MEMBERS ONLY

Banks, Insurance And Apple Lift Dow Jones Near 23K

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 16, 2017

In true bull market fashion, U.S. stocks rose once again in rather boring action. The Dow Jones, S&P 500 and NASDAQ gained 0.37%, 0.18% and 0.28%, respectively, to each finish at all-time closing highs. The record levels...

READ MORE

MEMBERS ONLY

There's No Spooking The Bulls As Friday The 13th Results In New Record Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 13, 2017

There are plenty of superstitious folks out there, but apparently the majority of stock traders don't fall under that umbrella. U.S. equities again rose on Friday with the Dow Jones, S&P 500 and NASDAQ all climbing to all-time...

READ MORE

MEMBERS ONLY

Will Seasonal Tailwinds Stem The Tide Of Selling In This Technology Company?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Juniper Networks (JNPR) was under heavy selling pressure last week to open October, a seasonally bullish month for JNPR as the stock has averaged gaining more than 13% each October over the past two decades. The irony here is that we've seen JNPR twice in recent years open...

READ MORE

MEMBERS ONLY

Sectors Mixed, But That Doesn't Slow Down U.S. Equities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, October 12, 2017

It was certainly a bifurcated day among sectors. Four sectors advanced, including industrials (XLI, +0.53%) and utilities (XLU, +0.52%), while five declined. Financials (XLF, -0.76%) were hardest hit as the 10 year treasury yield ($TNX) has struggled to gain any...

READ MORE

MEMBERS ONLY

Bullish Momentum Building Again On AMD

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Advanced Micro Devices (AMD) spent over a year with its SCTR among the highest of all individual stocks. It was an impressive rally for sure as its stock price rose from below $2 to above $15 in 13 months. But even the hottest stocks need to evenually consolidate to unwind...

READ MORE

MEMBERS ONLY

Broadline Retailers Move To Two Month High To Lead Major Indices

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

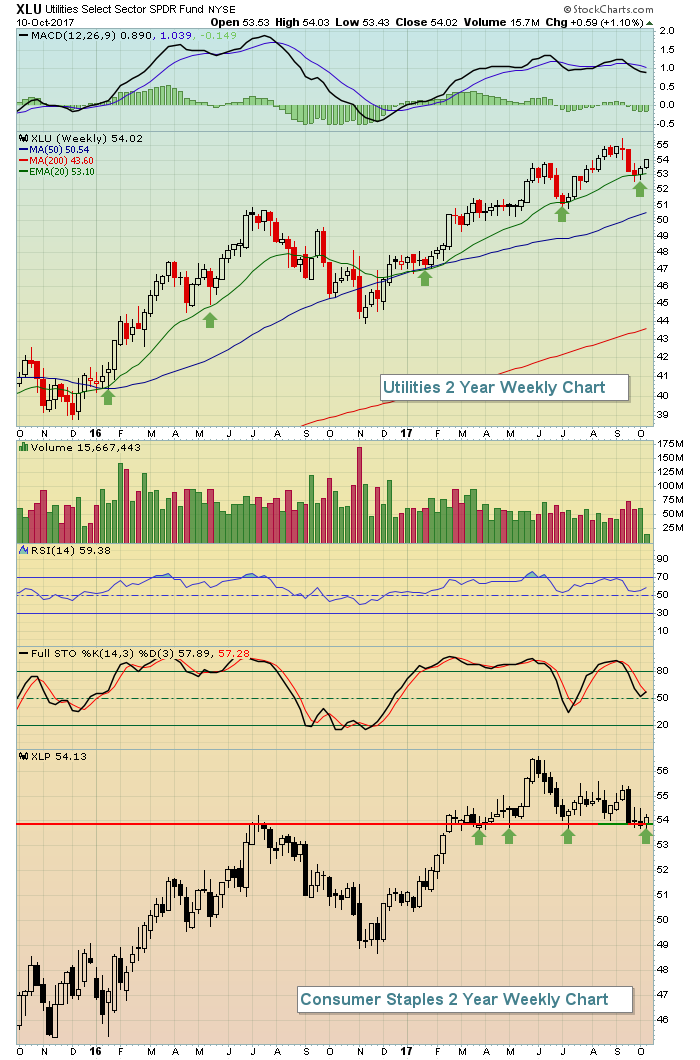

Market Recap for Wednesday, October 11, 2017

A strange pair - utilities (XLU, +0.43%) and technology (XLK, +0.33%) - combined to lead our major indices higher on Wednesday with the NASDAQ rising 0.25% to close at another all-time high. Seven of the nine sectors ended the day...

READ MORE

MEMBERS ONLY

Late Day Buying Sends Dow Jones Into The Record Books Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 10, 2017

The Dow Jones finished 69 points higher on Tuesday to close at yet another all-time high. It's an illustration of how equities can remain overbought for an extended period of time. The Dow Jones moved into overbought territory (RSI 70+) 7-8...

READ MORE

MEMBERS ONLY

Is Now The Time To Jump In F5 Networks?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

F5 Networks (FFIV) has a seasonal history of performing extremely well in October and November, but technically the stock has been a wreck since topping in March 2017 and the early October returns haven't been very good either. There is hope, however, in the form of upcoming price...

READ MORE

MEMBERS ONLY

Specialty Retailers Flash Short-Term Sell But Long-Term Buy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 9, 2017

The U.S. major stock market indices took a breather - if you want to call it that - on Monday as the Dow Jones, S&P 500 and NASDAQ all fell less than 0.25%. Only the Russell 2000 lost more...

READ MORE

MEMBERS ONLY

Bull Market Resiliency Shines Through After Weak Jobs Report

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 9, 2017

Extremely overbought and extended conditions. Complacency in the form of a very low Volatility Index ($VIX) reading. Geopolitical tensions. Then a negative jobs report. The market was surely doomed on Friday, right? Wrong. That complacency, as evidenced by near record low readings in...

READ MORE

MEMBERS ONLY

This Tech Company Just Broke Out Of Bullish Pattern With Rising SCTR

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

While we've seen many indices, ETFs and individual stocks break out over the past several weeks, there are still many that are consolidating in bullish fashion and those, upon breakout, provide solid trading opportunities. Enter DXC Technology Company (DXC). Over the past two months, the S&P...

READ MORE

MEMBERS ONLY

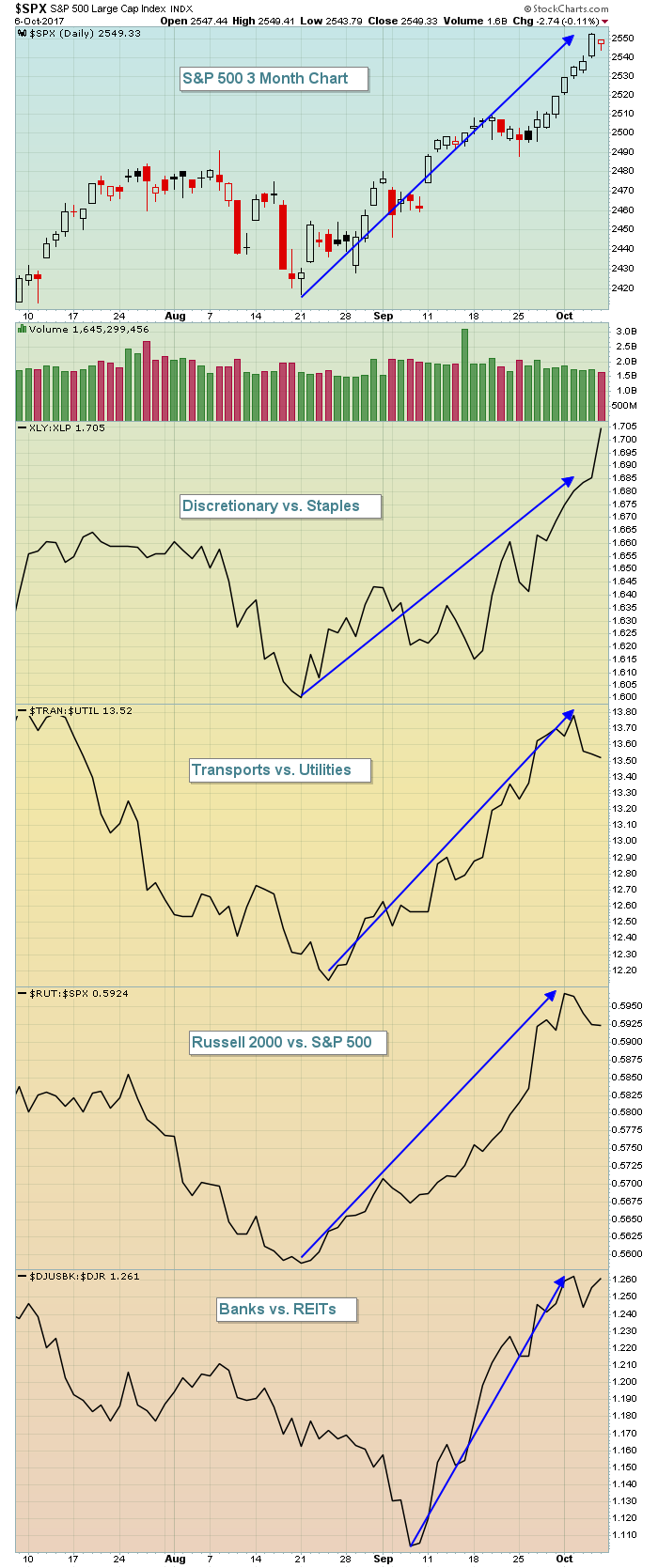

Four Critical Signals That Confirm It's Full Speed Ahead For Equities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been following the stock market for a long time and I'm always searching for that perfect signal that never fails. I still haven't found it and there are never any guarantees in the stock market, BUT following the rotation of money to aggressive...

READ MORE

MEMBERS ONLY

Right On Cue, Internet Stocks Break Out; NASDAQ 100 Soars

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, October 5, 2017

Well, if you were worried about an underperforming technology sector and the inability of the NASDAQ 100 ($NDX) to reach new highs, you can stop worrying. Both broke out on Thursday with emphatic moves to clear highs established over the summer. First, check...

READ MORE

MEMBERS ONLY

BlackBerry: Will This Rally Be Any Different Than The Last Several?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Blackberry's (BBRY) demise from 2008 through 2012 has been well documented and I'm not really interested in dwelling in that past. More recently, however, BBRY has attempted on multiple occasions to clear price resistance in the 11-12 range. Clearing such resistance would be technically significant and...

READ MORE

MEMBERS ONLY

Consumer Stocks, Healthcare Take Their Turn To Lead U.S. Equities To New Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 4, 2017

This bull market advance continues to be about rotation. Index rotation. Sector rotation. Individual stock rotation. Few areas of the market are breaking down. It's mostly about gains, consolidation, then more gains. On Wednesday, the red hot Russell 2000 took a...

READ MORE

MEMBERS ONLY

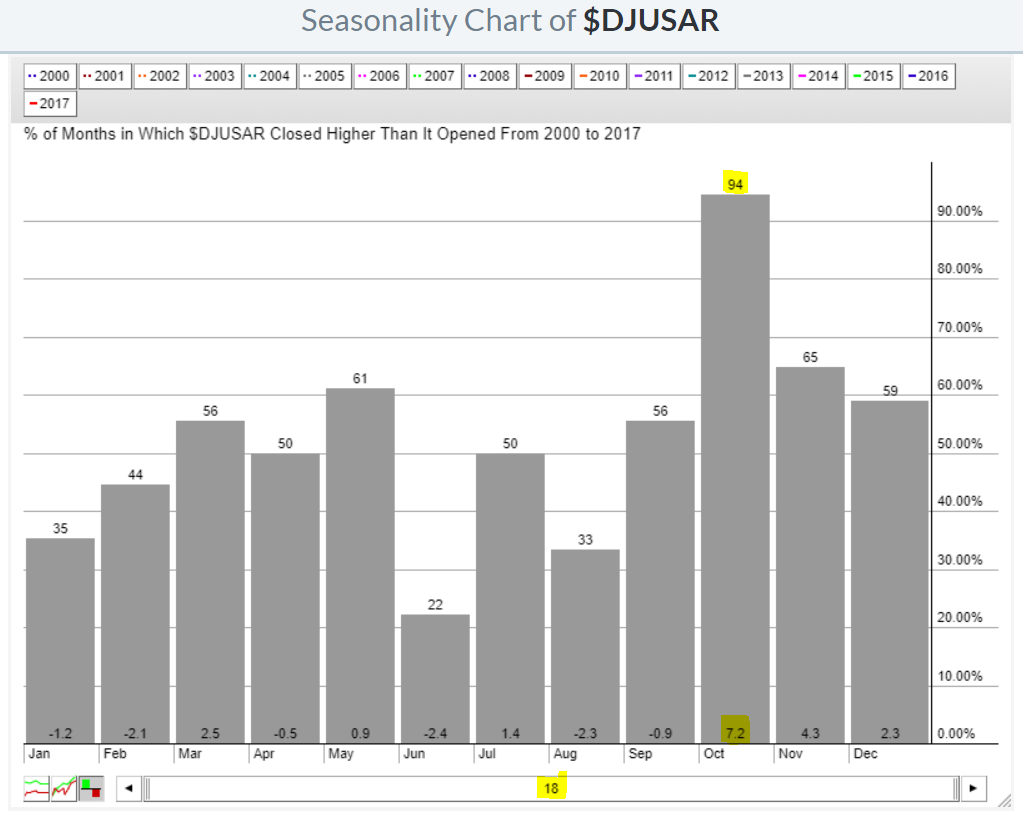

Airlines Catch Seasonal Jet Stream To Lead Transports, Market Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 3, 2017

It didn't take long for the seasonal tailwinds to kick in for airlines ($DJUSAR). I posted last Friday that airlines were poised to breakout technically and highlighted Alaska Air Group (ALK) as one airline that has performed extremely well during the...

READ MORE

MEMBERS ONLY

Airlines Begin Their Typical October Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Airlines ($DJUSAR) absolutely "took off" in today's action as buyers emerged to drive nearly every airline higher. Spirit Airlines (SAVE) surged 7.10%. JetBlue Airways (JBLU) popped 7.08%. Delta Air Lines (DAL) jumped 6.62%. One fundamental reason for the group's strength was...

READ MORE

MEMBERS ONLY

October Begins In Record-Setting Fashion

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 2, 2017

It was another record day on Wall Street. The Dow Jones, S&P 500, NASDAQ and Russell 2000 all closed at fresh all-time highs. Wide participation is a hallmark of a bull market rally and, make no mistake, there's been...

READ MORE

MEMBERS ONLY

The Fourth Quarter Begins With Seasonal And Technical Signals Aligning Bullishly

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 29, 2017

We wrapped up the third quarter on Friday with all-time highs showing up everywhere. There was a big buying push into the close on Friday, likely in anticipation of more strength during the fourth quarter. There was strength in most aggressive areas of...

READ MORE

MEMBERS ONLY

Two Bullish Charts In A Very Bullish Industry

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Delivery services ($DJUSAF) broke out of a bullish continuation cup with handle pattern a few weeks ago and appears poised for a further fourth quarter rally, albeit with some profit taking along the way. Bullish continuation patterns require a prior uptrend and the DJUSAF certainly had that. Check out the...

READ MORE

MEMBERS ONLY

Airlines Looking To Rally In October?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 28, 2017

After early selling on Thursday, U.S. indices mostly rebounded throughout the balance of the day resulting in mostly slight gains by day's end. Materials (XLB, +0.71%) performed quite well after nearly testing its rising 20 day EMA on Wednesday....

READ MORE

MEMBERS ONLY

U.S. Equities Rally As Treasury Yields Soar

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 27, 2017

U.S. stocks were lifted at least in part by rising treasury yields. The 10 year treasury yield ($TNX) spiked 8 basis points and that represents a significant selloff in treasuries. Those proceeds tend to be reinvested in equities and that was certainly...

READ MORE

MEMBERS ONLY

Bearish Seasonal Summer Period Coming To An End

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 26, 2017

Late day selling created a bifurcated U.S. market on Tuesday as small caps performed quite well ($RUT, +0.34%), while the Dow Jones finished slightly in negative territory. Technology (XLK, +0.36%) rebounded after Monday's selling to lead most of...

READ MORE

MEMBERS ONLY

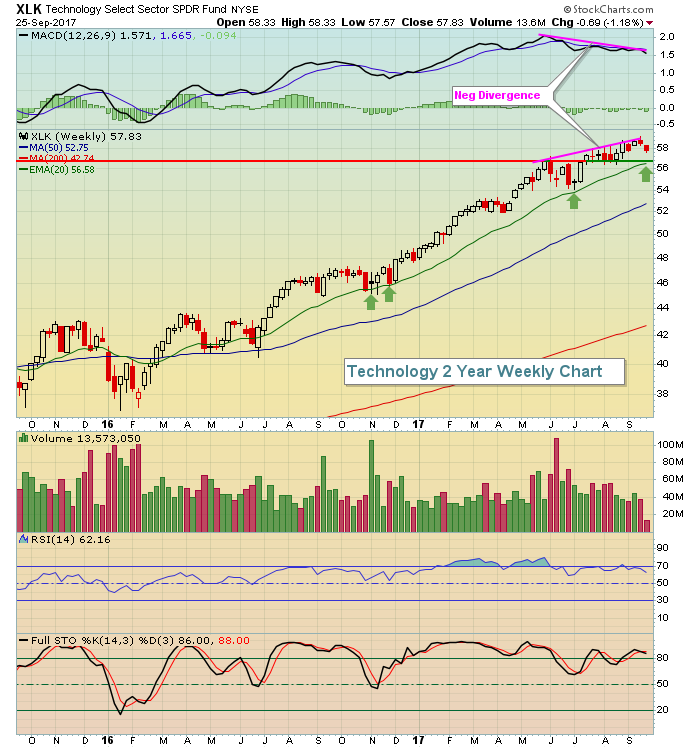

Technology Slumps As Facebook Falls On Heavy Volume

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, September 25, 2017

Technology (XLK, -1.18%) was the only real problem on Monday, but it was a big problem. Mobile telecommunications ($DJUSWC) and internet stocks ($DJUSNS) were the big losers with the latter slammed by Facebook (FB), which dropped nearly 5% on extremely heavy volume....

READ MORE

MEMBERS ONLY

Russell 2000 Tests Key Resistance, Primed To Lead In 4th Quarter

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 22, 2017

Friday was a bifurcated kind of day on Wall Street. We saw a small loss on the Dow Jones, while there were slight gains on the other major indices. The Russell 2000, in particular, saw relative strength and gained nearly 7 points to...

READ MORE

MEMBERS ONLY

Tesla Weakens But Chart Is On Cruise Control

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Tesla (TSLA) remains a crowd favorite as the stock's 2017 advance has been accompanied by extremely heavy volume. I see major accumulation when I look at TSLA's chart. But like every other stock, momentum can become an issue from time to time and TSLA appears to...

READ MORE

MEMBERS ONLY

Taking A Look At Near-Term Downside Risk For The S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 21, 2017

We are in one of the most bearish historical periods of the year and I've provided a bit more information about it in the Historical Tendencies section below. I'm pointing this out because equities took a break on Thursday...

READ MORE

MEMBERS ONLY

Let Interest Rates Soar If You're Long Equities!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Fed Chair Janet Yellen suggested there'd be another interest rate hike in 2017 and the Fed's overall tone was a bit more hawkish than was anticipated by Wall Street. That resulted in a big spike in the 10 year treasury yield at 2pm EST yesterday, the...

READ MORE

MEMBERS ONLY

Railroads, Transports Lead Dow Jones To 6th Consecutive All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 20, 2017

It was another stellar day for industrials (XLI, +0.73%) as this sector led the Dow Jones to a 6th consecutive record closing high. The gains have been fairly slow and methodical, but that's how bull market advances work. They tend...

READ MORE

MEMBERS ONLY

The Fed's On Deck And THIS Is Why We Want To See Interest Rates Rise

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reminder

Be sure to scroll down to the bottom of my article and click the "Notify Me" button if you'd like to receive my article each morning before the stock market opens. The subscription is FREE and my article is a great way to start your...

READ MORE

MEMBERS ONLY

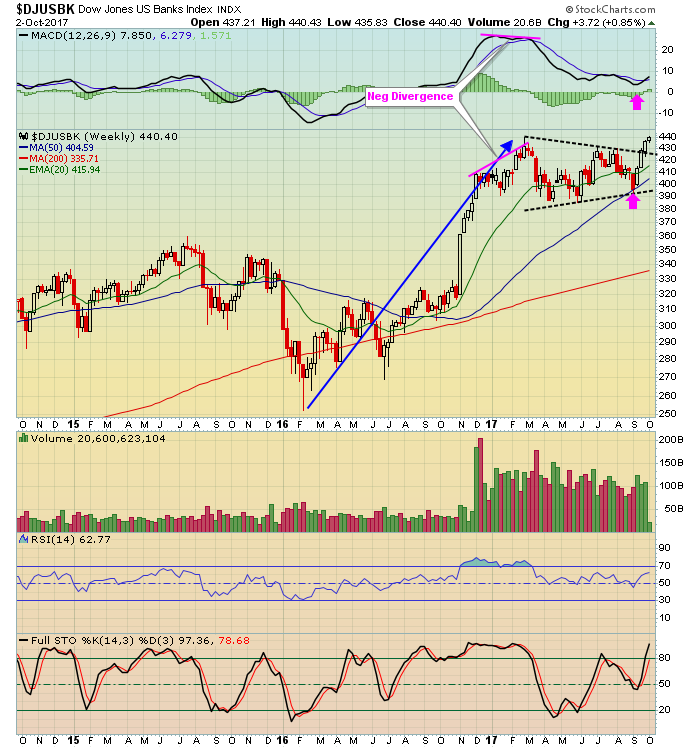

Banks Strengthen To Lead Financials, Major Indices Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, September 18, 2017

It was another very bullish day on Wall Street as most indices finished with gains once again. The Russell 2000 ($RUT) led the charge with a 0.65% rise. Gains in the Dow Jones and S&P 500 were more modest, but...

READ MORE

MEMBERS ONLY

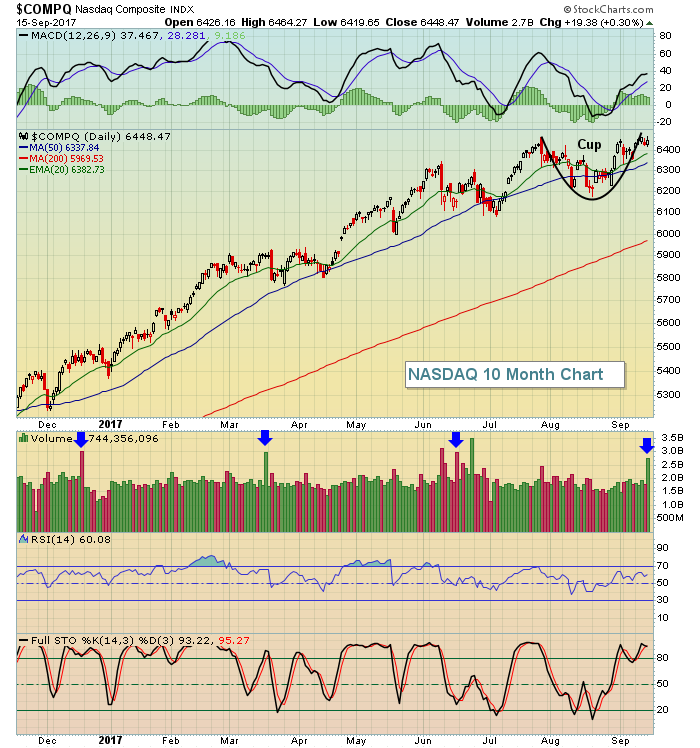

S&P 500 Tops 2500 For First Time; Monday Trade Setups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 15, 2017

It was another day of records on Wall Street to close out the week. Despite the peak of seasonal summer weakness approaching, buyers stepped up to the plate once again, this time driving S&P 500 prices to another all-time high close...

READ MORE

MEMBERS ONLY

Finding Stocks Poised To Begin A Pre-Earnings Run Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If only it was that easy, right? The problem many times is that a company that reports great results one quarter fails to do so the next. But my strategy is to find companies that not only reported great results in the prior quarter, but also showed major accumulation at...

READ MORE

MEMBERS ONLY

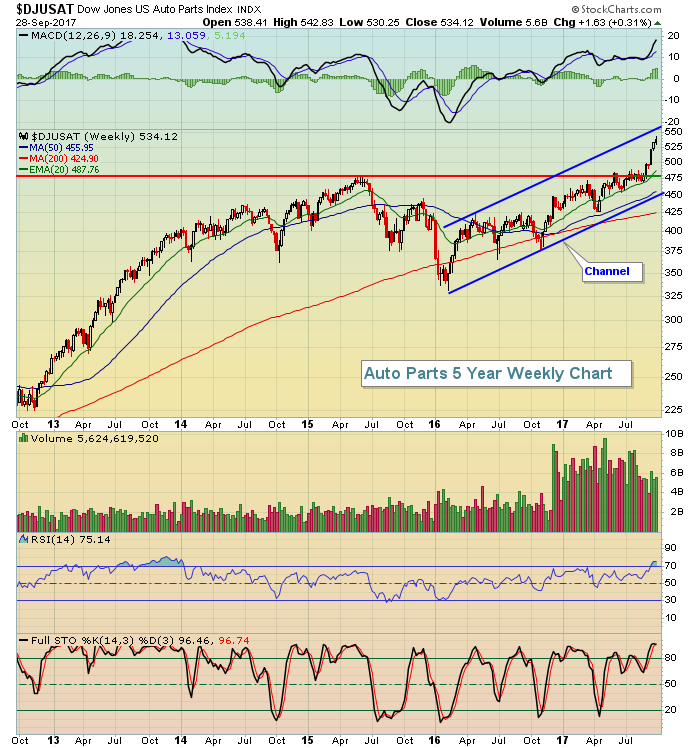

Autos And Auto Parts Continue To Strengthen After Their Recent Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 14, 2017

Consumer discretionary (XLY, -0.54%) was the worst performing sector on Thursday, but you'd never know it from looking at the automobiles or auto parts stocks. The Dow Jones U.S. Automobiles & Parts Index ($DJUSAP) is featured below in the...

READ MORE

MEMBERS ONLY

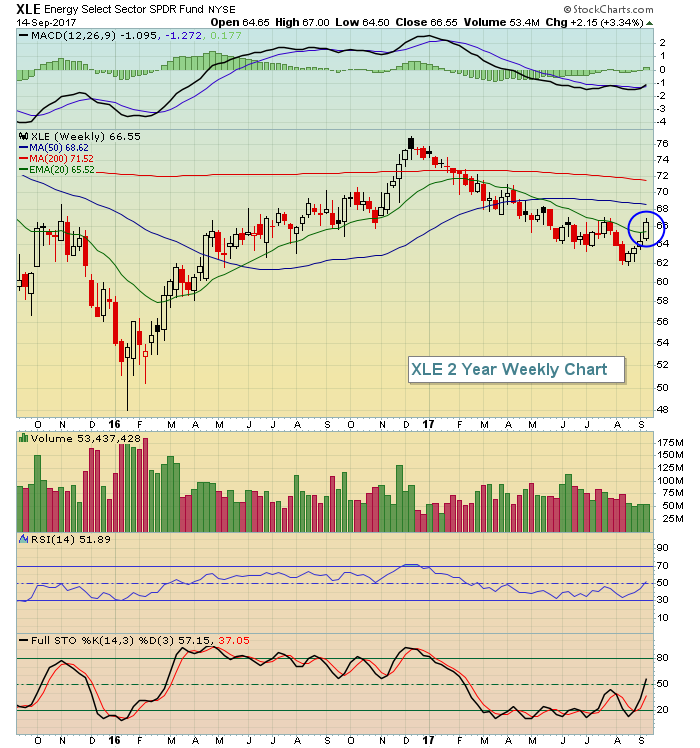

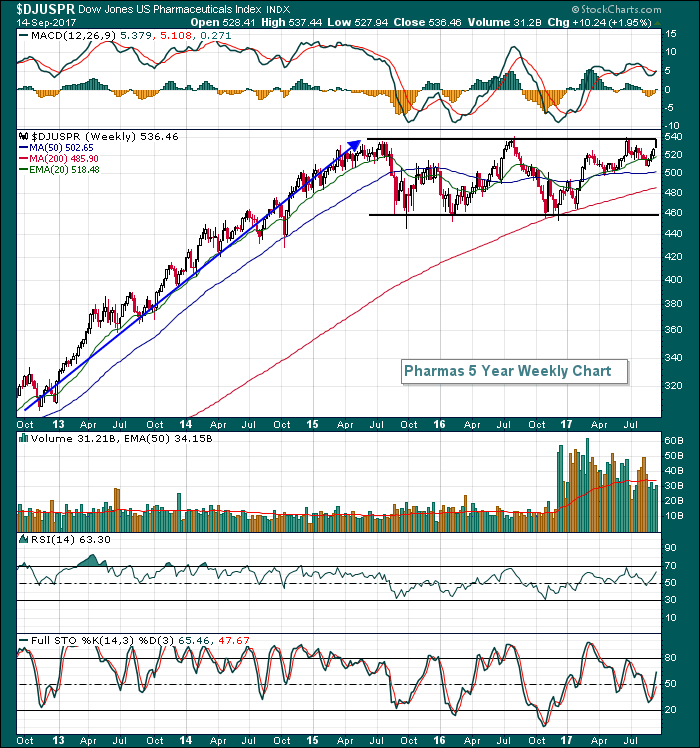

After Long Basing Period, Pharmas Look To Break Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Sometimes the best moves higher occur after an extended period of sideways price action, or basing. We recently saw a breakout in biotechs ($DJUSBT) and that industry quickly became one of the strongest. The healthcare sector (XLV) also has been among the strongest sectors. It makes sense that other healthcare...

READ MORE

MEMBERS ONLY

All-Time High Virus Spreads; NASDAQ And Dow Jones Catch It

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

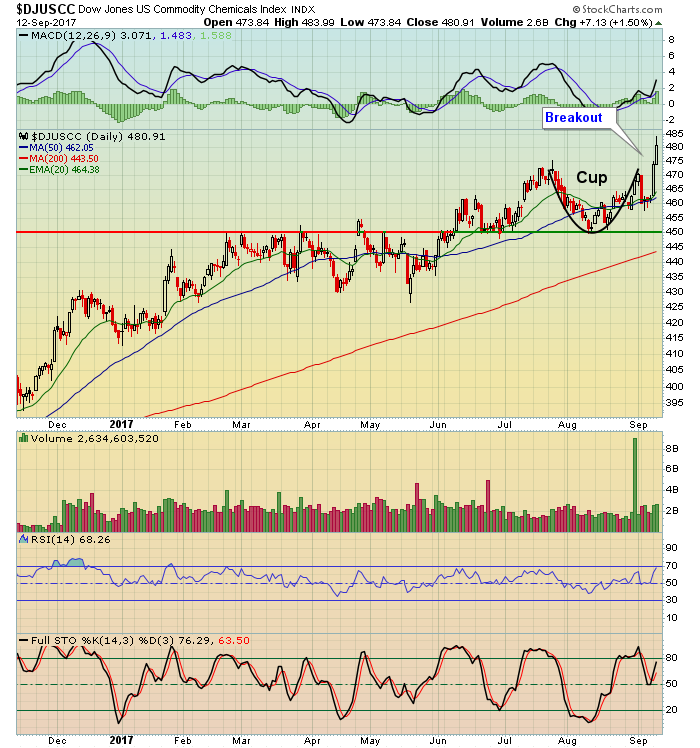

Market Recap for Wednesday, September 13, 2017

Wide participation is a key to sustaining a bull market advance. We want as many indices, sectors and stocks on a buy signal as possible. That makes it nearly impossible for bears to regain control of the market as technical buyers show up...

READ MORE

MEMBERS ONLY

Banks Lead Follow Through Rally As They Bounce Off Key Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 12, 2017

Financials (XLF, +1.18%) were the primary beneficiary on Tuesday as treasury yields rose. That typically leads to strength in this sector, with particular strength usually seen in banks ($DJUSBK) and life insurance ($DJUSIL). Yesterday was no exception and the DJUSBK is featured...

READ MORE

MEMBERS ONLY

S&P 500 Breaks Out To All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

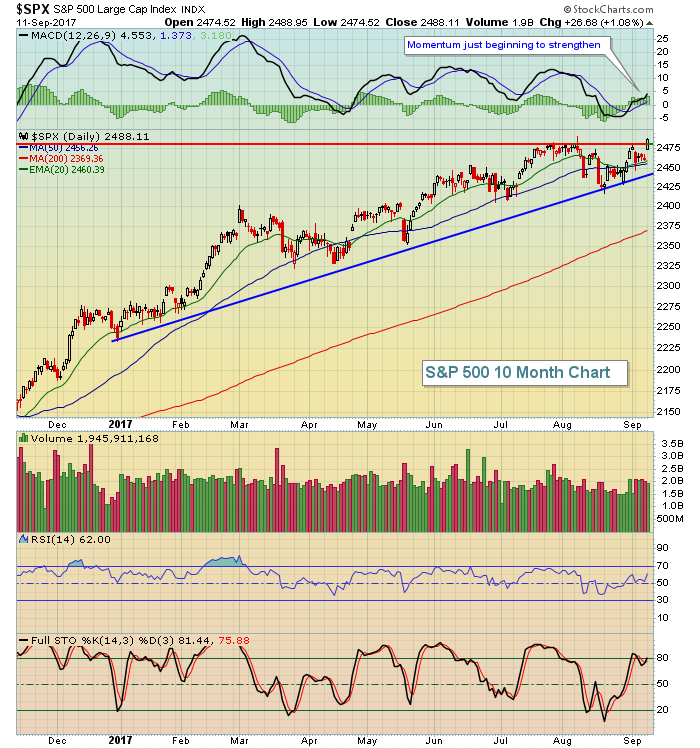

Market Recap for Monday, September 11, 2017

It was a very bullish day on Wall Street. First and foremost, the benchmark S&P 500 rose more than 1% to close at a fresh all-time high. Its previous closing high was approximately 2481. The bulls left no doubt about this...

READ MORE

MEMBERS ONLY

Bifurcated Friday Session For Major Indices, Sectors

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 8, 2017

The NASDAQ fell on Friday mostly due to a very weak technology sector (XLK, -0.82%). Computer hardware ($DJUSCR) tumbled as Apple (AAPL) closed well below its 20 day EMA on heavier than normal volume for the first time since its big drop...

READ MORE

MEMBERS ONLY

September StockCharts Outlook Webinar Begins At 11am EST

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Just a quick reminder that Greg Schnell and I will be hosting StockCharts Outlook webinar for September in one hour, beginning at 11am EST. Please join us if you're available. It's free and you can REGISTER HERE!

Happy trading!

Tom...

READ MORE