MEMBERS ONLY

How to Navigate September Trading with Gold, Junk Bonds, and Long-Term Bonds

The market is about to enter the month of September, which many investors view as a historically negative month in the trading year. Also called the September effect, some analysts attribute a selling from investors rebalancing their portfolios at the end of the summer. However, is the September effect something...

READ MORE

MEMBERS ONLY

Are These 5 Key Sectors and Small-Cap Index Lagging or Leading the Market Higher?

On Monday, both the S&P 500 (SPY) and the Nasdaq 100 (QQQ) climbed to new highs once again.

While the large-cap indices continue to lead the market, the Economic Modern Family made little progress. However, each Family member is standing its ground and may only be lagging when...

READ MORE

MEMBERS ONLY

The Market Boasts Strength While the Dollar Drops and Gold Rises

On Friday, the Fed's Jackson Hole symposium stimulated the market, with all 4 major indices closing positive. Due to the improvement in the economy, the Fed feels more comfortable with tapering monetary policy possibly near the end of 2021. This means the Fed would begin to reduce the...

READ MORE

MEMBERS ONLY

Will the Upcoming Fed Meeting Affect the Market?

With the Jackson Hole Fed meeting coming up, the market could be expecting taper talks, as the Fed at some point will be looking to decrease their $120 billion monthly bond-buying program. However, the Fed has been very accommodating and with the COVID-19 delta variant, does not want to jostle...

READ MORE

MEMBERS ONLY

Does Lower Bitcoin Volume Matter as $BTC Attempts to Clear 51K?

Bitcoin continues its rally up with a recent break over the 50K price level. However, many investors are watching for Bitcoin to clear 51K as the next hurdle. With that said, if we are expecting Bitcoin to run higher, we should keep in mind recent support levels, along with volume...

READ MORE

MEMBERS ONLY

Which Symbols to Watch if Russell 2000 (IWM) Clears Key Resistance

On Monday, the market continued its rally from Friday of last week, with the S&P 500 (SPY) and Nasdaq 100 (QQQ) clearing all-time highs. Again, the tech sector and large-cap stocks are leading the market higher.

However, we should not forget about the Russell 2000 small-cap index (IWM)...

READ MORE

MEMBERS ONLY

How Strong is Russell 2000's (IWM) Current Rally?

Above is a chart of the Russell 2000 (IWM), which is one of the most valuable indices as it tracks 2000 small-cap companies and, therefore, gives a great picture of the overall market direction.

Since the beginning of 2021 IWM has been mostly rangebound. The high of the range is...

READ MORE

MEMBERS ONLY

Can Key Sectors Along with Bitcoin Hold Nearby Support?

The Economic Modern Family now has 5 members sitting in a confirmed cautionary phase. A cautionary phase is defined by the 50-day moving average stacked over the 200-DMA, with the price between both moving averages.

As seen above, the only member holding a bullish trend with its price over the...

READ MORE

MEMBERS ONLY

Will the Market Bounce After the Nasty Retail Earnings Report?

On Tuesday, the retail earnings report came out -0.8% lower than expected, amid recent highs in two of the major indices. This caused the market to gap lower following a continued selloff throughout the day. However, the market did not close at the lows of the day, which could...

READ MORE

MEMBERS ONLY

Which Symbols Hold the Key to the Next Market Run?

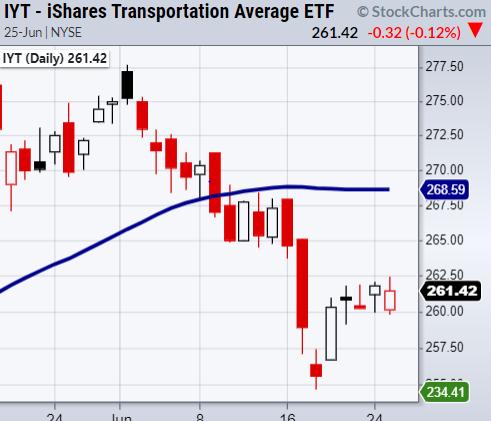

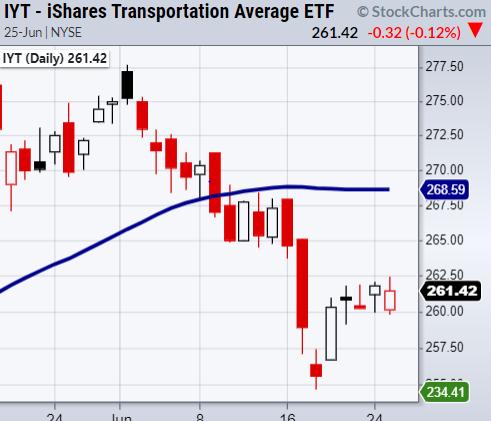

Since mid-May, the Transportation sector (IYT) has been trending lower. Currently, IYT sits just under resistance from its 50-day moving average at $257.97. Additionally, the small-cap index Russell 2000 (IWM) has traded sideways for over a month and continues to have trouble clearing its pivotal $225 resistance level. Because...

READ MORE

MEMBERS ONLY

Could Long-Term Bonds (TLT) Help Form a Worrisome Market Trend?

Recently, we talked about the ongoing battle between the Regional Banking Sector (KRE) and the 20+ Year Treasury Bonds ETF (TLT). Each has its 50-day moving average nearby and is looking to use them as potential support. Currently, the 50-DMA is at $145.97 for TLT and $65.09 for...

READ MORE

MEMBERS ONLY

Can the Regional Banking Sector (KRE) Hold its 50-DMA?

From June to late July, Regional Banking ETF (KRE) has been stuck within a downward trend. Coming close to its 200-day moving average, it was able to find some support and, from there, consolidated over the major moving average. With that said, on August 6th, KRE gapped higher and closed...

READ MORE

MEMBERS ONLY

Why You Need to Watch These 5 Key Sectors and Major Index

One of the best ways to get a quick snapshot of the market is by using Mish's Economic Modern Family. These 5 sectors and 1 index can help guide us through the overall market, as well as reveal potential weak spaces to be cautious of.

Tuesday has seen...

READ MORE

MEMBERS ONLY

What to Watch if Bitcoin Confirms a Phase Change Over the 200-DMA

On Monday, Bitcoin cleared its major moving average, while Ethereum, the second-largest-cap currency, tested its new support level at $2900. For the moment, this shows the crypto space can hold its weekend progress. Often, the weekend can be pivotal for cryptocurrencies, since they are given more attention when the stock...

READ MORE

MEMBERS ONLY

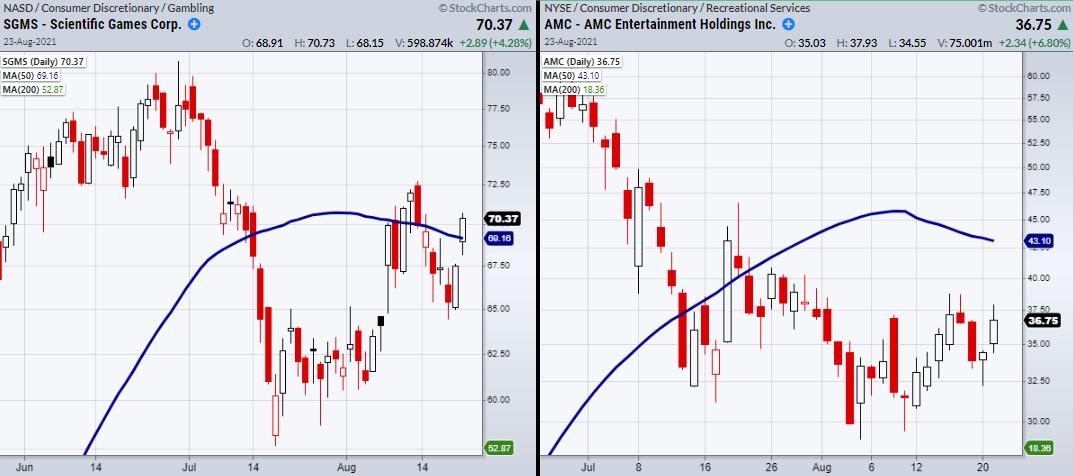

Crypto Companies to Trade Now That Bitcoin Is Looking to Clear Resistance

Two of the major cryptocurrencies, including Ethereum ($ETH) and Bitcoin ($BTC), are looking to clear and hold over resistance; Bitcoin at $40–42k and Ethereum at $2900. Their next test is to hold at or over these price levels through the weekend. If they do, we could see not only...

READ MORE

MEMBERS ONLY

Why These 3 Sectors Are Leading the Market Trend

In the past couple of weeks, the market has shown to have higher volatility paired with scattered daily price action. With the recent discovery of yet another COVID-19 variant (lambda) and with the spread of the highly contagious delta variant, we could be seeing the market begin to rotate into...

READ MORE

MEMBERS ONLY

How to Properly Manage Risk in a Choppy Market Environment

For the past week, the major indices have been very choppy. Without clear direction in the indices, volatility has increased making price swings faster and, thus, tougher to time. However, times like this prove how important risk management is and, if done correctly, can help preserve trader's capital....

READ MORE

MEMBERS ONLY

When the Market Trades Sideways, This Sector Pushes to New Highs

The small-cap Russell 2000 index (IWM) cannot make up its mind.

For the past three trading days, IWM has not been able to clear a pivotal resistance area created from the 50-day moving average at $225. Other key sectors, including Transportation (IYT) and Retail (XRT), have also been under pressure...

READ MORE

MEMBERS ONLY

Pivotal Price Levels the Market Must Hold or Clear Next Week

The past week's earnings have set the market stage, with large tech companies such as Apple (AAPL), Google (GOOG/GOOGL) and Microsoft (MSFT) beating earnings estimates. With that said, prices look to be waning not only in the large tech companies, but in the overall market. This could...

READ MORE

MEMBERS ONLY

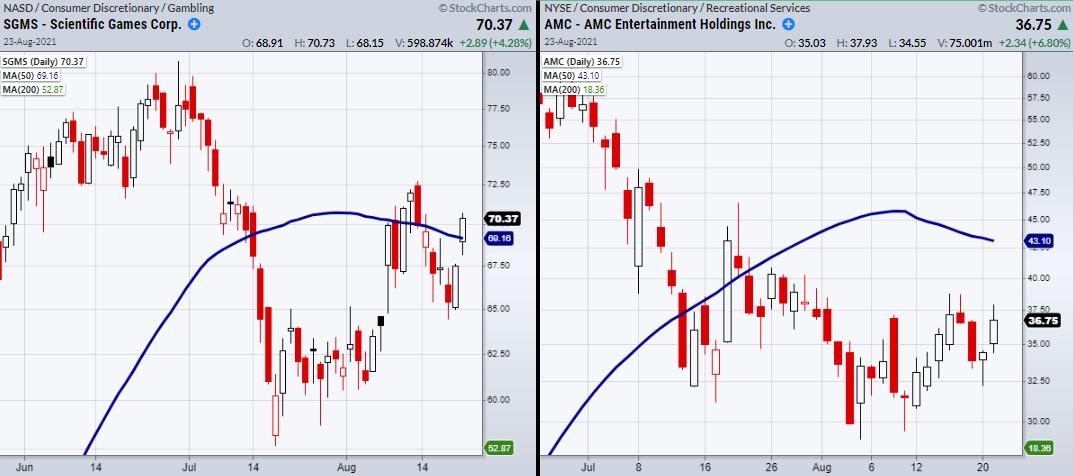

Symbols to Watch as the Stay-at-Home Trend Continues

Google recently joined the list of growing companies to postpone their back-to-work plans as the COVID-19 delta variant continues to spread. Along with Google, Apple has previously extended working from home for the same reason. As large corporations postpone back-to-office mandates, many other companies are giving their employees the option...

READ MORE

MEMBERS ONLY

What are the Key Support Levels in the Major Indices?

As the COVID-19 delta variant spreads across the United States, the CDC continues to update its guidelines to mitigate further spread. Although we don't know if there will be any nationwide lockdowns or reduced travel restrictions in the immediate future, it has become abundantly clear that COVID issues...

READ MORE

MEMBERS ONLY

Is the Market Gaining or Losing Momentum?

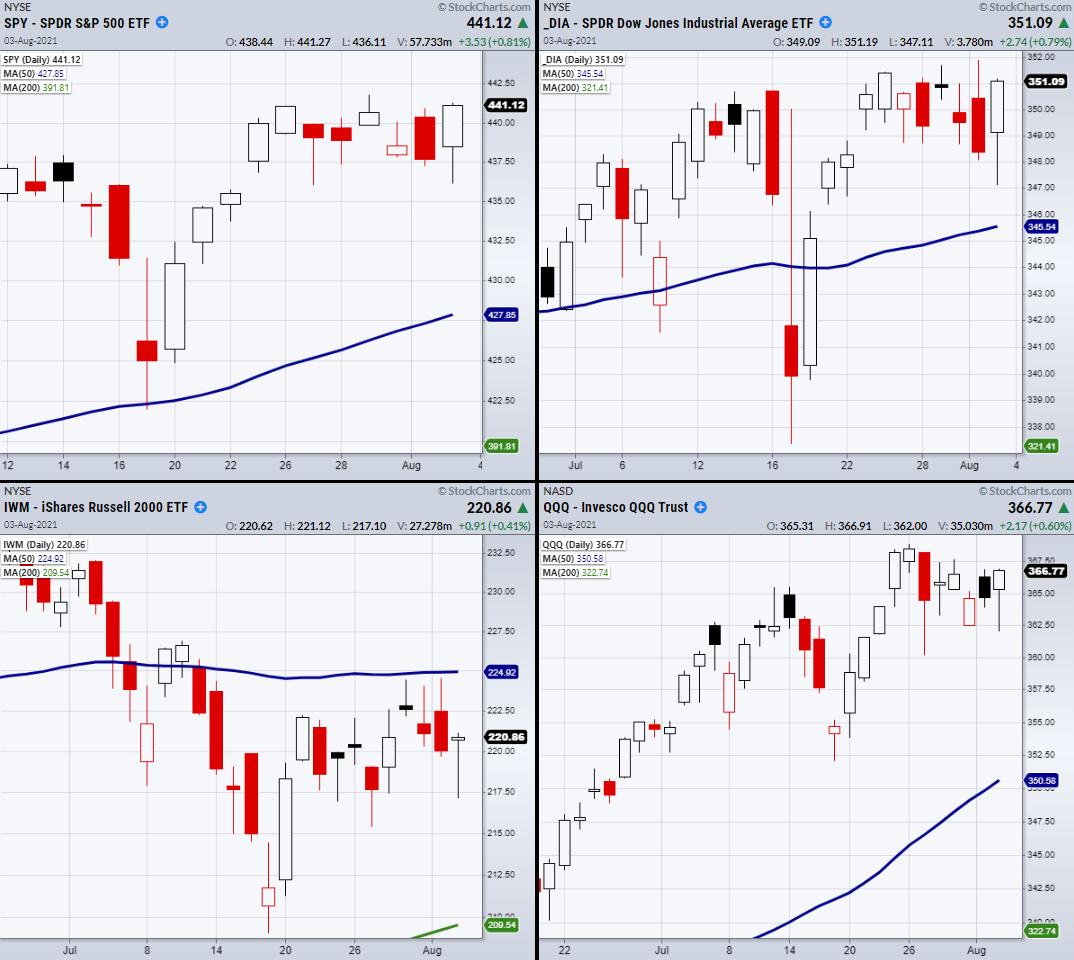

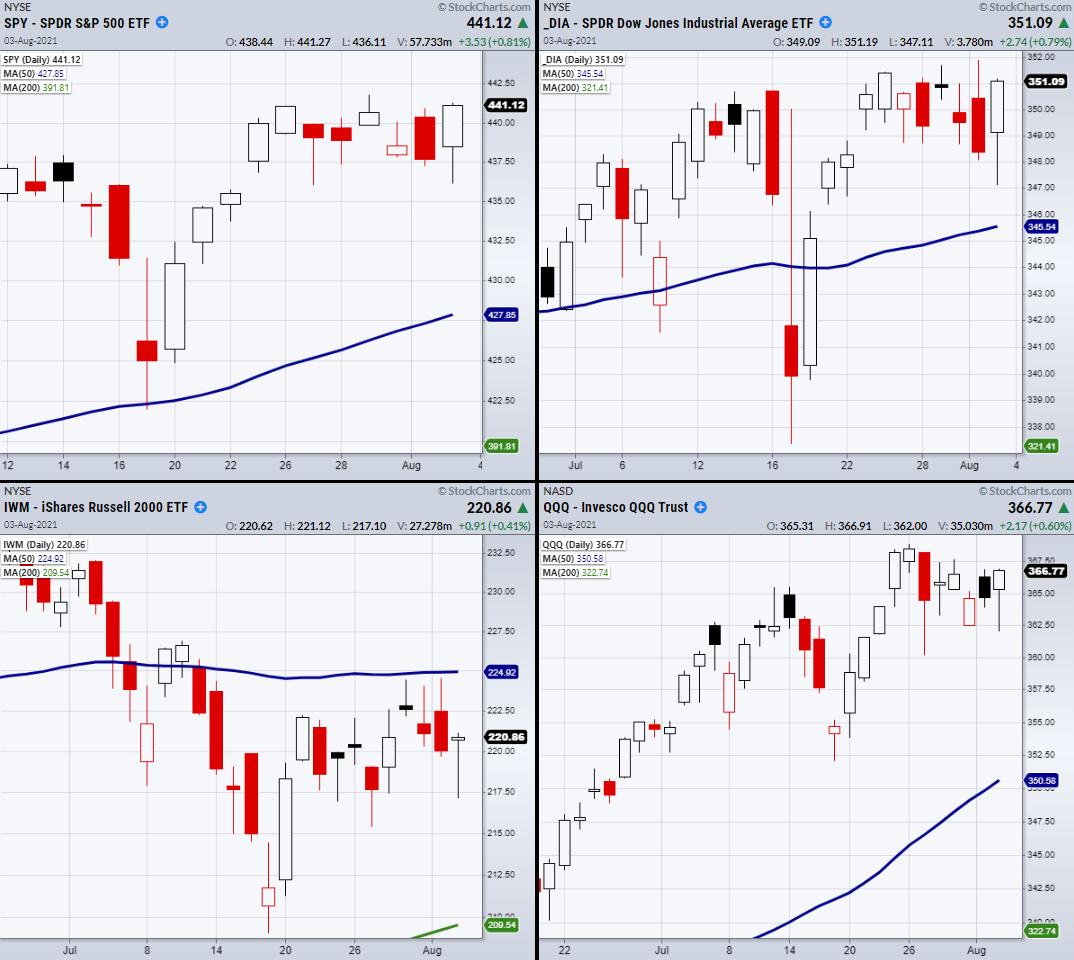

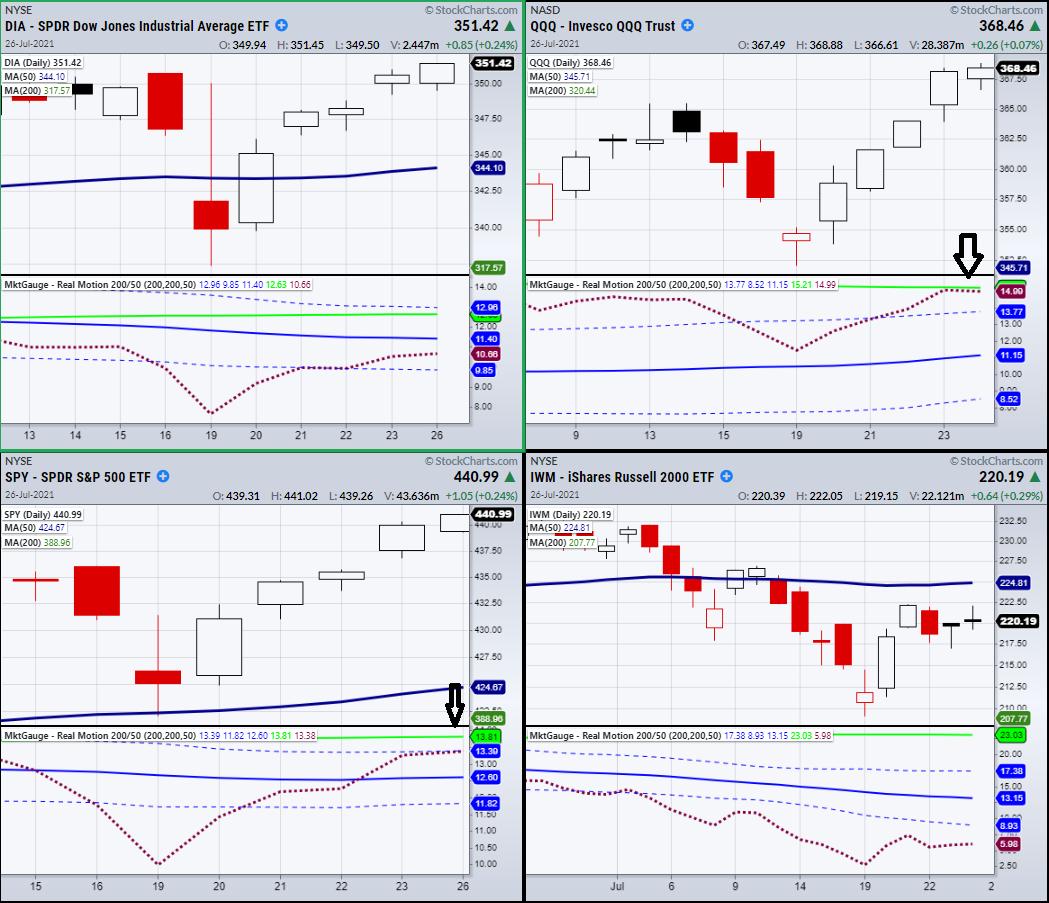

Three of the four major indices, including the S&P 500 (SPY), Nasdaq 100 (QQQ) and the Dow Jones (DIA), inched to new highs, while the Russell 2000 (IWM) is struggling in its current price range. It is important for IWM to keep pace with the other indices, for...

READ MORE

MEMBERS ONLY

Why Everyone Should be Watching IWM and IYT Through Next Week

The week started with a large rally and is now ending with the Nasdaq 100 (QQQ) and the S&P 500 (SPY) at all-time highs.

Though the Dow Jones (DIA) is not far behind, the small-cap index Russell 2000 (IWM) struggles in the middle of its trading range. The...

READ MORE

MEMBERS ONLY

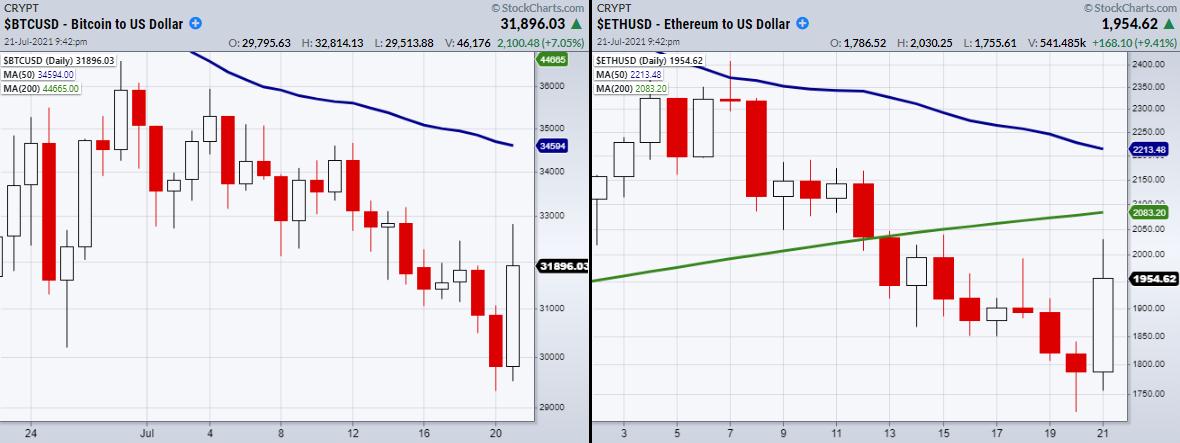

What to Watch If the Crypto Space Rallies Higher

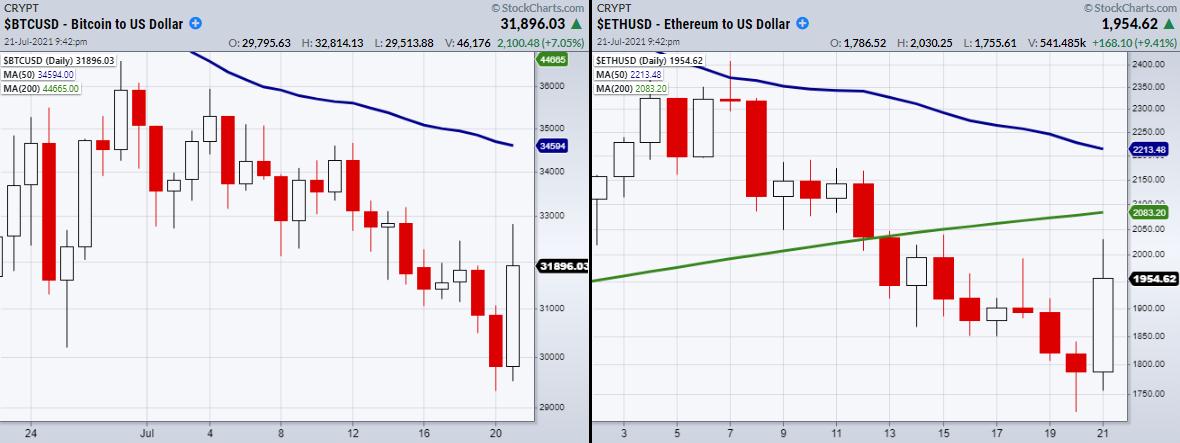

Two of the biggest-by-market cap cryptocurrencies, Bitcoin and Ethereum, have perked up near the lows. Both have been trending down for the past month and looked as if they would test their recent lows created on 6/22: $28.8k for Bitcoin and $1700 for Ethereum.

However, while Wednesday'...

READ MORE

MEMBERS ONLY

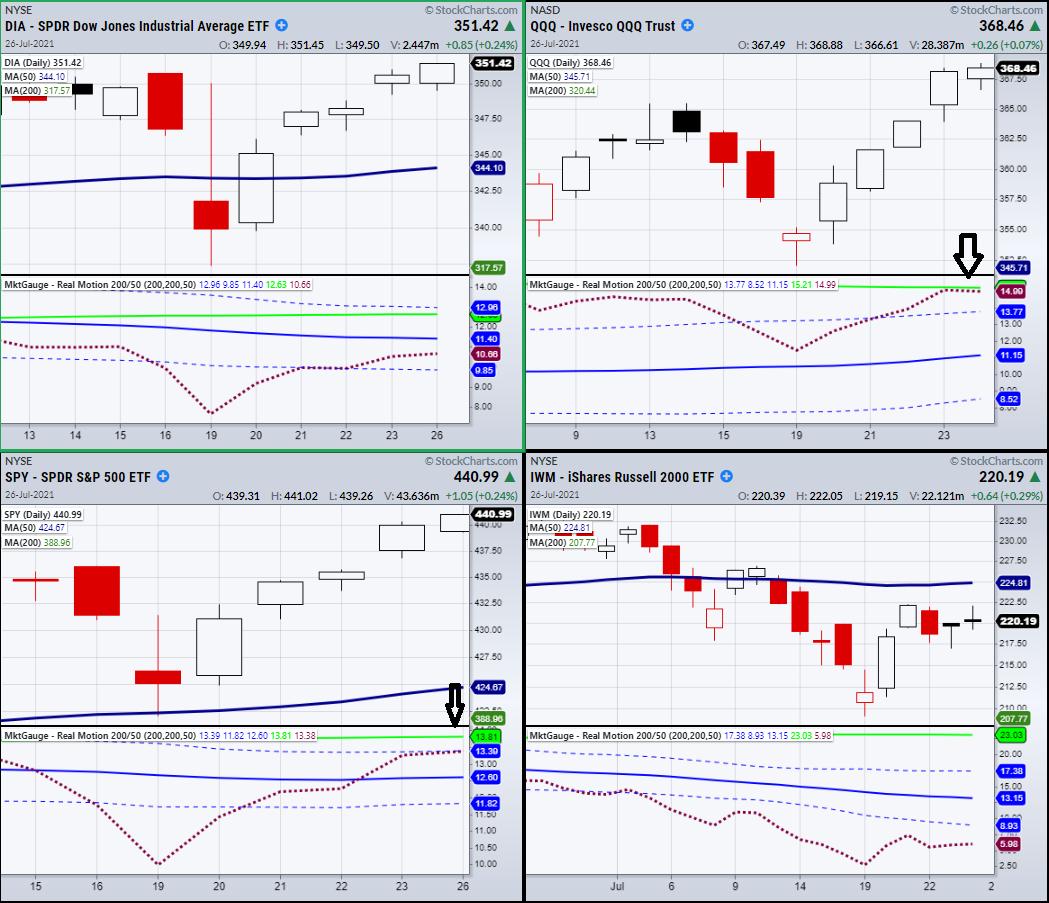

How to Profit Off the Market's New Reversal Pattern

On Tuesday, the 4 major indices confirmed a reversal pattern with a close over the prior day's high. In the above chart, you can see all four indices created a new support level that needs to hold based on Monday's low. Having said that, we can...

READ MORE

MEMBERS ONLY

Why It Might Be Time to Start Looking at Consumer Staples

With the markets' recent decline, investors' mindsets could be shifting into protecting gains made throughout the year. The recent blowoff from highs has also brought in more volatility with a potentially choppier environment. Additionally, pandemic worries have increased as the COVID delta variant threatens progress towards reopening countries...

READ MORE

MEMBERS ONLY

Market Reckoning -- Will Support Levels Hold?

Over the last week, we heard the chair of the Federal Reserve, Jerome Powell, address worries over the recent 5.4% year over year inflation increase. While the Fed continues to hold an accommodative stance with its bond-buying program, some are doubting whether the Fed is taking inflation seriously.

So...

READ MORE

MEMBERS ONLY

Bank Earnings are Here, But Which Companies Show the Most Profit Potential?

Earnings season is upon us and with, the rising market, earnings expectations have followed. This is especially true for the banking sector, which is supposed to have well outperformed the first quarter. The reason for such predictions can be attributed to banks' increased profits from low-interest rates enticing a...

READ MORE

MEMBERS ONLY

How to Time Your Next Trade in Precious Metals

With the release of the Consumer Price Index (CPI) report showing an inflation increase of 5.4% compared to the expected 3.8%, we should pay close attention to investments that keep inflation in mind. Though we have recently talked about food commodities and agricultural tech as potential hedges against...

READ MORE

MEMBERS ONLY

Is it Time to Watch the Agricultural Tech Trend?

Supply chain issues have become a common term heard throughout 2021 now that companies are struggling to bring back pre-pandemic supply levels. With that said, scaling supply is not so easy and takes time. This is especially tough within the agricultural space, which operates on cycles and can take multiple...

READ MORE

MEMBERS ONLY

Has the Market Jumped from Cautious to Bullish Sentiment?

On Friday, the Economic Modern Family, which consists of 5 sectors and 1 major index, made a quick turnaround in the small-cap index (IWM) and the retail space (XRT). Both closed over their 50-day major moving averages and are now in unconfirmed bullish phases, as seen in the above chart....

READ MORE

MEMBERS ONLY

Practical Ways to Live Through Inflationary Times

Whether we head into hyperinflation, stagflation or recession, it is always good to be prepared for more of the same-rising commodity prices, low supply, high demand and a low labor force wreaking havoc on your wallet. Inflation especially hurts people on fixed incomes. Wage growth can partially offset inflation as...

READ MORE

MEMBERS ONLY

How to Read the Market's Mixed Signals with these 6 Key Symbols

The safest place in Tuesday's trading session was the tech sector.

The tech-heavy Nasdaq 100 (QQQ) closed a pinch up on the day, while the small-cap Russell 2000 (IWM) broke its 50-day moving average and closed -1.62% lower. Conflicting major indices does not make trading easy, as...

READ MORE

MEMBERS ONLY

How to Profit in the Market Amidst Rising Consumer Prices

General Mills (GIS) recently stated they would have to increase prices on many staple products. This relates to recent price surges in fuel, packaging and shipping costs, which has put a strain on not only food supply companies, but many small and large companies throughout the pandemic.

With the markets&...

READ MORE

MEMBERS ONLY

Is the Crypto Space Heating Up?

Tuesday's market action has been sluggish at best. Of the four major indices, the Nasdaq 100 (QQQ) made the largest gain, ending +0.45% on the day. Tuesday's average daily volume in the QQQs also took a hit, with 27,800,000 shares traded compared to...

READ MORE

MEMBERS ONLY

Can Big Tech Lead the Stock Market Higher?

According to Mish's Economic Modern Family, the market remains mostly bullish, with only the transportation sector (IYT) and regional banking (KRE) sitting in cautionary phases under their 50-day moving average. However, most of the Modern Family closed lower or flat on the day, while the semiconductors ETF (SMH)...

READ MORE

MEMBERS ONLY

Has the Infrastructure Bill Stolen the Inflation Spotlight?

The stock market steadied itself, as the major indices clear or head to new highs. Additionally, the media has slowed its aggressive inflation stance and looks to be shifting into the next trend, as the new infrastructure bill that has recently emerged from bipartisan talks adds a chunk of areas...

READ MORE

MEMBERS ONLY

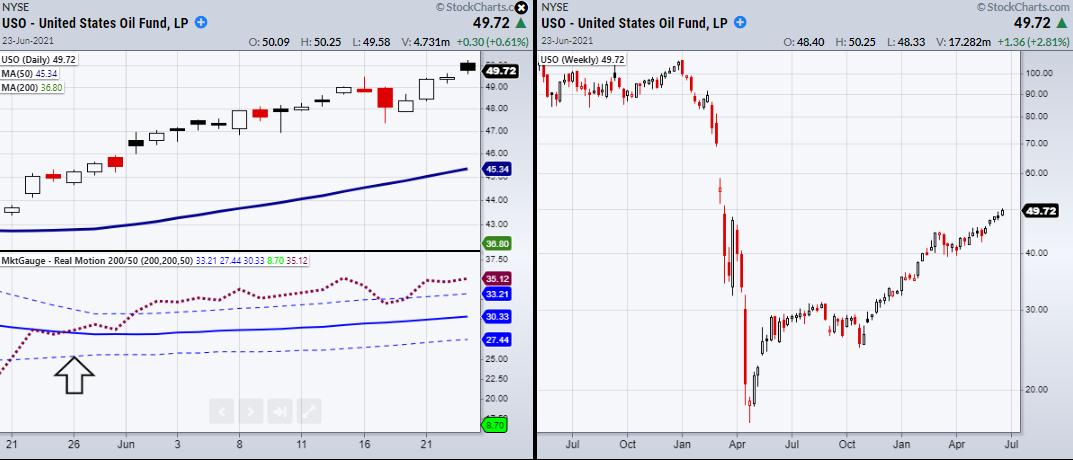

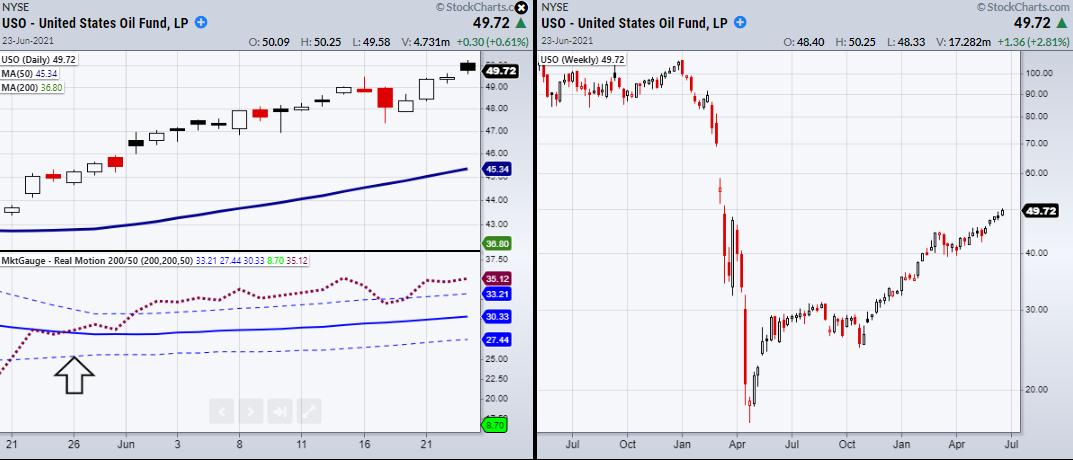

Will Oil Prices Continue to Climb?

Since the lows of March 2020, the stock market has made a huge rally and has broken to new highs in all the major indices. Trillions of dollars have been spent to keep the economy in a strong recovery and bullish phase. This has pushed most sectors beyond price levels...

READ MORE

MEMBERS ONLY

Bitcoin Pulls Back Over Its Pivotal 30k Price Level

Tuesday morning's trading session continued a large sell-off in Bitcoin, which recently lingered near 41k in the prior weeks before selling off to roughly 29k. However, dip buyers that have been waiting for the chance to scoop up the largest-cap cryptocurrency under 30k were finally given one. Or...

READ MORE

MEMBERS ONLY

How to Effectively Use a Moving Average Confirmation Rule

On Friday, the major indices, including the small-cap Russell 2000 (IWM) and S&P 500 (SPY) closed underneath their 50-day moving average. However, on Monday, both reversed and ended the day above their 50-DMA. With Friday's weak price action, any bearish traders who decided to short these...

READ MORE