MEMBERS ONLY

The Technical Case For A Major Reversal In Bond Yields

by Martin Pring,

President, Pring Research

Two charts that may soon look to the bullish side for rates

Short-term technicals

Watch those metals

In the last 35 years, analysts and investors have gotten used to seeing ever lower rates, even negative ones in Europe and Japan. It seems to me that things may be getting out...

READ MORE

MEMBERS ONLY

Bearish Short-Term Equity Indicators May Bring Tears To The Bears Themselves!

by Martin Pring,

President, Pring Research

* Short-term technicals

* Two indicators that have not yet gone bullish

* More base building by commodities

* Oil greasing the way?

Last week we looked at some of the longer-term equity indicators. I concluded that prices were likely to work their way significantly higher for the balance of the year, despite historically...

READ MORE

MEMBERS ONLY

Are Commodities About To Take Off?

by Martin Pring,

President, Pring Research

* The long-term trend

* Shorter-term aspects

* The stock market’s view

Several weeks ago I suggested that commodity prices were likely to experience a correction of some kind. I also felt that any digestive process might well take the form of the right shoulder of an inverse head and shoulders pattern...

READ MORE

MEMBERS ONLY

Better Days Lie Ahead

by Martin Pring,

President, Pring Research

* More long-term US Equity indicators turning bullish

* The case for a spirited rally

* Testing the theory

At my webinar last week I pointed out a couple of observations on the US equity market. First, that more and more indicators are signaling a bull market. Second, there are some characteristics that...

READ MORE

MEMBERS ONLY

What's Up/Down With The Dollar?

by Martin Pring,

President, Pring Research

* The Dollar Index-too heavily weighted in favor of the Euro

* A closer look at the long-term cross Dollar relationships

* What are the Dollar sympathy indicators saying?

* Short-term technicals

The Dollar Index - Too heavily weighted in favor of the Euro

A few months ago I declared the Dollar Index to...

READ MORE

MEMBERS ONLY

Equity Markets Start To Broaden Their Appeal

by Martin Pring,

President, Pring Research

* Whipsaw leads to sharp rally

* Global equity markets starting to heat up

* Broad sector participation

* What’s going on with the yield curve?

Whipsaw leads to sharp rally

Chart 1 compares the Dow ETF (DIA) with my Dow Diffusion Indicator, an oscillator that monitors a basket of Dow Stocks above...

READ MORE

MEMBERS ONLY

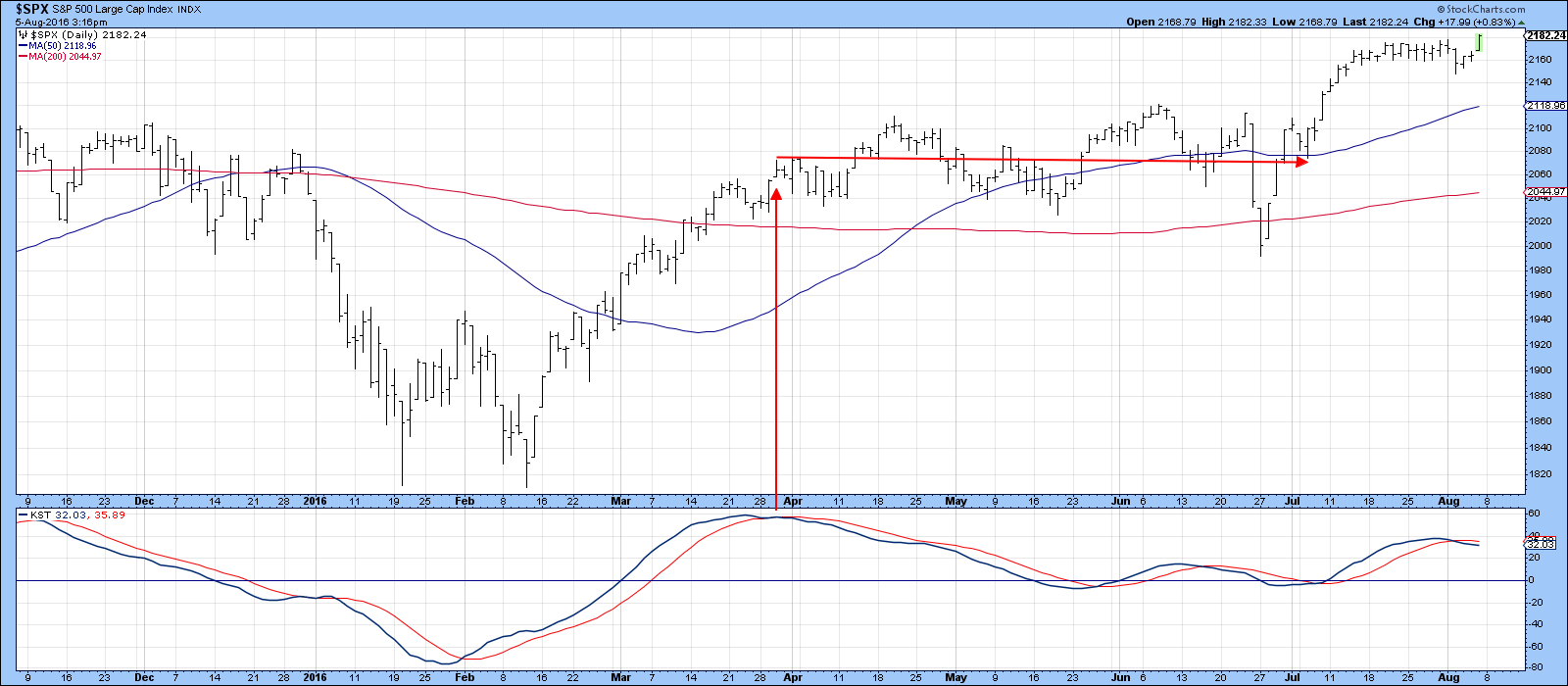

Breakout Or Fakeout

by Martin Pring,

President, Pring Research

* Take a deep 'breadth'

* Broadening formations

* Long-term indicators support an upside breakout

The recent breakout by the S&P and Dow to new high ground has caught the attention of market observers. Some say that the market is overvalued and that prices are unlikely to move higher....

READ MORE

MEMBERS ONLY

Why The June Employment Report Is Worth Closer Attention Than Usual

by Martin Pring,

President, Pring Research

* Labor market crystal ball

* What are the credit markets saying

* Commodities ripe for a correction?

Labor market crystal ball

The weakness of last month’s Employment Report was a surprise to just about everyone, including yours truly. One month doesn’t make a trend, but two months of bad data...

READ MORE

MEMBERS ONLY

Trend Of US Equities Slipping In A Southerly Direction

by Martin Pring,

President, Pring Research

* Low momentum close to price highs is often followed by above-average declines

* Failed patterns are often followed by above average price moves

* Those credit spreads are widening again

Last week I wrote that there were some positive short-term signs that suggested the reaction to Brexit might be overdone. Monday’s...

READ MORE

MEMBERS ONLY

Brexit Or Bropportunity? What The Charts Are Saying

by Martin Pring,

President, Pring Research

* Selling climax at the opening

* UK versus European Monetary Union

* What are global equities saying?

* What’s up with the pound?

Selling climax at the opening

There is an old saying on Wall Street that the market does not discount the same thing twice. Back in early June, we saw...

READ MORE

MEMBERS ONLY

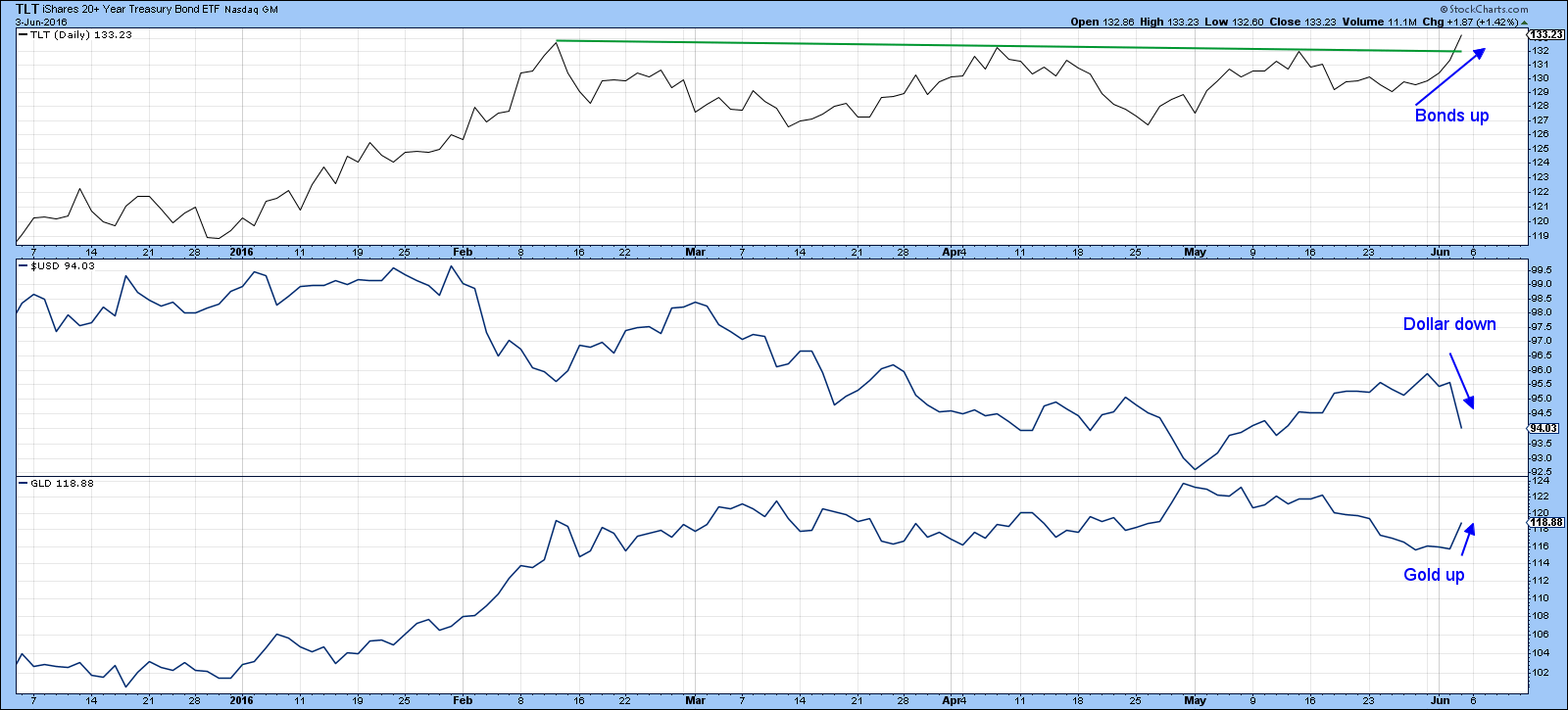

Turnaround Thursday: Several Markets Reverse On The Day: What Are The Implications?

by Martin Pring,

President, Pring Research

* Stocks show signs of a near-term reversal

* What about those bonds?

* Gold showing signs of tiredness

Stocks show signs of near-term reversal

On Thursday, several markets started off strongly in one direction but by the end of the day, these same markets reversed course. Normally when one market or an...

READ MORE

MEMBERS ONLY

A Funny Thing Happened On The Way To The Rally

by Martin Pring,

President, Pring Research

* Some short-term equity market cracks are starting to appear

* Rates are starting to breakdown

* Keep watching those credit spreads

Some short-term equity market cracks are starting to appear

In my last article, I pointed out that most of the short-term oscillators were in a bullish configuration. Moreover, they were not...

READ MORE

MEMBERS ONLY

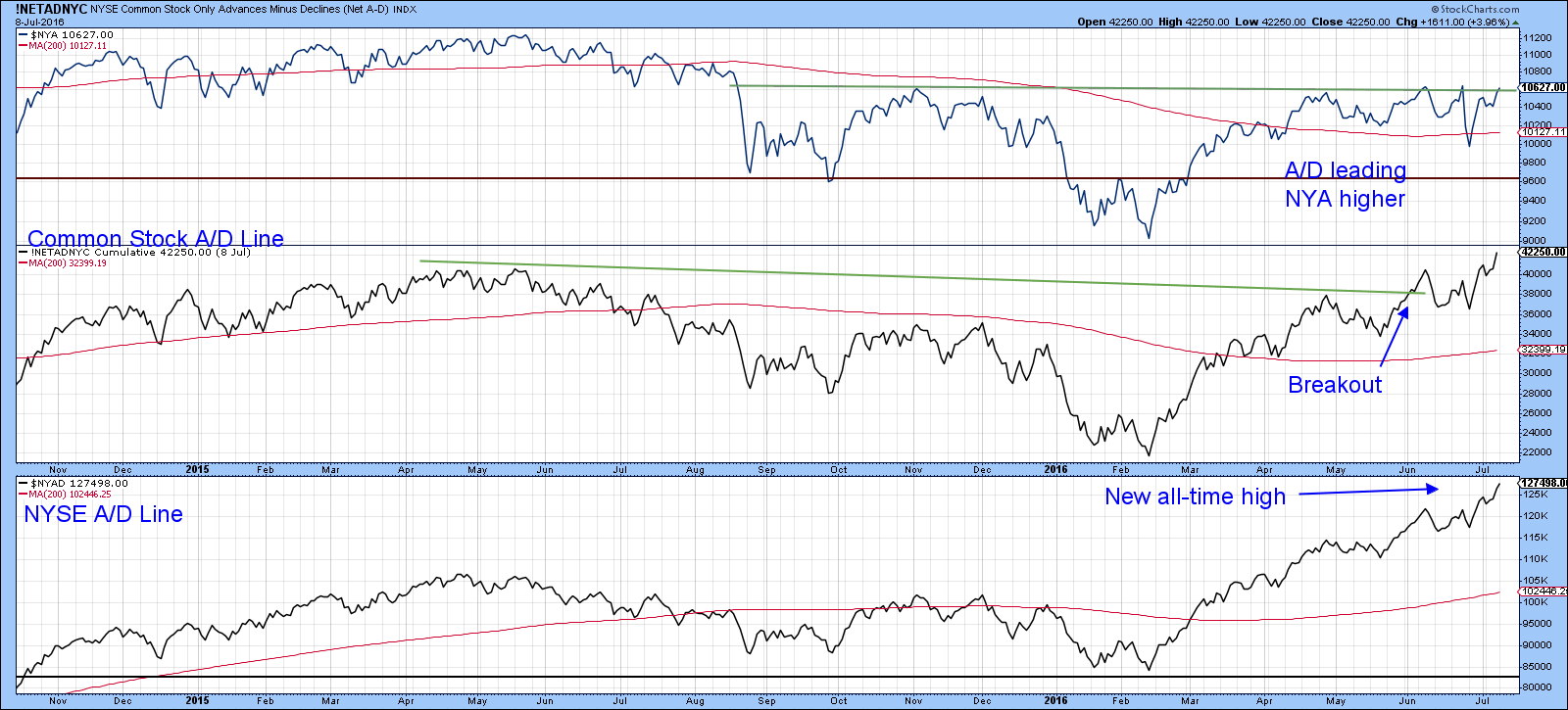

US Equities Primed To Move Higher

by Martin Pring,

President, Pring Research

* Market reacts to bad news with a nothing-burger and that’s bullish

* NYA Coppock goes bullish

* NYSE A/D Line at all-time high

* Pretty well all sectors pointing north

* Those interest rates

Market reacts to bad news with a nothing-burger and that’s bullish

In my book Investment Psychology Explained,...

READ MORE

MEMBERS ONLY

Why There Is A Good Chance That The Chinese Equity Market Has Bottomed

by Martin Pring,

President, Pring Research

* The bullish reverse dominos

* Chinese ETF’s

* PEK or FXI?

* What would a Chinese rally mean for US equities

* Chinese short interest

The Chinese equity market as reflected in the Shanghai Composite $SSEC has fallen by close to 50 % from the 5166 level on the June 2015 high to its...

READ MORE

MEMBERS ONLY

The Balance of Technical Evidence At The Short-end Is Now Pointing Towards Higher Rates

by Martin Pring,

President, Pring Research

* A tale of two possible market scenarios

* Are we there yet?

* Watch those techies

* The charts support a higher interest rate scenario

A tale of two possible market scenarios

I have been calling for a US equity market correction for the last few weeks because an overbought condition in several...

READ MORE

MEMBERS ONLY

Is The Recent Superior Performance Of Oil Over Equities Sustainable?

by Martin Pring,

President, Pring Research

* The big picture for oil prices

* Oil versus stocks

* Commodities versus bonds-the ultimate inflation/deflation relationship

* Clean-tech starting to turn around

This morning ‘s MarketWatch had a story featuring a recent Goldman Sachs report favoring oil over equities. They also had another, right next to it, saying to the effect...

READ MORE

MEMBERS ONLY

Using The Special K To Identify Major Trend Reversals

by Martin Pring,

President, Pring Research

Using The Special K To Identify Major Trend Reversals:

* What’s the Special K saying for US equities?

* Important parts of Asia are looking sick

* Gold and the dollar two diverging trends

At my bi-weekly Tuesday Market Roundup Webinar 2015-05-10 last week, I had a few words to say about...

READ MORE

MEMBERS ONLY

We Were Told That Rates Were Going Up, But Government Bond Yield Charts Look Like They Are Headed South

by Martin Pring,

President, Pring Research

* Balancing out the possibilities for US equities

* Show me the bullish sectors

* Those rates were supposed to go up but the charts say that might not be the case

Balancing out the possibilities for US equities

Chart 1 shows the NYSE Composite ($NYA) and the Coppock Curve. The curve gives...

READ MORE

MEMBERS ONLY

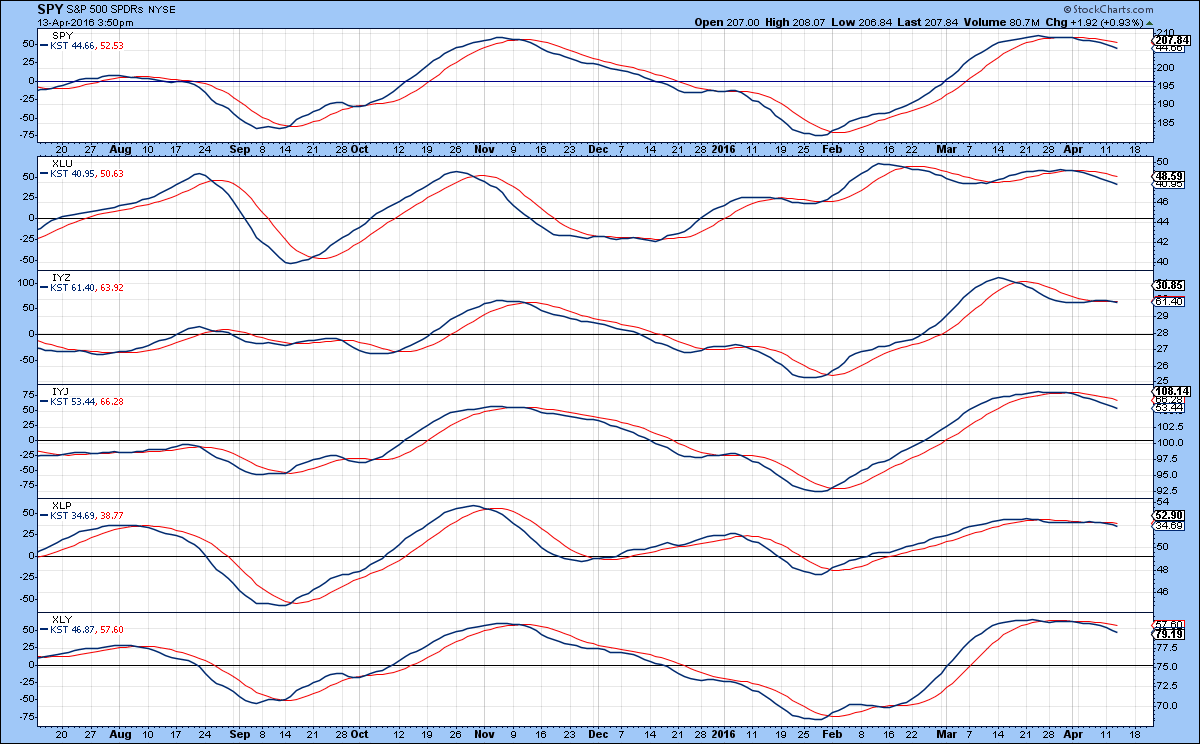

All Sectors Experiencing Short-term Momentum Sell Signals. Does This Mean The February Lows Will Be Taken Out?

by Martin Pring,

President, Pring Research

* Long-term picture still mixed

* Analyzing the Short-term Picture

* Global equities are still vulnerable

* Confidence looking questionable again

* Spot the bullish sector

Long-term picture still mixed

A couple of weeks ago I pointed out that several long-term indicators had tentatively turned bullish and that others were not far behind. The problem...

READ MORE

MEMBERS ONLY

Bearish Dollar Index Signal Has Major Implications For All Kinds Of Markets And Relationships

by Martin Pring,

President, Pring Research

* Changes in key relationships

* Implications for specific stock sectors of a declining dollar

* The US versus the world

At this week’s Market Roundup webinar, I suggested that we had reached an inflexion point for many markets as well as several Intermarket and inter-asset relationships. That inflexion point centered on...

READ MORE

MEMBERS ONLY

Indicators Still Mixed As The Market Reaches All-Time Highs

by Martin Pring,

President, Pring Research

* Coppock Curve on a buy and sell?

* Record high indicator signals a bull market

* 6/180 PPO right on the cusp of a bull market signal

* Short-term overbought condition argues for a pause

* Commodities breaking to the upside

* Interest rates waffling

During the last couple of months I have been...

READ MORE

MEMBERS ONLY

Which Sectors To Hold And Which Sectors To Fold Part II

by Martin Pring,

President, Pring Research

Earlier in the week I reviewed several US market sectors from the point of view of their potential strength or weakness. In this article I’ll cover the rest and then some. If you know what I mean by the term “Nirvana Template” you can skip the next paragraph and...

READ MORE

MEMBERS ONLY

Which Sectors To Hold And Which Ones To Fold?

by Martin Pring,

President, Pring Research

In my Tuesday webinar, I opined that the US equity market is pretty close to a make or break point. While several indicators were still bearish it would not take much in the way of upside action to turn them positive. Of course, they never make it easy, and right...

READ MORE

MEMBERS ONLY

Equities Are Rolling Over Into Corrective Mode

by Martin Pring,

President, Pring Research

* The Coppock Curve tells us the market is at a significant juncture point

* Those pesky credit spreads are deteriorating again

* The US credit markets are close to some important signals

The Coppock Curve tells us the market is at a significant juncture point

Chart 1 features a long-term smoothed momentum...

READ MORE

MEMBERS ONLY

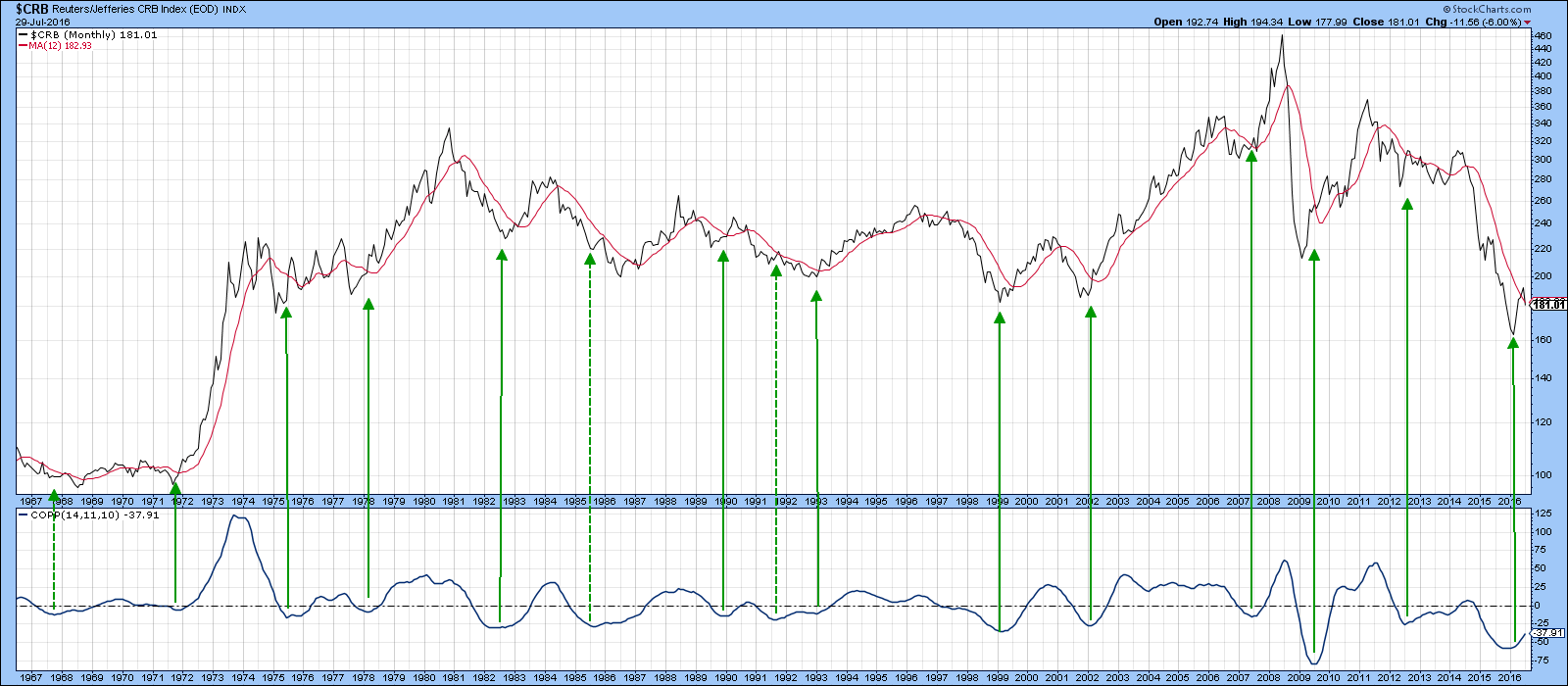

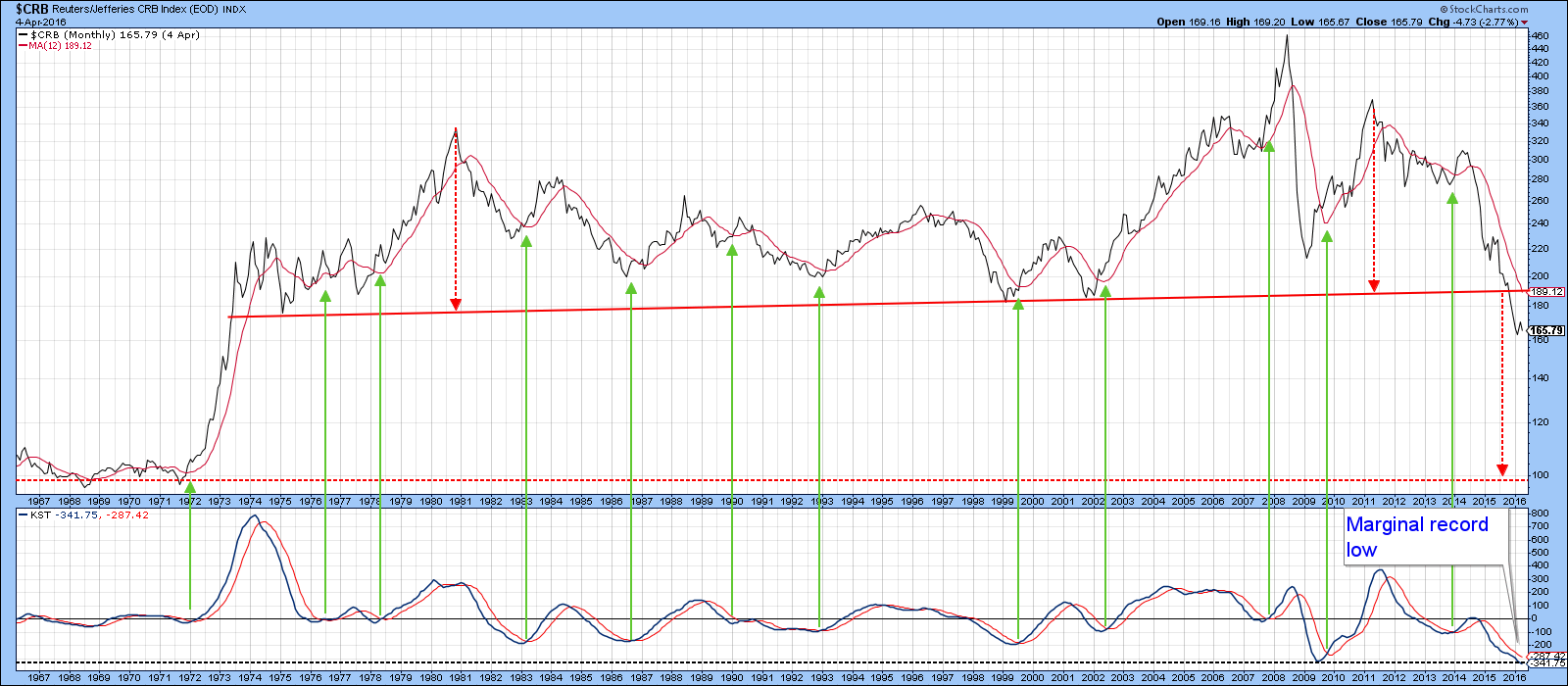

Could Commodities Be In The Process Of Forming A Major Bottom?

by Martin Pring,

President, Pring Research

* A test of the bear market low for commodities is underway

* Relative commodity action favors metals and agriculture

* Stocks to continue to outperform commodities

This week I am focusing on commodity prices, or more specifically on the Commodity Research Bureau Composite ($CRB) to see what might need to take place...

READ MORE

MEMBERS ONLY

US Equities Remain At A Bull/Bear Crossroad

by Martin Pring,

President, Pring Research

* Consistently reliable primary trend indicator on the fence

* Strong breadth

* Equities overbought and lacking in volume

* Rates headed lower?

Consistently reliable primary trend indicator right on the fence

The US equity market continues to bump up against resistance at a time when most short-term oscillators are overstretched. Since volume has...

READ MORE

MEMBERS ONLY

Is This The Top Of The Rally Or A New Bull Market?

by Martin Pring,

President, Pring Research

* World indexes not yet above their 200-day MA’s

* USA indexes very overstretched short-term

* Two reliable primary trend indexes at make or break points

Three world equity indexes

StockCharts carries three stock market indexes measuring “The World”. All of them are overbought on a short-term basis, two are below their...

READ MORE

MEMBERS ONLY

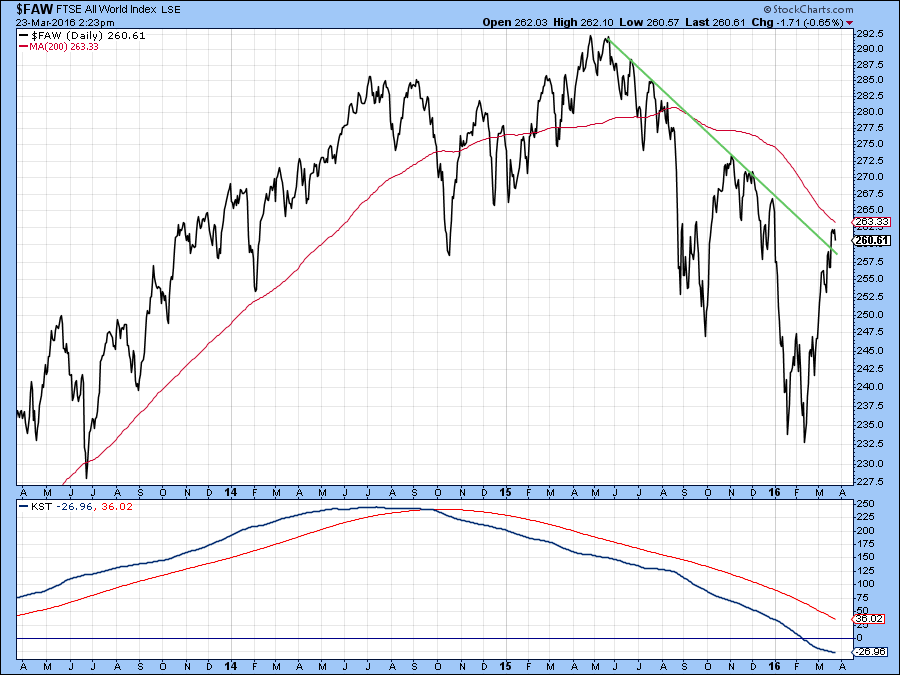

World Stock ETF Rallies Back To Its Bear Market Trendline And 200-day MA. Is The Bear Market Over?

by Martin Pring,

President, Pring Research

* World markets are just below key resistance

* Junk bonds break through their 200-day MA. Will the break hold?

* World Bond Index breaks to the upside

Last week I called for some corrective action in the US equity market based on what, at the time, appeared to be a couple of...

READ MORE

MEMBERS ONLY

Contrarian Thinking Says The Equity, Oil And Junk Bonds Rally Is Over

by Martin Pring,

President, Pring Research

* Inflection point for junk bonds?

* Fake out rally a la 2008?

* Short-term oil rally over?

Inflection point for junk bonds?

It has been a feature of this bear market that stocks sell off in concert with junk bonds and oil prices as investors fret over potential energy company defaults. Not...

READ MORE

MEMBERS ONLY

Three Indicators You Should Watch To Signal A New Bull Market

by Martin Pring,

President, Pring Research

* Credit spreads about to turn?

* A PPO that calls primary trends

* Record High Indicator

The market is now starting to respond positively to several bullish intermediate indicators. I still believe the main trend is down, but it seems like a good idea to look at three currently bearish indicators and...

READ MORE

MEMBERS ONLY

Bearish Two Bar Reversal Says Further Probing of Recent Lows Is Likely

by Martin Pring,

President, Pring Research

* Intermediate rally/consolidation for US equities still on the menu

* Test of the lows is likely first

* Emerging markets continue to look vulnerable

* Gold showing strong technical signs

The Intermediate Rally/trading range

The intermediate rally possibilities, which I have been discussing for several weeks, is still a probability. That’...

READ MORE

MEMBERS ONLY

Forget The Hindenburg Omen - Here's Another Possibility To Consider

by Martin Pring,

President, Pring Research

* Five days of Armageddon

* Does the British market still lead the US market

Five Days of Armageddon

For some time, I have been drawing your attention to the fact that many intermediate indicators have been flashing buy signals that even in primary bear markets have triggered some kind of a...

READ MORE

MEMBERS ONLY

More Evidence Of An Intermediate Bear Market Rally Falls Into Place

by Martin Pring,

President, Pring Research

* World breadth series signal that global equities are ready to advance

* Dollar faces an important technical test

Sometimes when the market declines, things actually improve, and that’s what may have been happening this week. In my most recent article, Intermediate Indicators Signal a Rally but Remember It’s a...

READ MORE

MEMBERS ONLY

Intermediate Indicators Still Signal A Rally But Remember, It's A Bear Market

by Martin Pring,

President, Pring Research

* Monday may have been a successful test of the January low

* Five inter-market relationships break out

* The 5-year yield breaks down

For the last two weeks I have been pointing out that several intermediate type indicators that have traditionally signaled rallies were in a bullish mode. The problem is that...

READ MORE

MEMBERS ONLY

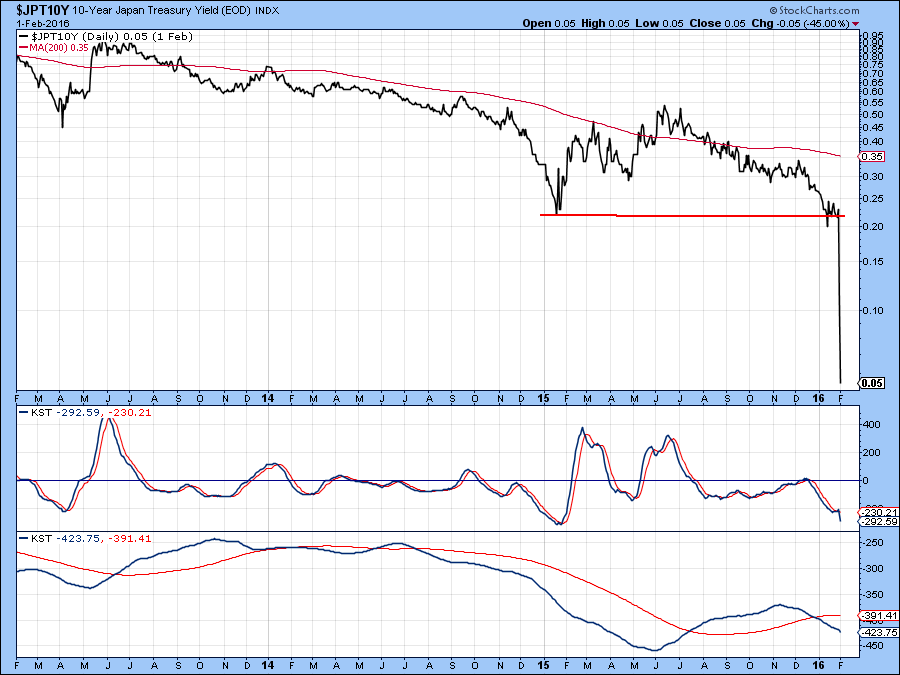

The BOJ Did Not Start The Trend - They Are Following It

by Martin Pring,

President, Pring Research

* Global rates are in freefall

* Interest-sensitive sectors will continue to improve their relative action

* Two sectors that are likely to underperform

The recent move by the Bank of Japan (BOJ) confirmed what rates around the world have already been doing, i.e. moving lower. In Japan’s case, some rates...

READ MORE

MEMBERS ONLY

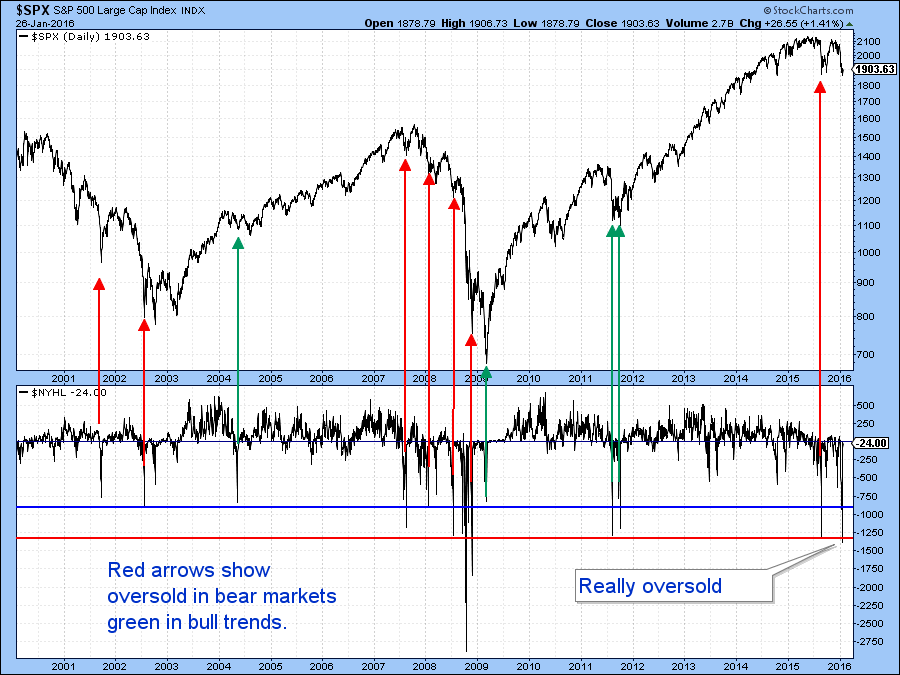

A Bear Market Rally Looks As If It Is Underway

by Martin Pring,

President, Pring Research

Several key short/intermediate indicators reverse from oversold conditions

Gold ETF very close to violating its bear market trendline

The intermediate Indicators are bottoming

Internal market action in the last week is starting to confirm the possibility of an intermediate low that I laid out last week. That’s because...

READ MORE

MEMBERS ONLY

Trolling For Bottom Fishing Indicators

by Martin Pring,

President, Pring Research

* Dow Jones Utility Average just above its secular up trendline

* 2-year yield probably gave a false upside breakout signal

* Three indicators to watch for an intermediate equity bottom

Yesterday at the webinar Greg asked me a question that was posed by one of the attendees relating to a potential reverse...

READ MORE

MEMBERS ONLY

What Happens If The Fed Is Wrong

by Martin Pring,

President, Pring Research

* Erie comparisons to 1929

* Credit spreads worsen

* 30-year bond yields break down prices break out

When the fed raises interest rates after a long series of declines it usually signals a change in policy and the start of a new trend to higher rates. What happens, though, when the Fed...

READ MORE

MEMBERS ONLY

Please Show Me A Bullish Long-Term Equity Chart

by Martin Pring,

President, Pring Research

* Europe, Asia and Latin America all look bearish

I am not kidding. Today I went through pretty well all of the country ETF charts looking back a few years with the long-term KST. I could find only one bullish chart as displayed here as Chart 1. As you can see...

READ MORE

MEMBERS ONLY

Long-Term Top Looking More And More Likely

by Martin Pring,

President, Pring Research

* Several historically reliable indicators are saying “bear”

* World stocks looking extremely toppy

* Shanghai may be forming a head and shoulders top

At my first webinar of the year on Tuesday, it seemed a good idea to load the presentation with some longer-term charts, as they are all pointing to trouble...

READ MORE