MEMBERS ONLY

Who Is Swimming Against The Tide?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

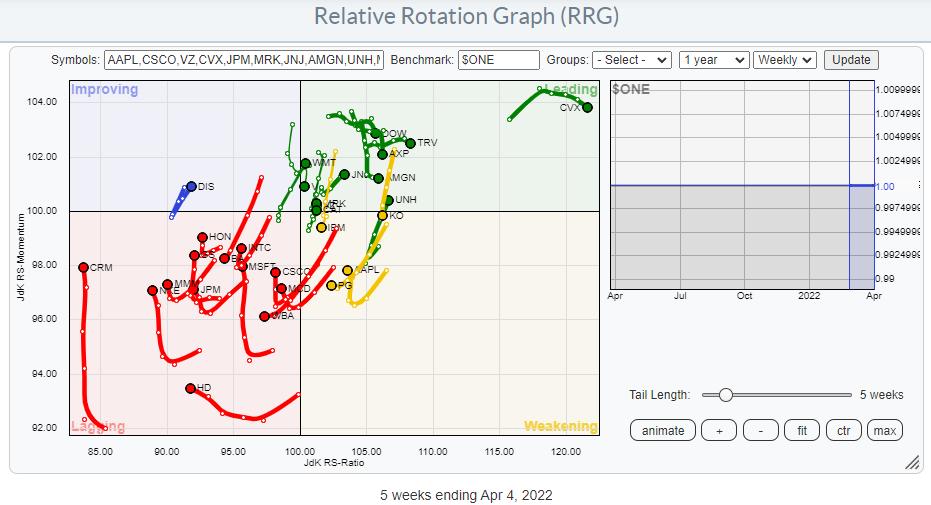

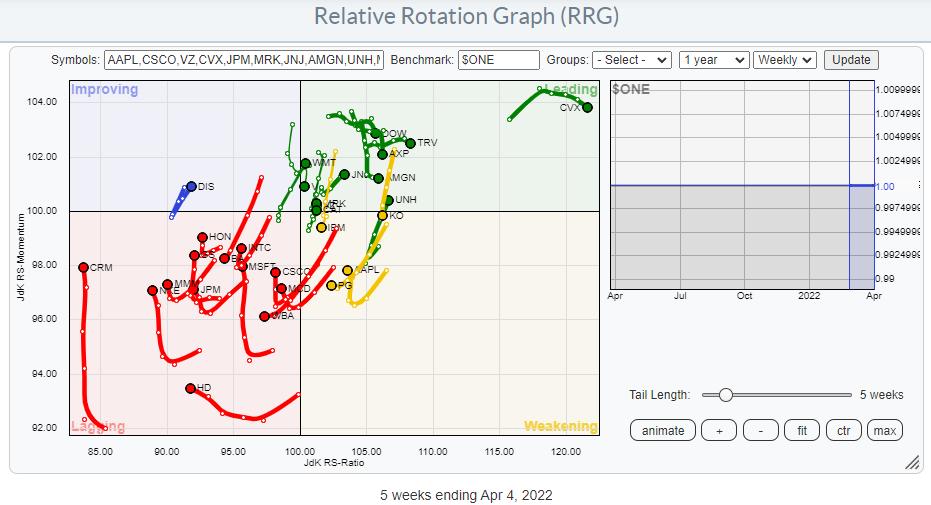

The Relative Rotation Graph above shows the members of the DJ Industrials index against $ONE as the benchmark. This way of looking at RRG helps us to gauge the price trends within the universe. You can see quite clearly that the majority of the tails are inside the lagging quadrant,...

READ MORE

MEMBERS ONLY

SECTOR RANKINGS REMAIN DEFENSIVE...HEALTHCARE HITS NEW RECORD WHILE TECHNOLOGY WEAKENS....DOW AVERAGES SIGNAL MORE CAUTION

by John Murphy,

Chief Technical Analyst, StockCharts.com

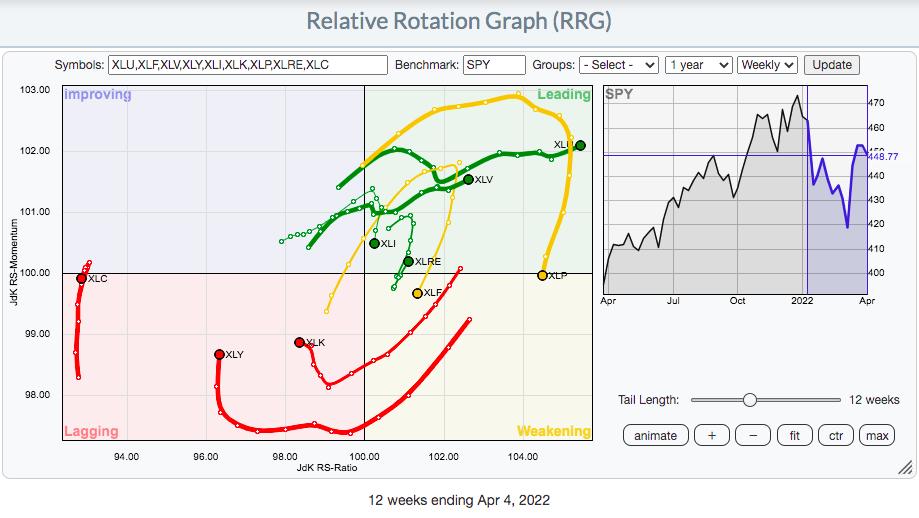

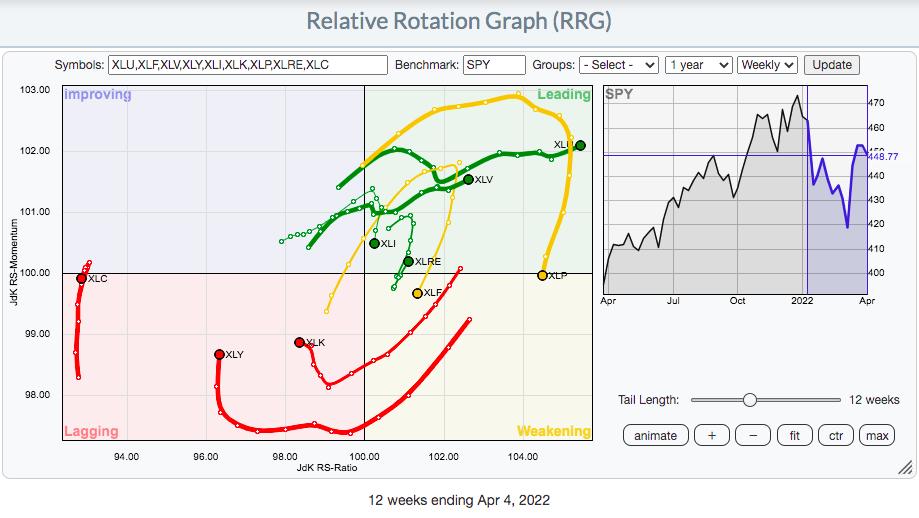

WEEKLY SECTOR RANKING... A rebound on Friday leaves the major stock indexes either flat or with minor losses for the week. The weekly sector rankings in Chart 1, however, show a lot of movement beneath the surface. One factor that stands out is that defensive stock groups continue to show...

READ MORE

MEMBERS ONLY

Untrusted Bounce

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG discusses the wild action going on. Yesterday, the market experienced a bounce, but TG is not so sure you can trust it. Using examples like the SPY and XXX, he outlines his "inverse trampoline pattern" and why...

READ MORE

MEMBERS ONLY

Please Do NOT Ignore These 3 Warning Signs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We've rallied a TON off the February low, which is certainly encouraging. While I believe it's still possible that we print a new low sometime over the next 3-6 months, the significant rally over the past few weeks should not be ignored and increases the odds...

READ MORE

MEMBERS ONLY

How to Use Stock Scans to Your Advantage

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe discusses how he uses scans to help save time. He shows a specific scan in StockChartsACP and what he is trying to identify. He then talks about the limitations to scans and how to go about using...

READ MORE

MEMBERS ONLY

GNG TV: Inflection Point for a Rising Rate Environment

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

As the 10-Year Treasury Yield reaches 2.6% and Fed minutes point to a far more aggressive stance by many central bank governors, $TNX presents a critical inflection point on a multi-decade basis. Going back to 1981, the steady downward sloping trendline has presented resistance over and over again. From...

READ MORE

MEMBERS ONLY

Keep Eyes on Momentum in the Small-Cap Index and the Biotech Space

On Wednesday, the Russell 2000 (IWM) made a divergence in price and our momentum indicator Real Motion (RM). In the above chart, we can see that, while the price has broken underneath the 50-day moving average (blue line), it has yet to break the 50-day moving average in Real Motion...

READ MORE

MEMBERS ONLY

Flight Path: Risk-On in a Rising Rate Environment?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

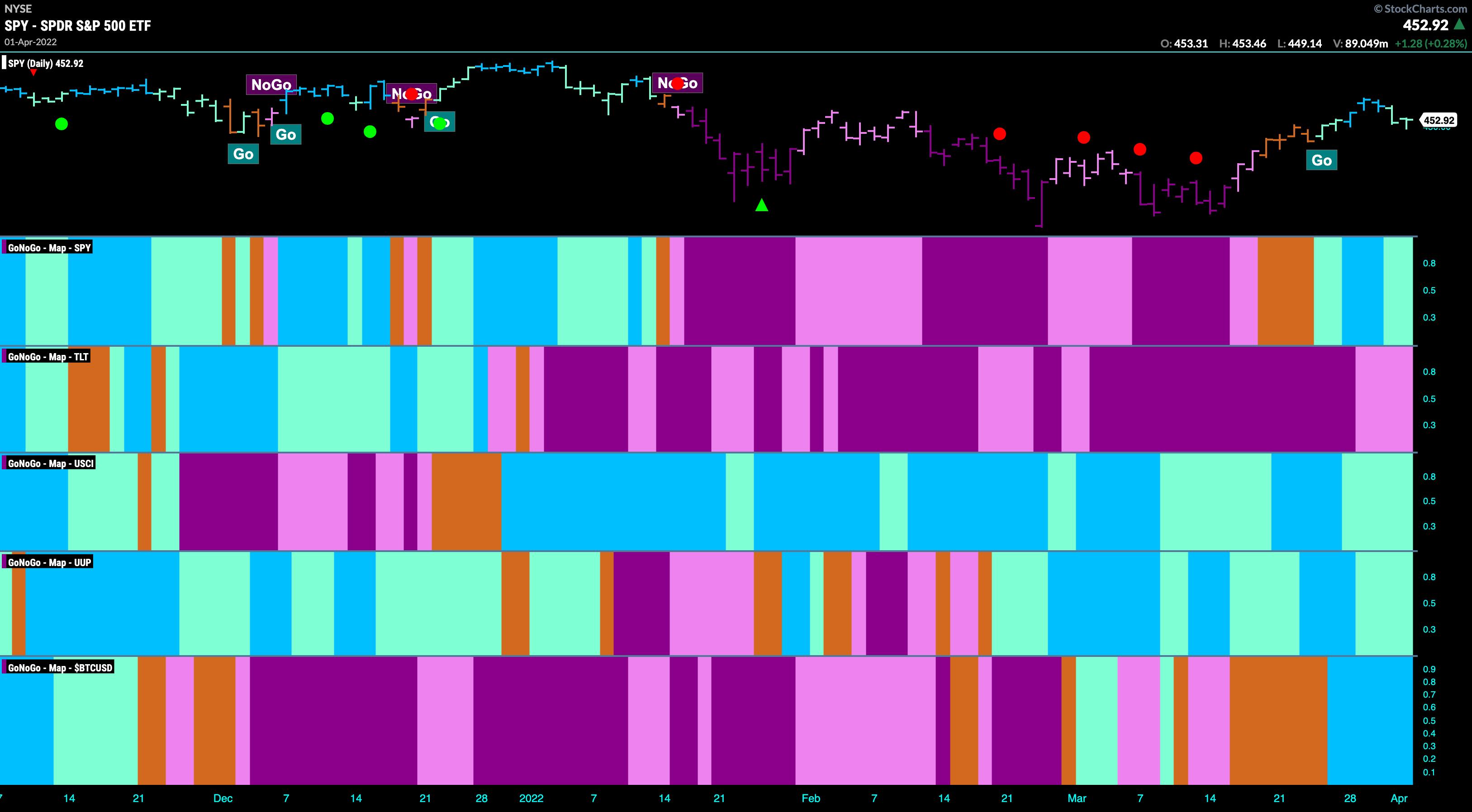

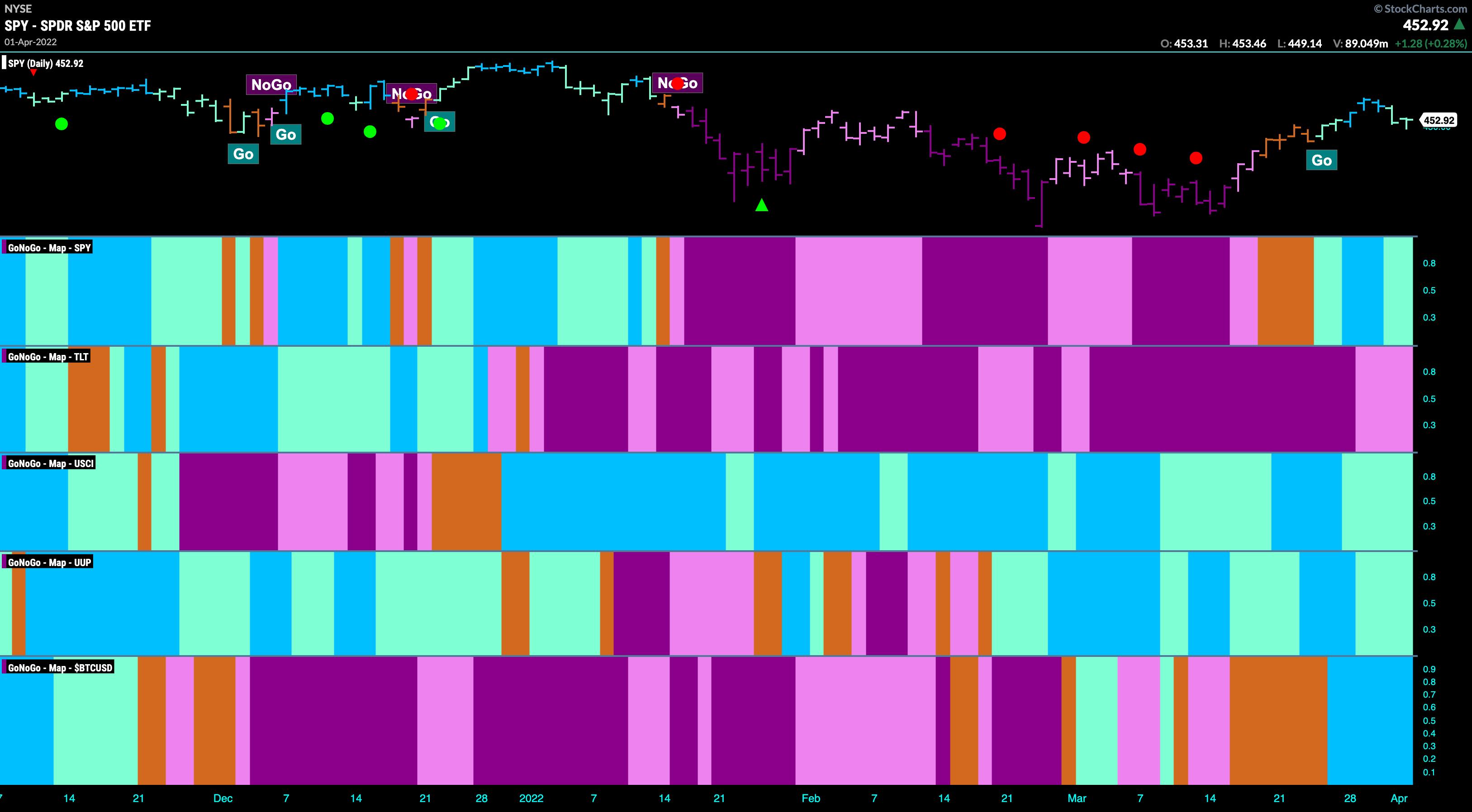

Good morning and welcome to this week's Flight Path. For this week, let's take a look at the below GoNoGo Asset Map. The top panel shows that the trend in U.S. equities continues in its new "Go" trend, albeit weakening to end the...

READ MORE

MEMBERS ONLY

Sector Spotlight: A Killer Combination - Strong Utes and Weak Bonds

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, for this first Tuesday in April, I present the monthly charts for asset classes and sectors to the forefront again. After a review of last week's rotations, I bring up the monthly charts for the most important asset...

READ MORE

MEMBERS ONLY

A Pretty Clear Message From The Dow Theory

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Sometimes less is more. When things are messy and there are a lot of things that are moving markets I usually like to take a step back and look at some of the very basic stuff to get rid of all the noise and clutter.

On this occasion, I thought...

READ MORE

MEMBERS ONLY

DP TV: Bullish Short-Term Bias for SPY

by Erin Swenlin,

Vice President, DecisionPoint.com

On this episode of DecisionPoint, Erin flies solo and spends a little more time going over the indicators. She explains what they measure and why it is important for them to be in line. She spends the most time looking at the "bias assessment" chart and explains why...

READ MORE

MEMBERS ONLY

Regional Banking (KRE) Holds onto Support and Momentum

Last Friday, the Regional Banking Sector ETF (KRE) closed underneath its 200-day moving average. This can be seen in the above chart, with the green line showing the 200-DMA.

However, while this was a key area to hold, KRE has now dipped into a support area illustrated by the black...

READ MORE

MEMBERS ONLY

Watch this Market for a Huge Potential Upside Breakout

by Martin Pring,

President, Pring Research

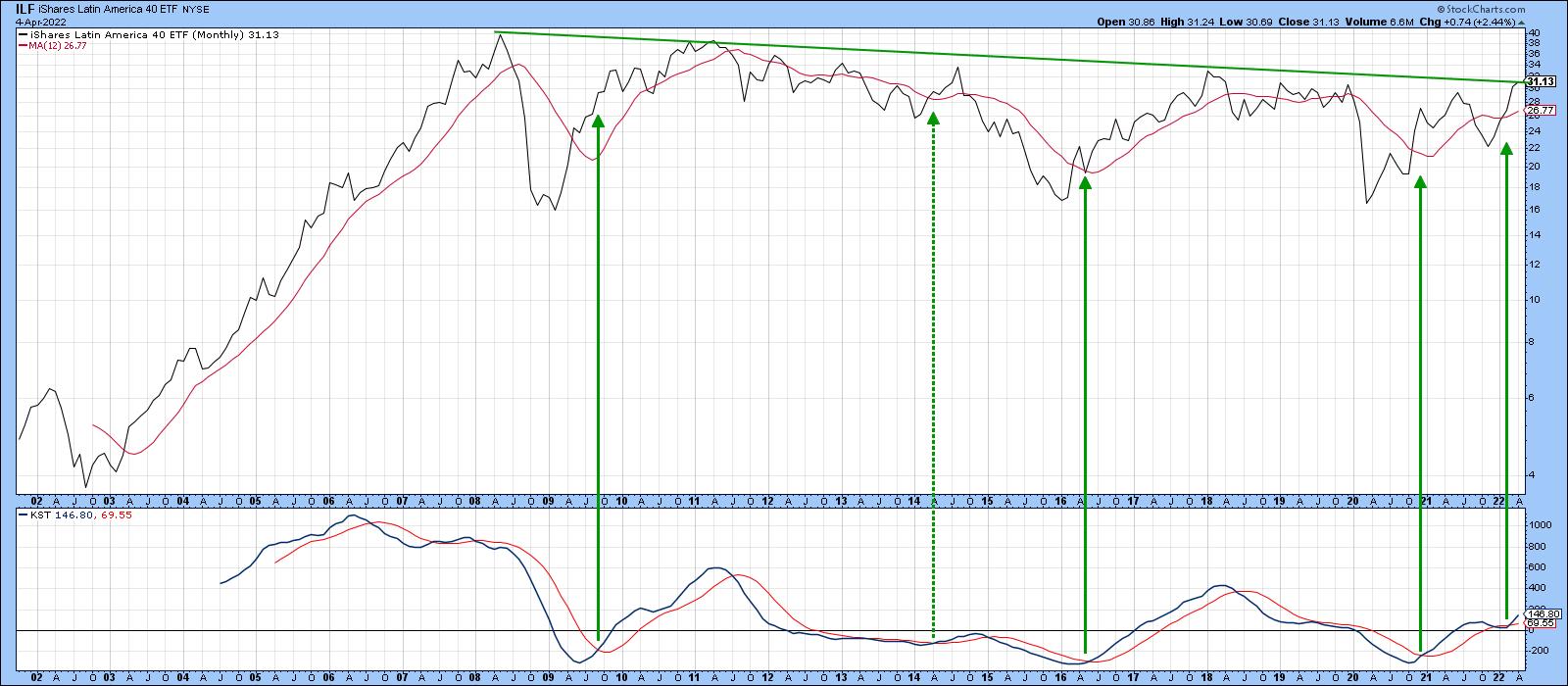

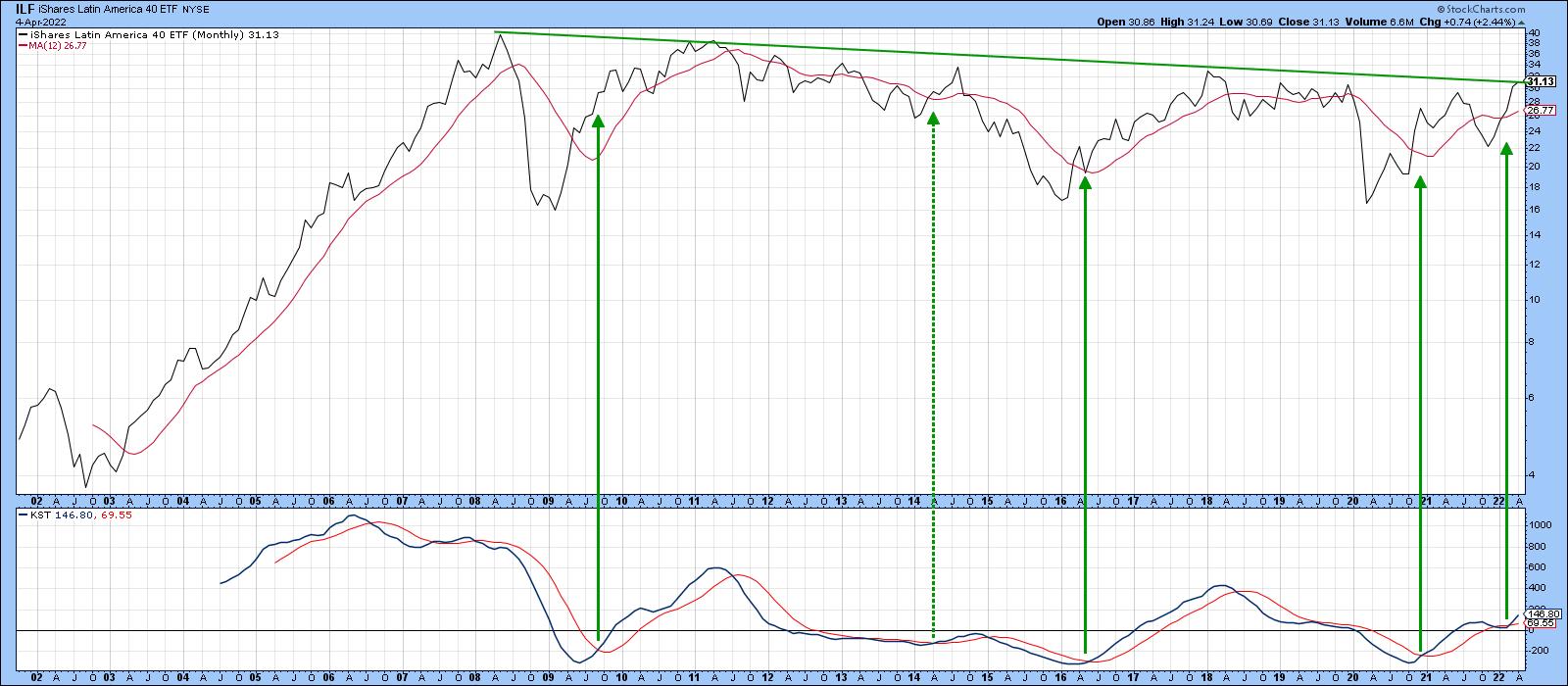

At the turn of the century, this ETF achieved a ten-timer, rallying from $4 in 2002 to $40 in 2008. It's been consolidating for the last 12 years and looks set to embark on a move to new all-time highs. It's not a tech stock, nor...

READ MORE

MEMBERS ONLY

Smile and Say "SQUEEEEEZE"!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Perhaps the most exciting part of any trader's journey is catching that runaway short squeeze. Many traders have only dreamt it, while others have lived it. GameStop Corp (GME) is the most recognizable short squeeze stock of this generation as it soared from 20 on January 13, 2021...

READ MORE

MEMBERS ONLY

Wyckoff Principles within Principles

by Bruce Fraser,

Industry-leading "Wyckoffian"

Trouble for the S&P 500 Index became apparent last September when an outsized decline arrived. Downward volatility with volume expansion (presence of Supply) characterized the decline into October, touching the demand trendline. Bulls were relieved by the near vertical rise into November which included a new high in...

READ MORE

MEMBERS ONLY

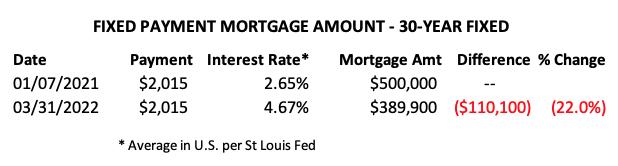

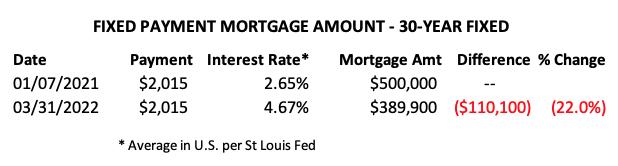

Revisiting the Vertical Rise in Mortgage Rates

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

The following is an excerpt from this week's subscriber-only DecisionPoint ALERT Weekly Wrap.

We have been commenting on mortgage rates for several months, and this week we finally saw a report on Fox Business that reported on the problem of rising mortgage rates. Also, for a couple of...

READ MORE

MEMBERS ONLY

A Winning Strategy During Earnings Season

by John Hopkins,

President and Co-founder, EarningsBeats.com

In this extremely volatile market, it pays to develop a trading strategy that can work in any market environment. And with Q1 Earnings getting ready to heat up in just a week or two, this, in turn, should provide traders with a ton of opportunities to make money through focusing...

READ MORE

MEMBERS ONLY

Capitalizing on Strength in a Flat Market

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares areas of the market that are experiencing relative strength and reveals ways to take advantage. She also reviews weaker areas that could trade lower as the yield curve inverts.

This video was originally recorded on April 1,...

READ MORE

MEMBERS ONLY

If the Market Holds, Watch Bitcoin and the Biotech Space

The past week was a chop fest in the major indices, with large intraday price swings. While the 3 major indices closed roughly flat on Friday, the Russell 2000 (IWM) made a late-day turnaround, ending up over 0.8% on the day. Although IWM closed under its pivotal $209 level,...

READ MORE

MEMBERS ONLY

Wild Swings and a Classic Setup for Palladium

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Volatility is through the roof for many commodities and commodity-related ETFs, but this does not mean we have to abandon technical analysis and classic setups. High volatility does, however, imply higher risk and we probably need to give setups a little more wiggle room.

The Palladium ETF (PALL) surged over...

READ MORE

MEMBERS ONLY

Where is the Strength?

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG discusses where he is seeing strength in the market. Specifically, he takes a deep dive into commodities, including GLD, USO, and UNG.

This video was originally broadcast on April 1, 2022. Click this link to watch on YouTube. You...

READ MORE

MEMBERS ONLY

GNG TV: Growth Equities - Return or Revert?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

On this week's edition of the GoNoGo Charts show, Alex and Tyler take a look at the cross-asset GoNoGo Heat Map® for a sense of overall bullish and bearish trends this week. The top panel shows that U.S. equities reversed the trend last week into "Go&...

READ MORE

MEMBERS ONLY

How to Find Entry Setups Using MACD & ADX

by Joe Rabil,

President, Rabil Stock Research

In this week's edition of Stock Talk with Joe Rabil, Joe shows the different entry setups that can be found using multiple time frames. MACD and ADX can help with both isolating the best opportunities and dramatically improving your timing. Joe discusses the 1-2-3 change in trend which...

READ MORE

MEMBERS ONLY

DEFENSIVE SECTORS LEAD THIS WEEK -- FLATTER YIELD CURVE MAY BE HURTING BANKS -- YIELD CURVE NEARS INVERSION

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS HAVE WORST QUARTER IN TWO YEARS...The month of March has seen a rebound in stocks. Even with that rebound, however, the first quarter of this year has been the weakest in two years. Which raises the bigger question of whether or not the recent rebound is the start...

READ MORE

MEMBERS ONLY

Utilities vs. Technology - Which Sector Wins?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In a fantastic sign of the times, I find myself writing an article with a legitimate discussion as to which of these two sectors has a more attractive technical setup - Utilities or Technology.

For younger investors, the idea that anything other than Technology would be leading the market is...

READ MORE

MEMBERS ONLY

Picking the Best Opening Gap Reversals

by Dave Landry,

Founder, Sentive Trading, LLC

On this week's edition of Trading Simplified, Dave discusses profit centers and how to trade Opening Gap Reversals (OGRes). He also talks Mystery Charts and shows more of his methodology in action. He continues with a follow-up on his prior show about cryptos rising from the dead, and...

READ MORE

MEMBERS ONLY

Has the Small-Cap Index (IWM) Tricked Us?

Recently, we talked about the volatility fund standing its ground in price. While the market has been trending higher, the short-term volatility fund S&P 500 VIX (VXX) was able to stay mostly over its 200-day moving average near 24. Then, on Tuesday, many commodities rallied into the close....

READ MORE

MEMBERS ONLY

Sector Spotlight: Bonds Remain a Threat

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, after having missed last week's show, I catch up with a discussion on rotations for asset classes and sectors, in particular pointing out the rapidly-rising interest rates and their potential impact on stocks. The near-term rotations are in...

READ MORE

MEMBERS ONLY

Commodities Make a Quick Turnaround!

On Tuesday, many commodity ETFs gapped lower while the major indices gapped up. Additionally, the Russell 2000 (IWM) finally cleared its pivotal price level at $209. However, while the indices made a nice close on the day, ETFs such as Oil (USO), Agricultural Fund (DBA), and Silver (SLV) regained a...

READ MORE

MEMBERS ONLY

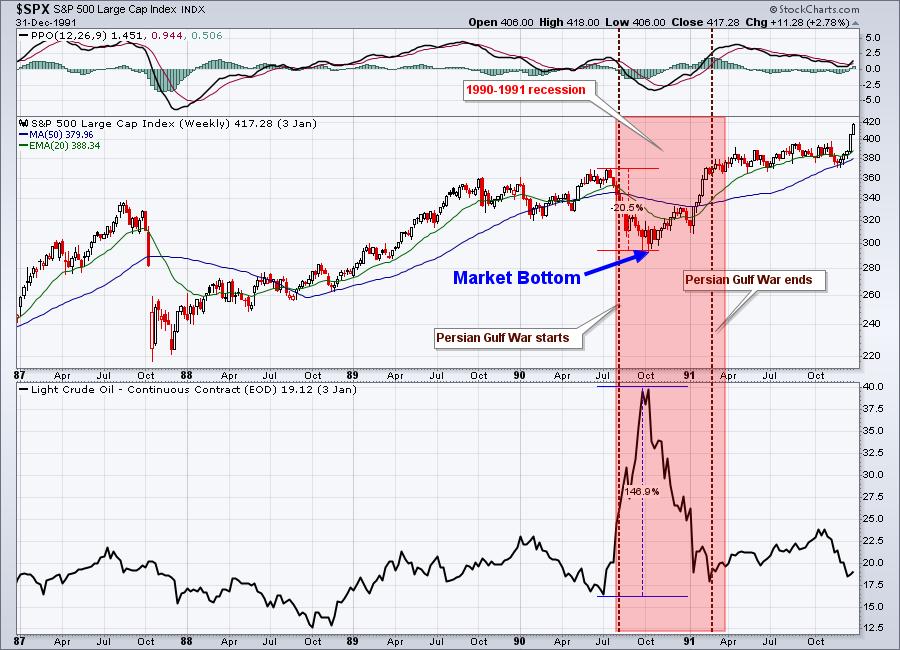

The Fed Raises Rates; What If it's Already Priced into the Market?

by Martin Pring,

President, Pring Research

Markets discount the future, so if the Fed tells the market it's going to raise rates, it goes ahead and raises them anyway. Why wait on the railroad tracks when you know a train is coming? Ironically, the widely-telegraphed rate rise has arrived at a time when bond...

READ MORE

MEMBERS ONLY

S&P 500 (SPY) Leads a Mixed Market Higher

The S&P 500 (SPY) and the Nasdaq 100 (QQQ) continue to trek upwards, along with the Dow Jones (DIA). While the DIA and QQQ still need to clear their 200-DMA, the 4th major index is flashing a warning sign.

When watching the major index, it is always important...

READ MORE

MEMBERS ONLY

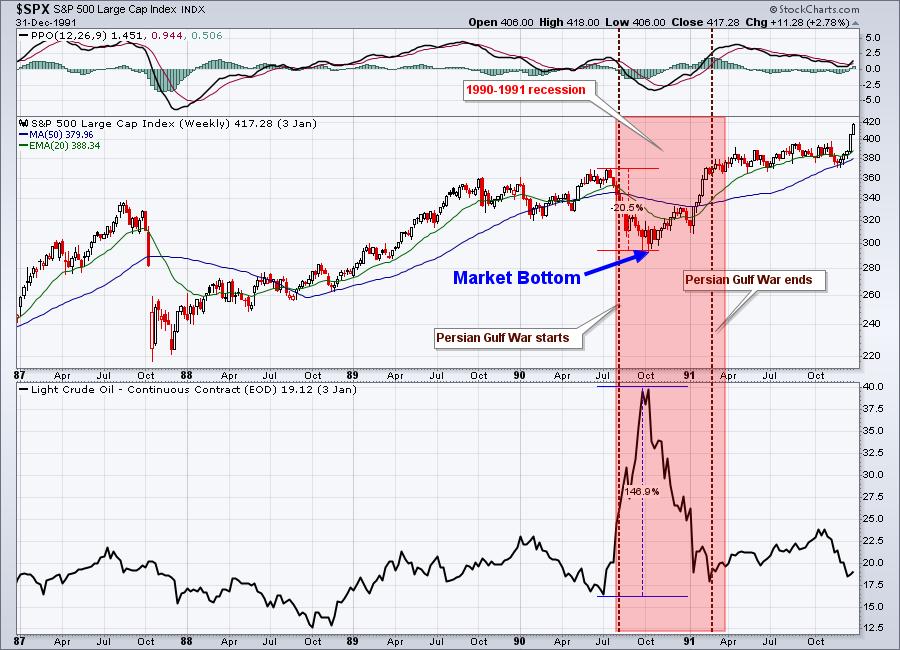

Do Not Make This Critical Mistake - Nearly Everyone Does

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The stock market never works the way we think it should. When the news stories are bleak, we tend to think the stock market must react negatively. But that's not the way things work. Most times, the stock market bottoms LONG BEFORE we see any positive developments in...

READ MORE

MEMBERS ONLY

Trading Themes to Watch Going Forward

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Several trading themes emerged over the past month and these themes could have legs. Russia invaded Ukraine a month ago and the broader market is significantly higher since the invasion. The Russell 2000 ETF is up 6.81%, the S&P 500 SPDR is 7.29% higher and the...

READ MORE

MEMBERS ONLY

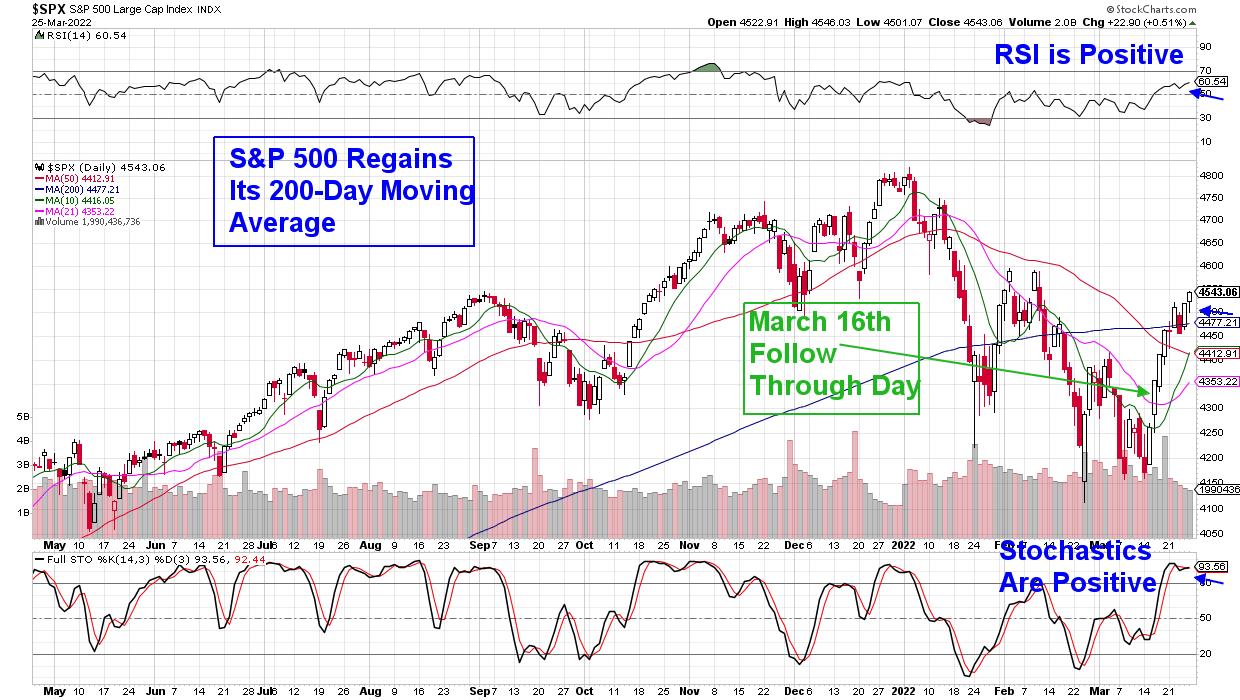

S&P 500 CLEARS ITS 200-DAY MOVING AVERAGE -- COMMODITY STOCKS CONTINUE TO LEAD -- UTILITIES HIT A NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS ADVANCE FOR A SECOND WEEK...Major U.S. stock indexes gained ground for the second week in a row building the case for a short-term bottom having been formed. And one of them has cleared an important resistance line. Chart 1 shows the S&P 500 moving back...

READ MORE

MEMBERS ONLY

Friday Trade Setup: NIFTY Continues to Hang in Balance; Sustainable Upside Moves Unlikely So Long as Index is Below This Point

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, it was mentioned that it was just the short covering that had fueled the rally over the past two weeks. The NIFTY had piled up over 1100 points in the two weeks before this one; there were clear signs of some impending consolidation at that...

READ MORE

MEMBERS ONLY

Base Breakouts & Turnarounds

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews where the strength in the markets is and ways that you can capitalize on it. She also shares stocks and ETFs that are breaking out of bases, as well as turnarounds that are taking place.

This video...

READ MORE

MEMBERS ONLY

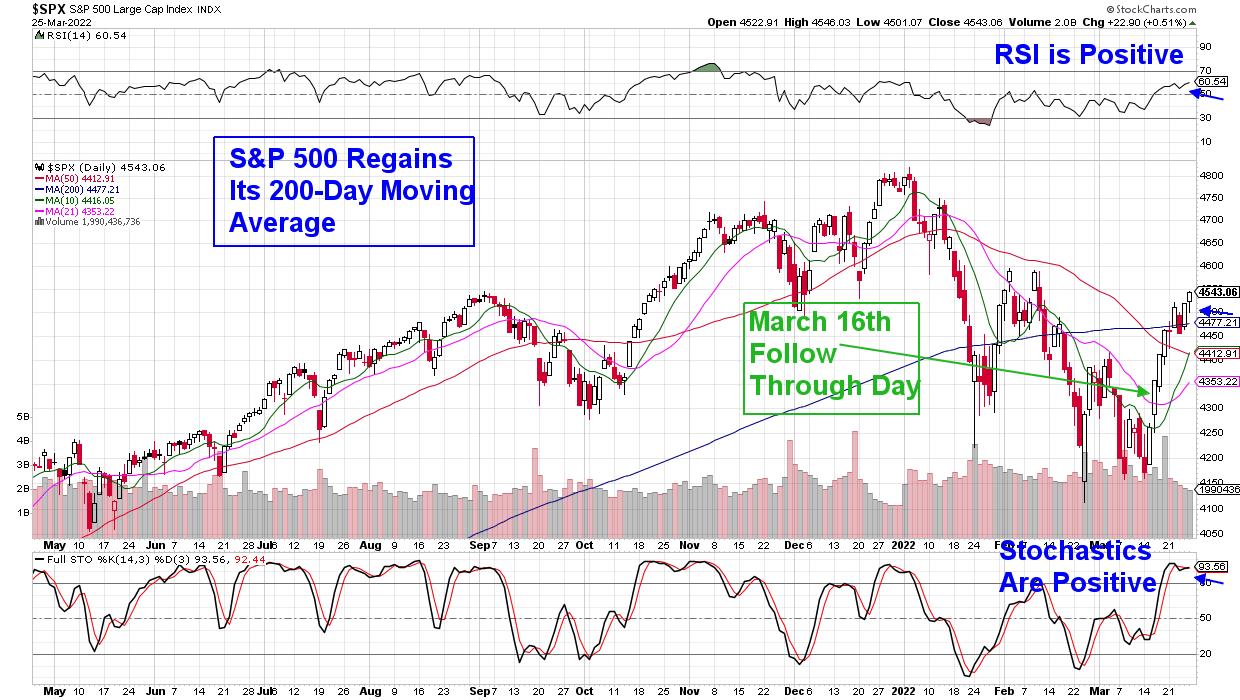

The Markets Have Bottomed - Here's Where You Need to be Investing

by Mary Ellen McGonagle,

President, MEM Investment Research

Over the past 2 weeks, the S&P 500 has managed to reverse a good part of this year's losses with a rally that's put the markets back into an uptrend that began on March 16th. Subscribers to my MEM Edge Report were immediately alerted...

READ MORE

MEMBERS ONLY

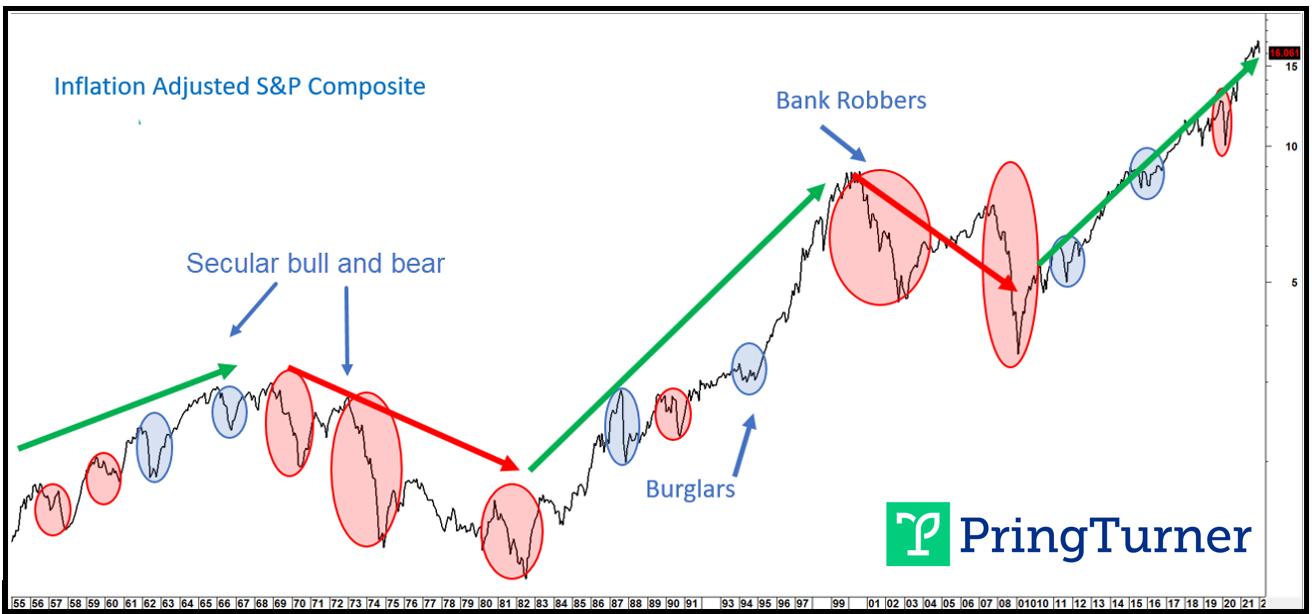

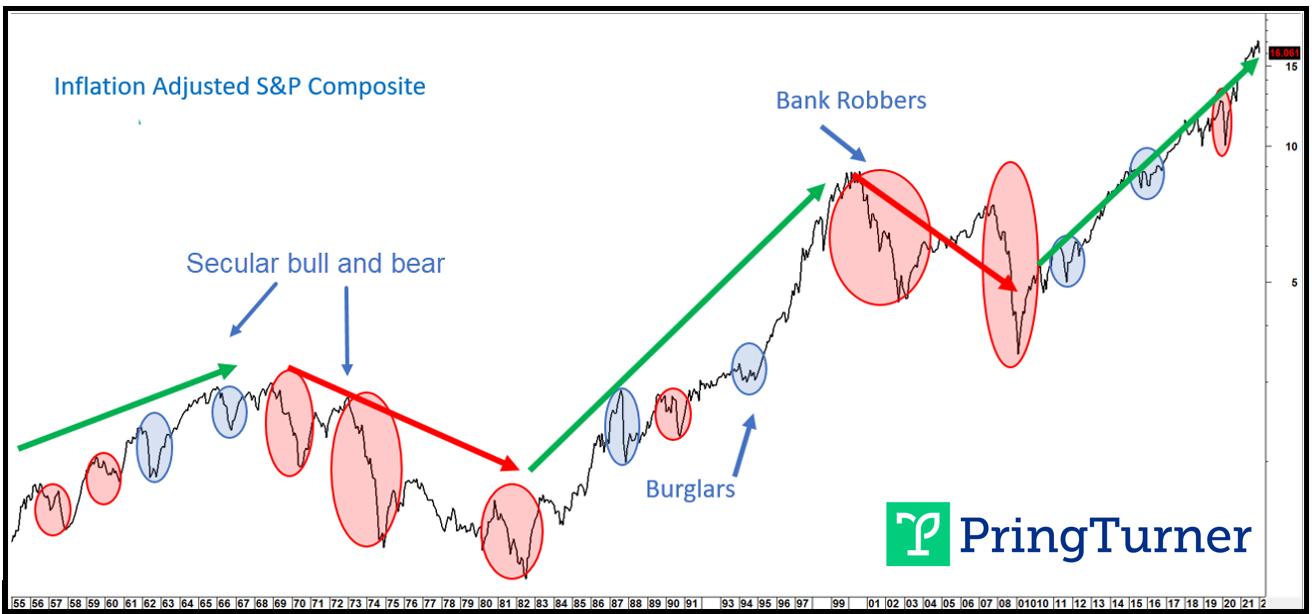

Burglar or Bank Robber? Time to Watch Your Wallet and Stock Portfolio!

by Martin Pring,

President, Pring Research

In October 2021, we made the case for a new secular commodity bull marketand concluded that this environment would likely spill back into the economy and stock market. That process is already underway, as the NASDAQ Composite was recently down 20% from its high, compared to a drop of 12%...

READ MORE

MEMBERS ONLY

The Renewed Rise of Bitcoin

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In hosting The Final Bar on StockCharts TV, I get the opportunity to ask successful traders and market practitioners which charts are top of mind in their process at any given time.I've found this to be a fantastic way to track market sentiment from some of the...

READ MORE

MEMBERS ONLY

A New Round of Crypto Strength Seems to be Around the Corner!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The interest in Bitcoin or, more generally, cryptocurrencies comes and goes, and the moves are highly volatile from time to time. Nevertheless, this investment space is becoming more and more mainstream and, no matter what your personal opinion is, it is more and more a force to be reckoned with....

READ MORE