MEMBERS ONLY

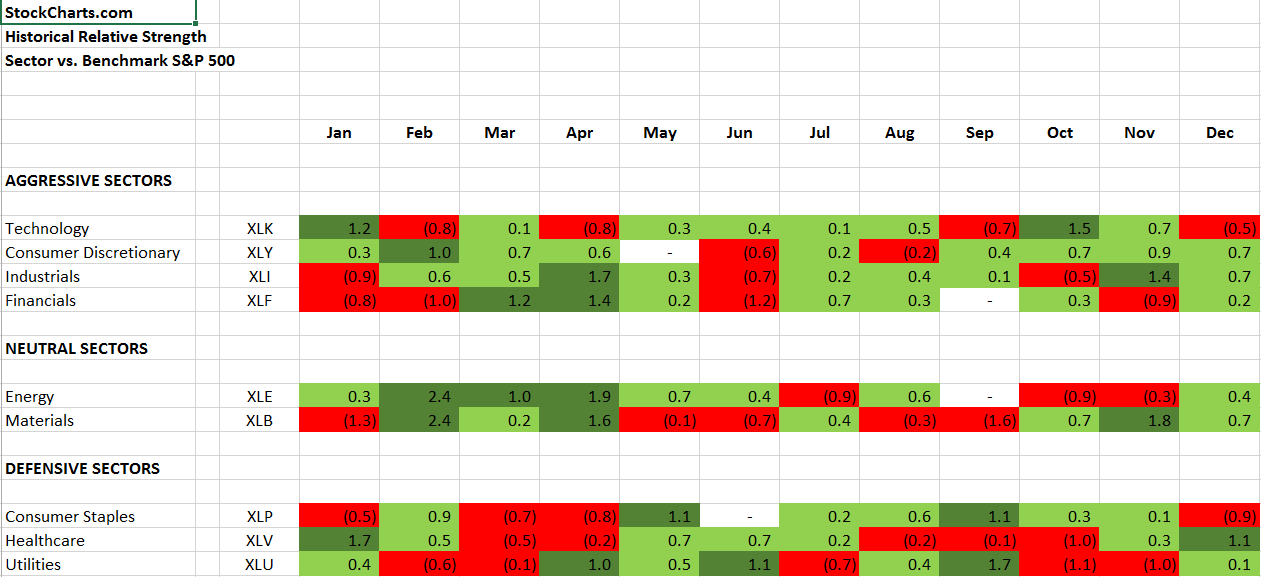

Summary Of Sector Relative Strength By Calendar Month

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Normally, I provide a daily blog article every day that the U.S. stock market is open. That eliminates Saturdays and Sundays. I'm making an exception today to share some historical information that I believe you'll find useful as you work your way through 2017. Also,...

READ MORE

MEMBERS ONLY

Financials Take Beating Amid Falling Treasury Yields

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, January 5, 2017

The 10 year treasury yield ($TNX) tumbled on Thursday, dropping more than 8 basis points to close at 2.37% - its lowest daily close since December 7th's 2.35% finish. The sudden interest in treasuries could have been the result...

READ MORE

MEMBERS ONLY

This S&P 500 Company Is On Verge Of Major Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Since the beginning of 2012, Fastenal Co. (FAST) has tested its 48-49 price resistance zone on seven different occasions - most recently four weeks ago - without any success. But this multi-year consolidation follows a prior uptrend so I expect that we'll see a breakout sooner rather than...

READ MORE

MEMBERS ONLY

Autos Gain Traction, Break Out To Lead Equities Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, January 4, 2017

Materials (XLB, +1.46%) and consumer discretionary (XLY, +1.33%) were easily the two best performing sectors on Wednesday to lead our major indices to a second consecutive day of across-the-board gains in 2017. There is a very strong correlation between January performance...

READ MORE

MEMBERS ONLY

Biotechs Lead Stocks To Open 2017

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, January 3, 2017

Healthcare (XLV, +1.31%) took over sector leadership on Tuesday to open 2017 as the Dow Jones U.S. Biotechnology Index ($DJUSBT) jumped 2.05%. It's not too surprising to historians as January tends to be very kind to both the...

READ MORE

MEMBERS ONLY

U.S. Futures Strong, Crude Oil On The Move

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

First, I want to wish everyone a very happy new year! Second, I'm excited to announce that Greg Schnell (think Canadian Technician and Commodities Countdown) and I will be co-hosting a Stock Market 2017 Outlook webinar in mid-January where we'll compare notes and share our...

READ MORE

MEMBERS ONLY

QCOM's Rough Week Could Provide Opportunity

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

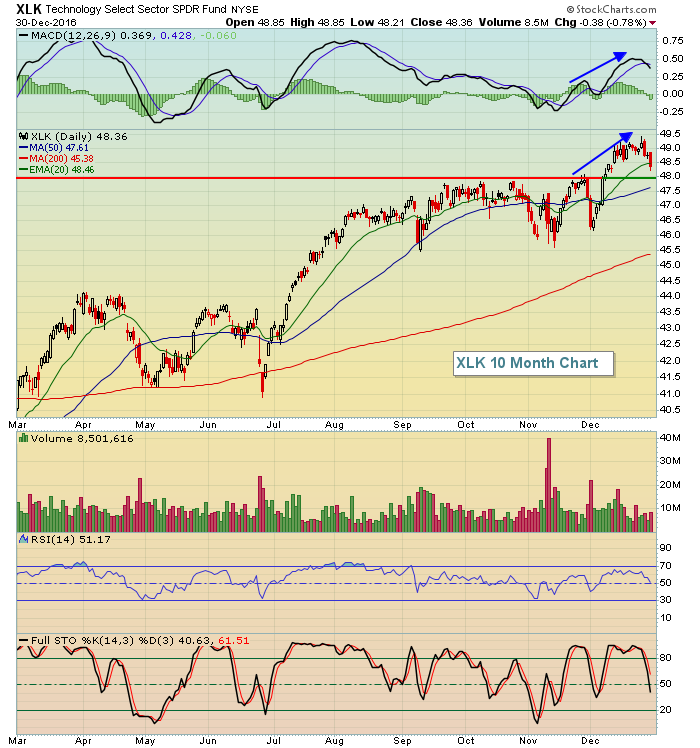

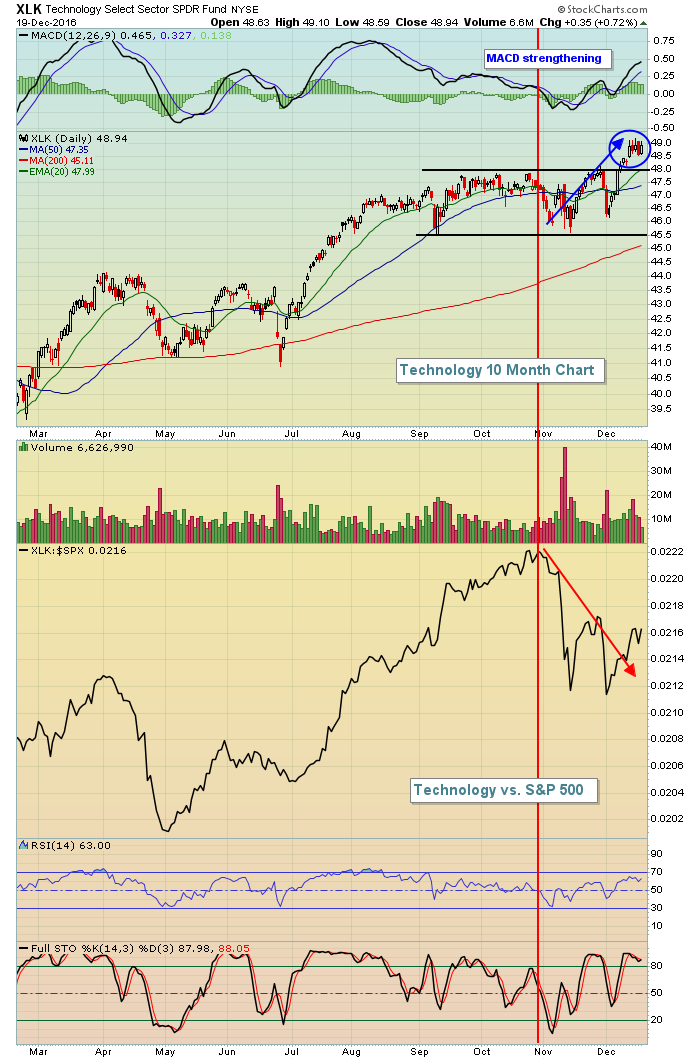

Technology stocks (XLK) have shown signs of slowing momentum via lower weekly MACD readings while prices have moved higher. Component industry groups like semiconductors ($DJUSSC) and software ($DJUSSW) have similar momentum issues and that contributed to industry weakness as technology was one of the worst performing sectors last week. One...

READ MORE

MEMBERS ONLY

Banks Test 20 Day Along With TNX

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, December 29, 2016

The 10 year treasury yield ($TNX) closed at 2.48% and hit an intraday low of 2.46% to test its rising 20 day EMA for the first time since early November. Not too surprisingly, the Dow Jones U.S. Banks Index ($DJUSBK)...

READ MORE

MEMBERS ONLY

NVDA's Magic Ride Likely Over

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

NVIDIA Corp (NVDA) has been one of the best performers of 2016, nearly quadrupling during the year. Its long-term chart has been phenomenal, but its weekly RSI and stochastic have been overbought since early May. That's a very long time of outperformance and a rest is not only...

READ MORE

MEMBERS ONLY

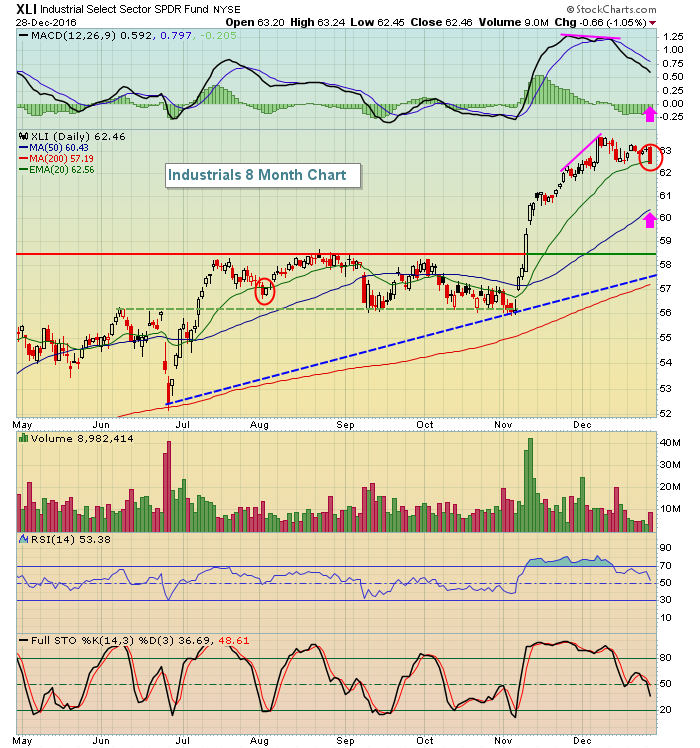

Broad-Based Selling Finally Hits U.S. Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 28, 2016

It's been awhile since this happened, but on Wednesday all nine sectors declined, led by energy (XLE, -1.08%), industrials (XLI, -1.05%) and financials (XLF, -1.02%). The carnage was evenly spread as consumer staples (XLP, -0.61%) and consumer...

READ MORE

MEMBERS ONLY

Oil Closes Near $54 Per Barrel; Home Construction Rises

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, December 27, 2016

Eight of the nine sectors rose on Tuesday with only consumer staples (XLP, -0.02%) losing ground. The NASDAQ and Russell 2000 once again were the leading indices, powered by home construction ($DJUSHB) and renewable energy ($DWCREE). Home construction looks very interesting on...

READ MORE

MEMBERS ONLY

Small Caps Lead Friday; Biotechs Ready To Resume Uptrend?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 23, 2016

The Russell 2000 gained 0.65% on Friday to lead the major U.S. indices. The NASDAQ followed with a 0.28% gain while the S&P 500 and Dow Jones pushed higher, but only by 0.13% and 0.07%, respectively....

READ MORE

MEMBERS ONLY

Seasonality: What Lies Ahead In January?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

First, U.S. markets are closed today in observance of the Christmas holiday. Second, my regular Trading Places article which covers the prior days market action, in addition to pre-market action, the current outlook, sector/industry watch, historical tendencies and earnings and economic reports, will be back Tuesday morning as...

READ MORE

MEMBERS ONLY

Priceline: Name Your Own (Entry) Price

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I ran a scan of NASDAQ 100 stocks with RSIs between 40-45 and it returned eight stocks - ATVI, BIDU, FB, JD, PCLN, QVCA, VIAB, VOD. I ran this scan because RSI 40-45 many times offers up great support to an uptrending stock. So the next step, of course, was...

READ MORE

MEMBERS ONLY

Global Markets Mostly Bullish But Mixed

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, December 22, 2016

Yesterday's action here in the U.S. had a short-term bearish tone to it, but there were certainly no price breakdowns and no reason to believe it was anything other than a bout of profit taking during a continuing bull market...

READ MORE

MEMBERS ONLY

AMAT's Candle Suggests A Reversal Is Imminent

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Applied Materials (AMAT) printed a shooting star candlestick on Thursday, with a long-term negative divergence in play on both its daily and weekly charts, signs of slowing momentum to the upside from both an intermediate- and long-term perspective. AMAT, just a few days ago, printed a reversing dark cloud cover...

READ MORE

MEMBERS ONLY

Energy Looks To Lead In 2017 For Multiple Reasons, Here's Why

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 21, 2016

Energy (XLE, +0.16%) was one of just two sectors that headed higher on Wednesday with materials (XLB, +0.4%) being the only other. That wasn't enough to carry the market higher as our major indices all finished fractionally lower on...

READ MORE

MEMBERS ONLY

Dow Nears 20,000, Crude Oil Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, December 20, 2016

Treasuries were sold off on Tuesday with the corresponding 10 year treasury yield ($TNX) moving back up to 2.57%. The recent high was 2.60% so the TNX is not far from another new high. Of course, the bounce in the TNX...

READ MORE

MEMBERS ONLY

Technology Leads U.S. Stocks; Out Of Their Funk Now?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for December 19, 2016

Over the past three months, technology (XLK) has been the 6th best performing industry group, beating out only the three defensive groups - consumer staples (XLP), utilities (XLU) and healthcare (XLV). But the XLK is not in bad shape technically. Instead, we've...

READ MORE

MEMBERS ONLY

Defensive Sectors And Energy Lead On Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 16, 2016

Utilities (XLU, +1.22%) soared on Friday and came very close to a breakout above reverse head & shoulders neckline resistance. This is also very near overhead trendline resistance as well. While we don't want to see the defensive utilities sector...

READ MORE

MEMBERS ONLY

Ryder Driving The Wrong Way

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Ryder System (R) was having a huge 2016 until the past several days. Profit taking has kicked in and R has dropped 10% in that brief span. The obvious question from a trader's perspective is.....when does it make sense to jump in on the long side. Well,...

READ MORE

MEMBERS ONLY

The Best And Worst Of 2016; Watch This One In 2017

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We're two weeks away from another stock market year in the books. Where does the time go? Anyhow, since this is the last ChartWatchers newsletter of 2016, it would be an appropriate time to check out the best and worst industry group awards for 2016.

Drum roll please!...

READ MORE

MEMBERS ONLY

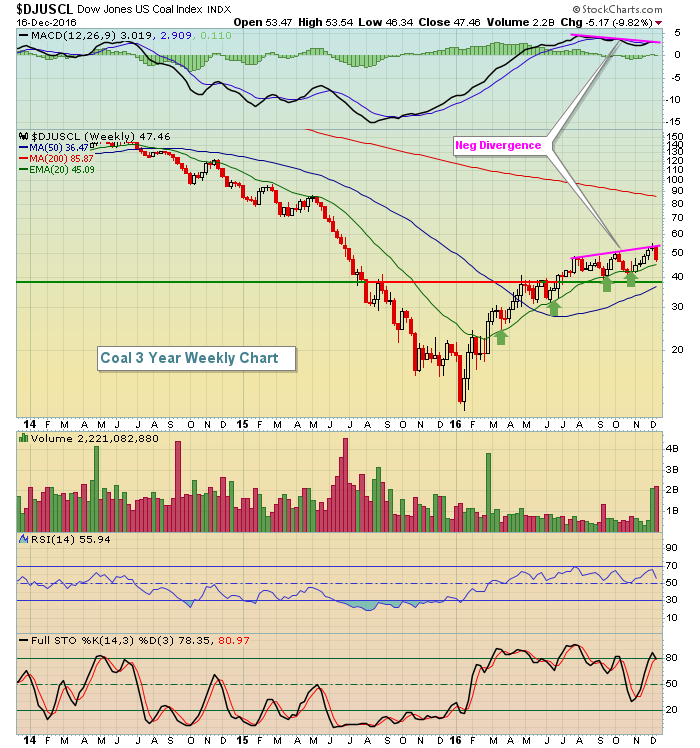

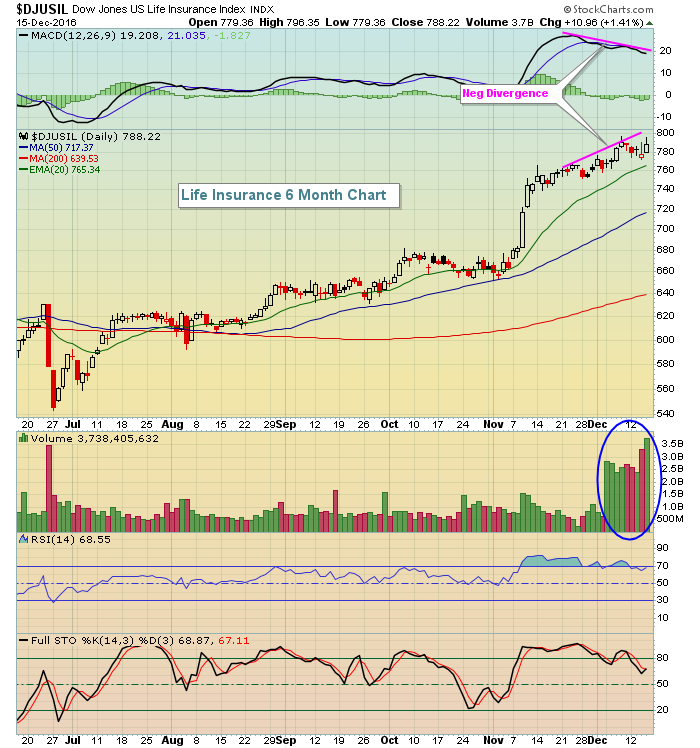

Weekly Negative Divergences A Problem For A Few Key Groups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, December 15, 2016

With treasury yields on the rise again, it wasn't surprising to see financials (XLF, +0.85%) on top of the sector leaderboard. The problem, however, is that we're beginning to see slowing price momentum on key industry groups -...

READ MORE

MEMBERS ONLY

Medical Supplies Breaks Out Of Bullish Wedge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Healthcare stocks (XLV) have been underperforming the benchmark S&P 500 for the past 4-5 months, but they're beginning to show some life as the XLV has been the best performing sector ETF over the last week. Recently, I noticed pharmaceuticals testing a major price support level...

READ MORE

MEMBERS ONLY

Fed Raises Rates, Says More To Come

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 14, 2016

As expected, volatility kicked in around 2pm EST yesterday as the Fed delivered what traders most likely anticipated, but still didn't want to hear. Rates are going higher. Everyone was looking for the 25 basis point hike so that didn'...

READ MORE

MEMBERS ONLY

Traders Await Latest From The Fed

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, December 13, 2016

Well it's Fed day and both equity and bond markets are prepared for a quarter point rate hike. The big question, however, is whether the market is ready to hear what the Fed has to say about future policy guidance. Will...

READ MORE

MEMBERS ONLY

Defense Leads Dow Jones To Another Record

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 12, 2016

The Dow Jones advanced for the 21st time in the last 25 trading days on Monday, capturing yet another record high close on Monday. While it was led by mostly defensive areas like utilities, REITs and pharmaceuticals, offensive areas didn't exactly...

READ MORE

MEMBERS ONLY

Big Day In Oil Awaits Energy Sector

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 9, 2016

Gains permeated our major indices on Friday, but it was difficult to overlook the flight to safety. Perhaps traders were just growing a bit more cautious after the huge run higher the past month or maybe it was big money knowing that the...

READ MORE

MEMBERS ONLY

A Bottom May Be Brewing In BUD

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The U.S. stock market has been flying high over the past month, but shares of Anheuser-Busch InBev (BUD) have fallen close to 30% since reaching an all-time high in late September. Technically, there's hope that BUD is at or approaching a very significant bottom, however. Let'...

READ MORE

MEMBERS ONLY

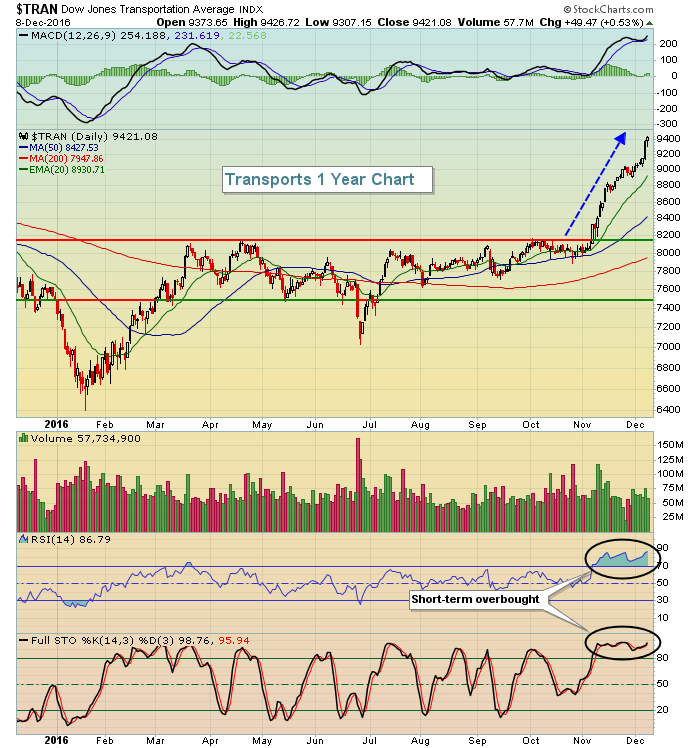

Transports And Financials Lifting Dow Jones Near 20000

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, December 8, 2016

The Dow Jones Transportation Average ($TRAN) finished higher once again on Thursday and has now risen more than 4% this week. In addition, the TRAN has climbed 16.7% since the close on November 4th. It's been an amazing run for...

READ MORE

MEMBERS ONLY

Measuring An Inverse Head & Shoulders Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It took two months of consolidation, but Cabot Corp (CBT) finally pulled it off. It cleared neckline resistance in its inverse head & shoulders pattern at the 52.50 level. One of the keys of any continuation pattern is that it requires a prior trend in place to continue. CBT...

READ MORE

MEMBERS ONLY

Rallies Don't Get Any Stronger Than This One

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 7, 2016

Money poured into risk yesterday as global markets rallied in anticipation of strengthening economies worldwide. Here in the U.S., nearly every single industry group pushed higher, many of them 1%-2% higher or more. Significant leadership came in the form of consumer...

READ MORE

MEMBERS ONLY

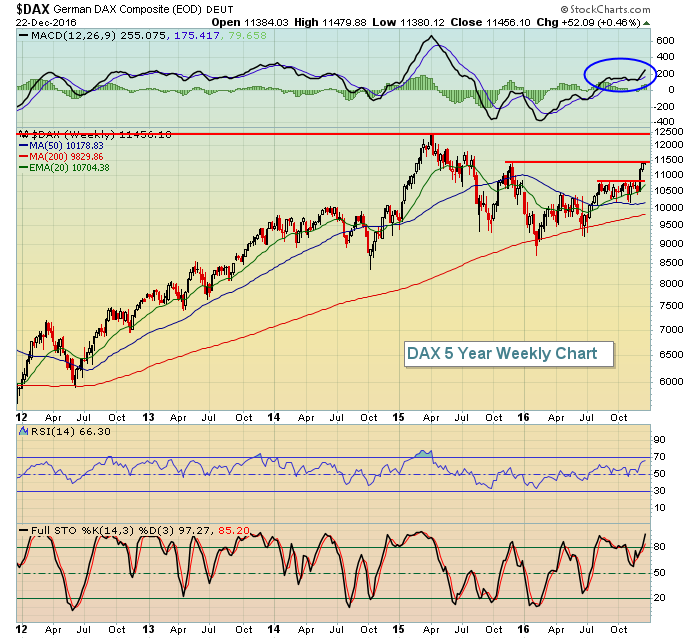

The German DAX Surges, Joins S&P 500 In Breakout Mode

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, December 6, 2016

I've been waiting to see if the German DAX would join the S&P 500 in breakout territory and, thus far, I'm getting my answer today with the DAX currently up 155 points, or 1.44%, this morning...

READ MORE

MEMBERS ONLY

Crude Oil Again Challenging Major Breakout; Renewables Bottoming

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 5, 2016

Financials (XLF, +1.19%) were back on top of the sector leaderboard on Monday after taking a "lengthy" one day pause. It's been a crazy run for financial stocks and we're growing accustomed to the almost daily...

READ MORE

MEMBERS ONLY

TNX Hits Resistance, Financials Sell

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 2, 2016

Friday saw continuing bifurcation, but with this time the NASDAQ and Russell 2000 leading while the Dow Jones and S&P 500 lagged. Rotation wasn't all positive, however, as utilities (XLU, +0.91%) and consumer staples (XLP, +0.64%) led...

READ MORE

MEMBERS ONLY

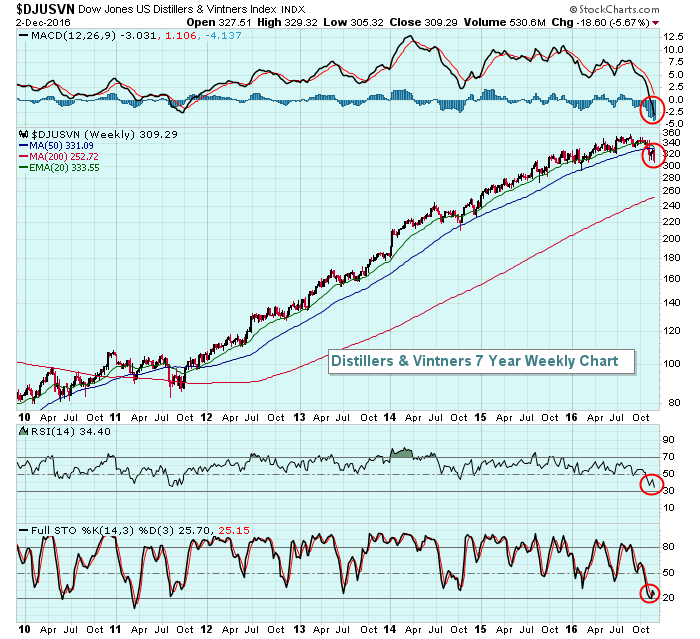

Weekly MACD Turns Negative On This Group For First Time In Five Years

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I pulled up one month returns for all industry groups and there were several groups that have performed quite poorly over this period, despite the overall market strength. Toys ($DJUSTY) are down 6.78% over the last month, but a negative divergence on its weekly chart is likely the culprit....

READ MORE

MEMBERS ONLY

ChartLists Are The Key To Disciplined And Successful Trading

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I spend a great deal of time scouring the market and looking for interesting trade setups. It's quite often that I see a stock that I really like, but it's not at a price level where I'm ready to pull the trigger. If I...

READ MORE

MEMBERS ONLY

Technology Crushed, NASDAQ Lags Badly

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, December 1, 2016

It was another very strange day on Wall Street. The Dow Jones finished the session Thursday with a gain of 68 points, closing at 19192 and another all-time high. The NASDAQ appeared to be trading in another world as technology was crushed, leading...

READ MORE

MEMBERS ONLY

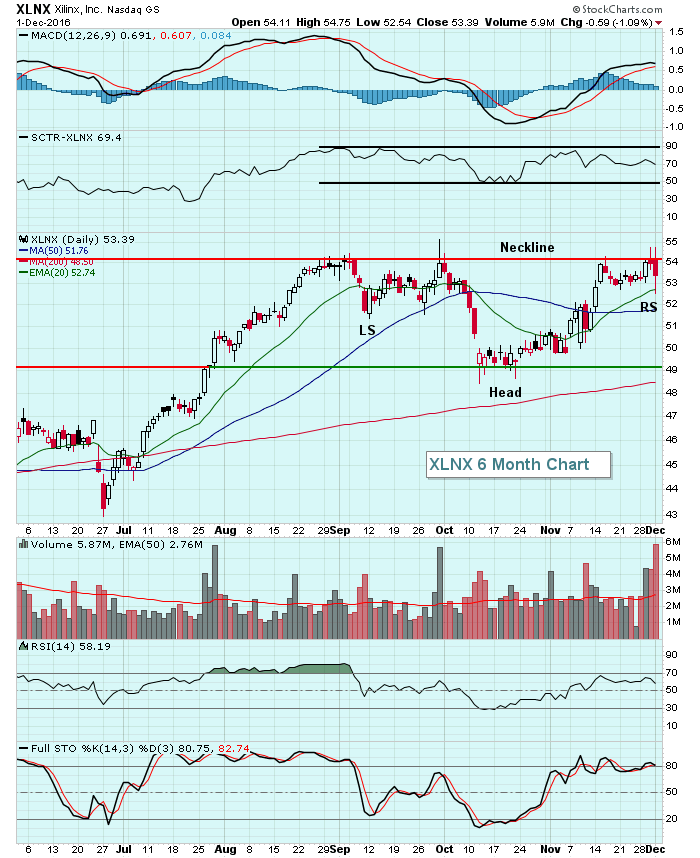

Waiting On This Inverse Head & Shoulder Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Xilinx (XLNX) is a $13.5 billion semiconductor company and it nearly broke out of a very bullish inverse head & shoulders pattern on heavy volume today. But it didn't. Instead, it reversed lower along with most semiconductor stocks and tested its rising 20 day EMA. The technical...

READ MORE

MEMBERS ONLY

Crude Oil Surges 9%, Lifts Energy Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, November 30, 2016

Crude oil ($WTIC) rose more than 9% on Wednesday and energy shares (XLE, +5.08%) were the beneficiary. Rising treasury yields also helped to lift the financial sector (XLF, +1.35%) with banks ($DJUSBK) storming to another high. But the bifurcation was quite...

READ MORE