MEMBERS ONLY

Banks Lose Two Year Support Despite Solid Results

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Technical analysis doesn't try to answer why questions. Fundamentalists are constantly bewildered by price action, especially when it seems to contradict fundamental news. Technicians simply don't care. The stock market looks ahead and therefore price action precedes news. That's why it's important...

READ MORE

MEMBERS ONLY

Oil, China Drop; U.S. Futures Tanking AGAIN

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note: Two quick reminders. First, if you haven't already, please subscribe to my blog. By doing so, my blog articles will be sent directly to your email upon publishing. You'll receive my article the moment it's published. It's easy and it'...

READ MORE

MEMBERS ONLY

Energy Ignites U.S. Equity Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's no secret that crude oil prices ($WTIC) have been tumbling over the past 18 months, but that has kept tremendous pressure on energy-related shares and the energy ETF (XLE). Crude oil managed to close back above $31 per barrel with the Dow Jones U.S. Pipelines Index...

READ MORE

MEMBERS ONLY

How To Approach A Technically Broken Market?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, January 13, 2016

What a mess. Money has been rotating toward defense for months and now we know why. Because market participants want nothing to do with risk right now. Last year, the sectors attracting sellers were energy (XLV) and materials (XLB). Those two groups held...

READ MORE

MEMBERS ONLY

Stocks Rally Finally But....Huge Resistance Now Looms

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

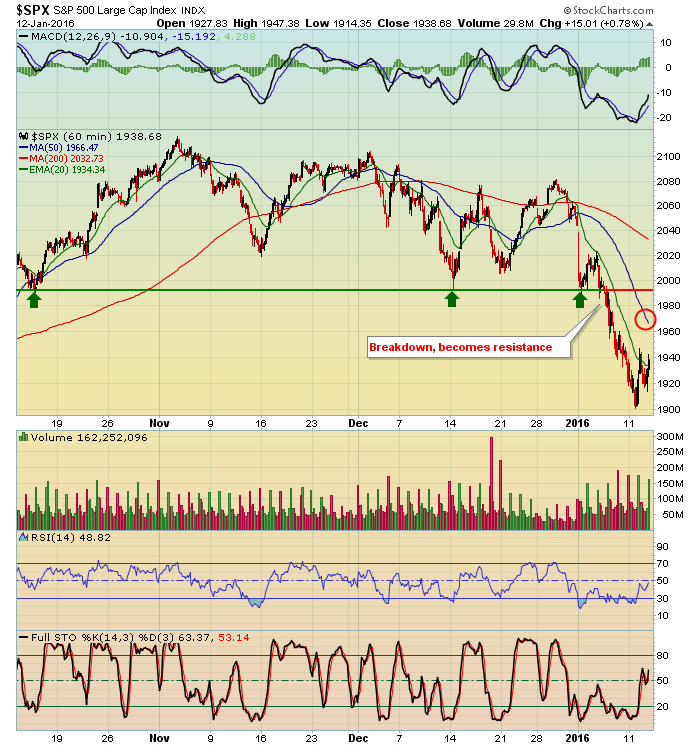

Market Recap for Tuesday, January 13, 2016

There were a few positives regarding the rally on Tuesday. First, all of our major indices finished in the green for the first time in 2016. Whew! The better news is that aggressive areas of the market benefited most and that should provide...

READ MORE

MEMBERS ONLY

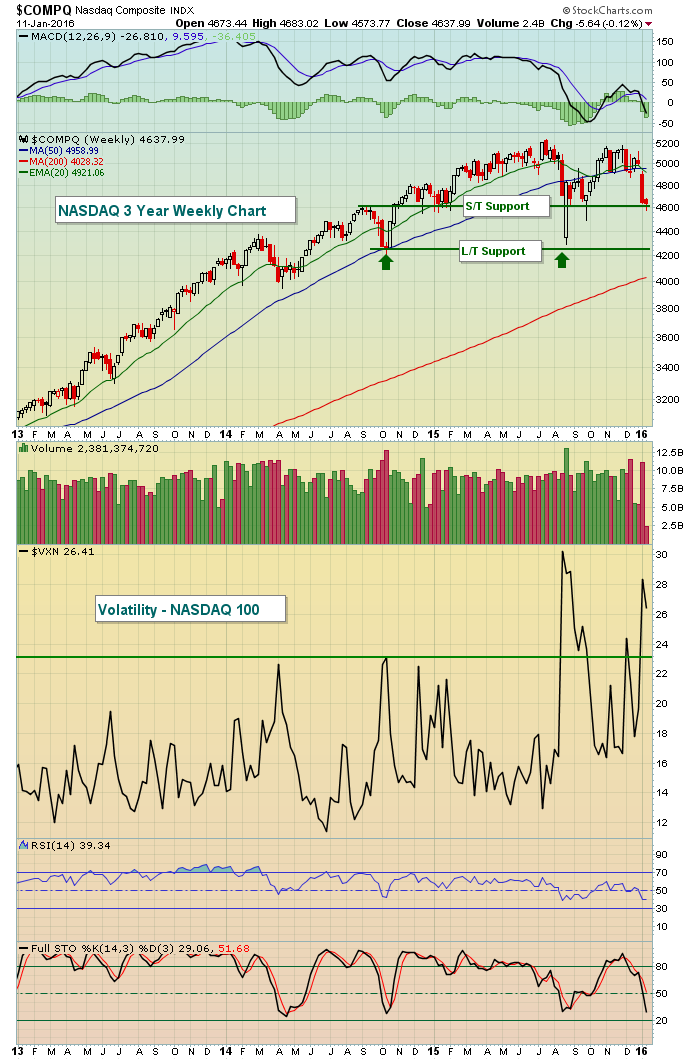

High VXN And Support Approaching

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for January 11, 2016

Monday was a bifurcated market in which we saw both the Dow Jones and S&P 500 rise for the session while the underperforming NASDAQ extended its losing streak to start the year. Both the NASDAQ and Russell 2000 have fallen more than...

READ MORE

MEMBERS ONLY

Market Is All About Defense

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for January 8, 2016

Honestly, most traders are probably just happy last week finally came to an end. While Monday through Wednesday consisted mostly of gaps with sideways trading intraday, we saw much more of a concerted selling effort the latter part of the week with bouts of...

READ MORE

MEMBERS ONLY

Last Two Key Industry Groups Break Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past year, the Dow Jones U.S. Internet Index ($DJUSNS) has risen 23% while the only industry group to outperform the DJUSNS has been the Dow Jones U.S. Toys Index ($DJUSTY), which has risen 31%. Last week's selling to open 2016 was strong enough to...

READ MORE

MEMBERS ONLY

The Bulls Need These Leading Industries To Hold Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for January 7, 2016

Once again the best performing sectors were the three defensive groups - utilities (XLU), consumer staples (XLP) and healthcare (XLV). All of our aggressive sectors tumbled anywhere from 2%-3% with technology leading the way. A number of industry groups within technology are either...

READ MORE

MEMBERS ONLY

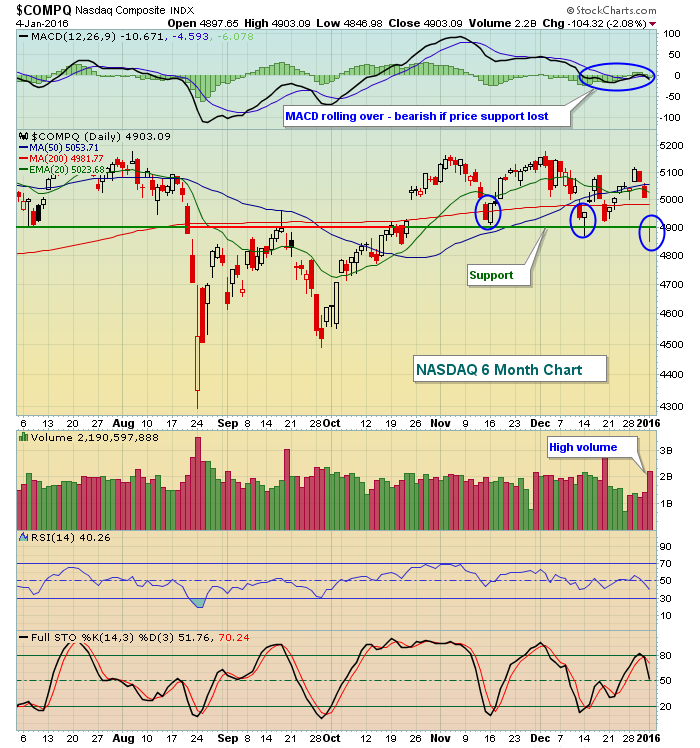

NASDAQ Tumbling; Chaikin Money Flow and Accum/Dist Line Rising - Huh?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you've ever used the Chaikin Money Flow (CMF) or Accumulation/Distribution (AD) as indicators to help gauge buying and selling pressure, just make a note that gaps to both the upside and downside are ignored in their calculations. Let's take the NASDAQ Composite as an...

READ MORE

MEMBERS ONLY

Futures Tumble; Dow Jones Down 400 Points

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for January 6, 2016

If the stock market could avoid the opening bell catastrophes, the action in 2016 wouldn't be bad at all. Thus far this year, the NASDAQ has had net gap downs of 173 points on a cumulative basis. Trading from 9:30am EST...

READ MORE

MEMBERS ONLY

Plummeting Futures Confirm Poor Tuesday Leadership

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, January 5, 2016

Let's start with the good news. After a big selloff on Monday morning, the U.S. stock market rallied into the close to print reversing candles across most of our major indices, sectors and industry groups. That was followed up with...

READ MORE

MEMBERS ONLY

S&P 500 Tests Key Support For Third Time

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, January 4, 2016

China's Shanghai Composite ($SSEC) sent global markets lower on Monday after the SSEC shred nearly 7% of its value. Asian markets tumbled and those losses triggered sizable gaps lower in Europe and here in the U.S. A late rally in...

READ MORE

MEMBERS ONLY

Futures Point To Ugly Start To 2016

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

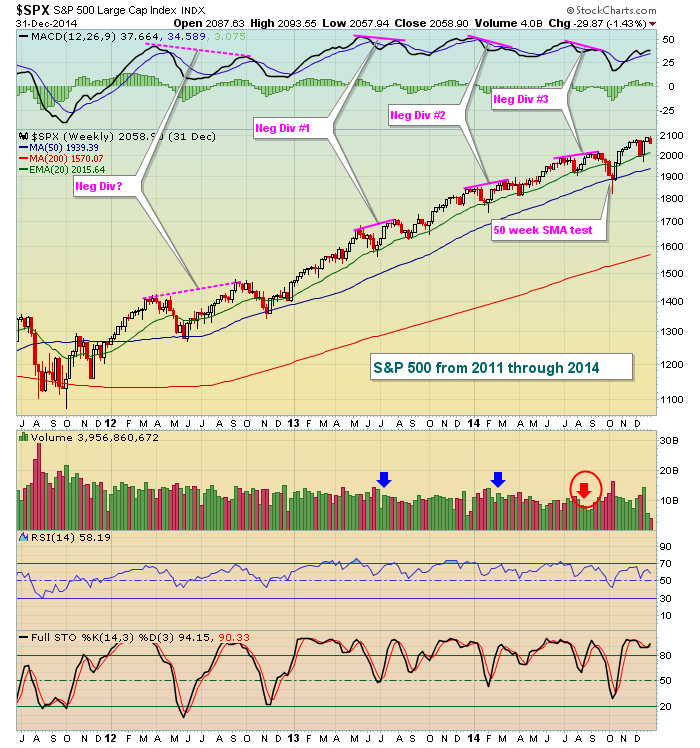

Market Recap for Thursday, December 31, 2015

Happy New Year! The action on Thursday to close out the year symbolized trading throughout all of 2015. We were down early, rallied to try to move into positive territory and then fell again in the second half of the session to finish...

READ MORE

MEMBERS ONLY

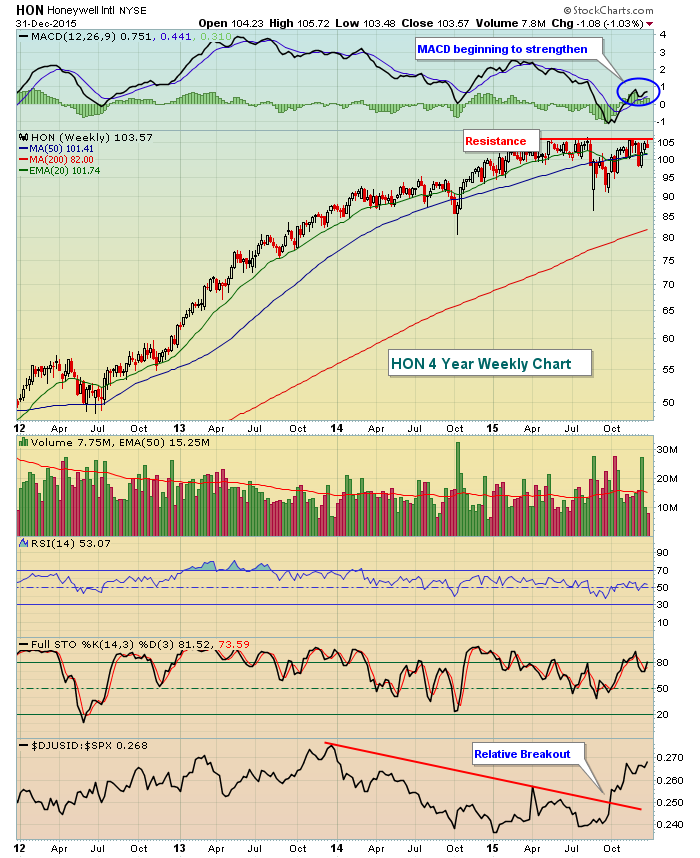

Honeywell Looking For A Happy New Year

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Honeywell (HON) is part of the diversified industrials ($DJUSID) that saw excellent relative strength in the fourth quarter of 2015. General Electric (GE) reported excellent quarterly results in October and moved to its highest level in 15 years last week. HON appears to be on a path to do the...

READ MORE

MEMBERS ONLY

2016 Leadership: Where Should We Look?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

2015 was a very difficult year. We witnessed our first serious selling since 2011. It's unusual to trade in a bull market for four years with little interruption, yet that's exactly what we did. Despite not breaking down, the trading environment was quite challenging in 2015....

READ MORE

MEMBERS ONLY

Technology Leads Big Rally; Internet Stocks Threatening Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

NOTE:

I will be out tomorrow so I won't provide my next article until Monday, January 4th. HAPPY NEW YEAR! I'm wishing everyone health and happiness in 2016.....and of course great trading results! Do me a favor. At the bottom of this article, click on...

READ MORE

MEMBERS ONLY

Energy Fails At 20 Day EMA, Leads Monday's Selling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 28, 2015

On Monday, energy (XLE) did what it's done best in 2015 - it led the nine sectors to the downside by falling 1.82%, much more than the S&P 500's .22% decline. Materials (XLB), another 2015 laggard,...

READ MORE

MEMBERS ONLY

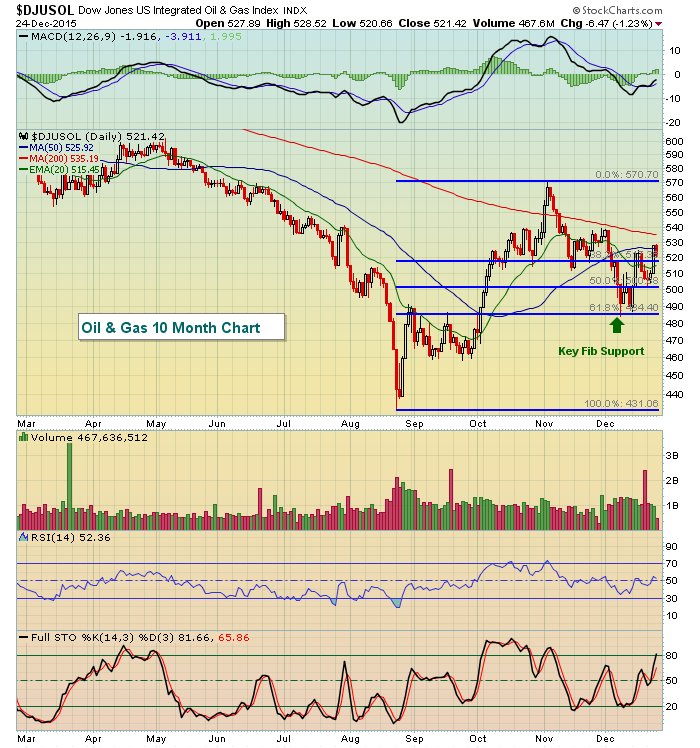

Oil & Gas Bouncing Off Key Fibonacci Level

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, December 24, 2015

Thursday was a shortened trading session before the Christmas holiday and there was little movement in our major indices and on little volume. Eight of nine sectors moved lower on Thursday, although energy (XLE) was the only space to see much selling. Oil...

READ MORE

MEMBERS ONLY

Toys Bullish For The Holidays

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Toys Index ($DJUSTY) is ending the year just about the same way it began - on a very bullish note. Recently, the DJUSTY completed a bullish ascending triangle pattern in August and September before breaking out in October. Since that time, the DJUSTY has printed...

READ MORE

MEMBERS ONLY

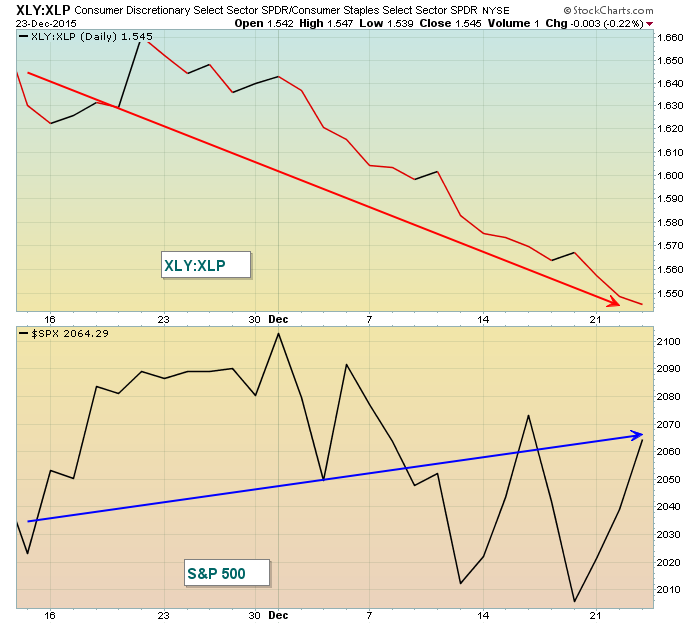

Energy Leads Pre-Holiday Rally; Consumer Stocks Lag

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for December 23, 2015

All nine sectors finished higher on Wednesday, led by energy (XLE) which gained a very impressive 4.35%. Materials (XLB) also showed outsized gains of 2.36%. Aggressive sectors like technology (XLK) and consumer discretionary (XLY) rose but underperformed. This rally has been marked...

READ MORE

MEMBERS ONLY

Santa Claus Rally Underway?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, December 22, 2015

Tuesday's action was bullish on a few fronts. First, it was a trend day where we saw buying throughout. The last time that happened was December 4th, nearly three weeks ago. Second, the rally was led by industrials (XLI) which gained...

READ MORE

MEMBERS ONLY

Houston, We Have.......Indecision!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 21, 2015

Nothing in this market can seem to make up its mind. The Volatility Index ($VIX) is straddling a key 20 level, not allowing sentiment to move favorably in either the bulls or bears favor. The German DAX is straddling key short-term support/resistance...

READ MORE

MEMBERS ONLY

Bulls' Resolve To Be Tested This Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 18, 2015

Friday's action was marked by short-term price breakdowns in a few of our major indices, sectors and industry groups. It also was accompanied by extremely heavy "quad-witching" volume. Quad-witching refers to the 3rd Friday of March, June, September and...

READ MORE

MEMBERS ONLY

Great Fundamental Story, But Will Gap Support Hold?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Last month, Ctrip.com (CTRP) posted both revenues and EPS well above Wall Street consensus estimates and it came on the heels of an earlier announcement where CTRP was involved in a share swap that resulted in Baidu (BIDU) owning a 25% ownership interest in the Chinese online travel company....

READ MORE

MEMBERS ONLY

More Bearish Signals Emerging

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm not ready to write off this bull market as the most important indication of all - the combination of price/volume - remains bullish in my view. But the signals "under the surface" are beginning to erode. One of two things will likely happen. Either...

READ MORE

MEMBERS ONLY

Fed Effect Lost.....And So Are The Gains

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, December 17, 2015

Traders seemed overjoyed to finally put the uncertainty of higher interest rates behind them on Wednesday....only to find new worries on Thursday. After attempting to rally the past few days, crude oil ($WTIC) fell again on Thursday to close near 36.00...

READ MORE

MEMBERS ONLY

Apple Shows Positive Divergence on 60 Minute Chart

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Apple (AAPL) is breaking down beneath its November low and on the surface appears to be a broken stock, but its intraday 60 minute chart is telling a much different story. Given the slowing volume this afternoon and near test of Wednesday's pre-Fed low, AAPL's turn...

READ MORE

MEMBERS ONLY

Fed Decision Sparks Rally But.........

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 16, 2015

First, the good news. The Federal Reserve raised interest rates in the U.S. for the first time in nine years, signaling their belief that economic strength lies ahead with an improving labor market. The quarter point hike really will do little to...

READ MORE

MEMBERS ONLY

Traders Bid Up Shares Ahead of Fed Decision

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, December 15, 2015

Energy and financials were the leaders in Tuesday's rally as all nine sectors gained ground, supporting the market's two day rally. Given the significance of today's Fed decision which will likely produce the first interest rate hike...

READ MORE

MEMBERS ONLY

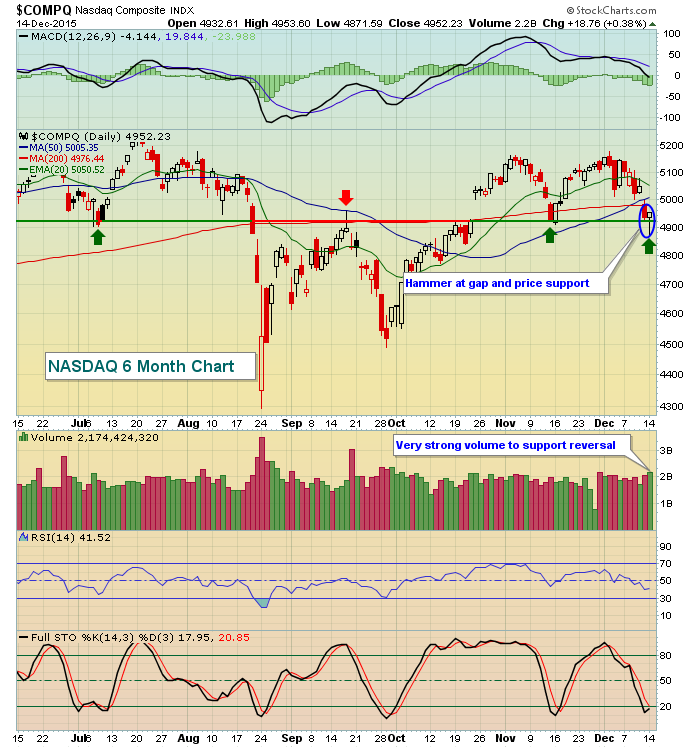

NASDAQ Prints Bullish Hammer At Price Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 14, 2015

Eight of the nine sectors finished higher on Monday as the U.S. stock market made a case for a near-term bottom. We know the middle of December tends to turn in favor of the bulls and there were plenty of kick saves...

READ MORE

MEMBERS ONLY

High Volatility Equals Impulsive Bouts Of Selling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 11, 2015

Friday was a very rough day for U.S. equities on a number of fronts, but the most obvious was the approximate 2% loss that each of our major indices sustained. In my Friday blog article, "Futures Tank, Bears Have A Big...

READ MORE

MEMBERS ONLY

Volatility Now Becomes Bulls' Enemy #1

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Conditions changed on Friday and the short-term market prospects grew significantly riskier. Why? Because in addition to price support breakdowns across many key indices, sectors and industry groups, the volatility index ($VIX) spiked 26% on Friday to close at 24.39. Historically, the 20 level on the VIX has carried...

READ MORE

MEMBERS ONLY

Futures Tank, Bears Have A Big Opportunity

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, December 10, 2015

We finished higher across all of our major indices, which is a positive. The negative, however, is that we saw much higher prices earlier in the day only to watch them deteriorate in the afternoon. I never like afternoon selling, especially when history...

READ MORE

MEMBERS ONLY

Dollar's Cup With Handle Appears Complete

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The U.S. Dollar index ($USD) saw a parabolic rise from mid-2014 through March 2015 and has been consolidating since in a classic cup with handle pattern. The pattern doesn't confirm until we see a breakout, but there's a Federal Reserve meeting next week that could...

READ MORE

MEMBERS ONLY

NASDAQ Weak; Materials Buoyed By Falling Dollar, Dupont Deal

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 10, 2015

The action on Wednesday was crazy. The Dow Jones was higher by 200 points in the first hour of trading. At that same time, the NASDAQ was up less than 10 points, a complete reversal of what we saw on Tuesday when the...

READ MORE

MEMBERS ONLY

Industrials (XLI) Weak Amid Signs Of Toppiness

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for December 8, 2015

I indicated on Tuesday morning that the bulls' resiliency would be tested as our major indices were poised to open significantly lower. They proved they're a resilient bunch once again, frustrating those on the bearish side of the aisle. It feels...

READ MORE

MEMBERS ONLY

Same Ole Same Ole, Energy Plunges

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 7, 2015

As baseball great Yogi Berra would famously say, "It's deja vu all over again". The S&P 500 keeps trying - and failing - to break out and one big reason is the lack of participation from energy...

READ MORE

MEMBERS ONLY

Friday Rebound Keeps Bull Market On Track - Maybe

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 4, 2015

Major indices here in the U.S. rebounded Friday in a big, big way after Thursday's drubbing. During uptrends, I always look to rising 20 day EMAs for support. On Thursday, all of our major indices lost 20 day EMA support,...

READ MORE

MEMBERS ONLY

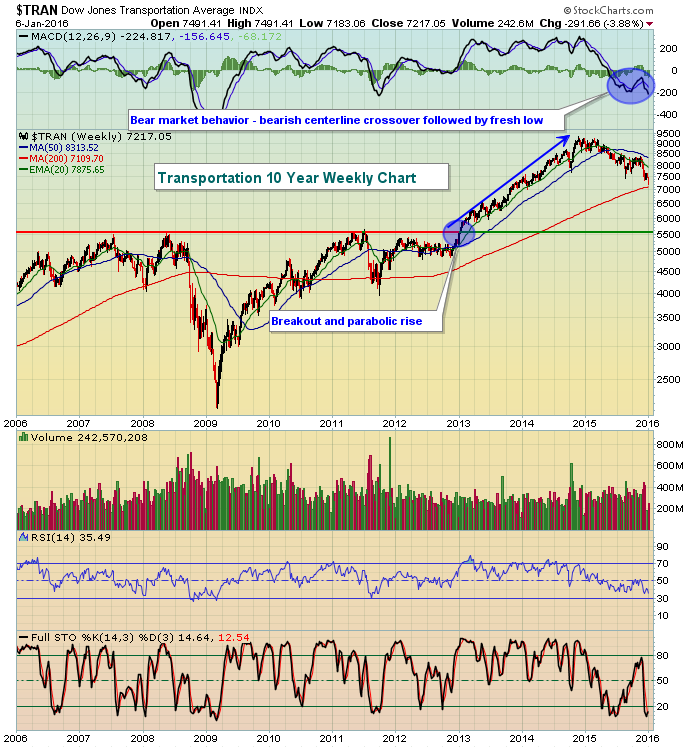

This Is How Money Rotates Prior To Bear Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

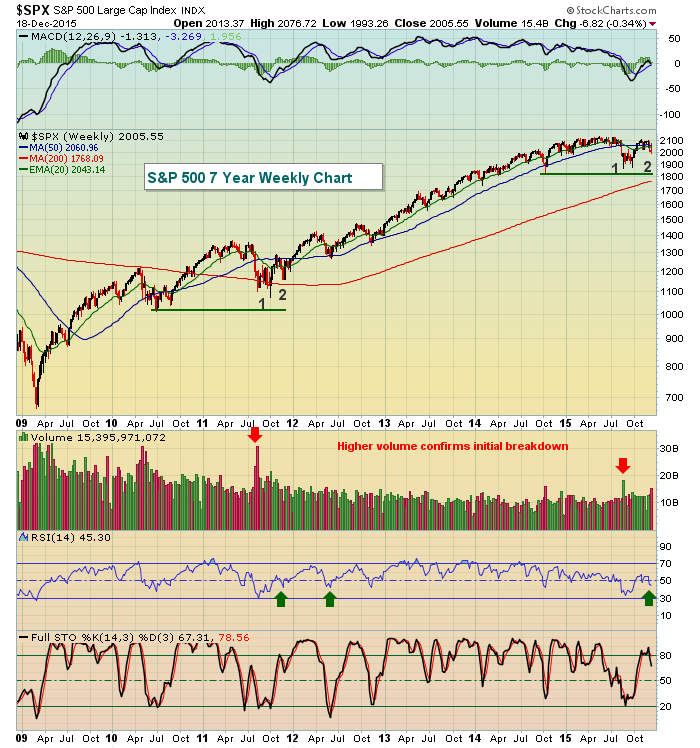

The start of every bear market is different. Sometimes it's driven by technology stocks, other times it's a financial crisis. Whatever the case, one common denominator seems to be that aggressive areas of the stock market are abandoned as final tops are made or challenged. In...

READ MORE