MEMBERS ONLY

Major Indices Fall, But Pare Losses

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, January 10, 2018

We saw losses across our major indices on Wednesday, but the bulls spent most of the day recovering from steeper losses just after the opening bell. Losses were inconsequential as they ranged from 0.02% on the aggressive Russell 2000 (small caps) to...

READ MORE

MEMBERS ONLY

JNJ Breaks Out; Why Pharmas Could Lead The Market In 2018

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

At the bottom of this article, you can type in your email address and hit the green "Notify Me" button to subscribe to my blog for FREE! Then my article will immediately be sent to your email address upon publishing. Thanks!

Market Recap for Tuesday, January 9,...

READ MORE

MEMBERS ONLY

The Dow Jones Ends Its 2018 Winning Streak.....Barely

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, January 8, 2018

After mostly a weak start on Monday, our major indices resumed their bullish ways and finished with positive returns. The lone exception was the Dow Jones, which dropped 13 points to end its impressive winning streak to open 2018. Weakness in Unitedhealth Group...

READ MORE

MEMBERS ONLY

No Jobs? No Problem! U.S. Equities Soar Despite Weak Report

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, January 5, 2018

Not even a disappointing jobs report on Friday could slow down this bull market train. U.S. futures were strong before the release of December's nonfarm payrolls and they didn't give up a thing after the release, which showed...

READ MORE

MEMBERS ONLY

2018 Stock Market Forecast

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

HAPPY NEW YEAR!

In my first Trading Places blog article of 2018, "Here's One Chart That Screams BUY As We Begin 2018", I highlighted my favorite relative chart in the Current Outlook section. It's one of the biggest reasons why I believe 2018 will...

READ MORE

MEMBERS ONLY

Global Markets Rally, U.S. Futures Higher; Nonfarm Payrolls On Deck

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, January 4, 2018

Where's the top? Who knows and the bulls don't seem to care. As of Wednesday, the Dow Jones was left out as the only index not to clear a psychological or significant price level for the first time ever...

READ MORE

MEMBERS ONLY

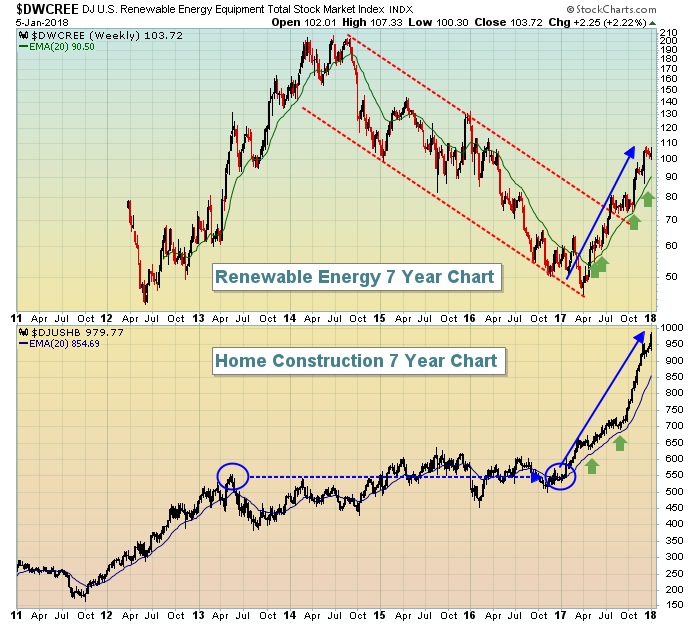

Here's A Must-Own Industry Group For 2018 And A Very Bullish Relative Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, January 3, 2018

We're only two trading days into 2018 and already we've seen the S&P 500's first close ever over 2500, the NASDAQ's first close ever above 7000, the Russell 2000's first close...

READ MORE

MEMBERS ONLY

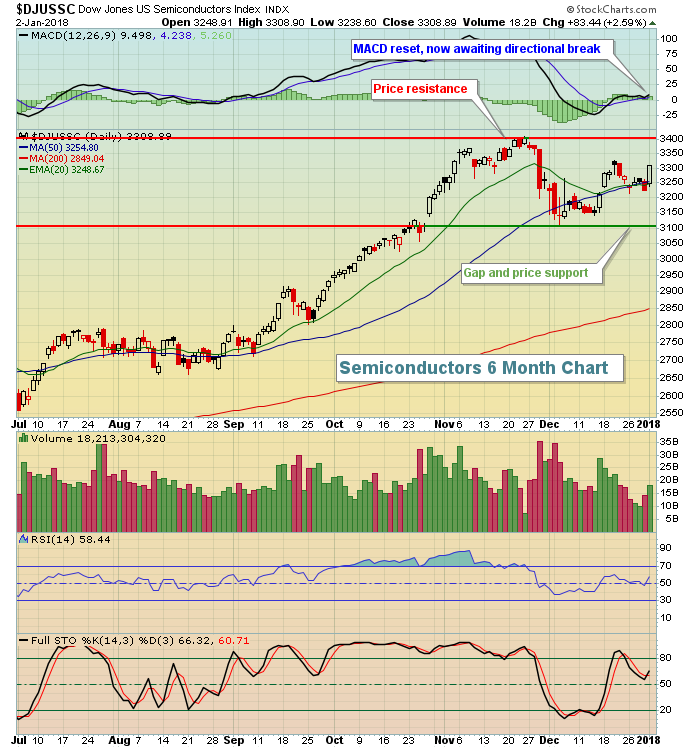

Bulls Open 2018 With A Party Like It's 1999

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, January 2, 2018

The NASDAQ loves January and January loves the NASDAQ. If there's one month where the NASDAQ really shines on a relative basis, it's January (see Historical Tendencies below) and that index opened the new year like it owns January....

READ MORE

MEMBERS ONLY

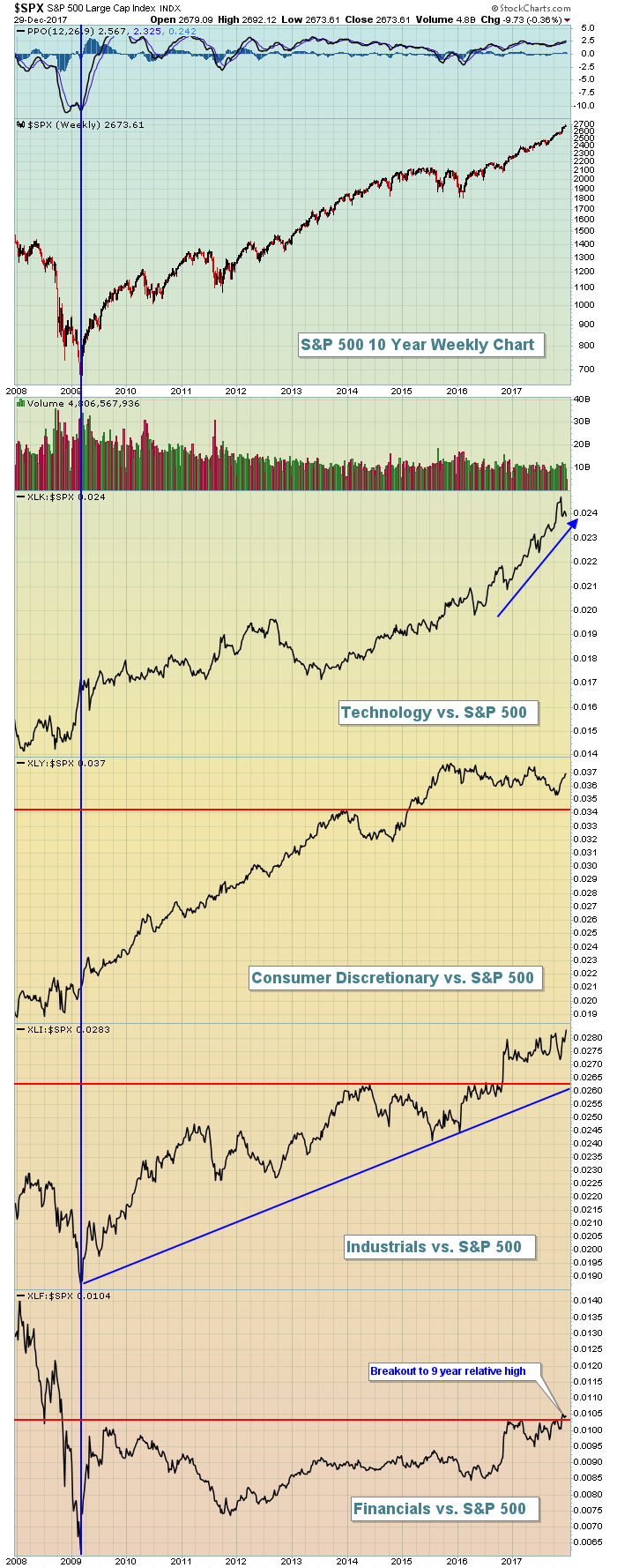

Here's One Chart That Screams BUY As We Begin 2018

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

First, I'd like to wish everyone a Happy New Year! Let's make 2018 our best yet! Here are a couple of quick reminders:

(1) If you like my Trading Places blog and you'd like to follow my articles every morning, scroll down...

READ MORE

MEMBERS ONLY

New Years Resolutions For Traders

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

Happy New Year to all and thanks so much for your support of me and StockCharts.com in 2017 (and please subscribe at the bottom of my article - it's FREE!). If you're not a member, your first resolution should be to become one....

READ MORE

MEMBERS ONLY

Technology Stocks Set To Lead Year End Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 27, 2017

Wednesday's action was characterized by thin volume and low volatility, normal for trading during the holidays. Our major indices moved fractionally higher, with the Russell 2000 ($RUT) being the exception after that index fell during the afternoon session to finish slightly...

READ MORE

MEMBERS ONLY

What Industry Will Lead The Stock Market In 2018? You Might Be Surprised....

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, December 26, 2017

Energy stocks (XLE, +0.88%) continued their merry way higher, which really isn't surprising after the sector made a very significant price breakout above the 70 level. With an RSI approaching the 80 level now, however, I wouldn't be...

READ MORE

MEMBERS ONLY

Time For Another Santa Claus Rally?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 22, 2017

The major indices all fell back slightly during Friday's pre-Christmas holiday, light volume trading session. Materials (XLB, +0.38%) was the best performing sector, while healthcare (XLV, -0.32% and financials (XLF, -0.28%) lagged.

The 10 year treasury yield ($TNX)...

READ MORE

MEMBERS ONLY

Energy And Banks Dominate The Trading Session; All Major Indices Advance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, December 21, 2017

In afternoon trading, all of the major indices except the NASDAQ appeared headed for another record all-time high close. But a late afternoon selling bug hit Wall Street and much of those earlier gains disappeared. The small cap Russell 2000 was able to...

READ MORE

MEMBERS ONLY

Schlumberger Ends Downtrend, Now Looks To Confirm Price Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The energy ETF (XLE) has been blistering hot this week and today its three largest holdings - Exxon Mobil (XOM at 23%), Chevron Corp (CVX at 17%) and Schlumberger (SLB at 7%) - all had some form of a breakout. XOM surged to its highest close since January. CVX closed...

READ MORE

MEMBERS ONLY

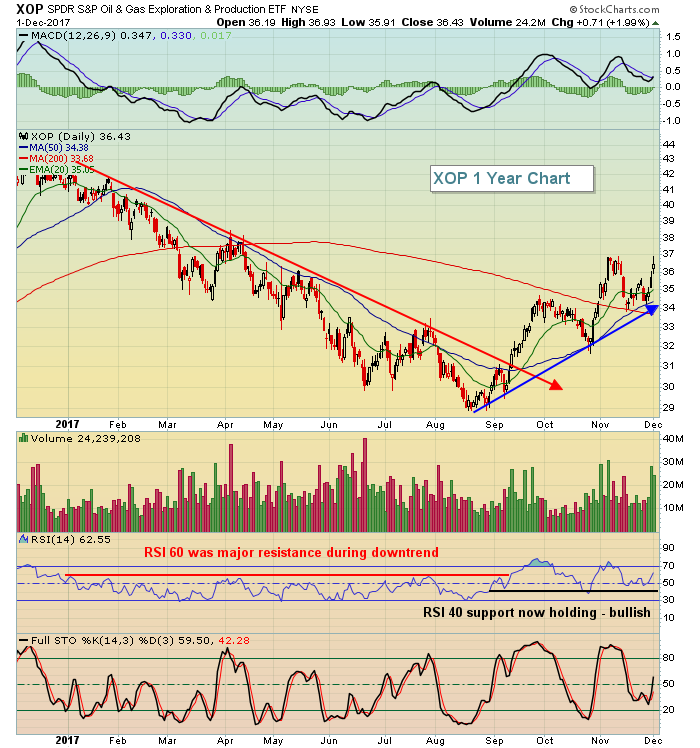

Energy Breaks Out As Oil Equipment & Services Strengthen

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 20, 2017

It's been a rough road for oil equipment & services stocks ($DJUSOI, +2.33%). They haven't broken down below summer lows, but they also haven't kept pace with the energy sector as a whole either. Yesterday'...

READ MORE

MEMBERS ONLY

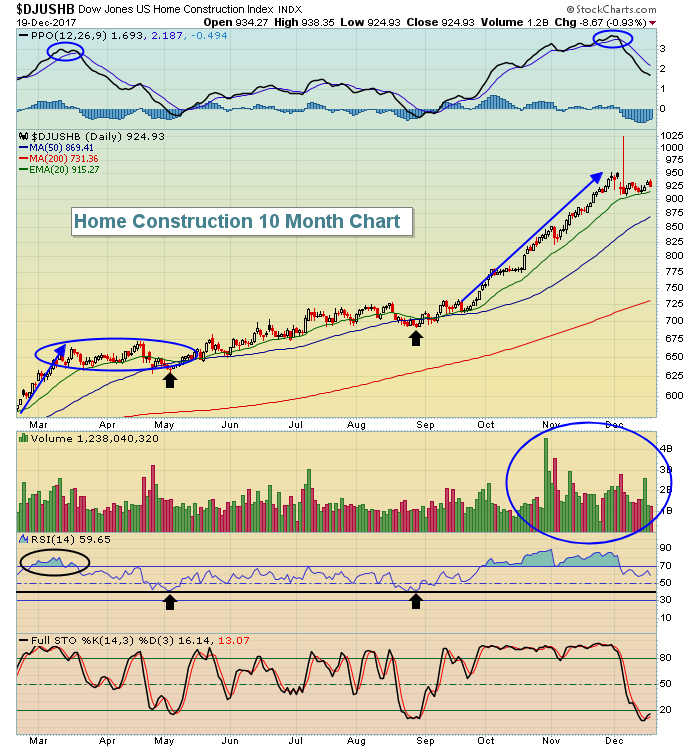

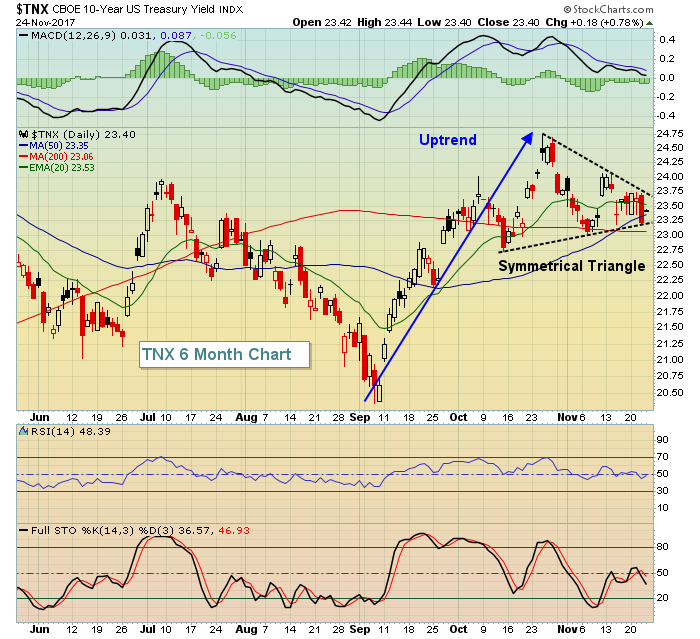

Treasury Yields Soar, On Verge Of Key Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, December 19, 2017

Housing data released the past couple days has been extremely hot with the housing price index well above expectations and then yesterday housing starts and building permits both easily surpassing Wall Street consensus estimates. This data has been expected by the stock market...

READ MORE

MEMBERS ONLY

USX, Alcoa Lead Strong Materials Sector; Russell 2000 Breaks Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 18, 2017

Rotation is powerful during bull markets and Monday's action was a perfect illustration. On November 15th, both the materials sector and small cap stocks were clear market laggards, but over the past 4-5 weeks we've seen both areas gather...

READ MORE

MEMBERS ONLY

Russell 2000 Leads Friday's Strong Advance; Small Caps Ready To Explode

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 15, 2017

Friday's action was extremely bullish. I always love to see "trend days", where prices rise across the board from opening to closing bells. Strength was found in all of our major indices with the Russell 2000 (small caps) leading...

READ MORE

MEMBERS ONLY

Here Are Five Solid Small Cap Trades And A Powerful ChartList For 2018

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Happy holidays! I want to wish everyone a joyous holiday season and here's to a happy, healthy and prosperous 2018! Thank you so much for all your support of StockCharts.com in 2017!

To better understand the reasoning for the stocks selected below, you first need to understand...

READ MORE

MEMBERS ONLY

Disney-Fox Deal Lifts Broadcasting, Consumer Discretionary

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

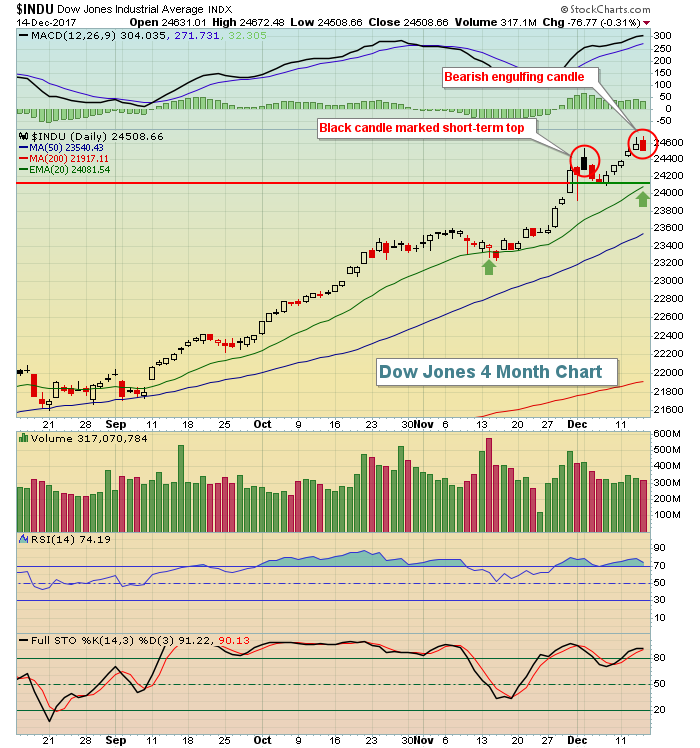

Market Recap for Thursday, December 14, 2017

Walt Disney (DIS) announced plans to purchase $52 billion of 21st Century Fox (FOXA) assets and that lifted both the broadcasting & entertainment index ($DJUSBC) and the consumer discretionary sector (XLY, +0.31%), not to mention both DIS (+2.75%) and FOXA (+6....

READ MORE

MEMBERS ONLY

Did Mylan's Shooting Star Candle Mark A Near-Term Top?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We'll soon find out. But, as a short-term trader, I'd have sold Mylan (MYL) into the close today. A close above 40.09 on heavy volume would confirm a breakout. Today, MYL hit 41.59 intraday, but fell all the way back to close at 40....

READ MORE

MEMBERS ONLY

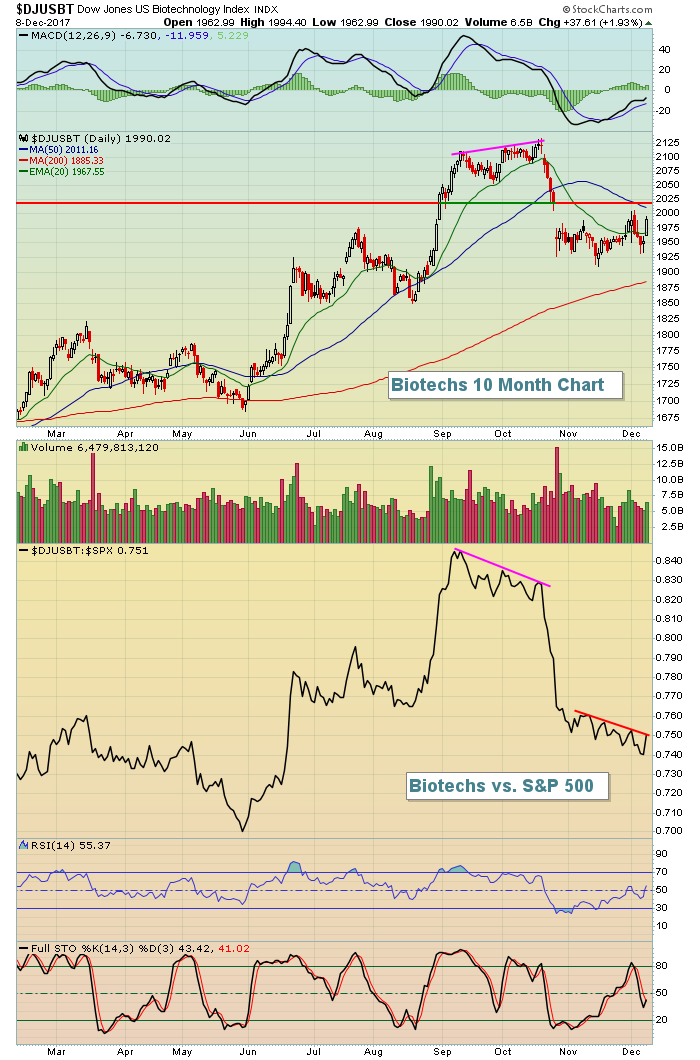

Fed Rate Hike Slams Financials; Biotechs Picking Up Steam

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 13, 2017

It was a simple case of "buy the rumor, sell the news". Financials (XLF, -1.24%) slumped on Wednesday after the Fed decided to raise interest rates another quarter point. Higher 10 year treasury yields ($TNX) typically result in money rotating...

READ MORE

MEMBERS ONLY

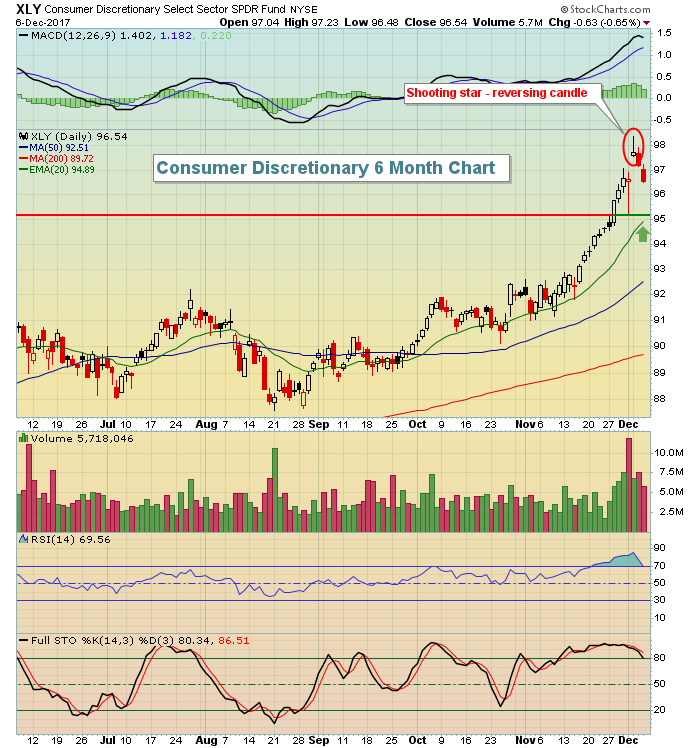

Consumer Stocks Look To Lead The Bull Market Into 2018

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, December 12, 2017

It was mixed and bifurcated action on Tuesday. The Dow Jones and S&P 500 continued their assault on the record books, but the NASDAQ and Russell 2000 both paused and pulled back. With the 10 year treasury yield ($TNX) moving back...

READ MORE

MEMBERS ONLY

Historically Low VIX Is Very Bullish For Equities; Check Out These Numbers

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 11, 2017

The Russell 2000 remained in true December form as it continues to struggle during the first half of the month, despite records being set on both the Dow Jones and S&P 500 on a daily basis. It truly is an anomaly....

READ MORE

MEMBERS ONLY

9 Trade Setups To Consider After Recent Selling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 8, 2017

While we didn't set intraday all-time highs, we did manage to close at record levels on both the Dow Jones and S&P 500, which rose 0.49% and 0.55%, respectively, on Friday. The NASDAQ tacked on 0.40%...

READ MORE

MEMBERS ONLY

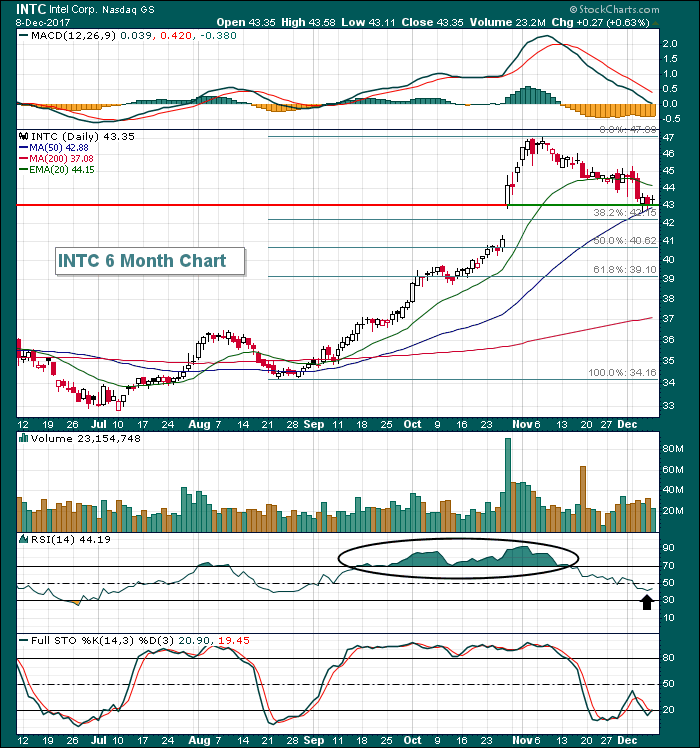

Intel Testing Key Short-Term Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

On October 26th, Intel (INTC) posted quarterly earnings results and beat both revenue and EPS estimates. It resulted in a very strong gap higher the next morning and then INTC continued rising, tacking on another 10% within a week. But INTC became very overbought with an RSI above 90 and...

READ MORE

MEMBERS ONLY

U.S. Equities Post Strongest Day In December

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, December 7, 2017

December began with a huge intraday selloff and recovery and since then, it's been mostly down action. Yesterday was the first day this month that the bulls could celebrate and feel good. Eight of nine sectors advanced with many of the...

READ MORE

MEMBERS ONLY

Here's A Pharma Printing A Hammer After Filling Gap

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm constantly looking for short-term trading opportunities and Perrigo (PRGO) fits the bill. After reporting better-than-expected results in its latest quarter, PRGO gapped up strongly and today filled its gap before finishing on a solid note to print a hammer (blue circle below) - many times a signal...

READ MORE

MEMBERS ONLY

Recent Selling In Technology Improving Trading Opportunities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 6, 2017

It was a bifurcated day on Wall Street with the NASDAQ being lifted by an improving technology sector (XLK, +0.64), while a very weak energy group (XLE, -1.30%) put the brakes on both the Dow Jones and S&P 500....

READ MORE

MEMBERS ONLY

Here's One Case For A Near-Term Top

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reminder

If you enjoy my blog articles, I'd love for you to subscribe. It's the only way I know that I'm providing you with useful and thought-provoking information. There is no charge for subscription, it's completely FREE! Simply scroll down to the...

READ MORE

MEMBERS ONLY

Dow Transports Gain 1000 Points During Last 8 Days' Melt Up

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 4, 2017

Recent bullish themes continued on Monday. Outperformance by the Dow Jones (+0.24%) and S&P 500 (-0.11%) overshadowed ugly relative performance from technology (XLK, -1.61%) and the NASDAQ (-1.05%). Even the riskier Russell 2000 index ($RUT, -0.30%...

READ MORE

MEMBERS ONLY

We're Quickly Approaching A Seasonal Bearish Period; Consider Taking Some Profits

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 1, 2017

An early selloff on Friday quickly became a buying opportunity as the bulls jumped back on board for what they hope will be another big upturn. All of our major indices ended the Friday session in negative territory, but the losses early in...

READ MORE

MEMBERS ONLY

Here Are Two Stocks To Consider In December...And One To Avoid

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I love to combine bullish seasonality with strong or strengthening technical conditions. As we move into December, it's important to realize that there has been no better month for the S&P 500 since 1950 than December, which has produced annualized returns of +19.51%. Also, December...

READ MORE

MEMBERS ONLY

The Dow Jones Has Its Biggest Gain of 2017, Closes Above 24000

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, November 30, 2017

It was another broad-based rally on Wall Street with traders ditching bonds and rushing into equities. The Dow Jones rallied 331.67 points to easily close above 24,000 for the first time in its history. The records just keep piling up. It...

READ MORE

MEMBERS ONLY

Rising Treasury Yields Signal Two Things

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's a renewed selling effort in U.S. treasuries and that's sending yields soaring. Bullish performance in small caps, transportation stocks (especially railroads), financials, industrials and consumer discretionary are painting a picture of a strengthening economy ahead and the selling of treasuries would certainly support that...

READ MORE

MEMBERS ONLY

Three Things To Take Away From Wednesday's Bizarre Market Action

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, November 29, 2017

One quick glance at the S&P 500's meager 1 point loss on Wednesday and you might assume that Wall Street meandered through another one of its boring days. But a deeper look will tell you that yesterday was anything...

READ MORE

MEMBERS ONLY

Equities Explode Higher, Led By Financials, Industrials And Small Caps

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, November 28, 2017

It was party day on Wall Street. The bullish environment accelerated into a much faster gear as all nine sectors advanced and the small cap Russell 2000 soared 23 points, or 1.53%, to a fresh new record with its most bullish historical...

READ MORE

MEMBERS ONLY

Defense Industry Stocks Look Poised To Benefit From Market Rotation

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, November 27, 2017

We saw bifurcated action in the major indices on Monday as the Dow Jones tacked on another 23 points after nearly closing above 23600 for the first time ever. Instead, the bulls had to settle for an all-time intraday high of 23638.92....

READ MORE

MEMBERS ONLY

Abbreviated Holiday Session Results In More Records

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, November 24, 2017

Wall Street was only open for half a day on Friday, but that didn't stop the bulls' momentum as all the major indices closed at fresh all-time highs. Amazon.com (AMZN) and a host of semiconductor stocks led the advance...

READ MORE