MEMBERS ONLY

Small Cap Stocks: Is This Group Friend or Foe?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Since the S&P 500 Index ($SPX) broke out above price resistance that was established in 2000 and 2007, the secular bull market rally has been led by the Nasdaq 100's influence. If you compare relative performance (to the benchmark S&P 500 Index), small caps...

READ MORE

MEMBERS ONLY

Short-Term Traders: Beware of This Flaw In Leveraged ETFs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've written many articles and discussed several times that it's unwise to buy and hold leveraged exchange-traded funds (ETFs) unless you're at a major support level or you catch an uptrend. Buying and holding through volatile periods results in erosion. In other words, if...

READ MORE

MEMBERS ONLY

Here's A Chart That's Flashing a Major Buy Signal During This Selloff

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

You've probably heard the adage, "Don't judge a book by its cover?" Well, it's tempting to say that when you look at the possible Fed-induced selloff in the stock market. While we're seeing a lot of negativity, let's...

READ MORE

MEMBERS ONLY

Keeping 2022 In Perspective Will Help You in 2023

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At our MarketVision 2022 event on Saturday, January 8, 2022, I said stock market bulls would need patience—a lot of it—because it was going to take some time for sentiment, which was ridiculously bullish, to reset. I also said at the time that we should expect a minimum...

READ MORE

MEMBERS ONLY

December Historical Tendencies Tell Us This Could Be a Stock Picker's Month

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's a great debate as to whether we've seen the market bottom. I'm firmly in the camp of "YES, we've seen it." I called a bottom in mid-June and, if it weren't for FedSpeak from Jackson Hole in...

READ MORE

MEMBERS ONLY

5 Things To Know Right Now; Our Fall Special Ends Today!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's been a long 2022 for many in the stock market as we've seen all-time highs in early January morph into one of the worst bear markets since 1950. While we've seen a significant decline in equity prices, the market environment now is much...

READ MORE

MEMBERS ONLY

Improve Your Portfolio Performance With This Improving Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm seeing more and more industry groups that have either broken out above August highs or on the verge of doing so. Meanwhile, I believe it's important to focus on individual stocks within these improving groups for possible trading candidates. I prefer sticking with leading stocks...

READ MORE

MEMBERS ONLY

The Three Key Ingredients Of Stock Portfolio Construction

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I always stress the importance of combining technical and fundamental analysis. I practiced in public accounting for more than 20 years, with most of that time spent at a large, regional CPA firm in the Washington DC area. While I believe technical analysis is an absolute necessity to observe price/...

READ MORE

MEMBERS ONLY

Building A Portfolio To CRUSH The S&P 500!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At EarningsBeats.com, we're one day away from the most exciting day of our quarter. I call it our Portfolio "Draft". I'll be announcing the 10 equal-weighted stocks that are included in each of our three portfolios - Model, Aggressive, and Income. We may...

READ MORE

MEMBERS ONLY

Now Is the Time To Add This Industry Group to Your Portfolio

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As the winter season approaches, I'm going to suggest that you consider buying into what might seem to be a warm weather industry—home construction ($DJUSHB). The "go away in May" theory applies very strongly to this cyclical group. Over the past 20 years, the average...

READ MORE

MEMBERS ONLY

Walmart (WMT) and Target (TGT) Earnings: Who's Winning The Retail War?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earnings season is quickly coming to a close, but it's just starting among the big retailers. On Tuesday, we'll get the latest earnings results from Walmart, Inc. (WMT), and that'll be followed by Target Corp's (TGT) quarterly earnings on Wednesday. Walmart and...

READ MORE

MEMBERS ONLY

Everything Has Changed and It's For The Better

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The stock market has been like a volcano, simply waiting to erupt. The hawkish Fed and stubbornly-high inflation have wreaked havoc on stocks in 2022, but market participants have been awaiting good news on the interest rate front and I believe they got it on Thursday. The October CPI was...

READ MORE

MEMBERS ONLY

The VIX Is Screaming to GET IN NOW!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

My two favorite sentiment indicators are (1) the 5-day moving average of the equity-only put-call ratio ($CPCE) and (2) the Volatility Index. On September 6th, I wrote about the elevated CPCE likely providing a short-term market bottom, and it did; the S&P 500 jumped 5% in a week....

READ MORE

MEMBERS ONLY

3 Things I'll Be Watching After Today's Fed Policy Statement

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Like all of you, I'm just waiting. The Fed concludes its two-day meeting this afternoon and its latest policy decision will be released at 2pm ET. It's widely expected that the Fed will raise the fed funds rate by 75 basis points. Anything other than that...

READ MORE

MEMBERS ONLY

This Industry Group Is Churning Out Hugely Profitable Trades

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If a huge recession is looming, someone forgot to tell the apparel retail group ($DJUSRA), because their absolute and relative strength is undeniable right now. The past three months have seen many stocks within this space SOAR. Here's the visual of the DJUSRA on both an absolute and...

READ MORE

MEMBERS ONLY

The Most Important Stat That No One Is Talking About

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Most of you are probably aware by now that I'm not a fan of CNBC, or any media for that matter. It's because their goals and objectives differ from mine. I want to educate. They want clicks, viewership, and ad revenue. Whatever it takes to achieve...

READ MORE

MEMBERS ONLY

Today Marks The Beginning Of An Overwhelmingly Bullish Period

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

While current technical conditions are "iffy" at best, I want to point out that we have just entered THE most bullish historical period of the year. The S&P 500 and NASDAQ can be broken down into 3 lengthy historical periods, in my view - the good,...

READ MORE

MEMBERS ONLY

My Sustainability Ratios Remain Fairly Strong And Suggest We Be LONG, Not Short

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I made a bold bottoming call on June 16th, just prior to a massive 700-point rally in the S&P 500. I didn't see the recent drop and double-bottom coming, however. Now that we've seen it, has anything changed? Are my signals still bullish? For...

READ MORE

MEMBERS ONLY

Do We Have A BIG Drop Ahead?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have a feeling that most of you would say "Yes, there's no way we've reached bottom."

Let me start by saying that calling tops and bottoms is GREAT if you get it right. For me, it's not about calling every stock...

READ MORE

MEMBERS ONLY

Net Put Premium And Options Expiration Week Suggest A Huge Rally Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I love trading during options expiration week. It's the one time when I have a pretty good idea of which market direction would likely benefit market makers. It doesn't provide us a guarantee, but, in my opinion, does tilt the odds heavily in our favor. I...

READ MORE

MEMBERS ONLY

It's Homework Time: Improving Stocks In Improving Industry Groups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

By all accounts, it's been a very difficult year. There were plenty of stock market warning shots fired in December 2021 and we're now paying seeing the carnage. While the current environment is dangerous, it's no time to rest on our laurels. There'...

READ MORE

MEMBERS ONLY

Do Earnings Warnings Really Matter?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Of course they do. One of the key metrics in any business valuation is earnings/earnings growth. When a company cuts its forecast, Wall Street must decide whether it's a "one-off" type of earnings miss or if it's more indicative of a longer-term trend....

READ MORE

MEMBERS ONLY

Do You Believe In Equal-Weighted ETFs? Really?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of my favorite intermarket relationships exist between consumer discretionary (XLY) and consumer staples (XLP). It's a very quick way to see whether the stock market favors offense or defense. If the XLY:XLP ratio is rising, it's a signal to me that Wall Street believes...

READ MORE

MEMBERS ONLY

This Chart Provides Tradable Bottom Signals and It's Flashing a MAJOR Buy Right Now

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When we endure a lengthy bear market, many technical buy signals can be thrown right out the window. They don't work as pessimism and outright fear take over the market; instead, you have to be prepared for reversals based on extreme sentiment readings.

Historically, Volatility Index ($VIX) readings...

READ MORE

MEMBERS ONLY

I'm No Skeerdy Cat, I'll Fight The Fed

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Yes, I'm very familiar with that old Wall Street adage, "Don't Fight The Fed!" But similar to the "Go Away In May" theory, I'm happy to poke holes in it. Rather than just blindly buy what the media is selling,...

READ MORE

MEMBERS ONLY

Here are the Two Industry Groups We Need to Watch Closely

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's no secret that I've turned very bullish. I stuck my neck out and made my bullish call on June 16th -- right at the bottom. I've seen absolutely nothing to change my mind since that bottom. The biggest question to me is whether...

READ MORE

MEMBERS ONLY

Using Options-Related Weakness To Find Excellent Trades

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I alerted EarningsBeats.com members to the probability of short-term weakness at the start of options expiration week last Monday. There are plenty of short-term inefficiencies in the stock market and none are bigger than the manipulation around options-expiration week. It's the primary reason why the S&...

READ MORE

MEMBERS ONLY

Zeroing In On Renewed Relative Strength

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In the very near-term, we have options issues that could take a toll on key technology (XLK) and consumer discretionary (XLY) stocks. If those options issues kick in this week, the overall market is likely to struggle. That will definitely be one headwind as we start the new week. But...

READ MORE

MEMBERS ONLY

Can the Stock Market Overcome This MAJOR Issue?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm a believer that Wall Street will eventually overcome all obstacles and move back to all-time highs. It's a big "wall of worry", but the bulls are up to the task. The cyclical bear market is over, and we've resumed the secular...

READ MORE

MEMBERS ONLY

This One Would Make A Great Short Candidate

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm very much in the bullish camp and have been for weeks now. However, there are isolated situations where I'd consider a short position. Netflix (NFLX) is on that list. I believe the reward-to-risk is set up beautifully right now on NFLX. Remember the horrid earnings...

READ MORE

MEMBERS ONLY

STOP Following The News And Focus On The Charts

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We're going higher. Sure, we'll have pullbacks along the way. Secular bull markets typically test their key moving averages like the 20-day EMA and/or 50-day SMA frequently, and I'll be looking for those in the weeks and months ahead. But it's...

READ MORE

MEMBERS ONLY

August Is Historically the Best Month for This Lagging Industry

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Since the mid-June market bottom, we've seen improvement in a large number of areas. Technology (XLK) has resumed its leadership role in a big way, as evidenced by the following relative breakout:

I believe this is just the beginning of the resumption of the secular bull market. If...

READ MORE

MEMBERS ONLY

Key Strategies To Improve Your Trading Performance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I love earnings season. New information abounds and the stock market is constantly trying to reprice thousands of securities based on this new data. It creates periods of temporary imbalances in supply and demand, which leads to a very inefficient market in the short-term. Put another way, we can make...

READ MORE

MEMBERS ONLY

We're Heading For New All-Time Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When I turned bearish at the end of 2021, I made it quite clear that I expected this stock market downturn to be fairly brief - at least in historical bearish terms. At our MarketVision 2022 event on Saturday, January 8th, I suggested that the S&P 500 would...

READ MORE

MEMBERS ONLY

These 3 Earnings Massacres Last Night Had 1 Thing in Common

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Trying to predict how Wall Street might react to an earnings report is no simple task. Sometimes, a stock has a big run into its earnings report, but then sells off after delivering solid results. It's the old adage, "buy on rumor, sell on news." In...

READ MORE

MEMBERS ONLY

The Bears Have Lost Their Best Friend

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Every day's action convinces me more that the bottom is in. I called it in mid-June and nothing has changed my mind. This morning we got the horrible inflation news (a bit of sarcasm). Here was a CNBC headline:

And if you'd like to spend some...

READ MORE

MEMBERS ONLY

Shhhhh! Don't Tell Anyone, But Here's a Wall Street Secret!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One very interesting and intriguing part of stock trading is that Wall Street disguises their buying/selling and rotation, as many times the absolute charts don't tell us the REAL story. I want you to look at the absolute price action in both mid-cap growth ($DJUSGM) and mid-cap...

READ MORE

MEMBERS ONLY

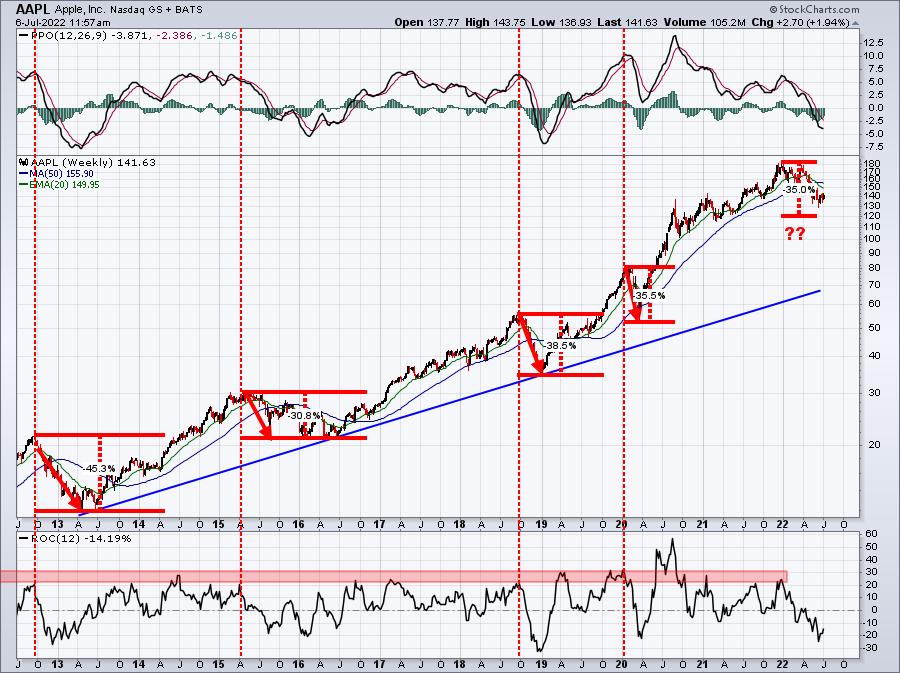

AAPL Is A Strong BUY Now, Here's Why

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In case you haven't followed my work, I was very bearish U.S. equities as we opened 2022. I didn't wait to see the carnage to tell you that there was carnage. I predicted the carnage before we ever saw it. Included in those bearish predictions...

READ MORE

MEMBERS ONLY

Falling VIX Spells BIG Trouble For The Bears

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If there's one thing that a bear market - secular or cyclical - feeds on, it's fear. The further the drop, the bigger the spike we see in the Volatility Index ($VIX). From the CBOE.com website, the VIX "measures the level of expected volatility...

READ MORE

MEMBERS ONLY

Money is Rotating Back to Growth

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of my favorite ratios, and it's a very simple one, is comparing NASDAQ 100 performance vs. the S&P 500 (QQQ:SPY). History tells us that the more aggressive QQQ performs better on a relative basis during bullish cycles, while the SPY performs better during bearish...

READ MORE