MEMBERS ONLY

American Express Beats Earnings, Raises Guidance And Challenges Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wednesday, after the closing bell, American Express (AXP) posted quarterly results that blew away consensus estimates for EPS and also managed to top revenue estimates. Furthermore, AXP raised its guidance on a forward-looking basis and shareholders are being rewarded today with a gap higher on massive volume. AXP is up...

READ MORE

MEMBERS ONLY

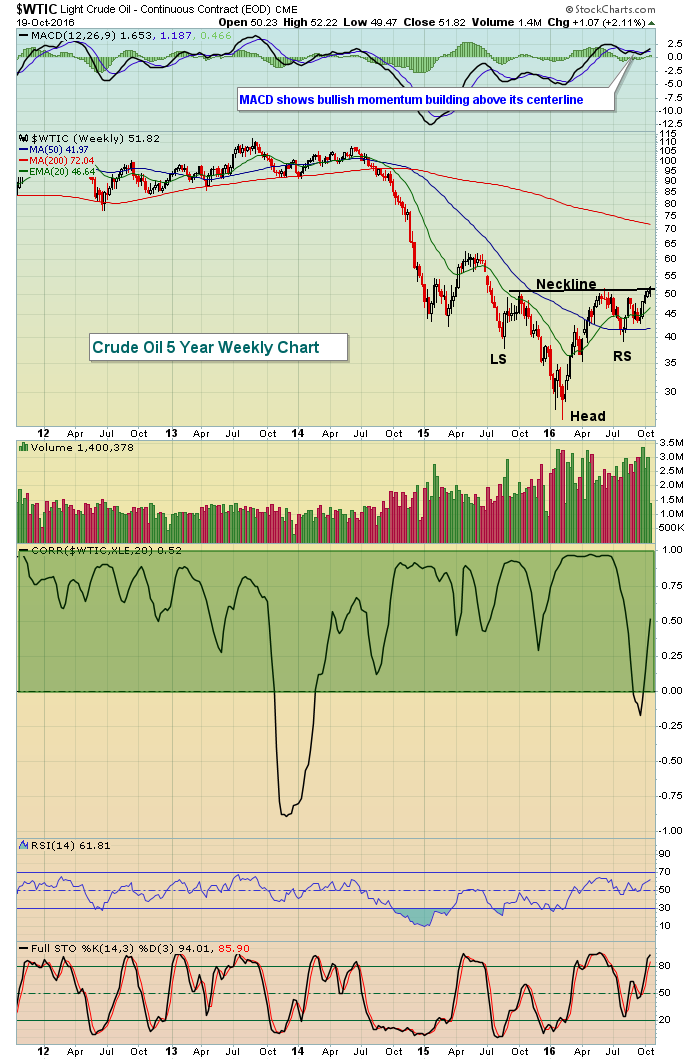

Energy Leads As Crude Oil On Verge Of Major Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 20, 2016

Energy (XLE, +1.42%) was clearly in charge throughout Wednesday's session as crude oil prices ($WTIC) neared a major breakout at $52 per barrel. This would represent a breakout of a bottoming head & shoulders formation that projects a future price...

READ MORE

MEMBERS ONLY

United Health Spurs Healthcare Providers, S&P 500 To Big Gains

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for October 18, 2016

Healthcare (XLV, +1.20%) performed extremely well on Tuesday, despite being the worst performing sector over the past month. There may have been some bottom fishing in the group as United Health (UNH) surged nearly 7% to lead the health providers group ($DJUSHP) to...

READ MORE

MEMBERS ONLY

Futures Strong As Key Support Continues To Hold

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 17, 2016

The benchmark S&P 500 flirted with key short-term price support at 2120 once again, this time finishing at 2126 as consumer discretionary (XLY, -0.82%) was the weakest sector and also approached key price support. Consumer discretionary is an important sector...

READ MORE

MEMBERS ONLY

Life Insurance Makes Bullish Bounce To Lead Financials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 14, 2016

The U.S. stock market ended last week in bifurcated fashion with the NASDAQ and S&P 500 barely finishing in positive territory, while the Russell 2000 lost 0.27%. The Dow Jones was the most bullish index, gaining 0.22% to...

READ MORE

MEMBERS ONLY

Bottomline Is Hoping Gap Support Is The Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

About seven weeks ago, Bottomline Technologies (EPAY) produced excellent quarterly earnings results when its top line edged Wall Street consensus estimates and its bottom line crushed them. Market participants were expecting 9 cents per share and management delivered a huge beat - to the tune of 18 cents. That doubling...

READ MORE

MEMBERS ONLY

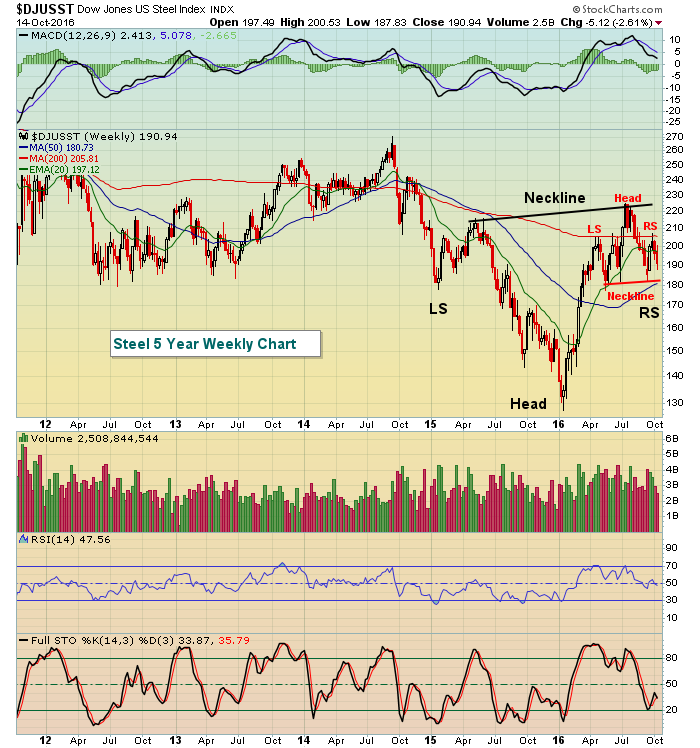

Looking Ahead To Potential November Strength

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We've entered a very strong historical part of the year for our major indices and most sectors and industry groups. Today, I want to focus on one of the best of the best, the Dow Jones U.S. Steel Index ($DJUSST). Average DJUSST monthly gains over the past...

READ MORE

MEMBERS ONLY

U.S. Stocks Hammer Out Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, October 13, 2016

It got a little scary during Thursday's morning session as key support was lost on an intraday basis. Fortunately for the bulls, it wasn't lost for very long as U.S. equities rallied and printed hammers across the board....

READ MORE

MEMBERS ONLY

Here's How To Use The MACD For A Sell Signal

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

My favorite indicator, other than the combination of price and volume, is definitely the MACD. I've studied it for years and I use it as a very important momentum indicator in my trading strategy. It's mostly a lagging indicator as it uses prior closing prices to...

READ MORE

MEMBERS ONLY

Stocks Hold Steady Wednesday, HUGE Test Today

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 12, 2016

Considering the selling that began early Monday and continued all day Tuesday, Wednesday provided some relief to the bulls. The U.S. market did finish in bifurcated fashion with the Dow Jones and S&P 500 gaining fractionally while both the NASDAQ...

READ MORE

MEMBERS ONLY

Stocks Are Hammered Tuesday But Here's Why The Selling Is Not Likely To Last

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 11, 2016

There was a lot of carnage on Tuesday for sure. Every sector declined, led by a very weak healthcare sector (XLV, -2.51%). Biotechs ($DJUSBT) were primarily responsible for the sector's underperformance as this aggressive part of healthcare tumbled 3.27%...

READ MORE

MEMBERS ONLY

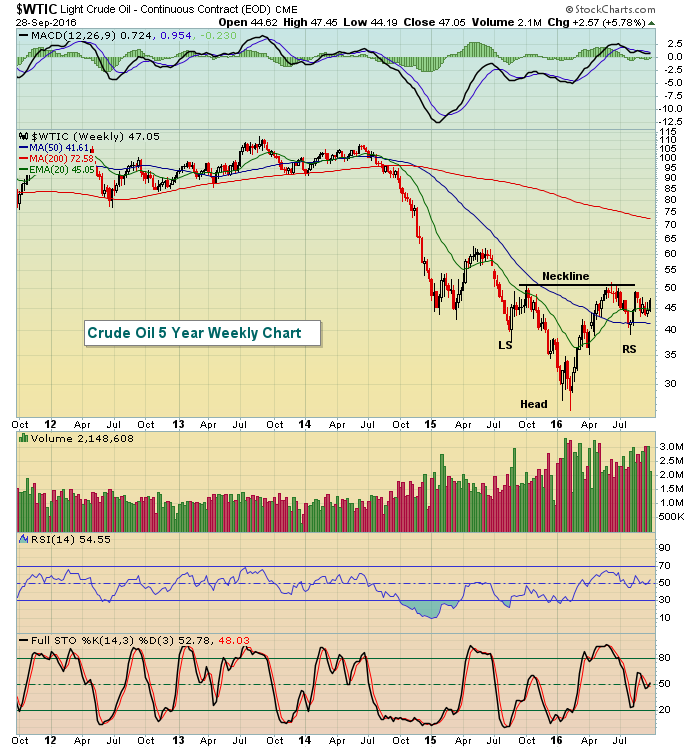

Crude Oil On Verge Of Major Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 10, 2016

Crude oil ($WTIC) rose more than 3% on Monday and energy (XLE, +1.57%) was easily the best performing sector as a result. Utilities (XLU, +0.83%) saw surprising strength as did REITs. The strength for the XLU and REITs, however, is not...

READ MORE

MEMBERS ONLY

Crude Oil Prices Rise Slightly, Aiding U.S. Futures

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 7, 2016

It was another down day on Friday for Wall Street, but there were no technical breakdowns to suggest we'd see follow through this week. Instead, we saw the materials sector (XLB, -1.86%) endure a painful session after two decent days...

READ MORE

MEMBERS ONLY

Lining Up Multiple Buy Signals To Minimize Risk

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There is no such thing as a guarantee when it comes to stock trading. However, using technical analysis as a predictive tool to manage your risk is the key to success in my opinion. Let's take EnCana Corp (ECA) as an example. ECA lost more than 15% over...

READ MORE

MEMBERS ONLY

Dollar's Two Month High Spells Trouble For Gold

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, October 7, 2016

It was mostly a flat day, although basic materials (XLB, +0.82%) managed to produce a stronger gain on a relative basis. Paper, aluminum and commodity chemicals were the three industry groups helping to lead the materials sector. While commodity chemicals ($DJUSCC) have...

READ MORE

MEMBERS ONLY

MetLife Leads Strong Life Insurance Group

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Life Insurance index ($DJUSIL) broke above 650 for the first time in 2016, buoyed by suddenly surging 10 year treasury yields ($TNX). Leading the charge in the group is MetLife (MET), which at today's high had gained 33% since its post-Brexit low near...

READ MORE

MEMBERS ONLY

Selling Of Treasuries Helping Banks, Life Insurers

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 5, 2016

Well, the market rotation continues unabated. It was bounce back day on Wednesday, although no key levels of price resistance were cleared. Volume did accelerate, however, as a shorter-term triangle unfolds on the S&P 500. You can check out the recent...

READ MORE

MEMBERS ONLY

Is Volatility Suggesting We're In For A Rough 4th Quarter?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 4, 2016

Over the past week, energy (XLE, +4.41%) and utilities (XLU, -5.70%) have been at opposite ends of the stock market spectrum, while all of the other sectors have been fairly close to the flat line. Pacing energy has been the Dow...

READ MORE

MEMBERS ONLY

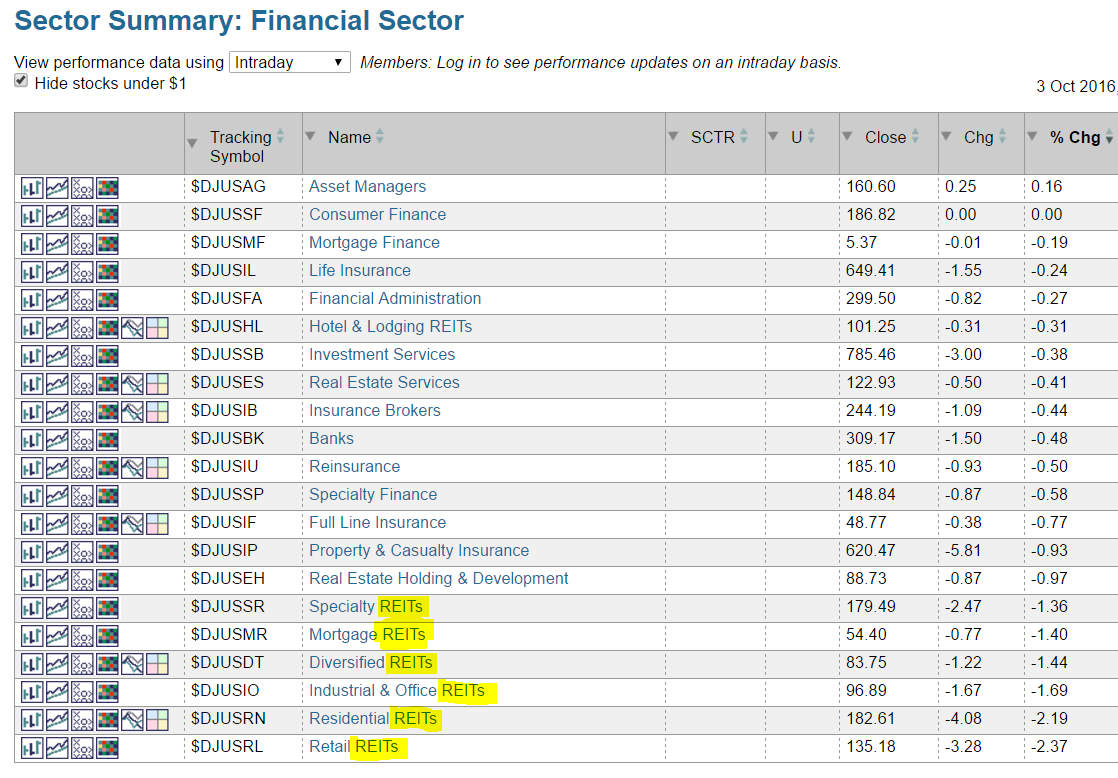

Equities Open 4th Quarter With Widespread Losses

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 3, 2016

Q3 performance was fairly solid, especially on the NASDAQ where the strength in technology shares carried the load. Q4 didn't start off quite so well as each of our major indices finished down and eight of nine sectors were lower. The...

READ MORE

MEMBERS ONLY

Higher Yields Send Financials Higher, Utilities Lower

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 30, 2016

Financial (XLF, +1.37%) and energy (XLE, +1.36%) shares paced Friday's advance to close out September on a very strong note for U.S. equities. Like most of the summer, September was a bifurcated month, one in which two sectors...

READ MORE

MEMBERS ONLY

The Next Breakout In This Pipeline Stock Would Be Huge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

On a weekly closing basis, Antero Midstream Partners LP (AM) has vacillated between support near 18.00 and resistance at 28.00 for the past two years. While the Dow Jones U.S. Pipelines Index ($DJUSPL) still has miles to go to reach its high from two years ago, the...

READ MORE

MEMBERS ONLY

Technology Stocks Produce Huge Third Quarter; 3 Stocks To Watch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Technology stocks (XLK) produced gains of more than 10% in the third quarter of 2016, more than double that of any other sector. Industrials (XLI) were the second best group, posting a quarterly gain of 4.80%. We all know the bigger names in technology, so this article will focus...

READ MORE

MEMBERS ONLY

S&P 500 Led Lower By Defensive Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 29, 2016

Healthcare stocks (XLV, -1.76%), utilities (XLU, -1.50%) and financials (XLF, -1.40%) led a broad-based decline on Thursday with energy (XLE, -0.17%) the only sector to escape relatively unscathed. In particular, biotechnology and pharmaceutical shares were weak with the latter...

READ MORE

MEMBERS ONLY

Looking For A Breakout Stock In Energy? Listen Up Nabor

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Energy stocks (XLE) have been lifted the past couple days due to OPEC agreeing to stem production in an attempt to balance supply and demand. It's difficult to say whether it'll actually work, but thus far the stock market likes what it's hearing. Energy...

READ MORE

MEMBERS ONLY

Energy Enjoys Biggest Day of 2016; Equities Surge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 28, 2016

Energy shares (XLE, +4.32%) soared on Wednesday to their largest single day gain of the year as crude oil ($WTIC) gained more than 5% on the back of OPEC's agreement to curb oil production. This was the first such agreement...

READ MORE

MEMBERS ONLY

Technology And Consumer Discreitionary Lead Stock Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap

First, I'd like to thank everyone who attended ChartCon 2016, making it a HUGE success! It was great interacting with folks from around the globe via Guidebook and I can't wait to have the opportunity to do it again! I will be back on...

READ MORE

MEMBERS ONLY

Crude Oil And Energy Stocks Remain Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Crude oil prices ($WTIC) have been hovering between $40-$52 per barrel for the past six months, but the bottoming reverse head & shoulders pattern is telling us to watch closely to see if we can get a confirming breakout on this pattern above neckline resistance at $52. In the...

READ MORE

MEMBERS ONLY

Renewable Energy Stock Fills Breakaway Gap

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's nice to see a heavy volume gap higher to break a downtrend. It can be a very strong signal that sentiment has changed on a particular stock or industry group. While renewable energy stocks ($DWCREE) remain technically-challenged, one of its components - Sunrun (RUN) - has certainly...

READ MORE

MEMBERS ONLY

This Relative Ratio Suggests U.S. Weakness Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I continue to move into ChartCon 2016 mode, so bear with me as all of us here at StockCharts.com prepare to descend upon California. My travel day is tomorrow so I will not likely post at all. Of course, there's always the possibility of a...

READ MORE

MEMBERS ONLY

U.S. Equities Stumble on Friday As Banks Test 50 Day

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

My blog articles will be brief the next two days as I prepare for ChartCon 2016. I will be traveling on Wednesday so there will be no article that day. While in California, my blog schedule will not be set so I'll simply post when I...

READ MORE

MEMBERS ONLY

Combining Seasonality And Strong Technical Patterns

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This is the final ChartWatchers newsletter before all of us here at StockCharts.com descend upon Northern California to produce what I believe will be one of the most educational online financial conferences of our time. Leading technical experts will be divulging their best kept secrets to hopefully add weapons...

READ MORE

MEMBERS ONLY

Here Are The Four Technology Industry Groups You Don't Want To Ignore

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

After technology stocks (XLK, +2.70%) clubbed the energy sector (XLE, -2.64%) last week, the former group is now the leading sector over the past six months, widely outperforming the benchmark S&P 500 index. Within technology, there are four industry groups that have been outperforming the benchmark...

READ MORE

MEMBERS ONLY

Technology Shares Lead Strong U.S. Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 15, 2016

There was plenty of good news to go around on Thursday, which was nice because the bulls have been beaten up a little bit of late. All of our major indices finished with solid gains and all nine sectors advanced. Technology (XLK, +1....

READ MORE

MEMBERS ONLY

Live Nation Chart Is Like Music To My Ears

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Live Nation Entertainment (LYV) is a $5 billion consumer discretionary company that in late July reported excellent quarterly results and gapped higher to touch the 28.00 level. The stock's all-time high came in October 2015 just beneath 30.00. It's consolidating just above its rising...

READ MORE

MEMBERS ONLY

Let's Get Ready To Rum.....Errrr, Gamble!!!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 14, 2016

Market and sector performance was bifurcated on Wednesday with the NASDAQ performing much better on a relative basis, gaining 0.36% on the session. The Dow Jones, S&P 500 and Russell 2000 all finished with fractional losses. Leading the NASDAQ were...

READ MORE

MEMBERS ONLY

Back Down We Go...Where Will It End?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for September 13, 2016

Honestly, I'm not at all surprised at the failure on Tuesday for the bulls to capitalize on Monday's rally. We had a lot of room to key short-term price resistance after Friday's free fall in our major indices....

READ MORE

MEMBERS ONLY

U.S. Stocks Rebound Strongly But......

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, September 12, 2016

There were two problems with the rally on Monday. First, there was the issue of failure at price and gap resistance as I will discuss in the Current Outlook section below. Second was the issue of leadership on the advance. Don't...

READ MORE

MEMBERS ONLY

Heavy Volume Selling Turns Tables; Expect More Selling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

We're less than two weeks away from ChartCon 2016, the biggest online financial conference of the year!!! Be sure to reserve your spot today! CLICK HERE to learn more about the event, including the speakers and agenda. The theme this year is "building a successful...

READ MORE

MEMBERS ONLY

Energy Soaring To Stabilize Weakness Elsewhere

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 8, 2016

If you haven't noticed, maybe you should. Energy (XLE, +1.87%) is in a bull market, posting 5.17% gains in just the last week! That's not a bad year. It's not like U.S. equities have...

READ MORE

MEMBERS ONLY

Will This Paper Company Hold Key Gap Support?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Domtar Corp (UFS) has returned to a key support zone between 37.00-37.50. A close below this level would be bearish as Domtar's longer-term chart is neutral at best. I'd be looking for the top of the earnings-related gap higher in late July to hold....

READ MORE