MEMBERS ONLY

This Pharma Stocks Offers A Potentially Profitable Hedged Option Setup

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Piramal Enterprises Limited -- PEL.IN

The stock has under-performed the Pharma Index over the past couple of weeks. Against the broader markets as well, the stock has not performed while it stayed in a prolonged sideways consolidation.

Currently, it is just broken out on the upside with greater-than-average volumes....

READ MORE

MEMBERS ONLY

Week Ahead: These Things Happen in a Risk-On Setup: RRG Shows These Sectors Losing Relative Momentum

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a yet another week where we witnessed a gush of liquidity continuing to chase the equities, the Indian equity markets saw a buoyant week and ended once again with an up week. The trading range of the week remained wider on the expected lines. The headline index oscillated over...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Moves Towards Major Resistance Zone; RRG Shows Diminishing Outperformance From these Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week remained contrary to expectations; instead of staying within ranged movement, it was a wide-ranging one with the Index ending with robust gains. The NIFTY saw a 600-point wide trading range, much broader than expected. The NIFTY pulled back from the low point and finished on a strong...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May See Ranged Movements; RRG Chart Tells This Sector May Offer Maximum Alpha

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Markets ended a week that continued to play out much on the expected lines, except for the fact that the volatility was much less than what was expected. Also, the markets continued to display lack of directional bias throughout the week. Despite making a sharply lower top and lower bottom...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to Continue Exhibiting Bearish Intent; RRG Shows This Sector Topping Out

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The past couple of days performed much along the anticipated lines as the markets, in general, continued to portray a bearish undertone and ended the weak on a negative note. After halting the pullback, the NIFTY has formed a lower top near 9900 levels and continued its slide, confirming the...

READ MORE

MEMBERS ONLY

Special Note: These 3 Charts Show Why You Should Choose NIFTY Next 50 over Small-Caps

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The global equity markets have seen the mother of all volatile times during the first five-and-a-half months of the year 2020. From the peak of early 2020, the key equity markets saw a sharp decline of over 35% in most cases. Following those lows, the stocks have also managed to...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Marks Important Technical Event; RRG Chart Shows Key Sectors Continuing to Lag

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets fared much along the expected lines over the past five sessions. In the previous weekly note, we had mentioned that if the NIFTY failed to move past the previous week's high, it might end up forming a lower top for itself. Things turned out on the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Not Moving Past this Level, May Form Lower Top; RRG Suggests Underperformance May Continue in These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week saw the markets trading on a much better-than-expected note as the headline index continued to surge higher, ending with strong gains. The markets had seen a loss of momentum in the week before this one; however, the truncated week saw the resumption of the technical rebound, which...

READ MORE

MEMBERS ONLY

With No Signs of Equities Bottoming Out, These Two Charts Tell an Interesting Story

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After declining over 35% from the 2020 peaks, the global equity markets found a temporary base, and, in the current technical pullback, have recouped over one-third of total losses. Traders and investors alike have formed differing opinions on whether the equities have bottomed out as they pulled back over the...

READ MORE

MEMBERS ONLY

Week Ahead: Upside in NIFTY May Stay Capped; RRG Chart Says it May Be Time to Reduce Weight on this Sector

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, we mentioned the loss of momentum in the technical pullback that the markets had started to witness. In the week that followed that note, the loss of momentum became more evident. Despite a 500-point oscillation and a trading range, the NIFTY halted its pullback and...

READ MORE

MEMBERS ONLY

The Relationship Between Two Most Important Indian Indices Has Changed

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The front line index NIFTY50 ($NIFTY) and the Nifty Bank Index ($BANKNIFTY) have always shared a steady one-sided relationship since the inception the two indices.

The above chart shows the NIFTY and BankNifty's co-performance since inception. Right from the introduction of these two indices in the year 2000,...

READ MORE

MEMBERS ONLY

Opportunity To Collect Premiums By Writing Options In This Stock

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

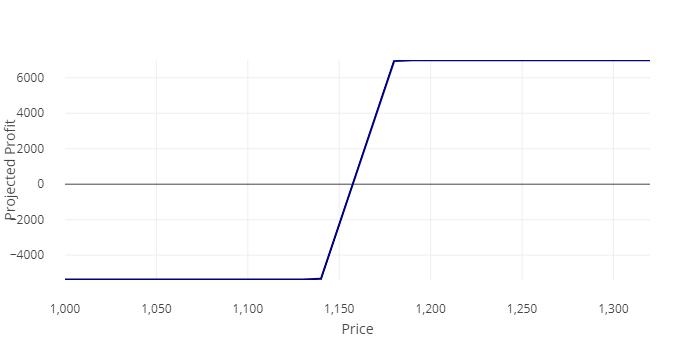

Titan Industries Limited - TITAN.IN

The chart above shows highest Put OI in Titan at 900 and maximum Call OI at 1100 for the April 30 expiry. To interpret this data, that means that it is highly unlikely that the stock will find strong support at 900 and strong...

READ MORE

MEMBERS ONLY

Week Ahead: Loss Of Momentum May Be a Slight Worry; RRG Chart Shows These Sectors Languishing

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After a sharp technical pullback in the week before this one, the Indian equities continued with the extension of the pullback, but on a very modest note. The trading range over the past five days remained broad, as the NIFTY oscillated in a 500-point range but kept the net incremental...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Get Vulnerable at Higher Levels; RRG Suggests Continued Focus on these Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After several negative weekly closes, the Indian equity markets finally ended their losing streak this truncated week as they finally finished with gains. In our previous weekly note, we had categorically mentioned the possibilities of a sharp technical pullback despite ongoing uncertainties because of the outbreak of COVID-19. While trading...

READ MORE

MEMBERS ONLY

This Pharma Stock May Be In For A Technical Pullback

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Glenmark Pharmaceuticals Ltd (NSE) (GLENMARK.IN)

Along with underperforming the broader markets, Glenmark Pharmaceuticals has been underperforming the pharma group as well. Over the past couple of weeks, the stock has been consolidating in a 187-215 range while creating a congestion zone. Now, a few signals have appeared that point...

READ MORE

MEMBERS ONLY

Truncated Week May See Mild Technical Pullbacks; RRGs Show Strong Relative Momentum in these Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After taking a breather the week before this one, the Indian equity market resumed its downtrend again and ended this week with a net loss. With this week's decline, the NIFTY has, as of now, has declined nearly 35% on a closing basis. A week before, NIFTY had...

READ MORE

MEMBERS ONLY

Week Ahead: Avoid Getting Carried Away By Pullbacks, If Any; These Are Resilient Sectors, Says RRG

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

We are using Line Charts, as they enable us to take a look at the longer-term structure of the weekly charts. We do this so that we can examine the behavior of the markets against the decade-long trend line, which now stands violated. After a massive decline of over 12%...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Has Multiple Negatives to Deal With; RRG Chart Suggests Adopting a Defensive Play

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The unabated meltdown in the equities markets continued this week as well, which saw the NIFTY plunging to the fresh weekly lows. The Indian equities traded in line with the weak global setup and lost ground as rapidly as other global markets. The benchmark index NIFTY declined and ended in...

READ MORE

MEMBERS ONLY

Special Note: Know Where NIFTY Stands from a Broader Perspective; What RRG Says About the Week Ahead

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After the violation of critical near-term support a week before, the Indian equities suffered their worst-ever weekly decline of the decade. In line with the global mayhem, the Indian stock markets also saw an equally sharp meltdown, going on to end well below the key moving average and slipping further...

READ MORE

MEMBERS ONLY

Week Ahead: Avoid Chasing Technical Pullbacks, If Any; RRG Suggests Taking Refuge in These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The global scare of an economic slowdown following the outbreak of coronavirus saw the world markets taking a severe knock, and Indian equities were no exception. While trading on anticipated lines, the Indian equity markets saw a wide-ranging week wherein the headline index NIFTY moved in the range of 606...

READ MORE

MEMBERS ONLY

Week Ahead: After One of the Most Brutal Selloffs of the Decade, What Next?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week saw one of the worst sell-offs of the decade when the global markets reacted with absolute panic to the spread of the coronavirus, and the Indian markets were affected as well. The global financial markets went in disarray as the world grappled with the possibility of the...

READ MORE

MEMBERS ONLY

Week Ahead: Watching This Level Important; RRG Chart Show These Sectors Rotating Favorably

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

While trading just on the anticipated lines, the Indian equity markets continued to consolidate around critical levels throughout the previous week, ending flat with negligible loss. Just as mentioned and expected in the last weekly note, the NIFTY did not make any major headway; the upsides stayed limited and within...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Vulnerable at Current Levels; RRG Chart Shows These Groups Doing Relatively Better

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week saw the markets consolidating in a 256-point move, as the headline index NIFTY50 ended flat with a negligible gain. After bouncing off from the 50-week MA in the earlier week, the NIFTY continued to trade near its critical zone of 12100-12225 throughout the week while making no...

READ MORE

MEMBERS ONLY

This Stock Looks Promising Over The Coming Days

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

VIPIND.IN - VIP Industries Limited

VIPIND.IN marked a peak near 641 in August 2018, formed a lower top 562 and saw a range-bound corrective move that took the stock to 342. The stock has attempted to form a base around that level - given the multiple pieces of...

READ MORE

MEMBERS ONLY

Consolidation May Spill Over To The Coming Week; RRG Chart Show These Pockets Staying Resilient

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The previous week remained a six-day trading week for the markets. Saturday, February 01, 2020, was a full-trading day because of the Union Budget that was presented. The day turned out to be a wide-ranging day for the markets on expected lines as Union Budget is one of the most...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Has a Stiff Overhead Resistance to Deal With; RRG Chart Show Mid-Caps to Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After starting the week on a corrective note, the market recouped some of its losses on the last two trading days of the week. The last few days have remained volatile for the markets as the headline index NIFTY traded in a wider-than-usual range. The index oscillated in an over-340-point...

READ MORE

MEMBERS ONLY

NIFTY to Stay in a Defined Range; RRG Chart Points Towards this Sector Potentially Bottoming Out

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

With geopolitical tensions subsiding, the market had a quiet week as it continued to post a small amount of incremental gains. The trading range also remained capped due to the market oscillating in a capped range. While showing no volatility at all, the NIFTY made minor advancements on the higher...

READ MORE

MEMBERS ONLY

Special Note: These 3 Charts Have a Story to Tell; RRG Chart Points Toward Higher Alpha Generation on a Relative Basis

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

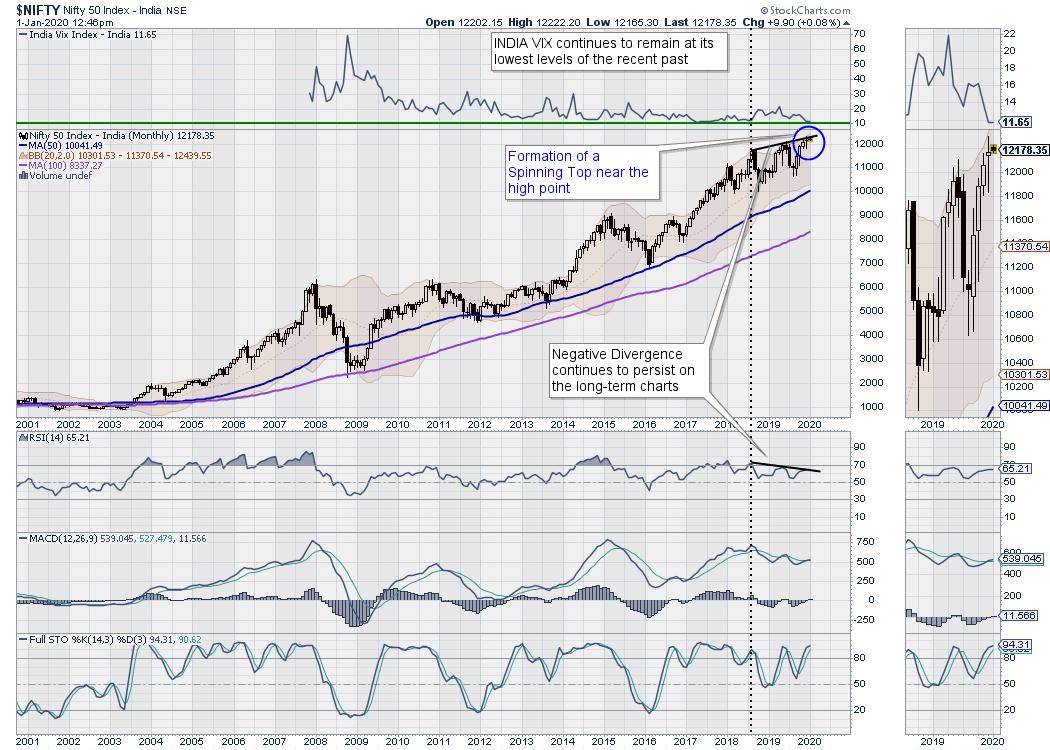

The headline index NIFTY is presently trading near its lifetime-high levels, returning a stellar 15% over the past 12 months and 1.08% on a Year-to-Date basis. Having said this, the loss of momentum and few negative divergences on the leading indicators are quite evident on the charts. It will...

READ MORE

MEMBERS ONLY

NIFTY May Remain Volatile in the Coming Week; RRG Charts Show Key Sectors Continuing to Lose Momentum

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As the Indian markets traded on the anticipated lines, they continued to consolidate, but also saw tremendous volatility owing to the geopolitical tension in the West Asian region. The NIFTY traded in a wider-than-usual range and ended the week on a relatively flat note. The index witnessed close to 400...

READ MORE

MEMBERS ONLY

Week Ahead: Likely to See Increase in Volatility; RRG Chart Shows Likely Resilience from These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian markets witnessed consolidation again for the second week in a row. The markets saw a generally stable week, one that remained in a limited and defined range and ended mildly in the negative. In the previous weekly note, we had expected the consolidation to continue, and indeed the...

READ MORE

MEMBERS ONLY

Special Note: Are We Looking At 2020 As A Year Of Capped Gains? These Charts Have A Story To Tell

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As 2019 ended, we saw the markets ending near the high point of the year. Despite the negative ending on the last trading day of the year, the front-line NIFTY50 has ended the year with strong gains of 11.53% on an annual note. However, that being said, the year...

READ MORE

MEMBERS ONLY

Are We Looking At Some Moves Here?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

JUBLFOOD.IN

This stock has seen 2 months of sideways moves and, during this time of consolidation, the RS line, which compares the stock against the broader NIFTY 500 Index, is strongly moving higher.

The Bollinger Bands have grown over 60% narrower than usual, which reflects a period of low...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY at a Crucial Juncture Again; RRG Chart shows Steady Rotation of These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

With just two trading days left in the year, this week will usher us into 2020. The markets are set to end near their highs this year, but they are also leaving us at a critical juncture if we look at the market technical from the long-term point of view....

READ MORE

MEMBERS ONLY

Week Ahead: Follow Trend Cautiously as Loss Of Momentum Seen; RRG Tells Us to Focus on These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The risk-on global setup, which had begun a week before, continued throughout the past week as well. The resultant buoyant setup fueled the Indian markets higher as well, which ended at their high lifetime levels. Though the momentum continued to falter, the markets did not show any sign of retracement...

READ MORE

MEMBERS ONLY

As The NIFTY is Marking New Highs...

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian headline index NIFTY ($NIFTY) moved past its double top resistance level of 12103 on a closing basis, ending at a fresh life-time high at 12221.25. However, looking at the broader NIFTY500 Index ($CNX500) throws up some interesting insights.

The above chart tells a story of a thousand...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Crucially Poised with Mixed Cues; RRGs Suggest These Groups Will Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The risk-on global setup towards the end of the week saved the Indian markets from ending on a net negative note. Following a weak initial performance, the Indian markets picked up in the second half of the week. The NIFTY pulled itself back after testing the lower end of the...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Crucially Poised; RRG Shows Loss of Momentum Among a Few Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In contrast to the one that came before, this past week gave back all its gains while ending near the low point of the trading range. The markets were sitting on the verge of a breakout, but that did not amount to anything as the markets refused to break above...

READ MORE

MEMBERS ONLY

Week Ahead: RRG Shows Private Banks & Financials Rolling Over; Coming Days Crucial for NIFTY

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After healthy consolidation around the 12000 level over the past couple of weeks, the NIFTY has attempted to break above a year-long secondary trend that it was in by ending the week with gains. Throughout the week, the markets pushed hard to breach the double-top resistance on the shorter-term charts...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Find it Difficult to Deal with Stiff Overhead Resistance; Watch these Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As I complete this weekly technical note, I have just wound up the inaugural CMT India Summit at Mumbai yesterday. Insights shared by the Association's co-founder Ralph Acampora, Martin Pring and Julius de Kempenaer were the key takeaways of the event.

Coming back to the markets, although they...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Healthy But Exhausted At Higher Levels; RRG Shows These Sectors To Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by continued to trade on the expected lines, while the 12000-12050 zone continued to pose resistance to the markets on the upside. The week was spent with the markets consolidating at higher levels while demonstrating weakness near the critical resistance zone. The NIFTY headed nowhere over...

READ MORE