MEMBERS ONLY

Beneficiaries Of A Strengthening Dollar

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

I'll be traveling and on vacation this week, so my blog articles will focus on very brief topics regarding current market themes or my own trading strategies. I'll return to my "normal" blog postings regarding market action, outlook, historical tendencies, etc. when I...

READ MORE

MEMBERS ONLY

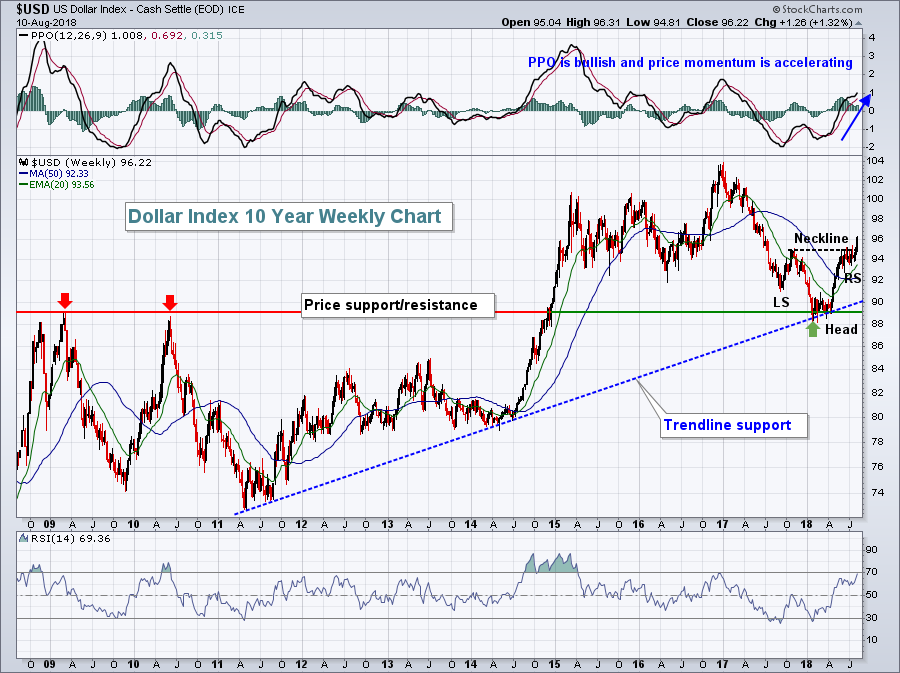

Dollar Breakout Signals Resurgence In Small Cap Relative Strength

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

I'll be traveling and on vacation this week, so my blog articles will focus on very brief topics regarding current market themes or my own trading strategies. I'll return to my "normal" blog postings regarding market action, outlook, historical tendencies, etc. when I...

READ MORE

MEMBERS ONLY

Banks Showing Renewed Strength; ChartCon FINAL CALL

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

ChartCon Starts Today!

If you haven't already, I'd highly recommend that you join me and many of my StockCharts.com colleagues from around the globe for ChartCon 2018. We did our rehearsals and walkthroughs yesterday and my great friend Greg Schnell kicks off the conference in...

READ MORE

MEMBERS ONLY

When Financials Lead On A Relative Basis, This Usually Happens

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 8, 2018

Wall Street ended Wednesday's action in a bifurcated state as the NASDAQ withstood a final 20 minute selloff to finish with a slight 4 point gain. The other major indices finished lower, but just fractionally so. In sector performance, slight gains...

READ MORE

MEMBERS ONLY

Energy And Industrials Lead Wall Street Rally, But Here's The Bullish News

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 7, 2018

It was another nice rally on Wall Street, led by energy (XLE, +0.74%) and industrials (XLI, +0.71%). Since the beginning of July, we've seen renewed strength in larger cap stocks. Industials, along with financials (XLF, +0.46%) have been...

READ MORE

MEMBERS ONLY

Small Caps Ready To Flourish With Dollar Surge? Watch This Signal

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 6, 2018

The Russell 2000 and NASDAQ paced a day of strength on Wall Street as they gained 0.65% and 0.61%, respectively. The S&P 500 and Dow Jones enjoyed smaller gains as money rotated back towards more aggressive areas. The 10...

READ MORE

MEMBERS ONLY

Friday Action Bifurcated As Dollar Awaiting Bullish Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, August 3, 2018

The stock market has clearly turned more defensive over the past 2-3 months and Friday was another perfect example of that. The more aggressive small cap Russell 2000 was the laggard, dropping 0.52%. Meanwhile, the NASDAQ produced only a minor 0.12%...

READ MORE

MEMBERS ONLY

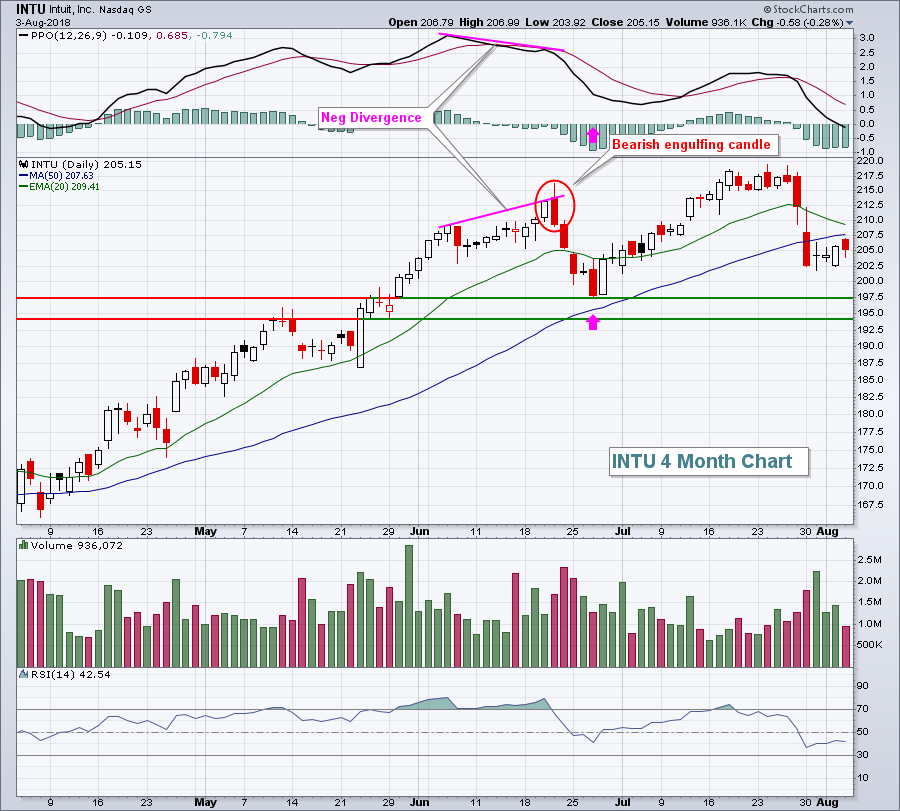

The Question Rarely Addressed - When Do I Sell?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Buying is so easy. When you pull that trigger to buy, optimism abounds. Maybe it was a recommendation from a friend. Perhaps there was water cooler talk of the next Apple (AAPL). You might even have uncovered it from a time-tested scan. The reason doesn't really matter. The...

READ MORE

MEMBERS ONLY

Apple Tops $1 Trillion Market Cap, Leads Technology Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I will be traveling to Seattle this weekend for ChartCon 2018. My schedule the next two weeks is likely to be quite different and sporadic, perhaps posting articles during the trading day or possibly even after the market closes. If you've grown accustomed to my articles...

READ MORE

MEMBERS ONLY

Apple Soars, Trade Fears Send Futures Plummeting

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 1, 2018

Wednesday was a day of bifurcated action with Apple (AAPL) leading technology (XLK, +0.90%) and the NASDAQ higher, while the Dow Jones, S&P 500, Russell 2000 and most sectors finished lower. It was a case of one behemoth, nearly $1...

READ MORE

MEMBERS ONLY

Apple Delivers With The Fed On Deck

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 31, 2018

It was a solid day on Wall Street to close out July. The small cap Russell 2000, weak on a relative basis during July, regained its leadership role, spiking more than 1% and doubling the performance of its other major index counterparts. Industrials...

READ MORE

MEMBERS ONLY

This Part Of Energy Completes Right Side Of Cup, Very Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 30, 2018

Only three sectors were able to finish in positive territory on Monday as bears permeated Wall Street. Two of the three - financials (XLF, +0.07%) and healthcare (XLV, +0.06%) - barely managed to eke out gains. The only real strength was...

READ MORE

MEMBERS ONLY

Twitter Provides Internet Bears A Double Dose Of Adrenaline

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 27, 2018

A second wave of internet troubles came in the form of Twitter Inc (TWTR) after the recently-soaring internet giant disappointed traders with its latest quarterly results. It was an UGLY reaction by Wall Street as TWTR fell nearly 21% exactly one day after...

READ MORE

MEMBERS ONLY

Key S&P 500 Support To Watch And Why I Wouldn't TOUCH Facebook

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, July 26, 2018

There was clear market bifurcation on Thursday as The Travelers Cos (TRV) and Walt Disney Co (DIS) both gained more than 2% to lead the Dow Jones Industrial Average to a 113 point gain. Five other Dow components gained more than 1%, while...

READ MORE

MEMBERS ONLY

Facebook Slammed After Missing Revenues And Lowering Future Revenue Growth Rate

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 25, 2018

All of our major indices finished higher on Wednesday, as did all sectors. Relative strength was found in several areas including industrials (XLI, +1.52%), healthcare (XLV, +1.28%) and technology (XLK, +1.25%). Waste & disposal services ($DJUSPC, +5.04%) surged on...

READ MORE

MEMBERS ONLY

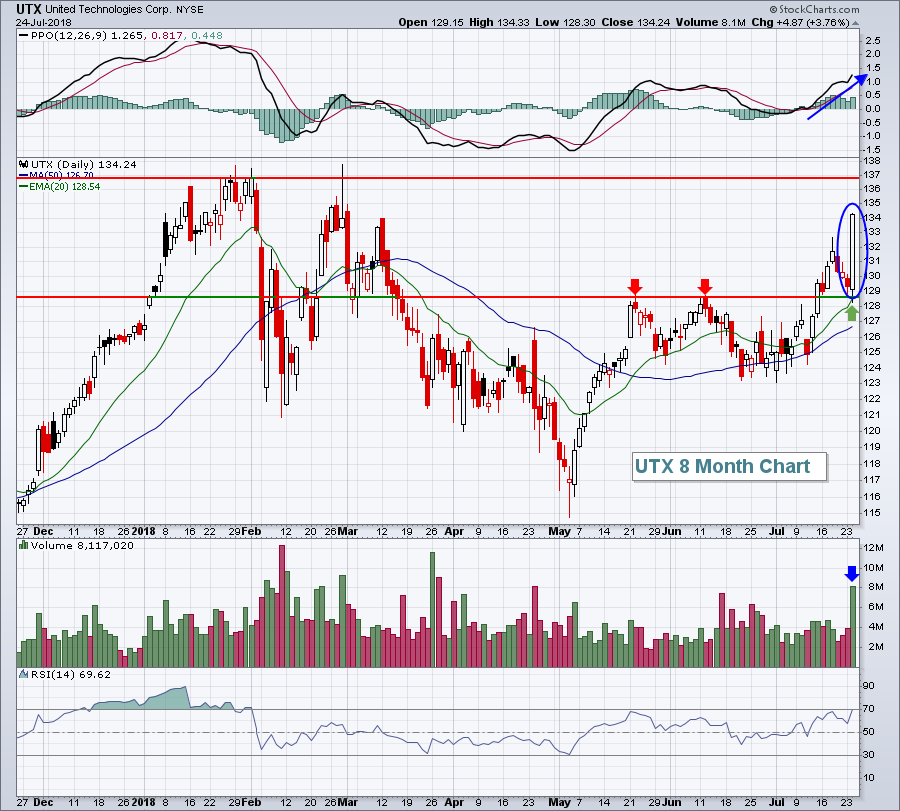

Small Caps Are Looking To Regain Their Relative Strength

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 24, 2018

Earnings are dominating the headlines and the action on Wall Street. The Dow Jones and S&P 500 had been underperforming its NASDAQ and Russell 2000 counterparts throughout much of the second quarter. As a result, their positive earnings surprises seem to...

READ MORE

MEMBERS ONLY

Toys Have Been Hot, But Don't Ignore This Warning Sign

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

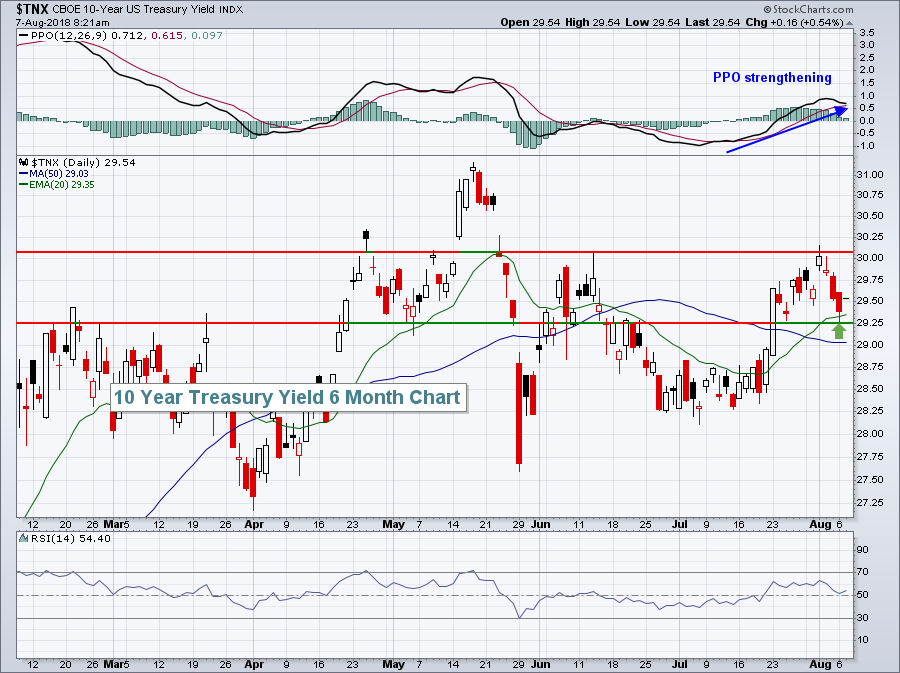

Market Recap for Monday, July 23, 2018

Financials (XLF, +1.38%), especially banks ($DJUSBK, +1.86%), led Wall Street on Monday as the rising 10 year treasury yield ($TNX) provides hope for increasing profits in the quarters ahead for this influential industry group. There's a very strong and...

READ MORE

MEMBERS ONLY

This Small Cap Healthcare Stock Is My Pick Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 20, 2018

Software ($DJUSSW, +0.86%) led once again on Friday, thanks in large part to another impressive quarterly earnings report from technology (XLK, +0.03%) giant Microsoft Corp (MSFT). It was a fairly narrow technology advance as software and internet ($DJUSNS, +0.25%) were...

READ MORE

MEMBERS ONLY

Financials Appear Poised To Regain Their Leadership

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 18, 2018

We were mostly higher on Wednesday, although gains were slight. One exception was the NASDAQ, which finished less than one point lower. Otherwise, we saw green. Despite mostly higher prices, leadership really came from just two sectors - financials (XLF, +1.60%) and...

READ MORE

MEMBERS ONLY

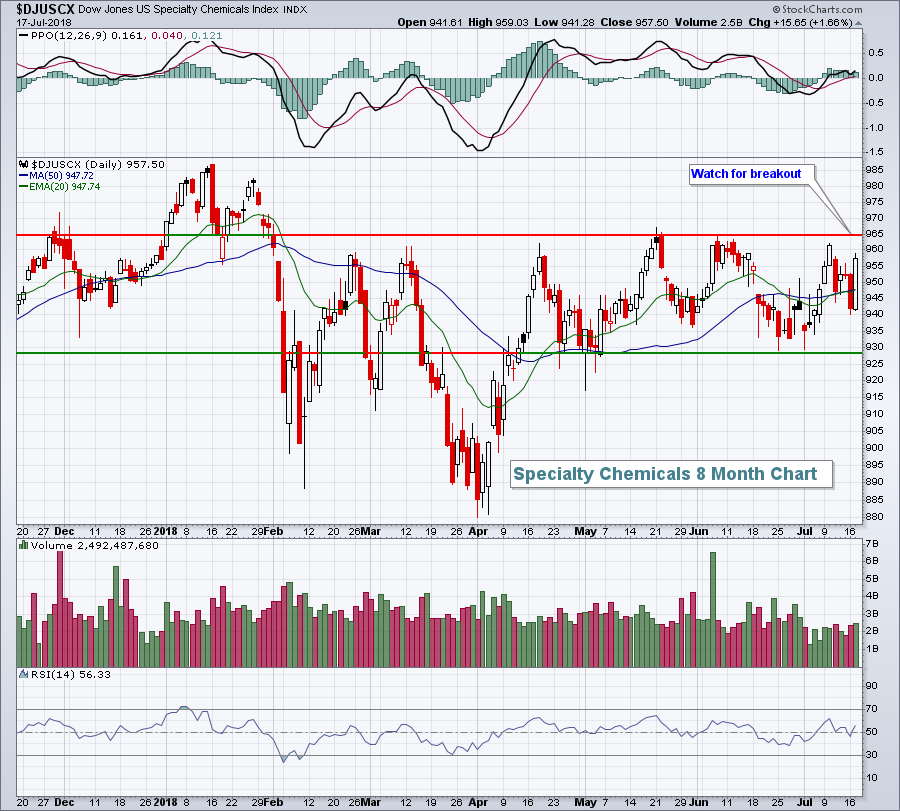

Consider This Materials Stock That Just Broke Out From Bullish Inverse Head & Shoulders Pattern

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I will be on a short mini-vacation beginning Friday, July 20th. Therefore, I will not be writing a Trading Places blog article that day. I will be back on Monday, however, with my latest recap and thoughts on the stock market. If you enjoy my blog, please subscribe...

READ MORE

MEMBERS ONLY

Netflix Slammed After Missing Revenue And Subscriber Estimates

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 16, 2018

The Dow Jones saw buying late in Monday's session, pushing this index of giants into positive territory. Leadership was clear. Large money center banks performed well and JP MorganChase (JPM) was easily the best perfoming Dow Jones stock, gaining nearly 4%...

READ MORE

MEMBERS ONLY

Newest Dow Jones Component Leads Market Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 13, 2018

The Dow Jones moved back above 25000 and the S&P 500 cleared 2800 for the first time since February 2nd on the backs of two unlikely heroes. Walgreens Boots Alliance (WBA), the newest member of the Dow Jones, and Walt Disney...

READ MORE

MEMBERS ONLY

Internet, Software Break Out To Lead NASDAQ To All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, July 12, 2018

Those looking for a bear market to develop were dealt a serious blow on Thursday as the NASDAQ forged to yet another all-time high. The Russell 2000 was on the verge of doing so earlier this week as it reached an intraday all-time...

READ MORE

MEMBERS ONLY

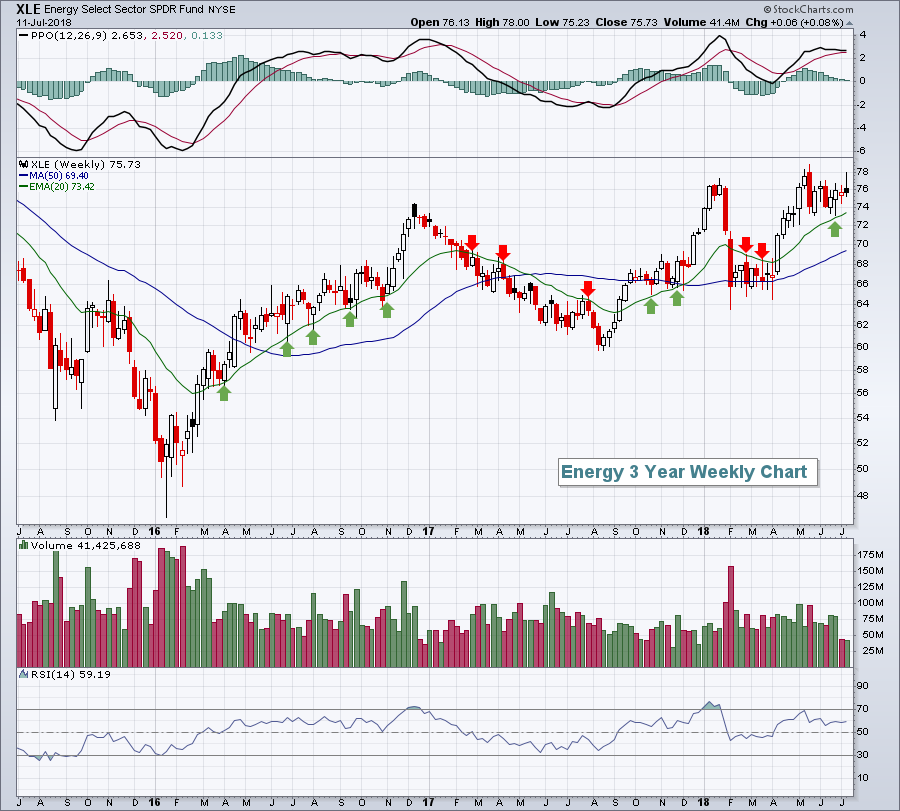

Trade Headlines Spook Traders, But Weak Energy Sector Remains Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 11, 2018

Utilities (XLU, +0.90%) moved higher in an otherwise down day, highlighted by the latest trade headlines in which the U.S. announced another $200 billion in Chinese imports to be subject to a 10% tariff. While the initial reaction was obviously negative,...

READ MORE

MEMBERS ONLY

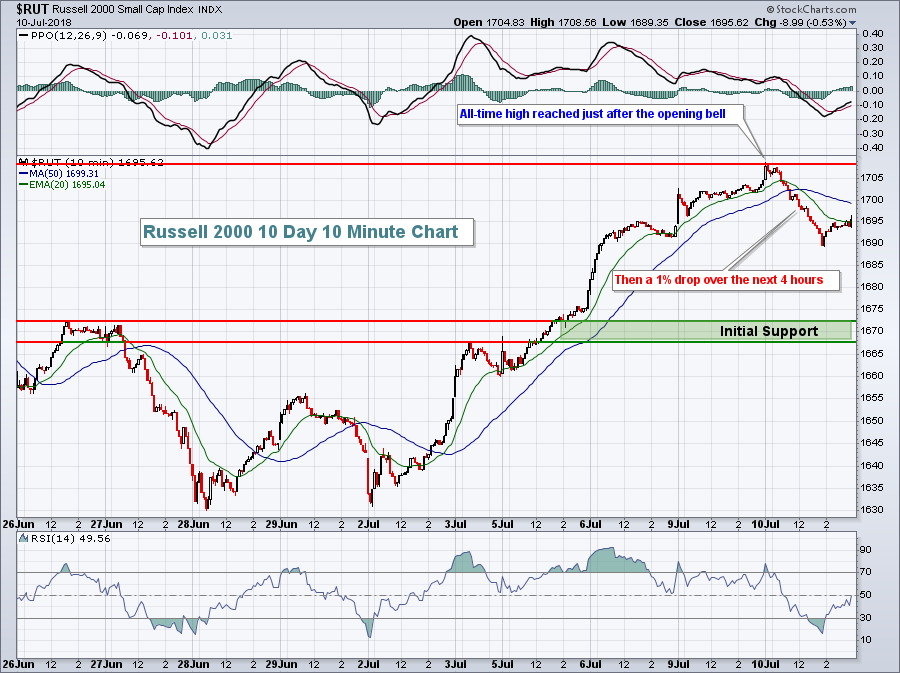

Stocks Reach Key Resistance, Could Be Poised For Selling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 10, 2018

The good news from yesterday is that the Russell 2000 hit an intraday all-time high at 1708.56, edging out intraday highs from June 20th and 21st. The bad news? Sellers took over from there. The record took place in the opening minutes...

READ MORE

MEMBERS ONLY

Rising Dollar Will Provide Further Leadership In Small Caps

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

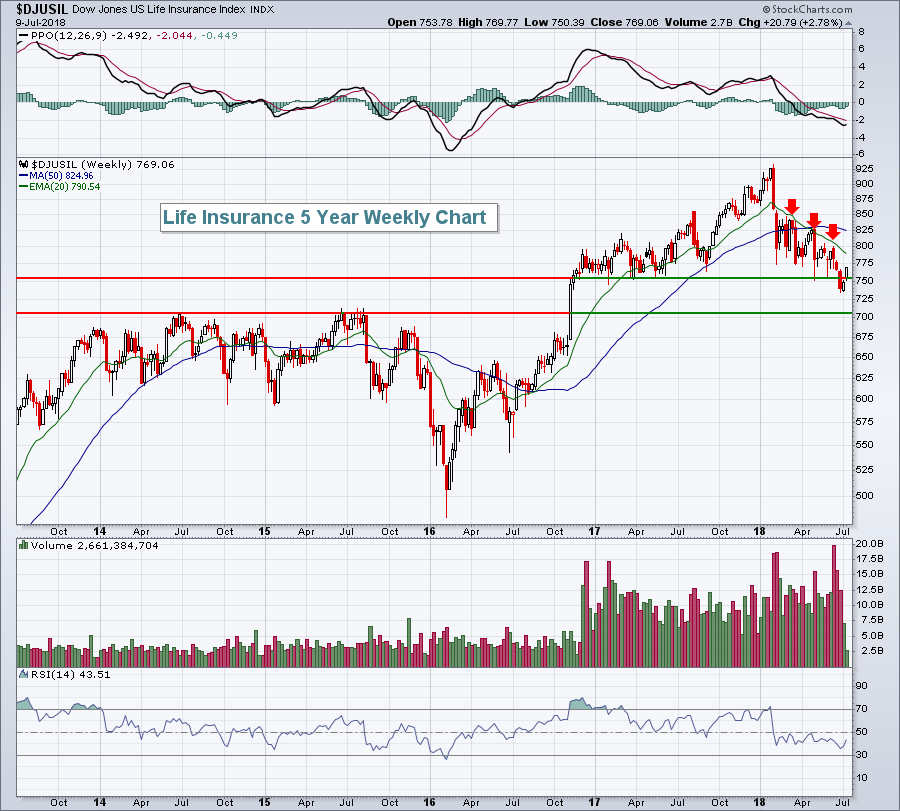

Market Recap for Monday, July 9, 2018

In the famous words of Yogi Berra, it was "deja vu all over again" as financials (XLF, +2.29%) and industrials (XLI, +1.86%) returned to the top of the sector leaderboard. Life insurance ($DJUSIL, +2.78%) and banks ($DJUSBK, +2....

READ MORE

MEMBERS ONLY

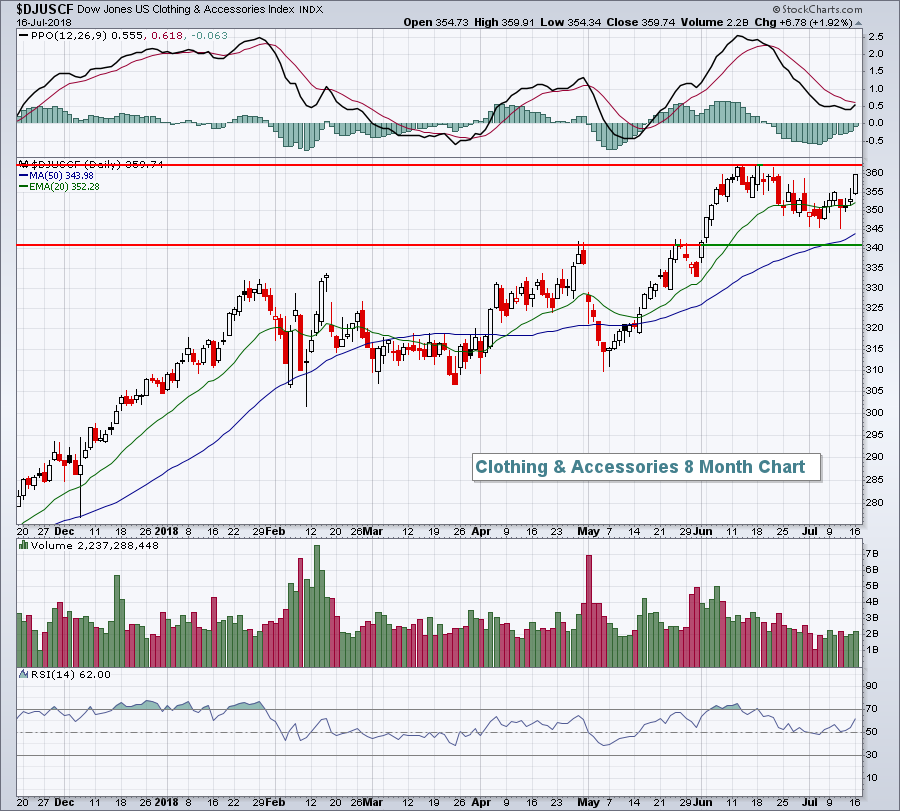

A Big Name Clothing & Accessories Company Provides Excellent Reward To Risk Opportunity

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 6, 2018

It was a solid close to the week on Friday, especially on the tech-laden NASDAQ where that index rose 101 points, or 1.34%. Biotechnology stocks ($DJUSBT, +3.74%) surged on news of positive trial results for Biogen's (BIIB, +19.63%...

READ MORE

MEMBERS ONLY

The Trading Strategy That Makes Money

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let's first talk about a trading strategy that doesn't work.

I steer clear of companies that struggle to meet Wall Street expectations and there's a very simple reason why. Management helps Wall Street set their expectations. So when companies miss their targets, it'...

READ MORE

MEMBERS ONLY

This NASDAQ 100 Giant Flashed BUY Yesterday; History Confirms It

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, July 5, 2018

U.S. equities rallied on Thursday, led by the NASDAQ and Russell 2000, which gained 1.12% and 1.15%, respectively. The Dow Jones and S&P 500 tacked on lesser gains. Technology (XLK, +1.41%), consumer staples (XLP, +1.38%) and...

READ MORE

MEMBERS ONLY

Is It Time For A Rally In The Worst Industry Group In 2018?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 3, 2018

U.S. equities started the holiday-abbreviated trading session on Tuesday quite nicely with gains across each of our major indices. But that strength deteriorated throughout the day and, by the close, all but the small cap Russell 2000 had finished in negative territory....

READ MORE

MEMBERS ONLY

Are Biotechs Poised To Surge? If So, Consider This Giant

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 2, 2018

A brief recap from yesterday:

All of our major indices climbed higher with renewed leadership from the NASDAQ and Russell 2000. Technology (XLK, +0.89%) and utilities (XLU, +0.71%) led the action, while energy (XLE, -1.47%) was very weak. Given the...

READ MORE

MEMBERS ONLY

Watch Potential Channel Support On The NASDAQ 100

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

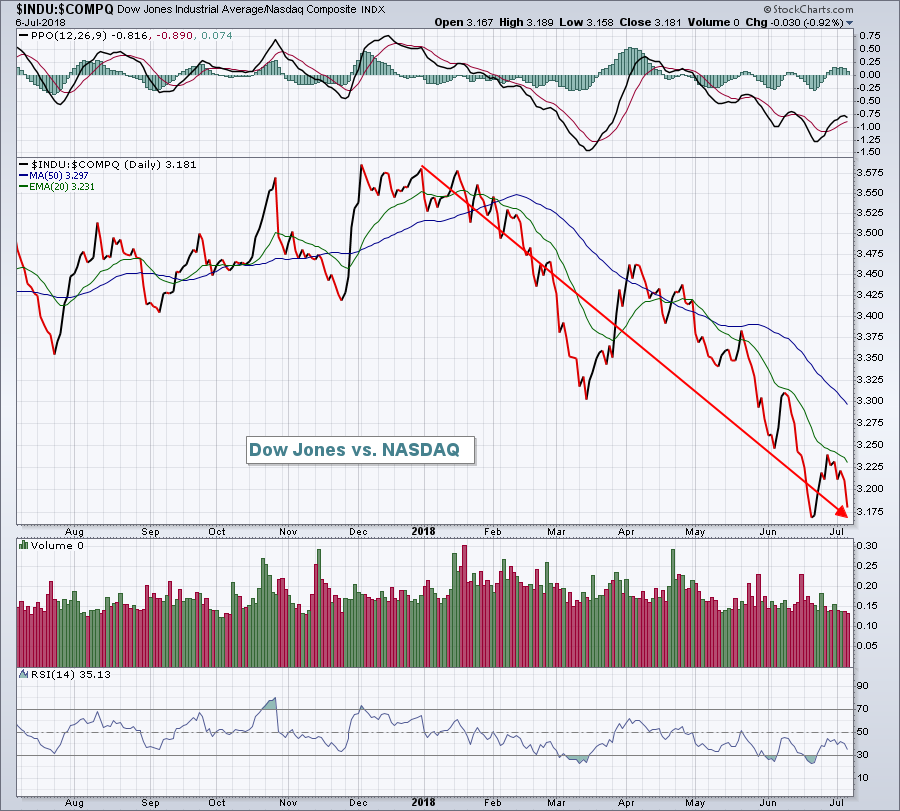

Market Recap for Friday, June 29, 2018

The first half of 2018 ended on Friday in bifurcated fashion, which is fitting given that most of 2018 has seen bifurcated action thus far. The NASDAQ gained nearly 9% in the first six months, with the Russell 2000 not too far behind,...

READ MORE

MEMBERS ONLY

Technology And Financials Lead End Of Month Rebound

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

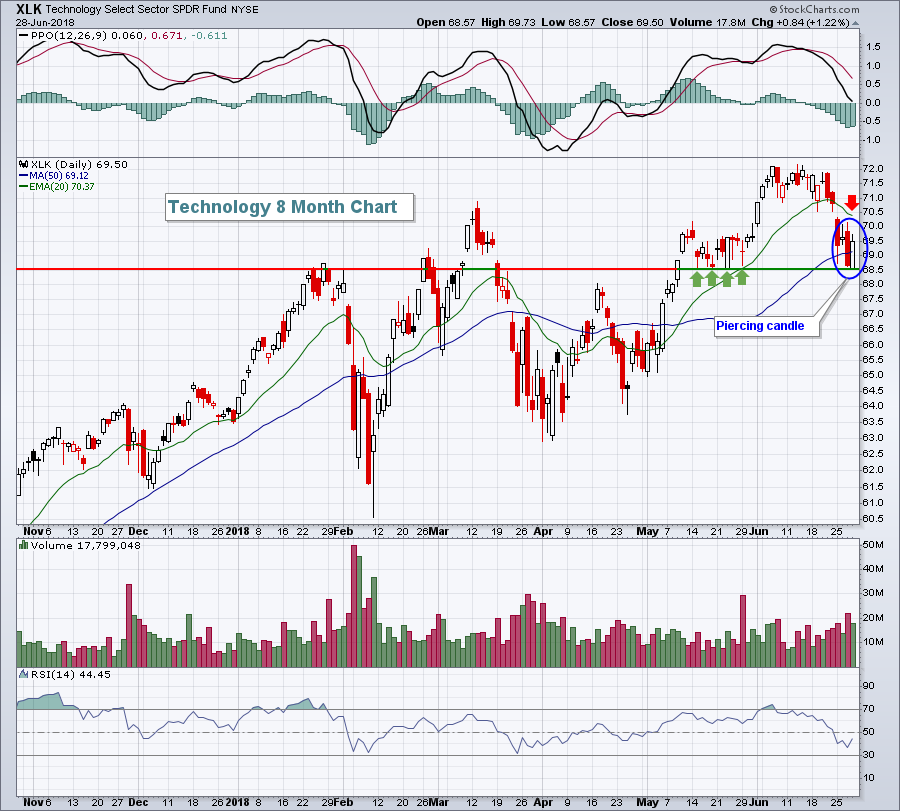

Market Recap for Thursday, June 28, 2018

The selling episode went according to plan, with many higher risk areas taking on most of the bears' wrath. The three worst performing sectors over the past week led the rebound on Thursday. Technology (XLK, +1.22%), financials (XLF, +0.87%) and...

READ MORE

MEMBERS ONLY

Dollar Breakout Good News For Small Caps, But Rising Volatility Weighs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

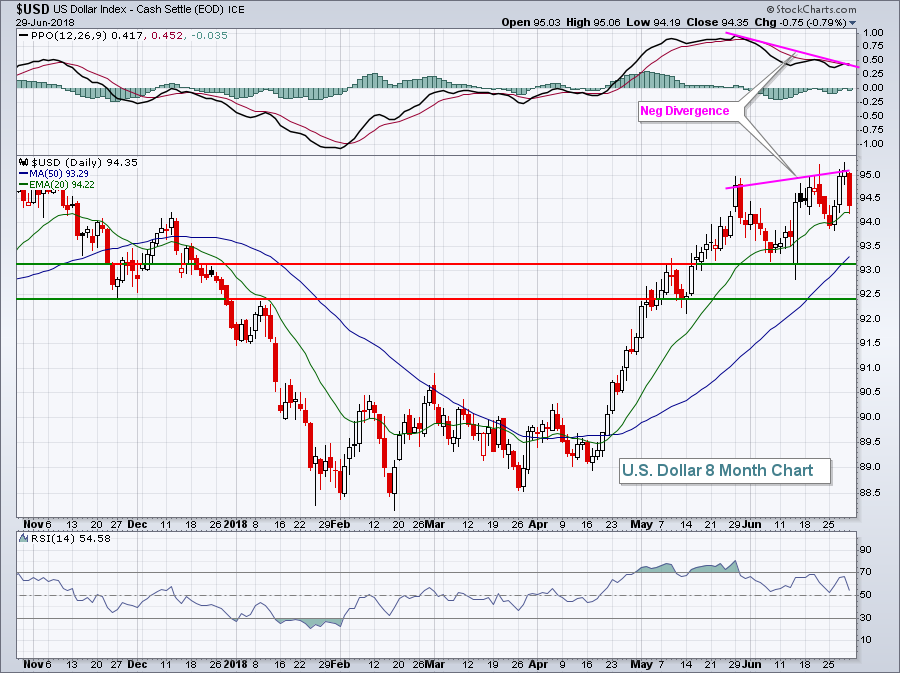

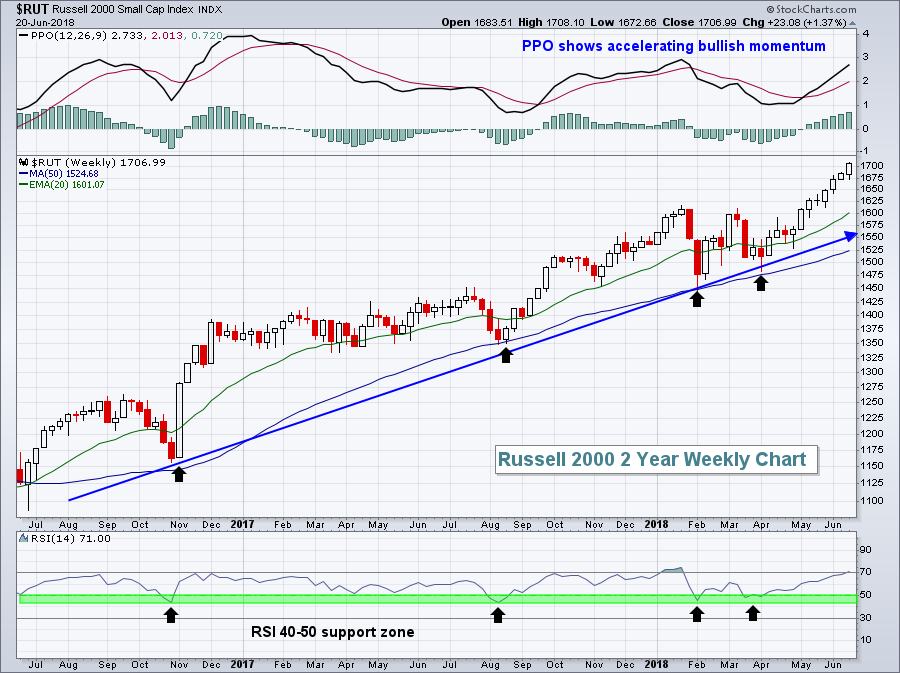

Market Recap for Wednesday, June 27, 2018

Trade war fears are dominating the headlines, but U.S. Dollar Index ($USD) strength is quietly making the biggest news of all. The rising greenback is potentially good news as it signals that the U.S. economy is humming along, and is perhaps...

READ MORE

MEMBERS ONLY

Weakness In Railroads Setting Up Trading Opportunities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 26, 2018

Tepid gains on Wall Street allowed trade fears to subside for a day, but technical indications suggest this is likely just a temporary breather. The Dow Jones gained 30 points on the session, while the small cap Russell 2000 and tech-laden NASDAQ produced...

READ MORE

MEMBERS ONLY

Comparing 2018 To The Two Previous Bull Market Tops

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 25, 2018

We ended a bearish historical period yesterday with.....well.....bearishness. It was an ugly start to the day on more trade threats and, with an hour left in the session, the Dow Jones was down nearly 600 points. Buyers did emerge in that...

READ MORE

MEMBERS ONLY

Here's An Overlooked Stock To Consider For Second Half 2018

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 22, 2018

Bifurcated market action once again permeated Wall Street, but with much different results this time. Instead of the Dow Jones lagging badly and finishing in negative territory, this large cap index broke its eight session losing streak and gained 119 points (+0.49%...

READ MORE

MEMBERS ONLY

Dollar Reversal Likely Points To Short-Term Shift In Trading Strategy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 21, 2018

The Dow Jones closed lower for the 8th consecutive trading session, this time falling 196 points. It's been a steady decline, spurred by fears of a trade war with China and a rising U.S. Dollar Index ($USD). Trade tensions tend...

READ MORE

MEMBERS ONLY

Rising Dollar Tide Lifting Small Cap Boats; Clearing This Level Could Create Bullish Tsunami

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reminder

If you haven't already subscribed to my blog, I'd love to keep you up-to-date on the latest news and technical developments. It's FREE and simple. Scroll down to the bottom of this article and type in your email address in the space provided....

READ MORE

MEMBERS ONLY

Defensive Areas Shine As Investors Seek Out Safety; Netflix Clears 400

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

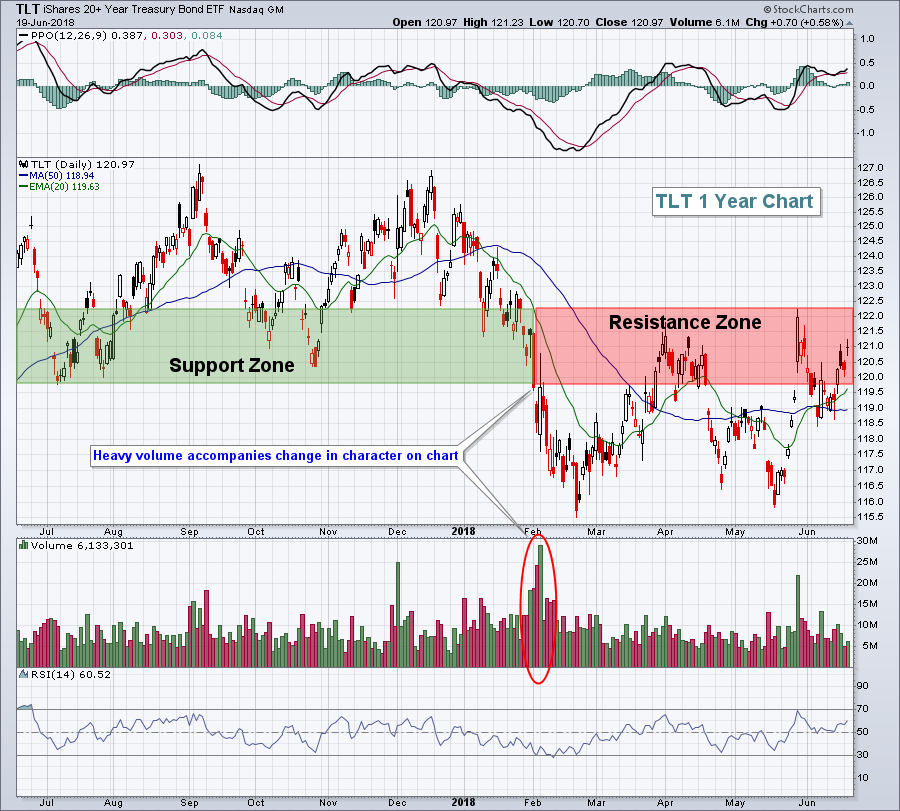

Market Recap for Tuesday, June 19, 2018

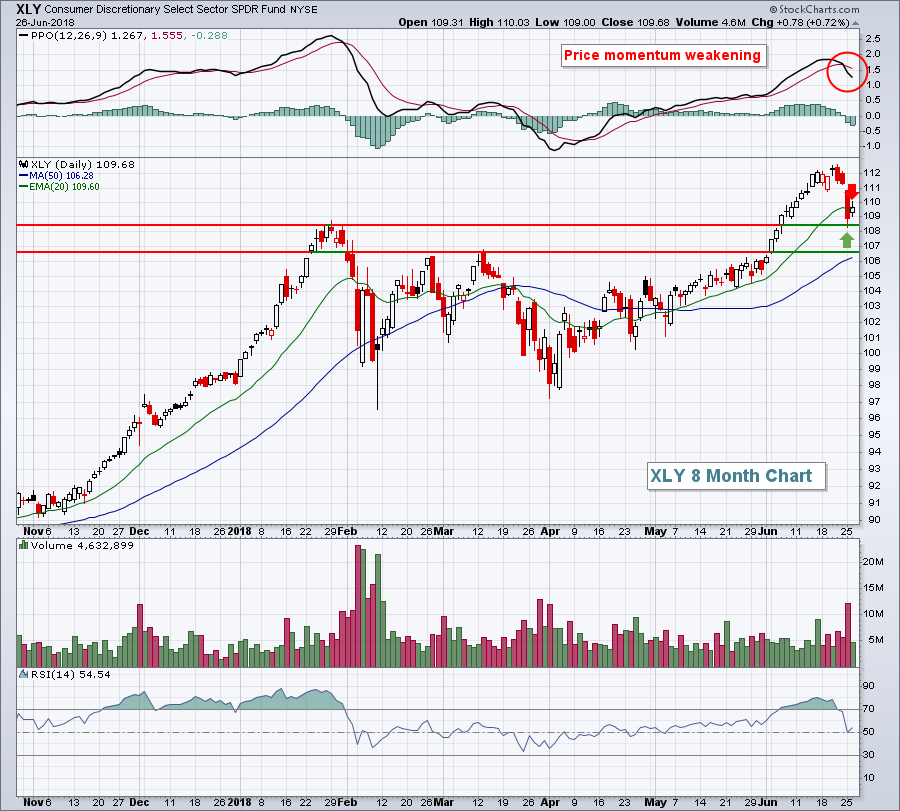

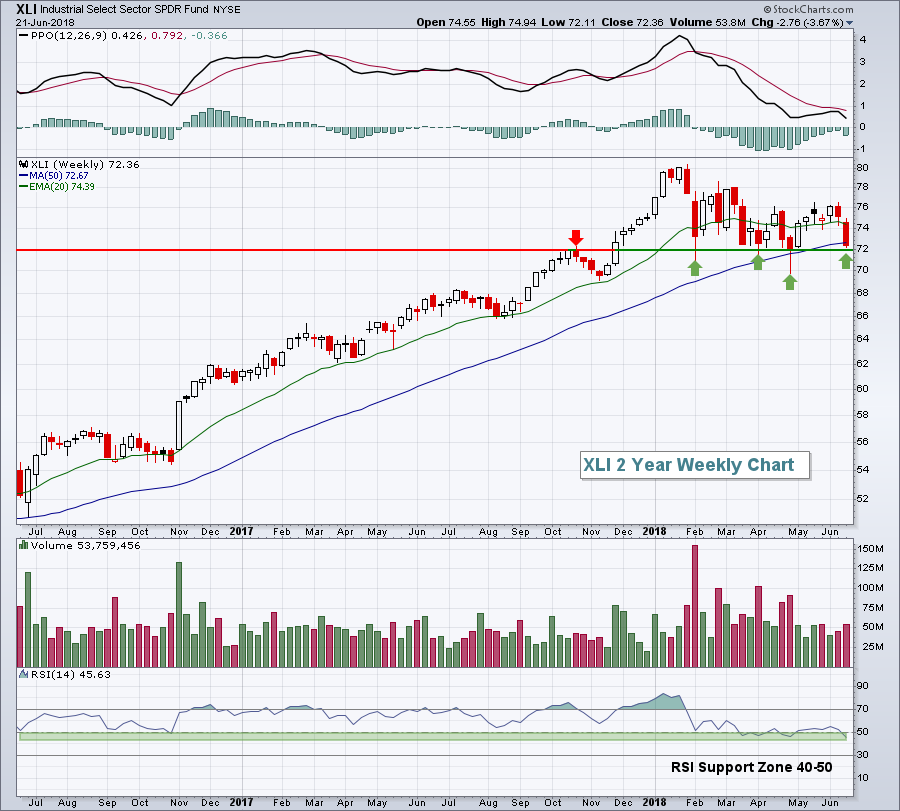

Treasuries (TLT, +0.58%), utilities (XLU, +0.99%), consumer staples (XLP, +0.53%) and healthcare (XLV, +0.26%) highlighted the strength on Tuesday. Wall Street suffered painful losses at the opening bell for a second straight day, but also rallied off those early...

READ MORE