MEMBERS ONLY

Keeping Your Mind on the Right Side of the Market

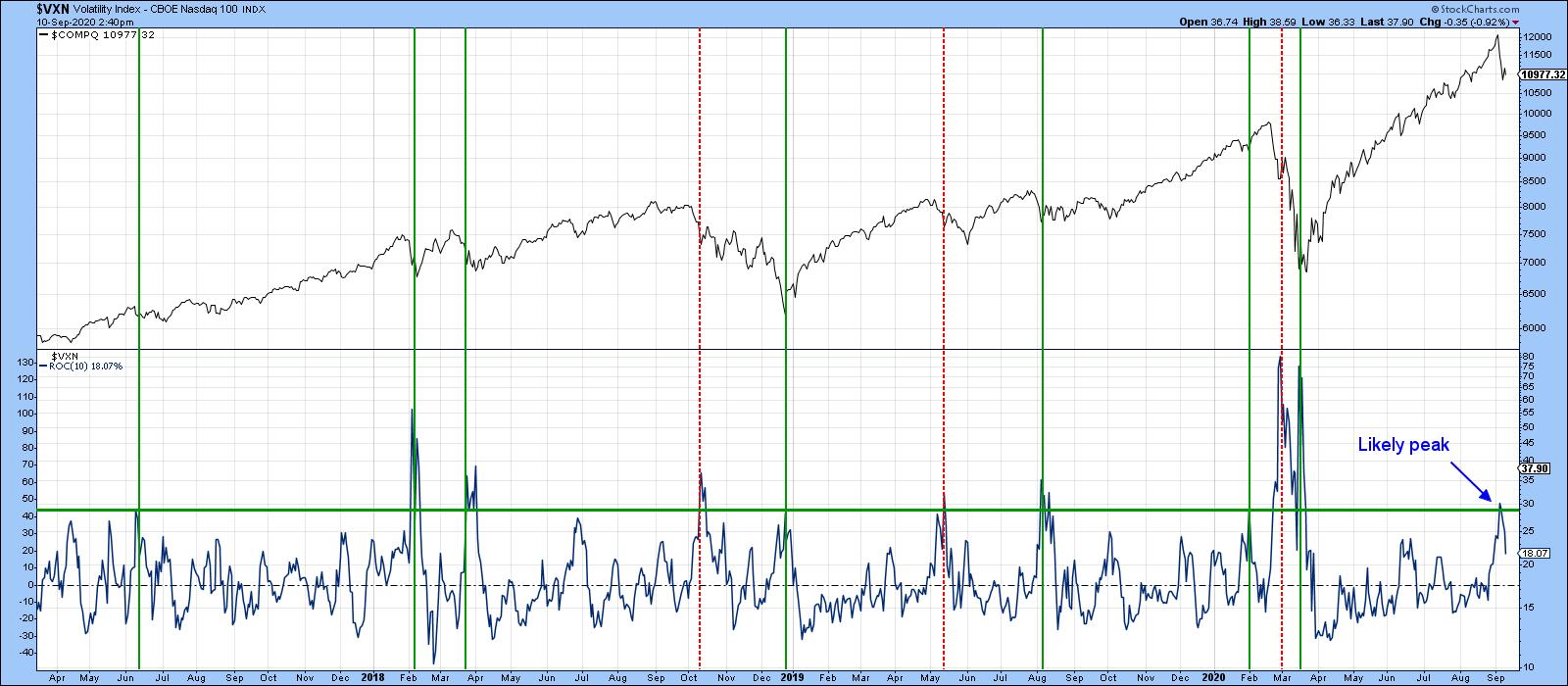

Yesterday, we were watching the VXX to gauge fear in the market. Today, it gapped higher and then continued to sell off while the indices gapped lower and began to rise.

Now the QQQs, DIA and SPY, while selling off from the highs, had some end-of-day buying comeback, which pushed...

READ MORE

MEMBERS ONLY

Chartwise Women: Finding Your Comfort Stocks

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

As the country has maneuvered through the pandemic, one thing we all can agree on is the need for comfort. In this week's edition of Chartwise Women, Erin and Mary Ellen explain why investing in stocks or products you know can give you investing insight. Walk with Mary...

READ MORE

MEMBERS ONLY

Some Sectors Starting to Rotate from their Post-March Pattern

by Martin Pring,

President, Pring Research

From time to time, I like to review the various sectors to see which ones are in a positive or negative relative trend and which might be in a position to change. To do this, I use what I call my Nirvana Template or, in StockCharts-speak, Nirvana Chart Style. It...

READ MORE

MEMBERS ONLY

NASDAQ LEADS TODAY'S RETREAT -- LAST WEEK'S LOWS ARE BEING RETESTED -- SO ARE 50-DAY AVERAGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES RETEST LAST WEEK'S LOW... Stocks are under pressure and are retesting lows formed late last week. And are putting 50-day moving averages in jeopardy on daily charts. The tech-driven Nasdaq is leading today's retreat. The hourly bars in Chart 1 show the Invesco...

READ MORE

MEMBERS ONLY

Sentiment Issues Have Evolved Into Technical Issues - Be Careful!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

This is a copy of today's DMR that I just sent to our members. I believe we're setting up for a HUGE rally in Q4 and the current weakness will provide tremendous opportunities. In the very short-term, however, we need to get through the next...

READ MORE

MEMBERS ONLY

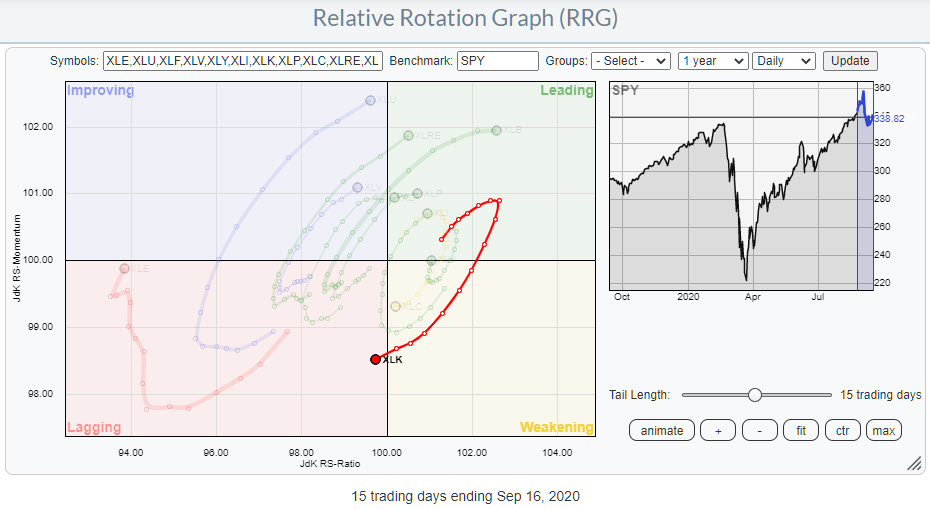

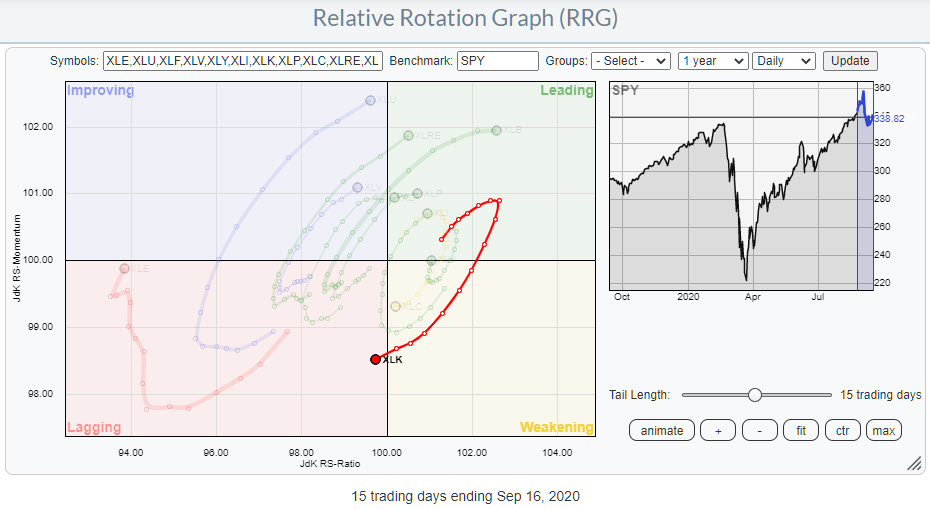

Is the Technology Sector at Risk?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

At yesterday's close XLK, the technology sector, rotated into the lagging quadrant. This happened a few times since the market started to rally out of the March low. On the daily chart to be exact.

On the weekly RRG, XLK remained far to the right inside the leading...

READ MORE

MEMBERS ONLY

Market Loves/Hates Fed Days

Last night we wondered, is the market correction was over? After all, both SPY and QQQs traded into resistance. For SPY, that number is 342; for the QQQs, it's 282. The DIA had to hold 28,000.

Today, SPY tried to clear 342, but wound up closing red...

READ MORE

MEMBERS ONLY

DOW TRANSPORTS NEAR NEW RECORD -- FEDEX IS THE DAY'S BIGGEST WINNER -- AIRLINES ARE STARTING TO HELP -- SOUTHWEST AIRLINES TESTING JUNE HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS NEAR RECORD TERRITORY...The weekly bars in Chart 1 show the Dow Transports rising above their late 2019 peak and challenging their 2018 intra-day peak at 11623. A close above that level would put the Dow Transports in record territory. Their relative strength ratio in the upper box...

READ MORE

MEMBERS ONLY

"A Man's Got to Know His Limitations"

by Carl Swenlin,

President and Founder, DecisionPoint.com

That's the line spoken by Dirty Harry in Magnum Force right after he blew away his crooked boss. I also personally use that line to curb any tendency toward hubris I might have. For example, if you put me and Greg Morris in the same room, there is...

READ MORE

MEMBERS ONLY

How Does this Really Work?

by Dave Landry,

Founder, Sentive Trading, LLC

Dave believes in the importance of his methodology in action - what he is really doing and what makes him do it, warts and all. It doesn't work all the time, but does over time. In this edition of Trading Simplified, Dave revisits mystery charts and, introduces some...

READ MORE

MEMBERS ONLY

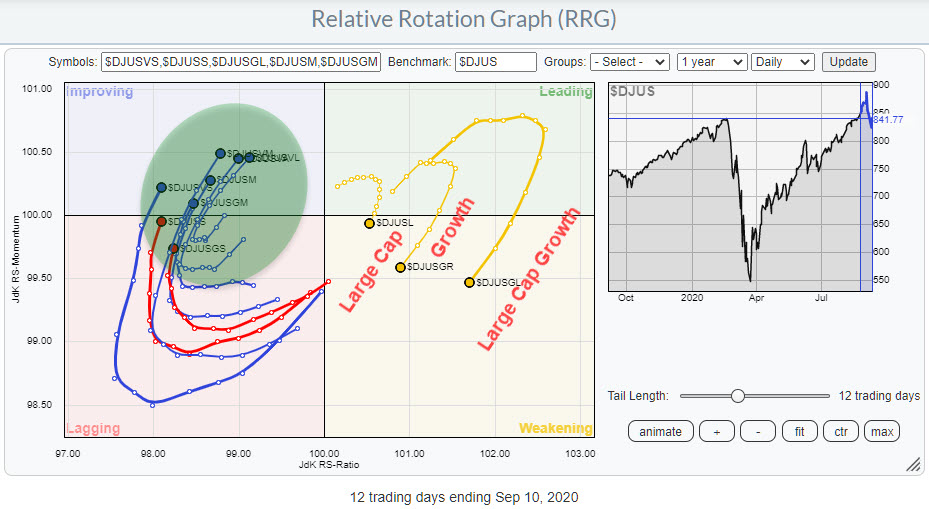

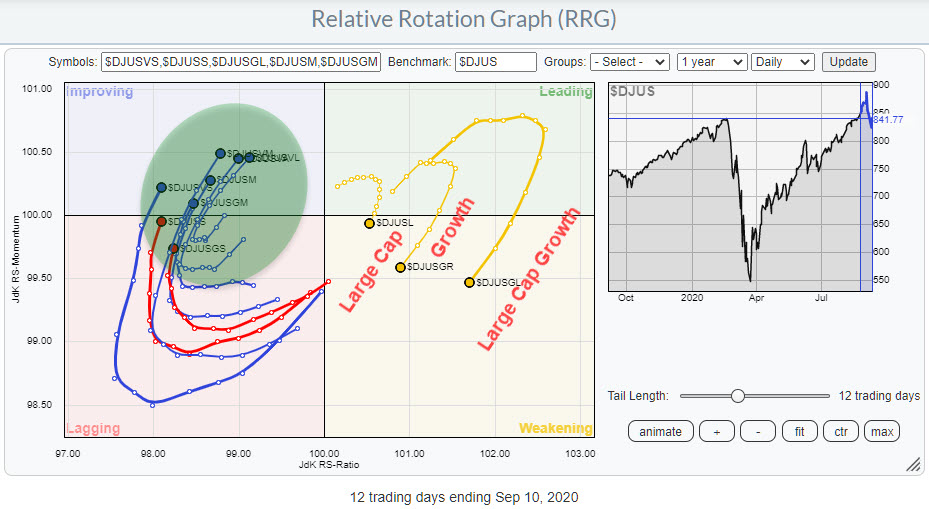

Sector Spotlight: A Full Mailbag

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of Sector Spotlight, I present the usual look at the rotations for Asset Classes and US Sectors via Relative Rotation Graphs. In addition, the better part of the show is spent on answering questions from the mailbag. These questions range from slowing down animations on RRGs to...

READ MORE

MEMBERS ONLY

A Rally to Resistance

Is the market correction over?

Although a 10-15% correction is normal, the bigger question is whether the bounce we just saw from recent lows is a sell (rather than buy) opportunity. Both SPY and QQQs are trading into resistance. In SPY that number is 342; for the QQQs, we are...

READ MORE

MEMBERS ONLY

MATERIALS SPDR HITS NEW RECORD -- AVERY DENNISON AND WESTROCK ACHIEVE BULLISH BREAKOUTS -- DOW HOLDINGS HEADING TOWARD 2019 HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

MATERIALS SPDR HITS NEW RECORD... Stocks are trading higher today with ten of eleven sectors in the green. The only one to hit a new record is shown below. Chart 1 shows the Materials SPDR (XLB) trading at a new record high. Its relative strength line in the upper box...

READ MORE

MEMBERS ONLY

Key Ratios Speak to Market Rotation

by David Keller,

President and Chief Strategist, Sierra Alpha Research

"Great chart, but it seems super short-term. When would you get out of this?"

That was the reaction I received on social media when I posted this chart showing the relative strength of semiconductors to the S&P 500.

In terms of my process, I focus my...

READ MORE

MEMBERS ONLY

VALUE STOCKS CONTINUE TO LAG BEHIND GROWTH STOCKS -- FINANCIALS ARE HOLDING VALUE BACK -- RATIOS SHOW GROWTH STILL IN THE LEAD

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 GROWTH ISHARES HOLD 50-DAY LINE... A lot has been written about the relationship between growth and value shares. During last week's pullback in technology shares, cheaper value stocks held up better which raised questions about whether a rotation was starting from growth into value...

READ MORE

MEMBERS ONLY

XLC and XLK Continue to Lose Relative Strength, Which is Picked Up by the Rest of the Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week, the rotations for the Communication Services and Technology sectors continued on their trajectory deeper into the weakening quadrant, heading towards lagging. As always with relative strength, one sector's loss is another sector's gain - or, in this case three sectors' losses are the...

READ MORE

MEMBERS ONLY

What Impact Will Monthly Options Expiration Have In September?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's max pain time.

Every month as we approach monthly options expiration, I go through an exercise to evaluate the open interest of puts and calls to help determine the likely short-term direction of equities. It provides me no guarantee. Rather, it serves as another tool in my...

READ MORE

MEMBERS ONLY

DP Show: Time to Jump Back into Natural Gas?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin debate whether it's time to jump back in to Natural Gas (UNG). Erin zeroes in on the Nasdaq and Technology Sector (XLK) to determine if today's bounce is a beginning of finer things to come; she takes a...

READ MORE

MEMBERS ONLY

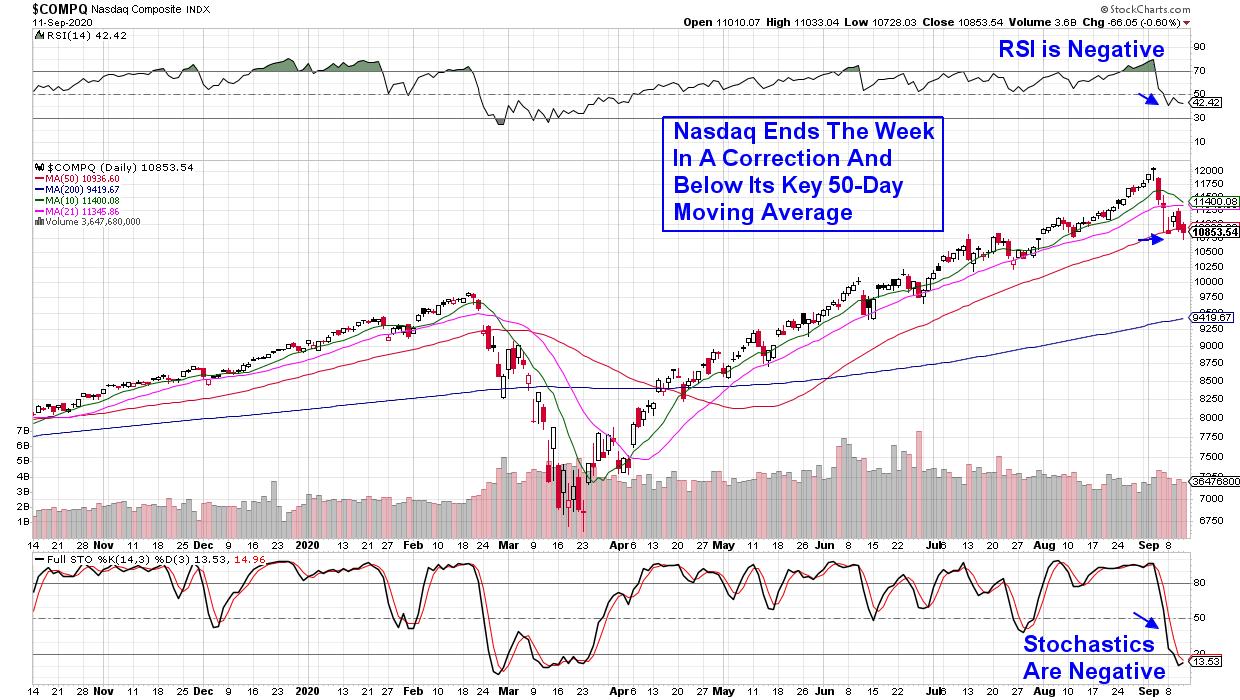

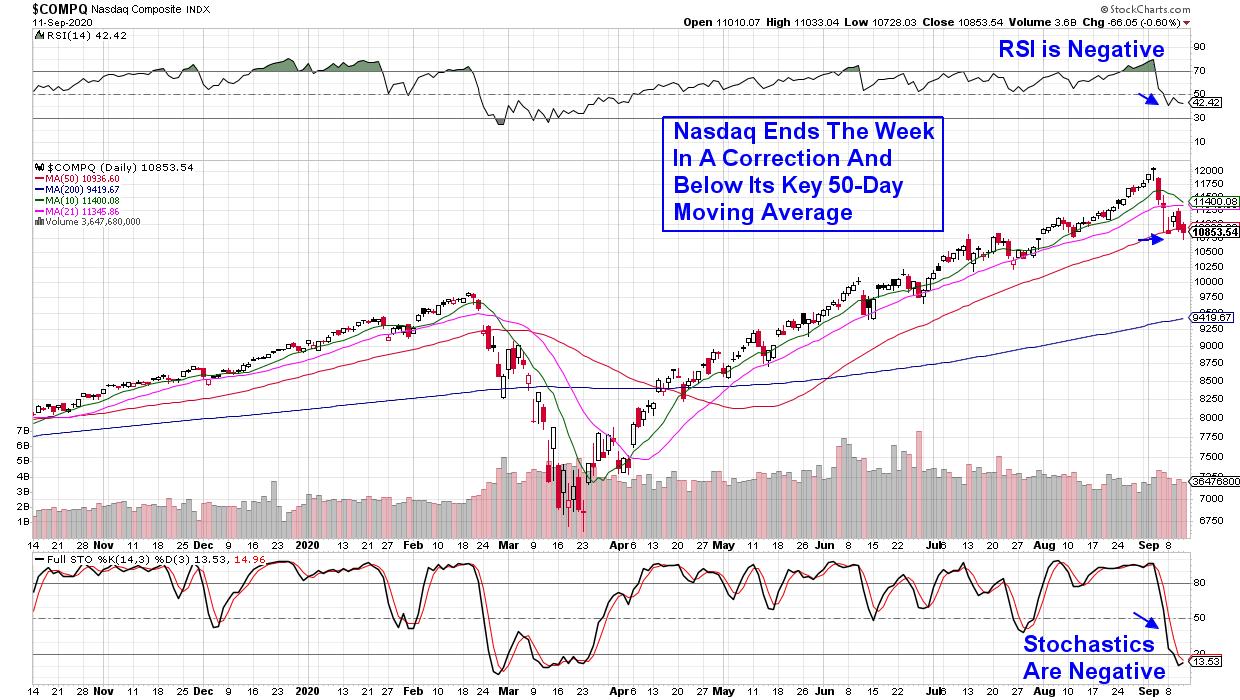

Is the Correction in Technology Over?

by Erin Swenlin,

Vice President, DecisionPoint.com

This is an excerpt from today's DecisionPoint Alert on DecisionPoint.com:

It may only be a one-day bounce, but the questions are already appearing..."Is the correction over in Technology? Is this a BUY point?" Below I have the chart of the Nasdaq, followed by the...

READ MORE

MEMBERS ONLY

Mergers and Pfizer (PFE) Give the Market Hope

On Friday the 11th, the QQQs (Nasdaq) and IWM (Russell 2000) both closed under the 50-DMA. They were not followed by their friends the DIA (DowJones) and the SPY (S&P 500). The temporary divergence they were in has quickly been resolved because all four are now back over...

READ MORE

MEMBERS ONLY

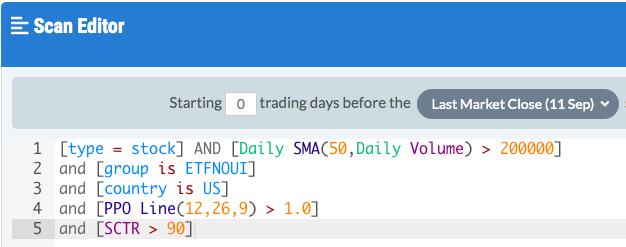

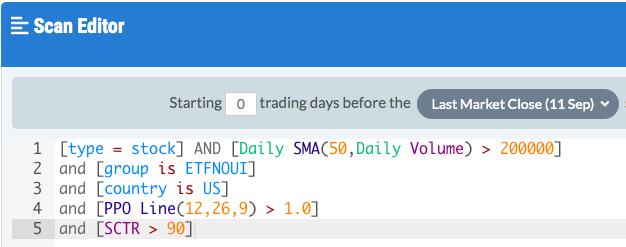

Building A Winning Portfolio Of ETFs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At EarningsBeats.com, we provide market guidance and analysis of the major indices, sectors, industry groups, and individual stocks. Our research provides our members with various ChartLists to organize strong trading candidates by categories such as Strong Earnings, Strong AD, Short Squeeze, etc. Over the years, I've never...

READ MORE

MEMBERS ONLY

The Importance of Rising Growth vs. Value Ratio

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I follow a very simple ratio every day, which is the iShares Russell 1000 Growth ETF vs. the iShares Russell 1000 Value ETF (IWF:IWD). This ratio tells us whether traders have the necessary risk appetite that typically drives equity prices higher, especially the NASDAQ, which is littered with high-growth...

READ MORE

MEMBERS ONLY

Week Ahead: This Fractal Pattern is a Concerning Factor for Near Term; RRG Charts Warn to Stay Sector-Specific

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equities ended the week with modest gains, as they struggled to keep afloat when the global markets showed sharp corrective moves that led to the revision of means. In a trading range that stayed narrower compared to the week prior, the headline index ended with gains, while the...

READ MORE

MEMBERS ONLY

Buffering Your Portfolio With Attractive High Yielders

by Mary Ellen McGonagle,

President, MEM Investment Research

Fast moving Growth stocks have been taking it on the chin with the Tech-heavy Nasdaq now down over 10% from its recent peak in price. The drop puts this Index into a correction which has investors on the lookout for more potential downside.

DAILY CHART OF NASDAQ COMPOSITE

Those who...

READ MORE

MEMBERS ONLY

Is There More Corrective Activity Ahead?

by Martin Pring,

President, Pring Research

Some Indicators Have Moved to Levels Consistent with a Low

Most corrections in a bull market fall in the 5-10% range. On Thursday, the NASDAQ is down 10% intraday and the S&P Composite 7%, so it's not unrealistic to conclude that the correction might be over....

READ MORE

MEMBERS ONLY

Will the Markets Crash?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the status of the markets and what to be on the lookout for going forward. In addition, she shares attractive high-yield stocks to help buffer against the drop in growth names, as well as growth stocks holding...

READ MORE

MEMBERS ONLY

Dominant Energy Supplier is Still Coal

Partly inspired by our recent trip throughout the West, and also partly inspired by our long position in Teck Resources Limit (TECK), which gained over 11% on Friday while the SPY closed basically flat, coal is the topic for the weekend.

Coal is the major supplier to steel and utilities....

READ MORE

MEMBERS ONLY

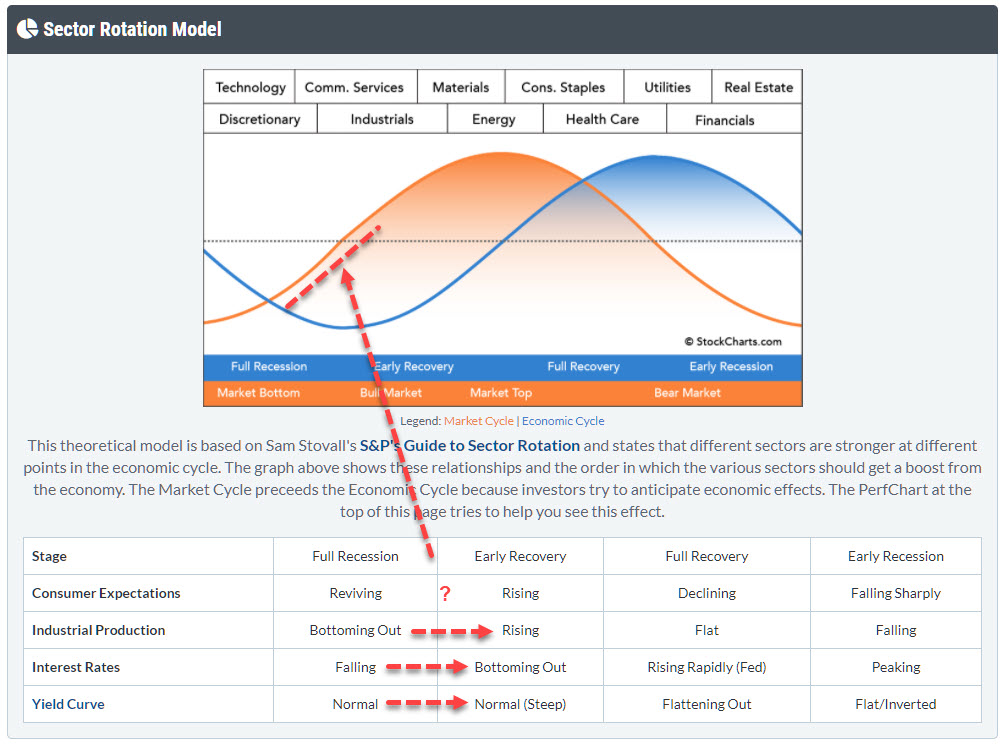

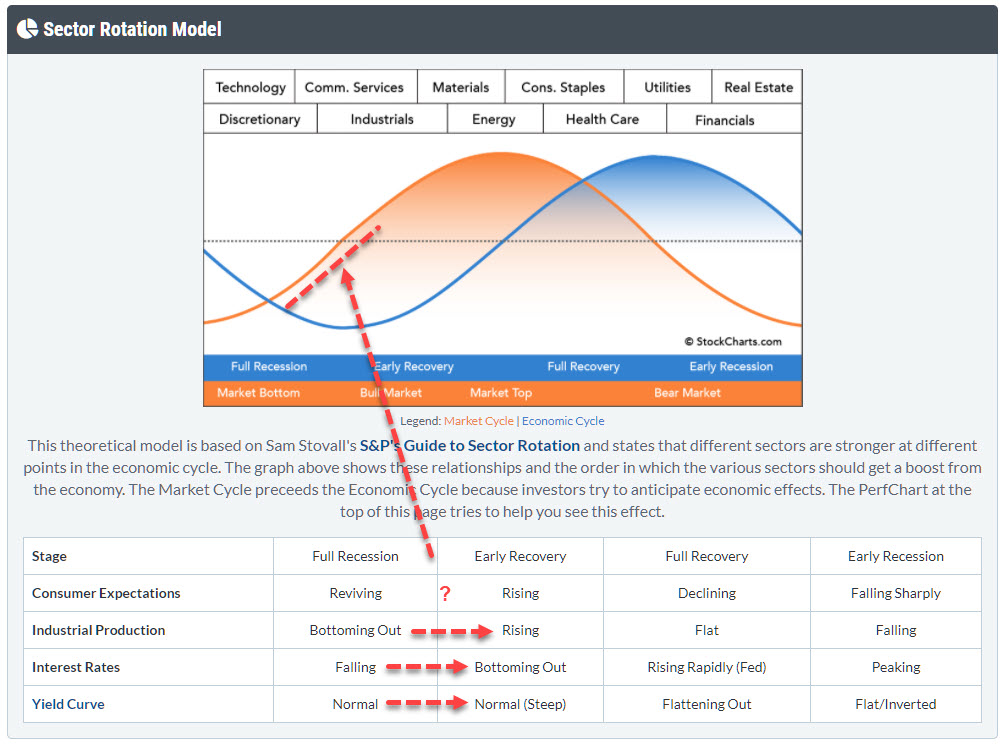

Are We Just Coming Out of a Full Recession?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With markets flying everywhere from day to day, I want to take a step back in this article and look at the bigger economic cycle picture, in order to see if we can fit things into the "Sector Rotation Model" as it can bee seen under the PerfCharts....

READ MORE

MEMBERS ONLY

The Ratios Speak to Market Rotation

by David Keller,

President and Chief Strategist, Sierra Alpha Research

"Great chart, but it seems super short-term. When would you get out of this?"

That was the reaction I received on social media when I posted this chart showing the relative strength of semiconductors to the S&P 500.

In terms of my process, I focus my...

READ MORE

MEMBERS ONLY

Here are 3 Ways to Calculate S&P 500 Downside Targets

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Despite remaining very bullish, I've written several short-term bearish articles lately, mostly dealing with extreme sentiment issues. Those sentiment extremes have been rectified and are no longer a problem, but they've now changed the mentality in the market from "buy on the dip" to...

READ MORE

MEMBERS ONLY

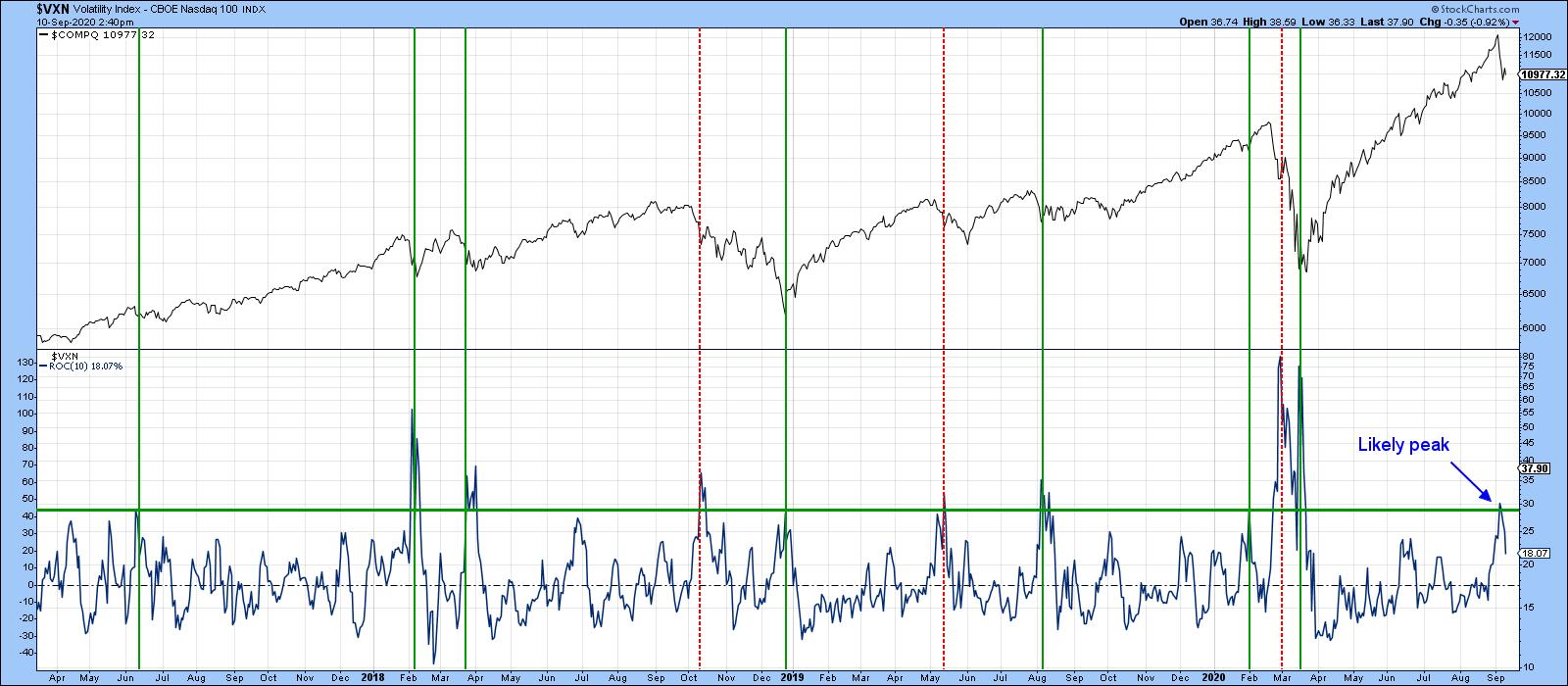

A NUMBER OF NEGATIVE DIVERGENCES SUGGEST MORE VOLATILITY AHEAD

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNICAL DIVERGENCES WARN OF MORE VOLATILITY... We're all focused on the meaning and severity of the recent selloff in stocks and trying to determine if this is a short-term pullback or something more serious. A number of technical divergences that have appeared on price charts suggest that the...

READ MORE

MEMBERS ONLY

Silver Crosses Lose Some Shine

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are fewer silver crosses in the major stock indexes and this shows less participation during the last leg higher, a situation that could foreshadow a correction.

A silver cross occurs when the 20-day EMA crosses above the 50-day EMA. DecisionPoint took this concept on step further and developed breadth...

READ MORE

MEMBERS ONLY

Chartwise Women: Should You Trade the Current Markets?

by Mary Ellen McGonagle,

President, MEM Investment Research

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of Chartwise Women, Mary Ellen and Erin review how to handle your stocks depending on your investment horizon. They also share ways to stay on top of sector rotation as well as the broader markets.

This video was originally recorded on September 10th, 2020....

READ MORE

MEMBERS ONLY

Taking a Temperature Check on the Modern Family

WIth the SPY, QQQ, DIA, and IWM closing down on the day, now it's a good time to check the health of the Modern Family to give us a bigger picture of the market.

Above, you can see the weekly charts for Modern Family (IWM, IYT, XRT, KRE,...

READ MORE

MEMBERS ONLY

If it's a Bull Market Correction, What Should We Look for to Signal the All-Clear?

by Martin Pring,

President, Pring Research

* Some Indicators Have Moved to Levels Consistent with a Low

* Others Suggest the Likelihood of More Corrective Activity

* Indicators that Should Be Monitored for a Possible Upside Reversal

Some Indicators Have Moved to Levels Consistent with a Low

Most corrections in a bull market fall in the 5-10% range. So...

READ MORE

MEMBERS ONLY

Where Is All That Money Going To?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week's selloff primarily hit some mega-cap names in Technology, Communication Services and Discretionary stocks. For sure, it shook up markets pretty well and, as usual, the selling of risk assets led to an inflow into risk-off assets like bonds and more defensive sectors.

Another ways of breaking...

READ MORE

MEMBERS ONLY

This Short Squeeze Stock Has Gained 170%+ In A Month

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When you own a stock in a short squeeze, your investing world looks a lot brighter. There are many traders that live and die with short positions, which I'll never understand. But hey whatever works, right? I'm not an advocate of blindly buying heavily shorted stocks...

READ MORE

MEMBERS ONLY

AN HOURLY LOOK AT QQQ REBOUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

HOURLY CHART SHOWS OVERHEAD RESISTANCE... The hourly price bars in Chart 1 show the Invesco QQQ Trust which measures the Nasdaq 100 Index trying to build on yesterday's bounce off its 50-day moving average. The big question is whether a bottom has been seen, or whether more testing...

READ MORE

MEMBERS ONLY

Market Bears' Whitewater Raft Now Dry-Docked

The 50-DMA did its job! After a perfect touchdown in the NASDAQ QQQs to the 50-DMA at 270, today the NASDAQ gained 2.92%.

All the issues for the tech drop -- Softbank, overbought conditions, lack of a stimulus deal, China tensions, vaccine delays, etc. -- got the bears suited...

READ MORE

MEMBERS ONLY

One Pattern to Success

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave presents the pattern that he sees as the key one to know for success. He also analyzes the Mystery Charts he has presented in the past and their phenomenal performance since he covered them, then caps things off with a discussion of volatility....

READ MORE