MEMBERS ONLY

The Market Can Remain Irrational Longer Than You Can Remain Solvent

In the past month, we have written about the Russell 2000 (IWM) Index leading the market higher. Recently, IWM's stellar performance has revealed it as the new superhero of Mish's Economic Modern Family. Today was no exception, as Grandad IWM was able to make all-time highs,...

READ MORE

MEMBERS ONLY

Numerous International Multi-Year Trading Ranges are Reminiscent of the 1982 Dow 1,000 Breakout

by Martin Pring,

President, Pring Research

Years ago, before online charting platforms were widely available, technicians resorted to chartbooks published on a weekly or monthly basis and received days later in the snail mail. Using their long-term perspective helped a lot of us to appreciate that surpassing Dow 1,000 (see Chart 1) was a really...

READ MORE

MEMBERS ONLY

20-DAY MOVING AVERAGES ARE HOLDING FOR MAJOR STOCK INDEXES -- TECHNOLOGY SPDR NEARS TEST OF OLD HIGH -- APPLE HAS A BREAKOUT DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES MAINTAIN UPTREND... Stocks experienced some minor profit-taking over the last week but have maintained their uptrends. All three of the major stock indexes have found support along their 20-day moving averages. Chart 1 shows the Dow Industrials bouncing off their green 20-day line. Charts 2 and 3 show...

READ MORE

MEMBERS ONLY

Sector Spotlight: Performance and Trends in Performance

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I review last week's rotations for asset classes and sectors, then answer questions from the mailbag. I explain the difference between outright performance and "trends in performance" and discuss potential entry points using Relative Rotation Graphs....

READ MORE

MEMBERS ONLY

Investing with the Trend

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Investing with the Trend provides an abundance of evidence for adapting a rules-based approach to investing by offering something most avoid, and that is to answer the "why" one would do it this way. It explains the need to try to participate in the good markets and avoid...

READ MORE

MEMBERS ONLY

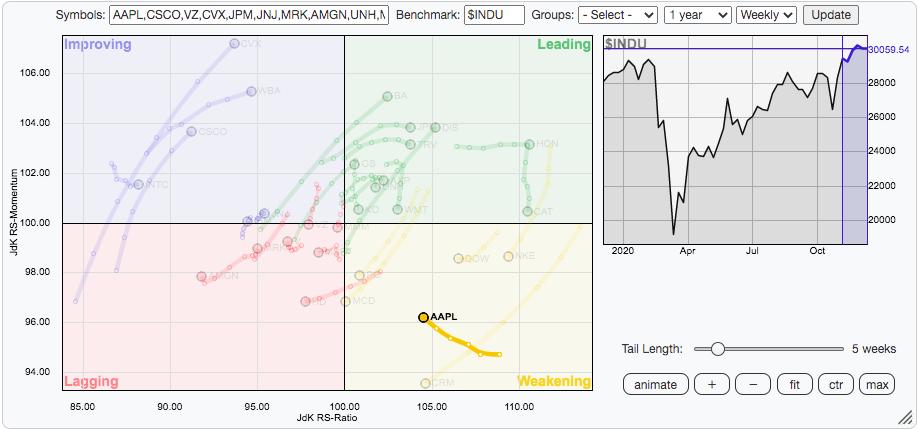

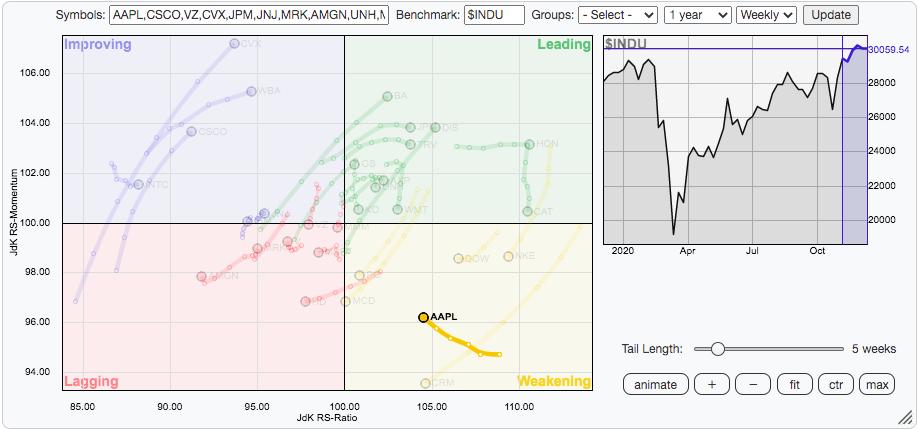

AAPL Is Strengthening Again - Check Out These RRGs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Yesterday, in my Daily Market Report to members, I pointed out three of the Dow Jones component stocks that were showing leadership, or in Apple's (AAPL) case, a return to leadership. While it isn't very apparent on AAPL's own price relative chart vs. its...

READ MORE

MEMBERS ONLY

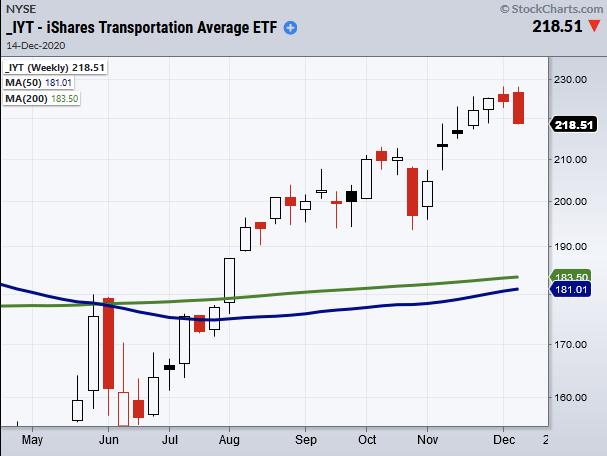

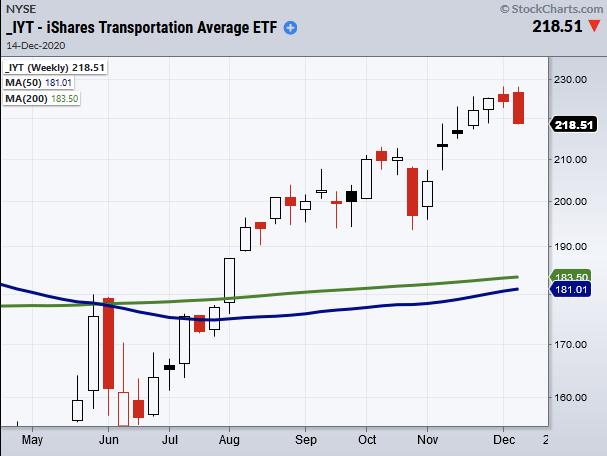

Transportation/Retail Sectors - Correcting, Exhausted or Signalling Something Worse?

On Monday, the tech sector (SMH) and biotechnology sector (IBB) held as the other sectors of the Economic Modern Family failed to hold their gaps. Similarly to SMH, the only major index to close green today was the Nasdaq 100 (QQQ), which tends to have a high concentration of tech...

READ MORE

MEMBERS ONLY

DP TV: What We're Expecting in 2021

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin reveal their 2021 expectations as they review the major indexes, global markets and "Big Four" - Dollar, Gold, Oil and Bonds. After analyzing current market conditions, Carl and Erin explain why you should expect a difficult week as the overvalued...

READ MORE

MEMBERS ONLY

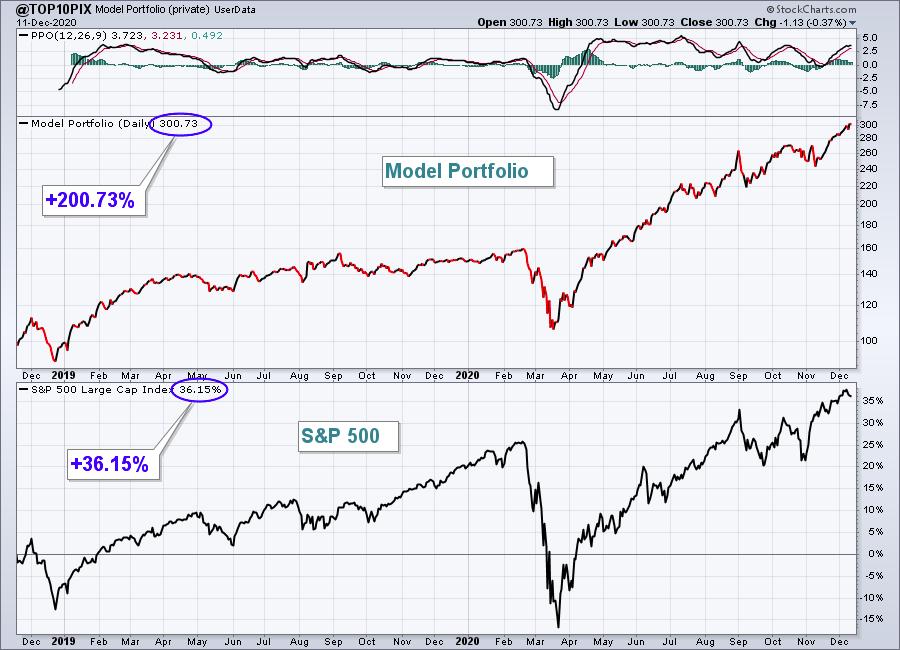

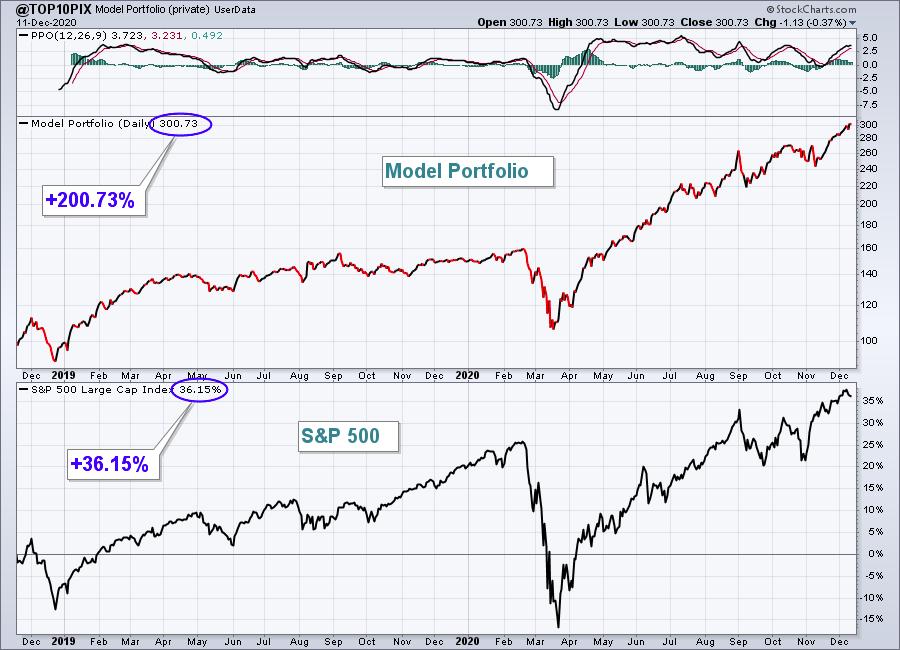

Investment Professionals: Sharpe Ratios Don't Get Any Better Than This

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We now have 2 years under our belt at EarningsBeats.com with respect to our flagship Model Portfolio and the results have been stunning - quite honestly better than I could have ever predicted or imagined. We had to suffer through a 20%+ drawdown in Q4 2018 (trade war), just...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Strong, But Warrants Caution at These Levels; RRG Chart Shows Good Activity in These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In what was a sixth consecutive week of gains, the Indian equities continued with their up move and extended their gains. It was a measured move ahead for the markets, which went on to close with fresh lifetime highs once again. The trading range over the past five days was...

READ MORE

MEMBERS ONLY

Four RRGs That Give You a Clear Overview of What is Going On in the Markets

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Asset Classes

Starting at Asset Class level, the first Relative Rotation Graph shows the rotation of various asset classes (ETFs) against VBINX (the benchmark).

The relationship that stands out here is the very clear preference for stocks. It is the only tail that is inside the leading quadrant. As an...

READ MORE

MEMBERS ONLY

The Agony and the Ecstasy of the Stock Market Outliers

This past week, we saw the market peak in some areas, while others look more like they have a healthy correction in the works. The weakest area, and one that we wrote about last Wednesday, is the reversal top in the Nasdaq 100 (QQQ).

The formation in the NASDAQ is...

READ MORE

MEMBERS ONLY

United States Oil Fund Breaks Out

by John Murphy,

Chief Technical Analyst, StockCharts.com

The price of crude oil continues to rise and is pulling energy shares along with it. Chart 1 shows the United States Oil Fund (USO) surging to the highest level in eight months after clearing its previous high formed during August. The USO has also climbed above its 200-day moving...

READ MORE

MEMBERS ONLY

Stocks That Rock During December!

by John Hopkins,

President and Co-founder, EarningsBeats.com

At EarningsBeats.com, we created a list of stocks that are historically among the best-performing ones during the month of December. This list was created on November 30 and one of the companies on the list, Seagate Technology Holdings (STX), has not disappointed.

As you can see, so far this...

READ MORE

MEMBERS ONLY

Markets Find Support!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews year-to-date winners that have plenty more upside ahead. She also looks at turnaround candidates in strong sectors while sharing Biotech and Yield stocks poised to trade higher.

This video was originally recorded on December 11th, 2020. Click...

READ MORE

MEMBERS ONLY

Trader vs. Investor, IRS vs. Investor Self

by Gatis Roze,

Author, "Tensile Trading"

"It's not how much money you make, but it's how much money you keep."

—Robert Kiyosaki

This blog addresses two of my favorite topics:

(1) Minimizing taxes

(2) Aligning what we call your "Investor Self" with the unique type of trading or...

READ MORE

MEMBERS ONLY

Squeezing the Apple for a Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Several big tech stocks have consolidation patterns working the last few months and Bollinger Band squeezes in December. These include Apple, Amazon, Microsoft and Nvidia. Today's article will focus on the strongest of the four, and the one with a breakout working already. There is a video at...

READ MORE

MEMBERS ONLY

The Big Winner Leading Our Model Portfolio Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Since we announced our latest portfolio "draft" selections, one Model Portfolio stock - Tesla (TSLA) - has been flying. Even after some recent profit-taking, TSLA was higher by 25.6% from our November 19th selection to Thursday's close. Out of our 10 equal-weighted stocks in our...

READ MORE

MEMBERS ONLY

Chartwise Women: Stocks Around the World!

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

Around the world in 30 minutes! In this week's edition of Chartwise Women, Mary Ellen and Erin review emerging areas of the world as the recovery takes place globally, sharing the importance of diversifying your portfolio not just domestically but internationally as well. They also share top stocks...

READ MORE

MEMBERS ONLY

MTB is Ready to Break Resistance and Push Into The Leading Quadrant

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the weekly Relative Rotation Graph for US sectors, the Financial sector is gradually improving more and more, with the tail having just crossed over into the leading quadrant.

Zooming in on the RRG for the constituents of the Financial sector against XLF, we see a high concentration of banking...

READ MORE

MEMBERS ONLY

TODAY'S ENERGY LEADERS INCLUDE APACHE, HESS, DEVON ENERGY, AND CHEVRON

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY LEADERS...This morning's message showed the price of oil breaking above its August high which helped make energy the day's strongest sector. Energy stocks are also among the day's biggest individual gainers in the overall market. Three of the individual leaders are shown...

READ MORE

MEMBERS ONLY

UNITED STATES OIL FUND BREAKS OUT -- ENERGY CONTINUES TO SHOW NEW LEADERSHIP -- ENERGY ETFS APPEAR HEADED TOWARD JUNE HIGHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

UNITED STATES OIL FUND BREAKOUT... The price of crude oil continues to rise and is pulling energy shares along with it. Chart 1 shows the United States Oil Fund (USO) surging to the highest level in eight months after clearing its previous high formed during August. The USO has also...

READ MORE

MEMBERS ONLY

NASDAQ Dashes for the Exit Door - And Without Serving Food!

There have been many stimulus bills that have been denied, pushed off and almost forgotten about since the initial March selloff. This time was supposed to be different, since its key purpose was to be a condensed plan in order to keep small business loans and unemployment benefits extended past...

READ MORE

MEMBERS ONLY

STOCK INDEXES MAY BE LOSING SOME UPSIDE MOMENTUM

by John Murphy,

Chief Technical Analyst, StockCharts.com

SHORT-TERM MOMENTUM INDICATORS START TO WEAKEN... Stocks are still in the midst of a strong run that started in early November. But they're starting to look stretched over the short run; and may be vulnerable to some profit-taking. The two upper boxes in Chart 1 show the RSI...

READ MORE

MEMBERS ONLY

Time for an Energy Break?

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Energy Sector has been a top performer in the last six weeks, rallying over 50% since the October low. Now it is beginning to look as if it is in the process of topping. On the chart below we can see that wedge patterns have played a major role...

READ MORE

MEMBERS ONLY

Water Futures on the Chicago Mercantile Exchange

California Water futures have been added to the list of tradable commodities.

Historically, commodity futures contracts were first created as a way for farmers to hedge against fluctuating crop prices. If someone thought a drought might devastate their corn season, buying a corn futures contract would mitigate the loss. Conversely,...

READ MORE

MEMBERS ONLY

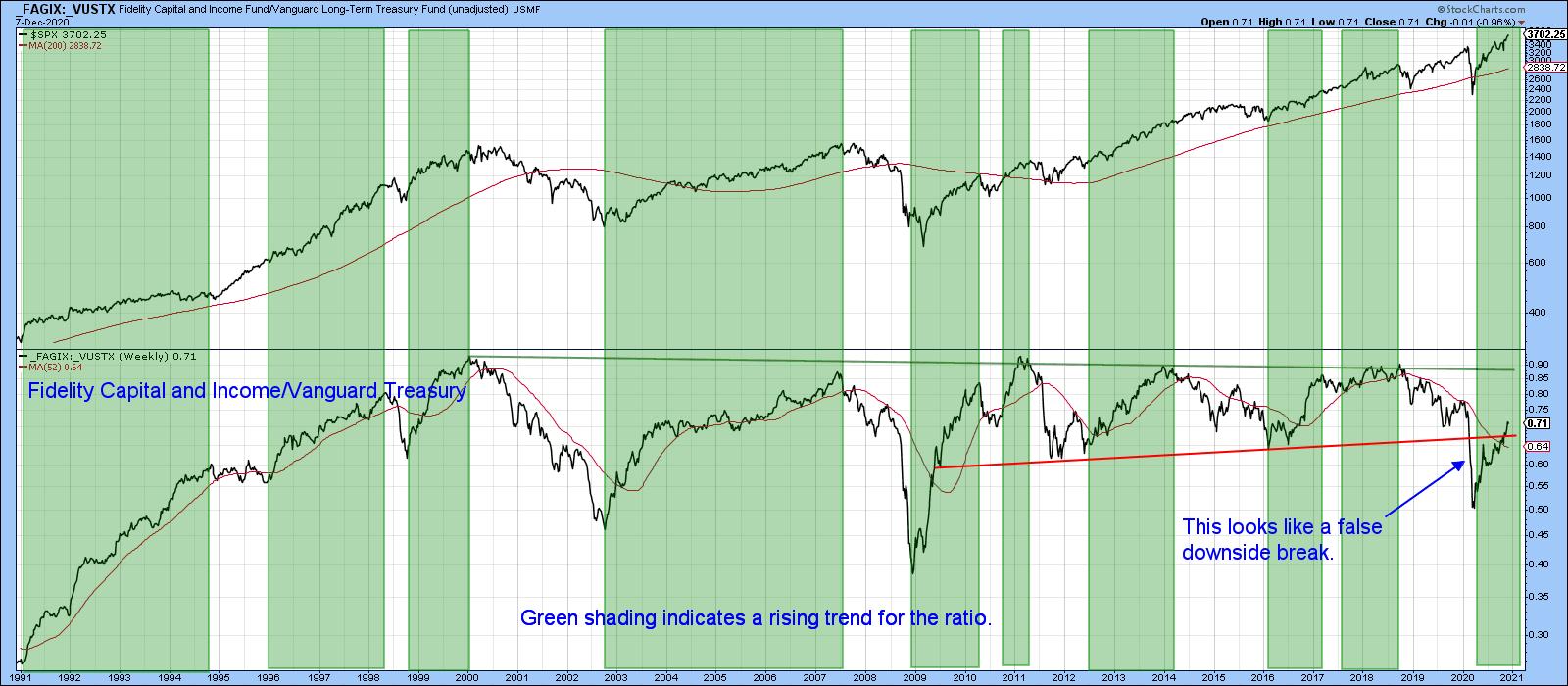

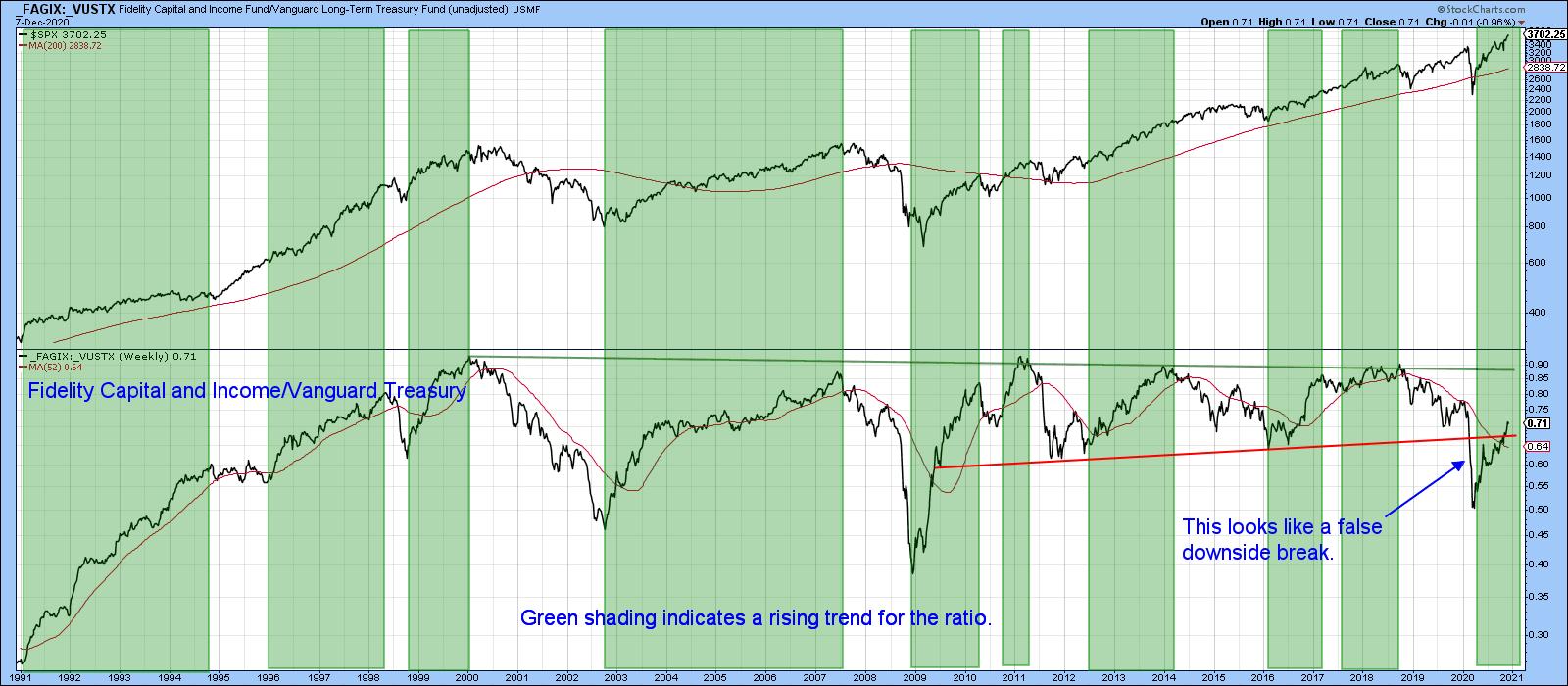

Five Charts that are Pointing to Higher Stocks and Bond Yields

by Martin Pring,

President, Pring Research

Two Stock Market Relationships That Have Just Turned Positive

A few weeks ago, I wrote about some intermarket relationships pointing in the direction of higher stock prices. Picking through my StockCharts chart lists earlier in the week, I noticed a couple more that have only just moved into the bullish...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stocks Massively Beating Bonds

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV's Sector Spotlight, I spend a big part of the show going over the (completed) monthly (bar-) charts for November, in order to get a handle on the long-term trends that are in play for both asset classes and sectors. In particular, the...

READ MORE

MEMBERS ONLY

GOLD AND ITS MINERS TRY TO HOLD 200-DAY LINES -- SILVER AND ITS MINERS ARE SLIGHTLY STRONGER BUT ALSO TESTING UNDERYING SUPPORT LEVELS -- RISING BOND YIELDS MAY BE HOLDING GOLD BACK

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD SPDR TRIES TO HOLD 200-DAY LINE...Gold has been in a downside correction since the start of August. And it's now undergoing an important test. Chart 1 shows the Gold Shares SPDR (GLD) trading back above their 200-day moving average after slipping below it near the end...

READ MORE

MEMBERS ONLY

Sentiment Speaks

by Bruce Fraser,

Industry-leading "Wyckoffian"

Sentiment measures are environmental to the stock market. They speak to the general state of speculation in stocks, but are difficult to use for precise timing. Sentiment is considered in a contrary way for speculative markets. In the example of the Equity Put to Call ratio (plotted below), when an...

READ MORE

MEMBERS ONLY

DP TV: Sentiment Too Bullish in Overvalued Market

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl opens the show by analyzing SPY market action, but also schools us on how to determine when the market is "overvalued" or "undervalued." (Currently, it is highly overvalued.) Carl also displays many DP indicators that are extremely overbought and accompanied...

READ MORE

MEMBERS ONLY

Is Gold Signaling Inflation?

The current market situation shows a quick attempt to push a smaller stimulus bill by the end of December before eviction protection and unemployment benefits end. If failed, it could potentially leave as many as 19 million people at risk of becoming evicted. This potential strain on the market could...

READ MORE

MEMBERS ONLY

Three Bullish Tells for Gold Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As much as people speak of gold's value as a safe haven, its performance in 2020 has done much to dispel that investment thesis. Recent months have seen gold and gold stocks underperforming the S&P 500. Is the pattern of new highs for stocks and new...

READ MORE

MEMBERS ONLY

Santa Claus Rally Exposed

by Larry Williams,

Veteran Investor and Author

In this special episode of Real Trading with Larry Williams, Larry explores the famous "Santa Claus Rally" and how it applies in 2020. The rally is coming earlier than you might expect in the season for toy, candy, jewelry, and other related stocks. So when does/did the...

READ MORE

MEMBERS ONLY

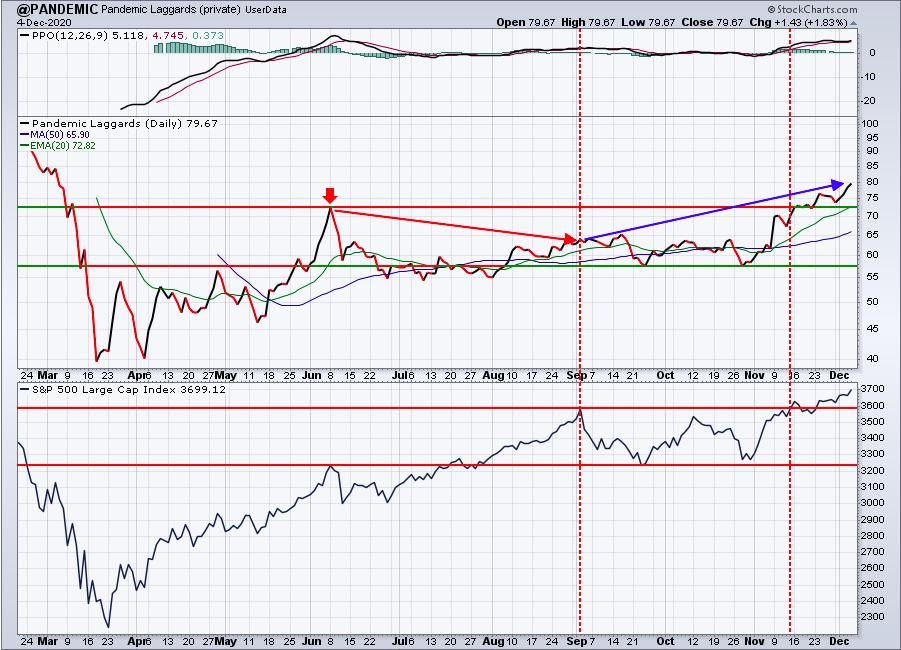

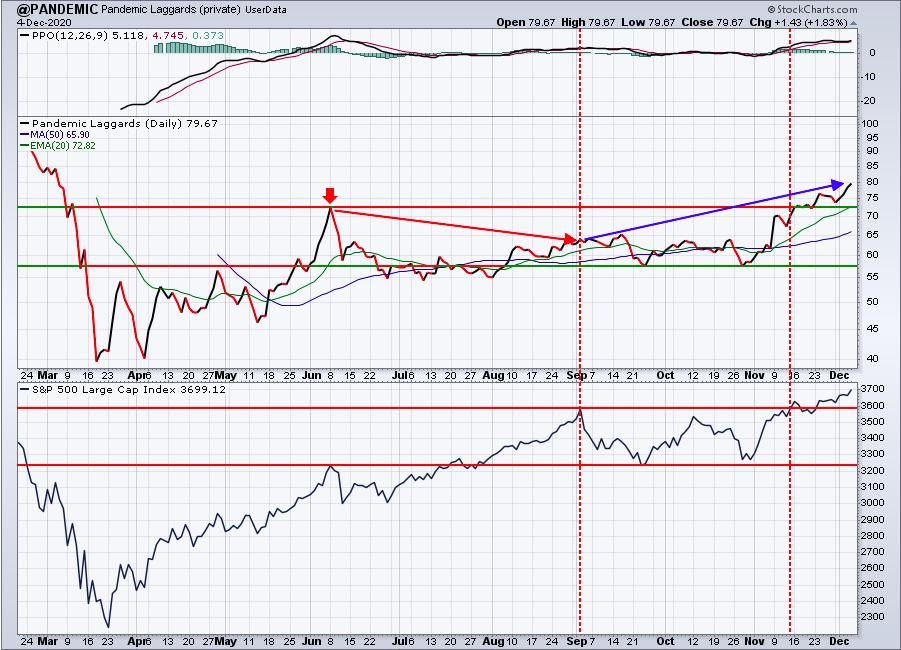

9 of 10 Industries In My Pandemic Index Have Broken Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I developed my Pandemic Index several months ago to track the progress of the 10 worst performing industry groups during the onset of COVID-19. It's an equal-weighted index of those 10 industries and I track it using StockCharts.com's User-Defined Index tool. Here's how...

READ MORE

MEMBERS ONLY

Performance Divergences that Make You Go Hmm...

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There was a serious shift over the last five weeks as commodities surged, bonds fell and the Dollar recorded new lows. There were also some noticeable divergences as the Inflation-Indexed Bond ETF (TIP) edged higher and the 20+ Yr Treasury Bond ETF (TLT) moved lower. This divergence is only five...

READ MORE

MEMBERS ONLY

A December Seasonal Powerhouse Is Exploding Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We prepared a list of the 20 best stocks to own in December and sent it to our EarningsBeats.com members one week ago. The TOP-RATED stock on our list was Western Digital (WDC), which has advanced in 70% of Decembers this century and has produced an average return of...

READ MORE

MEMBERS ONLY

CANADIAN DOLLAR HITS TWO-YEAR HIGH -- WHILE CANADIAN ISHARES HIT NEW RECORD -- RISING CURRENCY FAVORS CANADA ISHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

CANADIAN DOLLAR HITS TWO-YEAR HIGH...With the U.S. dollar falling to the lowest level in more than two years, foreign currencies are rising. One of them is the Canadian Dollar. The weekly bars in Chart 1 show the $CDW rising to the highest level in two years. Since Canada...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Slightly Overstretched But Strong; RRG Chart Suggests These Sectors will Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the week that went by, we saw the markets adding more strength and piling up some more incremental gains. The NIFTY has not only stayed above the crucial 2-year long pattern resistance trend line, but also added some directional bias to it by moving higher. The markets were much...

READ MORE

MEMBERS ONLY

2 Intermarket Relationships are Providing MASSIVE Buy Signals

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I always credit John Murphy for all of my work regarding intermarket relationships. He's inspired me in a number of ways and I continue to look for relationships that can better increase my odds of calling the stock market correctly. The great thing about these relationships is that...

READ MORE