MEMBERS ONLY

The Dance Of The Outperformers: Peter Lynch Preaches You Best Start With Yourself

by Gatis Roze,

Author, "Tensile Trading"

Novice investors seldom like to hear that before asset growth (trading) must come asset protection. Boring! Similarly, they are reticent in embracing the reality that before they begin analyzing equities, they must first analyze themselves. Really? Legendary stock-picker Peter Lynch specifically warned investors of these "Investor Self" priorities....

READ MORE

MEMBERS ONLY

TECHS RETREAT AS OTHER GROUPS GAIN -- INDUSTRIALS ARE WEEK'S TOP SECTOR -- SMALL CAPS AND TRANSPORTS ALSO GAIN -- FEDEX DELIVERS 52-WEEK HIGH WHILE UPS REACHES NEW RECORD--

by John Murphy,

Chief Technical Analyst, StockCharts.com

MODEST ROTATION TAKES PLACE... Big tech has been the main story in the market since the start of the pandemic with most of the rest of the market largely left behind. Over the past couple of weeks, however, we've started to see some money moving into weaker parts...

READ MORE

MEMBERS ONLY

3 Major Market Themes for the Rest of August

As Keith and I are heading on a vacation (with social distancing) starting Monday for 3 weeks, this is the last Daily that I will write until September 1st. Yet, not to worry, Geoff Bysshe will be taking over both my subscription service and the writing of the Daily blog....

READ MORE

MEMBERS ONLY

MicroSector ETN With All The Right Stocks - And It's Leveraged!

by Mary Ellen McGonagle,

President, MEM Investment Research

We can thank one of the subscribers to my MEM Edge Report for today's chart you don't want to ignore! It's for an Exchange Traded Note (ETN) that tracks 3x the daily movements of an index of U.S. listed technology and consumer discretionary...

READ MORE

MEMBERS ONLY

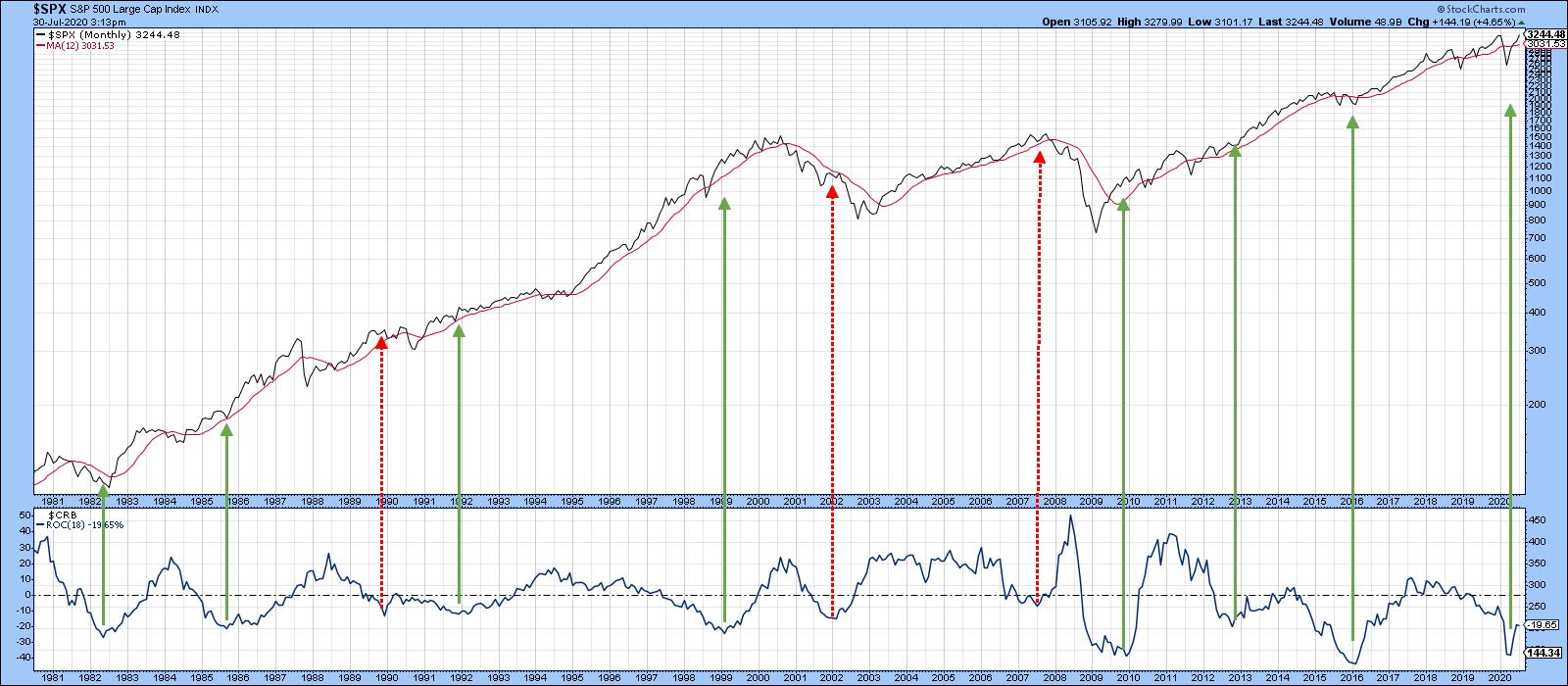

Evidence of a Commodity Bull Market Continues to Grow

by Martin Pring,

President, Pring Research

I have written about commodities several times in the last four months or so as evidence of a major reversal had begun to appear. Now, more indicators are starting to turn. Near-term, things look overdone, but if this is really is a bull market, that will not matter, as short-term...

READ MORE

MEMBERS ONLY

Break from "Pennant" Targets $500 for AAPL

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

To get some inspiration for a nice subject or stock to show in this article, I went to my dashboard, on which I have one widget that shows the most actively traded stocks in the Dow Jones Industrials index.

A nice little gimmick is that you can run an RRG...

READ MORE

MEMBERS ONLY

DP Show: Sky's the Limit for Gold (and Silver!)

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Erin reviews the technicals on the DecisionPoint Scoreboard Indexes (SPX, NDX, OEX & Dow) and points out some negative divergences on primary indicators that are troubling her bullish outlook. Carl discusses how Gold Premiums and Discounts are calculated and the implications of seeing high discounts...

READ MORE

MEMBERS ONLY

Regional Banks - The Prodigal Dunce

With the Russell 2000 breaking out over the 50 and 200-week moving averages, the market looks like blue skies, right?

Retail (XRT) ran to just over $50.00. Sister Semiconductors (SMH) rocked to another new all-time high. Transportation (IYT) passed the critical test at the 200-WMA. Biotechnology (IBB) consolidated over...

READ MORE

MEMBERS ONLY

SMALL CAPS AND DOW TRANSPORTS EXCEED THEIR JUNE PEAKS -- DOW EXCEEDS JULY PEAK -- XLI CLEARS 200-DAY LINE -- DEERE BREAKS OUT -- S&P 500 NEARS TEST OF FEBRUARY PEAK

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 ISHARES AND DOW TRANSPORTS PASS JUNE HIGH...DOW GAINS...The rally in stocks continues to broaden out. Market groups that had lagged behind the stock recovery are starting to catch up. Small caps and transports are two examples. Chart 1 shows the Russell 2000 iShares (IWM) trading above...

READ MORE

MEMBERS ONLY

The Right Place at the Right Time

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave explains that right now, we are in the right place at the right time. This episode is a second show on Methodology where Dave further explores money management, stocks in action and trading psychology.

This video was originally broadcast on August 5th, 2020....

READ MORE

MEMBERS ONLY

Waters Corp (WAT) Tests Key Gap Support - Could be a Great Trading Opportunity!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When a stock gaps higher and keeps running, it generally tells me that the top of gap support is what we need to concern ourselves with. It's definitely not a guarantee that it holds, but the odds are greater. When I trade stocks, it's all about...

READ MORE

MEMBERS ONLY

DOLLAR DROP BOOSTS COMMODITIES -- AND STOCKS TIED TO THEM -- GOLD MOVES FURTHER ABOVE $2000 -- COPPER MINERS BREAK OUT -- SO DOES FREEPORT MCMORAN -- A STRONG COPPER MARKET IS A GOOD SIGN FOR THE GLOBAL ECONOMY

by John Murphy,

Chief Technical Analyst, StockCharts.com

COPPER MINERS LEAD MATERIALS HIGHER... A falling dollar has been one of the big factors pushing commodity prices higher and stocks tied to them. Today's drop in the greenback to another two-year low is continuing the flow of money into commodity assets. Several messages over the last month...

READ MORE

MEMBERS ONLY

Here's Another Stock Setting Up Exactly Like AMD Did, Just Before Its 70% Rise In 5 Weeks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm a big fan of buying stocks at support. On June 29th, Advanced Micro Devices (AMD) tested a very important price support level and printed a reversing hammer candlestick that same day. In my Daily Market Report to EarningsBeats.com members, I suggested mid-day that a bottom could...

READ MORE

MEMBERS ONLY

Sector Spotlight: Bonds are Looking Good

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

As is usual for the first episode of Sector Spotlight of a new month, I take an in-depth look at developments on the monthly charts for Asset Classes and Sectors. There's also a short intermezzo on Flag patterns and a book suggestion!

This video was originally broadcast on...

READ MORE

MEMBERS ONLY

Multiple Time Frames and Overextended Amazon

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Last week on The Final Bar, one of our Mailbag questions related to Amazon.com (AMZN) and how far it has reached above its 200-day moving average. This phenomenon speaks to the long-term strength of AMZN's price movements, the short-term overreaching of the price since the March market...

READ MORE

MEMBERS ONLY

Prodigal Son Regional Banks - A Ball and Chain

With the Russell 2000 breaking out over the 50- and 200-week moving averages, we should see nothing but blue skies, right? Maybe.

We have lots of positives based on hope, of course. Retail (XRT), as featured a while back, is doing well. Sister Semiconductors (SMH) is on the road less...

READ MORE

MEMBERS ONLY

Watching Rotations into Real Estate and Technology (again)...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

At the start of the week, two tails on the Relative Rotation Graph for US sectors are showing interesting rotations. These are the tails for for XLRE and XLK.

Real Estate

The positive rotation for the daily tail on the RRG coincides nicely with the improvement for XLRE on a...

READ MORE

MEMBERS ONLY

Is NASDAQ Tiring?

A few cautious flags were thrown up today in spite of the new all-time highs in NASDAQ.

1. The volume was light. After Friday's spike in volume, Monday QQQssaw below-average daily volume.

2. The momentum indicators that we use to measure tops, bottoms, and big trends show a...

READ MORE

MEMBERS ONLY

NASDAQ HITS ANOTHER RECORD -- MICROSOFT AND SEMIS LEAD TECH SECTOR -- JACOBS ENGINEERING AND QUANTA LEAD XLI

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHS AND NASDAQ CONTINUE TO LEAD THE WAY... Big techology stocks are leading the market higher today again. Chart 1 show the Nasdaq Composite Index reaching a new high as did the Technology SPDR (XLK). Its biggest percentage gainers were Microsoft and a number of chip stocks. Chart 2 shows...

READ MORE

MEMBERS ONLY

A Summer Road Trip with the Economic Modern Family

Last week, Max Wiethe from Real Vision and I sat down for about an hour to discuss a myriad of timely and relevant market topics. (See the link at the end of the commentary).

So much happened in this past week. The short list:

* Blow-out Earnings of Apple (AAPL), Alphabet...

READ MORE

MEMBERS ONLY

Building Our 6 Pillars (ChartLists) Of Trading

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

First, welcome to August! It's hard to believe that we're into our 8th month of 2020. It's been a very difficult year on a number of fronts, but I hope that EarningsBeats.com has at least been able to help you navigate through the...

READ MORE

MEMBERS ONLY

APPLE, AMAZON, AND FACEBOOK HAVE BIG DAY FOLLOWING STRONG EARNINGS -- MAJOR STOCK INDEXES MAINTAIN UPTRENDS -- EXPD AND UPS DELIVER NEW RECORDS -- DOW TRANSPORTS CONTINUE TO GAIN GROUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

THREE BIG TECHS LEAD FRIDAY REBOUND... Going into Thursday evening, most of the TV stock market commentary centered around the big tech stocks that were announcing quarterly earnings after the close. The consensus seemed to be that the big tech stocks had already seen huge gains for the year, and...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Makes Some Room for Consolidation at Higher Levels; Expect RRG Leadership From These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After testing a couple of important levels in the week before this one, the NIFTY took a breather and consolidated over the past five sessions. In the previous weekly note, we had highlighted that the momentum at higher levels is diminishing, which might lead to some consolidation at higher levels....

READ MORE

MEMBERS ONLY

FAANG Stocks Exploding Higher? – Here's The Real Story This Earnings Season

by Mary Ellen McGonagle,

President, MEM Investment Research

It's been quite a week for the markets and while market news is likely to focus on the explosive gains in select FAANG stocks, I believe there's an even bigger story that's come to light during this surprisingly robust earnings season.

You see, Facebook...

READ MORE

MEMBERS ONLY

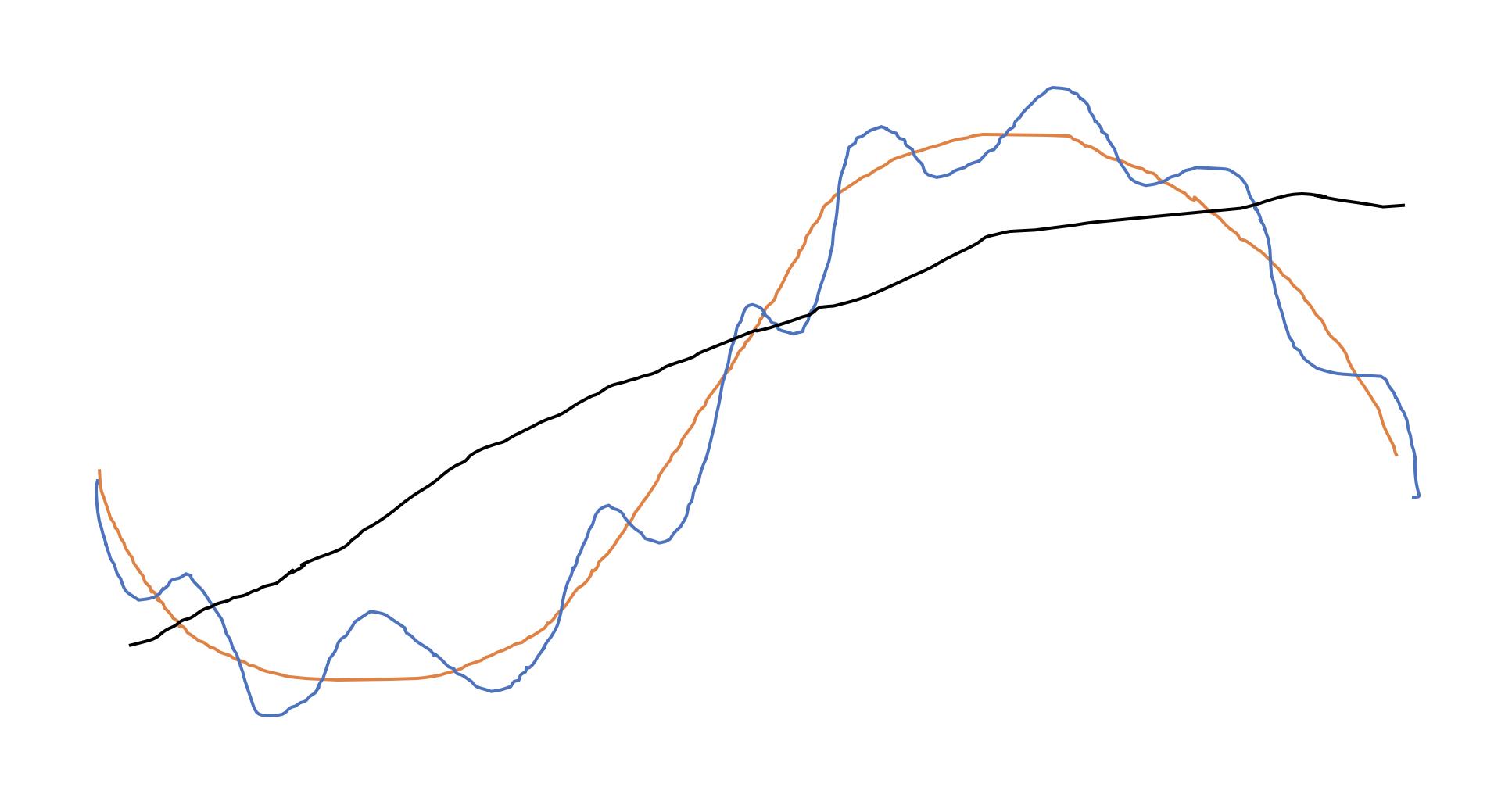

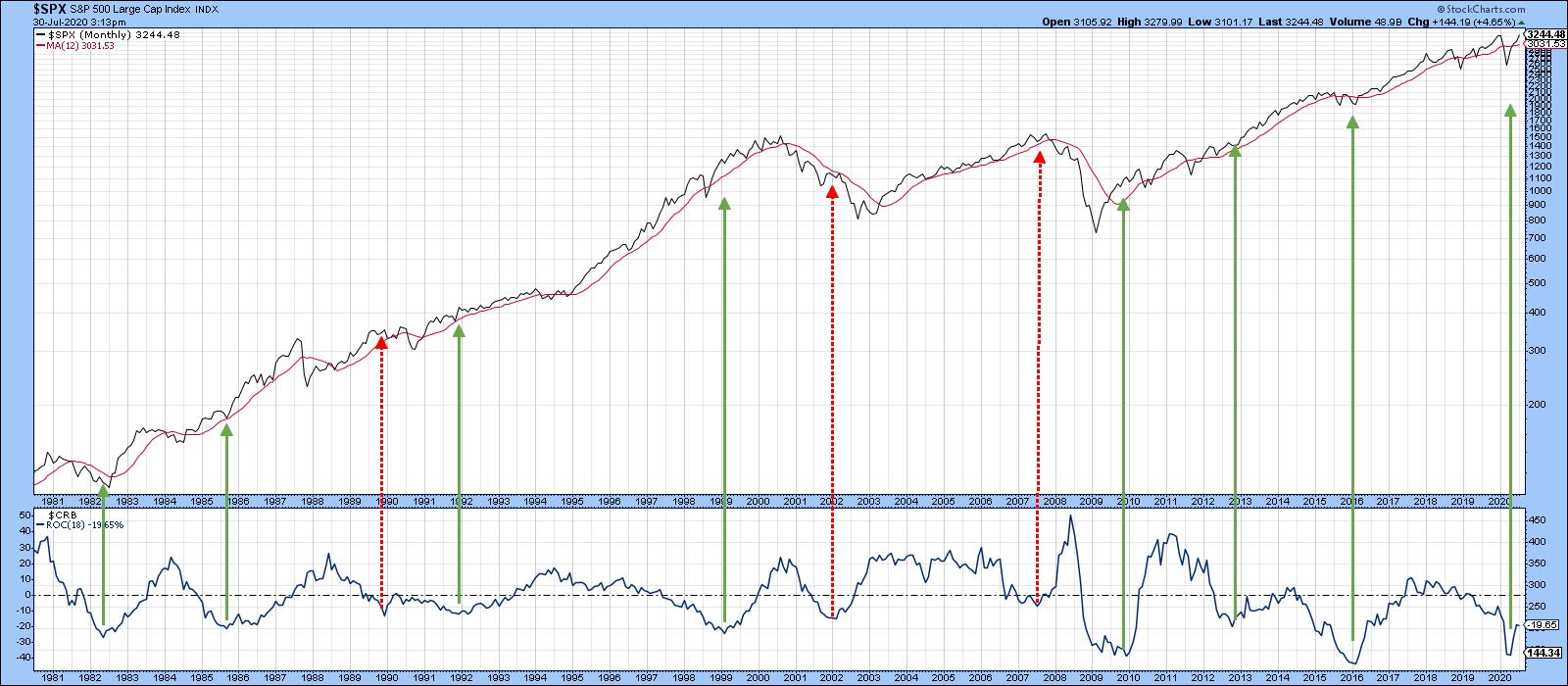

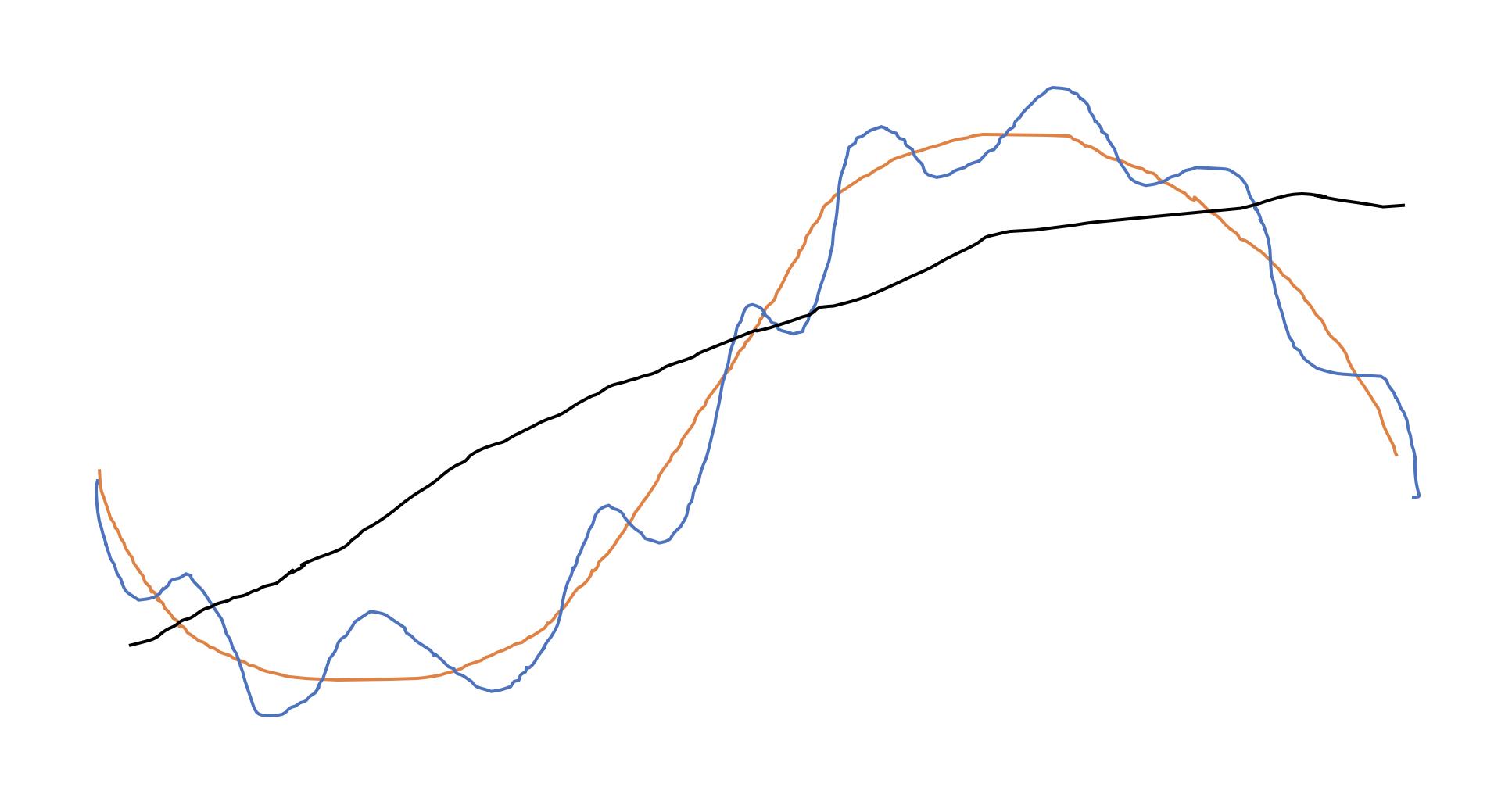

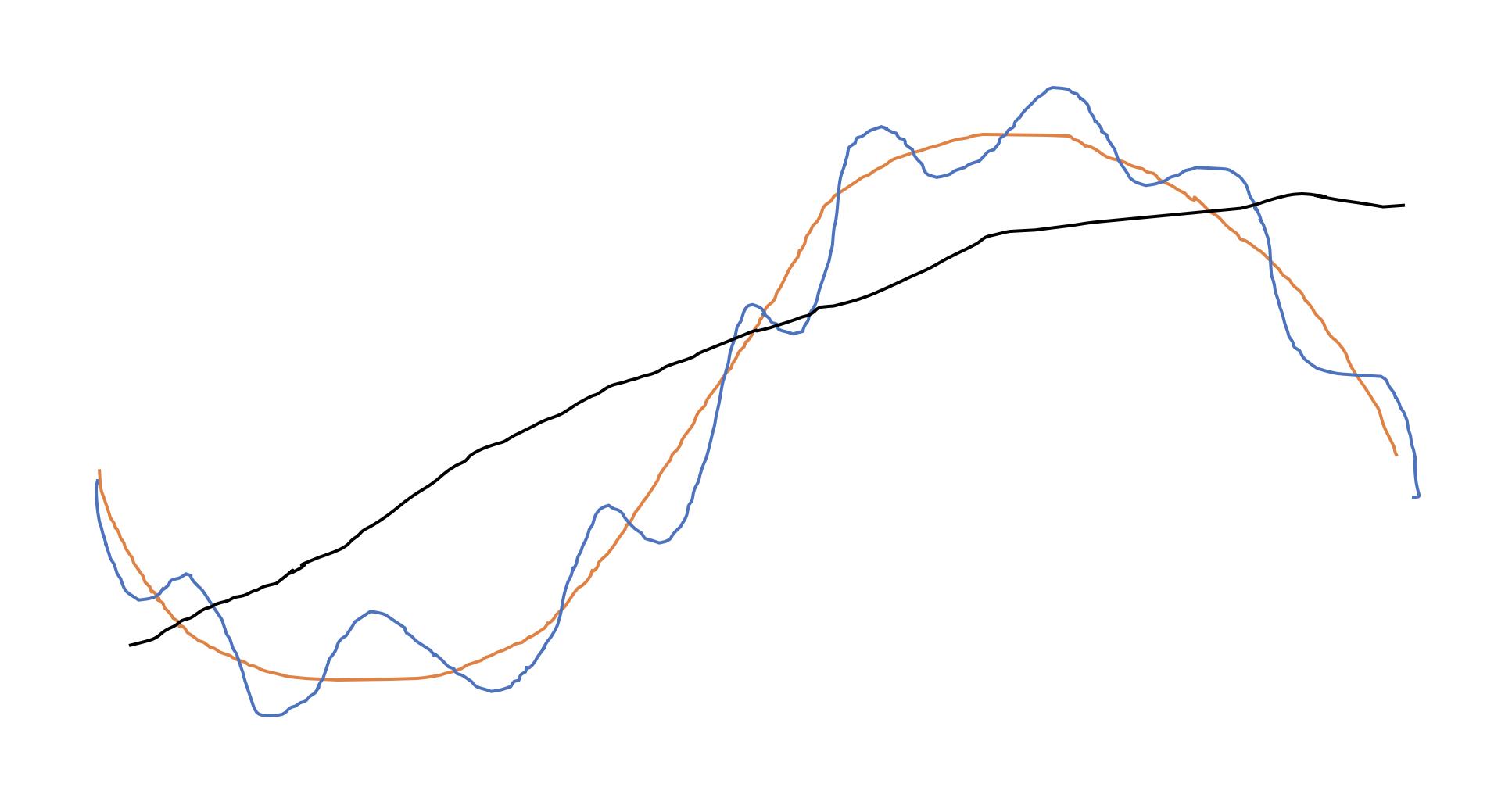

Copper Could Hold the Key for the Next Leg Up in the Stock Market Rally

by Martin Pring,

President, Pring Research

Swings in commodity prices are both a market and an economic indicator. There are certainly exceptions, but when the economy is in a recovery phase, commodity prices generally rise. During the early phase of the business cycle, rising commodities are beneficial for stocks, not only for commodity-sensitive sectors such as...

READ MORE

MEMBERS ONLY

Our Model Portfolio Is +118% In 21 Months; Here Are The 10 Equal-Weighted Stocks That Comprise It

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Every three months, we fill out our four portfolios with 10 equal-weighted and leading stocks, mostly in leading industries. We combine fundamental research and technical analysis to make our money work harder, which is the whole idea. We know there's a strong correlation between earnings growth rates and...

READ MORE

MEMBERS ONLY

Too Far, Too Fast for Amazon

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This week on The Final Bar, one of our Mailbag questions related to Amazon.com (AMZN) and how far it has reached above its 200-day moving average. This phenomenon speaks to the long-term strength of AMZN's price movements, the short-term overreaching of the price since the March market...

READ MORE

MEMBERS ONLY

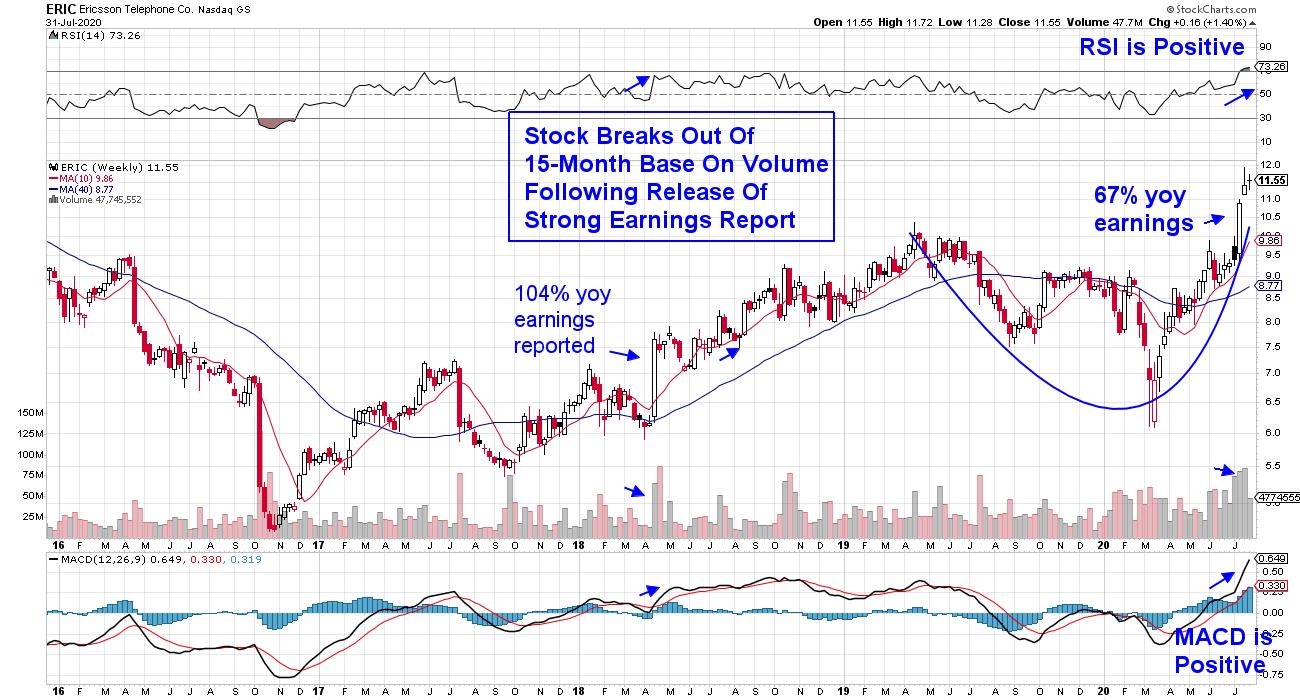

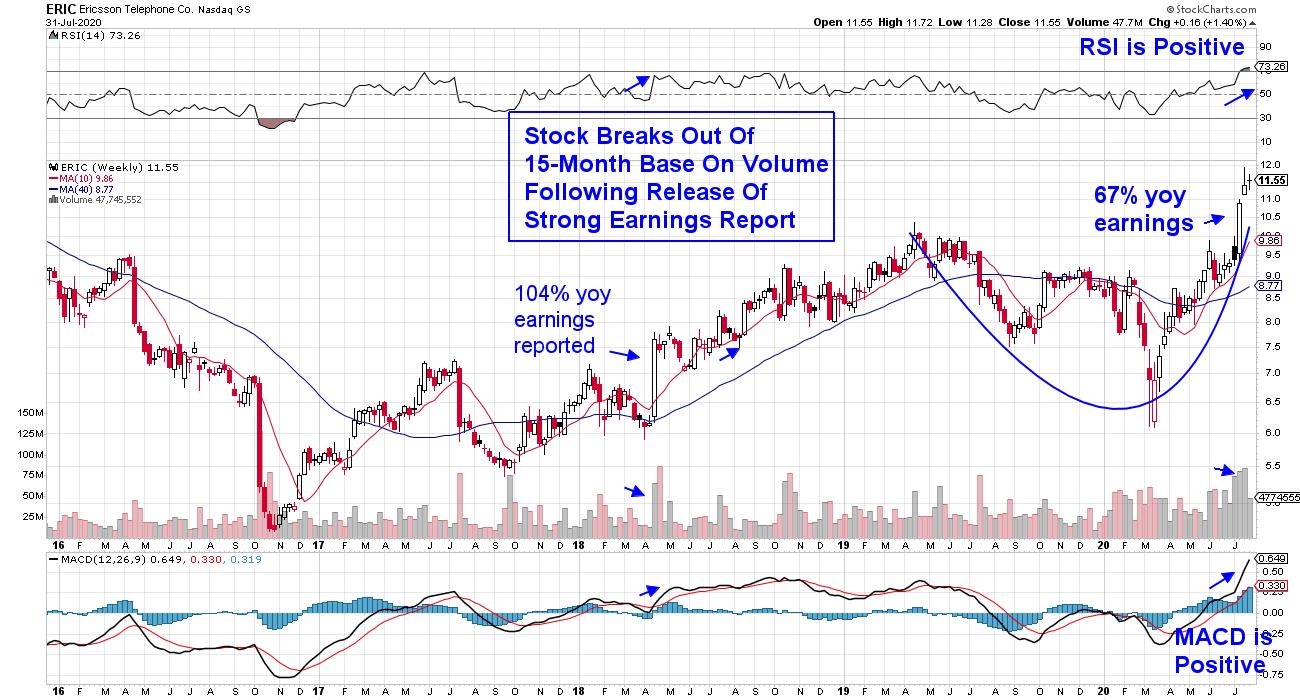

Pivotal Week Unveils Amazing Opportunities

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen examines how corporate earnings results are uncovering a resurgence in an area due to see explosive growth over the next year and beyond. She also shares tips on how to uncover the next set of winners from one...

READ MORE

MEMBERS ONLY

Will The Next Big Move Be in Bonds?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

(Financial) Markets rotate, that's a given. When we look at the stock market, we call it sector rotation, which is probably the most widely-used term. But there is definitely also rotational action going on in other markets or cross assets. Think in terms of country or regional stock...

READ MORE

MEMBERS ONLY

Stocks in China to Get Body-Slammed

by Larry Williams,

Veteran Investor and Author

On this special episode of Real Trading with Larry Williams, Larry goes out on a limb to explain why he thinks stocks in China are ready for significant decline. You'll get a sneak peek of his unique indicators coming soon to StockChartsACP, as Larry demonstrates their functions and...

READ MORE

MEMBERS ONLY

A Solid Way To Find Great Short Squeeze Candidates

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Too many traders focus on the wrong things when looking for a big short squeeze. It's not about how many short shares there are for a particular stock. And it's not about high short percentage of float. And, quite honestly, it's not even about...

READ MORE

MEMBERS ONLY

Copper Could Hold the Key for the Next Leg Up in the Stock Market Rally

by Martin Pring,

President, Pring Research

* Rising Commodity Momentum is Bullish for Stocks and the Economy

* Long-Term Technicals Look Promising for Copper

Swings in commodity prices are both a market and an economic indicator. There are certainly exceptions, but when the economy is in a recovery phase, commodity prices generally rise. During the early phase of...

READ MORE

MEMBERS ONLY

Real Estate Emerging Out of Doldrums

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Ok, the header image may not be entirely accurate to the message of this article, as it deals with the Real Estate sector which is all about listed REITs, but I could not resist using it ;)

When I looked at the Relative Rotation Graphs for sectors this morning, I noticed...

READ MORE

MEMBERS ONLY

DP Show: Gold Rush - Worry or Rejoice?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl discusses his recent article on Gold. The yellow metal is enjoying a huge rally, but should we be excited or nervous? Carl and Erin both give you their strategies on taking advantage of (and protecting profits during) this parabolic move. Erin outlines some short-term...

READ MORE

MEMBERS ONLY

Best, Worst and Missed Trades

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave presents a broad selection of charts that he uses to present his methodology in action. Most of the charts are actual stocks that Dave trades or has traded himself, and have also been "Mystery Charts" in past shows. Dave also demonstrates...

READ MORE

MEMBERS ONLY

Who Says Gold is Topping?

MarketGauge has some pretty cool proprietary software.

One indicator is Triple Play, which measures the ratio between a particular instrument and a benchmark. Triple Play reveals the true trend strength of a market based on "price leadership" and "volume power." This measure of the market'...

READ MORE

MEMBERS ONLY

POINT & FIGURE CHARTS OF TRANSPORTATION LEADERS SHOW BULLISH BREAKOUTS

by John Murphy,

Chief Technical Analyst, StockCharts.com

POINT & FIGURE CHARTS SHOW TRANSPORTATION BREAKOUTS...My morning message wrote about four transportation stocks that were achieving bullish breakouts. A glitch in the system, however, prevented me from showing their usual bar charts. So I've improvised a bit to bring their point & figure versions. Unlike bar...

READ MORE

MEMBERS ONLY

TRUCKERS LEAD TRANSPORTS HIGHER -- CHRW AND LANDSTAR SCORE BIG BREAKOUTS -- EXPEDITORS INTL HITS NEW RECORD -- TRANSPORTS LEAD XLI HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS MOVE FURTHER ABOVE 200-DAY LINE... Transportation stocks are one of today's strongest groups. Chart 1 shows the Dow Transports gaining 2% this morning and moving further above their 200-day moving average which is now acting as a line of support (see red arrow). My message on...

READ MORE

MEMBERS ONLY

RSI for Trend-Following and Momentum Strategies - Apple Example

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

RSI is widely used as a momentum oscillator to identify overbought and oversold levels. A dive into the formula, however, reveals that RSI is quite well equipped for trend-following strategies. It can even be used to rank ETFs and stocks to find those with the strongest momentum.

The strategy basically...

READ MORE

MEMBERS ONLY

Bullish on Gold, but Getting Nervous

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Monday, gold rallied above the top in 2011 and made new, all-time highs. I've been more or less bullish on gold for several years, but it hasn't always been particularly easy, because gold's progress could usually best be described as "tortured."...

READ MORE