MEMBERS ONLY

Financials Lead Dow Jones Rally; Costco Rebounds

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 31, 2017

The Dow Jones set another all-time high on Monday, rising another 60 points in its lone attempt to carry the bull market to new heights. All of our other major indices fell on Monday despite the renewed strength of financials (XLF, +0.72%...

READ MORE

MEMBERS ONLY

Defense Stocks Bounce Off Price Support; Dow Jones Sets New Record

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 28, 2017

The U.S. stock market has been quite resilient and today wraps up a very strong July. On Friday, only the Dow Jones finished higher - and at a fresh new record high - while healthcare (XLV, +0.50%) and industrials (XLI, +0....

READ MORE

MEMBERS ONLY

The Best Industry Within The Best Sector Awaits Its Next Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

You might find it surprising, but healthcare (XLV, +15.51%) has posted the best six month performance among all sectors - even technology (XLK, +14.10%). All five industry groups within healthcare have gained 10% or more in the past six months with medical supplies ($DJUSMS, +23.32%) leading the...

READ MORE

MEMBERS ONLY

Amazon Disappoints, Techs Look To Head Lower

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, July 27, 2017

The mostly unabated rise in technology shares off the early July low took a sudden turn lower on Thursday afternoon and the initial reactions to quarterly earnings reports from Amazon.com (AMZN) and Starbucks (SBUX) won't help this morning as they&...

READ MORE

MEMBERS ONLY

Tractor Supply May Have Set A Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The NASDAQ 100 has been quite strong in 2017, but it's not because of Tractor Supply's (TSCO) performance. TSCO had lost one third of its market value from the beginning of the year through early July, but a positive divergence emerged and that suggested that downside...

READ MORE

MEMBERS ONLY

Transportation Services Ready To Breakout, Ryder Trucking Along

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 26, 2017

The small cap Russell 2000 index struggled, finishing down 0.56% on Wednesday's session, but it was another day of record high closes elsewhere as the Dow Jones, S&P 500 and NASDAQ all advanced. The FOMC provided its latest...

READ MORE

MEMBERS ONLY

Copper And Oil Surge; Materials Among Leaders

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 25, 2017

Energy shares (XLE, +1.26%) received another boost when crude oil prices ($WTIC) surged on Tuesday to close at $47.89 per barrel (+3.34%), its highest close in nearly two months. While the crude oil spike extends a very nice rally off...

READ MORE

MEMBERS ONLY

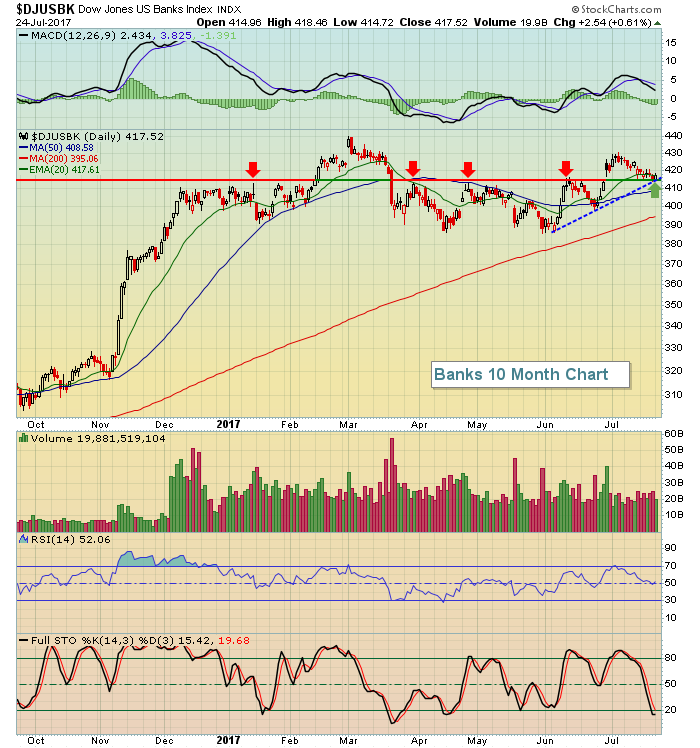

Banks Bounce Off Support, Financials Lead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 24, 2017

It was another bifurcated session as the more aggressive NASDAQ and Russell 2000 led while the Dow Jones and S&P 500 took a breather. That's been the theme of late and as long as the more aggressive indices lead,...

READ MORE

MEMBERS ONLY

U.S. Stocks Finish A Strong Week With A Flat Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 21, 2017

Friday was definitely a boring kind of day, but the bulls will generally take boring - especially after a nice push higher and a huge slate of earnings about to be released this week. While all of our major indices finished Friday on...

READ MORE

MEMBERS ONLY

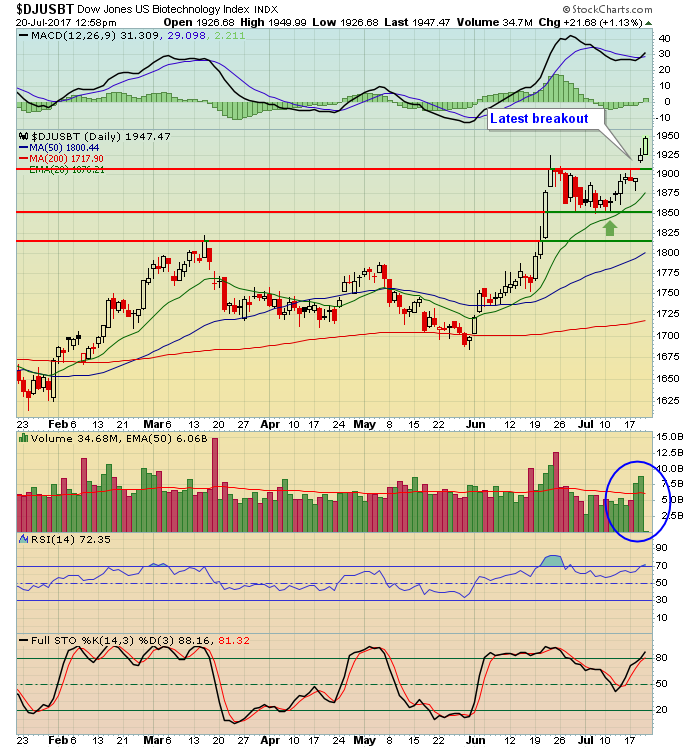

Biotechs Surge Again To New Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Biotechnology stocks ($DJUSBT) are among the best performing stocks since the beginning of June with an approximate 16% gain over the past seven weeks. It's not unusual for biotechs to remain on a tear for an extended period of time so pullbacks should be considered for entry. The...

READ MORE

MEMBERS ONLY

Coal And Renewable Energy Surge To Lead U.S. Equities To Fresh Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 19, 2017

Energy (XLE, +1.46%) and materials (XLB, +0.96%) led the major U.S. indices to all-time highs on Wednesday, with particular strength in coal ($DJUSCL) and renewable energy ($DWCREE), which rose 6.36% and 3.08%, respectively. The former's strength...

READ MORE

MEMBERS ONLY

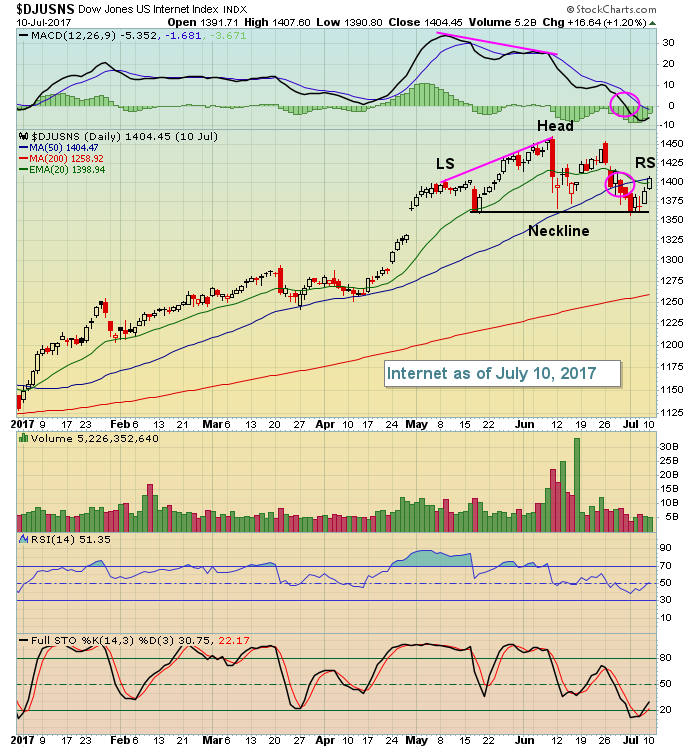

Internet Stocks Break Out, Lead Technology And NASDAQ

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 18, 2017

It was a rough June for technology stocks and, more specifically, internet stocks ($DJUSNS), but they've both rebounding during an exceptional July. It appears that traders have re-entered this space in anticipation of very strong upcoming quarterly earnings reports. It'...

READ MORE

MEMBERS ONLY

Small Stocks Close At Fresh All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 17, 2017

It seems that every major U.S. index is taking its turn at all-time highs and on Monday small cap stocks stepped up to the plate, closing at 1431.60, its highest close ever. It's interesting because it did so on...

READ MORE

MEMBERS ONLY

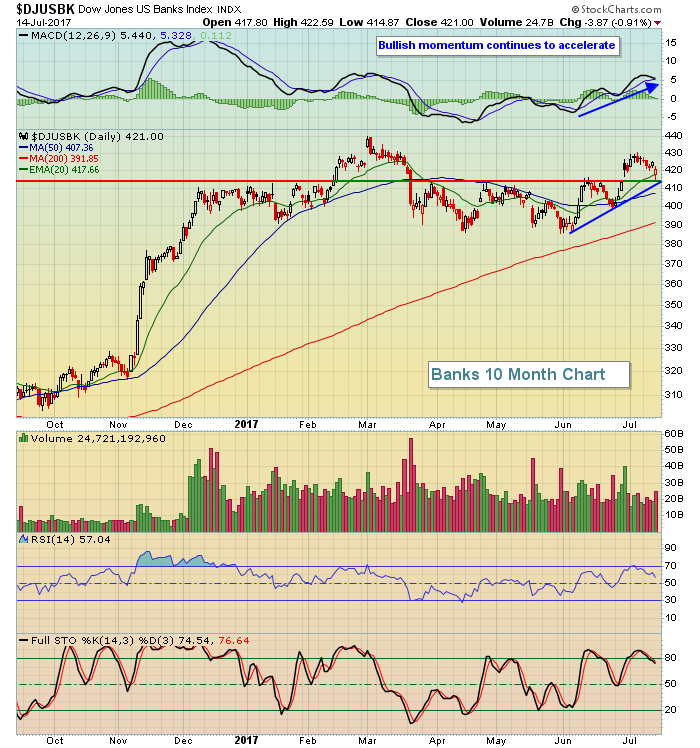

Long Awaited Bank Earnings Were A Dud.....Or Were They?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 14, 2017

JPMorgan (JPM), Citigroup (C), PNC Financial (PNC) and Wells Fargo (WFC) were a formidable sample of bank stocks ($DJUSBK) reporting earnings last Friday and it was set up to be a very interesting trading day - to see if the huge run up...

READ MORE

MEMBERS ONLY

Texas Roadhouse Might Whet Your Appetite

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When money begins rotating to defense in a big way, I look for topping patterns in the market. But when we're in the midst of a full-fledged bull market - as we are now - I'd much rather search for stocks in bullish continuation patterns. That...

READ MORE

MEMBERS ONLY

Go Away In May? Let's Try July

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As a stock market historian, if there's one thing that really annoys me, it's the talking heads saying to "go away in May". While the May through October period is clearly less bullish than its November through April counterpart, there are loads of reasons...

READ MORE

MEMBERS ONLY

Large Banks Kick Off Earnings Season

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

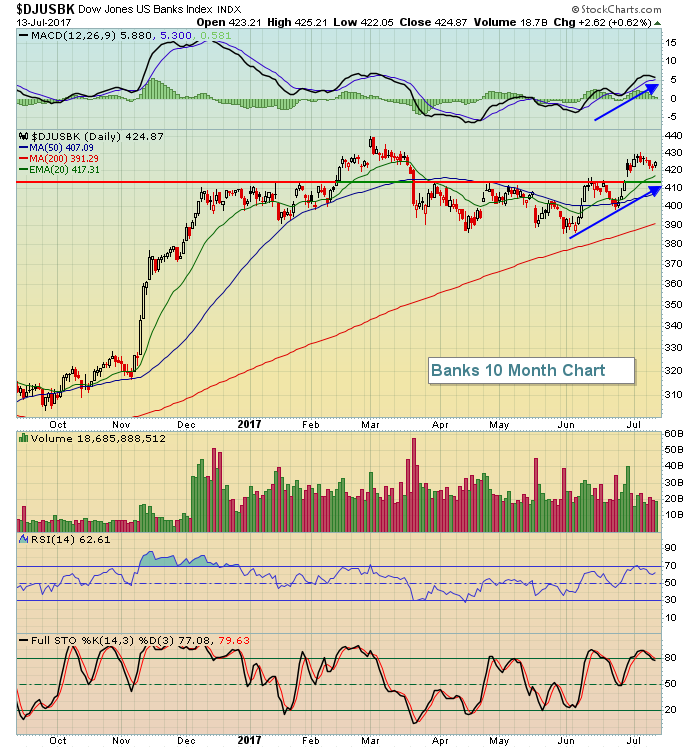

Market Recap for Thursday, July 13, 2017

Financials (XLF, +0.60%) rebounded to lead the market action on Thursday, in anticipation of large bank earnings scheduled to be reported this morning. The Dow Jones U.S. Banks Index ($DJUSBK) remains in a strong technical pattern, but has room to the...

READ MORE

MEMBERS ONLY

Equities Surge On Dovish Fed Remarks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 13, 2017

Fed Chair Janet Yellen provided the Fed's semiannual monetary policy to the House Financial Services Committee on Wednesday morning, just prior to the opening of the stock market and both the bond market and stock market loved what it heard. The...

READ MORE

MEMBERS ONLY

Financials Hit Resistance And Weaken As Yields Fall

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

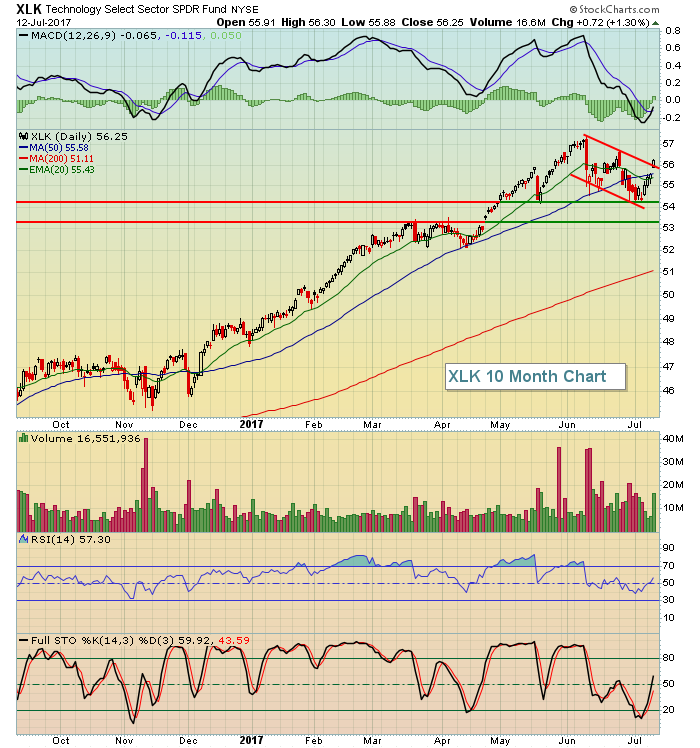

Market Recap for Tuesday, July 11, 2017

Only two of nine sectors - energy (XLE, +0.54%) and technology (XLK, +0.22%) were able to finish in positive territory on Tuesday. Given that overall weakness, it was interesting to see that only one of our major indices lost ground (S&...

READ MORE

MEMBERS ONLY

Technology Rebound Strengthens With Internet Stocks Hitting Key Level

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 10, 2017

The NASDAQ and S&P 500 rallied on Monday, posting gains of 0.38% and 0.09%, respectively. The small cap Russell 2000 index was easily the worst performing major index, losing 0.52% on the session. Despite the weakness, the Russell...

READ MORE

MEMBERS ONLY

Homebuilders Strong; Dow Component McBreaks Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 7, 2017

Dow Jones component McDonalds Corp (MCD) jumped more than 2% on Friday, extending an already strong 2017 with another all-time high closing breakout. It helped to lead a strong restaurants & bars ($DJUSRU) industry, which rose 1.26%. That, in turn, helped the...

READ MORE

MEMBERS ONLY

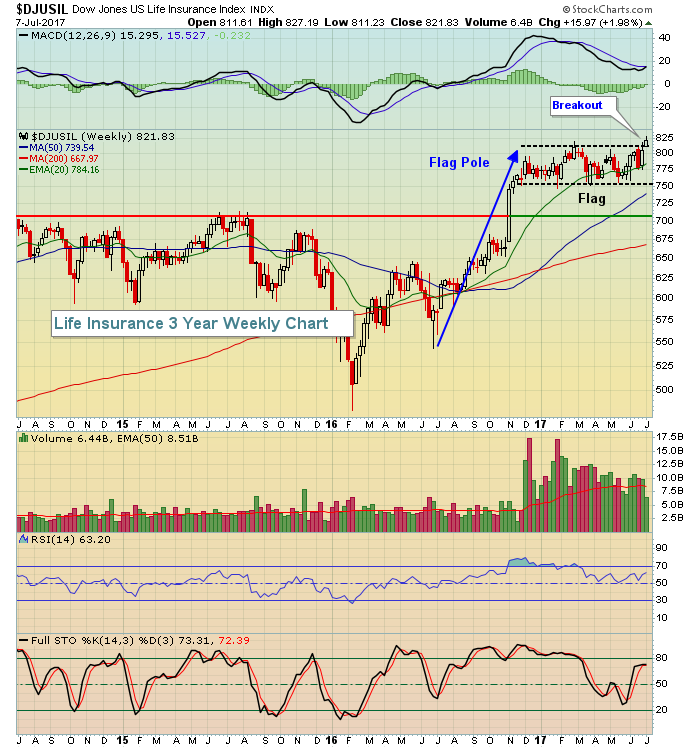

Life Insurance Index Breaks To All-Time High; Check Out This Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Higher treasury yields ($TNX) are feared in some parts of the stock market like utilities (XLU), but not in others - especially in banking ($DJUSBK) and life insurance ($DJUSIL) where profits tend to soar during periods of rising interest rates. The recent spike in the 10 year treasury yield ($TNX)...

READ MORE

MEMBERS ONLY

Bears Grip Wall Street, Key Levels To Watch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Announcement

Greg Schnell and I will be co-hosting the latest StockCharts Outlook webinar tomorrow, July 8th at 11am EST. Please join us as we discuss what went right and wrong during the first half of 2017 and where we see the market heading in the second half. Have we...

READ MORE

MEMBERS ONLY

Healthcare Is Entering A New Period Of Relative Strength

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Bull markets are comprised of rotating sector strength and bullishness. On a relative basis, healthcare (XLV) was a laggard during 2009 and 2010 before outperforming in a major way from 2011 through 2015. The sector saw relative weakness for nearly two years beginning in mid-2015, but has now resumed its...

READ MORE

MEMBERS ONLY

Technology Rebounds, Crude Oil Plunges

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 5, 2017

Crude oil prices ($WTIC) tumbled on Wednesday and that put an abrupt end to the recent strength in energy shares (XLE, -2.03%). It's also one reason why I need to see the XLE downtrend end before I'd grow...

READ MORE

MEMBERS ONLY

Energy And Financials Fuel Rally As 10 Year Treasury Yield Breaks Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 3, 2017

Energy (XLE, +1.93%) had another strong day as crude oil ($WTIC) surged above $47 per barrel and tested its 50 day SMA for the first time in over a month. The XLE has overhead resistance issues using multiple time frames, the first...

READ MORE

MEMBERS ONLY

Industrials Lead Friday's Action But Market Bifurcated

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 30, 2017

We once again witnessed market bifurcation with both the Dow Jones and S&P 500 rising slightly, while the more aggressive NASDAQ and Russell 2000 finished with absolute and relative weakness. The Dow Jones received a big lift from Nike (NKE), which...

READ MORE

MEMBERS ONLY

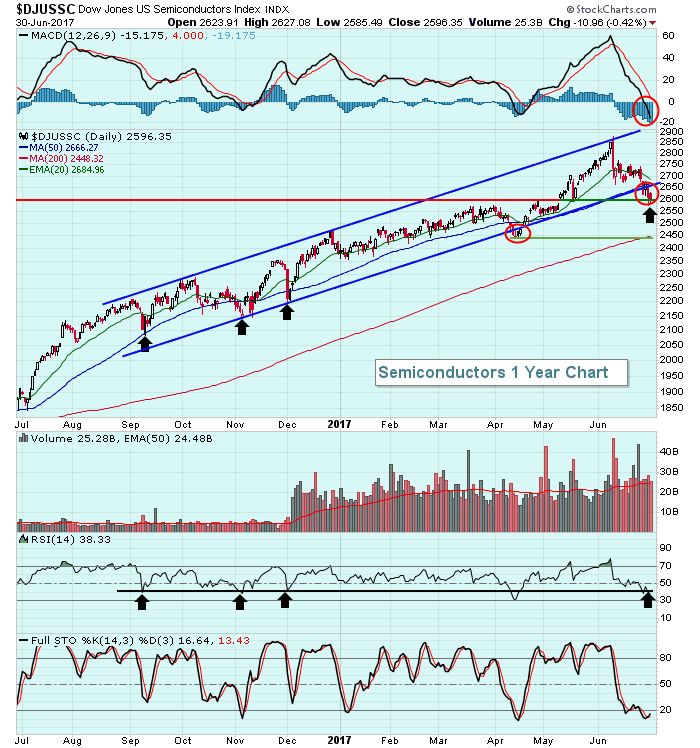

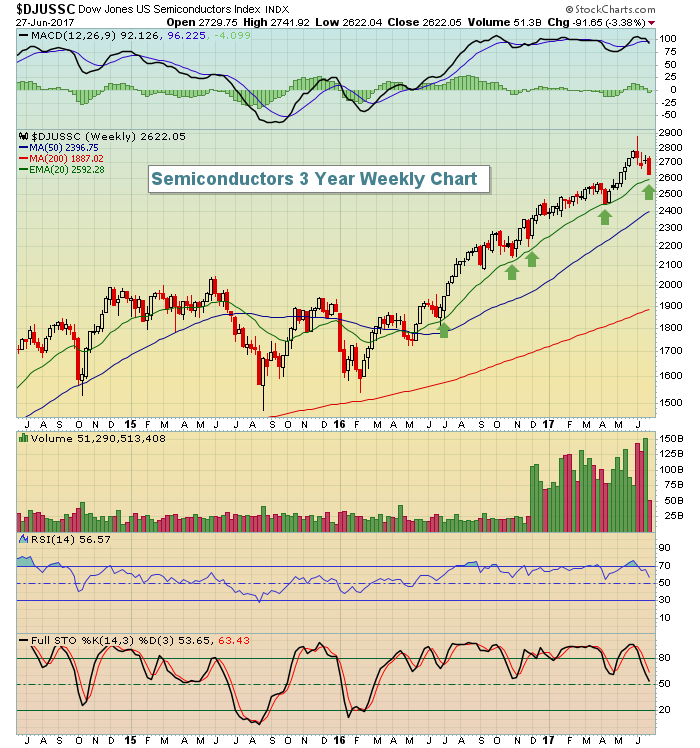

Semiconductors: Goodbye or a Good Buy?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Semiconductors Index ($DJUSSC) is an extremely volatile index. When this index is trending higher, there aren't too many better places to be invested. But when the fire goes out, you want to run, not walk, for the exits. So where are we now,...

READ MORE

MEMBERS ONLY

Will These Summer Breakouts Materialize?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's generally not a great idea to wait until after a stock or index breaks out to consider short-term trades. It would seem somewhat obvious to instead plan for those breakouts by watching patterns develop and keeping an eye on volume. So let's do exactly that...

READ MORE

MEMBERS ONLY

Give Me Financials.....Or Give Me Breadth

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 29, 2017

That's exactly what it's felt like recently. Financials (XLF) have easily been the best performing sector over the past week, rising nearly 3%, while energy (XLE) is the only other sector in positive territory as crude oil ($WTIC) has...

READ MORE

MEMBERS ONLY

Yields Soar, Banks Explode Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The stubbornness of treasury buyers has kept a lid on treasury yields and, as a result, banks ($DJUSBK) have struggled to determine which direction they should move. Well.....this morning's reaction to an upwardly-revised GDP number (TNX up 7 basis points to 2.29% at last check) for...

READ MORE

MEMBERS ONLY

Rising Treasury Yields Lift Banks, Financials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

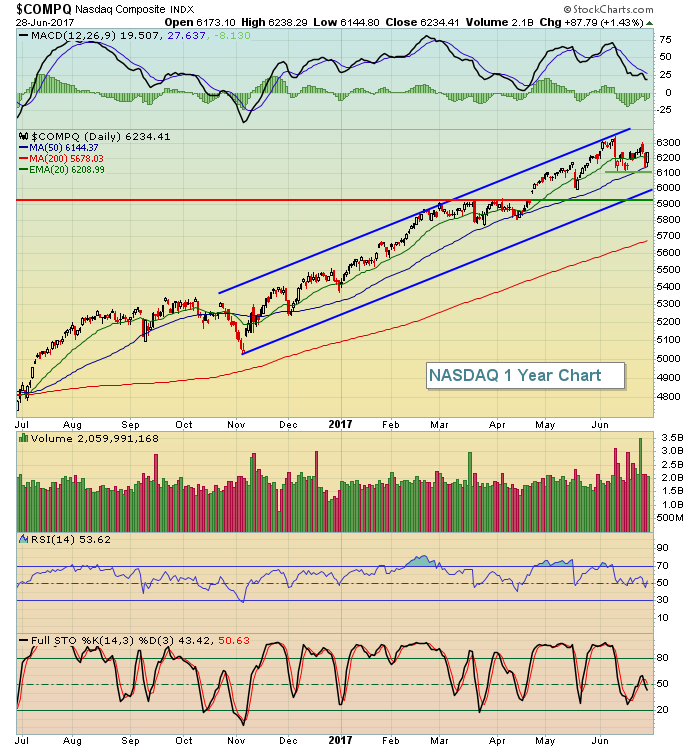

Market Recap for Wednesday, June 28, 2017

All of our major indices finished higher on Wednesday with the small cap Russell 2000 and tech-laden NASDAQ indices leading the charge with 1.55% and 1.43% gains, respectively. We saw solid participation across the board, however, with the Dow Jones ending...

READ MORE

MEMBERS ONLY

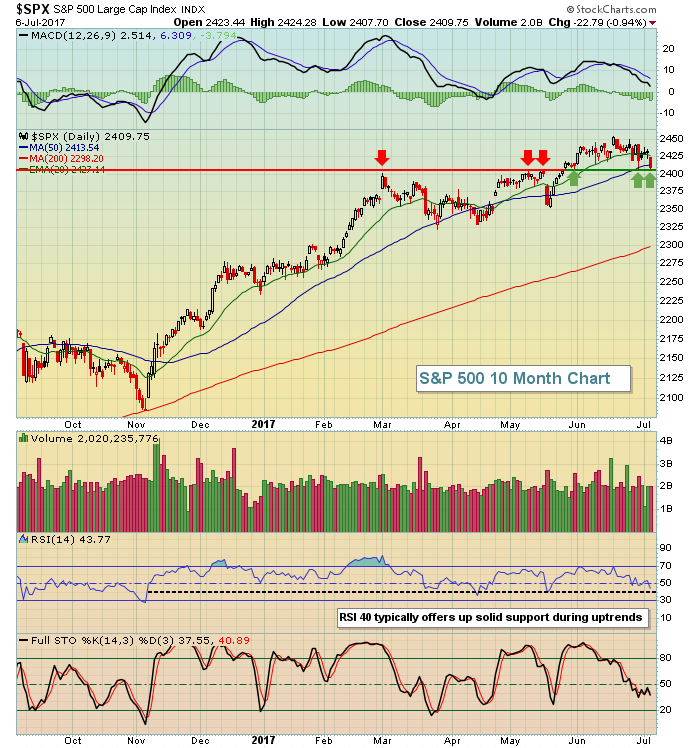

S&P 500 Loses 20 Day EMA Support As Second Shoe Drops In Technology

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 27, 2017

The relative sector leader for over a year - technology (XLK, -1.64%) - took another beating on Tuesday as selling ramped up for a second consecutive session. All industry groups within technology took a hit, but semiconductors ($DJUSSC) and internet stocks ($DJUSNS)...

READ MORE

MEMBERS ONLY

Extremely Low VIX Still Paints Bullish Picture

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 26, 2017

The Volatility Index ($VIX) is a signal of what the market expects in terms of volatility over the near-term (1 to 2 months). While some look at the current reading below 10 as a signal of extreme complacency that will result in a...

READ MORE

MEMBERS ONLY

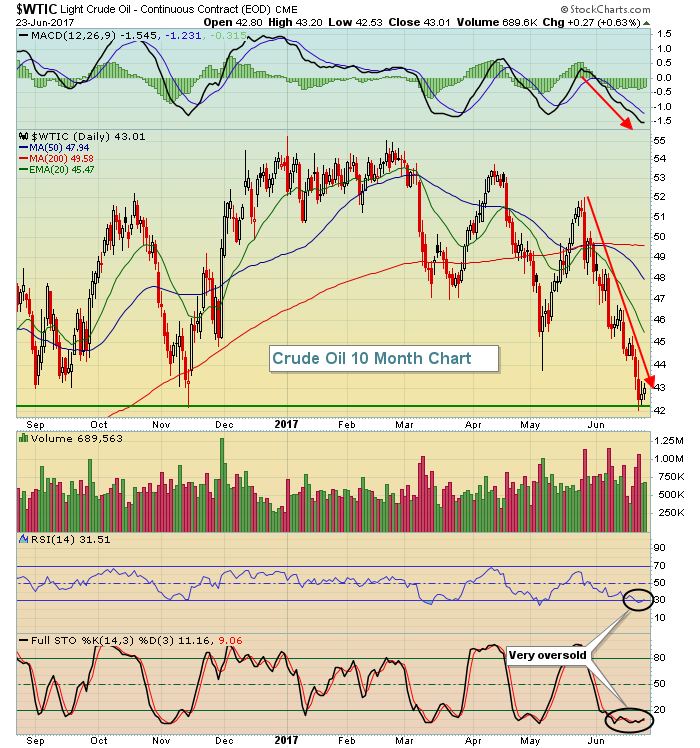

Crude Oil Bounces Off $42 Support, Energy Rebounds

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 23, 2017

It's been a rough ride for crude oil ($WTIC) over the past several months and the steady march lower has taken oil back to test its November low just above $42 per barrel. It hasn't been a robust advance...

READ MORE

MEMBERS ONLY

BLUE Looking At Blue Skies Ahead?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Biotechnology stocks ($DJUSBT) were the second best performing industry group last week, trailing on renewable energy ($DWCREE). Both groups appear poised to continue their rally based on their longer-term weekly technical outlook. Therefore, it's probably not a bad idea to look at stocks in these groups that pull...

READ MORE

MEMBERS ONLY

BioMarin Next In Line For Breakout Among Biotechs?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

BioMarin Pharmaceutical (BMRN), like the overall biotech industry ($DJUSBT), has struggled for the past 18 months to clear overhead price resistance. But over the past couple trading sessions, we have seen one biotech company after another clear resistance on strong volume and accelerate. It appears that BMRN is awaiting its...

READ MORE

MEMBERS ONLY

Biotechs Explode, Send Healthcare To Leadership Role; Energy Runs Out Of Fuel

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 21, 2017

Biotechs ($DJUSBT) are the "semiconductors of healthcare". When they move, they move! Healthcare (XLV, +1.27%) was easily the best performing sector on Wednesday as the DJUSBT soared 3.43%. Unless we see a major reversal between today and tomorrow, we&...

READ MORE

MEMBERS ONLY

Biotechs Breakout, Lead Healthcare Stocks Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 20, 2017

Healthcare (XLV, +0.33%) was one of just two sectors - utilities (XLU, +0.06%) was the other - to rise on Tuesday as much of Monday's gains was relinquished. The good news, however, is that biotechs ($DJUSBT) made a significant...

READ MORE

MEMBERS ONLY

Technology Stocks Rebound Sharply, Lift S&P 500 To Next Record

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 19, 2017

Technology (XLK, +1.48%), healthcare (XLV, +1.04%) and financials (XLF, +1.03%) led a broad-based rally on Monday that included seven of the nine sectors. Only energy (XLE, -0.63%) and the defensive utilities (XLU, -0.33%) failed to participate in the...

READ MORE