MEMBERS ONLY

The NASDAQ 100, On The Brink Of A Breakout, Needs Help From This Group

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

U.S. stocks are on the cusp of a very impressive breakout to all-time highs, but are still missing one key ingredient. They need help in the form of a semiconductors ($DJUSSC) breakout of its own. When the DJUSSC reached its all-time high on June 20, 2024, one year ago,...

READ MORE

MEMBERS ONLY

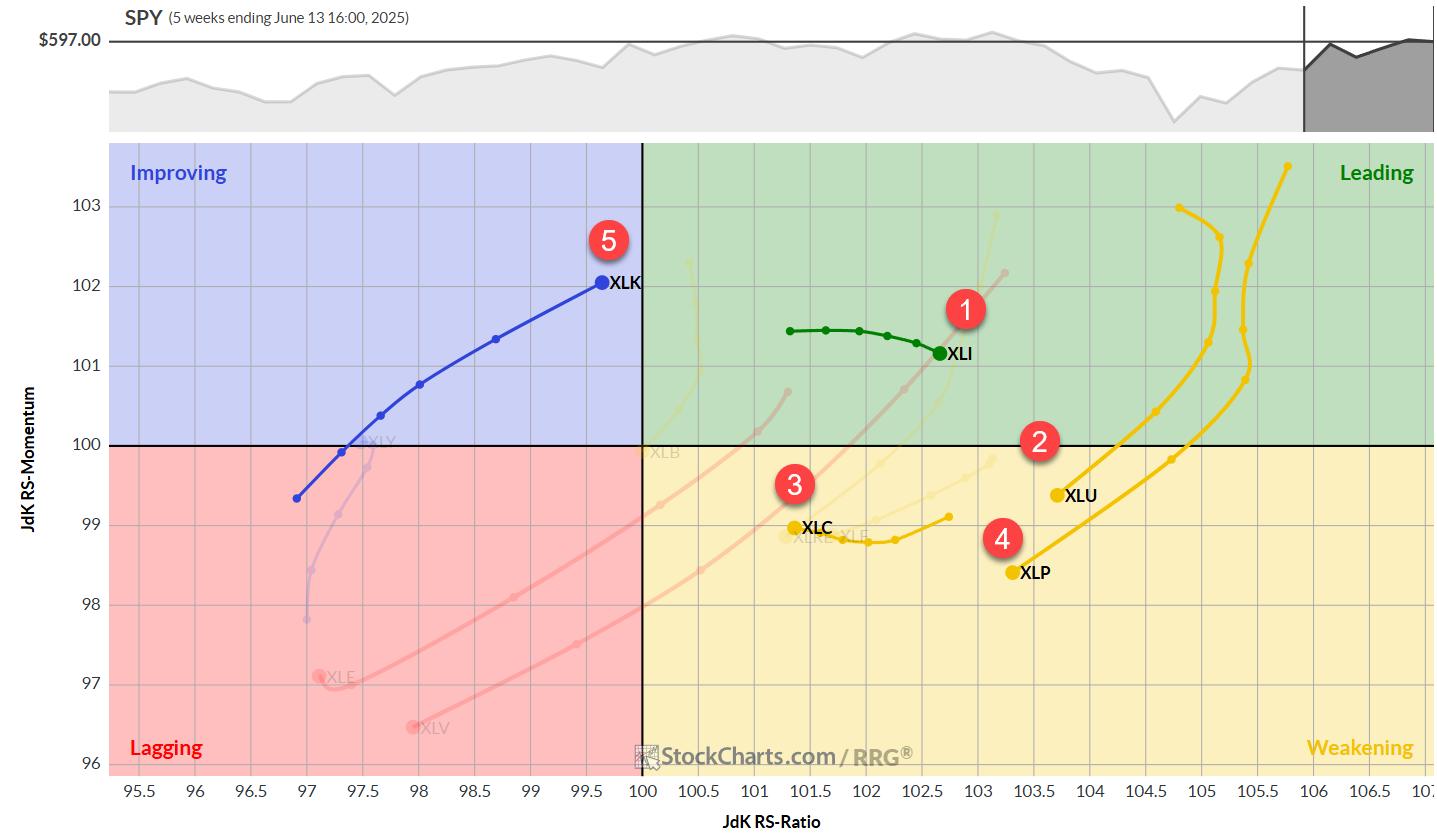

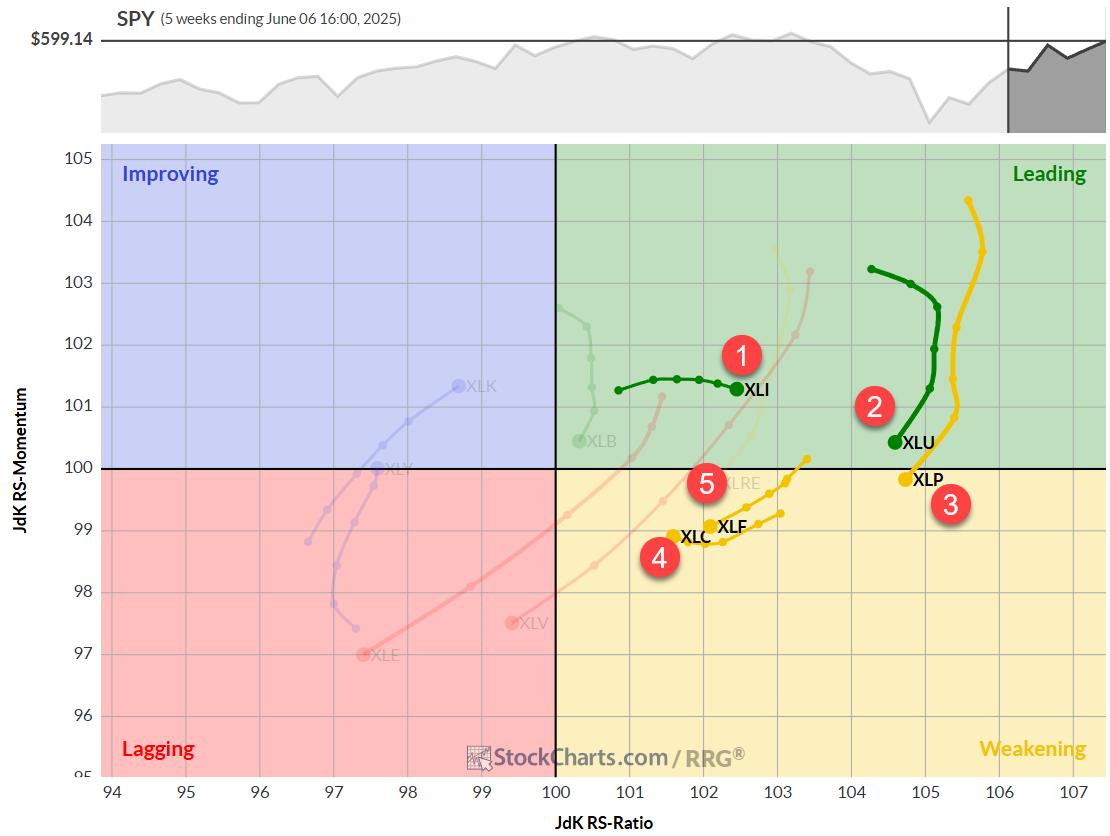

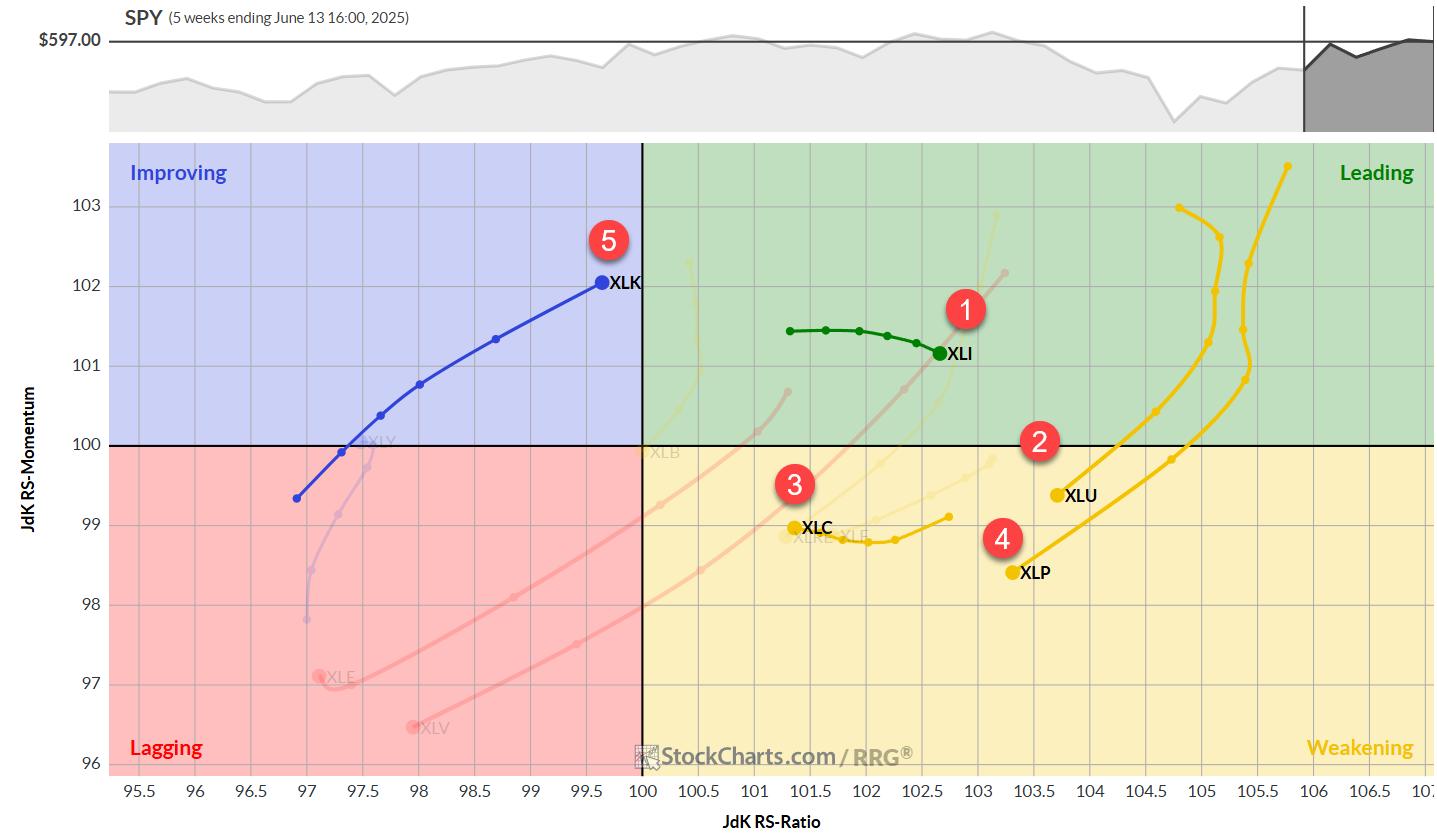

RRG Alert Tech Vaults to ‘Leading'—Is XLK Signaling a New Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This week, Julius breaks down the current sector rotation using his signature Relative Rotation Graphs, with XLK vaulting into the leading quadrant while utilities and staples fade. He spotlights strength in the technology sector, led by semiconductors and electronic groups that are outpacing the S&P 500. Microchip heavyweights...

READ MORE

MEMBERS ONLY

The Fed Is Getting It Wrong AGAIN As They Hold Rates Steady

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Fed should absolutely stop talking about being "data dependent". That's so far from the truth. If they were data dependent, we'd have either seen a rate cut today or Fed Chief Powell would have been discussing one for the next meeting. Inflation reports...

READ MORE

MEMBERS ONLY

Feeling Unsure About the Stock Market's Next Move? These Charts Can Help

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

When the stock market seems to be drifting sideways without displaying a clear bullish or bearish bias, it's normal for investors to get anxious. It's like being at a crossroads, wondering whether to go left, right, or stay put.

The truth is nobody has a crystal...

READ MORE

MEMBERS ONLY

The Secret To Streamlining Your Charting Workflow

by Grayson Roze,

Chief Strategist, StockCharts.com

Grayson explores a hidden gem on the SharpCharts platform: StyleButtons! These handy little customizable tabs give you quick, one-click access to your favorite chart templates, allowing you to jump from ChartStyle to ChartStyle with a seriously streamlined charting workflow. Grayson demonstrates how to create and save ChartStyles and assign them...

READ MORE

MEMBERS ONLY

Joe Rabil's Undercut & Rally Pattern: From DROP to POP

by Joe Rabil,

President, Rabil Stock Research

Joe presents his game-changing "undercut and rally" trading pattern, which can be found in high volatility conditions and observed via RSI, MACD and ADX signals. Joe uses the S&P 500 ETF as a live case study, with its fast shake-out below support followed by an equally...

READ MORE

MEMBERS ONLY

3 S&P 500 Charts That Point to the Next Big Move

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Follow along with Frank as he presents the outlook for the S&P 500, using three key charts to spot bullish breakouts, pullback zones, and MACD signals. Frank compares bearish and bullish setups using his pattern grid, analyzing which of the two is on top, and explains why he&...

READ MORE

MEMBERS ONLY

G7 Meeting in Canada Could Be Opportune Time for Accumulating Canadian Dollar and Canadian Equities

by Martin Pring,

President, Pring Research

The Canadian dollar peaked in 2007 and 2011 at around $1.05, and it has been zig-zagging downwards ever since. Now at a lowly 73 cents USD, the currency looks as if it may be in the process of bottoming, or at the very least entering a multi-year trading range....

READ MORE

MEMBERS ONLY

Navigate the Stock Market with Confidence

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

When you see headlines about geopolitical tensions and how the stock market sold off on the news, it can feel unsettling, especially when it comes to your hard-earned savings. But what you might not hear about in the news is what the charts are indicating.

Look at what happened in...

READ MORE

MEMBERS ONLY

Diving into Energy Investments: Uncover Hidden Gems Today!

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

With oil prices surging and geopolitical unrest stirring in the Middle East, it's no surprise that energy stocks are drawing renewed attention. And, quite frankly, this week didn't have many market-moving earnings. So this week, we skate to where the puck is, or, in this case,...

READ MORE

MEMBERS ONLY

Major Shift in the Markets! Here's Where the New Strength Is

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, Mary Ellen spotlights breakouts in Energy and Defense, Technology sector leadership, S&P 500 resilience, and more. She then unpacks the stablecoin fallout hitting Visa and Mastercard, highlights Oracle's earnings breakout, and shares some pullback opportunities.

This video originally premiered June 13, 2025. You...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #23

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This Time Technology Beats Financials

After a week of no changes, we're back with renewed sector movements, and it's another round of leapfrogging.

This week, technology has muscled its way back into the top five sectors at the expense of financials, highlighting the ongoing volatility in...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Continue Showing Resilience; Broader Markets May Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

An attempt to break out of a month-long consolidation fizzled out as the Nifty declined and returned inside the trading zone it had created for itself. Over the past five sessions, the markets consolidated just above the upper edge of the trading zone; however, this failed to result in a...

READ MORE

MEMBERS ONLY

Bearish Divergence Suggests Caution For S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With Friday's pullback after a relatively strong week, the S&P 500 chart appears to be flashing a rare but powerful signal that is quite common at major market tops. The signal in question is a bearish momentum divergence, formed by a pattern of higher highs in...

READ MORE

MEMBERS ONLY

Is a Bold Rotation Brewing in Healthcare and Biotech? Here's What to Watch Now

by Karl Montevirgen,

The StockCharts Insider

Catching a sector early as it rotates out of a slump is one of the more reliable ways to get ahead of an emerging trend. You just have to make sure the rotation has enough strength to follow through.

On Thursday morning, as the markets maintained a cautiously bullish tone,...

READ MORE

MEMBERS ONLY

Three Sectors Stand Out and One Sports a Bullish Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Three sectors stand out, with one sporting a recent breakout that argues for higher prices. Today's report will highlight three criteria to define a leading uptrend. First, price should be above the rising 200-day SMA. Second, the price-relative should be above its rising 200-day SMA. And finally, leaders...

READ MORE

MEMBERS ONLY

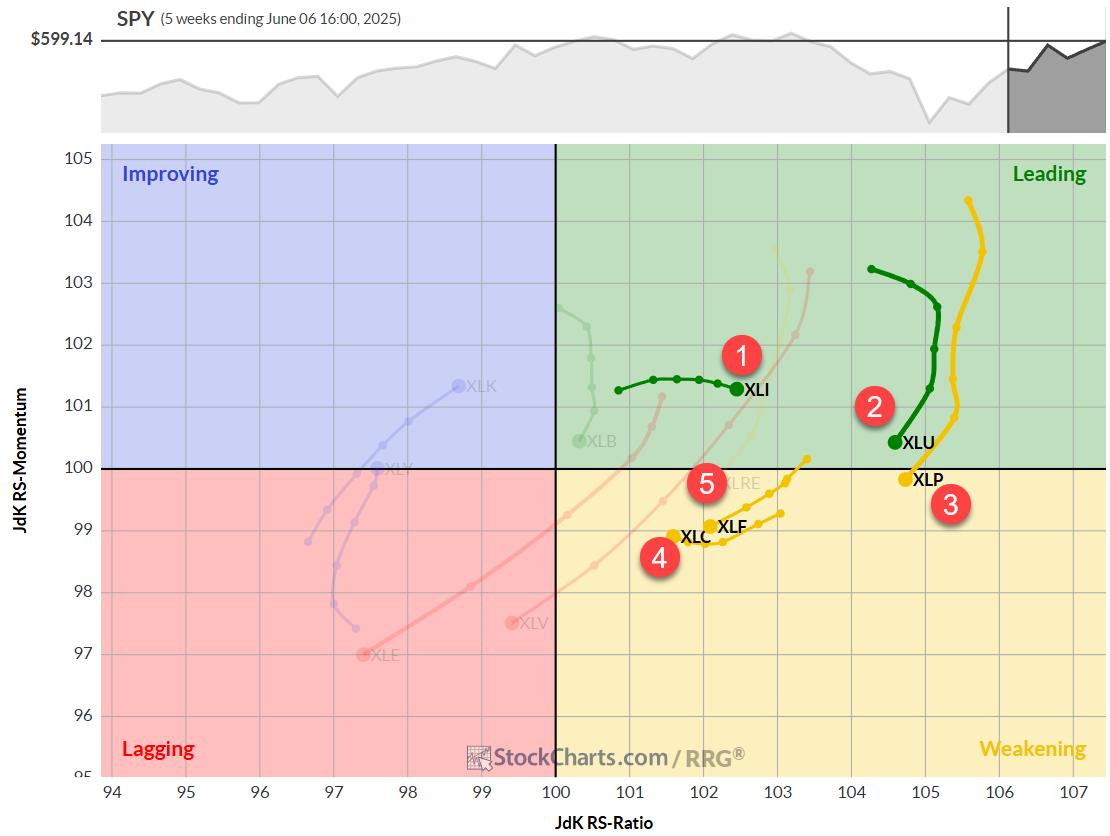

RRG Update: Is Tech Ready to Break Out?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This week, Julius shows how the Technology sector is edging toward leadership, alongside Industrials and soon-to-follow Communication Services. He highlights breakout lines for SPY, XLK, and XLC, noting that conviction climbs when daily and weekly RRG tails align to point northeast together. Bitcoin is sprinting into the leading quadrant next...

READ MORE

MEMBERS ONLY

What the S&P 500, VIX, and ARKK are Telling Us Now

by Frank Cappelleri,

Founder & President, CappThesis, LLC

While the S&P 500 ($SPX) logged a negative reversal on Wednesday, the Cboe Volatility Index ($VIX), Wall Street's fear gauge, logged a positive reversal. This is pretty typical: when the S&P 500 falls, the VIX rises.

Here's what makes it interesting: the...

READ MORE

MEMBERS ONLY

10‑Year Yield Warning! ADX + RSI Point to a Major Shift

by Joe Rabil,

President, Rabil Stock Research

Joe kicks off this week's video with a multi‑timeframe deep dive into the 10‑year U.S. Treasury yield (TNX), explaining why a sideways coil just below the 5% level could be "downright scary" for equities. From there, he demonstrates precise entry/exit timingwith a...

READ MORE

MEMBERS ONLY

Master Debit Spreads: Upgrade Your Options

by Tony Zhang,

Chief Strategist, OptionsPlay

Ready to elevate your options game?

In this must-watch video, options trading expert Tony Zhang dives deep into debit vertical spreads. He explains the key differences between single-leg options and debit vertical spreads, illustrates step-by-step how to set up these strategies, and teaches how you can master the art of...

READ MORE

MEMBERS ONLY

Unlocking Stock Market Insights: Identify Global Opportunities with StockCharts' Market Summary

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The U.S. stock market has been painting a subtle picture recently. While the broader indexes, such as the S&P 500 ($SPX), Nasdaq Composite ($COMPQ), and Dow Jones Industrial Average ($INDU), are indeed grinding higher, the daily movements have been relatively subdued. This is a noticeable shift from...

READ MORE

MEMBERS ONLY

This Widely Used Commodity Could Be About to Surprise Us on the Upside

by Martin Pring,

President, Pring Research

Chart 1 lays out the long-term momentum (KST) relationship between gold, copper, and crude oil for the last 30 years. The arrows slant towards the right, indicating that gold leads copper, which subsequently turns up ahead of oil. Gold reversed to the upside in early 2023 and copper at the...

READ MORE

MEMBERS ONLY

Is the S&P 500 Flashing a Bearish Divergence?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Unlock the power of divergence analysis! Join Dave as he breaks down what a bearish momentum divergence is and why it matters. Throughout this video, Dave illustrates how to confirm (or invalidate) the signal on the S&P500, Nasdaq100, equal‑weighted indexes, semiconductors, and even defensive names like AT&...

READ MORE

MEMBERS ONLY

Micron's Coiled for An Explosive Move (Up or Down): Here's What You Need to Know Now

by Karl Montevirgen,

The StockCharts Insider

Micron Technology, Inc. (MU) appears poised for an explosive breakout, both technically and fundamentally. While it remains to be seen whether this materializes by its Q3 earnings report on June 25, the setup suggests a high-probability move is about to happen, and soon.

The fundamental case for a breakout is...

READ MORE

MEMBERS ONLY

A Few Charts Worth Watching This Week

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

There are a few very different setups unfolding this week that are worth a closer look: two software-related names that are struggling to reclaim their winning ways, plus one lovable and reliable stock wagging its tail in the spotlight.

Let's break it down.

Adobe (ADBE): Mind the Gaps...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #22

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Sector Rotation: A Week of Stability Amidst Market Dynamics

Last week presented an intriguing scenario in our sector rotation portfolio.

For the first time in recent memory, we witnessed complete stability across all sector positions -- no changes whatsoever in the rankings.

1. (1) Industrials - (XLI)

2. (2) Utilities...

READ MORE

MEMBERS ONLY

Tech ETFs are Leading Since April, but Another Group is Leading YTD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

QQQ and tech ETFs are leading the surge off the April low, but there is another group leading year-to-date. Year-to-date performance is important because it includes two big events: the stock market decline from mid February to early April and the steep surge into early June. We need to combine...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY's Behavior Against This Level Crucial as Index Looks at Potential Resumption of Up Move

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After consolidating for two weeks, the Nifty finally appeared to be flexing its muscles for a potential move higher. Over the past five sessions, the Nifty traded with an underlying positive bias and ended near the week's high point while also attempting to move past a crucial pattern...

READ MORE

MEMBERS ONLY

From Tariffs to Tech: Where Smart Money's Moving Right Now

by Mary Ellen McGonagle,

President, MEM Investment Research

Stay ahead of the market in under 30 minutes! In this video, Mary Ellen breaks down why the S&P 500 just broke out, which sectors are truly leading (industrials, technology & materials), and what next week's inflation data could mean for your portfolio.

This video originally...

READ MORE

MEMBERS ONLY

Your Weekly Stock Market Snapshot: What It Means for Your Investments

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

This week, we got a smorgasbord of jobs data — JOLTS, ADP, weekly jobless claims, and the nonfarm payrolls (NFP). Friday's NFP, the big one the market was waiting for, showed that 139,000 jobs were added in May, which was better than the expected 130,000. Unemployment rate...

READ MORE

MEMBERS ONLY

Big Rally Ahead Should Yield All-Time High on This Index

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

All of our major indices continue to rally off the April 7th, cyclical bear market low. A couple, however, have broken out of key bullish continuation patterns that measure to all-time highs. I'll focus on one in today's article.

Russell 2000

The IWM is an ETF...

READ MORE

MEMBERS ONLY

Silver's Surge is No Fluke—Here's the Strange Ratio Driving It

by Karl Montevirgen,

The StockCharts Insider

Silver just hit a 13-year high, breaking above a key resistance level that could ignite a major bull run. Some metals analysts now say a rally to $40 isn't a long shot, but a matter of time. So, are the odds finally shifting in favor of the bulls?...

READ MORE

MEMBERS ONLY

Everyone Talks About Leaving a Better Planet for Our Children: Why Don't We Leave Better Children for Our Planet?

by Gatis Roze,

Author, "Tensile Trading"

Most religions of the world have the fundamental beliefs that are strikingly similar to the Ten Commandments. History has taught humanity that life does not seem to work well without such guiding principles. As responsible parents, we should have a parallel foundation of ten life skills that we impart part...

READ MORE

MEMBERS ONLY

Three Charts Showing Proper Moving Average Alignment

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I'm a huge fan of using platforms like StockCharts to help make my investment process more efficient and more effective. The StockCharts Scan Enginehelps me identify stocks that are demonstrating constructive technical configuration based on the shape and relationship of multiple moving averages.

Today, I'll share...

READ MORE

MEMBERS ONLY

Clusters of Long Winning Streaks: What They're Telling Us

by Frank Cappelleri,

Founder & President, CappThesis, LLC

Recently, the S&P 500 ($SPX) has been racking up a good number of wins.

Since late April, the index has logged its third winning streak of at least five: a nine-day streak from April 22–May 2 and a six-day streak from May 12–May 19. That makes...

READ MORE

MEMBERS ONLY

S&P 500 on the Verge of 6,000: What's at Stake?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

A lot has happened in the stock market since Liberation Day, keeping us on our toes. Volatility has declined significantly, stocks have bounced back from their April 7 low, and the economy has remained resilient.

If you're still feeling uncertain, though, you're not alone. The stock...

READ MORE

MEMBERS ONLY

Why ADX Can Mislead You — And How to Avoid It

by Joe Rabil,

President, Rabil Stock Research

In this video, Joe walks through a comprehensive lesson on using the ADX (Average Directional Index) as part of a technical analysis strategy. Joe explains the key components of the ADX indicator, how to interpret DI+ and DI- lines, and how to identify strong or weak trends in the market....

READ MORE

MEMBERS ONLY

Strategic Chaos or Tactical Goldmine? What QQQ's Chart is Whispering Right Now

by Karl Montevirgen,

The StockCharts Insider

Despite the uncertainty prevailing in the markets, the Nasdaq 100 Index ($NDX) has proven resilient, perhaps more so than its peer benchmarks. The 90-day trade truce between the U.S. and China, initiated in May, boosted investor confidence. Yet that's now at risk amid mutual accusations of violations....

READ MORE

MEMBERS ONLY

S&P 500 Bullish Patterns: Are Higher Highs Ahead?

by Frank Cappelleri,

Founder & President, CappThesis, LLC

In this market update, Frank breaks down recent developments across the S&P 500, crypto markets, commodities, and international ETFs. He analyzes bullish and bearish chart patterns, identifies key RSI signals, and demonstrates how "Go No Go Charts" can support your technical analysis. You'll also...

READ MORE

MEMBERS ONLY

This Important Metal Could Be on the Verge of a Mega-Breakout

by Martin Pring,

President, Pring Research

Gold has been on a tear since 2022, leaving other metals in the dust. Nevertheless, it's important to remember that the yellow metal has a strong tendency to lead commodities in general, which implies the likelihood of inflationary pressures in the commodity pits going forward. The leads and...

READ MORE