MEMBERS ONLY

The First Half of 2023 Was Very Bullish, But What Should We Expect in the Second Half?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Have you noticed how every roadblock the bears use against the bulls just quietly goes away over time? I just chuckle. There have been SO many bullish signals over the past year, but pessimists/bears don't give in easily and that's actually good for the stock...

READ MORE

MEMBERS ONLY

Which Way Is The Dollar Heading? Watch This ONE Signal

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've always been impressed by the strong correlation between the U.S. and German stock markets. Sometimes the strength in one of these markets can help to influence the direction of the other. Let me show you a long-term chart of the S&P 500 ($SPX) and...

READ MORE

MEMBERS ONLY

One Year Anniversary Of A Very Bold Call

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wow, things have changed. I looked at some charts that I had produced a year ago and looked at those same charts today. You'd never know it was the same stock market. Let's start with the S&P 500 and NASDAQ 100 (SPY and QQQ,...

READ MORE

MEMBERS ONLY

What Could Go Wrong This Week? Ummmm, A Lot!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I remain steadfastly bullish, but I do recognize reasons to be short-term cautious when I see them. I suppose the first question is, "what does it mean to be cautious." Well, I can only tell you what it means to me. While I still believe it makes sense...

READ MORE

MEMBERS ONLY

Recent Manipulation in Small Caps Led To Friday's Big Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I wasn't expecting a huge 4% move in small caps on Friday, but I was looking for this group to start flexing its muscles. I've been telling our EarningsBeats.com members that small caps were poised for a big move to the upside. We've...

READ MORE

MEMBERS ONLY

Fight This Bullish Development At Your Own Risk

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Sentiment was a HUGE problem for the bulls to start 2022 and now it's become a similarly big issue for the bears now. If you haven't noticed, most bulls don't begin to turn bearish until after all or most of the selling is complete....

READ MORE

MEMBERS ONLY

Small Caps Are Ready To Launch!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are many who have given up on the small cap community, but I'm not one of them. The long-term 15-year chart remains in a solid uptrend. Yes, the group has been underperforming the S&P 500 for quite awhile, but that's been the standard...

READ MORE

MEMBERS ONLY

Wall Street's Hunger Games Are Now Complete

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It was the culmination of many months of accumulation by Wall Street firms. I've discussed this accumulation, or manipulation, over and over and over and indicated that it was the likely precursor to a big stock market advance. I've updated a chart of the QQQ (ETF...

READ MORE

MEMBERS ONLY

Where Are We? Can We Say This Is A Bull Market?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

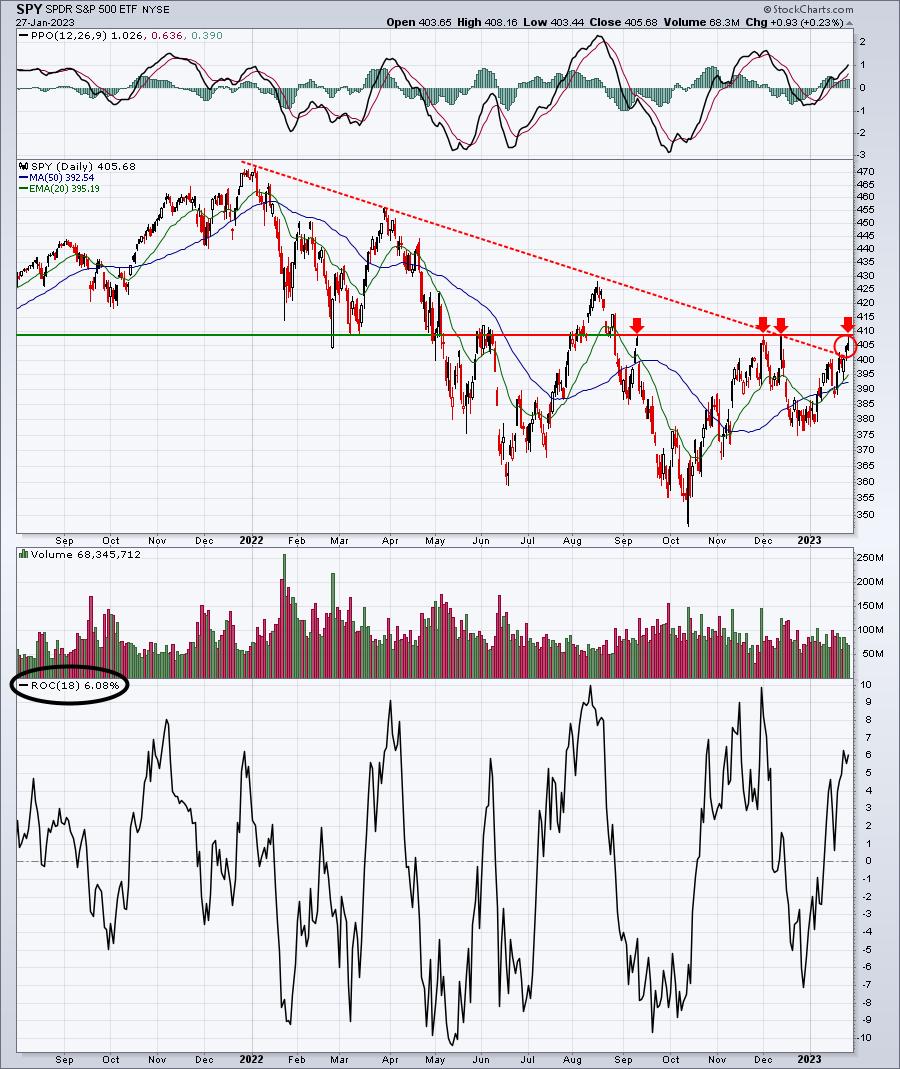

Price Action

Clearly, the most important aspect of the stock market is price action. That's where it all begins. Currently, I like the daily and weekly charts, but we do still have one very important price resistance level to clear:

S&P 500 - Weekly:

There are...

READ MORE

MEMBERS ONLY

May Begins A Very Strong Period For Growth Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

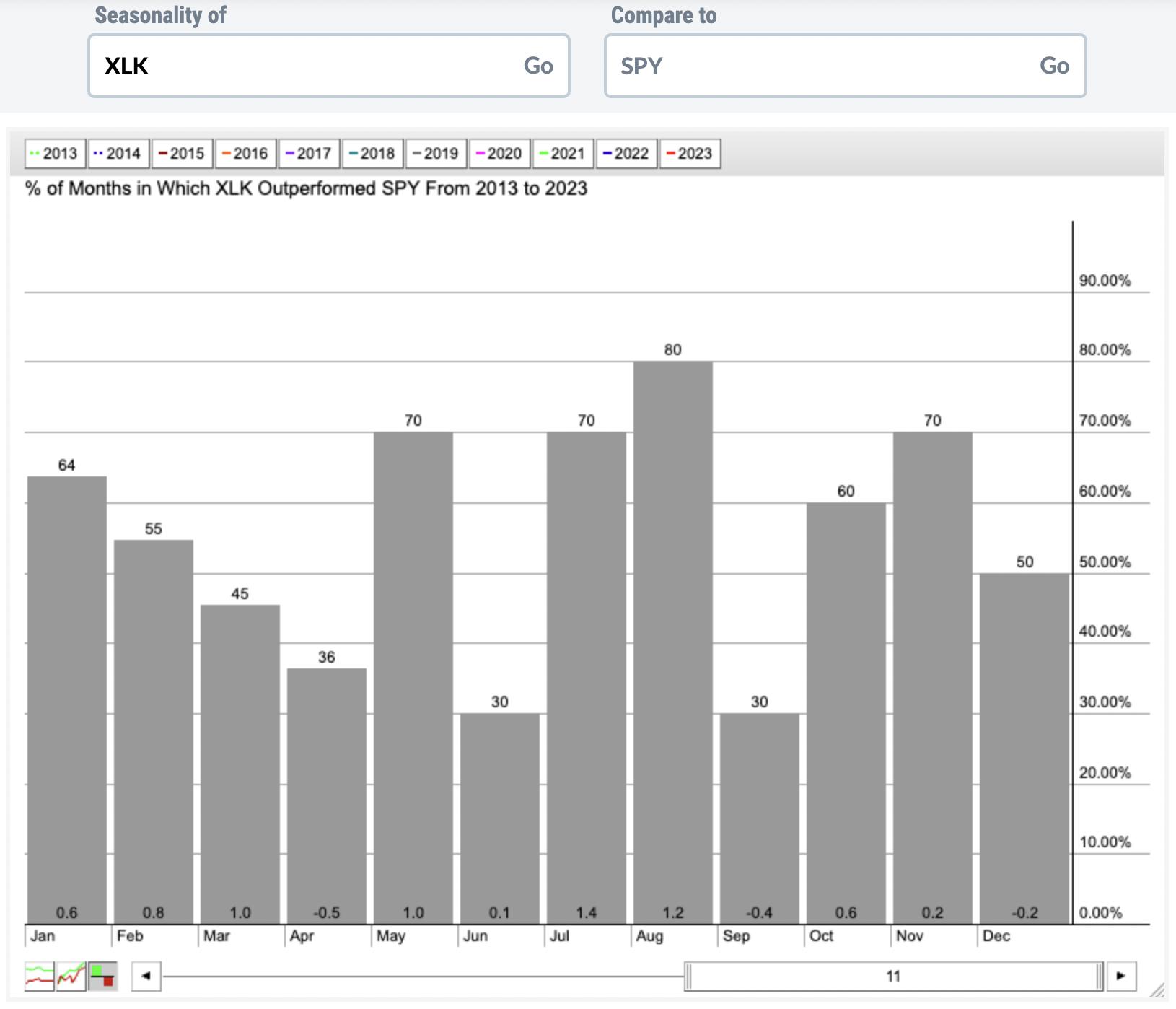

Growth-oriented stocks tend to have their best relative showing vs. value-oriented stocks beginning in May and running through August. Check out the relative seasonal performance of the XLK (vs. the SPY) over the next four months:

If you add the bottom numbers of each calendar month (represents average monthly outperformance...

READ MORE

MEMBERS ONLY

Setups That I Like Right Now

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I remain quite bullish the overall market. I call what I see and what I saw in 2022 were stock market participants that turned incredibly bearish. I said at the beginning of 2022 that we needed a bear market brutal enough to send the masses to the sidelines and never...

READ MORE

MEMBERS ONLY

Is The Bear Market Over? Watch The VIX

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The normal relationship between the Volatility Index ($VIX) and the S&P 500 is an inverse one. The easiest way to illustrate this is to pull up a chart showing both and their correlation coefficient:

The red arrows mark bottoms in the S&P 500 and they generally...

READ MORE

MEMBERS ONLY

Will This Massive Reverse Head & Shoulders Bottom Execute?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

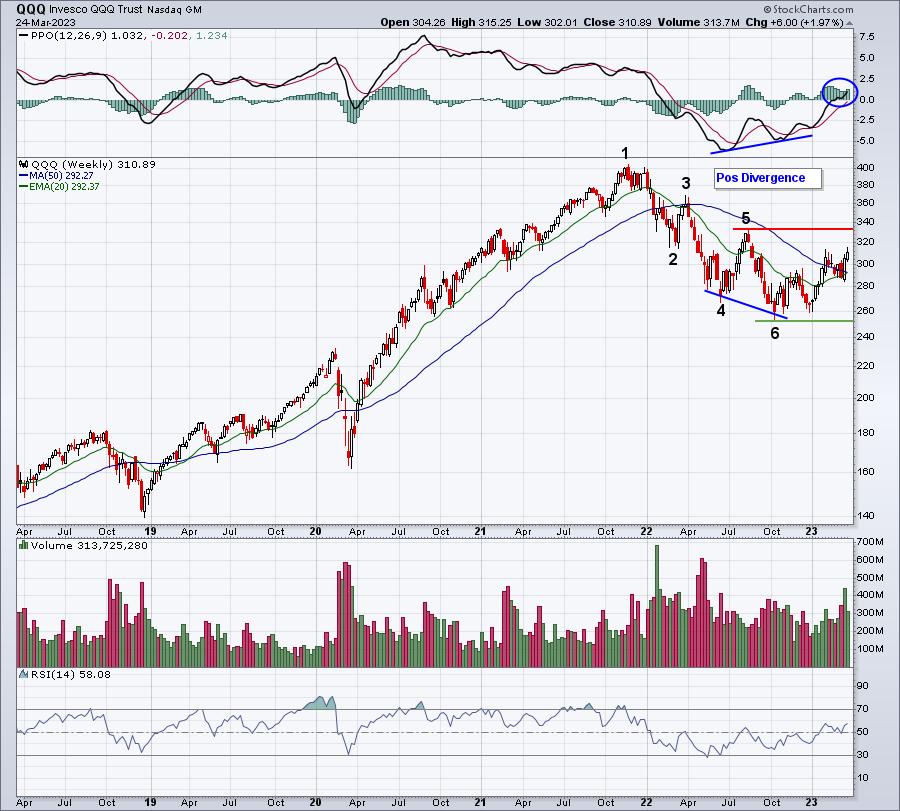

There are plenty of reversing patterns in technical analysis, but my personal favorite is the combination of a weekly positive divergence and a bottoming head & shoulders pattern. The positive divergence captures the slowing downside momentum and the head & shoulders provides confirmation that prices are indeed turning up. Keep...

READ MORE

MEMBERS ONLY

Patience Required As A Handle Forms

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Cintas Corp (CTAS) is just 1 of 83 companies that have qualified to be on our most powerful ChartList, our Bullish Trifecta ChartList. In order to make it, it must be on our (1) Strong Earnings ChartList (SECL - tracks companies that beat quarterly revenue and EPS estimates), (2) Strong...

READ MORE

MEMBERS ONLY

Why Try To Call Tops And Bottoms? It's Easy!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Okay, first when I say "it's easy", I'm not saying it's easy to call tops and bottoms. Instead, I'm say that answering that rhetorical question is easy. If you can call a top, you can exit equities with your capital...

READ MORE

MEMBERS ONLY

BEWARE Leveraged ETFs: Invest With Caution

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The following was a special educational Daily Market Report that I sent to our EB.com members last week....

I always refer to EarningsBeats.com as a "Research, Guidance, and Education Platform", because that's truly what we strive to be. HERE IS WHAT WE ARE NOT...

READ MORE

MEMBERS ONLY

NASDAQ Breaks Out Again; 2 Stocks To Consider NOW

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

U.S. equities are wrapping up the first quarter in grand style. The QQQ, which tracks the NASDAQ 100, is zeroing in on a 20% gain for the quarter, as I write this. We saw a huge rally in January 2023 and strong Januarys usually suggest a strong year ahead....

READ MORE

MEMBERS ONLY

Is Intel Now A Market Leader?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Well, it might be a little early to anoint Intel (INTC) a leader, but there's no denying a significant breakout in the chip stock above key price resistance. On November 15, 2022, INTC opened at 30.72, and the stock hasn't seen an open or close...

READ MORE

MEMBERS ONLY

The NASDAQ Is Eyeing a Major Breakout Level

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Ultimately, breaking out above the August 2022 high represents the key level to reverse the downtrend that began in early-January 2022. I like to use longer-term charts to determine whether we're currently trending higher or lower, and right now the downtrend is firmly in place:

The numbers on...

READ MORE

MEMBERS ONLY

The Bears Are On Life Support And Hoping For A Fed Miracle

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The end is at hand. Bears, just surrender now. Since the mid-June low (where I called the S&P 500 bottom), we've seen the fed funds rate jump from 1.00% to 4.75%. Of course, all we've heard since then is what?

Don'...

READ MORE

MEMBERS ONLY

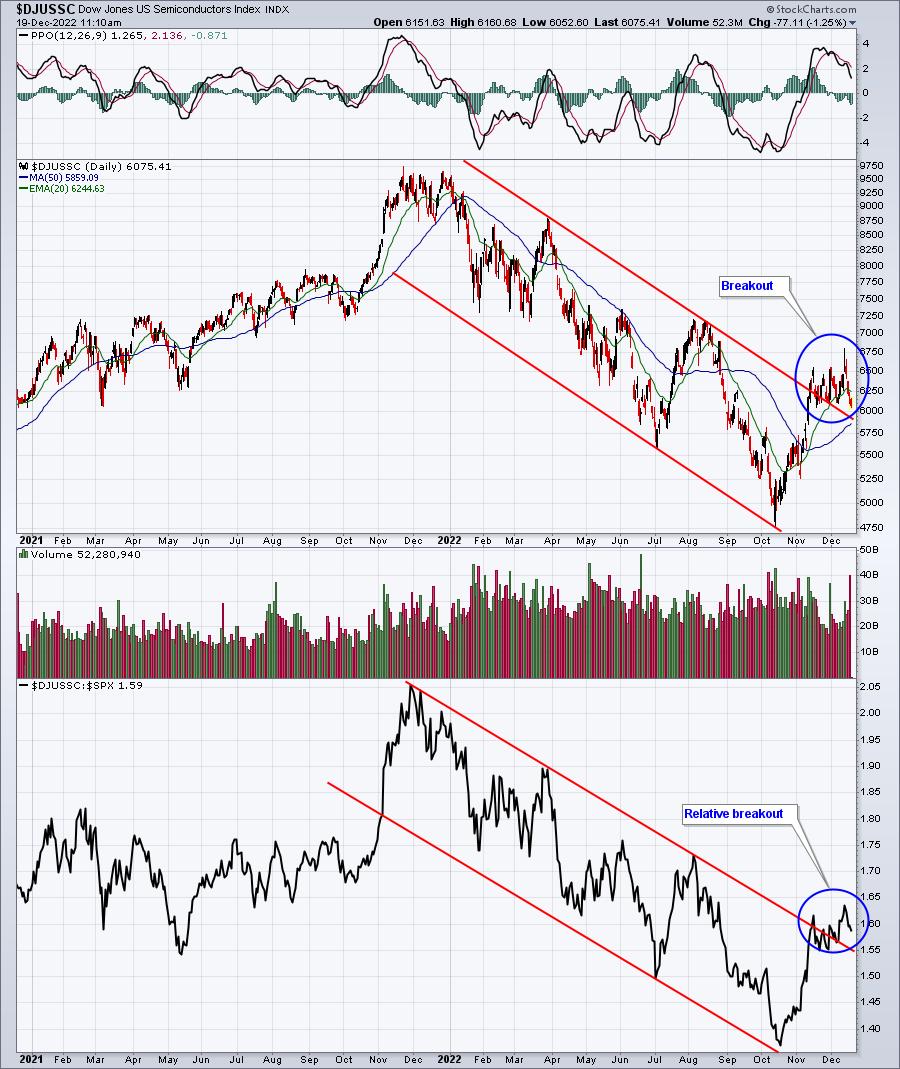

Semiconductors Making Big Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Semiconductors ($DJUSSC) opened 2023 with a BANG! They spent the entire month of February and the first two weeks of March consolidating in a bullish ascending triangle pattern, but today we're either going to get a confirmed breakout or a false breakout. It simply depends on where we...

READ MORE

MEMBERS ONLY

Technology Resets PPO, Now Rolling; Fed Should Pause

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I remain extremely bullish stocks the balance of 2023 and into 204, but I've been a little short-term cautious the overall market since mid-February, but bullish signals are beginning to emerge once again. The most important sector, in my opinion, is technology (XLK). This sector reeks of aggressiveness...

READ MORE

MEMBERS ONLY

Let The Charts Do The Talking

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We are provided constant reminders that important company information is reflected in the absolute and relative performance of the company's stock price. That may go against common sense in a few instances, especially when it comes to earnings. After all, the company is supposed to be delivering fresh...

READ MORE

MEMBERS ONLY

This Industry Group Loves the Next 3 Months

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

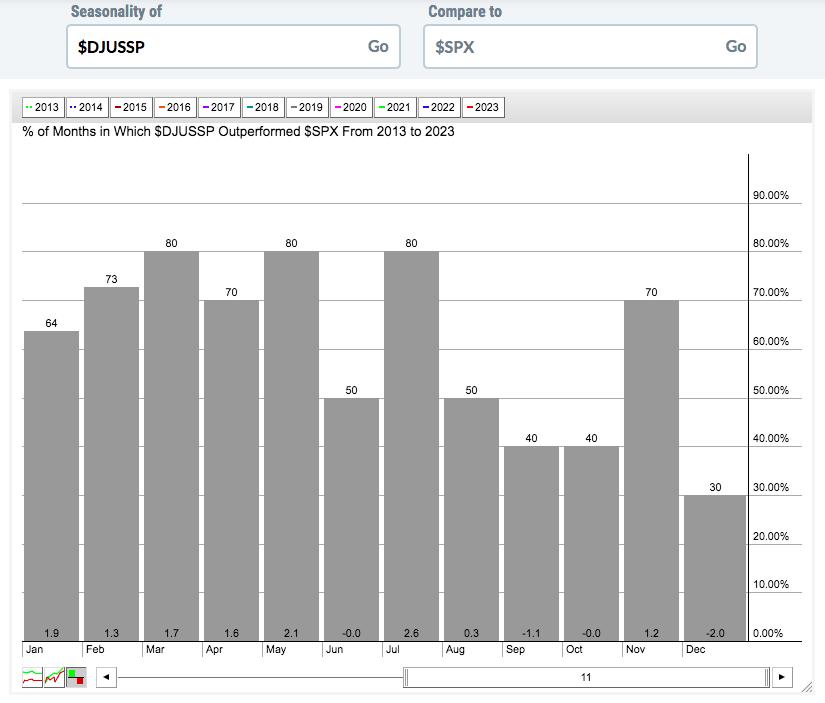

Our research at EarningsBeats.com includes extensive seasonal studies, working off the seasonality tool here at StockCharts.com. We've recently ended the best historical period of the year, which runs from the close on October 27, 2022 through the close on January 18, 2023. But the bullishness doesn&...

READ MORE

MEMBERS ONLY

The Big Wall Street Firms Use Manipulation Strategies To Fatten Their Wallets

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have been preaching Wall Street manipulation for years. And Wall Street took manipulation to a completely new level in 2022, accumulating shares of panicked retail traders after the distribution period from January through May 2022 ended. Sure, we had two more price lows - one the very next month...

READ MORE

MEMBERS ONLY

This Is Why You Shouldn't Have Bought Disney (DIS) After Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Monthly options expiration creates a whole new set of headaches for retail traders. As if trading wasn't already hard enough, throw in the short-term financial incentive for market makers to "manipulate" prices and cash in big time at options expiration, and you have a recipe for...

READ MORE

MEMBERS ONLY

History Tells Us We're Going A LOT Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm a follower and believer of history when it comes to the stock market. After years of research, I understand that some aspects of U.S. equity performance are rather transparent and resulting technical signals generally can be relied upon. There were plenty of warning signals to open...

READ MORE

MEMBERS ONLY

SPY Knocks on the Door of Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

2022 was a year that required a ton of patience, waiting out the cyclical bear market that unfolded, especially during the first five to six months of the year. But we saw significant strength in many areas during Q4, and growth stocks have powered the market forward in January 2023....

READ MORE

MEMBERS ONLY

Ready, Set, COVER! Breakouts Are A Short Seller's Worst Enemy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It was one week ago that I wrote about Wayfair's (W) big breakout in the Don't Ignore This Chart blog. It had just broken above key resistance and volume accelerated to its highest level EVER! And EVER is a very long time! 22 million shares traded...

READ MORE

MEMBERS ONLY

The S&P 500 Showing More Bullish Signals, Watch This Key Level

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Say what you want, but January has proven to be a very reliable predictor of U.S. stock market action from February through December since 1950 and, with just a little more than a week left to go in January 2023, market action is suggesting that we're going...

READ MORE

MEMBERS ONLY

Friday's 20% Gain Has This Stock's Short Sellers Running For the Exits

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At EarningsBeats.com, we keep a Short Squeeze ChartList (SSCL). There are currently 42 stocks on it that have very high percentages in terms of short percentage of float. What these stocks have in common is a propensity for short sellers to panic and cover their short positions as price...

READ MORE

MEMBERS ONLY

Earnings Season Started As Expected: Will the Trend Continue?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Quarterly earnings is a time when management teams announce whether they've kept all their promises that were made over the prior 90 days. These quarterly earnings announcements shouldn't be shockers. Investors despise big surprises, especially when companies fall short of their consensus estimates. Wall Street firms...

READ MORE

MEMBERS ONLY

The QQQ is Bouncing Off VERY Significant Price Support; MarketVision 2023 is TOMORROW!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The past three months have been torture for the Invesco QQQ Trust (QQQ), the ETF that tracks the NASDAQ 100. The large-cap stocks that dominate the QQQ performance have been breaking down one after another, and that has weighed much more heavily on the NASDAQ 100 than it has on...

READ MORE

MEMBERS ONLY

This Sentiment Signal Is Solid And Says We Could Soar Short-Term

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Late yesterday afternoon, I sent out a quick update to our EarningsBeats.com members, suggesting that we could see a sudden surge higher in equities. A bullish signal emerged in the Volatility Index ($VIX), one that doesn't appear very often. Typically, the S&P 500 and VIX...

READ MORE

MEMBERS ONLY

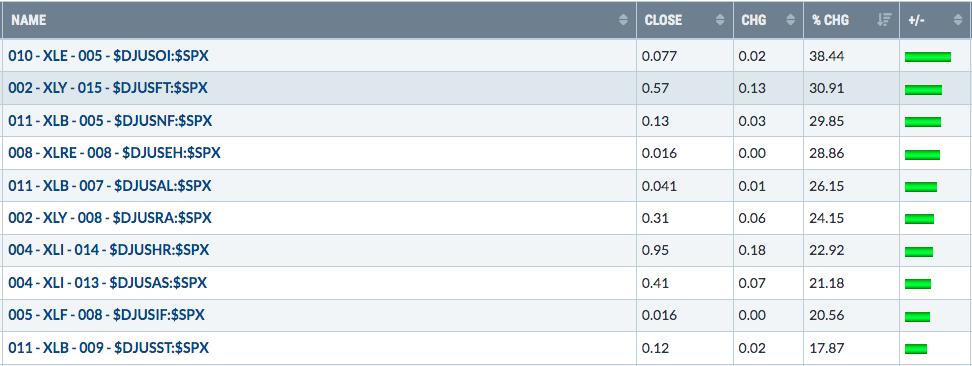

Top 10 Performing Industry Groups In Q4: Recap of 2022

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you're looking for stocks that are momentum gainers, the best place to start is to find the leading industry groups. So which sectors were strong in 2022?

The first step is to identify the strong and/or strengthening industry groups. I keep an industry group relative strength...

READ MORE

MEMBERS ONLY

Is This Stock Setting Up As the Trade Of 2023?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There were times over the past few years that you probably wondered if Boeing (BA) would ever recover from its own miscues and the COVID-19 pandemic. Well, BA and its peer group, aerospace ($DJUSAS), were literally "flying" into the end of 2022. Check out the chart below.

If...

READ MORE

MEMBERS ONLY

My 2023 Stock Market Forecast

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

First of all, happy new year!!! I hope 2023 turns out to be a healthy and prosperous year for all!

As we look back on 2022, it was anything but that. We started the year on a very sour note and things went downhill from there - at least from...

READ MORE

MEMBERS ONLY

Money Is Pouring Into These 3 Industries Right Now

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been watching critical areas like semiconductors ($DJUSSC), software ($DJUSSW), and internet ($DJUSNS) underperform vs. the S&P 500 throughout 2022. But the good news is that, since June, money rotating out of the three aforementioned aggressive sectors is finding a home in other industry groups. That&...

READ MORE

MEMBERS ONLY

This Is The Chart To Watch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

According to Fidelity.com, Apple, Inc. (AAPL) represents 12.95% and 6.51% of the QQQ and SPY, respectively. The QQQ and SPY are exchange-traded funds that track the NASDAQ 100 and S&P 500 Index respectively. That's a very large weighting, so it would seem to...

READ MORE

MEMBERS ONLY

Will This Major Support Level Hold?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Semiconductors hold the key to a major market advance, in my opinion, as they're a critical part of the NASDAQ 100 ($NDX). There are 16 semiconductor companies in the NDX, including NVIDIA (NVDA), Advanced Micro Devices (AMD), Texas Instruments (TXN), Applied Materials (AMAT), QUALCOMM, Inc. (QCOM), and Intel...

READ MORE