MEMBERS ONLY

With The Top 10 Picks In The Stock Market DRAFT, EarningsBeats.com Selects...

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We're one day away from "DRAFT Day"! Every quarter, we select the 10 equal-weighted stocks that will comprise our 3 portfolios - Model, Aggressive, and Income. My background is in public accounting as I audited companies in the Washington, DC - Baltimore, MD metropolitan area for...

READ MORE

MEMBERS ONLY

A Very Accurate Sentiment Reading That Is Flashing A RED Light For Bulls

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

While many analysts follow sentiment signals that involve feelings about market direction, I prefer one that follows the MONEY. I want to know what retail traders are doing with their money with respect to options. Extreme readings provide eerily accurate reversals in trend, which are obviously very important to any...

READ MORE

MEMBERS ONLY

There Remain A Lot Of Mixed Signals, But One Bullish Signal That We Cannot Ignore

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The masses have been confounded by the strength of this current secular bull market. Too many keep betting against it and they've cost themselves a huge opportunity for profit as prices have soared. I've pointed out on many occasions that the biggest stock market gains have...

READ MORE

MEMBERS ONLY

The EarningsBeats.com Strategy For Uncovering The New Winners

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earnings and interest rates are always the key drivers to stock market success. There may be other short-term factors that influence price action, but, at the end of the day, rising earnings and interest rates conducive to job and economic growth is what results in secular bull markets.

Organize Your...

READ MORE

MEMBERS ONLY

Based on Relative Strength, Alphabet (GOOGL) Is An Unloved Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Nearly two weeks ago, I was discussing in our FREE EB Digest newsletter why I felt Alphabet (GOOGL) was poised for a decline after earnings. It was continuing to push higher, which, on the surface, was a fairly bullish signal. However, if you looked at how strong internet stocks ($DJUSNS)...

READ MORE

MEMBERS ONLY

Why This Latest Bull Market Advance Is So Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been bullish for nearly two years now. Bullish rotation and Wall Street manipulation started the latest leg of this SECULAR bull market back in June 2022. If you follow my research and work, then I'm sure you remember these two headlines on YouTube:

You can...

READ MORE

MEMBERS ONLY

Value Stocks' Continued Strength Might Depend on One Area Of Transports

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know all the talk continues to surround technology stocks (XLK), particularly semiconductors ($DJUSSC) and software ($DJUSSW). And why wouldn't it? These groups have been absolutely on fire since the end of the 2022 cyclical bear market. Rates remain low and many of these companies are seeing double...

READ MORE

MEMBERS ONLY

Your Money And You: This Investment Strategy May Very Well Be Your Best Choice?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Every one of us faces this question as we look to the stock market for a better financial future. Let me first start this article with the understanding that the stock market isn't your only choice in terms of investing in your future (or your child's...

READ MORE

MEMBERS ONLY

Perspective And History Tell Us To Lower Our Expectations For Technology Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

No one loves a good bull market more than me. History tells us that we want remain mostly on the side of the bulls. Perma-bears have an awful long-term track record. They've called 30 of the last 3 secular bear markets. Honestly, those who cannot ever see anything...

READ MORE

MEMBERS ONLY

Breakout Or Failed Breakout: It's Important To See The Difference

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Important days for stocks usually are associated with big volume, major support/resistance, and a test of leadership. As I look at Upwork, Inc. (UPWK), it's check, check, and check. Before I look at UPWK individually, let me show you what we typically see with internet stocks (which...

READ MORE

MEMBERS ONLY

Oops, I Did It Again!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm sure most of you, by now, know that I'm a student of history. 2023 played out beautifully and mostly according to its historical road map. Here are a couple things in 2023, with respect to the S&P 500, that could have been predicted...

READ MORE

MEMBERS ONLY

These Stocks Are Looking Good As We Move Into 2024

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Happy New Year!

Throughout 2024, I'll be commenting on various sectors, industry groups, and individual stocks that flash breakouts and relative strength, but what about stocks that are just beginning to strengthen? There are many individual stocks that set 52-week and all-time highs as we ended 2023, but...

READ MORE

MEMBERS ONLY

Think Really Hard About Who You Want On Your Team

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm going to start this article a bit different than all the others I've written here at StockCharts.com and talk off topic for a paragraph or two.

I grew up in Maryland, quite close to Washington, DC, and was an avid Washington Redskins and Baltimore...

READ MORE

MEMBERS ONLY

This Combination Makes Trading Next Week VERY Dicey

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

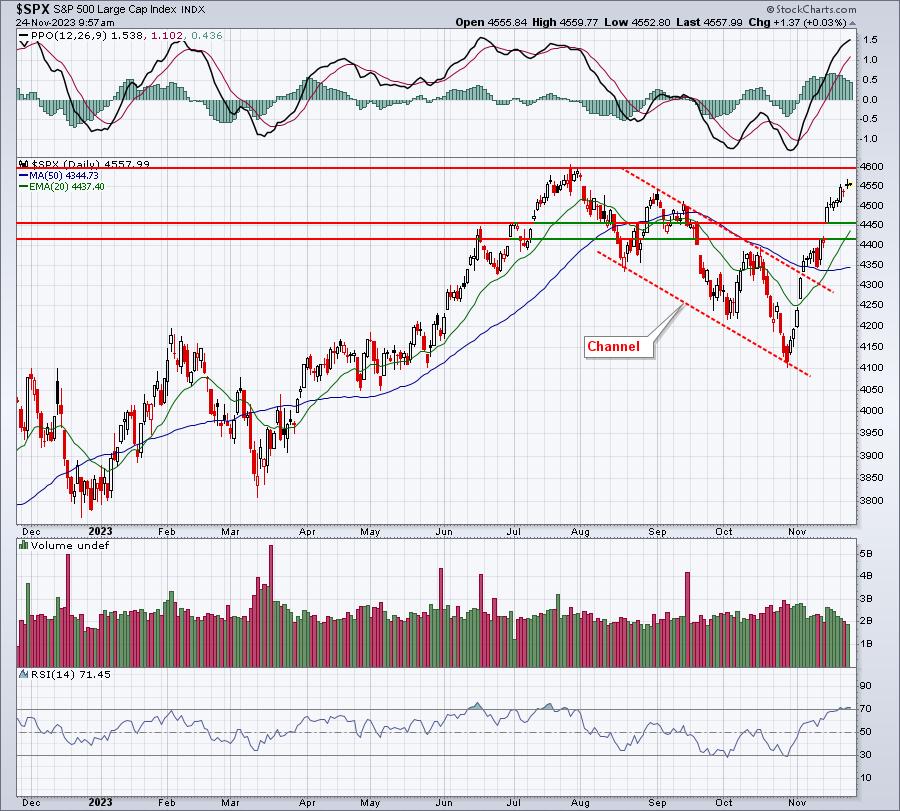

I think just about everyone is on "4600 watch" on the S&P 500 and I can't blame them. It's a big level. That was our high in July and now the subsequent recovery has returned the S&P 500 to the...

READ MORE

MEMBERS ONLY

Bullish Rotation Fully Supports Further Gains Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Well, we're into the final month of 2023. Are we having fun yet? I'd argue that the bulls are having a blast, with many stocks surging year-to-date. I love all the attention that the "Magnificent 7" are attracting. Stock market skeptics are ALWAYS looking...

READ MORE

MEMBERS ONLY

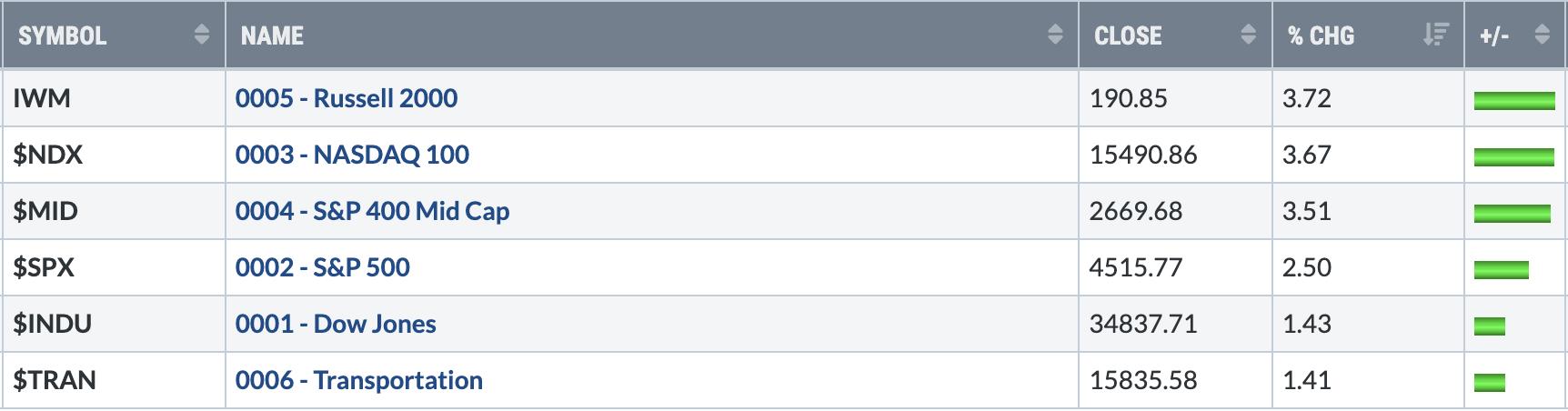

What A Week! This Small Cap Party Might Just Be Getting Started

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Last week, in my Weekly Market Report to EarningsBeats.com members, I pointed out the upcoming bullish history of the small cap Russell 2000 Index (IWM tracks this index). Most probably have no clue why small caps outperformed by such a wide margin this week. But history saw it coming...

READ MORE

MEMBERS ONLY

What Are The Chances Of A Market Crash? This Indicator Says ZERO!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We can use sentiment indicators for a lot of purposes. I routinely follow the 5-day SMA of the equity only put call ratio ($CPCE) to help spot short- to intermediate-term bottoms. It's not quite so effective at calling market tops, but it does work in that regard many...

READ MORE

MEMBERS ONLY

Seasonality Points To Higher Prices NOW

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

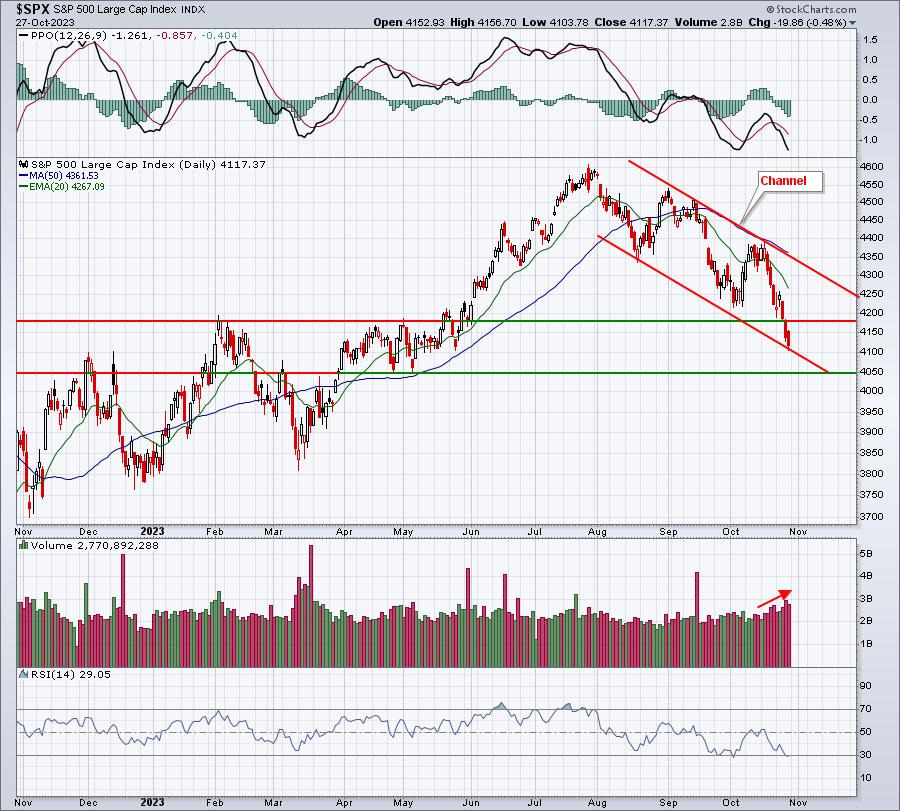

I know we're in the midst of a powerful rally that began EXACTLY when seasonality suggested it would - at the close on October 27th. I discussed the very bearish seasonality leading up to that October 27th close in my article, "Odds Favor Further Selling This Week...

READ MORE

MEMBERS ONLY

EB Weekly Market Report - Monday, November 20, 2023

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Sample Report

Below is our latest Weekly Market Report (WMR), which is published on Sunday/Monday of every trading week. It's unlike our Daily Market Report (DMR) as the WMR focuses almost exclusively on the Big Picture and is more designed for those with longer-term investing/trading horizons....

READ MORE

MEMBERS ONLY

Expedia (EXPE) Taking The Road Less Traveled

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

After crushing its revenue and earnings expectations on November 2nd, Expedia (EXPE) has been on a roll. Here are the quarterly numbers that the internet travel giant posted a little over two weeks ago:

* Revenues: $3.93 billion (actual) vs. $3.87 billion (estimate)

* EPS: $5.41 (actual) vs. $5....

READ MORE

MEMBERS ONLY

Channeling The Energy From Lower Interest Rates

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The 10-year treasury yield ($TNX), and its recent decline, is certainly aiding, at least in part, the recent surge in U.S. equities. After hitting 5.0% on October 23rd, the TNX has been in a steady decline. As I see it, we've got further downside in the...

READ MORE

MEMBERS ONLY

Soaring Semiconductors Carry NASDAQ To Key High; A Solid Trade Off An Earnings Gap

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It was another very solid day on Friday, this time with the S&P 500 powering above 4400 and the NASDAQ 100 busting back above 15500, both clearing key price resistance levels that effectively end the series of lower highs and lower lows from the July high. The best...

READ MORE

MEMBERS ONLY

QQQ Breaking Out Again; Watch This Key Component Stock As It Breaks Out Too

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've already pointed out that I believe the July through October correction is over. I'm sticking to my earlier convictions that we'll experience a very strong finish in 2023, breaking out to all-time highs later in Q4 or sometime in Q1 2024. Growth continues...

READ MORE

MEMBERS ONLY

Why We're Going Higher And Two Necessary Steps To Become A Better Trader

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Trading isn't easy. It requires knowledge, experience, patience, discipline, risk management, preparation, research, and sometimes just old-fashioned good luck! After recognizing several cautious signals back in July, EarningsBeats.com suggested exercising patience to get us through whatever lied ahead. Well, hindsight now tells us that it was a...

READ MORE

MEMBERS ONLY

A Soft Landing Is Starting To Look Much More Likely

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Since the 2020 pandemic, we've seen many relative leaders come and go. I've found the most difficult part of trading/investing these past few years to be trusting the relative strength we see. Rotation is normal as we move through various economic cycles, but trying to...

READ MORE

MEMBERS ONLY

Should We Use Weakness To Accumulate NVDA Before Its Next Launch?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past six trading days, NVDA has fallen from a high of 476.09 to Friday's low of 410.78. That's a drop of 65.31, or nearly 14%, in just over one week. Would it make sense to take advantage of this selling? Well,...

READ MORE

MEMBERS ONLY

Odds Favor Further Selling This Week (Maybe a LOT of it)

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been watching the Volatility Index ($VIX) for years and it provides us a number of very important signals. One of those signals is BE CAREFUL when the VIX moves from the teens and into the 20s. In my experience, moving from 13 to 15 isn't...

READ MORE

MEMBERS ONLY

Striking While The Iron Is HOT!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Few individual stocks are truly worthy of a long-term investment. The truth of the matter is that most stocks have solid quarters, but rarely sustain that strength and growth over years and decades. In fact, many industry groups suffer from the same problem and it's one reason why...

READ MORE

MEMBERS ONLY

RRG Shows Explosion In Growth Stocks Is Taunting The Fed

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One thing I repeatedly talk about is ignoring the talking heads and following the charts. If I had to provide a chart as the "poster child" for this, I might start with the following RRG chart:

We're downtrending, right? We're heading back to the...

READ MORE

MEMBERS ONLY

Yields Soar on Strong Jobs Report

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

From a bullish perspective, I was hoping to see the "goldilocks" jobs report, one which still showed job growth, but came in below consensus estimates. The thought there is that the Fed would see that its rate-hiking campaign was working and the economy was slowing. Instead, we saw...

READ MORE

MEMBERS ONLY

I Say We're Setting Up For A Major Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's almost impossible to call market tops and market bottoms using basic technical analysis tools like price and volume. Don't get me wrong, that combination is my favorite during trend-following periods. But trying to spot bearish reversals is difficult when price action keeps riding higher and...

READ MORE

MEMBERS ONLY

Here's My Latest View of Current Market Action

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Hello to all my StockCharts supporters! First of all, thank you for your readership of my Trading Places blog, which is now in its 8th year. Also, thanks to all of you that watch my Trading Places LIVE shows that air on Tuesdays, Wednesdays, and Thursdays at 9:00am ET....

READ MORE

MEMBERS ONLY

You MUST Be Aware of This Seasonality Change

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I love the seasonality information that StockCharts.com provides. It's important to keep in mind that seasonal tendencies are secondary indicators. I don't buy and sell based on them, because the price/volume combination will always be my primary indicator. But if technical indications point to...

READ MORE

MEMBERS ONLY

Are You Ready for a Huge Rally?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It was one month ago that I discussed the serious (short-term) warning signs that the stock market faced. I summed it up pretty well on a Your Daily Five recording that aired on July 19th. Calling weakness after it hits is easy, but discussing objectively the warning signs BEFORE the...

READ MORE

MEMBERS ONLY

Why Sector Rotation Matters NOW! And What You NEED to Know

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In this episode of StockCharts TV'sThe Final Bar, guest host Tom Bowley discusses how, though sector rotation is displaying a slight shift towards bullish sentiments, things have still been rough. Acknowledging the recent rough patch in the market, Tom believes that market manipulation through options expiration might be...

READ MORE

MEMBERS ONLY

Opposite George Week Is Underway!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I always refer to monthly options expiration week as "Opposite George" week. It's a reference to the Seinfeld episode where George Costanza is, as always, down on his luck. Jerry and Elaine suggest that if everything he does in his life is wrong, then why not...

READ MORE

MEMBERS ONLY

Stay Ahead Of The Curve To Make More Money

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Everyone's a stock picker. And to be quite honest, everyone gets hot and everyone gets cold. Every trader has to find strategies that work for him/her and then hit the "rinse and repeat" button. Personally, I've found three keys that have helped me...

READ MORE

MEMBERS ONLY

Manipulation Around Earnings Season Is Insane!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Every quarterly earnings season, we hear the same thing on CNBC and other media outlets. "Earnings are going to be rough this quarter." Blah, blah, blah. After decades of technical, fundamental, and historical research, I've concluded that the games on Wall Street are designed to thoroughly...

READ MORE

MEMBERS ONLY

How Bad Could This Selling Get?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The first thing I always look at are the technical conditions. For me, that's a very simple analysis of price/volume. Here's what that looks like right now on the S&P 500 and NASDAQ 100:

S&P 500 ($SPX):

During any uptrend, I...

READ MORE

MEMBERS ONLY

Expect A Very Strong Earnings Report From This High Flyer!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We're about a week away from the start of Q2 earnings season, so now's the time to start doing your pre-earnings season homework. I'm not sure what that means to everyone else, but for me, it's all about evaluating relative strength. Which...

READ MORE