MEMBERS ONLY

Did The Market Go Up or Down In 2015?

by Martin Pring,

President, Pring Research

* This week’s bearish two-bar reversal threatens a bullish seasonal for equities

* Airlines may be set to join railroads and truckers on the downside

* Dollar Index keeps us guessing, which means the next move is likely to be worthwhile

* Pound completes a bearish long-term head and shoulders

The title of...

READ MORE

MEMBERS ONLY

Market Sectors: The Good The Bad And The Ugly

by Martin Pring,

President, Pring Research

* Home builders, KBW banks, consumer cyclicals and resources look vulnerable

* REIT's, utilities, and healthcare look promising

This week I am going to back off from the usual market commentary in order to focus on some industry groups and sectors that have the potential to lead the market higher...

READ MORE

MEMBERS ONLY

Bearish Two Bar Reversal Threatens The Pre-Christmas Rally

by Martin Pring,

President, Pring Research

* Two bar reversal brings the effect of the rate hike back to reality

* Broadly based dollar ETF breaks to new highs

* Gold closes at a new low on expanding volume

Earlier in the week I pointed out that many of the market averages had formed exhaustion days on Monday and...

READ MORE

MEMBERS ONLY

Small Caps Complete 12-year Top Relative To Large Caps

by Martin Pring,

President, Pring Research

* Bullish exhaustion on Monday suggests that last week’s lows will hold during 2015

* Longer-term indicators continue to point to an overall topping out process

* Small caps break down against large caps

* 30-year yield at a critical juncture

* Euro and yen-denominated gold complete large bearish (deflationary) formations

Small year-end rally...

READ MORE

MEMBERS ONLY

More Of The Santa Sell-Off To Come?

by Martin Pring,

President, Pring Research

* Volume starting to expand on the downside

* Half a Dow Theory sell signal on the weekly charts

* 30-year yield locked in a tight trading range

* Dollar Index facing important test

Expanding volume on the downside

This market continues to be plagued with volume problems. Initially, it was a lack of...

READ MORE

MEMBERS ONLY

Did Friday's 370-Point Rally Change Anything For The Equity Market?

by Martin Pring,

President, Pring Research

* Friday’s rally fails to reel in new highs

* Guggenheim asset flows just above critical support

* 30-year yield caught between two converging trendlines

* Energy SPDR XLE completes a bearish head and shoulders

A couple of days ago I wrote that a bearish two-bar reversal that had developed in many averages...

READ MORE

MEMBERS ONLY

Volume Is About To Expand, But Which Way Will It Send Prices?

by Martin Pring,

President, Pring Research

* Two bar reversal for the S&P says the rally is over

* Volume is oversold. That means volume is likely to expand on the downside.

* Credit spreads challenging their bear market lows

* Commodities breaking down in a very big way

* This week's two-bar reversal says the market...

READ MORE

MEMBERS ONLY

Time To Watch Those Commodities Like A Hawk

by Martin Pring,

President, Pring Research

* CRB Composite touches a 40-year low but is deeply oversold

* Oil is also at critical support

* Short-term commodity picture finely balanced but narrowly favors the bears

* Dollar Index is back at its March 2015 high

* Some short-term dollar indicators starting to roll over

Long-term commodity picture

Chart 1 shows that...

READ MORE

MEMBERS ONLY

Market Explodes On Bad News. Has The Year-End Rally Begun?

by Martin Pring,

President, Pring Research

* Two bar reversal says the market is going higher near-term

* Credit spreads at key juncture point

* Oil showing tentative sign of a short-term reversal but confirmation is required

They say that a market that does not decline on bad news is usually ready to reverse to the upside. Over the...

READ MORE

MEMBERS ONLY

Onward And Downward, The Correction Is Likely To Continue

by Martin Pring,

President, Pring Research

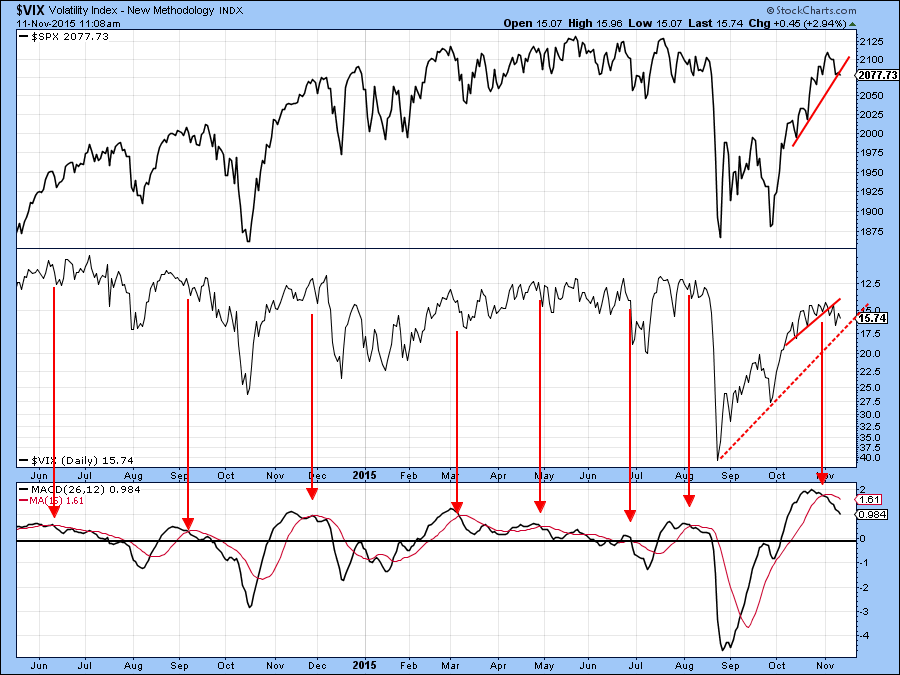

* KST for the VIX triggers a sell signal for equities in general

* Junk Bonds have reversed to the downside

* Dollar breaks to the upside on a broad basis

* Some commodities break to new lows

The corrective process we talked about last week is still underway. Sometimes the technical position improves...

READ MORE

MEMBERS ONLY

November Should Tell Us Whether US Equities Are In A Bull Or Bear Market

by Martin Pring,

President, Pring Research

Market pullback likely in November

* Rates rising across the yield maturity spectrum

* Dollar Index close to an upside breakout

* Commodities look weaker

The short-term condition of the market is very overstretched, to say the least. Even if we are still in a bull market some form of November correction appears...

READ MORE

MEMBERS ONLY

Upside Breakout In The Dollar Index May Be Close At Hand

by Martin Pring,

President, Pring Research

* Market breadth on the rally not so hot

* Credit spreads are a likely bell weather for equities

* Dollar Index reaches critical resistance

The power of the recent rally has been a surprise to most observers including myself. The big question is whether it is part of a topping out process,...

READ MORE

MEMBERS ONLY

Lots Of Markets Are At Crucial Juncture Points

by Martin Pring,

President, Pring Research

* US Equities remain short-term overbought

* Yield curves starting to steepen (decline)

* All bond maturities are at critical trendlines

* Dollar about to break down?

* Gold about to break out?

US Equities

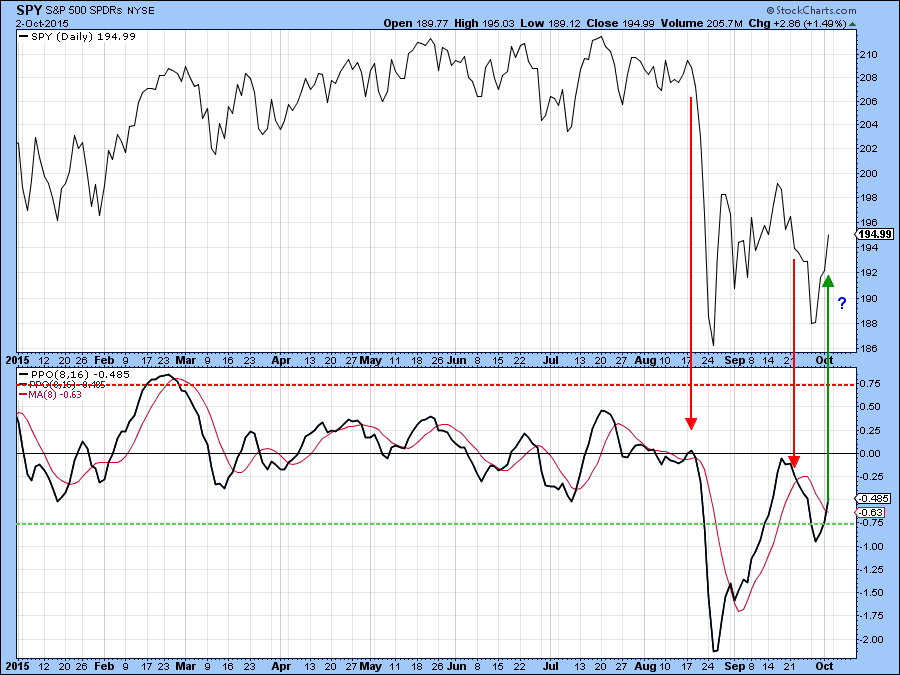

Earlier in the week I indicated that several short-term indicators such as the Price Percentage Oscillator(PPO) using an 8/...

READ MORE

MEMBERS ONLY

Is it Time for a Digestion of Recent Equity Gains?

by Martin Pring,

President, Pring Research

* The 8/16 PPO for the SPX is overbought

* Nasdaq is running into major resistance

* The HYG experiences a false upside breakout and a bearish shooting star

The week before last, I drew your attention to the fact that since the August sell-off recent market gyrations had been truncated in...

READ MORE

MEMBERS ONLY

Is The Dollar Likely To Make A Big Move Soon?

by Martin Pring,

President, Pring Research

* The primary trend in the dollar is still bullish but..

* Broad momentum measures of the dollar are negative

* Euro is caught between two possible scenarios

The US Dollar Index ($USD) has been in a trading range for several months and may be about to break out, but which way? The...

READ MORE

MEMBERS ONLY

US Stock Market Successfully Tests its August 24 Low

by Martin Pring,

President, Pring Research

* 8/16 PPO triggers a buy signal for the S&P Composite

* Resource-based stocks showing signs of improving relative action

* Bonds experience an exhaustion day

Earlier in the week I noted that the market was getting pretty close to the August lows but that the indicator that I usually...

READ MORE

MEMBERS ONLY

Bond Market Quality Spreads Are Signaling More Trouble Ahead

by Martin Pring,

President, Pring Research

* Test of the August 24 intraday lows is at hand

* Junk bonds complete 3-year top

* Credit spread may be leading the Dollar Index higher

* The yields on short-term treasury maturities may be peaking

Testing the lows

Normally I like to use the KST to determine when momentum has reversed direction....

READ MORE

MEMBERS ONLY

Which Sectors, If Any, Are Poised To Lead The Market Higher?

by Martin Pring,

President, Pring Research

It’s no secret that I have been bearish on the equity market for some time. Nevertheless, it's always a good idea to remain flexible and look at all angles, so at Tuesday's webinar Greg asked me a great question. What would need to happen to...

READ MORE

MEMBERS ONLY

Market Loses Confidence in the Fed

by Martin Pring,

President, Pring Research

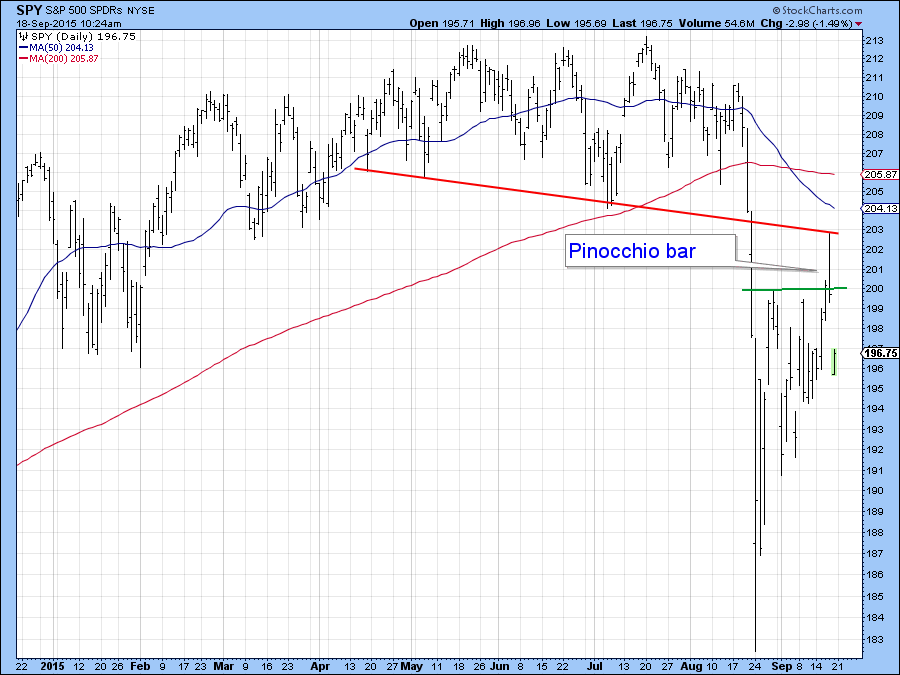

* Thursday’s action represents a bearish Pinocchio bar.

* Long-term indicators remain bearish.

* Will Friday’s trading have a silver lining?

Thursday’s Pinocchio bar

In last week’s article I pointed out that several market averages had experienced bearish engulfing patterns and that a test of the lows was likely....

READ MORE

MEMBERS ONLY

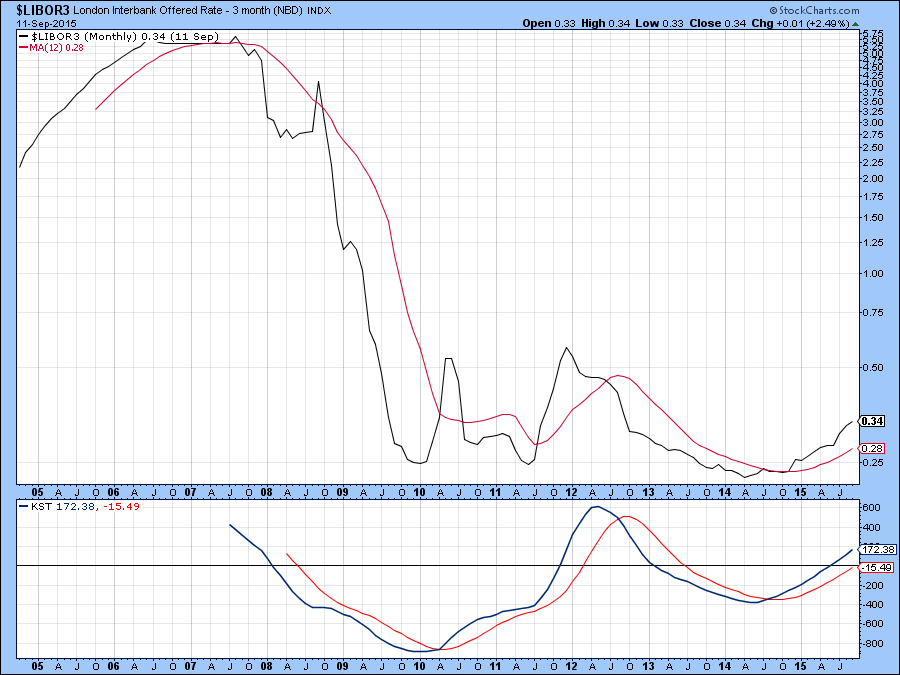

Six Reasons Why the Fed Will Not Raise Rates; One Bad Reason Why it Will

by Martin Pring,

President, Pring Research

* Consumer sentiment flags a sell signal

* Short rates rise before commodity prices do. That's not supposed to happen.

* TIPS break key support

The biggest question in financial markets this week is "will she or won't she?". The ”she” in this case is Janet Yellen...

READ MORE

MEMBERS ONLY

Evidence Points to Further Testing of the Lows

by Martin Pring,

President, Pring Research

* S&P engulfing pattern hints at downside pressure to come

* Guggenheim asset ratio continues to signal money outflow

* EEM give indications of a better short-term performance to come

* BOJ so far fails the inflation test

US Equities short-term

The recent wild swings in the market may look random in...

READ MORE

MEMBERS ONLY

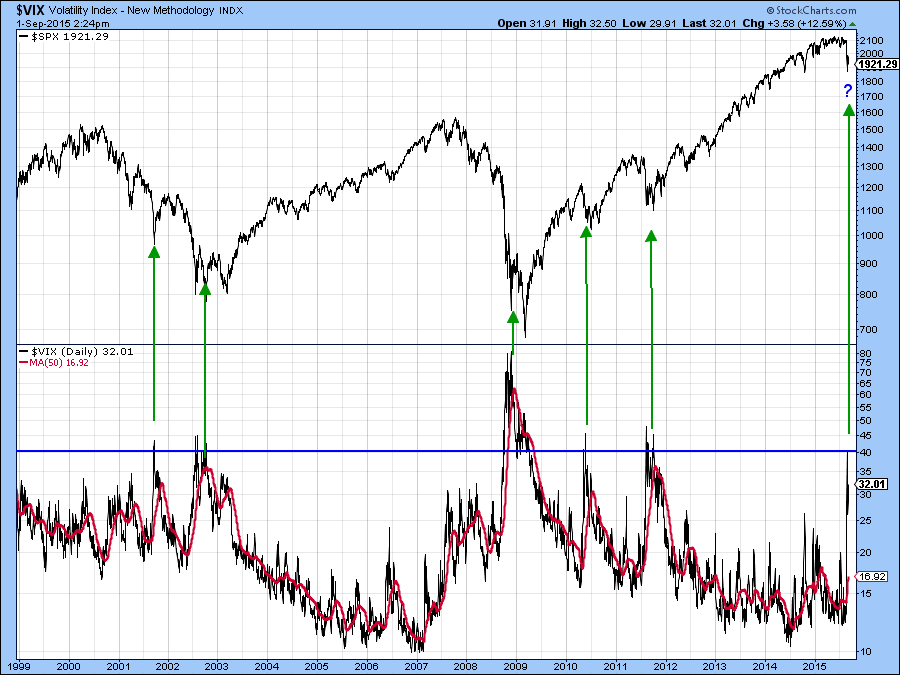

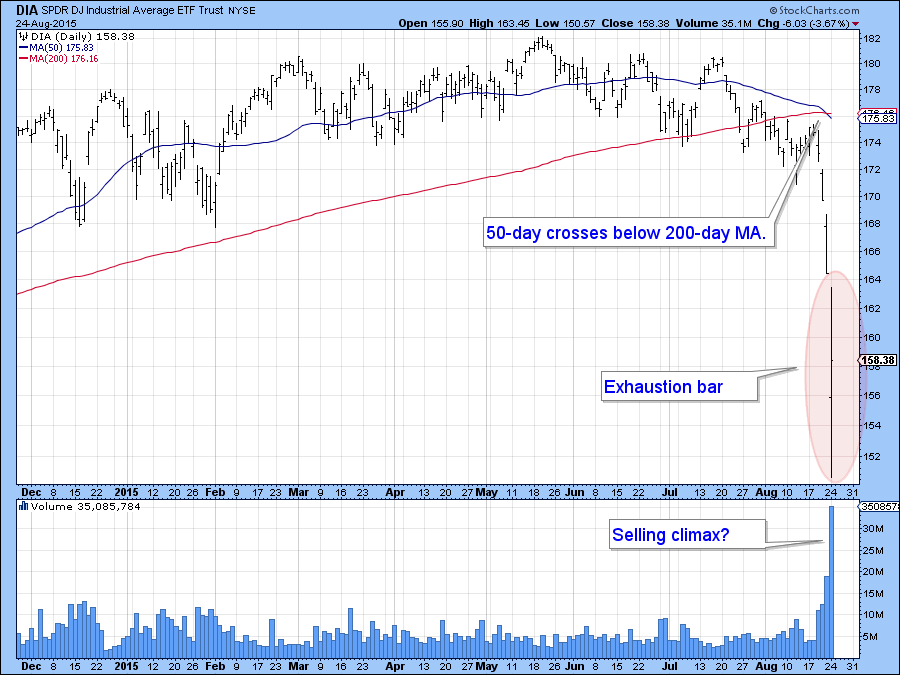

Long-term Indicators Signal A Primary Bear Market But Last Monday's Panic Low Ought To Hold For A While

by Martin Pring,

President, Pring Research

* Right shoulder rally is a work in progress.

* Dollar Index showing some technical cracks.

* Gold breaks out against stocks.

Last week I pointed out that the S&P 500 ($SPX), along with several other averages, had experienced a bullish exhaustion day. That fact, along with an excessively high reading...

READ MORE

MEMBERS ONLY

Whipsaw Decline Or The Start Of The Right Shoulder?

by Martin Pring,

President, Pring Research

* Monday’s action suggests a short-term rally is in the cards.

* Action by the S&P 48-month ROC argues for a bear market.

Catching a falling knife with your bear hands is never fun. Sorry, Freudian slip. Should be bare hands! I am not going to try to call...

READ MORE

MEMBERS ONLY

Major Equity Market Breakdowns Warn of Lower Prices to Come

by Martin Pring,

President, Pring Research

* McClellan Volume Model for NASDAQ goes bearish.

* EEM breaks down from a major top.

* Chinese equities are right on the brink.

The last time I wrote about equities, two weeks ago, I pointed out the dearth of breadth. I also mentioned that following the end of the 'bullish end-of-the-month&...

READ MORE

MEMBERS ONLY

Commodities Have Stopped Going Down... But For How Long?

by Martin Pring,

President, Pring Research

* Momentum indicators for commodities are turning up.

* The Dollar Index has violated a small down trend line.

The major averages have moved sideways over the last 12-months or so but under the surface a few sectors have managed to gain in price and some have lost considerable ground. Chart 1...

READ MORE

MEMBERS ONLY

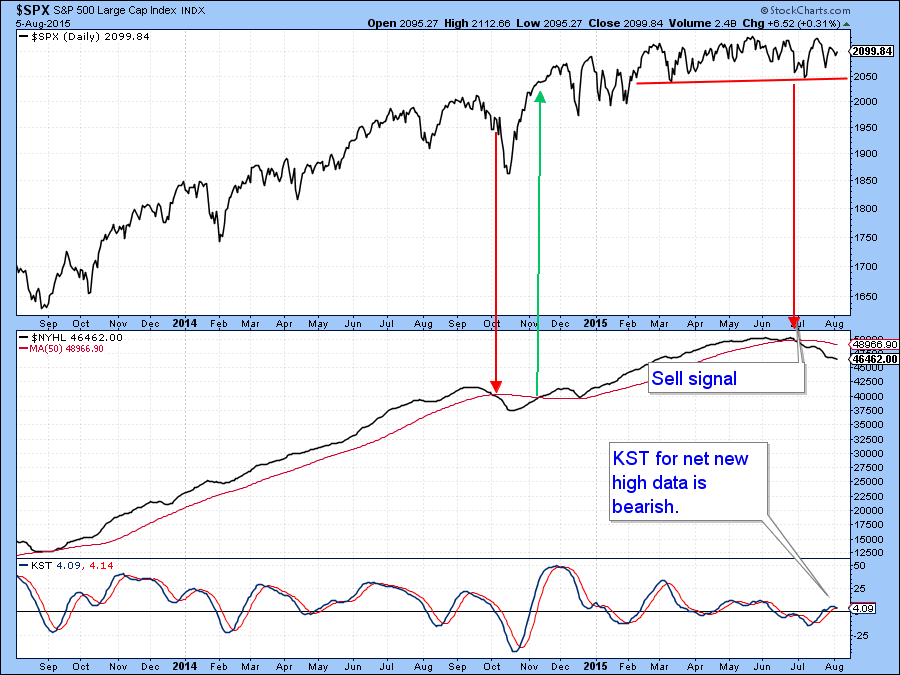

Recent Quiet Market Action Continues To Mask Deteriorating Breadth

by Martin Pring,

President, Pring Research

* Special K continues to point to lower stock prices.

* Dollar looks set to break out on the upside.

* Euro and yen denominated commodities at new lows.

The market continues to move sideways, but under the surface things continue to deteriorate. For example, Chart 1 features a cumulative line derived from...

READ MORE

MEMBERS ONLY

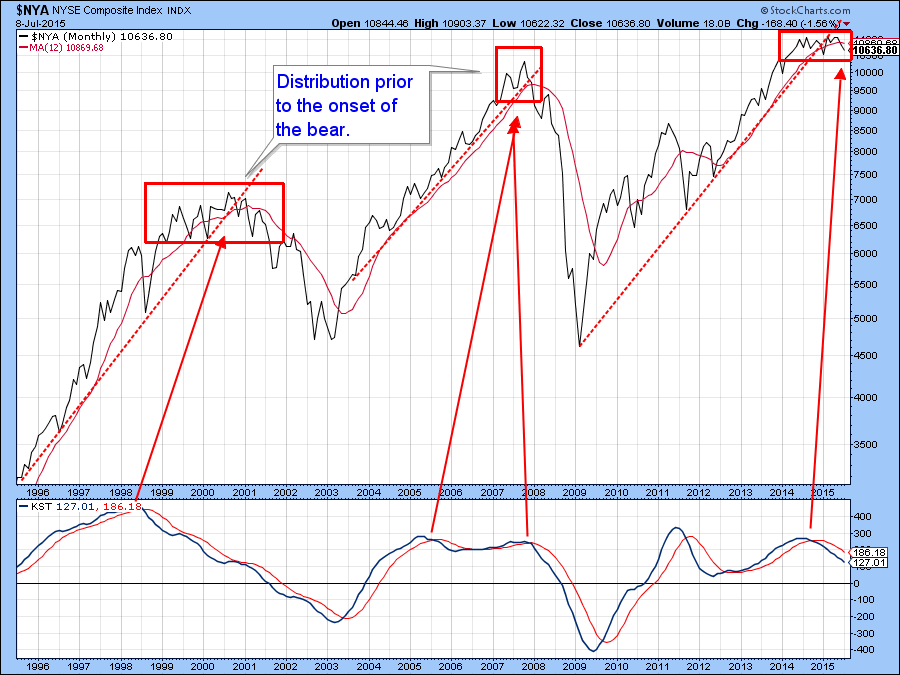

Is it Time to Pull the Plug?

by Martin Pring,

President, Pring Research

* NASDAQ, IWM and NYSE Composite face key tests early next week.

* Confidence in the bond market about to snap?

* Dow violates key bull market trendline.

Market tops are not usually straight up and down affairs but typically experience a trading range separating the primary bull from the bear. During that...

READ MORE

MEMBERS ONLY

The Market May Rally But Take Note, It's Getting Pretty Selective Out There

by Martin Pring,

President, Pring Research

* Dow diffusion indicator still on a buy signal.

* Dow Jones Composite Index facing important technical challenge.

* The reflation gold rallies in Euro and Yen are over.

Long-term Background

Last week at the webinar I came to the conclusion that enough short-term indicators were reversing from oversold readings to justify a...

READ MORE

MEMBERS ONLY

Is The Chinese Equity Bull Market Over?

by Martin Pring,

President, Pring Research

* 25-day ROC experiences a mega oversold.

* Shanghai Composite rallies from 200-day MA.

* In 1929 in the US and 2007 in China, stocks retraced 50% of their first bear market decline. What does that say about today?

This week I am focusing on the Chinese equity market since events in China...

READ MORE

MEMBERS ONLY

Longer-term Equity Charts Offering An Ominous Warning

by Martin Pring,

President, Pring Research

* Emerging markets are on the brink.

* The European IEV tentatively breaks its bull market trend line.

* Copper being driven down by weakness in China.

Equities

“Price action on Tuesday was quite remarkable since it seemed at the opening that the equity market was about to fall off a cliff but...

READ MORE

MEMBERS ONLY

Investors no Longer Hunting for Yield as Junk Bonds Break Down

by Martin Pring,

President, Pring Research

* Leading sectors experience false breaks to the upside.

* NYSE A/D Line completes a head and shoulders top.

* Dollar Index may be about to resume its bull market.

US Equities

Last week there appeared to be a sporting chance that the market was headed higher as several short-term indicators were...

READ MORE

MEMBERS ONLY

Oversold Short-term Indicators Suggest Another Attempt At New Highs Is In The Cards

by Martin Pring,

President, Pring Research

* Pring Dow Diffusion indicator triggers a tentative buy signal.

* Net new high bond indicator is deeply oversold.

* Aussie and Canadian dollars experience bullish KST.

US Stocks

Action this week has been somewhat disappointing since several averages and sectors experienced reversal characteristics on Tuesday. This suggests that, over the next few...

READ MORE

MEMBERS ONLY

Is The Greek Stock Market About To Collapse Or Explode?

by Martin Pring,

President, Pring Research

* HYG/IEF bond confidence indicator may be peaking.

* Cyclicals and financials have the ability to break to the upside.

* Spider Metal and Mining and Materials less favored.

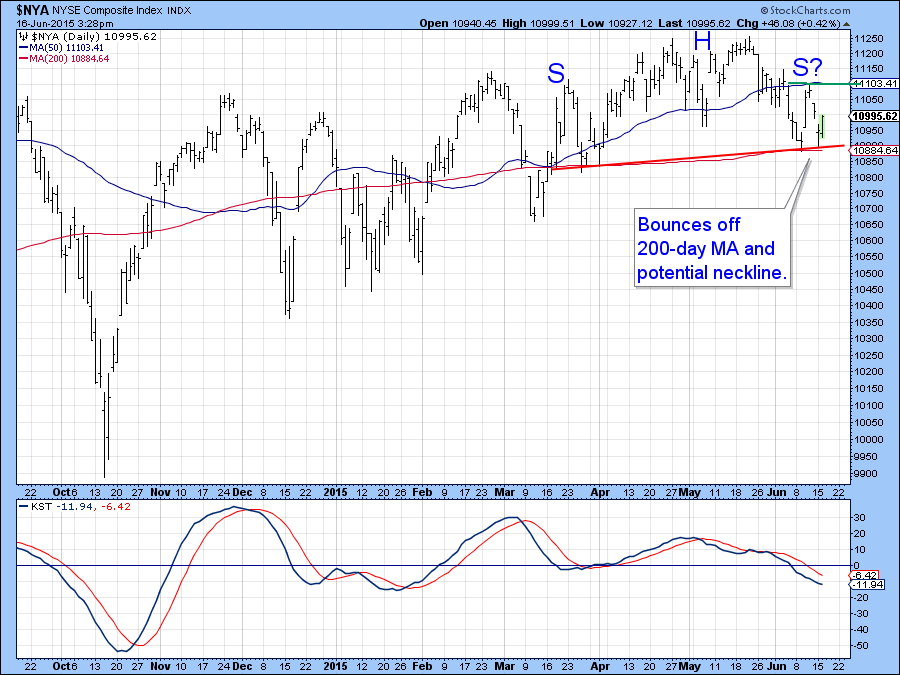

US Equities

The NYSE Composite ($NYA) continues to trade in a narrow range frustrating bull and bear alike. The 200-day MA often acts...

READ MORE

MEMBERS ONLY

If You Are Bullish On US Equities Try Looking At China For A Signal

by Martin Pring,

President, Pring Research

* - Special K for the NYSE Composite breaks support

* - Emerging markets getting oversold

* - Commodities are about to resolve their recent trading range

A Chinese leading Indicator?

It’s a well-known fact that the Chinese market has been the hottest on earth in recent months. What’s not so...

READ MORE

MEMBERS ONLY

What Are The Implications Of Rising World Interest Rates?

by Martin Pring,

President, Pring Research

* -World Bond Index completes a major top.

* -US short-term bonds on the verge of a breakout.

* -Stocks now being threatened by rising rates.

World Bond Index

Global bond markets have really been taking it on the chin recently without that usual push they get from rising commodity prices. Monetary policy...

READ MORE

MEMBERS ONLY

Is Thursday's Negative Action The Start Of Something More Serious?

by Martin Pring,

President, Pring Research

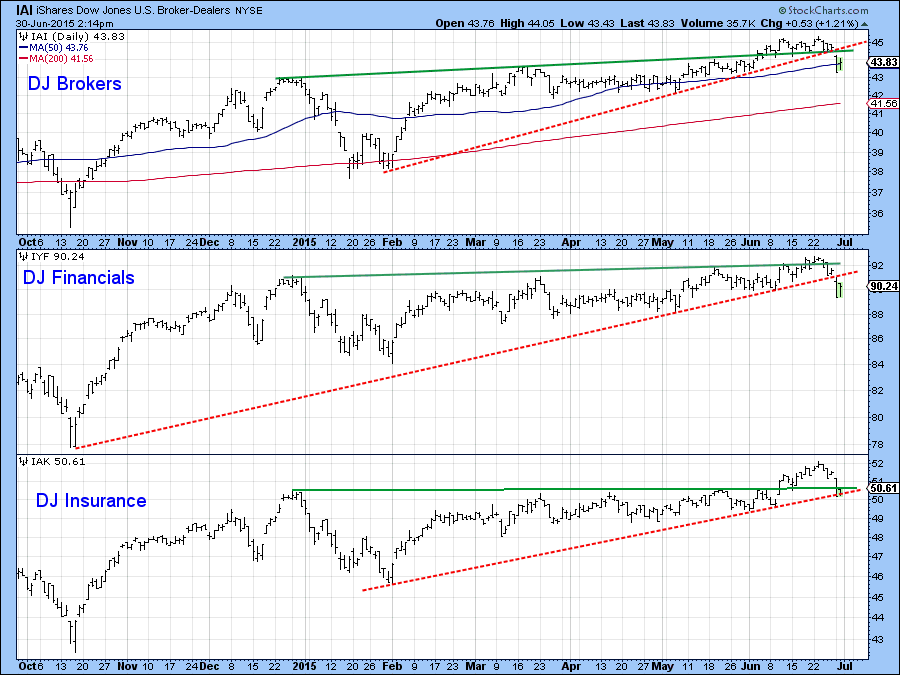

* -Brokers experience a bearish two bar reversal.

* -Dollar diffusion indicator ticks up for the first time in many weeks.

* -Gold in dollars experiencing a short-term breakdown.

* -Gold in yen and euro at crucial support levels.

US Equities

The market has been working its way irregularly higher over the last few...

READ MORE

MEMBERS ONLY

Is It Too Late To Sell In May?

by Martin Pring,

President, Pring Research

* World Stock ETF falls to important support.

* Key bond confidence indicator at a key level.

* Dollar offering stronger signals that the correction is over.

Global Stocks

A couple of weeks ago I drew your attention to the $61 area on the MSCI World Stock ETF, the ACWI, as I felt...

READ MORE

MEMBERS ONLY

Is it Time for the Dollar Bull Market to Resume?

by Martin Pring,

President, Pring Research

* Dollar Index ETF experiences a 38% Fibonacci correction and bounces.

* Key dollar relationships either at or just above major support.

* One way or another individual major currencies look vulnerable.

The Dollar Index ($USD) has been correcting for the last 9 weeks causing some observers to question the legitimacy of the...

READ MORE

MEMBERS ONLY

Why Is $61 Such An Important Number?

by Martin Pring,

President, Pring Research

* Key levels for the MSCI World Stock ETF.

* Asia Ex Japan and Japan ETF’s can support higher prices.

* Latin America and the Middle East look the most vulnerable.

Occasionally a specific price can show up as a pivotal number that provides a valuable clue as to the probable direction...

READ MORE

MEMBERS ONLY

Will the Giant Trading Range for the Emerging Markets ETF be Resolved on the Upside or Downside?

by Martin Pring,

President, Pring Research

* China, Taiwan and South Korea digesting gains following upside breakouts.

* India, Russia, and Brazil face technical challenges.

* The counter-cyclical commodity rally may well be over.

Emerging Markets

The MSCI Emerging Markets ETF, the EEM, has been in a large trading range during the last few years, as you can see...

READ MORE