MEMBERS ONLY

Stocks Move Lower But Biotechs Clear 50 Day

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 27, 2015

It was a rather non-eventful day on Tuesday with our major indices in negative territory throughout much of the day. There was a bit of bifurcation once again as the NASDAQ 100 finished in positive territory while the Russell 2000 once again lagged...

READ MORE

MEMBERS ONLY

Market Calms As Traders Await Apple Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 26, 2015

Relatively speaking, there was little volatility in U.S. equities on Monday as each of our major indices showed minor gaps at the open and then traded within Friday's trading range. In other words, we didn't see any higher...

READ MORE

MEMBERS ONLY

NASDAQ Flies Led By Technology

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 23, 2015

Huge earnings reports from the likes of Amazon.com (AMZN), Alphabet (GOOGL) and Microsoft (MSFT), among others, sent NASDAQ 100 shares flying higher on Friday, far outpacing the broader stock market. For the week, technology and industrial shares rose 4.43% and 4....

READ MORE

MEMBERS ONLY

Priceline - Will It Be A Repeat Of Google And Amazon?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I don't like to place bets into earnings reports, but priceline.com (PCLN) sure does look to be a replica of Amazon (AMZN) and Google (GOOGL). AMZN and GOOGL both reported strong results in July and gapped significantly higher. After pulling back for several weeks to fill their...

READ MORE

MEMBERS ONLY

Resilient Bulls Defy Gravity

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 22, 2015

It was a very bullish kind of day. There was strength at the opening bell and outside of a brief mid-day bout of selling, buying continued through the close. Adding an exclamation point was the volume. Barring option expiration days and the panicked...

READ MORE

MEMBERS ONLY

Let's Get Sirius - A Breakout Is Coming

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Sirius Satellite (SIRI) has been trying to clear the 4.00-4.10 resistance area for two years now. This consolidation or basing period is very bullish since it follows a period of rising prices. We need to see the breakout first, however. SIRI reported its quarterly earnings and met Wall...

READ MORE

MEMBERS ONLY

NASDAQ Fails At Resistance; Closes At One Week Low

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 21, 2015

The U.S. stock market closed on a sour note on Wednesday as only very minor gains in consumer staples and industrials saved the bulls from an entire sector sweep. Leading to the downside were energy and healthcare as it's been...

READ MORE

MEMBERS ONLY

Biotechs, IBM Drag Market Lower

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 20, 2015

The Dow Jones U.S Biotech Index ($DJUSBT) fell 2.5% on Tuesday, failing to hold onto the 20 day EMA it had barely broken above the prior three trading sessions. That led to a healthcare group that lagged the overall market badly...

READ MORE

MEMBERS ONLY

Market Stalling Near Those Pivotal 20 Week EMAs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 19, 2015

It was mostly bifurcated action throughout Monday's session with the NASDAQ leading. The Dow Jones and S&P 500 did manage to finish with gains after rallying in the final two hours. Among sectors, consumer stocks resumed their leadership role...

READ MORE

MEMBERS ONLY

Option Expiration Day Provides No Answers

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 16, 2015

Friday's action was fairly calm for an option expiration day, especially given that there's so much at stake technically. We did see a sudden drop in the early part of the afternoon session only to be followed by a...

READ MORE

MEMBERS ONLY

QCOM Rally Sets Up Shorting Opportunity

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past three weeks, Qualcomm (QCOM) has rallied from a low of 52.17 to Friday's close at 59.91 - barely eclipsing the falling 20 week EMA currently at 59.78. Has that 15% recovery signaled that the worst is over? Or is this just the...

READ MORE

MEMBERS ONLY

Seasonality Favors Precious Metals And Travel Stocks In November

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

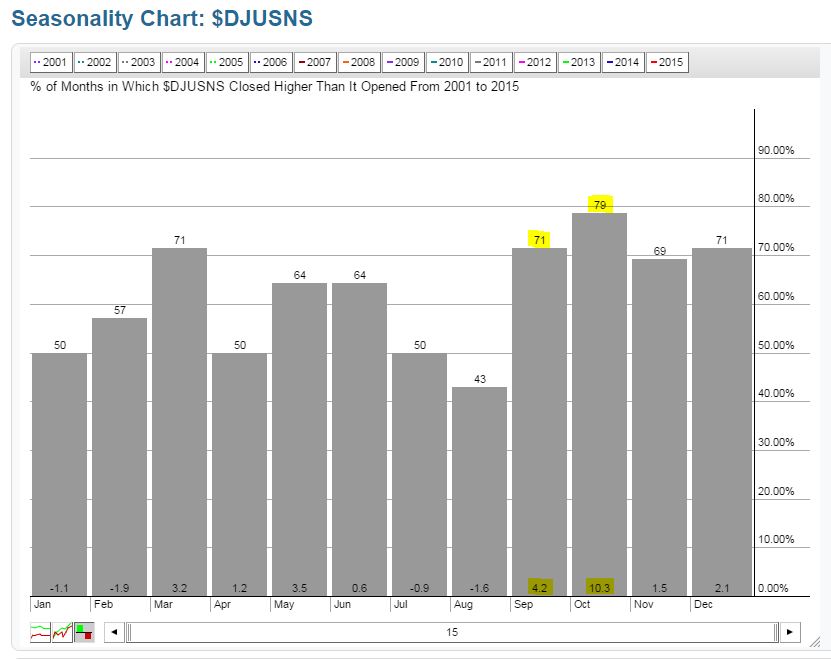

In prior months, I've used the seasonality tool here at StockCharts.com to identify industry groups poised to perform well. In September, internet ($DJUSNS), footwear ($DJUSFT), recreational services ($DJUSRQ), and reinsurance ($DJUSIU) stocks were shown to outperform the benchmark S&P 500 and all four either held...

READ MORE

MEMBERS ONLY

Bears Had Their Two Day Glory

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, October 15, 2015

On the surface, the big gains yesterday appear quite bullish - and they may turn out to be. There are definitely positives and negatives. On the plus side, volume really accelerated in the final hour or two to support the buying. We saw...

READ MORE

MEMBERS ONLY

Biotech Rallies But Resistance Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The technical conditions surrounding biotechs ($DJUSBT) are bad, no sugar-coating here. It's not pictured below but the DJUSBT did manage to clear 20 day EMA resistance on today's close. However, I'm more concerned with the longer-term weekly charts where we've seen heavy...

READ MORE

MEMBERS ONLY

Futures Up, New Battle Begins

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 14, 2015

Materials and energy managed to eke out fractional gains, while utilities were flat. Unfortunately, as I evaluate the strength of the stock market, those are not the sectors that heavily influence me. Instead, the other six sectors were lower with consumer stocks being...

READ MORE

MEMBERS ONLY

Short-Term Signs Pointing To Weakness Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 13, 2015

One piece of good news on Tuesday was that technology was the leading sector. However, all nine sectors moved lower and the action was probably the most bearish over the past 2-3 weeks. Serious short-term technical ramifications quickly surfaced. In no particular order:...

READ MORE

MEMBERS ONLY

What Makes A Bear Market?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 12, 2015

It was a relatively quiet session as many market participants shied away from action in observance of Columbus Day. NASDAQ volume was only 1.33 billion shares, extremely light compared to recent sessions. Still, the bulls managed to remain in control of the...

READ MORE

MEMBERS ONLY

Key Long-Term Moving Averages Being Tested

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 9, 2015

There wasn't much news out towards the end of last week so all eyes were on overseas action and technical developments here in the U.S. Of course, earnings season is kicking into gear and that now becomes more of a...

READ MORE

MEMBERS ONLY

Internet Group Poised For Higher Prices

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The long-term pattern is bullish. Short-term technical conditions are improving. And the season is right as October is the best calendar month of the year in terms of historical performance for internet stocks. The Dow Jones U.S. Internet Index ($DJUSNS) looks poised for another explosion to the upside. We&...

READ MORE

MEMBERS ONLY

Selling Of Treasuries Helps To Fuel Market Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, October 8, 2015

One very good thing has emerged lately with respect to the U.S. stock market. It trends higher into the close and afternoon buying is generally healthy market action. The S&P 500 has now finished higher 7 of the last 8...

READ MORE

MEMBERS ONLY

Airlines Awaiting Take Off

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Airlines ($DJUSAR) have traded sideways to down most of 2015. Yet this industry group is one of the best performers historically in the month of October. Furthermore, several airline stocks are in bullish patterns OR are approaching key technical levels of support/resistance. The chart below summarizes several of the...

READ MORE

MEMBERS ONLY

60 Minute Negative Divergences Wreaking Havoc

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 7, 2015

European markets ended in positive territory again on Wednesday and that's certainly providing a lift for the U.S. market. Healthcare (XLV) picked itself off the floor and led the action, gaining 1.60%. The beaten down biotech space bounced 2....

READ MORE

MEMBERS ONLY

Bulls Fail But Hold Rising 20 Day EMAs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 6, 2015

No one could claim victory on Tuesday. First, we had a bifurcated market in which the Dow Jones rose while the S&P 500, NASDAQ and Russell 2000 all lost ground. Three sectors gained while the other six fell. Clearly, there was...

READ MORE

MEMBERS ONLY

Bulls Face Yet Another Major Test Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 5, 2015

This tennis match continues to unfold with the bulls returning serve the past few trading sessions. It appeared to be game, set and match on Friday morning when the disappointing jobs numbers were released, but there's been nothing but buying since....

READ MORE

MEMBERS ONLY

Energy Propels Stocks To Major Reversal Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One reminder: You can subscribe to my blog and receive all of my blog posts via e-mail each morning by simply clicking on the "Yes" button below and providing your e-mail address. This applies to all of the blogs here at StockCharts.com so stay ahead of the...

READ MORE

MEMBERS ONLY

How To Spot A Positive Divergence

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In evaluating whether a positive (or negative) divergence exists on a chart, you must remember to use closing prices. If you use candlesticks like I do, it's not always easy to spot divergences. I'll give you an example - Baidu (BIDU). On the chart below, the...

READ MORE

MEMBERS ONLY

Crude Oil's Relationship With The XLE

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you believe that crude oil ($WTIC) is dirt cheap and the primary trend from here will be higher, then one simple trading strategy is to own the XLE (Energy Select Sector SPDR). Over the years, the correlation between the two is strong - and perhaps obvious. Since the 2000-2002...

READ MORE

MEMBERS ONLY

Big Jobs Report: Who Won?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, October 1, 2015

We finished on a strong note on Thursday by rallying into the close and ending near highs of the day across our major indices - very similar to Wednesday. Unfortunately, the strength was centered in materials and healthcare, two of the three worst...

READ MORE

MEMBERS ONLY

Intel (INTC) Letting Its Chips Fall?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Actually, this chipmaker's chart looks very strong, especially longer-term. After a strong advance in late 2014, a negative divergence emerged and was followed by a topping head & shoulders pattern. The measurement of that pattern - from the top of the head to the neckline -was roughly 17....

READ MORE

MEMBERS ONLY

Volume Strengthens On Wednesday Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 30, 2015

The month of September and the third quarter of 2015 came to a close on Wednesday and the bulls were able to reduce their losses for the month and quarter. The S&P 500 finished September down 2.6% while the tumultuous...

READ MORE

MEMBERS ONLY

Fear Remains High As U.S. Market Wobbles

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 29, 2015

We once again saw a bifurcated market - one in which both the Dow Jones and S&P 500 finished in positive territory while both the NASDAQ and Russell 2000 fell. That relative weakness in our more aggressive indices is not a...

READ MORE

MEMBERS ONLY

Russell 2000 First To Lose August Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, September 28, 2015

It was another case of the Monday blues. Following the lead in Europe, the U.S. indices gapped lower and continued selling throughout the session with barely a pause. It was a distribution day for sure and small caps (Russell 2000) were among...

READ MORE

MEMBERS ONLY

September Going Out Like A Bear

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 25, 2015

Friday looked like two different markets. The Dow Jones gained 113 points, the S&P 500 finished flat and the NASDAQ and Russell 2000 both fell more than 1%. Talk about bifurcation. Crazy. But in the end, the problems remained across the...

READ MORE

MEMBERS ONLY

Healthcare ETF (XLV) Seeking First Aid

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Healthcare stocks led much of the market's rally off the 2009 lows - especially since early 2011. That was then. This is now. Technical conditions have deteriorated immensely since the Spring of this year when warning signs emerged (see "Healthcare Stocks Are Vulnerable To Weakness Ahead"...

READ MORE

MEMBERS ONLY

The Bulls Aren't Screamin, They're Yellen

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 24, 2015

It wasn't so much about what happened during the trading session on Thursday as it was about what happened after it. U.S. equities were sharply lower in the first half of Thursday's session as the Germany drubbing continued,...

READ MORE

MEMBERS ONLY

German DAX Dropping Bearish Bombs On The S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 23, 2015

The S&P 500 keeps trying to regain its footing as it watched its German counterpart (DAX) lose August support two days ago and then fail to recapture that support level on Wednesday when it had the opportunity. 9648 was that August...

READ MORE

MEMBERS ONLY

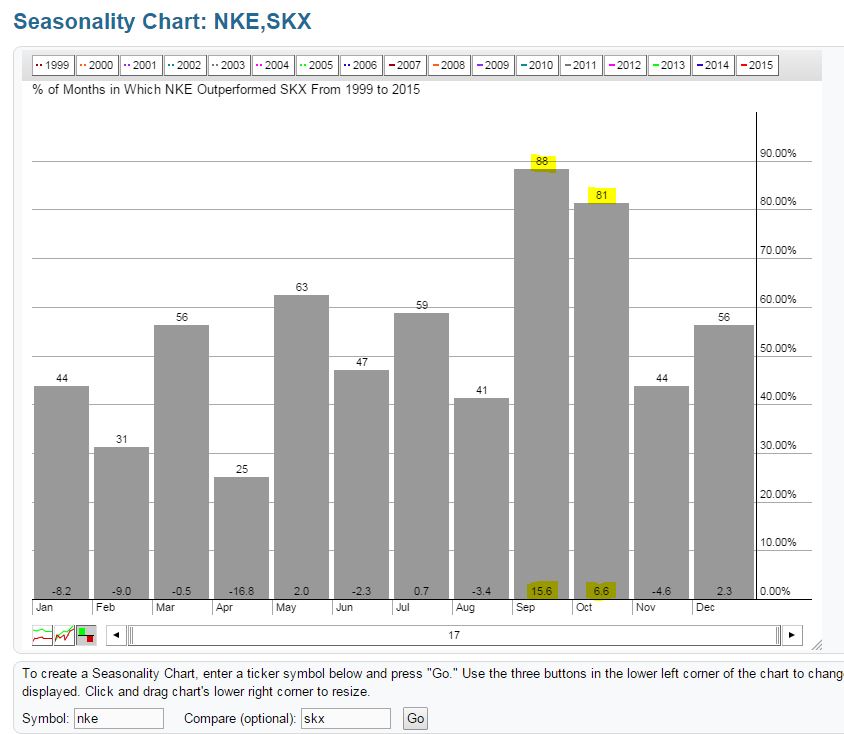

Comparing NKE vs. SKX Using The Seasonality Tool

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One cool feature at StockCharts.com is the ability to check the seasonal tendencies of stocks. For instance, I can tell you that Amazon.com (AMZN) performs its best during the month of September, which is odd because September is the worst month of the year historically for the S&...

READ MORE

MEMBERS ONLY

Afternoon Buying Encourages Money From Sidelines

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 22, 2015

Simply put, it's ALWAYS better to see afternoon buying.

Despite the late day strength, all 9 sectors finished lower on Tuesday, but most areas finished well off their intraday lows, a positive sign at least for the very near-term. Healthcare (XLV)...

READ MORE

MEMBERS ONLY

Market Skies Looking Quite Ominous

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, September 21, 2015

Impulsive selling has been the signature of the past month. Beginning with the August free fall, when the selling has hit, it's hit in a hurry. Monday was a perfect example of why we are not out of the woods just...

READ MORE

MEMBERS ONLY

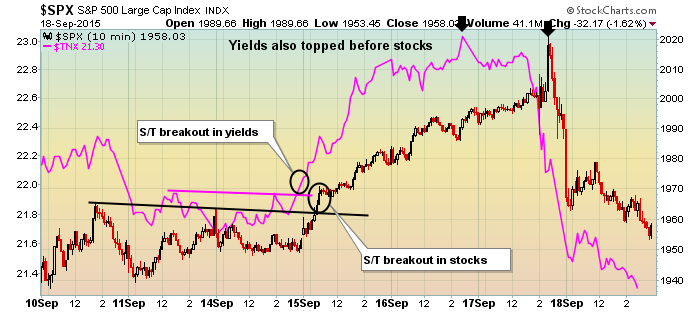

Money Rotates To Bonds, Not Good For Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 18, 2015

Traders were not thrilled by the Federal Reserve's decision to leave interest rates unchanged as they quickly turned their attention to defensive bonds. The 10 year treasury yield ($TNX), after closing above 2.30% for the first time in two months...

READ MORE