MEMBERS ONLY

What the Heck Just Happened?!!

by Carl Swenlin,

President and Founder, DecisionPoint.com

Yesterday's monster rally was not expected by most people, me included, and it left me a little disoriented. For weeks the Fed has been expected to raise interest rates by 50 basis points, and the realization of that expectation should have caused the market to sell off, shouldn&...

READ MORE

MEMBERS ONLY

STOCKS RESUME SELLING AFTER FED RELIEF RALLY -- BOND YIELDS NEAR TEST OF OVERHEAD RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK SELLING RESUMES... Stocks are being sold heavily today and are totally reversing yesterday's Fed relief rally. Stocks have given back all of Wednesday's price gains and look poised to fall further. Chart 1 shows the Dow Industrials falling sharply today after meeting resistance at their...

READ MORE

MEMBERS ONLY

Why the Nasdaq 100 (QQQ) Is a Great Trade Example for Thursday

The rate increase came in, as expected, at half a percent, showing that the Fed is going for the safest play instead of pushing for a .075% increase.

With that announcement, the market made a late-day rally. While all the major indices have similar price action, we will focus on...

READ MORE

MEMBERS ONLY

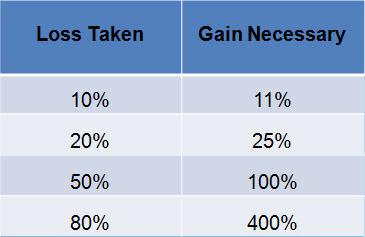

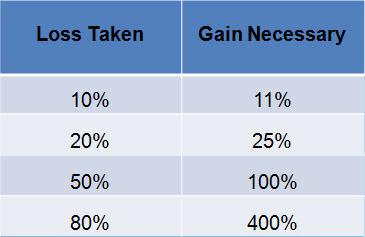

Understand This and Avoid Losing Billions

by Dave Landry,

Founder, Sentive Trading, LLC

With the market being iffy at best, now's a good time to take a step back. On this week's edition of Trading Simplified, Dave starts the show by talking about how the markets really work. He follows with a discussion about how to use his "...

READ MORE

MEMBERS ONLY

140 (XLK) And 160 (XLY) Are The Crucial Levels To Watch

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The current sector rotation still shows all defensive sectors inside the leading quadrant, albeit with a slight loss of relative momentum (JdK RS-Momentum scale). Nevertheless, the relative uptrends in those sectors are still intact.

Consumer Staples

Relative strength of the staples sector vs. SPY is in a clear pattern of...

READ MORE

MEMBERS ONLY

It's Not What the Fed Does, But How the Market Reacts to its Decision, That Counts

by Martin Pring,

President, Pring Research

I'll get to the Fed element later, but, first, a few words on the Dow Jones Global Stock Index. Chart 1 shows that it has been experiencing a series of declining peaks and troughs since last November. That's not a bullish sign. Neither is the fact...

READ MORE

MEMBERS ONLY

Can Transportation (IYT) and Retail (XRT) Make a Positive Momentum Divergence?

In reference to Monday's article, we are watching for signs of a reversal in the major indices based on price and momentum. As a follow-up, we can also look at Mish's Economic Modern Family to see which areas are holding, with strength going into Wednesday'...

READ MORE

MEMBERS ONLY

Sector Spotlight: Monthly Charts Resting at Support

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, for this first Tuesday for the month of May, I review the completed monthly charts for April. This process takes up almost the entire show, so you will get a thorough feel for what's going on at the...

READ MORE

MEMBERS ONLY

DP TV: Time for Inverse ETFs?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

How low can we go? On this episode of DecisionPoint, Carl walks viewers through the FAANG+ mega-cap stocks. Using earnings per share and P/E, Carl shows how to find "fair value" support. Erin discusses oversold indicators now versus 2020 bear market low. She then analyzes technical support...

READ MORE

MEMBERS ONLY

Watch for Key Resistance to Clear and Hold Before Wednesday's Fed Announcement

This Wednesday, the Fed will announce an interest rate increase. So far, expectations are for +0.5%. While some believe this is too high, as the market is struggling, others believe the Fed needs to be more aggressive and push rates up by 0.75%.

One reason for a smaller...

READ MORE

MEMBERS ONLY

Is the Trend About to Bend?

by Bruce Fraser,

Industry-leading "Wyckoffian"

When studying the markets chartists can tend to become myopic and close in on smaller and smaller timeframes (certainly that is the case for this Wyckoffian). Meanwhile, the tsunami of monster trends can engulf portfolios with unexpected reversals. A powerful antidote to this vulnerability is awareness of the major price...

READ MORE

MEMBERS ONLY

Bear Markets and Drawdowns

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I thought this article that I wrote over three years ago on January 11, 2019 is quite appropriate for today. If you have read my blog you know that I use the Nasdaq Composite as my measure of the market and it is down significantly as I write this. Enjoy!...

READ MORE

MEMBERS ONLY

NASDAQ BREAKS SUPPORT -- THE DOW AND S&P 500 MAY BE NEXT -- HALFWAY TO RECESSION?

by John Murphy,

Chief Technical Analyst, StockCharts.com

A BAD APRIL ENDS UNDER PRESSURE... Stocks fell sharply on Friday to end one of the weakest months in recent memory. The Nasdaq market lost -13.2% to register its worst month since 2008. The S&P 500 and Dow lost -8.8% and -4,9 % and experienced the...

READ MORE

MEMBERS ONLY

Bollinger Band Squeeze: Watch These Stocks as They Get Ready for a Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Bollinger Bands are the volatility bands placed above and below the Moving Average. Being based on volatility, the bands widen and narrow, i.e. they adjust themselves dynamically as the prices move. When the prices are volatile, the Bands widen with the increase in volatility; they contract in times of...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Continues To Remain Poised At A Crucial Juncture; RRG Charts Show These Sectors Lending Support To The Markets

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

While continuing to trade precisely on the expected lines, the NIFTY continued to struggle to keep its head above the key levels as it closed the week on a flat note with a negative bias. All the five days of the week stood very shaky for the markets; NIFTY either...

READ MORE

MEMBERS ONLY

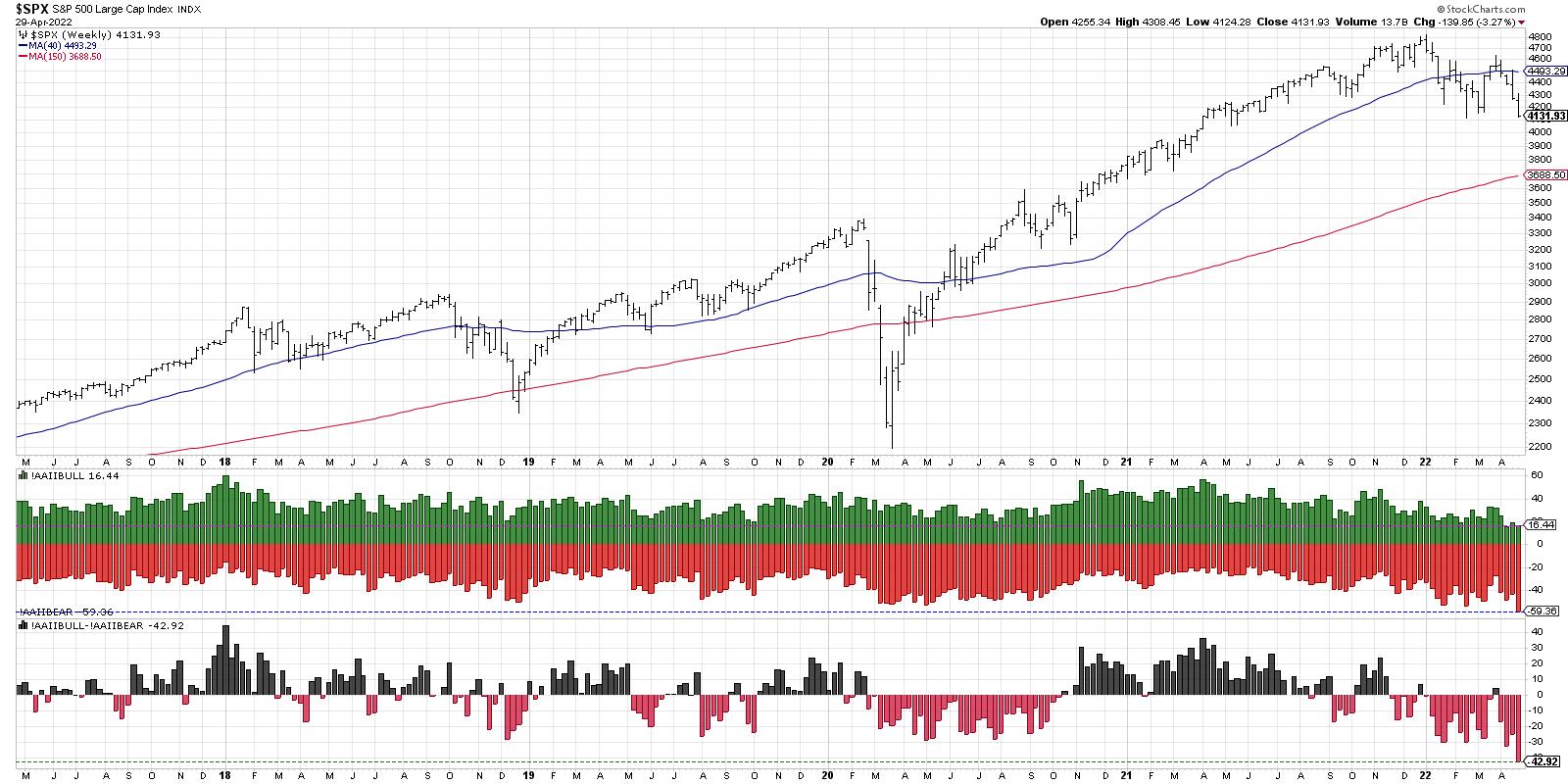

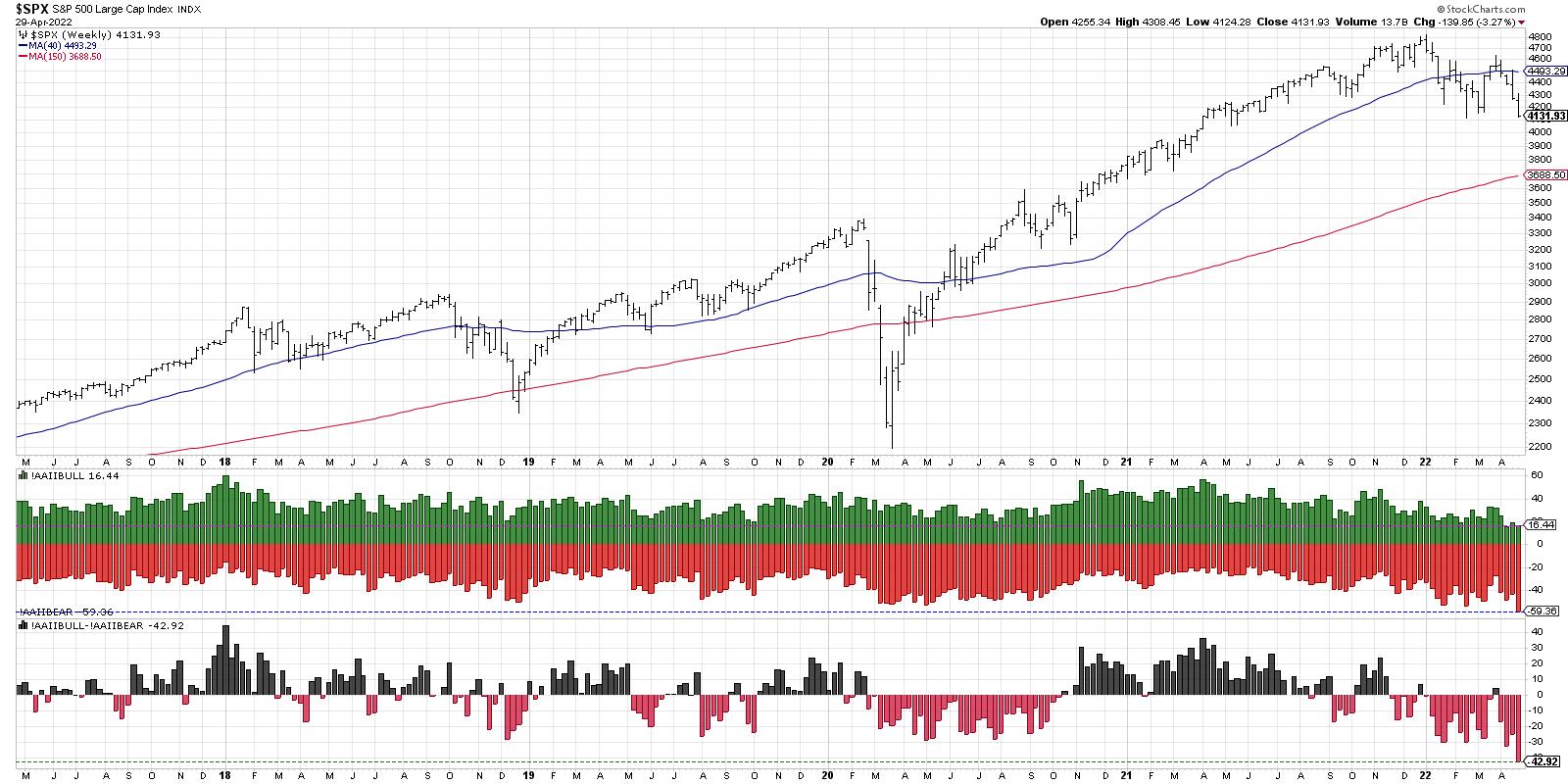

Key Sentiment Indicator at Bearish Extreme

by David Keller,

President and Chief Strategist, Sierra Alpha Research

My weekly investment routine involves a review of key sentiment indicators every Thursday. This is mainly because the survey data I review is usually updated on Wednesday and Thursday of each week, so it's a perfect time to reflect on survey data (how investors are voting with their...

READ MORE

MEMBERS ONLY

Nasdaq Breaks Support... What's Next?

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what's driving market weakness and what to be on the lookout for over the coming weeks. She also shares pockets of strength in an otherwise bleak market.

This video was originally broadcast on April 29,...

READ MORE

MEMBERS ONLY

Earnings Hits and Misses Present New Opportunities

by John Hopkins,

President and Co-founder, EarningsBeats.com

Over the past two weeks, we have heard from many of the most visible companies in the world, including the FAANG stocks, Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX) and Google (GOOGL), who reported their Q1 earnings. The overall market reaction to the reports was mixed with traders particularly...

READ MORE

MEMBERS ONLY

Will The Stock Market Bloodbath Continue?

On Friday, the Nasdaq 100 (QQQ) closed -4.4% on the day. Not far behind came the S&P 500 (SPY) at -3.6%, along with the Russell 2000 (IWM) at -2.8%. This comes after each failed to hold support from previous lows dating back to mid-March.

While...

READ MORE

MEMBERS ONLY

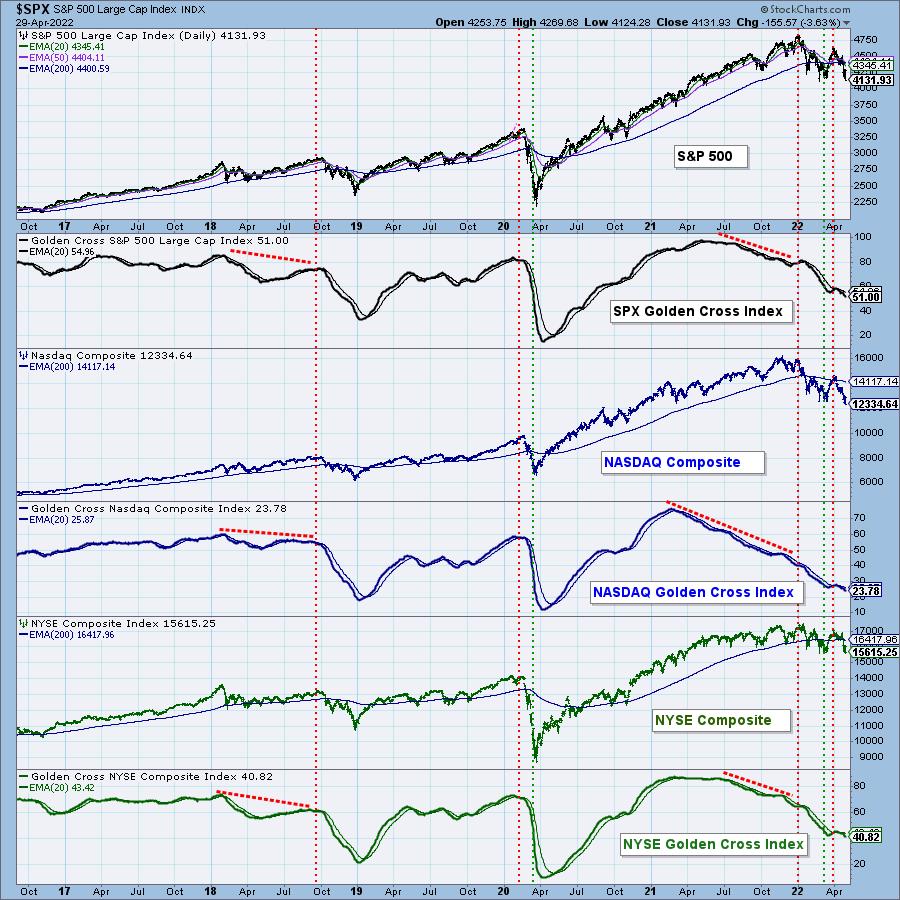

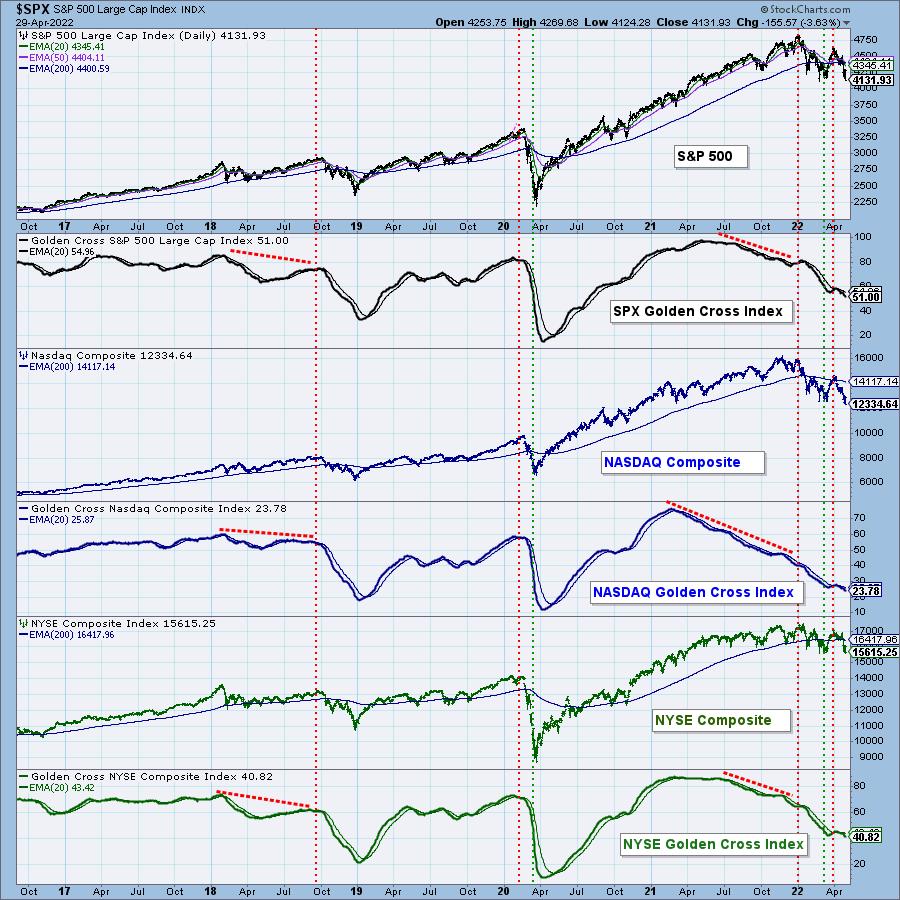

Long-Term Participation at One-Year Lows and Bear Market Levels

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Golden Cross Index (GCI) and Silver Cross Index (SCI) give a much better picture of market breadth than any advance-decline based indicator. And, rather than breadth, we think of them as giving an accurate measure of participation -- the percentage of stocks participating in the up or down pressures...

READ MORE

MEMBERS ONLY

Which Path Forward After Earnings?

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG covers the overall market action after some key players reported their earnings. How did Google, Facebook, Amazon, and Apple affect the market? He then goes into detail on where he thinks the market is headed next.

This video was...

READ MORE

MEMBERS ONLY

GNG TV: With Rates Near 2018 Highs, U.S. Markets Sell Off

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

On this week's edition of the GoNoGo Charts show, U.S. markets continue to sell off as the picture of the asset classes change. Stocks join bond prices in a strong "NoGo" as commodities and and the dollar continue to maintain their "Go" trends....

READ MORE

MEMBERS ONLY

Yields May Be Peaking for a While

by Martin Pring,

President, Pring Research

A few weeks ago, I wrote a piece entitled "The Fed Raises Rates; What if it's Already Priced into the Market?". The idea was to point out that the Fed is a lagging indicator and that multiple bond yields had already reached mega resistance in the...

READ MORE

MEMBERS ONLY

Why the 18 Moving Average is So Important

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe explains why the 18 Moving Average is so important to him. He shows 4 time frames with a single moving average on the SPX and discusses how valuable they have been over the past few years. He...

READ MORE

MEMBERS ONLY

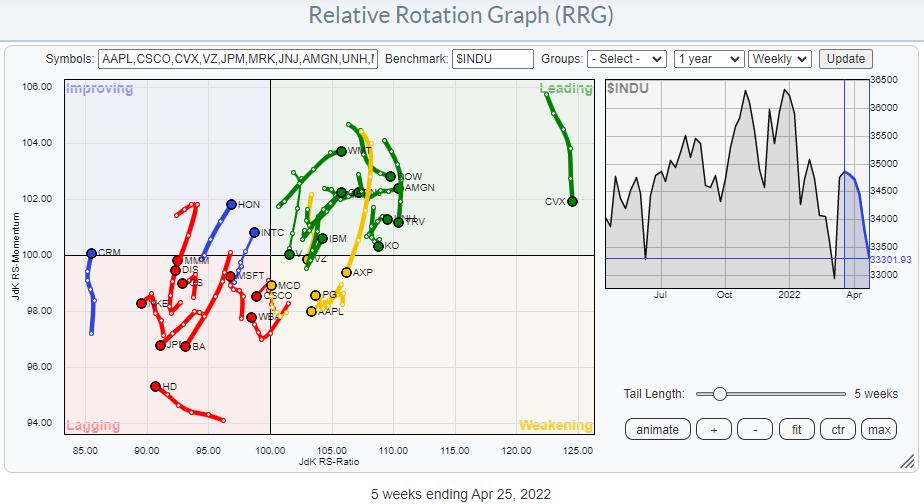

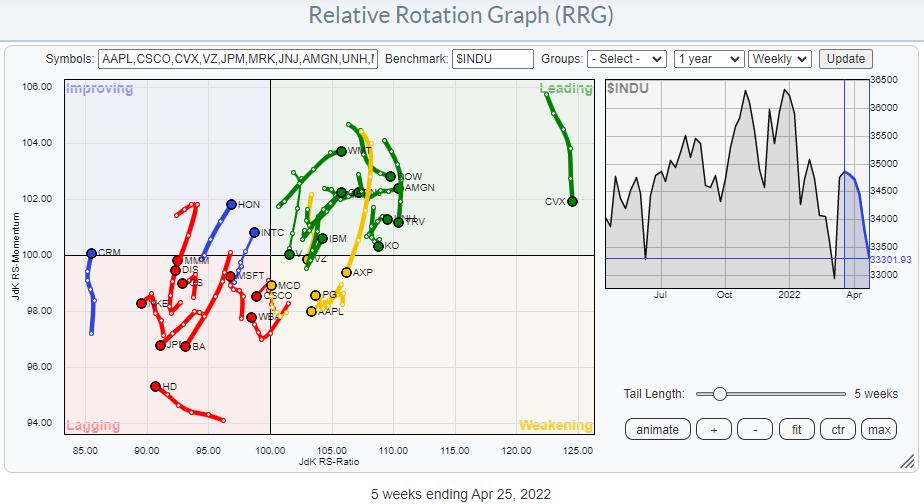

Which Stocks Inside the DOW Are Worth Holding?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With the general market going through a rough time at the moment, it makes sense to see if we can find pockets that are worth watching and potentially holding in portfolios.

For this occasion, I am using the DJ Industrials universe.

As you know Relative Rotation Graphs are based on...

READ MORE

MEMBERS ONLY

Why Traders Should Be Waiting for Confirmation When Buying Dips

For the past 10 years, dip-buying weakness has worked out very well, as the market has only been under pressure for short periods. However, the economy and world are in a new situation, one that involves geopolitical stress, rising inflation and the continued recovery from the pandemic.

With that said,...

READ MORE

MEMBERS ONLY

Finding Where the Real Money Is

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave talks about what he actually does and the methodology behind it. He discusses "Pirate Profits", how to find where the money is and how to get there through proper money management. Dave also discusses an opening gap reversal...

READ MORE

MEMBERS ONLY

Predicting Earnings Reports Is As Simple As Analyzing One Key Indicator

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let me start off by saying that nothing is a guarantee. In technical analysis, we don't work in guarantees. We work in probabilities. As I approach earnings season, I like to separate companies into 3 baskets:

1. The strong

2. The weak

3. The I don't...

READ MORE

MEMBERS ONLY

The Economic Modern Family Breaks Down

Mish's "Economic Modern Family" is made from 7 keys symbols that act as a guide for the stock market macro picture. The Family consists of the small-cap Russell 2000 index (IWM), Transportation (IYT), Retail (XRT), Regional Banking (KRE), Biotech (IBB), Semiconductors (SMH) and Bitcoin (BTC).

Just...

READ MORE

MEMBERS ONLY

Sector Spotlight: Financials at Risk

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, as it is the last Tuesday of the month, I bring in my analysis of the seasonal patterns for sectors for the new month (of May) and try to align them with the current rotations as I see them unfolding...

READ MORE

MEMBERS ONLY

DP TV: State of the Market -- BEARISH!

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl was unable to join Erin for this episode of DecisionPoint, but she packed a punch with plenty of charts to give you the current "state of the market". As noted in the headline, it is UGLY out there. Where's the strength? Erin does an in...

READ MORE

MEMBERS ONLY

Is the Small-Cap Index Showing a Dip-Buying Opportunity?

On Monday, the small-cap index Russell 2000 (IWM) found support near the bottom of its range. After last week's selling, this could either be a temporary bounce or a fake-out before weakness again sets in.

Because we are looking at the stock market from a rangebound perspective, we...

READ MORE

MEMBERS ONLY

The Last 3 Selloffs Have This One Common Ingredient

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In addition to my non-stop writing in 2022 about the bearish market environment and why I believe we're going lower, I've also provided EarningsBeats.com members with some valuable historical information.

Here was an excerpt from last Monday's Daily Market Report (DMR) to our...

READ MORE

MEMBERS ONLY

Week Ahead: What Will NIFTY Do Over The Coming Days? Read on to Find Out...

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The bulk of the past five sessions was spent on a corrective note by the Indian equity markets. There were bounces that did not sustain as the NIFTY struggled to keep its head above the 200-DMA level. The previous week saw a wide trading range of 590 points. In the...

READ MORE

MEMBERS ONLY

Bearish Signals Accelerate As Dow Jones Drops 1000 Points on Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Ok, I was being a bit dramatic. The Dow Jones Industrial Average only dropped 981 points on Friday, not 1000. But it was another reminder that this bear market has not ended. In fact, I believe the short-term signals are pointing to much more weakness ahead.

Key relative ratios either...

READ MORE

MEMBERS ONLY

This Household Name Just Had a Bullish Gap Up in a Difficult Market

by Mary Ellen McGonagle,

President, MEM Investment Research

The Nasdaq has re-entered a bear market after last week's drop put this index 20.4% below its November high in price. At this time, the index is 2.6% above its next area of downside support, which is its February lows.

Below is a weekly chart of...

READ MORE

MEMBERS ONLY

Death Cross for Technology Sector

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

The following is an excerpt from this week's subscriber-only DecisionPoint ALERT Weekly Wrap.

Today, the Technology Sector (XLK) 50-day EMA crossed down through the 200-day EMA, effecting what is widely (and dramatically) known as a Death Cross. In our vernacular, we call it a LT Trend Model SELL...

READ MORE

MEMBERS ONLY

Nasdaq in Bear Market -- What's Next?

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what triggered last week's sharp selloff and what to be on the lookout for going forward. She also identifies pockets of strength, as well as ETFs to hedge against the current market.

This video was...

READ MORE

MEMBERS ONLY

How to Prepare for Monday by Watching Trading Range Lows

After both the Russell 2000 (IWM) and the Nasdaq 100 (QQQ) failed to hold or clear over the 50-day moving average (blue line), the bleeding has not stopped. Now that IWM and many key ETFs are near the bottom of their trading range, how should we prepare for next week?...

READ MORE

MEMBERS ONLY

Updated Downside Targets for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Back in January, I shared a video with four potential outcomes for the S&P 500 index. These ranged from the "very bullish" view, where the SPX would rise to 5000 and beyond to the "very bearish" view involving a retest of long-term Fibonacci levels....

READ MORE