MEMBERS ONLY

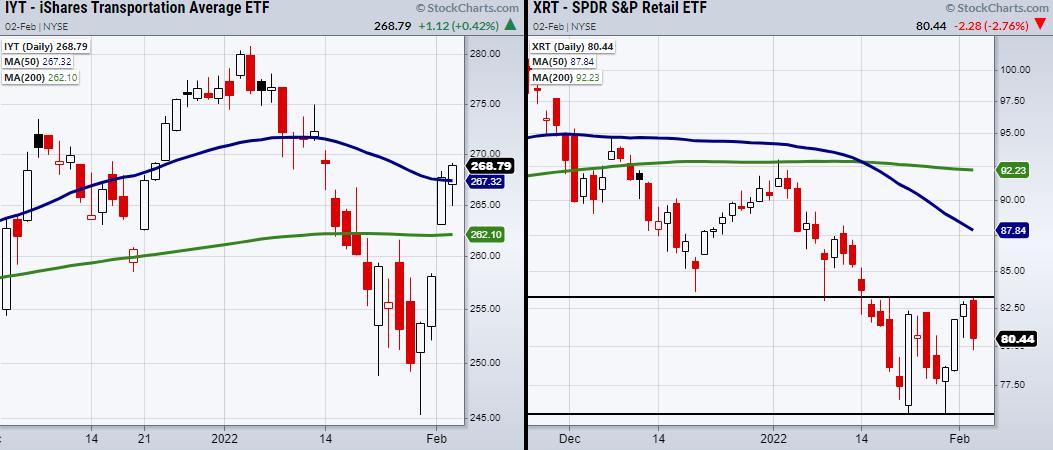

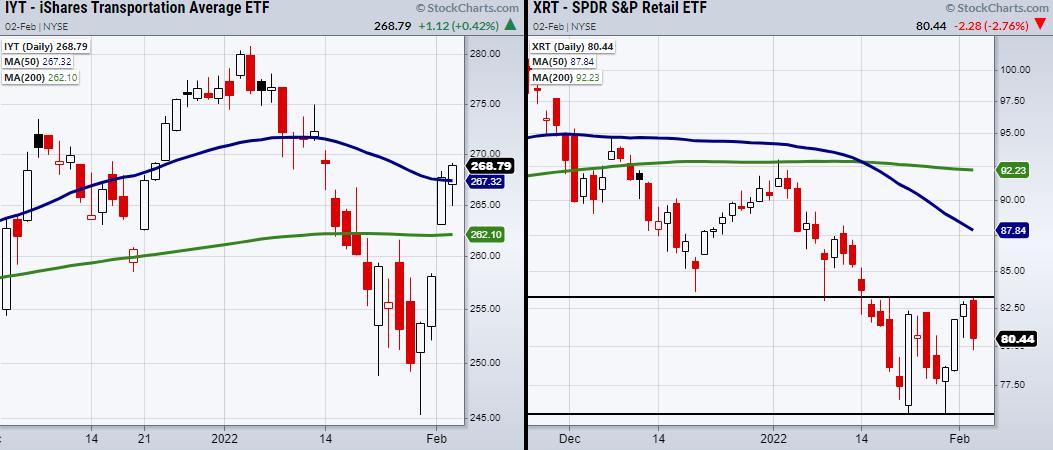

Transportation Gets Boosted While Retail Fumbles

On Tuesday, the transportation sector (IYT) gapped higher on earnings from one of its top holdings, United Parcel Service (UPS). Beating earnings per share estimates by 6.5%, UPS was able to bring IYT back over both its 200-day moving average and 50-DMA. IYT has now confirmed a bullish phase...

READ MORE

MEMBERS ONLY

3 Key Price Levels the Nasdaq 100, Russell 2000, and Bitcoin Need to Clear

The stock market has rallied right into resistance, along with Bitcoin teetering at its 39k price level. However, the market is holding its current trading area and, though we are at a pivotal point, Wednesday could have another push higher if key levels are cleared. With that said, which price...

READ MORE

MEMBERS ONLY

Should We Start Watching Noncyclical Stocks?

The past week has been very challenging, as the market can't seem to pick a direction. Though short-term momentum has more overhead pressure, even the bears have had difficulty shorting the choppy price action. In times like this, it can be helpful to take a step back, watch...

READ MORE

MEMBERS ONLY

Key Price Levels to Watch in the Current Choppy Market

Recently, we've talked about trading the market with a rangebound stance. This means we are looking to determine the main support/resistance levels the indices are trading within to define the current range, then watch for trading opportunities based on those key levels. With that said, which price...

READ MORE

MEMBERS ONLY

The Major Indices Set a Key Support Level as Commodities Heat Up

The market is looking to hold its current price area, along with Monday's low as a new key support level. Additionally, with many banks coming out of earnings season, the Regional Banking ETF (KRE) is perking up; now it needs a close over its 50-day moving average at...

READ MORE

MEMBERS ONLY

Watch These Two Symbols as Indictors for a Continued Market Rally

The stock market has been under pressure from upcoming interest rate hikes, inflation and a worrying overseas situation in Ukraine. However, Monday's gap lower was followed by a late-day rally in all four major indices. With that said, has this created a key support level to hold, and...

READ MORE

MEMBERS ONLY

Do You Have a Solid Trading Plan?

As the stock market corrects and potentially forms a new trend, traders who don't have strict plans might be wondering what to do next. So far, many symbols, along with the market, are not dipping like many expected and people are either realizing large losses or sticking to...

READ MORE

MEMBERS ONLY

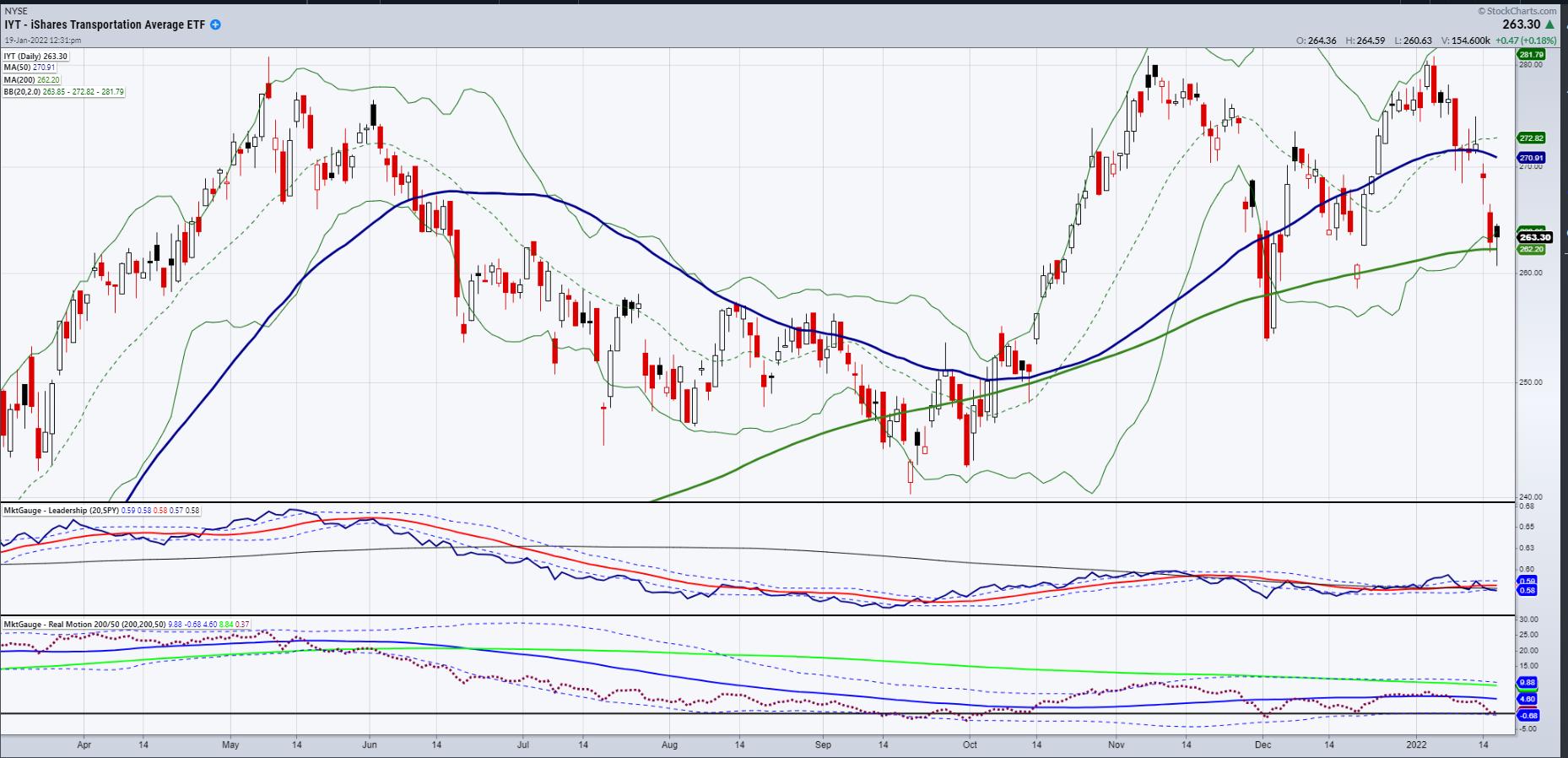

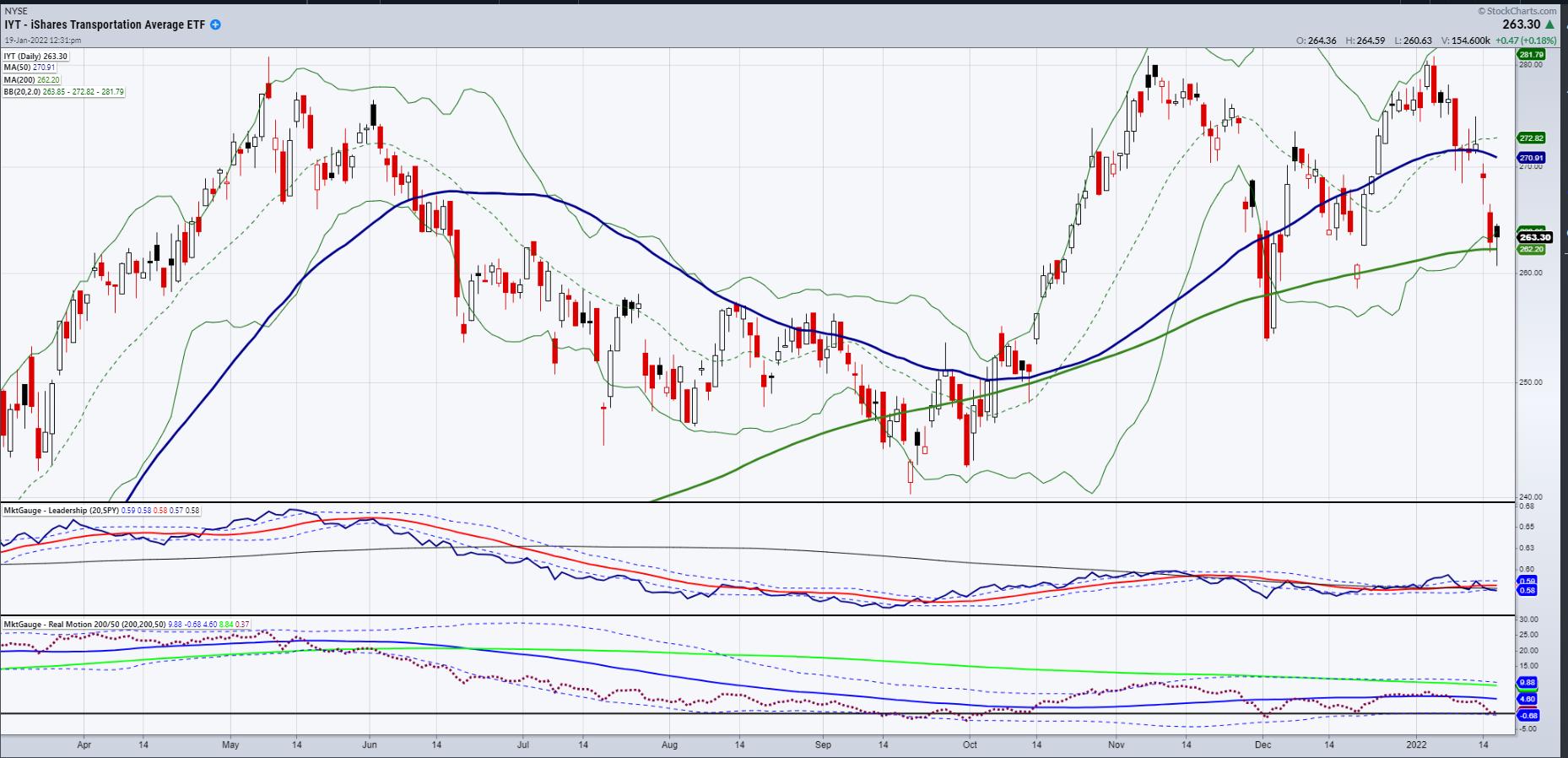

Mish: Transportation Sector (IYT) -- Way to Hold The Support Level!

So far these last couple of weeks, we have written and talked about trading ranges, January calendar ranges, inflation, stagflation and precious metals. We have also talked and written about the Transportation sector as the prime example of not only trading ranges, but also why we believe the market will...

READ MORE

MEMBERS ONLY

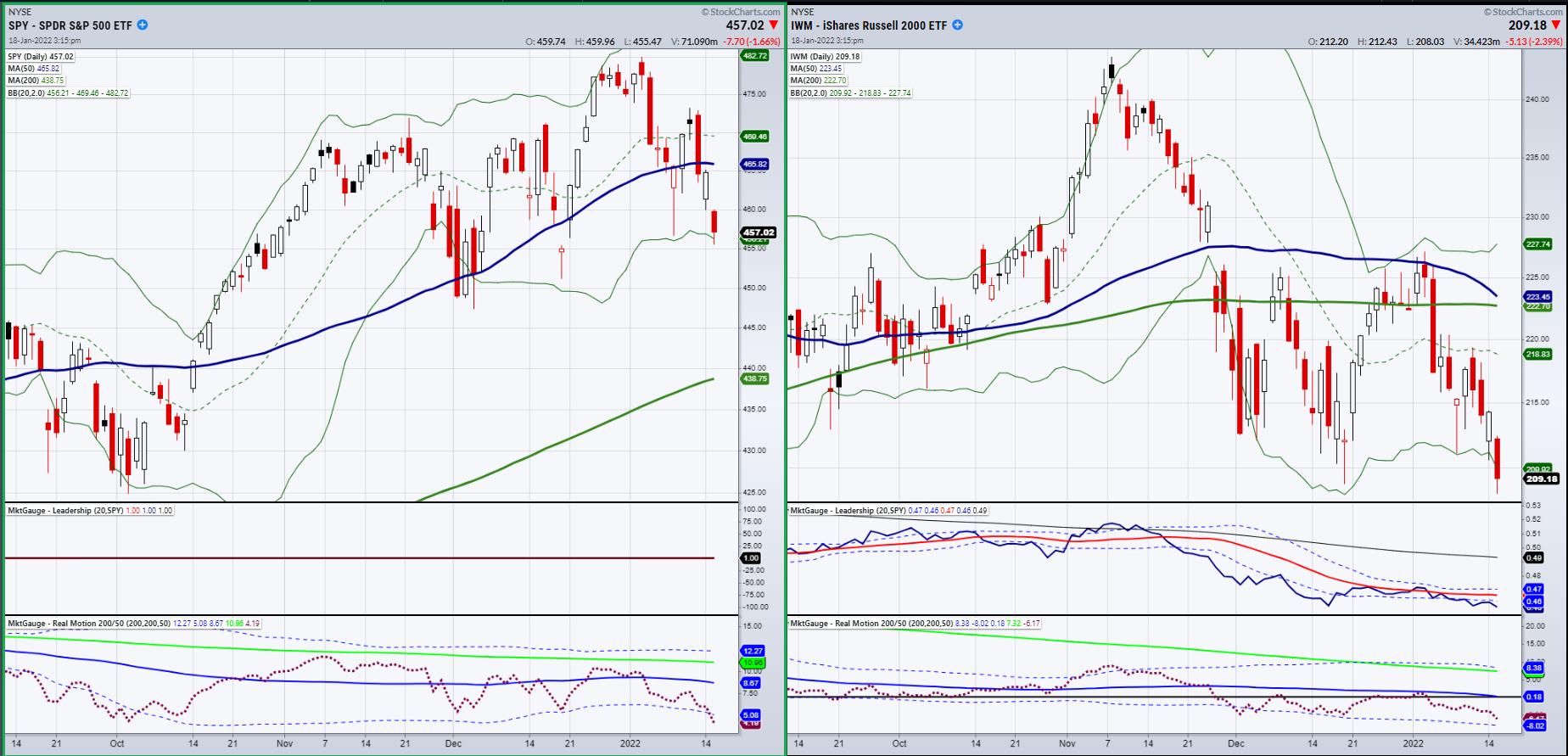

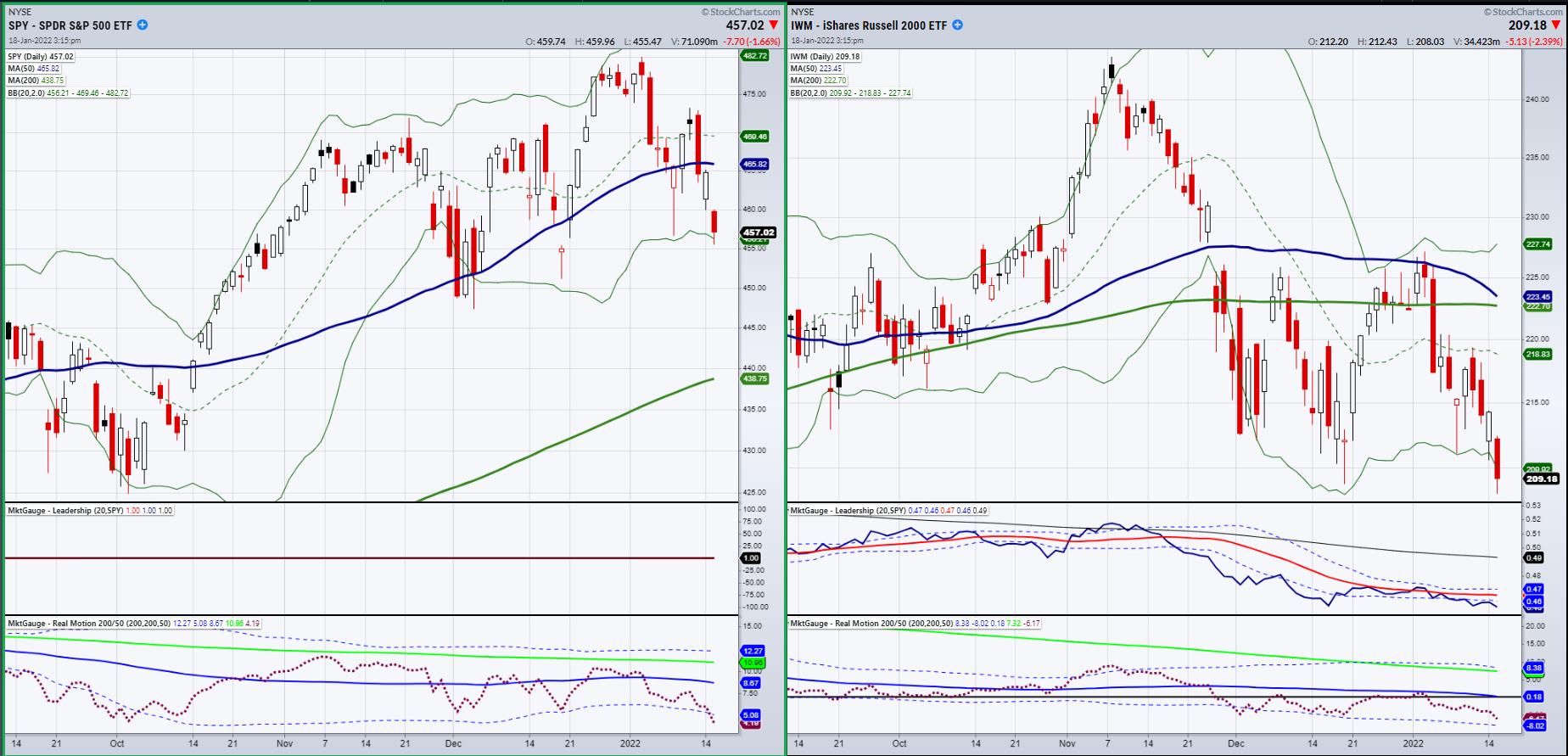

Mish: A Trading Range Within a Trading Range

As we now enter the second half of January in a new year, the persistent trading range continues. Particularly in the small caps or Russell 2000 (IWM), the trading range has been from 204-233 since February 2021.

As we begin this week, IWM is tackling the December 2021 low and,...

READ MORE

MEMBERS ONLY

Is the Market Falling into a Rangebound Trap?

To get a quick overview of the markets direction, let's look at Mish's Economic Modern Family (MF).

Also, if you haven't picked up Mish's 2022 Yearly Outlook, here is a full report that not only shows an in-depth view of the market,...

READ MORE

MEMBERS ONLY

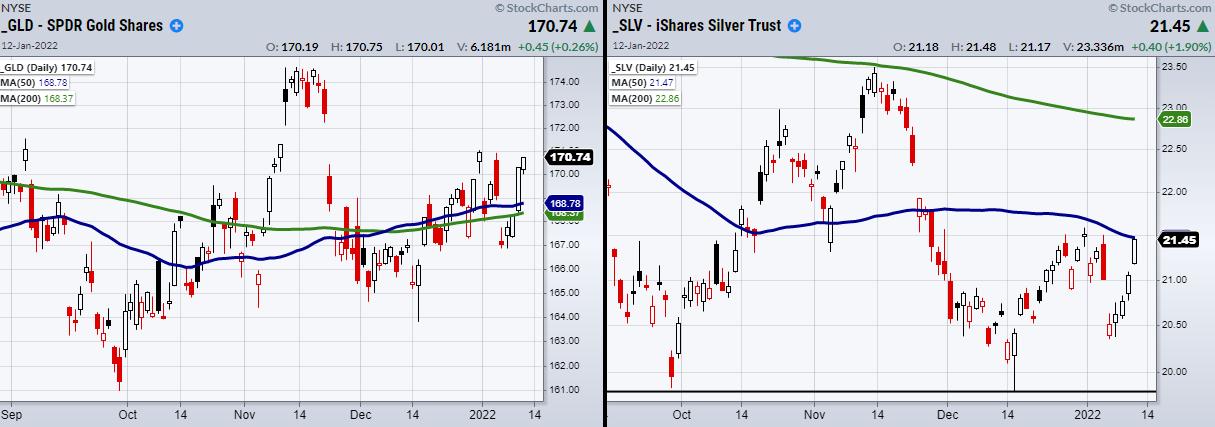

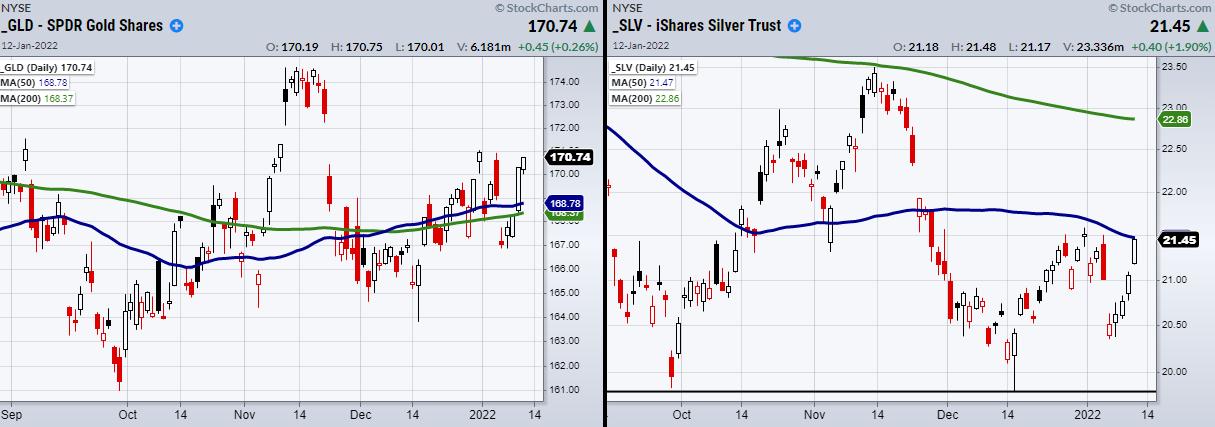

Can Silver and Gold Break Out from Stagnant Price Action?

Everyone knows inflation is on the rise and, with the latest year-over-year inflation numbers up 7%, investors are finally getting the picture that market growth has challenges ahead. Now they are searching for the next areas to trade given the market's unfolding dilemma, with rates looking to increase...

READ MORE

MEMBERS ONLY

How Biotech Confirmed a Reversal Pattern in Both Price and Momentum

For roughly three months, the biotechnology ETF (IBB) has been trending lower. Though it's made multiple attempts to clear the 50-day moving average, it has failed. However, IBB has made consistent runs towards its 50-DMA and, with the recent breakdown, is showing that it's potentially ready...

READ MORE

MEMBERS ONLY

Could Greece (GREK) be Waking Up?

Last week, Mish released her yearly outlook report,with dozens of ideas on trends and trades going into the new year.Greece ETF (GREK) is one of those picks.

While the major indices were selling off Monday, GREK held near an important breakout area. Though Mish has called GREK the...

READ MORE

MEMBERS ONLY

Will the Nasdaq 100 (QQQ) Hold Key Support?

This week has been a wild ride from new highs, followed by a quick pullback towards support in certain indices. High Yield Corporate Debt ETF (JNK), which we use as a risk-on or -off indicator, has broken under minor support from $107.33. To make things even more confusing, the...

READ MORE

MEMBERS ONLY

The Fed Confirms They Were Wrong About Inflation

Earlier this week, Mish released her annual report for the year ahead, titled "2022 Trends, Themes, and Trades to Watch".Today, the market showed why she has inflation as one of her 8 important themes.

On Thursday (Jan. 6th), Mish will be hosting a special webinarabout how her...

READ MORE

MEMBERS ONLY

What are Tuesdays Market Outliers Telling Us?

On Monday, we talked about the potential for the market to get stuck in rangebound trading if pivotal price levels were not cleared in the major indices. That uncertainty carries into Tuesday, as the major indexes besides the Dow Jones (DIA) are struggling or making little to no change. This...

READ MORE

MEMBERS ONLY

Can the Major Indices Avoid Rangebound Trading?

After a roller coaster start to a new year with major indices having a choppy Monday morning, each has closed positive showing traders optimism for the beginning of 2022.

However, the major indices including the S&P 500 (SPY), Nasdaq 100 (QQQ), Russell 2000 (IWM), and the Dow Jones...

READ MORE

MEMBERS ONLY

Key Areas to Watch This Weekend and Into the New Year

With the holiday weekend upon us, let's take a quick review of Mish's Economic Modern Family for new trends and ideas as we head into the new year.

The Family consists of 7 symbols that show a complete view of the overall market.

To start with,...

READ MORE

MEMBERS ONLY

Is Everyone Loading Up on Trades Before Christmas?

High-yield corporate bonds ETF (JNK) cleared its 50-day moving average at $108.24, but sits in a pivotal resistance zone. Along with JNK, the major indices are sitting near overhead resistance from recent highs or, in the case of the Russell 2000 (IWM), the middle of the trading range. At...

READ MORE

MEMBERS ONLY

Is the Santa Claus Rally Finally Here?

As the year nears its end, we have a lot of ideas to keep watch of.

Tuesday's price action could be the late Santa rally people were hoping for. Though it's better late than never, we should watch for the major indices to hold up through...

READ MORE

MEMBERS ONLY

Is it Time to Start Range Trading?

Currently, the major indices are trading near the lows of December or, in the case of IWM, near the bottom of its trading range, around $208.

With 2021 wrapping up, there is still a lot of uncertainty in the market. The past month has been tough from a trading standpoint,...

READ MORE

MEMBERS ONLY

Is the ARKK ETF Showing Big Potential Going into 2022?

While the Nasdaq 100 (QQQ) is down 0.3% on Friday's close, Cathy Woods Ark Innovation ETF (ARKK) closed over 6% on the day. Additionally, ARKK made a strong close over yesterday's high, showing added strength when compared to the major indices. With that said, this...

READ MORE

MEMBERS ONLY

Will Wednesday's Momentum Continue or Fade?

On Wednesday, investors waited for the FOMC minutes release at 2 PM EST to see whether the Fed would be hawkish or dovish in its response to the recent Producer Price Index report (PPI). With the PPI showing inflation rising rapidly, the market gapped lower Tuesday on an expectation that...

READ MORE

MEMBERS ONLY

ETFs to Hedge Against Increasing Inflation

The Producer Price Index is accelerating at a quick pace, with a 0.8% increase this November. For the year, producer prices are up 9.6%. As the media and market digest the increase in prices, the stagflation narrative becomes more realistic.

With that said, this gives us more confirmation...

READ MORE

MEMBERS ONLY

Is the Santa Claus Rally Almost Here?

Tis the season for a Santa Claus rally.

Though the reasons for a Santa Claus rally are debatable, the main school of thought is that, because there is less institutional participation in the market as many take time off to travel, the stock market is left in the hands of...

READ MORE

MEMBERS ONLY

The Large-Cap Indices Reach a Pivotal Point

With a stock market gap up on Tuesday, many traders scrambled to re-enter as they grappled with FOMO (fear of missing out). Additionally, the market is reaching a pivotal point as traders who piled in wait for a breakout towards highs.

Looking at large-cap and big-tech indices, the S&...

READ MORE

MEMBERS ONLY

Is the Russell 2000 (IWM) Setting a Bad Example?

Over the past three trading days, the major indices have made a remarkable rally from the recent lows. However, the small-cap index Russell 2000 (IWM) has only bounced back into the middle of its trading range. As seen in the above weekly chart, IWM has spent a large portion of...

READ MORE

MEMBERS ONLY

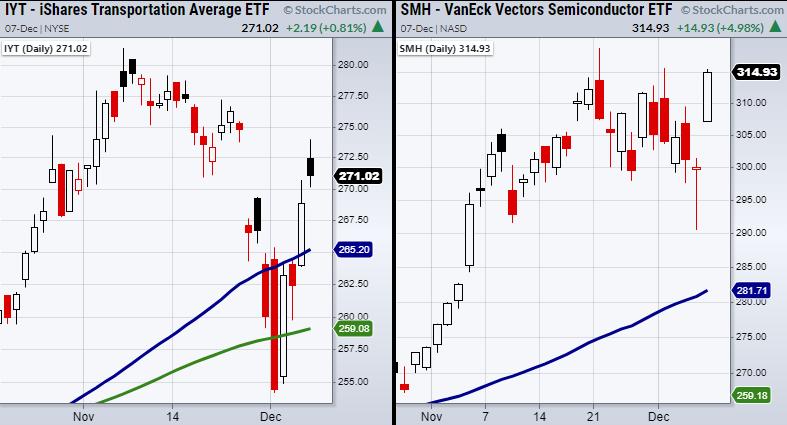

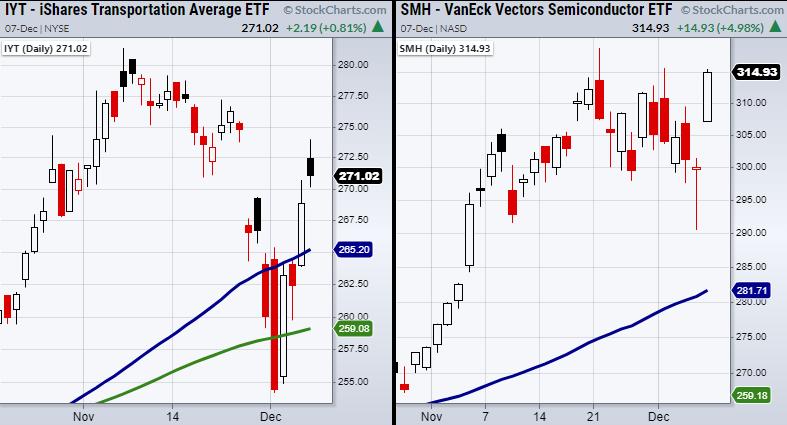

Transportation and Semiconductor ETFs Need to Make New Highs

Two sectors within Mish's Economic Modern Family, Transportation (IYT) and Semiconductors (SMH), have rallied near all-time highs. Now, we should watch for the highs to clear, as this could signify the next step for economic improvement.

Currently, semiconductor suppliers have one of the largest supply chain issues the...

READ MORE

MEMBERS ONLY

Why is the Nasdaq 100 Fighting an Internal Battle?

The Nasdaq 100 (QQQ) continues to show a weak hand. Riddled with tech companies that are selling off, it has struggled to hold over its 50-day moving average at $381.02.

Having said that, the QQQ is one of the most important indices to watch right now, as its current...

READ MORE

MEMBERS ONLY

3 Important Tips to Improve Trading This Coming Week

I have recently heard a saying stating that the current market behavior can lead to "death by a thousand cuts." This is often the case in a choppy market where buyers and sellers are constantly battling each other, making the stock market tough to trade from either the...

READ MORE

MEMBERS ONLY

Is the Stock Market Entering a Distribution Phase?

A distribution phase, as taught through Mish's book Plant Your Money Tree, is when the price of a symbol is trading underneath the 50- and 200-day moving averages while the 50-DMA is trading above the 200-DMA. This can be seen in the above chart of the Russell 2000...

READ MORE

MEMBERS ONLY

Keep Your Eyes on Junk and Treasury Bonds

The stock market sits in a dicey situation, with not only the Omicron variant adding stress to economic growth, but the Fed chair Jerome Powell also commenting on the possibility of speeding up tapering. Though the Fed has long stressed inflation to be transitory, it seems as though their tune...

READ MORE

MEMBERS ONLY

Is the Stock Market Turning Over?

Besides the Russell 2000 (IWM), the Nasdaq 100 (QQQ), S&P 500 (SPY) and the Dow Jones (DIA) have closed over Friday's high, creating a decent reversal. This has placed the four major indices in an interesting spot, as they were showing technical weakness before news surfaced...

READ MORE

MEMBERS ONLY

What Is Going On With the Oil Market?

The oil market has the media spotlight, with projected prices continuing to rise. Shortages, inflation and economic growth have all been major factors in oil trending higher throughout this year. With gas at a 7-year high, pressure has been mounting on the Biden administration to ease the consistent price climb....

READ MORE

MEMBERS ONLY

Can the Market Bounce if Junk Bonds Sell Off?

The small-cap index Russell 2000 (IWM) looks hopeful for a Wednesday bounce, while the High-Yield Corporate Debt ETF (JNK) sends another warning sign. Though we are watching all major indices, IWM is the most interesting since it found intraday support near its 50-day moving average at $228.06. It should...

READ MORE

MEMBERS ONLY

Mish: The Key Market Relationships -- Love or Rancor?

This past week, the market found both love and irreconcilable differences.

The love came from the big cap tech stocks. Nvidia, Apple, Google, Microsoft all gave investors hearts and flowers. On the flip side, small caps, energy, industrial metals, and transportation stocks gave investors indigestion, inconveniently ahead of Thanksgiving.

It&...

READ MORE

MEMBERS ONLY

CryptoPulse Daily Report: Cryptocurrencies Get a Healthy Reset

Pretty much everyone in crypto is hurting this week, with the overall Cryptocurrency market cap decreasing by over $300 billion since Sunday 11/14. The first domino to fall was Bitcoin (BTC), as the coin sold off 3% on Monday and then another 8% Tuesday, finally finding support at its...

READ MORE

MEMBERS ONLY

Did the Long-Term Treasury Bonds (TLT) Turn Risk On?

On Tuesday, the Long-Term Treasury Bond ETF (TLT) closed underneath its 50-day moving average for two consecutive days confirming a cautionary phase. TLT's trend has been relatively dormant for the past four months with multiple failed attempts to clear the $151.80 price area. However, this recent breakdown...

READ MORE

MEMBERS ONLY

Is The Retail Sector (XRT) Stronger Than Investors Expect?

As of Monday, the strongest sector within Mish's Economic Modern Family is the Retail space (XRT). Though we will look at other key sectors in the Family, XRT is of special interest with the upcoming holiday season.

Struggling from limited employees, companies are feverishly attempting to keep an...

READ MORE

MEMBERS ONLY

Stocks to Watch in the Top 3 Performing Sectors

Last week the market faced a pullback. However, the four major indices closed above Thursday's high on Friday, ending the week on a positive note. With each index potentially poised to run towards highs, we should prepare our watchlist with picks from the top-performing sectors.

Looking at the...

READ MORE