MEMBERS ONLY

Commodities May Be Down, But Are They Out?

by Martin Pring,

President, Pring Research

* Long-Term Commodity Technicals are Finely Balanced

* Gold Leads Commodities

* Commodities Rise and Fall with Confidence

* Short-Term Technicals are Encouraging

* Platinum Breaking Out

Commodities have been losing ground recently, but the latest data suggest that they may be in the process of turning around. If so, that could be important for...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-09-03

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for September is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Four More Short-Term Indicators Turn Bullish for Equities

by Martin Pring,

President, Pring Research

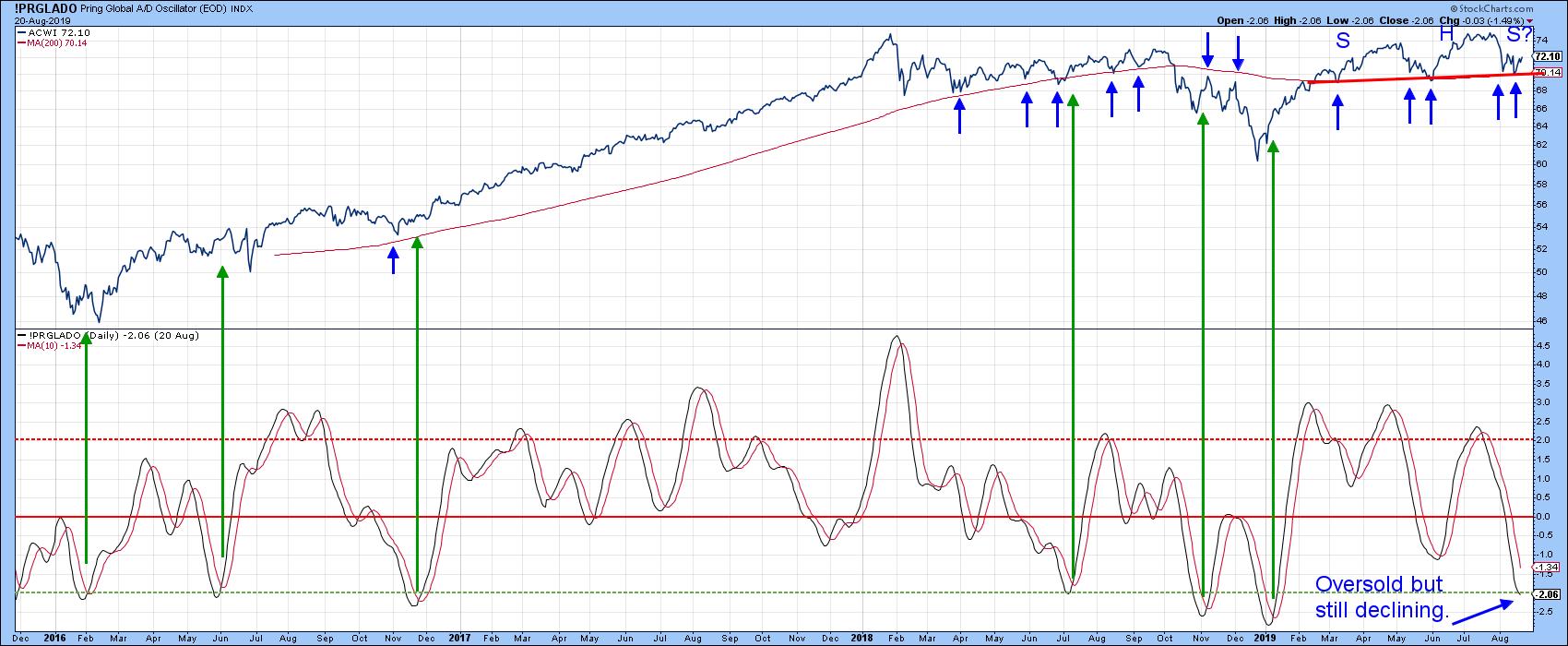

* Breadth Acting Positively

* Four Short-Term Indicators Turn Bullish

* Stocks Could Be Breaking Against Gold

The mood on Wall Street is turning ever more cautious as the economic numbers continue to soften. We need to remember, though, that the stock market is a forward-looking indicator, as it looks through the foggy...

READ MORE

MEMBERS ONLY

Most Sectors Still Experiencing Rising Peaks and Troughs

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Wednesday, August 27th at 4:15pm ET.

One simple and very much overlooked technique for trend identification is to observe whether the price of a security is experiencing a series of rising peaks...

READ MORE

MEMBERS ONLY

When The Crowd Screams Recession, Technicians Should Prepare For A Bull Market

by Martin Pring,

President, Pring Research

* Support Holds in an Oversold Market

* Most Sectors Still Experiencing Rising Peaks and Troughs

Last week, I pointed out that the stock market faced a challenge at its recent lows. This was because I saw that a breach of the solid red trend lines in Charts 1 and 2 would...

READ MORE

MEMBERS ONLY

Trick or Treat for Global Equities?

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Wednesday, August 21st at 9:36pm ET.

During my many decades in this business, I have never heard of a recession so well-advertised as the one we are witnessing currently. It's...

READ MORE

MEMBERS ONLY

If It's Trick Or Treat In The Equity Market, I'll Take The Treat

by Martin Pring,

President, Pring Research

* Trick or Treat for Global Equities?

* Several Reliable US Short-Term Indicators Turning Bullish

During my many decades in this business, I have never heard of a recession so well-advertised as the one we are witnessing currently. It's a fact that financial market events that are widely expected rarely...

READ MORE

MEMBERS ONLY

The Truth About the Yield Curve, The Economy and The Stock Market

by Martin Pring,

President, Pring Research

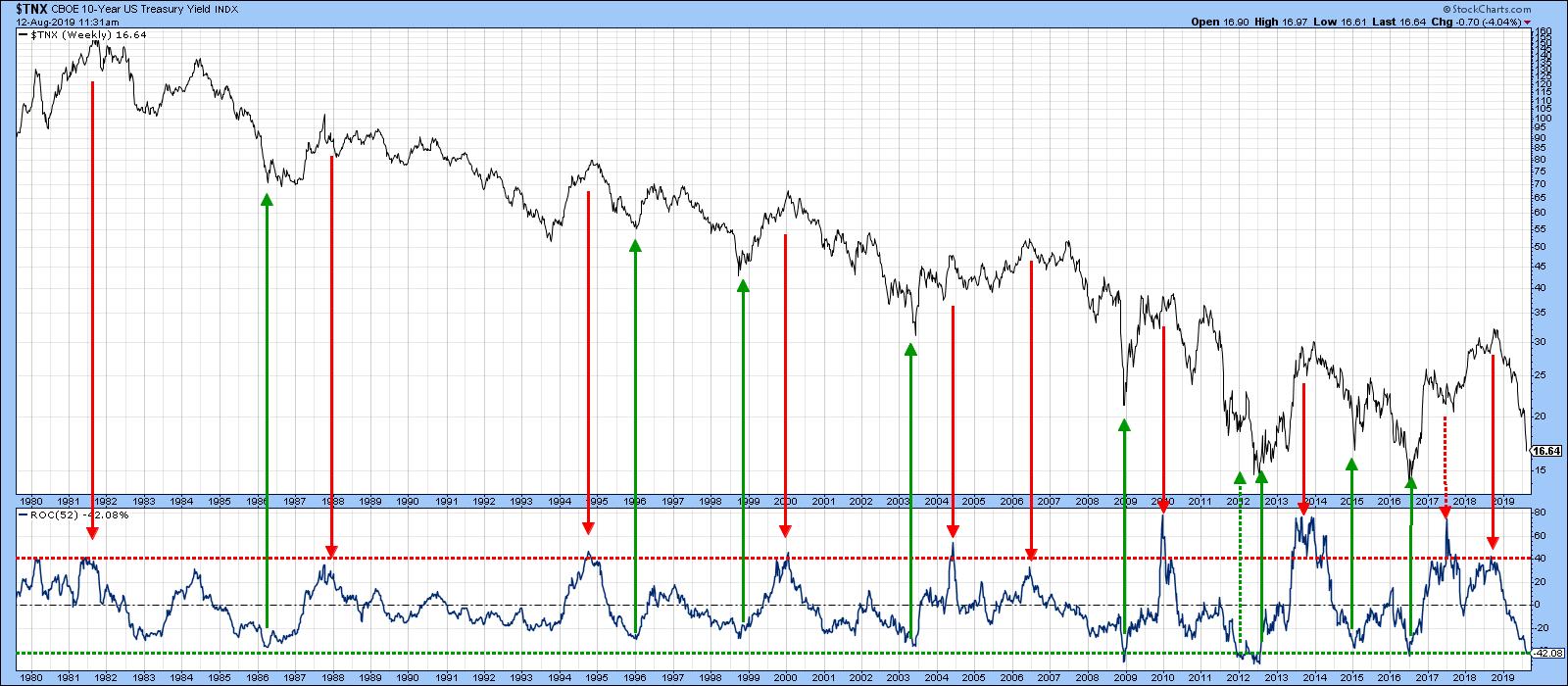

* Yield Curve Inversion and Recessions

* Using the Economy to Forecast the Economy

* What Happens to the Stock Market after an Initial Inversion?

* Yield Curve Conclusion

* Catch a Falling Knife, Anyone?

By now, everyone and his dog is aware that the yield curve has inverted. An event such as this is...

READ MORE

MEMBERS ONLY

Thinking the Unthinkable - Bonds are Peaking

by Martin Pring,

President, Pring Research

* Long-Term Bond Oscillators Almost Fully Stretched

* Key Reversal Bars and Other Evidence Suggests Bonds are Exhausted on the Upside

* The Trend is Your Friend.... Until It Isn't

About a month ago, I wrote an article entitled "Bond Yields May Not Be Headed Lower After All". In...

READ MORE

MEMBERS ONLY

Seven Lucky Indicators Starting To Look Bullish

by Martin Pring,

President, Pring Research

* Three Short-Term Oscillators Positioned for a Rally

* Two Psychological Indicators Looking Bullish

* Just When You Thought Bonds Would Go Up Forever

Usually, it takes a long time for some of the indicators to reach what we might call "deep fear" levels, points from which important rallies can be...

READ MORE

MEMBERS ONLY

Is It A Short-Term Correction or The Start of a Bear Market?

by Martin Pring,

President, Pring Research

* Two Indicators That are Not Yet Oversold

* Several Confidence Ratios are at the Brink

* Global Equities Probably Need to Test Their 200-day MA

In the third week of July, I wrote an article entitled "Is It Time For A Contra Trend Correction?" (currently unavailable). Initially, the market thumbed...

READ MORE

MEMBERS ONLY

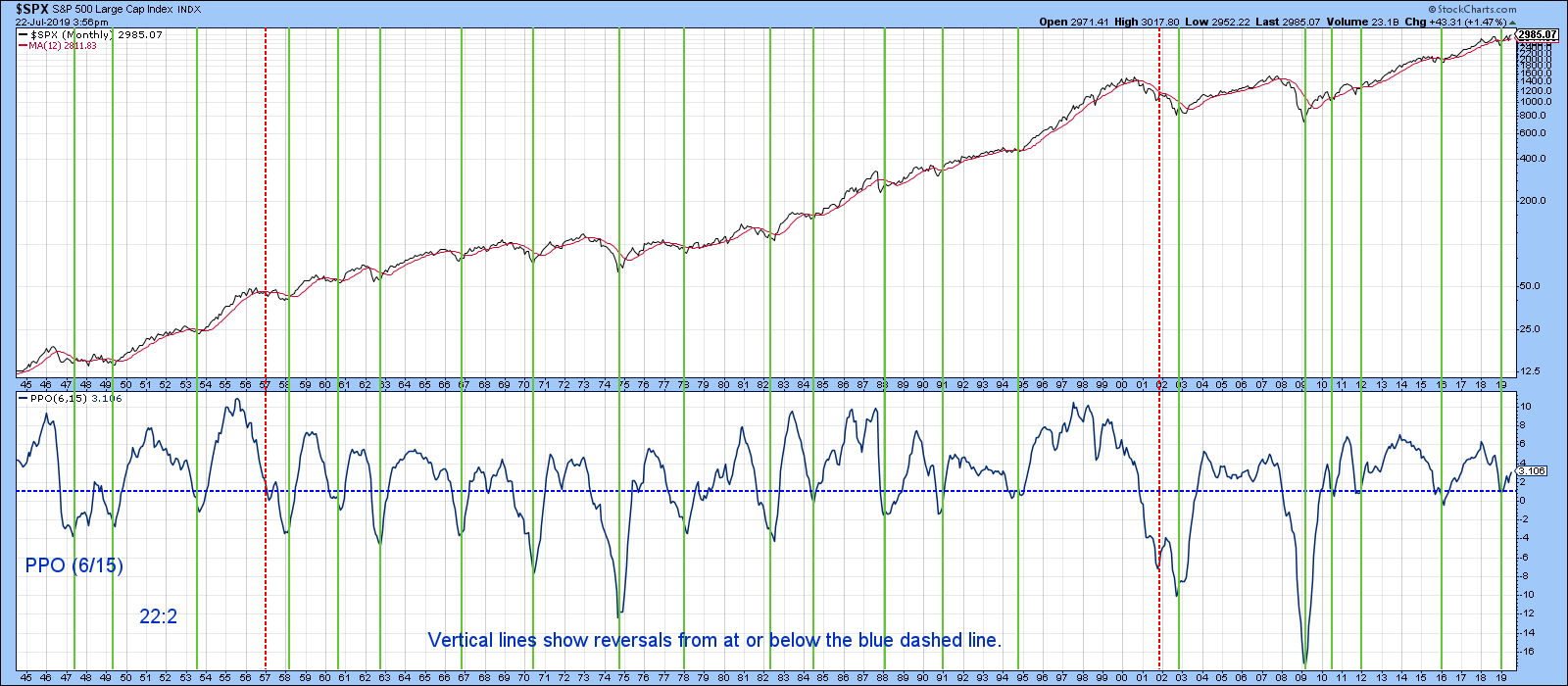

Defining a Bull or Bear Market Using a Two-Way Test

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Tuesday, July 30th at 1:14pm ET.

Technical Analysis is an art form, one in which we put together several reasonably reliable indicators and form a weight-of-the-evidence opinion about the status of the...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-08-02

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for August is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Tricky Dollar Is Still In A Bull Market

by Martin Pring,

President, Pring Research

* Defining a Bull or Bear Market Using a Two-Way Test

* Applying the Test to the Dollar

* The Euro and the Pound

Defining a Bull or Bear Market Using a Two-Way Test

Technical Analysis is an art form, one in which we put together several reasonably reliable indicators and form a...

READ MORE

MEMBERS ONLY

Is It Time For A Contra Trend Correction?

by Martin Pring,

President, Pring Research

* Major Trend Remains Positive

* Weekly Bar and Candle Charts Offer a Warning

* Reliable Short-Term Indicators, like Sentiment, are Overstretched

Major Trend Remains Positive

Each weekend, I go through a ChartList featuring weekly bar and candle charts of key markets. The idea is to spot technical events that appear on the...

READ MORE

MEMBERS ONLY

The 5-Year Yield is in a Secular Uptrend

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Tuesday, July 16th at 1:24pm ET.

When we get to longer-dated securities, that's where I start to question if yields are likely to move much lower. Let’s start with...

READ MORE

MEMBERS ONLY

Bond Yields May Not Be Headed Lower After All

by Martin Pring,

President, Pring Research

* Money Market Yields Continue to Look Vulnerable

* The 5-Year Yield is in a Secular Uptrend

* Longer-Dated Maturities Overstretched on the Downside

Money Market Yields Continue to Look Vulnerable

Everybody and their dog thinks that short-term rates will be cut by the Fed later this month. Count me in with the...

READ MORE

MEMBERS ONLY

Three Sectors And Five Industry Groups Poised To Move Higher

by Martin Pring,

President, Pring Research

Market Tentatively Triggers a Long-Term Buy Signal

Chart 1 features a Coppock indicator for the NYSE Composite, which triggers buy signals by reversing to the upside from a position at or below the equilibrium level. Since 1970, there have been thirteen such signals and only one failure (in 2002). That&...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-07-03

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for July is now available.

Good luck and good charting, Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

CRB Still Caught in a Trading Range

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Tuesday, July 2nd at 12:36pm ET.

Back in May, I wrote an article entitled “Commodities: Down Now, Up Later?" in which I pointed out some of the long-term technical bullish potential...

READ MORE

MEMBERS ONLY

Are Commodities About To Turn Up?

by Martin Pring,

President, Pring Research

* CRB Still Caught in a Trading Range

* Commodity/Bond Ratio Holding On By its Teeth

* Watch the Canadian Dollar for Clues

CRB Still Caught in a Trading Range

Back in May, I wrote an article entitled “Commodities: Down Now, Up Later?" in which I pointed out some of the...

READ MORE

MEMBERS ONLY

Four Reasons Why The Gold Breakout Is Likely To Be Valid

by Martin Pring,

President, Pring Research

* A Weaker Dollar is Bullish for Gold

* The Gold 6/15 PPO Model for Gold is Bullish

* Global Gold is Breaking Out

* Gold Shares Showing Signs of Strength

* Gold Special K Crossed its Bear Market Trend Line

Last week, Gold experienced an upside breakout from a multi-year base. I always...

READ MORE

MEMBERS ONLY

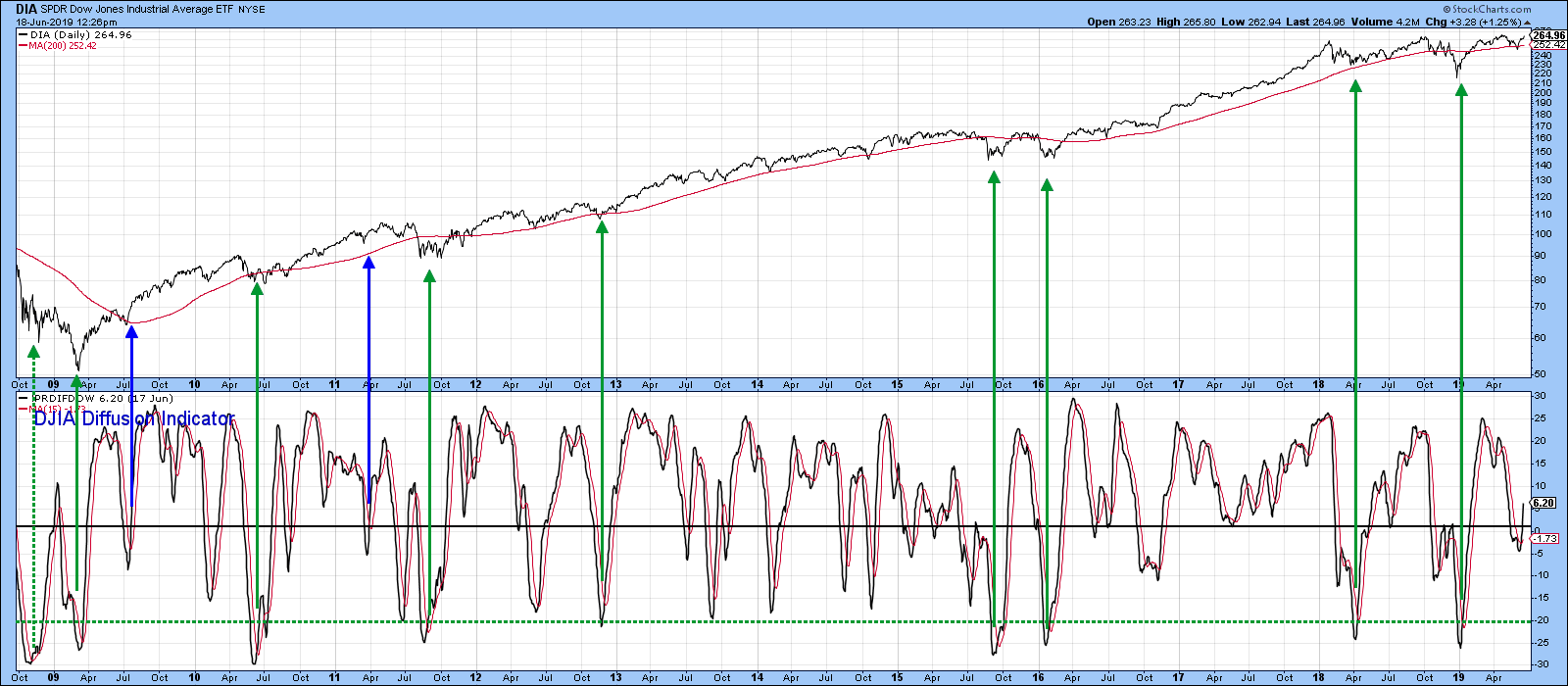

More Short-Term US Market Indicators Turn Bullish

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Tuesday, June 18th at 2:30pm ET.

Several reliable short-term oscillators have just turned bullish. Chart 5, for instance, features my Dow Diffusion Indicator. This one is similar to the Global Oscillator, but...

READ MORE

MEMBERS ONLY

S&P Composite Continues To Lead The World Higher As More Short-Term Indicators Go Bullish

by Martin Pring,

President, Pring Research

* US Breaking Out Against the World

* The World Itself Looks to be in Pretty Good Technical Shape

* NYSE A/D and Upside/Downside Lines at Record Levels

* More Short-Term US Market Indicators Turn Bullish

* Multiple Momentum Trend Line Breaks is Very Positive

* There Is Always Something to Worry About

US...

READ MORE

MEMBERS ONLY

Seven Reasons For Being Bullish

by Martin Pring,

President, Pring Research

* Financial Velocity Indicator Poised to Go Bullish

* Oversold NASDAQ Volume in a Position to Support a Rally

* Rapid Expansion of Net New Highs is Bullish

* Global Breadth Turning?

* When Stock Exchanges Break to the Upside, That’s Usually Bullish for Stocks

Financial Velocity Indicator Poised to Go Bullish

One of...

READ MORE

MEMBERS ONLY

Long-Term Picture Shows Gold Close to a Breakout

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Tuesday, June 4th at 2:57pm ET.

From a long-term aspect, Gold looks as though it is in the process of duplicating its action at the turn of the century by forming a...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-06-03

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for June is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Can They Pull The Trigger On Gold And The Yen?

by Martin Pring,

President, Pring Research

* Long-Term Picture Shows Gold Close to a Breakout

* The Shares Are on the Cusp As Well

* Short-Term Indicators for Gold Go Bullish

* Yen Emerging From a Breakout

I like to use an indicator that I call “Risk On Risk Off,” which combines an index comprising several risky entities with another...

READ MORE

MEMBERS ONLY

Deteriorating Confidence Is Not Good For Stocks And Commodities But Is For Bonds

by Martin Pring,

President, Pring Research

* Flight to Safety Leaves Stocks Behind

* S&P vs. Gold is Another Measure of Confidence That’s Deteriorating

* High-Quality Bonds Like Deteriorating Confidence

* A Rising Gold/Commodity Ratio is Actually Bearish for Commodities

Flight to Safety Leaves Stocks Behind

Last week, I wrote that it was nail-biting time for...

READ MORE

MEMBERS ONLY

Current Trend of Declining Rates Seen as Part of a Large Base

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Friday, May 24th at 4:42pm ET.

This week has seen many interest rate series, both in the US and around the world, breaking down from important trading ranges or reaffirming previous breaks....

READ MORE

MEMBERS ONLY

Interest Rates Are Breaking Down On A Worldwide Basis

by Martin Pring,

President, Pring Research

* Current Trend of Declining Rates Seen as Part of a Large Base

* Downside Breakouts in Yields are Worldwide in Scope

* US Short-Rates Look Vulnerable as Well

* 30-Year Yield Completes a Top

* Stocks and Commodities versus Bonds

Current Trend of Declining Rates Seen as Part of a Large Base

This week...

READ MORE

MEMBERS ONLY

Nail Biting Time For Equities, Green Shoots For Agricultural Commodities

by Martin Pring,

President, Pring Research

* Top or Consolidation for Equities?

* Agricultural Commodities Perking Up Following a Severe Sell-Off

* Grains Fully Supporting Price Action in the DBA

Top or Consolidation for Equities?

The S&P, like the other market averages, has been in a trading range since March. We will have to see how it...

READ MORE

MEMBERS ONLY

Gold Breaks Out Against Stocks; What Does That Mean, Apart From The Obvious?

by Martin Pring,

President, Pring Research

* Gold Breaks Out against Stocks

* Gold Itself is about to Test Mega-Resistance

* When Gold Beats Stocks, that’s usually Bullish for Gold - and Bearish for Stocks

* Gold Leads Commodities

Gold Breaks Out against Stocks

Monday saw the gold/stock ratio break decisively above its 2019 downtrend line. The line...

READ MORE

MEMBERS ONLY

Prices May Be Falling, But Bond Spreads (Confidence) are Holding in There

by Martin Pring,

President, Pring Research

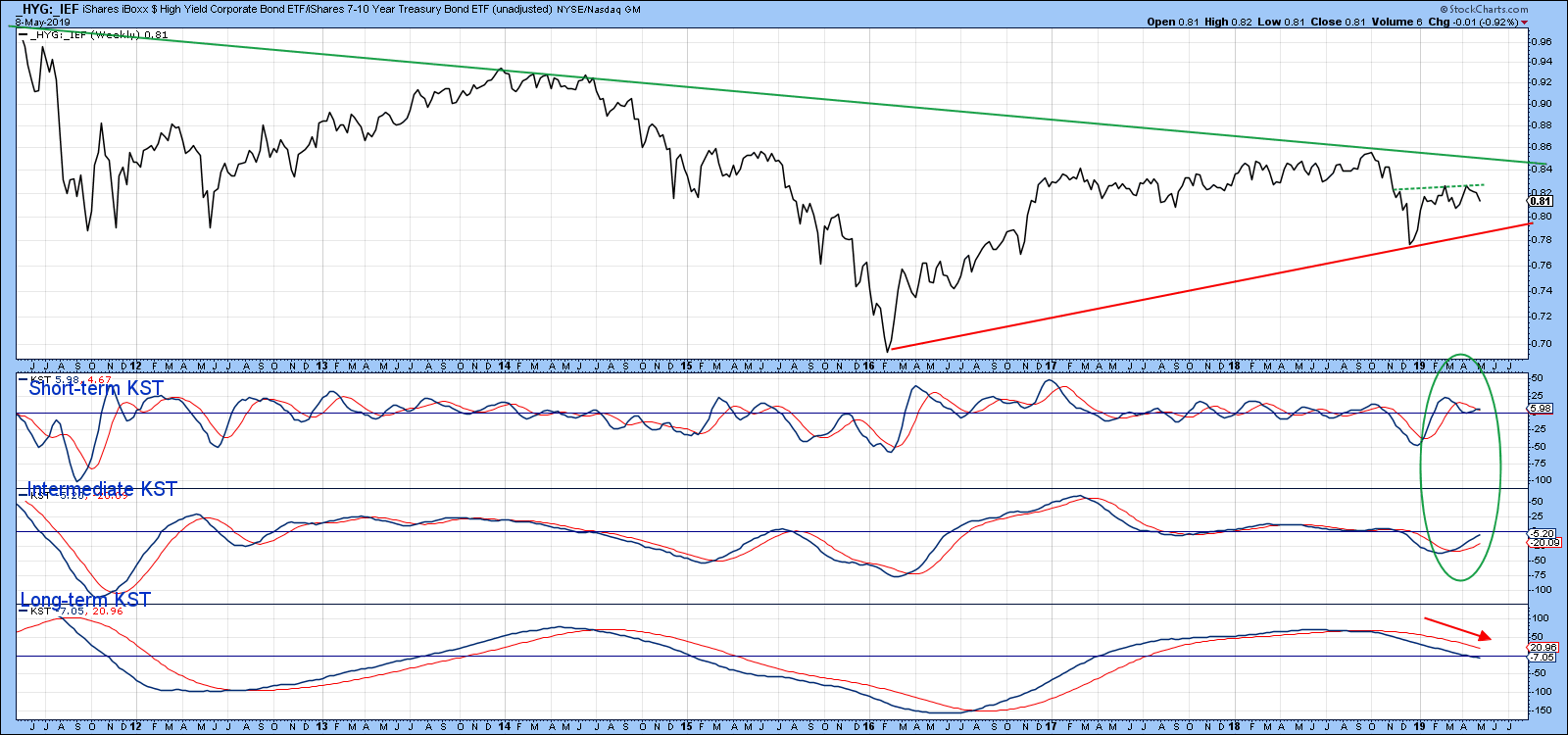

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Wednesday, May 8th at 6:37pm ET.

One area I monitor daily is the technical picture of bond spreads and other market relationships that reflect confidence. That’s because changes in their direction...

READ MORE

MEMBERS ONLY

The China Trade Talks And The Technical Position Of The Equity Market

by Martin Pring,

President, Pring Research

* Long-Term Divergences

* Some Short-Term Technical Sell Signals Triggered in the Last Few Days

* Prices May Be Falling, But Bond Spreads (Confidence) are Holding in There

Long-Term Divergences

My first reaction to this week’s stock market tantrum (in response to the China trade talks) was to brush it off as...

READ MORE

MEMBERS ONLY

Commodities: Down Now, Up Later?

by Martin Pring,

President, Pring Research

* Two Key Commodity Benchmarks Violated Trend Lines

* Commodity Sector ETFs Breaking as Well

* Longer-Term Picture May be Reversing

In early April, I tacked on a couple of commodity charts at the end of an article that commented on global equities breaking out. There, I noticed that some commodity indexes were...

READ MORE

MEMBERS ONLY

Market Roundup With Martin Pring

by Martin Pring,

President, Pring Research

Here is the link to this month's Market Roundup video. There are a significant number of long-term charts that are starting to turn higher suggesting, that the brief economic slowdown in late 2018 is behind us and we are starting the next major leg higher. Market Roundup with...

READ MORE

MEMBERS ONLY

The SPY/EFA Ratio Completes an Inverse Head-and-Shoulders

by Martin Pring,

President, Pring Research

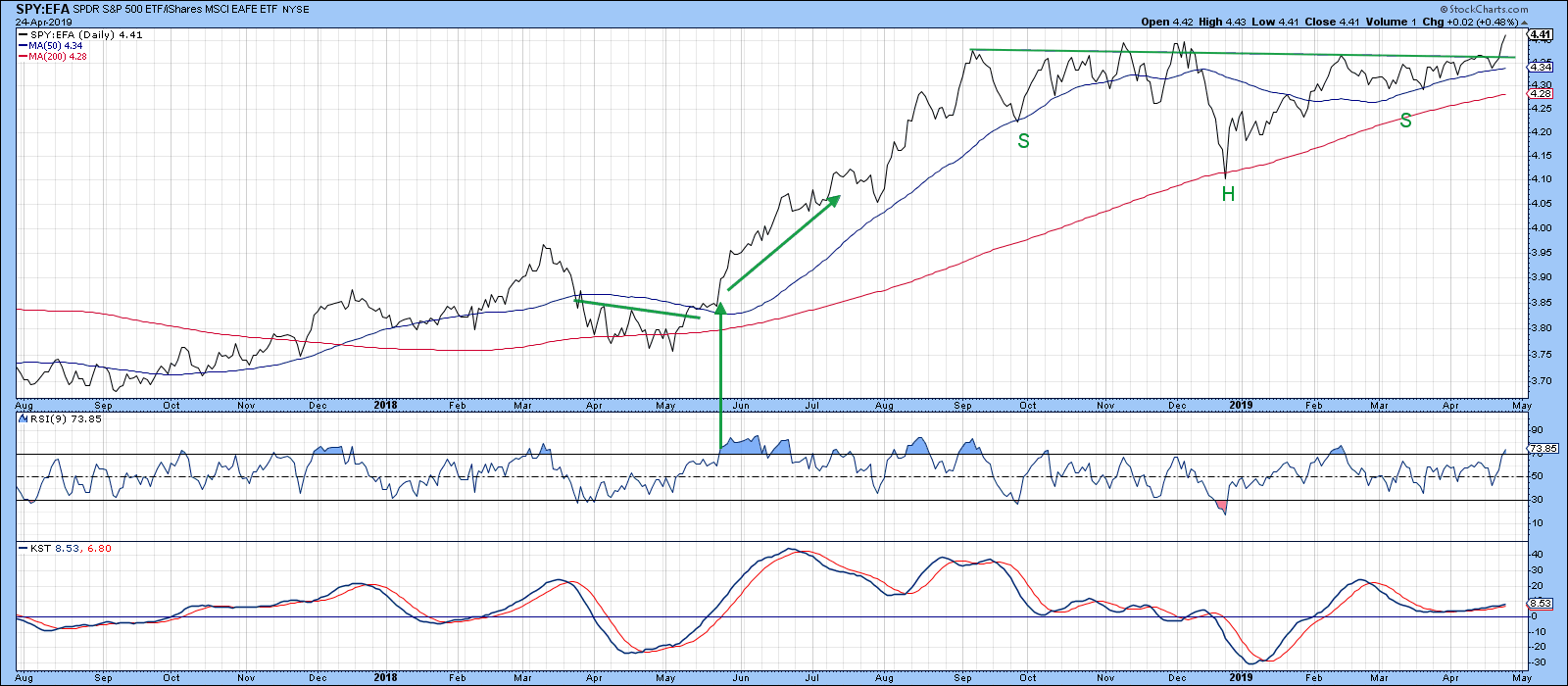

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Wednesday, April 24th at 7:03pm ET.

Yesterday’s all-time new high in the S&P was well documented by the media, but what did not receive any attention was the fact...

READ MORE

MEMBERS ONLY

US Equities Break Out Against The Rest Of The World

by Martin Pring,

President, Pring Research

* The SPY/EFA Ratio Completes an Inverse Head-and-Shoulders

* SPY/EFA Breakout also Bullish for the Dollar

* The Euro, Swiss Franc and Yen

* China Bucks the Flow

The SPY/EFA Ratio Completes an Inverse Head-and-Shoulders

Yesterday’s all-time new high in the S&P was well documented by the media,...

READ MORE

MEMBERS ONLY

Gold Starts To Break Down - But Is It For Real?

by Martin Pring,

President, Pring Research

* The Long-Term Picture Looks Positive

* Gold’s Tuesday Downside Breakout Could Be the Spoiler

* Platinum is Trying to Break Out Against Gold - Why That’s Important for the Economy

The Long-Term Picture Looks Positive

Over the last 6 years, it appears that the gold price has been trying to...

READ MORE