MEMBERS ONLY

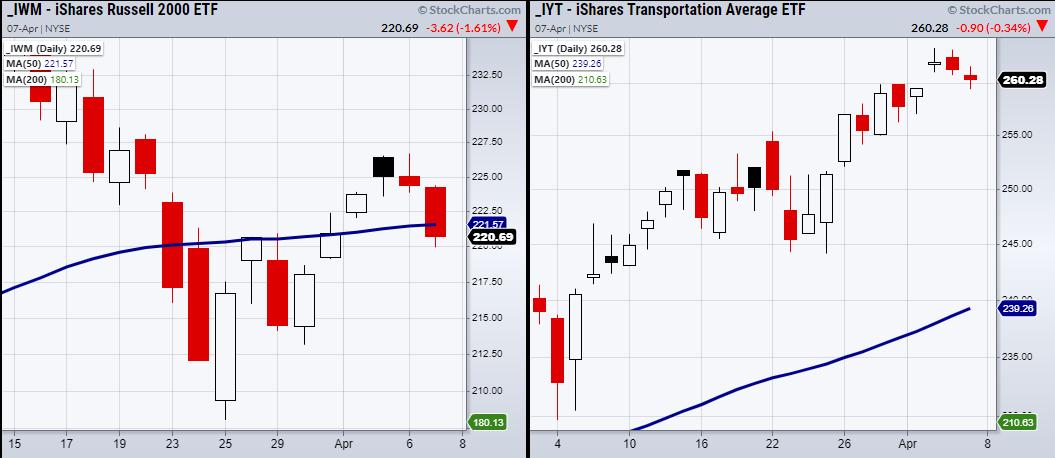

Can the Transportation Sector (IYT) Hold Up the Market?

The FOMC Minutes report released Wednesday stated little to no change. Rates will stay low until 2023 and the monthly $120 billion bond-buying program will stay in place.

The Fed has been hesitant to change any fiscal policy as it has been very attentive to the economic recovery. However, this...

READ MORE

MEMBERS ONLY

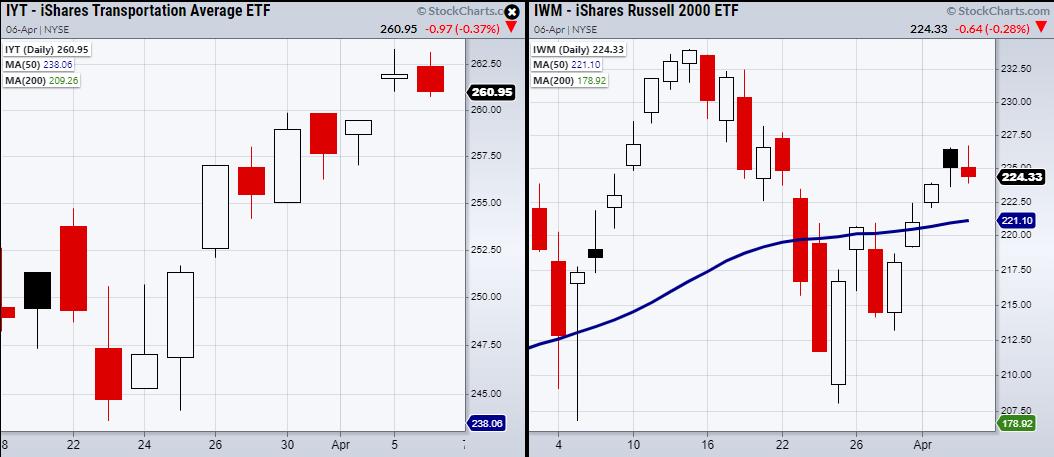

Has the Market Run Up Too Quickly?

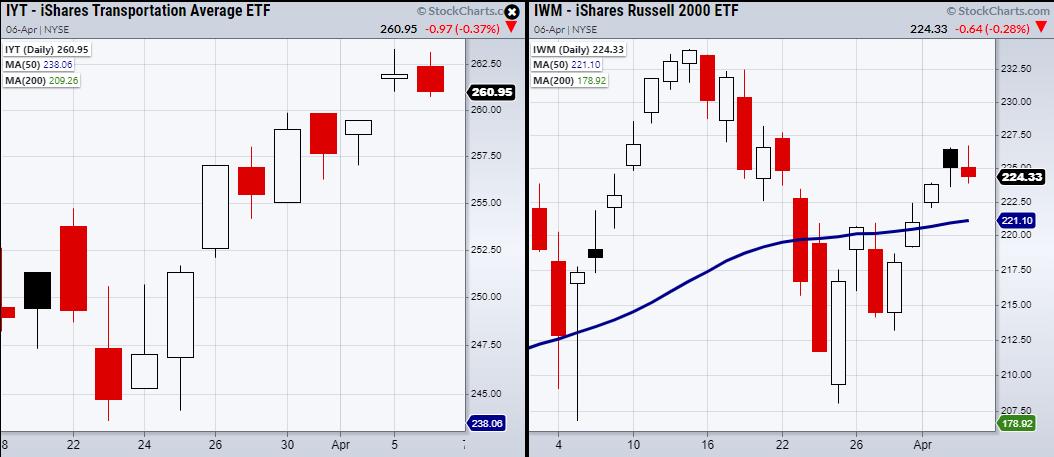

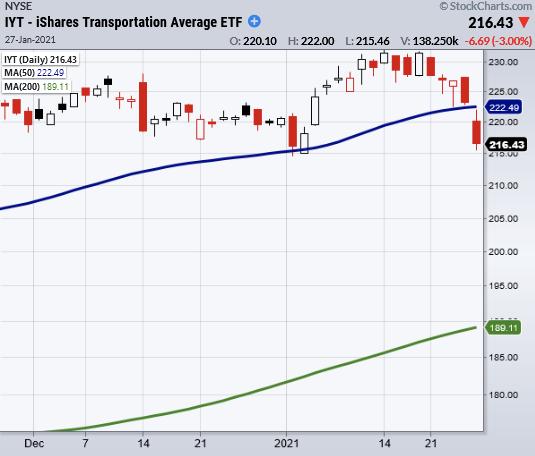

On Monday, we talked about the momentum in the Transportation (IYT) and Semiconductors (SMH) sectors, which showed strength when compared to the Russell 2000 (IWM). On Tuesday, IYT closed near Monday's low, making it a potential bearish engulfing day. Meanwhile, SMH failed to clear resistance at $258.59....

READ MORE

MEMBERS ONLY

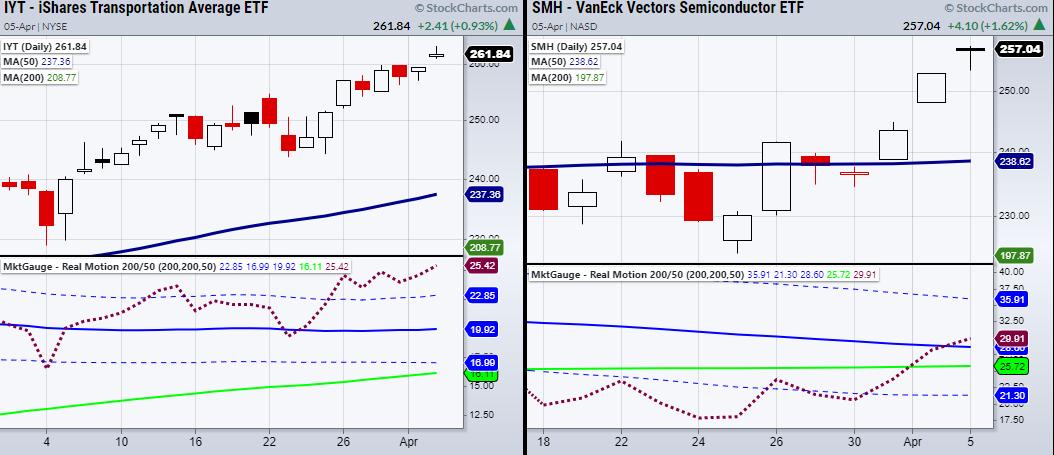

Why Transportation (IYT) and Semiconductors (SMH) Have Hidden Strength

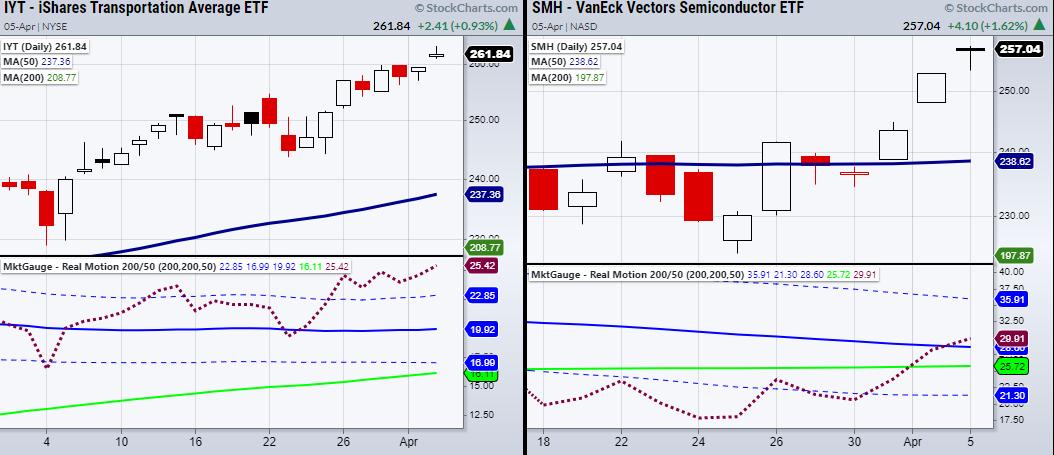

SMH and IYT are the strongest members of the Economic Modern Family, as they are both in a bullish phase in price and in momentum.

We are measuring momentum based on MarketGauge's proprietary indicator RealMotion. RealMotion was designed to show hidden strength/weakness in a security based on...

READ MORE

MEMBERS ONLY

With 2 Indices Clearing Major Resistance, Watch Out for This Common Trader Pitfall

On Thursday, both the Russell 2000 (IWM) and the Nasdaq 100 (QQQ) cleared major resistance levels from the 50-day moving average. In many traders/investors' minds, this has opened the bullish floodgates with new highs in view. Additionally, the High Yield Bond ETF (JNK) is holding over its 50-DMA....

READ MORE

MEMBERS ONLY

Is the Retail Sector (XRT) Heating Up?

Last Thursday, the retail sector ETF (XRT) opened near its 50-day moving average. It closed with a large range on increased volume, which was a good sign of strength. Though it has not made a decent-sized move since then, it has been holding its current price level.

Another factor is...

READ MORE

MEMBERS ONLY

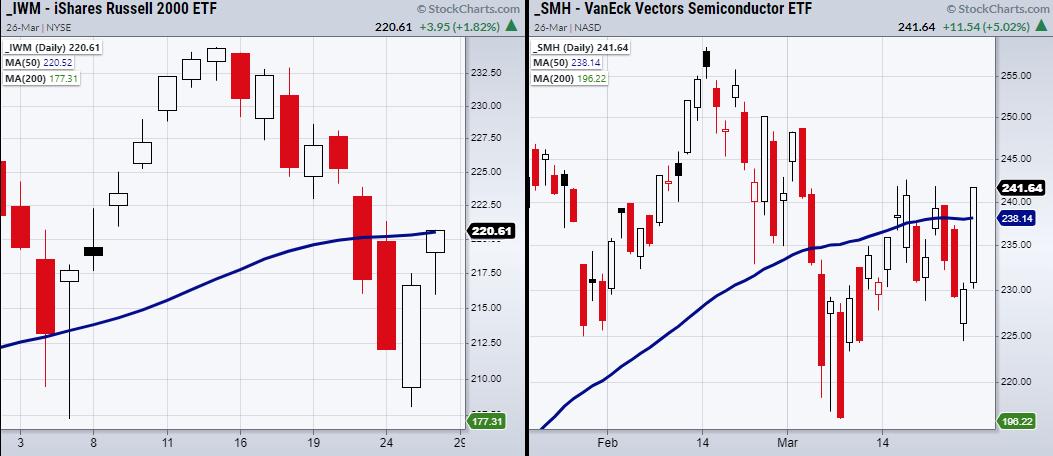

Expectations vs. the Market

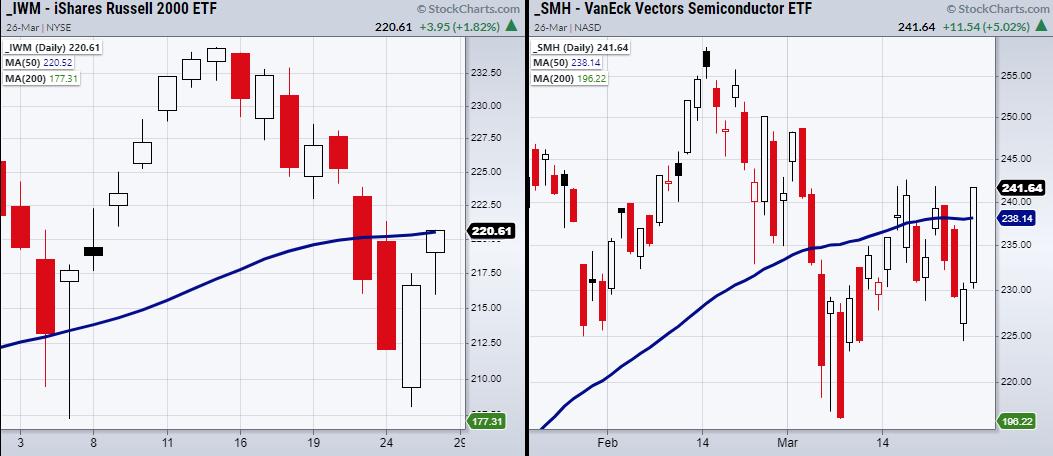

Last Friday, the Russell 2000 (IWM) index and Semiconductors (SMH) cleared their 50-day moving average. From a technical standpoint, this looked as though the rally would continue into Monday. At least, that is what traders/investors were hoping for when they bought near Friday's close.

Monday's...

READ MORE

MEMBERS ONLY

Can Transportation Lead the Market Higher?

Mish's Economic Modern Family is made up of 5 key sectors and 1 index. Each member has been specifically chosen to help investors/traders navigate the market by giving an easy way to see emerging trends and important price levels.

The Family consists of:

* Granddad Russell 2000 (IWM)...

READ MORE

MEMBERS ONLY

Are We in a Risk On or Off Environment?

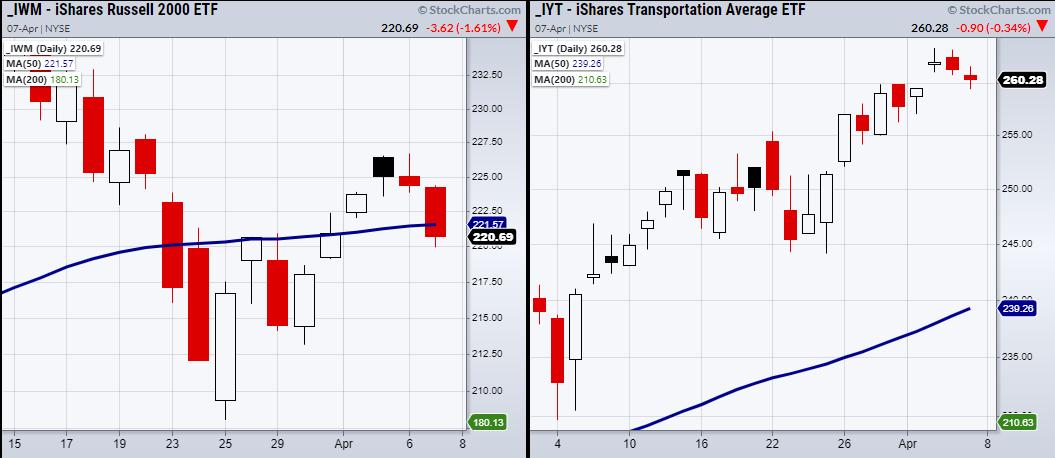

On Wednesday, the Russell 2000 (IWM) confirmed a cautionary phase change, with a second close under the 50-day moving average. A cautionary phase is defined by current price sitting under the 50-DMA, with the 50-DMA over the 200-DMA. Both IWM and Nasdaq 100 (QQQ) are in cautionary phases. This is...

READ MORE

MEMBERS ONLY

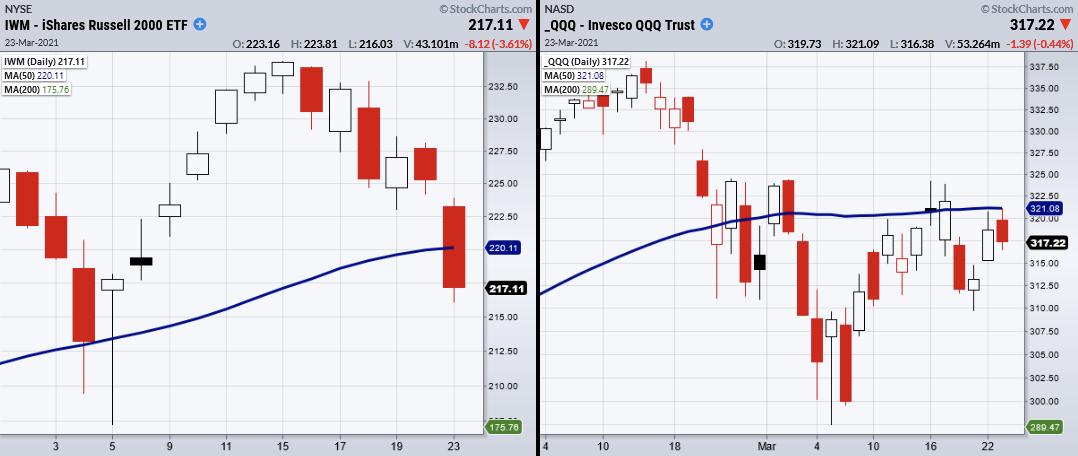

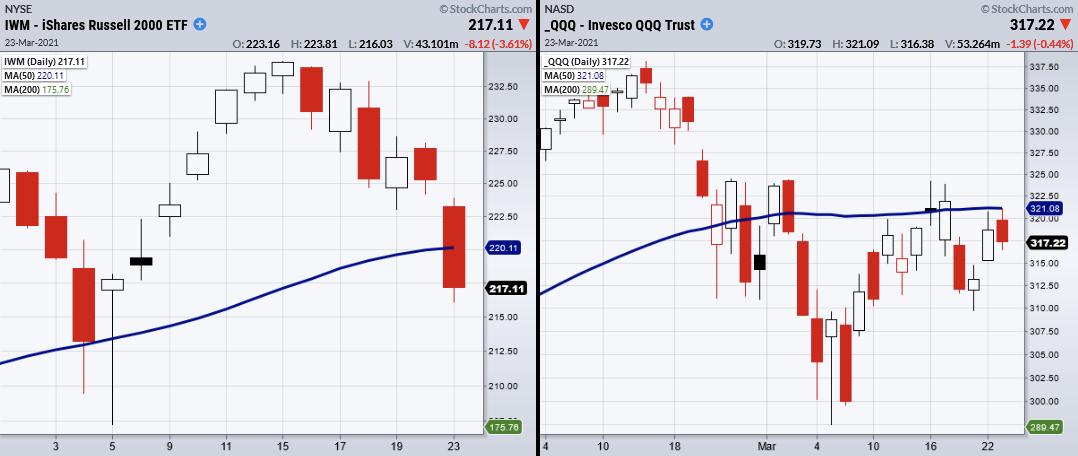

Why the Russell 2000 & Nasdaq 100 Had the Largest Market Impact

On Tuesday, the Nasdaq 100 (QQQ) came close to clearing the 50-day moving average at $321.08. This was the second attempt to clear this moving average, with the first attempt happening last week. Though the QQQs were unable to hold over the 50-DMA, they were able to hold over...

READ MORE

MEMBERS ONLY

Should We Be Worried About Bond Yields Increasing?

Last week, increasing bond yields had the market worried. Come Monday, the 20+ year treasury bond ETF (TLT) gapped higher and ended the day up 1.12%. This fared especially well for growth stocks as the Nasdaq 100 (QQQ) tests resistance from the 50-day moving average.

But what was the...

READ MORE

MEMBERS ONLY

When to Trade and When to Do Nothing

The easy answer to this question is if you do not know what to do, you should probably do nothing. But it gets more complicated if you do not know why you should be doing nothing. No one likes to feel as though they are missing out on profits by...

READ MORE

MEMBERS ONLY

My Special Inflationary Indicator

On Wednesday, the Federal Reserve stated that interest rates will continue to stay close to zero, along with a new estimate for the unemployment rate down to 4.5% instead of 5% for the year. Additionally, the GDP estimate was revised to +6.5% from +4.2% for 2021.

Many...

READ MORE

MEMBERS ONLY

Is the Cannabis Sector Primed for a Move Up?

Cannabis has seen a huge increase this year as the Biden administration took office. Though it is not completely clear if the Federal government will push for widespread legalization, its last bill to further decriminalize cannabis makes it easier for states to push their own legalization agendas. With 11 states...

READ MORE

MEMBERS ONLY

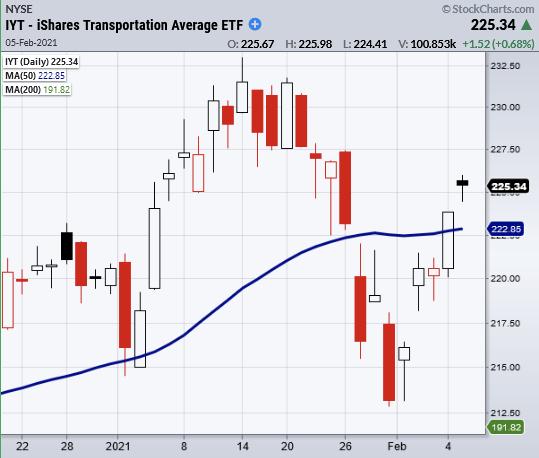

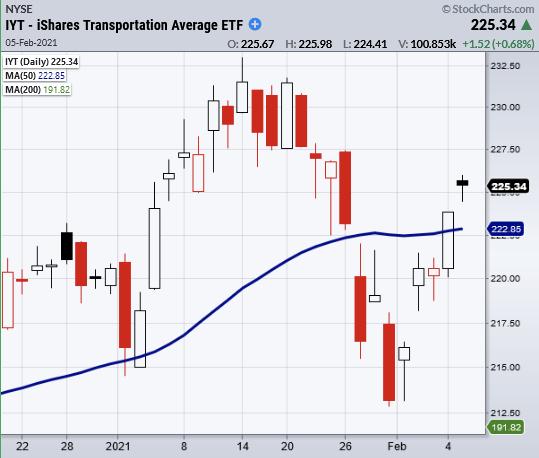

Transportation (IYT) and Retail (XRT) Lead the Market Higher

Recently, we talked about Transportation (IYT) and Retail (XRT) sectors as indicators for market strength/weakness. Transportation shows the movement of goods and travel expectations, while retail shows the consumer sentiment side. Both help us understand investor expectations of the economy reopening and therefore help us understand if we are...

READ MORE

MEMBERS ONLY

How Long Will the Market Remain Choppy?

The market is confused and choppy. This can be seen by looking at the major indices, as most disagree with each other. This is important because when the overall market moves together, it makes trading easier as it allows traders to better time their entries based on pullbacks and breakouts....

READ MORE

MEMBERS ONLY

Which Megatrends Have the Hottest Trending Stocks?

When looking for stocks that will continue to perform in 2021, we can look at the megatrends that will continue to grow considering the pandemic will be in the rear-view mirror.

On top of the list of trends is blockchain technology-and alternative currency. With Bitcoin above 52k and stocks like...

READ MORE

MEMBERS ONLY

The Market's New Normal

Monday's strange price action looks as though the market shrugged off the stimulus money in some areas, yet not others. While there are many factors at play, the most notable shift is in big tech, which continues to show weakness.

The tech-heavy index Nasdaq 100 (QQQ) sold off...

READ MORE

MEMBERS ONLY

Why You Should Watch Transportation (IYT) and Retail (XRT) Monday

The market has stopped the bleeding with a rally into Friday's close. The Small Caps index Russell 2000 (IWM) held over its 50-day moving average of 213.40. Additionally, the retail (XRT) and transportation (IYT) sectors never broke under their 50-DMAs, with IYT going on to clear its...

READ MORE

MEMBERS ONLY

Which Key Sectors Have the Ability to Support the Market

Wednesday was another disappointing day for the market as many short-term buyers from Tuesday got flushed out in the move lower. However, with a second down day, should we be worried about a potential correction? Or is the market still holding its main support?

To answer this, first let us...

READ MORE

MEMBERS ONLY

How to Stay on the Right Side of the Market with This Special Tool

Tuesday was a choppy day for the market, which had sporadic price swings plus a large amount of volatility. These days are tough to trade, as they can make it hard to see the daily trend direction.

One tool that can help you decide whether you want to trade the...

READ MORE

MEMBERS ONLY

NASDAQ's 50-Day Moving Average Continues to Provide Price Guidance

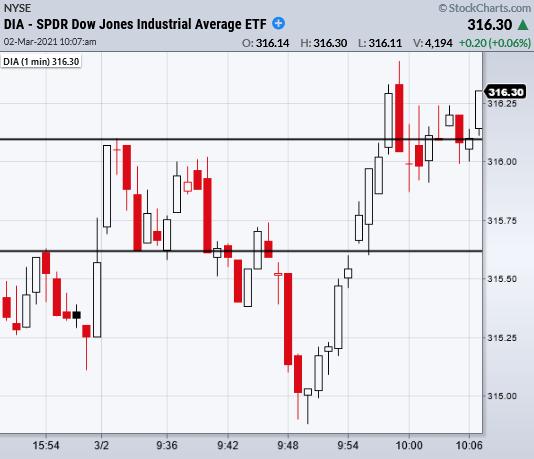

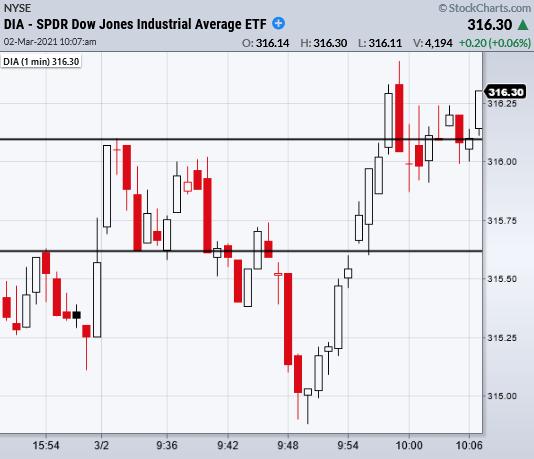

Last Friday, the market ended on a cliffhanger. The Nasdaq 100 (QQQ) closed under its 50-day moving average, while the S&P 500 (SPY) and Dow Jones (DIA) teetered on the edge of their 50-DMAs.

Not only did the market gap higher Monday, but the QQQs ended the day...

READ MORE

MEMBERS ONLY

Using the Economic Modern Family to Plan Ahead

With all but one member of the Economic Modern Family in a bullish phase, should we be worried? Or does Monday hold the next piece of pivotal price action?

Before we attempt to answer this question, we should first know where each member stands and if anyone sits in a...

READ MORE

MEMBERS ONLY

The Importance of the 50-Day Moving Average

On Tuesday, we talked about a reversal chat pattern in the Nasdaq 100 (QQQ) that was created from the price clearing over the 50-day moving average. Although today began with price under the 50-DMA, QQQs turned around, closing over Tuesdays high. Hence, the reversal pattern has confirmed right by a...

READ MORE

MEMBERS ONLY

QQQ Just Made a Rare Chart Pattern

On Tuesday, the Nasdaq 100 (QQQ) broke the 50-day moving average before the end-of-day rally brought it back over. This created a reversal pattern we like to call an expansion day.

An expansion day is formed when a large range day crosses over a major moving average, in this case...

READ MORE

MEMBERS ONLY

The Soft Commodities Make a Big Move

The pandemic has brought a multitude of supply chain disruptions reaching not only into the tech space, but also into the agricultural space.

The Invesco Agricultural Fund (DBA) recently cleared major resistance at 16.87 from the 200-week moving average, plus resistance going back from highs of 2019. Participating in...

READ MORE

MEMBERS ONLY

Two Growing Sectors with Huge Potential

Despite worry of a pending market correction, talks of stimulus and an infrastructure package paired with a supportive Federal Reserve helped boost market morale this week. However, specific sectors which suffered are now looking to make a comeback and, with correct positioning, anyone can jump on the trend train.

From...

READ MORE

MEMBERS ONLY

Where are the Market's Key Support Levels?

Wednesday could be a pivotal day for the market. With a gap down in the major indices, the market continued to sell-off until finding some late-day support, especially in the Dow, which closed green.

A key to what happens from here over the next few days could be decided on...

READ MORE

MEMBERS ONLY

Is Oil Just Getting Started?

News surfaced Tuesday about stress on oil production from the recent temperature drop in the U.S. Because water is involved in oil production, it can freeze equipment, thereby halting the process. Does this mean oil will continue to increase in price from a temporary weather condition? Possibly, but, by...

READ MORE

MEMBERS ONLY

Where Does the Economic Modern Family Look Next?

The Economic Modern Family members are all in a bullish phase, with transportation (IYT) leading the charge. A rundown of each member shows Russell 2000 (IWM) putting in some consolidation over Monday's low of 223.40.

Watching IWM instead of larger indices, like the S&P 500,...

READ MORE

MEMBERS ONLY

Plan Your Trade and Trade Your Plan

With crazy market volatility and wide price swings, having a trading plan couldn't be more important for a day like Wednesday.

At around 10:20 ET, the market began to sell off rapidly, turning into a large drop. Though the market rebounded, such large price swings could have...

READ MORE

MEMBERS ONLY

Does the Real Estate Sector Have Hidden Growth Potential?

The Real Estate sector (IYR) has cleared an important price level at $88.76 or the high of 11/9/2020. The real estate recovery has been slow compared to the rest of the market, which is more like a roller coaster ride at this point. However, IYR has put...

READ MORE

MEMBERS ONLY

Oil on the Move - Good Thing or Slippery Slope?

Oil (USO) has blasted off with the rest of the market in the last 5 trading days. And that is after it cleared the key 50-week moving average 4 weeks ago. This bodes well for the market and economy for now, as oil signifies a economic recovery is on the...

READ MORE

MEMBERS ONLY

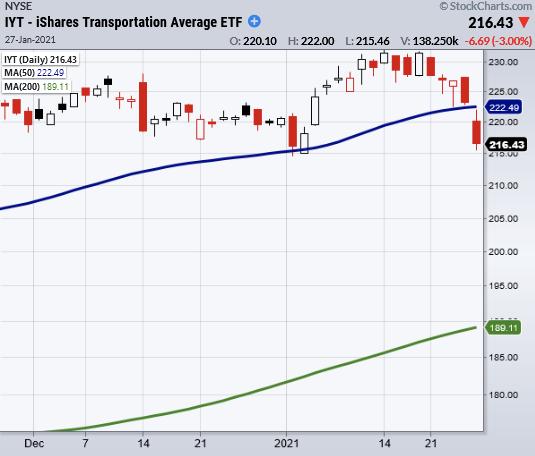

Transportation Sector Must Hold its Bullish Phase

The transportation sector (IYT) has entered back into a bullish phase. (A bullish phase is when the price is over the 50-day moving average, and the 50-DMA is over the 200-DMA.) IYT is now back in line with the rest of its Economic Family members who, as a whole, give...

READ MORE

MEMBERS ONLY

Does Big Tech Have Limited Upside?

With positive earnings out for big tech companies, should investors' appetites grow for companies like Google (GOOGL), Microsoft (MSFT) and Amazon (AMZN)? Or should they look for more potential elsewhere?

This can be a very loaded question, as many people have favored these companies for a long time.

As...

READ MORE

MEMBERS ONLY

What is Your Risk/Reward Plan?

"How much are you risking?" This is a key question to ask when making a trade and might even be the most important one to ask, as lately, the market's high volatility has created huge price swings.

Take the Retail Sector, (XRT) for example. In just...

READ MORE

MEMBERS ONLY

Mixed Technical Picture in the Market Indices

Dow Jones (DIA) sits alone under the 50-day moving average, while his friends, Russell 2000 (IWM), Nasdaq 100 (QQQ) and S&P 500 (SPY) cleared Friday's highs and remain above their 50-DMAs. Though only the DIA ended under the 50-day moving average, it still had an inside...

READ MORE

MEMBERS ONLY

WallStreetBets Storms the Financial Bastille

Out of the corner of my eye, a message pops up on my screen saying "Hold the line! Selling here means Wall Street wins!"

This is one of thousands of posts found on big social media platforms, which spurred from a Reddit page known as r/WallStreetBets (WSB)...

READ MORE

MEMBERS ONLY

Has Transportation (IYT) Confirmed a Warning Signal?

The GameStop (GME) saga continues as a Reddit page known as r/WallStreetBets and its members of small-time traders have pushed GME through another round of all time highs. Their influence and constant stream of messages throughout social media have reached even Elon Musk, who posted a tweet late Tuesday...

READ MORE

MEMBERS ONLY

A Simple Trick for Buying Short Squeezes Like BBBY and GME

Short squeezes and high-risk trades have been all the rage in the media, with stocks like GameStop (GME) and Bed Bath & Beyond (BBBY) flying up to unthinkable daily prices. But how can you profit from a short squeeze if you think a company is being targeted by a large...

READ MORE

MEMBERS ONLY

How to Time Your Market Entries and Avoid FOMO

Monday was a roller coaster ride for traders, with a steep late morning selloff followed by a steady wave of buying until the closing bell.

Highly volatile days can be great for making quick trades, but can also come with increased risk, as we saw. The fast-moving pace can easily...

READ MORE