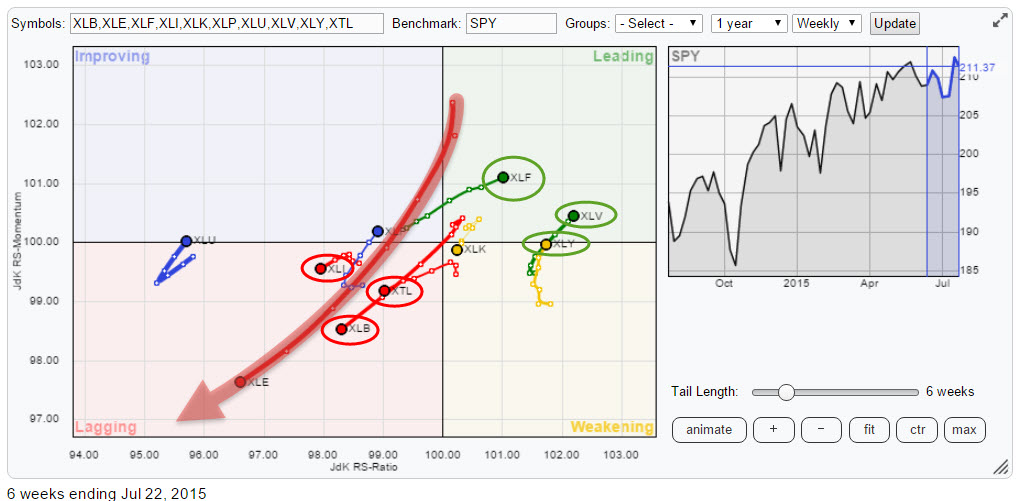

Summary

* XLE and XLB expected to turn back to lagging quadrant again

* XLI improving further towards leading

* XLK holding up well inside positive territory

* XLP and XLU both weakening but wider rotation for XLU

* XLF bottoming out in relative trading range?

Quick scan

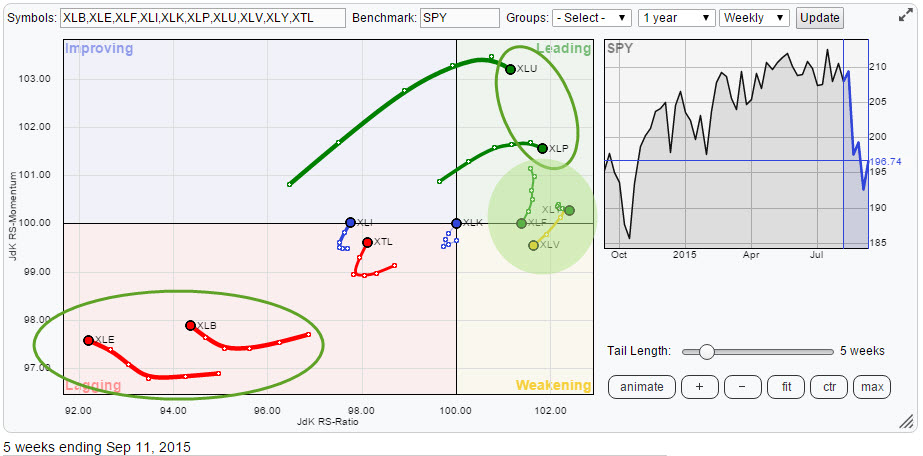

The Relative Rotation Graph above shows the...

READ MORE

MEMBERS ONLY

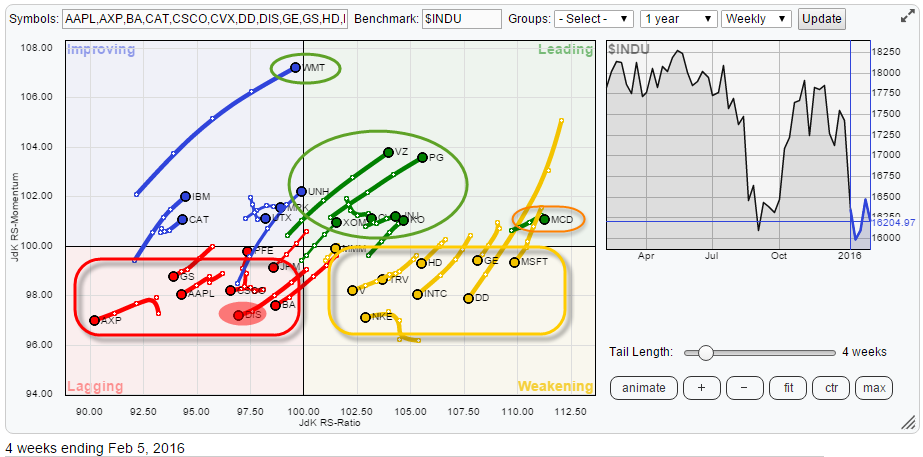

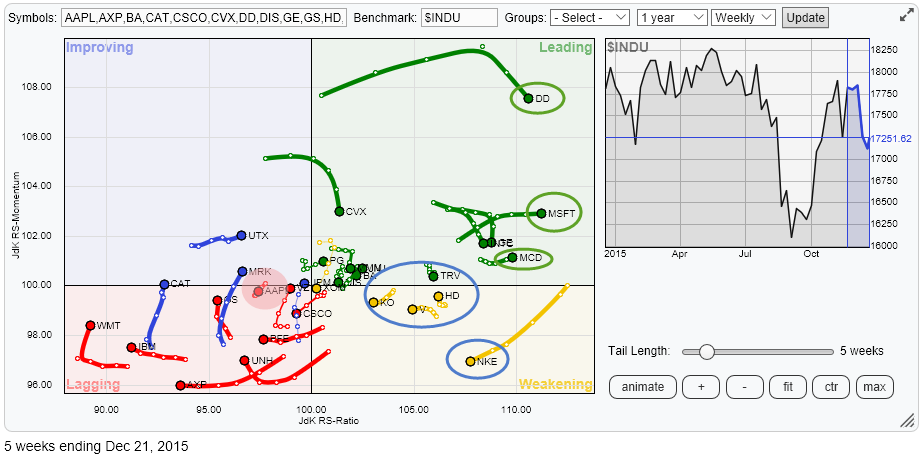

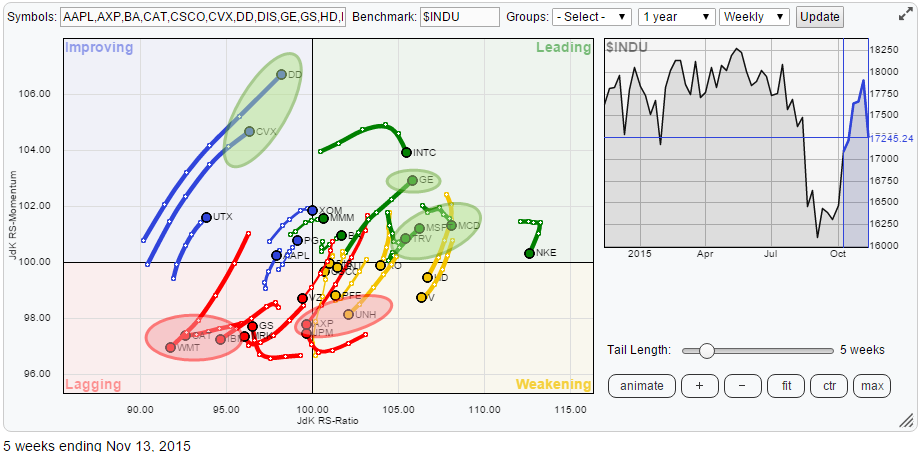

Big stock rotation among Dow Jones Industrials members

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

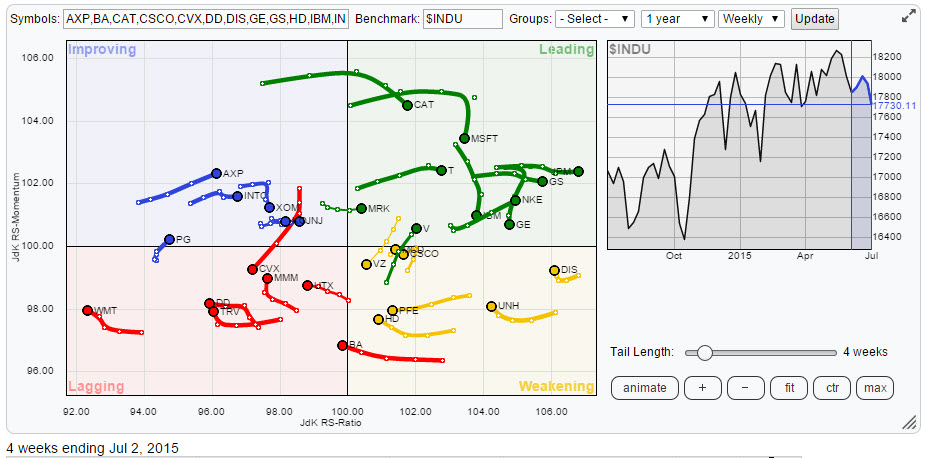

Summary

* Big rotation among members of the Dow Jones Industrials Index

* DD came to life surprisingly strong

* CVX and UTX still expected to rotate back down again to lagging quadrant

* WMT, CAT and IBM all moving further into the lagging quadrant confirming their relative weakness

* UNH and AXP entering the...

READ MORE

MEMBERS ONLY

S&P Leading International Equity Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Summary

* Commodities threatening to break down yet again

* Bond rally starting to fade already, halting turn for the better

* S&P 500 leading in international equity rotation

Quick scan

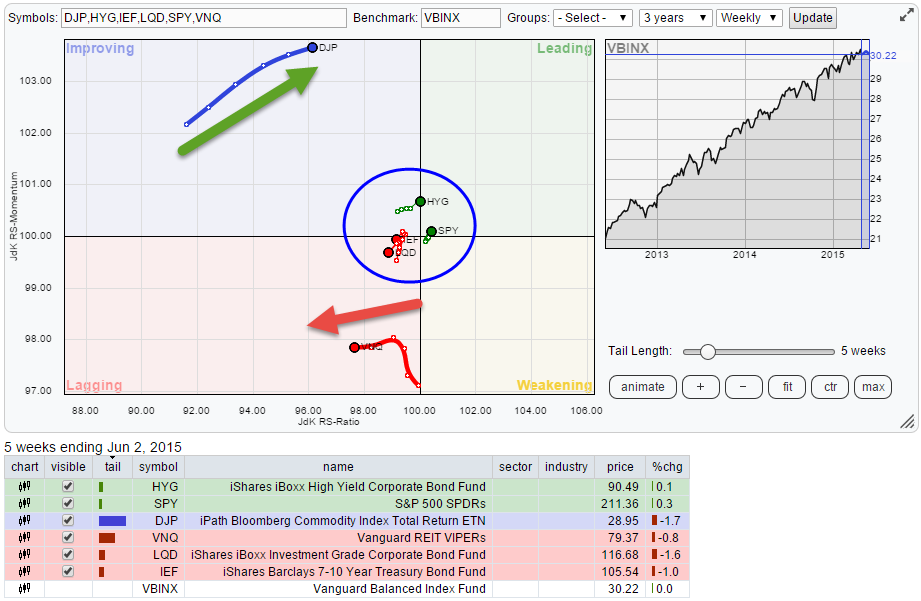

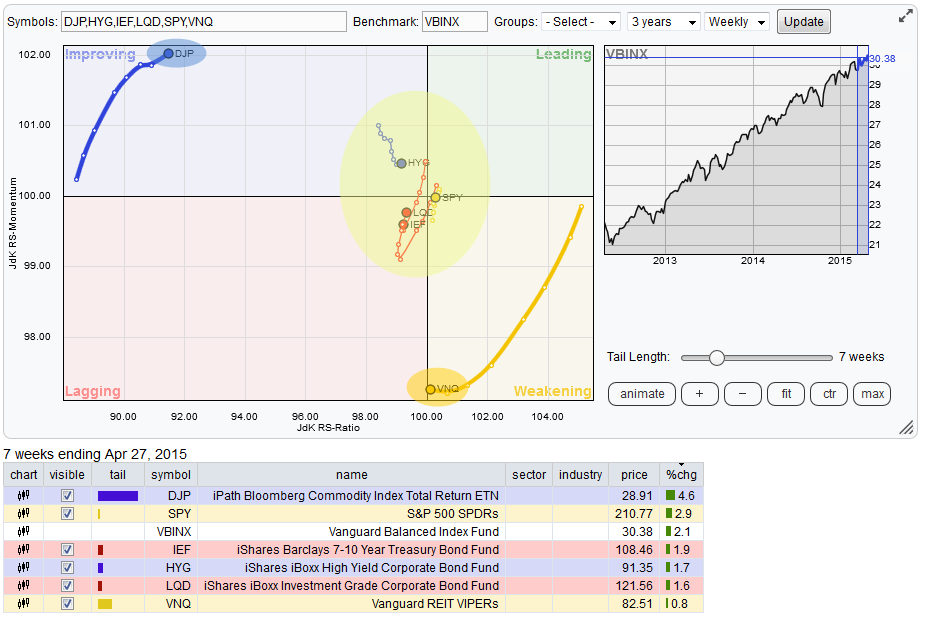

The Relative Rotation Graph above holds a number of asset class ETFs while using VBINX (Vanguard Balanced Index fund) as...

READ MORE

MEMBERS ONLY

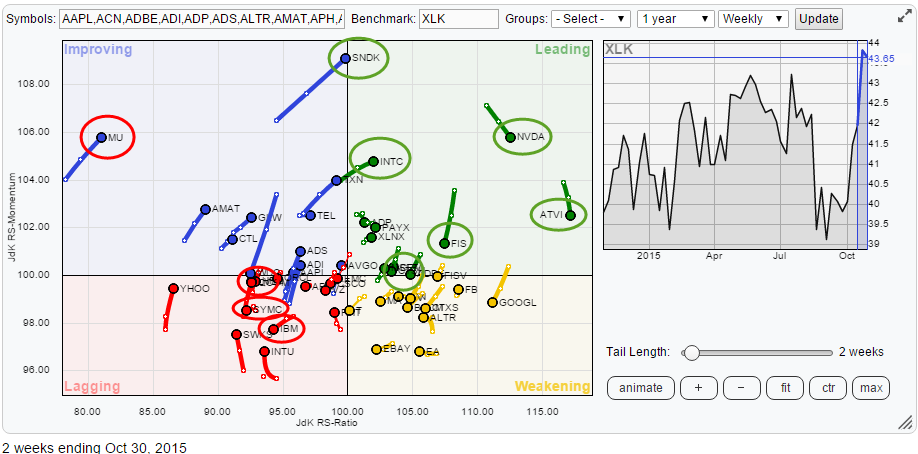

Inside the Technology Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Summary

* Information Technology standing out in S&P universe

* Weak rotation for HPQ, SYMC and IBM

* MU not expected to reach leading quadrant

* NVDA, ATVI and FIS show stable relative uptrends

* Opportunities for INTC, SNDK and MSFT

Information Technology positioned for strong sector rotation

My previous article already highlighted...

READ MORE

MEMBERS ONLY

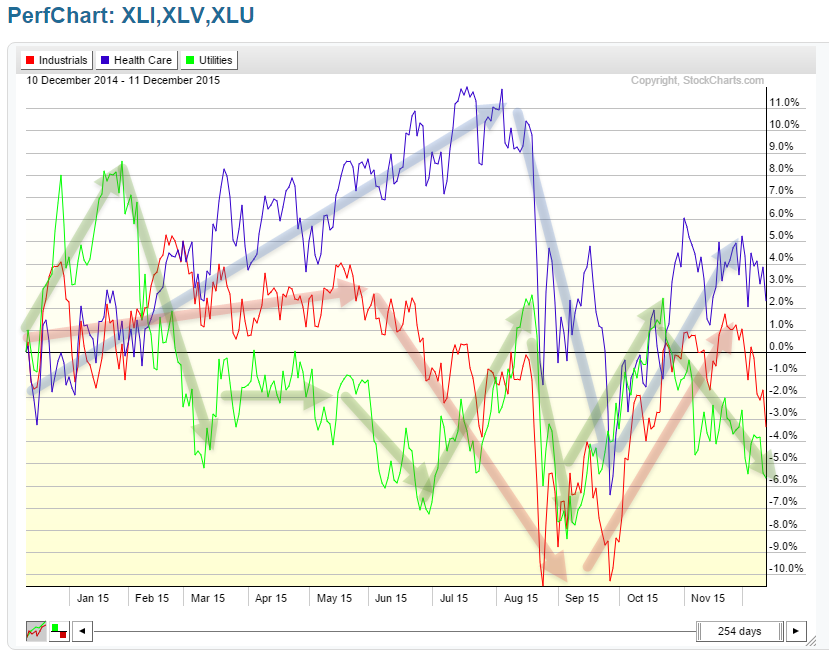

Watch technology (XLK) for positive sector rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Summary

* Health Care (XLV) catching a cold as it is rolling over

* Financials (XLF) at crossroads, needing to unlock one of two scenarios in coming weeks

* Energy and Materials gaining relative momentum inside the improving quadrant, but follow-through is questionable

* Utilities, Staples and Discretionary stable inside the leading quadrant

* Information...

READ MORE

MEMBERS ONLY

Intel (INTC) power inside!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

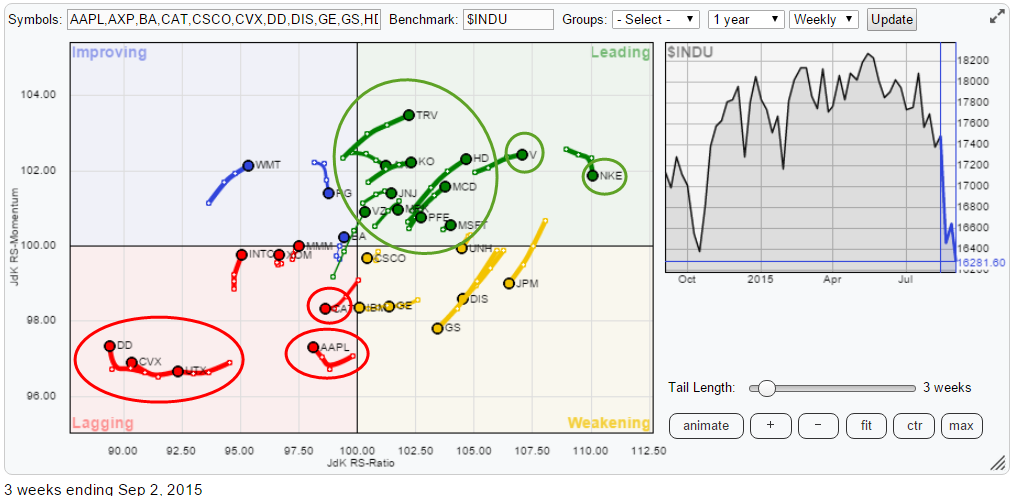

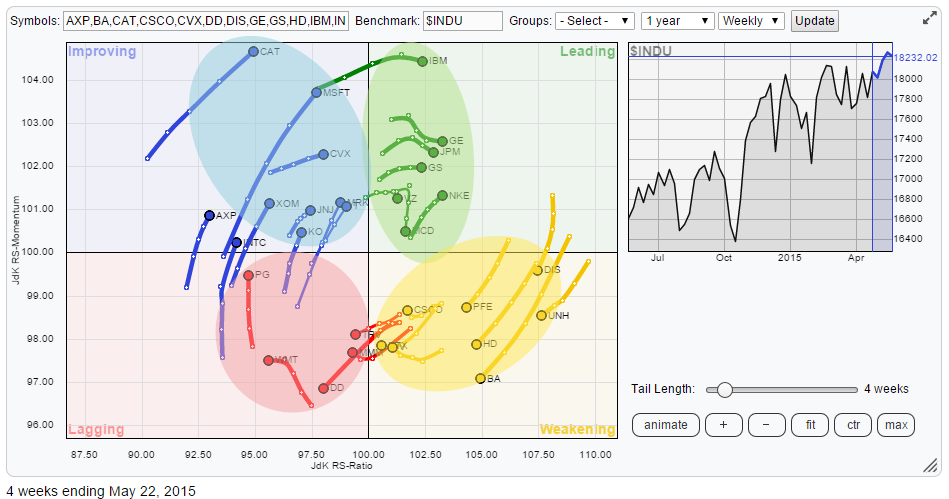

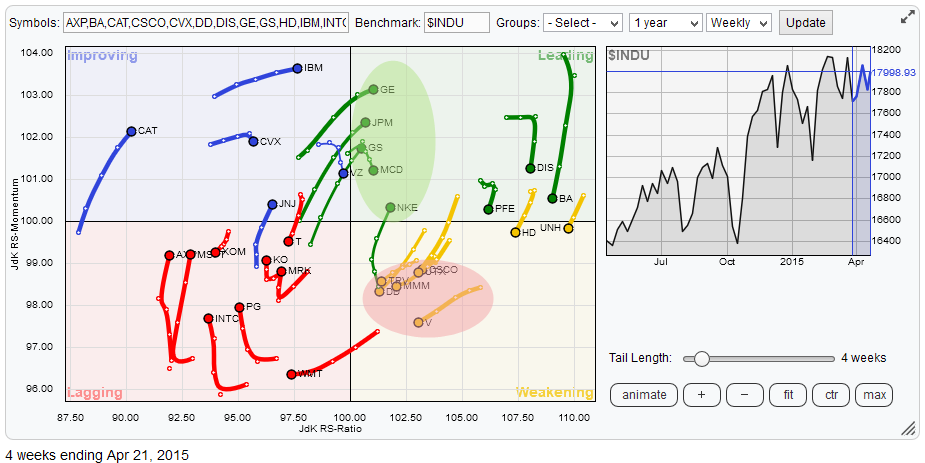

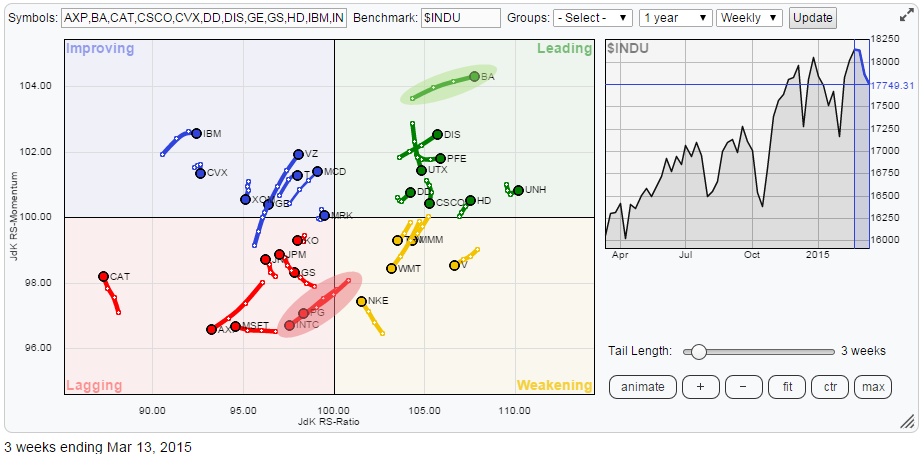

In my recurring cycle of blog subjects, it is time to take a look at the components of the Dow Jones Industrials index again.

Once again there is a lot to see on the Relative Rotation Graph for this universe. We have GS, JPM and DIS nose-diving into the lagging...

READ MORE

MEMBERS ONLY

Bonds are taking over!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph below shows the trends in relative strength for a number of asset classes against the Vanguard Balanced Index Fund (VBINX). The most important message sent by this chart is the opposite move of equities (SPY) versus bonds (IEF and LQD) indicating that the Equity / Bond ratio...

READ MORE

MEMBERS ONLY

Don't like SPY ? Utilities may have something to offer....

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The chart of the S&P 500 index ($SPX) or its ETF equivalent (SPY) has popped up in almost every blog article on the site over the past few weeks/months and the vote has been almost unanimous : It's not looking good! From an absolute point of...

READ MORE

MEMBERS ONLY

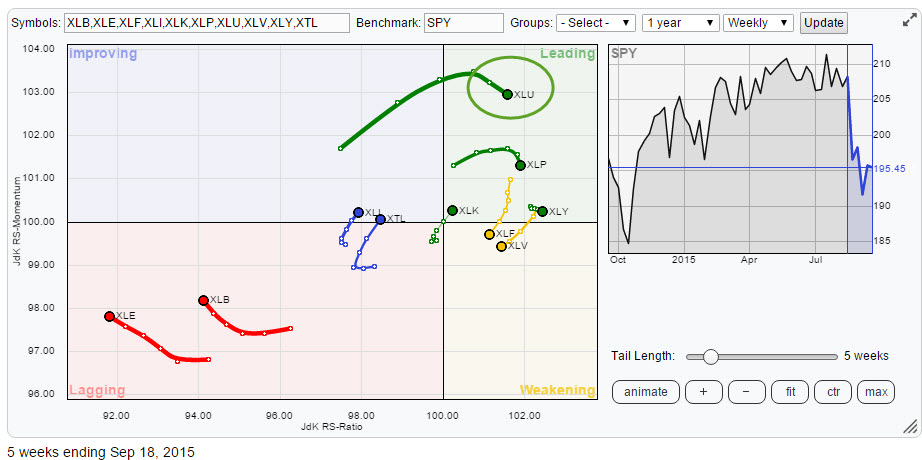

Steady Staples in the leading quadrant

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

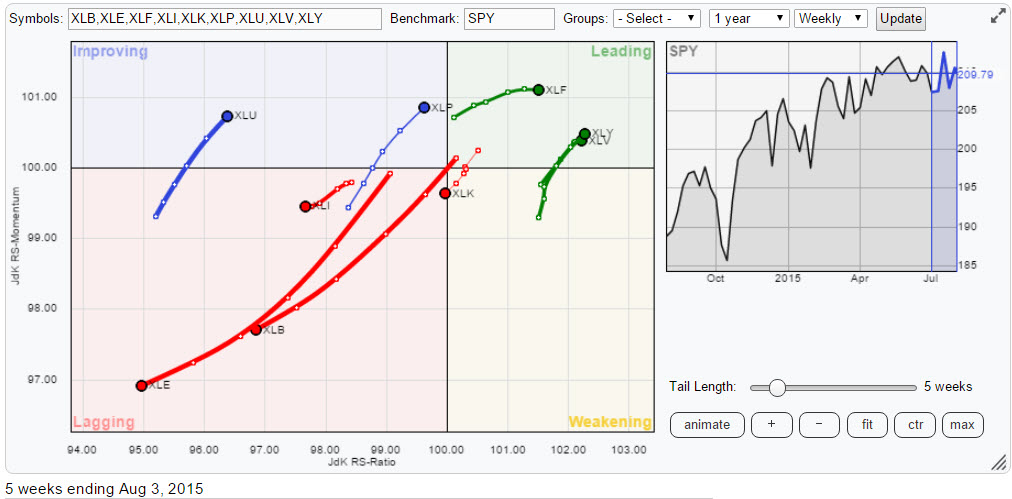

Despite wide swings in the US equity market the Relative Rotation Graph of sector ETFs will help you keep an eye on current sector rotation and point to favourable and less favourable sectors for the coming period.

Initial observations

A quick scan of the above Relative Rotation Graph immediately reveals...

READ MORE

MEMBERS ONLY

Get a burger at MCD and help the stock stand out from the crowd

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This article takes a look at the relative rotation of the members of the Dow Jones Industrials ($INDU) index. On the relative rotation graph below all members are plotted against $INDU. I will highlight and discuss some of the charts that show up on the RRG as "worth having...

READ MORE

MEMBERS ONLY

Ok, SPY is falling .... now what ?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Wow, there's a lot going on in the markets and some big shifts seem to be under way in asset class rotation as well as in (international) equity markets rotation. Relative Rotation Graphs may help you get a handle to put all this movement into (relative) perspective. Let&...

READ MORE

MEMBERS ONLY

Dissecting the Consumer Staples sector via XLP

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The top-level Relative Rotation Graph holding the nine S&P sectors clearly shows you which sector rotation is in play at the moment.

If I look at the rotation of the various sectors on this RRG chart, XLP, the Consumer Staples Sector, is catching my eye. The sector is...

READ MORE

MEMBERS ONLY

How to Set Up RRGs Holding Sector Constituents

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the subjects covered in this blog on a regular basis is the relative rotation (sector rotation) in the US equity market. The data, ticker symbols, that I use for the analysis are the nine ETFs from the SPDRS family, provided by State Street Global advisors. SPDR actually stands...

READ MORE

MEMBERS ONLY

Energetic move for XLE!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph holding the 10 SPDR sector ETFs comparing them to the S&P 500 index there is one sector standing out .... big time that is!! I am talking about XLE here, the Energy select sector SPDR.

Initial observations

As you can see on the RRG...

READ MORE

MEMBERS ONLY

Combining AA and International equity markets

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

As I am writing this I am on holiday in Greece and overlooking the Ionian sea. A good time to clear the head and get some fresh thoughts. As it's also almost a year since I started writing my RRG-Blog here on StockCharts.com, and I still enjoy...

READ MORE

MEMBERS ONLY

Tech & Energy are losing their power supply

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

As usual the 30 members of the Dow Industrials index are fairly evenly spread out over the Relative Rotation Graph, highlighting the good, the bad and the ugly ! Before moving into further detail I'll give you a bit of a head start saying that some technology stocks are...

READ MORE

MEMBERS ONLY

If you can't stand the heat, get out of the (Asian) kitchen!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

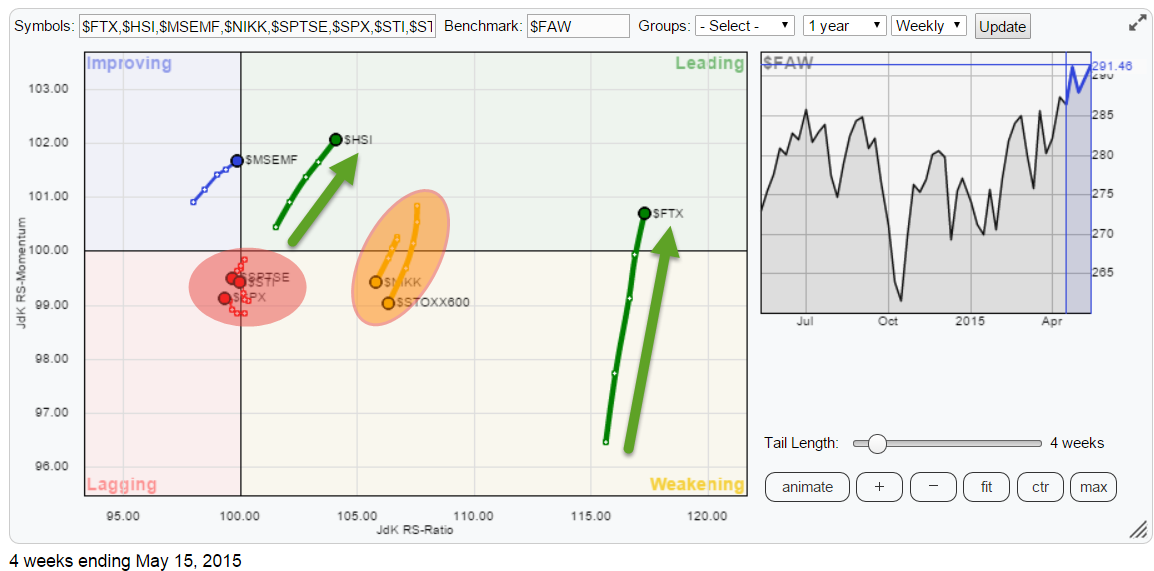

International stock markets continue to show us big rotations on the Relative Rotation Graph. The picture below holds a number of international stock market indices in comparison with the FTSE all world index ($FAW).

click the chart for the live RRG

Initial observations

Following the headline of my previous blog...

READ MORE

MEMBERS ONLY

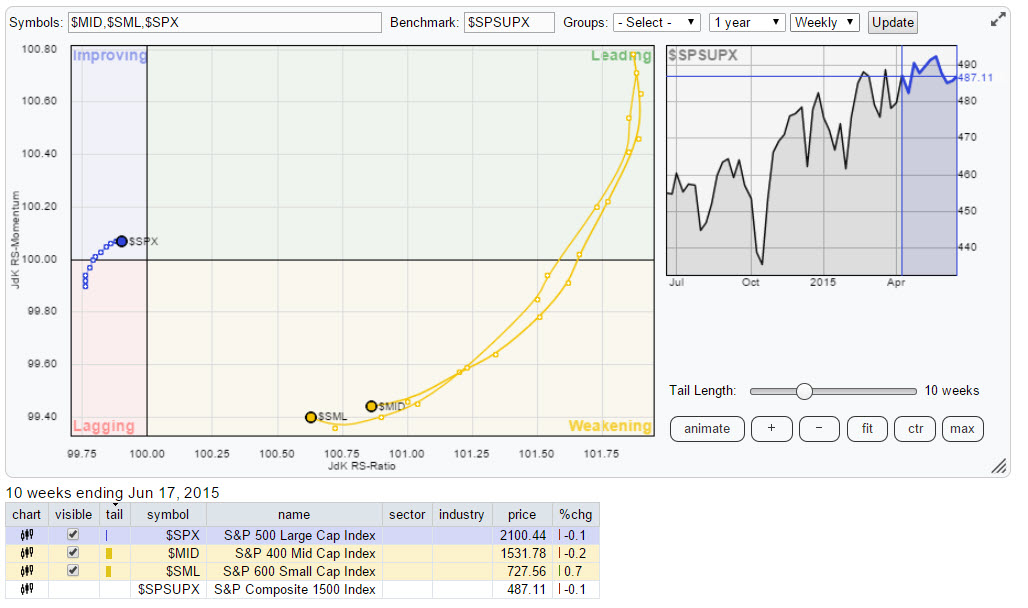

Using RRG on size indices

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In last Tuesday’s (6/15) webinar with Arthur Hill I presented a Relative Rotation Graph based on size indices and how this can be used to focus attention to a specific part of the broader market. You can re-play the recording of this webinar here.

One of the most...

READ MORE

MEMBERS ONLY

Financials and Technology .... really ?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph of US sectors (10 ETFs) is showing some interesting sector rotation going on at the moment.

Initial observations

Glancing over the RRG above continues to show Energy (XLE) and Utilities (XLU) "standing out", as in "far away from the mean", like they...

READ MORE

MEMBERS ONLY

Equities likely to out-perform (government) bonds.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph holding a number of Asset Class ETFs in comparison to the Vanguard Balanced Index fund, the opposite moves of commodities and REITs continue to attract attention.

Initial observations

The opposite moves in Commodities (DJP), heading higher on the JdK RS-Ratio axis at positive relative momentum,...

READ MORE

MEMBERS ONLY

Think 'twice' before buying 3M

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The 30 stocks that make up the Dow Jones Industrials index are more or less evenly spread out over the Relative Rotation Graph below.

There is a group of stocks that has entered the leading quadrant a few weeks ago and which are establishing solid relative up-trends including the stocks...

READ MORE

MEMBERS ONLY

Hong Kong ($HSI) on track towards all-time-high

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph below holds a number of world equity indices and shows their relative rotation versus the FTSE all world index ($FAW).

click the chart to open the live RRG

Initial observations

A couple of quick observations from the RRG before we move into more detail of the...

READ MORE

MEMBERS ONLY

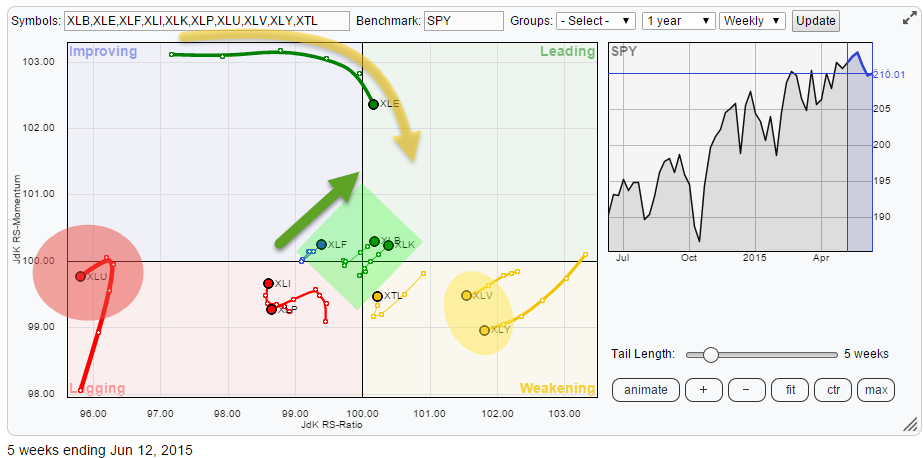

Weak industrials (XLI) vs. strong(er) energy (XLE)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Sector time!

With the general market picture being a bit 'un-clear' and showing pretty wide swings from week to week, the Relative Rotation Graph holding the ten (I added XTL - Telecom) sector ETFs will shine some light on the sector rotation that is going on within the...

READ MORE

MEMBERS ONLY

All asset classes starting to hug the benchmark

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph below shows the rotation of various asset classes (ETFs) around a balanced portfolio as represented by VBINX (Vanguard Balanced Index Fund).

While reading this RRG the two asset classes that remain on the outskirts of the plot are commodities (DJP) and Real Estate (VNQ). All other...

READ MORE

MEMBERS ONLY

Strong relative rotation for GE, JPM and GS

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It is time for a look at the relative rotation of the Dow 30 industrial stocks again. The Relative Rotation Graph below shows the 30 stocks that make up this index.

When I look at that RRG there are two things that immediately catch my eye.

The first thing is...

READ MORE

MEMBERS ONLY

China flying off the (RRG) charts!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The first time I wrote about international equity markets on this blog was last year in October. Already back then China had entered the leading quadrant on the Relative Rotation Graph holding a number of international equity indices. And if we look today we will see that China is still...

READ MORE

MEMBERS ONLY

XLV remains a very "healthy" sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In the previous article on US sectors I mentioned Energy (XLE) and Consumer Discretionary (XLY) as sectors to watch for sector-rotation. XLE as being suspect and at risk for more or renewed under-performance and XLY as pushing further into the leading quadrant and thus expanding its out-performance. Looking at the...

READ MORE

MEMBERS ONLY

Commodities still in trouble

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph holding a number of ETFs tracking various asset classes continues to be dominated, or distorted if you wish, by the two asset classes that are moving far away from the center for quite some time already.

Regular readers of this blog will recognize VNQ (Vanguard REIT...

READ MORE

MEMBERS ONLY

Touch and go for Boeing

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last Tuesday I joined Arthur Hill's market message webinar which was great fun. Not only because the (stock selection) approach we are taking makes total sense, at least that is what I tend to believe. But also because it gives Art and myself a good excuse to meet...

READ MORE

MEMBERS ONLY

It's lonely for Europe in the leading quadrant...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In previous blogs on international (equity) markets I used to plot all markets on one RRG canvas which makes a pretty crowded picture. As most individual ticker symbols are from European markets which are much more fragmented than other global regions I have grouped them together by using one ticker...

READ MORE

MEMBERS ONLY

High ENERGY move is suspect

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph showing the sector rotation in the nine S&P sector ETFs there is one that really stands out. But is it good or is it bad?

XLE, the Energy select sector SPDR is showing up in the top-left 'improving' quadrant with a...

READ MORE