MEMBERS ONLY

DP TV: 3000 Level for SPX?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, as we head into the holiday week, Carl and Erin talk about why the Dow sometimes seems to outperform the SPX (today was a great example!). Carl follows up on Climax Analysis and how it can give you the very short-term signals of exhaustion or...

READ MORE

MEMBERS ONLY

Will Supply Disruptions be the New Market Bottleneck?

The Purchasing Managers Index (PMI) release came out today, giving insight into the economy's health as the market ramps up with increased consumer sales and all time highs for hiring. Additionally, the Economic Modern Family got another positive boost from Oxford and AstraZenica's vaccine.

Grandad Russell...

READ MORE

MEMBERS ONLY

ENERGY SPDR CLEARS 200-DAY LINE -- THE OIH IS RISING EVEN FASTER -- TIDEWATER, HALLIBURTON, AND BAKER HUGHES LEAD -- CRUDE OIL CHALLENGES OVERHEAD RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY ETFS CLEAR THEIR 200-DAY AVERAGES... Energy stocks are continuing to show new market leadership. They're getting help from rising oil prices. Last Thursday's message showed the Energy SPDR (XLE) testing its 200-day moving average. Chart 1 shows the XLE moving decisively above that long term...

READ MORE

MEMBERS ONLY

Bull Markets Die on Euphoria

by David Keller,

President and Chief Strategist, Sierra Alpha Research

"Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria." - Sir John Templeton

My macro process has three key steps: Price, Breadth and Sentiment. While most measures of price and breadth indicate the bull market is in decent shape, the third...

READ MORE

MEMBERS ONLY

The Calm before the Storm in QQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The weekly high-low range for the Nasdaq 100 ETF (QQQ) was the narrowest of the year this past week and the ETF is battling triangle resistance. A narrowing range shows indecision and a volatility contraction. Even though this is just one weekly bar, QQQ is at a moment of truth....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Flirts with an Important Pattern Resistance; RRG Chart Shows Good Activity in These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, we mentioned that the NIFTY was testing its crucial pattern resistance. Over the past five trading sessions, the markets, in general, displayed some corrective tendencies, but continued to extend gains. As compared to the previous two weeks, which had a wide trading range of 723...

READ MORE

MEMBERS ONLY

This Fast Moving ETF Is Revealing Top Candidates In A Strong Sector

by Mary Ellen McGonagle,

President, MEM Investment Research

With the move into Cyclical stocks continuing to expand, sectors such as Industrials have stocks with multiple reasons to continue to trade higher. In addition to industrial production reports, which just posted a fourth month of improvements, factory orders have also been steadily increasing, which in turn is helping select...

READ MORE

MEMBERS ONLY

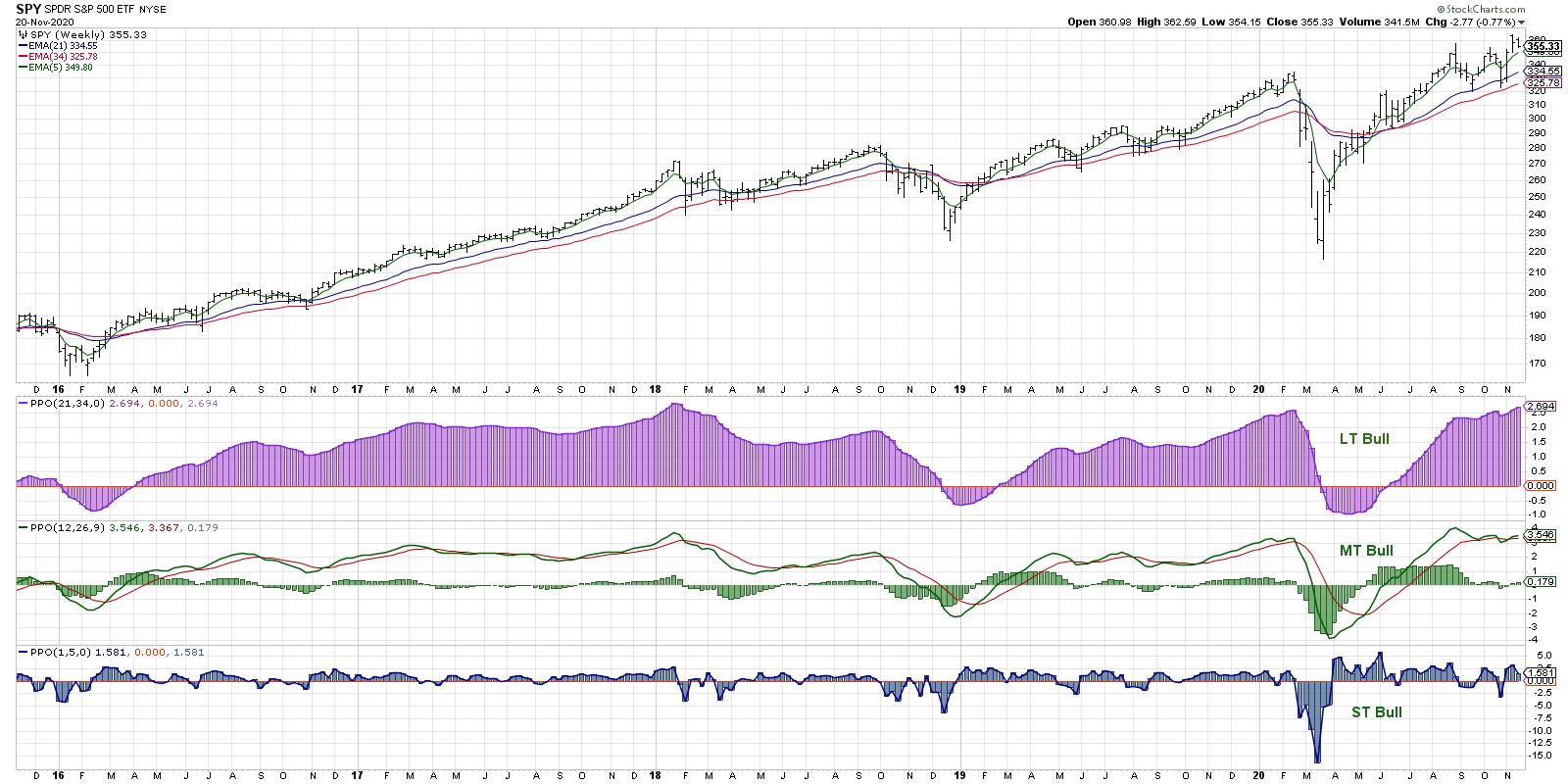

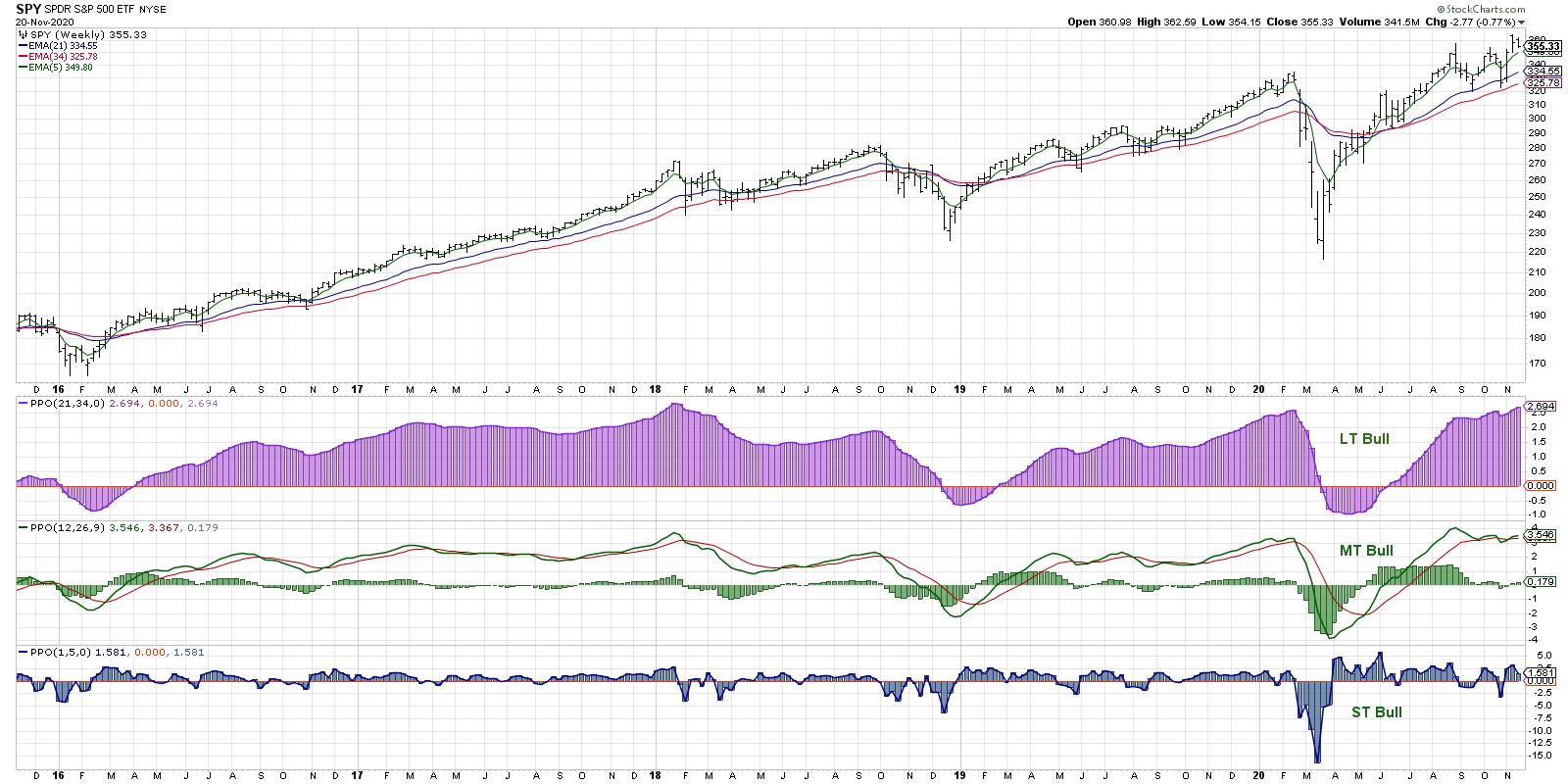

We Now Have Confirmation That It's Full Speed Ahead for this Secular Bull Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm going to keep this article short and sweet. We're going higher.

If you're still convinced that the U.S. stock market is staring at a doom-and-gloom environment, I don't know what to say. Several months ago, I created a User-Defined Index,...

READ MORE

MEMBERS ONLY

Sentiment Suggests Exhaustion of Buyers

by David Keller,

President and Chief Strategist, Sierra Alpha Research

"Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria." - Sir John Templeton

My macro process has three key steps: Price, Breadth and Sentiment. While most measures of price and breadth indicate the bull market is in decent shape, the third...

READ MORE

MEMBERS ONLY

Has Reality Hit the Stock Market?

On Monday, we talked about positive vaccine news from Pfizer (PFE) and Moderna (MRNA) holding up the market. Friday proved the market was able to hold up through the week. And yet, the same day, many articles surfaced about the market's health related to the increasing state lockdowns...

READ MORE

MEMBERS ONLY

Stock Uptrend Consolidates Above Support

by John Murphy,

Chief Technical Analyst, StockCharts.com

Major stock indexes continue to consolidate their November gains, and remain above recent support levels. Chart 1 shows the Dow Industrials pulling back over the last three days, but remaining above underlying support along their October peak and recent low near 29,000. Chart 2 shows the S&P...

READ MORE

MEMBERS ONLY

Pockets of Strength in a Tired Market

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares how to uncover and then capitalize on the strength that is continuing to emerge from select areas of the market. She also reviews select stocks that are poised to trade higher due to strong earnings and attractive...

READ MORE

MEMBERS ONLY

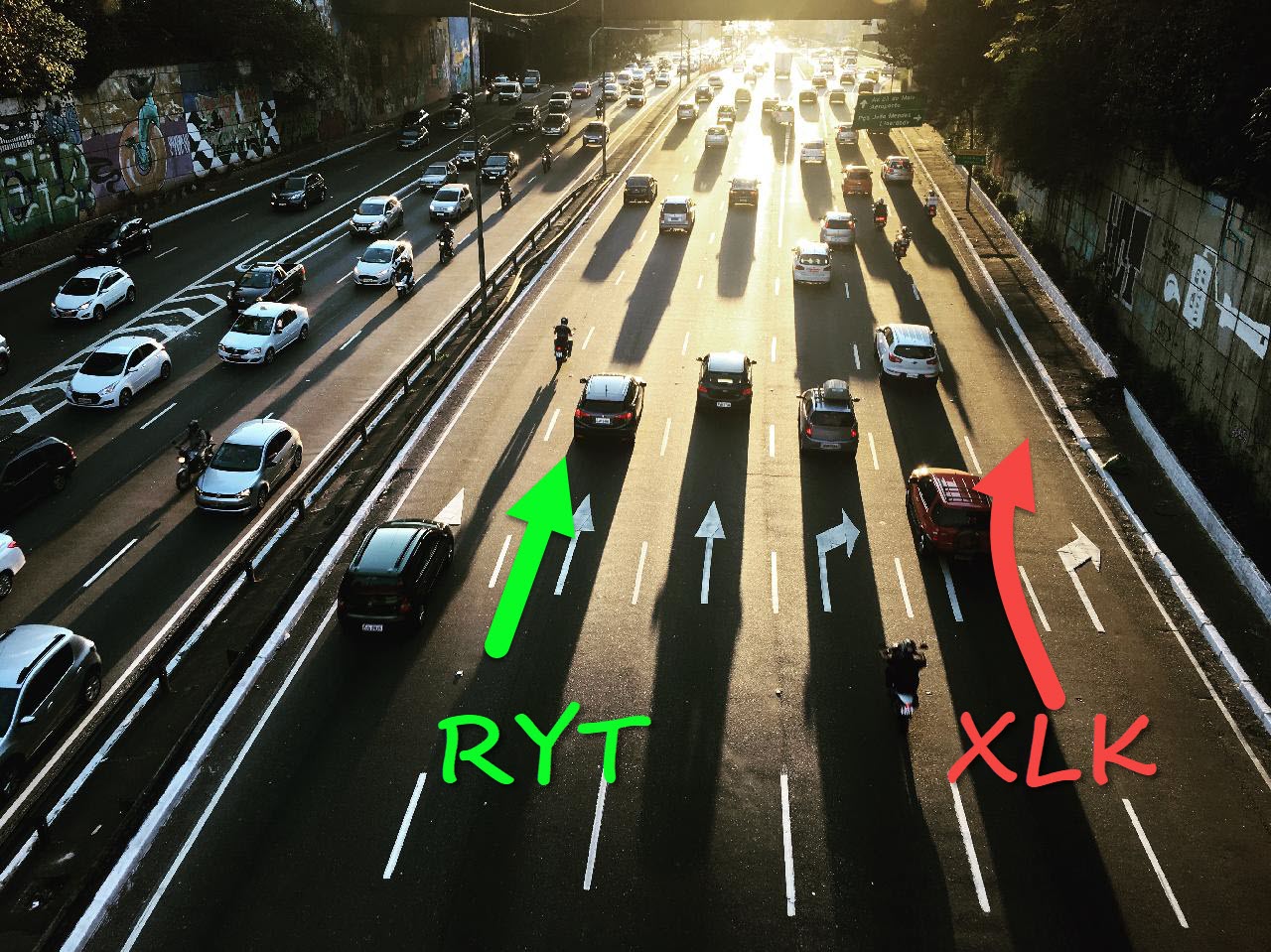

Sometimes You Need to Change Lanes to Stay on the Right Track

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

When I was preparing for last week's episode of Sector Spotlight and writing an article for the RRG Blog on the Growth/Value Rotation, I had to think back to an article that I wrote for this newsletter back in August.

The title for this article was "...

READ MORE

MEMBERS ONLY

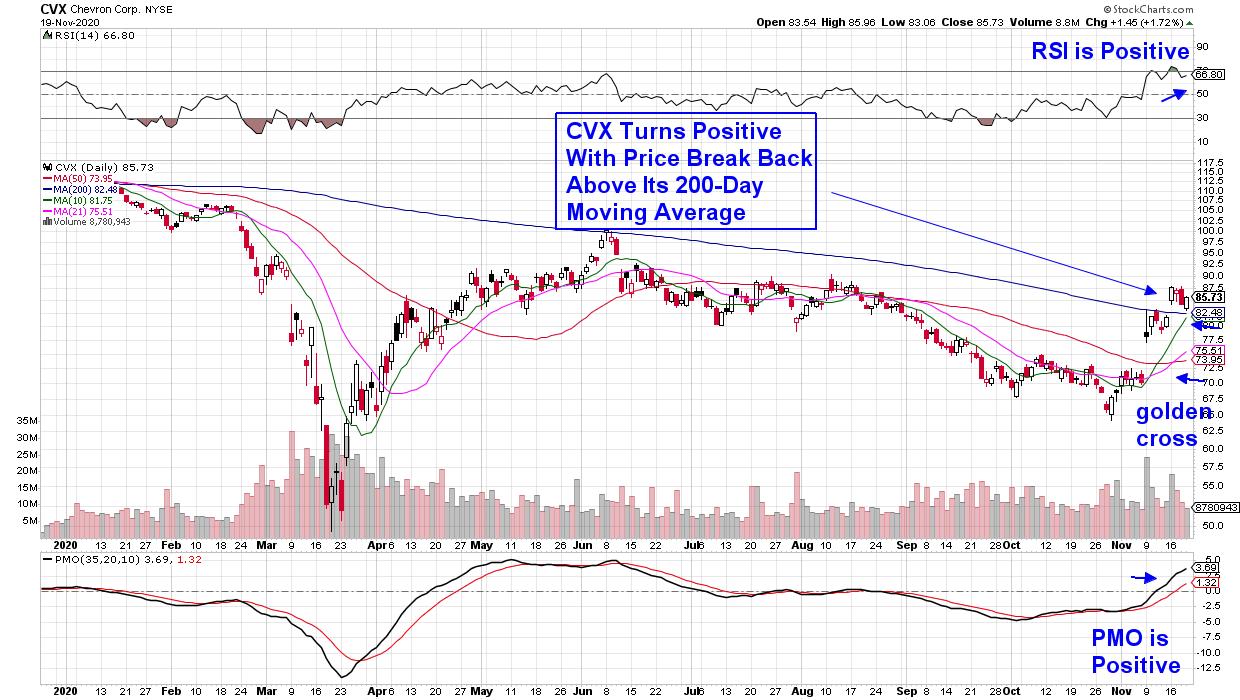

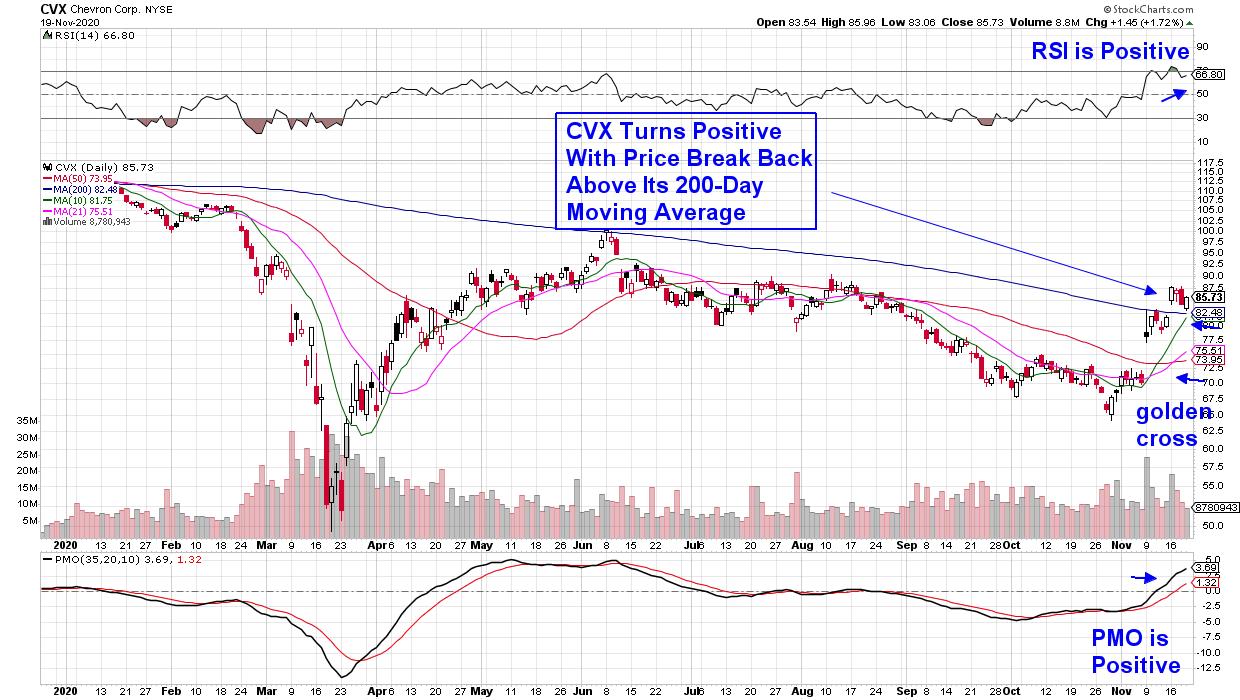

This Mega Cap Stock In A Strong Group Just Turned Bullish!

by Mary Ellen McGonagle,

President, MEM Investment Research

It's been a tricky couple of weeks in the markets as lockdown stocks dropped sharply on the vaccine news but are currently "back in style" given the surge in new virus cases. Other areas such as Healthcare have seen their share of mixed signals as well....

READ MORE

MEMBERS ONLY

Chartwise Women: Lock-down or Recovery Stocks?

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

Lock-dow or recovery? In this week's edition of Chartwise Women, Mary Ellen and Erin review top candidates in both categories while revealing what they would rather do given 4 incredible scenarios. In "Yeah... That Happened!", they also talk about the Midwest city that will pay big...

READ MORE

MEMBERS ONLY

STOCK UPTREND CONSOLIDATES ABOVE SUPPORT -- ENERGY SPDR TESTS 200-DAY AVERAGE WHILE CRUDE OIL TESTS OVERHEAD RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES CONSOLIDATE...Major stock indexes continue to consolidate their November gains, and remain above recent support levels. Chart 1 shows the Dow Industrials pulling back over the last three days, but remaining above underlying support along their October peak and recent low near 29,000. Chart 2 shows...

READ MORE

MEMBERS ONLY

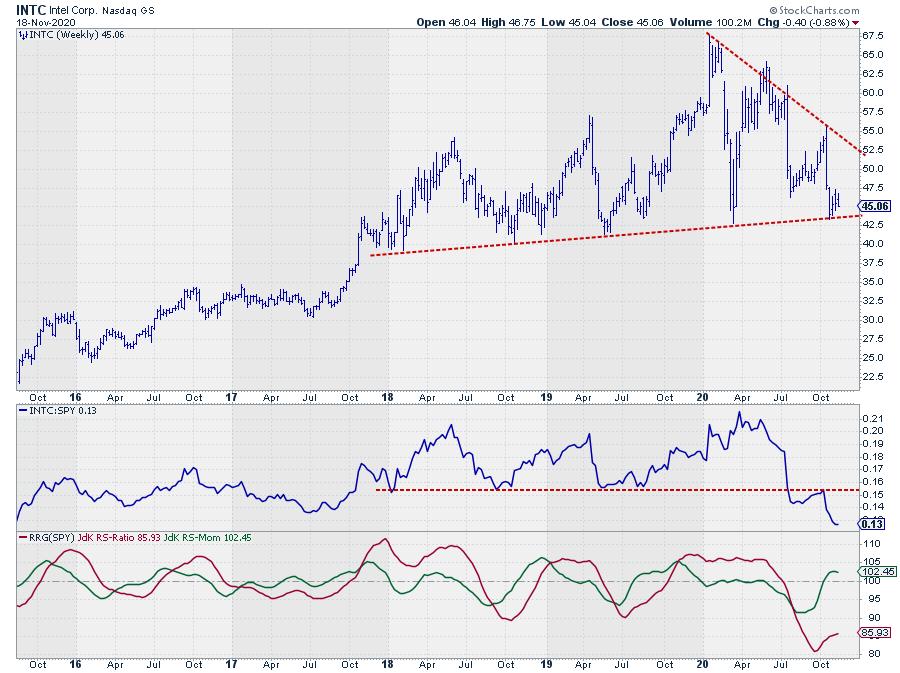

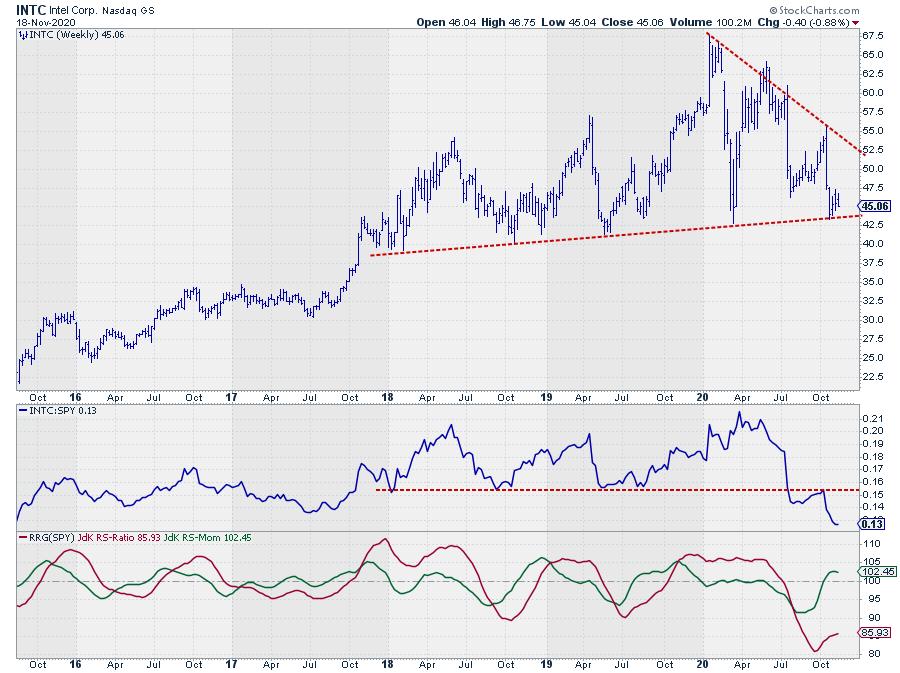

INTC at Risk for a Violent Move Lower

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for Technology stocks (XLK), the tail on INTC stands out - but not in a positive way.

INTC is positioned inside the improving quadrant after a recovery in relative momentum (JdK RS-Momentum), but recently started to roll over again, while still being the technology stock...

READ MORE

MEMBERS ONLY

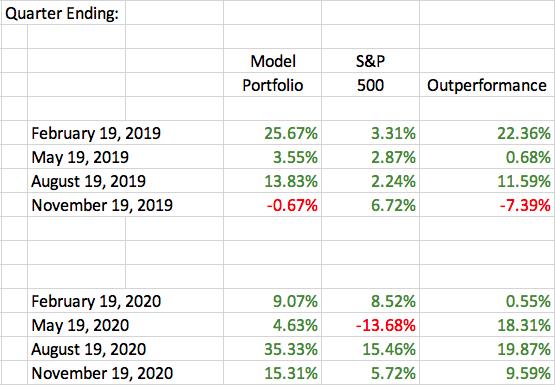

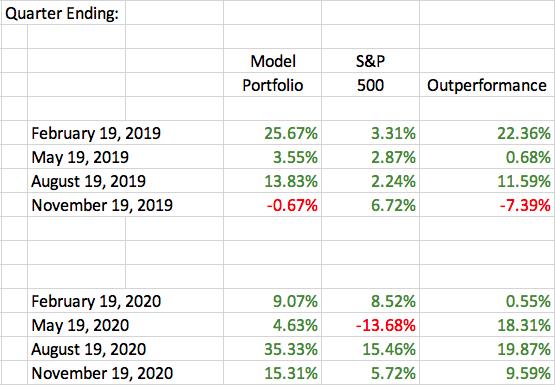

We Have The #1 Draft Pick (And Picks 2 Through 10) Once Again And We're Going To Make It Count!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Every 3 months, on February 19th, May 19th, August 19th, and November 19th, we host our own version of a "Draft Party". It's the most exciting day of the quarter for us at EarningsBeats.com. The anticipation has been building for weeks, and for good reason....

READ MORE

MEMBERS ONLY

Is it Time for the Oil and Gas Exploration Sector to Wake Up?

Today, Goldman Sachs (GS) announced that commodities were poised for a bull market. We have been taking advantage of that bull market for quite some time now.

We've seen nice moves from hard to soft commodities, which we are currently still holding. But what alerted us to this...

READ MORE

MEMBERS ONLY

A Very Strong Stock in an Industry Just Breaking Out and Showing Leadership

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Later tonight and tomorrow, I'll be evaluating literally thousands of stocks in determining which 10 equal-weighted stocks I'll include in each of our 4 portfolios at EarningsBeats.com. Our track record is sparkling and you can view our portfolio results HERE.

I start with sectors. I&...

READ MORE

MEMBERS ONLY

Trading in a Word... Continued

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave continues from last week's topic of "Acceptance." If you are willing to accept what Dave teaches, you are well on your way to becoming a successful trader. Alternatively, if you've lost your way, this will help you...

READ MORE

MEMBERS ONLY

Adding FB As a Short to RRG Long/Short Basket Trade Ideas

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

From time to time, I discuss possible long or short positions (stocks, ETFs) based on observations on Relative Rotation Graphs or ideas generated from them.

Currently, the baskets contain five positions each. Below, I will review all positions and come up with a few proposed changes to the mix.

Long...

READ MORE

MEMBERS ONLY

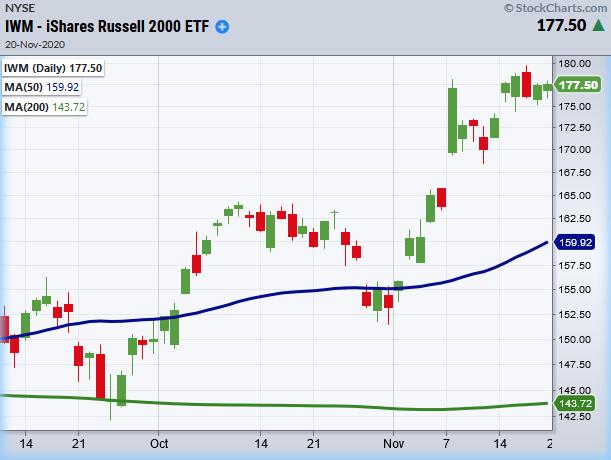

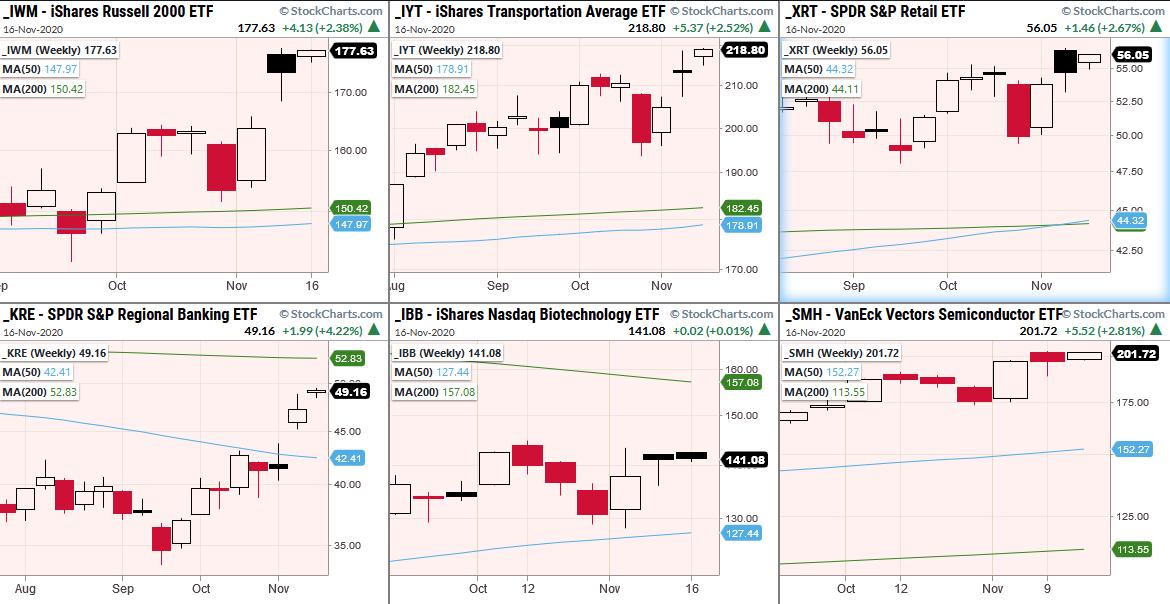

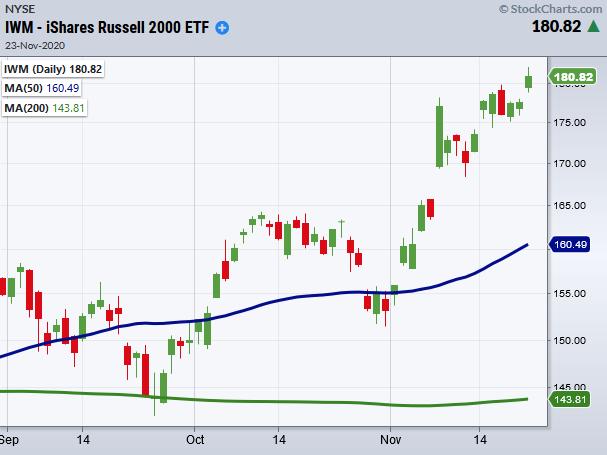

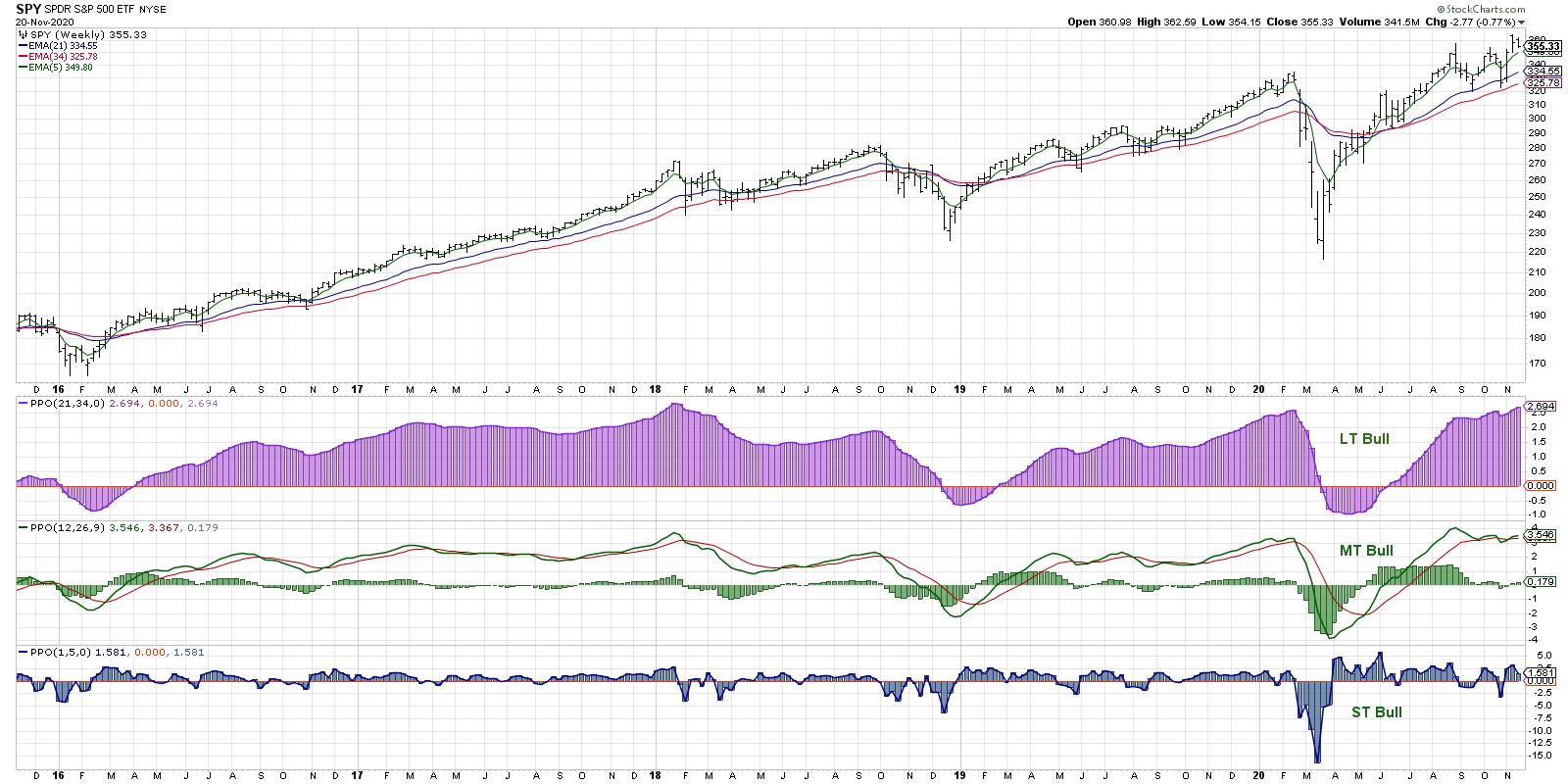

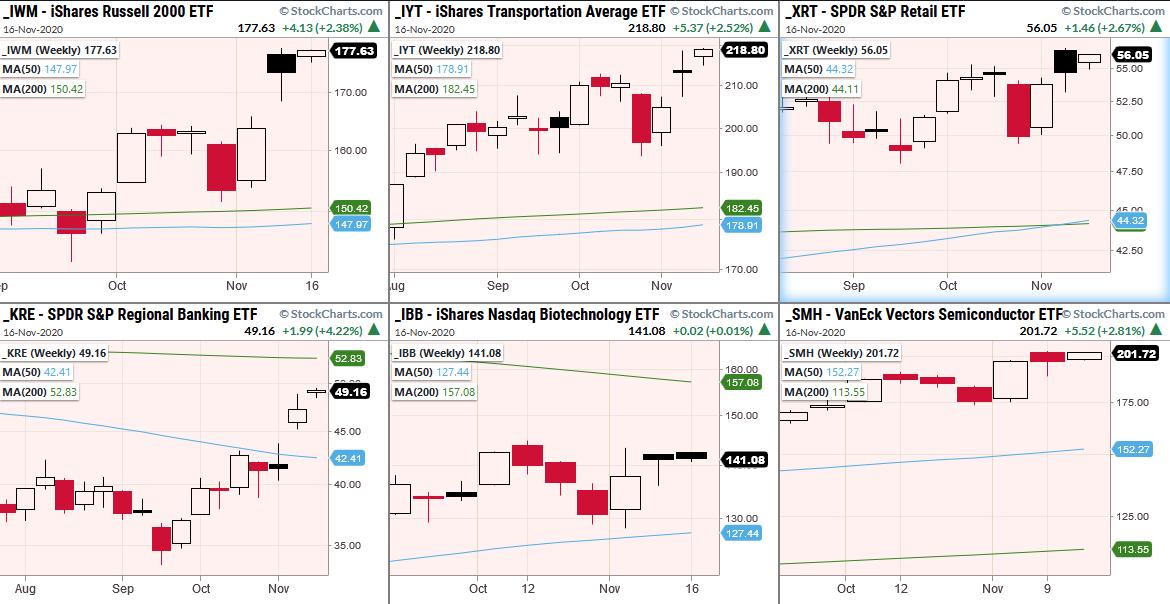

Grandpa Russell 2000's Secret Identity!

The S&P 500 (SPY), Nasdaq 100 (QQQ) and Dow Jones (DIA) all closed under their recent highs, while Granddad Russell 2000 (IWM) was able to close over 178.10, making new all-time highs.

It's no easy feat for the small caps to outperform the major indices,...

READ MORE

MEMBERS ONLY

This Stock Is Ready For Takeoff!

by Mary Ellen McGonagle,

President, MEM Investment Research

I'm regularly screening the market for stocks poised to outpace the markets and, since I'm looking for characteristics proven to be common among big winners prior to takeoff, the more of these traits a stock has, the better the odds it will do well.

Below is...

READ MORE

MEMBERS ONLY

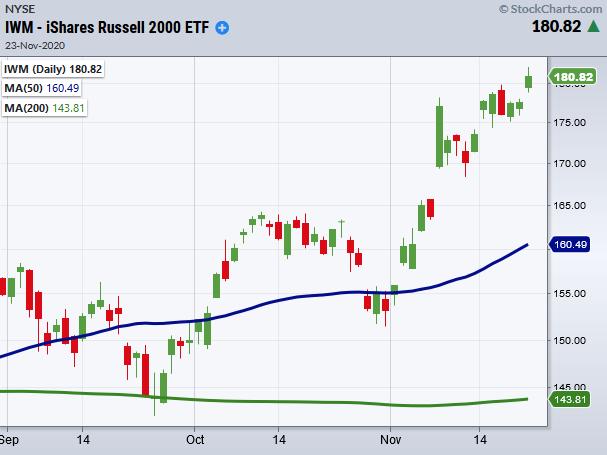

For the First Time in Three Years, Small Caps are Starting to Look Interesting

by Martin Pring,

President, Pring Research

* Russell 2K at a Record High

* Some Small-Cap Sector ETFs Breaking as Well

Russell 2K at a Record High

Small-caps have been underperforming since early 2018, but, in the last few weeks, have begun to emerge as relative outperformers. We can see this from Chart 1, where the iShares Russell...

READ MORE

MEMBERS ONLY

Sector Spotlight: Rotation OUT of Large-Caps

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I look at the performances for asset classes and sectors last week, noticing long tails on those daily RRGs - that indicates some big moves that have taken place. Following the lookback using daily RRGs, I move on to some weekly charts for stocks,...

READ MORE

MEMBERS ONLY

DP TV: Dow Forecast 2021

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin follow up their discussion regarding very short-term initiation and buying climaxes that have occurred recently. They look at the difference between Friday's initiation climax and the possible exhaustion climax that could be giving us a short-term attention flag regarding this...

READ MORE

MEMBERS ONLY

Can Positive Vaccine News Support the Economic Modern Family?

The Modern Family shows confidence as more positive vaccine news came out on Monday. This time, the positive news came from Moderna (MRNA). Hence, after last Monday's Pfizer (PFE) announcement, the market thrives on hope rather than fear, as COVID cases rise and areas of the country are...

READ MORE

MEMBERS ONLY

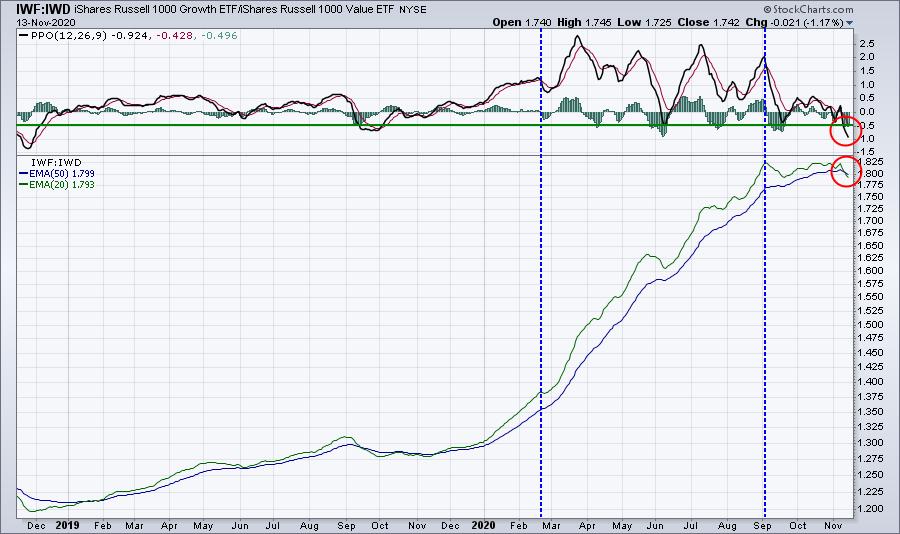

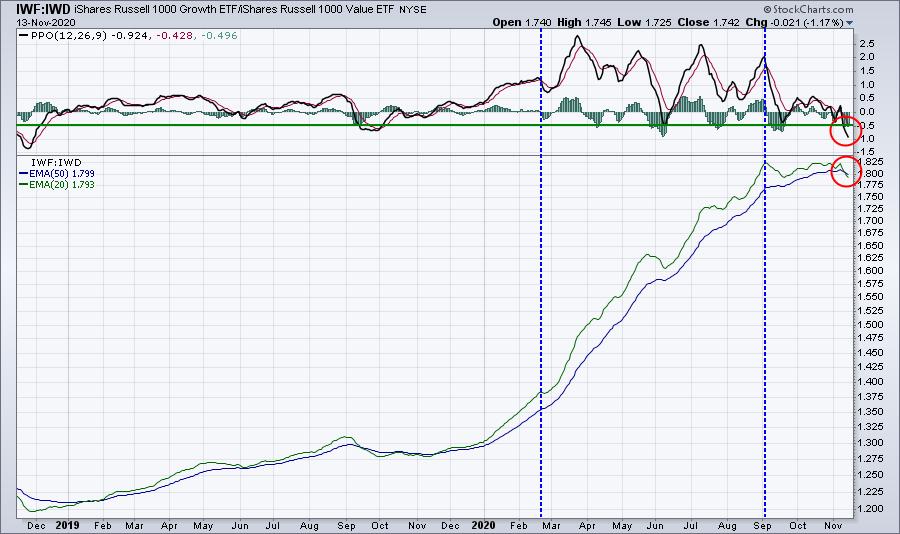

A Closer Look at the Growth to Value Rotation - There is More To It Than Meets the Eye...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

There is a lot of talk lately regarding the Growth to Value rotation that seems to be going on. And if you look at the surface, that is certainly true, but there is more to it than meets the eye...

The Relative Rotation Graph below visualizes this rotation and shows...

READ MORE

MEMBERS ONLY

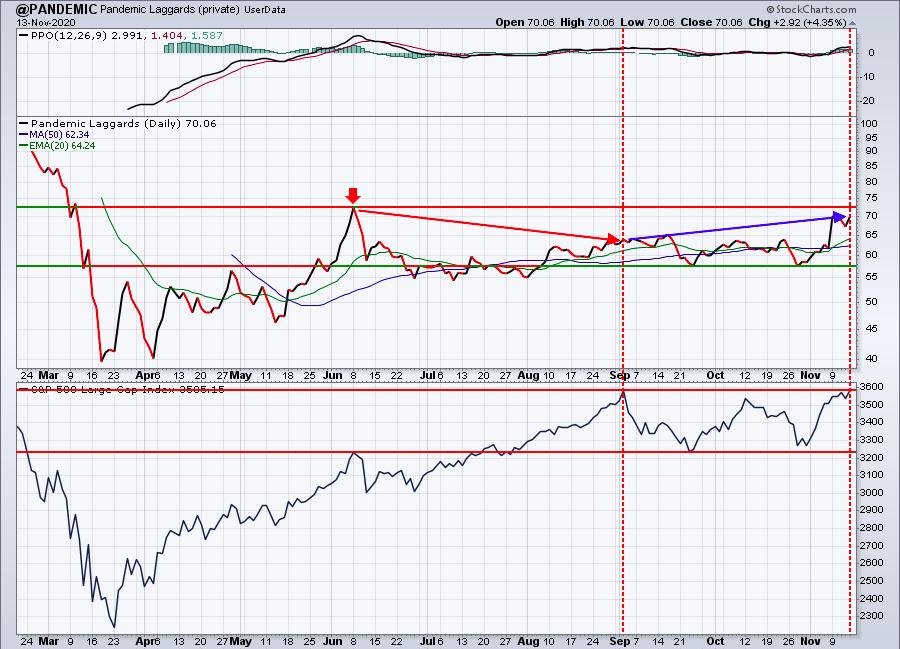

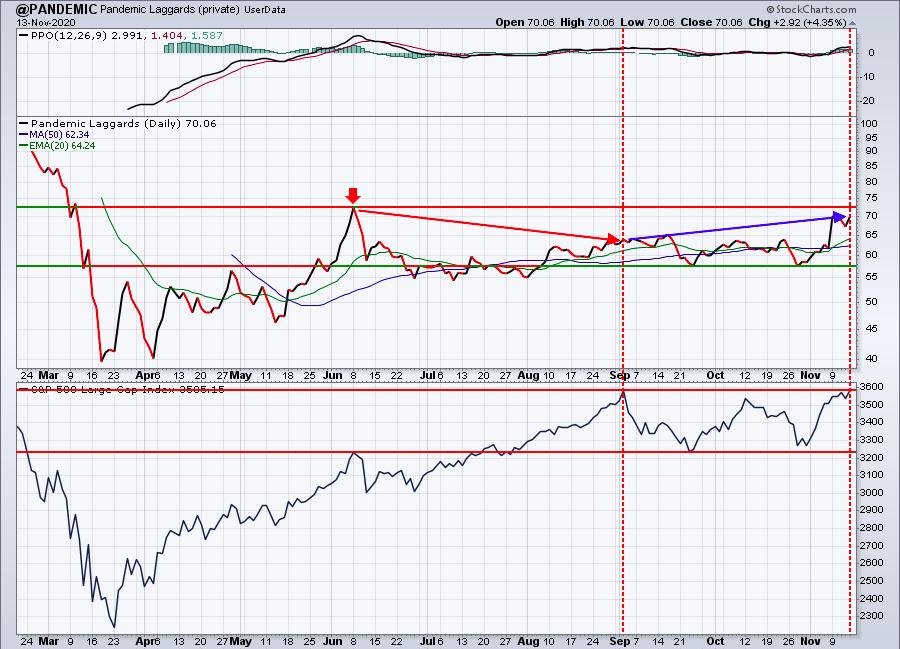

Pandemic Index: Recent Relative Strength Means We Should Start Looking At Different Industries

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Ever since the worst industry groups in March and April revealed themselves, I've been tracking what I refer to as my Pandemic Index. It's an equal-weighted index of the 10 worst performing industry groups during the pandemic's first few months. A key resistance level...

READ MORE

MEMBERS ONLY

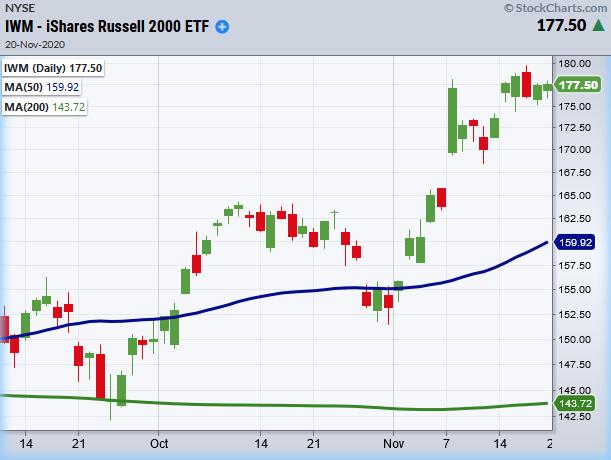

Sector And Industry Rotation Is The Most Important Factor In Outperforming The S&P 500.....And It's Changing

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

During the initial stages of the pandemic in March and April, it became quite clear to me that companies with a strong online brand and presence were set to outperform the broad S&P 500 index. The accumulation/distribution line (AD line) pointed us towards those companies that were...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Meets This Important Pattern Resistance; RRG Chart Shows Isolated Performance From These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a yet another gainful week for the markets, the Indian equities extended their move on the upside and posted decent weekly gains. The past five days saw the NIFTY moving higher and closing at its lifetime high levels. As compared to the week before this one, the trading range...

READ MORE

MEMBERS ONLY

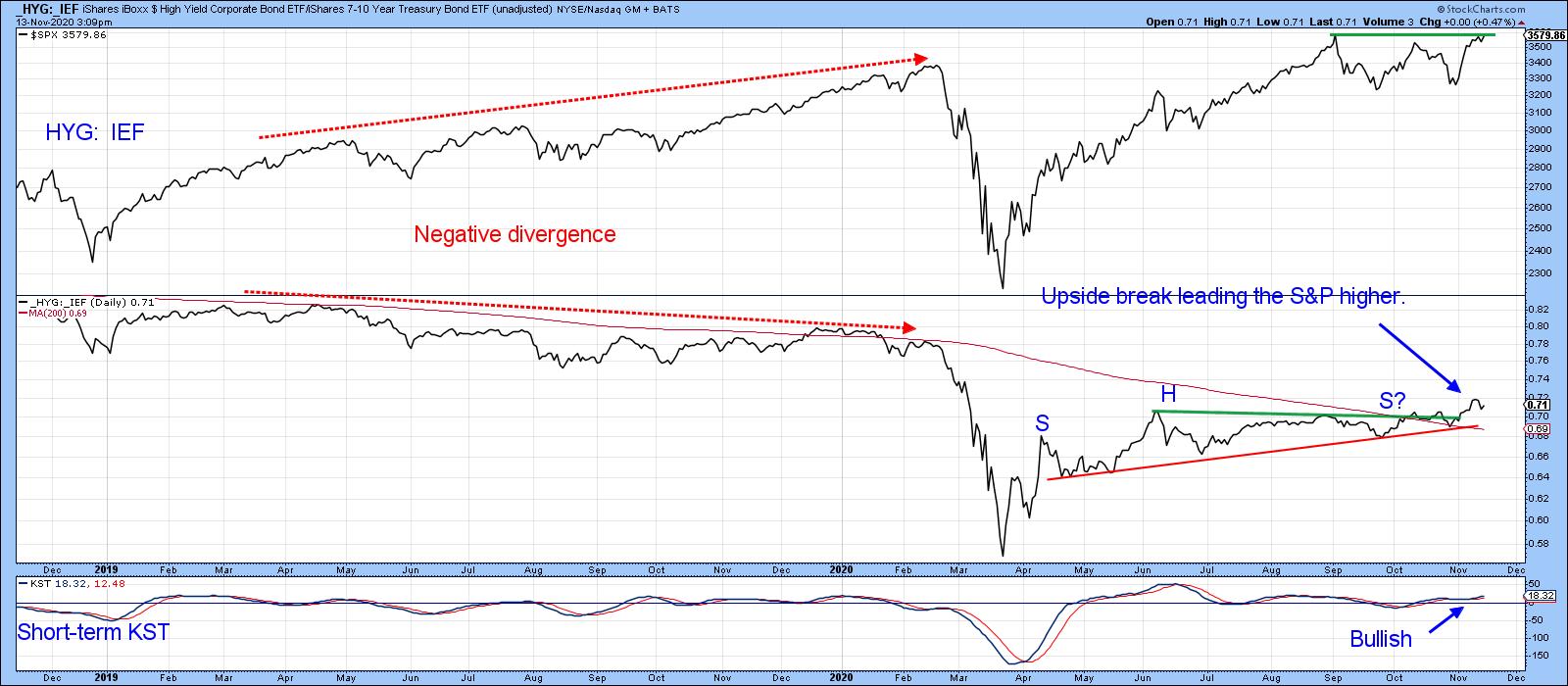

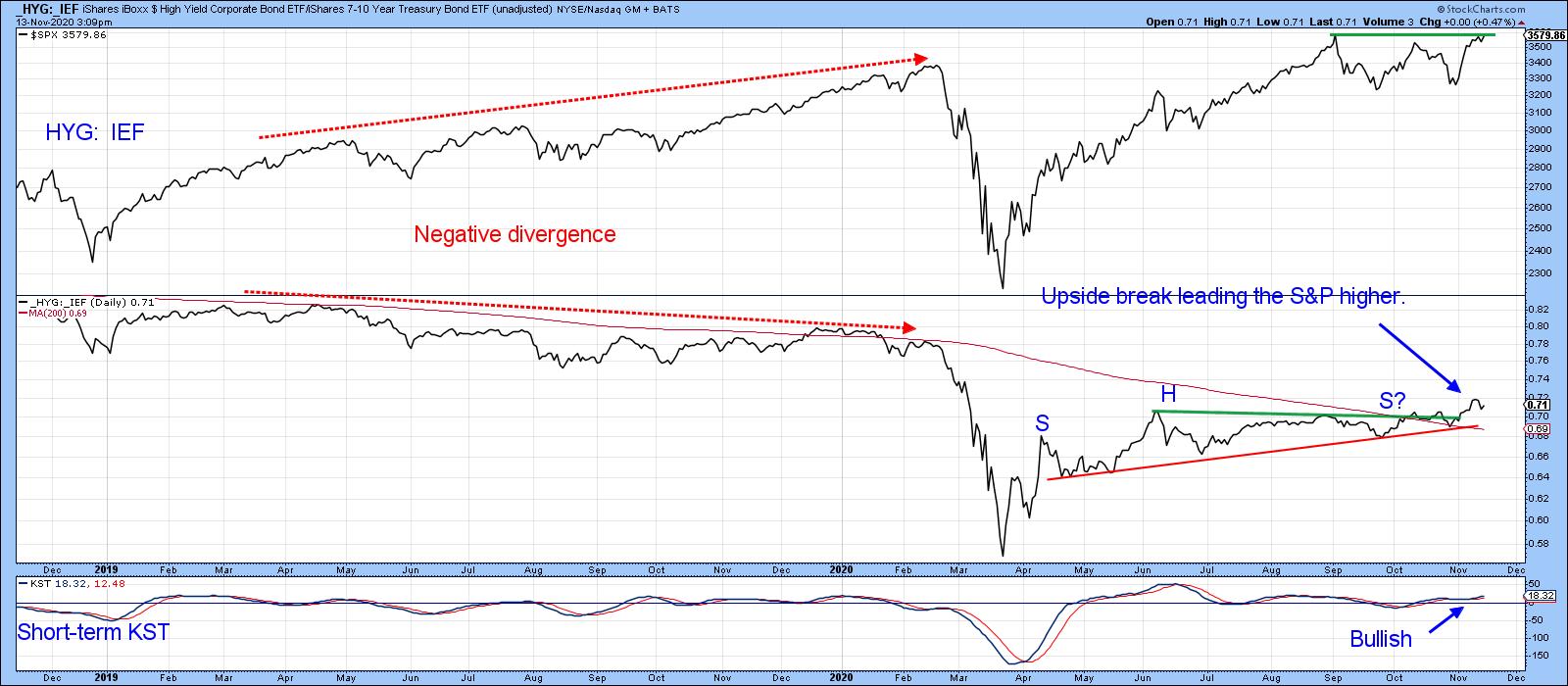

Confidence is Breaking Out All Over, Which is Bullish for Stocks/Commodities and Bond Yields

by Martin Pring,

President, Pring Research

Pfizer (PFE)'s announcement about a vaccine may have triggered a sharp rally on Monday, but its real effect was to boost confidence, which improved the status of a lot of different relationships that I follow, portending further gains for stocks and commodities down the road.

Swings in sentiment...

READ MORE

MEMBERS ONLY

It's Early, But Rotation is SCREAMING to Buy This Sector!

by John Hopkins,

President and Co-founder, EarningsBeats.com

This past week, we saw traders turning their attention away from some of the high-flying "Stay at Home" tech stocks to some other sectors that could fare well if the recently announced COVID vaccines have the promising effect that is hoped for. We've certainly noticed the...

READ MORE

MEMBERS ONLY

Will Small-Caps Hold Their Election Range?

Amid the news and initial reaction to this past Monday's selloff, we still need to take into account the week of the election range, or the range two weeks ago.

Created from Monday, Nov 2nd to Friday Nov 6th, the high and low from this period creates a...

READ MORE

MEMBERS ONLY

Energy Sector Still Has Potential + DP Diamond of the Week Ready to Explode Higher!

by Erin Swenlin,

Vice President, DecisionPoint.com

Energy was the big winner this week as it gapped up on the open Monday. Since then, price has consolidated somewhat and could be forming a reverse island formation. Looking under the hood at our indicators for XLE, we have quite a few that are very overbought. The 20-EMA is...

READ MORE

MEMBERS ONLY

Major Shift in Markets -- Best Ways to Capitalize!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the rotation taking place in the markets following news of a possible vaccine. She also shares top candidates in Biotech stocks as major innovations take place there. In addition, short squeeze plays are uncovered as investors were...

READ MORE

MEMBERS ONLY

Discipline Is A Synonym For Profitability In The Stock Market - Here's How To Achieve Both

by Gatis Roze,

Author, "Tensile Trading"

Maintaining the mindset of a serious investor takes discipline. Personally, I have found necessary motivations amongst sports analogies and metaphors. I confess — I lean on them heavily. After 30 years, I've learned that stock market profitability is a synonym for discipline.

Anyone who doubts this should read Michael...

READ MORE

MEMBERS ONLY

Two Biotech ETFs: One Stands Out as the other Forges a Big Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the Biotech ETF (IBB) and the Biotech SPDR (XBI) represent the same industry group, their composition is very different and one is clearly outperforming the other. Nevertheless, the laggard still has a big bullish continuation pattern and this group looks bullish as a whole.

First, let's...

READ MORE

MEMBERS ONLY

DOW AND S&P 500 HOLD THEIR GAPS -- NASDAQ HOLDS ITS 50-DAY LINE -- SMALL CAPS TURN UP -- SO DO FINANCIALS -- VALUE/GROWTH RATIO MAY BE BOTTOMING

by John Murphy,

Chief Technical Analyst, StockCharts.com

MONDAY BREAKOUTS ARE STILL INTACT... Stocks are ending the week on a firm note; and are holding onto upside gap breakouts achieved earlier in the week. Stock indexes have spent the week consolidating their sharp gains on Monday and are remaining above some chart support levels. Chart 1 shows the...

READ MORE