MEMBERS ONLY

MACD Trading Secrets

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The MACD is an awesome indicator, one that I use in my trading decisions every day. But there are misinterpretations at times, in my opinion, and I want to share a few of those with you. In my most recent article, "The Power of the MACD", I shared...

READ MORE

MEMBERS ONLY

Biogen Inc (BIIB) Suffers Massive Breakdown

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are pullbacks in uptrends and then flat out trend reversing breakdowns. We never know for sure which is which until history plays out. But Biogen's (BIIB) massive selling on Friday has all the makings of the latter. Any time a company rises more than ten fold in...

READ MORE

MEMBERS ONLY

Should FBHS Be A Fixture In Your Portfolio?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Fortune Brands Home & Security, Inc (FBHS) surged in volume today and appeared to be on its way to a breakout above closing price resistance near 48.00. FBHS actually printed an intraday high of 47.99 before reversing and finishing weak the final two hours. From the weekly chart...

READ MORE

MEMBERS ONLY

The Power Of The MACD

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

For me, the Moving Average Convergence Divergence (MACD) trails only the combination of price and volume in my hierarchy of trading tools and indicators. It's THAT good. But it has one major limitation in that it only considers price action, not volume. Hence, it cannot be trusted as...

READ MORE

MEMBERS ONLY

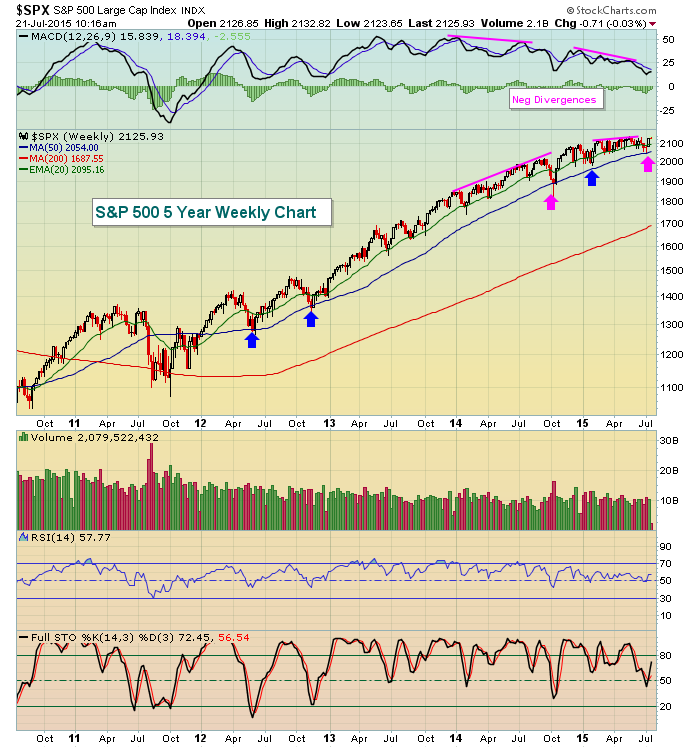

Is This Rally Sustainable?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Funny how the stock market does a complete turnaround in two weeks, isn't it? If you haven't already read my July 7th article, "Today Smells Like A Short-Term Bottom.....Maybe", go back and check it out. If you're going to short-term trade...

READ MORE

MEMBERS ONLY

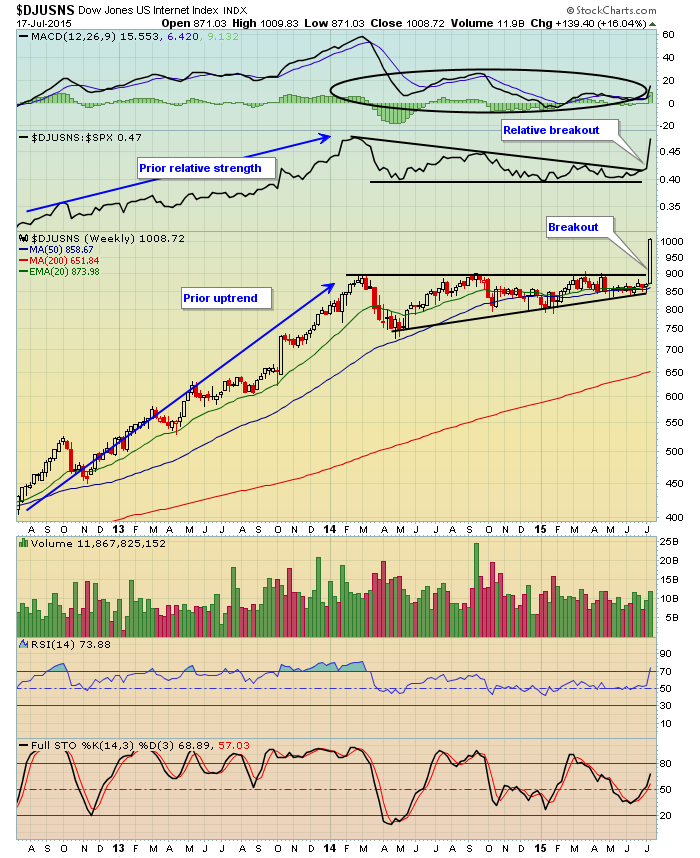

Internet Index Soars

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's a reason we watch chart patterns. Earlier this week in a DITC blog article, the internet index ($DJUSNS) finally cleared 900 resistance after failing at that level on a few occasions the past 18 months. This latest attempt was different, however. Many times it gets quite frustrating...

READ MORE

MEMBERS ONLY

Atmel (ATML) Shows Relative Strength, Nears Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Just a couple months ago in early May, ATML gapped higher on big volume and hasn't looked back since. Along the way, it cleared price resistance just below 9.00 on very heavy volume and subsequently surged to 10.50 before becoming violently overbought and in need of...

READ MORE

MEMBERS ONLY

4 Earnings Reports (and Reactions) You NEED To Watch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earnings season is always full of surprises. It's a time when we usher out the old (leaders) and welcome in the new. Companies that report better-than-expected results and are trading in bullish technical patterns typically have an advantage in the weeks ahead - at least that's...

READ MORE

MEMBERS ONLY

Technology And Internet Stocks Leading Today's Advance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Many traders are believing the Dow Jones U.S. Internet Index ($DJUSNS) is dead money and for the past 18 months or so, that's been mostly true. The DJUSNS has been unable to sustain a move above 900, testing that level in March 2014, September 2014, March 2015...

READ MORE

MEMBERS ONLY

Restoration Hardware (RH) Poised For A Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Restoration Hardware (RH) engages in the retail of home furnishings. Over the past three months, the home improvement retail index ($DJUSHI), to which RH belongs, is down more than 4% while RH consolidates ahead of what could be a triple top breakout. As a result, RH is showing solid relative...

READ MORE

MEMBERS ONLY

CME Group Consolidating in Bullish Ascending Triangle

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The recent movement in CME shares back and forth is nothing but noise. The technical picture here is very solid with an uptrend in place that began in early 2013, preceding the current ascending triangle formation. During that span, CME more than doubled its stock price although its March high...

READ MORE

MEMBERS ONLY

Can Earnings Season Stem The Tide Of Selling?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I want to start this article from a historical perspective. I'm convinced there's much truth in the numbers. The 28th through the 6th and the 11th through the 18th are historically bullish periods of the calendar month. I believe much of this strength has to do...

READ MORE

MEMBERS ONLY

Today Smells Like A Short-Term Bottom...Maybe

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Possibly a long-term bottom. But I do respect bearish market behavior, especially during the summer months where history tells me "corrections happen".

I'm watching the action closely today, however, and we're seeing significant bounces off of steep drops that have a rather distinct market...

READ MORE

MEMBERS ONLY

Attention Wal-Mart Shoppers!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wal-Mart Stores (WMT) has been under tremendous selling pressure since it topped at an all-time high near 90 back in early 2015. The selling began after a long-term negative divergence printed during the second week of the year. That's a sign of slowing momentum on the buy side...

READ MORE

MEMBERS ONLY

Higher Yields Mean Lower Utility Prices

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Utility stocks benefited as much as any sector during the unprecedented drop in treasury yields. Those who seek income were forced out of treasuries the past several years because of historically low treasury yields and they found a home in utilities. The problem now is that treasuries are being sold...

READ MORE

MEMBERS ONLY

Been A Rocky 2015 Flight, But Airlines Hitting Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market rotation is the key during every bull market. Indices begin to fall apart when rotation fails and money leaves many aggressive areas and doesn't move to others. But our major indices stay on course so long as market rotation continues and thus far that's what...

READ MORE

MEMBERS ONLY

MDSO: Recent Weakness Presenting Opportunity?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Medidata Solutions (MDSO) posted better than expected revenues and EPS in late April and the stock exploded higher as a result. Since that time, MDSO hasn't been able to add to those gains, instead consolidating in rectangular fashion with its RSI dropping to 40. As you look at...

READ MORE

MEMBERS ONLY

Fundamentals PLUS Technicals EQUALS Trading Success

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Strategy

Tuesday marked the end of the second quarter. During the 2015 "halftime report", I thought I'd take a moment to share my approach to individual stock trades. Trading can be a daunting task, especially if you're looking at individual stocks because there...

READ MORE

MEMBERS ONLY

AMZN Awaiting Next Bullish Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Amazon.com (AMZN) continues to reach for the stars and if the current technical pattern plays out, it'll likely be much closer. After soaring through price resistance in April to set a fresh all-time high on the heels of better-than-expected earnings, AMZN has been consolidating in a bullish...

READ MORE

MEMBERS ONLY

Technical Analysis - Its Strengths And Weaknesses

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There is little in this world that irks me more than listening to a fundamentalist eschew technical analysis. I have a somewhat unique background as a Technical Analyst, having passed the CPA exam some 30 years ago and having spent 20 years in public accounting. That has provided me a...

READ MORE

MEMBERS ONLY

IPG Photonics (IPGP) - Charting Upcoming Triangle Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

IPGP resides in the semiconductor industry and is pulling back with this industry group as June has proven to be a very rough month for this space. I'm expecting that to soon change and IPGP could be a direct beneficiary. But first, there's some technical business...

READ MORE

MEMBERS ONLY

Consumer Staples Leading One Week Charge To Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

After testing 2075 price support for about the sixth time a week ago, the S&P 500 has rallied close to 2.5% since that low. While all nine sectors have participated in this rally, energy has been the laggard while consumer stocks, especially staples, have led this rally....

READ MORE

MEMBERS ONLY

Home Properties (HME) Reverses At Key Support; Fed Decision Spurs REITs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Federal Reserve on Wednesday suggested the pace on increasing interest rates would be slower than previously thought. There was renewed interest in treasuries and the 10 year treasury yield dropping nearly 10 basis points in the two hours following the Fed policy statement. Those remarks by Fed Chair Janet...

READ MORE

MEMBERS ONLY

Specialty Consumer Services ($DJUSCS) - Bullish or Bearish?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Just like with fundamental analysis, technical analysis has two sides - those who look at the glass as half full and those who view it as half empty. The current technical state of the Dow Jones U.S. Specialty Consumer Services index ($DJUSCS) is certainly up for debate. There are...

READ MORE

MEMBERS ONLY

Shorting Candidates Over The Weaker Summer Months

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Okay, first let me preface this article with the notion that I don't short a bull market. I really try to trade with the trend. Going against the primary trend is similar to swimming against the current - it's not easy to make any head way....

READ MORE

MEMBERS ONLY

Twitter (TWTR) Nearing The UnTweetable

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There hasn't been much positive news to tweet about at Twitter (TWTR) lately. In the midst of its downward spiral in price action, CEO Dick Costolo announced he would be resigning from TWTR and TWTR's co-founder and Chairman Jack Dorsey would take over. The problem here...

READ MORE

MEMBERS ONLY

Don't Always Believe Your Technical Indicators

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I love technical analysis. I spent two decades in public accounting, was a prinicipal in a large regional CPA firm in the Washington DC metropolitan area and audited companies in several industries, including banks. But as I say over and over again, you can have the financial statements and review...

READ MORE

MEMBERS ONLY

Mobileye (MBLY) Sees Breakout on Heavy Volume

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Mobileye (MBLY) is one of the companies behind the car crash avoidance technology. MBLY broke its downtrend line in early March on surging volume and has been trending higher ever since. Volume trends remain very strong and today's breakout is occurring on excellent volume as it clears double...

READ MORE

MEMBERS ONLY

Steepening Yield Curve Says Buy These 3 Banks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The ten year treasury yield has surged from 1.65% to 2.40% since February 1st so it should be no surprise that the Dow Jones U.S. Bank Index ($DJUSBK) has risen more than 14% during that same span. From a sector perspective, the consumer discretionary (XLY) space is...

READ MORE

MEMBERS ONLY

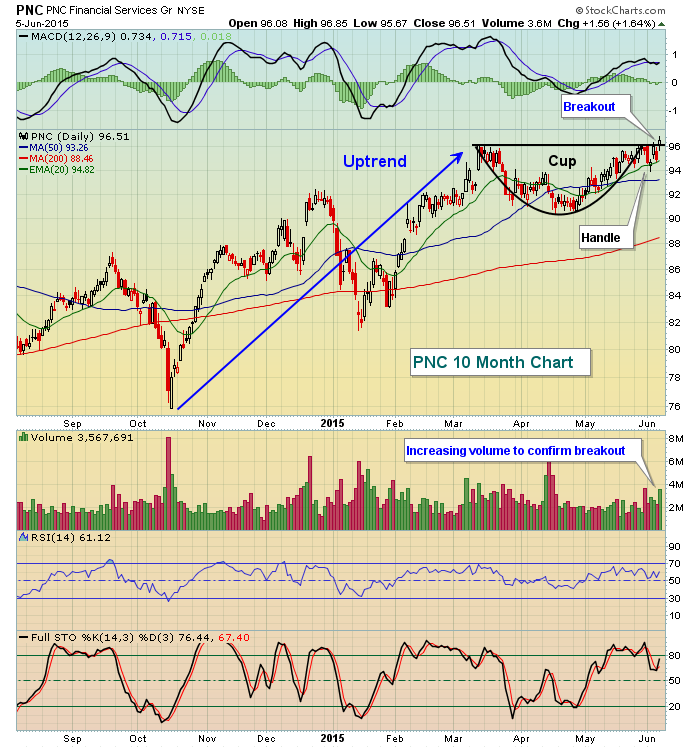

PNC Financial Services (PNC) Makes Bullish Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Money is rotating towards financial stocks as the market prepares for what appears will be Fed tightening later in 2015 into 2016. Higher yields on treasuries and a steepening yield curve generally increase net interest margin, the key metric in bank earnings. So traders are using this fundamental development to...

READ MORE

MEMBERS ONLY

Money Rotates To Financials, Is Consumer Finance Next?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A solid labor market had bond traders heading for the exits on Friday and that extended the recent surge in treasury yields. The 10 year treasury yield ($TNX) closed at its highest level since early October and that has many traders heading for the financial sector. While the financial ETF...

READ MORE

MEMBERS ONLY

Healthcare Stocks Are Vulnerable to Weakness Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Okay, I'm being a bit dramatic with this title because I'm not ready to throw the towel in on this bull market. But there are clearly warning signs technically that the next bout of rotation in the stock market could negatively affect the healthcare sector. As...

READ MORE

MEMBERS ONLY

Verizon Downgraded, Tests Short-Term Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

JP Morgan downgraded Verizon (VZ) this morning, instead choosing AT&T (T) and that has put pressure on VZ in the early going. Thus far, buyers have emerged and VZ has risen off its opening gap lower. Technically, VZ is continuing its downtrend that it started just over a...

READ MORE

MEMBERS ONLY

My Perspective On Go Away In May

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you know one thing about me, you should know that I'm a stock market historian. I've logged every day's S&P 500 activity onto an Excel spreadsheet since 1950. If there's a trend, I can tell you about it. So...

READ MORE

MEMBERS ONLY

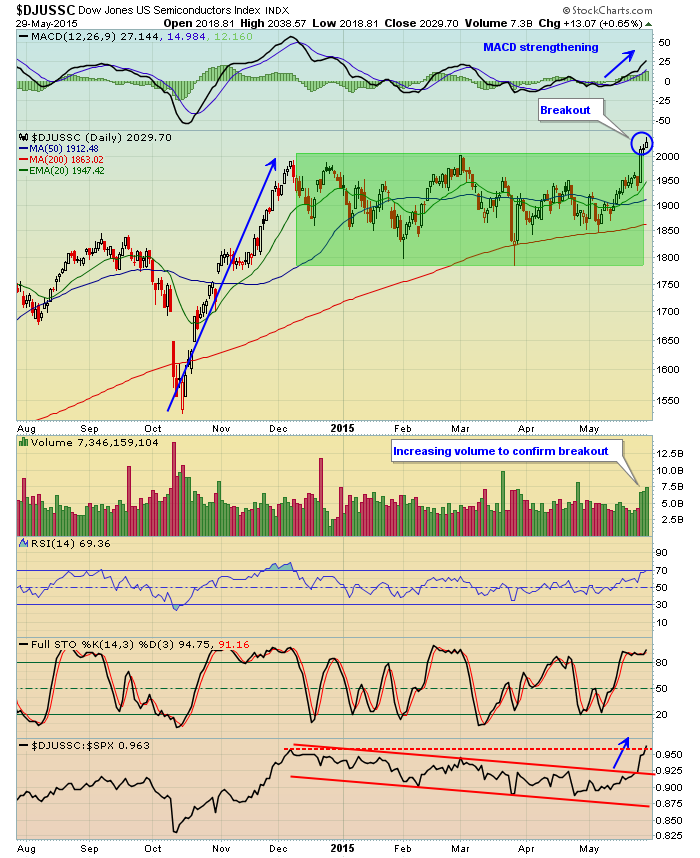

Semiconductors Surge To Fresh New Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Just a couple days after finally clearing two month resistance at 1950, the Dow Jones U.S. Semiconductor Index closed above 2000 for the first time in 14 years late last week. Semiconductors tend to move quickly in both directions so given the breakout, I'd be looking for...

READ MORE

MEMBERS ONLY

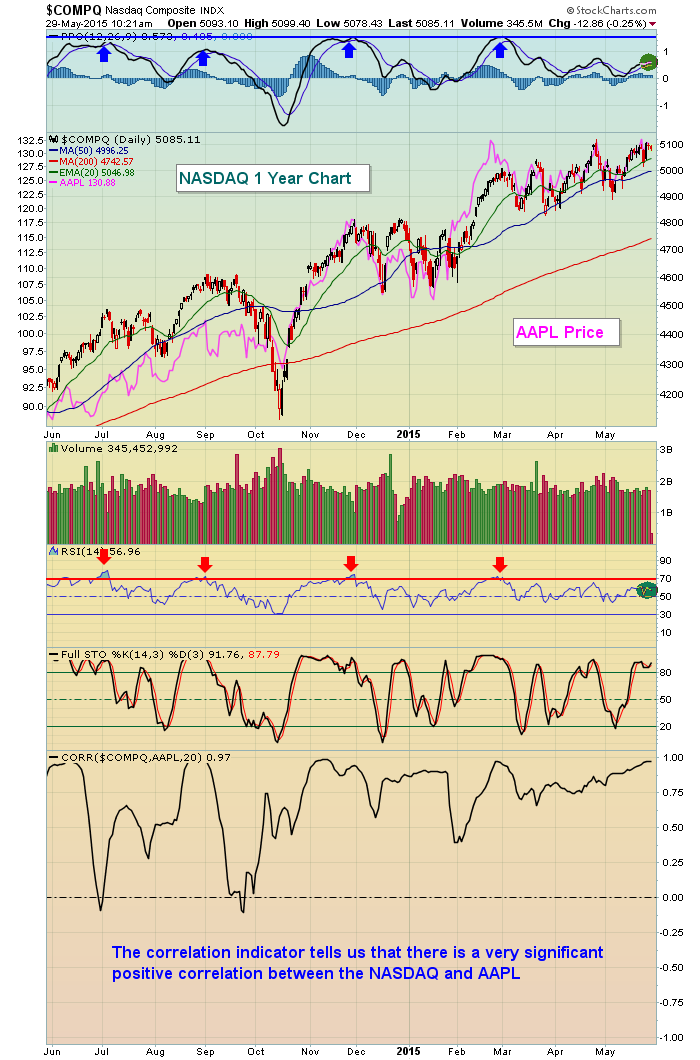

Apple (AAPL) Doesn't Fall Far From The NASDAQ Tree

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Apple (AAPL) is more than a $750 billion market cap company, by far the largest on the NASDAQ. Therefore, AAPL's price performance will have a rather significant impact on the overall performance of the NASDAQ as the NASDAQ is a market cap weighted index. In other words, AAPL&...

READ MORE

MEMBERS ONLY

ABIOMED Testing Gap Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

ABIOMED (ABMD) has fallen much of the past three weeks after surging on better-than-expected quarterly earnings results on May 5th. ABMD posted revenues of 67.56 million in its latest quarter, easily surpassing Wall Street forecasts of 62.33 million. In addition, ABMD's EPS trounced estimates, .28 vs....

READ MORE

MEMBERS ONLY

Gap Trading: A Case Study

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Gaps are strange creatures and knowing what to do after one is difficult because emotion does crazy things to our patience and discipline. Gaps 101 tells us that most gaps fill. What does that mean? Well, if ABC company closed yesterday at 10.00 and opened today at 11.00,...

READ MORE

MEMBERS ONLY

Bullish Industry Groups Awaiting Breakouts

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of the advantages that the technical trader carries in his/her back pocket is the ability to visualize the future price action before it happens - based on the prior price action. Trending price action to the upside is generally followed by bullish continuation patterns. Periods of consolidation can...

READ MORE

MEMBERS ONLY

Penn National (PENN) Awaiting Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Gambling Index ($DJUSCA) has been under pressure for quite some time with many gambling stocks under pressure as well. That has not been the case for Penn National Gaming (PENN), however, as it's been in an uptrend and has been a tremendous relative...

READ MORE