MEMBERS ONLY

There is a Pretty Good Chance the Correction is Over

by Martin Pring,

President, Pring Research

The S&P peaked in early September, but most other major averages and many internal indicators of breadth have been rangebound since March. Price action this week, though, suggests that there is a good chance this corrective process has run its course and we will see significant new highs...

READ MORE

MEMBERS ONLY

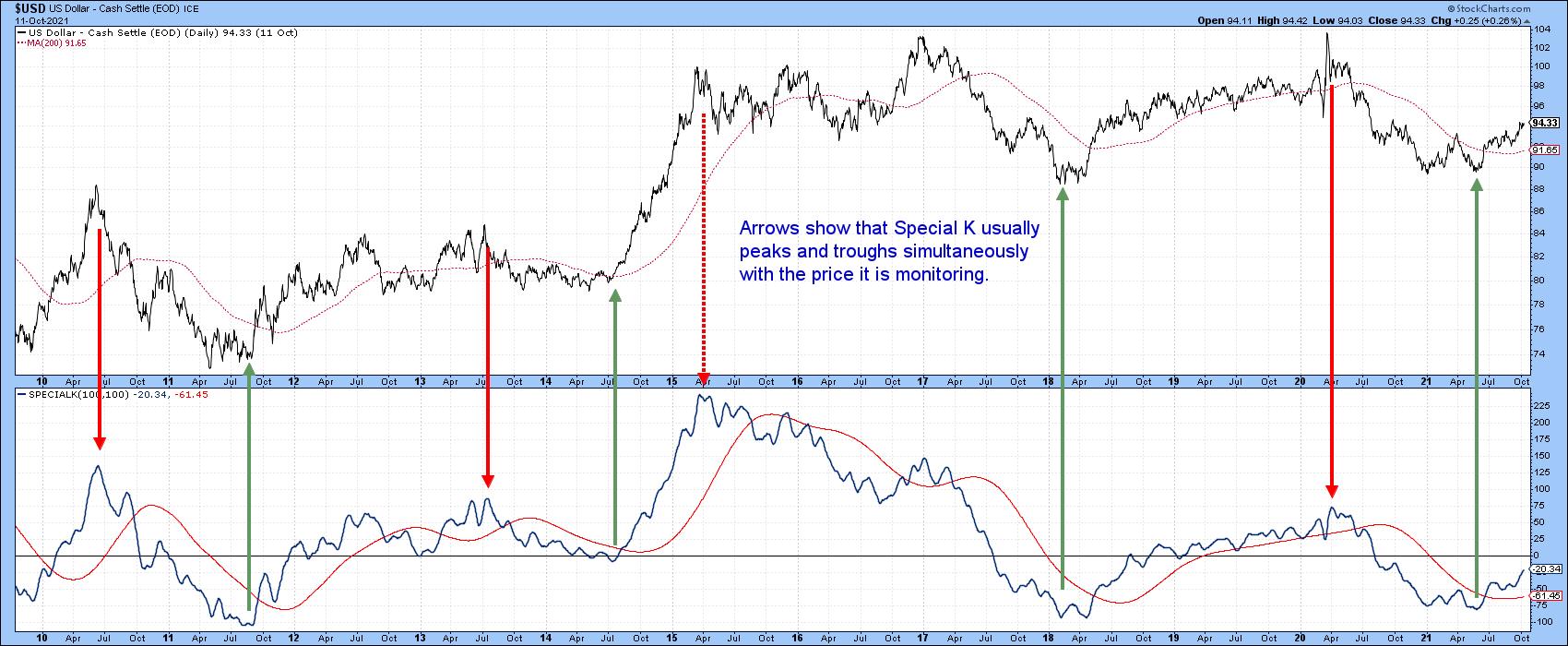

Using the Special K to Analyze the Dollar

by Martin Pring,

President, Pring Research

One of my favorite indicators is the Special K. It does not speak to us very often, but when it does, it's usually pretty reliable. I'll outline a few principles below, but for further reading, look hereandhere.

The Special K, or SPK, recognizes the fact that...

READ MORE

MEMBERS ONLY

This Sector is Likely to Outperform the NASDAQ in a Major Way

by Martin Pring,

President, Pring Research

Back in AprilandMay, I wrote about the possibility that the tech-dominated NASDAQ had begun to lose its mojo. The argument was based more on relative action than the absolute price, as I was, and still am, bullish on the primary trend.

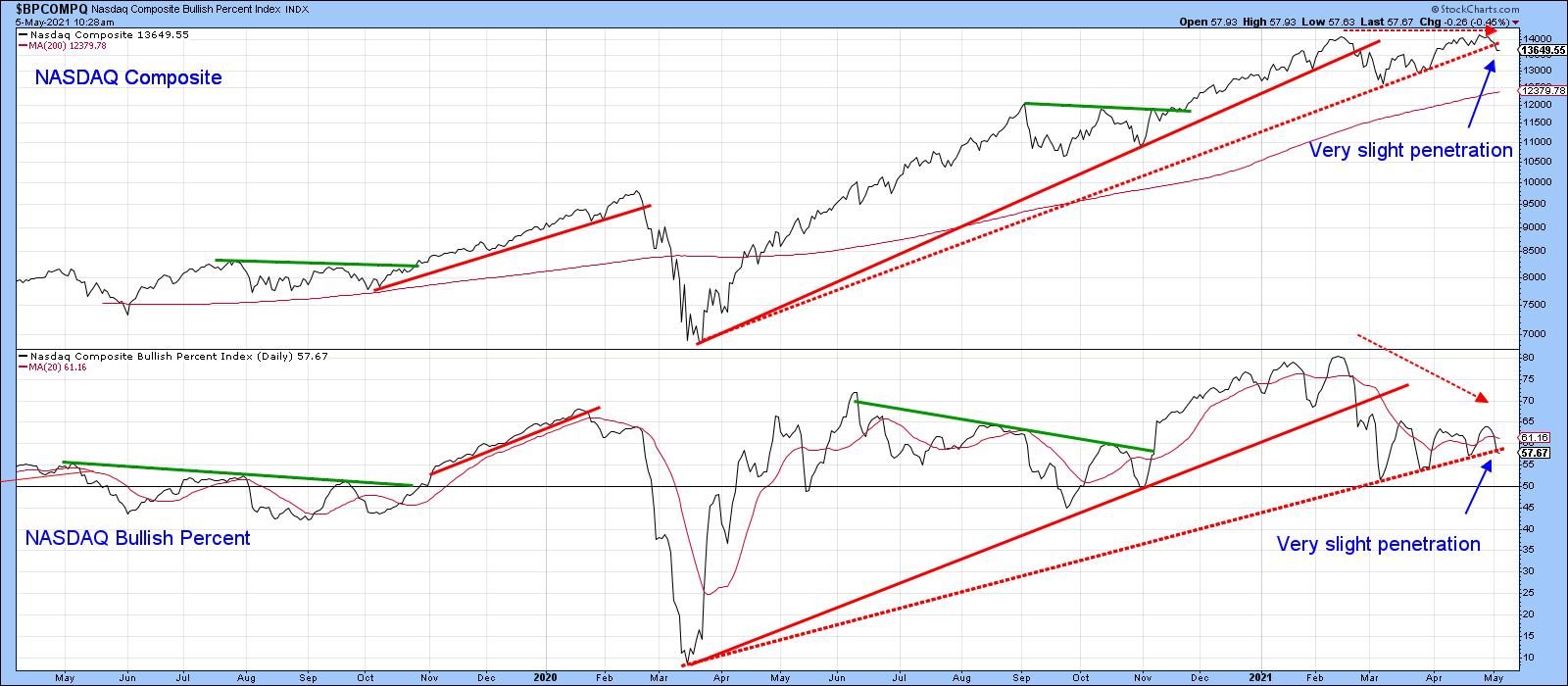

Recent NASDAQ Underperformance is Likely to Extend

Chart 1...

READ MORE

MEMBERS ONLY

Step Aside Chairman Powell, Mr. Market is Tightening for You

by Martin Pring,

President, Pring Research

Last week, the Fed announced that tapering is likely to begin later in the year, to be later followed by a leisurely hike in rates. As usual, those pesky impatient markets have decided to raise rates now rather than wait for the clobbering they know they will get later. It...

READ MORE

MEMBERS ONLY

Step Aside Chairman Powell, Mr. Market is Tightening for You

by Martin Pring,

President, Pring Research

Last week, the Fed announced that tapering is likely to begin later in the year, to be later followed by a leisurely hike in rates. As usual, those pesky impatient markets have decided to raise rates now rather than wait for the clobbering they know they will get later. It...

READ MORE

MEMBERS ONLY

Commodities Experience a False Upside Breakout -- Or Did They?

by Martin Pring,

President, Pring Research

Earlier in the month, I pointed out that the long-term indicators for commodities were still bullish, but getting overbought. At the same time, several intermarket relationships were signaling danger, which suggested some degree of vulnerability. Prices have not moved very much since then, but, bearing in mind that overstretched technical...

READ MORE

MEMBERS ONLY

Several Indicators are Shaping Up for a Counter-Cyclical Correction

by Martin Pring,

President, Pring Research

Most of the time, the charts I plot are constructed from daily data. As a result, the necessary perspective provided by weekly ones often gets overlooked. By way of a remedy, I decided, some time ago, to create chartlists for key markets featuring weekly high low close and candlestick arrangements....

READ MORE

MEMBERS ONLY

Nine Country ETFs That are Starting to Emerge

by Martin Pring,

President, Pring Research

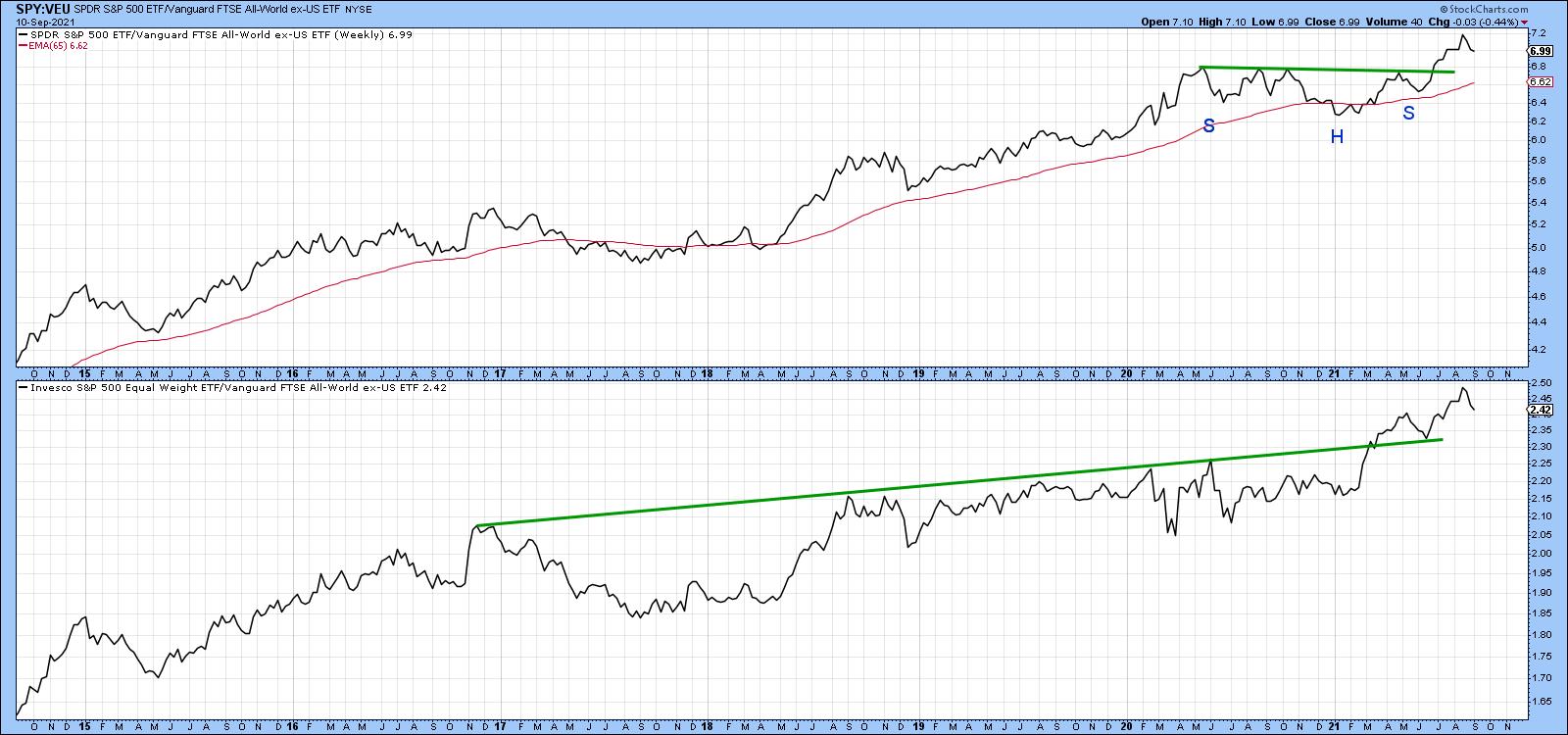

Chart 1 shows that the US stock market is in a long-term uptrend relative to the rest of the world. The upper window compares the S&P to the Vanguard All-World ex-US ETF and indicates a recent breakout from a consolidation reverse head-and-shoulders. The lower panel substitutes the S&...

READ MORE

MEMBERS ONLY

Nine Country ETFs That are Starting to Emerge

by Martin Pring,

President, Pring Research

Chart 1 shows that the US stock market is in a long-term uptrend relative to the rest of the world. The upper window compares the S&P to the Vanguard All-World ex-US ETF and indicates a recent breakout from a consolidation reverse head-and-shoulders. The lower panel substitutes the S&...

READ MORE

MEMBERS ONLY

Several Intermarket Relationships are Signaling Danger for Commodities

by Martin Pring,

President, Pring Research

When considered in their own right, commodities, as represented by the CRB Composite, are in a primary bull market. Chart 1, for instance, shows that the Index is above its 12- and 24-month moving averages and the long-term KST is also in a bullish trend. That said, this momentum indicator...

READ MORE

MEMBERS ONLY

Dollar Index Breakout Trick or Treat?

by Martin Pring,

President, Pring Research

Back in June, I wroteabout the possibility that a major reversal in the dollar could be underway, but that certain things had to happen before we could come to a firm conclusion. One of those conditions was a Dollar Index daily close above 93.5, as that would complete what...

READ MORE

MEMBERS ONLY

Michigan Consumer Sentiment Drops 13.5% in July; What Does that Mean for US Equities?

by Martin Pring,

President, Pring Research

Last Friday (August 13), the University of Michigan released the initial August response to their consumer sentiment survey. A sharp 13.5% retreat was recorded. The Expectations Index fared even worse, with a 17.5% drop. According to the summary report, only six of these monthly surveys since the late...

READ MORE

MEMBERS ONLY

Michigan Consumer Sentiment Drops 13.5% in July; What Does that Mean for US Equities?

by Martin Pring,

President, Pring Research

Last Friday, the University of Michigan released the initial August response to their consumer sentiment survey. A sharp 13.5% retreat was recorded. The Expectations Index fared even worse with a 17.5% drop. According to the summary report, only six of these monthly surveys since the late 1970s have...

READ MORE

MEMBERS ONLY

Which of These Three Leading Commodity Indicators are Forecasting Higher Prices?

by Martin Pring,

President, Pring Research

We hear a lot about inflation these days and have certainly experienced rising grocery bills, as well as runaway used car and housing prices. Commodity prices are often, but certainly not always, a leading indicator for the CPI, but there are three markets that have a useful, though imperfect, record...

READ MORE

MEMBERS ONLY

The Indicators are Mixed. What Does this Contradiction Mean for the Market?

by Martin Pring,

President, Pring Research

This morning, an interesting chart of the S&P Composite authored by Ed Clissold of NDR Research crossed my desk. It can be seen at @NDR_Research. It is a composite of 3 historic cycles: 1-year, 4-year (post-election) and 10-year decennial cycle with an average of years ending in...

READ MORE

MEMBERS ONLY

Bitcoin and Chinese Equities Go their Separate Ways

by Martin Pring,

President, Pring Research

After months of quiet frustrating trading, Bitcoin finally broke out to the upside this week. It's too early to say whether this is the beginning of a move to new all-time highs, as lots more backing and filling is probably necessary in order for it to form a...

READ MORE

MEMBERS ONLY

Bitcoin and Chinese Equities Go their Separate Ways

by Martin Pring,

President, Pring Research

After months of quiet frustrating trading, Bitcoin finally broke out to the upside this week. It's too early to say whether this is the beginning of a move to new all-time highs, as lots more backing and filling is probably necessary in order for it to form a...

READ MORE

MEMBERS ONLY

The Correction May Not Be as Bad as You Think

by Martin Pring,

President, Pring Research

The bad news is that a correction is underway and that many indicators and market averages have started to break through key support. The good news is that, internally, corrective activity has been underway for several months. Provided the bull market is still in existence (and there are few grounds...

READ MORE

MEMBERS ONLY

US Breaks Out Against the World as Bonds Fail at 200-day Moving Average

by Martin Pring,

President, Pring Research

The US Breakout

The S&P has been in a secular or very long-term uptrend against the Dow Jones World Stock Index since the financial crisis. That trend is still intact, as the ratio remains above its 2011-2021 up trendline. The primary trend picture is a bit mixed as...

READ MORE

MEMBERS ONLY

Three Intermarket Relationships That are at a Critical Point

by Martin Pring,

President, Pring Research

When reviewing my charts last weekend, several jumped out as being at a pretty critical juncture, and therefore worthy of monitoring going forward. A couple of them involved the stock market, so I'll start there.

Two Stock Market Relationships

I have always been fascinated by the relationship between...

READ MORE

MEMBERS ONLY

Three Intermarket Relationships That are at a Critical Point

by Martin Pring,

President, Pring Research

When reviewing my charts last weekend, several jumped out as being at a pretty critical juncture, and therefore worthy of monitoring going forward. A couple of them involved the stock market, so I'll start there.

Two Stock Market Relationships

I have always been fascinated by the relationship between...

READ MORE

MEMBERS ONLY

What Does a Flattening Yield Curve Mean for Bonds, the Economy and Stocks

by Martin Pring,

President, Pring Research

In the last couple of weeks or so, US treasury yield curves have begun to flatten. That may sound unduly technical and boring, but it has implications for bonds stocks and the economy. I'll get to the investment implications later, but for now I'll quickly through...

READ MORE

MEMBERS ONLY

NASDAQ and S&P at a New High, But It's Very Lonely Up There

by Martin Pring,

President, Pring Research

This week saw the NASDAQ and S&P Composites rally to a new high, but not the DJIA, NYSE Composite, Unweighted S&P and Russell 2000. That's not necessarily the kiss of death, as these discrepancies can always be cleared up over time. In any case,...

READ MORE

MEMBERS ONLY

Can Positive Short & Intermediate Indicators for the Dollar Tip Long-Term Balance to the Bullish Side?

by Martin Pring,

President, Pring Research

Chart 1 shows that, since 2015, the Dollar Index has been in a narrowing trading range bounded by two converging trendlines. That period has also embraced the end part of the 2011-2016 bull market, a mini-bear and bull market and the current bear. I use the term "bear"...

READ MORE

MEMBERS ONLY

Can Positive Short & Intermediate Indicators for the Dollar Tip Long-Term Balance to the Bullish Side?

by Martin Pring,

President, Pring Research

Chart 1 shows that, since 2015, the Dollar Index has been in a narrowing trading range bounded by two converging trendlines. That period has also embraced the end part of the 2011-2016 bull market, a mini bear and bull market and the current bear. I use the term "bear&...

READ MORE

MEMBERS ONLY

Oil May Be on the Verge of a Major Breakout

by Martin Pring,

President, Pring Research

Last week, I featured three energy-related ETFs as part of an article on the bond market, as they had just broken out on a short-term basis. Chart 1 shows that those breakouts have held so far. This week, though, I'd like to take a deeper dive into the...

READ MORE

MEMBERS ONLY

Bonds at the Crossroad as Energy Breaks to the Upside

by Martin Pring,

President, Pring Research

The Dilemma Between the Long and Short-Ends

Last March, I wrote an articleopining that, while the primary trend was positive, the idea of rising bond yields may have been become too popular for the time being. In the intervening 2 ½-months, yields at the long end have backed off a...

READ MORE

MEMBERS ONLY

I Don't Know If the Correction Will Extend, But Here are Five Charts I'm Watching

by Martin Pring,

President, Pring Research

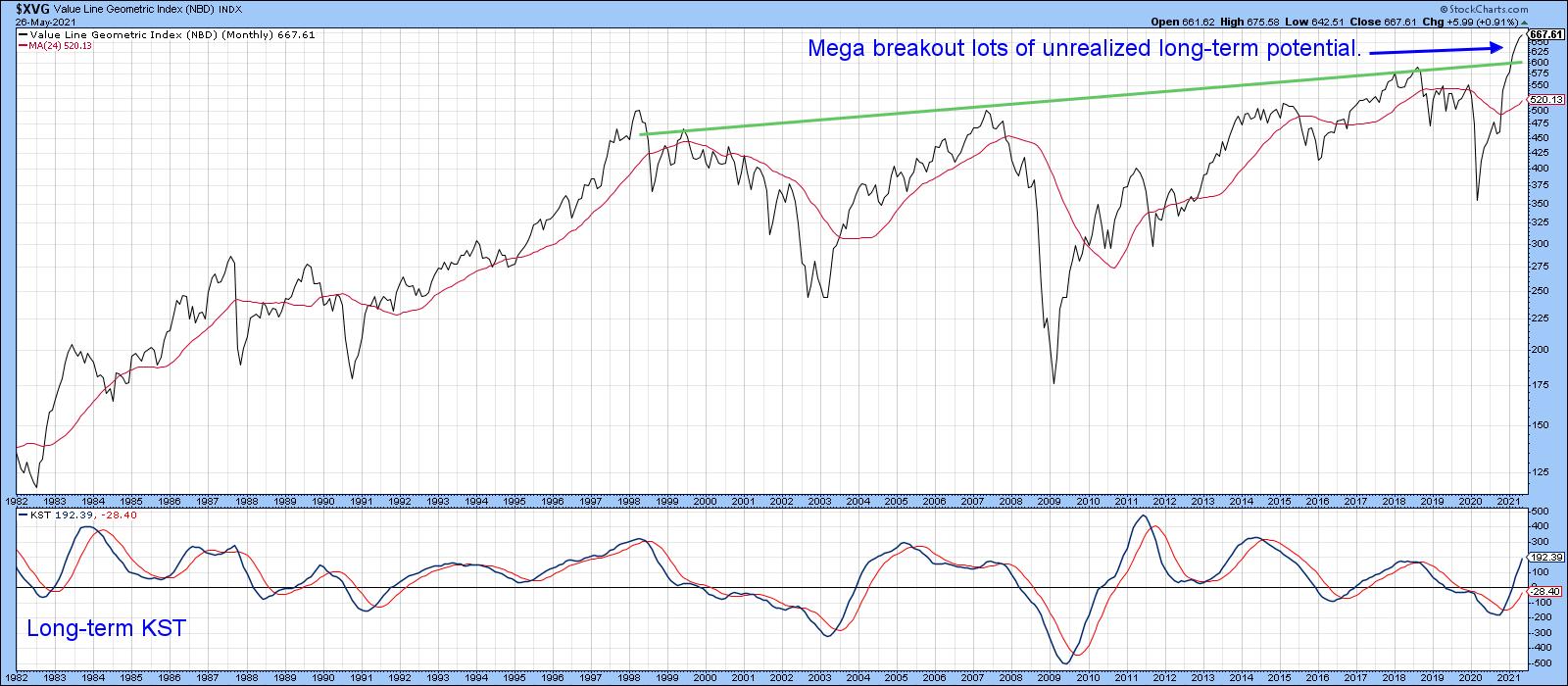

The Big Picture

Before we get into the subject of corrections, it's important to make sure that we do not lose focus on the big picture. For instance, take Chart 1, which features the Value Line Geometric Average. It reflects the performance of the average stock, as opposed...

READ MORE

MEMBERS ONLY

I Don't Know If the Correction Will Extend, But Here are Five Charts I'm Watching

by Martin Pring,

President, Pring Research

The Big Picture

Before we get into the subject of corrections, it's important to make sure that we do not lose focus on the big picture. For instance, take Chart 1, which features the Value Line Geometric Average. It reflects the performance of the average stock, as opposed...

READ MORE

MEMBERS ONLY

Gold Starting to Look Interesting Again

by Martin Pring,

President, Pring Research

Gold has rallied nicely in the last few weeks, so the question naturally arises as to whether it's ready to resume its secular bull market. I'll get to that later, but first, a little perspective.

Longer-Term Perspective

Chart 1 plots the real price as adjusted by...

READ MORE

MEMBERS ONLY

Monday's Falling Dominos May Be Enough to Tip the Short-term Trend to the Downside

by Martin Pring,

President, Pring Research

Many internal short-term indicators are overextended and starting to look vulnerable, but need some kind of a push to tip the near-term technical balance to the bearish side. That push may have been delivered with Monday's action, as several indexes gave the appearance of some selected short-term buyer...

READ MORE

MEMBERS ONLY

Putting Forward a Candidate to Take Over Tech Leadership

by Martin Pring,

President, Pring Research

A couple of weeks ago, I posted an articlequestioning whether the tech-dominated NASDAQ still had the mojo to lead the market higher. At the time, many sub-surface indicators, such as breadth, volume and relative action, looked weak. Several charts indicated that many of them had experienced multiple negative divergences, but...

READ MORE

MEMBERS ONLY

Putting Forward a Candidate to Take Over from Tech Leadership

by Martin Pring,

President, Pring Research

A couple of weeks ago, I posted an article questioning whether the tech-dominated NASDAQ still had the mojo to lead the market higher. At the time, many sub-surface indicators, such as breadth, volume and relative action, looked weak. Several charts indicated that many of them had experienced multiple negative divergences,...

READ MORE

MEMBERS ONLY

Commodities are Breaking Out All Over

by Martin Pring,

President, Pring Research

The Fed has pumped a lot of money into the system -- and that liquidity has to go somewhere. We know a lot of it has already been flowing into stocks. Now it looks like it's time for commodities to participate. So much money, combined with bottlenecks in...

READ MORE

MEMBERS ONLY

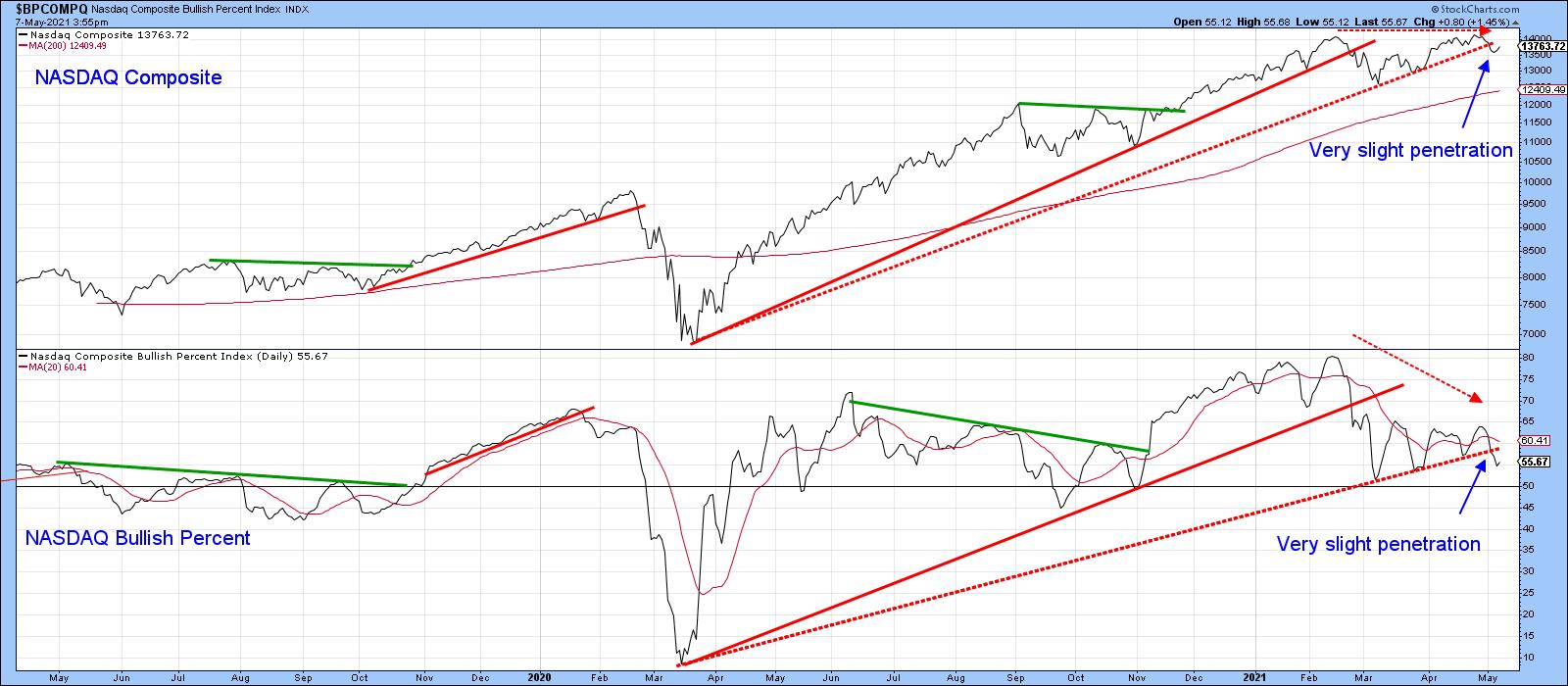

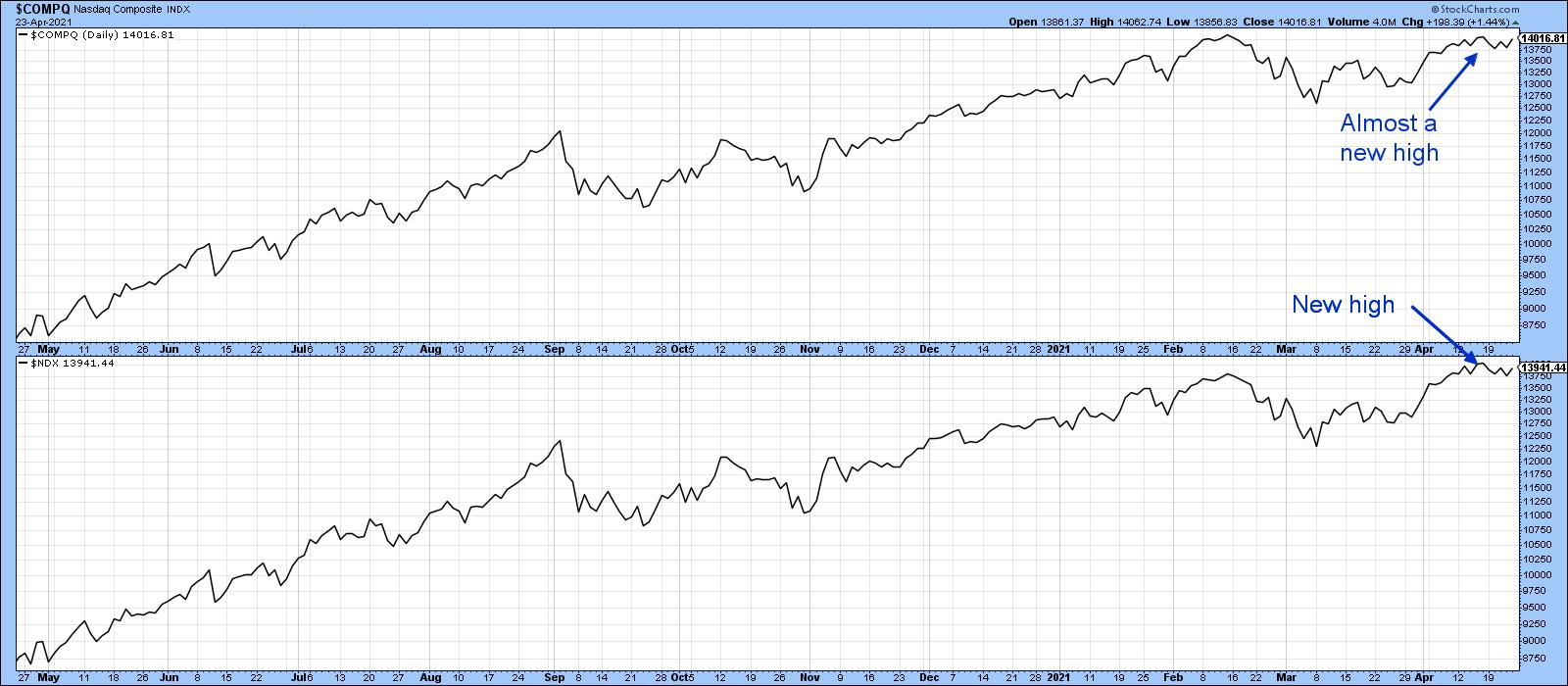

Has the NASDAQ Lost its Mojo?

by Martin Pring,

President, Pring Research

The NASDAQ Composite peaked on February 16, sold off and subsequently rallied back to the February high last week. Chart 1 shows that it just missed the earlier peak by a smidgen, whereas the NASDAQ 100 (in the lower window) did marginally take out its February high. Taken together, the...

READ MORE

MEMBERS ONLY

Has the NASDAQ Lost its Mojo?

by Martin Pring,

President, Pring Research

The NASDAQ Composite peaked on February 16, sold off and subsequently rallied back to the February high last week. Chart 1 shows that it just missed the earlier peak by a smidgen, whereas the NASDAQ 100 (in the lower window) did marginally take out its February high. Taken together, the...

READ MORE

MEMBERS ONLY

Dollar Hits a Crucial Fork in the Road

by Martin Pring,

President, Pring Research

The Dollar Index has been rangebound since 2015. During that period, it has experienced two mini bull and bear markets, as flagged by the dashed arrows in Chart 1. The latest bear has been in force for just over a year, as signaled by the Index trading below its 12-month...

READ MORE

MEMBERS ONLY

Is it Time to Buy Gold?

by Martin Pring,

President, Pring Research

The gold price peaked last August and has been zig-zagging down ever since. The approximate loss from the high has so far been just north of 15%. During that period, sentiment numbers have been slowly eroding, but not to bearish extremes, so is now a good time to buy? It...

READ MORE

MEMBERS ONLY

Trolling the StockCharts Economic Database for Useful Stock Market Indicators

by Martin Pring,

President, Pring Research

Many of you may be unaware of the fact that StockCharts has a small database of economic indicators. (You can find them by searching for symbols that begin with $$.) This week, I ran through a number of series to see if any could be useful from a long-term stock market...

READ MORE

MEMBERS ONLY

Several Key Indexes Testing Important Support

by Martin Pring,

President, Pring Research

It's never a good idea to try and predict contra-trend moves in a strong equity bull market, because the benefit of the doubt always goes with the prevailing trend. If false moves develop, they have a strong tendency to develop on the downside. That said, several key indexes...

READ MORE