MEMBERS ONLY

Sector Spotlight: Seasonality Points to a Weak Start for 2023!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this year's first episode of StockCharts TV's Sector Spotlight, I address the expected seasonal performance for the stock market and the individual sectors. I locate one sector at high odds for outperforming the S&P 500 in January, as well as a sector with...

READ MORE

MEMBERS ONLY

Looking Back at The Biggest Rotation of 2022

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

I have been quiet on the video and blog side of things over the past weeks. Still, just before you pop the champagne for a grand New Year's eve celebration, I want to take the opportunity to look back at maybe the most important or dominant rotation that...

READ MORE

MEMBERS ONLY

How to Benefit From a Two-Stock Wrecking Ball

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

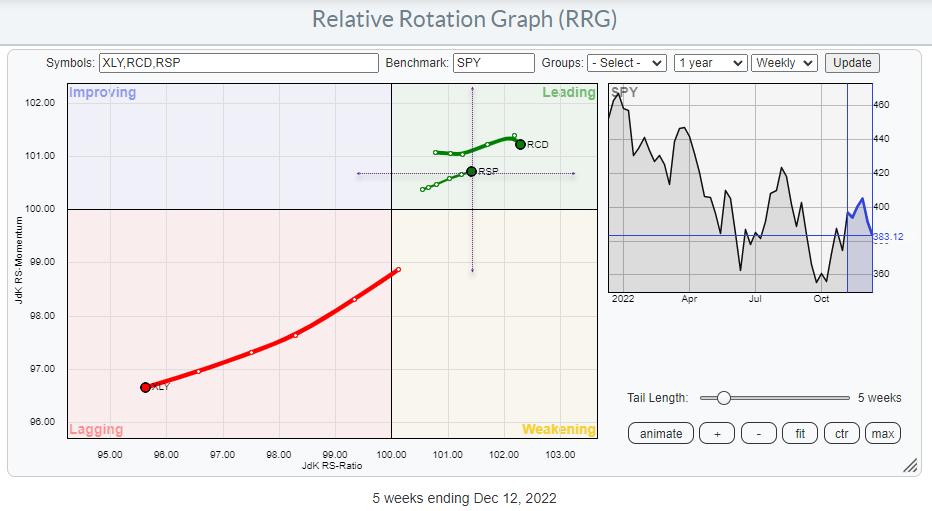

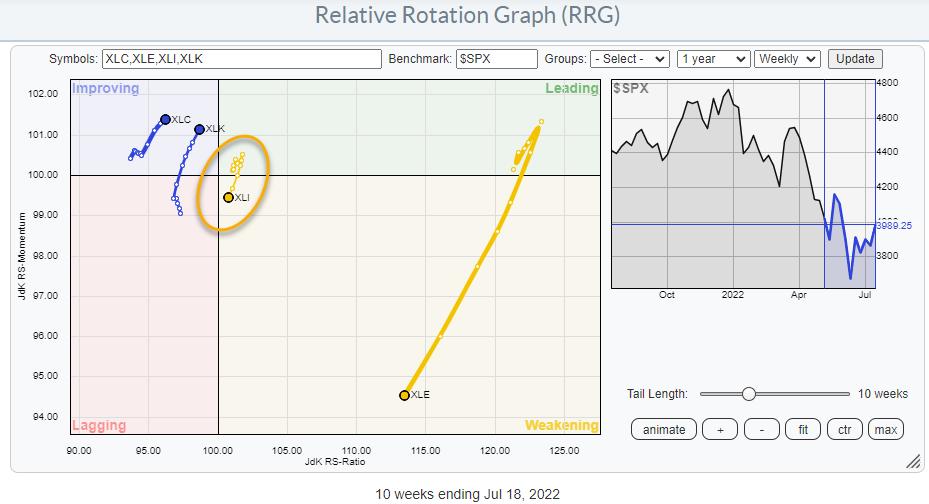

The Relative Rotation Graph above shows an intriguing picture.

Opposite Rotations

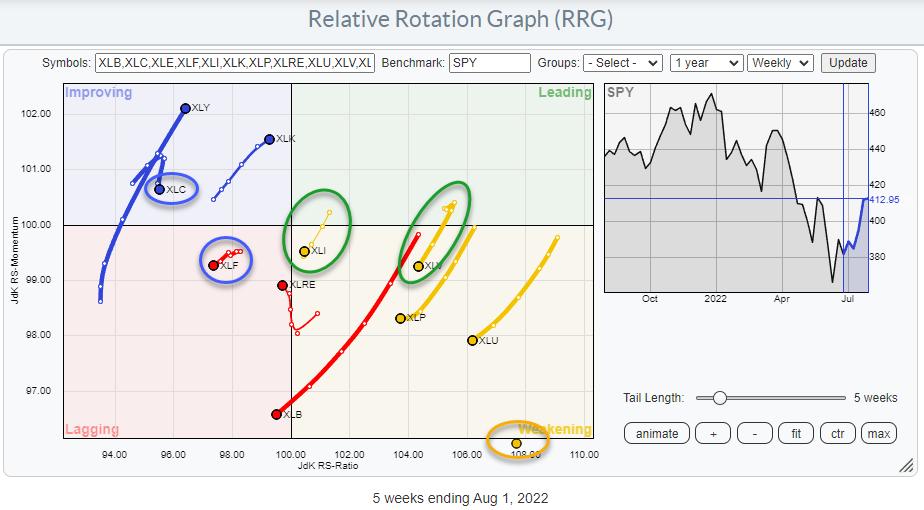

Last week in Sector Spotlight, I discussed the opposite rotations for XLY and its equal-weight counterpart RSP vs. their respective benchmarks (SPY and RSP). When you bring up the Relative Rotation Graphs for cap-weighted S&P sectors alongside...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stealth Sector Rotation for XLY

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I present a thorough review of the current state of sector rotation in the US market. Materials and Industrials are showing strong tails on the Relative Rotation Graph, but the most interesting -- Under The Hood Rotation -- is showing...

READ MORE

MEMBERS ONLY

Stock Market View: Look Beyond The Length of Your Nose!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

EUR/USD Under Pressure From Long-Term Resistance

The EUR/USD ($EURUSD) relationship has been under pressure since late 2021, when a peak was set at 1.2350. In a steady downtrend, EUR/USD declined to a recent low of 0.9540. During this decline, a significant support level around 1....

READ MORE

MEMBERS ONLY

Sector Spotlight: USD Index Resting on Major Support

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, on this first Tuesday of the month, I address the trends for asset classes and sectors on the monthly charts. There is no clear trend for "the market" -- only one sector is in an uptrend, while five...

READ MORE

MEMBERS ONLY

Sector Spotlight: Are Financials Ready to Push?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, wrapping up the month of November, I address the seasonality effects for stocks in general, as well as sectors. I then align these historical observations with the actual rotations as they are playing out on the Relative Rotation Graph, while...

READ MORE

MEMBERS ONLY

SPY Remains Under Pressure, But These Sectors are Improving

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

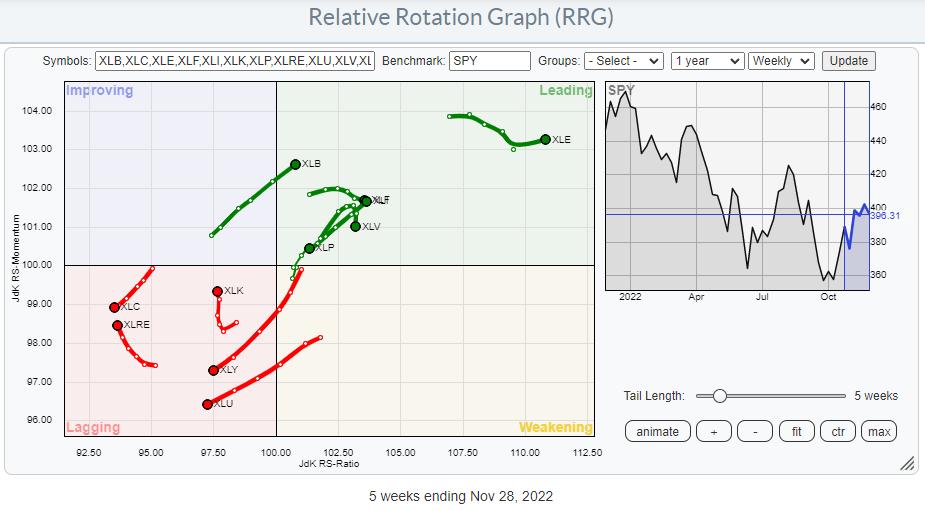

Relative Strength is Losing Its Concentration

Recent sector rotation shows a relative strength loss for two of the three defensive sectors. This is a move away from the trend we have seen for many months, where the defensive sectors were leading the market, sometimes even when the S&P...

READ MORE

MEMBERS ONLY

Sector Spotlight: AMZN & TSLA Causing Weak XLY Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I present a big sector special for the Consumer Discretionary sector. This follows a very brief review of Asset Classes and, more specifically, BTC, followed by a quick look at general sector rotation. For Consumer Discretionary, I highlight the difference...

READ MORE

MEMBERS ONLY

This Stock Trades At a 70% Discount In a Sector That Shows Strong Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

For weeks already, the rotation of the Industrial sector has been continuing its way deeper into the leading quadrant at a strong RRG-Heading.

For my appearance on the panel of The Pitch this month, I looked at the Relative Rotation Graph of US Sectors to identify three strong sectors where...

READ MORE

MEMBERS ONLY

Sector Spotlight: RRG Shows Rotation from Discretionary to Energy

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This episode of StockCharts TV's Sector Spotlightis dedicated to a review of the current state of sector rotation in both asset classes and sectors. At Asset Class level, the rotations for the USD and its digital counterpart Bitcoin are worth a closer look as both are showing interesting...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Model Shows the Way

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I update the theoretical sector rotation model with my current observations of the ongoing rotation of sectors on the Relative Rotation Graph. For this, I use the equal-weight sector universe, as well as the charts of the four macro economic...

READ MORE

MEMBERS ONLY

Another Risk OFF Signal

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Discretionary vs Staples Rotation

While preparing for my show Sector Spotlight this week and trying to put things together in a meaningful fashion, I also remembered to look at the XLY:XLP ratio.

When you look at the positioning of the various sectors that are likely to outperform during the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stocks Rally, But Monthly Trend Remains Down

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It's the 150th episode of StockCharts TV's Sector Spotlight! This week, I tackle the long-term trends in asset classes and sectors, looking at the monthly Relative Rotation Graphs and the monthly price charts. Despite the recent rally in stocks and the strong recovery for most sectors...

READ MORE

MEMBERS ONLY

Strong Rotation to Value Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Over the last 13 weeks, a notable shift from growth to value stocks has taken place. After a rotation from leading, through weakening, into lagging between April and mid-October, the tail for value stocks has re-entered the leading quadrant at a strong RRG-Heading.

Generally, value stocks are seen as more...

READ MORE

MEMBERS ONLY

SPY Rally While Technology and Discretionary Remain On Negative RRG-Heading

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

I don't like it when parts of a puzzle don't match. You just don't get a clear picture.

As participants in the markets, we are trying to solve the puzzle of the markets every day/week/month, and at the start of every new...

READ MORE

MEMBERS ONLY

Sector Spotlight: Inverted Yield Curve Looms Over Stock Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After one week of hiatus, I'm back with a new episode of StockCharts TV's Sector Spotlight. I'll be catching up with a refresher on asset class rotation, as well as sector rotation. In the AC segment, I point to the still-inverted yield curve and...

READ MORE

MEMBERS ONLY

About That Yield Curve Inversion

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

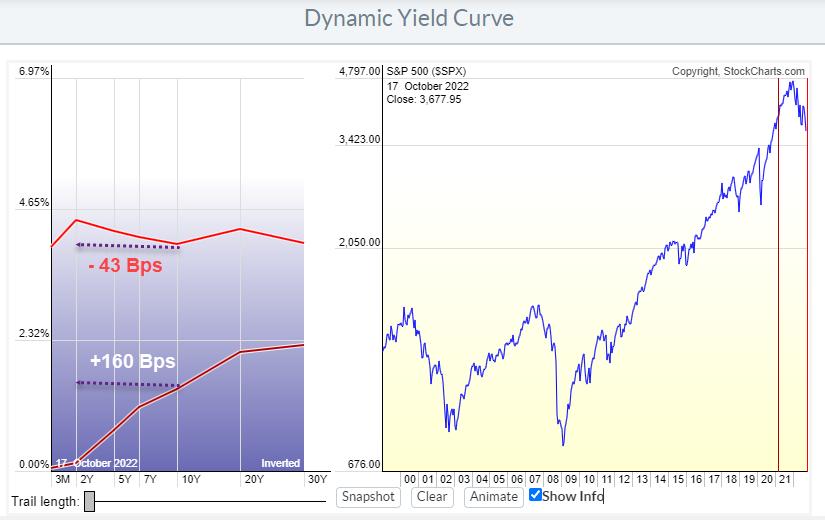

In March 2021, lending money to the US Government for ten years would give you a return of around 1.7%/ann over the next 10 years. Lending money to the government for 2 years at the same time would give you roughly 0.1%/ann for the next 2...

READ MORE

MEMBERS ONLY

Strong Sector Rotation To Financials, But Will It Be Enough to Turn the Market Back Up?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

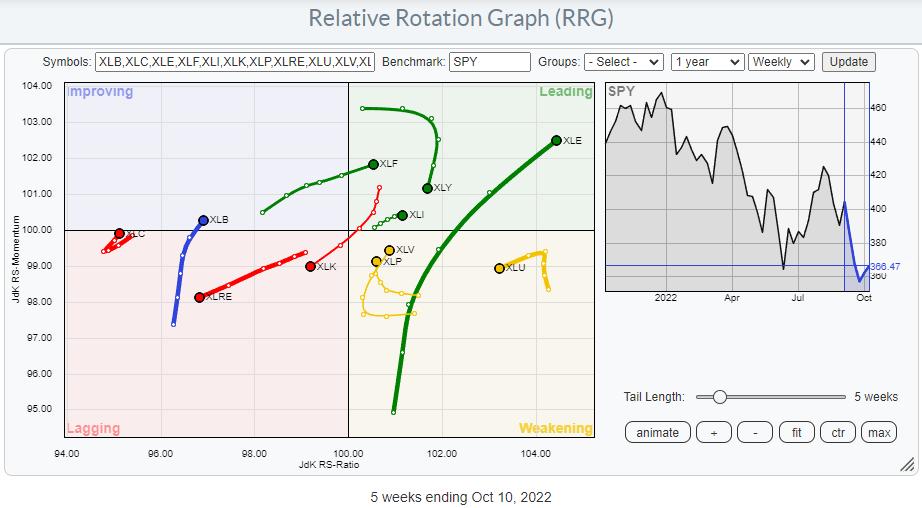

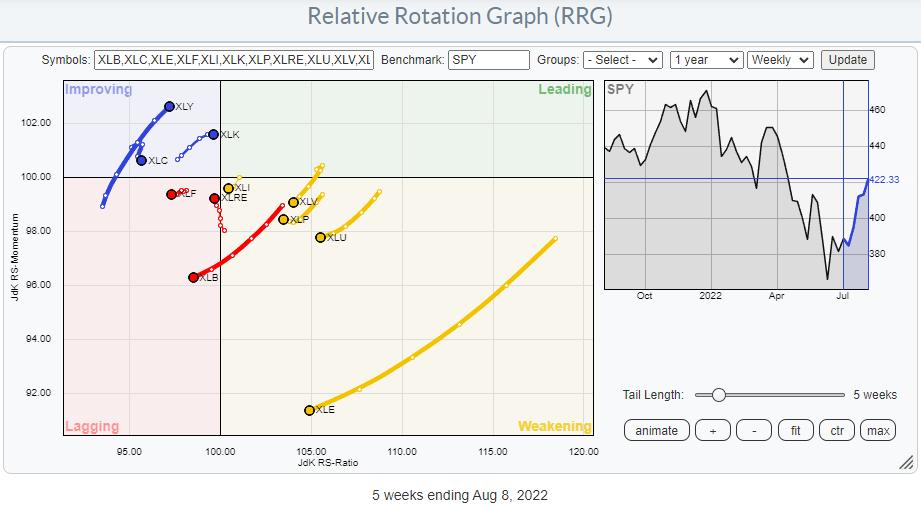

On the weekly Relative Rotation Graph, the tail for XLF has just crossed over into the leading quadrant while keeping up its rising relative momentum. This makes the financials sector one of the leading sectors in the market at the moment.

In the past week, XLF picked up 2.62%...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stocks and Bonds Both Breaking Major Support Levels

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, for the first show of October, I address long-term trends using monthly charts. In line with the longer-term perspective of this show, I start both the asset class and the sector rotation segments with a side-by-side comparison...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Back in Line

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, I review the current rotations for asset classes, where we find continuing strength for the US dollar and fixed-income-related asset classes, while stocks are rotating back to the lagging quadrant. As it is the last Tuesday of...

READ MORE

MEMBERS ONLY

Stocks Sinking Faster Than Dollar Can Rise -- Time to Broaden Your Horizon

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When markets across the world and all asset classes are dropping, it's time to put things into (international) perspective and see if any alternatives to US stocks are available.

I always keep an eye on this Relative Rotation Graph, which holds a group of international stock market indexes...

READ MORE

MEMBERS ONLY

Sector Spotlight: This is Still a Bear Market, Right?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, at asset class level, I highlight the strength of the USD, which also plays a role in the weakness of BTC. Stocks and bonds did not move much last week, while commodities seem to be turning. Sector...

READ MORE

MEMBERS ONLY

Two Things I Don't Expect to See in a Bear Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

I seriously hope that I was able to make clear in last Tuesday's Sector Spotlight that the market ($SPX) is still on shaky grounds and certainly not (back) in an uptrend. Sure, I mentioned the short-term improvement, which was undeniably there. But also that the upside was littered...

READ MORE

MEMBERS ONLY

Consumer Discretionary Picking Up Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the weekly Relative Rotation Graph, the consumer discretionary sector continues to improve and is now pushing further into the leading quadrant. It is now the sector with the highest JdK RS-Momentum reading. The tail length is fairly long compared to the other tails in the universe. All in all,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Money Moving Back to XLY and Bitcoin

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, I start with an overview of the current asset class rotation, using daily and weekly Relative Rotation Graphs. In this segment, I replace VNQ (real estate) with BTC, which better represents the asset class landscape, as Real...

READ MORE

MEMBERS ONLY

Sector Spotlight: 6/11 Sectors in Downtrend on Monthly Chart

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, for the first Tuesday of September, I dive into the monthly chart, which was completed last Thursday. We kick off with a view of sector rotation using the newly added monthly time frame on Relative Rotation Graphs;...

READ MORE

MEMBERS ONLY

Inside Tech, It's Really AAPL vs. MSFT

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

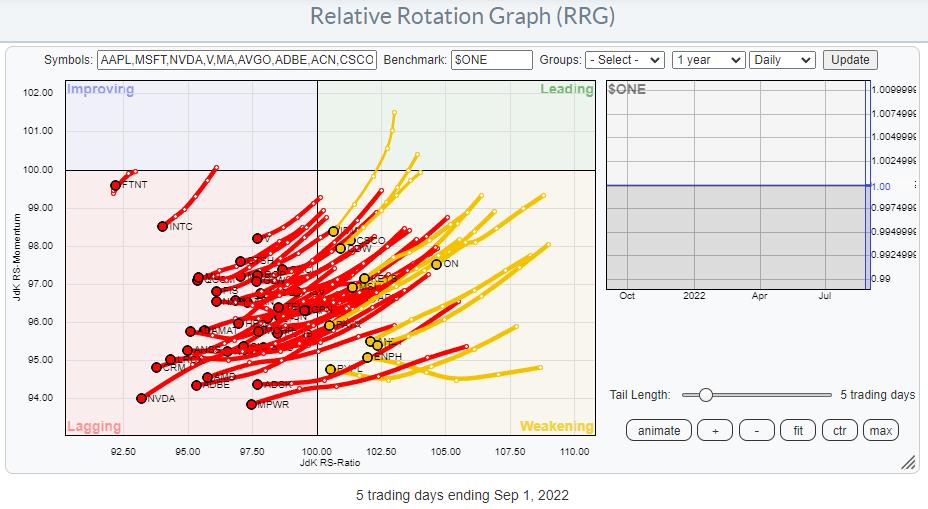

Plotting the components of the Information Technology Sector against $ONE provides us with a sobering picture. Pretty much every single stock in that index is in a downtrend, inside lagging, and/or inside weakening (and very close to entering lagging).

Plotting that same graph on a weekly timeframe shows almost...

READ MORE

MEMBERS ONLY

Sector Spotlight: Weak Sector Rotation Puts $SPX on Track for 3900

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, I look at seasonality and try to align the theoretical expectations for the relative performance of sectors against the S&P 500 going into September with the current reality as it is playing out on the...

READ MORE

MEMBERS ONLY

Don't Even Think About Buying... (This Sector)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Staying out of a sector can be as important as being in the right sector. This is particularly true for the Communication Services Sector, and has been for a long time already.

The Relative Rotation Graph above shows the rotation over the last 30 weeks, starting the week of 1/...

READ MORE

MEMBERS ONLY

Sector Spotlight: Rotation to Utilities Signals Caution for S&P 500

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, I share my thoughts on potential developments for the S&P 500. First, from an asset allocation perspective, I focus on the development of the USD and interest rates in relation to the stock market. Then,...

READ MORE

MEMBERS ONLY

Combining RRG with the Turtle Soup Scan is Now More Powerful

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Since my introductory article on the topic, 2018's "Combining Relative Rotation Graphs and the "Turtle Soup" setup", I have mentioned and used this strategy a few times in my articles and analyses. The main goal has been to combine the power of RRG and...

READ MORE

MEMBERS ONLY

Sector Spotlight: End of Downtrend ≠ New Uptrend

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, I take a look at recent rotations in asset classes and sectors. The recent strength for stocks over bonds at asset class level is clear, but the rotational picture for the weekly and daily time frames is...

READ MORE

MEMBERS ONLY

Only Two Sectors are Leading the Charge

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for US sectors, there are only two sectors that are leading the market higher. Not surprisingly, these are growth-related sectors, specifically XLK and XLY, which together make up 40% of the market capitalization of the S&P 500 index.

In last Tuesday's...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sectors Kissing Resistance

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, I start with a look at Growth/Value and Size (Large-, Mid-, and Small-Cap) rotations. After that, I take an extensive look at the rotations of Offensive, Defensive and Sensitive sectors and their individual charts. The common...

READ MORE

MEMBERS ONLY

Disconnected EW Sector Rotation Offers Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

From time to time, I compare the rotations of the SPDR sectors that we usually use with their EW counterparts.

The first RRG below shows the rotations for the SPDR sector spiders (cap-weighted). The second RRG shows the rotations of the Equal Weight sectors. In both, the Energy sector is...

READ MORE

MEMBERS ONLY

Sector Spotlight: Downside Risk Beats Upside Potential

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this week's edition of StockCharts TV's Sector Spotlight, I start with a look at the current state of Sector Rotation in US stocks. (Normally, I review seasonal patterns in sectors every last Tuesday of the month, but, last week, that segment had to make place...

READ MORE

MEMBERS ONLY

Are You a Short-Term Trader? Watch This!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

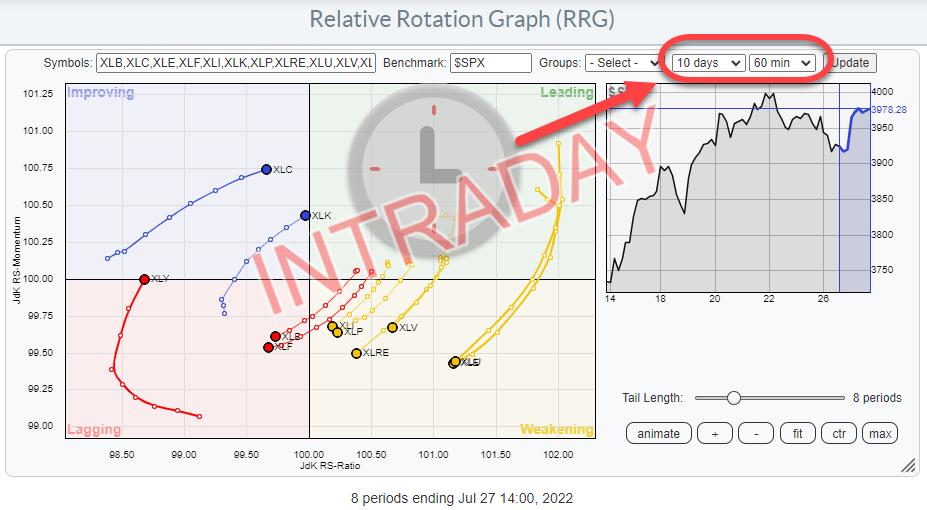

Relative Rotation Graphs (RRG) were introduced on StockCharts.com in July 2014. Since then, we have had the possibility to render the charts using weekly or daily data. Primarily, I think, because those were the time frames I was, and am, using most of the time for myself and in...

READ MORE

MEMBERS ONLY

Sector Spotlight: Bouncing Bonds and Intraday RRGs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This edition of StockCharts TV's Sector Spotlight marks an important milestone in the life of RRG on StockCharts.com. Following many user requests, the latest release of new functionalities and improvements (Bainbridge) of the website includes the support for intraday time frames on Relative Rotation Graphs. This addition...

READ MORE

MEMBERS ONLY

5 Interesting Industries In Industrials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this article, I'd like to dig a bit deeper into the Industrial sector.

Starting at the sector level, we find the tail for XLI inside the weakening quadrant and moving towards lagging. So definitely not one of the better sectors. As a matter of fact, it'...

READ MORE