MEMBERS ONLY

Is the State of Emergency a Sign of a Bottom?

by Martin Pring,

President, Pring Research

This week has seen U.S. administration fiscal proposals, as well as 1.5 trillion dollars in Fed support, aimed at limiting the economic damage from COVID-19. Friday saw a travel ban put into effect, along with a state of emergency. Unfortunately, these actions, just like the previous week'...

READ MORE

MEMBERS ONLY

Is the State of Emergency a Sign of a Bottom?

by Martin Pring,

President, Pring Research

This week has seen U.S. administration fiscal proposals, as well as 1.5 trillion dollars in Fed support, aimed at limiting the economic damage from COVID-19. Friday saw a travel ban put into effect, along with a state of emergency. Unfortunately, these actions, just like the previous week'...

READ MORE

MEMBERS ONLY

Safe Havens Look Like They are Reversing; Stock Market Still Searching for a Low

by Martin Pring,

President, Pring Research

* Bonds and Yen Starting to Lose Safety Appeal?

* One Indicator That Has Returned to Financial Crisis Levels

Bonds and Yen Starting to Lose Safety Appeal?

The stock market has got the majority of the attention in the last couple of weeks because of its exceptional volatility. On the other hand,...

READ MORE

MEMBERS ONLY

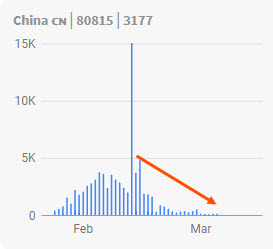

Market Tries to Hammer Out a Bottom As COVID-19 Tries to Hammer Out a Top

by Martin Pring,

President, Pring Research

* Revisiting the February 29 Hammer

* Hammering a Top for COVID-19

Revisiting the February 29 Hammer

On Friday, 29 February, I pointed out that the Wilshire 5,000 had formed a bullish hammer at a time when a couple of other short-term indicators had reached extreme levels, thereby suggesting a rally....

READ MORE

MEMBERS ONLY

"Bull in a China Shop" Revisited, Plus Some Interesting Chinese ETFs

by Martin Pring,

President, Pring Research

* Shanghai is Outperforming the US

* Interesting Chinese Sectors

Shanghai is Outperforming the US

Back in early January, I drew your attention to the fact that the Shanghai Composite ($SSEC) had broken to the upside, which is shown in Chart 1. A week or so later, when the coronavirus reared its...

READ MORE

MEMBERS ONLY

Three Charts That Suggest an Interim Bottom is at Hand

by Martin Pring,

President, Pring Research

It's been quite a week, but the charts are starting to look to me as if a bottom is close at hand. In order to identify one, I look at a couple of factors. First, are there any signs of a one or two bar reversal pattern? Take...

READ MORE

MEMBERS ONLY

The Correction May Well Extend, But Some Green Shoots are Starting to Appear

by Martin Pring,

President, Pring Research

* Some Signs of Weakness

* On a More Bullish Note

* Mind that Gap and Volatility

Last time I wrote about the stock market was the first week in February, where I concluded that a couple of indicators were oversold, but that many others were not, so further corrective action probably lay...

READ MORE

MEMBERS ONLY

Low Bond Yields May Not Be Around Much Longer

by Martin Pring,

President, Pring Research

* Secular Trend for the 20-Year Yield

* Lower Down Curve Yields Are Already in a Secular Bull

* Short-Term Oscillators Ready for Some Upside Action?

The coronavirus has triggered concerns about the recovery, which in turn has resulted in a sharp setback for yields. Falling yields are bullish for housing starts, which,...

READ MORE

MEMBERS ONLY

Commodities Remain on a Knife Edge

by Martin Pring,

President, Pring Research

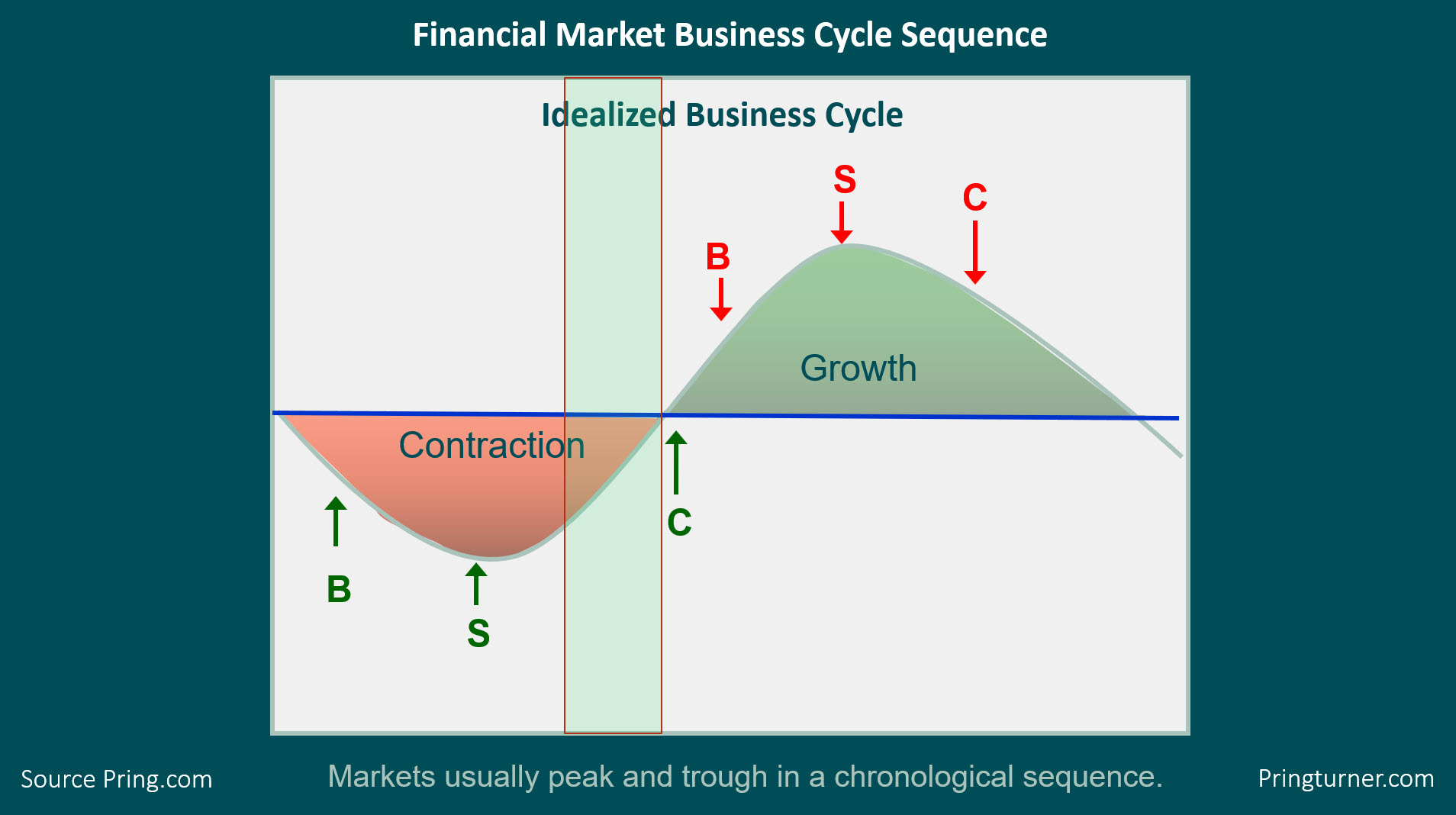

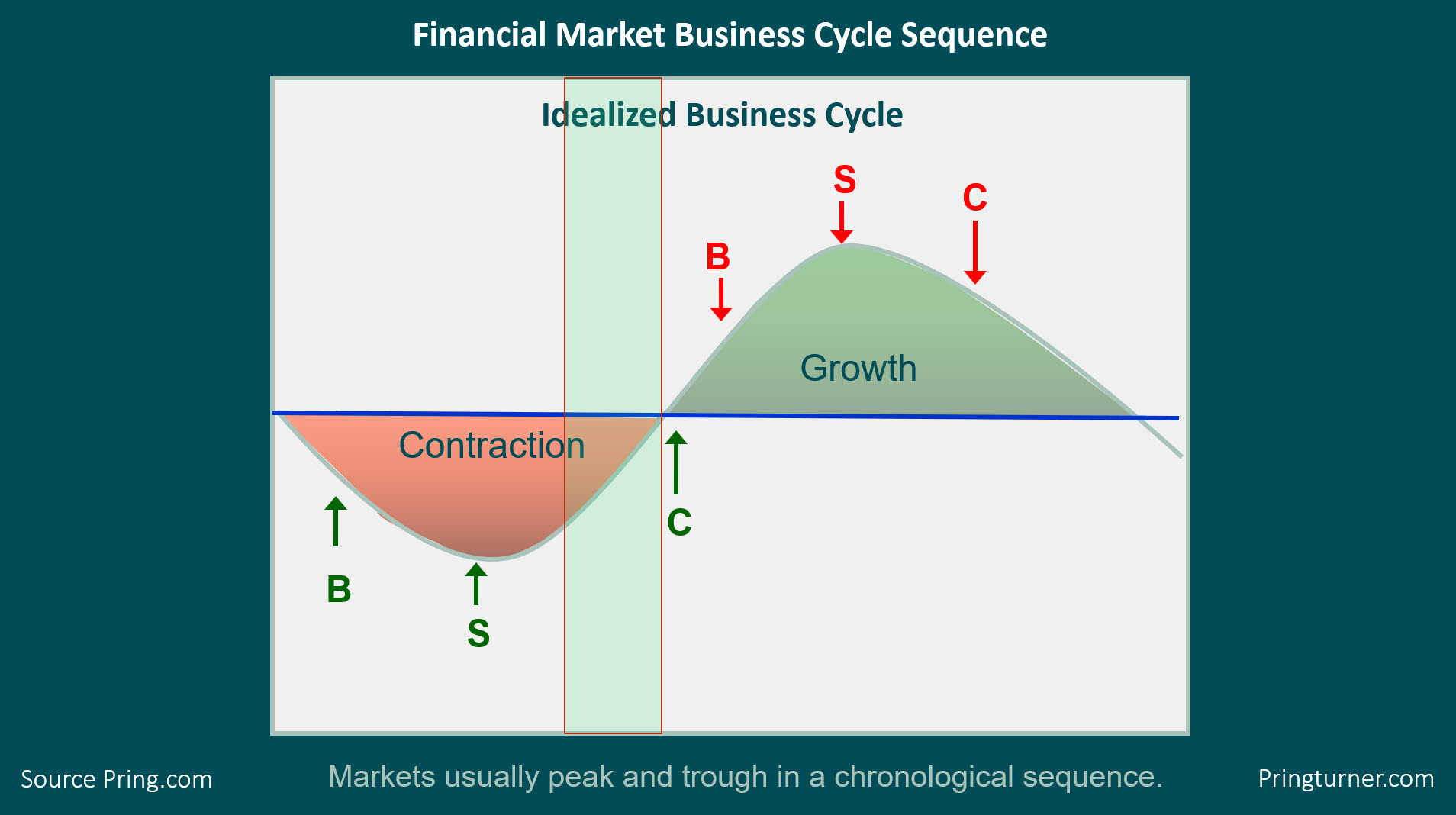

Back in December, I wrote an articlepointing out that the business cycle was nothing more than a set series of chronological sequences. The importance of this observation, for investors, is that the primary trend peaks and troughs of bonds, stocks and commodities fit nicely into that chronology, as shown in...

READ MORE

MEMBERS ONLY

Commodities Remain on a Knife Edge

by Martin Pring,

President, Pring Research

* Where Are We in the Cycle?

* The Economy is Currently on the Side of the Bulls

* The Technical Position of the DB Commodity ETF is Precarious

Where Are We in the Cycle?

Back in December, I wrote an articlepointing out that the business cycle was nothing more than a set...

READ MORE

MEMBERS ONLY

It's Still a Bull Market, But More Corrective Activity is Likely

by Martin Pring,

President, Pring Research

* Why the Correction Will Likely be Contained

* More Corrective Action Likely

* One Indicator Flashes a Buy Signal

* Conclusion

Why the Correction Will Likely be Contained

A couple of weeks ago, I wrote that a correction was inevitable, and presented a couple of indicators to suggest that it might be close....

READ MORE

MEMBERS ONLY

The Stock Market May Be Rattled by the Coronavirus, But Bond Yields Have a Battle of Their Own

by Martin Pring,

President, Pring Research

The stock market was roughed up by the coronavirus earlier in the week, but, under the surface, another battle has been going on -- the one between inflation and deflation, that is, as both yields and commodity prices have run up against key support levels. That's a dispute...

READ MORE

MEMBERS ONLY

The Stock Market May Be Rattled by the Coronavirus, But Commodities and Bond Yields Have Battles of Their Own

by Martin Pring,

President, Pring Research

* Bond Yields are Just Above Support

* Commodities are at Support

The stock market was roughed up by the coronavirus earlier in the week, but, under the surface, another battle has been going on -- the one between inflation and deflation, that is, as both yields and commodity prices have run...

READ MORE

MEMBERS ONLY

When the Inevitable Correction Comes, History Suggests It Won't Amount to Much

by Martin Pring,

President, Pring Research

One of the basic laws of technical analysis, which I have learned the hard way, is to be very careful about calling counter-cyclical short-term moves. The primary trend dominates everything. For example, if you are in a bear market and you see a short-term oversold condition, do not assume that...

READ MORE

MEMBERS ONLY

Dollar Index Reaches a Crucial Technical Juncture Point

by Martin Pring,

President, Pring Research

The Dollar Index has been rising in the last few sessions following its December decline, which has put it at a crucial technical juncture. Whichever way it breaks will have implications for commodities, gold and the relative performance of international equities to the US. A rising currency would have negative...

READ MORE

MEMBERS ONLY

Dollar Index Reaches a Crucial Technical Juncture Point

by Martin Pring,

President, Pring Research

The Dollar Index has been rising in the last few sessions following its December decline, which has put it at a crucial technical juncture. Whichever way it breaks will have implications for commodities, gold and the relative performance of international equities to the US. A rising currency would have negative...

READ MORE

MEMBERS ONLY

Bull in a China Shop

by Martin Pring,

President, Pring Research

Thursday's price action in China resulted in a powerful signal that Chinese equities are headed significantly higher. That should be bullish not only for China but for the world as a whole. In making that statement, I am assuming that that this market is in the process of...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2020-01-02

by Martin Pring,

President, Pring Research

The monthly Market Roundup videofor January is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Bull in a China Shop

by Martin Pring,

President, Pring Research

* Major Breakouts Coming Out of China

* Four Chinese ETFs

Major Breakouts Coming Out of China

Thursday's price action in China resulted in a powerful signal that Chinese equities are headed significantly higher. That should be bullish not only for China but for the world as a whole. In...

READ MORE

MEMBERS ONLY

Stocks are Overdue for a Correction, But These Charts Say it Doesn't Matter

by Martin Pring,

President, Pring Research

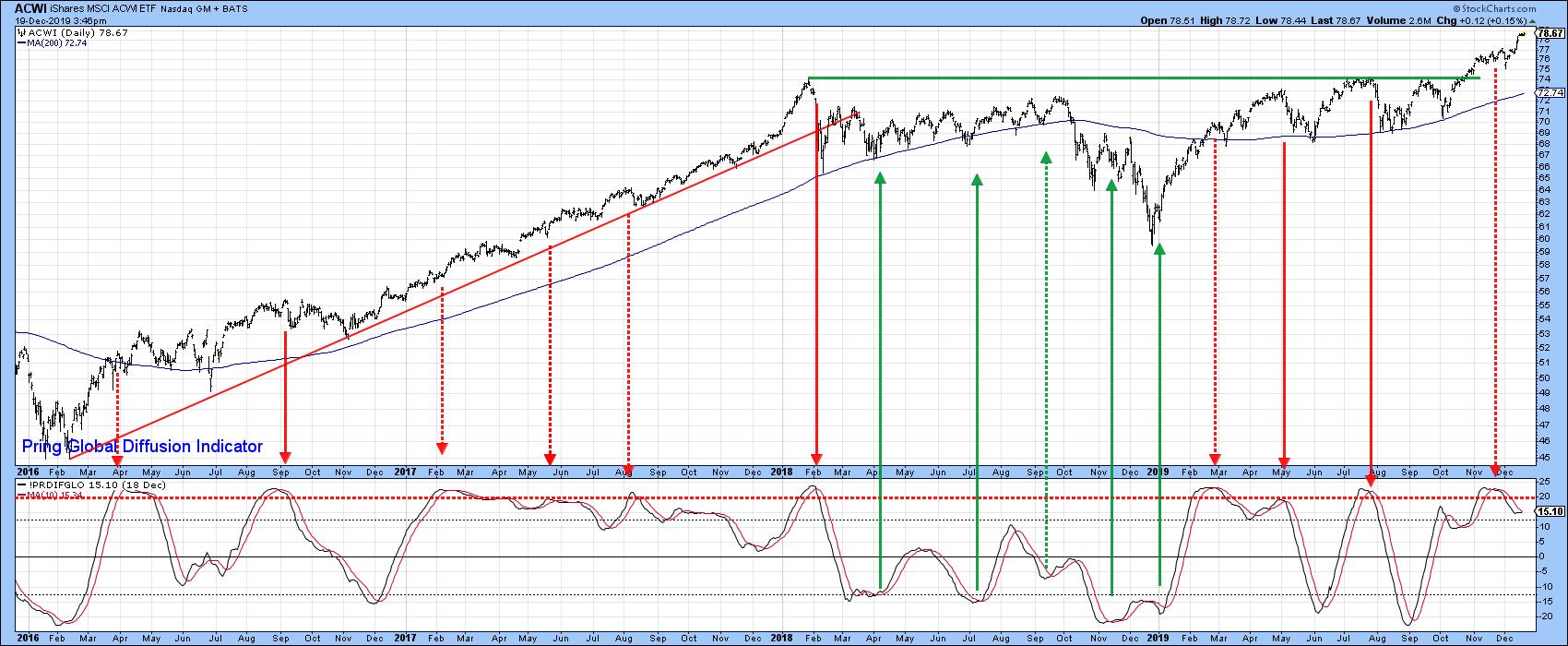

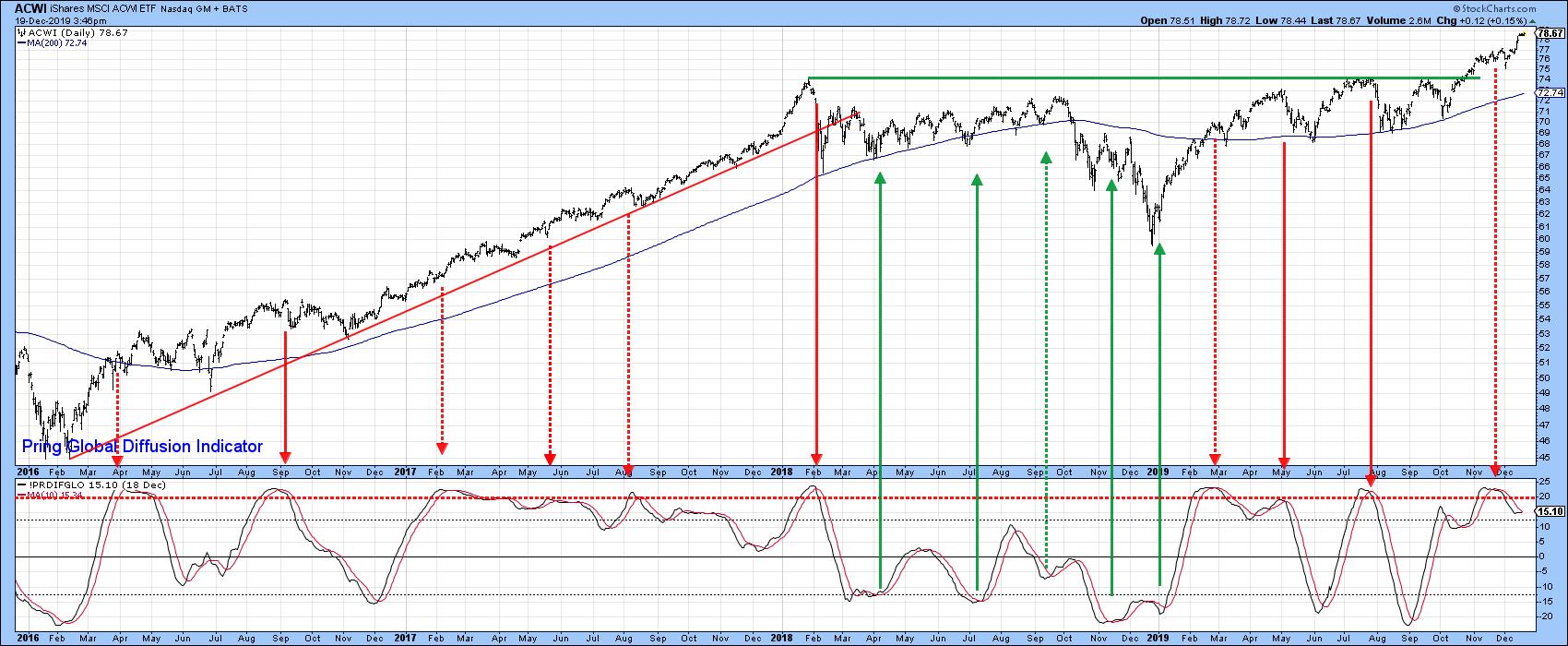

Right now, stocks are very overextended and likely due for a correction. In Chart 1, for instance, you can see that my Global Diffusion indicator has just triggered a sell signal from an extreme level. The solid red arrows show that the MSCI World Stock ETF (ACWI) has usually responded...

READ MORE

MEMBERS ONLY

Stocks are Overdue for a Correction, But These Charts Say It Doesn't Matter

by Martin Pring,

President, Pring Research

* Confidence is Breaking Out All Over

* Alternative Risk Relationships are Starting to Get Riskier

Right now, stocks are very overextended and likely due for a correction. In Chart 1, for instance, you can see that my Global Diffusion indicator has just triggered a sell signal from an extreme level. The...

READ MORE

MEMBERS ONLY

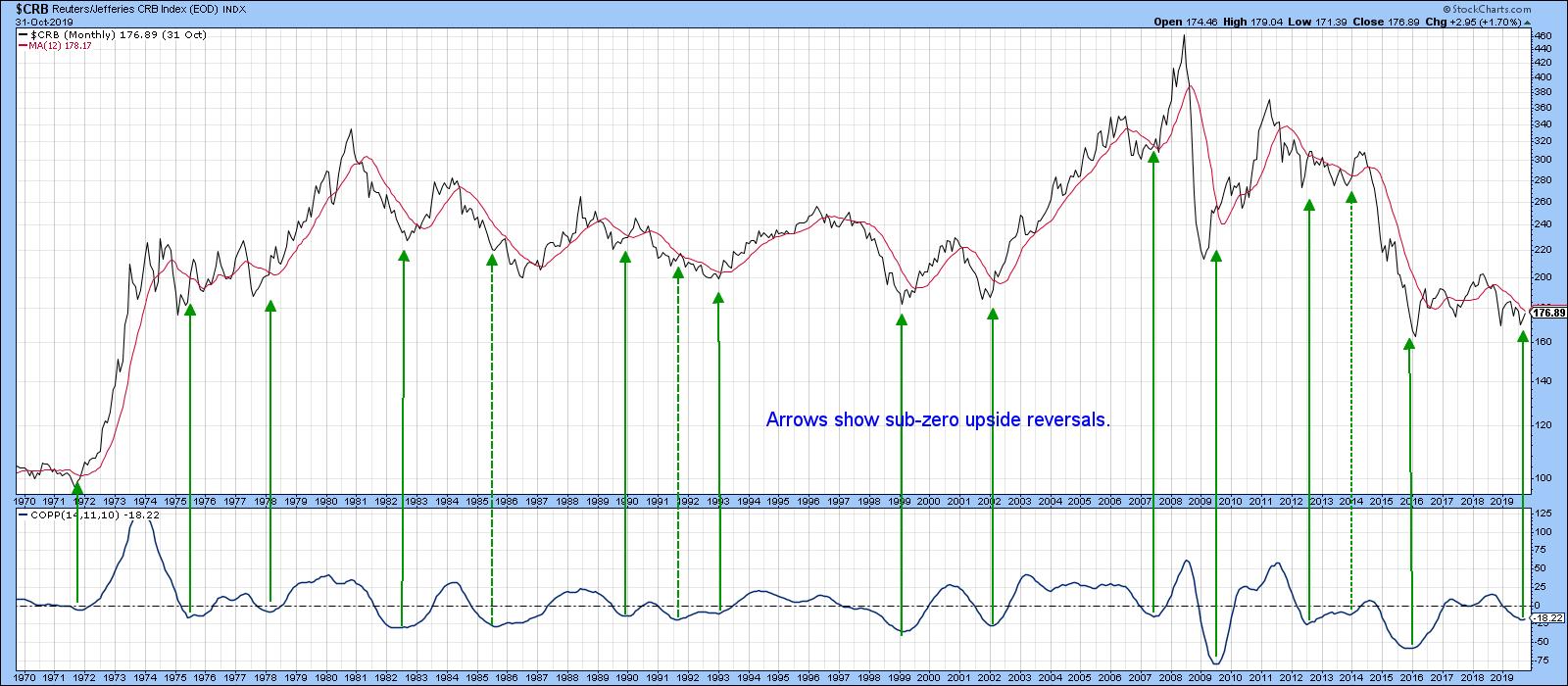

It's Time To Watch For A Bottom In Commodities

by Martin Pring,

President, Pring Research

In my Monthly Market Rounduplast week, I repeated a talk that I recently gave at the CMT Summit in Mumbai. The talk in question began with an outline of the approach we take at Pring Turner for our sub-advisory services and in the Intermarket Review, my monthly publication that analyses...

READ MORE

MEMBERS ONLY

It's Time To Watch For A Bottom In Commodities

by Martin Pring,

President, Pring Research

* The Markets and the Business Cycle

* Using Other Markets to Forecast Commodities

The Markets and the Business Cycle

In my Monthly Market Roundup last week, I repeated a talk that I recently gave at the CMT Summit in Mumbai. The talk in question began with an outline of the approach...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-12-02

by Martin Pring,

President, Pring Research

The monthly Market Roundup videofor December is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

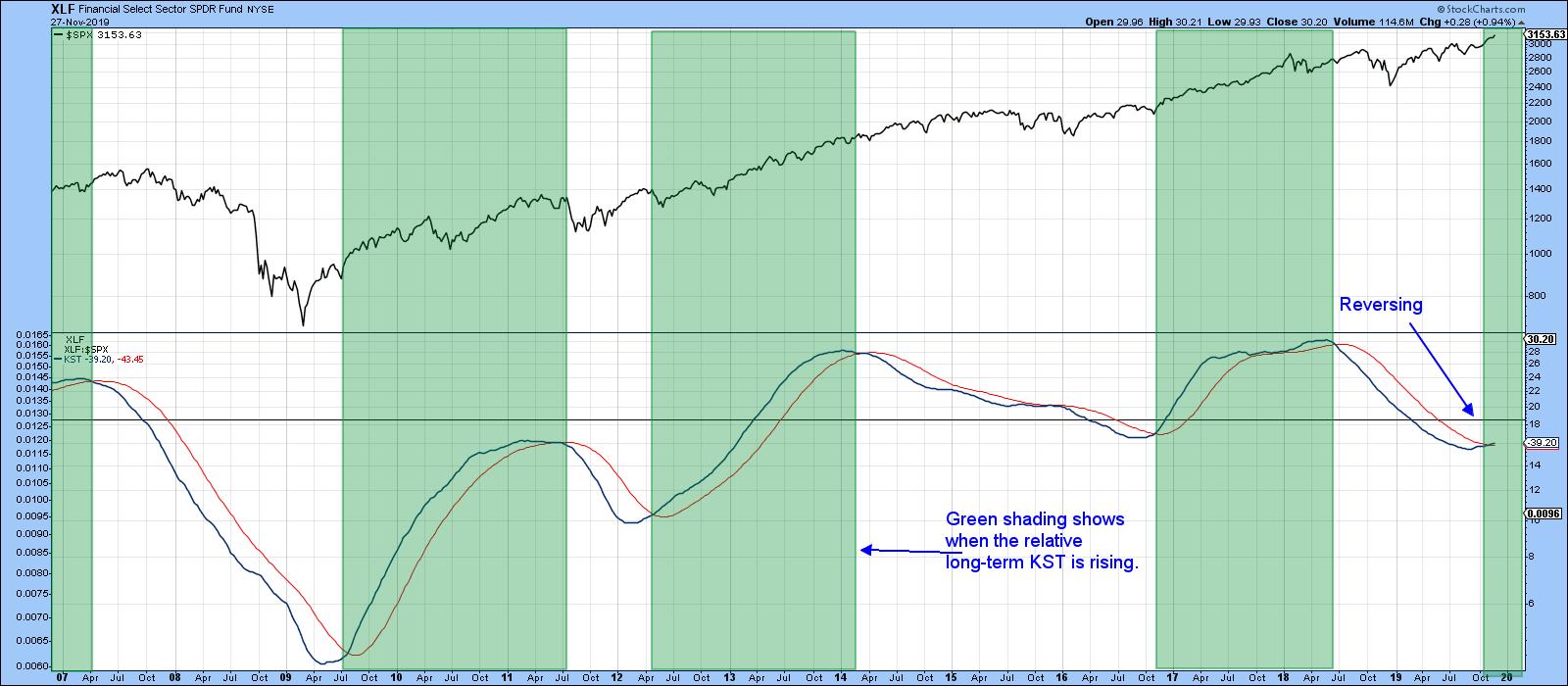

Three Good-Looking Sectors for the Ongoing Bull Market

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Thursday, November 28th at 4:08pm ET.

Chart 3 shows a long-term indicator that just went bullish for the market. It also points us in the direction of one of the sectors referred...

READ MORE

MEMBERS ONLY

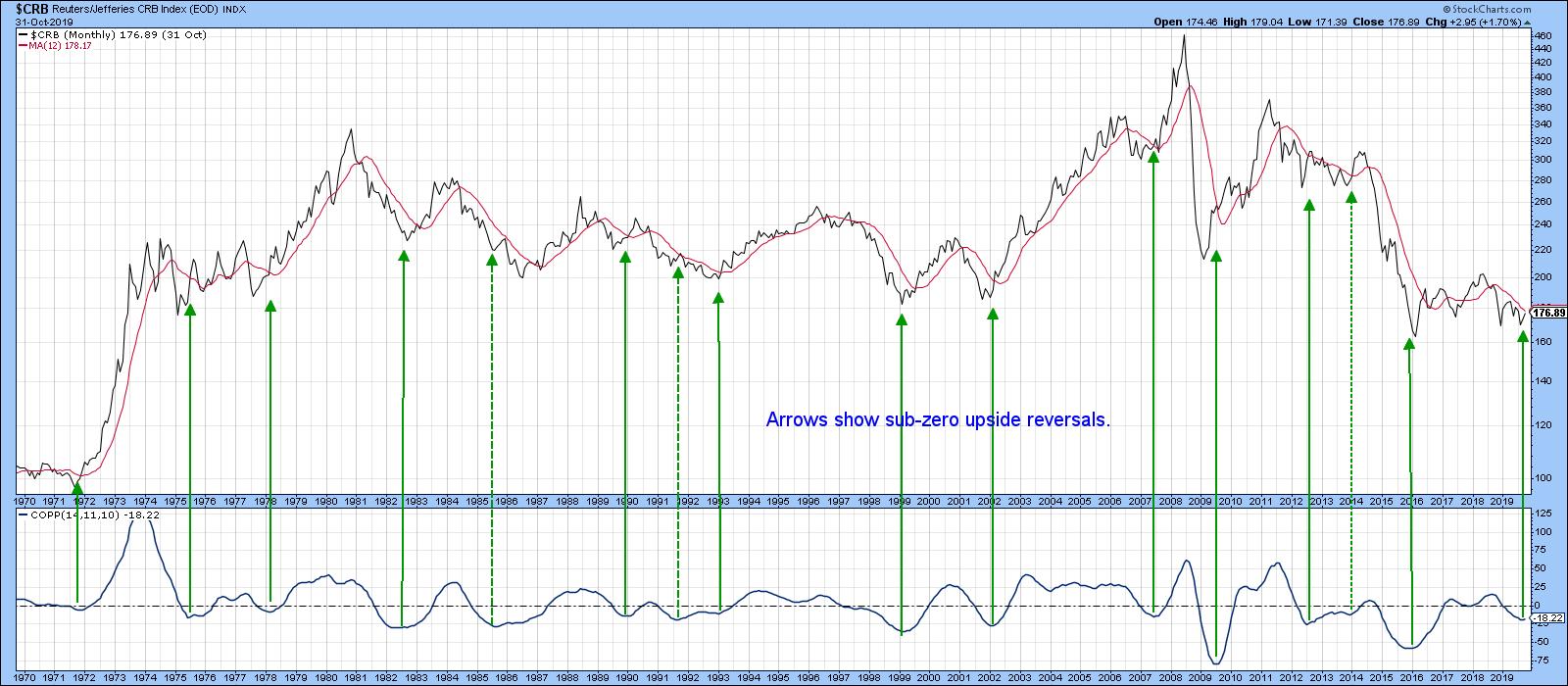

Three Good-Looking Sectors for the Ongoing Bull Market

by Martin Pring,

President, Pring Research

* The Game Has Just Begun

* Three Interesting Sectors

* Watch the DB Agriculture Fund

The Game Has Just Begun

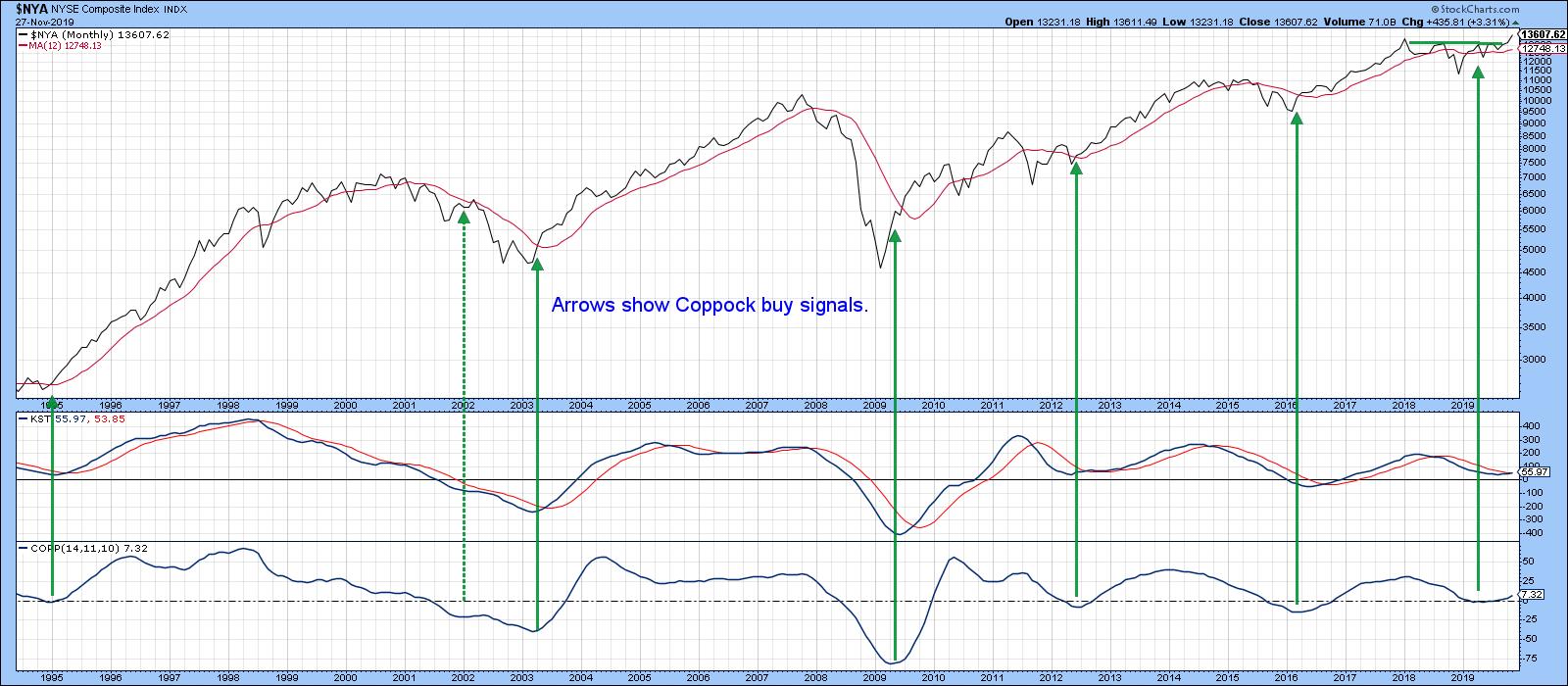

It is fairly evident by now that the equity market has broken to the upside big time. Chart 1 sets the scene by demonstrating that first the Coppock Indicator and later the...

READ MORE

MEMBERS ONLY

Recent Breakouts Say Equities are Headed Significantly Higher in the Next Six Months

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Thursday, November 7th at 1:28pm ET.

Back in mid-September, I wrote an article on US equitiesthat pointed out how several short-term indicators had reached extreme overbought levels, a sign of strong underlying...

READ MORE

MEMBERS ONLY

Two Recent Breakouts Say Equities Are Headed Significantly Higher In The Next Six Months

by Martin Pring,

President, Pring Research

* Two Meaningful Breakouts

* One Chart Still to Break Out

Back in mid-September, I wrote an article on US equitiesthat pointed out how several short-term indicators had reached extreme overbought levels, a sign of strong underlying momentum that historically had been followed by higher prices. However, since overbought conditions are typically...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-11-03

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for November is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Stocks are in a Bear Market; What About Commodities?

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Friday, November 1st at 1:36pm ET.

At Pring Turner Capital, the registered investment advisory firm where I serve as investment strategist, our investment approachinvolves the proactive rotation of client's assets...

READ MORE

MEMBERS ONLY

Stocks Have Broken Out; What About Commodities?

by Martin Pring,

President, Pring Research

* Commodities are in a Bear Market

* The Stock Market May Be on the Verge of Signaling a Commodity Rally

* Short-Term Commodity Momentum

At Pring Turner Capital, the registered investment advisory firm where I serve as investment strategist, our investment approachinvolves the proactive rotation of client's assets around the...

READ MORE

MEMBERS ONLY

Global Indexes Just Below Major Breakout Points

by Martin Pring,

President, Pring Research

* The Dow Jones and MSCI World Stock Indexes/ETF Poised to Move Higher

* Rest of the World Emerging

* Europe, Japan and Emerging Markets Looking Positive

The Dow Jones and MSCI World Stock Indexes/ETF Poised to Move Higher

US indexes have rallied sharply in the last week, but so have...

READ MORE

MEMBERS ONLY

British Pound Clears Its 200-day MA for an Initial Sign of a New Bull Market

by Martin Pring,

President, Pring Research

* Pound is in a Long-Term Secular Bear Market

* Crossing of the 200-Day Starts the Ball Rolling for a Primary Bull Market

* Pound Set to Break Against the Euro

Pound is in a Long-Term Secular Bear Market

Chart 1 shows that the British Pound has been in a secular bear market...

READ MORE

MEMBERS ONLY

Short-Term Indicators Behave Differently in Bull and Bear Markets

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Tuesday, October 8th at 12:48pm ET.

Short-term oscillators behave differently depending on the direction of the primary trend. In bull markets, prices are very sensitive to oversold conditions and quickly bounce. We...

READ MORE

MEMBERS ONLY

More Range-Bound Activity Ahead For US Equities?

by Martin Pring,

President, Pring Research

* Short-Term Indicators Behave Differently in Bull and Bear Markets

* Three Charts to Watch for a Potential Bearish Scenario

Short-Term Indicators Behave Differently in Bull and Bear Markets

Short-term oscillators behave differently depending on the direction of the primary trend. In bull markets, prices are very sensitive to oversold conditions and...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-10-02

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for October is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

What's Happening with Last Week's Three Featured Charts

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Friday, September 27th at 1:25pm ET.

Last week, I wrote that the short-term technical picture looked positive, but that I was watching three charts which would confirm a significant extension to the...

READ MORE

MEMBERS ONLY

Last Week, Three Charts Failed To Break To The Upside. Where Do We Go From Here?

by Martin Pring,

President, Pring Research

* What's Happening with Last Week's Three Featured Charts

* Short-Term Oscillators

* Longer-Term Indicators are Mostly Bullish

Last week, I wrote that the short-term technical picture looked positive, but that I was watching three charts which would confirm a significant extension to the bull market in the event...

READ MORE

MEMBERS ONLY

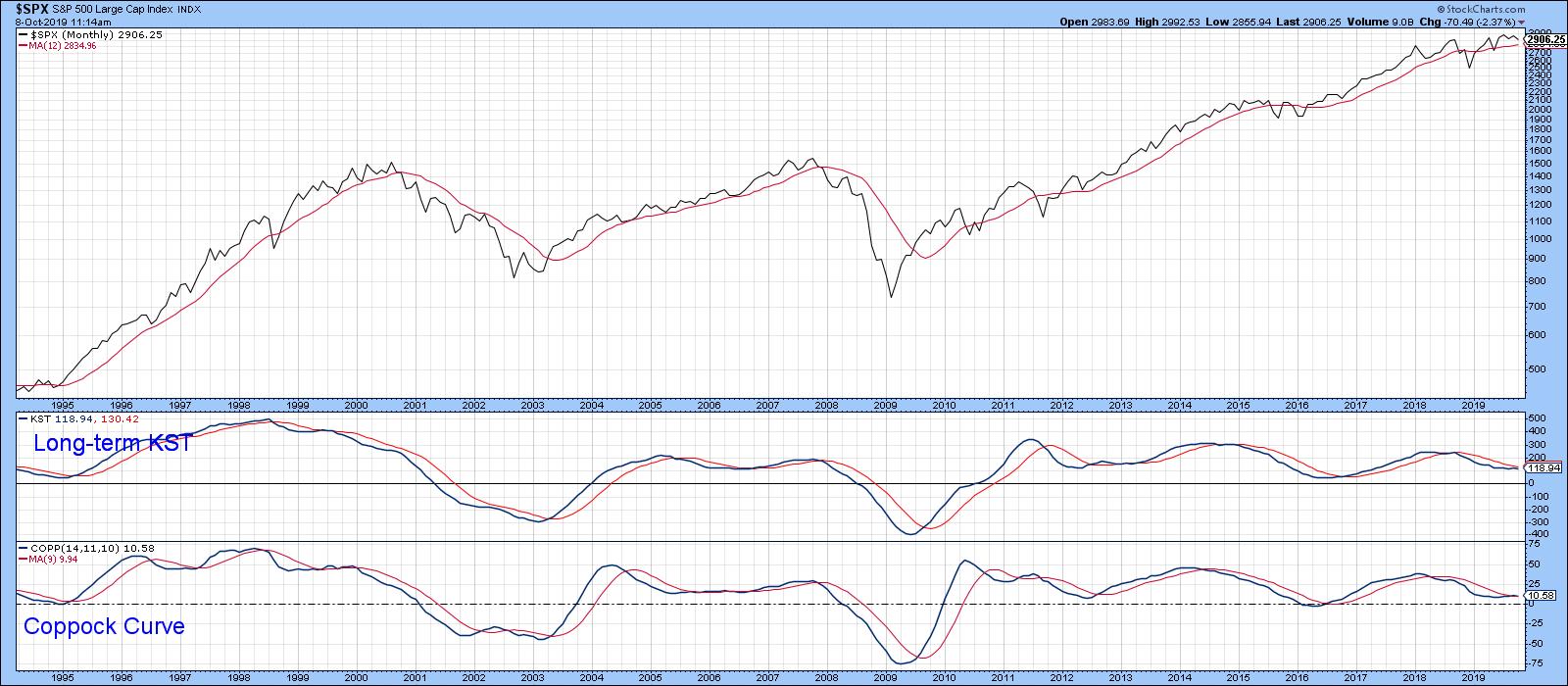

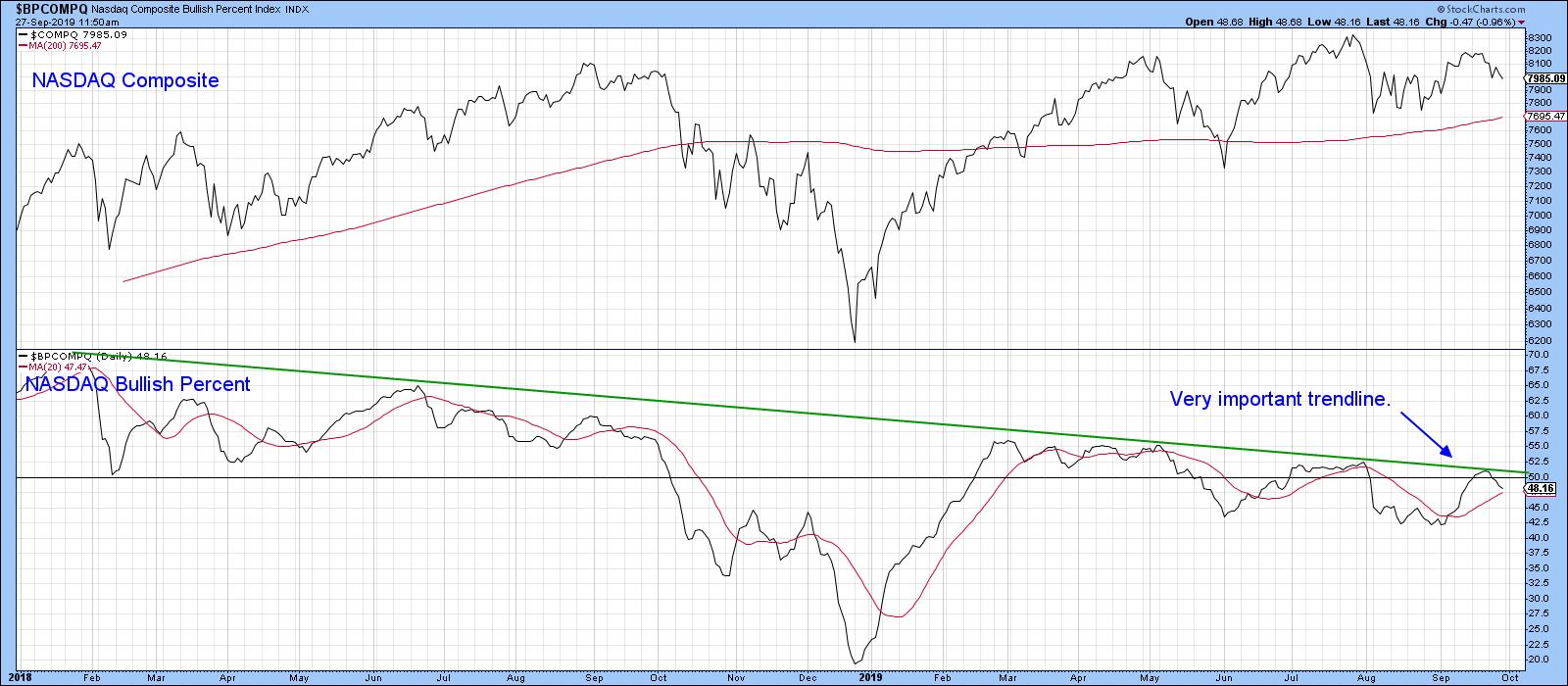

Three Charts That Could Signal a Significant Extension to the Equity Rally

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Monday, September 16th at 6:04pm ET.

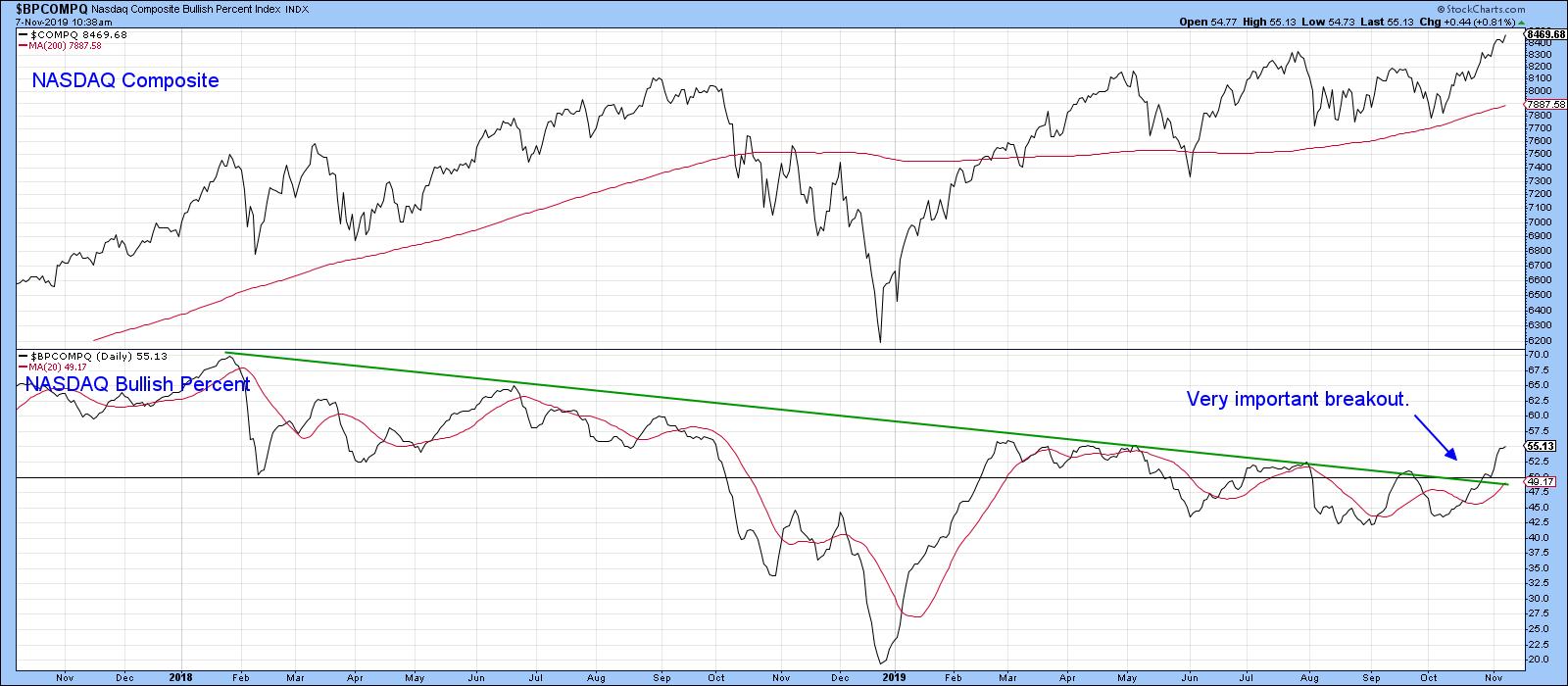

First of all, Chart 4 features the NASDAQ bullish percentage. You can see how it has been gradually working its way lower since early 2018, having...

READ MORE

MEMBERS ONLY

Three Charts That Could Signal A Significant Extension To The Equity Rally

by Martin Pring,

President, Pring Research

* High Velocity of Short-Term Indicators Indicate Higher Prices

* Three Charts to Monitor for More Upside Potential

High Velocity of Short-Term Indicators Indicate Higher Prices

A couple of weeks ago, I cited some short-term indicators for the US stock market that struck me as being bullish. Several of these are now...

READ MORE