MEMBERS ONLY

The Best Of The NASDAQ 100 Awards

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As we approach the end of the third quarter in 2015, it's time to unveil a few "Best Of" awards as they pertain to the NASDAQ 100. Let's get this party started:

Best Buy & Hold

Google (GOOGL). The long-term chart speaks for itself....

READ MORE

MEMBERS ONLY

Expedia Taking Road Less Traveled

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

U.S. equities have been very weak since mid-August with many sectors, industry groups and individual stocks broken down technically. In recent days and weeks, many high profile stocks have struggled to clear falling 20 day EMAs. So it's always nice to see industry groups or stocks bucking...

READ MORE

MEMBERS ONLY

Fed Decision "No Change".....Now Quad Witching Day

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 17, 2015

Much ado about nothing. That's my summation of the Fed policy statement. Fed Chair Yellen decided to do nothing as apparently Fed policy is now contingent upon....just about everything. Isn't the Federal Reserve THE central bank? In stock...

READ MORE

MEMBERS ONLY

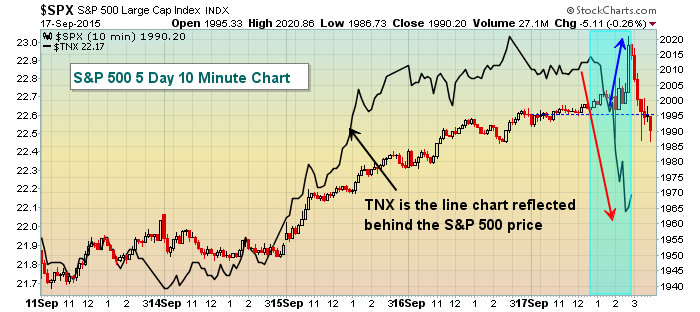

Fed Holds Steady; Treasury Bulls Send Stocks Bad Signal

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Well, the Fed meeting and announcement has come and gone. All the drama is over. At the end of the day, Fed Chair Janet Yellen decided to leave interest rates unchanged for now, citing weakness abroad as one of the reasons for such delay. It's not often that...

READ MORE

MEMBERS ONLY

It's Federal Reserve Day - What To Look For

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 16, 2015

The bulls continued to piece back together technical conditions on Wednesday ahead of the Fed announcement later today. All sectors finished higher, although it was the outsized gain in energy (XLE) that clearly "fueled" the rally. Coal ($DJUSCL) gained 6% and...

READ MORE

MEMBERS ONLY

Gravitating Towards Major Resistance Pre-Fed?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 15, 2015

Fairly light volume continued on Tuesday, but the bulls were in charge throughout the day with the Dow Jones, S&P 500 and Russell 2000 all joining the NASDAQ back above falling 20 day EMAs. At least that part of the damaged...

READ MORE

MEMBERS ONLY

Quiet Monday Session As Traders Await Fed

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, September 14, 2015

It's hard to take too much away from Monday's action. Volume was extremely light with the NASDAQ volume at 1.45 billion shares. It was one of the lightest volume days of the year and the lightest since June...

READ MORE

MEMBERS ONLY

What Will The Fed Do?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 11, 2015

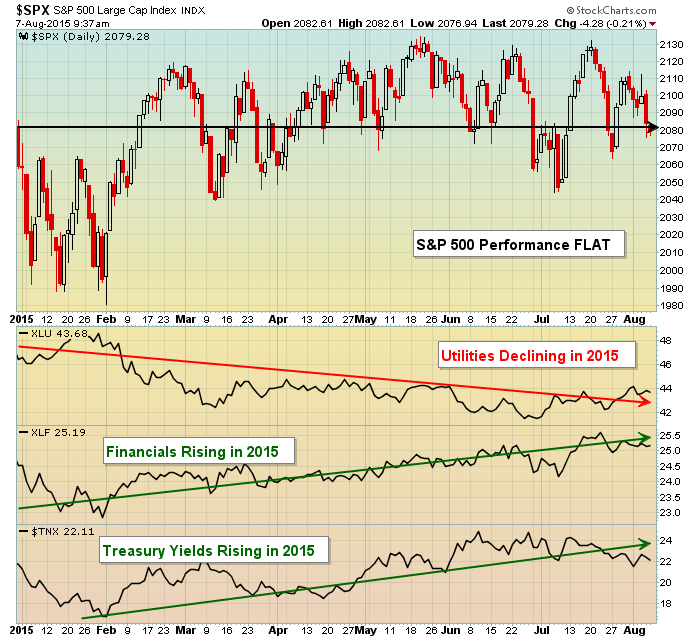

Utilities and consumer stocks led the market rally on Friday. All sectors finished fractionally higher, except energy and materials. Their weak performance has been the number one factor for the weakness we've seen in our major indices in 2015. Year-to-date, energy...

READ MORE

MEMBERS ONLY

Correlation: Banks And Treasury Yields

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As we await the Fed's interest rate decision this week, it's a good time to review a key area of the market that is heavily swayed by the direction of interest rates - banks ($DJUSBK). As the 10 year treasury yield ($TNX) rises and the yield...

READ MORE

MEMBERS ONLY

Confused? The Market Sure Is!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 10, 2015

I wouldn't view Thursday's action to be bullish as few technical resistance levels were cleared, but the fact there was no follow through to the downside after Wednesday's bearish candlesticks at major resistance was a moral victory...

READ MORE

MEMBERS ONLY

Diebold Bounces Off Support...Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Computer hardware ($DJUSCR) led the technology sector to outsized gains on Thursday and Diebold (DBD) benefited by bouncing off price support. The 29.50-30.00 area has served as excellent support in 2015. Consider the trading range to be 29.50-32.50 in the near-term until either support or resistance...

READ MORE

MEMBERS ONLY

Bears Regain Control, Look Out Below

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 9, 2015

Technical failure after technical failure. Bearish engulfing candles. Dark cloud cover candles. Opens above 20 day EMAs and closes beneath. You name the short-term failure and it probably occurred on a chart somewhere on Wednesday. After two weeks of torment, global markets rallied...

READ MORE

MEMBERS ONLY

Another Test of Critical Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 8, 2015

As we've seen often of late, the U.S. equity markets surged at the open but failed to add to those opening gains until the final 90 minutes of trading. At that point, buying resumed and all of our major indices...

READ MORE

MEMBERS ONLY

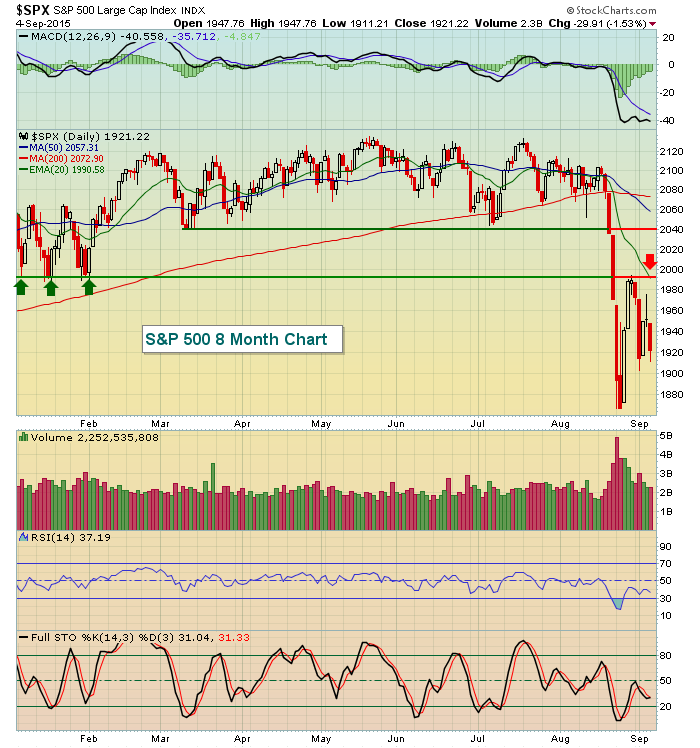

Which Way Is The U.S. Stock Market Headed?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 4, 2015

Volatility remains the key for traders. A Volatility Index (VIX) in the 20s and 30s suggests that we not only could wake up to anything, but that we also should expect to see wild swings both higher and lower during the trading day....

READ MORE

MEMBERS ONLY

20 Day EMAs Are Huge Technical Weapons

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Moving averages are lagging overlays by definition as we use historical data to determine their position on a price chart. But many traders use moving averages as support during periods of trending prices. Personally, my favorite is the 20 period EMA. Obviously, it can't guarantee us support in...

READ MORE

MEMBERS ONLY

This Bearish Story Might Be Fiction

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

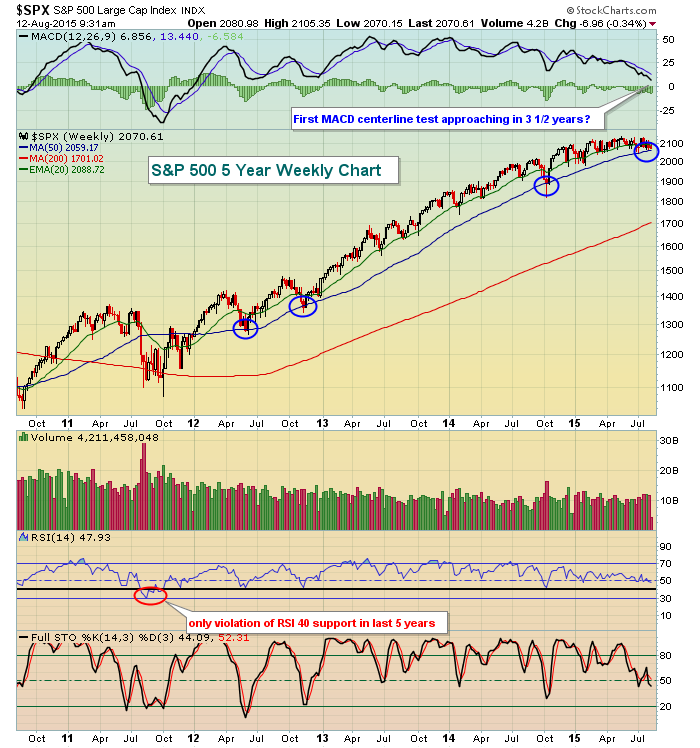

There are plenty of technical analysts calling for the beginning of a bear market after the past couple weeks of heavy volume selling. I'm certainly open to that possibility as I always respect price support breakdowns with accelerating volume. But the story behind the scenes isn't...

READ MORE

MEMBERS ONLY

Will We See September 4th Fireworks?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 3, 2015

First, if you're available, be sure to join me at noon EST today for my Trading Places LIVE webinar. It's free and you can register HERE. Also, you can "subscribe" to my blog and have this morning...

READ MORE

MEMBERS ONLY

Has Carl Icahn Timed His FCX Investment Correctly?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One week ago activist investor Carl Icahn disclosed that a group he belongs to owns nearly an 8.5% stake in Freeport-McMoran (FCX). Rumors suggest Icahn may seek representation on FCX's board of directors and is calling for changes in some of the Company's business practices....

READ MORE

MEMBERS ONLY

Final 30 Minute Rally Sets Up Thursday Test

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 2, 2015

The bulls did not crumble on Wednesday. After a big gap down on Tuesday with the market closing at or near its lows of the day, there was the opportunity for the bears of another serious gap lower and rout on Wednesday, but...

READ MORE

MEMBERS ONLY

Island Cluster Reversal Confirmed By Tuesday's Action

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 1, 2015

Off of the significant rally last week, a topping island cluster reversal pattern printed and was confirmed on Tuesday's open. This pattern, by itself, is simply a short-term reversing pattern and does not suggest a bear market is at hand. Now...

READ MORE

MEMBERS ONLY

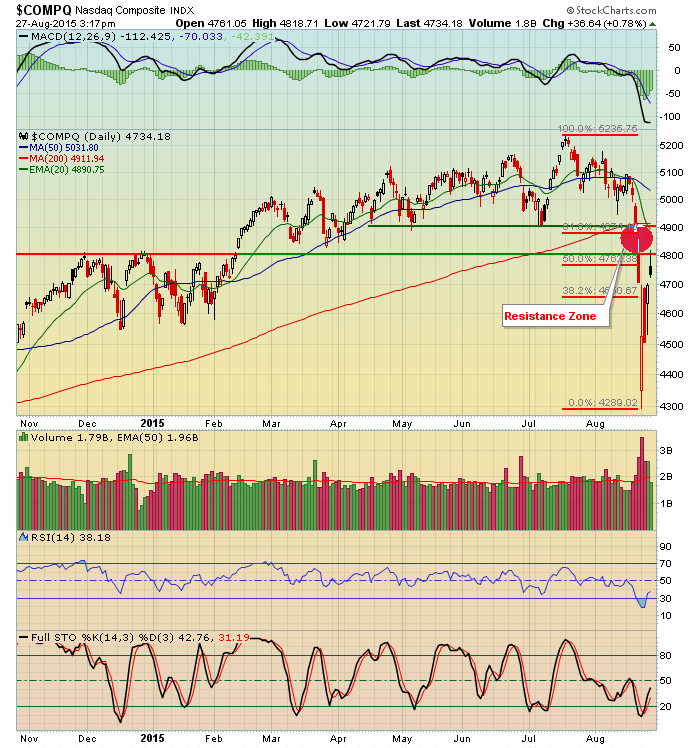

Energy Strong But Resistance Prevails On Major Indices

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 31, 2015

Technical sellers returned on Monday as our major indices approached key resistance areas. The NASDAQ, in particular, had penetrated into its 4800-4900 resistance area and the bulls were initially rebuffed there. Eight of the nine sectors fell on Monday with energy the only...

READ MORE

MEMBERS ONLY

Bulls Rebound Last Week With A Vengeance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Monday, August 31, 2015

Market Recap for Friday, August 28, 2015

Global markets were mixed on Friday, although most of the action here in the U.S. was positive, albeit on lighter Friday volume. Commodities were particularly strong, especially crude oil ($WTIC) and gold ($GOLD), but both have been long-term...

READ MORE

MEMBERS ONLY

Facebook (FB) One To Watch This Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Facebook (FB), like so many internet stocks, performs its best during the month of September. There's not much of a sample size with FB since it went public just a little more than 3 years ago. However, during its last 3 Septembers, FB has averaged gaining 15.7%...

READ MORE

MEMBERS ONLY

Bulls' First Test: FAIL

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

While we cannot rule out the possibility of a sustained advance to clear technical hurdles, the first attempt today was an epic fail at or just below a critical short-term resistance zone. Given the high volume selling over the past 7-10 days and loss of key price support levels and...

READ MORE

MEMBERS ONLY

Volatility Explodes, Major Tests Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

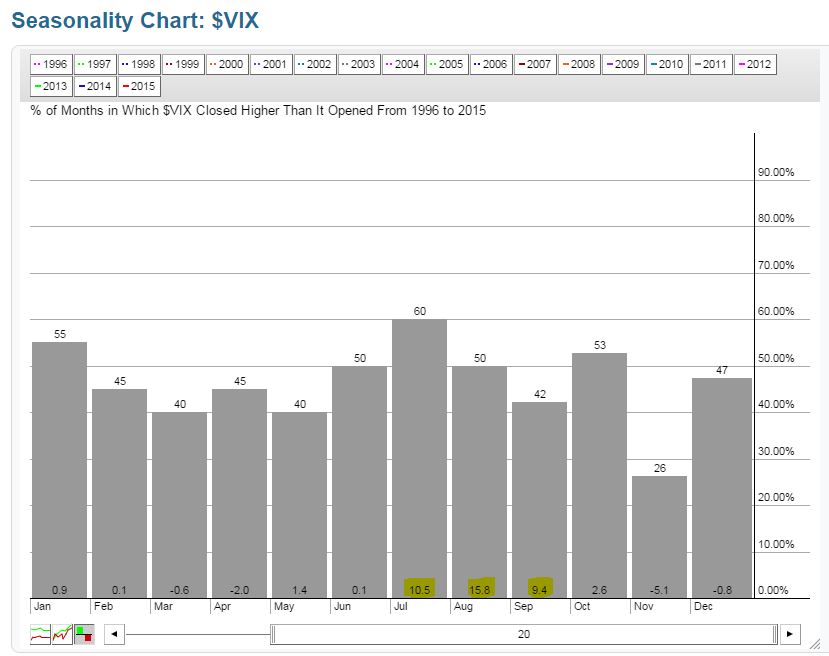

Welcome to August. Don't look now, but September is right around the corner. Given the recent short-term price support breakdowns and explosion in the Volatility Index ($VIX), we have to be very careful as we make our way through the next month as historically the market has shown...

READ MORE

MEMBERS ONLY

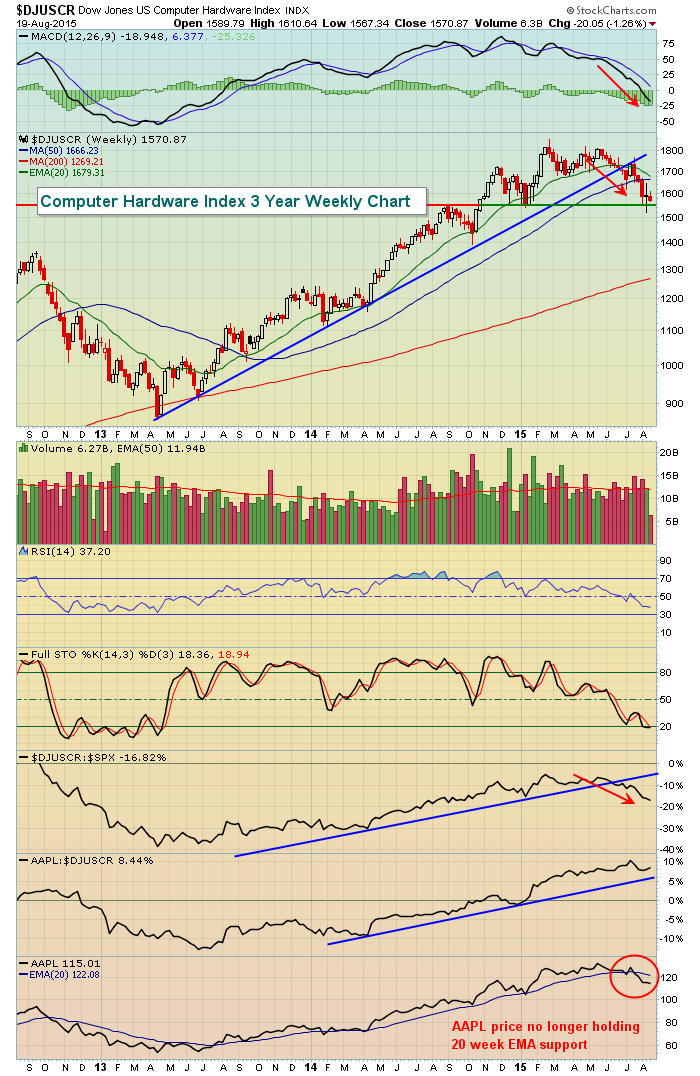

Can Apple (AAPL) Save Computer Hardware?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Computer Hardware Index ($DJUSCR) is testing significant price support created by the breakout in the fourth quarter of 2014 and the subsequent retracement back to that level just three months later. Recent weakness in Apple (AAPL) shares, along with other computer hardware stocks, has this...

READ MORE

MEMBERS ONLY

Are Energy Stocks Re-fueling?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have been ignoring much of the energy sector for months as their technical indications suggested weakness would continue. The energy ETF (XLE) is down over 13% in just the past six months and with crude oil unable to gain a bid, it's difficult to spend too much...

READ MORE

MEMBERS ONLY

Small Caps Bounce At Two Key Support Levels

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Bears are awaiting price breakdowns in key areas of the market, but thus far they remain highly disappointed. Last week they had their chance to take down the small cap universe on two fronts and both failed. This isn't meant to say that the bulls are out of...

READ MORE

MEMBERS ONLY

Priceline.com (PCLN) Fills Gap, Confirms Bullish Pattern

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

After its latest quarterly earnings report, traders rushed into priceline.com (PCLN) as it surged nearly 100 dollars from 1283.99 to 1382.61 on a post-earnings gap. Patient traders, however, have seen PCLN return to its pre-earnings level as it closed on Friday at 1283.80 just seven trading...

READ MORE

MEMBERS ONLY

Bottom Fishing: When Is Weakness An Opportunity?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I generally spend a lot of time writing and talking about areas of the market showing strength. The reason? I'm a momentum trader and we're in the midst of a six year bull market. When I trade a stock, I typically would like to see immediate...

READ MORE

MEMBERS ONLY

Home Construction Stocks Hitting Fresh Highs; DHI Leads

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The stock market looks ahead and based on the latest breakout in home construction stocks ($DJUSHB), apparently traders like what they see on the horizon. The 10 year treasury yield ($TNX) held key support and is bouncing. Proceeds from the sale of treasuries seems to be finding a "home&...

READ MORE

MEMBERS ONLY

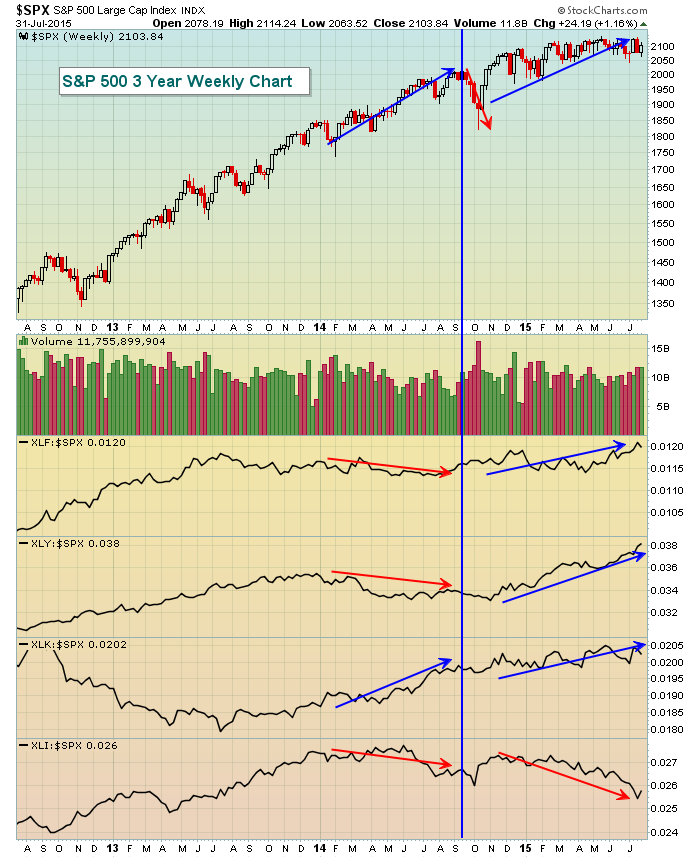

Weekly Negative Divergences Suggesting Difficult End Of Summer

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There have been more and more areas of the U.S. stock market that are showing signs of slowing momentum to the upside and it's begun taking a toll on several of those areas. Over the past six months, healthcare (XLV) and consumer discretionary (XLY) have outperformed. But...

READ MORE

MEMBERS ONLY

Correlation Tells Us To Ignore China

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have been reading with much interest how the potential slowdown in China will be the next reason why the S&P 500 will tumble. But by changing a few chart settings here at StockCharts.com, you can quickly visualize the correlation between the Chinese stock market and our...

READ MORE

MEMBERS ONLY

Making The Case For Buying Individual Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know many of you prefer the increased safety and diversification of ETFs over trading individual stocks. For some of you, it may simply be that you don't have time to watch over a portfolio of stocks, nor do you have the time and/or inclination to spend...

READ MORE

MEMBERS ONLY

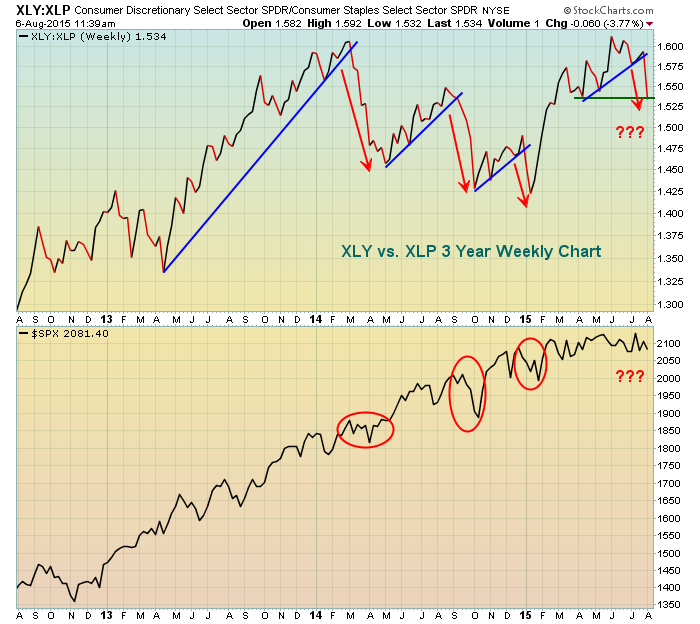

Consumer Stocks Issuing A Short-Term Warning?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In evaluating the likelihood of sustainable market rallies, one key relationship revolves around how consumer discretionary (XLY) stocks are performing vs. their consumer staples (XLP) counterparts. The reason is fairly simple. Consumer discretionary companies sell products that people WANT while consumer staples companies sell products that people NEED. If the...

READ MORE

MEMBERS ONLY

6 Bullish Continuation Patterns Awaiting Resolution

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've said many times before and I'll continue to repeat it - we must do our homework and then show the necessary patience and discipline to allow trades to set up for us. Part of doing homework is accumulating a number of stocks that are in...

READ MORE

MEMBERS ONLY

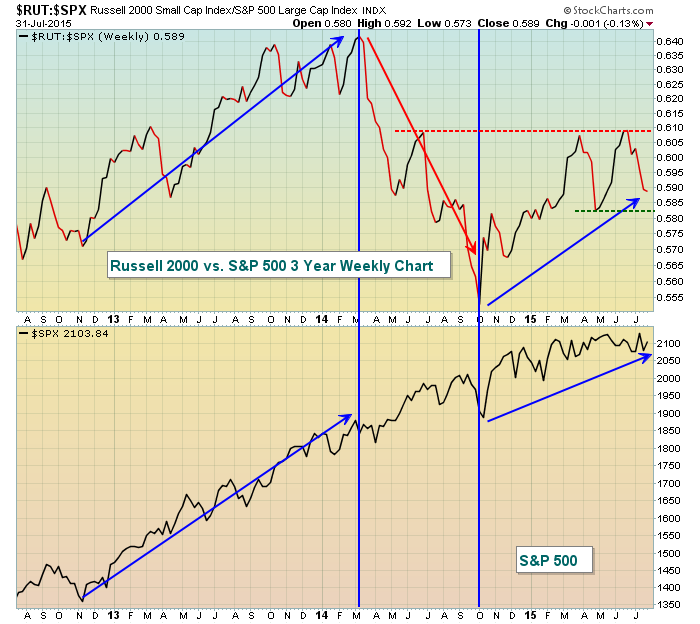

The Bulls Want Small Cap Leadership To Resume

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Advances in the stock market are much more bullish and likely more sustainable if small cap stocks are outperforming their large cap counterparts. Over the past three years, we've seen very volatile relative action between the S&P 500 and Russell 2000. During periods when the Russell...

READ MORE

MEMBERS ONLY

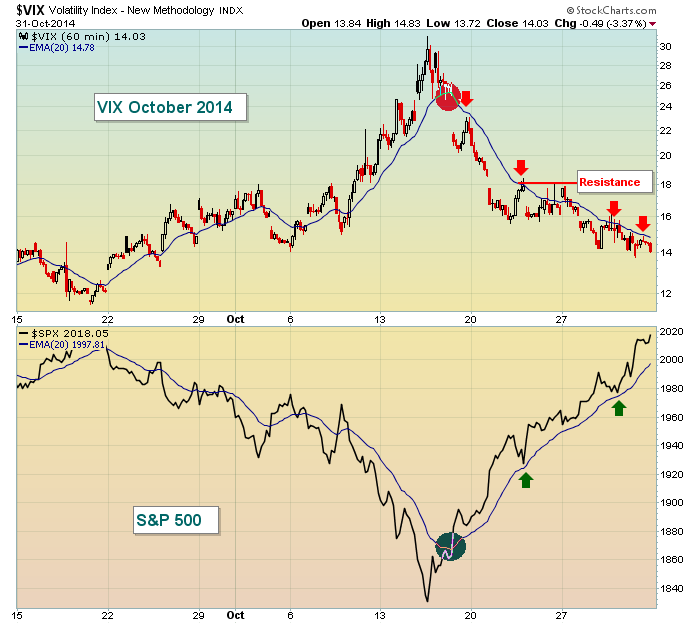

Are We Primed For An October-Like Selloff?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I don't think so. I'm always a bit leery of August and September because of the historical tendency for the stock market to struggle during the late summer season. Throughout the current 6+ year bull market, the Aug-Sept period has racked up gains four out of...

READ MORE

MEMBERS ONLY

Learn To Stalk Stocks, Then Pounce

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Risk management is paramount to a successful trader. It sounds easy enough, but what does it mean? Well, it can mean lots of different things to different people. The easiest way to manage risk is to remain in cash. You can sleep without worrying what happened in China overnight. But...

READ MORE

MEMBERS ONLY

Whole Foods Market (WFM) Poor Results Test Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

WFM posted underwhelming quarterly earnings results and the stock is down significantly in early action today. More importantly, however, is the longer-term price support that's being tested. WFM has not had an open or a close beneath 35.90 since early 2012 although WFM has tested this area...

READ MORE