MEMBERS ONLY

Dow Jones Falls For 8th Straight Day, Tests 50 Day

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 27, 2017

It was yet another bifurcated day in the market with the Dow Jones losing ground for the eighth straight session and the S&P 500 joining the Dow in negative territory. For the second consecutive session, the NASDAQ and Russell 2000 bucked...

READ MORE

MEMBERS ONLY

Dollar Threatening A Major Breakdown, Gold A Beneficiary

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 24, 2017

Friday was another day of bifurcated action with both the NASDAQ and Russell 2000 higher while the Dow Jones and S&P 500 lagged and finished lower. Sector performance wasn't any better with four sectors higher and five lower. To...

READ MORE

MEMBERS ONLY

There's Not Much To Like About This NASDAQ 100 Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Stocks that combine poor fundamentals, technicals and seasonal weakness are probably stocks to avoid. QUALCOMM Inc. (QCOM) is one such stock as it was hit in January with multiple lawsuits and Apple's (AAPL) suit against QCOM really damaged the QCOM chart technically. Here's a look at...

READ MORE

MEMBERS ONLY

Biotechnology's Recent Failure Is Disappointing But All Hope Is Not Lost

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 23, 2017

The Russell 2000 gained on Thursday while the other major indices declined slightly due to a selloff in the final three hours. Six of nine sectors finished in negative territory, led by energy (XLE, -0.41%). Oil & equipment services ($DJUSOI) led the...

READ MORE

MEMBERS ONLY

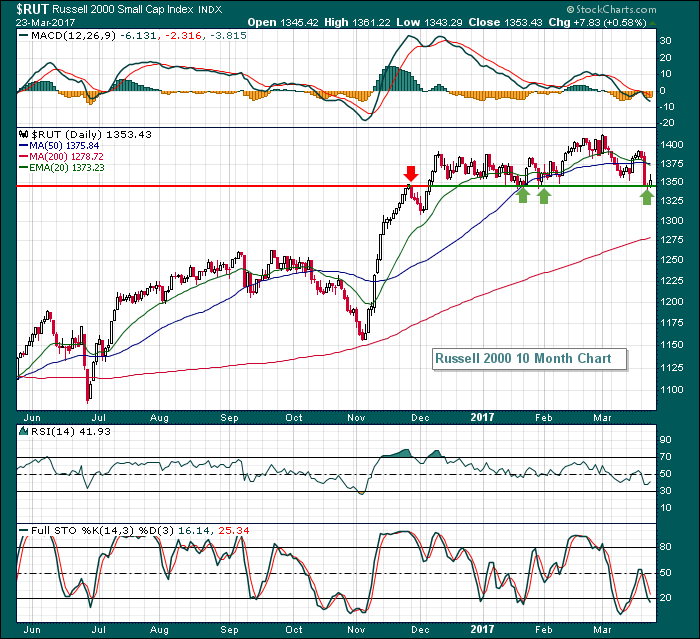

Small Caps Hang Onto Key Price Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Russell 2000 has been under selling pressure but is now testing key support on both its daily and weekly charts. There is a slight negative divergence that's present on its weekly chart, so that would be a signal of possible weakness ahead. The good news is that...

READ MORE

MEMBERS ONLY

Transports Mixed Technically As Market Rally Stalls

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 22, 2017

A strong technology sector (XLK, +0.63%) helped to lift the NASDAQ to moderate gains while the other major U.S. indices waffled near the flat line on Wednesday, a day after equities experienced their sharpest selling of 2017. From a bullish perspective,...

READ MORE

MEMBERS ONLY

U.S. Stocks Tumble Most Since September

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 21, 2017

After months of steady gains, Tuesday's action was painful with eight of nine sectors lower - the utilities sector (XLU, +1.39%) was the lone exception. Further, our major indices were led to the downside by the more aggressive Russell 2000,...

READ MORE

MEMBERS ONLY

NASDAQ's Negative Divergence Holding The Market At Bay

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 20, 2017

Financials (XLF, -0.73%) led the market lower on Monday as short-term price and gap support was lost on one of the best performing sectors since the early November run. While I don't view this as a big technical development in...

READ MORE

MEMBERS ONLY

Tires Gaining Traction, Ready To Put Your Portfolio In Overdrive

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 17, 2017

It was another bifurcated day in the market on Friday as rotation continued. The Dow Jones and S&P 500 both posted minor losses while the Russell 2000 led with a 0.40% gain. Utilities (XLU, +0.60%) and industrials (XLI, +0....

READ MORE

MEMBERS ONLY

Apparel Retailers Printing Bullish Inverse Head & Shoulders Pattern

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past year, the Dow Jones U.S. Apparel Retailers Index ($DJUSRA) has been one of only four industry groups in the consumer discretionary space that has posted a loss. And over the past three months the DJUSRA is the worst performing area of consumer discretionary. But keep in...

READ MORE

MEMBERS ONLY

Homebuilders Hot; DR Horton Forms Cup, Lennar Tests High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 16, 2017

Home construction ($DJUSHB) continued its torrid pace of recent gains, rising another 2% on Thursday. Since January 23rd, the DJUSHB has jumped roughly 20%. That's a great year by any measure, yet we're only talking the past two months...

READ MORE

MEMBERS ONLY

Fresh All-Time High For ORCL After Latest Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Oracle Corp (ORCL) needed a solid earnings report last night after the closing bell to reach all-time highs and it delivered exactly that. ORCL posted both top line and bottom line (.63 vs .57) results that exceeded Wall Street consensus estimates and this morning's open cleared price resistance...

READ MORE

MEMBERS ONLY

Fed Hikes Rates, But No New Hike Expectations Revealed

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 15, 2017

The Federal Reserve's latest policy meeting has come and gone. As expected, the FOMC announcement at 2pm EST indicated that rates would be hiked another quarter point. But the real question was whether the Fed would turn more hawkish on future...

READ MORE

MEMBERS ONLY

Technology Showing Signs Of Slowing Momentum

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Webinar Announcement

Please join me at noon EST for my Bowley Briefing webinar. It'll be a special one hour format and I'll be joined by Erin Heim. Many of you may know Erin from all of her Decision Point work here at StockCharts.com. We&...

READ MORE

MEMBERS ONLY

Footwear Is Strengthening; Here's My Choice In The Space

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 13, 2017

There really was very little movement in our major indices or in our sectors on Monday - which for Monday isn't really a bad day. But my guess is that traders are a bit cautious ahead of what many perceive will...

READ MORE

MEMBERS ONLY

Failure Of Treasury Yields Slow Financial Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 10, 2017

U.S. equities posted mostly strong results on Friday with a bit of relative strength from the more aggressive NASDAQ and Russell 2000. The NASDAQ 100 ($NDX) posted the best percentage gain of all, but keep in mind that the NDX does not...

READ MORE

MEMBERS ONLY

Heavy Construction Tests Support, Here's A Potential Winner

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Heavy Construction Index ($DJUSHV) is currently testing its rising 20 week EMA and is near key support in its four month sideways consolidation range from 440-480. Friday's close was 447 and the weekly RSI is now at 43, typically a solid level on...

READ MORE

MEMBERS ONLY

Weakening Aluminum, Steel And Gold Pressure Materials Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

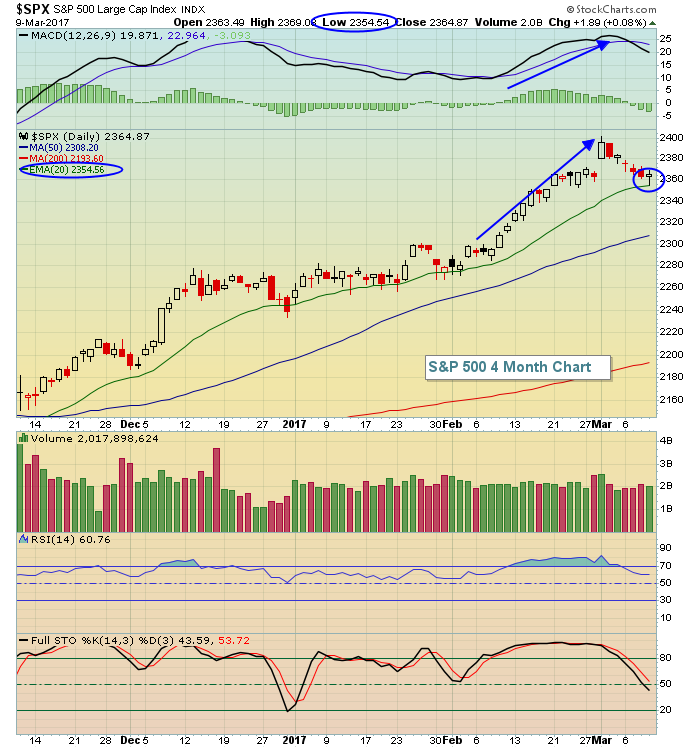

Market Recap for Thursday, March 9, 2017

The March 6th to 9th period once again produced not-so-good S&P 500 results. The S&P 500 did break its recent string of losses, gaining two points on Thursday. Technically, it bounced exactly where we would expect - off the...

READ MORE

MEMBERS ONLY

Record Crude Inventories Sink Oil, S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 8, 2017

The S&P 500 fell for a third consecutive day and it could have been five days in a row if not for a very small gain last Friday. The culprit yesterday was quite clearly the oil patch. The U.S. crude...

READ MORE

MEMBERS ONLY

Treasury Yield Shows Building Expectations For Next Rate Hike

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 7, 2017

Next Tuesday, another FOMC meeting begins with their policy decision announced next Wednesday. Expectations are that we'll see another quarter point rate hike. It's not a slam dunk and there are some who believe we should wait to see...

READ MORE

MEMBERS ONLY

Webinar Reminder 4:30pm EST Today

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I just wanted to send out a quick reminder about a webinar that I'll be conducting with EarningsBeats.com President and CEO John Hopkins. It starts in roughly an hour with the webinar doors opening as the stock market closes. I will be discussing trading strategies during earnings...

READ MORE

MEMBERS ONLY

Evaluating The Technical Health Of Energy And Healthcare

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 6, 2017

U.S. equities experienced a little profit taking on Monday, nothing technically damaging, but all our major indices did finish lower. The only sector to escape damage was energy (XLE, +0.22%), while all the others declined. On a relative basis, the XLE...

READ MORE

MEMBERS ONLY

Sticking With Global Theme, China Stocks Look Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 3, 2017

We saw bifurcated action on Friday with the Dow Jones, S&P 500 and NASDAQ all posting minor gains while the Russell 2000 fell slightly. Sector action behaved similarly as about half the sectors climbed fractionally while the rest finished in negative...

READ MORE

MEMBERS ONLY

Treasury Yields Rising As Home Construction Breaks To 10 Year High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The FOMC will be meeting to discuss a potential rate hike in less than two weeks. A hike would continue the hawkish tone that began when the FOMC increased interest rates in December 2015 for the first time in nine years. It was about six months later that the 10...

READ MORE

MEMBERS ONLY

Special Home Construction Review - Stocks To Consider

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm providing this special Saturday edition of Trading Places as a result of a very significant breakout in the home construction index ($DJUSHB). One way to participate in this breakout is to buy an ETF that tracks home construction stocks. One example is the ITB. The latest disclosure...

READ MORE

MEMBERS ONLY

Heavy Construction Ready To Do Some Heavy Lifting

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 2, 2017

Thursday was a day of profit taking as all of our major indices retreated with the small cap Russell 2000 taking the biggest hit, falling 1.27%. Every sector finished lower with the exception of the defensive utilities sector (XLU), which actually gained...

READ MORE

MEMBERS ONLY

This Part Of Europe Just Made A Major Long-Term Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The London Financial Times Index ($FTSE) had sideways consolidated for 17 years after topping back in 2000. That consolidation period has ended in a big way in 2017 and this index appears poised for a very significant rise. Despite how you might feel about Brexit, the market has casted its...

READ MORE

MEMBERS ONLY

Dow Jones Soars 300 Points, Breaks 21000; FTSE Very Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 1, 2017

U.S. equities surged on Wednesday, with the Dow Jones and S&P 500 gaining 1.46% and 1.37%, respectively. The small cap Russell 2000 rebounded big time after its Tuesday drubbing, spiking 27 points, or 1.94%, to 1413 -...

READ MORE

MEMBERS ONLY

Overbought Aggressive Sectors Lead Decline In U.S. Equities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, February 28, 2017

It was a day of profit taking on Tuesday. All of our major indices declined, although the selling was certainly contained. The S&P 500, for instance, dropped just 0.26% and remains near its all-time high. Weakness in consumer discretionary (XLY,...

READ MORE

MEMBERS ONLY

History Suggests Energy, Financials And Industrials Are Poised To Lead U.S. Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, February 27, 2017

Energy (XLE, +0.86%) led the market advance on Monday and that hasn't happened much over the past few months. But as I have shown below in the Sector/Industry Watch section, I believe there are several technical signs that we...

READ MORE

MEMBERS ONLY

Utilities Taking Advantage Of Tumbling Treasury Yields

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 24, 2017

The 10 year treasury yield ($TNX) tumbled 7 basis points on Friday and that continued the recent string of solid days for utilities (XLU, +1.52%). Healthcare (XLV, +0.48%) is also benefiting from the rotation to defensive areas of the market as...

READ MORE

MEMBERS ONLY

Weekly Candle Argues For Further Weakness Ahead For Oclaro

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Oclaro Inc (OCLR) is printing several warning signals as it appears to be topping after a stellar advance. OCLR has nearly quadrupled since the beginning of 2016, but it's difficult to ignore the heavy volume reversal last week - especially when you consider that a negative divergence has...

READ MORE

MEMBERS ONLY

Lessons To Be Learned From A Consolidating Industry Group (Tires)

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, February 23, 2017

The action on Thursday was not bullish at all. Yes, the Dow Jones and S&P 500 rose again with the Dow setting another all-time high. Great action, right? Wrong. The more aggressive NASDAQ and Russell 2000 both fell again by .43%...

READ MORE

MEMBERS ONLY

Eli Lilly Breaks 18 Month Downtrend

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Eli Lilly (LLY) printed an exhaustion gap in November on massive volume, marking a significant bottom and over recent trading days broke a downtrend line that spanned 18 months of action. Based on this combination and improving momentum, it certainly appears that LLY has seen its worst and has begun...

READ MORE

MEMBERS ONLY

Commodity Chemicals Break Out Again, Look Very Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, February 22, 2017

Utilities (XLU, +0.42%) showed relative strength again on Wednesday, leading the charge on an otherwise bifurcated kinda day. The Dow Jones was able to finish the session with a gain, but the benchmark S&P 500, NASDAQ and Russell 2000 were...

READ MORE

MEMBERS ONLY

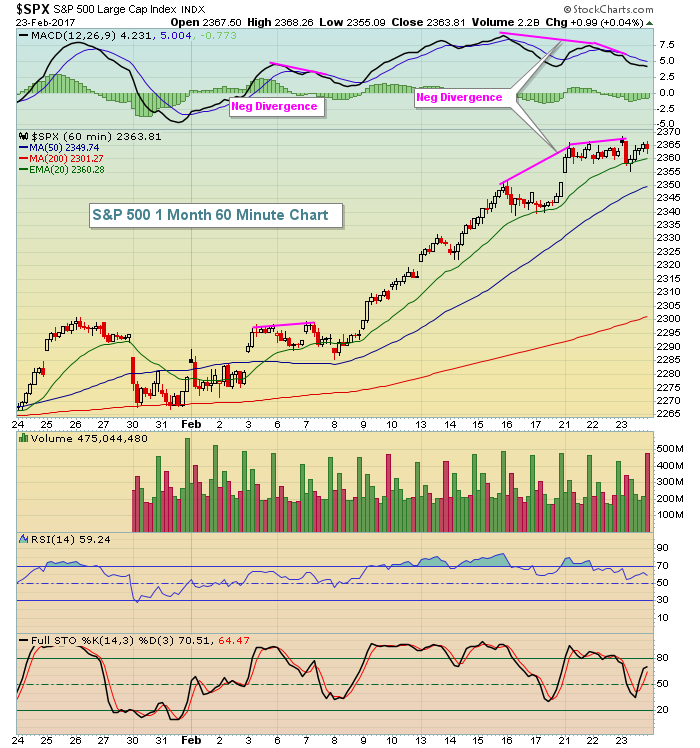

Warning Signs Beginning To Emerge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, February 21, 2017

Our major indices saw another solid day of gains with the Dow Jones, S&P 500, NASDAQ, NASDAQ 100 and Russell 2000 all breaking out to all-time highs once again. All nine sectors advanced and small caps led on a relative basis....

READ MORE

MEMBERS ONLY

Crude Oil Surges This Morning, Could Provide Big Lift To Energy Sector

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 17, 2017

Consumer staples (XLP, +0.50%) led the market action on Friday as personal products ($DJUSCM) jumped 3.39%. Brewers ($DJUSDB) continued their recent surge and now appear to have clearly broken their downtrend that began in October. Take a look:

The trendline break...

READ MORE

MEMBERS ONLY

Mondelez Takes Big Hit, But Remains in Bullish Triangle Pattern

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Mondelez International (MDLZ) had a rough week, tumbling over 5.5% after Kraft Heinz (KHC) made a bid for Unilever (UL). That suggested to many investors that the likelihood of a MDLZ acquisition was significantly reduced and the stock was priced lower accordingly. The technical pattern on MDLZ remains quite...

READ MORE

MEMBERS ONLY

Retail Stocks Remain Very Attractive And Here Are A Few To Consider

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

About a month ago, I wrote a ChartWatchers article detailing the bullish historical tendencies of retailers during the months of February, March and April. In particular, apparel retailers ($DJUSRA) have shown tremendous bullishness during the months of February, March and April. In addition, the DJUSRA was approaching a key price...

READ MORE

MEMBERS ONLY

Will Homebuilders Finally Make Their Breakout?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, February 16, 2017

U.S. indices finished in bifurcated fashion on Thursday as the Dow Jones logged gains, the S&P 500 finished flat and the NASDAQ and Russell 2000 both finished with minor losses. We could see some additional weakness in coming days based...

READ MORE