MEMBERS ONLY

Market Wavers while Food Commodities Shine

Strength picks up in Food commodities as securities struggle amid final stimulus negotiations.

It is now in the Senate's hands to pass or decline the $2000 dollar stimulus checks; a large amount compared to the original $600 proposed in the bill. This looks to be the final hold-up...

READ MORE

MEMBERS ONLY

RUSSELL 2000 GIVES SHORT-TERM WARNING -- RSI WEAKENS -- MACD LINES TURN NEGATIVE

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 ISHARES WEAKEN...Stocks are having trouble holding onto today's intra-day records. Small caps in particular are showing some new signs of weakness. The daily bars in Chart 1 show the Russell 2000 iShares (IWM) trading lower for the third day in a row. Of more concern...

READ MORE

MEMBERS ONLY

Sector Spotlight: Using RRG Top-Down

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I work my way down the investment pyramid and show how I use RRG as a tool to get from Asset Allocation all the way down to individual stocks to build a portfolio. You should be able to pick and...

READ MORE

MEMBERS ONLY

Is Amazon Finally Ready To Launch PLUS My Favorite Stock For 2021

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Consolidation requires patience and anyone that's owned AMZN during the 4th quarter knows what I'm talking about. Since September 30th, the S&P 500 has gained more than 10%, while AMZN has flat-lined. Many will view this relative weakness as a signal to avoid AMZN...

READ MORE

MEMBERS ONLY

When Large-Caps Rally, Do Small-Caps Get Smaller?

With another short trading week, it's best to stay cautious, as price action can get wacky towards the year's end.

Fund managers will rebalance their portfolios by selling losers and replacing them with strong performers to spruce up the look of their portfolio before the fourth-quarter...

READ MORE

MEMBERS ONLY

DP TV: It's All on the Chart!

by Erin Swenlin,

Vice President, DecisionPoint.com

In this special DecisionPoint workshop, Erin discusses what components are needed on your charts to give you the entire picture of a stock, ETF or index. After examining these components, she pulls her default charts up and explains where and how each of these components contribute to tight analysis. Did...

READ MORE

MEMBERS ONLY

Sector Spotlight: How CB3 Uses RRG in Portfolio Management

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I interview Charles Brown of CB3 Financial. Charles is an early adopter and long time user of Relative Rotation Graphs, which he actively promotes and uses in the investment process that he uses to manage his client portfolios.

This video...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Shows First Signs of Broad Consolidation, Even if it Shows Incremental Moves; These Sectors Poised for Strong Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the recent weekly notes, we had mentioned the markets getting overstretched and overextended over the immediate short term. It was a matter of concern, as any form of a consolidation or corrective move stood imminent; the absence of either was making the present uptrend highly risky and unhealthy. On...

READ MORE

MEMBERS ONLY

Stock Uptrend Continues

by John Murphy,

Chief Technical Analyst, StockCharts.com

Tuesday's message used hourly bar charts to show the three major stock indexes holding short-term support levels. Wednesday's daily bars show stocks continuing to stay above their green 20-day moving averages. They're usually the first line of support on market pullbacks. Ten of eleven...

READ MORE

MEMBERS ONLY

Market Bias Not So Bullish Anymore

by Erin Swenlin,

Vice President, DecisionPoint.com

(This is a reprint of the subscriber-only "DecisionPoint Alert" article from 12/22/2020. Merry Christmas & Happy New Year to all from Carl & Erin Swenlin)

One of the ways we measure market bias is by looking at the histograms of the Swenlin Trading Oscillators (STOs) and...

READ MORE

MEMBERS ONLY

This ETF Has Skyrocketed 58% in Just Two Months

by John Hopkins,

President and Co-founder, EarningsBeats.com

A lot of traders opt for individual stocks when looking for outsized gains. But ETFs can produce great gains as well if you are able to identify which ones are poised to rise.

As an example, take a look at the chart below on the Clean Energy ETF, PBW.

As...

READ MORE

MEMBERS ONLY

More Forest and Fewer Trees in 2021

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Way back in early September, a time long long ago, tech-related ETFs were leading the market and recording new highs. The Software ETF (IGV), Cloud Computing ETF (SKYY), Cyber Security ETF (HACK), Internet ETF (FDN) and Semiconductor ETF (SOXX), among others, were up 75 plus percent from late March to...

READ MORE

MEMBERS ONLY

Evaluating 2020: Did My Stock Picks Or My Asset Allocation Skills Generate The Most Profits?

by Gatis Roze,

Author, "Tensile Trading"

I'll be candid with you about my portfolio performance if you'll agree to be candid about yours.

This is the time of year when I subscribe to the routines outlined in Stage 10 of our book, Tensile Trading. The section entitled "Revisit, Retune, Refine"...

READ MORE

MEMBERS ONLY

Have The Banks Created An M2 Monster?

While Brexit settled, stimulus checks in the US were debated and Alibaba got their hand (stock) slapped, a few other events that did not make headlines occurred.

First, corn, soybean and sugar futures all advanced to new multi-month highs.

Secondly, as if without a care in the world, junk bonds...

READ MORE

MEMBERS ONLY

Investors Heed Granny Retail and Granddad Russell 2000

As the media focuses on a worsening situation with a new variant of the virus, Mish's Economic Modern Family shows that not all is doom and gloom.

Grandad Russell 2000 (IWM) is sitting right under all time highs of 197.83. The small cap sector continues to shine...

READ MORE

MEMBERS ONLY

STOCK UPTREND CONTINUES -- FINANCIALS HIT NEW RECOVERY HIGH -- CORPORATE BONDS MOVE UP WITH STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

20-DAY AVERAGES ARE HOLDING... Yesterday's message used hourly bar charts to show the three major stock indexes holding short-term support levels. Today's daily bars show stocks continuing to stay above their green 20-day moving averages. They're usually the first line of support on market...

READ MORE

MEMBERS ONLY

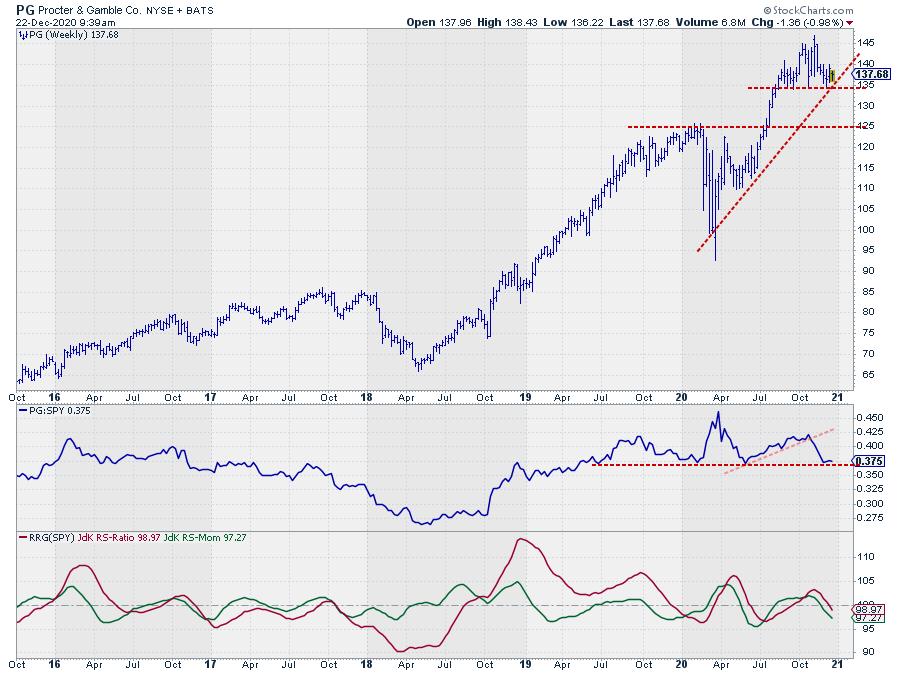

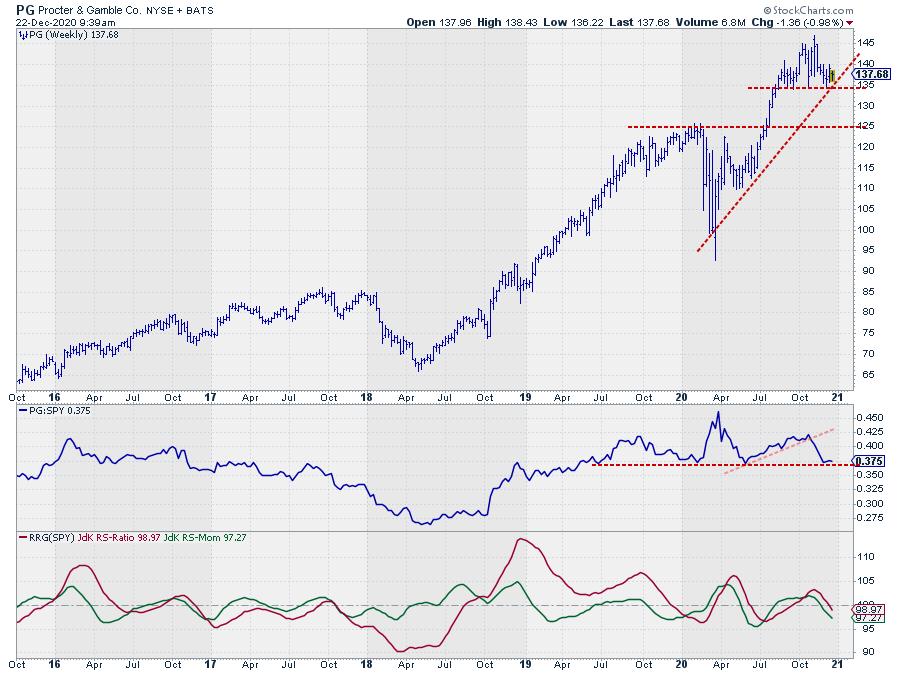

PG is Ready to GO..... !

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Into the lagging quadrant on the RRG and to the short side of the RRG Long/Short baskets.

Before diving into the PG chart, let's go over the current symbols on both lists. At the moment, both the Long and the Short basket have six names in them....

READ MORE

MEMBERS ONLY

Bullish Commodities Run Into Resistance

by Martin Pring,

President, Pring Research

The global business cycle is nothing more than a chronological sequence of economic and financial market turning points. One of these involves a bottoming of commodity prices, as a new bull market gets underway. That reversal occurred several months ago and has recently been confirmed by numerous long-term indicators. That...

READ MORE

MEMBERS ONLY

STOCK INDEXES HOLD SHORT-TERM SUPPORT LEVELS -- THE QQQ IS THE STRONGEST OF THE THREE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES HOLD SHORT-TERM SUPPORT... The Dow and S&P 500 have spend the past the last couple of weeks consolidating within existing uptrends. And they've managed to hold onto their existing uptrends. The hourly bars in Chart 1 show yesterday morning's pullback in the...

READ MORE

MEMBERS ONLY

Danger Zone

by Bruce Fraser,

Industry-leading "Wyckoffian"

In these holiday shortened weeks volatility could be the central story of the stock market indexes. Empty trading desks and light volume make it easier for markets to get pushed around. The emergence of a potential new strain of COVID-19 in England has kicked off this weeks market excitement. The...

READ MORE

MEMBERS ONLY

DP TV: Trading Success Based on Time Horizons

by Erin Swenlin,

Vice President, DecisionPoint.com

Are you a trader or an investor? Do your trade frequently or are you a "buy and hold" investor? In this special DecisionPoint workshop, Erin discusses specifically which charts and indicators to use for the short-term trader, intermediate-term investor and long-term buy-and-hold investor. Can an investment have a...

READ MORE

MEMBERS ONLY

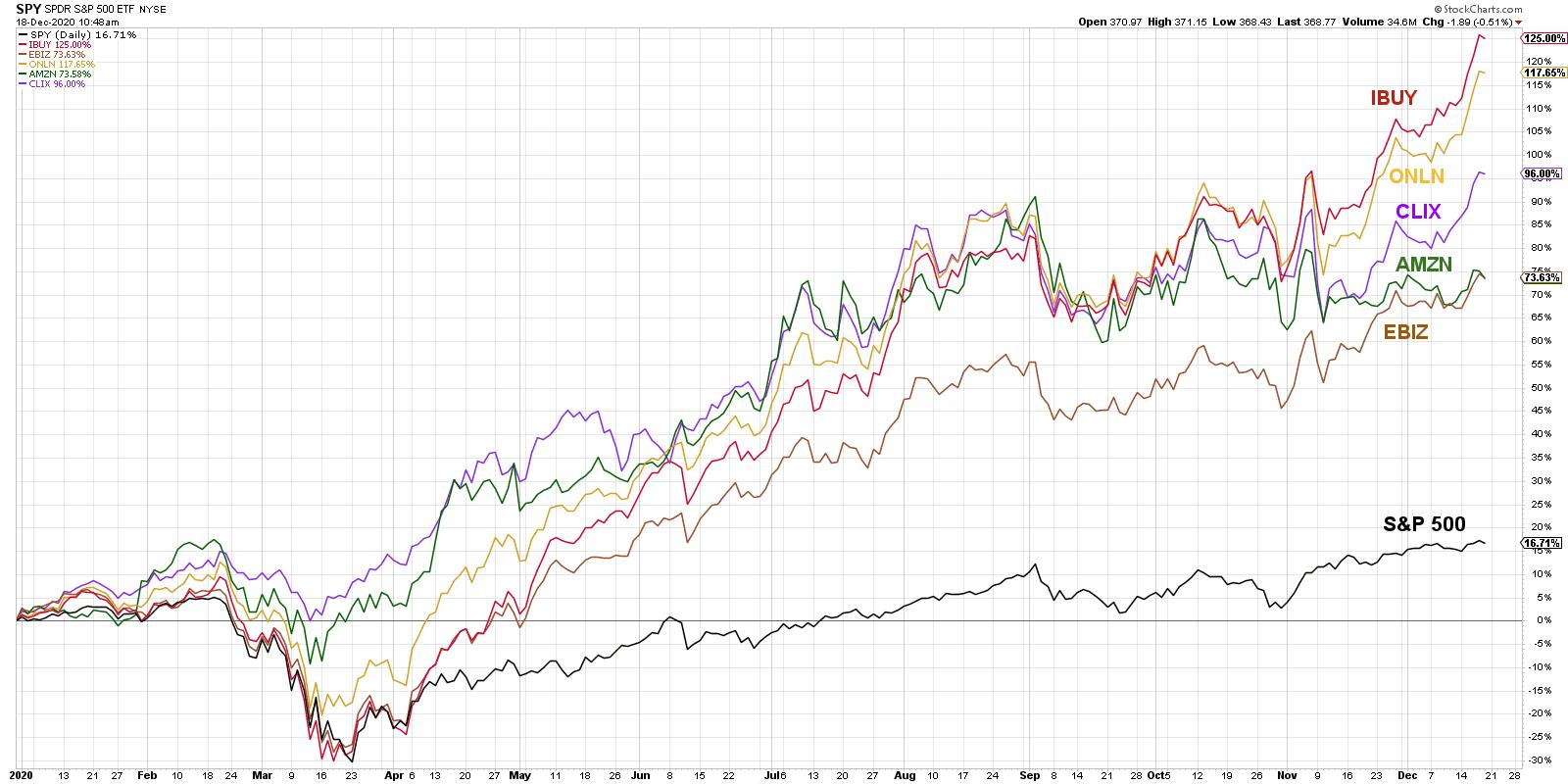

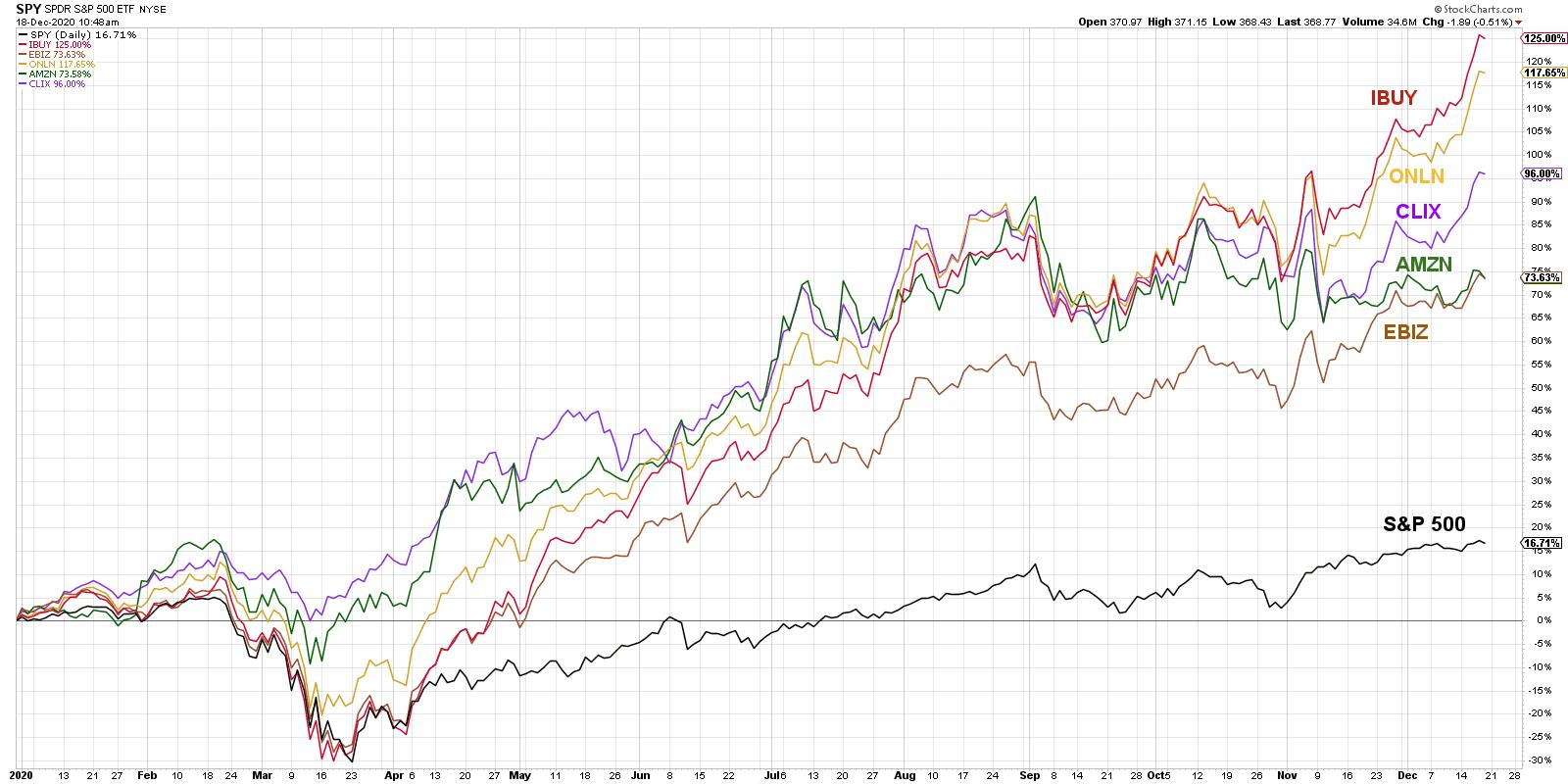

E-Commerce Names Driving Higher Into 2021

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As investors review the performance of stocks in 2020, e-commerce names like AMZN and SHOP exemplify the transition from brick-and-mortar stores to an online shopping experience. In the new year, potential stimulus packages and a rollout of the coronavirus vaccine should allow consumers to go back to old habits of...

READ MORE

MEMBERS ONLY

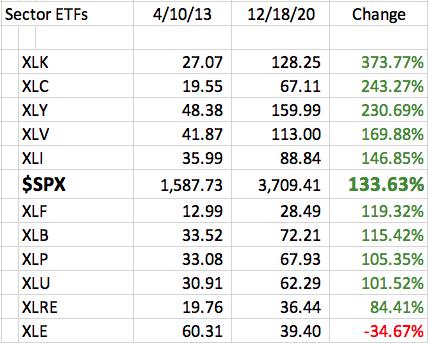

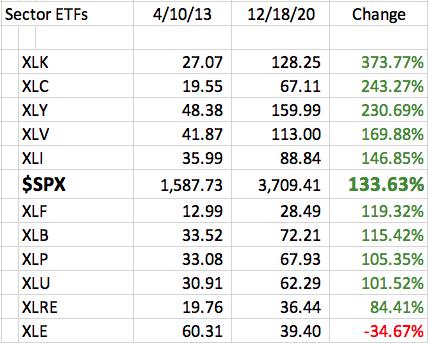

ETF Investors: Make This Your #1 New Years Resolution

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When I speak to anyone about ETFs, the conversation nearly always revolves around performance. I'm not saying that performance isn't important. Ultimately, it's what we all look at. But I'm surprised that many ETF investors have no plan. They hear about this...

READ MORE

MEMBERS ONLY

Is This Stock In For A Major Trend Reversal?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Take Solutions (TAKE.IN)

The study of both Daily and Weekly timeframes presents a few interesting insights.

The patterns appearing on both the timeframes are fractal. The area pattern that appears on the Daily timeframe is also present on the weekly charts. The RSI on the weekly chart has broken...

READ MORE

MEMBERS ONLY

Week Ahead: Markets See Sector Rotation; RRG Chart Tell Us to Focus Here as NIFTY Stays Prone to Consolidation

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past five days, the Indian equities continued with their measured up move and went on to pile up some more incremental gains. After some brief consolidation in the beginning of the week, the NIFTY went on to mark fresh lifetime closing highs each day as the liquidity continued...

READ MORE

MEMBERS ONLY

These Stocks are Poised for Explosive Moves Higher!

by Mary Ellen McGonagle,

President, MEM Investment Research

The broader markets are in an upward trending phase with positive news of a COVID vaccine helping investors to look past a steady uptick in virus cases. To be sure, the markets are forward-looking, and the likely prospect of a partisan split Congress, coupled with steady reports that point to...

READ MORE

MEMBERS ONLY

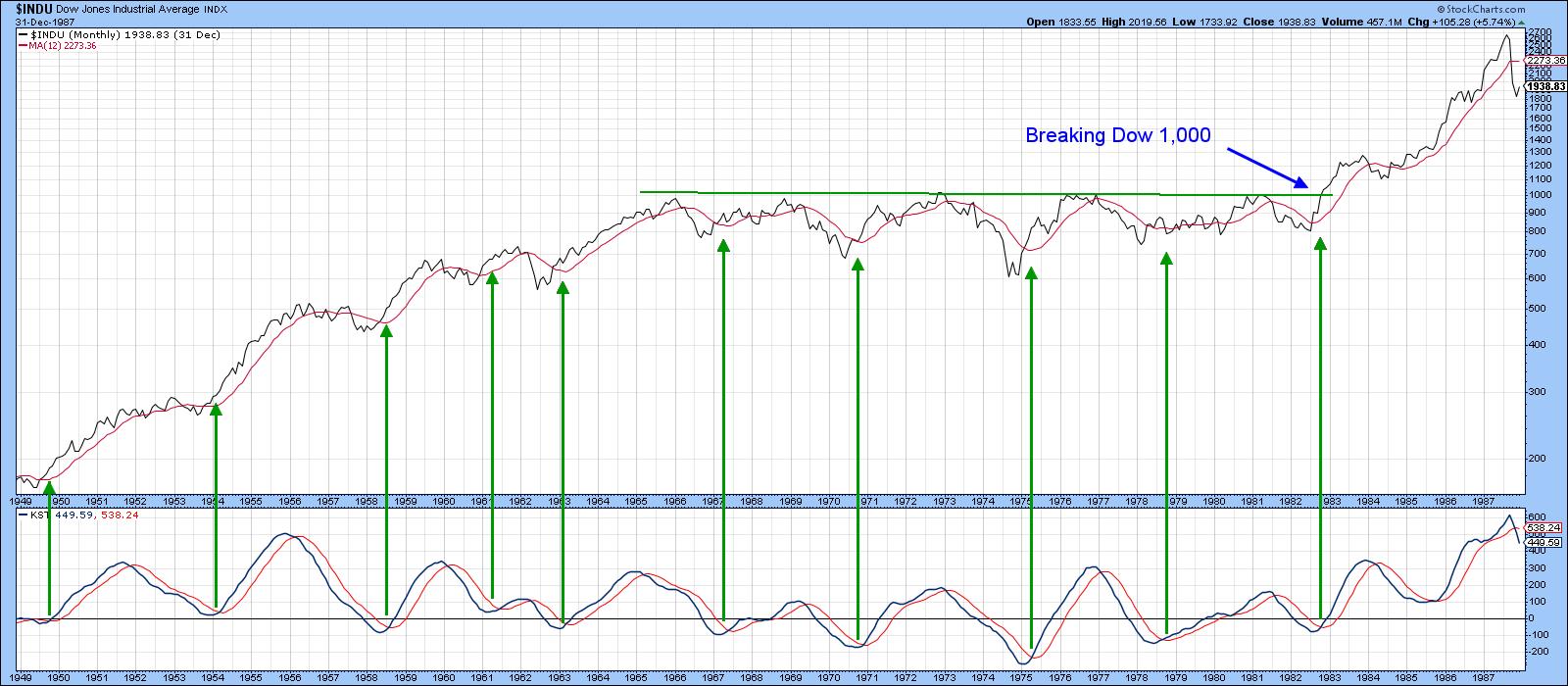

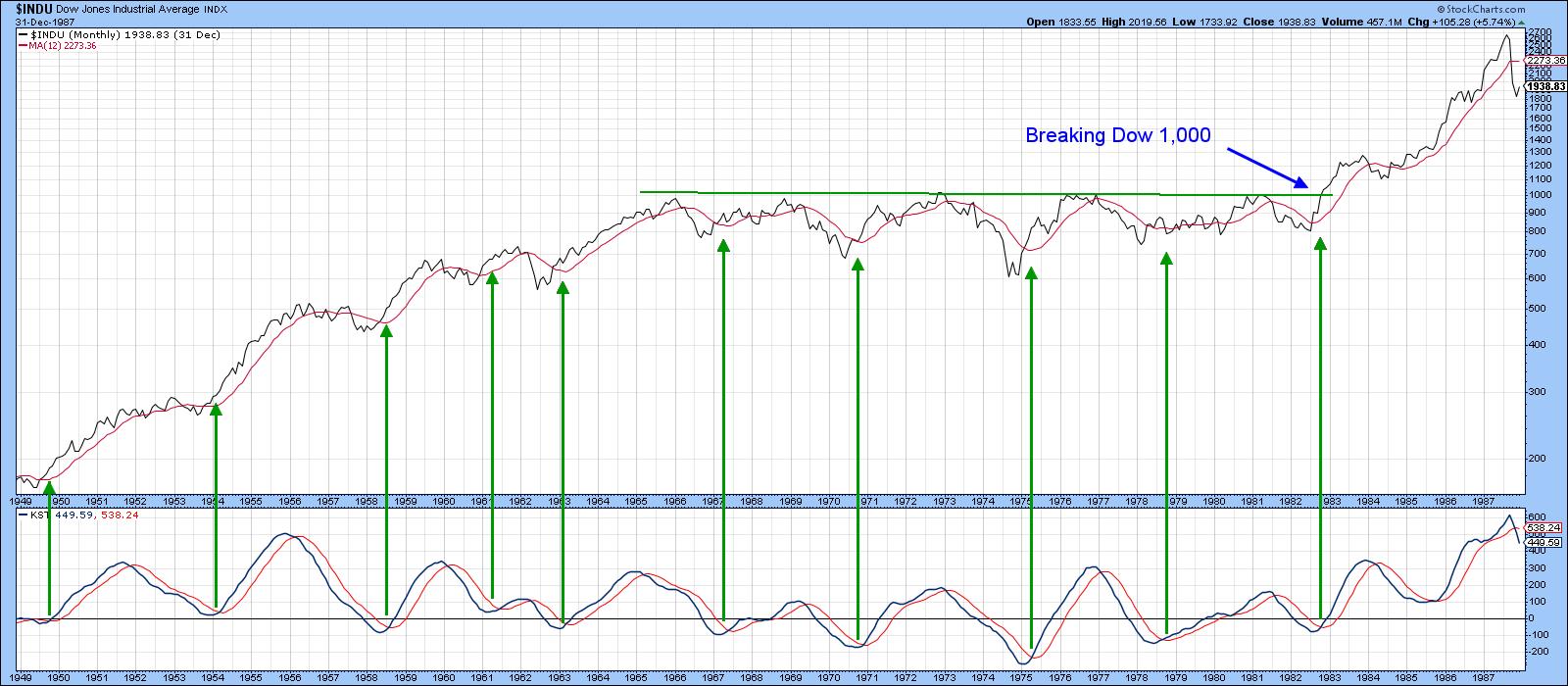

Numerous International Multi-Year Trading Ranges are Reminiscent of the 1982 Dow 1,000 Breakout

by Martin Pring,

President, Pring Research

Years ago, before online charting platforms were widely available, technicians resorted to chartbooks published on a weekly or monthly basis and received days later in the snail mail. Using their long-term perspective helped a lot of us to appreciate that surpassing Dow 1,000 (see Chart 1) was a really...

READ MORE

MEMBERS ONLY

What is Triple Witching Day - and Should You Worry About It?

Friday was triple witching day, meaning that stock options, stock index options and stock futures contracts were all due to expire. This happens four times a year and can lead to increased volume, as money is moved around resulting in sometimes unusual (or spooky) price action.

The S&P...

READ MORE

MEMBERS ONLY

E-Commerce Names Charging Into 2021

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As investors review the performance of stocks in 2020, e-commerce names like AMZN and SHOP exemplify the transition from brick-and-mortar stores to an online shopping experience. In the new year, potential stimulus packages and a rollout of the coronavirus vaccine should allow consumers to go back to old habits of...

READ MORE

MEMBERS ONLY

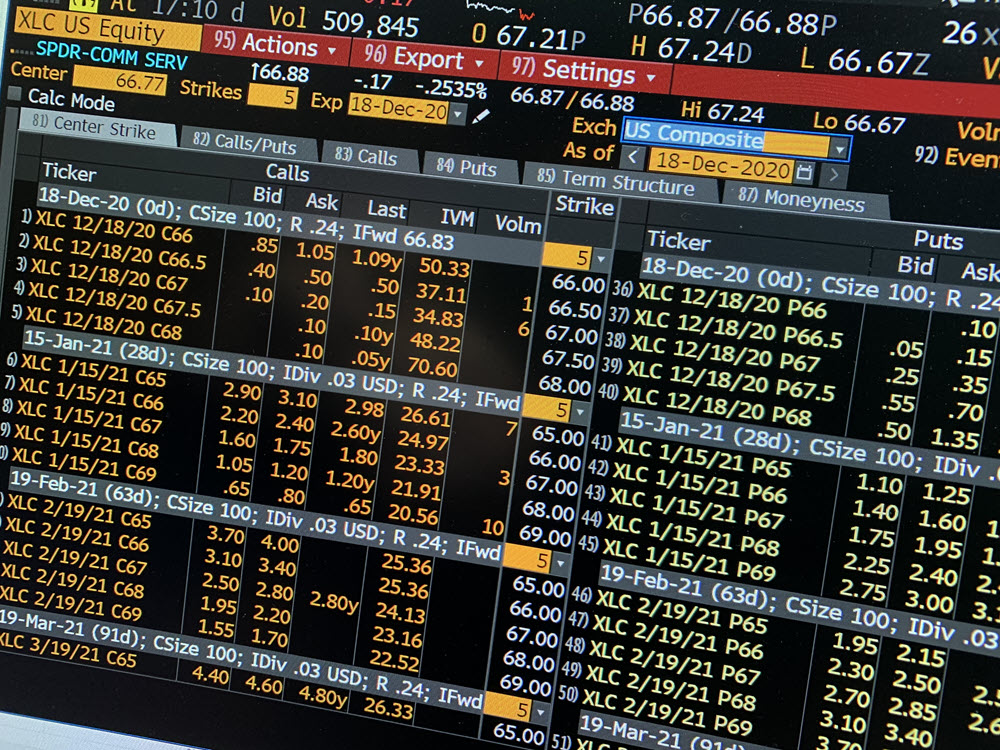

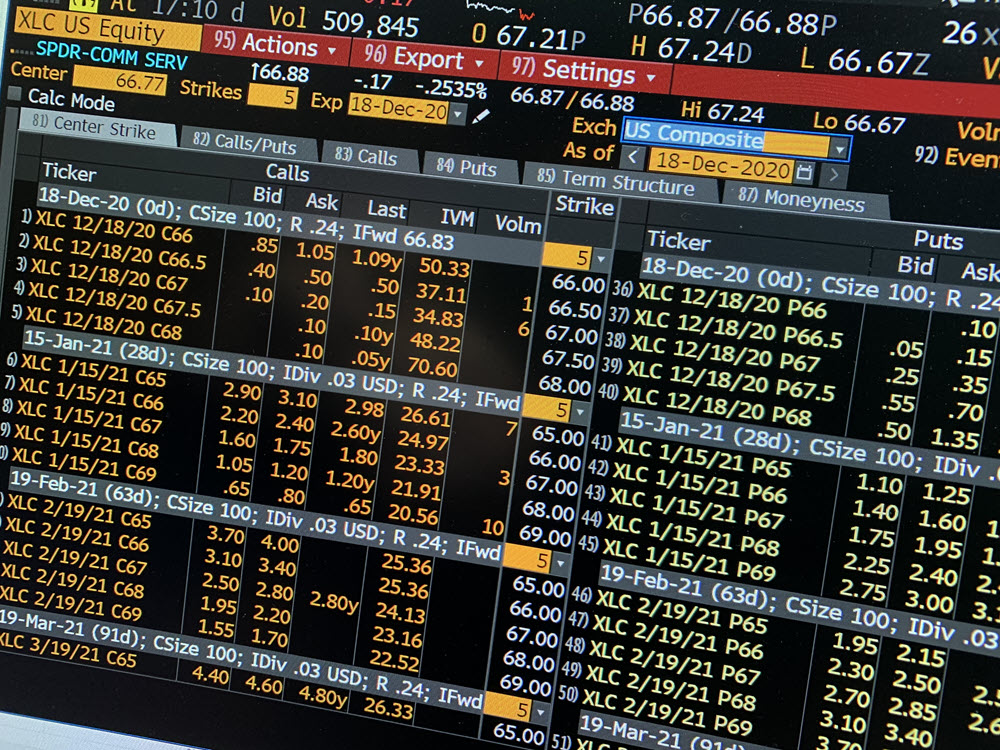

Getting Your Options Right Around Communication Services

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Over the last weeks, the Communication Services sector continued to improve and recently moved back into the leading quadrant after rotating through weakening and, very briefly, through lagging. This rotation, especially the increase in RRG-Velocity (the distances between the week-to-week observations), make XLC an interesting sector to keep your eyes...

READ MORE

MEMBERS ONLY

Best Plays into the New Year and Beyond!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen showcases stocks with very attractive charts and strong growth prospects that are poised to trade higher. She also shares a before-the-open event that's having a positive impact on select names, as well as ways to capitalize...

READ MORE

MEMBERS ONLY

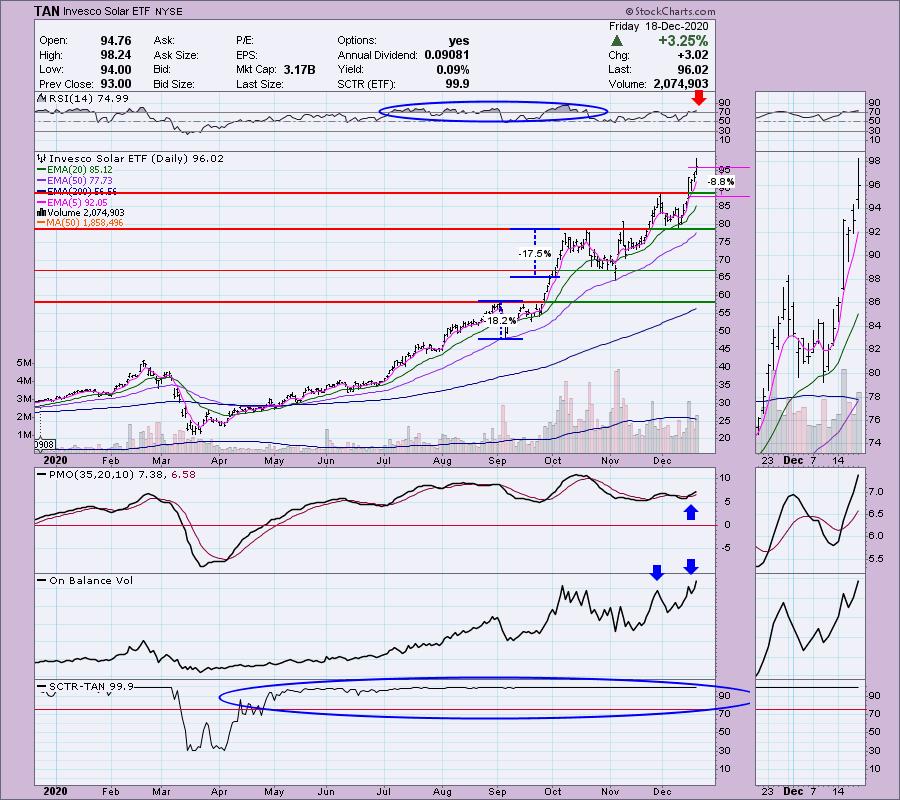

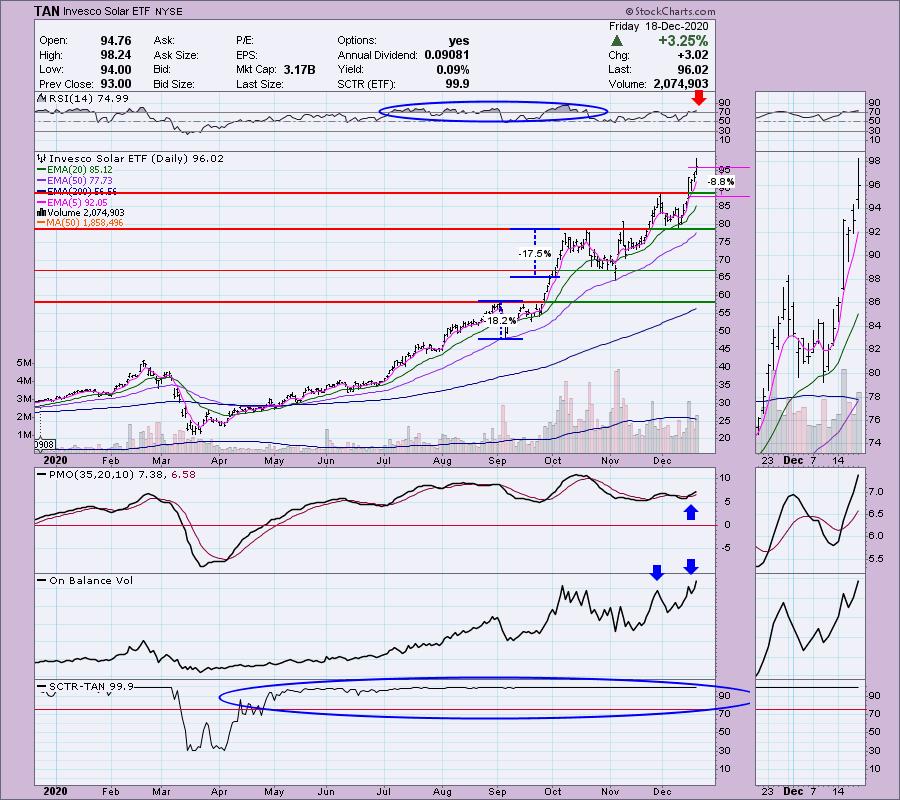

Is Solar Teflon?

by Erin Swenlin,

Vice President, DecisionPoint.com

If you have attended the free DecisionPoint.com Trading Room or you are a DecisionPoint Diamonds Report subscriber, you'll know that I have been very bullish on renewable energy stocks since the beginning of autumn. While they can be very volatile, overall they are an industry group that...

READ MORE

MEMBERS ONLY

Here's Why I'd Be Buying an Overbought Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Since the March lows, the NASDAQ has seen its RSI approach or pierce the overbought 70 level on 11 different occasions. The only meaningful correction that's taken place on any of those 11 occurrences, though, has been the September selling. Historically, September is a poor month, so we...

READ MORE

MEMBERS ONLY

We Have a New Software Leader and It's Exploding!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We combine fundamentals and technicals at EarningsBeats.com to deliver market-beating returns. While past results can never guarantee future results, our strategy has a documented record of crushing the S&P 500, not just beating it. Our approach is undeniably simple: find companies that are (1) underpromising and overdelivering,...

READ MORE

MEMBERS ONLY

U.S. Stocks Just Received Yet Another Bullish Signal

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I love to see a leading industry group go through a lengthy consolidation period on both an absolute and relative basis....and then break out. There haven't been too many groups that have consistently performed better than software ($DJUSSW) over the past several years. Here's a...

READ MORE

MEMBERS ONLY

Chartwise Women: Most Likely to Succeed in 2021

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of Chartwise Women, Erin and Mary Ellen finish out 2020 by revealing which indexes, sectors, stocks and ETFs they believe are "most likely to succeed" in 2021. Don't miss their analysis of the technology sector stocks, consumer discretionary, semiconductors, solar...

READ MORE

MEMBERS ONLY

GOLD ETF MOVES FURTHER ABOVE 200-DAY AVERAGE -- SILVER ETF HITS THREE-MONTH HIGH -- DEFINITION OF SANTA CLAUS RALLY

by John Murphy,

Chief Technical Analyst, StockCharts.com

PRECIOUS METALS ADVANCE... My message from December 8 wrote about gold trying to find support near its 200-day moving average. It also showed silver trying to stabilize as well. Both precious metals are having a strong day and moving above some short-term resistance levels. Chart 1 shows the Gold Shares...

READ MORE

MEMBERS ONLY

It's All About Da Base......

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With Bitcoin up around 10% and breaking beyond $20k, there can only be one chart today that should not be ignored.

BTC moved back to the forefront of financial markets and press recently. Dave Keller recently wrote about it and sent out this tweet (to the right) today. And I...

READ MORE

MEMBERS ONLY

When NASDAQ Leads, Bulls Worry

The FOMC reportcame out today, keeping rates unchanged as the Fed continues to buy into bonds, thus supporting the market going forward.

Both the S&P 500 (SPY) and the Nasdaq 100 (QQQ) closed green on the day, with the QQQs breaking new all time highs from their recent...

READ MORE

MEMBERS ONLY

How to Find and Trade Hot IPOs

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave discusses some of his favorite patterns for IPOs. He then delves into how you can use the tools available on StockCharts.com as a key resource for identifying and seizing on IPOs while they're hot!

This video was originally broadcast on...

READ MORE